Subsection 261(1) - Definitions

Functional Currency

Administrative Policy

28 November 2010 Annual CTF Roundtable Q. , 2010-0385891C6

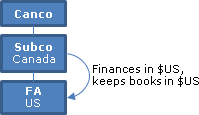

A Canadian public company (Canco), which carries on business primarily in Canada, incorporates Subco to hold its shares of a U.S. controlled foreign affiliate and to assume control of the financing of the affiliate, which will occur in U.S. dollars. Subco maintains its records and books of account in US dollars. Is Subco precluded from reporting its Canadian tax results in US dollars because its financial results are consolidated with those of Canco, whose reporting currency is the Canadian dollar?

CRA indicated that satisfaction of these two conditions was required:

1) The US dollar is the business currency of Subco (that is, the primary currency in which its transactions occur). In this respect, we expect that Subco would raise its capital in US dollars and derive the majority of its revenues in US dollars.

2) Subco's balance sheet and income statement are prepared in US dollars for the purposes of presenting the financial condition of the corporation to its shareholder and, where applicable, its creditors.

Respecting the second condition, CRA stated that "financial reporting must be the primary reason that the books and records are maintained in a qualifying currency," so that maintaining them in a qualifying currency without this purpose is not sufficient.

Articles

Eric Bretsen, Heather Kerr, "Tax Planning for Foreign Currency", 2009 Conference Report (CTF), C. 35.

Removal in new definition of principal business and consolidated financial statement requirements (pp. 35:32-33)

The new definition removed the requirements relating to "principal business activities" and "consolidated financial statements." The former requirement was arguably not significant in terms of establishing whether or not a taxpayer could qualify because the threshold for a qualifying business activity (which was left undefined) was presumably low enough that any sort of business activity would suffice. ...

The removal of the term "consolidated financial statements" from the definition of "functional currency" was significant because it also served to remove the reference to GAAP financial statements. The removal of the reference to GAAP arguably provides greater latitude in interpreting the term "functional currency" and perhaps broadens the circumstances in which a taxpayer is entitled to elect under section 261.

Relevant Spot Rate

Administrative Policy

10 October 2014 APFF Roundtable Q. 9, 2014-0538631C6 F

When asked to comment on the exchange rate to use for interest, dividends and capital gains, CRA stated, after referring to the reference in the definition to "another rate of exchange that is acceptable" (TaxInterpretations translation):

[A]n average rate of exchange could qualify in this regard. However, we do not accept using an average exchange rate respecting the calculation of capital gains and losses. Thus…all amounts expressed in a foreign currency before being taken into account in the calculation of such gains or losses (namely, the adjusted cost base, the proceeds of disposition and the expenses of the disposition) must be converted into Canadian dollars in accordance with the "relevant spot rate" for the day or days when they arose. This result accords with the principles elaborated…in Gaynor.

Subsection 261(2) - Canadian currency requirement

See Also

Agnico-Eagle Mines Limited v. The Queen, 2015 DTC 1008 [at 43], 2014 TCC 324

In 2002, the taxpayer ("Agnico") issued US-dollar denominated debentures which were convertible at the holders' option into common shares at a conversion price of U.S.$14 per share (or a conversion ratio of 71.429 per each U.S.$1,000 debenture). In December 2005 Agnico issued a notice of redemption for all outstanding debentures, which prompted the conversion of over 99% into common shares before the date specified for redemption. The balance of 0.8% of the debentures were redeemed, with the taxpayer exercising its right to satisfy the redemption price for each debenture by issuing common shares whose number was computed by dividing U.S.$1,000 by a heavily discounted share value.

The Crown took the position that gains were realized under s. 39(2) on conversion, as the U.S. dollar had depreciated substantially relative to the Canadian dollar between the debenture issuance and conversion.

In rejecting one of Agnico's arguments that s. 39(2) did not apply because the fair market value of the shares issued was higher than the debentures' principal amount, Woods J found (at paras. 47, 50) that, applying Teleglobe, "the amount paid out by Agnico is the amount for which the Common Shares were issued" and that "it is necessary ... to search for the consideration as agreed by the parties and as reflected in the stated capital account." Although Agnico had not added any specific dollar amount to its stated capital account, the common shares were issued on conversion because of a commitment to issue them at a price of U.S.$14 per share or U.S.$1,000 per debenture, so that this was the agreed consideration for their issuance.

How then should U.S.$1,000 be translated into Canadian dollars? She stated (at paras. 58, 61-63, 67):

Subsection 261(2) requires that the relevant amounts be translated into Canadian dollars at the spot rates when the amounts "arose."

...

In my view, the appropriate translation date should be when the consideration for the Common Shares was received by Agnico. ...

...[T]he appropriate translation date in this particular case is the date that the Convertible Debentures were issued. This is when the true consideration for the issuance of the Common Shares was received by Agnico. ...

...Suppose convertible debentures are issued for $1,500, [and] the principal amount ... is $1,100 ... . [T]he true consideration [for the shares on the debenture conversion] is $1,500. ...

...

...[T]he equivalent of $1,588 [the Cdn$ equivalent on that date of U.S.$ 1,000] per [Agnico] Convertible Debenture was received on issuance of the Convertible Debentures and the same amount was paid for the extinguishment of the Convertible Debentures on the conversions. There is no foreign exchange gain.

Agnico's alternative argument (at para. 43), that s. 51(1) "provides that on a conversion ... there was no transaction that could give rise to a gain," was not considered.

Conversely, given that the Debentures' terms "make it clear that the Common Shares issued on redemption are in satisfaction of the Redemption Price which became due and payable on the date of redemption" (para. 73), the amount the taxpayer paid on redemption was based on the Canadian dollar equivalent of such amounts at that time, so that Agnico realized s. 39(2) gains on redemption.

Administrative Policy

10 June 2014 Ministerial Correspondence 2014-0529961M4 - Capital gains on property in foreign currency

On the sale of capital property in foreign currency, the proceeds of disposition are converted using the exchange rate at the time of the sale, the adjusted cost base is converted using the exchange rate at the time the property was acquired, and outlays and expenses are converted using the exchange rate at the time they were incurred. "This method was confirmed… in…Gaynor…91 DTC 5288…and…codified in [s.] 261(2)… ."

4 June 2014 T.I. 2014-0517151E5 - S. 17.1 and debt denominated in foreign currency

A non-resident corporation owes a foreign-currency denominated amount to a CRIC which is a pertinent loan or indebtedness (a "PLOI"), as defined in s. 15(2.11) or 212.3(11), and the CRIC has not made a functional currency election pursuant to s. 261(3). How is the s. 17.1 income inclusion computed in Canadian dollars under the A-B formula? After referring to the reference in s. 261(2)(b) to "the relevant spot rate for the day on which the particular amount arose," CRA stated:

The moment the PLOI arose is the moment the indebtedness has been created. Therefore, the prescribed rate of interest [referenced in A]… will be applied to the principal of the loan converted in CAN$ using the relevant spot rate at the time the indebtedness has been created. …

Element B of the formula is the amount actually included in the CRIC's income on account of the interest with respect to the PLOI. …The moment such an inclusion arises is the moment the interest is received or becomes receivable… .Therefore, provided subsections 12(3) and (4.1) ITA do not apply, such amount will be converted into CAN$ using the relevant spot rate at that time.

14 January 2011 T.I. 2004-009860

In our view, pursuant to subsection 261(2) of the Act, the discount and yield tests set out in paragraph 214(8)(c) of the Act for a non-convertible, non-exchangeable, foreign currency denominated obligation are to be carried out by converting each of 'the amount for which the obligation was issued' and the 'principal amount' into Canadian currency using the relevant spot rate for the day of issue. Therefore, in our view, fluctuation in the value of a foreign currency affecting the Canadian dollar value of [the obligation], originally issued without a discount, would not result in the obligation being an excluded obligation under paragraph 214(8)(c) of the Act.

Articles

Chris Van Loan, Peter Lee, "Agnico Eagle Mines Limited v. The Queen", International Tax, Wolters Kluwer CCH, No. 80, February 2015, p.1.

Amount paid by Agnico for the extinguishing of its debentures was fond to be U.S.$1,000, being the amount for which the common shares were issued (p. 5)

[t]he Court found that "[t]he Indenture and the Prospectus [for the Debentures] clearly contemplate that the Common Shares are to be issued for US$14.00 per Common Share, which is equal to US$1,000 on a per Convertible Debenture basis …" And, further, "... in accordance with Teleglobe, this is the amount paid by Agnico for the extinguishment of the Convertible Debentures on the conversions.

Court found that the translation date therefore should be this issuance date (p. 5)

[T]he Court held that the translation date should be the date when the consideration for the common shares was received by Agnico. The court then stated:

The conclusion that I have reached is that the appropriate translation date in this particular case is the date that the Convertible Debentures were issued. This is when the true consideration for the issuance of the Common Shares was received by Agnico.

Strictly speaking, it is difficult to understand how consideration for the issue of the shares could have been received when the Debentures were issued, since at that time there was no binding agreement by Debenture holders to acquire shares. However, the Court's reasoning appears to be that the corporation received the funds for which the Debentures and (indirectly) the common shares were issued when the Debentures were issued and that no new funds were received by Agnico when the Debentures were converted.

Mosely v. Koffyfontein instead found that the consideration paid for shares on debenture conversion is to be determined at that conversion time, not the debenture issuance date

The UK Court of Appeal's decision in Mosely v. Koffyfontein [fn. 21 [1904] 2 Ch. 108] casts some doubt, arguably, …[on] the validity of the Agnico decision itself. The factual background of the case was described as follows in a recent company law text by Ferran and Ho: "The Court of Appeal analyzed a proposal to issue convertible debentures at a [20%] discount to their par value [of £100] where the debentures could immediately be converted into fully paid shares having a par value equal to the par value of the debentures." [fn: 22: E. Ferran, L.C. Ho, Principles of Corporate Finance Law 2nd ed. (Oxford: Oxford University Press, 2014), at page 88.] The issue of the debentures was challenged on the basis that they could be used as a device for issuing shares at a discount, and the UK Court of Appeal granted an injunction prohibiting the issue of the debentures.

Vaughan Williams L.J. stated in the decision that, in a normal case, "the immediate consideration for the issue of shares to a debenture-holder demanding such allotment in exchange for, or in satisfaction of his debenture, is clearly the surrender of his debenture, and the mere fact that the debenture was purchased at a discount of 20 per cent [does not imply that the shares were issued at a discount]." Effectively the Court concluded that, provided the debentures were not a mere device to avoid the prohibition on issuing shares at a discount, shares issued in exchange for exchangeable debentures with a face value of £100 are considered to have been issued for consideration of £100, not the £80 paid for the debentures. However, on the specific facts of the case, the conversion feature of the debentures was considered to be a mere device to circumvent the prohibition on the issuance of the shares at a discount, and hence the issuance of the debentures was improper.

Ferran and Ho, in the same passage quoted above, add that "Cozens-Hardy [one of the judges on the Court of Appeal panel who concurred with Vaughan-Williams LJ. in separate reasons] expressly left open the question of a debenture issued at a discount to its par value which conferred a right at some future date to demand a fully paid share in exchange for the par value of the debenture. [... In this] case, the discount can be explained because it represents the investors' return without which they would (presumably) have demanded a higher rate of interest."…

The clear implication of this case is that, absent colourable circumstances, the consideration paid for shares on the conversion or exchange of debentures is to be determined at the time the obligation to repay is extinguished, and not when the debentures are issued. Since there was no suggestion whatever in the Agnico case that the conversion feature was a device to circumvent basic rules of corporate law it is difficult to reconcile Tax Court's decision in Agnico with the UK Court of Appeal's decision in Mosely v. Koffyfontein.

Janette Y. Pantry, Soraya M. Jamal, "The Thin Cap Rules: Revisiting the Foreign Exchange Anomaly", Corporate Finance, 2011, p. 1934

Discussion of effect of s. 261(2)(b) on the thin capitalization rule.

Patrick Marley, Amanda Heale, "New Foreign Currency Rules: Are They Functional?", International Tax, CCH, December 2007, No. 37, p. 7.

Subsection 261(3) - Application of subsection (5)

Forms

T1296 "Election, or Revocation of an Election, to Report in a Functional Currency"

[F]or tax years that begin after July 12, 2013, the election to report in a functional currency must be filed within the first 61 days of the tax year to which the election applies. If the tax year starts prior to July 13, 2013, the election must be filed at least six months before the end of the tax year to which the election applies.

Subsection 261(5) - Functional currency tax reporting

Paragraph 261(5)(a)

Administrative Policy

11 July 2013 Memorandum 2012-0471111I7 - functional currency

In response to a query as to the basis for CRA's conclusion that s. 261(11)(d ) (which applies only to taxes that are computed "for the particular taxation year") applies to a Part III tax assessment pursuant to s. 184(2) (which arises "at the time of the election" and does not relate to a particular taxation year), CRA stated:

...an amount of Part III tax payable by a taxpayer which arises as a consequence of an election in respect of a dividend payable in a taxation year is an amount of tax payable "for the particular year" for the purposes of paragraph 261(11)(d)....

In response to the question:

Since paragraph 261(11)(e) applies "for the particular taxation year", whereas, pursuant to subsection 83(4), the penalty for a late-filed form T2054 is calculated based on the number of months ending on the day on which the election is made, how does a functional currency reporter compute the penalty imposed by subsection 83(4) in Canadian dollars?

CRA stated:

Canco's liability for the late filed capital dividend election will be the lesser of the two Canadian dollar amounts (i.e. the amount in paragraph 83(4)(a) computed in Canco's functional currency and converted into Canadian dollars) and the amount in paragraph 83(4)(b) computed in Canadian dollars.

20 September 2012 Memorandum 2012-0453071I7 - functional currency

Where Canco (a Canadian resident corportion) has elected a functional currency (i.e. other than the Canadian dollar), it would be permitted to have its shareholders' resolutions denominated "in a currency other than its elected functional currency, without affecting the validity of its functional currency election in Canadian dollars." However

Canco must maintain its capital dividend account in its elected functional currency and must report all amounts on Form T2054 [the capital dividend election form] in its elected functional currency.

Articles

Geoffrey S. Turner, "New and Improved Functional Currency Proposals", International Tax, No. 43, December 2008, p. 1.

Subsection 261(6) - Partnerships

Administrative Policy

22 April 2013 T.I. 2012-0471831E5 - Functional currency reporting for partnerships

In response to a query concerning the functional currency reporting requirements for partnerships where a corporate partner has made an election under s. 261(3) and a submission that the "corporation should bear the responsibility of complying with the information requirements in subsection 261(6) of the Act, notwithstanding that the information relates to the financial results of the partnership," CRA stated:

CRA requires that the required information be filed with the Partnership Information Return [T5013] as it is prescribed information for purposes of that return. As a partnership consists of a relationship between partners, we would expect that the partners of a partnership would come to a mutual understanding to ensure compliance with the reporting requirements....

Subsection 261(6.1) - Foreign affiliates

Subsection 261(7) - Converting Canadian currency amounts

Paragraph 261(7)(h)

Administrative Policy

20 September 2013 T.I. 2012-0471261E5 - conversion of CDA into functional currency

How should the capital dividend account of a Canadian corporation ("Canco") be converted from Canadian currency into US dollars, where Canco has a June 30th year end and has validly filed for its 12-month year commencing July 1, 2012 to use the US dollar as its functional currency? CRA stated:

Pursuant to paragraph 261(7)(h) of the Act, in applying the Act to a taxpayer for a particular functional currency year, any Canadian dollar amount that arises in a taxation year prior to the taxpayer's first functional currency reporting taxation year that is relevant in determining the taxpayer's "Canadian tax results" for the particular functional currency reporting year is to be converted from Canadian dollars into the taxpayer's elected functional currency using the "relevant spot rate" for the last day of the taxpayer's last Canadian currency year.

Pursuant to paragraph 261(5)(b) of the Act, any Part III tax due by Canco (pursuant to subsection 184(2) of the Act) in the event it makes a capital dividend election in excess of its CDA balance, is relevant in determining Canco's "Canadian tax results". Since the CDA balance is relevant in determining whether Canco will incur a Part III tax liability, Canco must maintain its CDA in its elected functional currency.

As Canco's last Canadian currency year ended on June 30, 2012, it must convert the balance in the CDA on June 30, 2012 using the "relevant spot rate" on that date as defined in s. 261(1).

Subsection 261(11) - Determination of amounts payable

Paragraph 261(11)(a)

Administrative Policy

21 January 2015 Memorandum 2014-0540631I7 - S.261 and loss carryback request

Canco, whose elected functional currency ("EFC") has been the U.S. dollar, deducted non-capital losses from subsequent years in computing its taxable income for Years 1 and 2. Where an amount is deducted under s. 111(1)(a) for a particular taxation year in respect of a subsequent year's non-capital loss for a subsequent taxation year, (a) which instalment method should be used, and (b) should previously applied non-capital losses from subsequent years be considered, in recalculating a functional currency reporter's taxes payable (or refund) for the particular taxation year?

Q. a

CRA noted that ss. 261(11)(a) and (b) incorporate the initial computation of the taxes payable as determined in the reporter's EFC ("EFC Taxes Payable") in order to determine the reporter's ultimate taxes payable in CAD ("CAD Taxes Payable"), and that they contemplate the use of any of the instalment methods described in s. 157(1)(a)(i) ("Estimated Method"), 157(1)(a)(ii) ("First Instalment Base Method"), or 157(1)(a)(iii) ("Second Instalment Base Method"). Furthermore, in computing the reporter's remainder of taxes payable, each of its required CAD instalment payment obligations are converted to its EFC at the applicable spot rates for the instalment due dates, with the total of the required instalments, as expressed in the EFC, then deducted from its EFC Taxes Payable for the year and with the difference, if any, converted to Canadian dollars at the spot rate on the balance-due day. After noting (following I.G. Rockies Corp, 2005 DTC 289) that "a corporation may opt for whichever instalment method under paragraph 157(1)(a) that it wishes, regardless of the instalment method that is deemed by subsection 161(4.1) to have been used for purposes of computing the corporation's interest in respect of unpaid or late instalments," CRA stated that "a corporation's functional currency election…does not hinder its ability to choose…[an] instalment method under paragraph 157(1)(a)," stated that it "will not consider the use of either the First Instalment Base Method or the Second Instalment Base Method where a reporter's Total EFC Instalments [the total required instalments, as converted to the EFC] using the respective instalment method exceed the reporter's EFC Taxes Payable for the year," and that it was appropriate "that each assessment of the CAD Taxes Payable of a functional currency reporter…[use] the instalment method that gives rise to the least amount of CAD Taxes Payable" – so that when re-determining the CAD Taxes Payable for a particular taxation year as a result of a s. 111(1)(a) deduction of a subsequent year's loss, the same instalment method that was originally used for the particular year is not required to be used to recalculate the CAD Taxes Payable.

Q. b

CRA noted that although s. 161(7) ensures interest and penalties are computed without regard to reductions in taxes payable resulting from application of subsequent years' losses, "no similar provision exists that would exclude such a deduction from the determination or redetermination of a taxpayer's actual instalment obligations, nor from the determination of the remainder of taxes payable in respect of a taxation year under paragraphs 157(1)(a) and (b)," and concluded:

[T]here is no provision…that would, in re-determining a functional currency reporter's CAD Taxes Payable for a taxation year as the result of a loss carried back to that year, prevent consideration of each prior amount of a loss that was previously applied in that year.

Subsection 261(12) - Application of subsections (7) and (8) to reversionary years

Administrative Policy

13 February 2013 T.I. 2011-0430921E5 F - S. 261 - Loss carry-back & loss carry-forward

The taxpayer elected in its December 31, 2009 taxation year to adopt the U.S. dollar as its functional currency in accordance with s. 261(2), and revoked that election in its December 31, 2011 taxation year in accordance with s. 261(4). The U.S. dollar to Canadian dollar exchange rates were 1.1 on December 31, 2008 and 1.2 on December 31, 2010.

A loss of Cdn.$1,200 which the taxpayer incurred in its 2008 taxation year would be converted under s. 261(7) to U.S.$1,090 (Cdn.$1,200/1.1) as the amount of such loss for its 2009 and 2010 functional currency years, and would be converted under s. 261(12) to Cdn.$1,309 (U.S.$1,090*1.2) for its 2011 and subsequent reversionary years.

Subsection 261(15) - Amounts carried back

Administrative Policy

13 February 2013 T.I. 2011-0430921E5 F - S. 261 - Loss carry-back & loss carry-forward

The taxpayer elected in its December 31, 2009 taxation year to adopt the U.S. dollar as its functional currency in accordance with s. 261(2), and revoked that election in its December 31, 2011 taxation year in accordance with s. 261(4). The U.S. dollar to Canadian dollar exchange rates were 1.1 on December 31, 2008 and 1.2 on December 31, 2010.

A loss of Cdn.$1,309 which the taxpayer incurred in its 2011 taxation year and wished to carry back to 2008 would be converted to U.S.$1,090 (Cdn.$1,309/1.2), and then to Cdn.$1,200 (U.S.$1,090*1.1), so that the amount carried back to 2008 would be Cdn.$1,200.

Subsection 261(18) - Anti-avoidance

Articles

Eric Bretsen, Heather Kerr, "Tax Planning for Foreign Currency", 2009 Conference Report (CTF), C. 35.

Carve-out for commerical transactions

Although this provision is now a broadly applicable anti-abuse rule, it contains a dual-step carve-out for commercial transactions where, first, the currency planning was not a main purpose and, second, the CRA would not direct the tax results to be determined in a different currency. In situations where a Canadian parent company whose functional currency is the US dollar transfers, say, a Canadian-dollar asset to its wholly owned subsidiary (which has not made a functional currency election), it is advisable to obtain a ruling from the CRA to be sure that the Canadian dollar will be respected for the purposes of computing the Canadian tax results. Subparagraph 216(18)(c)(i) refers to a "functional currency year" for the transferor. Therefore this anti-abuse rule will not apply to a transfer where the transferor has not made a functional currency election, because the transferor would otherwise not have a functional currency year. This result is consistent with the policy intent of the version in the original rules.

Subsection 261(20) - Application of subsection (21)

Administrative Policy

6 December 2011 TEI-CRA Liason Meeting Roundtable Q. 4, 2011-0426981C6

CRA confirmed its position respecting the example (first raised at the May 2011 IFA Roundtable), that where a parent with a Canadian dollar functional currency has lent in Canadian dollars to a US dollar functional currency subsidiary, a foreign exchange loss realized by the subsidiary on repayment of the loan will be denied under s. 261(21), noting that this accorded with the words of s. 261(20) and an example in the Finance Explanatory Notes.

Articles

Eric Bretsen, Heather Kerr, "Tax Planning for Foreign Currency", 2009 Conference Report (CTF), C. 35.

Loss denial arising where U.S. commercial paper issued through U.S. sub (pp. 35:42-43)

Canco…uses the Canadian dollar as its functional currency. Canco has a wholly owned Canadian subsidiary, Cansub, that (under the applicable GAAP) uses the US dollar as its functional currency. Canco issues US-dollar commercial paper and loans the same to Cansub in US dollars. Canco is perfectly hedged from both a book and a tax perspective. Assume that on maturity the Canadian dollar has appreciated relative to the US dollar so that Canco has an inherent loss on the US-dollar loan to Cansub and a gain on the commercial paper.

In this case, it is reasonable to say that the relevant fluctuation occurred during the accrual period. Thus, Canco's currency loss on the loan to Cansub will be deemed not to have occurred, resulting in an unsheltered gain on the settlement of the commercial paper. While there is clearly no abuse of the functional currency rules in this example, the absence of a purpose test results in an adverse outcome.

Subsection 261(21) - Income, gain or loss determinations

Administrative Policy

2015 Ruling 2014-0561001R3 - Functional currency election

underline;">: CanULC financial reporting. CanULC, is a wholly-owned subsidiary of Pubco (a U.S. public company), which reports its consolidated financial results to the public markets in USD and requires its subsidiaries worldwide (including CanULC) to maintain their accounts and report financial results in USD. CanULC does not independently report its financial results externally other than for Canadian tax purposes, and its financial statements approved by its Board are denominated in USD.

CanULC's commodites' trading business

CanULC trades commodities (both with related and unrelated parties), usually in USD and sometimes in CAD. While the substantial majority of its operating and administrative expenses are incurred in CAD, management estimates that these only represent XX% of the total expenses of that company. With one exception, it has issued its shares for USD. Its employees are experienced in trading commodities but not currencies.

FX hedging with U.S. sister (A-Co)

Where the settlement currency of its commodity contract is CAD, CanULC generally enters into a currency hedging transaction with A-Co (a direct U.S. subsidiary of Pubco) to purchase (or sell), in USD, the approximate amount of CAD that it will receive (or have to pay) on the settlement date of the Commodity Contract.

Inter-affiliate back-to-back FX hedging through CanULC

B-Co1 (an indirect wholly-owned subsidiary of Pubco) and B-Co1's wholly-owned subsidiary, B-Co2, are resident in Country B but have the USD as their reporting currency for Country B tax purposes), and engage in commodity trading. Where they enter into a Commodity Contract to be settled in CAD, they generally enter into a currency hedging transaction with CanULC to purchase (or sell), in USD, the settlement amount of CAD they will receive (or have to pay). Upon entering into a Currency Hedging Transaction with either B-Co1 or B-Co2, CanULC would generally enter into a back-to-back currency hedging transaction with A-Co, thereby offsetting, in turn, the CAD exposure assumed by it.

Proposed transactions

CanULC will file a s. 261(3) election to report its Canadian tax results in USD for the specified taxation year. It will continue to enter into commodity and hedging contracts as described above.

Rulings

S. 261(5) will apply to CanULC in respect of its taxation year beginning on XX, provided that USD remains the primary currency in which CanULC maintains its records and books of account for financial reporting purposes throughout that taxation year. For the purposes of determining CanULC's income, gain or loss in respect of the currency hedging transactions with A-Co, B-Co1 and B-Co2 (including the back-to-back currency hedging transaction with A-Co), s. 261(21) will not apply to deem each fluctuation in value referred to in s. 261(20)(c) not to have occurred, including for hedging transactions entered into before the election.

Respecting the second ruling, the summary states:

[S.] 261(21) will not apply for the purpose of determining the electing corporation's income, gain or loss in respect of its proposed currency hedging transactions with related, non-resident corporations to the extent that the other related, non-resident corporations are not subject to tax under the Act on any amount included in their respective Canadian tax results.

Articles

John Lorito, Trevor O'Brien, "International Finance – Cash Pooling Arrangements", draft version of paper for CTF 2014 Conference Report.

CRA relief where a cash pool head account has no presence in Canada and Canco has elected (p. 24)

Assume Canco…has elected to compute its Canadian tax results in US dollars. Canco is a wholly-owned subsidiary of USCo… the parent company of a multinational group and owns all the shares of BVCo, a corporation resident in the Netherlands. The multinational group has… a physical cash pooling arrangement wherein BVCo will be the head account holder.

Although BVCo may have no tax presence in Canada, as a non-resident corporation is unable to make a functional currency election, if BVCo were to be required to compute its Canadian tax results in a currency, that currency would have to be the Canadian dollar. As a result, for purposes of determining whether subsection 261(21) may be applicable to transactions entered into between Canco and BVCo under the cash pooling arrangement, it would appear that Canco and BVCo could be treated as being required to compute their Canadian tax results in different currencies. If this were to be the case and BVCo were to enter into a non-US dollar denominated transaction with Canco under the cash pooling arrangement, subsection 261(21) could require any income, gain or loss realized by Canco to be adjusted.

However, based on comments from the CRA, it would appear that subsection 261(21) should not be applicable to transactions entered into between a Canadian resident corporation and a related non-resident where the non-resident does not have a taxable presence in Canada…. [Citing 2014-0561001R3 above]

See description of cash pooling under s. 15(2.3).