Cases

Swirsky v. The Queen, 2014 DTC 5037 [at 6723], 2014 FCA 36, aff'g 2013 TCC 73, 2013 DTC 1078 [at 431]

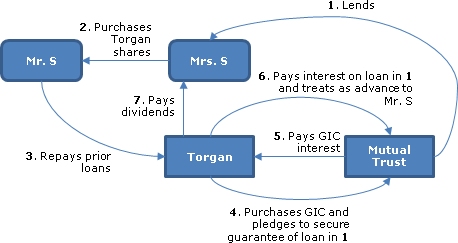

The taxpayer transferred shares in a family real estate development company ("Torgan") to his wife ("Ms. Swirsky") on three occasions in 1991, 1993 and 1995 for creditor-proofing reasons. In the 1991 transactions, his wife borrowed $2.5 million from a trust company ("Mutual Trust") at 11% interest to pay the shares' purchase price, the taxpayer used the sales proceeds to pay off loans owing by him to Torgan, and Torgan used the proceeds to purchase a $2.5 million GIC (bearing interest at 10%) from Mutual Trust. The GIC was assigned by Torgan to Mutual Trust to secure Torgan's guarantee of the Mutual Trust loan to Ms. Swirsky. The interest on the GIC was applied by Mutual Trust to the interest owing by Ms. Swirsky on her loan, and the balance of the interest was paid monthly by Torgan and charged to the taxpayer's loan account (para. 17). The regular application of the GIC interest by Mutual Trust also apparently was treated as advances by Torgan to the taxpayer rather Ms. Swirsky (para. 44), and Paris J. rejected submissions that this treatment of the funding of the interest payments was a mere bookkeeping error (para. 45).

The interest deducted by Ms. Swirsky on her loans totaled $1.445 million by the end of 2003. In 2003 Torgan paid a dividend of $1.573 million on Ms. Swirsky's shares (and dividends also were paid in 2004 and 2005; and a $2.5 million capital dividend was paid in 1999). The taxpayer deducted the interest expenses and other carrying costs of Ms. Swirsky in computing his income by virtue of s. 74.5(1) and also included the 2003 dividend in his income.

Paris J. found that the interest was not deductible to Ms. Swirsky (and, therefore, to the taxpayer under s. 74.5(1)) because she had not borrowed from Mutual Trust for the purpose of earning income from the shares. Operating income previously had been distributed as bonuses, and Ms. Swirsky had little basis for believing that dividends would be paid. Furthermore, her subjective intentions in borrowing the $2.5 million related entirely to creditor proofing.

In the Court of Appeal, Dawson JA stated (at para. 8) that "where the purpose or intention behind an action is to be ascertained, a court should objectively determine the purpose, guided by both objective and subjective manifestations of purpose," before going on to find that Paris J (contrary to the taxpayer's submission) had in, in fact given weight to a number of objective manifestations of purpose, including that Torgan had not paid any dividends prior to 1999 (with bonuses instead being paid) nor did it have a dividend policy in place, and that it could be inferred that Ms. Swirsky instead only had a reasonable expectation of receiving a capital dividend.

Collins v. The Queen, 2010 DTC 5028 [at 6625], 2010 FCA 12

The taxpayers owed approximately $2.7 million on mortgage loans including substantial amounts of interest that previously had been agreed to be deferred and added to the amount of the mortgage. The mortgage loan was restructured so that the taxpayers became obligated to make annual minimum interest payments of $20,000 for each of the first 15 years following the restructuring and had the right at any time within the 15-year period to discharge all amounts on the loan by the payment of the sum of $100,000 plus all of the unpaid interest payments of $20,000 per annum. The restructuring of the loan was stated to be in the form of a refinancing of a portion of the previous mortgage debt on the terms indicated above, with a statement that these amendments did not have the effect of discharging or novating the previous mortgage obligation. For the taxation years in question following the restructuring, the taxpayers sought to deduct unpaid interest amounts that continued to be added to the original amount of the mortgage loan, namely, $154,373, $160,254 and $168,782. The trial judge disallowed the deductions on the basis that they were not "payable" in the year if they were not required to be paid in the year.

The Court of Appeal found that such unpaid interest amounts were deductible in the years of accrual. The taxpayers computed their income on an accrual basis, under which "payable" does not mean "required to be paid." Sharlow J.A. stated (at paras. 24-25):

They are entitled to that deduction even though they were not obliged to pay the full amount of the interest in the year of accrual, and even though the lender would be obliged, if the appellants exercised the settlement option, to forgive most of the obligation to pay principal and interest.

The situation is analogous to that of a limited recourse mortgage loan, where the right of the lender to recover the principal and interest is limited to the proceeds of the sale of the mortgaged property at the end of the term. Even if it is absolutely certain that the value of the property will not cover the mortgage debt, the full amount of the debt remains a legal obligation of the borrower unless and until the mortgaged property is sold.

Scragg v. Attorney General of Canada, 2009 DTC 6024, 2009 FCA 180

Before finding that the taxpayer had failed to discharge the onus on him to establish that money borrowed by him had been used by him to invest in companies owned by him, the Court rejected the (at para. 12) taxpayer's argument that:

"the only difference between his case and Singleton is that he did not bother with the formalities, that is, he did not withdraw his equity from his companies and replace it with borrowed money, but in substance his transaction achieves the same result."

Novopharm Ltd. v. The Queen, 2003 DTC 5195, 2003 FCA 112

A profitable Canadian corporation ("Novopharm") acquired losses approximating $20 million of an arm's-length corporation ("Lossco") through a complicated series of transactions, which in simplified form were as follows:

- two special-purpose subsidiaries of Lossco formed a limited partnership ("Millbank") which borrowed $195 million from First Marathon Capital Corporation ("FMCC") and lent $195 million to First Marathon Inc. ("FMI") with FMI then immediately paying $20 million to Millbank as a prepayment of one year's interest and Millbank utilizing $20 million to pay down the principal of loan owing by it to FMCC to $175 million;

- Lossco acquired a 99.99% limited partnership in Millbank shortly thereafter (and immediately prior to the first fiscal year end of Millbank) thereby resulting in $20 million of income of Millbank being allocated to it, which eliminated its losses;

- the 99.99% partnership interest was transferred for nominal consideration by Lossco to an indirect special purpose subsidiary of Lossco ("540") and 540 then was sold to Novopharm;

- FMCC lent $175 million to Novopharm which used those proceeds to subscribe for shares of 540; 540 made a capital contribution of the same amount to Millbank, which paid off the $175 million loan owing by it to FMCC;

- a year later after $20 million of interest had accrued on the loan owing by Novopharm to FMCC, FMI repaid the $195 million principal amount owing by it to Millbank, Millbank distributed this sum to its partners (substantially 540), 540 purchased for cancellation most of the shares of Novopharm and 540 for $195 million (giving rise to a deemed dividend of $20 million), and Novopharm used the $195 million to discharge the amount owing by it to FMCC (including the $20 million of interest).

The borrowing by Novopharm to acquire shares of 540 (step 4) gave rise to deductible interest (before giving effect to former s. 245(1)) because the redemption of the shares gave rise to a deemed dividend (step 5). Rothstein J.A. stated (at p. 5200):

"The fact that the dividend received by Novopharm was a deemed dividend pursuant to subsection 84(3) is of no consequence. A deeming provision is a statutory fiction that replaces or modifies reality; and it cannot be ignored."

Stewart v. The Queen, 2002 DTC 6969, 2002 SCC 46

After finding that rental condominium properties of the taxpayer represented a source of income and that the interest expense on related borrowings was deductible, McLachlin C.J. stated (at p. 6982) that:

"The appellant's hope of realizing an eventual capital gain, and expectation of deducting interest expenses do not detract from the commercial nature of his rental operation or its characterization as a source of income"

and (at p. 6983):

"In our view, the motivation of capital gains accords with the ordinary business person's understanding of 'pursuit of profit', and may be taken into account in determining whether the taxpayer's activity is commercial in nature."

The Queen v. Canadian Helicopters Ltd., 2002 DTC 6805, 2002 FCA 30

The taxpayer borrowed money from a financial institution. It on-lent $8.95 million of the borrowed funds on an interest-free basis to its parent ("Holdings") and Holdings, in turn, on-lent the funds on an interest-free basis to the parent of Holdings ("CHC") which used those funds to purchase from an arm's length vendor shares of a company ("Viking") in a similar business. Malone J.A. found that the Tax Court Judge had correctly found that interest on borrowed funds that are used directly for an ineligible use (here an interest-free loan) nonetheless may be deductible in exceptional circumstances. Here, the course of action was intended to result in benefits to the taxpayer including the earning of significant management fees and the transfer to it of operations of Viking. Interest on the $8.95 million borrowing was deductible.

Hill v. The Queen, 2002 DTC 1749, Docket: 2000-3636-IT-G (TCC)

Under a non-recourse loan owing by the taxpayer and other tenants of an office building to the non-resident landlord, 90% of the cash flow was applied first to the payment of interest and then designated and paid as rent. If the interest expense (which had been reduced to a 10% rate in the taxation years in question) exceeded the cash flow, the taxpayer could request in writing that the landlord advance the excess to him as an addition to principal, with such excess interest also being added to the principal if no such request was made. By the taxation years in question, the principal had accumulated to well over twice the value of the property.

Miller T.C.J. found that under the terms of the mortgage, the mortgagee could sue for excess interest (i.e., the difference between cash flow and the stipulated interest for the year), and the existence of the taxpayer's liability to pay the excess interest was not contingent on any future event. Accordingly, the excess interest was not contingent.

Furthermore, the payment of accumulated interest in December 1995 with such payment being advanced to the taxpayer as required under the mortgage did not result in any portion of the 1996 and 1997 excess interest being compound interest.

Dansereau v. The Queen, 2001 DTC 5642, 2001 FCA 305

The taxpayer, who was a teacher by profession, owned eight rent-producing property of which seven had to be sold, following a recession, with the shortfall between the proceeds and mortgages on the sold properties being the amount of new mortgages that the taxpayer was required to place on his remaining property.

The taxpayer was able to deduct interest on the new mortgage based on a finding that he was in a business. Given that no management fee of any sort was paid by him, it followed that he saw to the financing, rental, upkeep and improvement of the properties over the years and he pooled the income resulting from the operations. He was engaged in the business of managing and operating the properties as opposed to merely collecting rents.

Singleton v. The Queen, 2001 DTC 5533, 2001 SCC 61

The taxpayer borrowed approximately $300,000 and deposited this sum with his law firm. On the same day, he put almost exactly the same amount, received as a distribution from the firm, towards the purchase of a new home for him and his wife. It was not clear in which order the two transactions occurred.

Because the direct use of the borrowed funds was for the purpose of refinancing the taxpayer's partnership account with debt, the interest on the borrowed money was deductible. To hold otherwise would introduce an inconsistency that interest would be deductible where a partner's initial capital investment was financed with borrowed funds, but not where a partner, who originally financed with his own money, later withdrew that money for personal use and refinanced with debt.

Ludco Enterprises Ltd. v. The Queen, 2001 DTC 5505, [2001] 2 S.C.R. 1082, 2001 SCC 62

A group of Canadian investors, including the taxpayers, invested in the shares of two Panamanian corporations (collectively, "Justinian") whose principal activity was investing in bonds. Each year Justinian paid an annual dividend equal to 1% of the original cost of the share subscriptions in its capital. It was contemplated that the Canadian investors would receive substantially all their return as a capital gain when their shares in Justinian were redeemed (which, in fact, occurred) and that, in the meantime, the earnings of Justinian after payment of the annual dividends would accumulate free of Canadian tax.

In finding that interest (equal to approximately 10 times the dividends received) on money borrowed by the taxpayer (which was traceable to the Justinian share investment) was deductible, Iacobucci J. stated (at paras. 51, 54) that:

[A]bsent a sham or window dressing or other vitiating circumstances, a taxpayer's ancillary purpose may be nonetheless a bona fide, actual, real and true objective of his or her investment, equally capable of providing the requisite purpose for interest deductibility in comparison with any more important or significant primary purpose

...Having determined that an ancillary purpose to earn income can provide the requisite purpose for interest deductibility, ... the requisite test ... is whether, considering all the circumstances, the taxpayer had a reasonable expectation of income at the time the investment was made.

In the present case, even though deferral of income tax was the primary purpose, an ancillary purpose (objectively determined) for subscribing in Justinian with the borrowed money was the earning of (dividend) "income", which in the context of s. 20(1)(c)(i) referred not to net income, but to income subject to tax.

With respect to one of the later taxation years in question, in which one of the taxpayers disposed of its shares of Justinian to a wholly-owned subsidiary on a rollover basis in consideration for both non-interest bearing notes and interest-earning assets (principally preferred shares), Iacobucci J. found that because the value of the income-earning assets received on this transaction exceeded the amount of the borrowed money, those income-producing replacement properties could be linked to the entire amount of the loan with the result that the purpose test continued to be satisfied.

The Queen v. Milewski, 2000 DTC 6559, Docket: A-596-99 (FCA)

The taxpayer financed virtually all of his investment in a limited partnership carrying on the business of renting apartments with borrowed money having a 25-year amortization schedule. Rothstein J.A. held that the finding of the Tax Court Judge that there was an expectation that this debt would be paid down was sufficient to establish a reasonable expectation of profit, so that the taxpayer's appeal of the disallowance of certain losses and interest expense should be allowed.

Létourneau J.A. (with whom McDonald J.A. concurred) went on to indicate (at p. 6561) that "the limited partnership was, admittedly, a viable business with a reasonable expectation of profit" and that the position of the Minister: "postulates that, as a result of the respondent's financial arrangements, the partnership in which the respondent invested did not carry on a business and was not a source of income, but only for the amount of the interest losses exceeding the income produced by the business". In this position was wrong as a matter of logic, law and common sense.

Chase Manhattan Bank of Canada v. The Queen, 2000 DTC 6018, Docket: A-367-97 (FCA)

A subsidiary ("Leasing") of the appellant (the "Bank") had been financed with loan capital received by the Bank, which subsequently had been converted into share capital. Later, in order to shift losses to Leasing, Leasing paid a cash dividend of $45 million to the Bank which was financed, as to $36 million out of the borrowing from the Bank, and as to the balance with cash from its operations. Revenue Canada allowed the deduction of interest only on that amount of the borrowing that was matched by Leasing's retained earnings.

In confirming this treatment, Noël J.A. noted ( at pp. 6018-9) that none of the borrowed money was used to redeem or cancel the share capital, that none of the share capital was converted to debt, and that "except to the extent of the retained earnings the borrowing was not a replacement of monies that had been withdrawn for the business".

Shell Canada Ltd. v. The Queen, 99 DTC 5669, [1999] 3 S.C.R. 622

The taxpayer borrowed NZ$150 million from three non-resident banks by issuing five-year debentures bearing interest at 15.40%. A comparable U.S.-dollar borrowing would have yielded approximately 9.1%. Immediately prior to the borrowing, the taxpayer entered into forward agreements with a different bank that effectively converted the NZ dollar receipts and payments into U.S. dollars, thereby locking in a foreign exchange gain on repayment of the principal.

McLachlin J. found that as the counterparty to the forward contracts was separate from the lenders under the debentures, the principal of the borrowing by the taxpayer was New Zealand dollars and should not be treated as a synthesized U.S.-dollar loan from those lenders - and the fact that the borrowed New Zealand dollars were converted by the taxpayer into U.S. dollars did not detract from the fact that all of the money borrowed under the debentures was used in the business of the taxpayer. Accordingly, interest was deductible at the Canadian-dollar equivalent of the New Zealand dollar coupons actually payable.

Singleton v. The Queen, 99 DTC 5362 (FCA), aff'd supra.

The taxpayer, who was a partner in a small law firm, withdrew $300,000 from his capital account in order to help fund the purchase of a home. Later on the same day, he borrowed $298,750 from a bank and contributed that sum, together with $1,250 of his own funds, into his capital account at the firm. In finding that the interest on the borrowed money was deductible, Rothstein J.A. noted that s. 20(1)(c), unlike other provisions of the Act, did not refer to the purpose of a "series of transactions", that under the jurisprudence reference should be made to the direct use rather than an indirect use of borrowed funds, and that if the two transactions were not to be viewed independently, an unexplained inconsistency would arise, i.e., interest would be deductible on a borrowing to finance an initial capital investment in a law firm or a refinancing of that capital investment, but not in a situation where a partner withdrew funds that he had initially invested of his own and refinanced his investment in the firm with borrowed money.

Hudson Bay Mining & Smelting Co. Ltd. v. The Queen, 99 DTC 5269 (FCA)

The taxpayer repurchased some of its outstanding debentures through brokers. The price negotiations with the vendor focussed on the price exclusive of the interest that was accruing on the debentures, with the final payment being equal to the negotiated price plus the full amount of the accrued interest. In finding that the amount so paid by the taxpayer in respect of the accrued interest was deductible, Strayer J.A. stated (at p. 5270):

"Given the fact that the appellant was the issuer of the debentures and therefore had a legal obligation to pay interest on the prescribed dates twice a year, its repurchase of them by agreement to pay that interest in advance of the repurchase date in reality involved a substitution of a new obligation by the same debtor to pay the same creditor the same rate of interest but for a shorter period. We are satisfied that the transaction of repurchase through a broker involved a mutual understanding that the rate of interest prescribed in the debenture would be paid in addition to the discounted price of the debenture, pro-rated to the date of purchase ... ."

Ludco Enterprises Ltd. v. The Queen, 99 DTC 5153 (FCA), aff'd supra

A group of Canadian investors, including the taxpayers, invested in the shares of two Panamanian corporations (collectively, "Justinian") whose principal activity was investing in Canadian bonds in accordance with the investment advice of a Canadian mutual fund manager who had moved to the Bahamas. Each year Justinian paid an annual dividend equal to 1% of the original cost of the share subscriptions in its capital. Under the planning that preceded the formation of Justinian, it was contemplated that Canadian investors would receive substantially all their return as a capital gain when their shares in Justinian were redeemed (which, in fact, occurred) and that, in the meantime, the earnings of Justinian after payment of the annual dividends would accumulate free of Canadian tax.

In determining not to allow the appeal of the taxpayers, Marceau J.A. found that the Trial Division's finding "that the appellants' true purpose in investing the two companies as structured was to defer tax and transform the income into capital gain - is a finding of fact." In concurring reasons, Desjardins J.A. stated (at p. 5332) that she agreed with the statement in the dissent reasons of Letourneau J.A. "that the taxpayer need only have had a reasonable expectation of income at the moment the investment was made, and that the borrowed money must have been used to acquire property for the purpose of deriving gross, not net, income."

Elmridge Country Club Inc. v. The Queen, 99 DTC 5127 (FCA)

The taxpayer, which was a country club that was found to be subject to tax on interest from the investment of surplus funds pursuant to s. 149(5), was not able to deduct interest on loans incurred by it from time to time to fund cash-flow shortfalls.

Laliberté v. The Queen, 98 DTC 6604, Docket: A-285-97 (FCA)

The taxpayer's husband borrowed $20,000, on the security of a mortgage on a rental property, to pay legal costs in connection with a civil suit unrelated to the rental property, with the taxpayer guaranteeing her husband's loan. The taxpayer borrowed $20,000 pursuant to a second mortgage loan on the property and used the proceeds to pay off the first loan to her husband and, later, repossessed the rental property pursuant to the second mortgage. In finding that the interest paid by the taxpayer on the second mortgage loan was not deductible, Létourneau J.A. noted that the effect of the taxpayer repaying the $20,000 initial loan was to release her from her obligation as guarantor in relation to a personal loan. Accordingly, the second loan did not satisfy the income-producing purpose test.

The Queen v. Sherway Centre Ltd., 98 DTC 6121 (FCA)

A twenty-year bond financing that was secured on a shopping centre owned by the taxpayer provided for the payment, in addition to interest at a fixed rate of 9.75% per annum, of "participating interest" equal to 15% of the operating surplus (as defined) of the shopping centre in excess of $2.9 million per annum. "The 15% rate of participating interest was chosen because it was expected that this rate would increase the yield on the loan to approximately 10.25% (the prevailing market rate) provided the project reaped the benefits of inflation over the term of the loan."

The participating interest paid by the taxpayer was deductible under s. 20(1)(c). The operating surplus was capable of being allocated on a day-to-day basis and, therefore, met the test for day-to-day accrual. Furthermore, given that the participating interest was payable only so long as there was principal outstanding and the only purpose it served was to provide a rate of return on the principal that would approximate a nominal rate of interest for the loan (i.e., 10.25% per annum), the participating interest also satisfied the test that it relate to the principal sum.

Parthenon Investments Ltd. v. MNR, 97 DTC 5343, Docket: A-514-93 (FCA)

The taxpayer was not entitled to deduct interest on a promissory note that it had delivered in payment of a dividend to its parent corporation and which the parent corporation had assigned to an affiliate of the taxpayer with the taxpayer's agreement.

74712 Alberta Ltd. (formerly Cal-Gas & Equipment Ltd.) v. The Queen, 97 DTC 5126 (FCA)

The taxpayer guaranteed a loan which the CIBC made to its parent corporation ("Trennd"), for on-lending to various corporations within the group including the taxpayer. When the CIBC called on its guarantee, the taxpayer used borrowed funds to pay $1.7 million to the CIBC and received a non-interest bearing promissory note from Trennd (1979).

Linden J.A. found that the interest on the borrowing of $1.7 million was non-deductible because, applying the current-use test, the borrowed money was used to pay off the Trennd debts to the CIBC.

In his concurring reasons for judgment, Robertson J.A. found that the concession of the Minister in IT-445 - that interest paid on funds borrowed to honour guarantees given for adequate consideration, may be deducted from income even though the use of such funds has only an indirect effect on the taxpayer's income-earning capacity - had a legal foundation. However, here the consideration (in the broad sense of the word) received by the taxpayer in return for granting the guarantee was inadequate and the granting of the guarantee was intended to facilitate the income-earning capacity of the principal debtor (Trennd) and not the guarantor (the taxpayer).

Brill v. The Queen, 96 DTC 6572 (FCA)

Interest that accrued between January 1, 1987 and the date of judicial sale of a property whose purchase had been financed with borrowed money, was non-deductible. Linden J.A. stated (at p. 6577) that "where it is clear that no profit could be earned in the year or forever after because of the judicial sale proceedings, Moldowan is applicable".

Tennant v. The Queen, 96 DTC 6121, [1996] 1 S.C.R. 305

The taxpayer used the proceeds of a $1 million bank loan to subscribe for common shares of an arm's length corporation ("Realwest"). After his common shares of Realwest had declined in value to $1,000, he (along with other investors in Realwest) transferred the shares of Realwest to a holding company in consideration for non-voting common shares of the holding company, thereby realizing an allowable business investment loss.

In finding that interest on the $1 million loan continued to be fully deductible following the transfer, Iacobucci J. found (at p. 6126) that "it is implicit in the principles outlined in Bronfman Trust that the ability to deduct interest is not lost simply because the taxpayer sells the income-producing property, as long as the taxpayer reinvests in an eligible use property" and noted (at p. 6127) that the alternative interpretation advanced by the Crown resulted in "an irrational asymmetry", i.e., if the replacement eligible property had a lower cost, there would be a loss of an interest deduction whereas, if the replacement eligible property had a higher cost, there would be no increase in the interest deduction.

Riddell v. The Queen, 95 DTC 5526 (FCTD)

A corporation paid the interest on a loan that had refinanced a loan received by its individual shareholder in order to finance a purchase by him of shares of the corporation. After including the resulting shareholder's benefit in the individual's income, Rouleau J. found that the individual should be entitled to a corresponding interest deduction given that the correspondence between the field auditor and his superior indicated that it was Revenue Canada's policy to allow a deduction as if the shareholder had paid the interest himself. Rouleau J. stated (at p. 5533) that "it is not open to the Minister to exercise his discretionary power to implement policy in an arbitrary and capricious fashion".

Farn v. The Queen, 95 DTC 5426 (FCTD)

Interest on mortgages owing by the taxpayers in their 1987 taxation years was found to be non-deductible given that they had defaulted on the mortgages in August 1986 and given their admission that throughout their 1987 taxation years they had no reasonable expectation of earning profit from the mortgaged properties. Pinard J. stated (p. 5435) that "it is clear to me that such properties had effectively ceased to be sources of income from at least the beginning of the plaintiff's 1987 taxation year".

Canassurance, Compagnie d'Assurance-Vie Inc. v. The Queen, 94 DTC 6186 (FCA)

The taxpayer, which was a mutual life insurance company without share capital, received subscriptions to its reserve fund from the Quebec Hospital Service Association and paid interest ("on a sporadic but constant basis") on such subscriptions at a rate of 5% per annum in those years in which it agreed with the Association that it was able to pay interest. The subscription proceeds advanced to the taxpayer were found to be loans given that the Association could not act in any other capacity than that of a lender (for example, it was not a member of the taxpayer). Furthermore, the payments of interest made in the years in question were pursuant to agreements to pay such amounts, notwithstanding that they were not reduced to written form. Accordingly, the interest was deductible.

The Queen v. Mandryk, 92 DTC 6329 (FCA)

Interest paid by the taxpayer on loans which were used to make advances to an insolvent corporation was non-deductible. In response to a submission that the taxpayer made the advances in order to protect income-producing assets from seizure by the bank, MacGuigan J.A. noted that the purpose of preserving income producing assets is an indirect rather than a direct use of funds and, therefore, is not a qualifying use.

Bowes v. The Queen, 91 D.T.C 5310 (FCTD)

The taxpayer was unable to establish that interest on money which initially had been borrowed to acquire a personal residence later was used to finance the acquisition of a rental property. In any event, the rents from the property were approximately 1/5 of the interest expense, so that there was no reasonable expectation of profit.

Livingston International Inc. v. The Queen, 91 DTC 5066 (FCTD), aff'd 92 DTC 6197 (FCA)

The taxpayer borrowed money from its parent in order to redeem high-low preference shares which had been issued on the amalgamation of the two predecessor corporations of the taxpayer, and later borrowed money from another shareholder corporation in order to pay off a portion of the first borrowing. Pinard J. upheld the reassessments of the Minister in which he disallowed interest on the amount of the borrowing which was in excess of the paid-up capital of the redeemed shares and the retained earnings of the taxpayer. He stated (p. 5070) that the borrowing could not "constitute within the reasoning of Trans-Prairie a replacement of capital which has already been used in the business".

Haro Pacific Enterprises Ltd. v. The Queen, 90 DTC 6583 (FCTD)

Amounts styled as "interest" which were paid pursuant to a promissory note which provided that the interest was to be paid "at such times and such amounts" as the directors of the taxpayer would decide, were non-deductible because there was no legal obligation to pay those amounts.

The Queen v. Attaie, 90 DTC 6413 (FCA)

The taxpayer took out a mortgage loan to help finance the acquisition of a Toronto house. The Minister allowed the deduction of interest for the initial period during which the house was rented out, but denied the deduction of interest thereafter when the taxpayer and his family commenced occupying the house as their principal residence in June 1980. At this time, the taxpayer chose not to pay off the mortgage with $200,000 in funds which he received from Iran, because the rate of interest on the mortgage was less than what he could earn on term deposits.

Desjardins, J.A. held that because the use of the borrowed monies in the house continued, and this asset had ceased to be an income-producing one, the interest incurred by the taxpayer ceased to be deductible. The indirect use of the borrowed funds (the earning of a higher return on the term deposits) did not make an interest deduction possible.

Kalthoff v. The Queen, 90 DTC 6378 (FCTD), aff'd 92 DTC 6001 (FCA)

On March 26, 1980 the taxpayer entered into an agreement for the purchase of land for a purchase price of $525,000. The agreement provided that the final payment for the land of $425,000 was due on August 1, 1980 and that interest would accrue on this amount from April 1, 1980 to the date of payment. At the insistence of the bank, a corporation incorporated by the taxpayer ("Kal-A") acquired the lands on August 1, 1980 and executed a mortgage debenture in favour of the bank, although the interest payments actually were paid thereafter by the taxpayer.

The interest which accrued between April 1 and July 31 was deductible under 20(1)(c)(ii), notwithstanding that the taxpayer became aware on May 20 that the bank intended to make the loan to Kal-A rather than the taxpayer. However, the interest in respect of the period after July 31, 1980 was non-deductible because Kal-A rather than the taxpayer was the borrower.

The Queen v. MerBan Capital Corp. Ltd., 89 DTC 5404 (FCA)

The taxpayer, which was engaged in the business of merchant banking, incorporated a subsidiary ("MKH") which in turn incorporated another subsidiary ("Holdings"). MKH and Holdings borrowed money from a bank in order to help fund the acquisition by Holdings of the shares of a public company, and the taxpayer provided the bank an indemnity (which the Crown alleged was in substance a guarantee) in respect of the payment of interest on the loans.

Iacobucci, C.J., in finding that payments made by the taxpayer pursuant to its indemnity were non-deductible, stated:

"paragraph 20(1)(c) requires that for interest to be deductible it must be paid pursuant to money borrowed by the taxpayer and not by someone else. The taxpayer must have created a borrower-lender relationship which gives rise to interest being paid ... If the taxpayer is calculating income from a source, it flies in the face of the intent and language of the Act to allow the taxpayer to deduct interest with respect to the income source of another taxpayer."

The Queen v. Malik, 89 DTC 5141 (FCTD)

Interest on loans which remained outstanding after the taxpayer sold a rental property at a loss was found, following Emerson, to be non-deductible.

Holotnak v. The Queen, 87 DTC 5443 (FCTD), aff'd 89 DTC 5527 (FCA)

The direct use of the proceeds of a loan secured by the taxpayer's rental property was the purchase of his residence, and the interest accordingly was non-deductible.

Bowater Canadian Ltd. v. The Queen, 87 DTC 5287, [1987] 2 CTC 47 (FCA)

After a company (Bulkley") in which the taxpayer and another corporation ("Bathurst") had substantial loan and share investments began experiencing financial difficulties, the taxpayer and Bathurst, at the time of the sale of Bulkley to an arm's length purchaser, agreed to equally guarantee new bank loans which replaced bank loans under which the taxpayer and Bathurst were also liable as guarantors. No payments were made by Bulkley on the new bank loans. Bathurst later acquired the remaining balance of the new notes from the banks for their principal amount and the taxpayer agreed to pay its 1/2 share of this amount to Bathurst in instalments together with interest.

The origin of this indebtedness to Bathurst was the obligations to the banks arising on the refinancing. The use test accordingly was not met, and the interest on the indebtedness to Bathurst was non-deductible. Interest on money which the taxpayer borrowed in order to prepay instalments owing to Bathurst also was non-deductible.

Bronfman Trust v. The Queen, [1987] 1 S.C.R. 32, 87 DTC 5059, [1987] 1 CTC 117,

Interest on money borrowed by trustees in order to make discretionary capital allocations to beneficiaries was non-deductible. Although the trustees could have instead paid the capital allocations by liquidating income-producing assets of the trust, and in this sense an indirect purpose of the borrowing was to preserve income, the court could not ignore the direct use to which the borrowed money had been put. Otherwise, the deduction of interest on borrowings for otherwise ineligible purposes, such as the making of capital gains or the purchase of speculative properties, would be permitted for any taxpayer who owned income-producing assets. "[T]he Act requires tracing the use of borrowed funds to a specific eligible use, its obviously restricted purpose being the encouragement of taxpayers to augment their income-producing potential."

Emerson v. The Queen, 86 DTC 6184, [1986] 1 CTC 422 (FCA)

The taxpayer sought to deduct interest charged on borrowed money that was used to repay a previous loan that had financed the purchase of shares. Since the shares were sold at the same time as the original loan was replaced, there was no source of income for which the interest on the replacement loan was incurred, and the deduction of that interest accordingly was denied. "[A]n essential for interest deductions [under s. 20(1)(c)] is the continued existence of the source to which the interest expense relates."

Even if the alleged indirect use could be considered, the income on the preserved assets was less than 10% of the interest on the borrowed funds.

Toolsie v. The Queen, 86 DTC 6117, [1986] 1 CTC 216 (FCTD)

The taxpayer was found to have borrowed $37,500 to acquire his residence, with the loan being secured by mortgages on two rental properties. The interest on the loan was non-deductible.

The interest payments made by the taxpayer after October 1977 were non-deductible: (1) the arrangements did not provide for the direct receipt of income by the taxpayer and the interest deducted accordingly was not applicable to its business; (2) the amount owing to Bathurst related to the guarantee given in 1972, and the "interest portion on a guaranteed loan is not interest to the guarantor"; and (3) the money was never borrowed from Bathurst and therefore was not borrowed money.

The Queen v. Terra Mining & Exploration Ltd. (N.P.L.), 84 DTC 6185, [1984] CTC 176 (FCTD)

The parenthetical expression refers to the method regularly followed by the taxpayer for financial statement purposes. Thus, where the taxpayer accounted in its financial statements for interest expense on an accrual basis in conformity with ordinary commercial practices and generally accepted accounting principles, it was precluded from computing its income for tax purposes by accounting for interest on the cash basis.

Alberta and Southern Gas Co. Ltd. v. The Queen, 76 DTC 6362, [1976] CTC 639 (FCTD), aff'd 77 DTC 5244 [1977] CTC 388 (FCA), aff'd 78 DTC 6566, [1978] CTC 780, [1979] 1 S.C.R. 36

The taxpayer borrowed $4 million (apparently at a commercial rate of interest) from its banker and paid that sum to Amoco in consideration of Amoco conveying certain working interests to the taxpayer, provided that the working interests would revest in Amoco when the taxpayer received $4 million in cash or the equivalent in petroleum substances, together with interest at 3% per annum. The taxpayer's interest expense was deductible. Cattanach, J. stated: "It is true that the interest rate on the money borrowed from its bank by the plaintiff exceeded the rate that the plaintiff received from Amoco but that does not detract from the fact that the interest the plaintifff received from Amoco was income."

The Queen v. Balmoral Holdings Ltd., 75 DTC 5296 (FCTD)

The taxpayer, one of whose objects was to provide management services to controlled corporations and which was prohibited by its objects from receiving dividends from such corporations, acquired in 1965 and 1966 all but one of the common shares of a company. The acquisition was financed, in part, from borrowed money. Collier, J. held that the taxpayer acquired the shares of the company in order to earn a management fee, and that the prohibition on the deduction of interest on money borrowed in order to acquire property the income from which would be exempt did not apply. Realistically, the taxpayer would never have caused the company to declare dividends.

Sternthal v. The Queen, 74 DTC 6646, [1974] CTC 851 (FCTD)

The taxpayer, who had a large excess of assets over liabilities, borrowed $246,800 from three private companies in which he had investments and on the same day made interest-free loans totalling $280,000 to his children. Interest on the borrowed money was not deductible. Although the taxpayer might have sold assets, loaned the proceeds to the children and then borrowed money to replace the assets, here he chose to find the money for the loans to his children by borrowing, and the fundamental purpose of the borrowing was to make those non-income-producing loans.

Byke Estate v. The Queen, 74 DTC 6585, [1974] CTC 763 (FCTD)

A company purchased by the taxpayers paid interest on money borrowed by the taxpayers to acquire its shares. The taxpayers were not permitted to deduct the interest paid by the company notwithstanding that they were assessed a s. 15(1) benefit in respect of those payments since s. 20(1)(c)(i) "permits a deduction by the taxpayer who paid the interest and not by some other taxpayer".

A similar finding was made respecting s. 20(1)(c)(ii).

MNR v. Yonge-Eglinton Building Ltd., 74 DTC 6180, [1974] CTC 209 (FCA)

In connection with the interim construction of a building, the taxpayer agreed to pay interest on the borrowed money at a rate of 9% plus 1% of its gross rental income from the building for 25 years. Notwithstanding the description of the 1% fee in the loan agreement as "interest", it was not interest because at the time it was paid and deducted, the lender had been reimbursed. "No capital being due there was no basis for the calculation of interest."

Matheson v. The Queen, 74 DTC 6176, [1974] CTC 186 (FCTD)

Interest paid by the taxpayer on a bank loan the proceeds of which had been used to refinance an interest-free loan to a controlled company ("Direct") was non-deductible. "[T]he money borrowed was used by Direct to earn income from its business rather than by the Plaintiff to earn income from his own business."

Lakeview Gardens Corp. v. MNR, 73 DTC 5437, [1973] CTC 586 (FCTD)

In 1954 the taxpayer borrowed money to acquire land inventory, and in 1962 acquired shares (generating exempt dividend income). The Minister was directed to reassess on the basis that the share acquisition was financed first out of available retained earnings, with the balance of the purchase price being financed through the existing indebtedness.

MNR v. Mid-West Abrasive Co. of Canada Ltd., 73 DTC 5429, [1973] CTC 548 (FCTD)

The taxpayer during its 1960 and 1961 taxation years borrowed $210,000 from its U.S. parent. The promissory notes stated "interest will be paid if requested, but not in excess of 6%." After the end of the 1966 taxation year, the parent requested, and was paid, interest for the period from 1962 on.

Sweet D.J. held that the phrase "in respect of the year" refers to the year during which the borrowed money was used and not to the year in which the lender chose to make the request for interest. The pre-1966 interest accordingly was not payable in respect of the taxpayer's 1967 taxation year, the year during which it sought to deduct it.

McLaws v. MNR, 72 DTC 6149, [1972] CTC 165, [1974] S.C.R. 887

The taxpayer provided his personal guarantee to the bank when it was threatening to call the loans it had made to a corporation owned by the taxpayer. The portion of the payments which the taxpayer later made to the bank pursuant to his guarantee that was attributable to the accrued interest due to the bank by the corporation, was not deductible under s. 11(1)(c) of the pre-1972 Act. Hall J. noted that "the interest paid by the appellant was not on an advance made to him but was paid on the principal sum remaining unpaid under his guarantee" (page 1653), and therefore was not paid on borrowed money used by the taxpayer for the purpose of earning income.

Trans-Prairie Pipelines Ltd. v. MNR, 70 DTC 6351, [1970] CTC 537 (Ex Ct)

When the taxpayer started business in 1954 it raised the capital required for its business by issuing common shares for $140,006 and preferred shares for $700,000. In 1956, the taxpayer raised $1 million by way of a bond issue for $700,000 and a common share issue for $300,000. The preferred shares were redeemed by using $300,000 from the common share issue and $400,000 out of the $700,000 received on the bond floatation.

After finding (p. 6353) that the income-producing use test refers to the dedication of "the mass of capital ... through all the different forms through which it passes while it remains in the business" rather than use in the sense of the initial payment made with money, Jackett P. went on to find that the interest on the $700,000 bond issue was deductible in full (rather than as to only 3/7 as alleged by the Crown) on the basis of the following characterization (p. 6354):

"Prior to the 1956 transactions, the appellant's capital used in its business consisted in part of $700,000 subscribed by preferred shareholders. As a result of those transactions, the $700,000 had been repaid to those shareholders and the appellant had borrowed $700,000 which, as a practical matter of business common sense, went to fill the hole left by redemption of the $700,000 preferred."

D.W.S. Corp. v. MNR, 68 DTC 5045, [1968] CTC 65 (Ex Ct), briefly aff'd 69 DTC 5203 (SCC)

The taxpayer (a distilling company) borrowed $3,485,000 from a U.S. subsidiary at 6% interest and on-lent those funds to another subsidiary ("World") in order to finance the acquisition by World of an exceptionally large quantity of unmatured Scotch fillings. Although it was agreed at the time that the taxpayer made the loan to World that interest on such loan might be a subject for later agreement, no agreement was made between the taxpayer and World for the sharing of any profits or losses on the venture or to remunerate the taxpayer for the use of the loaned money. Because there was no right accruing to the taxpayer to interest or to any other kind of remuneration, the income-producing purpose test was not met.

Société coopérative agricole du Canton de Granby v. MNR, 61 DTC 1205, [1961] CTC 326, [1961] S.C.R. 671

In finding that a purported issuance of preference shares was in fact a loan, with the result that the interest thereon was deductible, Cartwright J. noted (p. 1209) that the share:

"provisions are entirely inappropriate to describe the rights of a holder of preferred shares; they are an unequivocal and unconditional promise to pay the principal amount received from the holder at maturity and to pay interest thereon at 5 per cent per annum half-yearly on July 15 and January 15 until the principal has been paid."

Canada Safeway Ltd. v. MNR, 57 DTC 1239, [1957] CTC 335, [1957] S.C.R. 717

The taxpayer, which carried on a retail chain grocery business, used the proceeds of a debenture issue to purchase the shares of a sister company which had been supplying groceries and other products to it at favourable prices and which, following the acquisition of its shares, paid dividends to the taxpayer in excess of the taxpayer's interest expense. It was found that the borrowed capital was being used to purchase shares giving rise to exempt income (dividends) rather than being used in the taxpayer's business. Rand J. stated (p. 1244):

"What is aimed at by the section is an employment of the borrowed funds immediately within the company's business and not one that effects its purpose in such an indirect and remote manner."

Interior Breweries Ltd. v. MNR, 55 DTC 1090, [1955] CTC 143 (Ex Ct)

The taxpayer used money which it had borrowed under temporary bridge financing from a bank to acquire the shares of other brewing holding-companies, and shortly thereafter used the proceeds of loans from subsidiaries of the acquired companies, and of the issuance of bonds and debentures of the taxpayer, to retire the bank indebtedness. The interest on the replacement loans was not deductible because they were used to pay off a loan which had been used to acquire shares producing exempt income. The fact that the acquisition of the holding companies enabled the taxpayer to enter into remunerative management contracts with their subsidiaries was not sufficient to establish interest deductibility.

Stock Exchange Building Corp. Ltd. v. MNR, [1955] S.C.R. 235, 55 DTC 1014, [1955] CTC 5

The taxpayer realized $90 for each $100 bond issued by it in 1929 and invested the net proceeds in an office building. The taxpayer was only entitled to deduct interest on the $90 actually borrowed (because it was found that the reference in s. 5(1)(b) of the Income War Tax Act to "borrowed capital" referred to the amount of money borrowed and not to the extent of the obligation incurred in order to borrow it) and was not entitled to deduct "compound" interest (i.e., default interest on simple interest that was in arrears.) The simple interest in default "was merely a debt which became payable by reason of the inability of the borrower to pay the interest as it fell due. It was not, in any sense, capital used in the business to earn the income."

MNR v. T.E. McCool Ltd., 49 DTC 700, [1949] CTC 395, [1950] S.C.R. 80

An individual transferred the assets of his business to the taxpayer in consideration for the assumption of his business liabilities, the issuance of shares to him and family members, and the giving by the taxpayer of a demand interest-bearing promissory note. Interest on the note was not deductible by the taxpayer pursuant to s. 5(1)(b) of the Income War Tax Act, which provided for the deduction of "such reasonable rate of interest on borrowed capital used in the business to earn the income as the Minister in his discretion may allow". Kellock J. stated (p. 712):

"[I]n order to enable the statute to apply, 'there must be a real loan and a real borrowing'. Here there is nothing more than unpaid purchase money secured by a promissory note which, in my opinion, is insufficient."

Montreal Coke and Manufacturing Co. v. MNR, [1944] A.C. 126, [1944] CTC 94 (P.C.)

In connection with the retirement of old bonds and the issuance of replacement bonds, the taxpayer had to pay interest on both the old bonds and the new bonds for an overlapping period. Lord Macmillan held (at p. 134) that "the overlapping interest was paid as part of the cost of the refunding operations and on money borrowed temporarily in excess of what was required for the purposes of the businesses during the overlapping period, and was thus properly disallowed by the Minister" under s. 5(b) of the Income War Tax Act.

See Also

TDL Group Co. v. The Queen, 2015 TCC 60

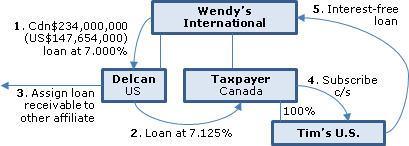

The ultimate parent of the taxpayer's group ("Wendy's International") made a US$147,654,000 loan to a US subsidiary ("Delcan") at 7% interest, which then lent the money at 7.125% interest to the taxpayer. The taxpayer used the funds to subscribe for common shares of its wholly owned subsidiary ("Tim's U.S."), and Tim's U.S., in turn, lent the money interest-free back to the parent. It was intended that this be replaced by an interest-bearing note but, due to delays, this did not occur until eight months later.

Pizzitelli J upheld the Minister's disallowance of the taxpayer's interest deductions under s. 20(1)(c) during the eight-month period.

Respecting the direct use of the borrowed funds, he concluded (at para. 32) that the taxpayer did not have "any reasonable expectation of earning non-exempt income of any kind, directly or indirectly, at the time of its purchase of additional shares in Tim's U.S.," in light of its loss history, the need for cash flow to be reinvested in business expansion, and a 10-year projection showing no dividends. He also suggested (at para. 27, see also para. 31: "or even increased capital gains") that the generation of capital gains also could satisfy the income-earning purpose test in s. 20(1)(c), but that purpose also was not demonstrated.

He further concluded (also at para.32) that "the evidence clearly and unambiguously only points to the sole purpose of the borrowed funds as being to facilitate an interest free loan to Wendy's while creating an interest deduction for the Appellant."

Respecting the relevance of having regard to this intended use by Tim's U.S. of the share subscription proceeds, he stated (at paras. 26, 29):

While Singleton made it clear that there was no room to consider a series of transactions in determining the "use" of the funds ... , the determination of the "purpose" for buying the shares does not preclude looking at the indirect use of the funds or any other relevant factor. All circumstances must be considered. ...

[I]t is clear that for the "purpose" test in paragraph 20(1)(c), the use of funds by the borrower subsidiaries can be considered as part of all the circumstances.

McLarty v. The Queen, 2014 DTC 1162 [at 3556], 2014 TCC 30

On December 31, 1993, the taxpayer and other parties to a joint venture acquired rights to exploit seismic data in consideration for $975,000 cash and a $5,525,000 promissory note (payable only out of 50% of net licensing revenues and 20% of any production cash flow generated out of any petroleum rights acquired by the joint venture) - which the Minister conceded was not a contingent liability.

All of the interest on his share of the note incurred by the taxpayer in his 1994 and 1995 taxation years was paid out of licensing revenues, and Favreau J found that the taxpayer was entitled to capitalize those expenses as Canadian exploration expenses. In 1998 and 1998, while licensing revenues of $53,800 were generated, interest of $242,600 and $262,500 was incurred. Total licensing revenues generated in 1997 to 2006 were close to $1 million. After reciting these facts, Favreau J stated (para. 71):

This shows that the Joint Venture, despite the fact that it had ceased its exploration activities in 1996, continued to earn licensing revenues from the Seismic Data until 2006. This justifies the deduction of the interest payable on the appellant's Promissory Note in the 1998 and 1999 taxation years.

Doulis v. The Queen, 2014 DTC 1054 [at 2933], 2014 TCC 26

Lamarre J dismissed the taxpayer's arguments that he should be able to deduct interest on tax arrears as a business expense. Such deductions were prohibited by s. 18(1)(t).

In any event, the interest payments would not have been deductible under s. 20(1)(c). There was no borrower-lender relationship with the Crown as CRA did not agree to lend money to the taxpayer and the taxpayer instead owed tax under the Act, and there was no contractual agreement between the two parties (paras. 13-14).

Garber v. The Queen, 2014 DTC 1045 [at 2812], 2014 TCC 1

The taxpayers bought units in limited partnerships, each of which was to acquire a large yacht to be used for catered vacation charters. The purported business plan for the 36 partnerships represented a "Ponzi-like scheme [which] was set to collapse eventually" (para. 344, see also 356). The unit purchases were mostly financed by the taxpayers issuing interest-bearing promissory notes, to the partnerships which were falsely represented as being intended to act as security for loans arranged by the general partner to the partnership to finance its intended business.

Rossiter ACJ found (at para. 410):

No such loans existed, and the Limited Partnerships were never capitalized. The Appellants entered into the promissory notes based on fraudulent misrepresentations, and any contractual obligation to pay interest amounts is vitiated by fraud.

Although interest on the notes thus did not satisfy the test that "there must be a legal obligation to pay interest on the amount paid or payable," the other three tests for interest-deductibility were satisfied, including the income –producing purpose test, as to which he stated (at para. 409):

[D]espite the fact that the Appellants were defrauded of their interest payments, they had a reasonable expectation of income at the time of their investment... . The Appellants' expectation of income was only in the long-term and was an ancillary purpose of an otherwise tax-motivated investment, but it nonetheless qualifies... . [emphasis in original]

A.P. Toldo Holding Corporation v. The Queen, 2014 DTC 1042 [at 2787], 2013 TCC 416

The taxpayer was a holding company for various direct and indirect subsidiaries which carried on an operating business. To resolve a shareholder dispute, it purchased for cancellation the shares of a corporate shareholder holding 12.5% of its shares in 10 tranches, each occurring on the same day. The consideration for the first five tranches was paid in cash, and for the last five tranches was paid by the issuance of an interest-bearing $20 million promissory note. The promissory note was repaid on its maturity, one year later, in cash, some of which was borrowed money.

D'Arcy J found that the taxpayer had not established that the interest on the promissory note was "paid in respect of money borrowed in the course of a money-lending business" (para. 58). Accordingly, the interest was not deductible under s. 9.

Nor could the taxpayer deduct the interest under s. 20(1)(c)(ii). This was not "an exceptional fact situation" such as in Penn Ventilator, which justified a finding of a qualifying indirect use of the shares purchased for cancellation (para. 71). Instead, the taxpayer's stated capital and retained earnings were nominal, and there was no evidence that the settled dispute had threatened its sources of income.

Collins v. The Queen, 2009 DTC 286, 2009 TCC 56, rev'd supra

The taxpayers owed approximately $2.7 million on mortgage loans including substantial amounts of interest that previously had been agreed to be deferred and added to the amount of the mortgage. The mortgage loan was restructured so that the taxpayers became obligated to make annual minimum interest payments of $20,000 for each of the first 15 years following the restructuring and had the right at any time within the 15-year period to discharge all amounts on the loan by the payment of the sum of $100,000 plus all of the unpaid interest payments of $20,000 per annum. The restructuring of the loan was stated to be in the form of a refinancing of a portion of the previous mortgage debt on the terms indicated above, with a statement that these amendments did not have the effect of discharging or novating the previous mortgage obligation. For the taxation years in question following the restructuring, the taxpayers sought to deduct unpaid interest amounts that continued to be added to the original amount of the mortgage loan, namely, $154,373, $160,254 and $168,782. In finding that these amounts were not deductible by the taxpayers in computing their income, so that the taxpayers were only entitled to deduct the $20,00 annual interest payments actually made by them, V.A. Miller, J. found that these deferred interest amounts were not "payable". She stated (at para. 29):

"I interpret the word 'payable' in paragraph 20(1)(c) to mean that the interest must be 'required to be paid' or 'due' as opposed to owing. Interest is 'payable' when there is an obligation to pay in the present as opposed to an obligation to pay in the future'."

She also indicated (at para. 38) that the amount of such interest that the taxpayer sought to deduct was not "reasonable", stating, (at para. 38):

"How could the amount of 'interest' be 'a reasonable amount in respect thereof' when it was not an amount that was paid nor was it an amount that had to be paid in the years under appeal?"

Rizak Estate v. The Queen, 2008 DTC 4460, 2008 TCC 434

The taxpayer was unable to deduct interest on an alleged deferred obligation to subscribe for further shares in a company in which it had made an initial subscription for shares given that the only evidence of any legal obligation was a blank subscription agreement and given that (in light of the principle that interest is deductible only when it is payable, the alleged obligation to pay interest on the obligation did not arise until December 31 of a subsequent taxation year.

Tesainer v. The Queen, 2008 DTC 2807, 2008 TCC 101

Interest on money borrowed by the taxpayers to invest in a real estate partnership was found, in reliance on the decision in Moufarrège v. Quebec (Dep. Min. of Rev.), 2005 SCC 53, [2005] 2 S.C.R. 598, to not be deductible in taxation years following the sale through power of sale by the mortgagee of the real estate, on the basis that the source of income thereby had disappeared.

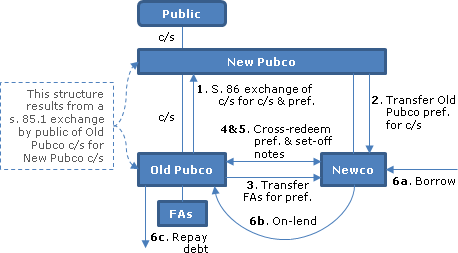

Lipson v. The Queen, 2006 DTC 2687, 2006 TCC 148, aff'd supra.

The taxpayer's wife ("Jordanna") borrowed $562,500 from the Bank of Montreal to fund the purchase of shares of a family company from the taxpayer for $562,500. A day later, the taxpayer and Jordanna borrowed, on a joint and several basis, $562,000 from the Bank secured by a mortgage on a new personal residence that they had just purchased, with the proceeds of that loan being used to pay off the loan the Bank had made to Jordanna. The taxpayer used the share sale proceeds to pay the vendor of the residence. The taxpayer filed his return on the basis that the inter-spousal rollover applied to the share sale and that s. 74.1(1) attributed to him the loss sustained by Jordanna resulting from the deduction of the interest expense on the mortgage loan from the dividend income she received on her purchased shares.

Before going on to find that the GAAR applied to deny the deduction of the interest on the home loan, Bowman C.J. noted that if he had not reached this finding it would not have been necessary, in order to find the interest deductible, that Jordanna had paid the interest notwithstanding that the money to pay the interest came out of a joint account between her and the taxpayer, and also that Jordanna's purpose was to earn income from the shares when at the same time the purpose of the arrangement was that the income on the shares would be deemed to be the taxpayer's for tax purposes.

Crown Forest Industries Ltd. v. The Queen, 2006 DTC 2321, 2006 TCC 47

The taxpayer, which consistently had filed for income tax purposes using the cash basis for computing its deductible interest, was permitted to follow this method for purposes of the Act. The Terra Mining Exploration case (84 DTC 6185) did not give effect to the express language of the Act permitting the taxpayer to follow the cash basis and was not consistent with subsequent decisions finding that there is no unexpressed legislative intention for conformity with generally accepted accounting principles.

Deputy Minister of Revenue of Quebec v. Moufarrège, 2005 DTC 5605, [2005] 2 S.C.R. 598

Interest on loans incurred to purchase real property and shares of a company was not deductible under s. 160(a) of the Taxation Act (Quebec) (which provided that interest paid on a loan used to earn income from a business or property was deductible) given that in the taxation year in question the real property had been sold, and the company was bankrupt. Accordingly, the sources of income had disappeared.

International Colin Energy Corp. v. The Queen, 2002 DTC 2185 (TCC)

The taxpayer paid a fee to a financial advisor, calculated as 0.7% of the market value of its equity and of the amount of its long-term debt net of working capital, in consideration for advice provided in connection with considering alternatives to maximize shareholders' value, with an emphasis on merger possibilities. The transaction ultimately implemented entailed the taxpayer's shareholders selling their shares, pursuant to a plan of arrangement, to another publicly-traded oil and gas company in consideration for treasury shares of that purchaser.

After finding that the fee was deductible in computing the taxpayer's income, Bowman A.C.J. went on to indicate that he found "attractive" the argument that the word "sale" in s. 20(1)(e)(i) did not refer to a sale by the taxpayer company itself (as such an event was covered by the word "issuance") and that "therefore 'sale' must imply something else and the only thing it can refer to is a sale by the shareholders in the course of a corporate transaction of the type involved here where the interests of the corporation are affected".

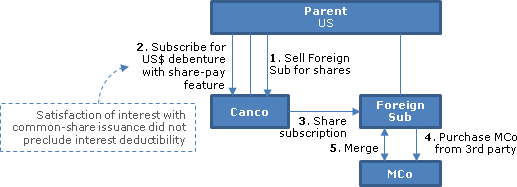

722540 Ontario Inc. and Novopharm Ltd. v. The Queen, 2002 DTC 1307, Docket: 98-2182-IT-G (TCC)

A profitable Canadian corporation ("Novopharm") acquired losses approximating $20 million of an arm's-length corporation ("Lossco") through a complicated series of transactions, which in simplified form were as follows:

- two special-purpose subsidiaries of Lossco formed a limited partnership ("Millbank") which borrowed $195 million from First Marathon Capital Corporation ("FMCC") and lent $195 million to First Marathon Inc. ("FMI") with FMI then immediately paying $20 million to Millbank as a prepayment of one year's interest and Millbank utilizing $20 million to pay down the principal of loan owing by it to FMCC to $175 million;

- Lossco acquired a 99.99% limited partnership in Millbank shortly thereafter (and immediately prior to the first fiscal year end of Millbank) thereby resulting in $20 million of income of Millbank being allocated to it, which eliminated its losses;

- the 99.99% partnership interest was transferred for nominal consideration by Lossco to an indirect special purpose subsidiary of Lossco ("540") and 540 then was sold to Novopharm;

- FMCC lent $175 million to Novopharm which used those proceeds to subscribe for shares of 540; 540 made a capital contribution of the same amount to Millbank, which paid off the $175 million loan owing by it to FMCC;

- a year later after $20 million of interest had accrued on the loan owing by Novopharm to FMCC, FMI repaid the $195 million principal amount owing by it to Millbank, Millbank distributed this sum to its partners (substantially 540), 540 purchased for cancellation most of the shares of Novopharm and 540 for $195 million (giving rise to a deemed dividend of $20 million), and Novopharm used the $195 million to discharge the amount owing by it to FMCC (including the $20 million of interest).

Bowie T.C.J. found that what distinguished this case and the Mark Resources and Canwest cases from Shell, Ludco and Singleton was that in each of the former cases "an elaborate series of transactions was carried out for no other reason than to create an interest deduction in the profitable corporation, while ensuring that the corresponding yield from the borrowed funds became income of the loss company, which then passed into the hands of the profitable company as an intercorporate dividend, free of taxation".

Notwithstanding that Novopharm received a deemed dividend (see 5 above) on its investment of the borrowed funds in 540, it did not borrow those funds (see 4 above) for an income-producing purpose, and the $20 million of interest was not deductible by it.

Penn Ventilator Canada Ltd. v. The Queen, 2002 DTC 1498, Docket: 97-3313-IT-G (TCC)

In order to effect a settlement of litigation brought by some of its shareholders, the taxpayer purchased for cancellation a portion of its common shares for cash and for an interest-bearing promissory note. The principal amount of the note did not exceed the aggregate of the paid-up capital and retained earnings of the taxpayer.

In finding that interest on the note was deductible, Lamarre Proulx T.C.J. indicated that although the promissory note did not represent borrowed money as required by s. 20(1)(c)(i), the test under s. 20(1)(c)(ii) was satisfied on the basis that the shares had been acquired for the purpose of gaining or producing income from the business of the taxpayer given that the promissory note replaced the paid-up capital and retained earnings that were used in the business.

Canada v. Confederation Life Insurance Co., [2001] OJ No. 2610 (Ont SCJ)

Two financial institutions purchased commercial paper in the form of discount notes which had a maturity date subsequent to the date of a winding-up date with respect to the issuer ("Confederation Life"). The note discounts were found to be interest, so that the purchasers could only claim the portion that had accrued up to the date of the winding-up order. Blair J stated (at para. 32):

Accordingly, their claims are for monies loaned to Confederation Life, plus an amount in excess of the monies advanced to reflect a consideration for the use of the monies advanced to the due date. Such a return, or consideration, is normally called "interest".

Sudbrack v. The Queen, 2000 DTC 2521, Docket: 98-2386-IT-G (TCC), aff'd 2001 DTC

Bowman A.C.J. affirmed a reassessment of the Minister which denied 15% of the interest on a loan used to renovate a tourist guest home based on the fact that 15% of the area of the home was used as personal living quarters of the family operating the home.

Dansereau v. The Queen, 2000 DTC 1559, Docket: 98-1868-IT-I (TCC)

A number of properties of the taxpayer were sold by the mortgagees under power of sale for less than the amounts owing. The mortgagees required the taxpayer to place new mortgages on his remaining rental property for the balance owing by him to them. The interest on these new loans was non-deductible because its source of income had been lost when the properties were sold.

The taxpayer was permitted to follow the cash method in computing his interest deductions because this method had always been followed by him.

Meggitt v. The Queen, 2000 DTC 1448, Docket: 1999-1460-IT-I (TCC)

The taxpayer argued that by borrowing to purchase her home, she was able to retain a rental property. In rejecting this argument and finding that the interest on that borrowing was non-deductible, Bowman TCJ. noted that a similar argument had been rejected in Bronfman and indicated (at p. 1450) that even if the Singleton decision "supported the appellant's position I would be obliged to follow Bronfman with which Singleton is impossible to reconcile".

Gagnon v. The Queen, 99 DTC 845, Docket: 97-3058-IT-G (TCC)

Bowman TCJ. indicated (at p. 849) that the fact that interest payments were made on money borrowed through non-recourse loans that were secured by an assignment of shares owned by the taxpayer was stated to be irrelevant.

C.R.B. Logging Co. Ltd. v. The Queen, 99 DTC 840, Docket: 96-95-IT-G (TCC), aff'd , 2000 DTC 6547, Docket: A-242-99 (FCA)

The taxpayer borrowed approximately $1.9 million from a Canadian bank and used the proceeds to subscribe for preferred shares of a company ("Meager") that used the funds to acquire the shares of the two controlling shareholders of the taxpayer. Sarchuk TCJ. found (at p. 843) that:

"There could be no realistic expectation of dividend income from the preferred shares because Meager had no income source of substance independent of the existence of C.R.B.'s business ... . In essence, CRB financed its own acquisition."

Accordingly, the interest on the bank loan was non-deductible.

Sarchuk TCJ. also noted that any income source to which the loan might have related disappeared when the preferred shares were redeemed.

Lewisport Holdings v. The Queen, 99 DTC 253 (TCC)

After a bank crystallized two floating debentures for debts owing by a land development company and its parent, the taxpayer used borrowed money to make a payment of $2.1 million pursuant to its obligation under a guarantee and received, in return, the two debentures. In finding that the interest on the borrowed money was deductible, Teskey TCJ. stated (at p. 259) that the taxpayer "believed the value of the properties was there and based on that, made business decisions that ought not to be second guessed".

Chisholm v. The Queen, 99 DTC 150, Docket: 96-3332-IT-I (TCC)

The taxpayer gifted a portion of his common shares of a family small business corporation to a trust for his children utilizing the rollover provisions of former s. 73(5) and then, approximately one month later, repurchased the shares in consideration for an interest-bearing promissory note. The trustee then issued a direction to him "to reinvest the interest payments due to the undersigned with respect to the Promissory Notes as you shall deem fit in the names of each of the children". the taxpayer was able to demonstrate that various expenditures he made on his children exceeded the amount of the interest on the notes.

In finding that no interest had been paid on the notes, Mogan TCJ. stated (at p. 155):

"In the absence of any evidence of accounting by Douglas to the trustee whereby the trustee could be satisfied that the annual interest payments had, in fact, been made and reinvested (whatever that word means) for the benefit of the children, I am not prepared to conclude that Douglas paid any interest ... ."

In any event, given that the dividends received on the shares that he repurchased were only a small fraction of the interest payable on the notes, the taxpayer was found to have repurchased the shares for the purpose of an estate plan rather than for an income-producing purpose.

Aitchison v. The Queen, 98 DTC 1956 (TCC)

The taxpayer borrowed money in order to acquire shares of a private mortgage investment corporation which, some years later, redeemed the shares, with the taxpayer using the proceeds to acquire mortgages from the corporation. Sobier TCJ. found that interest on the borrowed money continued to be deductible notwithstanding that the interest received on the mortgages was less that the interest on the borrowed money, given that the time of the redemption, the taxpayer had every right to believe that there would be sufficient income to more than cover the interest.

Canadian Pacific Ltd. v. The Queen, Docket: 95-3534-IT-G (TCC)

Although he would have decided the appeal on a different basis if not bound by authority, Bonner TCJ. applied the finding in the Shell Canada case to a similar set of facts in concluding that the true interest payable by the taxpayer should be an amount that represented an amortization of the gain to be realized under the forward currency purchase, and on the basis that the reasonableness limitation in s. 20(1)(c) was to be measured by reference to a reasonable rate of interest for the borrower to pay and not the rate which was reasonable for a lender to charge.

Mohammad v. The Queen, 97 DTC 5503 (FCA)

After finding that it was not proper of the Tax Court Judge to apply s. 67 to disallow a portion of the interest expense incurred by the taxpayer on the ground that the taxpayer had acquired a rental property with 100% debt financing, Robertson J.A. stated (at p. 5510):

"Certainly, the fact that a property was acquired with full financing is not a bar to deducting a rental loss, nor a ground for reducing the amount of interest that is deductible."

Integrated Wood Research Inc. v. The Queen, 98 DTC 1258 (TCC)

Before going on to find that interest accrued by the taxpayer was an expenditure for purposes of ss.194 and 37, Bonner TCJ. stated (at p. 1261):

"Firstly a transaction may be a loan even though lender and borrower do not deal with each other at arm's length. Secondly neither the presence of a high risk of default nor an actual default will convert a transaction which begins as a loan into something else or free the borrower from the obligation to pay interest under the loan agreement. Thirdly the recognition by a lender in its books of account that a receivable has become worthless does not free the debtor from its obligations under the loan agreement."

Robitaille v. The Queen, 97 DTC 1286 (TCC)

During a three-day period in 1985 the taxpayer, who was a partner in a law firm, withdrew $100,000 from his capital account, purchased a private residence for $113,500 in cash, mortgaged the residence for $100,000, and used the mortgage proceeds to restore his capital account. On January 31, 1988, he used $25,000 that he had obtained on further mortgaging his residence to make a contribution of capital to his firm while, at the same time, withdrawing $25,000 from the firm in order to make renovations to the residence.

In finding that the interest on both loans was not deductible, Dussault TCJ. stated (at p. 1292) that "investment in the law firm already existed and the purpose of the loans was only to reimburse money withdrawn and used for personal purposes a few days earlier in 1985 and on the same day in 1988".

Barbican Properties Inc. v. The Queen, 97 DTC 122 (TCC), briefly aff'd 97 DTC 5008 (FCA)

The taxpayer financed the purchase of "distressed" properties from the Royal Bank through non-recourse loans received from the Royal Bank which provided that to the extent that net operating revenue from each property was insufficient to cover the interest payable in that year, it was entitled to defer payment of the interest until the earlier of the maturity of the loan or the sale of the property. The interest whose payment, in fact, was deferred under these arrangements was not deducted by the taxpayer in its financial statements.

In affirming the denial by Revenue Canada of the deduction of the deferred interest, Margeson TCJ. found that there was uncertainty as to whether payment of the deferred interest ever would occur and that the deferred interest liability was contingent rather than a binding future liability.

WP Graphics Inc. v. The Queen, [1996] TCJ. No. 146 (TCC)

The taxpayer borrowed money in order to pay a dividend to a recent corporate purchaser of its shares which, in turn, used those monies to pay the purchase price for the shares to the individual vendors. Bowman TCJ. found that the Minister, by disallowing interest deductions by the taxpayer only to the extent that the borrowed money exceed the retained earnings of the taxpayer, had "adopted an approach that was very fair to the taxpayer".