Subsection 149(1) - Miscellaneous exemptions

Paragraph 149(1)(a) - Employees of a country other than Canada

Administrative Policy

14 January 2014 T.I. 2013-0510061E5 - Foreign doctors working in Canada

Non-resident doctors, who come to Canada to participate in post-graduate residencies and sub-specialty fellowships at various Canadian medical schools, are paid a salary by the foreign government, but with a "top-up" amount paid by the respective university out of a fund provided in advance to the university by XX, in order to ensure that their salaries are equivalent to their Canadian counterparts under various collective agreements.

CRA found that under s. 149(1)(a):

the Doctors will not pay income tax under Part I of the Act on any of their taxable income, including investment income. For purposes of paragraph 149(1)(a), we will consider the top-up amount referred to above to be paid by the XX Government.

Paragraph 149(1)(c) - Municipal authorities

Administrative Policy

10 December 2014 Memorandum 2014-0533151I7 - Qualified Donee - XXXXXXXXXX

A Park was established to encourage an appreciation and use of natural and recreational resources, was authorized under its constituting [Statute?] to make park bylaws and to appoint a constable to enforce them, was funded out of earmarked municipal levies and it was subject to oversight by representatives of participating municipalities or organizations, or volunteers as representatives to the Park. Before finding that the Park was a public body, and after stating that "the first condition is that the organization must be a municipal or public body and the second condition is that it must perform a function of government," CRA stated:

Generally, a public body has a governance purpose and is accountable to those governed, regulated or represented by it. ... [I]f a public body is incorporated, the federal government or a provincial or territorial government or the "public" that the corporation is serving or representing should have some specific control over the actions and operation of the corporation and the corporation should be accountable to that government and that public.

Respecting the second condition, CRA stated "providing a range of municipal-type services or providing a key service traditionally offered by the provinces or territories such as social services, oversight of the environment, health services, and education is generally considered to constitute performing a function of government," and then stated:

It is not sufficient to merely state that they are providing several municipal type services. A review of the Park's financial statements fails to show any significant expenditure on infrastructure such as roadways, buildings, and sewer systems it claims to be providing. …

In addition, while the Park… has not provided any evidence to support that they have in fact passed bylaws. …

Other evidence to support that the Park is performing a function of government may include:

- a copy of an agreement with a neighboring municipality to provide fire protection or waste removal services,

- invoices from organizations subcontracted to provide the municipal type services on behalf of the Park, and

- the name of the municipality that is charged with collecting taxes on behalf of the Park and the agreement that governs the relationship.

2014 Ruling 2012-0473041R3 - First Nation - Limited Partnership

A First Nation is governed by an elected chief and band council, has passed by-laws respecting zoning, health and emergency measures, operates a health centre, provides fire protection and policing, delivers employment training and adult education programs and is Ruling that responsible for all aspects of housing on the Reserves. Ruling that income allocated to the First Nation from a limited partnership is exempt from tax because the First Nation is a public body performing a function of government.

2013 Ruling 2012-0472821R3 - 149(1)(c) Ruling

The Council, which is a governing body made up of the elected chief or other authorized designate (e.g. tribal chief) of the Band Council for each Band comprising the "Nation," is authorized by the Bands to speak for them and make decisions on their behalf with respect to issues important to the Nation, including resource issues (e.g., protection of ecologically sensitive lands on the "Territory") and government-to-government negotiations, has developed and enforced various codes and applies distributions from a trust for a range of matters including environmental, heritage, education and administration.

Ruling that it is a s. 149(1)(c) public body.

11 June 2014 Memorandum 2014-0521411I7 - 149(1)(c)

In the course of a general discussion and before indicating that certain agencies and boards likely did not qualify, CRA stated:

The CRA's previous position was that an entity could be considered a municipality for the purpose of paragraph 149(1)(c) of the Act on the basis of the functions it exercises. However, in Tawich Development Corporation v. Deputy Minister of Revenue of Quebec [2001 D.T.C. 5144], the Quebec Court of Appeal found that merely exercising municipal functions was not sufficient to attribute to a body the status of a municipality. Instead, the Court held that this status could only be achieved as a result of statute, letters patent or order (in other words it has to be created by the province).

2013 Ruling 2013-0488661R3 - Indian Band -Public Body & Function of Government

An Indian Band governed by an elected chief and band council, which provides a wide range of listed health, social, educational and economic services to its members, is ruled to be a public body performing a function of government in Canada within the meaning of s. 149(1)(c).

12 August 2013 T.I. 2013-0498891E5 - public body performing a function of government

CRA confirms that 2009-0306281I7 and 7 March 2013 Memorandum 2011-0428491I7 continue to represent its position on s. 149(1)(c).

7 March 2013 Memorandum 2011-0428491I7 - Paragraph 149(1)(c)

A municipal body is typically considered to be a body established or exercising a power under a municipal act or a similar statute of a province or territory with respect to governing the affairs or purposes of a geographic area and is accountable to those governed by it.

Generally, a public body is:

- An Indian band as defined in the Indian Act with procedures to elect Chief and council.

- Other Aboriginal governments with election procedures.

- A body (whether incorporated or not, the members of which may be elected or appointed) established under or as a result of implementing a statute with specific authorization and duties assigned by the statute to the body to develop, administer or regulate governance functions.

A function of government generally means an activity or group of activities undertaken to meet a governance role or purpose within a geographic area. Historically, the CRA has required that to be performing a function of government an entity must have the ability and powers to govern, tax, pass by-laws and/or provide municipal- or provincial-type services to its members/citizens.

CRA has accepted that providing a range of municipal-type services, such as water, sewage removal, the pick-up of garbage and the maintenance of infrastructure such as roads, sewers and public buildings is a function of government. Further, providing a key service traditionally offered by the provinces or territories such as social services, overseeing of the environment, health services, and education is generally considered to constitute performing a function of government. The CRA also accepts that negotiating a treaty with the federal government, or a provincial or territorial government, is a function of government.

2012 Ruling 2012-0445071R3 - 149(1)(c) Ruling

On behalf of a First Nation body, the correspondent sought tax-exempt treatment for the following:

36. The First Nation is currently negotiating the XXXXXXXXXX, as described in 33 above [the particulars of which were redacted], with the Government of Canada. Once an agreement is reached, the First Nation will be in receipt of a large amount of compensation funds from the Government of Canada pursuant to that agreement.

The First Nation has implemented a Financial Management by-law for the purposes set out in s. 83(1) of the Indian Act; is in the process of entering into a joint land code and transfer agreement with Aboriginal Affairs; and provides fire, ambulance, police, water, garbage collection, electricity and health procurement, community support and school bus services and "an extensive list" of "public works, social services and infrastructure programs." It also provides housing for eligible members and primary schooling, and has passed 24 by-laws pursuant to s. 81 of the Indian Act. In granting the requested ruling, CRA stated:

The First Nation is a public body performing a function of government in Canada within the meaning of paragraph 149(1)(c) of the Act and, accordingly, no tax will be payable under Part I of the Act by the First Nation on receipt of the compensation funds from the Government of Canada as described in 36 above.

2004 Ruling 2004-008032 -

S.149(1)(c) would apply to exempt income allocated to a First Nation band on a limited partnership interest held by it in a partnership engaged in fishing, given that the band would be considered to be a public body performing a function of government in Canada.

2004 Ruling 2004-006020 -

Ruling that a First Nation would be considered a public body performing a function of government in Canada, so that income attributed (under s. 75(2) or payable (under s. 104(13)) to it by a personal trust settled by it would be exempt.

4 August 1995 T.I. 5-951992 -

"Indian band councils do not qualify as ... municipalities ... . They may, however, depending on all the circumstances, be a 'public body performing a function of government in Canada' and therefore be exempt from tax under paragraph 149(1)(c) ..."

92 C.R. - Q.36

Re Whether an Indian band council qualifies.

Articles

J. Peter Ranson, "The Evolution of Aboriginal Tax Exemptions: The Past, the Present and the Future", 2005 Conference Report, c. 24.

Sara K. McCracken, "Municipal Corporations: One Option for First Nations Businesses", Business Vehicles, Vol. VI, No. 3, 1999, p. 2406.

Paragraph 149(1)(d) - Corporations owned by the Crown

See Also

Nova Scotia Power Inc. v. The Queen, 2002 DTC 1432, Docket: 2001-347-IT-G (TCC)

A corporation ("NSPC"), which was described in s. 4 of the Power Corporation Act (Nova Scotia) "as agent of Her Majesty in right of the province", transferred its assets to the taxpayer in its 1993 fiscal period. NSPC (which previously had not filed any income tax returns as it was exempt on its taxable income) filed T2 corporate income tax returns for 1980 to 1993 in which it purported to elect under subsections 21(1) and (3) of the Act to capitalize interest as part of the capital cost of the depreciable assets it had transferred to the taxpayer. The capital cost of the transferred depreciable assets to the taxpayer was deemed under s. 85(5.1) to be its capital cost to NSPC.

The Minister assessed on the basis that NSPC carried on its income-earning activities as an agent of the Queen in right of Nova Scotia, with the result that the Act did not apply to it by reason of s. 17 of the Interpretation Act and, therefore, NSPC was not capable of filing income tax returns and making the election under s. 21; and that the exemption that NSPC enjoyed was derived from section 17 and not s. 149(1)(d) of the Act.

In responding to questions posed under s. 173 of the Act as to whether NSPC conducted its income-earning activities, and owned its assets, as agent for the Nova Scotia Crown, Bowman A.C.J. first found that, in the absence of s. 4 of the Power Corporation Act, NSPC did not conduct its activities or own its property as a Crown agent given that the Power Corporation Act treated NSPC as carrying on its own business and owning its own property separate from the province, and as being capable of borrowing money from the province. Respecting s. 4, the jurisprudence established that the words "agent of Her Majesty the Queen" did not go so far as to make NSPC an agent for all purposes and that the courts had been reluctant to confer Crown privileges and immunities on entities merely because they happened to be called agents of Her Majesty. The Power Corporation Act contrasted with other statutes which specifically stated that the property of a corporation or board and all profits earned in the administration of the same were property of Her Majesty. Accordingly, the answer to the questions was "no".

Otineka Development Corp. Ltd. v. The Queen, 94 DTC 1234 (TCC)

Two corporations carrying on business for profit that were owned by an Indian band were exempt under s. 149(1)(d) because the Indian band was a "municipality" within the ordinary meaning of that word, i.e., a "community having and exercising the powers of self-government and providing the type of services customarily provided by such a body". Bowman TCJ. stated (p. 1239):

"There can be no justification for interpreting the paragraph to deny the exemption to corporations owned by a band of Indians that has all the attributes of a municipality on the ground that it derives those attributes from the Indian Act rather than from one of the provincial statutes that regulate municipal institutions".

Administrative Policy

6 July 2001 T.I. 2001-008157 -

It is CRA's position that a corporation that is a non-share corporation has its ownership determined with reference to the capital of the corporation; as the word 'capital' is not defined for this purpose, in determining the ownership of the corporation's capital CRA will look to factors such as the identity of the members, the structure of the corporation, who has the right to elect the board of directors, details regarding asset distributions on a winding-up or dissolution and whether a person other than the government has a right to acquire any capital of the corporation.

13 July 1995 T.I. 5-950326 -

A regional district in B.C. is a Canadian municipality for purposes of s. 149(1)(d); and s. 149(1)(d) applies to a corporation owned by more than one municipality.

6 July 1995 T.I. 3-943135

"The expression 'Her Majesty in Right of a Province' includes agents of Her Majesty in right of the province."

The expression "capital" does not include loans made to the corporation. "In our view, where the organization is a corporation with share capital, ownership is determined with reference to the corporation's shares and where it is a corporation without share capital, a commission or an association, ownership is determined with reference to the capital of the organization."

21 June 1995 T.I. 5-950988

S.149(1)(d) is satisfied where at least 90% of the shares of the corporation are held by a combination of qualifying entities, eg., more than one municipality.

29 March 1994 T.I. 940775 (C.T.O. "Right of Redemption")

S.149(1)(d)(i) applies where a corporation, 90% of whose shares are held by the Crown, has the right to redeem those shares.

11 January 1993 Memorandum (Tax Window, No. 28, p. 19, ¶2387)

Because an Indian band council is not a municipality, a corporation at least 90% of whose shares are owned by a band council will not qualify for exemption under s. 149(1)(d).

8 September 1992 T.I. (Tax Window, No. 24, p. 16, ¶2182)

In order to qualify for the exemption, a corporation must actually be under the control of the municipality and not merely nominally owned by it.

Articles

J. Peter Ranson, "The Evolution of Aboriginal Tax Exemptions: The Past, the Present and the Future", 2005 Conference Report, c. 24.

Paragraph 149(1)(d.3) - 90% owned corporations

Administrative Policy

2003 Ruling 2002-016808

Ruling based on the interpretation that a corporation's capital does not include its indebtedness for purposes of s. 149(1)(d.3).

Paragraph 149(1)(d.4) - Combined ownership

Administrative Policy

12 October 2012 T.I. 2011-0428521E5 F - Société d'État

In confirming that s. 149(1)(d.4) does not apply to a corporation a portion of whose shares are held by Her Majesty in right of Canada or a province, and another portion by a corporation, commission or asssociation (an "Entity") to which one of s. 149(1)(d) to (d.4) applies, CRA stated (TaxInterpretations translation):

For an Entity envisaged in paragraph 149(1)(d.4), its shares (other than directors' qualifying shares) or capital must be owned by an Entity to which paragraphs 149(1)(d) to (d.4) apply. When a part of the shares or capital of an Entity are owned directly by Her Majesty in right of Canada or a province, paragraph 149(1)(d.4) is not applicable. For example, an Entity whose shares or capital are owned partly by Her Majesty in right of Canada or a province and partly by an Entity to which paragraph 149(1)(d.1) applies, is not an entity contemplated by paragraph 149(1)(d.4).

In confirming that in the case of a share capital corporation, only the ownership of its shares is taken into account in the application of ss. 149(1)(d) to (d.4), CRA stated:

When an Entity is one with share capital, it is the ownership of shares which serves in the application of the criteria stipulated in paragraphs 149(1)(d) to (d.4). The ownership of capital of an Entity is utilized only in the situations where the Entity is one without share capital.

Paragraph 149(1)(d.5) - Income within boundaries of entities

Administrative Policy

2 December 1999 T.I. 991389

It remains the Department's view that indebtedness is not included in "capital". S.149(1.3) completely codifies the ownership test, rather than being in addition to ownership determined on general principles.

Articles

Sara K. McCracken, "Municipal Corporations: One Option for First Nations Businesses", Business Vehicles, Vol. VI, No. 3, 1999, p. 2406.

Paragraph 149(1)(e) - Certain organizations

Administrative Policy

2013 Ruling 2012-0438831R3 - 149(1)(e) Ruling

underline;">: Proposed transactions. An organization which previously had filed as an s. 149(1)(l) organization will contract with Distributor to set up a direct distribution network in Canada whereby it will receive a set fee from the Distributor for each item distributed to "Producers" (presumably, farming enterprises) across Canada mostly through a "sales order website…[which] will appear to be a website of the Organization, will in fact be a sales order system of the Distributor." The Organization will decide, with the Manufacturer of the items, the price at which the items are to be sold to the Producers, with the Distributor collecting the proceeds from the Producers, deducting its costs and remitting the remainder to the Organization. All services will appear to Producers as being supplied by the Organization, with the Distributor providing logistics on a national basis.

Ruling

: Provided the Organization continues to meet the requirements described in paragraph 149(1)(e), income of the Organization from the sale of the XXXXXXXXXX, as a result of the proposed transactions above, will not, in and of itself, prohibit the Organization from being exempt from tax under Part I of the Act, pursuant to paragraph 149(1)(e).

11 June 1993 Memorandum (Tax Window, No. 32, p. 21, ¶2625)

RC would permit an agricultural organization that inadvertently made payments to its members to rectify the situation by requiring its members to make a capital contribution, with interest.

Paragraph 149(1)(f) - Registered charities

Cases

The Queen v. Nova Scotia Power Inc., 2003 DTC 5090, 2003 FCA 33

Section 4 of the Power Commission Act (Nova Scotia) provided that the Nova Scotia Power Commission ("NSPC") "shall continue as a body corporate and as agent of Her Majesty The Queen in right of the province" under the name of "Nova Scotia Power Corporation". The respondent, which had acquired the undertaking of NSPC, sought to establish that NSPC was not an agent of the Crown, so that purported elections made by NSPC under s. 21 of the Act, to step up the capital cost of the depreciable assets transferred to the taxpayer pursuant to s. 85(5.1) of the Act, would be valid.

Pelletier J.A. noted (at p. 5096) that a finding that an entity is a Crown agency does not automatically lead to the conclusion that the entity enjoys Crown immunity (under s. 17 of the Interpretation Act or otherwise) and indicated (at p. 5096) that:

"Once a corporation is found to be an agent of the Crown, the question of Crown immunity turns on the scope of the corporation's mandate and whether, on the facts, it was acting within that mandate."

Here, NSPC had acquired and operated the assets pursuant to its objects of developing for Nova Scotia the maximum use of power on an economic and efficient basis with the result that the questions put to the Court should be answered on the basis that NSPC was acting within its authorize purpose so as to benefit from Crown immunity.

Paragraph 149(1)(i) - Certain housing corporations

Administrative Policy

11 July 1994 T.I. 7-941446

Because the constitution for a housing corporation authorized it to provide accommodation to persons other than aged persons, it did not qualify. (If the constitution did not reflect its true purposes, the constitution should be revised.) It also was noted that the fact that the corporation operated on a non-profit basis and provided accommodation primarily to persons of low or modest income did not necessarily mean that the cost of such accommodation was low. "The phrase 'low-cost housing accommodation' has been interpreted to include comfortable but modest rental accommodation at rent levels which are low relative to rent levels generally available for similar accommodations (other than subsidized or non-profit accommodations) in the same community."

Paragraph 149(1)(j) - Non-profit corporations for scientific research and experimental development

Administrative Policy

5 May 1995 T.I. 5-942198

Discussion of distinction between an approved research institute (s.37)(1)(a)(ii)(B)) and a non-profit corporation described in s. 149(j).

19 October 1993 Memorandum 932981 (C.T.O. "Approved for Scientific Research")

Discussion of criteria to be met by a corporation if it is to be considered a non-profit corporation for scientific research and experimental development.

18 May 1993 T.I. (Tax Window, No. 31, p. 8, ¶2517)

Discussion of criteria for determining whether approval of a research institute or similar organization will be granted.

4 August 1992 T.I. (Tax Window, No. 23, p. 9, ¶2166)

Criteria of RC for determining whether a corporation qualifies.

11 January 1990 T.I. (June 1990 Access Letter, ¶1278)

The corporation seeking exemption under s. 149(1)(j)(ii) must expend at least 90% of its income on SR&ED, in addition to not carrying on any business. The higher the level of its revenues the more probable it is that a business is being carried on. If the corporation does not qualify under s. 149(1)(j), this could result in disqualifying the non-profit organization which holds the shares from exemption under s. 149(1)(l).

Paragraph 149(1)(k) - Labour organizations

Cases

O'Brien v. The Queen, 85 DTC 5202, [1985] 1 CTC 285 (FCTD)

It was not seriously disputed by the Crown that five unions who ran a newspaper business were not subject to tax on the profits generated.

Administrative Policy

5 February 1996 T.I. 5-953282 -

"A labour organization is generally an association of workers of the same trade, or of several allied trades, organized for the purpose of securing the most favourable conditions, wages, or hours of work for its members." An organization that has as its mandate the furtherance of interests of employers only would not be considered to be a labour organization.

28 December 1995 T.I. 952934 (C.T.O. "Union Owning Shares")

The acquisition by a union of 50% of the shares of a corporation owning and carrying on a business would not, by itself, result in loss of the union's exempt status under s. 149(1)(k).

91 C.R. - Q.44

RC cannot comment on the general application of the reasoning in the O'Brien case.

Paragraph 149(1)(l) - Non-profit organizations

Cases

MNR v. Lakeview Golf Club Ltd., 52 DTC 1164 (Ex Ct)

A share corporation that operated a golf course did not qualify for exemption given that it was profitable for the years in question, its bylaws did not contain any suggestion that the company was organized for non-profitable purposes and, instead, provided that dividends, when earned and declared, "shall" be paid to the shareholders, and the retained earnings of the company resulted in a benefit to the shareholders because such retention of earnings increased the value of their shares.

Gull Bay Development Corp. v. The Queen, 84 DTC 6040, [1984] CTC 159 (FCTD)

It was found that a corporation without share capital had been set up to improve living and social conditions on an Indian reserve, and thereby qualified as a non-profit organization under s. 149(1)(l) and as a charitable organization under the predecessor of s. 149.1(1)(b). It was stated "that the corporation was not set up, as its Letters Patent indicate, to carry on a commercial activity although it is no doubt true that the motive for forming the corporation may have been that it was desirable to provide employment and training to otherwise unemployed Indians on the Reserve by engaging in a commercial activity [i.e., a viable commercial logging operation] which would not only provide such employment but raise funds to be used for the very worthy social and charitable activities required on the Reserve".

Woodward's Pension Society v. MNR, 62 DTC 1002, [1962] CTC 11, [1962] S.C.R. 224

The taxpayer, which was incorporated under the Societies Act of British Columbia, was organized in order to provide funds for the payment of pensions to employees and ex-employees of Woodward Stores Limited and to pay over its surplus funds to the trustees of a pension fund for those employees and ex-employees. Its by-laws provided that on dissolution all its assets should be conveyed to the trustees. The taxpayer operated a share sale plan for the employees, by purchasing blocks of shares in the various Woodward stores at par and reselling them at par to employees. The taxpayer earned profits attributable to the difference between interest at 3% payable by it on the unpaid balance of subscriptions by it for Woodward shares, and interest at 4% charged by it to employees on the unpaid balances of their subscription prices, and attributable to other dealings in shares.

In finding that the taxpayer was not exempt under s. 62(1)(i) of the pre-1972 Act, Judson J. noted (p. 1004) that its purpose of assisting the provision of funds for employee pensions "could not be achieved without the share sale plan which was designed to make a profit to enable the payments to be made to the pension trustees".

MNR v. St. Catharines Flying Training School Ltd., 55 DTC 1145, [1955] CTC 185, [1955] S.C.R. 738

The taxpayer was incorporated under Part I of the Dominion Companies Act for the purpose of operating a flying school for the training of members of the RCAF and was restricted in its letters patent from distributing any dividends during the Second World War hostilities. It was intended by the incorporators (as stipulated in a declaration of trust for their shares) that any surplus from the taxpayer's operations would enure to the benefit of the St. Catharines Flying Club, a non-profit organization.

Profits earned by the taxpayer under a training contract with the Crown which did not place any restrictions on the use of profits therefrom were fully taxable. "The question of the liability of the respondent to taxation depends, not upon the intention of the promoters or shareholders as to the disposition to be made of the profits but rather upon consideration of the terms of the letters patent, the nature of the business authorized to be carried on and of the business which was carried on which resulted in the earning of the income."

See Also

BBM Canada v. The Queen, 2008 DTC 4129, 2008 TCC 341

In finding that a non-share federal corporation that undertook audience measurement activities for the benefit of its members (commercial TV and radio stations) qualified as a not-for-profit organization, Boyle J. rejected a submission of the Crown (at p. 28) "that 'for any other purpose except profit' means unrelated to any commercial or business activity" and stated (at para. 54) that "a public benefit or purpose is not a pre-requisite to qualifying for the paragraph 149(1)(l) exemption".

Canadian Bar Insurance Association v. The Queen, 99 DTC 653 (TCC)

The taxpayer, whose letters patent stated that "in no event shall the purposes of the organization and/or operation of the Corporation include profit" sponsored (but did not underwrite) national insurance programs for lawyers and negotiated with insurance companies with respect to particular products in the insurance programs and their cost. For the initial taxation years in question, the taxpayer had three basic sources of annual revenue: a 5% administration fee retained by it from premiums it collected on behalf of the insurers; amounts remitted to it by the insurance companies (in years where claims were low) pursuant to a retention agreement for the purpose of funding a stabilization reserve (i.e., for the purpose of producing more stable premiums over time); and investment income earned on the stabilization reserves. The basic program was altered somewhat in the later taxation years.

In finding that even though there was "no doubt that the Appellant engages in a high level of commercial activity" (p. 661), e.g., invoicing and collecting premiums, negotiating lower commission rates and entering into complicated retention agreements, and even though the taxpayer earned substantial profits in some years under the above arrangements, its preponderant purpose was to facilitate the availability of insurance products at cost to the legal community in Canada; and the large reserve did not reflect a profit purpose but, rather, a purpose of providing service to members. Accordingly, the taxpayer was not only not organized for profit, but also was not operated for profit.

Otineka Development Corp. Ltd. v. The Queen, 94 DTC 1234 (TCC)

Two corporations owned by an Indian band that owned and operated a shopping mall and a building supply business had as their sole raison d'être the owning and running of the businesses for profit, notwithstanding that the profits, when distributed to the band, might ultimately be used for the social or civic welfare of the band. Furthermore, the income was available for the benefit of the corporations' shareholder (the band) because excess cash not needed for operations or repairs was loaned to the band and, in most cases, then written off. Accordingly, the exemption was not available.

L.I.U.N.A. Local 527 Members' Training Trust Fund v. The Queen, 92 DTC 2365 (TCC)

A fund established by the Labours International Union of North America, Local 527 and the Ottawa Construction Association (an employers' association) (the "OCA") in order to train union members and which was funded with a grant of $45,000 from the union's existing training and recreation fund, by government grants and by contributions by members of the OCA at a fixed rate per employee hour worked would have been found not to be a person (and therefore not to have standing) given that it was a non-charitable purpose trust, but for section 16 of the Perpetuities Act, which deemed the fund to be a valid trust.

The fund was an "association" (i.e., "a relationship between two or more persons for a common purpose") between the union and the OCA. The substantial accumulation of short-term investments by the fund in treasury bills and term deposits was explained by its inadequate facilities, by its inability to find adequate personnel to do training during the relevant periods, and by the high interest rates prevailing in those years. With respect to the opinion of the Minister, he could not use his failure to form an opinion as to whether the fund was a charity as a basis for denying the fund's claim.

Accordingly, the fund's exempt status was upheld.

C. & E. Commrs v. Bell Concord Educational Trust Ltd., [1989] BTC 5061 (C.A.)

An incorporated college which, in fixing the student fees, budgeted for a substantial surplus of revenues over expenditure to be applied in maintaining and improving the school's facilities, was providing education "otherwise than for profit" because the surplus could never redound for the profit of any member but must instead be applied for the charitable purposes of the company.

Re Ogdensbury Bridge and Port Authority (1989), 56 DLR (4th) 56 (Ont HC)

A public benefit corporation which was incorporated in New York to build and operate an international bridge to Canada was not exempt from business assessment since it was permitted to make a profit and in most years it made a small profit sufficient to pay a small subsidy to other operations.

Re Kitchener-Waterloo Real Estate Board (1986), 56 OR (2d) 94 (HCJ)

The predominant activity of the Kitchener-Waterloo Real Estate Board, which was a non-share corporation that was prohibited from distributing profits to its members, was the operation of a multiple-listing service. Since the predominant purpose of the Board was to facilitate the generation of profits by its members, its activities were a business. There was no need for the profits generated by the Board to be the Board's profits. (Assessment Act (Ont.), s. 7(1)).

Regional Assessment Commissioners v. Caisse Populaire de Hearst Ltd., [1983] 1 S.C.R. 57, 143 DLR (3d) 590

The predominant purpose of a credit union was to provide loans to its members for provident and productive purposes at low cost and not to make a profit. It accordingly did not occupy its premises in connection with a "business" (s.7(1), Assessment Act (Ont)).

Administrative Policy

4 March 2015 T.I. 2014-0537941E5 - Non-Profit Organization fibre-optic cable

The Institute, a not-for-profit organization, received a provincial grant and subsequently accessed provincial debentures to finance the construction of a substantial fibre-optic cable network. It will charge an access fee to commercial enterprises using the network and the cash flow generated will initially service the debt and subsequently will support community enhancement projects within the Institute's mission. CRA stated:

[T]he revenue generated from the fibre-optic cable network could affect the tax-exempt status of the Institute since it does not appear that this revenue is incidental or arises from activities directly connected to its not-for-profit objectives, which are to support the building of community capacity and the sustainability and growth of its business community.

11 September 2014 T.I. 2014-0540031E5 - Community Contribution Company (C3)

The B.C. Business Corporations Act now allows for a "community contribution company" to do business and generate profits in the normal course of its commercial activities, while at the same time capping the dividends that can be paid out to shareholders. This structure provides a (limited) return to the investor, while providing social enterprise benefits to the community. Does such a company whose incorporating documents stipulate that 100% of its profits must be donated to a local charity which assists children and families qualify under s. 149(1)(l)? CRA stated:

[C]ommunity contribution companies are organized and operated to make a profit with which to provide both a return to investors and community benefits. … . Even though all or substantially all of the profits of this particular community contribution company are destined for a good cause…it will nevertheless be organized (and operated) for profit and, as such, would not qualify… .

26 August 2014 T.I. 2014-0528701E5 - Non-profit organization - Condominium

A commercial condominium corporation manages the property and assets of a commercial building consisting of units that are individually owned by various businesses, and collects monthly contributions to cover common expenses and to fund a replacement reserve. Does it qualify under s. 149(1)(l)? In the course of a general non-committal response, CRA stated:

Some characteristics that might indicate that an activity is a trade or business are as follows:

(a) it is a trade or business in the ordinary meaning, that is, it is operated in a normal commercial manner;

(b) its goods or services are not restricted to members and their guests;

(c) it is operated on a profit basis rather than a cost recovery basis; or

(d) it is operated in competition with taxable entities carrying on the same trade or business.

Generally, the carrying on of a trade or business directly attributable to, or connected with, pursuing the non-profit goals and activities of an association will not cause it to be considered to be operated for profit purposes.

30 May 2014 T.I. 2014-0518841E5 - 149(1)(l) - Fundraising

In response to a query on a fundraising event whose description CRA did not repeat, it stated:

Limited fundraising activities involving games of chance (e.g., lotteries, draws), or sales of donated or inexpensive goods (e.g., bake sales or plant sales, chocolate bar sales), generally do not indicate that the organization as a whole is operating for a profit purpose. However, the scope of the fundraising activities, especially by comparison with other activities, should not be so significant that fundraising can be considered a purpose of the organization, in which case the organization may not qualify as a 149(1)(l) entity.

It does not appear…that your event would meet the conditions in paragraph 149(1)(l)… as the event is not organized as a club, society or association and the scope of the fundraising activities in relation to other activities seems substantial.

18 August 2014 T.I. 2014-0528171E5 - Condominium Corporations and 149(1)(l)

A condominium corporation (the "Corporation") enters into a leasing agreement with a solar company, which would lease several roofs within the complex for the use of solar panels, with the output sold to the public electrical grid. The solar company would assume all costs of the arrangement, and the Corporation would receive annual income of approximately $XX or a percentage of the revenues generated, which would be contributed to the Corporation's reserve fund thus potentially offsetting or freezing any annual reserve fund increase, and/or reducing annual reserve fund contributions and/or reducing property owner's monthly maintenance fees. Would this jeopardize its s. 149(1)(l) exemption? CRA stated:

[I]ncidental income from the rental of common areas may be treated as income of the Corporation and generally will not affect [its] tax-exempt status… . Incidental, in this context, means both minor and directly related to activities undertaken to meet the Corporation's not-for-profit objectives of managing and maintaining the condominium property and required reserves. …

Income that is not incidental will usually be considered to be income of the unit owners, if this is appropriate under the relevant provincial law. Subsection 11(2) of the Condominium Act of Ontario (S.O. 1998, c.19) provides that "the owners are tenants in common of the common elements…". …

Where the relevant provincial law indicates that the income is the income of the Corporation, then we would agree that the Corporation may not be tax-exempt pursuant to paragraph 149(1)(l)… .

Non-Profit Organization Risk Identification Project Report 17 February 2014

Purpose of Project

[T]he Non-Profit Organization Risk Identification Project (NPORIP)…, which the CRA started in 2009…was designed to provide the CRA with insight into the way organizations claiming the exemption under paragraph 149(1)(l)… .

Any profit must be incidental

[T]he NPORIP…observed that many in the non-profit sector believe that NPOs must produce a profit for their programs to thrive and for their capital assets to be maintained. In particular, there is a common view that, as long as profits are used to further the organization's purpose, the source of the funding shouldn't matter. However, it is the CRA's position that a NPO can earn profits, but the profits should be incidental and arise from activities that are undertaken to meet the organization's non-profit objectives. The earning of profit cannot be or become a purpose of the organization, even if the profit is earned to fund non-profit objectives. …

A significant number of NPOs violate the incidental profit test or have large equity

The results from the review of the randomly-selected organizations suggest that a significant portion of incorporated organizations would fail to meet at least one of the requirements set out in paragraph 149(1)(l)… . Of these:

- A significant portion would fall into a higher category of risk, which includes organizations earning profits that were not incidental or not related to their non-profit objectives; organizations with disproportionately large reserves, surpluses, or retained earnings; and organizations where income is payable or made available for the personal benefit of a proprietor, member, or shareholder. Many of the organizations that fall within this higher-risk category would not actually qualify for the tax exemption under paragraph 149(1)(l)… and would need to be reassessed if they were audited outside the purview of the NPORIP… .

No immediate assessment activity

[CRA] will work with representatives of the non-profit sector to determine how the sector's knowledge of the income tax rules can be improved

23 September 2013 Memorandum 2012-0471531I7 F - Non-profit organization

Generally, the distribution by a non-share Quebec corporation of assets to one of its creditors (in this case, its only creditor which was a member and which had financed its operations) would not cause it to lose its exempt status under s. 149(1)(l).

12 August 2013 T.I. 2012-0468581E5 - Condo corp sale or rental of caretaker suite

A condominium corporation would probably retain its s. 149(1)(l) exemption if it were to sell a caretaker suite at fair market value and put the proceeds of disposition in its reserve fund for future repairs and improvements.

Because a rental at fair market value is a profit-generating activity, renting the caretaker suite would probably deprive the corporation of its s. 149(1)(l) exemption.

The conversion of the caretaker suite to a guest suite (rentable to tenants for their guests) may deprive the corporation of its s. 149(1)(l) exemption if it charges market prices - but charging below market prices may confer a taxable shareholder benefit on its members (i.e. tenants) pursuant to s. 15(1) and the s. 248(1) definition of "shareholder."

Converting the suite to a fitness centre will deprive the corporation of its s. 149(1)(l) exemption if the centre is operated for profit.

2 August 2013 T.I. 2013-0475041E5 - NPO - rental income

An NPO intended to rent vacation properties to non-members without giving up its s. 149(1)(l) exemption. CRA indicated that such activities would likely not bring the NPO out of s. 149(1)(l), provided that:

...the rental income was incidental, the rental of the property to non-members was infrequent or for a short period of time during a transition period (e.g. for a period during which the property was being prepared for sale), any incidental income earned from the rental of the property was used for the organization's not-for-profit objectives, and the incidental income earned was not made available for the personal benefit of the organization's members.

Such rental income would be subject to tax under s. 149(5), assuming it were property income (as would probably be the case). If it were business income, the NPO would probably lose its s. 149(1)(l) status, as business income intrinsically indicates a for-profit purpose.

2 July 2013 T.I. 2012-0454251E5 - 149(1)(l) donations to capital fund

Generally, an organization referred to under s. 149(1)(l) will not lose its s. 149(1)(l) exemption for collecting donations from members or from businesses affiliated with its members for use in a capital project that furthers the organization's non-profit purposes, nor will it lose its exemption for maintaining a "wall of honor," naming rights, or similar systems for recognizing such contributions, providing that such recognition has only nominal value.

CRA stated:

However, amounts received by an organization in exchange for naming rights may be received, either wholly or partially, in relation to advertising or other income (e.g., where the naming rights provide a prospective economic benefit to a business, or if a business is able to deduct from its income the amount as an advertising or other expense). If such income received by the organization is not incidental, the organization may be considered to have a profit purpose and may be considered to have made income available for the personal benefit of its members, particularly when the amounts are received from non-members.

...

An organization's accounting records should clearly identify the capital funds accumulated for the capital project and all transactions concerning the capital project. In addition, since the Sports Club's main purpose appears to be providing sporting and recreational facilities to its members, any property income earned from the investment of the funds that are accumulated for the capital project will be subject to tax under subsection 149(5).

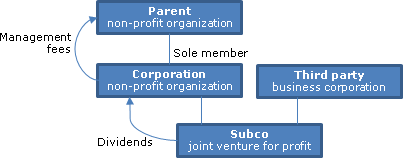

21 November 2012 Memorandum 2012-055501I7 -

The Corporation was a non-share corporation with only one member (the "Parent"). The Corporation, which had substantial retained earnings, was invested in shares of a for-profit corporation ("Subco") along with a non-exempt third party. But for the payment of substantial management fees to Parent, the Corporation would have generated profits.

The Corporation was ineligible for the s. 149(1)(l) exemption. The management fees, which likely were "unreasonable in comparison to any actual work done," had the effect of making income of the Corporation available to its member. (CRA implied that the Parent's management fees should have been on a cost-recovery basis only.)

The Corporation's substantial retained earnings and its investment in Subco (indicating that it had "excess funds available to invest in a taxable corporation") also indicated a for-profit purpose.

20 November 2012 Memorandum 2012-0439951I7 - NPO Project

CRA indicated that the NPO in question would probably not qualify for s. 149(1)(l) exemption:

In our view, the fact that the Association has sufficient funds available to purchase and finance a taxable organization, whether the objects of that organization are connected to the objects of the Association or not, suggests that the Association has not been organized and operated for a purpose other than profit and thus does not meet the requirements of paragraph 149(1)(l) of the Act. Further, in our view, the amount of reserves and annual excess of revenues over expenditures, also support that the Association does not meet those requirements.

16 October 2012 T.I. 2012-0448531E5 - XXXXXXXXXX update on NPO audit project

CRA previously sent "education letters" to organizations claiming s. 149(1)(l) exemption in order to remind them of the criteria of that provision. CRA's decision to discontinue these letters due to concerns expressed by some of those organizations does not indicate an intention to change how s. 149(1)(l) is applied. IT-496R continues to represent CRA's position on s. 149(1)(l).

28 September 2012 T.I. 2011-0429141E5 - NPO - Loan to Taxable Subsidiary

Before concluding that a non-profit organization which make loans to a taxable subsidiary would "likely not" qualify for the exemption, CRA stated:

the fact that a 149(1)(l) organization has funds available to provide loans to its taxable subsidiaries generally suggests that the organization has retained earnings larger than is necessary to meet the organization's not-for-profit objectives and is therefore not operating exclusively for a purpose other than profit. As a result of large reserves, a 149(1)(l) organization may also be earning large amounts of tax-free investment income on funds that are not necessary to meet its not-for-profit objectives.

27 September 2012 T.I. 2011-0412961E5 - NPO and Taxable Subsidiary

CRA noted that holding shares in a for-profit subsidiary will not necessarily disqualify an organization from the benefit of 149(1)(l).

...if an organization holds shares to earn income from property, it may be considered to have a profit purpose, even if the income from those shares is used in furtherance of the organization's not-for-profit objectives. However, the CRA has accepted that where an organization that otherwise qualifies for the exemption under paragraph 149(1)(l) engages in an income-generating activity that is carried out in a taxable, wholly-owned corporation, and this corporation pays dividends out of its after-tax profits to the organization to enable the organization to carry out its not-for-profit activities, the organization may still qualify for the exemption as set out in paragraph 149(1)(l).

When asked "if, instead of a taxable subsidiary corporation, a trust fund was established to carry out the for-profit activities," CRA stated that it would need "to fully review all of the facts and relevant agreements."

20 June 2012 Memorandum 2011-0426231I7 -

CRA found that an organization likely did not qualify as a non-profit organization given that the size of its operating reserves, and the rate at which the reserves were accumulating, outstripped any reasonable need the organization had to cover its operating expenses. CRA stated:

An organization should fund capital projects and establish (reasonable) operating reserves from capital contributed by members, from gifts and grants, or from accumulated, incidental profits.

CRA also noted that the Woodward's decision stands for the proposition that:

[I]f the objectives of the organization cannot be achieved without the making of a profit, then the organization must be organized and operated for the purpose of profit.

23 May 2012 T.I. 2011-0418691E5 - 149(1)(l) - Lease or Sale of Lockers to Members

The lease or sale of lockers to members will generally not jeopardize an organization's eligibility under s. 149(1)(l), provided that doing so is incidental to the organization's activities and that the profits therefrom are used to fund the organization's activities (see IT-83R3). A condominium organization may rent out storage lockers to its members, for example.

30 March 2012 Memorandum 2011-0408851I7 - XXXXXXXXXX and 149(1)(l)

CRA indicated that it is reasonable under s. 149(1)(l) for a non-profit organization to invest funds before it is required to distribute them (in this case, between the time that Members earn commissions and the time that they are periodically distributed) and not be found to have an income-earning purpose. However, CRA stated:

If the XXXXXXXXXX has a reserve, or is building up a reserve, for investing purposes, either by delaying payments [to Members] (amounts not paid as soon as reasonably possible) or by charging more than necessary in commissions, this could indicate that the XXXXXXXXXX is operating for a profit purpose.

12 March 2012 Memorandum 2012-0404671I7

CRA indicated that a corporation's large retained earnings probably disqualified the corporation from the s. 149(1)(l) exemption:

Based on the facts provided, there is little or nothing to distinguish the Corporation from a for-profit XXXXXXXXXX business, and we understand that it competes directly in this market. The regular and consistent increase in retained earnings supports the view that the Corporation has operated for a profit purpose. The net income, while not large in comparison to gross revenues, has been consistently accumulated and used to expand the business of the Corporation or to acquire investments. The fact that all of the income of the Corporation is derived from third parties is of particular concern in this regard. The objective of maximizing revenues in order to pay higher salaries and bonuses to member-employees indicates a profit purpose. Finally, we share your concern that at least some part of the reserves have been accumulated for the purpose of generating investment income.

29 March 2012 T.I. 2010-0391311E5 F -

An organization whose overall objective is not to to earn profit may nonetheless be considered to be carrying on a business if it carries on activities regularly over a period of time, with the result that it would not be considered to be operated exclusively for non-profit purposes.

28 March 2012 T.I. 2011-0395201E5

Where IT-496R, para. 12 indicates that payments may be made to delegates to cover expenses of attending conventions and meetings, "delegates" "generally means a person sent or authorized to represent others," so that it is possible that an individual will be a delegate even where the individual has not authority to vote.

Furthermore, "an activity undertaken by a member primarily for the benefit of the organization generally will not be considered to result in a personal benefit to the member...."

20 February 2012 Memorandum 2011-0429461I7 F

The generation of profits from retail sales of consumer products such as food, beer and wine during shows and outside activities in the course of annual festival organized and promoted by an organization, with such profits being minimal when compared with its total revenues (mostly government grants and sponsorship) would not cause it to lose its status as a non-profit organization.

27 November 2011 CTF National Conference CTF Roundtable Q. , 2011-0426111C6

In the course of answering questions pertaining to CRA's Non-Profit Organization Risk Identification Project, comprising the random auditing over three years of 1440 of the 39,000 entities claiming NPO status and possible legislative recommendations, CRA was asked about the treatment of events connected to an NPO's not-for-profit activities where the event itself generates a profit:

Whether profit is incidental depends on the amount involved and the scope and nature of the activities compared to the operations of the organization as a whole.

The amount of the profit, both in absolute dollars and especially relative to the organization's other revenues and expenses, is relevant.

23 June 2011 T.I. 2011-039788 -

In the case of a corporation to which s. 149(1)(l) applied (non-profit corporation for recreation or pleasure), use by a shareholder of corporate property, for less than fair market value of the use, might be a taxable benefit under s. 15(1). If so, then the value of the benefit is the difference between such fair market value and the consideration paid by the shareholder.

28 November 2010 CTF Roundtable Q. , 2010-0386301C6

In response to a general inquiry as to when an NPO is carrying on a business, CRA stated:

Paragraph 7 of Interpretation Bulletin IT-496R (note 3) provides a list of characteristics that the CRA will consider in making this determination. The court in BBM agreed that these were reasonable considerations for the purposes of applying the tax exemption. The characteristics considered include whether

- there is a trade or business in the ordinary sense,

- goods or services are restricted to members and their guests,

- the business is operated on a profit basis rather than a cost-recovery basis, and

- the business is operated in competition with taxable entities carrying on the same trade or business.

21 November 2001 T.I. 2001-009528 -

the exemption in s. 149(1)(l) is equally available to a non-resident NPO. If the corporation qualifies as an NPO under s. 149(1)(l), it also will be exempt from branch tax under s. 219(2).

The practical guidelines in IT-496 essentially are "no more than a notice to the public that if too much income is earned or if large surpluses are accumulated the Minister will draw an inference of fact that the fund is being operated for profit."

2 July 1998 T.I. 980455

Damages received by a teminated employee that could be attributed to aggravated and punitive damages relating to malicious actions, intentional infliction of mental suffering, defamation or injury to reputation, would be exempt as would damages awarded by a Human Rights Tribunal or a settlement in lieu thereof, provided the damages did not relate to the loss of employment but related solely to damages arising from human rights violations by the former employer.

2 August 1995 T.I. 951683 (C.T.O. "NPO - Indian Forestry Corporation")

Comments on whether a non-profit forestry corporation set up by aboriginal persons and described as an aboriginal community development corporation would be tax exempt.

Income Tax Technical News, No. 4, 20 February 1995

Most residential condominium corporations will qualify as non-profit organizations because they are normally operated "for any other purpose except profit".

25 July 1994 T.I. 5-941379 -

With reference to a testamentary trust established for the purpose of providing funds for the care and treatment of domestic animals in a specified area, RC indicated that it was its view "that trusts that are set up, not to benefit specified persons, but to ensure that particular purposes are carried out, i.e., purpose trusts, could qualify as non-profit organizations provided, among other factors, they spend their funds on furthering the non-profit purposes for which they were formed".

21 July 1994 T.I. 941422 (C.T.O. "Non-Profit Organization")

A company that carries on a dockside monitoring program on fish landings potentially could qualify.

10 July 1994 T.I. 5-941497

"Generally, the Department is of the view that an organization is not operated exclusively for non-profit purposes, when its principal activity is the carrying on of a trade or business. Some characteristics of an activity that might be indicative of a trade or business are as follows:

- it is a trade or business in the ordinary meaning, that is, it is operated in a normal commercial manner;

- its goods or services are not restricted to members;

- it is operated on a profit basis rather than a cost recovery basis; or

- it is operated in competition with taxable entities carrying on the same trade or business."

27 June 1994 T.I. 5-940814

"Employee training trust funds are similar to purpose trust and provided, among other factors, they spend their funds on furthering the non-profit purposes for which they were formed, it is likely they could qualify as non-profit organizations."

A direction in the trust deed that surplus money and assets of the trust must be distributed to the employer and other contributors in the event of the wind-up of the trust, could disqualify the trust to the extent that such property might include income of the trust.

23 March 1994 T.I. 933525 (C.T.O. "Non-Profit Organizations")

Re Whether a subsidiary of a labour union which has purchased a building for rental to the union will qualify for exemption under s. 149(1)(l).

26 August 1992 T.I. 921469 (April 1993 Access Letter, p. 150, ¶C144-207)

The provision of goods and services to persons other than members and their guests may be characteristic of a profit motive.

Where a special project requires the accumulation of funds over a number of years, monies received as capital should be deposited in one account and monies earned on it should be accumulated in the other. Funds to carry out the project should first be taken from the revenue account.

9 March 1992 T.I. (Tax Window, No. 17, p. 23, ¶1790)

A non-profit organization that acquires office space in excess of its current needs (but not in excess of what it might be expected to need in the foreseeable future), will not jeopardize its status by earning rental income from that space.

14 February 1992 T.I. (Tax Window, No. 16, p. 22, ¶1749)

An organization may qualify as a non-profit organization if it receives dividends from a wholly-owned taxable corporation which carries on an income-producing activity related to the organization's purpose.

23 October 1991 T.I. (Tax Window, No. 11, p. 12, ¶1533)

Where the facilities of an organization are available to non-members and used by them to a significant degree with the result that (a) activities carried on for the members are subsidized by the profits earned from non-members because the fees or assessments charged to the members are well below cost, or (b) profits from non-members are used to acquire or maintain facilities for which the charge to members is significantly below cost, the income of the organization will be considered to be payable to or for the benefit of the members.

6 September 1991 T.I. (Tax Window, No. 9, p. 21, ¶1448)

Where a non-profit community organization arranged to have a charity issue official receipts to members of the non-profit organization in respect of donations made by the organization to the charity, this would indicate that income of the organization was being made available for the personal benefit of the members, with the result that the organization ceased to qualify for the exemption under s. 149(1)(l).

17 July 1991 T.I. (Tax Window, No. 6, p. 14, ¶1358)

Where an organization accumulates profits rather than using them to achieve its non-profit objectives, it may lose its NPO status.

15 November 1990 Memorandum (Tax Window, Prelim. No. 2, p. 15, ¶1079)

Where funds are paid to or otherwise made available for the personal benefit of any member of a Canadian political party, it will lose its tax-exempt status.

23 February 1990 T.I. (July 1990 Access Letter, ¶1340)

If the letters patent, trust deeds or by-laws of an entity indicate that anything more than a return of capital or taxable capital gains may be made available to members by way of dividend or otherwise, or the entity otherwise has the power in the current or future years to declare and pay dividends out of current or retained income, it will not qualify. If the balance of the accumulated excess is greater than the non-profit organization's reasonable needs to carry on its non-profit activities, RC will consider profit to be one of the purposes for which the organization was operated.

11 January 1990 Memorandum (June 1990 Access Letter, ¶1277)

Where an organization is engaged in operations intended to make a profit, it cannot qualify unless there is a causal relationship between the profit-making activity and the exempt purpose of the organization. The non-profit organization also may carry on a commercial operation which is incidental to the attainment of its non-profit objectives where all the revenues generated by the commercial operation are used to carry on the non-profit activities.

IT-83R3 "Non-Profit Organizations - Taxation of Income from Property"

IT-496 "Non-Profit Organizations"

IT-409 "Winding-up of a Non-Profit Organization"

Articles

Joel Secter, "New Regime for Federal Not-For-Profits is Coming Soon", The Canadian Taxpayer, Vol xxxiii No. 14, 22 July 2011, p. 105: Overview of Canada Not-for-profit Corporations Act.

Knechtel, "Tax Treatment of Non-Profit Organizations", 1989 Conference Report, c. 35

Paragraph 149(1)(n) - Housing companies

Administrative Policy

9 September 1996 Memorandum 962846 (C.T.O. "Limited Dividend Housing Company")

Ninety percent or more of the business of a limited-dividend housing company must be demonstrated to be for the construction, holding or management of low-rental housing projects which lease accommodation to low-income families for the relevant years.

29 July 1992 T.I. 5-921729

The 5% limit is calculated by reference to the invested capital, eg., the paid-up capital.

It is not possible for a corporation which was originally constituted for other purposes to be converted into a limited-dividend housing company.

8 June 1992 T.I. 912877 (December 1992 Access Letter, p. 30, ¶C14-188)

S.2 of the National Housing Act and s. 149(1)(n) are in parri materia, with the result that s. 2 defines what constitutes a "low-rental housing project".

Paragraph 149(1)(o.2) - Idem [Pension corporations]

Subparagraph 149(1)(o.2)(ii)

Administrative Policy

5 March 2014 T.I. 2013-0490641E5 - Pension Corp-Real Property Development

Less than 20% of a parcel acquired by a s. 149(1)(o.2)(ii) pension corporation (Pensionco) to develop a shopping centre (the "Excess Land") would not be needed for developing the shopping centre. Pensionco would sever the Excess Land, thereby permitting its sale, which would occur before there was any development of the Excess Land. Before "concluding" respecting the test in s. 149(1)(o.2)(ii)(A)(I) that "it would be a question of fact whether the Excess Land has been acquired by Pensionco as capital property," CRA stated:

[A]ctivities undertaken to increase the investment income earned from the real property, e.g., activities to increase rental income, would be acceptable. …[W]e view the development of real property as being synonymous with the improvement of real property. However, development activities that are undertaken for the purpose of increasing the value of the real property for the purpose of selling the property at a profit would not be acceptable.

14 January 2014 T.I. 2012-0453871E5 F - Pension Real Estate Corporation

Can a corporation qualify under subparagraph 149(1)(o.2)(ii) if it makes non-real estate investments permitted under the pension benefits legislation? CRA stated (TaxInterpretations translation):

When a corporation invests in investments permitted under the pension benefits legislation referenced in clause 149(1)(o.2)(ii)(B)…it is possible, in limited circumstances, that the corporation will have limited its activities to those stipulated in clause 149(1)(o.2)(ii)(A) even if such investments are not real estate investments. This could be the case when a corporation makes a modest ["modique"] and necessary investment in furtherance of the activities described in clause 149(1)(o.2)(ii)(A).

26 June 2002 T.I. 2002-013488

"The conditions of clause 149(1)(o.2)(ii)(C) would not be satisfied, where borrowed money is used to replace the capital contributed by the shareholders of the corporation. This view also applies where such capital contributions were originally used to invest in real property for the purpose of earning income."

2001 Ruling 2000-009708 -

The refinancing of money borrowed for the purpose of earning income from real property will meet the requirements of s. 149(1)(o.2) provided that the original borrowed amount met such requirements.

2001 Ruling 2000-007094 -

"The acquisition or holding of interests in a limited partnership that invests in real property will not, in and by itself, result in the corporation not satisfying the requirements of 149(1)(o.2)."

Income Tax Technical News, No. 1, 22 July 1994

A pension fund realty corporation that acquires or holds an interest in capital property that is real property will not lose its tax-exempt status if a taxable entity is a co-owner.

18 February 1994 T.I. 940241 [taxable co-owner permitted, inventory development prohibited]

A pension fund realty corporation may acquire or hold capital property that is real property irrespective whether or not the co-owners are non-qualified persons. If it owns, say, a 50% undivided interest in the real property, it may accept responsibility for 50% of the obligation to maintain, improve, lease or manage the property.

Development activities undertaken with respect to an asset that was acquired with the intent to improve and develop it for sale at a profit are not acceptable.

93 C.R. - Q. 7

Because ownership of an undivided interest in a property gives each co-owner rights in respect of the entire property, if a s. 149(1)(o.2) corporation were to acquire an undivided interest in a rental real estate project where the other co-owner was not exempt, the acquiring corporation would loose its tax-exempt status.

25 November 1992 T.I. 921520 [development of capital property permitted]

A corporation is permitted to develop a capital property as long as such development is associated with the earning of passive investment income on the capital property. Activities undertaken in respect of an asset that has been acquired with the intent of developing it or improving it for sale of the profit are not permissible.

28 August 1992 T.I. (Tax Window, No. 23, p. 18, ¶2164)

None of the entities described in ss.149(1)(o), (o.1) and (o.2) can participate in the active development of properties.

8 April 1992 T.I. (Tax Window, No. 18, p. 20, ¶1860)

The corporation will lose its tax exempt status if it acquires an undivided 1/2 interest in a parcel of land that will be improved and leased to third parties, given that this would not represent the carrying on of the activities permitted by s. 149(1)(o.2)(ii)(A).

11 October 1991 T.I. (Tax Window, No. 11, p. 23, ¶1524)

The exemption in s. 149(1)(o.2)(ii) is applicable only to corporations that maintain a passive role in real estate activities and is not available to corporations in the real estate development business.

June 1990 T.I. (November 1990 Access Letter, ¶1532)

In order for an amalgamated corporation to qualify under s. 149(1)(o.2) as a non-taxable corporation, the amalgamated corporations must have so qualified prior to the amalgamation.

Articles

D. Williamson, "Real Estate Investment Trust", 1997 Corporate Management Tax Conference Report, c. 5.

Shafer, "Investments in Real Estate by Tax-Exempt Entities and Intermediaries", 1995 Corporate Management Tax Conference Report, c. 13.

Krasa, "Pension Real Estate Investment Corporations: Compliance Issues", 1995 Canadian Tax Journal, Vol. 43, No. 3, p. 610.

Subparagraph 149(1)(o.2)(iii)

Administrative Policy

17 April 2014 T.I. 2012-0461151E5 F - pension fund real estate

Would an advance made by a registered pension plan ("RPP") to a wholly-owned corporation (the "retirement investment fund corporation," or "RIFC") qualify under s. 149(1)(o.2)(iii)(B)? CRA stated (TaxInterpretations translation):

[W]hen an advance paid by an RPP to an RIFC is not evidenced by [lit., "recorded by"] the issuance of a bond, debenture, note or similar obligation…that advance complies with the condition in clause 149(1)(o.2)(iii)(B). As required by the preamble in subparagraph 149(1)(o.2)(iii)…such advance must in addition be permitted under the Pension Benefits Standards Act, 1985 or a similar law of a province.

14 August 2006 T.I. 2005-016291 -

Derivatives such as forward contracts, futures, swaps and options would be considered to be qualifying investments provided that they were permitted as an investment for a pension fund or plan under the PBSA or a similar law of a province.

2002 Ruling 2001-010848 -

A participating bond that is permitted under the PBSA would be considered to be an investment allowed within the meaning of s. 149(1)(o.2)(iii)(A).

2001 Ruling 2000-005546 -

A cash call obligation requiring the (o.2) corporation to acquire additional equity in an investment would not constitute a debt obligation for purposes of s. 149(1)(o.2)(iii).

8 May 1997 T.I. 5-963604

"Nonrefundable commitment fees, loan fees and inducement payments which can be directly traced to a specific mortgage loan investment would generally constitute income from investments under clause 149(1)(o.2)(iii)(C) of the Act. However, in the case of refundable commitment fees, such fees would be earned only if the investment is not made. Given that there is no related investment, it is our view that refundable commitment fees would not normally constitute income from investments notwithstanding that they would constitute income from an investment business."

15 February 1993 T.I. 9231345 [loan from pension fund shareholder]

Does a non-interest bearing demand loan by a pension plan to a subsidiary corporation to facilitate the transfer of monies into and out of the corporation comply with s. 149(1)(o.2)(iii)(B)? CRA stated:

"A non-interest bearing loan from a pension plan to a subsidiary corporation to facilitate the transfer of monies into and out of the corporation would not be prohibited by virtue of clause 149(1)(o.2)(iii)(B) as long as such a loan was permitted under the PBA."

Subparagraph 149(1)(o.2)(iv)

Administrative Policy

28 May 2015 T.I. 2015-0582901E5 - 149(1)(o.2) Pension corporation

Is a related segregated fund trust that has only one beneficiary (which is a registered pension plan) a permissible shareholder of a tax-exempt pension corporation pursuant to s. 149(1)(o.2)(iv)(C)? CRA responded:

Subsection 33(2) of the Interpretation Act provides that words in the singular include the plural and words in the plural include the singular. Thus, for the purpose of clause 149(1)(o.2)(iv)(C), the reference to a related segregated fund trust all the beneficiaries of which are registered pension plans can include a related segregated fund trust that has only one beneficiary, provided the beneficiary is a registered pension plan. The same position applies for the purpose of clause 149(1)(o.2)(iv)(B) of the Act and paragraphs 4802(1)(a) and (f) of the Income Tax Regulations, which contain similar language, provided the beneficiary is of the type listed in the applicable provision.

Paragraph 149(1)(o.4) - Master trusts

Administrative Policy

14 August 1992 T.I. (Tax Window, No. 23, p. 19, ¶2143)

Provided all relevant conditions are satisfied, once a trust elects to be a master trust in a taxation year, it will be exempt from tax for the entire year in which the election is made.

1 October 1991 T.I. (Tax Window, No. 10, p. 23, ¶1490)

A master trust that was in existence before the enactment of s. 149(1)(o.4) which elects under that provision will have its period of exemption commence no earlier than the beginning of the taxation year for which the election was made.

Articles

Krasa, "Income Tax Implications of Joint Investment by Pension Plans through a Private Pooled Fund Vehicle", 1997 Canadian Tax Journal, Vol. 45, No. 1, p. 1.

Paragraph 149(1)(t) - Farmers’ and fishermen’s insurer

Administrative Policy

28 June 2010 T.I. 2009-034267 -

The exemption in s. 149(1)(t) is available to a non-resident insurer; and in applying ss. 149(4.1) and (4.2) the activities of the non-resident insurer as a whole must be considered rather than only those of its Canadian branch.

21 December 1993 T.O. 933153 (C.T.O. "Unable to Rule/Question of Fact")

For purposes of the requirement in s. 149(1)(t) that the person not be engaged in any business (other than insurance) "if the nature of [a] computer software operation is an incidental one such that, objectively, it can be said to be carried out solely in an attempt to defray or recover the development costs [the person] would otherwise incur in any event to create the software for its use, then the Department would not likely consider the operation to be a business."

29 January 1990 Memorandum (June 1990 Access Letter, ¶1279)

Where properties are only partly used in a farming business, one must examine the nature of the property and the proportion in which it is used in the farming business. For example, because the nature of a tractor relates more to farming than any other business, a tractor will be farm property provided that the non-farming use (such as the provision of a snow-removal service) is minimal. Property owned by a farmer prior to his retirement will cease to be farm property. The concept of a farmer's residence is discussed.

Subsection 149(1.2) - Income test

Administrative Policy

26 February 2014 T.I. 2014-0518651E5 - 149(1)(c) - municipal corporation

Respecting whether income received from the Ontario Power Authority would be exempt from tax under paragraph 149(1)(c), CRA referred to the exemptions in ss. 149(1)(c) and (d.5), and then stated:

Subsection 149(1.2) excludes certain income from the determination of whether more than 10% of the income (of the corporation to which paragraph 149(1)(d.5) applies) is derived from activities carried on outside the relevant geographical boundaries. Generally, income derived from activities carried on pursuant to an agreement in writing between the corporation and Her Majesty in right of Canada or a province, or a municipality or a public body performing a function of government, or certain subsidiaries, within their geographical boundaries, are not included in the determination. Additionally, income is excluded from activities carried on in a province as a producer of electrical energy or natural gas, or as a distributor of electrical energy, heat, natural gas or water, where the activities are regulated under the laws of the province.

Subsection 149(3) - Application of s. (1)

Cases

Actra Fraternal Benefit Society v. The Queen, 97 DTC 5243, Docket: A-491-95 (FCA)

Investments allocated by the taxpayer to its life insurance fund were in excess of those necessary to meet the risks of the life insurance business carried on by it. Accordingly, the investment income on the excess was free from tax.

Robertson J.A. noted that the argument of the Minister that the decision of the taxpayer to maintain the excess funds in the life insurance business was determinative of the matter amounted to an argument that there should be a subjective standard of "necessity" and not an objective one as established in McCutcheon Farm Ltd. v. The Queen, 91 DTC 5047 (FCTD).