Cases

Sommerer v. The Queen, 2012 DTC 5126 [at 7219], 2012 FCA 207

After finding that s. 75(2) did not apply to attribute to the Canadian-resident taxpayer a taxable capital gain realized by an Austrian private foundation (a resident of Austria), the Court went on to find that, in any event, such application of s. 75(2) would have been precluded by the Canada-Austria Income Tax Convention, as found in the Tax Court. Sharlow J.A., after referring to the Minister's argument that Article 13(5) did not exempt the gain because the taxpayer was "not resident in Austria, and also because the tax in issue is not imposed on the basis that [he] is the alienator of the shares, but by the operation of the attribution rule in subsection 75(2)," stated (at para. 64):

Justice Miller rejected that argument because he considered it inconsistent with the language of Article XIII (5), and the apparent premise for another provision of the Canada-Austria Income Tax Convention, Article XXXVIII (2). In that provision, Canada reserves the right to tax residents of Canada on income and gains attributed to them pursuant to section 91 of the Income Tax Act (the foreign accrual property rules). The existence of that reservation suggests that an underlying premise of the Canada-Austria Income Tax Convention is that tax on attributed income generally is within its scope. There is no similar reservation relating to the attribution of income and gains under subsection 75(2), which means that Canada has not reserved the right to tax residents of Canada on income and gains attributed to them under subsection 75(2).

Regarding the Minister's argument that Article 13 was only included "for greater certainty", Sharlow J.A. noted that treaties addressed double taxation, and stated:

"Double taxation" may mean either juridical double taxation (for example, imposing on a person Canadian and foreign tax on the same income) or economic double taxation (for example, imposing Canadian tax on a Canadian taxpayer for the attributed income of a foreign taxpayer, where the economic burden of foreign tax on that income is also borne indirectly by the Canadian taxpayer). By definition, an attribution rule may be expected to result only in economic double taxation.

The Crown's argument requires the interpretation of a specific income tax convention to be approached on the basis of a premise that excludes, from the outset, the notion that the convention is not [sic] intended to avoid economic double taxation. That approach was rejected by Justice Miller, correctly in my view.

Haas Estate v. The Queen, 2001 DTC 5001, Docket: A-709-99 (FCA)

Where a United States resident has disposed of Canadian real property, the calculation of the reduction under Article XIII(9) of the Canada-U.S. Convention begins at the point at which the gain first began to accrue for Canadian income tax purposes which, in the case of properties acquired prior to V-Day, means the starting point for calculating the reduction will be December 31, 1971. "Thus, calculating the amount of reduction in such cases entails subtracting the V-Day value from the proceeds of disposition and multiplying the difference by the number of months that the gain accrued from V-Day to 1985, divided by the number of months the gain accrued from V-Day to date of disposition. That was the conclusion in Kubicek." (p. 6702)

Attorney General of Canada v. Kubicek Estate, 97 DTC 5454, Docket: A-671-96 (FCA)

Given that "the ordinary meaning of 'gain' for the purposes of Article XIII of the [Canada-U.S.] Convention is the gain which is subject to tax" (p. 5454) the proration of gain under paragraph 9 of Article XIII, was required to be calculated by reference to the period of time that the property in question (a cottage owned by the taxpayer and his previously-deceased wife since 1967) had been held subsequent to December 31, 1971 (the date on which the capital gains became subject to tax) rather than during the whole period of ownership.

Gladden Estate v. The Queen, 85 DTC 5188, [1985] 1 CTC 163 (FCTD)

The "sale or exchange" of capital assets under Article VIII of the 1942 Canada-U.S. Convention included a deemed disposition of capital property under s. 70(5)(a) of the Act. "[T]o hold that a deemed disposition would, as claimed by the Minister, be taxable as a capital gain while a true sale or exchange would not, would be both unreasonable and absurd".

Hurd v. The Queen, 81 DTC 5140, [1981] CTC 209 (FCA)

The purchase of shares pursuant to an employee stock option agreement was found not to be "an exchange of capital assets" within the meaning of the 1942 Canada-U.S. Convention.

See Also

Commissioner of Taxation v. Resource Capital Fund III LP, [2014] FCAFC 37 (Fed. Ct. of Austr.)

The appellant ("RCF") was a non-Australian partnership which was assessed on the basis that its gain from the sale of a "member ship interest" in an Australian company ("SBM") with two underground gold mines in Western Australia was from "taxable Australian real property". The SBM membership interest qualified as TARP "if the sum of the market value of [SBM]'s assets that [were] taxable Australian real property exceed[ed] the sum of the market values of its assets that [were] not taxable Australian real property." The primary judge below had found that the SBM membership interests were not TARP, in part, on the basis that the mining information of SBM (a non-TARP asset) had a substantial value in light of the substantial exploration cost that would be required to reproduce this information, as well as the substantial present value of the mining production that would be foregone during the three to five year exploration and evaluation process and that the valuation of the mining rights (a TARP asset) should be discounted by the same factors.

In rejecting this approach on appeal, the Court stated that the market values of the various assets should be made:

on the hypothesis of a simultaneous sale to the one purchaser with the capacity to use those assets in combination in a gold mining operation as their highest and best use. …[A]ll the experts…agreed that in the case of a simultaneous sale to the one purchaser, the hypothetical purchaser could expect to acquire the mining information and plant and equipment for less than their re-creation costs with little or no delay.

Accordingly, it appeared that the Commissioner was successful, although the parties could make submissions on the final calculations.

Resource Capital Fund III LP v. Commissioner of Taxation, [2013] FCA 363 (Fed. Ct. of Austr.), rev'd supra.

The appellant ("RCF") was a Caymans limited partnership with mostly US-resident partners, which was assessed under the "taxable Australian real property" rules on its gain from the sale of an Australian company ("SBM") with two underground gold mines in Western Australia. The SBM shares qualified as TARP "if the sum of the market value of [SBM]'s assets that [were] taxable Australian real property exceed[ed] the sum of the market values of its assets that [were] not taxable Australian real property." After already having decided in RCF's favour on the basis that the gain was Treaty-exempt, Richard Edmonds J further found that the SBM shares were not TARP, so that the gain also was not assessable under the TARP rules.

In reaching this conclusion, he found that:

- the plant and equipment, to the extent it was fixtures, was fixtures to the land (which was not owned by SBM and, therefore, was not TARP of SBM) and not to its mining rights (which were TARP): para. 112

- the mining information of SBM (which was not TARP) had a substantial value in light of the substantial exploration cost that would be required to reproduce this information, as well as the substantial present value of the mining production that would be foregone during the three to five year exploration and evaluation process (para. 105, 132)

- the question of what a hypothetical purchaser would pay for the mining information, being anything in the range of nil (being what it could be sold for by itself) to the full replacement cost (including foregone production as noted above), was indeterminate – however, "the fair valuation is one which shares equally between the holder, and the potential user, of the relevant asset the benefit to the user of immediate acquisition of the asset" (para. 157, see also 106, 129), so that the mining information was valued at the mid-point between the two extremes

- similarly, the plant and equipment should be valued "by dividing the notional ‘bargaining zone' equally" (para. 159, see also 107) between its replacement cost and its minimal scrap value

- it was not necessary to address whether any value should be assigned to goodwill as the SBM non-TARP assets were more valuable even without doing so

- it was inappropriate to add an asset value representing the excess of the market capitalization of SBM (which was a listed company) over its discounted cash flow valuation (para. 111, 121)

The taxpayer ("Tradehold") was an investment holding company incorporated in South Africa and trading on the Johannesburg Stock Exchange. Its only relevant asset was a 100% shareholding in Tradegro Holdings, also a resident of South Africa. In July 2002, Tradehold relocated its place of effective management from South Africa to Luxembourg by resolving that all future board meetings would be held there. However it did not cease to be resident in South Africa for purposes of the Income Tax Act (South Africa) (the "Act") until 2003, when an amendment was made to the Act to provide that a resident did not include a person who was the resident of another country under the terms of the Treaty between that county and South Africa.

The Commissioner's position was that when Tradehold ceased to be resident in South Africa in 2003 (or when it became effectively managed in Luxembourg in July 2002), it was deemed to have disposed of its shares of Tradegro Holdings for their market value, resulting in the realization of a capital gain of approximately ZAR 400 million. Although Art. 13(4) of the Luxembourg-South Africa Treaty stipulated that "gains from the alienation of any property other than [specified exceptions]…shall be taxable only in the Contracting State of which the alienator is a resident," the Commissioner argued that the term "alienation", as used in Art. 13(4) did not cover a deemed disposal of shares.

In rejecting this submisison and finding for Tradehold, the Court noted that Art. 13(4) does not distinguish between the capital gains that arise from actual, and those arising from deemed, alienations of property, and concluded (at para. 25):

The term "alienation"…is not restricted to actual alienation. It is a neutral term having a broader meaning, comprehending both actual and deemed disposals of assets giving rise to taxable capital gains.

Kaplan Estate v. The Queen, 94 DTC 1816 (TCC)

Land of U.S.-resident (which had an adjusted cost base to him of $17,050 based on its V-day value) was acquired by him in 1952 at a cost of $7,000 and disposed of by him for $91,000 in 1989.

Couture C.J. allowed the appeal of the individual's estate from a reassessment of the Minister that sought to calculate the portion of the gain that was exempt under paragraph 9 of Article XIII of the U.S. Convention on the basis of the number of months of ownership subsequent to December 31, 1971 rather than subsequent to the date of acquisition in 1952. In doing so Couture C.J. referred to the Technical Explanation of the U.S. Treasury Department and to IT-173R2, para. 14, both of which referred to the period of [total] ownership, and also found that s. 3 of the Income Tax Conventions Interpretation Act had no application because paragraph 9 of Article XIII referred to the "gain" rather than to the "capital gain".

Administrative Policy

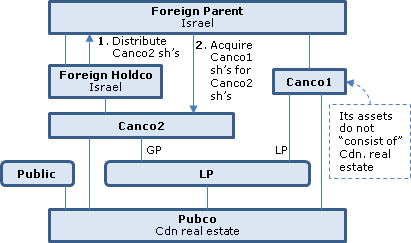

2014 Ruling 2014-0527221R3 - Disposition of shares under Canada-Israel Treaty

Current structure

Foreign Parent, an Israeli public company, holds its LP interest in LP trough a Canadian subsidiary (Canco1) and holds its GP interest through a Canadian subsidiary (Canco1) of an immediate Israeli subsidiary (Foreign Holdco) of Foreign Parent. LP's only asset is shares of Pubco, a Canadian public company whose assets consist principally of Canadian real estate. Canco1 and Canco2 also hold Pubco shares.

Proposed transactions

In order to simplify the structure: Foreign Parent will acquire from Foreign Holdco for no consideration the shares of Canco2; and Canco2 will purchase all the shares of Canco1 from Foreign Parent in exchange for Canco2 common shares with an equivalent fair market value, but with their paid-up capital limited by s. 212.1.

Ruling

that any gains on these dispositions will be exempt under Art. XIII, para. 4 of the Canada-Israel Treaty. Art. XIII, para. 3 provided that "gains from the alienation of shares of a company, the property of which consists principally of immovable property situated in [Canada], may be taxed in [Canada]." The summary stated:

The property of the Canadian corporation the shares of which are being disposed of cannot be said to consist principally of immovable property situated in Canada and therefore, the gain does not meet the requirements of paragraph 3 of Article XIII… .

17 November 2014 T.I. 2014-0555061E5 - Canada-Japan Income Tax Convention, Article 13

Paragraph 4 of the Canada-Japan Treaty states that "Gains derived by a resident of a Contracting State from the alienation of any property other than that referred in paragraphs 1 to 3 and arising in the other Contracting State may be taxed in that other Contracting State". Would a gain be considered to arise where the property (which is taxable Canadian property) is located (Canada) or where the transaction is completed (in Japan)? CRA responded:

Pursuant to paragraph 6.3 of the Income Tax Convention Interpretation Act (Canada) (the "ITCIA"), except where a convention expressly otherwise provides, a gain from the disposition of TCP is deemed to arise in Canada. …[T] here is nothing in the Treaty that expressly provides where a gain described in paragraph 4 of Article 13 arises. Therefore, if the gain pertains to the disposition of TCP, it would be deemed by paragraph 6.3 of the ITCIA to arise in Canada even if the sale took place in Japan and paragraph 4 of Article 13 of the Treaty would permit Canada the right to tax such gain.

24 September 2014 T.I. 2014-0543071E5 F - Article XIII of the Canada-France Treaty

An individual resident in Canada, who held the bare ownership of French immovable property, disposed of the property at a gain. France was permitted by Art. XIII, para. 1(a) of the France-Canada Convention to tax the gain, which did not trench on the right of Canada to also tax the gain under ITA .s 2(1), although on the satisfaction of certain conditions, a foreign tax credit would be available.

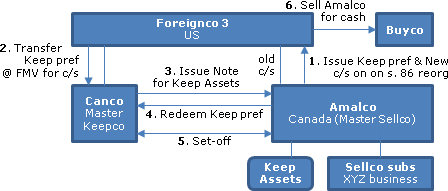

2012 Ruling 2011-0403291R3 - Treaty exempt sale

Following a preliminary reorganization (including an amalgamation of predecessors of Amalco so as to "consolidate the tax attributes"), all the shares of Amalco are held by Foreignco3 (resident in the U.S.) which, in turn, is an indirect wholly-owned subsidiary of Foreign Parent, a listed company. Amalco has various direct or indirect (mostly Canadian) subsidiaries carrying on the XYZ Business and also holds the "Keep Assets," which mostly are non-resident or resident subsidiaries. The following transactions occur in order to accomplish an indirect sale of the XYZ Business by Foreignco3 to Buyer (an arm's length purchaser) after a spin-off of the other "Keep Assets" to a newly-incorporated Canadian spinco whose initial common share is held by Foreignco3 ("Canco"):

- On a s. 86 reorganization Foreignco3 will receive "Keep Shares" (non-voting redeemable retractable preferred shares) and New Common Shares in exchange for its old common shares of Amalco (which are taxable Canadian property).

- Foreignco3 will transfer the Keep Shares to Canco in exchange for additional Canco Shares, electing under s. 85(1) at fair market value.

- Amalco will transfer the Keep Assets to Canco in exchange for the Canco Note and the assumption of the Assumed Debts, with a net taxable capital gain resulting.

- Amalco will purchase the Keep Shares from Canco for cancellation (giving rise to an obligation, but with no note issued).

- The obligations arising in 3 and 4 and other obligations are set-off.

- Foreignco3 will sell the New Common Shares (which now derive their value from the XYZ Assets) to the Buyer for cash.

Rulings include:

- the gain realized by Foreignco3 on the transfer of the Keep Shares to Canco in 2 and on the sale in 6 will be exempt from tax under Art. 13 of the Treaty.

- 55(2) will not apply to the deemed dividends arising in 4.

14 April 2014 Memorandum 2013-0516151I7 F - Article XIII(4) of the Canada-XXXXXXXXXX Convention

A non-resident corporation (Vendor) disposed at a gain of shares of Canco, which held partnership interests in two Quebec real estate partnerships (an SEC and SENC). Vendor applied for a s. 116 certificate and submitted that the gain was exempt under Art. XIII, para. 4 of the Canada-Singapore Convention, on the basis that para. 3 did not apply, which refers to:

gains from the alienation of shares of a company, or of an interest in a partnership or a trust, the property of which consists principally of immovable property… .

In finding that the gain was not Treaty-exempted, CRA stated (TaxInterpretations translation):

In general, an interest in a Canadian partnershp is not an immovable property, even if the value of its property is principally derived from immovable property. ..[T]hus...the interests of Canco in SEC and SENC cannot be considered as immovable property… .

[T]he better position…is to consider that SEC and SENC are not distinct persons for purposes of the Convention and that their respective patrimonies can be assimilated to that of their members. Consequently, the Canadian immovable properties which are held by means of SEC and SENC should be considered as being directly held by Canco to the extent of its interests in them. Recall…that the presumption provided in paragraph 96(1)(a)…does not apply except for the purposes stipulated in the preamble… .

4 December 2013 Memorandum 2013-0489051I7 - Personal-Use-Property & Article XIII(9)

A U.S. resident owned vacant land in Canada from before September 26, 1980 and after that date built a cottage thereon. CRA found:

If the cottage is substantially connected to the land and permanently improves the land, then it is our view that the cottage constructed on the property is a fixture and becomes part of the land on which it is situated.

Accordingly, the total gain (including that attributable to the building) on a subsequent disposition would be eligible for reduction under Art. XIII, para. 9 of the Canada- U.S. Treaty, and only one notification would be required under s. 116. As the building was personal-use property rather than depreciable property, Reg. 1102(2) (excluding land upon which depreciable property is situated from depreciable property) was not relevant.

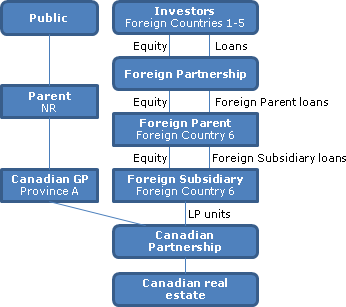

2013 Ruling 2012-0444431R3 - Taxable Canadian Property

A partnership (Foreign Partnership), whose non-resident members (Investors) are resident in Foreign Countries 1 through 5, uses a portion of its cash from unit and loan subscriptions to subscribe for equity of a Newco resident in Foreign Country 6 (Foreign Parent), and applies the balance of its subscription cash to subscribe for a mixture of profit-participating loans and non-interest-bearing loans of Foreign Parent (the Foreign Parent Loans). Foreign Parent, in turn, uses such cash proceeds to subscribe for shares of another Newco (Foreign Subsidiary), also resident in Foreign Country 6 and to subscribe for interest-bearing loans of Foreign Subsidiary (the Foreign Subsidiary Loans). Foreign Subsidiary, in turn, uses such cash proceeds to acquire partnership interests in a partnership (Canadian Partnership) holding Canadian real property.

Rulings:

- Each Investor's interest in the Foreign Partnership will be taxable Canadian property

- Such interest will be treaty-protected property for Investors resident in Foreign Countries 1 through 4 provided stipulated conditions relevant to the applicable Treaty are satisfied, as follows:

- Treaty 1 - the only properties of the Foreign Partnership are the shares of Foreign Parent, the Foreign Parent Loans and the Foreign Subsidiary Loans

- Treaty 2 – the Investor does not have a controlling interest, (a controlling interest being where the Investor and persons related to the Investor have an interest of 50% or more), in the Foreign Partnership

- Treaty 3 – no additional conditions

- Treaty 4 - the Investor and any persons related to or connected with the Investor are entitled to an interest of less than 10% of the income and capital of the Foreign Partnership immediately before the Disposition Time

- Treaty 5 - not treaty-protected property

28 November 2011 CTF Roundtable Q. , 2011-0425901C6

After the questioner referenced the previous position that, in the context of Treaty references to shares deriving in their value principally from real property, CRA would accept a valuation method that assigned the debt of a company to the assets to which the debt reasonably related, CRA stated:

In the context of tax treaties...the determination whether a share of a company derives its value principally from real or immovable property situated in Canada should be made by reference to the value of the properties of the company without taking into account its debts or other liabilities. This approach is in line with paragraph 28.4 of the [OECD] Commentary....[T]his new more restrictive position will initially be applied only with respect to dispositions of properties that are acquired after 2011.

17 May 2012 IFA Roundtable Q. , 2012-0444161C6

In responding to a query which noted that the Canada-U.S. Treaty, unlike other Conventions, specifically referred to deferral agreements of competent authorities being entered into to avoid double taxation, and asked whether "the Canadian Competent Authority [would] be willing to enter into a deferral agreement under one of these other treaties where the profit, gain or income is exempted or excluded from taxation under the domestic laws of the residence," CRA responded negatively:

...the Canadian Competent Authority requires taxpayers seeking a deferral agreement to demonstrate that the profit, gain or income for which an agreement is being sought is only deferred - not exempted or excluded - from taxation under the domestic laws of the residence state.

More specifically, CRA noted that the conditions respecting a deferral application under the U.S. Treaty in paras. 76-85 of Information Circular 71-17R5 are "equally applicable to all requests made under the deferral provisions in any of Canada's tax treaties."

22 June 2012 T.I. 2011-0416521E5 -

The definition in Art. XIII of the Canada-US Convention of "real property situated in the other Contracting State" includes, in the case of real property siuated in Canada "a share of the capital stock of a company that is a resident of Canada, the value of whose shares is derived principally from real property situated in Canada;" and Art. III, para. 2 provides subject to certain exceptions that otherwise undefined terms have the meaning which they have under the law of the State whose taxes are concerned.

Before concluding that the reference in this Art. XIII definition does not include "an option in respect of the share even where the share, itself, is [taxable Canadian property]," CRA stated:

Under the current Act there is no longer a provision that is equivalent to former subsection 115(3). The former provision deemed a share to include an option in respect of the share. By virtue of paragraph 2 of Article III we were able to reach the conclusion that a share for the purpose of subparagraph 3(b)(ii) of the Treaty also included an option therein. With the consolidation of the definition of taxable Canadian property ("TCP") under subsection 248(1) of the Act, an option in a share is no longer defined or deemed to be a share for purposes of the Act. An option in a share where, among other things, more than 50% of the share's value is derived from real property is included in the definition of TCP but is treated as a separate property. Although the option may be TCP it is not considered a "share".

2012 Ruling 2011-0429961R3

Ruling that the transfer of shares of a UK company (Forco2) by two other UK companies (Forco1 and Forco4) would be exempt under Art. XIII, para. 8 of the Canada-UK Convention on the basis of an internal estimate prepared by Canco management that the going concern value of the gas storage business carried on by Canco (which was carried on in real estate facilities held on leased land) was greater than X% of the value of the shares of Canco, and that the hydrocarbon assets of Canco did not exceed Y% of the assets of Canco.

2008 Ruling 2008-0272141R3 -

The shares of a U.S. corporation (D Co) holding two Canadian subsidiaries (G Co and H Co) whose shares are taxable Canadian property are contributed by its U.S.-resident parent (B Co) to a U.S. affiliate. Ruling that "although there will be a disposition of the D Co shares when B Co contributes them to C Co, any gain on this disposition will be exempt from tax in Canada under Article XIII(4) of the Treaty."

20 August 2007 T.I. 2005-011115 -

"Real property would not be considered rental property for purposes of Article 13(4) of the [Canada-Germany] Treaty unless the property was subject to a lease agreement that created a landlord/tenant relationship ... It is our view that a full-service motel would not normally constitute a rental property ...".

9 September 2004 T.I. 2004-009309

An "approved stock exchange" in Article 13 of the Luxembourg and Netherlands Conventions meant a stock exchanged prescribed for purposes of the Income Tax Act.

5 September 2003 T.I. 2003-002967

Although in most cases comparing gross asset values will be the simpler (and perhaps quite often the most reasonable) method for making the 50 percent determination respecting whether a share derives its value principally from Canadian real property, depending on the facts and circumstances of a particular situation other valuation methods such as the net asset value method may be appropriate. This flexibility generally will be an advantage to the taxpayer except where questionable transactions are occurring.

8 April 2003 T.I. 2003-000199 -

After referring to Bromley v. Tryon, [1952] AC 265 (HL) ("'greater part' means anything over one-half"), CCRA stated that:

"The term 'value or the greater part of their value' as used in paragraph 5(a) of Article 13 of the [Canada-U.K.] Convention generally requires that more than 50% of the value of the shares being alienated be derived from immovable property or a right referred to in paragraph 4 of Article 13 in order for paragraph 5(a) to apply."

9 January 2001 T.I. 2000-004254 -

The exception for real property in which the business of the enterprises carried on apparently was viewed as being available where the shares of a private corporation resident in Canada actively carried on a farming business in Canada.

30 November 1999 T.I. 982515

Where an individual resident of the U.K. owns all the shares of a private Canadian corporation that, in turn, has as its principal asset less than 1% of the shares of a real estate company that is publicly traded on The Toronto Stock Exchange, the exclusion for shares deriving their value "indirectly" from Canadian real estate would apply to a disposition of the shares of the private company even though a direct sale of the shares of the public corporation would be exempt from Canadian capital gains tax.

22 October 1997 T.I. 971083

Where an individual resident of Canada moves to the United States in 1994 and becomes a resident of the United States at that time for treaty purposes under the "tiebreaker" rule, a subsequent disposition of personal property by him under s. 128.1(4)(b) as a result of ceasing to be resident for Canadian purposes will be exempt under Article XIII, paragraph 4, of the Canada-U.S. Convention.

15 October 1997 T.I. 971385

Canada has the right to tax gains of a taxpayer from the deemed disposition of real property situate in Israel as a result of the taxpayer ceasing to be resident in Canada. "the word 'alienation' ... includes deemed disposition referred to in paragraph 128.8(4)(b) ...".

25 April 1997 T.I. 970990

A gain realized by the disposition by a U.S. resident of an interest in a partnership the value of which is not derived principally from real property situated in Canada will be exempt under paragraph 5 of Article XIII of the U.S. Convention.

2 January 1996 T.I. 951418 (C.T.O. "Shares and the Canada-Israel Treaty Article XIII")

Where a corporation resident in Israel alienates shares of a corporation resident in Canada the only assets of which are shares of a second Canadian corporation, paragraph 3 of Article XIII of the Canada-Israel Income Tax Convention generally will not be applicable, and by virtue of paragraph 4 of that Article, the Israeli corporation will not be liable to taxation in Canada on the gain notwithstanding that the property of the second Canadian corporation consists principally of immovable property situated in Canada.

13 September 1995 T.I. 951036 (C.T.O. "Source of Capital Gain - Canada-Japan Treaty")

In considering where a gain from the alienation of shares would be considered to "arise" for purposes of paragraph 4 of Article XIII of the Canada-Japan Convention, RC would generally not look to the situs of the underlying assets of the corporation but rather would look to the location of the sale of the shares (i.e., usually where the contract is signed)".

13 September 1995 Memorandum 951808 (C.T.O. "Gains in U.S. Treaty & Life Insurance Proceeds")

The word "gains" in article XIII of the Canada-U.S. Convention means capital gains.

15 August 1995 T.I. 950678 (C.T.O.)

"Property... in which Business of Co. Carried on"): Respecting the exclusion in Article XIII, paragraph 4 of the Canada-Netherlands Convention for property (other than rental property) in which the business of the company is carried on, RC stated that in its view "Oil & Gas reserves and royalty interests will be excluded from the definition of immovable property ... if the owner is actively engaged in the exploitation of natural resources and if such assets are actively exploited or kept for future exploitation by such owner ... . [A]s a general rule, in order for a company to be 'actively engaged' in the exploitation of natural resources, the company must be directly involved in the management and daily activities of the exploitation process on a regular, continuous and substantial basis, and the company's employees must devote time, work and energy to the exploitation. We contrast this with a passive investor or an investor who is in the business of buying and selling working interests or royalties for speculation purposes without being directly involved in the exploitation of the underlying reserves."

13 July 1995 T.I. 950518 (C.T.O. "U.K. Convention Art. XIII - Shares")

Capital gains realized by a U.K. shareholder on the alienation of shares of a Canadian public corporation and whose shares derived most of their value from Canadian real estate will be exempt, provided that the proceeds of disposition are remitted to or received in the U.K., as required in Article XXVII of the U.K-Canada Convention.

26 April 1995 T.I. 950181 (C.T.O. "Cap. Gain - Canada - Ireland Tax Agreement")

A resident of Ireland is subject to tax of 15% on the disposition of shares that are taxable Canadian property in light of Article VI of the Canada-Ireland Convention.

10 February 1995 T.I. 942640 (C.T.O. "Art III(3) Canada-U.S. Convention - Share Includes Option")

"The reference in paragraph 3 of Article XIII [of the Canada-U.S. Convention] to 'a share of the capital stock of a company, the value of whose shares is derived principally from real property situated in Canada' includes an option in respect of such a share."

12 June 1995 T.I. 950091 (C.T.O) "Article 13 Canada-U.K. Treaty and Look-Through Basis")

Given that paragraph 5 of Article 13 of the Canada-U.K. Convention is to be applied on a look-through basis, subparagraph 7(b) of Article 13 also should be applied on the same look-through basis.

Income Tax Technical News, No. 4, 20 February 1995

When the pro rata method in Article XIII, para. 9 of the U.S. Convention is used to reduce the amount of the capital gain, the months before 1972 are never relevant in determining "the amount of the gain which is liable to tax" in Canada.

6 June 1994 T.I. 5-933542 -

A resident of the U.K. will be granted relief from Canadian tax under Article 13, paragraph 8 of the Canada-U.K. Convention on the deemed disposition by her of taxable Canadian property on her death notwithstanding that no income tax will be payable at that time in the U.K. Paragraph 2 of Article 27 of the Canada-U.K. Convention will not apply because capital gains arising from a deemed disposition on death are not gains that can remitted or received as referred to in that provision.

1993 A.P.F.F. Round Table, Q. 25

A capital gain arising as a result of a distribution of paid-up capital on common shares held by a non-resident generally would be exempt under Article XIII(4) of the Canada-U.S. Convention, unless the gain was derived from shares described in paragraphs 1, 2 or 3.

11 December 1992 T.I. (Tax Window, No. 27, p. 17, ¶2329)

A U.K. citizen who is resident in Canada for 20 years, then resident in the U.K. for seven years, before he sells a U.K. real property in respect of which he had made an election under s. 48(1)(c) upon ceasing to be a resident in Canada, will be exempt from tax on the disposition pursuant to Article XIII(8). Article XIII(9) will not apply.

6 November 1992 T.I. 923320 (September 1993 Access Letter, p. 418, ¶C111-054)

With respect to the exclusion in paragraph 7 of Article XIII of the Canada-U.K. Convention for property (other than real property) in which the business of the company is carried on, RC is of the view that: rental property means property rented by the company as landlord/lessor; office buildings, factories, processing plants and fixed machinery and equipment operated by the company together with the land under or subjacent thereto and necessary for use thereof qualify; and oil and gas reserves, mines and well interests qualify if the owner is actively engaged in the exploitation of natural resources subject to the exception relating to hydrocarbons contained in the Convention; and that immovable property that is inventory or property not used in the business but held as an investment for capital gains, will not qualify.

8 October 1992 T.I. 920970 (September 1993 Access Letter, p. 419, ¶C111-056)

Where a property drops in value after 1984 and then recovers before the date of its disposition, the availability of any transitional relief in paragraph 9 of Article XIII of the Canada-U.S. Convention should be discussed with the competent authority.

The acquisition of a depreciable property on a partial (1/2 step-up basis) under former s. 70(5)(b) would be regarded as a non-recognition transaction for the purposes of paragraph 9.

17 March 1992 T.I. (Tax Window, No. 18, p. 11, ¶1809)

The gain realized by a U.S. resident who sells an interest in a U.S. partnership which conducts a manufacturing business in Canada and does not own Canadian real estate, will not be taxable in Canada. Article XIII(2) of the U.S. Convention will not apply because the property sold is a partnership interest rather than the property used in the Canadian business.

18 July 1991 T.I. (Tax Window, No. 6, p. 7, ¶1361)

An individual is resident of Canada for 15 years or more (paragraph 9) if he is a resident of Canada for discrete periods aggregating 15 years and each consisting of at least 12 consecutive months. Years of deemed residence under s. 250(1) also are included, unless the tie-breaker rule in Article IV alters this result.

90 C.P.T.J. - Q.33

Although Canadian resource properties are now viewed as something other than capital assets, paragraph 9 of Article XIII of the U.S. Convention may be applied by U.S. residents to the disposition of those resource properties which would have been exempt from capital gains tax under Article VIII of the 1942 Convention, provided that such properties are not excluded by virtue of paragraphs 9(c), (d) and (e).

27 February 1990 Memorandum (July 1990 Access Letter, ¶1335)

The Canada-U.S. Income Tax Convention would have the effect of exempting a U.S. resident from AMT with respect to capital gains.

84 C.R. - Q.58

guidelines re principal derivation of value from real estate.

84 C.R. - Q. 40

RC accepts the interpretation of "alienation" contained in the Treasury Department's technical explanation, which refers to deemed dispositions under the domestic law.

Articles

Michael Lang, "Income Allocation Issues Under Tax Treaties", Tax Notes International, April 21, 2014, p. 285.

Allocation conflict in Sommerer (pp. 289-90)

[S]ubsection 75(2)…is an allocation rule that can lead to the income being taxed in the hands of a person resident in Canada. If this were to result in the taxation in Canada of Sommerer (who is resident there), it would cause a conflict of allocation, since Austrian tax law allocates the income to the private foundation. Therefore, the legal questions actually relevant here are which legal consequences will be triggered under treaty law in such an allocation conflict.

D. Economic Double Taxation

This conflict of allocation was clearly identified by the Federal Court of Appeal. One must agree with the court that the consequence is economic double taxation — the same increases in value are subject to taxation in the hands of different persons in different states:…

…It is not understandable why the court still assumes that the application of the treaty generally leads to the avoidance of economic double taxation.

Allocation conflict in OECD Partnership Report (p. 290)

In the case of allocation conflicts, it seems obvious to take a look at the OECD partnership report. [fn 22: OECD, "The Application of the OECD Model Tax Conventions to Partnerships," Issues in International Taxation No. 6 (1999).]…

…Case study 16 is based on a situation that resembles one that the Canadian courts had to decide:

Example 16

P is a partnership established in State P. Partner B is a resident of State R while partner A is a resident of State P. State P treats the partnership as a taxable entity while State R treats it as a transparent entity. P derives royalty income from State R that is not attributable to a permanent establishment in State R. P has an office in State P and may therefore be considered to have a permanent establishment in State P. [fn 23: OECD, "The Application of the OECD Model Tax Conventions to Partnerships," Issues in International Taxation No. 6 (1999), at p. 45.]

The considerations made by the Canadian courts regarding treaty law are based on the assumption that Austria treats the private foundation as a taxpayer, while Canadian tax law treats it as transparent. If from this point of view one compares the private foundation with a partnership, Austria is in the position of State P and Canada in that of State R….

Majority opinion in partnership Report (p. 292)

[A]ccording to the majority's opinion regarding the solution of case study 16, the allocation of income in its source state is ultimately determinative — the royalties originate in State R and, under the tax laws of State R, must be allocated to the partners resident there. When applied to the case decided by the Canadian courts, this would mean that only the allocation of income according to Canadian law matters for the application of the treaty, since this involves gains from the alienation of Canadian companies. If one follows the opinion of the majority at the OECD, then Canada, as the residence state of Sommerer, can continue to exercise the right of taxation for the income allocated to him under Canadian tax laws.

Geoffrey S. Turner, "Harmonizing Tax Treaty Exemptions and Taxable Canadian Property: Demise of the Buisness Property Exemption", International Tax, No. 64, CCH, June 2012, p. 5

"The older tax treaties with broad exeptions for business property, listed shares, and minority 'non-substantial' interests no longer manifest Canada's current tax treaty policy and could potentially be amended by the tie the disposition occurs...."

Greg S. Lindsay, "U.S. Investment in Canadian Resource Property: Recent Developments", International Tax Planning, Vol. XVI, No. 3, 2011, p. 1120

Includes discussion of exclusions in immovable property definition in Luxembourg and Netherlands treaties; and treaty shopping.

Lanthier, "Acquiring, Holding and Financing Canadian Corporations", Bulletin for International Fiscal Documentation, Vol. 48, No. 8/9, August/September 1994, Special IFA issue, p. 419.

Discussion of "Canadian spider" structure.