Cases

Trieste v. The Queen, 2012 FCA 320, aff'g 2012 DTC 1125 [at 3133], 2012 TCC 91

Lamarre J. found that the taxpayer, a U.S. citizen, was resident in Canada during the relevant tax period, pursuant to Art. IV(2)(b) of the Canada-U.S. Convention. The taxpayer had spent only 69 of 623 days in the United States.

The taxpayer's residence could not be determined under Art. IV(2)(a). He had permanent homes in both Tennessee and Ontario, both of which were purchased after his first work contract in Ontario. His employment was in Ontario, but his prior work history and his investments were mainly in the U.S. He maintained hobbies and family ties in Tennessee, but established social ties and health coverage in Ontario. Lamarre J. found that this evidence was not determinative of his centre of vital interests.

Turning to Art. IV(2)(b), Lamarre J. found that the taxpayer's habitual abode was in Canada. Following a review of the OECD commentaries and the Vienna Convention, she concluded (at para. 30):

[T]he proper approach to determining whether the Appellant had an habitual abode in the United States is to enquire whether he resided there habitually, in the sense that he regularly, customarily or usually lived in the United States.

In affirming that this decision, Dawson J.A. remarked (at para. 6):

The [vital interests] test to be applied under the Convention is one of fact: in which, if any, state does the individual have closer personal and economic relations?

Furthermore, the trial judge had made no error in applying the habitual abode test, as stated most recently in Lingle at para. 6.

St. Michael Trust Corp. v. The Queen, 2010 DTC 5189 [at 7361], 2010 FCA 309, aff'd sub nom Fundy Settlement v. Canada, 2012 DTC 5063 [at 6881], 2012 SCC 14

Barbados trusts, which were resident in Barbados under ordinary principles but which were deemed to be resident in Canada under s. 94(1)(b), were not resident in Canada for purposes of the Canada-Barbados Income Tax Convention given that s. 94 did not deem a foreign trust to be a person resident in Canada for all purposes of Part I, but only for the purposes of Part I that were relevant to the determination of its Canadian source income and its foreign accrual property income.

RCI Trust v. MNR, 2009 FC 434

In finding that a Barbados trust was resident in Barbados and not in Canada for purposes of the Barbados-Canada Income Tax Convention, Simpson, J., after noting Crown arguments that the trust potentially might be deemed to be resident in Canada under s. 94, stated (at para. 37) that the trust met "the physical criteria associated with actual residence of the kind described in Article IV, paragraph 1, of the Treaty which speaks of 'domicile', 'place of management' and 'criterion of a similar nature'. In my view, similar criteria would include other aspects of actual physical presence and not more esoteric concepts such as deemed residence."

Bujnowski v. The Queen, 2006 DTC 6071, 2006 FCA 32

The taxpayer, who lived and worked in the United States for ten months in 2001 (throughout which period his wife continued to live in the family home in Mississauga) as a result of accepting a position which he believed to be of indefinite duration, but returned to Canada after ten months when the job ended unexpectedly. The trial judge had not committed a reviewable error in finding that the centre of vital interests of the taxpayer under the tie-breaker rule in the Canada-U.S. Income Tax Convention remained in Canada.

Allchin v. The Queen, 2004 DTC 6468, 2004 FCA 206,

The taxpayer, who held a green card and worked in the hospital industry selling hospital supplies throughout the United States, was thereby a resident of the United States for purposes of Article IV of the Canada-U.S. Convention, as green card status was a "criteria of a nature" similar to United States residents. Accordingly, a decision of the Tax Court that Article IV did not apply because, on common law principles, the taxpayer was resident in Canada and not resident in the U.S., should be set aside and the matter referred back to the Tax Court for re-determination.

The Queen v. Crown Forest Industries Ltd., 95 DTC 5389, [1995] 2 S.C.R. 802

Some of the income derived from a corporation incorporated in the Bahamas was effectively connected with the conduct by it of a business in the United States. However, Norsk paid no U.S. tax on barge rental payments received by it, including barge rental payments received from the Canadian taxpayer, by virtue of the exemption for international shipping companies contained in s. 883 of the U.S. Internal Revenue Code.

Norsk was liable to U.S. tax by reason of being "engaged in a trade or business" in the U.S. rather than on the basis of having a place of management in the U.S. Furthermore, liability for income effectively connected to a business engaged in the U.S. was not a "criterion of a similar nature" to those listed in Article IV, para. 1, of the Canada-U.S. Income Tax Convention because the other criteria entailed being subject to a comprehensive tax liability on the entity's world-wide income. Accordingly, Norsk was not a U.S. resident for purposes of that convention, with the result that rentals paid by the taxpayer to Norsk were not eligible for a reduced rate of withholding tax.

Placrefid Ltd. v. The Queen, 92 DTC 6480 (FCTD)

A Panamanian corporation was resident in Switzerland for purposes of the Canada-Swiss Convention given that its Panamanian incorporation was "a mere flag of convenience" (p. 6486), that its directors were Swiss and that the corporation was managed from Switzerland, with the exception of negotiations carried out on its behalf in Montreal by a Canadian lawyer.

See Also

Anson v. HMRC, [2015] UKSC 44

The relevant provision of the UK-US Treaty required that the UK tax on LLC distributions be "computed by reference to the same profits or income by reference to which the United States tax [was] computed." Before finding that the profits of a Delaware LLC belonged to the members as they arose, so that a UK member was taxed on the "same" income in both countries, and was entitled to double taxation relief under this provision, Lord Reed stated:

The words "the same" are ordinary English words. ...[A] degree of pragmatism in their application may be necessary...for example where differences between UK and foreign accounting and tax rules prevent a precise matching of the income by reference to which tax is computed in the two jurisdictions.

See summary under Art. 24.

Commissioner of Taxation v. Resource Capital Fund III LP, [2014] FCAFC 37 (Fed. Ct. of Austr.)

The appellant ("RCF") was a Caymans limited partnership, with more than 97% of its capital held by a diversified group of US residents, principally funds and institutions. For Australian income tax purposes, it was deemed to be a corporation; whereas for Code purposes, it was a (fiscally transparent) foreign partnership, so that under Code s. 701, any liability for US tax on partnership income was that of its partners (except to the extent they also were fiscally transparent). It was assessed under the Australian equivalent of the Canadian taxable Canadian property rules on its gain from the sale of an Australian company with two underground gold mines in Western Australia.

Article 1 of the Australia-US Convention provided that the Convention applied only to persons (defined to include partnerships) who were residents of one or both of the Contracting States; and Article 4 provided that a person is a US resident if the person is a US corporation "or any other person…resident in the United States for purpose of its tax…." Article 13 provided that gains of a US resident from the disposition of real property situated in Australia (including, in this case, the shares of the Australian company) may be taxed in Australia.

In reversing a finding of Edmonds J that the assessment was invalid as it was an assessment of the partnership (RCF) rather than its US-resident partners, the Court stated (at para. 26):

The primary judge held that RCF was not a resident of the US. It follows from that finding that the DTA does not apply to the gain in the hands of RCF because RCF was neither a resident of the US nor a resident of Australia: see Article 1 of the DTA.

The Court went on to state (at para. 30):

US law attributes to the partners the liability for any tax payable on the gain made by RCF, Australia attributes the liability for any tax payable to RCF. It may be open to argument by the US partners that they should obtain the benefits of the DTA on the basis that it was appropriate for Australia to view the gain as derived by the partners resident in the US, and to apply the provisions of the DTA accordingly, as discussed in the OECD commentary (about which we express no view) but that consideration is a separate issue to the question of whether the effect of the provisions of the DTA was to allocate the liability for the tax on the gain differently to the Assessment Act.

Black v. The Queen, 2014 DTC 1046 [at 2882], 2014 TCC 12, briefly aff'd 2014 FCA 275

In 2002, the taxpayer was resident both in Canada and the U.K. for domestic tax purposes, but by virtue of Art. 4, para. 2(a) of the Canada-U.K Income Tax Convention (the "Convention") he was a resident of the U.K. for purposes of the Convention. S. 250(5) of the Act, which otherwise might have explicitly deemed his non-residence under the Convention to apply for purposes of the Act, did not apply to him in 2002.

The taxpayer argued that, even in the absence of s. 250(5), his treaty non-residence caused him to not be resident under the Act, so that he was not subject to tax under the Act on non-Canadian sourced income such as $2.9 million of U.S. employment income, imputed benefits of $1.4 million from free use of a corporate jet, and interest and dividends.

In rejecting this submission, Rip CJ indicated that the stipulation in Art. 4 that the taxpayer was resident in the U.K. for "purposes" of the Convention engaged only a "particular object" being "the Convention itself, nothing else" (para. 26), that "it is clear that if an income or capital item is not provided for in the Convention, Canada's authority to tax that item is not restricted" (para. 29), that in the OECD discussions of the residence tie-breaker rules "no mention is made of an override of domestic law" (para. 33), and that the Convention merely "allocates to each country the authority to tax" (para. 51).

Resource Capital Fund III LP v. Commissioner of Taxation, [2013] FCA 363 (Fed. Ct. of Austr.), rev'd supra.

The appellant ("RCF") was a Caymans limited partnership, with more than 97% of its capital held by a diversified group of US residents, principally funds and institutions. For Australian income tax purposes, it was deemed to be a corporation; whereas for Code purposes, it was a (fiscally transparent) foreign partnership, so that under Code s. 701, any liability for US tax on partnership income was that of its partners (except to the extent they also were fiscally transparent). It was assessed under the Australian equivalent of the Canadian taxable Canadian property rules on its gain from the sale of an Australian company with two underground gold mines in Western Australia.

Article 1 of the Australia-US Convention provided that the Convention applied only to persons (defined to include partnerships) who were residents of one or both of the Contracting States; and Article 4 provided that a person is a US resident if the person is a US corporation "or any other person…resident in the United States for purpose of its tax…." Article 13 provided that gains of a US resident from the disposition of real property situated in Australia (including, in this case, the shares of the Australian company) may be taxed in Australia.

Before finding that the assessment was invalid as it was an assessment of the partnership (RCF) rather than its US-resident partners, Edmonds J referred (at para. 65) with approval to a statement in the OECD Commentary that

…when partners are liable to tax in the country of their residence on their share of partnership income it is expected that the source country (in this case, Australia) will apply the provisions of a convention "…as if the partners had earned the income directly so that the classification of the income for purpose of the allocative rule of Articles 6 to 21 will not be modified by the fact that the income flows through the partnership."

Dysert v. The Queen, 2013 DTC 1070 [at 373], 2013 TCC 57

The taxpayers were middle-aged "all American" certified cost estimate professionals, with no significant previous exposure to Canada, who came to Alberta under two-year contracts (later extended by two years) to work on the Syncrude project. Although they acquired and modestly furnished apartments in Alberta, they maintained their substantial homes in the U.S. where their families stayed (other than for short visits to Alberta) and otherwise maintained their social ties and financial assets in the U.S. After finding that the taxpayers were deemed to be resident in Canada under the "sojourner" rule in s. 250(1)(a), Boyle J. found that they were resident only in the U.S. under Article IV of the Canada-U.S. Income Tax Convention. After noting that the taxpayers' Edmonton apartments qualified as permanent homes (so that the taxpayers had permanent homes in both jurisdictions), he proceeded to find that the taxpayers' centre of vital interests was in the US, stating (at para. 74):

It can be observed that for each of the Appellants:

(i) they lived only in the United States before coming to Canada...;

(ii) they left Canada at the conclusion of their Syncrude work;

(iii) they maintained all of their pre-existing ties to the United States throughout the relevant period that they were working on the Syncrude project in Canada. It was only their physical presence of being in Canada that was no longer entirely focused in the US;

(iv) the only ties they established to Canada were those necessary for, or reasonably incidental to, the requirement that they physically be in Canada for the period they were working on the Syncrude project.

TD Securities (USA) LLC v. The Queen, 2010 TCC 186

The taxpayer, which was a U.S. limited liability company ("LLC") that carried on business in Canada through a Canadian branch with the income from such branch being included in the consolidated return of the "C-Corp" parent of the taxpayer's immediate parent (also a U.S.-incorporated C-Corp.) was assessed on the basis that the profits of the Canadian branch were subject to Canadian branch tax at the non-treaty reduced rate of 25% (rather than 5%). Before finding that the taxpayer was entitled to the treaty-reduced rate of 5%, Boyle, J. indicated (at para. 86) that "the treatment of partnerships and of LLCs should be analogous for purposes of the interpretation application of the U.S. Treaty" and noted (at para. 76) that a partnership which is not liable to tax in its home country by virtue of being fiscally transparent should nonetheless get the benefit of the tax convention based on the residence of its members. The taxpayer should be considered to be a resident of the U.S. for purposes of the U.S. Treaty, and its income should be considered to be subject to full and comprehensive taxation under the U.S. Internal Revenue Code by reason of a criterion similar in nature to the enumerated grounds in Article 4, namely the place of incorporation of its members (para. 101).

He also noted (at para. 103) that the U.S. Treaty as amended by the Fifth Protocol would not necessarily be interpreted and applied in a similar manner.

Lingle v. The Queen, 2009 DTC 1705, 2009 TCC 435, aff'd 2010 DTC 5100 [at 6932], 2010 FCA 152

Campbell J. found that the taxpayer's habitual abode was in Canada. She stated at para. 30:

It follows that the proper approach to determining whether the Appellant had an habitual abode in the United States is to enquire whether he resided there habitually, in the sense that he regularly, customarily or usually lived in the United States. Paragraphs 27 to 32 of the Agreed Statement of Facts and Issue contain pertinent statements which assist in the determination of whether the Appellant "normally lived" in the United States. It was agreed between the parties that the Appellant "consistently and repeatedly returned to his home in Canada for the majority of the days in this period." In the settled routine of his life "he regularly, normally and customarily lived in Canada." He "did not have any other contracts clients or business in the USA." In addition, he spent only 69 days out of 623 days in the relevant period at his home in the United States.

In the Court of Appeal, Létourneau JA (at para. 6, 8) indicated "in light of the clearer French version" ("séjourne de façon habituelle") that "habitual abode"

refers to a stay of some substance in the jurisdiction as a matter of habit, so that the conclusion can be drawn that this is where the taxpayer normally lives....This is also consistent with commentary on Article IV(2) of the OECD Model....

Minin v. The Queen, 2008 DTC 4463, 2008 TCC 429

The taxpayer, who worked on a succession of jobs in the United States and stayed at different places there, was found to have a permanent home available to him in Canada given that his separated wife, children and mother stayed at a home in Canada and it did not "seem plausible that his mother, as a former Russian General, would take orders from the Appellant's spouse (her daughter-in-law) if the Appellant's spouse should attempt to deny him (the taxpayer) entry to the home" (para. 14).

Garcia v. The Queen, 2007 DTC 1593, 2007 TCC 548

The taxpayer, who was resident both in Canada and the United States in 2003 when he received a bonus that had been earned in 2002, was found to be resident for Treaty purposes in Canada given that he owned a home in Canada and did not own, rent or occupy any home, permanent or otherwise, in the U.S. It was not relevant that he may have purchased a Canadian home with the idea in mind that his stay in Canada would only be temporary (two or three years).

Salt v. The Queen, 2007 DTC 520, 2007 TCC 118

The taxpayer, when he was moved by his employer to Australia rented the Canadian home of him and his wife under 22 1/2 month lease which, under Quebec law, was not terminable other than on six months notice, and was provided with a furnished house in Australia. In these circumstances, the Canadian house was not a permanent home available to him under Article 4 of the Canada-Australia Income Tax Convention, so that he was resident in Canada for purposes of that Treaty and for purposes of the Act by virtue of s. 250(5).

Yoon v. The Queen, 2005 DTC 1109, 2005 TCC 366

Given the depth of her roots in South Korea, the taxpayer's centre of vital interests was in South Korea rather than Canada. South Korea also was the country of her habitual abode given that she stayed there more frequently.

Allchin v. The Queen, 2005 DTC 603, 2005 TCC 476

The taxpayer, who stayed in Michigan in a condominium owned by her friends without paying rent and who visited, on a weekly basis, her husband and children in Windsor, did not have a permanent home in either Canada or the U.S. She had a centre of vital interest both in Canada (where she had closer personal ties notwithstanding that most of her friends were in Michigan) and in the U.S., where she earned her living. However, her habitual abode was in the U.S., so that under the tie-breaker rule in Article 4, paragraph 2(b), she was a resident of the United States.

Gaudreau v. The Queen, 2005 DTC 66, 2004 TCC 840, aff'd 2005 DTC 5702, 2005 FCA 388

The taxpayer, who had moved with his wife to Egypt for a four-year work assignment and who maintained their home in Ontario in addition to an apartment in Egypt, was found to have his centre of vital interests in Canada throughout the period given that he "did not really maintain any economic relations with Egypt apart from those he needed to have in order to meet his day-to-day living expenses" (p. 73).

Edwards v. The Queen, 2002 DTC 1856, Docket: 2000-1183-IT-G (TCC)

The taxpayer, who was a resident of Canada and was employed as a commercial airline pilot by a wholly-owned subsidiary of a Hong Kong airline company ("Cathay Pacific"), took the position that his employment income was exempt from Canadian tax by virtue of the Canada-China Convention because it was earned in respect of an employment exehrcised aboard aircraft operated in international traffic by an enterprise resident in China (i.e., Cathy Pacific). The term "resident of a Contracting State" was defined in the Convention as "any person who, under the laws of that Contracting State, is liable to tax therein by reason of his ... residence ... ." For the purposes of this definition, Hong Kong's Internal Revenue Ordinance was not a law of the People's Republic of China (but, instead, was derived from an independent authority to enact taxation laws); and Cathay Pacific was not "liable to a tax therein" (given that the term "tax" must be interpreted against the background of the phrase "under the laws of that Contracting State", and as the Ordinance was not a law of the PRC, the taxes under the Ordinance were not a PRC tax). Furthermore, to the extent that the definition of "tax" for these purposes was found in Article 2 of the Treaty, which described various types of taxes imposed in the Mainland of China in 1986 and also referred to any identical or substantially similar taxes imposed after 1986, the Hong Kong income taxes were not "identical or substantially similar" to such taxes as Hong Kong imposed income taxes on a territorial basis and the PRC taxed on world-wide income of residents.

Wang v. The Queen, 2001 DTC 433, Docket: 2000-4635-IT-I (TCC)

A Chinese national who entered Canada in April 1998 after receiving landed immigrant status and was paid $19,000 by a Chinese company in order for her to attend school in Canada and to cover her living expenses was found to have her centre of vital interest in China given her family ties there, the provision to her by the company of housing in China which continued to be available to her as well as her ownership of an apartment unit in China which was also available to her and her maintenance of bank accounts and credit cards in China, her maintenance of personal belongings, a driver's licence and membership in an association there.

McFadyen v. The Queen, 2000 DTC 2473 (TCC), aff'd 2003 DTC 5015 (FCA)

After already having concluded that the taxpayer was not resident in Japan and only resident in Canada, Garon C.J. went on to state (at p. 2493):

"Although I do not decide the matter, I doubt that this Court has the authority to apply the tie breaker rules referred to in the Canada-Japan Income Tax Convention. The words of the Convention state specifically that 'the competent authorities of the Contracting States shall determine by mutual agreement the Contracting State of which that person shall be deemed to be a resident for the purposes of this Convention' and this should be done by resorting to the tie breaker rules. It therefore appears that the Contracting States intended that the application of the 'tie breaker rules' is a matter for the competent authorities of the Contracting States and not for this Court."

Boston v. The Queen, 98 DTC 1124, Docket: 96-1454-IT-G (TCC)

The taxpayer was posted to Malaysia, where he lived in rented premises. His wife whom he was having marital difficulties with continued to live in their Edmonton home. The taxpayer was found to have a center of vital interests in Malaysia rather than Canada given that he reported for work there every day and given that, in the years in question, his personal life was centered in Malaysia.

Endres v. The Queen, 98 DTC 1101 (TCC)

The taxpayer, who had business interest both in Canada and the United States, commenced spending most of the year, other than the summers, in North Carolina and acquired with his wife a home in North Carolina. He was found to be resident in the United States for purposes of Article IV of the Canada-U.S. Income Tax Convention because the house in North Carolina was their permanent home whereas the house in Nova Scotia (which they continued to own) was leased for the major part of each year with minimal furniture. Moreover, North Carolina was the center of their vital interests given that their children were being educated in North Carolina, more of his business life was conducted there, North Carolina was the center from which their yachting and skiing was conducted, and her social and household life was centered there.

Hertel v. MNR, 93 DTC 721 (TCC)

The taxpayer, who was born in Germany but had landed immigrant status in Canada, and who had bank accounts, credit cards, real property, a driver's licence, insurance policies, a telephone listing and a summer residence in Canada, was found to have his center of vital interest in West Germany for purposes of Article 4(2) of the Canada - West Germany Convention given that his family, business and community service ties were there.

Padmore v. IRC, [1987] BTC 3 (Ch. D.), aff'd [1989] BTC 231 (C.A.)

A Jersey partnership comprising over 100 U.K. resident partners and carrying on a trade which was managed and controlled in Jersey, was a body of persons resident in Jersey rather than in the U.K. in the context of the provisions before the English court.

Administrative Policy

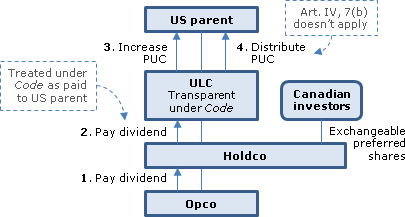

2014 Ruling 2014-0534751R3 - Deemed dividends from ULC holdco and Art IV(7)(b)

Existing structure

U.S. Parent, which is a qualifying person for purposes of the Canada-U.S. Treaty and whose common shares trade on a recognized exchange, holds all the outstanding shares of ULC (which is disregarded for Code purposes). ULC holds all the common shares of Holdco, which holds Opco. Exchangeable shareholders of Holdco also hold special voting shares of U.S. Parent.

Proposed transactions

- Opco will declare and pay a dividend to Holdco.

- Holdco will declare and pay a dividend to ULC (which for Code purposes will be considered a dividend paid directly to U.S. Parent out of its E&P).

- ULC (which will not have any E&P pool) will increase the stated capital of its shares.

- ULC will distribute that amount as a return of paid-up capital to U.S. Parent less Part XIII taxes remitted by it on U.S. Parent's behalf.

- U.S. Parent will use those funds to fund a stock buy-back.

Additional information

The stated capital increase in 3 will not result in income etc. for Code purpose, and no such income would have been recognized if ULC instead had not been fiscally transparent. The proposed transactions "will not affect the U.S. tax treatment of any subsequent distributions on the ULC shares."

Ruling

Art. IV, 7(b) of the Treaty will not treat the deemed dividend arising in 3 as not having been derived by U.S. Parent, so that a withholding rate of 5% will apply.

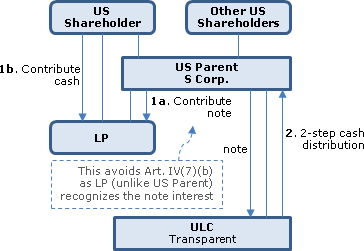

2014 Ruling 2013-0491331R3 - Introduction of a partnership and Art.IV(7)(b)

Structure

U.S. Parent (an S Corp. with only U.S.-resident shareholders and a qualifying person by reason of Art. XXIX(2)(a) or (e) of the Canada-U.S. Treaty) holds the U.S. Note owing by ULC, its wholly-owned (disregarded) Canadian subsidiary, with the interest thereon subject to 25% Part XIII tax by virtue of the application of Art. IV(7)(b) of the Treaty.

Proposed transactions

In order "to permit future interest payments on the U.S. Note to qualify for benefits under the U.S. Treaty":

- U.S. Parent (as the x% general partner) and one of its shareholders (as the (100-x)% Limited Partner form LP.

- U.S. Parent contributes the U.S. Note, and the Limited Partner contributes some cash, to LP.

- ULC Inc. increases the capital account for its common shares by an amount previously credited to its retained earnings (thereby giving rise to a s. 84(1) deemed dividend) and then makes a cash distribution as a return of capital to U.S. Parent.

- LP makes regular distributions equal to its income (net of expenses, if any) to its partners.

Additional information

"For U.S. federal income tax purposes, interest on the U.S. Note will be reported as income of LP, and will be allocated as an item of income to the Limited Partner, and to the General Partner, in the same manner as the interest would be if ULC was not fiscally transparent under those laws."

Rulings

Art. IV(7)(b) of the Treaty will not apply to treat the dividend in 3 or the payment of interest on the U.S. Note as not having been paid to or derived by U.S. Parent.

16 June 2014 T.I. 2014-0516451E5 - Application of Canada-Israel Tax Convention

If the "mind and management" of a BC venture capital corporation (which was incorporated in Canada) resided in Israel, resort would be necessary to the tie-breaker rule in Art. IV, para. 3 of the Canada-Israel Treaty, which deems a dual-resident corporation to be resident in the state in which it is a national. A legal person deriving its status as such from the laws in force of Canada or Israel is a "national" of the respective jurisdiction. The place of incorporation (Canada) is therefore determinative of the corporation's "nationality."

12 February 2014 T.I. 2013-0486931E5 - Distribution by ULC to a Trust to a NR beneficiary

Trust is resident in Canada, is not subject to s.75(2), has one individual beneficiary (the "Non-resident Beneficiary") who is a a qualifying person for the purposes of the Canada-U.S.Treaty, and is the sole-shareholder of a Canadian-resident unlimited liability company. Trust and ULC are fiscally transparent for U.S. tax purposes. ULC will pay a dividend to the Trust, which Trust will distribute to the Non-resident Beneficiary.

In finding that the Trust distribution was not eligible for the Treaty-reduced rate of 15%, CRA stated:

In determining whether the U.S. treatment of the Trust distribution to the Non-resident Beneficiary is the same…if the Trust is not fiscally transparent for U.S. tax purposes, we will refer to:

(i) the timing of the recognition/inclusion of the amount,

(ii) the character of the amount, and

(iii) the quantum of the amount.

For U.S. tax purposes…if the Trust is not viewed as fiscally transparent, then the Non-resident Beneficiary would be seen to receive a trust distribution from the Trust which the Non-resident Beneficiary would be required to include in income. In sum, on the one hand when the Trust is treated as fiscally transparent, the distribution to the Non-resident Beneficiary would be completely ignored for U.S. tax purposes and when the Trust is not fiscally transparent, the Trust distribution would be recognized for U.S. tax purposes and included in the computation of the income of the Non-resident Beneficiary. The treatment of the amount is different in all respects.

In going on to find that the answer does not change if a deemed dividend under s. 84(1) arises by increasing the PUC of the ULC shares, followed by a cash distribution in the same amount as a return of capital, CRA stated:

The analysis of the U.S. tax treatment does not focus on the amount moving between the ULC and the Trust regardless of whether the Trust is fiscally transparent. Thus, any deemed dividend created by the ULC cannot affect the analysis.

11 October 2013 APFF Roundtable Q. 3, 2013-049281 F

Question 3a - Factual dual residency

How will CRA apply the tiebreaker rules in the Canada-US Convention in the case of dual residency?

Competent authorities in each country shall attempt to reach an agreement under Article IV(4). The Canadian competent authority will consider (as a non-exhaustive list): the residency of the settlor and beneficiaries, the location of the trust property, the reason the trust was established in its jurisdiction, etc..

Although Article IV(4) obliges the authorities to attempt to resolve residency questions, it does not require them to actually reach a resolution. A failure to resolve a residency question may thus result in a dual residency.

Question 3b - Deemed dual residency in Canada under s. 94(3)

As s. 4.3 of the Income Tax Conventions Act prevails over the Convention, the Convention's tiebreaker rules cannot be applied where s. 94(3) deems a trust to be resident in Canada.

CRA considers Sharlow JA's remarks on s. 94 in St Michael Trust Corp., to the effect that s. 94 "falls short of displacing the treaty definition of residence" (St Michael at para. 87), to be obiter dicta.

Question 3c - Resolving deemed dual residency

The rules in s. 94 should generally ensure that a foreign tax credit will be available in the event of double taxation. CRA is willing to work with particular taxpayers "in the unlikely event" of double-taxation.

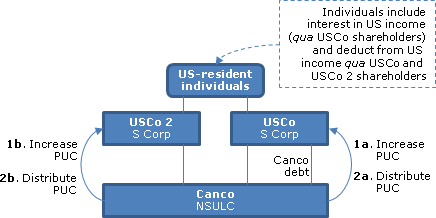

2013 Ruling 2012-0467721R3 - IV(7)(b) & PUC increase

USCo and USCo2 are each S Corporations whose shares are owned in the same proportions by U.S.-resident and qualifying-person individuals, who are required under the Code to include a proportionate share of each separately stated item of income, deduction, loss or credit of the corporation. USCo and USCo2 are the shareholders of an unlimited liability company governed by the Companies Act of a province (Canco), and Canco also previously borrowed under an interest-bearing loan (the Canco Debt) from USCo.

Canco will:

(a) increase, in accordance with the provisions of the Companies Act, the paid-up capital in respect of its shares held by USCo and USCo2 by an amount equal to the amount of cash that it wishes to distribute; and

(b) reduce the paid-up capital in respect of such shares by an amount equal to such increase and distribute an amount in cash, as a return of paid-up capital on its shares held by USCo and USCo2, equal to such reduction.

The transaction in (a) will not affect the tax treatment in the U.S. of any subsequent distribution on the Canco shares including the PUC distribution in (b).

The payment of interest by Canco to USCo will be treated for Code purposes as a payment of interest by a partnership (Canco) to one of its partners (USCo), with such interest being included in the income of the U.S. individuals in proportion to their interests in USCo. If Canco were not a fiscally transparent, such interest would be included in their income in the same manner. Such interest also will be deductible by USCo and USCo2 in the computation of their income in proportion to their respective interests in Canco. As they are "S" Corps, such interest will be deductible by the individuals in the computation of their income under the Code, in proportion to their respective interests in USCo and USCo2.

Rulings inter alia that:

- the s. 84(1) dividends resulting under (a) to USCo and USCo2 will be subject to Part XIII tax at 5%

- Art. IV, subpara. 7(b) of the Treaty will not apply to such dividends

- Subpara. 7(b) will not apply to treat the interest on the Canco Debt as not having been paid to or derived by USCo

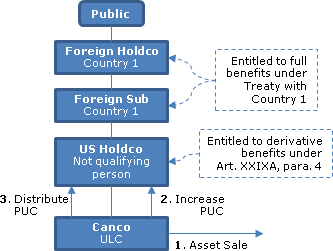

2013 Ruling 2012-0471921R3 - Deemed dividend on return of capital

Canco and U.S. Holdco

Canco, which is an unlimited liability company, is wholly owned by U.S. Holdco, which is resident in the U.S. for purposes of the Canada-U.S. Income Tax Convention (the "U.S. Treaty"), but is not a qualifying person for purposes of the U.S. Treaty.

Foreign Holdco and Foreign Sub

X% of the shares of U.S. Holdco are owned by Foreign Sub which, in turn, is a wholly-owned owned subsidiary of Foreign Holdco. Foreign Holdco and Foreign Sub are resident in Country 1 (not the U.S. or Canada), are not qualifying persons under the U.S. Treaty and are entitled to all the benefits of the Treaty ("Treaty 2") between Canada and Country 1. The common shares of Foreign Holdco are publicly traded on Exchanges 1, 2 and 3.

Proposed transactions

Canco will sell its investment in a Canadian business held through a Canadian LP to an unrelated 3rd party. It will distribute the net proceeds of disposition to U.S. Holdco by adding an amount to its paid-up capital account pursuant to the applicable provincial Company Act, and then distribute the amount of that addition to U.S. Holdco as a return of capital on its shares. The representations are made that:

no income, profit or gain will arise or will be recognized under the taxation laws of the United States as a result of the[se] transactions….Similarly, no amount of income, profit or gain would arise or be recognized under the taxation laws of the United States as a result of those transactions if Canco were not fiscally transparent under the taxation laws of the United States….The proposed transactions… will not affect the tax treatment in the United States of any subsequent distribution on the Canco shares owned by U.S. Holdco….

Rulings

include:

- Art. IV, para. 7(b) of the U.S. Treaty will not apply to treat the s. 84(1) dividend arising to U.S. Holdco as not having been paid to it.

- U.S. Holdco will be entitled to the benefits of the U.S. Treaty in respect of such dividend by virtue of Art. XXIX A, para. 4

17 October 2012 T.I. 2011-0428781E5 - US LLC owned by Canadian residents

USLLC, whose central management and control is in the U.S. and which is owned by two related Canadian residents, owns residential rental properties in the U.S. Where USLLC is treated as a partnership in the US:

It is CRA's view that a fiscally transparent entity (such as USLLC) is not a resident of the United States for purposes of applying the Treaty as the USLLC is not itself liable to tax in the US. Therefore, Treaty benefits will not be applicable.

23 May 2013 IFA Round Table, Q. 10

Are there any new issues with respect to Article IV(6) and (7) of the US treaty?

Response

: Since the 5th Protocol to the Canada-U.S. Treaty, CRA has considered many strategies designed to ensure that either Art. IV, para. 6 applies to a particular amount, or that para. (7) of that Article does not apply, along with the possible application of the general anti-avoidance rule. CRA has recognized that some structures may be utilized for legitimate reasons. Among the strategies previously considered, the CRA is aware of some structures designed to avoid the application of para. (7) through the introduction of an interposing entity located in a third jurisdiction. In this regard, the CRA has previously expressed its long-standing concerns over "treaty shopping;" and Finance bolstered these concerns in Budget 2013, in announcing consultations on these practices. In addition, the GAAR Committee recently approved the application of the GAAR to a treaty shopping case. Accordingly, taxpayers should not expect the Directorate to look favourably upon the interposition of an entity in a third jurisdiction to avoid the application of para. (7).

27 March 2013 Folio S5-F1-C1

1.41 [T]o be considered liable to tax for the purposes of the Residence article of Canada's tax treaties, an individual must be subject to the most comprehensive form of taxation as exists in the relevant country. For Canada, this generally means full tax liability on worldwide income. This is supported by ... The Queen v Crown Forest Industries Limited, [1995] 2 S.C.R. 802, 95 DTC 5389... .

1.42 An individual does not necessarily have to pay tax to another country in order to be considered liable to tax in that country under paragraph 1 of the Residence article of the tax treaty with Canada. There may be situations where an individual's worldwide income is subject to another country's full taxing jurisdiction, however, the country's domestic laws do not levy tax on an individual's taxable income or taxes it at low rates. In these cases, the CRA will generally accept that an individual is a resident of the other country... .

1.44 [H]olders of a United States Permanent Residence Card (otherwise referred to as a Green Card) are considered to be resident in the United States... .

1.47 ... The OECD Model Tax Convention states in part, as follows:

"…the permanence of the home is essential; this means that the individual has arranged to have the dwelling available to him at all times continuously, and not occasionally for the purpose of a stay which, owing to the reasons for it, is necessarily of short duration (travel for pleasure, business travel, educational travel, attending a course at a school, etc)."

1.49 Where an individual has two permanent homes while living outside Canada (for example, a dwelling place rented by the individual abroad and a property owned by the individual in Canada that continues to be available for his or her use, ... the permanent home test will not result in a residency determination.

1.50 ... [T]he commentary to paragraph 2 of the Residence article of the OECD Model Tax Convention, which states in part, as follows:

"If the individual has a permanent home in both Contracting States, it is necessary to look at the facts in order to ascertain with which of the two States his personal and economic relations are closer. Thus, regard will be had to his family and social relations, his occupations, his political, cultural or other activities, his place of business, the place from which he administers his property, etc. The circumstances must be examined as a whole, but it is nevertheless obvious that considerations based on the personal acts of the individual must receive special attention. If a person who has a home in one State sets up a second in the other State while retaining the first, the fact that he retains the first in the environment where he has always lived, where he has worked, and where he has his family and possessions, can, together with other elements, go to demonstrate that he has retained his centre of vital interests in the first State."

25 September 2012 B.C. CTF Roundtable Q. 10, 2012-0457591C6

As CRA is not in agreement with the decision in TD Securities (which, in any event, involved pre-5th Protocol timeframes). Accordingly:

Treaty benefits [under the Canada-U.S. Treaty as amended by the 5th Protocol] claimed by a fiscally transparent LLC with respect to an amount of income, profit or gain will be permitted only if the amount is considered to be derived, pursuant to Article IV(6), by a person who is a resident of the United States and that person is a "qualifying person" or is entitled, with respect to the amount, to the benefits of the Treaty pursuant to paragraph 3,4 or 6 of Article XXIX-A.

2012 Ruling 2012-0458361R3 - Cross-Border Financing

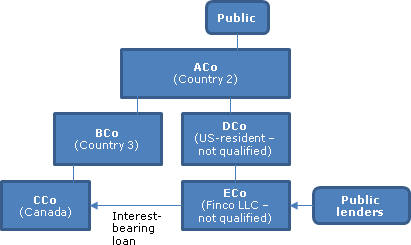

ECo, which is fiscally transparent for U.S. purposes and resident in the U.S. (a.k.a., Country 1) but is not a qualifying person (as defined in Art. XXIX-A of the Canada- U.S. Convention), makes a loan (the "Charlie Debt") bearing non-participating interest to CCo, which is a CBCA corporation and affiliated with Eco. (Both Eco and CCo are indirect wholly-owned subsidiaries of a public company (ACo), which is resident in Country 2.) ECo is a wholly-owned subsidiary of DCo, which is resident in the U.S. but is not a "qualifying person (as so defined). ECo acts as a lender to various affiliates in various countires (although no financing has been provided to CCo to date), and raises much of the necessary financing through public issuances of debt and commercial paper. CCo uses the proceeds of the Charlie Debt for an income-producing purpose.

The following four rulings are given:

A. For any interest paid by CCo to ECo in respect of the Charlie Debts, such interest will be considered to be derived by DCo pursuant to paragraph 6 of Article IV of the Treaty.

B. Paragraph 3 of Article XXIX-A of the Treaty will apply so that the benefits of the Treaty will apply to DCo in respect of any interest paid on the Charlie Debts.

C. Paragraph 1 of Article XI of the Treaty will apply to reduce the Canadian withholding tax rate to nil for any interest paid by CCo to ECo.

D. Subject to the rate of interest being reasonable and subject to the limitations of subsection 18(4), the interest payable on the Charlie Debts will be deductible pursuant to paragraph 20(1)(c).

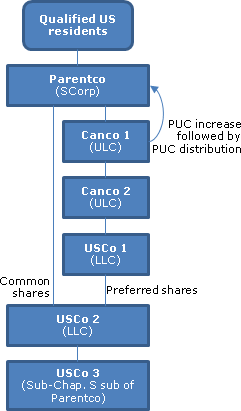

2012 Ruling 2011-0430761R3 - Paid-up capital Increase

Canco1 is a Canadian-resident unlimited liability company which is a wholly-owned subsidiary of Parentco, which is a qualifying person for purposes of the Canada-US Income Tax Convention and has elected to be taxed in accordance with subchapter S of Chapter 1 of the Code. Canco1 is the shareholder of another ULC (Canco2), which is the parent of an LLC (USCo1) which, in turn, is the preferred shareholder of another LLC (USCo2), whose common shareholder is Parentco. Parentco has elected to treat direct and indirect subsidiaries of USCo2 as qualified subchapter S subsidiaries, as defined in s. 1361 of the Code.

In lieu of declaring and paying a cash dividend, Canco 1 will:

(a) increase, in accordance with the provisions of the applicable Canadian company legislation, the paid-up capital in respect of its shares held by Parentco by an amount equal to the amount of cash that it wishes to distribute to Parentco;

(b) reduce, as soon as practicable, the paid-up capital of those shares in accordance with the provisions of such company legislation by an amount equal to the amount of such increase; and,

(c) distribute an amount of cash as a return of paid-up capital on its shares held by Parentco equal to the amount of such reduction.

Before ruling, CRA states representations that:

Notwithstanding that the proposed transaction... would, pursuant to subsection 84(1) of the Act, result in a deemed payment of a dividend on the shares of Canco 1, no amount of income, profit or gain will arise or will be recognized under the taxation laws of the United States as a result of that transaction. Similarly, no amount of income, profit or gain would arise or be recognized in the United States as a result of that transaction, if Canco 1 was not fiscally transparent under the taxation laws of the United States....The proposed transaction...will not affect the United States tax treatment of any subsequent distributions on the shares of Canco 1.

Ruling (not in these words) that Parentco will be entitled to the Treaty-reducded rate of 5% on the dividend that it is deemed to receive under s. 84(1), as the rule in Art. IV, para. 7(b) of the Convention will not apply.

19 April 2012 Memorandum 2012-043622I17 -

Where the members of a fiscally transparent LLC are entitled to Treaty benefits in accordance with Art. XXIX-A of the Canada-US Income Tax Convention, then the effect of Art. IV, para. 6 "is to suppress Canadian taxation of the LLC to give effect to the benefits available under the Treaty to the U.S. resident members of the LLC in respect of the particular amount of income , profit or gain of the LLC." The LLC will file a Canadian return in which it will claim the Treaty benefits and complete Form NR303 and include a list of all of its members on Worksheet A of the NR303.

16 February 2012 T.I. 2011-0430841E5 -

CRA indicated that if s. 94(3) applied to deem a US grantor trust with US-resident settlors to be a resident of Canada, then Art. IV(6) of the Canada-US Convention would not apply to dividends paid to the grantor trust by a Canadian corporation as both that corporation and the trust would be residents of Canada.

2 February 2012 T.I. 2012-0434311E5

in the situation where a Canadian unlimited liability company ("ULC"), which is a disregarded entity for US tax purposes, pays an excessive management fee to its US parent (Xco) that is deemed to be a dividend under s. 214(4)(a) and Xco is an LLC that has two qualifying persons (ACo and BCo) as its members, Art. IV, para. 6 of the Canada-US Convention would not apply to treat the management fee as being derived by ACO and BCO because such amounts would be disregarded under the Code in this situation. Similarly, if XCo were a partnership with two partners, ACo and BCo, who were qualifying persons, Article IV(7)(b) would apply because they would be treated under the Code as deriving a management fee or shareholder benefit if ULC were not a disregarded entity, whereas such amounts would be disregarded if ULC were disregarded.

If XCo is an S-Corp, although CRA has taken the position that any Canadian source income received by an S-Corp may be considered to be derived instead by its shareholders pursuant to Art. IV, para. 6, the S Corp will continue to be ordinarily accepted by CRA as being itself a resident of the US, so that the S Corp may benefit from the reduced 5% dividend withholding rate on the (deemed) dividend on the basis that it owns more than 10% of the ULC.

2010 Ruling 2010-036453

Canco1, which is an Canadian unlimited liability company that is owned, in part, by S corps and by a US limited partnership whose partners are US-resident individuals and trusts and that has elected to be taxed as a partnership for US tax purposes, increases the capital account of its shares through a transfer from retained earnings and then makes a cash distribution to each shareholder as a return of capital.

No amount of income or gain wil arise to any person under US taxation laws as a result of the capital increase; nor would there be any such recognition if Canco1 were not fiscally transparent. Accordingly, Article IV(7)(b) of the US Treaty will not apply to treat any portion of the dividend deemed to arise under s. 84(1) on the capital increase as not being derived by the beneficial owners thereof.

2010 Ruling 2010-0361591R3 -

Canco, a ULC and fiscally transparent under the Code, is wholly-owned by USCo, which is a C-Corp and a qualified person for purposes of the Canada-US Treaty. Canco will pay interest on the "new Note" issued by it to US Loanco, which also is a qualified person. Article IV(7)(b) is not applicable such interest, because the US tax treatment of the interest income to the recipient is the same regardless of whether the Canadian-resident company was fiscally transparent. In particular, US Loanco will include the interest in its income under either alternative, notwithstanding that the dual loss consolidation loss rules may apply at the level of determining the consolidated taxable income of the US group.

2010 Ruling 2010-035310

If a ULC is prohibited from increasing its paid-up capital, it will instead declare and pay a stock dividend of additional common shares having full paid-up capital, with the number of its common shares thereafter immediately being consolidated, and cash being distributed as a paid-up capital distribution on the common shares. Before a ruling was given that Art. IV.7(b) of the US Convention did not apply to this transaction (or the alternative transaction entailing a paid-up capital increase), there was a statement that:

Notwithstanding that the payment of the stock dividend...will be treated as a taxable dividend under the Act, the integration of the payment of the stock dividend and the subsequent share consolidation will result in no income, profit or gain arising or being recognized under the taxation laws of the United States. Similarly, no amount of income, profit or gain would arise or be recognized under the taxation laws of the United States as a result of those transactions if Canco ULC Amalco were not fiscally transparent under the taxation laws of the United States for the purpose of the Convention.

26 October 2010 T.I. 2009-033995

It is the current practice to treat an S Corporation as a resident of the U.S. for purposes of the Canada-U.S. Convention provided that it is a qualifying person or otherwise eligible for benefits under paragraph 3 or 6 of Article XXIX - A of that Convention.

However, treaty benefits under Article X(6) claimed by an LLC with respect to an amount of profit attributable to a Canadian permanent establishment will be recognized by CRA only if the amount is considered to be derived, pursuant to Article IV(6), by a corporation that is a resident of the U.S. and a qualifying person (or entitled to benefits under paragraph 3 or 6 of Article XXIX-A).

19 May 2010 IFA Roundtable Q. , 2010-0366521C6

A Canadian ULC has interest accrue on a loan from its US-resident parent ("USCo"), with the election being made under s. 78(1)(b) of the Act at the beginning of the third year to have the accrued interest deemed to be paid on that day. In response to an argument that this deemed payment was not subject to Article IV(7)(b) of the US Convention "because the deemed receipt in itself is not recognized under the taxation laws of the United States and would not be recognized if the ULC were not fiscally transparent", CRA indicated that what was required was "an analysis of the treatment of the item of income to which the deemed receipt relates" and that, in this instance, the interest itself would have been recognized under US laws if the ULC were not fiscally transparent. Accordingly, Article IV(7)(b) would apply to the interest deemed to be paid under s. 78(1)(b).

1 June 2009 T.I. 2009-031948 -

The Canadian rate of withholding tax on a dividend paid by a Canadian corporation, that is fiscally transparent for U.S. purposes, to an S Corp of which an individual resident of the U.S. is the shareholder, will be subject to a 25% withholding tax due to Article IV(7)(b) of the Canada-U.S. Convention. Furthermore, Article IV(6) will not apply to treat the dividend as being derived by the shareholder of US Co because for U.S. purposes the shareholder will not be considered to have derived a dividend through US Co given the fiscally transparent nature of the Canadian corporation.

19 May 2009 T.I. 2007-026344 -

A SOPARFI that has a material economic nexus to Luxembourg will be considered to be a resident of Luxembourg for purposes of the Canada-Luxembourg Convention.

Income Tax Technical News, No. 35, 26 February 2007, "Treaty Residence - Residence of Convenience"

2006 Ruling 2004-010610 -

Ruling that a German open-end real estate fund would be treated as a resident of Germany for purposes of Article 4 of the German Treaty.

IC75-6R2 "Required Withholding from Amounts Paid to Non-Resident Persons Performing Services in Canada"

Discussion of limited liability corporations in para. 10 of Appendix A.

6 August 2004 T.I. 2004-0066621E5 -

Three entities (a unit trust, investment company and limited partnership) which were certified by the Irish Revenue Commissioners to be investment undertakings which were resident in Ireland for income tax purposes and thereby subject to Irish tax legislation were found not to be resident under the new Treaty as they were not subject to comprehensive taxation in Ireland (i.e., they currently were not chargeable to Irish tax on their income).

3 August 2004 T.I. 2003-005125 -

A corporation registered as an Undertaking for collective investment in transferable securities in Ireland would not be eligible as a resident of Ireland for purposes of the new Canada-Ireland Treaty signed on October 8, 2003 as it would not be subject to tax in Ireland. (Its gains would be attributed as chargeable gains accruing to unitholders.)

29 March 2004 T.I. 2004-005483 -

It has been a long-standing position of the CRA that FCPs, SICAVs and SICAFs are not "liable to tax" and so are not residents of Luxembourg for purposes of the Canada-Luxembourg Convention.

24 March 2004 T.I. 2003-003278 -

An Irish Investment Undertaking would not be considered to be a resident of Ireland for purposes of the Canada-Ireland Convention given that it was not subject to comprehensive taxation in Ireland. Instead, only tax in the nature of a withholding tax was imposed on distributions made to Irish residents.

2003 Ruling 2003-004406 -

Ruling that Mr. X is a resident of France under the Canada-France Tax Convention given that he is liable to tax on worldwide income in France, his permanent home is in France (where his family now is), and his home in Canada is rented to arm's length third parties so that it is not available to him or his family.

2 September 1999 TI 981635

A qualified subchapter S subsidiary is a resident of the U.S. for purposes of the Canada U.S. Convention, given that the position of the Agency on the resident status of an S corporation has remained unchanged.

Income Tax Technical News, No. 16, 8 March 1999

Discussion of Crown Forest case.

12 March 1998 T.I. 980521

Before concluding that Canada had the right to tax a trust that was resident in Barbados and which was deemed to be resident in Canada under s. 94(1)(c), Revenue Canada stated:

"... A trust is an entity on its own, distinguishable from an individual for the purposes of the Treaty. This interpretation is consistent with the scheme of the Treaty as well as the clear distinction which is made between an individual and a trust in the definition of person in Article III of the Treaty. In addition, the wording in paragraph 2 in Article IV and the relevant literature indicates that paragraph 2 is intended to deal with human beings only."

10 November 1997 T.I. 972844 [check-the-box corp a Treaty resident]

A U.S. LLC that elects to be treated as a corporation under the check-the-box rule will be considered a resident of the U.S. given that, as a result of so electing, it would be treated under the Code as a regular domestic Corporation that, therefore, is taxable in the U.S. on its world income.

15 August 1997 T.I. 971126

Sociétés d'investissement à capital variable are not considered by RC to be residents of a contracting state as they are not liable to taxation in their own right. However, in the case of France an amending protocol will provide that Sicavs will be resident in France to the extent that their shareholders are liable to French tax on the income from the Sicav. This is an extension of the policy on LLCs.

17 February 1997 T.I. 961753

After indicating that the ten-year tax holiday for Barbados Enclave Enterprises does not, by itself, disqualify them from being considered as being resident in Barbados, RC indicated that the phrase "liable to taxation" refers to "full liability to tax", being the most comprehensive form of taxation of a person under the law of Barbados (i.e., taxation based on world income).

8 March 1996 T.I. 960067

A foreign affiliate incorporated in Barbados and licensed under the Exempt Insurance Act, 1983 will not be considered to be "liable to taxation" in Barbados given that its main and, most likely, source of income will effectively be exempt from taxation in Barbados for a guaranteed period of 30 years with the exception of amounts, which although expressed as an income tax, in substance represent an annual licence fee of Bds. $5,000.

22 August 1995 T.I. 952040 (C.T.O. "Treaty ('Residence') Status of a 'S' Corporation"

Because an S corporation will be subject to tax in the U.S. on its world-wide income if certain conditions are not met, it is considered to be a resident of the U.S. for purposes of the Canada-U.S. Convention.

3 April 1995 T.I. 941645 (C.T.O. "S. Corps - LLC's Res of a Contracting State (HAA 4093 U5-100-4)

An S corporation, unlike a limited liability company, is considered to be an entity resident in the U.S. under the Canada-U.S. Income Tax Convention.

25 October 1994 T.I. 941750 (C.T.O. "Limited Liability Company (HAA 4093-U5-100-4)")

If any limited liability company is treated as a partnership for purposes of the Internal Revenue Code such that the shareholders rather than the limited liability company are liable to tax under the Code on the income of the limited liability company, the limited liability company will not be considered to be a resident of the U.S. under Article IV, paragraph 1, of the Canada-U.S. Convention. If the central management and control of the limited liability company is situate in Canada, it will be a resident of Canada for such purposes. Where the mind and management of the limited liability company is situate in the U.S., it will be considered resident in the U.S. for Canadian tax purposes, but will not be considered a resident of either contracting state under the Convention.

27 June 1994 T.I. 940600 (C.T.O. "Corporate Status of a Delaware LLC (4093-U5-100-4)")

If a Delaware limited liability company is treated as a partnership for purposes of the Internal Revenue Code such that the shareholders rather than the company are liable to tax under the Code on the income of the company, such company will not be considered to be a resident of the U.S. under paragraph 1 of Article IV of the Canada-U.S. Convention.

22 March 1994 Memorandum 940204 (C.T.O. "Centre of Vital Interests - Employee (4093 - U5 - 100 - 4)")

Where a taxpayer has not severed his residential ties with Canada, RC must analyze the personal and economic ties over a period of time in order to make a determination of those more meaningful or significant ties. In this regard, RC "would be inclined to think that a house owned in Canada versus a home rented for the length of the stay in the United States or a long-term job in Canada versus a temporary job in the United States should be viewed as the more meaningful or significant ties".

93 C.M.TC - Q. 4

The continuance of a corporation incorporated in Canada to the United States will not result in that corporation ceasing to be considered to have been created in Canada for purposes of Article IV of the U.S. Convention notwithstanding s. 250(5.1).

17 May 1993 T.I. (Tax Window, No. 31, p. 4, ¶2510)

Tax-exempt entities are resident in the jurisdiction in which they are organized.

8 August 1991 T.I. (Tax Window, No. 7, p. 23, ¶1389)

The Canada-U.S. Convention is not intended to benefit individuals, wherever resident, who were subject to tax in the U.S. only by virtue of being citizens of the U.S. Accordingly, a citizen of the U.S. is a resident of the U.S. for the purposes of the Convention only if he or she is ordinarily resident in the U.S. or is deemed to be a resident of the U.S. under domestic U.S. law.

14 December 1990 T.I. (Tax Window, Prelim. No. 2, p. 4, ¶1047)

In the case of a corporation incorporated in Canada and having its place of effective management in The Netherlands, Canada will not agree that the corporation is a resident of The Netherlands in the absence of evidence that Canadian tax is not being avoided.

Articles

Corrado Cardarelli, Peter Keenan, "Planning Around the Anti-Hybrid Rules in the Canada-US Tax Treaty", Draft Paper for 2013 Conference Report (CTF annual conference)

IV(6)(a) and (b) not satisfied where sole shareholder of ULC is LLC (pp.4-5)

Following the approval by CRA of the "two-step" process, the expectation was that the "two-step" process could be combined with the lookthrough rule in article IV(6) to overcome the anti-hybrid rule in article IV(7)(b) in the case of a fiscally transparent LLC that is the sole shareholder of a fiscally transparent ULC where the members of the LLC are qualifying US residents. However, in a technical interpretation released in February 2010, [fn 13: ... 2009-0345351C6, February 11, 2010, See also Income Tax Technical News no. 44, April 14, 2011] CRA cast considerable doubt on this expectation. The crux of the problem lies with the first step (the increase in the paid-up capital in respect of the shares) which, as noted above, is not a taxable event for US federal tax purposes and puts in doubt whether this step satisfies either of the tests in paragraphs (a) and (b) of article IV(6). The test in paragraph (a) requires the members of the LLC to be considered under the taxation laws of the United States to have "derived" an amount through the LLC. However, since the increase in paid-up capital is not a taxable event and is disregarded for US federal tax purposes, it is arguable that the members of the LLC have not "derived" any amount through the LLC. Pursuant to the test in article IV(6)(b), the treatment of the derived amount under the taxation laws of the United States must be the same as its treatment would be if that amount had been derived directly by the members. It is arguable that this test is also not met by the increase in paid-up capital for essentially the same reason, namely, the US tax system does not see a taxable event of any sort so there is simply no amount "derived" through the LLC. CRA stated in the technical interpretation that "the better view is that Article IV(6) does not apply to treat a particular amount of Canadian-source income, profit or gain as being derived by the US resident member(s) of a LLC if that amount is 'disregarded' under the taxation laws of the US."…

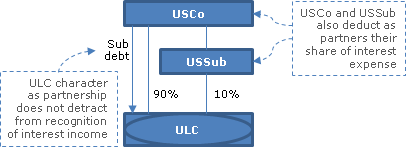

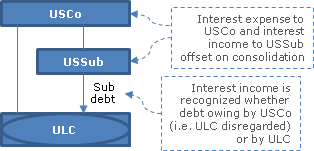

Multiple ULC shareholder solution to IV(7)(b) interest problem: loan by 90% US. Shareholder of ULC (pp. 5-6)

Article IV(7)(b) would also apply to payments of interest to a USCo which is the sole shareholder of a fiscally transparent ULC and also holds debt of the ULC….

[I]n an internal technical interpretation, [fn 16: ...2009-031849117, November 13, 2009, See also CRA document no. 2009-0348041R3, 2010] CRA gave a number of examples which seemed to provide for fairly simple solutions. One example ... involved the ULC having more than one shareholder, namely, USCo and its wholly owned regarded subsidiary ("USSub"), with ownership of 90 percent and 10 percent of the shares of the ULC, respectively, and with USCo alone holding the subordinated debt of the ULC. This multi-shareholder ULC would be treated as a partnership for US federal tax purposes and this fact results in an important distinction from the case of a sole-shareholder ULC. For US federal tax purposes, USCo would be considered to be receiving interest income from the partnership and this is the same as what the treatment would be to USCo if the ULC was not a fiscally transparent entity (that is, it would be receiving interest income from a regarded corporation). It does not matter that USCo and USSub, as partners of the fiscally transparent partnership, would also be considered for US federal tax purposes to have incurred a proportionate share of the interest expense, treatment that would not be the same as the treatment that would apply if the ULC was not a fiscally transparent entity. According to CRA, in determining whether article IV (7)(b) applies to the interest on the debt, the focus is on the treatment for US federal tax purposes of the interest as an item of income without reference to the allocation of other income or expenses from the partnership (the interest as an item of income being what is potentially subject to Canadian withholding tax). As a result, CRA concluded that article IV(7)(b) would not apply…

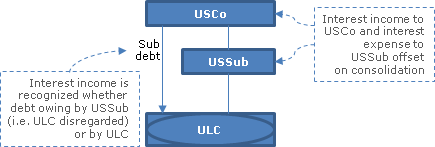

Consolidated U.S. group solution to IV(7)(b) interest problem: loan from U.S. grandparent to ULC (p.6)

A second example considered by CRA in the internal technical interpretation, [fn 18: See, also, ... 2009-0348041R3, 2010] ...involved a USCo that once again wholly owned a regarded subsidiary ("USSub"), with USCo alone holding the subordinated debt of the ULC. In this case, USSub was the sole shareholder of the ULC. The example assumed that USCo and USSub file a consolidated group tax return for US federal tax purposes (a reasonable assumption to make). In this case, the ULC was a disregarded entity for US federal tax purposes so that USCo would be considered to have loaned the debt proceeds to USSub and would include the interest income from the loan in the computation of its "separate taxable income" for US federal tax purposes. This is effectively the same as what the treatment would be to USCo if the ULC was not a fiscally transparent entity (USCo would be receiving interest from the ULC as a regarded corporation). The CRA noted that, for US federal tax purposes, USSub would be considered to owe the loan to USCo and would deduct the interest expense-in respect of the loan in the computation of its "separate taxable income."…CRA once again noted that only the US tax treatment of the interest income to USCo as an item of income, not the treatment of the corresponding expense item to USSub, is relevant for the purposes of the sameness of treatment analysis under article IV(7)(b)….

Second consolidated U.S. group solution to IV(7)(b) interest problem: loan from U.S. regarded sub to ULC sub of its U.S. parent (pp. 6-7)

[A] common variation ... involves the situation where a USCo wholly owns both a US regarded subsidiary ("USSub") and the ULC, so that USSub and the ULC are sister entities, and it is USSub (not USCo) that makes the interest bearing loan to the ULC. [fn 19: See ... 2011-0429261R3, 2012.] From a US federal tax perspective, the ULC is disregarded with the result that the loan is considered to have been made by USSub to USCo and USSub would be required to include the interest income from the loan in the computation of its "separate taxable income." This is effectively the same as what the treatment would be to USSub if the ULC was not a fiscally transparent entity (it would be receiving interest from the ULC as a regarded corporation)….

Questionable solution of use of intermediary in another Treaty county (pp. 7-8)

One of the strategies that had been considered to deal with the anti-hybrid rule in the case where a US corporation (USCo) would otherwise own the shares of a disregarded ULC involved using a foreign company resident in a third jurisdiction that has a favourable income tax treaty with Canada and the United States where such foreign company may be treated as fiscally transparent for US federal tax purposes….This strategy with respect to ownership of shares of a ULC by a foreign company (a Dutch BV) was the subject of a favourable ruling issued by CRA. [fn 22: ... 2009-0343641R3, 2009]…

[fn 25: ... 2013-0483801C6, May 23, 2013] [W]hile noting that CRA would continue to consider ruling requests involving the application of Article IV(7) on a case-by-case basis, CRA also cautioned that "taxpayers should not expect the Income Tax Rulings Directorate to look favourably upon a ruling request involving interposing an entity located in a third jurisdiction designed to avoid the application of paragraph (7) of Article IV of the Treaty."…

U.S. LLC (as U.S. partnership) transaction prompting Code s. 894(c)(1) (pp. 10-11)

[A]rticle IV(7)(a) recalls the transaction that originally focused attention on hybrid LLCs. As the use of LLCs grew widespread in the 1990s, the US Congress became increasingly concerned about a particular cross-border transaction involving the funding of a US subsidiary of a Canadian parent corporation. In the transaction, the Canadian parent contributed equity to a US LLC classified as a partnership for US federal tax purposes. The LLC lent the funds to its US corporate subsidiary. The LLC received interest from the US subsidiary and distributed the cash to its Canadian parent. The US LLC is fiscally transparent from a US tax perspective, so the US subsidiary is treated as paying interest directly to the Canadian parent. The interest was deductible by the US subsidiary and at the time was subject to a 10 percent US withholding tax. From a Canadian tax perspective, where the US subsidiary carried on an active business in the United States, the interest paid by the US subsidiary to the US LLC was not FAPI…

The LLC transaction led to the enactment of section 894(c)(1) of the IRC as part of the Taxpayer Relief Act of 1997. [fn 36: Taxpayer Relief Act of 1997, Pub. L. no. 99-514.] Under section 894(c)(1), treaty benefits are not available to a foreign person with respect to an item of income derived through a partnership (or other fiscally transparent entity) if (i) the item is not treated as an item of income of such person under the tax laws of the foreign country, (ii) the treaty does not address the treatment of income derived through a partnership, and (iii) the foreign country does not impose tax on a distribution of such item of income from the partnership to the foreign person….

IV(7)(a) similar to s. 894(c)(1) (pp. 10-11)

Article IV(7)(a) achieves the same result as section 894(c)(1). The operative test under article IV (7)(a) is satisfied by the LLC transaction: because the LLC is not fiscally transparent under the laws of Canada, the treatment to the Canadian resident of amounts received by the LLC is not the same as it would be if the resident had derived the amounts directly. If received directly, the Canadian parent would have received interest income for Canadian tax purposes, rather than a dividend….

Adverse impact of IV(7)(a) on Canadian pension plan invested in LLC portfolio vehicle (p. 11)

Article IV(7)(a) appears to apply to US-source dividends received by a fiscally transparent LLC even if the LLC immediately distributes the cash to its members. This can create a particularly harsh result for a Canadian pension fund receiving portfolio dividends through an LLC. Pursuant to article XXI, a complete exemption from US withholding tax would generally be available if the pension fund held the portfolio investment directly or through a partnership. However, article IV(7)(a) appears to deny treaty benefits, resulting in a 30 percent withholding tax. To resolve a similar issue under the treaty between the United States and the Netherlands for Dutch pension funds investing in the United States through LLCs, the competent authorities agreed to, in effect, treat dividends and interest paid to an LLC for the benefit of a pension fund as derived by a resident to the extent of the pension fund's share in the dividends and interest paid to the LLC.

Does IV(7)(a) apply to LLC carrying on U.S. branch business? (pp. 11-13)

[S]ection 894(c) generally applies only to withholding taxes on so-called FDAP income [fn 39: FDAP income is "fixed or determinable annual or periodic gains, profits, and income" such as interest, dividends, rents and wages. IRC sections 871(a)(1)(A) and 881(a)(1)] and not to regular business income.

The technical explanation makes clear that article IV(6) applies to business profits derived through an entity, in addition to FDAP income….

One unresolved issue under article IV(7)(a) involves the application of the US branch profits tax to a Canadian corporation (Canco) that is engaged in a trade or business within the United States through an LLC that is fiscally transparent for US federal tax purposes….

Article lV(7)(a) apparently applies to business profits and thus to this situation. In particular, the United States views Canco as earning an amount through an entity (the LLC) that is fiscally transparent under the laws of the United States but not fiscally transparent under the laws of Canada. The operative test under article IV(7)(a) would appear to be satisfied: by reason of the LLC not being viewed as fiscally transparent under the laws of Canada, the treatment of the amount under Canadian tax law (active business income earned by a foreign affiliate of Canco) is not the same as it would have been if the amount had been derived directly by Canco….The main consequence would appear to be that Canco would not be entitled to the lower 5 percent rate of US branch tax. Instead it would be subject to the 30 percent rate under the IRC.

The uncertainty as to whether article IV(7)(a) would be applied by the United States to the Canco/LLC example to deny the lower 5 percent rate of US branch tax has had a chilling effect on the use of the Canco/LLC structure….

Adverse impact of IV(7)(b) on Canadians investing in U.S. private REIT partnerships (pp. 14-15)

Article IV(7)(b) caught US tax practitioners by surprise. The US Treasury Department had previously issued detailed regulations that generally permitted a foreign interest holder to claim treaty benefits with respect to payments by a domestic reverse hybrid as long as the payment was not a deductible payment (for example, interest) to a related foreign person. [fn 46: See Treas. reg. section 1.894-l(d)(2)(ii). When a domestic entity makes a payment to a related domestic reverse hybrid entity that is characterized as a dividend under US law or the laws of the jurisdiction of a related foreign interest holder, a payment by the domestic reverse hybrid entity to the related foreign person may be recharacterized as a dividend for deductibility and withholding purposes. This re-characterization effectively eliminated "tower structures" where the loan to the DLP was made by the Canadian partner.]

Private REITs

A US real estate investment trust (REIT) can be an efficient vehicle for a non-US person to invest in US real estate. A REIT generally does not pay corporate-level tax provided it satisfies the detailed organizational, asset ownership and operating tests under the IRC. Foreign shareholders generally are subject to 30 percent US withholding tax on an ordinary REIT dividend; but the rate may be reduced to 15 percent under the treaty for Canadian residents (and to nil for Canadian pension funds and charitable organizations).

[F]oreign investors in certain jurisdictions may prefer investing in a RElT formed as a partnership. However, in that case, a Canadian resident is precluded under article IV(7)(b) from claiming reduced withholding rates under the treaty. Forming the REIT as a corporation or LLC that elects to be treated as a corporation avoids the problem.

Non-application of IV(7)(b) to interest paid by check-the-box Delaware LP (DLP)(pp. 16-17)

[A] domestic reverse hybrid entity (but not one that has only Canco 1 and Canco 2 as it partners) is formed by a group of investors, including Canadian investors, to invest in a US business. As described above, amounts paid as distributions by DLP (that are considered to be dividends for US federal tax purposes) to a Canadian partner would be subject to article IV(7)(b). Consider the case where the Canadian partner also holds a debt instrument of DLP and receives interest from DLP that does not qualify as exempt "portfolio interest" under the IRC.

[D]oes the anti-hybrid rule apply to the payment of interest by DLP to the Canadian partner and debtholder such that the Canadian partner and debtholder would not be entitled to the treaty reduced rate of withholding tax on interest (which would be nil)?