23 May 2013 Roundtable Q. , 2013-0483811C6

Principal Issues: Form T1134 - Information Return Relating to Controlled and Not-Controlled Foreign Affiliates

Position: General comments provided.

IFA Roundtable - May 2013

Question 8 - Form T1134

The following questions are related to the new Form T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates, released by CRA early in 2013.

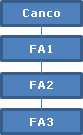

Section 3B of the new T1134 Summary Form requires a disclosure of the equity percentage between two foreign affiliates of a reporting entity. In the case of a tiered corporate structure where Canco (the reporting entity) owns 100% of FA 1, FA 1 owns 100% of FA 2, and FA 2 owns 100% of FA 3, please consider the following:

Since "equity percentage" is defined in subsection 95(4) as including direct and indirect share ownership percentages, both FA 1 and FA 2 will have a 100% equity percentage in FA 3. In this case, should FA 3 be reported in Section 3B twice (i.e., FA 1's 100% equity percentage in FA 3, and FA 2's 100% equity percentage in FA 3)?

CRA Response

Yes, that is correct.

If the answer to Question A is yes, this could mean a great number of repetitive reporting by large multinational groups. For example, if FA 3 owns another 200 foreign affiliates, those 200 foreign affiliates will each be reported at least 3 times, resulting in a Section 3B disclosure of more than 600 entries. Would the CRA provide any administrative relief in this repetitive reporting situation?

CRA Response

The CRA is considering developing administrative policy to provide relief in such situations.

There has been a change in the administrative relief on filing requirements previously provided for dormant or inactive foreign affiliates. The new Form T1134 now limits the administrative relief for dormant or inactive foreign affiliates to situations where the total cost of investment in all foreign affiliates is less than $100,000. The $100,000 threshold is very low for large multinational corporations. This basically means that large multinational companies would now have to report dormant or inactive foreign affiliates. Is this the intent of the proposed change?

CRA Response

Yes. Section 233.4 of the Income Tax Act requires reporting of information regarding all foreign affiliates. In order to reduce the burden on filers, the CRA provided relief from filing this information for dormant or inactive foreign affiliatesthe relief was simply an administrative relief.

Unfortunately, the previous administrative thresholds surrounding dormant or inactive foreign affiliates created a reporting gap between Form T1135 filing requirements and Form T1134 filing requirements. Since the CRA continues to prioritize efforts to ensure compliance surrounding offshore tax matters, it was necessary to close this gap to be consistent with the legislative thresholds for Form T1135.

Gillian Godson

2013-048381