2 December 2014 Annual CTF Roundtable

Q1. Derivative forward agreement (“DFA”)

Q1. (a) Embedded exchange right in share

Question

The explanatory notes to the definition of “derivative forward agreement” provide two fact patterns under the heading “Example – Exchangeable Shares”.

Can the CRA confirm that the first fact pattern, involving a share of a Canco that is exchangeable by its terms for shares of a Forco, is not a DFA because the exchange right embedded in the share is not an agreement?

Notes from Presentation

The character conversion rules were added to deal with the conversion of amounts which otherwise would be received on income account into capital receipts. CRA cannot confirm that an embedded call right is not an agreement for purposes of these rules. The exchangeable security with the call right will be assessed under the criteria in (c)(ii) in the definition of derivative forward agreement to determine whether there is risk of loss or opportunity for gain with respect to the investment, irrespective of whether it is embedded. Accordingly, where there is the requisite risk of loss or opportunity for gain under the terms of the exchangeable security, there generally will not be a DFA.

In the first Finance example (where the right was embedded) CRA accepts that the exchangeable share is not a DFA, i.e., there was sufficient exposure to YCo shares. In the second example, where the right was not embedded (i.e., it was in a separate agreement), the speculative character of the right indicated that the DFA definition should be applied.

CRA Response

The DFA rules are a set of anti-avoidance rules colloquially referred to as the “character conversion rules” that are intended to address certain structures that have the effect of transforming income into capital gains. The heart of these rules is the definition of “derivative forward agreement” (“DFA”) in subsection 248(1) of the Act. The CRA cannot confirm that an exchange right embedded in a share is not an “agreement” for purposes of the DFA definition. The reason why the first fact pattern in the explanatory note example is not a DFA and the second pattern is a DFA relates to subparagraph (c)(ii) of the DFA definition, as discussed further below. An analysis of the other portions of the DFA definition needed to be undertaken regardless of whether the exchange right is an agreement because the call right is an agreement.

See summary under s. 248(1) – derivative forward agreement.

Written Response

2 December 2014 CTF Conference Q. 1, 2014-0546701C6

Q.1 (b) Ancillary put right

Question

Can the CRA confirm that, in the context of an exchangeable share the terms of which permit the taxpayer to exchange its shares with the issuer for shares of another company, ancillary rights enabling such taxpayer to put their shares to another person for the shares of the other company in the event the issuer is unable to effect the exchange will not, in and of themselves, be considered an agreement for purposes of the definition of DFA?

CRA Response

No, the CRA cannot confirm this. We would require further information regarding the nature and form of these rights to make a determination.

See summary under s. 248(1) – derivative forward agreement.

Written Response

2 December 2014 CTF Conference Q. 1, 2014-0546701C6

Q1. (c) Embedded partnership unit

Question

Is the answer to Q1(a) or Q1(b) affected by whether the property is a share or a partnership interest? In particular, as a partnership interest is contractual in nature, will an exchange right be viewed as embedded (and not a separate agreement) such that the same result as set out in the explanatory notes in the exchangeable share example applies to exchangeable partnership interests?

Notes from Presentation

The same answer applies as above, [i.e. an assessment must be made as to whether the (c)(ii) criteria are satisfied assuming that the call right is contained in the terms of the partnership interest].

CRA Response

The answers to [(a)] and [(b)] apply equally to a partnership interest. As discussed further below, we would expect that, depending on their terms, many exchangeable partnership interests would not be DFAs as a result of subparagraph (c)(ii) of the DFA definition.

See summary under s. 248(1) – derivative forward agreement.

Written Response

2 December 2014 CTF Conference Q. 1, 2014-0546701C6

Q1. (d) Parent with other assets

Question

How will the CRA apply (c)(ii) of the DFA definition to the right to exchange shares for securities of another entity (the “second securities”):

- that only holds interests (directly or indirectly) in the entity that issued the exchangeable shares, or

- that holds interests (directly or indirectly) in the entity that issued the exchangeable shares as well as other property the fair market value of which exceeds the fair market value of direct and indirect interests in the entity.

Notes from Presentation

It is difficult to comment as not many facts are given. Many standard exchangeable share transactions come within (c)(i) of the definition. Para. (c)(ii) of the definition requires a comparison of the risk of loss and opportunity for gain with respect to the two securities.

CRA Response

The CRA will compare the opportunity for profit and risk of loss of the exchangeable shares to the opportunity for profit and risk of loss of the second securities. Consistent with the explanatory notes, many standard exchangeable share transactions will not be DFAs as a result of the application of (c)(ii) of the DFA definition because the risk of loss and opportunity for profit associated with the exchangeable shares will generally be very similar to the risk of loss and opportunity for profit associated with the second securities.

See summary under s. 248(1) – derivative forward agreement.

Written Response

2 December 2014 CTF Conference Q. 1, 2014-0546701C6

Q2. Loss consolidation - update

Q2. (a) Positive spread/independent income source

Preliminary Question

Does the CRA require a positive spread between the dividend yield on the preferred shares acquired with intercorporate debt and the interest rate on that debt?

Does the CRA continue to hold that the payor of the dividends must have an independent source of income to pay the dividends?

If the payor of dividends does not itself have an independent source of income but the parent of the company paying the dividends does, is the independent source of income requirement satisfied if the parent funds the dividend payor?

Question From Official Response

In certain loss consolidation arrangements, a profitable taxable Canadian corporation (“Profitco”) is related or affiliated to a taxable Canadian corporation that has incurred non-capital losses (“Lossco”). Under the loss consolidation arrangement, Lossco lends money to Profitco at a reasonable stated rate of interest and Profitco in turn uses the inter-corporate debt to acquire preferred shares of Lossco.

Does the CRA require a positive spread between the dividend yield on the preferred shares acquired with inter-corporate debt and the interest rate on that debt?

Does the CRA continue to hold that in such situations the payor of the dividends must have an independent source of income to pay the dividends?

Notes from Presentation

CRA’s practice has been to not rule unless there is a positive spread between the preference dividends paid to the Profitco and the interest paid by it.

In the less usual situation of preferred shares held in the parent, the parent must demonstrate that it has assets sufficient to pay the required dividends, as discussed in Income Tax Technical News, No. 30. In the more usual situation of a downstream transfer of losses to a Newco, CRA will engage in a factual enquiry before determining to rule favourably. It must be satisfied that the criteria in s. 20(1)(c) are met.

CRA Response

In the context of loss consolidation arrangements, it is the CRA’s policy not to provide rulings without a positive spread between the interest paid and the dividends earned.

The CRA has previously commented on loss consolidation arrangements in circumstances of upstream shareholding in which a subsidiary acquired dividend paying preferred shares of the parent. Our views on the independent source of income issue are expressed in Income Tax Technical News No. 30 (May 21, 2004), which continues to reflect the CRA's position. In the circumstances described, “The key criteria to be met in such situations is the existence of other assets in the parent company that can generate sufficient income to pay the dividends on the preferred shares held by the subsidiary.”

Whether the funding for the dividend payments is acceptable will depend on the circumstances and the particular loss consolidation structure. Where taxpayers have concerns with respect to a specific situation, we encourage them to request an advance income tax ruling.

See summaries under ss. 20(1)(c) and 111(1)(a).

Written Response

2 December 2014 CTF Conference Q. 2, 2014-0546911C6

Q2. (b) Affiliated v. related

Preliminary Question

Can the CRA confirm its position as to whether corporations must be affiliated, related, or both affiliated and related in a loss consolidation arrangement?

Question From Official Response

Prior to 1996, the CRA’s policy permitted loss consolidation arrangements only where the corporations were related. After April 26, 1995, the concept of "affiliated person" was introduced in section 251.1 of the Act, which was used as the criteria under certain loss restriction provisions, e.g., subsection 69(11). As a result, the CRA’s position on loss consolidations was changed to allow loss consolidation transactions only where the corporations were affiliated. In 2010, the CRA issued a ruling for a loss consolidation where the two corporations were related, but were not affiliated.

Can the CRA confirm its position as to whether corporations must be affiliated, related, or both affiliated and related in a loss consolidation arrangement?

Notes from Presentation

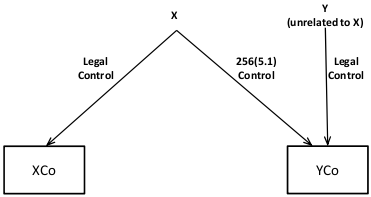

Where the other criteria are satisfied, CRA will rule where the corporations are related and affiliated and where they are related. It can also rule where the corporations are affiliated and not related. However, they must be affiliated for s. 69(11) purposes, i.e., the affiliation must occur by reason of de jure rather than de facto control. The diagram above illustrates a situation where there was a refusal to rule because the relevant common control was only de facto control (i.e., X had de jure control of XCo but only de facto control of YCo, which was subject to the de jure control of a third party (Y) . A Folio on interest deductibility is in progress in which CRA will comment on issues respecting loss consolidation transactions.

CRA Response

The CRA will consider ruling requests where the corporations are related and affiliated, as well as circumstances in which the corporations are related.

We will also consider loss consolidation arrangement where the corporations are affiliated but not related. In that context, however, the meaning of affiliated will be determined on the same criteria as stipulated in subsection 69(11), which is if subsection 251.1 were read without reference to subsection 251.1(3). In other words, where two corporations are not related, but are affiliated, the CRA would consider a loss consolidation arrangement only if the corporations are affiliated by reason of de jure control.

The CRA is in the process of preparing Income Tax Folio S3-F6-C1, “Interest deductibility and related issues.” We intend to add our positions on related and affiliated relationships into new Folio S3-F6-C1 with respect to loss consolidations.

See summaries under ss. 69(11) and 111(1)(a).

Written Response

2 December 2014 CTF Conference Q. 2, 2014-0546911C6

Q2. (c) Interprovincial shifts

Preliminary Question

Can the CRA provide an update on whether the announcement in the 2013 Federal Budget not to proceed with the implementation of a formal corporate group taxation system has had an impact on issuing advance income tax rulings for loss consolidation arrangements?

Question From Official Response

The Federal Budgets in 2010 and 2012 noted the Government's intention to undertake a consultation process to consider implementing new rules for the taxation of corporate groups, which if implemented, would allow for a formal system of loss transfers or consolidated reporting. As a result of the consultations, which included discussions with provincial and territorial officials, the 2013 Federal Budget announced it would not proceed with the implementation of a formal corporate group taxation system.

Can the CRA provide an update on whether the 2013 Federal Budget has had an impact on issuing advance income tax rulings for loss consolidation arrangements?

Notes from Presentation

This withdrawal has had no effect on CRA’s rulings practice. Loss consolidation transactions generally accord with the scheme of the Act. Accordingly, CRA continues to provide loss consolidation rulings including federal GAAR rulings and provincial GAAR rulings in the case of provinces with which there are comprehensive tax agreements. However, if the principal purpose of the transactions appears to be to shift losses to a particular province, CRA will take a close look to see if the applicable provincial GAAR applies. Given that there could be an adverse effect on some of the smaller provinces, it is CRA’s duty to do so.

CRA Response

The 2013 Federal Budget announcement has not had an impact on the advance income tax rulings process for loss consolidations arrangements. The CRA’s position continues to be that certain loss consolidation arrangements are in accordance with the scheme of the Act and do not usually result in a misuse or abuse for the purposes of the general anti-avoidance rules (“GAAR”).

Advance income tax rulings are generally provided for the purposes of federal “GAAR”. We have also provided provincial GAAR rulings in respect of a province (or territory) with which the Government of Canada has entered into a tax collection agreement.

It should be noted, however, that where we consider that one of the main reasons for engaging in a loss consolidation arrangement is for the purposes of shifting income among provinces, the CRA may challenge that loss consolidation under provincial GAAR legislation.

See summary under s. 111(1)(a).

Written Response

2 December 2014 CTF Conference Q. 2, 2014-0546911C6

Q3. Restrictive covenants

Question

Would the CRA consider amending the position set out in document number 2014-0522961C6 (June 2014) to the effect that the allocation in an agreement of $1 of consideration to a restrictive covenant, merely to ensure that the agreement constitutes a legally binding contract, does not constitute proceeds for the purpose of paragraphs 56.4(6)(e) and (7)(d)?

Notes from Presentation

CRA has reconsidered its answer. If there is a standard contractual recital of $1 (but not a dollar more) of consideration and other good and valuable consideration, as an administrative concession CRA will consider that this does not preclude the exceptions from exemption from s. 68 allocation treatment from being available.

CRA Response

We have reconsidered our earlier response to this question as set out in 2014-0522961C6. The CRA is now prepared to accept that where a contract relating to granting a restrictive covenant uses words such as “$1 and other good and valuable consideration” simply to ensure that the contract is legally binding, and means in effect that “no more than a $1 worth of consideration” is conveyed by a purchaser for the restrictive covenant, such consideration will not, in and of itself, constitute proceeds received or receivable by the particular party for granting the RC for purposes of paragraph 56.4(6)(e) and paragraph 56.4(7)(d). However, this treatment is subject to the potential application of anti-avoidance rules such as subsection 56.4(10) of the Act where warranted.

If more than nominal consideration of $1 is paid for a restrictive covenant under the wording “$1 and other good and valuable consideration”, the exceptions set out in subsections 56.4(6) and (7) would not apply because the respective conditions in paragraph 56.4(6)(e) and paragraph 56.4(7)(d) would not be met. In such cases, the amount of proceeds (or any additional amount deemed to be proceeds by paragraph 68(c)) received or receivable by the taxpayer for the RC would be taxable as ordinary income under subsection 56.4(2) unless one of the three exceptions in subsection 56.4(3) otherwise applies

See summary under s. 56.4(6)(e).

Written Response

2 December 2014 CTF Conference Q. 3, 2014-0547251C6

Q4. Section 212.1 and the GAAR

Preliminary Question

Has the CRA’s GAAR Committee had the opportunity to consider pre-acquisition PUC planning since the time of its comments at the International Fiscal Association (IFA) Conference (in May 2013) where it provided comments on (i) pre-acquisition, (ii) post-acquisition and (iii) non-acquisition PUC planning?

Given the infusion of new capital by Foreign Parent into CanAc followed by an arm’s length acquisition of NR Target, would the CRA consider the above outcome offensive having regard to section 212.1?

Question From Official Response

At the International Fiscal Association (IFA) Conference in May 2013, the CRA made comments regarding the potential application of the GAAR to cross-border paid-up capital (PUC) planning. The comments were provided in the context of three scenarios referred to as, pre-acquisition, post-acquisition and non-acquisition, PUC planning. In its response the CRA indicated that the GAAR Committee had determined that GAAR applies to cases involving post-acquisition and non-acquisition planning but that the Committee had not recently addressed pre-acquisition PUC planning. Has the GAAR Committee had the opportunity to consider pre-acquisition PUC planning since the time of those earlier comments?

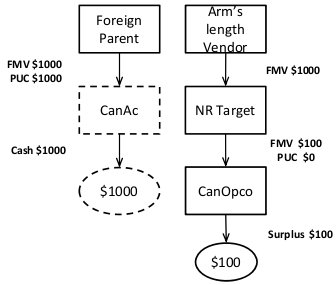

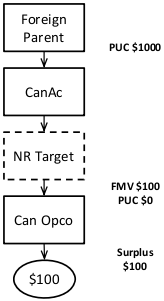

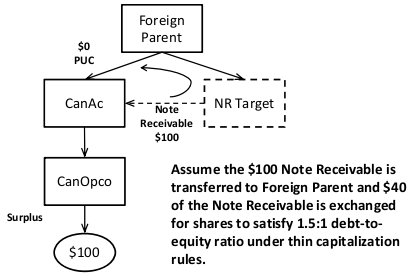

For the purpose of this question consider the following hypothetical fact pattern.

1) A non-resident corporation (Foreign Parent) makes a capital contribution to its wholly-owned Canadian resident acquisition company (CanAc). The PUC of the shares of CanAc are increased by the amount of the capital contribution.

2) CanAc acquires from an arm’s length vendor the shares of a non-resident corporation (NR Target). NR Target owns high value, low PUC shares of a Canadian operating corporation (CanOpco).

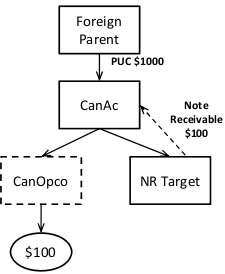

3) NR Target then sells the shares of CanOpco to CanAc in consideration for a Note Receivable in an amount equal to the fair market value of the shares of CanOpco. The capital gain realized by NR Target is not taxable in Canada as the shares of CanOpco are not taxable Canadian property. Section 212.1 does not apply because of the exception thereto in subsection 212.1(4).

4) CanAc distributes the shares of NR Target to Foreign Parent on a reduction of PUC.

5) After the completion of the above transactions the surplus of CanOpco is distributed to CanAc via dividend that is deductible to CanAc under subsection 112(1). CanAc then distributes the same amount outside Canada as a principal repayment on the Note Receivable.

Given the infusion of new capital by Foreign Parent into CanAc followed by an arm’s length acquisition of NR Target, would the CRA consider the above outcome offensive having regard to section 212.1?

It is noteworthy that in light of the PUC reinstatement rule in subsection 212.3(9), the above transactions would not appear to be impeded by section 212.3 even if carried out after March 28, 2012.

Notes from Presentation

This transaction entailed a foreign acquirer (Foreign Parent) doing pre-acquisition planning by capitalizing the Canadian Buyco (CanAc) with full ($1,000) PUC, which then acquires NR Target for that amount. NR Target then sells its CanOpco shares, which have nil PUC, to CanAc for $100. Following the distribution of NR Target by CanAc to Foreign Parent as a stated capital distribution (thereby reducing the PUC of the CanAc shares to nil), NR Target distributes the $100 note to Foreign Parent, with the note being converted in Foreign Parent’s hands into shares with a PUC of $40 and an interest-bearing note of $60. CanAc then typically would amalgamate with CanOpco.

The GAAR committee considered similar transactions. The purpose of s. 212.1(1) is to prevent the foreign parent from accessing Canadian corporate surplus. However, s. 212.1(1) does not apply if the exception in s. 212.1(4) applies. The s. 212.1(4) exception is intended to apply if there is no increase in the ability to strip such surplus. Accordingly, it was inappropriate to rely on the s. 212.1(4) exception in this case (respecting the sale by NR Target of CanOpco to CanAc). As the transactions access the surplus of CanOpco, GAAR is engaged. Respecting a supplementary observation of a panelist that the same result could have been obtained if Foreign Parent had acquired CanOpco directly, Randy Hewlett noted that in fact it was the shares of NR Target that were to be acquired and the attributes of its shares were the starting point. If CanOpco had simply distributed its surplus to NR Target, such distribution would have been subject to Part XIII tax.

CRA Response

The GAAR Committee has addressed a pre-acquisition PUC planning scenario and concluded that the GAAR would apply. On the basis of that GAAR decision, we feel that in the hypothetical scenario described above the GAAR indeed applies. The infusion of capital by Foreign Parent into CanAc and the arm’s length acquisition of the shares of NR Target by CanAc do not mitigate the potential for the future payment of Part XIII tax by NR Target on the distribution of CanOpco surplus. The PUC of the shares of CanOpco held by NR Target remains low such that NR Target’s access to CanOpco’s surplus is reliant on CanOpco making dividend distributions to NR Target.

Subsection 212.1(1) is an anti-surplus stripping rule designed to prevent a non-resident corporation from avoiding Part XIII tax when extracting the corporate surplus of a corporation resident in Canada by way of a disposition of the shares of that corporation to a non-arm’s length corporation resident in Canada. Subsection 212.1(1) does not apply, however, if the conditions in subsection 212.1(4) are satisfied.

Subsection 212.1(4) is intended to provide relief if there has been no corporate surplus stripped out of Canada and no increase in the ability to strip surplus tax-free out of Canada. For example, this would be the case where the ultimate parent company in the group is a corporation resident in Canada. The sale of CanOpco shares to CanAc together with the subsequent transfer by CanAc of NR Target to Foreign Parent sidestep the provisions of subsection 212.1(1) resulting in the surplus of CanOpco being transferred offshore without payment of Part XIII tax by NR Target. It would be inappropriate for subsection 212.1(4) to operate to prevent a deemed dividend arising under paragraph 212.1(1)(a) and/or a reduction of PUC under paragraph 212.1(1)(b) in respect of a sale of shares that results in or enables the tax-free distribution of the corporate surplus of CanOpco. Therefore, the CRA is of the view that the application of subsection 212.1(4) in this case would defeat the objective of section 212.1 and we would seek to apply the GAAR.

We observe that other transactions could be carried out by the corporate group after the capitalization of CanAc by Foreign Parent and the acquisition by CanAc of the shares of NR Target as described in facts 1 and 2 above, to achieve the tax-free distribution of the surplus of CanOpco out of Canada. From a policy perspective, the CRA considers that the result of these transactions is similar to that of the post-acquisition and non-acquisition PUC planning arrangements that were discussed at the 2013 IFA Conference where a series of transactions enables a non-resident taxpayer to create cross-border PUC which can later be used to extract the corporate surplus of a Canadian resident corporation without attracting Part XIII tax in a manner that is contrary to the object and spirit of section 212.1. While any such series would have to be analysed based on its own facts, the series would be viewed by the CRA as abusive and it would seek to apply the GAAR.

Q5. Streaming partnership income

Question

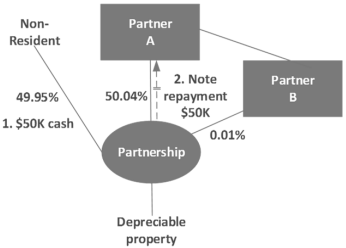

Does the CRA accept the streaming of certain types of income (e.g., interest income) to a particular partner of a partnership where the partnership agreement provides for such allocation?

[Final version of question excluded this further question as well as diagram above:] Under what circumstances might the CRA apply subsections 103(1) or 103(1.1)?

Notes from Presentation

CRA generally has not accepted the streaming of particular sources of income. In the particular example, there clearly is a streaming for tax purposes as the company with losses has interest income streamed to it, and the taxable partner has income eligible for the s. 112(1) deduction streamed to it. In this case, CRA refused to rule. This does not mean that CRA will not be concerned where the tax advantage of streaming is less obvious (and it does not have the audit resources to deal with the countenancing some streaming arrangements and not others). S. 103(1) will be applied in the obvious cases where the allocation of income changes from year to year in accordance with an allocation discretion based on the tax circumstances of the respective partners, but CRA also will take a close look even where the income allocation approach was hardwired from the partnership’s inception.

CRA Response

Generally, the CRA has not accepted the streaming of certain types of income, such as interest income, to a particular partner of a partnership even if the partnership agreement provides for the allocation.

We have received ruling requests where certain types of income are streamed to a particular partner and we have been asked to provide a favourable subsection 103(1) ruling, which we have declined. It is our view that the streaming of certain types of income to a particular partner is not acceptable by virtue of subsection 103(1).

Example

Assume a partnership is made up of two corporate members. One partner (Partner A) expects to incur losses in excess of its income from the partnership. The second partner (Partner B) expects to earn income from partnership as well as from sources other than the partnership. Partner A and B agree to amend the partnership agreement so that the interest income of the partnership will be allocated to Partner A and the dividend income will be allocated to the Partner B. The dividend income is deductible under subsection 112(1).

The additional interest income that is allocated to Partner A will not result in taxable income since it can be offset by Partner A’s losses from other sources. That interest income, if allocated to Partner B, would have generated additional taxable income to Partner B. As a result of the amendment to the partnership agreement, Partner B’s tax payable is reduced.

The CRA would seek to apply subsection 103(1) (and may also apply the general anti-avoidance rules in subsection 245(2)) to the allocation of income under the amended partnership agreement.

See summary under s. 103(1).

Written Response

2 December 2014 CTF Conference Q. 5, 2014-0547311C6

Q6. Subsection 97(2) and the “Canadian partnership” requirement

Preliminary Question

Does the formation of a partnership with only Canadian partners in order to meet the requirement of a “Canadian partnership” under subsection 97(2) followed by the admission of a non-resident as a partner soon after (e.g., the next day) jeopardize the rollover?

Are subsections 100(1.4) and 100(1.5) relevant?

Question From Official Response

In order for the rollover in subsection 97(2) of the Income Tax Act to be available, the requirement of a “Canadian partnership” must be met. A “Canadian partnership” is defined in subsection 102(1) as “a partnership all of the members of which were, at any time in respect of which the expression is relevant, resident in Canada.” Does the formation of a partnership with only Canadian partners in order to meet the requirement of a “Canadian partnership” under subsection 97(2) followed by the admission of a non-resident as a partner soon after (e.g. the next day) jeopardize the rollover?

Notes from Presentation (revised)

This fact situation (where a resident rolled in a building to the partnership and took back (i) a note for an amount equal to the transferred property’s UCC ($50,000) and (ii) units with a nil ACB and $50,000 FMV, and then a day later the non-resident subscribed $50,000 cash for units, with that cash being used to repay the note) was described in a ruling request which the GAAR committee concluded ran afoul of GAAR. In the absence of rollover treatment under s. 97(2), s. 97(1) would have applied to produce a $50,000 gain. S. 97(2) should not be looked at in isolation. GAAR would apply to this transaction in light of the broad policy evident in the amendments to s. 100 in 2012 and the introduction of ss. 100(1.4) and (1.5) [dealing with the avoidance of gains through partnership interest dilution]. The subscription by the non-resident diluted the resident’s interest by approximately 50%. If the resident had instead sold its one-half interest in the partnership to the non-resident it would have realized taxable income under s. 100 of $25,000. Accordingly, the transactions represent an abuse having regard to the policy of the 2012 amendments to s. 100. In a supplementary comment, Randy noted that but for the desire to have a s. 97(2) rollover, the non-resident in the ruling request would have been a partner at inception, so that no rollover would have been available. In response to a panelist comment, he indicated that it would not be appropriate to take a wait and see approach instead, i.e. to wait to subsequent years to apply s. 103(1) to income allocations by the partnership.

CRA Response

Recently, an advance income tax ruling request (the “ATR request”) involving such planning went to the GAAR Committee. The facts in the ATR request included the formation of a partnership with only Canadian partners, the transfer of assets to the partnership and the admission of a non-resident as a partner immediately after the transfer.

Example

Corp A is a taxable Canadian corporation that is carrying on a business outside of Canada. Corp A intends to transfer the business into a partnership of which a non-resident will be a member. If the partnership is formed with the non-resident as an initial partner, the conditions in subsection 97(2) would not be met. In an attempt to secure the rollover under subsection 97(2), Corp A forms a partnership with its wholly-owned Canadian subsidiary (Corp B). Corp A contributes $99 for 99 partnership units (99%) and Corp B contributes $1 for 1 partnership unit (1%). Corp A transfers depreciable property with a cost of $100,000, FMV of $100,000 and UCC of $50,000 to the partnership in exchange for a promissory note of $50,000 and 50,000 partnership units with a FMV of $50,000. The elected amount is $50,000. Absent the rollover under subsection 97(2), pursuant to subsection 97(1), the disposition of the depreciable property to the partnership would be at its FMV of $100,000 resulting in recapture of $50,000 to Corp A.

The next day, the non-resident becomes a partner by contributing $50,000 for 50,000 partnership units (49.95%) which contribution is then used by the partnership to repay the promissory note of $50,000 to Corp A. With the admission of the non-resident as a partner, Corp A’s interest in the partnership is reduced to 50.04%. As part of the series of transactions, there is a dilution on a percentage basis in favour of a non-resident but without any Canadian tax recognition of the latent income gain. The new anti-avoidance rules under subsections 100(1.4) and (1.5) do not yield taxation to Corp A on the admission of the non-resident as a partner because there is no dilution of its partnership interest on a fair market value basis (i.e. the FMV of Corp A’s partnership interest is still $50,099). If instead there had been a direct disposition by Corp A to the non-resident of part (49.95%) of its partnership interest, amended subsection 100(1) would have resulted in a fully taxable gain to Corp A of $24,975, which amount is also equivalent to 49.95% of the latent recapture in the depreciable property of $50,000.

The CRA will challenge such an arrangement by applying the GAAR. In our view, the determination of a misuse or abuse of the Act must be made having regard to the 2012 amendments to subsection 100(1) that extend its application to acquisitions by non-residents and the addition of the anti-avoidance dilution provisions contained in new subsections 100(1.4) and (1.5).

Written Response

2 December 2014 CTF Conference Q. 6, 2014-0547321C6

Q7. Article XXIX-A(3) of the Canada-US Tax Convention: meaning of “substantial”

Preliminary Question

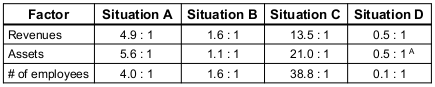

In the context of the active trade or business test in paragraph 3 of Article XXIX-A of the Canada–US tax Convention (the LOB Article), in what circumstances would the CRA consider the US business to be “substantial” in relation to the Canadian business?

Question From Official Response

Can the CRA provide its views on the active trade or business test in paragraph 3 of the Limitation on Benefits (LOB provisions) in Article XXIX-A of the Canada – US tax treaty and, in particular, in what circumstances the CRA would consider the US business to be “substantial” in relation to the Canadian business?

Notes from Presentation

More detailed comments will be provided in the written response, which will give some numerical sense of what has been required in relation to rulings requests, which had all the numbers redacted in their published form. Briefly, CRA requires more than a lemonade stand in the other jurisdiction.

CRA Response

Where applicable, paragraph 3 of Article XXIX-A may extend benefits under the Treaty to a US resident that is not otherwise a qualifying person under paragraph 2. In particular, paragraph 3 provides that treaty benefits may be available to a US resident with respect to income derived from Canada, provided that the income is derived in connection with, or is incidental to, the active conduct of a trade or business (other than certain investment businesses) carried on in the US by the US resident, or a person related to the US resident, and provided that the US trade or business is substantial in relation to the activity carried on in Canada giving rise to the income.

As highlighted in our response to a similar question at the 2013 CTF Annual Tax Conference, the Income Tax Rulings Directorate (“IT Rulings”) of the CRA has issued several advance tax rulings confirming the availability of treaty benefits by virtue of Article XXIX-A(3) to a person resident in the US that was not otherwise a qualifying person. For the purpose of determining whether the US business was “substantial” in relation to the Canadian operations in the context of those rulings, a number of factors were considered which included, but were not limited to: the relative amount of assets and revenues, number of employees involved in each jurisdiction, and in certain circumstances the relative amount of income and compensation expenses. These factors were not considered in isolation and were applied in the context of all the facts and circumstances of each particular case to determine whether the US business activities can be reasonably viewed as substantial in relation to the activities carried on in Canada.

In considering these factors for purposes of applying Article XXIX-A(3), some of the more significant comparative ratios are summarized below:

Factor (US vs. CAN)

Situation A Situation B Situation C Situation D Revenues 4.9:1 1.6:1 13.5:1 0.5:1 Assets 5.6:1 1.1:1 21.0:1 0.5:1i # of Employees 4.0:1 1.6:1 38.8:1 0.1:1 To date, based on the situations that we have had opportunity to consider, IT Rulings has not denied the availability of treaty benefits under Article XXIX-A(3) on the determination that the US business was not substantial in comparison to the Canadian activities. In addition, the US business has been equal to, or larger than, the Canadian operations in the majority of situations considered.

We note that these rulings were generally issued under the caveat that the US resident, or the person related thereto, continue to carry on its active business activities in the US, and that those US business activities remain substantial in relation to the activities carried on in Canada. Any material change in the type, composition, or the size of either the businesses carried on by the US resident or person related thereto, or the relevant Canadian activities, would generally render such a ruling inapplicable.

Endnote

i: Comparison of relative average fixed asset base in US versus Canada.

See summary under Treaties - Article 29A.

Written Response

2 December 2014 CTF Conference Q. 7, 2014-0549621C6

Q8. Base erosion – services (ss.95(2)(b)(ii))

Question

In document number 2013-0474431E5, the CRA takes the position that FAPI can arise, as a result of subparagraph 95(2)(b)(ii), on the secondment of employees by a Canadian parent company (Canco) to its foreign affiliate (FA) where FA reimburses Canco for the salaries of the employees plus a 25% markup. On the other hand, the CRA seems indicates that no FAPI would arise if no such markup is charged.

(a) Did the CRA intend to indicate that no FAPI would arise under 95(2)(b)(ii) if no mark-up was earned on the compensation of the seconded employees whereas FAPI will arise if an appropriate mark-up is charged?

(b) Does the CRA agree that the fee charged to the CFA is deductible in computing the FAPI of the CFA such that there may not be any net FAPI if the fee reflects an arm’s length charge for the services rendered by the relevant employees?

Notes from Presentation

There was insufficient time to provide a response at the presentation. However, it is understood that the written response will maintain the position reflected in the previous T.I.

CRA Response

(a) Yes, however, some clarification might be in order as to what we are contemplating in terms of a “markup”. The key is whether the markup includes a profit element. It would not always be the case that a markup over direct salary reimbursements would constitute a “profit” element. Such a markup could conceivably represent solely a proxy for other employment benefits. If such a proxy is reasonable in the circumstances, and no element of profit is built in, the relevant Canadian corporation would not be considered to be providing services to the foreign affiliate, and subparagraph 95(2)(b)(ii) would not apply. That is the key distinction: if the Canadian parent earns a profit, then it would be considered to provide the services of its seconded employees in the course of its own business and that, in our view, would trigger the application of subparagraph 95(2)(b)(ii). If it is simply receiving a full reimbursement for all of its costs relating to the seconded employees, the situation is no different than if the FA had hired the employees directly and, as such, the Canadian parent would not be considered to be providing services to the FA.

(b) Depends on the facts and circumstances and the application of proper transfer pricing principles. In general, the markup would be taken into account in computing FAPI, but whether or not it would result in a total offset of FAPI depends on the proper determination of the related profit to be attributed to the activities of the relevant personnel.

See summary under s. 95(2)(b).

Written Response

2 December 2014 CTF Conference Q. 8, 2014-0550511C6

Q9. 95(6)(b) – post Lehigh

Question

How will the Federal Court of Appeal’s decision in Lehigh Cement affect the CRA’s interpretation of paragraph 95(6)(b)?

Will the CRA be revisiting its various published positions on paragraph 95(6)(b)?

Notes from Presentation

CRA accepts the Lehigh decision. Accordingly, s. 95(6)(b) applies principally for the purpose of dealing with situations where there has been manipulation of status (i.e., manipulation so as to be a foreign affiliate or so as not to be a CFA). However, CRA will also look at situations where the share percentage ownership was manipulated. Randy noted that the since-enacted s. 212.3 would alleviate concerns about Lehigh-type situations. CRA discussed s. 95(6)(b) in ITTN No. 36 and will consider revising it.

CRA Response

The CRA accepts the decision in the Lehigh Cement case that paragraph 95(6)(b) is generally targeted at acquisitions and dispositions of shares in non-resident corporations that are carried out for the principal purpose of manipulating status of the non-resident corporation for the purposes of subdivision i of Division B of Part I of the Act with a view to avoiding, reducing or deferring Canadian tax. However, the CRA believes paragraph 95(6)(b) could still apply in other contexts such as, for example, in a case involving the manipulation of a taxpayer’s participating percentage in a controlled foreign affiliate.

Going forward, the CRA’s 95(6)(b) Committee intends to review cases and assess whether they include a share investment or divestment in a foreign affiliate that could be considered to have been for the principal purpose of manipulating share ownership in the affiliate in order to secure a tax benefit, such as for example, a subsection 113(1) deduction for a stream of dividends. This may be the case where it could be considered that the share ownership in the foreign affiliate is transitory on the basis that it is reasonable to conclude that a subsequent disposition was contemplated at the outset.

After March 28, 2012, tax planning of the kind in the Lehigh Cement case is generally subject to the foreign affiliate dumping rule in section 212.3. However, we observe that the Technical Notes accompanying the introduction of that provision indicate that the government believes that existing anti-avoidance rules in the Act, including the general anti-avoidance rule in section 245, would apply to certain past cases of this nature. Consideration will be given by the CRA to whether any pre-section 212.3 cases involving foreign affiliate dumping could be challenged under existing anti-avoidance rules, including section 245.

Written Response

2 December 2014 CTF Conference Q. 9, 2014-0550441C6

Q10. Update on folio project

Question

Can the CRA comment on the status of the publication of Folio chapters and provide a schedule for the future release of new chapters?

Notes from Presentation

Good progress is being made on the Folio project. Although some do not like the Folio name, it works both in French and English.

Q11. Rulings update

Question

Can you provide us with an update on changes to the prerulings process?

Notes from Presentation

CRA considers the pre-Rulings consultation process to be a success and it will be continued. In light of the availability of this process, phone consultations as to the potential availability of a ruling will be kept short (e.g., five minutes).