Cases

The Queen v. Melford Developments Inc., 82 DTC 6281, [1982] CTC 330, [1982] 2 S.C.R. 504

The exclusion in Article III(5) of the Canada - Germany Income Tax Agreement Act, 1956 of "income (e.g. dividends interest, rents or royalties) derived from sources within" Canada from the industrial or commercial profits of a German enterprise did not apply to guarantee fees paid to a German bank because such fees did not constitute "interest" under the ordinary meaning (in 1956) of that word, and the 4 words after "e.g." were an exhaustive list of what was meant by "income".

The Queen v. Associates Corp. of North America, 80 DTC 6140, [1980] CTC 215 (FCA)

Guarantee fees received by a U.S. corporation from its Canadian subsidiary did not constitute "interest" within the meaning of the 1942 Canada-U.S. Tax Convention, given the absence of any provision therein permitting the assimilation of guarantee fees within "interest" by a deeming provision such as ss.214(15)(a) of the Act.

Administrative Policy

2014 Ruling 2014-0521831R3 - Withholding on interest payments

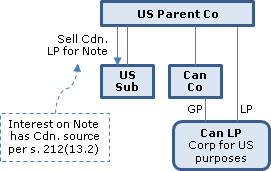

Structure

US Parent Co, which is a U.S. public corporation and a qualifying person under the Canada- U.S. Treaty, carries on business in Canada through a permanent establishment by virtue of being the limited partner of Can LP (of which a wholly-owned subsidiary, Can Co, is the GP) which has elected to be a corporation for Code purposes.

Proposed transactions

US Parent Co will transfer its limited partnership interest in Can LP to US Sub (a wholly-owned LLC that has elected to be a corporation for Code purposes and apparently will not hold significant other assets) for fair market consideration consisting of an interest-bearing Promissory Note and shares of US Sub. The interest on the Promissory Note will be treated as a payment of interest to US Parent Co and will not be disregarded for Code purposes. US Parent Co and US Sub will elect to file a consolidated return under the Code.

Ruling

To the extent that US Parent Co would otherwise be subject to Part XIII tax under ss. 212(13.2) and 212(1)(b) on the Promissory Note interest, it will be exempted under Art. XI, para. 1.

26 August 2013 Memorandum 2013-0494211I7 - participating debt interest

Canco, which carries on a business of exploring and developing oil and gas properties in Canada (so that its principal assets consist of rights to explore for and exploit oil and gas), and which does not own any inventory of oil or gas, pays interest to a resident of the US (which is a "qualifying person" within the meaning of Art. XXIX-A of the Canada-U.S. Treaty). Such interest (which is "participating debt interest" under s. 212(3)) is calculated by reference to the market price of oil and gas as reflected in an index. Is this interest subject to 15% Canadian withholding tax by virtue of Art. XI, para. 6(b) of the Treaty?

After noting that Code s. 871(h)(4)(C) provides that interest is not contingent interest merely because it is determined by reference to changes in the index value of property that is actively traded (other than a U.S. real property interest), CRA stated:

although, US source interest that is determined by reference to the index value of certain actively traded property would satisfy the stated exception to section 871(h)(4) of the Code (and thus, would not fall within the ambit of subparagraph 6(a) of Article XI of the Treaty), such contingent interest arising in Canada… would not necessarily be excluded from the ambit of subparagraph 6(b)….

And then concluded that Art. XI, para. 6(b):

…forces a determination as to whether there is a strong enough link between the value of the debtor's property and the value of a commodity on an exchange, so that interest linked to the index price of a commodity will fall within the ambit of subparagraph 6(b)…. Since Canco's principal assets consist of resource property rights that it holds for the purpose of extracting the commodities that make up the index…there is a sufficient link between the interest (which is computed by reference to the commodity index) and the change in value of the debtor's property (i.e. the rights), such that the interest…is subject to Canadian withholding tax at a rate of 15%

6 September 2013 T.I. 2013-0478241E5 - U.K. Individual Savings Account (ISA)

Although income earned in a UK Cash ISA is not subject to taxation in the U.K., under the Canadian Income Tax Act ("Act") Canadian residents ... must report their worldwide income, including income earned on investments held in the U.K., for Canadian tax purposes. As such, the interest received or receivable in the year from the investments in a UK Cash ISA must be included in a Canadian resident's income tax return pursuant to paragraph 12(1)(c) of the Act.

CRA also indicated that neither Article 11 nor Article 17 of the Canada-UK Convention would apply to relieve taxation. (Article 17 is equivalent to Art. XVIII of the Canada-US Convention.)

17 May 2012 IFA Roundtable Q. , 2012-0444041C6

When asked to "comment on what factors it will take into account in determining beneficial ownership," CRA stated:

Where a recipient of income does not receive the payment as agent or nominee for another party, the CRA will consider the recipient to be the beneficial owner of the income if the payment is received for the recipient's own use and enjoyment and the recipient assumes risk and control over the payment. In light of Prévost Car and Velcro Canada, the CRA will generally accept that a payment will be for the recipient's use and enjoyment, and that the recipient assumes risk and control over the payment, if the recipient holds a sufficient degree of discretion with respect to the use or application of the payment.

2009 IFA Roundtable Q. 1, 2009-0321451C6

In the Prévost Car case, "the Court implied that where an intermediary acts as a mere conduit or funnel in respect of an item of income, the intermediary would not have sufficient economic entitlement to the income to be considered the 'beneficial owner'. The CRA will examine future back-to-back dividend, interest and royalty cases that have encounters with a view to whether an intermediary could, on the facts, be considered a mere conduit or funnel".

2004 IFA Roundtable Q. 1, 2004-0072131C6

In the context of a "tower" structure, a partnership of which two taxable Canadian corporations are the partnerships borrows money from a U.S. financial institution in order to acquire an interest in a U.S. limited liability company. The Directorate indicated that in a recent tax ruling request, the CRA had concluded in light of the foreign law applicable to such a partnership, the provisions of the partnership agreement and the terms and conditions of the loan agreement between the partnership and the U.S. lender that the partners of the partnership were considered to be the payers of the interest on the loan, with the result that such interest was not exempt from withholding tax as the loan did not qualify under s. 212(1)(b)(vii). CRA indicated that Article XI, para. 6 of the Canada-U.S. Convention would apply to deem the interest to arise in Canada and that generally the second sentence of para. 6 of Article XI would not apply to re-source such interest to the U.S. unless the CRA was convinced that (i) investing in the interest in a wholly-owned subsidiary (i.e., the LLC in this case) of the partnership constituted a business carried on by it through a permanent establishment in the U.S. (which would not normally be the case where the partnership was merely holding shares or interests in a wholly-owned subsidiary), (ii) the loan was incurred in connection with such permanent establishment and (iii) the interest paid on the loan was borne by such permanent establishment.

5 February 2002 Memorandum 2000-005863 -

Where the Australian branch of a Canadian bank pays interests to an Australian subsidiary of the bank, the interest paid would not be covered by Article XI of the Canada-Australia Convention (as it would be borne by an Australian permanent establishment and, therefore, would not arise in Canada) and would be exempted by the business profits Article (Article VII) rather than by Article XXI. Where the interest is paid by a non-Australian branch of the Canadian bank to the Australian subsidiary, the interest would be sourced to the state (Canada) in which the payor is resident, with the result that the interest would be subject to Canadian withholding tax subject to the limits described in paragraph 2 of Article XI. In similar fact patterns involving the Canada-U.S. Convention, Article XXII rather than Article VII of that Convention would be relevant, in light of the Technical Explanation of the U.S. Treasury Department.

1 February 2002 T.I. 2001-007820 -

The exclusion in subparagraph 3(b) of Article XI of the Canada-Argentine Convention is applicable where the payor of the interest is not the final user of the purchased machinery.

1997 Ruling 972926

Ruling that where income of a Canadian trust was distributed to a U.S. partnership, then subject to Article XXIXA of the Canada-U.S. Income Tax Convention, the provisions of that Convention would apply to a partner's share of the partnership income derived from the distributing trust.

23 July 1996 T.I. 5-961236 -

A payment by a credit union to a member, in respect of a share of capital stock, which is deemed to be interest by s. 137(4.1) of the Act will be considered to be interest for purposes of Article XII of the Canada-U.S. Convention because it is "income assimilated to income from money lent by the taxation laws of [Canada]".

24 May 1995 Memorandum 950508 (C.T.O. "Art XI(3)(e) Canada-U.S. Income Tax Convention")

Where a decision was made with respect to an interest-bearing obligation of a company that the interest due and payable for that year would not be paid, the unpaid interest represented a new obligation for purposes of the exemption in paragraph 3(e) of Article XI of the Canada-U.S. Convention, with the result that interest on such amount was not grandfathered under that provision.

1 March 1995 T.I. 942680 (C.T.O. "Withholding Tax on Interest (HAA 4093 UF-100-11)")

The exemption in the post-1994 version of paragraph 3(d) of Article XI of the Canada-U.S. Convention would apply to exempt interest paid by a Canadian resident on a U.S. dollar credit card issued by a Canadian financial institution where that institution had agreed with a U.S. bank that the U.S. bank would reimburse U.S. merchants for purchases made by the customer in the U.S.; the Canadian financial institution assigned to the U.S. bank all receivables due to it arising from such use of the card; and the cardholders made all payments with respect to their account balances directly to the U.S. bank.

93 C.M.TC - Q. 15

The reductions in rates of withholding tax pursuant to the 1991 protocol to the Mexico Convention (arising when Mexico agrees to a lower rate in other treaties) do not take effect until the time that the lower rates of withholding tax take effect under the relevant tax treaty between Mexico and the third country, and only apply to the extent that the particular types of payment receive a lower rate of withholding tax under the other tax treaty.

17 July 1992 T.I. 920168 (January - February 1993 Access Letter, p. 35, ¶C180-134)

Whether an arrangement under which the U.S. seller assigned its receivables, or nominated a U.S. bank as its agent to collect the receivables, gave rise to a change in beneficial ownership of the interest on the receivables could only be determined after an examination of the relevant documentation.

1 May 1991 Memorandum (Tax Window, No. 3, p. 25, ¶1228)

Discussion of modification to position contained in 4 September 1990 memorandum.

15 November 1990 TI 902937

Interest on a borrowing by a U.S. resident to acquire a rental property in Canada would be subject to Canadian withholding tax if the rental property was a rental business, as the interest would be borne by a permanent establishment in Canada and, therefore, would arise in Canada, thereby giving Canada the right to tax the interest under s. 212(13.2) of the Act.

4 September 1990 Memorandum (Tax Window, Prelim. No. 1, ¶1013)

Where an individual who has Canadian source income which is fully taxable in Canada (e.g., employment income) but who is deemed by the tie-break rules in the Canada-Japan Income Tax Convention to be a resident of Japan, such interest income will be included in his income in the usual way, the resulting tax will be reduced to ensure that the effective rate of tax and the gross amount of the interest is limited to 10%.

Articles

Abraham Leitner, "BEPS Targets Commonly Used Canada-U.S. Hybrid Structures", Tax Notes International, 9 February 2015, p. 531.

BEPS Report (p. 531)

…‘‘Neutralising the Effects of Hybrid Mismatch Arrangements,'' was released by the OECD on September 16, 2014, as part of a package of seven reports addressing different aspects of the BEPS action plan.

Repo structures for financing U.S. subs by Canadian parent (or Cdn Finco) pref share purchaser/"lender" (pp. 531-2)

Repos are sometimes used by Canadian entities to finance their U.S. operations. In a typical repo structure, the U.S. entity that requires the financing issues preferred shares to one of its U.S. affiliates (the ‘‘borrower''), which sells the preferred shares to the Canadian financing entity for cash. The U.S. seller/borrower then directly or indirectly enters into a forward share purchase agreement to repurchase the preferred shares from the Canadian purchaser/lender. Under a substance-over-form approach, the repo arrangement is characterized for U.S. federal income tax purposes as a borrowing, with the payments made by the issuer of the preferred shares being characterized as deductible interest payments. The interest payments on the repo are generally exempt from U.S. withholding tax under Article XI of the Canada-U.S. treaty. From a Canadian perspective, on the other hand, most practitioners are comfortable that the Canadian purchaser would be respected as the owner of the preferred shares, in accordance with the form of the arrangement.

…In the likely event that Congress does not adopt the recommendation of the hybrid arrangement report, the report contains a corollary defensive rule…[under which] the payee jurisdiction (here, Canada) would impose a rule that would make the payment received under a hybrid arrangement taxable if the paying jurisdiction does not apply a hybrid mismatch rule to eliminate the mismatch.

Loans to ULC by US consolidated-affiliates of US ULC shareholder (p. 532)

Another recommendation made by the hybrid arrangement report could affect loans by a U.S. affiliate to a Canadian unlimited liability company (ULC) treated as a wholly owned disregarded entity of its U.S. shareholder for U.S. tax purposes. The report recommends that payments made by an entity that is disregarded in the payee jurisdiction (for example, payments by the ULC to its U.S. owner) not be deductible in the paying entity's jurisdiction unless the income against which the deduction is being offset is currently includible in the payee jurisdiction.

…[A] variation more frequently used [than a direct loan by a US shareholder of a ULC in light of Art. IV(7)(b)] is for the loan to the ULC to be made by another member of the U.S. owner's affiliated group. In the latter structure, the interest payments made by the ULC are not disregarded under the check-the-box rules but are viewed instead as having been made by the U.S. owner to its affiliate and are eliminated in the group's consolidated return (subject to the potential application of the U.S. dual consolidated loss (DCL) rules).

Loan by a reverse hybrid Canadian LP (p. 532)

One structure that used to be quite popular for financing U.S.-owned Canadian operations involves the use of a Canadian LP that elects to be treated as a corporation for U.S. tax purposes. The U.S. financing entity contributes capital to the partnership in exchange for an interest in the partnership, and the partnership then uses the proceeds of the contribution to make loans to its Canadian corporate affiliates. Interest payments made by the affiliates to the partnership are deductible in Canada (subject to applicable thin cap rules), while the income earned by the partnership is viewed as having been earned by the U.S. partner for Canadian tax purposes. From a U.S. perspective, the interest income is earned inside a Canadian corporation and is not characterized as subpart F income under section 954(c)(3) or (6). The popularity of this structure has declined since the anti-hybrid rules of the fifth protocol to the Canada-U.S. treaty came into force, since the interest payments are no longer eligible for treaty relief from Canadian withholding taxes. Under the hybrid arrangement report, the benefits of this structure would be eliminated entirely because the report recommends the disallowance of the deductions in Canada for the interest payments made to an entity that is a reverse hybrid from the owner's perspective.

Tower

structures for Cdn financing of US Opco through use of hybrid borrowing Delaware LP (p. 533)

The hybrid arrangement report would target tower and similar structures through the recommended adoption of a DCL [dual consolidated loss] regime in the investor's jurisdiction (here, Canada), under which the deductions for interest payments would be limited to the income earned by the entity as seen in Canada. Since tower structures are designed to avoid such income from being earned, such a rule would effectively disallow the interest deductions in Canada.

Andrew Spiro, Ian Caines, "Welcome News from the CRA in the Continuing Saga of Cross-Border Convertible Debt", International Tax, Number 73, December 2013, p. 5.

Narrowness of U.S. Treaty definition (p. 8)

The definition of "participating interest", while similar to the Canadian domestic definition, notably does not include a general catch-all for interest determined by reference to "any other similar criterion", and accordingly appears to be limited to interest computed by reference to the particular items enumerated therein. It is therefore arguable that deemed interest computed by reference to the value of the debtor's equity (such as a conversion premium deemed to be participating debt interest under the Act) should be exempt from Canadian withholding tax under the Treaty, since the equity issued by the debtor is not "property of the debtor" or any of the other enumerated items. However, a recent CRA technical interpretation suggests that the CRA may not agree with this interpretation. [note 9: CRA Document No. 2013-049421117]

Broad link or connection test in CRA Interpretation (p. 9)

If the reasoning in this interpretation were applied to the conversion premium on a convertible debt, it is possible that the CRA could take the position that there is a sufficient "link or connection" between the value of the equity interests in the debtor (by reference to which the amount of the conversion premium is arguably computed) and the value of the debtor's property, such that interest on the debt would not qualify for the Treaty exemption. It is submitted that such an analysis would not be a correct application of the Treaty for the reasons discussed above. (This is arguably even clearer in the context of convertible debt, where the property in question, as equity interests in the debtor, is never expected to be property of the debtor in the future.) Nonetheless, issuers should be cautious in relying on the Treaty exemption in situations involving non-standard convertible debt.

Marco Rossi, "An Italian Perspective on the Concept of Beneficial Ownership", Tax Notes International, December 23, 2013, p. 1133.

Application of 1977 OECD commentary on beneficial ownershp to Italian manatarios (p. 1139)

The commentary stated that the limitation of tax in the state of source was unavailable when an intermediary, such as an agent or nominee, was interposed between the beneficiary and payer, unless the beneficial owner of the income is a resident of the other contracting state. [fn 24: See para. 12 of the commentary to article 10 of the 1977 OECD model, para. 8 of the commentary to article 11, and para. 4 of the commentary to article 12.]

Under Italian internal law, an agent, a nominee, or an intermediary is a person that acts on behalf of and for the account of another person (the principal, so that the transactions or arrangements it enters into are legally binding and juridically affect, directly and exclusively, the principal, or the legal owner of the assets and income from the transaction.

This is not the case when a person (commission agent, or mandatario) acts on its own behalf but for the account of another person (principal, or mandante) without authority to bind the principal. In that case, the legal effects of the transaction are on the agent and then transferred to the principal under a separate legal relationship.

The agent is the legal owner of the assets or the income from the transaction for general law purposes. For bankruptcy, the agent's creditors can enforce their claims on the assets or income acquired in the transaction, which is treated as the agent's personal assets and income.

Therefore, following the commentary's explanation, in Italian law, the principal as opposed to the agent would be regarded as the beneficial owner only when a person acted with authority to bind and as an agent on behalf of (that is, with legal effects on) the principal.

Comparison of Aiken Industries and Northern Indiana Public Service (p.1148)

1. Aiken Industries

In Aiken Industries Inc. v. Commissioner, 56 T.C. 925 (1971), back-to-back loans, in the identical amount of principal and interest, were made between a U.S. corporation and a related corporation organized under the laws of Honduras, and between the Honduran corporation and its indirect parent.

No withholding tax was due on the interest paid by the U.S. corporation to the Honduran corporation under the Honduras-U.S. tax treaty, and no withholding tax was charged on the interest paid by the Honduran corporation to its indirect parent under Honduran law.

Had the interest been paid directly by the U.S. corporation (the ultimate borrower) to the indirect parent (the ultimate lender), a 30 percent withholding tax would have applied under U.S. law.

The Tax Court emphasized the identity in both terms and payments between the back-to-back loans, as well as the close relationships between the parties involved, and saw the transaction as an attempt to channel outbound interest payments through a corporation based in a treaty partner to avoid the U.S. withholding tax.

It ruled against the taxpayer and held that the withholding tax was due, as if the interest had flowed directly from the ultimate borrower (U.S.) to the ultimate lender (the non-treaty-partner resident).

The taxpayer lost because the treaty partner corporation earned no profit from the transaction, and was passing debt service payments on to the ultimate lender simultaneously with receipt of those payments from the ultimate borrower. Although the Honduras-U.S. treaty exempted interest received by a treaty partner resident (and the Honduran corporation was respected and not treated as a sham), the court interpreted the phrase "received by" to require dominion and control over the funds, and concluded that the intermediary had no such control and, instead, functioned as a collection agent.

2. Northern Indiana Public Service

In Northern Indiana Public Service Co. v. Commissioner, 105 T.C. 341, 350 (1995), on appeal (7th Cir. March 13 and 25, 1996), a U.S. corporation organized a finance subsidiary in Curaçao, then part of the Netherlands Antilles (to which the Netherlands-U.S. treaty applied) to issue notes in the Eurobond market. The finance subsidiary borrowed $70 million at a 17.25 percent interest rate in the market and lent that amount to its U.S. parent at an 18.25 percent interest rate.

Like in Aiken Industries, no withholding tax applied on the interest payments (under the Netherlands-U.S. treaty and Netherlands Antilles domestic law).

The Tax Court found that the Dutch finance subsidiary (unlike the Honduran subsidiary in Aiken Industries) engaged in substantive business activity that resulted in significant earnings, and held that the finance subsidiary was not a mere conduit or agent and was relieved of withholding tax under the treaty.

Michael N. Kandev, Matthew Peters, "Treaty Interpretation: The Concept of 'Beneficial Owner' in the Canadian Tax Treaty Theory and Practice", Canadian Tax Foundation, 2011 Conference Report, 26:1-60

Is "beneficial owner" a question of legal or economic substance? (p. 3)

On the one hand, "beneficial owner" may be construed in light of the classical legal ownership notions of possession, use, risk, and control. On the other hand, it may be interpreted on the basis of factual or economic substance considerations. In other words, the differing views seem to stem from stressing either "beneficial" or ownership" in the expression.

The answer in Canada is legal substance

Prévost Car (p. 20-21)

The domestic solution to the meaning of "beneficial owner" described in Prévost Car is the current law in Canada. It has been accepted by the minister and has been applied in subsequent cases, in accordance with the principle of stare decisis.

Recent Canadian jurisprudence has confirmed the general domestic meaning of "beneficial owner" adopted by the Tax Court in Prévost Car and subsequent relied on in Velcro for the purposes of the Act. These cases reiterate that (1) the beneficial owner of property is the person who has possession, use, risk, and control of the property; (2) a person acting as an agent or nominee in respect of the property cannot be the beneficial owner of property; (3) the concept of a "conduit" is layered on top of the general beneficial owner and agent/nominee analysis, although for this purpose the test for a conduit appears practically indistinguishable from the general tests for possession, use, risk, and control and agent/nominee; and (4) underlying the entire beneficial owner analysis is the concept that legal substance prevails over economic substance in the absence of a sham.

1977: Impetus for adding "beneficial owner" to OECD model in 1977 (p. 29)

The recently released minutes of the relevant OECD working party meetings in the period 1969-71 reveal that the concept of beneficial ownership was introduced in the 1977 OECD model because of a concern, voiced by the United Kingdom, that articles 10-12 would otherwise apply to an agent or nominee who had a legal right to the income.

1986: "Beneficial owner" distorted in 1986 to fight perceived abuses (p. 29)

Starting is 1986 with the CFA report, "double Taxation and the Use of Conduit Companies," the OECD effectively sought to give "beneficial owner" a meaning other than its legal meaning in the common-law legal tradition and to shape this term into a weapon the tax administrators could use to fight perceived abusive treaty shopping.