Cases

The Queen v. Prévost Car Inc., 2009 DTC 5721, 2009 FCA 57

The taxpayer paid dividends to its shareholder, ("Prévost Holding"), a Netherlands holding company which, in turn, paid dividends in substantially the same amount to its two corporate shareholders, a Swedish and UK corporation. Prévost Holding was not party to a shareholders agreement that contemplated that dividends received by Prévost Holding would be paid to its shareholders and Prévost Holding was not otherwise obligated to pay those dividends to its shareholders.

The Court accepted (at para. 13) the finding of the Trial Judge that "the 'beneficial owner' of dividends is the person who receives the dividends for his or her own use and enjoyment and assumes the risk and control of the dividend he or she received" and (at para. 16) the finding of the Trial Judge that "the corporate veil should not be pierced because Prévost Holding is not 'a conduit for another person', cannot be said to have 'absolutely no discretion as to the use or application of funds put through it as a conduit' and has not 'agreed to act on someone else's behalf pursuant to that person's instructions without any right to do other than what that person instructs it ..."

Hunter Douglas Ltd. v. The Queen, 79 DTC 5340, [1979] CTC 424 (FCTD)

A Canadian company shifted its central management and control to the Netherlands, thereby becoming a resident of the Netherlands for purposes of the 1957 Canada-Netherlands Convention, and then paid a stock dividend to its shareholders. Since paragraph IV(5) provided that where a Netherlands resident company derived income from within the other State (Canada) "that other State shall not impose any form of taxation on dividends paid by the company to persons not resident in that other State", it was held that shareholders of the company who were not resident in either Canada or the Netherlands, in addition to resident Netherlands shareholders, were entitled to the exemption. It was noted that the Crown's contention, that the exemption did not apply to third-country residents, would lead to double-taxation of such shareholders by Canada and the Netherlands and "such a result would be contrary to the purpose of all of Canada's 32 international treaties."

See Also

RMM Canadian Enterprises Inc. v. The Queen, 97 DTC 302, [1998] 1 C.T.C. 2300 (TCC)

After finding that sale proceeds was deemed to be a dividend by s. 84(2), Bowman TCJ. went on to find that this deemed dividend was a dividend for purposes of Article X of the Canada-U.S. Income Tax Convention, rather than being exempted from tax by Article XIII. In reaching this conclusion, he noted that "the word 'alienation' in Article XIII connotes a genuine alienation, and not one that was made to an accommodation party as an integral part of a distribution of surplus", and also noted that neither Canada nor the United States reserved on Article X of the OACD Model Convention, which stated that payments regarded as dividends included "disguised distributions of profits".

Specialty Manufacturing Ltd. v. The Queen, 97 DTC 1511 (TCC)

Article IX of the 1980 Canada-U.S. Convention and Article IV of the 1942 Canada-U.S. Convention did not prevent the application of s. 18(4) of the Act to limit the deduction of interest by the taxpayer, not withstanding that the loans in question bore interest at an arm's length rate.

Administrative Policy

28 May 2015 IFA Roundtable Q. 12, 2015-0581521C6

A corporation resident in Switzerland ("Swissco") wholly-owns "Holdco," which wholly-owns "Canco"). S. 214(3)(a) deems Canco to pay a dividend to Swissco. The rate of withholding tax would be 15% under the English version of the Swiss Treaty but 5% under the French version. How would Art. 10(2)(a) of the Swiss Treaty apply? CRA responded:

[T]axpayers should, in these circumstances, apply the version of the Swiss Treaty that gives them the most favourable result. We would normally expect that this would be the French version… .

28 May 2015 IFA Roundtable Q. 2, 2015-0581551C6

What is CRA's position on the application of the GAAR to treaty shopping arrangements? CRA stated:

The…comments on treaty shopping… made in the February 2014 Budget as well as in the August 2014 Finance news release [do not] preclude[e] the application of the GAAR to treaty shopping arrangements.

The CRA continues to contemplate the application of the GAAR to transactions undertaken primarily to secure a tax benefit afforded by a tax treaty and, in fact, the GAAR Committee has recently approved the application of the GAAR to certain treaty shopping arrangements.

11 July 2014 T.I. 2013-0497381E5 - REIT investment in a US IRA.

An IRA account of Mr. X (who is a citizen and a resident of the US) receives a distribution on units held in a REIT as defined in s. 122.1(1). Before concluding that the REIT distributions would not be eligible for 0% withholding under Art. XXI, para. 2 of the Canada-U.S. Treaty as the REIT was not a SIFT trust, CRA stated:

[A] distribution of income from a SIFT Trust is deemed to be a dividend pursuant to subsection 104(16)… and is similarly treated as a dividend for the purposes of the Treaty pursuant to the 2007 Protocol Annex B in regards to paragraph 3 of article X.

31 May 2013 T.I. 2013-0486011E5 - Loan to non-resident - Part XIII tax

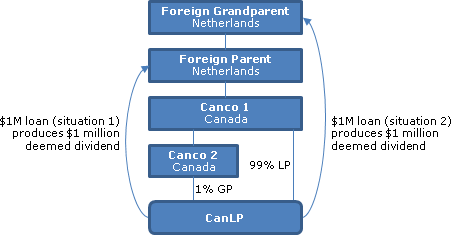

A Canadian-resident corporation (CanCo1) and its wholly-owned Canadian-resident subsidiary (CanCo2) are the 99% limited partner and 1% general partner, respectively, of CanLP. CanLP lends $1 million to the immediate Netherlands-resident parent of CanCo1 (Foreign Parent) or, alternatively ("situation 2"), lends $1 million to the Netherlands parent of Foreign Parent (Foreign Grandparent). In either situation, the loan is not repaid on a timely basis, so that in the absence of Treaty relief, Foreign Parent or Foreign Grandparent is deemed under s. 214(3)(a) to receive a dividend which is subject to Part XIII withholding tax of 25%. Subpara. 2(a) of Art. 10 of the Canada-Netherlands Treaty provides that if the recipient of the dividend (i.e., Foreign Parent or Foreign Grandparent, as applicable) owns at least 25 per cent of the capital of, or controls directly or indirectly at least 10 per cent of the voting power in, the company paying the dividend, a 5 per cent withholding tax rate would apply.

In finding that the 5% Treaty-reduced rate applied to either deemed dividend, CRA stated:

In the context of applying the provisions of Article 10 of the Treaty, subsection 96(1) of the Act does not apply and CanLP is not considered a separate person. As CanLP is not a separate person, each of the partners thereof would be viewed as having made their pro rata share of the loan described in hypothetical situations 1 and 2 above. It follows, in our view, that each of CanCo1 and CanCo2 would be considered, for the purposes of Article 10 of the Treaty, to have paid their pro rata share of the dividend deemed to have been paid pursuant to paragraph 214(3)(a)….

Furthermore, the above structure would satisfy the indirect voting control test in para. 2(a) so that, for example, it would be considered that Foreign Grandparent "satisfies the controlling threshold of controlling directly or indirectly at least 10 per cent of the voting power in each of CanCo1 and CanCo2."

23 October 2012 T.I. 2012-0440101E5 - Article X(6) Canada-US Treaty

A US LLC, which has two US-resident members (either two corporations or an individual and a corporation) who quaify for Treaty benefits, carries on business in Canada through a permanent establishment. CRA indicated:

To facilitate the computation of the relevant Article X(6) earnings that may be eligible for a reduced 5% branch tax, the earnings are computed by the LLC as if it were the company referred to in Article X(6). Once the LLC has computed its earnings attributable to permanent establishments in Canada, they are then allocated to the LLC's members by applying Article IV(6). Accordingly, the LLC can generally pay the reduced rate of branch tax in Article X(6) in respect of the share of branch profits that are considered to be derived by its corporate members.

After indicating that the LLC may not claim the reduction under Art. X(6) in respect of the portion of its "branch profits that are considered, by virtue of Article IV(6), to be derived by individual members," CRA stated:

It is the CRA's view that a LLC has only one $500,000 cumulative exemption. It must be shared by associated companies with respect to the same or similar business and reduced by any portion which has previously been deducted.

17 May 2012 IFA Roundtable Q. , 2012-0444151C6

The two partners of a partnership which has elected to be a domestic corporation for Code purposes are: a corporation which is resident in the U.S. for purposes of the Canada- U.S. Income Tax Convention; and a corporation resident in a non-Treaty country.

CRA indicated that a member of the partnership can access benefits under Article X(6) of the US Treaty ("partnership-level benefits") to the extent that the partnership could have claimed such benefits had the partnership been the entity subject to Canadian branch tax. Although the partnership would not so qualify as a "qualifying person" as defined in Art. XXIX A(2) of the US Treaty due to the absence of share capital for the partnership, "partnership-level benefits" under Art. X(6) may apply to business profits earned by a US-resident partnership through a Canadian permanent establishment in accordance with the "active trade or business" test under Art. XXIX A(3), or, if treaty benefits are granted by the Canadian competent authority, under Article XXIX A(6).

Additionally, a member of the partnership that is itself eligible to claim treaty benefits under Article X(6) may still apply the reduced branch tax rate to its share of the partnership's profits earned through a Canadian permanent establishment.

In the first "partnership-level benefits" situation, partnership profits will not be reduced by partner-level expenses or Canadian income tax liabilities. "Consequently, the member of the partnership may find that its share of the partnership's Article X(6) earnings amount exceeds the amount upon which Part XIV tax is otherwise payable under subsection 219(1)."

2012 Ruling 2012-0435211R3 - Article XXIX-A(3) of the Canada-US Tax Convention

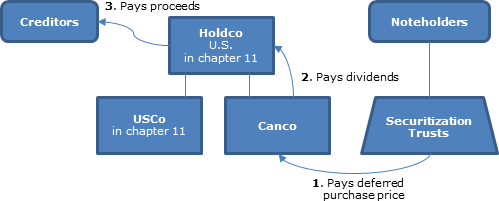

Holdco, which had been a listed U.S. company, was taken private by L5, which was a fund whose members are not known. Holdco and its subsidiary, USCo (neither of which carry on a business of making or managing investments) filed a Chapter 11 Plan (following their filing of a petition in bankruptcy), and a Plan Administrator was appointed. Although a Canadian subsidiary of Holdco (Canco) ceased to sell assets to securitization trusts when the group financial difficulties became severe, it continues to earn income from obligations to it of those trusts, including the receipt of deferred purchase price. Canco will pay three cash dividends to Holdco, its sole shareholder. "Through the Plan Administrator under the Plan of Liquidation, Holdco will have full discretion and control over the Dividends throughout the period during which the Dividends are paid."

Ruling that the rate of withholding under Art. X will be 5%.

2012 Ruling 2011-0424211R3 - Article X(2) and 84(3) deemed dividends

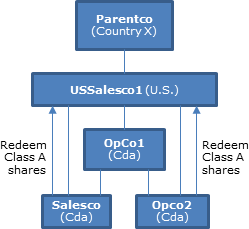

All of the Class A shares of two taxable Canadian corporations ("OpCo2" and "Salesco") are owned by a corporation ("USSalesco1") which is not fiscally transparent and is resident in the U.S. for purposes of the Canada- U.S. Treaty, and all their commons shares (with essentially identical attributes to the Class A shares) are owned by a taxable Canadian corporation ("OpCo1") which is a direct wholly-owned subsidiary of USSalesco1. OpCo2 and Salesco are not fiscally transparent for U.S. purposes.

Salesco and OpCo2 purchase for cancellation all the issued and outstanding Class A shares (held by USSalesco1) for cash or promissory note consideration equal to the shares' fair market value.

Rulings that provided that USSalesco1 is the beneficial owner of dividends paid on the Opco2 and Salesco Class A shares pursuant to Article XXIX-A(3) and Article X(2)(a) of the Treaty, the benefits of the Treaty will apply to USSalesco1 with respect to the s. 84(3) deemed dividend resulting from the redemptions.

Ruling that provided that USSalesco1 is the beneficial owner of dividends paid the Opco2 and Salesco Class A shares, pursuant to Article XXIX-A(3) and Article X(2)(a) of the Treaty, the benefits of the Treaty will apply to USSalesco1 with respect to the subsection 84(3) deemed dividend resulting from the redemptions.

Income Tax Technical News No. 44 13 April 2011 [archived]

After commenting on a transaction in which a ULC held by a US C corporation (USco) increases its paid-up capital (giving rise to a deemed dividend) and then distributes that PUC to USco, CRA then was asked to consider a Luxembourg s.à r.l. (which is resident in Luxembourg but disregarded for U.S. purposes) inserted between USco and ULC. Would the 5 percent withholding tax rate under the Canada-Luxembourg treaty generally apply to dividends paid by ULC to Luxco? CRA stated:

The 5 percent withholding rate will normally apply if Luxco is the beneficial owner of the dividends. Our recent views on the meaning of "beneficial owner" in the light of Canada v. Prévost Car Inc. are set out in document no. 2009‑0321451C6

30 November 2010 Annual CTF Roundtable Q. , 2010-0386391C6

In response to a query as to whether the branch tax reduction in Art. X(6) of the Canada-US Tax Convention is available to a fiscally transparent LLC that is wholly-owned by US-resident individuals, CRA stated that such Treaty benefits may be claimed by an LLC on behalf of its members with respect to an amount of profit attributable to a Canadian branch only if the amount is considered to be derived, pursuant to Art. IV(6), by a US-resident company that is a "qualifying person" (or entitled, with respect to the amount, under Art. XXIX A(3)) – so that no such benefits would be available here as the earnings of the LLC are derived by individuals.

13 July 2009 T.I. 2009-031870 -

Where a US corporation that is a qualifying person is a 99.99% limited partner of a Delaware limited partnership which, in turn, is a 99.99% limited partner of a second Delaware limited partnership which owns all the shares of Canco, the US corporation will be considered to have an "ownership interest" in Canco, so that it will be entitled to the 5% rate on dividends paid by Canco.

2009 IFA Roundtable Q. 1, 2009-0321451C6

In the Prévost Car case, "the Court implied that where an intermediary acts as a mere conduit or funnel in respect of an item of income, the intermediary would not have sufficient economic entitlement to the income to be considered the 'beneficial owner'. The CRA will examine future back-to-back dividend, interest and royalty cases that have encounters with a view to whether an intermediary could, on the facts, be considered a mere conduit or funnel".

2007 Ruling 2007-024802

a dividend deemed to be received by significant Japanese corporate shareholder of a Canadian corporation under s. 84(3) on the purchase for cancellation y the Canadian corporation of shares held by the shareholder was eligible for the treaty-reduced rate of 5% under the Canada-Japan Convention.

2004 IFA Roundtable Q. 3, 2004-007223

Although a partner is not considered to own a specified percentage of the shares of a corporation held by a partnership, a favourable ruling was granted where a corporation issued sufficient voting preferred shares directly to each partner in order to comply with the formal requirements, of the Canada-U.S. Convention, Article X, para. 2(a), that the beneficial owner of the dividend must own at least 10% of the voting stock of the corporation paying the dividend.

17 December 2002 T.I. 2002-015500 -

Following the repeal of U.K. ACT in 1999, paragraph 3 of the Canada-U.K. Convention continues to apply since individuals in the United Kingdom are still entitled to a tax credit in respect of dividends paid by a U.K. company. However, the U.K. Competent Authority has informed CCRA that non-resident individuals should no longer be eligible for any net refund from the U.K. because the tax credit available under paragraph 3(b) is now less than the tax allowed by paragraph 3(a)(ii).

30 January 2002 T.I. 2001-010669

A deemed dividend under s. 219(5.3) of the Act will be treated as a dividend governed by Article X, paragraph 2 of the Canada-U.S. Convention, rather than paragraph 6, notwithstanding that such deemed dividend could be attributed to the decision not to pay branch tax pursuant to s. 219(5.1) at the time the non-resident insurance company incorporates the Canadian branch.

8 January 1996 T.I. 942802 (C.T.O. "Return of Capital from a Delaware Corporation")

Because the purpose of the "source country deemed dividend rule" in the definition of "dividend" in paragraph 3 of Article X of the Canada-U.S. Convention is only "to ensure that the source country's right to tax an amount that would not otherwise meet the definition of a 'dividend', but is treated as such in the source country, will be governed by paragraph 2 of Article X", that rule does not trammel the ability of Canada to tax as a dividend a distribution received by Canadian-resident shareholders of a Delaware corporation that might not be treated like a dividend under the U.S. Internal Revenue Code.

4 March 1993 Memorandum (Tax Window, No. 30, p. 18, ¶2472)

A Canadian resident will not be entitled to a foreign tax credit or to a refund of ACT from the U.K. authorities with respect to a stock dividend received from a U.K. corporation.

October 1992 T.I. 921009 "Loans to Non-Residents"

Where a Canadian subsidiary issues a demand note to its U.S. parent, the deemed dividend arising under s. 214(3)(a) will be eligible for the reduced rate of withholding tax under Article X, paragraph 2(a) of the Canada-U.S. Convention.

3 September 1992 T.I. 920333 "Interest-Free Loans - Reason for Withholding"

The word dividend in the Canada U.S.-Convention includes deemed dividends arising under s. 214(3)(a) of the Act.

8 April 1992 T.I. (913412 (March 1993 Access Letter, p. 83, ¶C180-135; Tax Window, No. 18, p. 10, ¶1847)

Where s. 214(3)(a) imputes a shareholder benefit to U.S. resident shareholders of a U.S. corporation which allows them to use a Canadian vacation property free of rent, Article X(5) of the Canada-U.S. Convention will not grant relief to them because s. 214(3)(a) deems the dividend to have been paid by a corporation resident in Canada rather than by a U.S. corporation.

91 C.R. - Q.1

A U.S. corporation holding shares through a U.S. partnership will not be eligible for the 10% rate.

Articles

Jack Bernstein, "Canada-US Tax Traps for LLCs", Canadian Tax Highlights, Volume 22, Number 2, February 2014, p. 11

High US branch tax if use LLC (p.11)

Assume that a Canco expands into the United States and forms an LLC to be the US opco. For Canadian tax purposes, the LLC is regarded as a controlled FA. For US tax purposes, the LLC is disregarded, and the Canco is subject to US corporate tax and to a 30 percent US branch tax. The branch tax reduction in treaty article X does not apply, both because of US domestic law and because of article IV(7)(a). Alternatively, if the Canco carried on business directly in the United States, the US branch tax will be reduced to 5 percent and may apply after a $500,000 threshold is exceeded.