Subsection 40(1) - General rules

Cases

Abrametz v. The Queen, 2009 DTC 5828, 2009 FCA 111

The taxpayer would have established that he realized a capital loss if he had established the following:

- a fellow shareholder ("Paulhus") of the corporation in question had paid a sum of money to the holders of defaulted mortgage debt of the corporation pursuant to a settlement agreement that also contemplated that the taxpayer would transfer to Paulhus all of his shares of another corporation ("Placid") in order to pay to Paulhus his share of the settlement payment;

- the taxpayer satisfied this payment obligation to Paulhus;

- as a consequence of the law of subrogation, Paulhus acquired the mortgage debt; and

- by transferring his shares of Placid to Paulhus, the taxpayer acquired ½ of the indebtedness formerly owing to the mortgage holders that Paulhus had acquired from the mortgage holders.

The Trial Judge had incorrectly found that the taxpayer had not made the payment referred to in (2) above, and the matter was referred back to the Minister for reconsideration of the third and fourth points above, together with consideration as to whether the claim by the taxpayer in his return for a business investment loss represented an election under s. 50(1).

Administrative Policy

Calculating and reporting your capital gains and losses

Use the exchange rate that was in effect on the day of the transaction or, if there were transactions at various times throughout the year, you can use the average annual exchange rate.

Paragraph 40(1)(a)

Subparagraph 40(1)(a)(i)

Cases

Martin v. The Queen, 2015 CAF 204

The taxpayer's employment at his brokerage employer was terminated. He was unable to find replacement employment or to establish his own financial advisory business, so that he lost his clientele. He was unable to claim a capital loss of $14.8 million, computed as the fair market value of his clientele, and the value of property seized as a result of his ensuing financial troubles. He did not have a cost for his clientele (and the expenses incurred in building up his clientele had been deducted as business expenses) and his financial losses were not disposition expenses.

Gaynor v. The Queen, 91 DTC 5288 (FCA)

In rejecting a submission that the capital gain realized by the taxpayer from the purchase and sale in U.S. dollars of U.S. securities should be computed by multiplying the gain measured in American currency by the exchange rate prevailing at the time of the disposition, Pratte J.A. stated that "both the cost of the securities and the value of the proceeds of disposition must be valued in Canadian currency which is the only monetary standard of value known to Canadian law" and that "once this is realized, it becomes clear that the cost of the securities to the appellant must be expressed in Canadian currency at the exchange rate prevailing at the time of their acquisition while the valuation of the proceeds of disposition of the same securities must be made in Canadian currency at the rate of exchange prevailing at the time of the disposition".

The Queen v. Demers, 86 DTC 6411, [1986] 2 CTC 321 (FCA)

Although the price stipulated in the agreement for the sale of shares of a corporation ("Chibougamau") was $7,800,000, the agreement also provided that the vendors were required to use the sale proceeds to acquire from Chibougamau a debt owing to it by its subsidiary with a face amount of approximately $1,400,000 but a fair market value of only $600,000 (the difference being $800,000). Hugessen J.A., in his concurring reasons, found that the vendors were able to deduct $800,000 as an outlay or expense of the disposition (pp. 6413-6414):

"In my opinion it is not necessary for a payment to be made without any consideration for there to be a 'débours' or 'outlay' ... However, the provision recognizes that an outlay can be for more than one purpose: it is only 'to the extent' that it is made for the purposes of making the disposition that it can be taken into account in calculating the capital gain ... As it was not in dispute that in the case at bar the payment of $1,400,000 vested in the respondents property worth only $600,000, it follows that the sum of $800,000 was spent for purposes other than purchasing this property, namely for the disposition of their shares in Chibougamau."

See Also

Brosamler Estate v. The Queen, 2012 DTC 1193 [at 3493], 2012 TCC 204

he estate of a deceased German resident sold three rental properties in BC. The estate added probate and legal fees that were paid in establishing the title of the estate to the properties to the adjusted cost base of the rental properties. The Minister denied the increase in adjusted cost base, and thereby reduced the estate's capital loss (which was deemed to be a capital loss of the deceased under s. 164(6).)

After finding that these fees were part of the estate's acquisition cost, Webb J. noted, in the alternative, that the fees could be characterized as outlays or expenses the estate incurred for the purpose of making a disposition of the rental properties, which would reduce the estate's proceeds of disposition under s. 40(1)(a), leading to the same capital loss that the deceased claimed.

Dubois v. The Queen, 2007 DTC 1534, 2007 TCC 461

The taxpayer had to pay an amount in settlement of the damages claim of the vendor and incurred related legal expenses as a result of a cancellation by the taxpayer of an agreement to purchase a building. After finding that these amounts were incurred on capital account, Paris J. rejected (at para. 22) a submission of the Crown that the taxpayer "would not be entitled to a capital loss because...the Appellant did not dispose of any property in 2001," and stated:

...the expenses may have been incurred as part of a disposition of the Appellant's right to purchase the building , and the disposition of that right may constitute a disposition of property within the meaning of section 38...

Avis Immobilièn G.M.B.H. v. The Queen, 94 DTC 1039 (TCC)

The taxpayer, which was a corporation resident in West Germany, borrowed deutschemarks ("DM") from a German bank to help finance the acquisition in 1983 of three properties in Montreal. The bank consented to a sale in 1986 of the properties to an arm's length purchaser ("MCLR") provided that the taxpayer repaid the loans out of the proceeds of a sale of the properties to its shareholders ("Vogel" and "Fischer"). Vogel and Fischer financed the purchase by borrowing DM personally from the bank secured by hypothecs on the properties, then sold the properties to MCLR subject to the hypothecs.

In finding the that taxpayer had not made or incurred an outlay or expense for purposes of s. 40(1)(a)(i) by virtue of the appreciation of the DM between 1983 and 1986, Rip TCJ. found that no foreign exchange loss had arisen on the repayment of the DM loan with DMs, and that the foreign exchange loss arose as a result of DM being exchanged for dollars in 1983 and dollars being reconverted into DM in 1986. This exchange transaction was not effected "for the purpose of" disposing of the properties, i.e., "for the immediate or initial purpose" of so doing. S.40(1)(a)(i) "does not contemplate expenses or outlays which may have merely facilitated the making of the disposition or which were entered into on the occasion of the disposition." (p. 1046).

Capcount Trading v. Evans, [1993] BTC 3 (C.A.)

A capital loss of a British company from the disposal of shares of a Canadian company was to be determined by computing the difference between the cost, converted into pounds sterling at the spot rate prevailing at the time of acquisition, and the proceeds, converted into pounds sterling at the spot rate prevailing at the time of disposal.

Campbellton Enterprises Ltd. v. MNR, 90 DTC 1869 (TCC)

A bonus equal to three months' interest which the taxpayer paid in order to discharge a mortgage upon the sale of a rental property was deductible in computing its capital gain.

Samson Estate v. MNR, 90 DTC 1150 (TCC)

Professional fees incurred in seeking the cancellation of a zoning by-law were found to have been incurred in order to more easily dispose of the property, and therefore were deductible under s. 40(1)(a)(i). However, professional fees relating to a disputed municipal assessment were found instead to relate to the maintenance of the property.

Bentley v. Pike, [1981] T.R. 17 (HCJ.)

Mrs. Bentley was considered under the Finance Act 1965 to have acquired, on her father's death in 1967, a 1/6 share of real property situate in West Germany which passed to her for a consideration equal to its fair market value, and sold her interest for DM in 1973. It was held that her capital gain should be computed by translating her DM cost into sterling in 1967, and her DM proceeds into sterling in 1973, rather than by multiplying her DM gain by the 1973 exchange rate. Sterling was the only permissible unit of account.

Administrative Policy

9 July 2015 Folio S4-F2-C1

1.22 If a fine or penalty (such as a mortgage prepayment penalty) is incurred in connection with the disposition of a capital property, the fine or penalty is taken into account under subsection 40(1) for purposes of calculating any gain or loss on that disposition.

10 June 2013 STEP Round Table Q. 10, 2013 0480411C6 (Brosamler decision)

CRA considers Brosamler Estate to be confined to "a very specific fact situation," noting that the legal and probate fees in issue would have been deductible in determining capital losses on the disposition of the properties regardless of whether they could be added to the property's ACB.

CRA's decision not to appeal reflects its general policy not to appeal decisions made under the informal procedure, rather than its views on the merits of the decision.

11 January 2013 T.I. 2012-0436771E5 - Sale of a business

The sole shareholder of Aco is required under the terms of the share sale agreement to repay, in full, at closing, a bank loan owing by Aco and an early repayment penalty. Consistently with Demers, 86 DTC 6411, both amounts are deductible in computing the shareholder's gain under s. 40(1)(a)(i) as amounts incurred for the purpose of disposing of the shares.

29 July 2004 Memorandum 2003-002376

After concluding that the payment, on the termination of an equity swap, by the taxpayer of the swap termination payment gave rise to a capital loss, the Directorate indicated that in order for that capital loss to be deductible it was necessary for the taxpayer to demonstrate that the amount paid constituted an expense made or incurred with a view to realizing a disposition of the intangible rights which were the equity swap agreement.

9 June 2003 Memorandum 2003-001330

Legal fees incurred, following the disposition by the taxpayers of a property, in a dispute as to the amount of the final payment due to the taxpayers for the sale of the property did not qualify under s. 40(1)(b)(i) as being directly incurred for the purpose of making the disposition of the property.

21 October 1993 T.I. 9325325 [loan penalty on sale]

Where penalty payments are made in order to pay off a mortgage, or reduce the interest rate on a mortgage, prior to the sale of the mortgaged capital property, the payment will be considered to have been made or incurred for the purpose of making the disposition and s. 40(1)(a)(i) will be applicable. However, if a substitute property is acquired, s. 18(9.1) may have application.

26 January 1993 Memorandum (Tax Window, No. 28, p. 15, ¶2399)

Legal fees incurred by a taxpayer in a year subsequent to the sale of a capital property in order to collect the proceeds of disposition will not be deductible in calculating the gain from the original disposition or on any other basis.

91 CR - Q.29

Where a landlord makes an inducement payment outside the ordinary course of its business to facilitate the sale of a building by increasing the occupancy rate, the unamortized amount of the inducement may, depending on the facts, form part of the cost of disposition of the building.

18 November 1991 Memorandum (Tax Window, No. 11, p. 19, ¶1537)

S.40(1)(a)(i) may reduce the taxpayer's capital gain on the sale of shares where under the agreement the taxpayer is required to use a portion of the sale proceeds to repay a debt owed to the corporation.

89 C.M.TC - "Leasing Costs"

"payments made in contemplation of the sale of the property, i.e., to bring the property to full occupancy to enhance the sellling price ... are outlays and expenses made or incurred to dispose of the property ..."

Subparagraph 40(1)(a)(iii)

Cases

Pineo v. The Queen, 86 DTC 6322, [1986] 2 CTC 71 (FCTD)

The reserve was not available in respect of a demand promissory note received by the vendors as partial consideration for the sale of shares of a family farm corporation, notwithstanding that the shares were held subject to an escrow agreement until the promissory note was paid off.

The Queen v. Derbecker, 84 DTC 6549, [1984] CTC 606 (FCA)

In S.40(1)(a)(iii)(A), "the words 'due to him' look only to the taxpayer's entitlement to enforce payment and not to whether or not he has actually done so." Thus, where part of the proceeds of disposition of shares was represented by a promissory note expressed to be payable "on demand after December 31, 1976", no reserve was available to the taxpayer after 1976 notwithstanding that no demand for payment was made by him.

Neder v. The Queen, 82 DTC 6022, [1981] CTC 501 (FCA)

Where a taxpayer has been reassessed so as to include in his income a taxable capital gain, a S.40(1)(a)(iii) reserve is not available to the taxpayer if the Minister's assessors have not been provided with the necessary information from which they could determine the applicability or otherwise of that provision. Here, the taxpayer did not even mention the S.40 reserve in his notice of objection, and in his statement of claim "facts [were] not pleaded providing any details of the mortgage [taken back] which could possibly form the basis of a proper claim for a reserve".

See Also

Alguire v. The Queen, 95 DTC 532 (TCC)

In 1981, the taxpayer sold the shares of a corporation owned by him to his mother for $600,000 under an oral agreement that she would pay him when she received cash dividends from the corporation. In 1983, his mother received $50,000 in dividends and paid such amount to him. Thereafter, the corporation became insolvent.

The sale transaction was not disclosed until the taxpayer's 1983 return, which took the $50,000 receipt into account in claiming a reserve of approximately $550,000 under s. 40(1)(a)(iii). In 1988, Revenue Canada included the amount of the reserve in his income, without allowing any further reserve. Bell TCJ. found that the taxpayer was entitled to claim approximately $550,000 as a reserve in his 1988 taxation year, given that such amount could not be said to be due to him during that year, and also stated (at p. 934) that "it would be illogical for the Appellant to be required to include in income any amount which he has not received unless it is required by statute so to be included".

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.95 A person entitled to a reserve under paragraph 20(1)(n), subparagraph 40(1)(a)(iii) or subparagraph 44(1)(e)(iii) in respect of an amount not yet due from a predecessor corporation will not become disentitled to the reserve by virtue of the amount becoming an obligation of the new corporation on the amalgamation.

24 February 2014 T.I. 2013-0505391E5 F - Clause de earnout renversé

CRA confirmed its position in 2000-0051115 that:

Where the cost recovery method is not used and the sale price of a property is not certain at the time of the disposition because of an earnout agreement, a taxpayer may estimate the proceeds of disposition and use this amount to compute the capital gain or capital loss pursuant to subsection 40(1) of the Act. Where a taxpayer chooses this method… no amount is deductible as a reserve under subparagraph 40(1)(a)(iii) of the Act by virtue of the fact that…[a] "legally enforceable" entitlement to proceeds of disposition pursuant to the earnout agreement cannot be established until certain future events have occurred such that no amount is "payable" at the time the property is disposed of.

In the case of a reverse earn-out clause (i.e., "the sale price initially is fixed to a maximum equivalent to fair market value…but this sale price can be reduced in accordance with pre-established conditions…" so that on such reduction no reimbursement of the sale price occurs):

the actual proceeds of disposition are not determinable at the moment of the disposition of the shares. Consequently…the taxpayer will not be entitled to a capital gains reserve under subparagraph 40(1)(a)(iii).

7 October 2013 Memorandum 2013-0504081I7 F - Interaction between 55(2) and 40(1)(a)(iii)

Vendor, following a sale to Buyer of various blocks of shares, received a deemed dividend from Buyer (as a result of a sale [i.e., purchase for cancellation?] of shares of Buyer), which s. 55(2) deemed to be proceeds of disposition. After the Directorate confirmed that 1999-0009295 (respecting the availability of a reserve under s. 40(1)(a)(iii) to a capital gain under s. 55(2) where the capital gain arose on the receipt of a promissory note made as a conditional payment), the Directorate was then asked whether this position also applied where there was unpaid purchase price rather than receipt of a conditional-payment promissory, and where the sale agreement provided that the payment of the annual sale instalments was to be based on annual corporate profits in future years and provided that the Buyer had the right to pay off the balance of sale price prior to the due dates.

After noting that (consistent with IT-436R, para. 10) the prepayment right did not preclude the reserve, CRA stated (TaxInterpretations translation):

[T]he position stated in Technical Interpretation 1999-000929 applies to a situation entailing an unpaid purchase price, rather than a promissory note. Furthermore, the payment methods stipulated in the sale contract do not prevent the Vendor from claiming a reserve by virtue of subparagraph 40((1)(a)(iii) in the year... .

16 November 2001 T.I. 1999-0009295 -

Decision summary 55-066 dated 29 November 29 1985 addressed whether a shareholder could claim a reserve under s. 40(1)(a)(iii) when its shares were redeemed in exchange for a promissory note payable in the future and, pursuant to the application of s. 55(2) to the resulting s. 84(3) deemed dividend, the shareholder was deemed to have a capital gain on the redemption. The finding there – "that if the promissory note is a conditional payment then a reserve is permitted and if the promissory note is an absolute payment then a reserve is not permitted" – still represents the Directorate's views.

17 November 1999 T.I. 990126

"[W]here and individual transfers property to a partnership under subsection 97(2) of the Act and receives, in addition to a partnership interest as consideration, a promissory note payable over, say, five years, the agreed amount would include the note and this amount would be deemed to be the proceeds for the individual and the cost to the partnership. In such a situation, where a gain has been triggered, i.e., the agreed amount exceeds the adjusted cost base of the property transferred, the transferor will be entitled to claim a reserve under paragraph 40(1)(a) of the Act if the note taken back is received as a 'conditional payment'."

31 March 1995 T.I. 5-943011

A reserve may not be claimed where an individual transfers property to a partnership pursuant to s. 97(1) and receives as consideration a promissory note payable over five years. "According to the Derlago v. The Queen, 88 DTC 6290 (FCTD) case, where a provision in the Act deems property to have been disposed of for certain proceeds, the proceeds are considered to have been received by the taxpayer at the time of, or immediately after, the disposition."

93 C.R. - Q. 41

Re whether changes to the terms of a take back note or mortgage result in loss of the reserve.

10 October 1991 T.I. (Tax Window, No. 11, p. 14, ¶1515)

Where the original due date on a vendor take-back mortgage or promissory note is extended by agreement, the entitlement of the vendor to continue claiming a reserve under s. 40(1)(a)(iii) is unaffected by the extension if the note or mortgage continue to be merely evidence of the original debt.

21 August 1991 T.I. (Tax Window, No. 8, p. 6, ¶1403)

The entitlement of a vendor to claim a reserve where a promissory note was accepted only as evidence of the purchaser's obligation for the unpaid purchase price is unaffected by a renegotiation of the promissory note to extend the term or make other changes which IT-448 would consider to result in a disposition provided that the renegotiation occurs before the original due date of the note and before the end of the year in which the reserve is claimed, and the renegotiated note is accepted only as evidence of the continuing debt obligation.

14 February 1991 T.I. (Tax Window, Prelim. No. 3, p. 12, ¶1119)

A vendor take-back mortgage, whose scheduled payments of principal are substantially deferred due to the financial difficulty of the purchaser, would be considered to be a new mortgage. Where the new mortgage has been accepted as absolute payment of the original debt rather than being continuing evidence of the original debt, no reserve will be available to the vendor in the year in which the mortgage was amended. In addition, the purchaser's default might cause the debt to become due in the year of default, thereby resulting in no reserve being available in that year.

IT-236R2 "Reserves - Dispositions of Capital Property"

IT-436R "Reserves - Where Promissory Notes are Included in Disposal Proceeds"

Articles

Smith, "Corporate Restructuring Issues: Public Corporations", 1990 Corporate Management Tax Conference Report, pp. 6:6-6:8: discussion of claiming of reserve by vendor under a take-over bid.

Paragraph 40(1)(b)

Administrative Policy

18 August 2014 T.I. 2014-0540361E5 F - CDA and the deeming rules of 40(3.6) or 112(3)

A corporation's capital dividend accounts will not be reduced by a loss on the redemption of shares held by it where such loss is deemed to be nil by s. 40(3.6) or 112(3), given that where s. 40(3.6) or 112(3) applies to deem its loss to be nil, it is not considered to have sustained a loss for the purpose of s. 39(1)(b). After referring to the "except as otherwise expressly provided" reference in the s. 40(1) preamble, CRA stated (TaxInterpretations translation):

Our longstanding position is…that subsection 112(3) is an express contrary indication. In accordance with subsection 112(3), the amount of a loss as [otherwise] calculated…is reduced in accordance with that subsection. The resulting loss...is considered to be the loss determined in accordance with paragraph 40(1)(b).

Subsection 40(2) - Limitations

Paragraph 40(2)(b)

Cases

Cassidy v. The Queen, 2011 FCA 271

The taxpayer sold his six-acre rural property after it was rezoned for residential use as a result of an application made on behalf of owners of adjacent properties. He claimed a principal residence exemption on the entire gain. The Minister denied the gain on the basis of paragraph (e) of the definition of "principal residence" in s. 54 of the Act, which provides that a principal residence only includes up to a half-hectare of land contiguous with the residence unless the taxpayer can establish that a larger portion of the property was "necessary to the use and enjoyment" of the residence. The Tax Court rejected the taxpayer's appeal on the reasoning that the determination under paragraph (e) is to be made at the time the property is sold, and at that time the property had been rezoned and could be subdivided. Therefore, the entire six acres was no longer necessary to the use and enjoyment of the residence.

The Court of Appeal granted the taxpayer's appeal. Sharlow J.A. stated (at para. 35):

The error in the interpretation of paragraph 40(2)(b) proposed by the Crown, and perhaps implicit in Joyner, is that it fails to give effect to the language of paragraph 40(2)(b) that defines variable B. As mentioned above, the determination of variable B requires a determination, for each taxation year in which the taxpayer owned the property in issue, as to whether the property met the definition of "principal residence" of the taxpayer for that taxation year.

Given that the rezoning and the sale both occurred in 2003, and in light of the "plus one" component of B, the taxpayer was entitled to the principal residence exemption on the entire gain.

The Queen v. Joyner, 88 DTC 6459, [1988] 2 CTC 280 (FCTD)

In 1972, 14 acres of land which the taxpayer had acquired in 1965 was prohibited, by virtue of an Order in Council passed pursuant to the Environment and Land Use Act (B.C.), from being subdivided. In 1975 the taxpayer obtained the right to subdivide 7.9 of the 14 acres into residential lots, and in 1980 the taxpayer sold this 7.9 acre parcel, which included his residence.

Reed J. rejected the taxpayer's contention that his capital gain that was exempt should be calculated on the basis that his principal residence was 14 acres from 1972 to 1975 and one acre thereafter until 1980. The relevant time for determining the area of the principal residence was at the time of its disposition.

The Queen v. Yates, 83 DTC 5158, [1983] CTC 105 (FCTD), aff'd 86 DTC 6296 [1986] 2 CTC 46 (FCA)

It was held that the gain from the disposition of a portion of a principal residence was completely exempt since "it was not argued that, by its very nature a principal residence cannot be subject of a partial disposition".

See Also

Cassidy v. The Queen, 2010 DTC 1336 [at 4287], 2010 TCC 471

The taxpayer sold his six-acre rural property after it was rezoned for residential use as a result of an application made on behalf of owners of adjacent properties. The taxpayer argued that the whole of the six acres was eligible for the principal residence capital gains exemption: when he bought the property, it could not be further subdivided; accordingly, the entire property was "necessary to the use and enjoyment" of the residence.

Favreau J. found that the taxpayer's exemption was limited, in accordance with paragraph (e) of the principal residence definition, to a half-hectare that included the house. The determination under paragraph (e) is to be made at the time of disposition of the property, and at that time the taxpayer's premise, that subdivision was impossible, was no longer correct.

Administrative Policy

11 April 1995 T.I. 950740 (C.T.O. "40(2)(b)")

A non-resident who disposes of his principal residence can reduce the amount of the resulting capital gain by virtue of the fact that the numerator in the formula in s. 40(2)(b)(i) will be one, even though he was never resident in Canada.

16 February 1995 Mississauga Breakfast Seminar, Q. 4

Discussion of interaction between capital gains election under s. 110.6(19) and claiming of principal residence exemption for some (but not all) the years of ownership.

88 C.R. - Q.55

The taxpayer is not required to review his use and enjoyment of the property on a year by year basis respecting the half-hectare test.

80 C.R. - Q.24

Where a taxpayer purchased a vacant lot and later constructed his principal residence on it, the denominator will include the years that he owned a vacant lot.

Paragraph 40(2)(e)

See Also

Plant National Ltd. v. MNR, 89 DTC 401 (TCC)

As a consequence of the disposition by the taxpayer of voting preference shares of a corporation ("Enterprises") to Enterprises, Enterprises ceased to be controlled by the taxpayer and by a corporation which also controlled the taxpayer. S.40(2)(e)(ii) applied to deny the loss. Bonner J. rejected a submission of taxpayer's counsel that the reference in s. 40(2)(e) to "control" is a reference to control at or after the disposition in question and not to control before that disposition.

Administrative Policy

12 May 1992 Memorandum 921006 (May 1993 Access Letter, p. 194, ¶C38-156)

Because there is only a deemed disposition under s. 50(1)(a) and not an actual disposition, s. 40(2)(e) does not apply to a loss arising under s. 50(1)(a).

25 March 1991 T.I. (Tax Window, No. 1, p. 7, ¶1170)

The word "person" in s. 40(2)(e) includes "persons". Accordingly, if X Co. is controlled by Mr. X and Mrs. X together, s. 40(2)(e) will apply to a sale at a capital loss by X Co. of undivided interests in property to Mr. and Mrs. X.

10 January 1990 T.I. (June 1990 Access Letter, ¶1257)

s. 40(2)(e) generally will not apply to the winding-up or liquidation of a foreign affiliate provided that under the relevant foreign corporate law, the shares of the foreign affiliate are not disposed of "to a person" as a result of the liquidation (as is the case under Canadian corporate law).

86 C.R. - Q.22

The phrase "was controlled" means controlled at the time of the disposition.

Paragraph 40(2)(e.1)

Administrative Policy

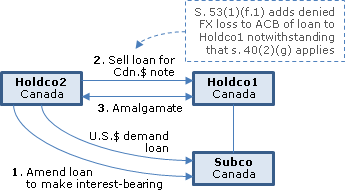

2014 Ruling 2013-0479701R3 - Transfer of US dollar loan

Current structure

Holdco2, which is wholly-owned by Mr. X (a Canadian resident), made seven non-interest-bearing demand U.S-dollar loans (collectively, the "US Loan") to another Canadian corporation ("Subco") which was wholly-owned by a Canadian corporation ("Holdco1"). Holdco1 is controlled by Mr. X through non-participating voting shares and its non-voting common shares are held by family trusts. There is an accrued FX loss to Holdco2 on US Loan.

Proposed transactions

- US Loan will be amended (without being novated) to bear a commercial rate of interest.

- Holdco2 will transfer the US Loan to Holdco1 in consideration for a demand Canadian-dollar interest-bearing promissory note.

- Holdco1 and Subco will amalgamate so that the US Loan will be extinguished.

Rulings

The US Loan amendment will not result in its disposition nor a gain or loss under s. 39(2). The denied capital loss for Holdco2's disposition of the US Loan will be added to Holdco1's ACB for the US Loan under s. 53(1)(f.1). S. 80.01(3) will apply on the amalgamation (no forgiven amount).

2012 Ruling 2011-0426051R3 - Debt Restructuring

Opco is a Canadian resource company whose liabilities far exceed the value of its assets. It is the indirect subsidiary of a foreign parent and is obligated under an interest-bearing loan (Loan 2) to its immediate Canadian parent (Holdco), which also holds the shares and an interest-bearing loan (Loan 3) of Canco 2. Opco and Canco 2 are the partners of a general partnership (GP) which holds an interest-bearing loan (Loan 1) of Opco.

The proposed transactions will be implemented before a potential acquisition of control of the foreign parent (which would "grind" the adjusted cost base of Loans under s. 111(4)):

- GP and Holdco will transfer Loan 1 and 2 to a newly-incorporated subsidiary (Subco) of Opco in consideration for Subco Preferred Shares

- Opco will transfer its partnership interest in GP to Canco 2, so that GP will cease to exist and Canco 2 will receive Subco Preferred Shares

- Canco 2 (which does not have significant tax attributes) will distribute such Subco Preferred Shares to Holdco in settlement of Loan 3 (thereby giving rise to a forgiven amount to it)

- Holdco will transfer its Subco Preferred Shares to Opco in consideration for Opco Preferred Shares

- Subco will be wound up into Opco under s. 88(1) (following a reduction of the stated capital of the Subco Preferred Shares)so that Loans 1 and 2 (previously owing to Subco by Opco) will be extinguished

Rulings (following ATR-66):

- Ss. 40(2)(e.1) and 53(1)(f.11) will apply to the dispositions of Loans 1 and 2 to Subco

- The settlement of Loans 1 and 2 on the Subco winding-up will not give rise to a forgiven amount per s. 80.01(4)

- Neither s. 40(2)(e.1) nor s. 40(3.4) will apply to deny the capital loss to Holdco on the settlement of Loan 3

- S. 61.3(3) will not apply to deny the application of s. 61.3(1) to Canco 2 (re inter alia the forgiven amount arising to it on the settlement of Loan 3)

- S. 245(2) will not be applicable

Articles

Mike J. Hegedus, "Paragraph 40(2)(e.1) Versus Subparagraph 40(2)(g)(ii): Potential Conflict?", Resource Sector Taxation (Federated Press), Vol. IX, No. 4, 2014, p.684.

2013-0479701R3 may not have dealt with conflict between s. 40(2))(g)(ii) and s. 40(2)(e.1) (pp. 686-7)

In the third and most recent ruling, the CRA opined in respect of paragraph 40(2)(e.1) but not subparagraph 40(2)(g)(ii), notwithstanding that subparagraph 40(2)(g)(ii) is specifically referenced in the title of the ruling. Although the redacted nature of the facts described in the third ruling makes it difficult to definitively conclude in this regard, it is possible that subparagraph 40(2)(g)(ii) had no reasonable prospect of applying to the situation described therein (e.g., the creditor corporation owned shares of the debtor corporation during a portion of the relevant period). Accordingly, no opinion may have been given (or for that matter, asked for) in respect, of subparagraph 40(2)(g)(ii).

S

40(2)(e.1) should have paramountcy over s. 40(2))(g)(ii)(pp. 688-9)

Even if the CRA was of the view that subparagraph 40(2)(g)(ii) may otherwise have been applicable in Ruling 2008-0300161R3, paragraph 40(2)(e.1) should be considered to have paramountcy over subparagraph 40(2)(g)(ii). Paragraph 40(2)(e.1), in conjunction with paragraph 53(l)(f.1) or (f.11) provides balanced treatment between debtors and creditors under the debt parking rule and the stoploss rules. That is, when a debt is transferred within a related group, these provisions deny the capital loss of a former debt holder while limiting the amount of debt forgiveness that the debtor may eventually be deemed to realize via the debt parking rules in subsections 80.01(6) to 80.01(8). This occurs because the new debt holder's ACB becomes that of the old debt holder by virtue of paragraph 53(l)(f.l) or (f11). Consequently, notwithstanding the transferred debt may become on or after the transfer a "parked obligation" pursuant to paragraph 80.01 (7)(b), the "forgiven amount" that subsection 80.01(8) may deem the debtor to realize will not include the old debt holder's denied loss. Presumably, Parliament did not intend the debt parking rules to apply as a result of capital losses realized within the related group. This policy could be frustrated if subparagraph 40(2)(g)(ii) had paramountcy over paragraph 40(2)(e.1) (i.e., the new debt holder's ACB would not be equal to the old debt holder's ACB, possibly resulting in subsection 80.01(8) deeming the difference to be a forgiven amount).

Paragraph 40(2)(f)

Administrative Policy

8 December 2014 Folio S3-F9-C1

Lottery Schemes

1.17 Paragraph 40(2)(f) specifies that no taxable capital gain or allowable capital loss results from the disposition of a chance to win or a right to receive an amount as a prize in connection with a lottery scheme. However, subsection 52(4) states that for the purposes of computing any tax consequences after receiving a prize, a winner in a lottery scheme is deemed to have acquired the prize at a cost equal to its fair market value at the time of acquisition. …

1.18 A lottery has been defined as a scheme for distributing prizes by lot or chance among persons who have purchased a ticket or a right to the chance. If real skill or merit plays a part in determining the distribution of the prize, the scheme is not a lottery (unless it is based essentially on chance and the degree of skill is minimal).

Pool system betting

1.19 Paragraph 40(2)(f) also provides that no taxable capital gains or allowable capital losses arise from the disposition of a chance to win a bet or a right to receive an amount as winnings on a bet in connection with a pool system of betting. The nature of pool system betting is such that the only winnings are in the form of cash from the respective pool. Consequently, no additional capital gain or loss tax consequences could arise on subsequent disposition of the winnings… .

1.20 The CRA considers a pool system of betting to be a pool on any combination of two or more professional athletic contests or events. The fact that a degree of skill is involved in the selection of the outcome of the contest or event distinguishes it from a lottery scheme as described in ¶1.18.

Paragraph 40(2)(g)

Subparagraph 40(2)(g)(ii)

Cases

Service v. The Queen, 2005 DTC 5281, 2005 FCA 163

The taxpayer, who was a minority shareholder of a corporation ("Homage") engaged in a condominium development project, lent money directly to Homage as well as lending money, on a non-interest bearing basis, to a corporation ("Prescient") owned by his wife which, in turn, advanced those funds to Homage.

The Tax Court had not made a palpable and overriding error in concluding that the taxpayer had not demonstrated a nexus between the loan to Prescient and the generation of income. The loan was non-interest bearing. He was not a shareholder of Prescient and had no expectation of dividend or any right to receive any income or benefits from Prescient.

Rich v. The Queen, 2003 DTC 5115, 2003 FCA 38

The taxpayer was entitled to recognize a business investment loss on an interest-bearing loan made by him to a company ("DSM") operated by his son and of which the taxpayer was a 25% owner. Although the predominant purpose of the loan was to help his son, it was sufficient that there be an ancillary income-producing purpose.

The Queen v. Byram, 99 DTC 5117, Docket: A-684-94 (FCA)

The taxpayer was able to deduct losses sustained on interest-free loans made by him to a U.S. operating company of which he was initially a direct shareholder and, subsequently, an indirect shareholder. In rejecting the Crown's submission that s. 40(2)(g)(ii) required the loan to represent a direct source of income, McDonald J.A. noted (at p. 5120) that, unlike s. 20(1)(c), the provision did not refer to the use of the debt but, rather, the purpose for which it was acquired, so that there was "no need for the income to flow directly to the taxpayer from the loan".

Cadillac Fairview Corp. Ltd. v. The Queen, 99 DTC 5121, Docket: A-282-96 (FCA)

he taxpayer was unable to recognize a capital loss in respect of its guarantees of bank loans made to real estate partnerships in which fifth-tier U.S. subsidiaries were invested given that, in one case, it did not make the payments in question pursuant to its guarantee of the partnership's debts (but, instead, as a contribution of capital to the relevant fifth-tier subsidiary in order for that subsidiary to repay a portion of the guaranteed debt owing by the relevant partnership) and, in the other cases, it received valuable consideration for its waiver of rights to become subrogated as a result of making payments pursuant to its guarantees, namely, the agreement of a third party to purchase the subsidiaries in question. The analysis of McDonald J.A. indicated (at p. 5126) that the taxpayer would have been considered to have disposed of subrogated debts acquired by virtue of making payments pursuant to its guarantee notwithstanding its agreement, in advance, to waive its claims of subrogation, given that "waiver 'presupposes the existence of a right to be relinquished'".

Bosa Bros. Construction Ltd. v. The Queen, 96 DTC 6193 (FCTD)

Interest-free advances that the taxpayer made to its U.S. subsidiary were found not to have been made to earn income (e.g., acquiring a product or ensuring a source of supply) but, rather, to cover losses and protect the guarantees of the principals of the taxpayer.

Brown v. The Queen, 96 DTC 6091 (FCTD)

The taxpayer made interest-free loans to a real estate corporation owned by him and others that were used to fund the corporation's obligations to pay interest. It was intended that the real estate would be used to earn rent from a farm equipment corporation also owned by the taxpayer. Because "as a shareholder of the real estate company, the plaintiff was directly linked to its income-producing potential" (at p. 6094), the loans made by him to that corporation had the requisite income-producing purpose, with the result that the loss ultimately sustained by him on those loans qualified as a business investment loss.

Smith v. The Queen, 93 DTC 5351 (FCA)

No deduction was available under s. 50(1)(a) in respect of a loan made by a corporation to an affiliate in the absence of any evidence that the recipient of the loan would be able to repay it.

The Queen v. Lalonde, 84 DTC 6159 (FCTD), aff'd 89 DTC 5286 (FCA)

Two doctors made interest-free advances to a non-profit corporation which had been established to construct and operate an old-age home. Since their purpose in loaning the money was to foster an increase in the number of potential patients in their immediate area, and thereby increase their professional income, the debt was acquired for the purpose of producing business income.

See Also

Coveley v. The Queen, 2014 DTC 1041 [at 2771], 2013 TCC 417, aff'd 2014 FCA 281

The taxpayers ("Michael and Solbyung"), were a married couple employed by a technology research corporation ("cStar"), and Solbyung was also a shareholder. They lent a significant portion of their salaries back to cStar over several years and then wrote the loans off as bad debts.

In the course of finding that the debts had not gone bad (see summary under s. 39(1)(c)), D'Auray J noted that Michael could not claim an investment loss in any event. He was not a shareholder and had no expectation of dividend income from cStar, so the loans were not made for the purpose of earning business income. Before concluding that the advances by Solbyung satisfied s. 40(2)(g)(ii), she rejected the Crown's position "that no purpose of gaining or producing income from a business or property can be inferred if the debtor was in a difficult financial position when the funds were advanced" (para. 100).

Audet v. The Queen, 2012 DTC 1208 [at 3556], 2012 TCC 162

The taxpayer, a certified general accountant, guaranteed a loan to one of his clients ("Cuisine Gourmet"), for which he became liable to pay $5168.46. Lamarre J. found that, pursuant to s. 40(2)(g)(ii), this amount was not an allowable business investment loss.

As a guarantor, the taxpayer was not entitled to any interest, and in that sense his guarantee was analogous to the interest-free loan made by the taxpayer in Byram. However, unlike in Byram, the taxpayer had never been a shareholder of Cuisine Gourmet. The taxpayer's corporation was not affiliated with Cuisine Gourmet either. Lamarre J. found that there was not a "sufficient linkage between the taxpayer and the anticipated income from the corporate debtor" (paras. 20-21).

The ability of the taxpayer to collect professional fees from Cuisine Gourmet was "too indirect and far too removed to conclude that the appellant could expect to obtain income from the loan he guaranteed" (para. 23).

MacCallum v. The Queen, 2011 DTC 1225 [at 1308], 2011 TCC 316

A corporation owned by the taxpayer and his wife wholly owned a trucking corporation ("D & N"), and his son wholly owned a small business corporation ("Mitchco"). After Mitchco started experiencing financial pressure from its bank, the taxpayer agreed to guarantee a loan that previously had been received by Mitchco from the bank, and ultimately paid on the guarantee, reporting the payment as an allowable business investment loss. The taxpayer testified (at para. 19) that he gave the guarantee in order "to keep Mitchco in business so that ... D & N could collect its receivable." V.A. Miller J. stated (at paras. 43-44):

I find that the Appellant has shown that one of his purposes for signing the guarantee in July 1996 was to support the continued existence of Mitchco, and thereby protect and collect a very significant source of earnings for D & N and for himself.

This purpose was not too remote to satisfy the requirements of subparagraph 40(2)(g)(ii) of the Act.

Scott v. The Queen, 2010 TCC 401, 2010 DTC 1273 [at 3910]

The taxpayer made a loan to a corporation owned by his son and daughter-in-law, whose business failed. Boyle J. allowed the loss because, while the taxpayer clearly meant to support his son, the contemplated return would have exceeded the taxpayer's cost of funds, but for the default (or, in the case of the final advance, there was a purpose of trying to recover his investment). All that is required to avoid excluding a loss under s. 40(2)(g)(ii) is that one of the purposes of acquiring the debt is to gain income; where that condition is met, incidental purposes are not relevant.

Alessandro v. The Queen, 2007 DTC 1373, 2007 TCC 411

The taxpayer had satisfied the burden of showing that loans advanced by her to a corporation of which she was only an indirect shareholder but for which she had direct and indirect control, so that causing that corporation to declare and pay dividend income to its corporate shareholders could result in their paying dividend income to her, were made for the purpose of earning income.

Daniels v. The Queen, 2007 DTC 883, 2007 TCC 179

The taxpayer and his brother used money borrowed by them from the Royal Bank of Canada to purchase debentures from a Canadian-controlled private corporation ("Shoppers") or to refinance money previously borrowed to purchase debentures from Shoppers. When the Royal Bank called for repayment of the loans following the placing of Shoppers into receivership, the brother was unable to repay and the taxpayer repaid the full amount owing under both his and his brother's loans from the Royal Bank, and the taxpayer obtained an assignment of the security the Royal Bank previously had in respect of its loans to his brother. The brother was unable to pay his indebtedness to the taxpayer, and the taxpayer accepted the debentures owing to his brother by Shoppers in satisfaction of his brother's indebtedness to him (that had arisen under the law of contribution).

After noting that section 79, which applied to this transaction, had the effect of transferring the accrued loss on the (bad) debt owing to the taxpayer by his brother on to the Debentures owing by Shoppers that the taxpayer acquired from his brother, Hershfield J. found that in order for this preservation of loss to occur, the income-producing purpose attaching to the original advances made by the taxpayer to Shoppers should be subsumed in the purpose of the taxpayer in acquiring the Debentures of his brother, with the result that the loss claimed by the taxpayer in respect of those acquired Debentures should be considered to satisfy the income-producing purpose test in s. 40(2)(g)(ii). Furthermore, even if it were necessary to consider the purpose of the taxpayer in acquiring the brother's Debentures without relating back to the previous transaction, the fact that the taxpayer took the action of obtaining an assignment of the Royal Bank's security "necessarily implies a belief that the Debenture itself had potential value" (para. 47) so that there might be considered to have been a subordinate, albeit faint hope, of income in respect of the acquired Debenture, which would have been sufficient to satisfy the test in s. 40(2)(g)(ii). Accordingly, the taxpayer realized an allowable business investment loss in respect of his write-down of the Debentures acquired from his brother.

Kyriazakos v. The Queen, 2007 DTC 373, 2007 TCC 66

Non-interest bearing advances that the taxpayer had made to a corporation after she had sold its shares to a friend were found not to have been made for the purpose of gaining and producing income, with the result that the subsequent loss she sustained when she found the advances to be bad debts could not be recognized as a business investment loss.

Toews v. The Queen, 2005 DTC 1359, 2005 TCC 597

The recognition of a loss realized by the taxpayer on a non-interest bearing loan made by him to a company owned by a family trust was denied given that under the terms of the trust the trustees could pay the income of the trust to any beneficiary to the exclusion of the others (including the taxpayer) and the taxpayer could not secure a distribution to him without the votes of the other two trustees.

Proulx-Drouin v. The Queen, 2005 DTC 487, 2005 TCC 116

When the taxpayer paid under her guarantee of debts owing by her husband's corporation, she became a creditor of the corporation by subrogation. Given that at that time and for some time earlier the corporation was not carrying on business and had no assets that could conceivably service the debt, the subrogated debt was not acquired for an income-producing purpose.

Bernier v. The Queen, 2004 DTC 3235, 2004 TCC 376

The taxpayer was entitled to recognize under s. 39(2) capital losses incurred in a Bahamian margin account when U.S.-dollar margin loans were repaid, notwithstanding that the taxpayer was unable to provide evidence that the margin account was placed in investments. As s. 39(2) constitutes an exception to the normal rules applicable to the calculation of capital gains and capital losses, the restriction in s. 40(2)(g)(ii) had no application.

Joncas v. The Queen, 2004 DTC 2315, 2005 TCC 647

Interest-bearing advances made by the taxpayer to a cooperative corporation of which he was a member were found to have been made for the primary purpose of enabling the cooperative corporation to have the necessary operating funds for its business and to retain ownership of a helicopter that it used in its business. After noting that any surplus earnings of the cooperative would have been allotted as rebates or paid into reserve in accordance with the members' decision at the annual meeting, Lamarre Proulx T.C.J. stated (at p. 2322 and before finding that a loss subsequently sustained by the taxpayer on the advances gave rise to an allowable business loss):

"In the appellant's case, the monetary reward for his investment will not be potential dividend income, as in Byram, supra, but a reduction in the cost of services required by his businesses in the course of their affairs. It seems to me that the relationship is just as close as in the case of a shareholder who lends to his corporation ... . His purpose in making the loans to the Cooperative was to facilitate and promote the commercial activities of his businesses and thus to increase his own income."

MacKay v. The Queen, 2003 DTC 748, Docket: 1999-4399-IT-G (TCC)

After a corporation of which the taxpayer was a significant shareholder entered into a period of financial difficulty, the taxpayer followed the practice of each year lending funds to the corporation on a non-interest-bearing basis and then writing off the amount of the loan at year-end.

Mogan T.C.J. found that deduction of ¾ of these losses as allowable business investment losses was not precluded by s. 40(2)(g)(ii) in light of the decision in Business Art Inc. v. MNR, 86 DTC 1842 (TCC).

Gordon v. The Queen, 96 DTC 1554 (TCC)

The taxpayer caused two related corporations ("Grandview" and "Formete") to advance funds on behalf of a corporation ("Engineering") owned by the taxpayer to a corporation ("Wilhem") that was one-half owned by Engineering. The taxpayer gave his personal guarantee to Grandview and Formete of Engineering's debt. When Wilhem went into default, the taxpayer advanced the requisite sum to Engineering in order for it to repay its debts to Grandview and Formete.

In finding that the taxpayer was able to recognize an allowable business investment loss in respect of the amount so advanced by him to Engineering, McArthur TCJ. found that at the time the taxpayer had given his guarantee to Grandview and Formete he had an income-producing purpose, i.e., the earning of dividend income by Engineering, and that it was not relevant that the taxpayer, when paying under his guarantee did not directly pay the creditors (Grandview and Formete) and, instead, advanced funds to Engineering to permit it to repay the creditors: the commercial reality was that the payment was made because of the taxpayer's guarantee obligation.

Burns v. The Queen, 94 DTC 1370 (TCC)

Five siblings, including the taxpayer, loaned money on a non-interest bearing basis to a corporation ("WFC") as part of transactions that resulted in them ceasing to be shareholders of WFC, in them ceasing to be obligated under guarantees with respect to indebtedness of WFC and in a sixth sibling acquiring an additional interest in WFC. Rowe D.J.TCC found that because the loans to WFC were made on the basis that WFC would sell machinery and provide parts at a reduced price to a farming corporation a majority of whose shares were owned by the five siblings, the loans made by them to WFC represented money that would lead to the production of income. Accordingly, s. 40(2)(g)(ii) did not prohibit the recognition of allowable business investment losses by them when the loans to WFC became bad.

National Developments Ltd. v. The Queen, 94 DTC 1061 (TCC)

The taxpayer, which was a significant shareholder of a Minnesota corporation ("K-Tel") agreed along with another major shareholder ("Tri-State") to guarantee a portion of K-Tel's bank loans. Tri-State provided cash collateral to secure the guarantees and the taxpayer agreed to indemnify Tri-State in respect of a pro-rata portion of the collateral. A year later, K-Tel filed for protection under Chapter 11 of the Bankruptcy Code (from which it ultimately re-emerged), the bank seized the cash collateral, and the taxpayer became subrogated to a portion of the bank debt, which it then wrote off.

In finding that the taxpayer was not limited from recognizing a capital loss under s. 50(1)(a) by s. 40(2)(g)(ii), Bell, TCJ. noted that in light of the object and spirit of s. 40(2)(g)(ii) the relevant time for determining the taxpayer's intentions was at the time the security was given rather than at the time it acquired the K-Tel debt through subrogation. Because at that time it believed in the potential of K-Tel to become successful again, the capital loss could be recognized. There also was no basis for according less favourable treatment to non-Canadian corporations.

W.F. Botkin Construction Ltd. v. The Queen, 93 DTC 448 (TCC)

The purchase price for the sale of the taxpayer's business to a corporation owned by the children of the taxpayer's shareholder was financed by the assumption of some liabilities and by funds advanced by a bank in reliance on a guarantee provided by the taxpayer. The recognition of the resulting loss when the purchasing corporation became insolvent was denied given that the business could have been sold to an arm's length purchaser without risk. "There was no commercial reality to the transaction as structured other than to benefit his children by distributing to them the potential large annual profits the company was expected to produce in light of its past history." (p. 450)

Glass v. MNR, 92 DTC 1759 (TCC)

Pursuant to a written agreement with the existing shareholders, the taxpayer purchased 25% of the shares of a land development corporation for U.S. $5,000 and made an interest-free loan of U.S. $295,000 to the corporation. Because the loan was made as part and parcel of an acquisition of the 25% shareholder interest in the corporation, the loan was made to assist the corporation with its business, and the taxpayer genuinely believed that it was a good development, the ultimate loss realized by the taxpayer was deductible.

Madaline v. MNR, 91 DTC 1451 (TCC)

A loss on a guarantee given by the taxpayer of a loan to his son's business was not made for the purpose of gaining or producing income but, rather, in order to allow his son's company to carry on business. The loss was non-deductible.

O'Blenes v. MNR, 90 DTC 1068 (TCC)

At the time that the taxpayer guaranteed amounts owing by a corporation of which her husband was the shareholder and officer, "she was not motivated by any benefit she might herself receive", and instead "family considerations played a key role". Her subsequent loss accordingly was denied.

Business Art Inc. v. MNR, 86 DTC 1842 (TCC)

Interest-free loans which the taxpayer made to a U.K. subsidiary, which had been established to purchase supplies in the U.K. for resale to the taxpayer but which ultimately became bankrupt, were found to have been made for an income-producing purpose. Rip J. stated (p. 1848):

"It is not uncommon for a shareholder to lend money without interest and without security to the corporation since he anticipates that the loans will assist the corporation to earn income and to pay him income by way of dividends; the loan is made for the purpose of earning income from a property ... that is, to receive dividends on the shares [he] owns in the corporation."

Administrative Policy

2014 Ruling 2013-0479701R3 - Transfer of US dollar loan

Holdco2, which is wholly-owned by a Canadian resident individual, made a non-interest-bearing demand U.S-dollar loans (the "US Loan") to the Canadian subsidiary of a Canadian corporation ("Holdco1") that was controlled by the individual but mostly owned by family trusts.

Ruling that the capital loss realized by Holdco2 on its disposition of the US Loan (representing U.S.-dollar depreciation) to Holdco 1 (following the amendment of the loan to be interest-bearing) will be deemed to be nil by s. 40(2)(e.1) (so that the denied capital loss is added to Holdco1's ACB for the US Loan under s. 53(1)(f.1)) notwithstanding that s. 40(2)(g.1)(ii) also applies.

See detailed summary under s. 40(2)(e.1).

6 May 2014 Memorandum 2014-0524651I7 - Loss on conversion

Canco indirectly controlled ULC which was the sole member (holding common membership units) of LLC. ULC also held non-interest-bearing Notes which were convertible into "Shares" (membership interests) at a specified price per share. The Notes were converted into "Preferred Shares" of LLC having a fair market value equal to the "fair market value of LLC as a whole (i.e., the remaining equity interests in LLC had no value at that time)."

After finding that s. 51 did not apply to the exchange, the Directorate noted that the fact that the Notes were non-interest-bearing did not establish that s. 40(2)(g)(ii) would deny the loss arising on the exchange, stating:

CRA has long taken the position that where a taxpayer makes a loan to a wholly-owned subsidiary at less than a reasonable rate of interest, there is still a clear nexus, for purposes of subparagraph 40(2)(g)(ii) of the Act, between the loan and the potential for future income in the form of dividends.

6 December 2012 T.I. 2012-0463431E5 F - Application of subparagraph 40(2)(g)(ii)

Creditor and Debtor were wholly-owned subsidiaries of the same parent. Creditor made an interest-free loan to Debtor, and subsequently sustained a total loss. After quoting IT-239R2, para. 5 and 6, CRA stated that this position "has not changed over the course of the years," and concluded that in accordance with this position the loss was denied under s. 40(2)(g)(ii) given that the loan did not bear interest (para. 5) and the position in para. 6 did not apply as (TaxInterpretations translation):

Creditor is not a shareholder of Debtor and has no right to receive directly or indirectly income of Debtor.

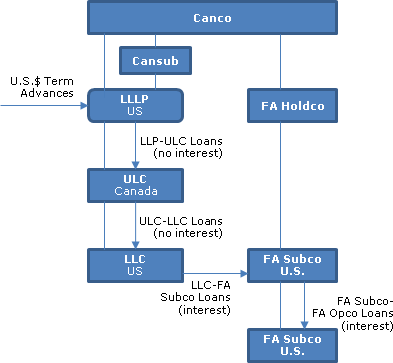

2012 Ruling 2010-0386201R3 - Tower structure capitalized by interest-free loans

Existing structure

Canco, which is a privately-owned taxable Canadian corporation, holds a US limited liability limited partnership ("LLLP") directly and through the wholly-owned GP (Cansub). LLLP borrowed U.S. dollars under interest-bearing "Term Advances" from arm's length "Senior Lenders," and on-lent those proceeds on a non-interest bearing basis to a wholly-owned special-purpose ULC under the LLLP-ULC Loans. ULC, in turn, on-lent those U.S. dollar proceeds on a non-interest-bearing basis to its special-purpose LLC subsidiary under the ULC-LLC Loans. LLC on-lent such proceeds on an interest-bearing basis under the LLC-FA Subco Loans to a grandchild U.S. subsidiary of Canco (FA Subco). FA Subco used those proceeds to on-lend them on an interest-bearing basis to its U.S. operating subsidiary (FA Opco) under the FA Subco - FA Opco Loans or to subscribe for common shares of FA Opco. FA Opco used such share subscription proceeds or borrowed money in its U.S. operating business, as described in the unredacted ruling.

Proposed transactions

LLC will pay a U.S. dollar dividend to ULC who, in turn will pay a U.S. dollar dividend to LLLP. The ULC-LLC Loans, the LLC-FA Subco Loans, the LLLP-ULC Loan and the Term Advances (owing by LLLP) will be settled in accordance with their terms – with the accrued interest owing by FA Opco, FA Subco and LLLP being paid.

Rulings

A. The income of FA Opco from carrying on its business operations…will be regarded as "income from an active business" carried on by FA Opco in the [U.S.], within the meaning of that definition in subsection 95(1) and for the purposes of Part LIX…..

B. Income derived by FA Subco from the interest payments [on the FA Subco FA Opco Loans] will be included in computing the income from an active business of FA Subco, for its taxation year in which the payment will be received, in accordance with subclause 95(2)(a)(ii)(B)(I) and in computing the "earnings" from an active business of FA Subco and its "exempt earnings" in accordance with the definitions in Part LIX of the Regulations.

C. Income derived by LLC from the interest payments [on the LLC-FA Subco Loans] will be included in computing the income from an active business of LLC, for its taxation year in which the payment will be received, in accordance with the following provisions:

(1) subclause 95(2)(a)(ii)(B)(I) to the extent of the portion of the interest paid or payable by FA Subco in respect of the portion of the proceeds from LLC FA Subco Loans that were used by FA Subco in the relevant period to earn income from the [FA Subco FA Opco Loans], and

(2) clause 95(2)(a)(ii)(D) to the extent of the portion of the interest paid or payable by FA Subco in respect of the portion of the proceeds from LLC FA Subco Loans that were used by FA Subco in the relevant period to subscribed for additional common shares of FA Opco… provided that the FA Subco common shares continue to be Excluded Property and FA Subco and FA Opco continue to meet the conditions in that clause with respect to their residence and being subject to taxation in the Foreign Country, and such interest will be included in computing the "earnings" from an active business of LLC and its "exempt earnings" in accordance with the definitions in Part LIX….

D. Provided that the [LLC-FA Subco Loans] continue to constitute Excluded Property to LLC, paragraph 95(2)(i) will apply to deem any gain or loss realized by LLC on the settlement of [such loans] to be a gain or loss from the disposition of Excluded Property.

E. Provided that the [FA Subco FA Opco Loans], and the shares of FA Opco, continue to constitute Excluded Property to FA Subco, paragraph 95(2)(i) will apply to deem any gain or loss realized by FA Subco on the settlement of the [LLC-FA Subco Loans] to be a gain or loss from the disposition of Excluded Property.

F. The following gain or loss will be accounted for under subsection 39(1) or (2), as the case may be:

(1) provided that ULC continues to hold the [ULC-LLC Loans] as capital property, any gain or loss realized by ULC on the settlement of those loans….;

(2) any loss or gain realized by ULC on the settlement of the [LLLP-ULC Loans];

(3) provided that LLLP continues to hold the [LLLP-ULC Loans] as capital property, any gain or loss realized by LLLP on the settlement of those loans…;

(4) any loss or gain realized by LLLP on the settlement of the [Term Advances].

G. Subparagraph 40(2)(g)(ii) will not apply to deny any loss that may be realized by LLLP on the settlement of the [LLLP-ULC Loans], nor to deny any loss that may be realized by ULC on the settlement of the [ULC - LLC Loans].

Further rulings re s. 17 not applying based on s. 17(3) or 17(8)(a)(i), s. 113(1)(a) deduction to ULC, s. 20(1)(c) deduction to LLLP, and re ss. 247(2) and 245(2).

14 January 2004 T.I. 2003-003875

CRA has accepted the decision in Byram so that, in its view, when the debtor is a wholly-owned subsidiary of the taxpayer, a clear nexus between the taxpayer and potential dividend income from the debtor can be demonstrated for purposes of s. 40(2)(g)(ii). Accordingly, the provision would not deny a capital loss to a taxpayer in respect of a non-interest bearing loan to a non-resident wholly-owned subsidiary.

17 December 1996 Memorandum 963454

A loss realized by an employee from the disposition of notes received by him from his employer in lieu of a cash bonus would not be subject to the stop-loss rule given that the notes bore interest.

Halifax Round Table, February 1994, Q. 1

A loss realized by a shareholder of a small business corporation on the sale of a non-interest bearing loan to an arm's length party may be deductible when the shares of the corporation are also sold, but not where the shares are not sold (or where there is no sale of either the shares or the loan, and the shareholder wishes to recognize the loss under s. 50(1)(a)).

23 December 1993 T.I. 931790 (C.T.O. "Allowable Business Investment Loss")

Discussion of when a shareholder can recognize a capital loss on a non-interest bearing loan owing to her by the corporation where the shareholder sells her shares of the corporation to an arm's length purchaser.

91 C.R. - Q.35

Where a holding company is required to have an interest-free debt owing to it by Opco settled for an amount less than its ACB as a condition to the sale of the shares of Opco to an arm's length purchaser, RC will not treat the loss resulting from the disposition as being nil provided the conditions in paragraphs 6 and 10 of IT-239R2 are met.

21 August 1991 T.I. (Tax Window, No. 8, p. 22, ¶1397)

A director's loss under s. 227.1 will be non-deductible by virtue of s. 40(2)(g).

12 September 1990 T.I. (Tax Window, Prelim. No. 1, p. 10, ¶1016)

Where A transferred a non-interest-bearing debt at a loss to its affiliate, B, and B then sold the debt in an arm's length transaction, the loss of B would be denied by s. 40(2)(g)(ii). RC stated that "'we are unable to envision a situation where the purchase of a non-interest-bearing debt by a person could be for the purpose of gaining or producing income'".

15 September 89 Memorandum (February 1990 Access Letter, ¶1105)

The position in IT-445 respecting interest-free loans is still supportable. The Business Art case, in which a Canadian corporation was allowed to deduct capital losses on interest-free advances made to a British corporation, should not be followed.

1 September 89 T.I. (February 1990 Access Letter, ¶1106)

Where a wife guaranteed for no consideration a bank loan to her husband's corporation in which she was not a shareholder, she was unable to claim a capital loss because the guarantee was given for no consideration and she was not a shareholder.

22 Aug. 89 T.I. (Jan. 90 Access Letter, ¶1078)

In light of the Canada Safeway and DWS cases, RC does not accept that when a shareholder incurs a debt to his corporation he does so to indirectly derive income from business or property through the preservation of his shares, and RC therefore is appealing the Fritz case.

81 C.R. - Q.4

Guidelines in the case of a guarantee granted a lender by a sole shareholder of the borrower for no compensation.

IT-239R2 "Deductibility of Capital Losses from Guaranteeing Loans for Inadequate Consideration and from Loaning Funds at less than a Reasonable Rate of Interest in Non-arm's Length Circumstances"

6. Where a taxpayer has loaned money at less than a reasonable rate of interest to a Canadian corporation of which he is a shareholder, or to its Canadian subsidiary, or has guaranteed the debts of such a corporation for inadequate consideration, any subsequent loss arising to him from the inability of the corporation to discharge its obligations to him, or from having to honour the guarantee, may be a deductible capital loss to him despite the absence of a reasonable rate of interest or adequate consideration. Generally it is the Department's practice to allow a loss on such a loan or guarantee and not treat it as being nil by virtue of subparagraph 40(2)(g)(ii) if the following conditions are satisfied:

(a) the corporation to whom the loan was made or whose debts were guaranteed used the borrowed funds in order to produce income from business or property, or used the borrowed funds to lend money at less than a reasonable rate of interest to its Canadian subsidiary in turn to be used to produce income from business or property,

(b) the corporation has made every effort to borrow the necessary funds through the usual commercial money markets but cannot obtain financing without the guarantee of the shareholder at interest rates at which the shareholder could borrow,

(c) the corporation has ceased permanently to carry on its business, and

(d) the loan from the shareholder to the corporation at less than a reasonable rate of interest (or at no interest) does not result in any undue tax advantage to either the shareholder or the corporation.

IT-390 "Unit Trusts - Cost of Rights and Adjustments to Cost Base"

A capital loss arising when additional units are issued in settlement of a unit holder's right to receive a distribution of a capital gain of the unit trust, is deemed to be nil.

Articles

Reid, "Capital and Non-Capital Losses", 1990 Conference Report, c. 16

Discussion of deductibility of losses arising from amounts paid under guarantees.

Subsection 40(3) - Deemed gain where amounts to be deducted from adjusted cost base exceed cost plus amounts to be added to adjusted cost base

Administrative Policy

30 October 2014 T.I. 2013-0488881E5 - Upstream Loan

///?page_id=873#2013-0488881E5">s. 90(9).

2011 Ruling 2010-0373461C6

Where a partner whose units have a negative ACB has his units redeemed equally over the course of five years, 20% of the negative ACB will be included in computing his capital gain from the disposition of 20% of his units in each year.

Rulings Directorate Discussion and Position Paper on Motion Picture Films and Video Tapes as Tax Shelters, Version 29/3/93 930501 (C.T.O. "Motion Picture Films - C.C.A.")

Discussion in Appendix of techniques for postponement of realization of negative ACB by investors in film limited partnership. RC also states that a negative ACB "is acceptable provided that the partnership in not artificially kept alive in order to prevent crystallization of the negative ACB into a capital gain ... or provided negative ACB has not resulted from a disguise sale of a partnership interest as in Richard K.G. Stursberg (91 DTC 5607)".

Articles

Melanie Huynh, Eric Lockwood, "Foreign Affiliates and Adjusted Cost Base", 2007 Canadian Tax Journal, Issue No. 1

Subsection 40(3.1) - Deemed gain for certain partners

Administrative Policy

18 June 2014 T.I. 2011-0417491E5 - Non-resident's partnership interest

A non-resident corporation (NRco) is deemed under s. 40(3.1)(a) to realize a gain in respect of its limited partnership interest in P, which is taxable Canadian property. Would NRco be considered to have thereby disposed of taxable Canadian property? CRA stated:

[P]aragraph 40(3.1)(b) deems NRco to have disposed of the interest in P only for the purpose of section 110.6…[and] NRCo would not be considered to have disposed of its interest in P for any other purpose including for the purpose of paragraph 2(3)(c) or clause 150(1)(a)(i)(D)… . However, NRco would be considered to have a taxable capital gain for the purposes of clause 150(1)(a)(i)(C) of the Act and would therefore be required to file an income tax return in Canada. …[N]on-taxation of the Deemed Gain in the above circumstances is contrary to policy and we have therefore brought the issue to the attention of the Department of Finance.

Subsection 40(3.3) - When subsection (3.4) applies

Administrative Policy

6 January 2009 Memorandum 2008-0280111I7

A Bermuda CFA (Forco) maintains U.S. dollar deposits and realizes FX losses when it uses such cash to pay a dividend or to make a loan. CRA referred to the statement in the definition of "property" in s. 248(1) that property includes money unless the contrary intention is evident, and then noted that if the stop-loss or superficial loss rules applied, "the suspended losses may be suspended indefinitely if Forco or any affiliated person receives additional $US cash." CRA then stated that "on a purposive reading, supported by policy guidance from the Department of Finance...the cash would not be 'property'....Consequently, those provisions do not apply...."

2007 Ruling 2007-0245281R3 -

Ruling that ss.40(3.3) and (3.4) and s. 107(1)(c), would not apply to any capital loss realized by a corporation ("Bidco") on the redemption, following its acquisition of all the units of an income fund, of all those units.

21 March 2007 T.I. 2004-0091061E5 -

After indicating that s. 13(21.2) would not apply to a transfer of depreciable property from a personal trust to a person affiliated with the trust, with the trust winding up within 30 days (as no person would be affiliated with the trust on the day that was 30 days after the transfer), CRA went on to indicate that the same result would not apply respecting the stop-loss rules in ss. 14(12), 18(15) and 40(3.3) et seq.:

These provisions will generally deny or suspend the loss if a person affiliated with the trust acquires the applicable type of property at any time within 30 days before or after the trust's disposition of the property.

Articles

Marc Ton-That, Rick McLean, "Navigating the Stop-Loss Rules", Corporate Structures and Groups, Vol. VI, No. 3, p. 324.

Subsection 40(3.4) - Loss on certain properties

Administrative Policy

27 October 2014 Memorandum 2014-0534981I7 F - Subsection 40(3.4)

Canco 1 ("C1") disposed of its interest in a partnership ("P") in its 2008 taxation year to a corporation ("C2") which was affiliated under s. 251.1(1)(c)(i) (affiliated respective controllers), so that its resulting capital loss was suspended, and then recognized the capital loss in its 2009 return as a result of the dissolution of P in 2009. Did this dissolution in fact de-suspend the capital loss under s. 40(3.4)(b)(i)? After paraphrasing s. 40(3.4)(c) (corresponding to the postamble in s. 40(3.4)), the Directorate stated (TaxInterpretations translation):

[F]or the purposes of paragraph 40(3.4)(b), P, despite its dissolution, is deemed to have not ceased to have existed and C2 is deemed to be a partner holding its interest in P. Consequently, the conditions for the application of subparagraph 40(3.4)(b)(i) are not satisfied, in which case C1 cannot avail itself in the course of its taxation year ending in 2009 of the capital loss resulting from the disposition of its interest in P in favour of C2.

Furthermore, we consider that it would be appropriate to conclude that C1 will be able to claim the loss when it ceases to be affiliated with C2, or when there is an acquisition of control of C1, at least where this does not occur in the context of an avoidance transaction. …[W]e do not necessarily exclude the possibility of other release events.

2 July 2014 T.I. 2014-0529731E5 F - Stop-loss Rules

In Scenario 1, Portco acquires 1,000 common shares of Publico on January 1, 201X and acquires a further 200 shares on December 15, 201X. Portco disposes of 200 shares to an unaffiliated person on December 16, 201X at a loss of $400, and a further 50 shares on December 31, 201X at a loss of $500. In all Scenarios, the shares are capital property. Portco treats the 200 shares disposed of on December 31 were those which it acquired on December 15, 201X (the "Replacement Property").

In Scenario 2, Portco acquires 100 common shares of Publico on February 1. 201X and a further 50 shares on February 15, 201X. It disposes of 60 shares to an unaffiliated person on March 15, at a loss of $100, and a further 50 shares on March 16, 201X at no loss or gain.

Scenario 3 is the same as Scenario 2 except that the final disposition is of 25 shares.

Respecting Scenario 1, CRA stated (TaxInterpretations translation):

…Portco having chosen that the 200 shares…of Publico which it disposed of on December 31, 201X were the Replacement Property, it follows that at the end of the 60 day specified period, Portco or a person affiliated with it was not the owner of the Replacement Property… . As the condition specified in paragraph 40(3.3)(c) was not satisfied, the losses of $400 and $500 sustained by Portco were not deemed to be nil… .

Respecting Scenario 2, for the same reasons, the $100 loss of Portco was not denied.

In Scenario 3, the denied loss was computed in accordance with the formula

A/B*C

where

A was the number of shares of Publico comprising the Replacement Property at the end of the period (25),

B was the number of Publico shares sold on March 15, 201X (60), and

C was the loss resulting from the disposition of the share of Publico on that date ($100).

Accordingly, the denied loss was 25/60*$100, or $41.67.

28 November 2010 , 2010 CTF Annual Conference Roundtable Q. , 2010-0386311C6

does the deemed existence of a partnership in the postamble to s. 40(3.4) apply for other purposes of the Act, e.g., subdivision j? CRA responded: