Section 161 - Early or Late Payments

See Also

Acme Video Inc. v. The Queen, [1995] GSTC 49 (TCC)

Late return charges made by a video rental store operator did not represent charges for late payment and, therefore, were not covered by s. 161.

Administrative Policy

GST M 300-7 "Value of Supply" under "Early/Late-Payments"

General discussion.

Subsection 165(3)

Administrative Policy

GST M 300-7 "Value of Supply" under "Pay Telephones"

General synopsis.

Section 162

Subsection 162(2) - Natural Resources

Administrative Policy

6 June 2014 Interpretation 150533

In finding that an agreement between two forestry companies (Company A and B), under which A Co will manage and harvest timber within B Co's licences, was not for the right to exploit a forestry resource to which s. 162(2) applied, CRA noted that "a person, who cuts trees where the timber remains the property of the person who was originally granted the right to exploit the resource, is not utilizing the resource or turning it to account," and then stated:

In substance, the purpose of the agreement is for A Co to supply to B Co a service of cutting trees. This position is supported by the fact that…the agreement states that title to the felled timber passes to B Co when the timber is felled in accordance with the applicable B Co licence. … Since B Co already owns the logs, the amounts paid by B Co are not consideration for a supply of logs by A Co but would appear to be [taxable] compensation paid to A Co for cutting the timber.

On the other hand, under a second agreement, B Co grants to A Co (in this regard, a "Harvesting Party") the right to harvest timber under the B Co licences for its own consumption at its mills on the terms and conditions contained in the agreement, and A Co grants to B Co (in this regard, also a Harvesting Party) the right to harvest timber under the A Co forest licence for its own consumption at its mills. In finding that s. 162(2) applied to both supplies, CRA stated:

The… harvested timber becomes the property of the Harvesting Party at the moment it is felled. Thus, the agreement is not for a supply of cut timber… . Nor is the agreement for a supply of a service of cutting trees, since title to the cut timber passes from the licence holder to the Harvesting Party. Furthermore, if the agreement was for a supply of a service of cutting trees, the Harvesting Party performing the cutting would be receiving payment, not making payment.

However, the provision of the licence holder's planning, engineering and assessment work was a taxable supply.

21 July 2014 Ruling 142194 [electricity not a product of water]

As part consideration for its services to Company A, an engineering firm receives from Company A a royalty equal to a percentage of the gross proceeds from the electricity generated by the contemplated hydroelectric plant. After ruling that s. 162(2)(c) does not apply to the supply (so that the royalty payments are consideration for a taxable supply of an engineering study), CRA stated:

Payments made to the Engineer pursuant to the Agreement are not computed by reference to the production from a natural resource as required by this paragraph. It is the CRA's position that although water is a necessary element required in the operation of a hydroelectric facility, water does not produce electricity nor is electricity a product of water.

29 August 2013 Interpretation 143128

The Optionor "options" mineral resource Tenures to an Optionee who is granted the right to explore the Tenures, and is required to make specified annual payments, to expend certain amount annually on exploration or development, to issue common shares of the Optionee and to assume all the costs for maintaining the Tenures. If these conditions are met, at the end of the specified period of XX years, the Optionor transfers title to the Tenures to the Optionee. In finding that the "optioning" under the agreement by the Optionor was a provision of natural resource rights in respect of an unproven property which s. 162(2)(a) deemed not to be a supply, CRA stated:

Strictly speaking, an option to acquire something is not necessarily the same as acquiring the thing itself and an option to acquire something is generally considered to be a supply. However…we do not consider the Optionor to be making a separate supply of the option. As long as the Optionee meets its obligations, it will automatically acquire the Tenure. It will be deemed to have exercised the Option, and no further consideration is paid. The nature of the Agreement is similar to a conditional sales contract for the sale of a good, whereby title to the good passes automatically upon full payment of the consideration.

Notice 269 – Draft GST/HST Memorandum 3.7, "Natural Resources" 15 February 2012

Overview of section 162

1. Section 162 deems the following supplies of natural resource property rights not to be supplies for GST/HST purposes:

- a right to explore for or exploit a mineral deposit, a peat bog or deposit of peat or a forestry, water or fishery resource,

- a right of entry or user relating to such rights,

- any right to a royalty or profit interest in relation to the resource, or

- a right to enter or use land to generate or evaluate the feasibility of generating electricity from sun or wind.

Meaning of mineral ss 123(1)

3. "Mineral" includes... substances that are considered to be minerals within the ordinary meaning of that word. Although not specifically mentioned, rock and riprap are also included.

Freehold v. royalty

19. Subject to the exceptions set out in subsection 162(3), a supply of a right to explore for or exploit a mineral deposit, if supplied by itself, is deemed not to be a supply pursuant to subsection 162(2). Where the right to explore for or exploit a mineral deposit is only one component of a supply of a bundle of rights, subsection 162(2) does not apply because subsection 162(2) applies only to supplies of those rights that are specifically listed therein. Therefore, subsection 162(2) does not apply to a sale of a freehold mineral title or a sale of land that includes the underlying minerals.

GST M 300-7 "Value of Supply" under "Natural Resource Royalties"

General synopsis of ss.162(1) and (2).

Subsection 162(4) - Exploration and Development of Mineral Deposits

Administrative Policy

29 August 2013 Interpretation 143128

After noting that "special rules are in place in subsection 162(4) to eliminate the requirement to establish a value for certain property or services exchanged between a farmor and a farmee in a farm-out agreement that is entered into for the purpose of the exploration and potential development of real property for mineral deposits," CRA stated:

[B]y virtue of paragraph 162(4)(b), the farmee's contribution need not be valued for purposes of determining any tax on the property or services given by the farmor. This is achieved by deeming the value of the farmee's contribution as consideration for any property or service given by the farmor to the farmee under the agreement to be nil.

However, if part of the consideration given by the farmor for the farmee's contribution is a service or property (each of which is referred to as the farmor's additional contribution) that is not a natural resource right in respect of unproven property:

- the farmee is deemed to have supplied a separate taxable service to the farmor and this separate service is deemed to be consideration for the farmor's additional contribution; and

- the value of the farmee's service is deemed to be equal to the fair market value of the farmor's additional contribution.

CRA provided an example:

[A] GST/HST registered farmor supplies natural resource rights in an unproven property and transfers equipment with a fair market value of $8,000 to a farmee in return for the exploration and development of the unproven property, and a processing service to be provided by the farmee. The usual charge for the processing service performed by the farmee is $10,000. The farmor must charge the farmee tax calculated on the value of the equipment that the farmor is supplying to farmee (i.e., $8,000). In turn, the farmee is deemed to have supplied a service to the farmor for the same value of consideration that was paid for the equipment and must charge tax to the farmor, which is calculated on $8,000. The farmee must also charge the farmor tax on the processing service actually supplied.

However, the tax on the processing service is only calculated on $2,000 (the amount by which the value of the service exceeds the value of the equipment). Therefore, the farmee must charge tax on the total amount of $10,000 (the fair market value of the processing service).

Consequently, with respect to the ancillary supplies of property and services between the farmor and the farmee, each party is required to charge tax on the fair market value of the supply that they made and to pay tax on the fair market value of the supply that they received in return.

Section 163

Subsection 163(1) - Consideration for Portions of Tour Package

Cases

Club Med Sales Inc. v. The Queen, [1997] GSTC 28 (TCC)

The appellant, a registrant, provided zero-rated vacation packages to customers who had also paid a non-refundable "membership fee" in the previous twelve months. In finding that this fee was part of the consideration for the zero-rated vacation package, Dussault TCJ. noted (at p. 28-10) that "if one concludes that there is a supply separate from the supply of the vacation package it must be of 'a useful article or service'" and that, here, the alleged benefits attached to membership "represent nothing more than promotional literature used by Club Med for marketing its vacation packages at Club villages abroad" (p. 28-11).

Administrative Policy

GST M 300-3-6 "Travel Services"

Section 164

Administrative Policy

GST M 300-7 "Value of Supply" under "Donations to Charities and Political Parties"

Where a charity conducts a fund-raising dinner, that part of the consideration paid for the dinner by an individual recipient for which he could receive a receipt for income tax purposes will not be subject to GST.

Section 165 - Imposition of Tax

Subsection 165(1) - Imposition of Goods and Services Tax

Cases

Imperial Parking Ltd. v. Canada, [2000] GSTC 52, Docket: A-27-99 (FCA)

The appellant operated a parking lot with a variety of payment options, including permits, hourly rates, and overnight rates. It posted notices in its lot that vehicles that did not otherwise obtain authorization would be charged $50. Robertson JA affirmed the Minister's opinion that the $50 "fines" were consideration for a taxable supply - the provision of parking services. He stated (at para. 13):

Properly construed, the agreement contemplated by the appellant's signage is that a motorist will pay a maximum of $50 per day for use of a parking space and less if the terms of the contract relating to payment of the lower hourly, daily or evening rates are adhered to. The terms of the contract are clear. If you want to pay less for a parking spot, purchase a ticket for the time needed. If you overstay, then you will pay more than the minimum as well as run the risk of having your vehicle towed. In summary, an overstayer remains contractually bound to the appellant until such time as the latter receives payment in accordance with the terms of the contract.

See Also

Simon Fraser University v. The Queen, [2013] GSTC 57, 2013 TCC 121

The appellant, a university, maintained parking spaces around campus and imposed parking fines pursuant to special statutory authority. The signs setting out the parking rates did not describe the fines other than to say "vehicles not displaying valid receipts are subject to ticketing." The Minister argued that the fines were consideration for a taxable supply (being the provision of parking services) and therefore were subject to GST or, in the alternative, that they were subject to GST under s. 182 on the basis of a breach of contract for those parking services.

C Miller J granted the university's appeal. The fines were pure fines rather than consideration for parking services. They were imposed pursuant to the university's mandate to conduct university business rather than a profit motive, and the obligation to pay was based on the university's statutory powers rather than contract. These two factors distinguished the present case from Imperial Parking. C Miller J stated that a non-paying driver does not agree to pay a fine as consideration for the supply of the parking spot - "the agreement is basically, if I get caught I pay a fine."

Stanley J. Tessmer Law Corporation v. The Queen, 2013 TCC 27

The appellant did not collect GST on the legal fees charged to some of its clients, who were defending against criminal charges. Paris J. found that the defendants' Charter rights under s. 10(b) and 11(d) to legal counsel did not entail a right to be exempt from GST. As a basic charging provision, s. 165 is a law of general application whose purposes do not include impeding a defendant's right to counsel; nor did the appellant demonstrate that s. 165 brought about an unconstitutional result, or that it could hypothetically bring about such a result.

Customs & Excise Commissioners v. Plantiflor Ltd., [2002] UKHL 33, [2002] 1 WLR 2287, [2002] STC 1132', [2002] BTC 5413 (HL)

The taxpayer, which sold horticultural products by mail order, indicated in its catalogue that customers would pay an additional charge to cover the costs of postage and packing, and stated "We will then advance all postage charges to Royal Mail on your behalf."

After finding that there in fact was only one supply involved (of delivered bulbs) Lord Slynn went on to find that, even if there were two supplies, the portion of the money received by the taxpayer for postage constituted part of the consideration received by it for the supply of the bulbs. The argument that the taxpayer received that portion as agent for the Royal Mail was contrary to the terms of the agreement between it and the Royal Mail, which made it clear that the Royal Mail was to deliver parcels for the taxpayer, i.e., there was no link between the Royal Mail and the customer.

Administrative Policy

25 August 2004 Headquarter Letter RITS 53938

A surcharge made by a car dealership to its customers in order to recover the cost to it of an amount payable by it to the manufacturer to reimburse the manufacturer for a $100 excise tax imposed on an air conditioner included in the car, would be part of the consideration for the sale of the automobile.

23 December 2002 Technical Interpretation RITS 38588

"Where a separate amount is paid by a lessee on account of property taxes, this amount is part of the consideration for the rental of the property, even if the lessee pays the amount directly to the municipality ... While the Tenant may be responsible under the agreement to pay property taxes to the municipality, the ultimate liability to pay the property taxes rests with the Landlord."

30 April 1999 Technical Interpretation RITS HQR001701

"... The payment of property taxes by a tenant, pursuant to the terms of a lease agreement, constitutes consideration for the lease of property where the landlord has a joint liability to pay such property taxes."

GST Memorandum 500-7 "Interaction Between the Excise Tax Act and the Income Tax Act," 26 November 1991, para. 67

The portion of the consideration for a taxable supply made by a charity or political party, that can reasonably be regarded as a gift or contribution, is that amount for which a receipt could be issued, or in the case of a donation to a charity, a receipt that could be issued to an individual. The GST is not charged on the portion that is deemed to be the gift or contribution.

Subsection 165.2(2)

Administrative Policy

28 November 2011 Interpretation Case No. 125136

It is pemissible both to compute the federal and provincial components of HST separately and round each component in accordance with s. 165.2(2), or to compute the combined HST first, and then so round.

The phrase "tax that is at any time payable" in subsection 165.2(2) is sufficiently broad to allow both rounding of total tax and rounding of each of the fderal and provincial part. As long as a registrant is consistent in its choice of method, and reports the tax charged, either method would be acceptable.

Section 166 - Supply by Small Supplier Not a Registrant

Administrative Policy

GST M 300-1 "Liability for Tax" under "Small Suppliers"

No tax is payable or collectible on taxable supplies made by small suppliers.

Section 167

Subsection 167(1) - Supply of Assets of Business

See Also

Cinnamon City Bakery Café Inc. v. The Queen, docket 2001-405-GST-I (TCC),

The appellant had established and operated cafés in major shopping malls and subsequently sold the cafés as franchises. Such sales to various franchisees qualified as the supply of a business for purposes of s. 167(1). However, no elections were filed on a timely basis and franchise fees received for the provision of initial training and procedure manuals to the franchisees and for the licencing of trademarks would have been excepted from the operation of s. 167(1) by virtue of s. 167(1.1). Although s. 167.1 would have allowed goodwill to be transferred free of GST, the appellant had been unable to specify in any way the value of the goodwill.

Customs and Excise Commissioners v. Padglade Ltd., [1995] BTC 5258 (Q.B.D.)

Schiemann J. found that the VAT tribunal had not made an error of law in finding that a transfer of stock and equipment to the taxpayer from a related corporation did not represent the transfer of part of a business as a going concern for VAT purposes in light inter alia of the fact that the intention of the vendor (which was in financial difficulty) was to achieve a certain value for the items in stock and, thereby, pay off creditors, and in light of evidence that the taxpayer did not intend to pursue a similar business to the vendor.

Administrative Policy

25 July 2014 Interpretation 158278

In finding that the grant of a franchise by the Franchisor to a new Franchisee respecting a specific site qualified as the supply of a business that was established by the supplier (the Franchisor) notwithstanding that the Franchisor did not directly supply real estate to the franchisee and the site instead was subleased by a subsidiary of the Franchisor to the Franchisee, CRA stated:

… Real property, whether purchased or leased, is normally required to carry on a food restaurant store/business.

[Here] the Franchisor is to provide to the Franchisee the right and licence to use proprietary marks, assistance in obtaining an approved location, initial training including the services of one experienced employee and loan of manuals, as well as having plans/specifications prepared and construction, decoration, outfitting of the required fixtures, furnishings, equipment, signs, accessories, supplies, etc. necessary to permit the Franchisee to commence the operation of the Franchised Business. Since the Franchise Agreement includes terms that transfer all of the above, and terms under which the land and buildings are transferred under a Sublease assigned by the Franchisor's subsidiary, the first condition to the election is met.

Respecting the second ("all or substantially all") test, CRA stated:

Any property acquired by the Franchisee subsequently or already in the possession of the Franchisee that can reasonably be regarded as being necessary for it to be capable of carrying on the Franchised Business would need to be 10% or less of the fair market value of all the property required to carry on the business.

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 20. ("Reorganizations - Amalgamations")

Shares of Newco, which was incorporated solely for the purposes of purchasing all of the business assets of a supplier, are sold to a third party purchaser and Newco is immediately amalgamated with the purchaser after the asset transfer. In confirming that the s. 167 election would not be available for the business acquisition by Newco if Newco did not carry on a business before its amalgamation, CRA stated:

Under section 271, an Amalco is deemed for GST/HST purposes to be a separate person from each of its predecessors, except as otherwise provided under the ETA. … There is no provision deeming a predecessor (in this case, Newco) to acquire the characteristics of its successor Amalco. In other words, Newco's ability to register cannot be based on the proposed actions of a corporation, i.e., Amalco, that does not exist at the time Newco needs to be a registrant so it can make the section 167 election.

In confirming that a s. 167 election is not available to Amalco where an operating company ("Opco") is amalgamated with another corporation, and the amalgamated corporation (Amalco) immediately sells all of the assets, CRA stated:

One of the conditions for making an election under subsection 167(1) is for the supplier to be supplying a business or part of a business that was established or carried on by the supplier or that was established or carried on by another person and acquired by the supplier. Since a predecessor corporation (in this case, Opco) is the entity that established or carried on the business, the Amalco cannot be considered to have done so, since it is deemed to be a separate person for GST/HST purposes. Moreover, the Amalco did not acquire the business from its predecessor (Opco) since paragraph 271(c) deems the transfer of property from Opco to Amalco not to be a supply for GST/HST purposes.

P-013 - "Accounts Receivable for Consumption in the Course of Commercial Activities"

Under the former version of s. 167(1), accounts receivable were not considered to be included in the determination of whether "all or substantially all" of the property was being transferred.

9 July 2003 Headquarter Letter Case No. 45377

"The supply by a partnership of an undivided interest in the partnership property to one of the partners would generally not be considered to be a supply of a business or part of a business because it cannot operate on its own and as a result, the election under subsection 167(1) would not be available."

19 March 2003 Ruling RITS 41838 [acquisition of real estate through lease]

Where a lessee agrees to pay monthly rentals for the leasing to it of the property of a business (which it commences to carry on), but with a lump sum paid for the buy-out of inventory of the lessor, and with the option after X months to purchase the leased property for a stipulated sum, an s. 167 election would apply to the inventory buy-out payment and the payment of the option exercise price. The form GST 44 would be filed by the filing date for the return for the reporting period in which the GST otherwise would have been payable on the inventory buy-out. The s. 167 election would not apply to the lease payments.

1996 Corporate Management Tax Conference Round Table, Q. 10

Where the purchaser of a "mothballed" restaurant must spend more than 10% of the purchase price to equip the restaurant before beginning its operations, the "all or substantially all" test would not be satisfied.

"Where a person purchases the land, building, or the manufacturing equipment, all the related office equipment and goodwill then generally the person is acquiring all or substantially the property that can reasonably be regarded as being necessary to carry on the business ...".

R.C. discusses various requirements for the purchase of an undivided interest in an oil and gas joint venture to qualify for the election.

GST Memorandum (New Series), 14.4 - Sale of a Business or Part of a Business, December 2010.

7. The value of any property that is not acquired under the agreement for the supply, but that the recipient requires to carry on the business must generally be not more than 10% of the fair market value of all the property necessary to carry on the business.... The recipient must be capable of carrying on the same kind of business that was established or carried on, or acquired, by the supplier, with the property that the recipient has acquired under the agreement.

9. In general, a "part of a business" is an activity that may be a functionally and physically discrete operating unit, or it may be an activity that supports or is related to the broader business, but is organized as a separate activity that is capable of operating on its own. The guidelines that apply when determining if there is a supply and acquisition of a business also apply when determining if there has been a supply and acquisition of "part of a business". [CRA then provides example of the sale (eligible for the election) by a pulp and paper company of the inventory, equipment and goodwill of its printing division, with the real estate being leased to the purchaser.]

21. In the case of a supply by a franchisor to a franchisee of a new business, the franchisor must make a supply of a business that was established (i.e., a turn-key operation and not just certain individual assets) in order to qualify for the election under subsection 167(1). In general...the following property and services should be included...: right to use a trade name/trademark, land and building, equipment necessary to operate the business, initial inventory, training of principals and staff, and operating manuals.

22. ...[W]ith respect to some service businesses, the nature of business is such that the land and building are not significant to the business operations (e.g., the office space required is minimal and the service is provided at the customer's location). In this case, a supply that does not include the land and building may still qualify as the supply of an established business... .

Forms

GST44 "Election Concerning the Acquisition of a Business or Part of a Business"

Do not use this form if you are a recipient that is a selected listed financial institution (SLFI) for Quebec Sales Tax (QST) purposes. Instead use Form RC7244, Elections Concerning the Acquisition of a Business or Part of a Business by a Recipient that is a Selected Listed Financial Institution for QST Purposes. ...

A recipient who is a GST/HST registrant must send this form with their GST/HST return for the reporting period in which the acquisition was made to the address specified on the return. If you file your GST/HST return electronically, send this form to your tax centre. When the supplier and recipient are both non-registrants, you do not need to send us this form. Instead, the recipient must keep this form or a copy on file in case we ask to see it.

FP-2044-V "Election Respecting the Acquisition of a Business or Part of a Business"

This form is to be completed by both the person acquiring a business (or of a part of a business) and the supplier, where both parties wish to jointly elect to have the GST/HST and QST not apply to the supply of the business (or the part of a business). ...

Under the QST system, if the recipient is a large business and does not carry on the business (or the part of a business) acquired, the supplier and the recipient can jointly elect that the recipient not have to pay the QST. This only applies to property entitling the business to an ITR, since the restrictions relating to an ITR apply to large businesses.

Section 167.1

See Also

R & C Commrs v. Mertrux, [2012] UKUT 274 (Tax and Chancery Chamber)

The taxpayer was a Mercedes dealer, licensed through Daimler-Chrysler UK ("DCUK"). DCUK exercised its rights under its dealer agreements to terminate the agreements. This would normally require 24 months' notice, but could be 12 months in limited circumstances. The dealers and DCUK disputed which period applied, and eventually arrived at a settlement in which dealers would receive a "territory release payment" ("TRP") for surrendering the dealership after 24, 18, or 12 months, with a higher TRP for an earlier termination. The taxpayer elected to take the earliest termination and highest TRP, which was paid by a third party ("Leadley") that took over the taxpayer's dealership.

Under UK tax law, an amount paid for goodwill would qualify for "roll-over relief," but an amount paid for the surrender of a right (such as the right to be a Mercedes dealer) would give rise to capital gains treatment.

The Upper Tribunal found (reversing the First-tier Tribunal) that, although the basic TRP (i.e. for a 24-month termination) could be attributed to goodwill, the additional amount for early termination could not. It stated that the "natural inference" was that, in receiving a higher TRP because of early termination, "Mertrux was being paid to forgo the opportunity to continue to earn profits as a dealer, as it was entitled to under the Dealer Agreement, as varied by the [settlement]" (para. 20).

Contrary to the First-Tier Tribunal's finding, the characterization of the payments from Leadley's perspective (who had no reason to pay compensation for the loss of the dealership) was irrelevant. The Tribunal stated (at para. 22):

In any case, it is inherently unlikely that Leadley paid the whole of the TRP for goodwill of Mertrux. The reality is surely that it paid the TRP because DCUK required it to as a condition of becoming a dealer. From Leadley's point of view, the TRP will have been the price of obtaining a dealership from DCUK.

Section 168 - When Tax Payable

Subsection 168(2) - Partial Consideration

Administrative Policy

23 January 2002 Ruling 36706 [rent prepayment accelerates tax payable date]

Respecting rent prepayments made under a capital lease of equipment to a registered lessor, CRA stated:

Subsection 168(2)...states that where consideration for a taxable supply is paid or becomes due on more than one day, the tax in respect of the supply is payable on each day that is the earlier of the day a part of the consideration is paid and the day that part becomes due and the tax that is payable on each such day shall be calculated on the value of the part of the consideration that is paid or becomes due, as the case may be, on that day. Consequently, tax is payable upon the prepaid rent at the time it is paid and tax becomes payable on the unpaid lease payments as they fall due under the agreement.

GST M 300-6-7 "Partial Payments"

Subsection 168(3) - Supply Completed

Paragraph 168(3)(c)

Articles

Sheila Wisner, "P3 Projects – The Real Issues", Canadian GST/HST Monitor, Number 304, January 2014, p. 1

In a typical P3 arrangement, the final construction payment often takes place at the time of "substantial completion". Given the significant dollar values at play (often in the millions and tens of millions) at the point of substantial completion, there is a significant cash flow cost to accelerating the payment of tax, if required under the undue delay rule. For this reason, it is critical to identify when the payment for the construction takes place, and when substantial completion takes place….

Subsection 168(6) - Value Not Ascertainable

Administrative Policy

GST M 300-6-15 "Value Not Ascertainable"

Subsection 168(8) - Combined Supply

Administrative Policy

GST M 300-6-16 "Combined Supplies"

Subsection 168(9) - Deposits

See Also

Tendances & Concepts Inc. c. R., 2011 TCC 141

The registrant was in the business of manufacturing kitchen and bathroom furniture. Its usual business terms required customers to pay 30% up front, 60% on completion and 10% on delivery. The registrant contended that the 30% payment was a deposit, and therefore exempt from GST collection.

Hogan J. reviewed at length the distinction between a deposit and a down payment in common law, and the related distinction between an arrhes and an accompte in Quebec civil law, and concluded (at paras. 45-46):

In my view, a "deposit" or "arrhes," within the meaning of the Act, is:

- security for the performance of the contract;

- retained by the vendor in the case of default by the purchaser, contrary to a down payment;

- refundable or not;

- subsequently applied as a reduction of the sale price;

- an amount on request prior to entering the contract;

- is akin to a means of withdrawal;

- is akin to a penalty clause or prepaid liquidated damages; and

- a set, invariable, minimum amount.

In order to determine whether an amount is a "deposit" or "arrhes" within the meaning of the Act, the following questions must be posed:

- Does the contract specify the nature of the first payment?

- Is the amount intended to secure performance of an obligation?

- Is the amount paid prior to or after the signing of the contract?

- Does a penalty clause already exist?

- Has the tax been calculated on the amount requested?

- Does it represent a relatively small or substantial amount compared to the total value of the contract?

- Have the parties set any terms respecting exercising their right of withdrawal?

Hogan J. found that the 30% was a down payment. The registrant's contracts had a separate penalty clause for early termination, which were to vary based on the costs the registrant incurred before the termination, and did not stipulate that on breach the deposit represented liquidated damages. Moreover, the registrant collected only 30% of the GST-exclusive contract price, whereas a deposit when forfeited would have been required by s. 182 to include the GST collectible on that amount.

Customs and Excise Commissioners v. Moonrakers Guest House Ltd., [1992] BTC 5077 (Q.B.D.)

Deposits received by a guest house were subject to VAT by virtue of s. 5(1) of the Value Added Tax Act 1983 (which provided that where a person receives a payment in respect of a supply it shall, to the extent of the payment, be treated as taking place at the time the payment is received), based on a finding that the deposit became the property of the guest house at the time of receipt.

Administrative Policy

GST M 300-6-8 "Deposits"

Section 169 - Input Tax Credits

Subsection 169(1) - General Rule for Credits

Cases

The Queen v. General Motors of Canada Limited, [2009] GSTC 64, 2009 FCA 114

The Appellant (a car manufacturer) was the administrator of various defined benefit pension plans for its unionized employees. It was the recipient of portfolio advisory services as it rather than the plans was contractually liable to pay the advisors' fees, and the Crown did not dispute that it also "acquired" those services if s. 167.1 did not apply to deem those services to instead have been acquired by the plans (which it did not).

These services also satisfied the requirement in s. 169(1) that they have been acquired by it in the course of its commercial activities. As noted by the Campbell, J below, its employee compensation program was a necessary adjunct to its making taxable sales, and it was contractually obligated to maintain the plans as part of that program.

Haggart v. The Queen, 2003 FCA 446

GST on legal services supplied to the applicant to enable him and his company to obtain damages from a bank for wrongfully calling in a loan to the company, thereby forcing it out of business, was not eligible for an input tax credit given that the applicant had not established a connection, direct or indirect, between his purchase of the legal services and any ongoing supply of taxable services. This conclusion was supported by the finding made by the Alberta Court of Appeal in upholding the award of damages made to the applicant that the damages were more accurately characterized as compensation for the total destruction of the business, rather than for loss of profit.

London Life Insurance Co. v. The Queen, [2000] GSTC 111, Docket: A-581-98 (FCA)

Under the terms of its leases, the Appellant, whose principal buisness was providing exempt financial services, undertook leasehold improvements to the leased premises at a cost of about $2.1 million and received tenant improvement allowances from its landlords of approximately $2.2 million.

The availability of an ITC was governed by s. 169(1)(c) rather than (b) because (under the definition of "improvement" in s. 123(1)), the cost of the improvements was not included in their adjusted cost base for purposes of the Income Tax Act because an election was made under s. 13(7.4) of the Income Tax Act to reduce the capital cost of the improvements by the amounts paid by the landlords.

Full ITCs were available under s. 169(1)(c) because the Appellant was supplying the leasehold improvements to the landlords for the leasehold improvement allowances, which was a commercial activity. Rothstein JA stated (at para. 33):

Certainly, the ultimate purpose of London Life is to lease improved premises for its financial services business of providing exempt supplies. But when the leasing transactions are considered independently, London Life is supplying the leasehold improvements to the landlords for the consideration of the leasehold improvement allowances. In turn, the landlords are providing the improved leased premises to London Life for its financial services business.

398722 Alberta Ltd. v. The Queen, [2000] GSTC 32, Docket: A-706-98 (FCA)

In order to receive approval under the Town of Banff bylaws for the development and operation of a 63-unit hotel in Banff, the respondent was required to build a 4-unit apartment building. In finding that the respondent was not entitled to input tax credit for the GST payable by it upon completion and first leasing of the apartment building Sharlow J.A. noted (at p. 32-8 to 32-9) that the definition of "commercial activity" recognized that a business may consist of a number of components each of which is integral to the business as a whole but nonetheless required "that any part of the business that consists of making exempt supplies be notionally severed", and further stated (at p. 32-9):

"It should not and does not matter whether the acquisition is motivated by the prospect of receiving rent or, as in the respondent's case, is the fulfillment of a legal obligation that must be met in order to accomplish another business objective."

Midland Hutterian Brethren v. The Queen, [2000] GSTC 109, Docket A-183-99 (FCA)

In finding that heavy cloth purchased by a Hutterian colony (which was engaged in a farming business) to be made into work clothes for its members was eligible for the ITCs claimed by the colony for 50% of the GST payable on the purchases, Malone J.A. indicated (at para. 25):

Once an item is found to be acquired and used in connection with the commercial activities of a GST registrant and that item directly or indirectly contributes to the production of articles or the provision of services that are taxable, then an ITC is available using the formula in that subsection.

In a dissenting opinion, Evans J.A. agreed with the majority that "for the goods to be acquired for use 'in the course of commercial activities', there must be a functional connection between the needs of the business and the goods" (para. 31), but disagreed as to whether the connection was sufficient on the present facts.

See Also

Lavoie v. The Queen, 2014 DTC 1104 [at 3218], 2014 TCC 68

The taxpayer's uncontradicted evidence was that his cottage in PEI was used approximately 170 days in a given year, only 10 of which were solely for personal use. C Miller J found that the cottage was used primarily for business purposes and, having no evidence as to how the losses were calculated, allowed them in full (para. 28).

PDM Royalties LP v. The Queen, 2013 TCC 270

The limited partnership units of the appellant were held by a sub-trust (the "Trust") of an income fund (the "Fund"). Unit subscription proceeds received by the Fund on its initial public offering ("IPO") and on a subsequent private placement of Fund units were used to acquire debt and units of the Trust, which in turn subscribed for LP units of the appellant. The appellant used those proceeds to acquire intellectual property and related rights to be used by it in a pizza franchising business.

Before completion of the IPO, the Fund, Trust, appellant and its general partner entered into a "Financing Agreement" in which they agreed that all financing expense in connection with the IPO, other than the underwriters' fee, were to be incurred on behalf of the appellant; and at the same time the appellant entered into an "Administration Agreement" with the Fund in which it agreed to administer the Fund and "as agent of the Fund" to pay for all outlays and expenses incurred by it in such administration.

V. Miller J found that, as pursuant to the Administration Agreement, various expenses (principally relating to the IPO and private placement) were incurred by the appellant as agent for the Fund, the appellant was not the recipient of the related services and was not entitled to input tax credits therefor (para. 31). The Financing Agreement did not render the appellant the recipient of such supplies as the supplies were not made pursuant to that agreement (para. 26), nor could it be construed as causing there to be a re-supply of the services by the Fund to the appellant, as the services were consumed by the Fund (para. 32).

Furthermore, even if the appellant was the recipient of the supplies, the expenses would have been incurred by it so that it could receive money from the Trust in exchange for issuing LP units, which constituted the making of an exempt supply (para. 42).

There also were various deficiencies in the invoices of the suppliers. V. Miller J stated (para. 51):

[W]here an invoice represented services to both the Appellant and the Fund and I could not ascertain the portion payable by the Appellant, I did not allow the ITC involved.

WHA Ltd. v. Revenue and Customs Commissioners, [2013] UKSC 24, [2013] 2 All ER 908

The appellant (WHA) was an affiliate of an English company (NIG) which issued motor breakdown insurance to car owners. The NIG policies indicated that "the insurer is undertaking to meet the cost of repairs…:it is not undertaking responsibility for the repairs themselves" (para. 27). The role of WHA encompassed "the negotiation, investigation, adjustment, settlement and payment of claims…[and not] the carrying out of repairs" (para. 33). When there was a claim, there was an implied agreement between the garage and WHA under which WHA agreed to pay for the repair work insofar as it was covered by the policy and authorized by WHA; and there was an implied agreement between the insured and the garage under which the insured: authorized the garage to examine the vehicle; and agreed to pay for the work insofar as it was not covered by the policy (para. 38).

WHA had taken the position that it was receiving a supply of repair services from the garage (with a view to deducting input tax on the basis that it was receiving such repair services for the purpose of making supplies to a Gibralter affiliate). In rejecting this position (so that WHA was not entitled to such deductions), Lord Reed stated (at para. 56-57):

If NIG were to perform the contract by itself paying the garage, that would be an example of third party consideration….[T]he garage supplies a service to the insured by repairing his or her vehicle, and NIG meets the cost of that supply because it has undertaken to the insured that it will do so….

WHA's role …is to act as the paymaster of costs falling within the cover provided by the policies. The interposition of WHA does not, by some alchemy, transmute the discharge of the insurer's obligation to the insured into the consideration for a service provided to the reinsurer's agent.

HMRC v. Aimia Loyalty UK Ltd, [2013] UKSC 15

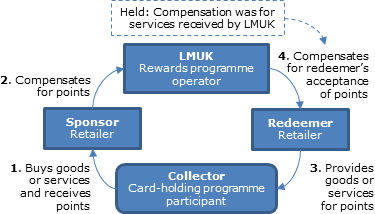

The appellant ("LMUK" ) operated a loyalty card programme. Card-holding customers ("collectors") would swipe LMUK's card during purchases at participating retailers ("sponsors") and receive points which could be redeemed at participating businesses ("the redeemers") for goods or services, or for a price reduction in goods or services. Whenever a redeemer accepted loyalty points, it became entitled to payment from LMUK for accepting those points. Those payments were less than the compensation paid to LMUK by the sponsors for issuing points to the collectors as customers of the sponsors.

The Court found that the payment of LMUK to a redeemer was consideration for a supply of services by the redeemer to LMUK itself, rather than representing third-party consideration for a supply of goods or services by the redeemer to the collector. Accordingly, LMUK was entitled to a deduction of input VAT (the British equivalent of an ITC) on the payments made by it to the redeemer. Lord Reed SCJ stated (at paras. 80-81):

In accepting points, which have no inherent value, in exchange for goods or services, the redeemer is acting in a manner which is only explicable because of its agreement with LMUK, under which LMUK will pay it for doing so. LMUK pays it for doing so because its business is dependent on redeemers accepting points in exchange for the provision of goods and services. The only economically realistic explanation of LMUK's behaviour is the value to LMUK itself of the redeemers' acceptance of points in exchange for the provision of goods and services.

Reluxicorp Inc. v. R., [2011] GSTC 138, 2011 TCC 336

The registrant was a hotel company that paid franchise fees to a hotel franchise ("Marriott") in the United States. Marriott's fees were based on gross room revenues. Lamarre J. found that, because 30% of the registrant's revenue was from exempt stays (i.e. exceeding one month), 30% of the franchise fees were not incurred in respect of a "commercial activity" as defined in s. 123(1). Accordingly, she affirmed the Minister's assessment, which was made on the basis that the provision by Marriott of franchise rights was an "imported taxable supply" under s. 217, for which the registrant was liable to pay GST on the consideration paid on the basis that 30% of the franchise fees was not eligible for an input tax credit. The registrant was unable to demonstrate that the franchise fees pertained only to the short-term stays.

Lyncorp International Ltd. v. The Queen, 2010 DTC 1351 [at 4335], 2010 TCC 532, aff'd 2012 DTC 5032 [at 6684], 2011 FCA 352

The taxpayer, owned and operated by Mr. Mullen, invested in shares and made non-interest bearing loans to a number of corporate ventures to which Mr. Mullen provided management services free of charge by him or the taxpayer. The taxpayer claimed input tax credits on expenses relating to the operation of a private jet, which were incurred primarily in connection with Mr. Mullen making visits to the offices of these ventures.

V. Miller J. found that the taxpayer could not claim input tax credits on the flight expenses that related to the business ventures rather than any business carried on directly by the taxpayer. She stated at para. 81:

This is a unique situation of a company incurring costs (inputs) to provide free services for its business ventures. In such circumstances, the company can best be viewed as the ultimate consumer - the end of the line: no [input tax credits] are available, as there is no further commercial activity of the company.

YSI's Yacht Sales International v. The Queen, 2007 TCC 306

Woods, J. accepted that an agreement pursuant to which the appellant ("YSI") agreed to contract with suppliers in connection with refurbishing a yacht and to charge the other party to the contract ("Platinum") a 5% mark-up on some of the purchases, did not establish an agency relationship between YSI and Platinum. Woods, J. noted (at para. 35) that whether YSI acquired goods and services on its own behalf on behalf of Platinum depended on the parties' mutual intention and that, accordingly, the essential question was whether Platinum agreed to be bound by YSI's agreements with suppliers. Accordingly, YSI was entitled to claim input tax credits respecting GST on purchases made by it in reconditioning the yacht.

Edible What Candy Corp. v. R., [2002] GSTC 33, docket 2001-2038-GST-I (TCC)

The taxpayer was found to have made a misrepresentation attributable to neglect when it claimed input tax credits for GST incurred before it became registered for GST purposes notwithstanding professed confusion over the interpretation of s. 171 of the ETA.

BJ Services Co. Canada v. The Queen, [2002] GSTC 124, docket 2001-1753-GST-G (TCC)

A Canadian public company ("Nowsco") that was engaged in the provision of oil field services incurred significant fees for services rendered by financial advisors and a law firm in connection with seeking a "white knight" following the commencement of a takeover bid for its shares, as a result of which it was able to secure a higher price for its shares from the original bidder. Miller J. found that even if he considered that the primary purpose of Nowsco in incurring these fees was to maximize shareholder value, this purpose did not take the inputs outside the realm of commercial activity for purposes of s. 169 given that a public company will suffer adverse financial consequences if it does not behave as commercially expected, and there was a secondary purpose of maintaining the ongoing viability and economic health of the company.

Customs and Excise Commissioners v. Redrow Group plc, [1999] UKHL 4, [1999] 2 All ER 13, [1999] 1 WLR 408

As an incentive to purchasers of its new homes, a residential home developer entered into agreements with prospective purchasers and real estate agents selected by it under which it agreed to pay the agent's fee plus VAT in connection with a sale of the existing purchaser's home, provided that the purchaser completed a purchase of a new home. In finding that the VAT paid on the agent's fee qualified for deduction as input tax in respect of the supply to the developer of services, Lord Hope indicated (at p. 6) that the matter was to be looked at from the standpoint of the person who is claiming the deduction by way of input tax and, that the relevant question was:

"Was something being done for him for which, in the course of furtherance of the business carried on by him, he has had to pay a consideration which has attracted VAT? The fact that someone else, in this case, the prospective purchaser, also received a service as part of the same transaction does not deprive the person who instructed the service and who has had to pay for it of the benefit of the deduction."

Similarly, Lord Millet stated (at 418 WLR):

Once the taxpayer has identified the payment the question to be asked is: did he obtain anything - anything at all – used or to be used for the purposes of his business in return for that payment? This will normally consist of the supply of goods or services to the taxpayer. But it may equally well consist of the right to have goods delivered or services rendered to a third party. The grant of such a right is itself a supply of services.

Hleck, Kanuka, Thuringer v. The Queen, [1994] GSTC 46 (TCC)

In finding that GST on an airline ticket purchased by a law firm in order for the wife of one of its partners to attend a conference with him, was creditable, Bell TCJ. stated (at p. 46-7):

"The test set out under the Act is more liberal that the test for deductibility of a business expense under the Income Tax Act. Expenditures made for the purpose of gaining or producing income from a business are, by definition, made in the course of commercial activity. However, those made in the course of commercial activity are not, necessarily, made for the purpose of gaining or producing income from a business."

P & O (Dover) Ltd. v. Commissioners of Customs and Excise, [1992] V.A.T.T.R. 221

The appellant along with seven individual employees was charged with manslaughter in connection with the sinking of its vessel. The appellant's own counsel formed the view that the success or failure of the prosecution of the appellant depended largely on the success of the prosecution of the individual employees. It was found that the legal services of the separate counsel representing the employees were used for the purpose of the appellant's business for purposes of s. 14(3) of the Value Added Tax Act 1985 given the various business benefits that the appellant derived from its successful defence of the charges against it.

Turner v. Customs and Excise Commissioners, [1992] BTC 5082 (Q.B.D.)

The appellant, who was ordered to pay the costs of the winning side in an unsuccessful lawsuit including VAT, was not entitled to a credit for input tax under s. 14 of the Value Added Tax Act 1983 because there were no "goods or services used or to be used for the purpose of any business carried on or to be carried on by him" for the purposes of that provision.

Administrative Policy

Memorandum (New Series) 8-3 "Calculating Input Tax Credits" August 2014

First-order v. second-order supplies

27. Where inputs are acquired, imported or brought into a participating province for consumption or use for the purpose of making a particular supply (the first-order supply), and the first-order supply is made for the purpose of making another supply (the secondary supply), it is the tax status of the first-order supply that determines whether the inputs are for consumption or use in a commercial activity.

Direct allocation method

49. The method that allocates inputs directly to activities should yield fair and reasonable results. Specifically, where it is possible to record the actual consumption or use of a particular input in making taxable supplies for consideration and otherwise, this is a reasonable method to apply. Where this is not possible, allocation factors could be applicable under the direct allocation method.

50. Where an allocation factor is used, it should directly approximate the use of the particular input in making taxable supplies for consideration and otherwise using a systematic approach and an appropriate allocation base. [Then gives example of snow removal costs being allocated between exempt and commercial real estate properties on relative square footage of cleared driveways for each property type].

Input-based method

52. An input-based method may be used to apportion ITCs for those inputs that cannot be allocated… using the direct allocation method. For this method to be considered fair and reasonable by the CRA, property and services that can be attributed using the direct allocation method must represent a significant part of the registrant's overall inputs.

53. The input-based allocation method is the use of an input-based formula to allocate those remaining inputs that cannot be allocated using the direct allocation method (e.g., the ratio of taxable inputs allocated to taxable activities using the direct allocation method as compared to total inputs allocated using the direct allocation method).

Output-based method

54. An output-based method is only appropriate when an analysis shows that the outputs generated by a person will give a reasonable approximation of the use of inputs in those activities. The method can use such items as:

- the number of transactions processed (e.g., purchase orders and sales orders);

- the number of telephone enquiries;

- revenues; or

- some other reasonable measure relating to the outputs of the registrant.

55. An output-based method can be used if the registrant can substantiate that:

- the method is fair and reasonable in the circumstances; and

- the method reasonably reflects the use or intended use of the inputs.

Revenue-based method

56. A revenue-based method uses the ratio of revenue from making taxable supplies for consideration to total revenues to determine the ITC eligibility. …

57. A revenue-based method should be used with caution

GST/HST Notice "Bare Trusts, Nominee Corporations and Joint Ventures" February 2014

After noting that "a trustee of a bare trust, for example, a nominee corporation, may act as an agent of the participants in a joint venture by performing certain activities on their behalf," CRA stated:

Generally, an agent is considered to be an extension of the principal and makes or acquires supplies on behalf of the principal who for GST/HST purposes is considered to have made or acquired the supplies. Therefore, it is the principal that is generally required to charge and account for the tax on the supplies made by the agent…[and] who is entitled to claim any input tax credits on the supplies acquired by the agent on behalf of the principal.

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 26.

An Ontario purchaser ("Ontario Co") remitted HST to a Quebec supplier ("Quebec Co," a GST registrant) on the basis of its view that the place of supply of a purchase of goods was in Ontario, but Quebec Co (which now is insolvent) did not remit the provincial component of the HST on the basis of a view that the place of supply was in Quebec. Ontario Co claimed an ITC.

CRA stated that "Ontario Co is not entitled to claim an ITC for any amount paid in error… ."

CBAO National Commodity Tax, Customs and Trade Section – 2013 GST/HST Questions for Revenue Canada, Q. 23 ("Pre-Incorporation Contracts")

In response to a question on pre-incorporation contracts, CRA stated that even in jurisdictions where the corporate legislation did not address such contracts:

CRA may accept the accounting for pre-incorporation transactions by a newly formed corporation which has adopted a written contract made in its name or on its behalf before it came into existence based on the intention and actions of the parties, and on a case-by-case basis.

To the extent that the adoption of a pre-incorporation contract is in connection with acquiring or establishing the commercial activities of a newly formed corporation, paragraph 141.1(3)(a) of the ETA will deem the adoption of that contract to be done in the course of the corporation's commercial activities.

Where property and services are acquired by a corporation prior to it becoming a GST/HST registrant, the corporation is precluded from claiming ITCs on those property or services, except as provided for under section 171… .

24 June 2011 Headquarters Letter Case No. 126708

After using a property partly to generate revenues from commercial activities and partly from exempt activities (programs geared to children under 14), a City constructs a multi-use recreational complex on the property.

CRA rules that the City will be eligible to claim full ITCs with respect to the construction of the complex provided that the construction costs form an improvement to the property, immediately after the property was last acquired by the City, the City was using the property primarily (more than 50%) i its commercial activities, and at the time tax in respect of the improvements is paid or becomes payable, the property is used primarily in commercial activities of the City.

In its explanation, CRA noted that the complex would generally be considered an improvement to the property (so that para. (b) of B of s. 169(1) would be relevant), and that ss. 169(1), 209(1) and 199(4) would apply provided that

where an election under s. 211 is not in effect in respect of capital real property, a municipality is entitled to full ITCs on the acquisition of an improvement to capital real property only if, at the time tax in respect of the improvement is paid or becomes payable, the capital real property is used primarily in commercial activities of the municipality.

Furthermore:

Subsection 141.01(3) provides that a person is considered to use property (e.g., capital real property) in commercial activities only to the extent that the property is used for the purpose of making taxable supplies for consideration....

CRA also rules on the availability of ITCs for acquisitions of capital personal property and operating property or services.

7 June 2011 Headquarters Letter Case No. 132324

A Canadian company enters into an agreement with a non-resident registered service provider for its equipment to be refurbished outside Canada, with the equipment then being returned to Canada by the non-resident acting as importer of record and paying the GST on importation. Given that the Canadian company is the de facto importer, it is the only person entitled to claim ITCs for such GST, which would require it to obtain copies of the customs documentation from the non-resident.

24 February 2011, CBA/CRA GST Round Table, Q. 15 - "Amalgamation & Successor Corp's ITC Entitlement"

In a corporate reorganization involving a GST registrant that is engaged exclusively in commercial activities, assets are first transferred to a NewCo who immediately thereafter is amalgamated with another corporation ("SuccessorCorp") who will use the assets exclusively in a commercial activity. After noting the CRA position that NewCo may not be eligible to register or clqim ITCs, the question asked whether SuccessorCorp would be entitled to claim ITCs for GST that was payable by NewCo. CRA responded:

It appears that NewCo will not be engaged in commercial activity as defined in subsection 123(1) of the ETA. As a result, SuccessorCorp would not be eligible to claim ITCs with respect to the property that NewCo acquired unless SuccessorCorp is using the property in commercial activity and a change-in-use provision applies. For example, if all other conditions of the provisions are met, SuccessorCorp may be eligible to claim ITCs on the change of use of capital personal property under subsection 199(3) and of capital real property under subsection 206(2) based on the basic tax content of the property.

16 March 2009 Interpretation Case No. 110027

A real estate nominee not only holds legal title to project real property but also, at the direction of the beneficial owners, enters into arrangements to maintain, develop, improve, manage or sell the project. CRA indicated that provided the nominee is a bare trustee, the beneficial owners rather than the nominee would be entitled to claim ITCs, including in respect of the commercial activities conducted by the nominee as their agent.

P-112R "Assessment of Tax Payable where a Purchaser is Insolvent" 9 March 2000

Where a registrant which hads claimed ITCs for accounts payable goes bankrupt, and the supplier then claims a bad debt deduction in computing net tax, the ITC will not be denied, but the "the registrant may be assessed for the tax payable that was not paid to the supplier."

12 April 2000 Interpretation No. 8394

Respecting the construction by a corporation of a facility and its sale to a subsidiary for lease back to that corporation for use by it in activities that entitled it to no or partial ITCs for the GST on the rents, CRA stated that it is its "position on sale-leaseback transactions that one must look to the first-order supply, not the ultimate intended use, for purposes of determining ITC entitlement."

16 August 1994 Headquarter Letter

"To be entitled to an ITC in respect of Division III tax, the person must be the de facto importer of the good (i.e., the person who caused the goods to be imported). Although the person listed as the importer of record on the B3 provides prime facie evidence that the person is the de facto importer, such evidence can be reversed through other evidence."

14 July 1997 Ruling R-11595-1 95 GAPR 425

GST paid for various services provided to a corporation relating to its issuance of bonds to Canadian residents and non-resident investors would be non-creditable given that the proceeds were used to make loans to Canadian social housing not-for-profit groups and given that the corporation did not qualify as a financial institution (so that no zero-rating would be available).

GST/HST Technical Information Bulletin B-068 "Bare Trusts" Amended 10 January 2005

[A] bare trust is not engaged in commercial activities and is not entitled to claim ITCs. Instead, the beneficial owners are entitled to claim ITCs for the GST on expenses relating to their commercial activities. These expenses may be incurred by the bare trust acting as their agent.

P-045 "Butterfly Transactions "

In a purported butterfly reorganization, Subco, which operates a department store, transfers its real estate to a newly-incorporated subsidiary (Newco) of its parent (Parent) in consideration for non-voting preference shares, with Newco then being immediately wound-up into Parent and with the real estate being leased to Subco. Rulings that Newco will be permittted to register under s. 240(3) and that Newco will be entitled to full ITCs.

GST M 400-1-2 "Documentary Requirements" under "Types of Input Tax Credits"

"'Exclusively' means 90 per cent or more consumption, use or supply in the course of commercial activities".

GST M 300-7 "Value of Supply" under "Nil Consideration"

The deeming by s. 153(3) of a supply to be made for nil consideration does not alter the status of the supply as a taxable supply for other purposes, e.g., ITC purposes.

Subsection 169(2) - Credit for Goods Imported to Provide Commercial Service

Administrative Policy

21 October 2004 Headquarter Letter RITS 38435

Where a registrant imports tangible personal property of an unregistered non-resident for the purpose of providing storage services to the non-resident, an ITC for Division III tax payable on the importation is available.

GST M 300-9 "Imported Services and Intangible Property"

When an imported taxable supply is used partly in a commercial activity, registrants will be able to claim an input tax credit on the GST payable on that part of the supply for use in a commercial activity.

Subsection 169(4) - Required Documentation

Cases

Systematix Technology Consultants Inc. v. The Queen, 2007 FCA 226, aff'g 2006 TCC 277

The appellant provided IT services through subcontractor consultants. The consultants in issue variously did not provide registration numbers on their invoices, did not have registration numbers, or used invalid registration numbers. The appellant was not entitled to ITCs in respect of these invoices. Sexton JA stated (at para. 4):

We are of the view that the legislation is mandatory in that it requires persons who have paid GST to suppliers to have valid GST registration numbers from those suppliers when claiming input tax credits.

See Also

Tan v. The Queen, 2015 TCC 121

The appellant incurred expenditures for her restaurant business, for which several of her suppliers provided her with receipts but did not and would not provide a registration number. Masse DJ agreed with the Minister that, without the registration number, the taxpayer's claim for ITCs on those supplies must fail. The appellant argued that the registration numbers were facts the Minister already possessed (and would not provide them to her, citing taxpayer confidentiality). However, this argument did not overcome the strict requirement (see Systematix) that the appellant provide registration numbers before a claim for ITCs could be made (para. 17). Moreover, the Minister should not be imposed with the administrative burden of providing registration numbers in a registrant's stead (para. 20).

Les Constructions Marabella Inc. v. The Queen, 2012 TCC 397

The registrant's sole shareholder and president ("Mirabella") was a building contractor who subcontracted various elements of construction. Mirabella was aware that one of his new subcontractors (Archambault) was having problems with the authorities and was short on funds, so he paid Archambault's invoices promptly. The invoices did not represent amounts payable to Archambault, but rather to three GST-registered corporations unrelated to him. The corporations were involved in a false invoicing scheme, and none of them in fact provided supplies or services to the registrant, or were equipped to do so.

Batiot D.J. affirmed the Minister's decision to deny the registrant input tax credits for the invoices, on the basis that the registrant did not meet the requirements of s. 169(4)(a) of the Excise Tax Act. Under s. 3(c) of the Input Tax Credit Information Regulations, a registrant is required to identify the registration number of its supplier. Batiot D.J. stated that "the supplier's name must match the registration number, and the supplier must in fact be the supplier" (para. 27).

Although the registrant was innocent of any participation in Archambault's scheme, this was insufficient to make out a due diligence defence. On the contrary, the registrant was aware that Archambault was having trouble with the authorities and yet accepted without question that his invoices were accurate. Batiot D.J. cited Corporation de L'École Polytechnique v. Canada, 2004 FCA 127, for the proposition that (FCA para. 29):

The due diligence defence, which requires a reasonable but erroneous belief in a situation of fact, is thus a higher standard than that of good faith, which only requires an honest, but equally erroneous, belief.

Comtronic Computer Inc. v. The Queen, 2010 TCC 55

The GST registration number of the supplier shown on the invoices provided to the Appellant ("Comtronic") was not that of the suppliers but was a validly issued number belonging to someone else. Comtronic paid for the supplies together with GST but the supplier never remitted the GST. Boyle J held that not only did s. 169(4) of the Act require that the registrant have obtained the GST registration number of the supplier, but it must be the number which had been assigned to that supplier. After quoting Systematix, he stated (at paras. 26, 33):

Given the wording of paragraph 169(4)(a), as well as the Reasons for Judgment of Archambault J. in the Tax Court ( 2006 TCC 277 (CanLII), [2006] G.S.T.C. 120) with which the Federal Court of Appeal agreed, I take the court's reference to "valid GST registration numbers from those suppliers" to mean GST registration numbers validly assigned to those suppliers.

… I am unable to see how the broad wording of the relevant provisions and the interpretation thereof by the Federal Court of Appeal that the wording is mandatory and should be strictly enforced, and which requires that the ITC claimant have the registration number assigned to the supplier, should result in any different outcome in this case

San Clara Holdings Ltd. v. The Queen, [1995] E.TC 6 (TCC)

The registrant was prohibited from claiming input tax credits in respect of amounts paid by it to subcontractors who had not provided their GST registration numbers to the registrant. Lamarre J.TCC concluded on the evidence that the subcontractors were small suppliers under the Act for the period in issue.

Administrative Policy

20 December 2012 Ruling Case No. 145166

As a result of delays in processing accounts payable invoices, two companies do not have monthly input tax credit accruals in their accounts that reflect all the invoices that have been received at that point. In response to a submission that the companies should be able to claim ITCs in their returns based on a conservative estimate of the ITC's for each month that had not yet been recorded, CRA stated:

There are no provisions in the ETA that provide for the claiming of ITCs based on an estimate of the amount of tax that may become payable and on the assumption that the required documentary requirements are met….The CRA does not accept your proposed methodology to address the administrative and processing delays inherent in the companies' respective bookkeeping practices.

16 August 1994 Headquarter Letter

In a situation where an unregistered non-resident was listed as the importer of record, and it supplied goods to a registrant who wishes to obtain an ITC under s. 180, CCRA indicated that "a copy of the B3 Customs Coding Form will be considered sufficient evidence for purposes of paragraph 169(4)(a) and subparagraph 180(a)(ii) of the Act ... . An agreement in writing between the supplier and the recipient of the commercial service, or other relevant documents which will provide sufficient evidence in determining the identity of the supplier and the recipient of the commercial service and verify that the non-resident caused the transfer of the physical possession of the goods to the resident will also constitute sufficient documentary evidence."

GST M 400-1-2 "Documentary Requirements"

Subsection 169(5) - Exemption

Administrative Policy

GST M 400-1-2 "Documentary Requirements" under "Meals and Entertainment - Reimbursements"

Discussion of simplified "6/106" method for claiming ITCs re meal and entertainment expenses.

Section 170

Subsection 170(2) - Further Restriction

Administrative Policy

6051944 Canada Inc. The Queen, 2015 CCI 180

The appellant, which engaged in a home construction business, paid management fees to its two shareholders, which were companies whose sole respective shareholders were the founder of its business (Germain) and his son (Eric). Germain managed the office including personnel management, financing and overseeing land purchases and house sales. Eric focused on home design and construction. The management fees were allocated between the two shareholder companies on a 50-50 basis for 2009 and were $1,250,000, $1,770,000 and $950,000 for the appellant's 2008, 2009 and 2010 fiscal years (each ending on July 31). The Minister applied s. 170(2)(b) to allow input tax credits ("ITCs") only on the first $950,000 of the management fees for the 2009 year. In allowing the appeal, Favreau J stated (22-25, 28, 30, TaxInterpretations translation):

[T]he Minister alleges that the management fee was a mere year end accrual, that there was not management agreement and that there were no objective criteria for determining the amount… . The management fee was merely a profit distribution mechanism as it varied from year to year, without any real change in the qualify or level of services rendered… .

The jurisprudence addressing section 67 of the [ITA] is not relevant…because the text of section 67 is different… .

The evidence reveals that we have here a very profitable business which was very well managed by very experienced managers… . The annual revenues…for…2007, 2008, 2009 and 2010 were $16,045,841, $12,883,743, $13,180,230 and $11,970,088, respectively.

The services rendered by the management companies and their shareholders were not limited to customary management services as they encompassed financing and access to a bank of serviced lots ready for development, which were held by corporations controlled by …Germain and his children, Lyne and Eric.

…The payment of the management expenses by the appellant was essential to protecting its assets from the risks associated with carrying on its construction business. …That which was deductible at the appellant's level was subject to taxation at the level of the management companies at the same rate of federal [income] tax.

…[T]he management fees paid…[for] 2009 were clearly justified for the level of services received and were reasonable in the circumstances.

Section 171 - Becoming and Ceasing to Be Registrant

Subsection 171(1) - Person Becoming Registrant

Cases

0741508 B.C. Ltd. and 0768723 B.C. Ltd. (Re), 2014 BCSC 1791

In 2011, the petitioners conveyed undeveloped B.C. lands to a limited partnership. In 2013, CRA assessed the petitioners for their failure to charge HST, as the exemption under s. 221(2) from the obligation of the petitioners to charge HST was not available, given that the partnership had not been registered.

Before rescinding the transfer, Loo J noted that because of BC's abolition of HST before the discovery of the problem in 2013, the partnership could only recover, under ETA s. 171(1), the federal (5%) portion of the HST payable by it to the petitioners (assuming no rescission and upon registration), as the "basic tax content" of the lands excluded the provincial HST.

Administrative Policy

15 November 2011 Headquarters Letter Case No. 135608

Where a "capital pool company" which has raised capital pursuant to a prospectus on a blind pool basis has identified an acquisition of assets that will be used in a commercial activity, anything done by the CPC (other than the making of a supply) in connection with the acquisition or establishment of that commercial activity shall be deemed by s. 141.1(3)(a) to have been done in the course of the commercial activities of the CPC. Once s. 141.1(3)(a) so applies, it may be able to claim ITCs under s. 171(1) on property held by it at that time including expenses previously incurred by it which are considered eligible capital property for income tax purposes, given that eligible capital may be considered property for ETA purposes.

1996 Corporate Management Tax Conference Round Table, Q. 11

Where a person does not register prior to acquiring a business, it will be subject to s. 171 upon becoming a registrant.

Section 172 - Appropriation of Property

Subsection 172(1) - Use by Registrant

Administrative Policy

GST M 300-7 "Value of Supply" under "Appropriation of Property"

General synopsis.

Subsection 172(2) - Benefits to Shareholders, Etc.

Administrative Policy

GST M 300-7 "Value of Supply" under "Appropriation of Property"

General synopsis.

Subsection 172.1(1)

Pension activity

Administrative Policy

19 October 2011 Interpretation Case No. 133414