Subsection 20(3) - Borrowed money

Cases

The Queen v. Shore, 92 DTC 6059 (FCTD)

The taxpayer and his wife gave a mortgage on their Thamesford home to raise approximately $42,000 for use in their new business. They then sold their Thamesford home, with the purchaser assuming the mortgage, and purchased a new home in Stratford which was encumbered by a mortgage in favour of Victoria and Grey Trust of a similar amount to the Thamesford mortgage. In finding that the interest on the Stratford mortgage was deductible, Strayer J. stated (p. 6061):

"The reality of that transaction, in taking on a house encumbered by the mortgage in favour of Victoria and Grey Trust similar to the one on their previous residence, was in essence the replacement of one borrowing of money for the purpose of their business by another borrowing of money for the same purpose, thus bringing it within subsection 20(3) ..."

Administrative Policy

6 March 2015 Folio S3-F6-C1

1.99 Refinancing. Subsection 20(3) provides a deeming rule where a taxpayer uses borrowed money to repay money previously borrowed, or to repay an amount for previously acquired property described in subparagraph 20(1)(c)(ii). Where this occurs, for the purposes of paragraph 20(1)(c), the borrowed money will be deemed to be used for the same purpose as the original borrowing, or as having been used to acquire the same property, as the case may be.

24 August 1994 T.I. 942051 (C.T.O. "Interest Deductibility")

Where the assets of a proprietorship are transferred to a corporation for consideration including a note payable, interest on money borrowed by the corporation from a financial institution to repay such note will be deductible.

5 January 1993 T.I. (Tax Window, No. 28, p. 10, ¶2395)

Where a loan subject to s. 20.2(2) is refinanced, s. 20(3) will apply to treat the new loan as a continuation of the old loan.

Subsection 20(4) - Bad debts from dispositions of depreciable property

Cases

Picadilly Hotels Ltd. v. The Queen, 78 DTC 6444, [1978] CTC 658 (FCTD)

It was found that some default in payments by a purchaser of depreciable property, and some doubts by the taxpayer-vendor as to the purchaser's management abilities, did not establish, on the balance of probabilities, that the amounts payable by the purchaser were uncollectible, and thus bad debts.

Belle-Isle v. MNR, 64 DTC 5041 (Ex Ct), briefly aff'd 66 DTC 5100, [1966] R.C.S. 354

After finding that the taxpayer has sold depreciable property for proceeds of disposition in excess of the original capital cost, Dumoulin J. noted that, although a portion of the consideration represented a mortgage which would not be paid over an extended period of time:

"The deferral of these debts creates no eventual prejudice to the appellant-vendor in the event of the financial ruin of the purchaser, since section 11(3d) ... assures the former a sufficient amount of protection." (p. 5043)

Administrative Policy

4 September 1991 T.I. (Tax Window, No. 10, p. 17, ¶1473)

A parent corporation is not entitled to a deduction under s. 20(4) to which a subsidiary would have been entitled if it had not been wound-up into the parent.

IT-220R2 "Capital Cost Allowance - Proceeds of Disposition of Depreciable Property" under "Bad Debts"

Subsection 20(5) - Sale of agreement for sale, mortgage or hypothecary claim included in proceeds of disposition

Administrative Policy

IT-323 "Sale of Mortgage Included in Proceeds of Disposition of Depreciable Property"

Subsection 20(7) - Where para. (1)(m) does not apply

Paragraph 20(7)(a)

Cases

Sears Canada Inc. v. The Queen, 86 DTC 6304, [1986] 2 CTC 80 (FCTD), aff'd 89 DTC 5039 (FCA)

It was found that an obligation to indemnify can exist where the obligation is not to pay monetary compensation but rather is one to perform an act or provide a service. The agreement by Sears to provide necessary repairs and maintenance services for an additional year beyond the expiry of its one-year warranty in exchange for an additional payment from its customer, was such an indemnity.

Amesbury Distributors Ltd. v. The Queen, 85 DTC 5076, [1984] CTC 667 (FCTD)

It was found, obiter, that a deduction under s. 20(1)(m)(ii) in respect of the estimated future costs of providing after-sales servicing of television sets which had been sold under a three-year warranty, would have been prohibited by s. 20(7)(a).

Mister Muffler Ltd. v. The Queen, 74 DTC 6615, [1974] CTC 813 (FCTD)

In consideration of charging a customer $1.00 more for the replacement of a muffler, the taxpayer undertook to replace a defective muffler free of charge as long as the purchaser remained owner of the car in which the muffler had been installed. The deduction by the taxpayer of a reserve under what now is s. 20(1)(m), based on its experience that only about 1/5 of the mufflers it installed had to be replaced, was denied by virtue of s. 20(7). It was intended that the words "guarantees, indemnities and warranties" "should be comprehensive enough to include all types of guarantees, indemnities or warranties, which the Act intended to exclude from immediate deduction by way of reserves because of their contingent and uncertain nature."

See Also

Redhead Equipment Ltd. v. The Queen, 2001 DTC 429, Docket: 90-159-IT (TCC)

As part of a warranty program provided by the manufacturer of graders, the taxpayer, which was a distributor, was required to inspect graters sold by it under the program twice per year for five years. Amounts paid by the manufacturer to the taxpayer only covered part of the cost of this inspection program.

The portion of the proceeds received on sale of the graders that the taxpayer estimated was equal to the future additional cost to it of the inspection program was eligible for the reserve under s. 20(1)(m).

Dubawn Holdings Inc. v. The Queen, 94 DTC 1252 (TCC)

A MURB project promoter who, at the time of sale of MURBs to investors by its subsidiary, received promissory notes of the investors in consideration for services to be provided by it over the following ten years, including using its best effort to find responsible tenants, arranging appropriate insurance, providing maintenance, filing documents and providing accounting services, was not precluded by s. 20(7) from deducting a reserve under s. 20(1)(m).

Administrative Policy

89 C.R. - Q.21

No reserve is available to a developer under 20(1)(m) in respect of cash flow guarantee fees.

Subsection 20(10) - Convention expenses

Cases

Graves v. The Queen, 90 DTC 6300 (FCTD)

Business meetings which the taxpayers, who carried on business in partnership as Amway distributors, attended in the United States along with other Amway distributors, which were primarily devoted to group meetings, seminars and training sessions of a primarily motivational character, constituted conventions for purposes of s. 20(10). In rejecting the distinction drawn in Friesen v. MNR, 89 DTC 682 (TCC) between "up-line" meetings which involved Amway sponsors senior to the taxpayer and "down-line" meetings involving people sponsored by the taxpayer, MacKay J. stated that "whether or not the meeting or conference can be a convention within section 20(10) depends upon an assessment of the nature of the meeting and its relationship to the taxpayer's business rather than upon the particular standing of the taxpayer or his status in relation to others who may attend." In light of the fact that the taxpayers were members of two Amway networks which had their bases in North Carolina and Maine, the expenses they incurred in attending the meetings in the U.S. were found to have been incurred in connection with their business and in a location reasonably consistent with the territorial scope of the two organizations.

See Also

Shaver v. The Queen, 2003 DTC 2112, 2004 TCC 10

Expenses incurred by the taxpayer, an Amway distributor, in attending "business training seminars" in Canada and the U.S. were found to be capital expenditures whose deduction was limited by s. 20(10). Lamarre J. stated (at p. 2119):

"... The seminars in question herein can very well be defined as formal meetings of members of an organization (Amway) that are held for business purposes and that result in the acquisition of knowledge by those attending them. Accordingly, in my view, these seminars are conventions ... ."

Administrative Policy

1 March 2013 T.I. 2013-0477911E5 - Expenses to host employees and spouses at a resort

A taxpayer intends to offer employees and their spouses an all-expenses-paid week-long trip to a resort located outside of North America, in which they will participate in various team building sessions and sessions related to improving their understanding of the taxpayer's business. CRA indicated that such a trip is not a "convention" under s. 20(10). As per para. 11 of IT-131R2, CRA does not consider intra-company meetings, seminars, courses, etc. to be conventions from the employees' perspective.

Articles

Novek, "Convention Expenses Are Subject to Territorial Limitations", Taxation of Executive Compensation and Retirement, February 1992, p. 557.

Subsection 20(11) - Foreign taxes on income from property exceeding 15%

Administrative Policy

10 June 2013 STEP CRA Roundtable Q. , 2013-0480301C6

" A U.S. citizen is required to pay U.S. tax on dividends and capital gains at a 20% rate (increased from the previous 15% rate). Does this mean that such citizen if also resident in Canada is only entitled to a deduction under s. 20(11) with respect to the additional 5% tax?

CRA stated that Art. XXIV, para. 5 of the Canada-U.S. Treaty is "a complete code in respect of the deductions and credits available to U.S. citizens resident in Canada for the purposes of eliminating double taxation on dividends, interest, and royalties," and that the deductions thereunder "are available in place of deductions under subsections 20(11) and 20(12), and are typically more advantageous to the taxpayer."

10 June 2013 STEP Roundtable Q. , 2013-0480371C6

US tax is paid on the income of an LLC by an individual resident in Canada to which the LLC is not a controlled foreign affiliate (so that its income is not FAPI). As this tax is independent of whether there is any distribution from the LLC that has been included in computing the taxpayer's income for the year, should it be concluded that s. 20(11) can never apply in these circumstances as the U.S. tax is not paid "in respect of" the individual's income?

In responding, CRA first noted that if no distribution were made in the year by the LLC, there would be no amount included in the individual's income so that: the US tax paid by the taxpayer would be deductible under s. 20(12) and not under s. 20(11); and that to the extent the tax was not deducted under s. 20(12), it would be creditable for purposes of s. 126(1). CRA then stated:

On the other hand, in a year that the taxpayer receives a distribution from the LLC there would be an amount of dividend income included in computing the taxpayer's income for the year from the LLC. In our view the words "tax paid as may reasonably be regarded as having been paid in respect of" in paragraph 20(11)(a) are broad enough to connect a US tax computed on the profits of the LLC to the dividend from the LLC. Therefore, in computing the taxpayer's income from the shares of the LLC, there may be deducted under subsection 20(11) the amount, if any, by which the amount of the US tax paid by the taxpayer exceeds 15% of the amount of such dividend income.

3 March 1997 Memorandum 964132

Discussion of the interaction of s. 20(11) and paragraph 5 of Article XXIV of the U.S. Convention.

84 C.R. - Q.34

Income received by beneficiaries of a Canadian resident trust earning income from foreign real property is income from a "property that is an interest in the trust" (s.108(5)(a)) and not income from real property. The 15% limitation in s. 20(11) does not apply because the foreign tax was not paid by the beneficiary.

IT-506 "Foreign Income Taxes as a Deduction from Income"

Articles

Manjit Singh, Andrew Spiro, "The Canadian Treatment of Foreign Taxes", draft version of paper for CTF 2014 Conference Report

Non-deductibility on general principles (p.6)

Subsections 20(11) and 20(12) specifically override the limitation in paragraph 18(l)(a) which would normally preclude the deduction of taxes paid, on the basis that taxes paid are typically viewed as an expense incurred as a result of earning income, rather than for the purpose of earning income. [fn 36: See…[IRC] v. Dowdall, O'Mahoney & Co., [1952] AC 401…cited in 4145356 Canada Ltd v. R., 2011 TCC 220 at para 62… .]

Picayune deduction where active LLC only distributes amount equalling Cdn member's US tax liability (p.25)

An individual investing directly in an LLC will not recognize any foreign source income from the LLC for Canadian tax purposes until the LLC pays dividends unless the LLC earns FAPI and is a controlled foreign affiliate of the individual….

The CRA takes the position that the full amount of U.S. taxes paid in the year should be used in the 20(11) formula in this instance, regardless of whether the LLC has distributed all or only a portion of its income for the year. [fn 111: … 9641375…1999-0010305.] The result of this position is that the 20(11) deduction may be based on an effective tax rate that exceeds the actual U.S. tax rate imposed on the LLC's income. For example, where the LLC earns income from an active business or is not a controlled foreign affiliate of the taxpayer, and if a taxpayer's share of the LLC's income for a taxation year is $10,000 and the taxpayer pays $4,000 of U.S. taxes for that year (based on an assumed U.S. tax rate of 40%), and if the LLC only distributes an amount for the year sufficient to cover that tax, the taxpayer's income for the year would be limited to $4,000 and the 20(11) deduction would be calculated as follows:

U.S. tax paid - (15% x Canadian income inclusion from the LLC shares)

= $4,000 - (15% x $4,000)

=$3,400

This would leave only $600 of U.S. taxes eligible for a foreign tax credit. [fn 112: By virtue of paragraph (b) of the definition of non-business income tax in subsection 126(7). See similar sample calculation in 1999-0010305... . Note that the ability to claim the amount eligible for a foreign tax credit would also be impacted by the taxpayer's Canadian tax otherwise payable, taking into account the impact of the 20(11) deduction... .] Under this formula, the less of its income an LLC distributes each year, the more its Canadian members will be limited to a foreign tax deduction in respect of the U.S. taxes paid – (oddly) unless the LLC distributes none of its income in which case the full amount of U.S. taxes would potentially be ( creditable (provided the taxpayer has other U.S. source income to support the credit)….

Subsection 20(12) - Foreign non-business income tax

Cases

FLSmidth v. The Queen, 2013 FCA 160, aff'g infra

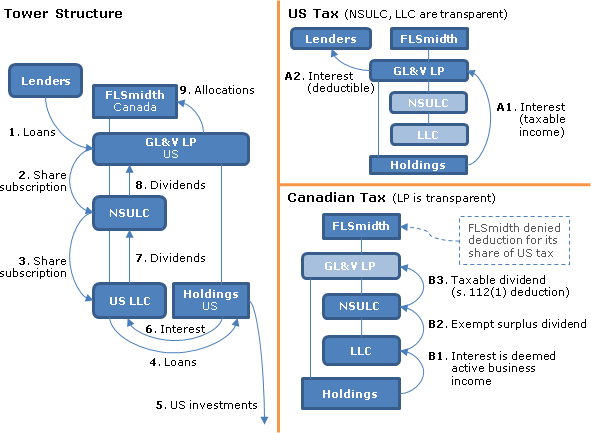

In order to finance the acquisition of U.S. companies, the taxpayer utilized a tower structure:

- The taxpayer held a 98.9% interest in a U.S. limited partnership ("GL&V LP").

- GL&V used mostly borrowed money to subscribe for shares of a Nova Scotia unlimited liability company ("NSULC").

- NSULC subscribed for shares of a U.S. limited liability company ("LLC").

- LLC made loans to a U.S.-resident holding company ("Holdings") which was a subsidiary of GL&V LP.

- Holdings carried on a business of investing in U.S. companies.

For U.S. tax purposes, GL&V LP was a corporation while NSULC and LLC were fiscally transparent. Therefore, for U.S. tax purposes, GL&V LP was considered to have made loans directly to, and received interest directly from, Holdings. For Canadian tax purposes, GL&V was fiscally transparent and NSULC and LLC were corporations. The taxpayer sought to deduct under s. 20(12) its 98.9% share of the US taxes paid by the hybrid partnership on such interest income on the basis that those taxes: (i) were paid by it in respect of its income, and (ii) could not be reasonably regarded as having been paid by it in respect of income on foreign affiliate shares (i.e., the LLC membership interests).

Noël JA noted (at para. 43-44) that if a narrow construction were given to the phrase "in respect of," the US taxes were paid by the partnership irrespective of whether the NSULC and LLC paid dividends, and therefore were not paid in respect of income allocated to the taxpayer (so that (i) above was not satisfied). On the other hand, if (on a broader construction) the U.S. taxes were considered to be paid in respect of such dividends because those dividends were indirectly derived from the interest paid by Holdings, the US taxes should be considered to be paid by the taxpayer in respect of the dividend income sourced from the LLC (a foreign affiliate), so that the foreign affiliate exclusion in (ii) above applied.

In response to a submission that the US taxes were not paid by a corporation as required under such exclusion in (ii), Noël JA agreed with 4145356 Canada Ltd., and found (at para. 46-49) that GL&V LP's legal personhood for US tax purposes did not affect the principle that, for Canadian tax purposes, the taxpayer's share of GL&V LP's US tax was paid by the taxpayer.

See Also

FL Smidth Ltd. v. The Queen, 2012 DTC 1052 [at 2745], 2012 TCC 3, aff'd 2013 DTC 6147, 2013 FCA 160

In order to finance the acquisition of U.S. companies, the taxpayer set up a tower structure. See above for details.

For U.S. tax purposes, GL&V was a corporation while NSULC and LLC were fiscally transparent. Therefore, for U.S. tax purposes, GL&V was considered to have made loans directly to, and received interest directly from, Holdings. For Canadian tax purposes, GL&V was fiscally transparent and NSULC and LLC were corporations.

Paris J. found that the taxpayer's U.S. income tax liabilities were paid "in respect of" its dividend income from the NSULC shares (allocated to it as a partner of GL&V) , even though the tax arose from Holdings' payments to LLC rather than NSULC's dividend payments to GL&V. The words "in respect of" do not require that the taxes be paid on the source of income - only that they be connected with or related to that income (para. 45). In this case they were connected because, if the taxpayer had not owned NSULC shares, it would not have had to pay U.S. tax.

However, by similar reasoning, the taxpayer's share of the U.S. income taxes was not deductible because those taxes were paid "in respect of income from a share of the capital stock of a foreign affiliate" (LLC). Paris J. stated (at para. 63):

I disagree with the appellant's position that the words "can reasonably be regarded" in subsection 20(12) do not enable the Minister to look through NSULC. It seems to me that this phrase, on its own, is a specific provision enabling the Minister to evaluate the economic substance of a transaction regardless of its legal form.

Kaiser v. MNR, 91 DTC 1057 (TCC)

Subsection 20(12) was found to be limited to the computation of income from a business or property, and did not permit a deduction from employment income earned in the U.S. of U.S. income taxes which were not deductible under s. 126(1).

Administrative Policy

27 March 2013 Folio S5-F2-C1

1.24 ...If an amount of what would otherwise qualify as NBIT for purposes of a foreign tax credit cannot be claimed as such, and dollar-for-dollar tax relief through a reduction to Canadian tax otherwise payable is not obtained, subsection 20(12) provides relief through a deduction in computing income.

11 June 2013 STEP Roundtable Q. , 2013-0480321C6

Is the US tax paid by a Canadian-resident taxpayer on the income (which also is foreign accrual property income) of an LLC which is owned by it (and is a controlled foreign affiliate) considered to be foreign accrual tax in respect of the LLC?

After responding that the US tax paid by the taxpayer would not qualify as FAT, CRA went on to note that any amount included under s. 91(1) in respect of the FAPI would be considered income from sources in the US for purposes of ss. 20(11) and 126(1), so that an individual taxpayer could deduct under s. 20(11) any portion of the US tax paid for the year in excess of 15% of the s. 91(1) income inclusion. "Any excess [i.e., the 1st 15%] will be eligible for a foreign tax credit under subsection 126(1) and any of the excess US tax paid that cannot be utilized by the foreign tax credit may be deducted from income pursuant to subsection 20(12)."

28 May 2013 Memorandum 2013-0476381I7 - Deemed Resident Trusts & Foreign Tax Credit

A deemed-resident s. 94 trust realized a capital gain and incurred gains tax of $10,000 for U.S. purposes on disposing in the U.S. of marketable securities but, for purposes of the Act, realized capital gains of only $20,000 (with Canadian tax thereon of $2,900) due to the securities' ACB previously having been stepped up under s. 128.1(1)(c). Before finding that a full foreign tax credit was available, CRA stated:

[T]he deduction of foreign non-business income tax provided under subsection 20(12)...is not available in the context of a capital gain, since the subsection 20(12) deduction is only available in computing income from business or property, and the foreign taxes have to be paid in respect of such income. In this case, the foreign taxes paid by the trust are in respect of a capital gain, and not any income from business or property as determined under Canadian law or foreign law.

18 July 2011 Memorandum 2011-0394631I7

Canco, and its wholly-owned subsidiary, Cansubco, are the 99.9% and 0.1% partners of USLP, which is a partnership for Canadian purposes and has elected to be a corporation for U.S. tax purposes. USLP holds all the shares of USLLC, which has elected to be disregarded entity for US tax purposes. USLLC earns active business income. USLLC has not distributed any dividends to USLP. For US tax purposes, USLP declares the active business income earned by USLLC. Would Canco be entitled to a s. 20(12) deduction where the US tax paid by USLP on business income is not in respect of the income that Canco would potentially receive as dividend income from USLLC shares held by USLP? CRA responded:

The phrase "in respect of that source" found in subsection 20(12) requires that the foreign taxes paid must be paid in respect of the particular business or property to which the tax relates. In other words, for the purposes of claiming the deduction in subsection 20(12), the computation of income from a business or property should be on a business-by-business and/or property-by-property basis. Therefore…in computing the income of Canco and Cansubco from the shares of USLLC (as partners of USLP), USLP cannot deduct, under subsection 20(12), the foreign taxes paid by it on income from business, computed under US tax law, because USLP would generally only receive income from property under Canadian tax law.

CRA went on to note that the prohibition against recognizing tax paid by a corporation in respecting income from foreign affiliate shares also applied in light of s. 93.1(1).

22 July 2008 Memorandum 2008-0284351I7 -

A Canadian resident individual taxpayer reported the income (which was not distributed) of a wholly-owned S Corporation in his U.S. tax return in 2006. He claimed a deduction under s. 20(12) respecting the U.S. tax that he paid on such income. CRA stated:

[A] deduction in a taxation year under subsection 20(12)…for U.S. tax paid by the taxpayer for the year in respect of his share of income of an S Corporation is not to be denied even though the taxpayer does not receive a distribution from the S Corporation in the year. …

[I]t has been Rulings' long-standing position that a loss may be created after the deduction of non-business-income taxes under subsection 20(12) as long as the foreign taxes sought to be deducted relate to an income source which is income from a business or property, even if there is no gross income from that source in the year the foreign tax is liable to be paid or if gross income from that source is less than the foreign tax paid.

19 March 2004 T.I. 2003-003730 -

"Amounts received out of an IRA are treated as pension income under paragraph 56(1)(a) of the Act and under the Treaty and not as income from a business or property. Accordingly, neither subsection 20(11) or 20(12) of the Act can apply to allow a deduction."

10 April 2003 T.I. 2003-0003095 -

May foreign tax attributable to a taxable capital gain be deducted under s. 20(12), notwithstanding that capital gains are not income from business or property? CRA responded:

Until 1991, subsection 20(12) began with the words "In computing the income of ...". This would indicate that foreign taxes paid in respect of capital gains would have been deductible under that prior language. ... Subsection 20(12) was amended by Bill C-15 effective for 1992 and subsequent taxation years. The Technical Notes of the Department of Finance indicate that the amendment was made to ensure that the deduction was available only with respect to foreign taxes paid in respect of income from business or property. Thus under the current wording any foreign taxes paid in respect of a capital gain would not be deductible under subsection 20(12).

10 February 1993 Memo 9300776

After noting that under the "current" (pre-1992) version of s. 20(12) "a subsection 20(12) deduction does not have to be sourced against a particular type of income (i.e. employment, business or property income)," CRA stated:

Consequently, in situations where a non-business-income tax is paid on amounts which are not, or may never be, subject to Canadian tax, income which should properly be taxed in Canada is inappropriately sheltered. The proposed amendment to subsection 20(12) is an attempt by the Department of Finance to correct this problem.

...[T]he wording of paragraph 3(d) is broad enough to allow for a loss from a property or business to be created by a subsection 20(12) deduction, provided the taxpayer had a property or business that could conceivably generate income for the year (notwithstanding that there may not have been any revenue for that particular year or that the non-business-income tax was not directly related to that property or business source). Therefore, in these circumstances, it would be possible to have a non-capital loss pursuant to paragraph 111(8)(b) effectively created by a subsection 20(12) deduction.

20 November 1992 T.I. 123456 (September 1993 Access Letter, p. 410, ¶C20-1160)

A Canadian exporter that exports to a particular country without carrying on business there and is subject to an income tax of that country, will not be allowed a tax credit, but the foreign tax can be deducted under s. 20(12) in computing the exporter's Canadian income.

October 1992 Central Region Rulings Directorate Tax Seminar, Q. J (May 1993 Access Letter, p. 231)

Because the deduction is only available in the computation of income from a business or property, foreign tax paid on the disposition of a foreign principal residence will not give rise to a deduction under s. 20(12).

25 March 1991 Memo 7-4727

US withholding taxes paid on the redemption of preference shares of a US subsidiary qualified as income or profits taxes within the meaning of s. 126(7)(c) given that

under U.S. income tax law all distributions of property from a U.S. corporation are considered to be dividends unless there exists certain prescribed conditions. One of the required conditions is that the corporation has no "earnings and profits" at the time of the distribution of property [as was the case here.]

88 C.R. - Q.57

As s. 20(12) provides for a deduction from income and not from tax, Conventions which provide for "a deduction from the tax on the income of that person" for taxes that have been spared will not render s. 20(12) applicable.

16 July 1985 Memo 7-4095

After noting that "U.S. consent dividends are not dividends received for purposes of section 90, that "where a U.S. corporation withholds and remits the U.S. consent dividend tax on behalf of a Canadian shareholder, the amount of such U.S. tax so withheld would constitute a benefit conferred on the Canadian shareholder for purposes of paragraph 15(1)(c)," and that such s. 15(1)(c) income inclusion constitutes "income from a share of the capital stock of a foreign affiliate of the corporation" for purposes of ss. 20(12) and 126(1)(b)(i)(D), so that "the U.S. consent dividend tax would not be creditable under subsection 126(1) against any Canadian tax arising on the paragraph 15(1)(c) income inclusion to the Canadian shareholder," the Directorate stated:

…For purposes of paragraph 126(1)(a) and subsection 20(12)…if the U.S. corporation is a foreign affiliate the U.S. consent dividend tax itself, which…qualifies as a non-business-income tax paid as defined by paragraph 126(7)(c) of the Act, may not be reasonably regarded as having been paid by the taxpayer (the Canadian shareholder-corporation) in respect of income from a share of the capital stock of a foreign affiliate of the taxpayer (corporation).

Subsection 20(14) - Accrued bond interest

Cases

Antosko v. The Queen, 94 DTC 6314, [1994] 2 S.C.R. 312

On March 1, 1975 the taxpayers acquired all of the common shares of the New Brunswick Industrial Finance Board in a company that manufactured charcoal briquettes for $1 and agreed to operate the company for the following two years in consideration for the agreement of the Board to postpone the obligation to pay principal and interest in excess of $5 million of indebtedness owing by the Company to the Board, and the Board's agreement that upon expiration of the two-year period it would sell such indebtedness and accrued interest to the taxpayers for $10.

The taxpayers were entitled to deductions under s. 20(14)(b) to the extent of the interest received by them on the indebtedness following the two-year period. There was no requirement that the accrued interest be included in the income of the transferor (the Board) in order for the transferee (the taxpayers) to be entitled to a deduction. Iacobucci J. noted at p. 6322 that "where specific provisions of the Income Tax Act intend to make the tax consequences for one party conditional on the acts or position of another party, the sections are drafted so that this interdependence is clear. Furthermore, the motives of the parties and the setting in which the transfer took place, are simply not determinative of the application of the subsection" (p. 6320).

In response to a submission that a deduction was not available under s. 20(14)(b) with respect to the interest that accrued during the two-year period because it became payable at the same time as the transfer of the debt occurred at the expiration of the two-year period, Iacobucci J. stated (p. 6323) that he found "it difficult to understand how the appellants could have made a valid demand for payment of the interest until after the debt had been fully transferred to them". Accordingly, such accrued interest did not become payable on demand until immediately after the time of the transfer.

See Also

Mitchell v. The Queen, 96 DTC o (TCC)

Accrued but unpaid interest on bonds of the taxpayer that it purchased in the open market was not deductible by it under s. 20(14) because "a company that acquires its own debt cannot pay interest to itself" and "therefore, it, as a transferee, is not entitled to interest".

Husain v. MNR, 91 DTC 278 (TCC)

In finding that the taxpayer was not entitled to a deduction under paragraph 20(14)(b) in respect of interest that had accrued on a bond while it had been held by her deceased non-resident husband, Sarchuk TCJ. stated (p. 284):

"Unless the transferor and transferee are both subject to income tax under Part I of the Act the exception created by subsection 20(14) is not available."

Administrative Policy

92 C.R. - Q.1

Where a taxable transferee acquires a debt obligation from a non-taxable transferor, a deduction may be available to the transferee if the accrued interest has been included in the transferor's income. It is a question of fact whether the requirements of s. 20(14) had been met where a taxable transferee acquires a debt obligation with accrued interest where the obligation trades on the public market.

90 C.R. - Q.13

The transferee will be entitled to deduction of interest pursuant to s. 20(14)(b) only to the extent that the interest is included in the income of the transferor of the interest-bearing obligation. This position was supported in Antosko.

Articles

Ewens, "Debt-for-Debt Exchanges", 1991 Canadian Tax Journal, p. 615

Ulmer, "Taxation of Interest Income", 1990 Conference Report, pp. 8:19-20

Subsection 20(16) - Terminal loss

Cases

May Bros. Farm Ltd. v. The Queen, 92 DTC 6342 (FCA)

On December 13, 1977 a corporation ("Bell") leased 200 acres of cranberry lots from another corporation ("Wingly") under a lease which expired on December 31, 1983. On June 27, 1980 Bell granted the taxpayer a profit à prendre for most of the acreage for the period to December 31, 1983, and on October 14, 1980 the taxpayer purchased the fee simple in the acreage from Wingly.

Because the intention of the parties (as determined from reading the relevant documents) was that both the lease and the right of the taxpayer to work the land should survive the transfer of the fee simple, there was no merger at equity. There also was no merger at common law given the statutory repeal of that operation. Finally, the intermediate estate in the lands (i.e., the leasehold interest of Bell) also precluded a merger. Therefore, the profit à prendre was not extinguished and no terminal loss was generated.

See Also

Benedict v. The Queen, 2012 DTC 1170 [at 3419], 2012 TCC 174

When the taxpayer filed his 2007 return, the capital cost allowance schedule attached to his return showed a terminal loss arising in the year (from his sale of a fish farm) of $74,250. However, he deducted only $16,670 of this amount in that return, and did not claim the balance (as non-capital losses) until his 2008 and 2009 returns. (It is not entirely clear from the reasons that $16,670 is the deduction which reduced his income for 2007 to nil.)

The Minister argued that the taxpayer could not claim these non-capital losses as he had failed to report the related deductions in his 2007 return. Woods J. found that this failure to claim the full amount of the terminal loss was not fatal because the terminal loss deduction under s. 20(16) was not elective ("there shall be deducted"). She stated (at para. 9):

The carryover is based on the terminal loss deduction required by the legislation and not what has been claimed by the taxpayer.

Greater Toronto Airports Authority v. International Lease Finance Corp. (2004), 69 OR (3d) 1 (CA)

S.55(2) of the Civil Air Navigation Services Commercialization Act (Canada), which provided that "'owner', in respect of an aircraft, includes ... (a) the person in whose name the aircraft is registered; ... and (d) a person in possession of the aircraft under a bona fide lease or agreement of hire" had the effect of restricting the meaning of owner to persons who are operating the aircraft and/or are the registered owners of the aircraft and have custody and control of the aircraft. Accordingly, the lessors of aircraft to an airline were not "owners" of the aircraft for purposes of such Act.

Administrative Policy

93 C.P.T.J. - Q.25

The words "where at the end of a taxation year" keep the UCC of a particular class open during the year in the event of additional purchases of that class of assets, so that a "terminal loss" which might otherwise have been available at a time during a taxation year may not exist at the end of the taxation year where other assets of that class have been purchased before the end of the taxation year.

13 May 1991 T.I. (Tax Window, No. 3, p. 15, ¶1231)

Where a taxpayer, whose only leasehold improvements (Class 13) were with respect to office space in a building, moves to a new building in which it does not acquire leasehold improvements, it is entitled to a terminal loss.

Subsection 20(21) - Debt obligation

Administrative Policy

19 March 1992 Memorandum (Tax Window, No. 18, p. 6, ¶1820)

S.20(21) does not apply in cases of bankruptcy as it is only meant to apply to over-accruals.

Articles

Ewens, "Debt-for-Debt Exchanges", 1991 Canadian Tax Journal, p. 615: Discussion of potential deduction to holders of debentures in a target corporation for arrears of interest realized under s. 76(1).

Subsection 20(24) - Amounts paid for undertaking future obligations

Administrative Policy

8 December 2010 T.I. 2010-0375921E5

A Canadian-resident Vendor agreed to sell all the assets of its business, having a fair market value of $1,000, to the Canadian-resident Purchaser. Deferred revenue which the Vendor had previously included in its income under s. 12(1)(a) was $400. The parties agree to a $400 offset against the asset purchase price of $1,000 in consideration for the Purchaser's assumption of the Vendor's commitments.

After noting that if a s. 20(24) election were made, the Vendor would be entitled to deduct $400 and that amount would be included in the Purchaser's income under s. 12(1)(a), CRA noted that there is no prescribed form for the election. If no election was made, the Vendor would not be entitled to the deduction, and the payment would be included in the Purchaser's income under s. 9 or 12(1)(x).

7 March 2005 T.I. 2005-011498

"We are of the view that subsection 20(24) of the Act may also apply to a transferred obligation for which an amount has been included in the taxpayer's income in a taxation year under paragraph 12(1)(e)."

20 November 2003 T.I. 2003-003354 -

As a partnership may be regarded as a taxpayer for purposes of s. 20(24), where a partnership that is being dissolved pays to the surviving partner who will continue the business as a sole proprietor as described in s. 98(5) a reasonable amount for undertaking to assume the partnership's obligations described in paragraph 12(1)(a), an election may be available to the partnership and the sole proprietor under s. 20(24).

15 November 1999 T.I. 5-992458

Discussion of the application of s. 20(24) where one corporation that has received prepaid rent on a leased building transfers the building to a related corporation and they make the s. 20(24) election.

June 1991 Memorandum (Tax Window, No. 4, p. 18, ¶1274)

Discussion of different ways to handle the assumption of take-or-pay obligations on the sale of a resource property.

22 April 1991 Memorandum (Tax Window, No. 2, p. 24, ¶1192)

A vendor is not permitted to deduct an amount paid by it to compensate the purchaser for the assumption of contingent liabilities of the vendor for product warranties.

5 June 1990 TI File 7-4678

In the normal case where the sale of a business occurs on capital account, the vendor would not be able to deduct a payment described in s. 20(24) in the absence of the election.

Articles

Ron Choudhury, "Non-Resident Issues in Acqusition Transactions", 2005 Conference Report (Canadian Tax Foundation), 42:9-16.

Bergen, "Purchase and Sale of Assets: An Update", 1996 Corporate Management Tax Conference Report, pp. 3:6-8.

Subsection 20(29) - Idem [Deduction before available for use]

Administrative Policy

13 April 1992 T.I. (Tax Window, No. 18, p. 13, ¶1843)

Where a taxpayer incurs soft costs in respect of an addition to an existing building, the deduction under s. 20(29) is restricted to the taxpayer's income from renting the addition.