Subsection 17(1) - Amount owing by non-resident

Cases

Liampat Holdings Ltd. v. The Queen, 96 DTC 6020 (FCTD)

The taxpayer's counsel was unsuccessful in an argument that the deemed receipt of interest pursuant to s. 17(1) was a rebuttable rather than an irrebuttable presumption. Accordingly, the taxpayer was required to recognize deemed interest income on a loan made to a U.S.-resident related corporation where under the oral terms governing the loan, interest was only payable when the non-resident could afford to pay it or when the non-resident was wound up.

See Also

Upper Lakes Shipping Ltd. v. MNR, 92 DTC 2381 (TCC)

An agreement between the taxpayer and the other arm's length shareholder of a Bermudan subsidiary ("Open Bulk") provided that to the extent that Open Bulk was unable to obtain bank financing each shareholder would fund 1/2 of the capital needs of Open Bulk through the making of loans payable on demand and bearing interest at the rate of 5% "or such other rate as the parties hereto may from time to time agree". The loans were made between 1971 and 1977.

Christie A.C.J. found that the pre-1979 version of s. 17(1) "clearly implied that 5% per annum was interest at a reasonable rate regarding loans preceding that date" (p. 2383) and that the amendments effective January 1, 1979 (which replaced the reference to 5% with a reference to the prescribed rate) should not be interpreted as "having the retrospective effect of creating new obligations on [the taxpayer] regarding the amount of interest to be included in computing its income commencing January 1, 1979, with respect to the loan transactions it had entered into with Open Bulk prior to that date" (p. 2384). Accordingly, s. 17(1) did not apply given that the taxpayer continued to charge interest on the pre-1979 loans at a rate of 5% per annum.

Leonard Reeves Inc. v. MNR, 91 DTC 425 (TCC)

The Minister conceded that s. 17 of the Act does not authorize the imputation of interest with respect to loans made by a Canadian corporation to a partnership.

E.H. Price Ltd. v. MNR, 91 DTC 135 (TCC)

Trade accounts receivable owing to the taxpayer by an Australian corporation in respect of merchandise shipped to the Australian corporation by the taxpayer for resale did not constitute loans for purposes of s. 17(1).

A.C. Simmonds & Sons Ltd. v. MNR, 89 DTC 707 (TCC)

Because a U.S. affiliate ("Dynacharge U.S.") of the taxpayer had insufficient bank credit, the taxpayer obtained letters of credit addressed to Japanese suppliers of Dynacharge U.S., and was reimbursed by Dynacharge U.S. for the expenses the taxpayer incurred (including interest and commissions) in arranging for the credits. Christie A.C.J. held that s. 17(1) did not apply to this arrangement notwithstanding that amounts paid in respect of the letters of credit were reflected as assets (labelled "Due from affiliated companies") in the taxpayer's balance sheet. He stated:

"[S]ubsection 17(1) is only concerned with money loaned ... I do not regard what was done by the appellant in establishing those credits and the benefit flowing from them to Dynacharge U.S. as constituting the creation of contracts between them whereby the appellant delivered sums of money to Dynacharge U.S. upon agreement by the latter to repay them without interest."

Administrative Policy

9 March 2011 T.I. 2003-0017231E5

The phrase "owes an amount" in s. 17(1) is not limited to money that is loaned, and includes unpaid consideration, amounts owing to a corporation in Canada, accrued liabilities in its favour and unpaid dividends. In determining how long an amount has remained outstanding, the relevant period commences when the amount becomes owing to the corporation resident in Canada. For example, if a foreign corporation transfers a loan to a Canadian corporation, s. 17(1) does not apply if the loan is repaid less than 12 months later, even if the loan was outstanding for more than a year.

16 February 1995 T.I. 943224 (C.T.O. "Interest on Loan to Non-Resident")

Where the non-resident subsidiary subsequently becomes resident in Canada, s. 17(1) will cease to apply to any amounts still outstanding after that time.

October 1992 Central Region Rulings Directorate Tax Seminar, Q. K (May 1993 Access Letter, p. 231)

The reasonable rate of interest should reflect the amount that the lender would expect to receive if the loans were made on an arm's length basis.

12 March 1992 T.I. 5-910839

With respect to an advance made by a Canadian licensor to a U.S. licensor that was repayable only out of royalties to be earned by the licensor, RC stated that "generally where the agreements in question do not contain an unconditional covenant to repay the principal amount of money advanced, the transaction cannot be considered to represent the loaning of money".

10 March 1992 T.I. (Tax Window, No. 17, p. 20, ¶1800)

An advance by a Canadian corporation to an unrelated U.S. corporation to assist the U.S. corporation in the development of specific computer software programs, where the advance is recoverable by the Canadian corporation by way of set-off against its royalty obligations to the U.S. corporation, the advance will not be a loan because there is no unconditional covenant to repay the principal amount of the advance and because the Canadian corporation must look exclusively to the commercial success of the software for reimbursement.

6 February 1992 T.I. 903218 (March 1993 Access Letter, p. 68, ¶C9-257; Tax Window, No. 16, p. 23, ¶1734)

S.17(1) will not apply if it is determined that nil is the reasonable rate of interest in the particular situation.

91 C.R. - Q.52

Re consequences of repossession by a non-resident individual.

17 April 1991 Memorandum (Tax Window, No. 2, p. 17, ¶1203)

On a merger of a direct U.S. subsidiary with a grandchild U.S. subsidiary under U.S. laws which provide that the assets and liabilities of a corporation which cease to exist on the merger are acquired by the survivor corporation, a loan between the Canadian parent and the grandchild subsidiary will be extinguished and s. 17(1) will cease to apply. On the other hand, where a Canadian corporation amalgamates with its wholly-owned subsidiary, the amalgamated corporation will be deemed by s. 87(2)(e) to have acquired a loan which the Canadian parent had made to a U.S. corporation which was a wholly-owned subsidiary of its Canadian subsidiary, with the result that s. 17(1) will continue to apply. The relieving provisions of s. 17(3) does not apply in the absence of a rule analogous to s. 87(7).

3 October 1990 Memorandum (Tax Window, Prelim. No. 1, p. 19, ¶1029)

Where a Canadian lender assigns the non-resident loan, s. 17(1) cannot apply to the assignee because the assignee did not make a loan to the non-resident debtor.

Articles

N. Boidman, "Revised Loan Proposals would Hit both Canadian and Foreign-Based Multi-Nationals: A Startling About-face", Tax Management International Journal, Vol. 28, No. 2, February 12, 1999, p. 75.

Elinore J. Richardson, A. Nikolakakos, "Proposed Amendments to the Taxation of Foreign Source Income", Corporate Finance, Vol. VII, No. 1, 1998, p. 574.

Subsection 17(2) - Anti-avoidance rule — indirect loan

Administrative Policy

2012 Ruling 2012-0452291R3 - XXXXXXXXXX - ATR

underline;">: Existing structure.

A Canadian public company (Pubco) has x% (apparently, over 50%) of its common shares held by a non-resident public company (Norco1). Pubco holds a y% indirect equity interest in a non-resident corporation (Opco), which holds the "Project" in Country 3 (perhaps, a development stage mining project), and is also resident in Country 3. A local government-owned corporation (Stateco), which has an entitlement to elect certain of the Opco directors, holds the balance of the shares of Opco. The indirect equity stake of Pubco in Opco is held partly through Forco2 (resident in Country 2), which is a subsidiary of Forco1 (also resident in Country 2), which is held by Pubco and a Canadian subsidiary of Pubco ("Cansub"). The balance of the equity stake is held through a chain of non-resident holding companies (Holdco1, holding Holdco2, holding Holdco3) resident in three different non-Canadian jurisdictions.

Proposed transactions

Additional internal debt and equity financing will be provided to Opco in accordance with the thin capitalization rules of the local country (Country 3), in accordance with two sets of transactions.

- Pubco (acting through a branch in Country 1 – assumed here to be Luxembourg) will subscribe with cash for common shares and/or mandatorily redeemable preferred shares ("MRPS") of Finco. Finco is a Luxembourg company (likely, a S.à r.l.). The MRPS are voting, do not bear dividends, are convertible at any time into a fixed value of Finco common shares or another class of MRPS at the holder's option, are redeemable before the maturity date at the holder's option and are required to be redeemed by Finco on the specified maturity date. They are debt for Luxembourg tax purposes, but shares for Luxembourg corporate purposes.

- Finco will lend the net proceeds (as the Finco Loan) to Forco2 which, in turn, will use the proceeds to make the Forco2 Loan (bearing interest at a positive spread) to "XXXX" which, in turn, will acquire common shares of Opco, to be used by Opco for its operational and capital requirements.

- Forco2 will transfer a portion of its shares of Opco to XXXX in exchange for an interest-bearing limited recourse obligation (Note A)

- Finco, upon a further subscription by the Luxembourg branch of Pubco for common shares or MRPS, will lend the net proceeds (as Loan X, bearing interest at a positive spread) to Forco2 which, in turn, will use the proceeds to make Loan Y to Opco for its operational and capital requirements.

- Pubco (and/or Cansub) will subscribe cash for Equity Investment A in Forco1, which will use such proceeds to make Equity Investment B in Forco2, which will use such proceeds to make Equity Investment C in Opco

Rulings

- Application of s. 95(2)(a)(i) to income on Forco2 Loan and Note A, and s. 95(2)(a)(ii)(B) to Finco Loan

- Non-application of ss. 17(1) and (2) to Pubco

- Non-application of ss. 95(6)(b) and 17(4)(b) to Pubco's direct acquisition of shares in Finco or its indirect acquisition of shares of Forco2

- Non-application of s. 258(3)

- Opinion that s. 212.3(2) may apply as "the exception provided for in subsection 212.3(16) may not be met here"

- Finco is a corporation, ownership interests in Finco are shares, and distributions of its profits are dividends (and similarly re Forco2 and Opco)

Articles

Joanna R. Barsky, "CCRA Oversteps its Bounds With Outbound Loans", Canadian Current Tax, Vol. 16 No. 1, October 2005, p. 1.

Allan R. Lanthier, "Not Comfortably in Debt", Canadian Tax Highlights, Vol. 8, No. 9, 26 September 2000, p. 70.

Subsection 17(3) - Exception to anti-avoidance rule — indirect loan

Cases

Massey-Ferguson Ltd. v. The Queen, 77 DTC 5013, [1977] CTC 6 (FCA)

It was found that the taxpayer had loaned funds on a non-interest-bearing basis to a wholly-owned Canadian subsidiary ("Verity") whose business included the making of loans to affiliates, and that Verity as a part of that business on-lent the funds to a U.S. operating subsidiary ("Perkins"), notwithstanding that the funds in question were transferred directly from the taxpayer to Perkins and notwithstanding that Verity had no bank account or employees. The Crown's contention, that the loan should be regarded as having been made directly by the taxpayer to Perkins, and that the supposed routing of the loan "via" Verity was a sham, accordingly failed.

See Also

Distillers Corp - Seagrams Ltd v. MNR, 80 DTC 1649 (T.R.B.)

An indirect subsidiary of the taxpayer did not qualify as a subsidiary controlled corporation given that "the word 'belong' means that the shares must belong directly to the parent company". (p. 1659)

Administrative Policy

31 January 1994 T.I. 5-933183 -

RC's answer to Question 10 of the 1988 Revenue Canada Round Table remains the same.

93 CPTJ - Q.4

S.17(3) will not apply where a Canadian corporation loans money on an interest-free basis to a U.S. holding company which then uses the proceeds to make an interest-bearing loan to, or to subscribe for shares of, its U.S. operating subsidiary, notwithstanding that the results of the two U.S. corporations are consolidated for U.S. tax purposes.

91 CPTJ - Q.8

The exception in s. 17(3) will not apply where a Canadian parent makes an interest-free loan to its wholly-owned U.S. subsidiary (a holding company) which in turn re-loans the amounts on an interest-free basis to a wholly-owned operating U.S. subsidiary.

17 April 1991 Memorandum (Tax Window, No. 2, p. 17, ¶1203)

Where a Canadian corporation makes a non-interest bearing loan to its wholly-owned U.S. subsidiary and then transfers the shares of the subsidiary to its Canadian parent (i.e., a grandparent of the U.S. subsidiary), after the transfer s. 17(3) will no longer apply to the loan because the U.S. subsidiary is no longer a "subsidiary controlled corporation" of the Canadian transferor.

26 March 1990 T.I. (August 1990 Access Letter, ¶1366)

In light of the meaning given to the word "belongs" by the trial judge in Massey-Ferguson, the term "subsidiary controlled corporation" does not include a second-tier foreign affiliate.

88 C.R. - Q.10

If the activities of the subsidiary consisted of financing other corporations, then the number of loans and the reasonableness of the interest rate charged would be factors in deciding whether these activities were a business.

80 C.R. - Q.28

If the principal activity of a nonresident subsidiary controlled corporation consists of financing other corporations, then the number of loans and the reasonableness of the interest rates charged would be factors in deciding whether the activities were a business. [C.R.: 20(1)(p)]

S.17(1), in any event, would not be applied if the subsidiary used the loan proceeds to subscribe for shares or make an interest-bearing loan to another nonresident subsidiary corporation, and such end user employed the funds in its business.

79 C.R. - Q.25

Where the funds are invested by the wholly-owned foreign subsidiary ("WOS") in a controlled subsidiary for use in gaining or producing income from its business, RC will not normally impute interest if the only undertaking of WOS is investing in its subsidiaries.

Subsection 17(7) - Exception

Articles

Mark D. Brender, Marc Richardson Arnould, Patrick Marley, "Cross-Border Cash-Pooling Arrangements Involving Canadian Subsidiaries: A Technical Minefield", Tax Management International Journal, 2014, p. 345.

Cash pooling description (p.345)

[W]e will examine a typical cash-pooling arrangement involving a Canadian subsidiary of a multinational group. Under such an arrangement, each member of the pool, including the Canadian subsidiary ("Canco"), transfers funds to, and/or receives funds from, a group member that is designated as the pool head, in this case a foreign subsidiary ("Forco") of the foreign parent corporation, resulting in intragroup payables and receivables between the pool members, including Canco and the pool head.

Effect of withholding refund (p. 346)

Where §15(2) applies, the amount of the loan from Canco to the pool head is deemed to be a dividend, and therefore subject to Canadian withholding tax at a rate of 25%, unless reduced under a tax treaty, and the interest imputation rule in §80.4(2) will not apply. A refund of the withholding tax is generally available under §227(6.1) when the loan is repaid (other than as part of a series of loans and repayments). In addition, to the extent withholding tax has been paid with respect to the loan, §17(1) will not apply to treat the pool head as having accrued interest. However, if on the repayment of all or any portion of the loan the pool head claims a refund of the withholding tax, §17(1) will apply to impute interest income to Canco on the amount owed by the pool head. A claim for a refund of withholding tax must be made by written application by the pool head within two years after the end of the calendar year in which the repayment was made.

Subsection 17(8) - Exception

Administrative Policy

2011 Memorandum 2011-0414111I7 F

where a taxable Canadian corporation makes a non-interest bearing loan to its controlled foreign affiliate which, in turn, uses the proceeds to acquired the debt of another CFA, s. 17(8)(a)(ii) will not be available as the acquired debt would not be considered to be a loan to the second CFA. The term loan requires an express or implied agreement between the parties under which one person advances or delivers funds to another and the latter agrees to return a sum equivalent to the borrowed amount at a future time.

Subsection 17(8.1) - Borrowed money

Paragraph 17(8.1)(b)

Administrative Policy

5 June 2015 Memorandum 2015-0569061I7 F - Non-interest-bearing loan to a controlled foreign affiliate

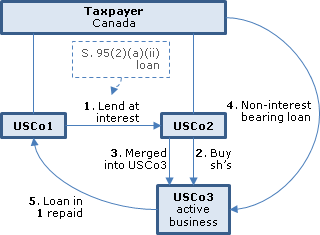

CFA 2, a controlled foreign affiliate of the taxpayer (a corporation resident in Canada), used the proceeds of a loan received from another CFA (CFA 1), to acquire from a third party (and as its only asset) shares of a corporation carrying on an active business (CFA 3). The interest paid by CFA 2 to CFA 1 was deemed active business income under s. 95(2)(a)(ii)(D). The following year, CFA 2 was merged into CFA 3, with CFA 3 as the survivor. The interest now payable by CFA 3 to CFA 1 was recharacterized under s. 95(2)(a)(ii)(B). In the third year, the taxpayer made a non-interest-bearing loan to CFA 3 to fund the repayment by CFA 3 of the loan owing to CFA 1. Did the exception in s. 17(8) apply? The Directorate responded (TaxInterpretations translation):

[P]aragraph 17(8.1)(b) provides that the following conditions must be satisfied in order the the use of the money borrowed by CFA 3 from the taxpayer to be deemed to the same as for the amount owing by CFA 3 to CFA 1: first, CFA 3 must owe an amount for property previously acquired; second, such amount must have been in respect of the acquired property throughout the period commencing with the moment when the amount became owing by the CFA and ending at the moment when the amount was paid; third, the property must have been acquired and the amount must have become owing by the CFA after the time that it last became a CFA of the taxpayer; and, fourth, the property acquired must have been used by the CFA principally to earn income from an active business or income which is recharacterized as income from an active business by virtue of subsection 95(2).

[T]o the extent that it can be established that the amount owing which was assumed by CFA 3 on the merger was in respect of assets previously acquired by CFA 3 in the course of carrying on an active business, the loan to CFA 3 by the taxpayer should be considered as having been incurred for the purpose of earning income form an active business. Under our understanding of the facts, such a link between the amount owing and the assets acquired by CFA 3 before the merger can be made out in the present case, because the assets of CFA 3 were used principally for the earning of income from an active business and the taxpayer can accordingly access the exception in subparagraph 17(8.1)(b)(i), by virtue of the application of paragraph 17(8.1)(b) and subsection 17(8.2) to the repayment of the amount owing by CFA 3 to CFA 1.

Subsection 17(11.2) - Back-to-back loans

Administrative Policy

9 March 2011 T.I. 2003-0017231E5

CRA considers a deposit with a bank or other financial institution to be a loan to the institution, including for the purposes of s. 17(11.2).

Subsection 17(15) - Definitions

Controlled foreign affiliate

Articles

Angelo Nikolakakis, "Lehigh Cement Limited v. The Queen – A Bridge Too FAAAR", International Tax Planning, Volume XIX, No. 1, 2013, p. 1284

In the course of a submission that it was contrary to the scheme of the Act to apply s. 95(6)(b) to attack indirect loans to a non-resident parent, he stated:

Purpose of CFA definition (p. 1290)

- Earlier changes to section 17 (introduced under the 1998 federal budget) also directly targeted the establishment of a Finco to make an "indirect loan" to a borrower Opco that was held by a non-resident ultimate parent corporation, but only where the borrower Opco was not a "controlled foreign Affiliate" under a special definition of that term that required Canadian control, though again not necessarily by the Finco owning taxpayer, and again subject to a transitional period. It cannot be that paragraph 95(6)(b) applies to defeat a structure that is deliberately facilitated by subsections 17(3)(and (8).

Exempt loan or transfer

Administrative Policy

2012 Ruling 2011-0417711R3

Canco, which is a grandchild subsidiary of Parentco (a resident of Country 1), borrows money from time to time under note offerings in Canada or through issuing commercial paper in Canada, in each case, under a Parentco guarantee, and uses the proceeds to make interest-bearing loans (at not less than the rate prescribed under Regulation 4301(c), and at a positive spread, and at a term of X to Y years) to non-resident members of the Parentco group which are not foreign affiliates of Canco.

Rulings that such loans will be exempt loans under s. 17(15), and will not be subject to s. 15(2) by virtue of s. 15(2.3).