Subsection 6205(1)

Administrative Policy

17 August 1995 T.I. 5-951498

Where the share capital of a corporation is divided into several classes of common shares, and the dividends that may be declared and paid on each class are limited to the surplus of the corporation allocated to the class, shares of any such class will not qualify as a prescribed share even if only one class of such shares has been issued by the corporation.

7 June 1990 Memorandum (November 1990 Access Letter, ¶1529)

Common shares which from the time of their issue were made convertible into preferred shares in order to facilitate an eventual estate freeze would not be prescribed shares.

2 March 1990 T.I. 5-9495 (August 1990 Access Letter, ¶1381)

A right of acquisition set out in the articles will not ipso facto disqualify the share as a prescribed share if such provision in the articles merely describes an acquisition procedure that is set out in the governing companies legislation.

Subsection 6205(2)

Administrative Policy

10 October 2014 APFF Roundtable Q. 19, 2014-0538041C6 F

Mr. X holds all 100 of Opco's Class A shares with a fair market value of $1,000,000 and nominal ACB and PUC. Opco pays a stock dividend comprising Class B shares which have a retraction right for $900,000; the 100 Class shares are exchanged for estate freeze Class C preferred shares; and the family trust subscribes for Class shares for $10. Would the Class B shares issued on the stock dividend be issued as part of an arrangement the main purpose of which was to permit any increase in the value of the property of the corporation to accrue to other shares that would, at the time of their issue, be prescribed shares, so that ITR subparagraph 6205(2)(a) is satisfied? CRA responded (Tax Interpretations translation):

…"[A]rrangement"…has a broad meaning. An arrangement can encompass more than one transaction. Thus, if several transactions are effected in the context of a freeze in favour of persons contemplated by ITR subparagraph 6205(2)(a), the CRA could consider that the arrangement includes these transactions if it appears to it that they are planned together to achieve the end in sight, being the freeze. For example, the payment of a stock dividend of B shares…in order to lower the value of the Class A shares …followed by an exchange of all of such class A shares in order to receive Class C shares…being transactions effected so as to be followed by the issuance of new participating shares to the family trust, could form part of the same arrangement in the circumstances. In such a case, the Class B and C shares of Opco would be issued as part of the arrangement.

The question of whether the main purpose of the arrangement is to permit any increase in the value of property of a corporation to accrue to other shares that would, at the time of their issue, be prescribed shares, is a question of fact. An arrangement could have been put in place mainly for purposes other than those described in ITR subparagraph 6205(2)(a), such as realizing certain financial, structural or other objectives, or for obtaining certain tax advantages.

…[I]t would be necessary in the current situation to determine if the test provided in ITR subparagraph 6205(2)(a) is satisfied at the completion of the arrangement, being when the Class A shares…are issued (assuming that these were prescribed shares at the date of their issue) to the family trust.

11 October 2013 APFF Roundtable Q. , 2013-0496511C6 F

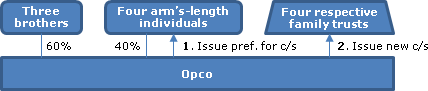

Situation 1

Opco is controlled by three brothers and its shares are held also by four minority shareholders (the "First Shareholders") who deal at arm's length with each other and the three brothers, and are later assumed by CRA not to be employees. Each First Shareholder implements an estate freeze under which the First Shareholder's shares of Opco are exchanged for preferred shares of Opco and a family trust subscribes for Opco participating shares. Are the preferred shares prescribed shares?

Response

In indicating that the preferred shares did not qualify as prescribed shares, CRA stated (Tax Interpretations translation):

[I]t is in particular necessary that the participating shares issued by Opco be owned by a person who does not deal at arm's length with each First Shareholder or a trust whose only beneficiaries are each First Shareholder or persons who do not deal at arm's length with each of them. ... [Here instead] the trusts ... do not deal not at arm's length with with each First Shareholder [and] ... the same applies for the beneficiaries... .

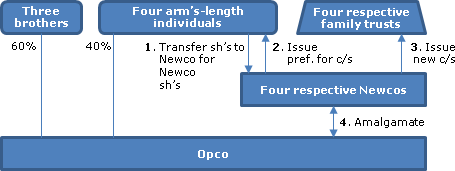

Situation 2

The estate freeze of each First Shareholder implemented differently. Each First Shareholder transfers its Opco shares to a Newco of which he or she is the sole shareholder in consideration for Newco shares, exchanges its shares of Newco for Newco preferred shares and the family trust subscribes for Newco participating shares. The four Newcos and Opco then amalgamate with the First Shareholders and trusts receiving replacement preferred and participating shares, respectively, from Amalco. Are the preferred shares prescribed shares?

Response

After summarizing the purpose requirement in Reg. 6205(2)(a)(i), and the requirement in Reg. 6205(2)(a)(i)(III) that each beneficiary not deal at arm's length with the relevant First Shareholder, and noting that each participating share would be required to satisfy Reg. 6205(1), and before noting the requirements of Reg. 6205(4)(c)(i) and (ii), CRA noted (Tax Interpretations translation) that, respecting the amalgamation, Reg. 6205(4)(c) "created a presumption under which preferred shares issued by Amalco to each First Shareholder qualified as a prescribed share."

CRA went on to state that although "certain doubts existed…it is possible that the presumption provided in paragraph 6205(4)(c) would apply to the preferred shares of Amalco issued to each First Shareholder so as to qualify as prescribed shares." In a live case, CRA would consult with Finance.

17 August 1995 T.I. 5-951498

The word "person" in Regulation 6205(2)(a) does not include a partnership.

31 March 1993 T.I. (Tax Window, No. 30, p. 5, ¶2462)

The test in Regulation 6205(2)(a)(ii)(A) would not be met where two individuals each owning ½ of the common shares of a corporation exchange their common shares of the corporation for preferred shares and have the corporation issue common shares to individuals related to one or other of the two shareholders, because "all" of the common shares would not be owned by non-arm's length persons.

1992 A.P.F.F. Annual Conference, Q. 6 (January - February 1993 Access Letter, p. 52)

Adverse comments on a scheme to retroactively make non-prescribed shares qualify as prescribed shares.

15 June 1992 T.I. 920755 (December 1992 Access Letter, p. 23, ¶C109-124)

Re application of Regulation 6205(2) where an individual exchanges his common shares for preferred shares under an s. 86(1) reorganization, then he and his son subscribe for new common shares.

24 February 1992 T.I. (December 1992 Access Letter, p. 22, ¶C109-123, Tax Window, No. 17, p. 4, ¶1762)

Where an individual transferred the common shares of Opco to Newco in consideration for preferred shares with the intention of having Newco issue common shares to his son but instead receives the common shares himself because this transaction is frustrated, the preferred shares of Holdco will be prescribed shares on the basis that increases in the value of the property of Holdco will accrue to the common shares owned by him.

16 September 1991 T.I. (Tax Window, No. 9, p. 8, ¶1449)

The exemption in Regulation 6205(2)(a) was not available where increases in the value of the corporation were intended to accrue to shares previously issued in connection with an estate freeze where those shares were redeemable for a fixed amount.

5 September 1990 T.I. (Tax Window, Prelim. No. 1, p. 13, ¶1032)

Three examples of situations where the exception in Regulation 6205(2)(a) is not satisfied.

31 January 1990 T.I. (June 1990 Access Letter, ¶1269)

Where the share capital of Opco is reorganized under s. 86 by Father exchanging all his common shares for redeemable preference shares, the preference shares issued to him will not be prescribed shares because no prescribed shares are issued to Son who held 10% of the common shares of Opco prior to the s. 86 reorganization.

4 January 1990 T.I. (June 1990 Access Letter, ¶1269)

Following a reorganization described in s. 6205(2), a transfer of the preferred shares to another corporation would disqualify the shares of prescribed shares.

Subsection 6205(4)

Administrative Policy

18 October 1991 Memorandum (Tax Window, No. 11, p. 15, ¶1528)

Regulation 6205(4)(c) does not apply if a preferred share is issued in substitution for a preferred share previously issued in an estate freeze.