Section 224 - Right of Supplier to Sue for Tax Remitted

Cases

S.P. Holdings Canada Inc.. v. Ikea Ltd., [2001] GSTC 93 (Que CA)

The Court was prepared to assume (without deciding) that the right of action in s. 224 was not exclusive and that a right to recover GST could be established if there was an unequivocal undertaking on the part of the debtor to pay GST. However, such an undertaking was not established on the facts on this case.

Governor's Hill Development Ltd. v. Robert, [1993] GSTC 35 (Ont. Ct. G.D.), aff'd [1996] GSTC 43 (C.A.)

A clause in an agreement for the sale of a new condominium unit for a purchase price of $775,000 providing that "Vendor agrees to pay the GST" meant that the Vendor was required to absorb the GST applicable to the $775,000 purchase price. Accordingly, the Vendor was required to recover $775,000 from the purchaser, rather than 100/107 of that amount (as alleged by the purchaser). Eberle J. also stated that, had the agreement not made reference to GST, it would have been added to the stated purchase price.

See Also

Concol Construction Ltd. v. Andrews, [1995] GSTC 46 (Ont. Ct. J.),

GD - Ottawa Small Claims Ct

House D.J. stated (at p. 46-3):

"I am of the strong view that where an agreement for a sale is silent as to the GST and there is no written documentation to the contrary, that when at any time the Minister properly assesses a supplier with a liability to pay the tax on that sale, and all appeals have been exhausted, then if the supplier, having paid such tax, and having made a written demand on the recipient for reimbursement, the supplier has, in fact, complied with subsec. 223(1) of the Act and may commence an action under 224."

Pellizzari v. 529095 Ontario Ltd., [1995] GSTC 51 (Ont. Ct. J.)

G.D. - Stratford Small Claims Ct.

Searle D.J. followed 390781 Alberta Ltd. v. Mensaghi, [1992] GSTC 10 in finding that s. 224 was intended to be the sole means for a supplier to recover unpaid GST from a purchaser and that no common law remedy was available.

Lloyd v. Reierson and Reierson Logging Ltd., [1995] GSTC 26 (B.C. Prov. Ct.),

But for the fact that the corporate defendant had admitted liability for unpaid GST, the plaintiff would have been unable to collect that amount from the defendant because of its failure to comply with subsection 223(1). DeVilliers PCJ. stated (at p. 26-3):

"The debt that arose by reason of the failure of the defendant to pay the GST, or by reason of the failure of the claimant to collect it was a debt due to Her Majesty, and therefore not recoverable at common law by the claimant from the defendant."

It also was noted that s. 224 does not create a cause of action for penalties or interest.

Winnipeg Waste Disposal Limited Partnership v. The City of Portage La Prairie, [1992] GSTC 11 (Man. Q.V.), briefly aff'd [1993] GSTC 10 (Man. C.A.)

A contract which a municipality entered into with a contractor in the fall of 1989 that provided that the price to be paid to the contractor for its services in collecting garbage would include "all applicable duty, freight, cartage, Federal and Provincial Taxes and charges governmental or otherwise paid" was found not to exclude an additional charge by the contractor for GST, given the failure of the contract to add the phrase "whether in effect or hereafter imposed", in light of the contra proferentem doctrine, and in light of evidence that the contractor had informed the municipality, before it accepted the tender, that future GST was not included in the contract price.

Subsection 262((1)

Administrative Policy

9 December 2014 Interpretation 165597

An Ontario builder, who submitted multiple applications for the Ontario transitional new housing rebate (OTNHR) using Form RC7000-ON, Ontario Retail Sales Tax (RST) Transitional New Housing Rebate, indicated that the OTNHRs had been assigned to it. However, neither section F, "Certification", nor section G, "Assignment of rebate", of Form RC7000-ON were signed by any of the purchasers. CRA stated:

Where the CRA receives a Form RC7000-ON in respect of the purchase of new housing by an individual and the assignment of that rebate to the builder, sections F and G of Form RC7000-ON must both be signed by the individual. The CRA should not accept that an assignment of the OTNHR has occurred, or pay any amount of a rebate to a supposed assignee, unless both sections F and G are signed by the individual (or there is other evidence of the individual having certified the information in those sections) and the CRA is satisfied as to the validity of the assignment.

Section 225 - Remittance of Tax

Administrative Policy

Excise and GST/HST News - No. 97 17 November 2015

Joint tax adjustment transfer election amounts

Where an investment plan manager that is located outside Quebec and is not an SLFI for either GST/HST or QST purposes filed its GST/HST return(s) with the CRA and included QST amounts that were transferred to it by an SLFI investment plan as a result of a tax adjustment transfer election in its net tax calculation for GST/HST purposes, the plan manager would be required to correct its GST/HST return(s).

Subsection 225(1) - Net Tax

Cases

The Queen v. Gastown Actors' Studio Ltd., Docket: A-663-99 (FCA)

In finding that the respondent was responsible for remitting any GST it had collected with respect to its exempt supply of full-time vocational training, Sharlow J.A. stated:

"... a taxpayer who has in fact collected GST, whether for services that are taxable or for services that are later determined to be exempt supplies, must remit those amounts as liable to be assessed if they are not remitted."

Administrative Policy

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 26.

An Ontario purchaser ("Ontario Co") remitted HST to a Quebec supplier ("Quebec Co") on the basis of its view that the place of supply of a purchase of goods was in Ontario, but Quebec Co (which now is insolvent) did not remit the provincial component of the HST on the basis of a view that the place of supply was in Quebec. In noting that Quebec Co is required to remit the HST, CRA noted that s. 222(1) deemed amounts (other than certain amounts in the case of bankruptcy) collected on behalf of HST to be held in trust for the Crown until withdrawn under s. 222(2); and that all amounts collected by Quebec Co on account of HST are required by s. 225(1) to be included in its net tax.

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 36. ("ETA 169/225")

An supplier makes an exempt supply for which it bills GST, but the recipient refuses to pay the GST and pays the invoice net of GST. Alternatively, there is no supply and the supplier simply issues a bill in error.

CRA indicated that as s. 225(1) "requires every person to include in its net tax calculation all amounts that became collectible," such GST was required to be included in its net tax remittance in both examples.

Subsection 225(4) - Limitation

See Also

Chew Estate v. The Queen, [2013] GSTC 52, 2013 TCC 89,

The registrant, who had a quarterly GST reporting period, had acquired a property for personal use, but converted it to commercial use (for short-term rentals) in the second quarter of 2005. The Minister denied his claim at the end of 2009 for an input tax credit on the basis that the four-year limitations period in s. 225(4)(b) had commenced on 1 July 2005.

VA Miller J dismissed the registrant's appeal. She stated (at para. 15):

According to paragraph 225(4)(b) of the ETA, ITCs must be claimed by a registrant in a return filed by the registrant on or before the due date of the return for the last reporting period that ends within four years after the end of the reporting period in which the ITC could have first been claimed. Mr. Chew filed his GST returns on a quarterly basis. Therefore he was required to claim an ITC with respect to the first significant change in use of the Unit before July 1, 2009. This he failed to do.

Subsection 225.1(2)

Administrative Policy

RC4082 "GST/HST Information for Charities" Rev. 13

Example

You are a charity resident in Alberta, and you are registered for the GST/HST. You operate an art gallery and use the net tax calculation for charities. Your main revenue is taxable gallery admissions.

During your reporting period, you earned revenues from exempt supplies of parking and admissions to a fund-raising dinner. In addition, you purchased computer equipment for use more than 50% in your commercial activities. You also purchased and installed a ventilation system in a building that you own and use more than 50% in commercial activities.

Your taxable revenues and expenses are as follows:

Taxable revenues: Gallery admissions $20,000 Sales from gift shop $5,000 Total $25,000 GST collected ($25,000 × 5%) $1,250 Taxable purchases: Contracted services (maintenance) $3,000 Utilities $1,500 Ventilation system $9,200 Computer equipment $2,000 Gift shop inventory purchases $2,500 Catering services for fundraising dinner $3,500 Total $21,700 GST paid on purchases ($21,700 × 5%) $1,085 Net tax calculation

Step 1

Enter $750 on line 105 of your GST/HST return (60% of the $1,250 GST collected).

Step 2

You can claim ITCs for the GST you paid for the ventilation system (improvement to real property) and for the computer equipment (capital property purchase) that you intend to use more than 50% in your commercial activities.

ITC 5% × ($9,200 + $2,000) = $560

Step 3

The amount you calculate in Step 1 less the amount you calculated in Step 2 equals your net tax before any rebates.

Net tax $750 – $560 = $190

Enter this amount on line 109.

You would also be entitled to claim a PSB rebate of the remaining GST/HST paid. For more information, see Rebate information for charities that are GST/HST registrants.

Subsection 225.2(1)

Selected Listed Financial Institution

Administrative Policy

Memorandum 17.6.1 "Definition of ‘Selected Listed Financial Institution'" July 2014

31. A series of tips were developed to help in the determination of whether a particular investment plan is an SLFI…[which] are found in Appendix B… .

Subsection 225.2(2)

Administrative Policy

B-107 "Investment Plans (Including Segregated Funds of an Insurer) and the HST" April 2013

9. Specified attribution method formula

An SLFI [selected listed financial institution] uses the SAM [specified attribution method] formula to calculate its liability for the provincial part of the HST for a participating province. If the amount calculated using the SAM formula for the provincial part of the HST for a participating province for a reporting period of an SLFI is less than the provincial part of the HST for the province that is actually paid or payable by the SLFI in the period (as a result of the application of the general place of supply rules to supplies made to the SLFI), the SLFI will make an adjustment when calculating its net tax that will either reduce its net tax or result in a refund. Conversely, if the amount determined under the SAM formula is more than the actual provincial part of the HST for the province that is paid or payable by the SLFI in the period, the SLFI will have an additional liability for the provincial part of the HST and make an adjustment when calculating its net tax that will increase its net tax.

Provincial ITCs

As SLFIs use the SAM formula to calculate their liability for the provincial part of the HST for a participating province, they are generally not required to track and allocate the extent of consumption or use of each property or service acquired in the participating provinces in order to claim input tax credits (ITCs) related to the applicable provincial part of the HST (either 7%, 8%, or 10% depending on the participating province), nor are they required to self-assess and account for tax on inputs acquired in a non-participating province for consumption, use or supply in a participating province.

Specifically, subsection 169(3) of the Act restricts an SLFI's ability to claim an ITC in respect of the provincial part of the HST... .

Modified SAM for stratified/real time investment plans

An SLFI investment plan uses the SAM formula in subsection 225.2(2) to calculate its liability for the provincial part of the HST. However, where the investment plan

- is a non-stratified investment plan with a real-time calculation method election in effect for a reporting period in a fiscal year, or

- is a stratified investment plan,

these investment plans would use an adapted SAM formula provided by section 51 [now s. 48] of the draft SLFI Regulations

Forms

Subsection 225.2(5)

Administrative Policy

18 February 2015 Ruling 147237 [late election not accepted]

The SLFI and the closely related Supplier filed a (Form GST497GST497) election to make an election under s. 225.2(4), which was processed by CRA. SLFI filed its GST494 return accordingly. Subsequently, they filed GST497 forms for years YYYY to YYYY. SLFI then filed return GST494 for the year YYYY, but the amounts it added to Element A of the special attribution method formula respecting property or services provided by the Supplier to SLFI were not calculated using a cost-based method. Three more annual GST494 returns were filed. The Supplier and SLFI then requested the Minister to accept under s. 225.2(5) the s. 225.2(4) elections for the YYYY, YYYY, YYYY or YYYY years.

In determining that such request would not be granted, CRA noted that P-250 states:

a late-filed subsection 225.2(4) election will not be accepted where, as of the effective date of the election, the parties to the election have not been consistently operating as if the election were in effect, or where, as of the date of the request to accept a late-filed election, not all GST/HST returns that are due by the selected listed financial institution have been filed.

Subsection 225.3(2)

Administrative Policy

B-107 "Investment Plans (Including Segregated Funds of an Insurer) and the HST" April 2013

For example, if a non-stratified exchange-traded fund has a large group of objecting beneficial owners and it is unable to obtain residency information required to determine the province of residency...for these unit holders from a third party service provider, the non-stratified exchange-traded fund may apply to the Minister for authorization to use an alternative method to determine its provincial attribution percentage for a participating province. A geographical analysis report from a third party indicating the province of residence of the unit holder that does not meet the specific information requirements in section 6 of the draft SLFI Regulations [now, s. 5] could be included to support the application to use an alternative method under section 225.3... .

Section 226

Subsection 226(2) - Taxable Supply of Beverage in Returnable Container

Administrative Policy

Returnable containers and goods [CRA Website]

Section 228

Subsection 228(4) - Self-Assessment on Acquisition of Real Property

Administrative Policy

25 February 2014 Memo 155876

The Corporation, which was registered, purchased a hotel through two unregistered nominees and was charged and paid GST, and claimed an ITC therefor. On audit, CRA adjusted the Corporation's return to add tax payable under s. 228(4) and told the Corporation to apply under s. 261 for tax paid in error.

After noting that the Corporation was required to self-assess under s. 228(4) and that the sellers were relieved under s. 221(2) of their obligation to collect GST, Headquarters found that the Corporation was eligible for the rebate as tax paid in error.

18 February 2014 Interpretation 155500

FinanceCo will offer a real estate financing product complying with the Islamic principle of declining Musharaka and with Sharia law. FinanceCo would purchase a percentage interest in the "Property" (with the "Purchaser" paying for the other interest) but with the Purchaser entitled to possession (and responsible for all Property expenses such as taxes, insurance, utilities and repairs) and concurrently providing an agreement, secured by a mortgage, to repurchase that interest in instalments, thereby resulting in an agreed upon profit to FinanceCo. On a default, the Purchaser is required to pay the full unpaid balance of FinanceCo's contribution plus the accrued Profit. CRA stated that provided this purchase agreement (the "APS") contained all the relevant terms:

and if the Purchaser is liable under the agreement to pay the consideration for the supply, then the Purchaser is required to pay the GST/HST payable on the supply. Further, if… [FinanceCo] not liable to pay consideration for the supply under that agreement, then [FinanceCo] is not liable to pay the GST/HST should the Purchaser fail to pay tax on the purchase of the Property.

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 31.

CRA will generally waive any applicable penalty and interest when a person registered for GST/HST: (A) acquires real property by way of sale for consumption, use, or supply (100%) in its commercial activities; (B) fails to self-assess the GST/HST in its return (either because it failed to file one, or filed and did not report the tax); and (C) never claims an ITC in respect of the GST/HST payable. Will CRA generally apply the same administrative tolerance if the reporting period at issue is beyond the (normal) four-year statutory limitation period for claiming an ITC?

CRA responded that "generally" it "will look to the same application of administrative tolerance where the ITC is now statute barred," but "on a case by case basis."

GST Memorandum (New Series) 19.1

After noting that registrants who are using or supplying the required real estate primarily in the course of commercial activities should report the acquisition on the regular (GST 34) return rather than GST 60, CRA states (at para. 90):

Note that if the recipient pays the tax to the supplier in error, the obligation to self-assess the tax under subsection 228(4) is not relieved.

Example – For example, Developer A, a registrant, takes over a construction project from Developer B, also a registrant, by purchasing the land and the units already under construction. The recipient, Developer A, pays an amount as consideration for the project and another amount that is clearly stated in the sale documents to be the GST/HST paid by the recipient and collected by the supplier, Developer B, in respect of this taxable supply of real property. In this situation, Developer A is till assessable under the provisions of section 296 for tax in respect of the acquisition of the taxable supply of real property, even though an amount was paid as tax to the supplier. In this case, it would be the responsibility of the recipient to recover the tax paid in error to the supplier.

GST M 500-2-6 "Other GST Returns" under "Goods and Services Tax Return for Acquisition of Real Property"

Subsection 228(7)

Articles

Allan Gelkopf, Zvi Halpern-Shavim, "Five Arbitrary Differences between Corporations and Partnerships for GST/HST Purposes", Sales and Use Tax, Federated Press, Volume XIII, No. 2, 2015, p. 674.

Set-off mechanism not available for partnerships (p. 675)

Subsection 228(7) of the ETA permits a set-off of refunds or rebates under certain circumstances by one person against tax owing by another person. . . .

The Offset of Taxes (GST/HST) Regulations provide that these rules apply in respect of closely related entities. …

One prescribed circumstance for the offset to be available is that "the person who may reduce or offset the tax that is remittable and any other person who may be entitled to a refund or rebate under the Act are corporations." Partnerships do not qualify. …

Section 229

Subsection 229(1) - Payment of Net Tax Refund

Administrative Policy

CBAO National Commodity Tax, Customs and Trade Section – 2014 GST/HST Questions for Revenue Canada, Q. 7

It appears that these refunds are being withheld when an audit is about to take place even if the returns have been filed and duly paid. Is this authorized? CRA responded:

Subsection 164(1) of the Income Tax Act and subsection 229(1) of the Excise Tax Act require that the Minister pay refunds with "all due dispatch" after the corresponding return is filed. This term allows for some discretion on the part of the Minister. When determining a refund amount, it is both fiscally responsible for the CRA to examine the potential liability of the claimant where other amounts may be due and payable and fair to both parties… .

Subsection 229(3) - Interest on Refund

Administrative Policy

CBAO National Commodity Tax, Customs and Trade Section – 2014 GST/HST Questions for Revenue Canada, Q. 5

In some cases the payment of an alleged deficiency precedes the notice of assessment by a significant period of time. Respecting the calculation of interest if the assessment is successfully appealed, CRA stated:

Where a person has paid an amount on account of tax, net tax, penalty, interest or other amount assessed under section 296, and the amount paid exceeds the amount determined on reassessment to have been payable or remittable by the person, the Minister will refund the amount of the excess, together with interest on the amount, for the period beginning on the day the amount was paid and ending on the day the refund is paid.

Section 231

Subsection 231(1) - Bad Debt — Deduction From Net Tax

See Also

Vivaconcept International Inc. v. The Queen, 2013 TCC 336

The appellant, a registrant in the events management business, invoiced a customer (Flora) for a total of $1,769,694 including GST of $103,440 for services rendered (and invoiced, see para. 22) over a 12-month period ending on October 2006, but was unable to collect anything as Flora was determined to be insolvent in November 2006. Flora made a settlement offer to its creditors in February 2007, which the appellant accepted, but no payments were made thereunder.

After Revenue Quebec indicated (at the end of 2008) that it would deny the appellant's claim (made for its quarterly reporting period ending on 31 January 2007) under s. 231 on the basis that the situation instead had called for a claim under s. 232 (apparently based on viewing the February 2007 agreement as an adjustment to the consideration), the appellant (in January 2009) entered into a write-off agreement with Flora, issued a credit note to Flora, and claimed a credit under s. 232(3) for the GST of $103,440 in its return for the reporting period ending on 31 January 2009. Revenue Quebec considered that the credit note had not been issued "within a reasonable time," as required by s. 232(3).

After stating (at para. 19) (TaxInterpretations translation) that the jurisprudence indicated "that the creditor need not have taken proactive measures if it reasonably and sincerely believed that recovery was impossible," Tardif J concluded (at para. 30) that in light of Flora's known insolvency, it was appropriate at the effective time of the bad debt claim to consider the debt to be irrecoverable and that any expense or effort to recover it would have been "a pure waste of energy and money." Respecting the "write-off" branch of s. 231(1), he stated (at para. 39) that "a contemporaneous document recording the decision to write-off the debt appears essential to the application of section 231," and (at para. 40) that here, the preponderance of evidence indicated the satisfaction of the write-off requirement.

The disposition of the "reasonable delay" issue is summarized below under s. 232(3). The appeal was allowed.

Ministic Air Ltd. v. The Queen, 2008 TCC 296,

The appellant was not entitled to a credit under s. 231(1) in respect of the GST of approximately $170,000 owing to it as there was "little evidence as to the actual measures taken by the appellant to collect any specific debt" (para. 12), there was no evidence of the debt having been written off in the reporting period in question (although, at para. 14, the finding in Burkman v. The Queen, [1997] G.S.T.C. 98, "that a written note, as opposed to a journal entry, could satisfy the requirement that the debt must be written off in the books of account, in circumstances where no ledger existed" was accepted.) Furthermore, 1/3 of the appellant's receivable was owing by the holder "Garden Hill") of 98% of its shares. In this regard, Bowie J rejected the appellant's submission (at para. 20) that the provisions of ITA s. 251(2) (adopted for ETA purposes by ETA s. 126(2)) "simply raise a rebuttable presumption that the appellant and Garden Hill did not deal at arm's length, and that this presumption is rebutted by the evidence that the appellant's policy was to provide service to Garden Hill and its members at the same commercial rates that it charged to all its other customers."

McCool v. The Queen, 2005 TCC 357

In finding that the appellant, a criminal lawyer, had not satisfied the "writing off" requirements of s. 231(1) in respect of amounts owing to him by the Ontario Legal Aid Plan, Bonner J stated (at para 6):

[A] bad debt cannot be considered to have been written off in a person's books of account unless and until a notation is made in those books that the particular debt has been written off. …A journal entry ought to be made to clear out each worthless receivable. Otherwise, subsection 231(3) would be impossible to enforce.

Administrative Policy

P-084R "Forgiven Debts Considered Bad Debts" 8 March 1999

[F]orgiven debts pursuant to an arrangement under the Companies' Creditors Arrangement Act are considered to be bad debts as opposed to reductions of consideration. As such, the provisions of section 231 of the ETA apply to forgiven debts as opposed to the provisions of section 232 of the ETA.

B-042 "Refund, Adjustment or Credit of GST"

Policy Statement P-029R "Bad Debts Reduction when Accounts Receivable are Bought or Taken Back"

GST Policy Statement P-029, dated September 4, 1992 "Assignment of Accounts Receivable"

A registrant is entitled to claim a deduction pursuant to the provisions of subsection 231(1) of the Act in situations where the receivable has been transferred, such as by way of assignment, and the registrant has been required to buy or take back the receivable, provided the other requirements of the subsections have been met (i.e., the registrant had charged, collected, remitted and accounted for the GST on the sale and subsequently found that it could not collect i.e., bad debt)."

Articles

Steven D'Arcy, "Tax Paid in Error", Canadian GST Monitor, No. 136, 31 January 2000, p. 1.

Section 232

Subsection 232(2) - Adjustment

Administrative Policy

GST/HST Memorandum 12.2 "Refund, Adjustment, or Credit of the GST/HST under Section 232 of the Excise Tax Act" April 2008

6. A reduction in consideration may occur under the following circumstances:

- when some or all of the consideration is returned;

- as a result of surpassing a certain volume of purchases, i.e., a volume rebate;

- where goods delivered are found to be substandard; or

- where goods are returned to the supplier for a full or partial refund of the consideration.

7. The reduction in consideration must be given to the original recipient of the supply, or that person's agent, and must relate to an amount that has been collected or charged.

P-084R "Forgiven Debts Considered Bad Debts" 8 March 1999

[F]orgiven debts pursuant to an arrangement under the Companies' Creditors Arrangement Act are considered to be bad debts as opposed to reductions of consideration. As such, the provisions of section 231 of the ETA apply to forgiven debts as opposed to the provisions of section 232 of the ETA.

Subsection 232(3) - Credit or Debit Notes

See Also

Vivaconcept International Inc. v. The Queen, 2013 TCC 336

This case is summarized in greater detail under s. 231(1). In brief, the appellant claimed a bad debt credit under s. 231 with respect to the GST in a customer receivable. After Revenue Quebec indicated that it would deny this claim on the basis that the situation instead engaged s. 232 (apparently based on the acceptance by the appellant of a proposal made by the customer to its creditors almost 23 months previously), the appellant thereupon issued a credit note to the customer, and claimed a credit under s. 232(3) for the GST in its return for the related reporting period. Revenue Quebec considered that the credit note had not been issued "within a reasonable time," as required by s. 232(3). Tardif J first found that the appellant was entitled to the s. 231 credit.

Respecting the "reasonable delay" issue arising under s. 232(3) in the alternative, Tardif J stated (at para. 55) that "it is true that a delay of 23 month is relatively long," but found that it was reasonable in the circumstances as the appellant did not find out that Revenue Quebec was denying its bad debt claim until shortly before issuing the credit note. The appeal was allowed.

Quinco Financial Inc. v. The Queen, 2013 TCC 20, aff'd 2014 FCA 108

For income tax planning reasons, the registrant followed a practice of not claiming input tax credits ("ITCs") for a number of successive monthly reporting periods ("Deferral Periods") and then, in its return for the reporting period following that grouping of Deferral Periods (the "ITC claim return"), claimed ITCs for the Deferral Periods.

Suppose that in a Deferral Period, the registrant was invoiced $1,070 including GST, and received credit notes (e.g., respecting order shortfalls) for $107 including GST. In its ITC claim return, it claimed ITCs of $70-$7, or $63 for that Deferral Period. Later, on the advice of KPMG, the registrant claimed ITCs for a further $7 (the "Residual ITC") in a return for a reporting period subsequent to that for which it filed the ITC claim return. (In fact, the Residual ITCs were claimed in returns for five different reporting periods within the s. 225(4) ITC-barring periods in respect of a three-year period of Deferral Periods commencing in 2000, and totaled $3,910,610.)

In finding that the registrant was entitled to the Residual ITCs, D'Auray J found (at para. 20) that "except for section 232…there are no provisions in the Act that require a registrant to make an adjustment to an ITC as a result of a credit note or debit note being received," so that (reverting to the above example) the registrant was entitled to ITCs of $70 for the Deferral Period as that was the month in which it was invoiced for the related supplies (see ss. 168(1) and 152(1)); and (at para. 26-27) that "additions to net tax will be required pursuant to paragraph 232(3)(c)…only if the appellant has claimed ITCs in respect of credited tax in the same, or a preceding, reporting period as the one in which the credit…notes were issued or received," whereas here the registrant instead claimed such ITCs in subsequent reporting periods.

Dowbrands Canada Inc. v. The Queen, [1997] GSTC 85 (TCC)

The registrant, when it paid volume rebates to customers, was found by McArthur J to be thereby reducing the consideration on the previous sales for purposes of s. 232(2) (stating at p. 85-5 that "volume rebates...[are] a mechanism which reduces the consideration paid by the customer to the manufacturer"). However, it was not obligated under s. 232(2) to rebate GST under s. 232(3) when the consideration was so reduced (as the word "may" only gave it the "option" of doing so), and it did not do so. Accordingly, for purposes of former s. 181.1, s. 232(3) did not apply to the volume rebates.

Administrative Policy

8 July 2013 Interpretation Case No. 145134

In Scenario 1, Corp A, a registrant, makes a taxable supply of tangible personal property to Corp B, also a registrant. On a subsequent refund of a portion of the consideration, Corp A also refunds an amount on account of GST but does not issue (or receive) a credit note (or debit note).

In Scenario 2, Corp A makes a taxable supply of the property to Corp B which, in turn, sells it to Corp C. Corp A then pays a rebate to Corp C and indicates in writing that its amount includes GST.

Respecting Scenario 1, CRA (after noting that a "credit note or debit note can be written in a memorandum, an invoice or in a letter"), stated that as there was no credit note or debit note, there was no adjustment made to the net tax of Corp A or Corp B for the refund. However, the recipient (Corp B) was required (presumably under s. 225(1) –A) to pay the refunded GST to the Receiver General.

Respecting Scenario 2, CRA stated, before finding that s. 181.1 applied:

[G]enerally, section 232 applies to refunds paid or credited by a supplier directly to a recipient in respect of a supply made by the supplier to that recipient, and section 181.1 applies to rebates paid by a supplier to third parties with whom the supplier was not dealing directly (e.g., rebates paid by a manufacturer to consumers in respect of property originally supplied by the manufacturer to a distributor or other intermediary). … [I]f subsection 232(3) applies, then section 181.1 cannot apply by virtue of paragraph 181.1(d).

GST/HST Memorandum 12.2 "Refund, Adjustment, or Credit of the GST/HST under Section 232 of the Excise Tax Act" April 2008

20. ...If the refund, adjustment, or credit of the tax relates to more than one invoice, the note should indicate the dates of the first and last invoices issued. ...

22. There is no requirement to issue a credit note or debit note unless a refund, adjustment or credit of the tax is made by the supplier to the recipient. However, no corresponding adjustment to net tax is permitted unless a credit note or debit is issued.

5 February 2013 Ruling Case No. 141852

Company A (a Canadian-resident registrant) sells crude oil for its market value to Company B (its U.S.-resident affiliate and also a registrant), with title and delivery occurring when it is injected into the pipeline, and with Company B being the importer of record into the U.S. Where Company B does not require the crude oil which it purchased, it will sell the crude back to Company A at the current market price, with payment generally made on a set-off basis.

In finding that the rule in s. 153(3) did not apply, CRA stated:

…the crude oil supplied by [Company B] does not serve as consideration for the supplies of crude oil by [Company A] to [Company B]….[T] here is a difference between property supplied as consideration for other property, and property which is supplied for which a credit is given for use against future supplies.

28 November 2011 Interpretation Case No. 137792

In response to a question as to whether s. 232 applies where the Corporation (which is a registrant) engaged in the resale of tangible personal property sold to it by registered vendors where the written agreement with the vendors provides that the Corporation will initiate subsequent adjustments for price differences, damages or shortage, promotional allowances and freight allowances with no GST or HST adjustments, CRA stated:

There is no requirement to issue a credit note or debit note unless a refund, adjustment or credit of the tax is made by the supplier to the recipient.

After referring to Policy Statement P-243 "Promotional Allowances," CRA stated:

Whether any particular price difference may be either a reduction in consideration under subsection 232 or a promotional allowance which is subject to section 232.1, would be determined by a review of the related documentation.

16 December 2005 RITS No. 76598

CRA would accept a reduction of consideration and corresponding tax adjustment shown on an invoice as meeting the Credit Note and Debit Note Regulations requirements provided that this was clearly indicated.

GST Memorandum 12.2

"Refund, Adjustments, or Credit of the GST/HST under Section 232 of the Excise Tax Act: 'Where the customer is a registrant, the supplier may choose not to refund, adjust or credit the GST/HT previously charged or collected. This may be desirable where the person making the refund, adjustment, or credit had already accounted for the tax and the recipient has already claimed or is entitled to claim a corresponding input tax credit. (para. 13)"

Articles

Sheila Wisner, "Imported Services Price Adjustments - Uneven Ground", Canadian GST Monitor, March, 2009, No. 246, p. 1.

Section 232.1

Administrative Policy

27 July 2012 Interpretation Case No. 126511

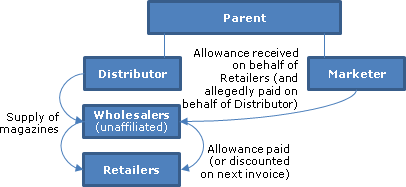

A Distributor and Marketer of magazines had the same corporate parent. The Distributor supplied magazines to Retailers by way of Wholesalers. Under a distribution agreement between the Marketer and Distributor, the Marketer agrees to pay, on behalf of the Distributor, an allowance to the Retailers as an inducement to prominently display the magazines. The allowance is actually paid by the Marketer to the Wholesaler, and the Wholesaler either makes a payment to the Retailer or applies an off-invoice allowance to the next invoice.

CRA stated that the Retailers' provision of services to the Distributor and/or Marketer was "promotion" for the purpose of determining whether s. 232.1 applied to the allowance. The other conditions of s. 232.1 had to be met, including that the payment of the promotional allowance and the supply of the promoted property be made by the same registrant. This requirement could be met on the present facts if the Marketer were paying the allowances as an agent of the Distributor. Not having seen the distribution agreement, CRA declined further comment. However, CRA accepted that it was the Retailer and not the Wholesaler who received the allowance is it was the former "who has a contractual right to receive the Allowance."

28 January 2005 Interpretation Case No. 55951

S.232.1 would apply to amounts paid by suppliers to a retailer to promote specified products, with the retailer offering point of sale "instant rebates" (i.e., a specified dollar amount discount) to purchasers of those products.

P-243

"Section 232.1- Promotional Allowances" 31 May 2004: Includes examples of co-promotion arrangment (Example 1), with s. 232.1 applying both to a discount provided by Manufacturer A and allowance provided by Manufacturer B; and situation where the goods (flour) is consumed rather than resold by the purchaser (a baker) so that s. 232.1 does not apply (Example 3).

Articles

Shashi Fernando-Eden, "Commodity Tax Highlights", CA Magazine, August 2004, p. 34.

Subsection 232.02(4)

Administrative Policy

Brent F. Murray, "Pension Plans: A Step-by-Step Guide for complying with GST/HST Obligations", Canadian GST/HST Monitor, July 2014, Vol. 310, p.1

Issuance of tax adjustment notes (p.3)

[W]here the employer directs the pension plan to pay a particular expense or the employer recharges an expense to the pension plan, GST/HST should be charged and collected by the employer and separately remitted. To eliminate double taxation, sections 232.01 and 232.02 enable the participating employer to issue a "TAN", in prescribed form and containing prescribed information, with respect to a deemed supply of a "specified resource" under subsection 172.1(5) and a deemed supply of an "employer resource" under subsection 172.1(6). On issuance of the TAN, the participating employer is entitled to take a net tax deduction equal to the amount specified in the TAN for the reporting period in which the TAN was issued. The amount of the TAN is generally equal to the lesser of (i) the amount of deemed tax paid under section 172.1; and (ii) the actual amount of tax that became payable under section 165. Given that the employer can only take the net tax adjustment when the TAN is issued, it is beneficial for the employer to issue the TAN prior to its fiscal year end so as to offset its remittance obligations.

Avoidance of TAN procedure (p. 3)

Given the complexities that are associated with TANs, newly enacted section 157 of the ETA allows the employer and the pension plan to make an election (Form RC4615) to deem every taxable supply that is made by the employer to the pension plan to be made for no consideration. Making this election eliminates the double taxation issue and, as such, eliminates the requirement for employers to issue TANs…

Section 236.1

Administrative Policy

GST/HST Memorandum 4.5.2 "Exports – Tangible Personal Property" August 2014

74. A registrant who receives a zero-rated supply of a continuous transmission commodity that is not subsequently exported or supplied, as required for zero-rating under section 15.2 of Part V of Schedule VI, is required to add an amount to its net tax for the reporting period that includes the earliest day in which tax on the initial supply would have become payable had that supply not been a zero rated supply. This net tax adjustment reflects the cash flow benefit obtained by the registrant in having received a supply on a zero-rated basis.

75. The amount to be added to net tax is equal to interest, at the prescribed rate, calculated on the total amount of tax that would have been payable in respect of the supply.

Subsection 236.01(2)

Administrative Policy

28 March 2013 Interpretation Case No. 141341

In finding that, in the situation where a large business is the operator under a joint venture and all three joint venture participants are small or medium businesses, the purchase of electricity by the operator would result in the recapture of the provincial component of HST, CRA stated:

Where the operator is a large business and a joint venture election has been made with one or more participants, the purchases are deemed under paragraph 273(1)(a) to be acquired by the operator and not the participants….Therefore, the recapture of ITCs for the provincial component of the HST would be required under subsection 236.01(2) for all purchases of specified property or services made by the operator, irrespective of whether the participants are large businesses or not.

Section 238 - Returns

Subsection 238(1) - Filing Required

Administrative Policy

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 4

In general, where a corporation became a GST/HST registrant on the first day of its fiscal year and its reporting period as established under s. 245(2) is a fiscal year, its first annual GST/HST return is required to be filed within three months after the end of its fiscal year even if its first fiscal year is a short year.

GST M 500-2 "Returns and Payments"

Section 239

Subsection 239(1) - Authority for Separate Returns

Forms

GST10 "Application or Revocation of the Authorization to File Separate GST/HST Returns and Rebate Applications for Branches or Divisions"

Section 240 - Registration

Subsection 240(1) - Registration Required

Administrative Policy

May 2013 ICAA Roundtable, GST Q. 5 (reported in April 2014 Member Advisory)

[I]f person has provided services to the province of Alberta and has exceeded the small supplier threshold, must it be registered for GST/HST back to that time, even if it is two or three years past? After listing the situations in which a registration will be backdated, CRA responded:

…[T]he mandatory registration for GST/HST will be backdated as far as when the registration become mandatory by meeting one of the conditions shown above. The tax status of a taxable supply of a property or service does not change to a zero-rated supply when made to a qualifying entity of the Government of Alberta; rather, the entity is relieved of paying the GST/HST on the supply.

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 15.

An unregistered non-resident enters into an agreement to supply and install a power generation facility inside Canada with the installation to take about eight months. Subsequently, it assigns the "in Canada" services portion of the contract to its Canadian subsidiary, and the parties and the Canadian subsidiary enter into a restated contract under which these respective roles are set out. In determining whether the non-resident "carries on business" in Canada, will the CRA look to the time of signing of the contract, or to its conclusion; and does the restated agreement represent a "novation" resulting in the cancellation of the original supply in favour of two new supplies by the resident and the non-resident? CRA essentially did not answer the 2nd question, and respecting the 1st stated:

The determination of whether a non-resident is carrying on business in Canada is generally made based on a complete set of facts at the time the non-resident enters into an agreement to make taxable supplies in Canada and those supplies are deemed to be made.

20 August 2012 Interpretation Case No. 140855r (see also Ruling Case No. 137186)

USco (a non-resident which is not registered) provides information to its customers including Canadian customers using its website (without direct human intervention), which is hosted on non-Canadian servers; and also purchases information from a Canadian provider. Its customers pay for subscriptions using credit cards, and USco does not have a Canadian bank account. "USco employees enter Canada on an irregular basis only."

In finding that USco was not required to register, CRA stated:

...the place from which transactions are solicited is in Canada. As discussed, the place where business contracts are made may also be in Canada....even if it were to be determined that the place of contract is in Canada based on additional information, there would be insufficient relevant factors present in Canada to conclude that USco is carrying on business in Canada for GST/HST purposes.

29 March 2012 Ruling Case No. 137186 [solicitation in Canada not sufficient]

A non-resident company which sold on-line books to Canadian residents over the internet was not carrying on business in Canada, given

that the only factors that are present in Canada in this case are the place of contract, solicitation, and payment.

As the company thus was not required to be registered, such supplies of intangible personal property by it were deemed by s, 143(1) to be made outside Canada.

16 March 2009 Interpretation Case No. 110027

After stating that "the categorization of the Nominee as an active or bare trust is significant as it dictates who, between the Beneficial Owner and the Nominee, will be required to account for GST/HST under Part IX and thus who will be required to report tax with respect to the Projects," CRA went on to indicate that the nominee corporation in question was a bare trustee rather than the trustee of an active trust.

Q.23 – Bare Trustee as "Operator" of Joint Venture

…a bare trustee is not seen as carrying on any commercial activity with respect to the trust property, and thus is not eligible to register….

RC2(E) "The Business Number and Your Canada Revenue Agency Program Accounts"

Indicates inter alia that the effective date of registration for someone who is required to be registered is the date it begins to provide taxable goods and services (see quote below), and that a new business number is required if a corporation merges to form a new corporation.

Depending on your situation, you may have to register for the GST/HST regardless of your GST/HST taxable sales. If so, your effective date of registration is the date you began to provide the GST/HST taxable goods and services.

GST/HST Technical Information Bulletin B-068 "Bare Trusts" Amended 10 January 2005

The determination that a trust is a bare trust generally will result in a conclusion that only the beneficial owner should register and that the trustee should not register. Hosever, the earning by a bare trustee of fees for its services would require the trustee to register unless one of the exemptions in s. 240(1) was available.

17 July 1995 Headquarter Letter File 11635-3

A non-resident company offers music discs for sale in Canada under a consignment arrangement with a distributor. The discs are both produced in Canada on its behalf by a contract manufacturer and produced in the U.S. and shipped to Canada. The non-resident would not be considered to be carrying on business in Canada provided that the contract for the sale of the compact discs to the distributor by the non-resident was concluded outside Canada.

Policy Statement P-051R2 "Carrying on Business in Canada" 29 April 2005

In the case of a supply of property by way of lease, factors that are typically of greater importance include the place where the property is acquired by the non-resident lessor and the place where the property is delivered to the lessee. In the case of a supply of a service that is the principal object of the contract (as opposed to a service that is merely ancillary to the supply of property), factors that are typically of greater importance include the place where the service is performed and the place where employees are located.

Ex. 2

Lease of industrial equipment entered into outside Canada, with lessee acquiring possession outside Canada and importing the equipment into Canada: non-resident lessor not carrying on business in Canada.

Ex. 3

Lease of industrial equipment entered into in Canada after the non-resident lessor has imported the equipment into Canada: non-resident lessor is carrying on business in Canada.

Ex. 8

Non-resident carrying on business in Canada where independent sales representative accepts orders and concludes contracts there, delivery is there, and advertising is directed to Canada

Ex. 9

Non-resident carrying on business in Canada where goods (manufactured outside Canada) are shipped from a rented warehouse in Canada pursuant to contracts concluded outside Canada

Ex. 10

Non-resident not carrying on business in Canada where, pursuant to unsolicited orders received outside Canada, goods are shipped directly from the non-resident's Canadian supplier to Canadian customers

Ex. 11

Non-resident not carrying on business in Canada where, pursuant to solicited orders received outside Canada, it delivers and installs specialized equipment at the customer's Canadian address

Ex. 14

Non-resident not carrying on business in Canada where it supplies downloadable audio files through its web site hosted at its main office outside Canada, notwithstanding that contracts are concluded in Canada and internet ads are directed at Canada

P-015 "Treatment of Bare Trusts under the Excise Tax Act", 20 July 1992

"The bare trustee would not be seen as carrying on any commercial activity with respect to the trust property, and thus the trust would not be required to register under the Act."

GST M 200-3 "Calculation of the Small Suppliers' Threshold" under "Determining the Value of Consideration"

The small supplier threshold is calculated by determining the value of taxable supplies made by the person or an associate on a world-wide basis.

Articles

David M. Sherman, "GST Tidbits – Backdating of Voluntary Registrations by 30 Days", GST & HST Times, Release No. 280C – March 2013

At CRA's annual GST/HST meeting with the Canadian Bar Association Commodity Tax section on February 23, 2012, CRA stated in Question 48:

For a voluntary GST/HST registration the CRA will accept an effective date of registration that is within 30 days of the date when the registration was made, regardless of the method of registration (online, telephone, or paper). See attached link to the CRA website for further confirmation.

www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/rgstrng/ffctv-eng.html

We note that the original complaints that generated the review could be easily addressed by merely stopping the "automatic backdating" of registrations with no specified effective date by 30 days.

Barry Hull, "GST Tidbits - Backdating GST/HST Registrations", GST & HST Times, No. 267P, 24 February 2012, p. 5

CRA will no longer automatically allow an HST registration application to be backdated up to 30 days.

Michael J. Welters, "GST Number Caution", Canadian Tax Highlights, Vol. 18, No. 1, January, 2010"

Discussion of denial of taxpayers' claim for ITCs in Systematix Technology Consultants Inc., 2007 FCA 226, on the basis that suppliers had provided invalid GST numbers; and of CRA practice of assigning apparently valid GST registration numbers only for the purpose of processing of rebates.

Vincze, Esteves, "Canadian GST: A Potential Tax Minefield for Nonresidents", Tax Notes International, Vol. 10, No. 12, March 20, 1995, p. 992

RC has taken a very strict approach respecting when a person is carrying on business in Canada for GST purposes, particularly in the area of consulting services.

Forms

RC1 "Request for a Business Number" (HST or GST)

GST/HST Registry: "The GST/HST Registry lets you validate the GST/HST number of a business."

LM-1-V "Application for Registration" (Quebec)

QST Registry "Purpose of the service: To validate a QST registration number"

FIN 418 "Application for Registration for Provincial Sales Tax (B.C. PST))

Subsection 240(3) - Registration Permitted

Administrative Policy

28 January 2014 Interpretation 156861

This interpretation essentially is an advance version of Notice [264] below. CRA stated that if a "nominee corporation is an agent and makes taxable supplies of its services of acting as an agent to the participants in a joint venture, the nominee corporation may register voluntarily if it is not required to register."

RC4022 "General Information for GST/HST Registrants"

If you are a small supplier and you are engaged in a commercial activity in Canada, you can choose to register voluntarily. If you register voluntarily, your effective date of registration is usually the date you applied to be registered. However, we will accept an earlier effective date, provided that the date is within 30 days of the date the application for registration is received, regardless of the method of registration.

GST M 300-4-7 "Exempt Supplies - Financial Services"

If listed financial institutions are not engaged in any commercial activities (e.g., zero-rated financial services), they cannot register.

GST Memeorandum (New Series), 2.3 "Voluntary Registration"

Paragraph 240(3)(a)

Administrative Policy

GST/HST Notice 284 "Bare Trusts, Nominee Corporations and Joint Ventures" February 2014

After noting that a nominee corporation potentially may makes taxable supplies as agent on behalf of the participants in a joint venture, CRA stated:

If the nominee corporation is an agent and makes taxable supplies of its services of acting as an agent to the participants in a joint venture, the nominee corporation may register voluntarily if it is not required to register.

15 November 2011 Headquarters Letter Case No. 135608

Where a "capital pool company" raises capital pursuant to a prospectus on a blind pool basis in order to invest in a company or make an asset acquisition, it will not be considered to be engaged in commercial activity (and, therefore, will not be entitled to register) until it has identified a particular asset acquisition. However, once it has identified an acquisition of assets that will be used in a commercial activity, anything done by the CPC (other than the making of a supply) in connection with the acquisition or establishment of that commercial activity shall be deemed to have been done in the course of the commercial activities of the CPC. Where the targeted acquisition instead is of a corporation, an input tax credit generally only will be available to the extent that the requirements of s. 186(2) are satisfied.

Paragraph 240(3)(b)

Administrative Policy

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 14. ("Voluntary Registration")

Respecting a non-resident person who purchases and sells tangible personal property in Canada, but does not "regularly solicit" orders in respect of such sales, CRA stated:

The CRA will register a non-resident person that purchases and sells taxable tangible personal property for delivery in Canada in the ordinary course of carrying on a business outside Canada, but does not regularly solicit orders in respect of such sales, if that person applies under subsection 240(3)… .

Subsection 240(6) - Security

Administrative Policy

Memorandum (New Series), 2.6 "Security Requirements for Non-Residents" May 1999

6. In general, the amount of security that must be posted is set at a minimum of $5,000 and a maximum of $1 million.

7. The initial amount of security required is based on 50% of the estimated net tax of the non-resident person, whether the net tax be a positive or negative amount, for the 12-month period following registration. After that, the security required will be equal to 50% of the net tax during the person's previous 12-month period.

Subsection 240(7) - Failure to Comply

Administrative Policy

CBAO National Commodity Tax, Customs and Trade Section – 2014 GST/HST Questions for Revenue Canada, Q. 6

What are the implications of the non- resident's failure to provide the required security? CRA stated:

Subsection 240(7), outlines what the CRA can do when there is a failure to comply. Essentially, the provision states that the CRA can retain any GST/HST refund or rebate payable to a non- compliant non-resident as the required security, and any amount retained as security is deemed to have been paid to the non-resident person. Generally, the CRA would not pursue enforcement action under subsection 329(2) where a non-resident corporation failed to provide the required security.

Section 242

Subsection 242(1) - Cancellation

Administrative Policy

GST M 200-8 "Cancellation of Registration"

Section 246

Subsection 246(1) - Election for Fiscal Months

Administrative Policy

GST M 500-2 "Returns and Payments" under "Reporting Periods and the GST Year"

Notwithstanding a threshold amount of under $6 million, "any registrant who wishes to do so may elect to file GST returns on a monthly basis."

Section 254

Subsection 254(2) - New Housing Rebate

See Also

Al-Hossain v The Queen, 2014 TCC 379

After signing an agreement to purchase a new home, the appellant was advised that to secure mortgage financing, he would need to obtain a co-obligor who would also be a co-owner. Accordingly, his friend ("Khandaker") agreed to co-sign the mortgage documents and to be placed on title as a co-owner. At the same time as the appellant applied for the new housing rebate, they signed a statutory declaration stating that the appellant was the 100% beneficial owner and that Khandaker held a 0.01% interest in trust for the appellant. The appellant occupied the home as his principal place of residence to the exclusion of Khandaker.

Before citing Davidson, Lyons J stated (at para. 17) that "where a supply is made to the particular individual as [part of] a group, subsection 254(2) applies so that each individual in the group must meet the criteria in paragraph 254(2)(b)." She found (at para. 22) that since both executed the agreements (and, at para. 29, that "Khandaker understood the nature of his involvement and that he was signing as a co-purchaser and co-owner"), "both individuals are the particular individual and both assumed liability" and "each must therefore meet the requirements in paragraphs 254(2)(a) to (g)." Ss. 254(2)(b) and (g) were not satisfied as Khandaker did not purchase as a primary place of residence and for occupation.

Respecting the statutory declaration, she stated (at para. 27):

The creation of a trust must be properly documented containing the requisite elements of a trust, dated, signed and in existence prior to or contemporaneous with the matter that is the subject of the trust arrangement.

Goyer v The Queen, [2010] GSTC 163, 2010 TCC 511

Angers J. denied the rebate to the appellant who, along with two other individuals, purchased vacant land in Quebec and signed an agreement for the construction of a unit thereon. Only the appellant resided in it and the other two (Miserany and Auger) were co-owners for financing reasons and co-signed the hypothec loan agreement. Angers J rejected a submission that Miserany and Auger were mere prête‑noms for financing reasons and found (at para. 13) that the purchase agreement showed that the unit was constructed for all three individuals. He further stated (at para. 14):

This rebate is also available when the provision of the residential unit is made for a number of individuals, as is the case here, except that the references to a particular individual apply to the entire group. ... In this case, the immovable in question was never used as the primary place of residence of Mr. Miserany and Ms. Auger.

Davidson v The Queen, [2002] GSTC 25, Docket: 2001-985-GST-I (TCC),

The appellant purchased a new duplex. Title was taken in his name and of another ("Waterhouse"), who was not a beneficial owner and was joined as owner for mortgage purposes only. McArthur J held (at para. 8):

The Certificate of Title and the mortgage sets out both individuals, as joint tenants. Pursuant to subsection 262(3), therefore, the references to a "particular individual" in section 254 necessarily refer to both the Appellant and to Ms. Waterhouse. This requires that Ms. Waterhouse also satisfy the conditions of section 254 before the Appellant may claim the GST/HST rebate. As Ms. Waterhouse did not enter into liability with the intention of acquiring the complex for use as her primary place of residence, and is not a relative of the Appellant, the conditions of section 254 have not been met. The Appellant is therefore not eligible to claim the new housing rebate.

Subsection 254(6) - Joint and Several Liability

See Also

GF Partnership v. The Queen, 2013 TCC 53, aff'd 2013 FCA 260

The registrant ("Mattamy"), which was a housing developer, paid municipal development levies at the time it entered into a subdivision agreement with the municipality, or when the municipality issued building permits. The sales agreements with home purchasers stated the parties' agreement that "as part of …the Purchase Price herein, the Vendor has or will pay on behalf of the Purchaser…all applicable development charges…." The development levies which were so reimbursed by the home purchasers were found to be part of the taxable consideration for such home sales, with the result that Mattamy was found to have been understating the sales price to the purchasers. As the new housing rebates ("NHRs") of the purchasers (which they had assigned to Mattamy and which it had rebated to them as contemplated in s. 234(1)) decreased as the sales price increased above $350,000, this increased taxable consideration decreased the NHRs which were properly claimable on some of the sales.

In finding that Mattamy was liable under s. 254(6) for the overstated amount of the NHR rebate claims, Woods J stated (at para. 92) that "in accordance with judicial interpretation of the phrase ‘ought to have known'…the test is an objective one," and then stated (at para. 94):

In my view, a reasonable person in Mattamy's circumstances would have concluded, based on competent professional advice, that the Purchasers did not pay development charges qua development charges. Quite simply, this is the only reasonable conclusion that may be drawn from the Purchase Agreements. Because the amount of a NHR is a function of the consideration for the home, it follows that a reasonable person would have known that some of the amounts paid or credited by Mattamy in respect of Purchasers' NHR claims were excessive.

Paragraph 254.1(2)(d)

Administrative Policy

4 July 2013 Interpretation Case No. 144290

The City leases land to the Developer (with a right to sever and remove improvements on the termination of the lease), and the Developer enters into a "Purchase Agreement" with the Purchaser (conditional upon the Lessor's consent to the transfer of the Lease) for a stipulated purchase price, with the Developer covenanting to construct a townhouse in accordance with specifications. CRA stated:

One of the basic principles of real estate law is that a fixture, such as a building, forms part of the land to which it is affixed, even if the person who affixed the building has retained the right to sever and remove it. …There is no indication in the Lease that the City has given ownership of the building portion of the Unit to the Developer. … The Developer has only an interest in the Unit constructed on the Lot and cannot therefore dispose of something more (i.e., the Developer cannot make a separate sale of the building portion of the Unit). …Instead of the sale of the building portion of the Unit and a lease, or assignment of a lease, in the land portion of the Unit, we would characterize the supply in this case as an assignment of a lease of land on which the building is located (i.e. an assignment of the leasehold in the Unit). As such, neither the condition in subparagraph 191(1)(b)(i) nor the condition in subparagraph 191(1)(b)(ii) is met and the Developer is not required to self-supply the Unit. As there is no self-supply under subsection 191(1), there is no rebate entitlement under section 254.1 (i.e., a… new housing rebate is not permitted). …This is a taxable supply as there are no provisions to exempt the supply.

However, the new housing rebate under section 256 for owner-built homes was available.

Section 256

Subsection 256(2) - Rebate for Owner-Built Homes

Administrative Policy

4 July 2013 Interpretation Case No. 144290

The City leases land to the Developer (with a right to sever and remove improvements on the termination of the lease), and the Developer enters into a "Purchase Agreement" with the Purchaser (conditional upon the Lessor's consent to the transfer of the Lease) for a stipulated purchase price, with the Developer covenanting to construct a townhouse in accordance with specifications. After finding that there was no rebate entitlement under s, 254.1, CRA found that the new housing rebate under section 256 for owner-built homes was available.

Subsection 256(3) - Application for Rebate

Cases

Lim v. The Queen, Docket: 98-1202-IT-G (TCC)

The appellant had demolished the fundamental assumption of the Minister that substantial completion occurred in April 1995 by advancing evidence that he had installed tiles in parts of the house, completed installation of some of the hardwood floor, installed light fixtures, installed moulding on the cabinet and installed shower stalls after that date. As the onus had shifted to the Minister to put forward evidence of another date that was still outside the two-year limit referred to in s. 256(3), and this had not been done, the appeal was allowed. Bowman T.C.J. also stated:

"I have concluded that the construction was not substantially completed until the railing on the stairs and balcony was installed. The appellant could not have obtained a certificate of occupancy before they were completed and they clearly were necessary for the safety of the house."

Bowman T.C.J. also indicated that the application of fixed percentages was not an appropriate method for determining substantial completion.

Paragraph 256(3)(b)

Cases

March v. Canada (Attorney General), [2013] GSTC 60, 2013 FC 394

The appellant built a new home and moved in May 2009. The deadline for her housing rebate application was May 2011, and the appellant filed her application in April 2011. The Minister did not receive the application, and dismissed the appellant's application to extend the filing deadline.

Heneghan J upheld the Minister's decision, as it was within the range of acceptable and rational solutions. There was some suggestion of a postal disruption that would have stopped the Minister from getting the rebate application, but the only evidence that the appellant gave on the extension application was a copy of her original rebate application.

Subsection 256.2(1)

See Also

Boissoneault Groupe Immobilier Inc. c. R., [2013] GSTC 41, 2012 TCC 362

The appellant build a 78-unit residential building meant for university student tenants. Although the appellant intended to enter one-year leases, construction delays meant that the leases in the first year were only 11 months.

Tardif J found that the appellant was nevertheless eligible for a s. 256.2 rebate. Clause (a)(iii)(B) of the definition of "qualifying residential unit" in s. 256.2(1) generally requires that there be a "reasonable expectation" that there be continuous occupancy for at least one year. From prior experience with similar projects, the appellant could expect a retention rate of 90% for the subsequent year.

Tsenkova v. The Queen, 2013 TCC 321

The appellant acquired a condominium unit for investment purposes, and leased it to a company ("Premier Suites") under an agreement which stated: "Landlord agrees that the intention of the Tenant is to sub-let the premises to corporate executives for the purpose of providing temporary accommodation."

Sheridan J found, notwithstanding this clause, that the appellant intended that the unit be used by a long-term occupant, and that the first subtenant in fact used the unit continuously as a residence for more than a year. Accordingly, and applying interpretation principles in Melinte, the property was a qualifying residential unit.

Melinte v. The Queen, 2008 TCC 185

The appellant leased his condo to CIBC World Markets ("CIBC"), which was bound to provide housing for one of its employees while she was on a long-term assignment in Toronto from Montreal. CIBC initially planned to lease the unit for several years, but declined to renew its lease after the first year because of cutbacks. The taxpayer claimed his s. 256.2 rebate sometime in the first year, which the Minister denied (the reasons do not state the basis for this denial).

Webb J found that the property was a qualifying residential unit. Regarding the definition of "qualifying residential unit" in s. 256.2(1), he found that:

- the reference to "individuals" in s. (a)(iii)(B) includes a single individual, so it did not matter that there was only one tenant during the relevant period (para. 11);

- the phrase "place of residence of individuals: in s. (a)(iii)(B) does not entail a requirement that the individuals be party to the lease, so it did not matter that the CIBC was the lessor (para. 19);

- "at a the particular time" in s. (a)(iii) refers to the time that the unit is acquired, so the appellant satisfied the one-year requirement (para. 24); and

- in any event, it was clear that the appellant reasonably believed that the lease would continue for several years, both at the time he acquired the unit and the time the GST became payable.

Subsection 256.2(3)

See Also

Blanche's Home Care Inc. v. The Queen, [2004] GSTC 30, 2004 TCC 192

The appellant was not eligible for the new residential rental property rebate in respect of its purchase of a property that was a "personal care home" under the Personal Care Homes Act and Personal Care Homes Regulations, 1996 (Saskatchewan) in light of evidence of the appellant that approximately $1,000 of the $1,750 monthly fee paid by residents of the home was attributable to personal care services. Baubier J. accepted the submission of the Minister that the appellant was making a single supply of services to the residents under the "Admission Agreements" with them.

Administrative Policy

12 February 2013 Interpretation File 145624

A bare trustee (Properties) entered into an agreement for the purchase of a new residential rental unit on behalf of Holdings, so that the statement of adjustments indicated that Properties was the purchaser. Before indicating that the application for the new residential rental property rebate should be filed by Holdings, CRA stated:

[I]n a bare trust situation, it is the beneficial owner that faces the obligations and entitlements under the ETA. As it applies to this scenario, it is the beneficial owner that may be entitled to the NRRP rebate.

RC4231 "GST/HST New Residential Rental Property Rebate" 28 March 2013

28 May 2004 Ruling RITS 47263

The person constructing a nursing home was not eligible for the rebate, given that the supplies to the residents were exempted under s. 2 of Part II of Schedule V rather than under Part I.

Subsection 256.21(7)

Administrative Policy

9 December 2014 Interpretation 165597

An Ontario builder, who submitted multiple applications for the Ontario transitional new housing rebate (OTNHR) using Form RC7000-ON, Ontario Retail Sales Tax (RST) Transitional New Housing Rebate, indicated that the OTNHRs had been assigned to it. However, neither section F, "Certification", nor section G, "Assignment of rebate", of Form RC7000-ON were signed by any of the purchasers. CRA stated:

Where the CRA receives a Form RC7000-ON in respect of the purchase of new housing by an individual and the assignment of that rebate to the builder, sections F and G of Form RC7000-ON must both be signed by the individual. The CRA should not accept that an assignment of the OTNHR has occurred, or pay any amount of a rebate to a supposed assignee, unless both sections F and G are signed by the individual (or there is other evidence of the individual having certified the information in those sections) and the CRA is satisfied as to the validity of the assignment.

Section 256.74

See Also

Lavigne v. R., 2011 GSTC 122, 2011 TCC 402

The Minister denied the taxpayer's s. 256.74 GST rebate on the taxpayer's purchase of her condominium, because, in moving into her condominium, she took "possession" of it in the sense of s. 256.74 before 2008. Although the taxpayer moved into her condominium in 2007, ownership did not pass to her until 2008. She argued that "possession" should be interpreted in a manner consistent with the Civil Code, as the "exercise of a real right." Favreau J. disagreed, noting that s. 256.74 had originally been drafted in English and therefore the common law meaning of "possession," which included mere tenancy, should prevail. He stated (at paras. 18-19):

The concept of "possession" under civil law is irreconcilable with the meaning that Parliament wanted to confer on the term in ETA provisions regarding the transitional rebate, since possession is an attribute of ownership rights.

Since Parliament does not speak in vain, a meaning must be given to the term "possession" for it to have any effect."

Section 257

Articles

Duquette, "Charities Have to Jump Through Hoops to get GST Rebate on Land", GST & Commodity Tax, Vol. XI, No. 8, October 1997, p. 58.

Section 258

Subsection 258(2) - Legal Aid

Administrative Policy

GST Memoranda Series 13.2 "Rebates: Legal Aid"

Section 259

Subsection 259(1) - Definitions

Facility Operator

See Also

Elim Housing Society v. The Queen, 2015 TCC 282,

The appellant ("Elim"), a B.C. non-profit organization, sought the enhanced (83%) public service body HST rebate respecting a long-term care facility with up to 118 residents (mostly with dementia, severely impaired mobility, complex medical issues and a life expectancy of between three months and three years), which was constructed and operated by it (the "Harrison"), on the basis that it was making "facility supplies." There were five nurses and 16 care aides available to provide care during the day. Before allowing Elim's appeal, Woods J found:

- Elim provided a medically necessary process of health care (noting, at para. 63, that "much of the care… is delivered through care plans, created by nurses, and which are tailored to address specific medical concerns" and rejecting, at para. 64, the Crown submission that "the term ‘medically necessary' should mean medically necessary as determined by a physician")

- there was active involvement of physicians (stating, at para. 71, that "the physicians generally have a pro-active approach by visiting their patients roughly every two weeks…[, they] receive updates from the nursing staff…[and] are available at all times and participate in The Harrison's inter‑disciplinary meetings and medication reviews")

- the residents were subject to medical management (stating at, para. 78, that "it is not necessary that the physician have management of the health care process itself")

- residents received sufficient therapeutic health care services

On the last point, she stated (at paras. 83, 86, 90-91, 95-97):

The gist of the dispute between the parties is whether the services provided by care aides at The Harrison, such as toileting and bathing, are therapeutic health care services.

…[T]he term "therapeutic" can mean "having a good effect on the mind or body": Cuthbertson v. Rasouli, 2013 SCC 53… .

…[M]any of the routine services provided to residents by care aides apply nursing expertise to address particular medical concerns…[and are] of a different type than ordinary assistance with activities of daily living… .

The agreed upon test was that therapeutic health care services had to be provided for at least 2.4 hours (10 percent) each calendar day. … [J]udicial interpretations…do not support the bright line 10 percent test. … The Harrison received funding during the relevant period for 2.8 hours of care per resident per day. Since some of the care… is provided in groups (e.g. oversight for choking risk at meals), the funding actually provides greater than 2.8 hours… .

Administrative Policy

3 July 2012 Ruling Case No. 109082

The residents in a nursing home