Subsection 132.2(1) - Definitions re qualifying exchange of mutual funds

Qualifying Exchange

Administrative Policy

2013 Ruling 2013-0492731R3 - qualifying disposition -mutual fund trust

The elimination of the subtrust of an open-end listed mutual fund trust (the "Fund") was to be accomplished by the subtrust transferring its assets (being units of subsidiary real estate partnerships and the shares of the GPs thereof) under s. 107.4 to a newly-formed subsidiary unit trust ("MFT") of the REIT, with a small percentage of MFT's units then being distributed to the REIT unitholders in order to qualify MFT as a mutual fund trust. MFT then will be merged into the REIT under s. 132.2.

See detailed summary under s. 107.4(1).

2013 Ruling 2013-0488351R3 - Conversion of a MFC to a MFT

The same (mutual fund corporation) taxpayer as for 2013 Ruling 2011-0395091R3 ("MFC to MFT Conversion") (immediately below) obtained essentially the same rulings for transactions which now reflected its acquisition of "Target" trust before the implementation of the merger of the taxpayer under s. 132.2 into REIT #1 (the internally-created replacement mutual fund trust) and the elimination of various subtrusts using s. 107.4 (or s. 248(1) – non-disposition) transfers and the s. 132.2 merger rules. To reflect the inclusion of Target in the starting structure, after the non-disposition transfers from the Direct Subtrusts of the taxpayer to Trust A (see step 2), Trust A, in turn, will effect a s. 107.4(3) transfer of all its property to Target, so that Trust A ceases to exist. Accordingly, the s. 107.4(3) transfer in step 8 will be by Target rather than Trust A. Furthermore, there will be similar transactions (involving "REIT#4" and "Target Operating Trust") for the elimination of a subtrust of Target.

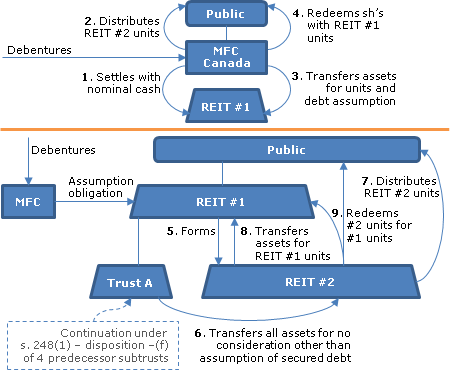

2013 Ruling 2011-0395091R3 - MFC to MFT Conversion

Background

Taxpayer, which is a listed mutual fund corporation, wishes to convert to a mutual fund trust (so that following the conversions transactions its remaining assets will be nominal) and to eliminate subsidiary (non-personal trust) subtrusts, including OT and various Direct Subtrusts. OT is the limited partner of MLP. According to the summary, the Taxpayer was a taxable Canadian corporation before it became a mutual fund corporation.

Transaction overview

Taxpayer will settle a subtrust with modest assets, and distribute the units of the subtrust to its public shareholders, who thus will now hold assets of a "good" mutual fund trust ("REIT #1"), albeit with nominal assets. Next, Taxpayer will merge into REIT #1 under s. 132.2, so that REIT #1 is now the successor to substantially all its assets. However, it will not be released under its covenant under convertible debentures, which will be assumed by REIT #1 only on an "internal" assumption. In order to get rid of a subtrust which now is an assets of REIT #1 (and which was the result of an earlier s. 248(1) – disposition, (f) consolidation of four predecessor subtrusts into one), there will be s. 107.4 transfers of all its assets to a new subtrust ("REIT #2"), followed by a distribution of its units by REIT #1 to the REIT #1 unitholders. REIT #2 then will be merged into REIT #1 under s. 132.2. The same steps will then be repeated for a lower-tier subtrust.

Proposed transactions

- In order "to capitalize the non-capital losses of OT into the capital cost of MLP's depreciable property," the general partner of MLP will file late elections under s. 21.

- The Direct Subtrusts will simultaneously transfer their assets to Trust A (newly formed by Taxpayer, which holds one unit) for no consideration other than the assumption of their liabilities, so that they cease to exist; and Trust A will not file the election in s. 248(1) – disposition, (f)(v) with a view to that disposition exclusion applying.

- Taxpayer will settle REIT #1, whose unit terms will comply with s. 108(2)(a), with a nominal amount.

- Taxpayer will distribute units of REIT #1 to its shareholders on the basis of one unit for each common share, as well as distributing a nominal amount of cash on a pro rata basis (in order to permit Taxpayer to withhold Part XIII.2 tax where applicable). Thereafter, REIT #1 will satisfy s. 132(6)(c). The terms of convertible debentures owing by Taxpayer (the Debentures) will be modified (but not as a novation) so that they also are convertible into units of REIT #1. S. 248(25)(b)(iii) will not apply in respect of any Debentureholder in relation to REIT #1.

- Taxpayer will effect a s. 132.2 merger with REIT #1 (with s. 132.2 elections filed in due course for this and the mergers below). Accordingly, Taxpayer will transfer all or substantially all its property to REIT #1 in exchange for (a) the assumption by REIT #1 of Taxpayer liabilities including a covenant of REIT #1 to Taxpayer to be responsible for interest payments on the Debentures and a REIT #1 guarantee of those Debentures, and the assumption of mortgage bonds, and (b) the issuance of units of REIT #1 with an aggregate fair market value equal to that of the transferred property minus the aggregate amount of assumed liabilities.

- All or substantially all the issued and outstanding shares of Taxpayer will then be disposed of by the shareholders to Taxpayer in exchange for units of REIT #1 with an equivalent fair market value. REIT #1 will subscribe a nominal amount for one Taxpayer common share, and the number of REIT #1 units then will be consolidated to equal the number of Taxpayer common shares outstanding immediately before the merger.

- Taxpayer will settle REIT #2, whose unit terms will comply with s. 108(2)(a), with a nominal amount.

- Trust A will transfer all of its property to REIT #2 for no consideration other than the assumption of secured debts (with any unsecured debts being paid off by Trust A) – so that Trust A will cease to exist. REIT #2 will file the election in s. 248(1) – disposition, (f)(v) for s. 107.4(3) to apply instead and Trust A will not file the election in s. 107.4(3)(a)(i) to have the transfer occur otherwise than at cost amount.

- REIT #1 will make a capital distribution of units of REIT #2 to its unitholders, so that thereafter, REIT #2 will satisfy s. 132(6)(c). REIT #1 will not claim any deduction under s. 104(6)(b) in respect of any income resulting from this distribution.

- REIT #2 will effect a s. 132.2 merger with REIT #1 under which:

(a) it will transfer all or substantially all its property to REIT #1 in exchange for the assumption of any REIT #2 liabilities and the issuance of REIT #1 units; and

(b) the units of REIT #2 (other than one unit held by REIT #1) will then be disposed of their holders to REIT #2 in exchange for units of REIT #1, with the units of itself received by REIT #1 being cancelled and the outstanding REIT #1 units being consolidated to equal the number of Taxpayer common shares outstanding immediately before the merger in 5.

- The steps in 7 to 10 above essentially will be repeated in order to transfer all the assets of a OT (a subtrust acquired by REIT #1 in 5 above) to REIT #1.

Rulings

- The transfers from the Direct Subtrusts to Trust A in 2 will not be considered a "disposition" by virtue of s. 248(1) – disposition, (f)(v), and Trust A will be deemed, to be the same trust as, and a continuation of, each of the Direct Subtrusts by virtue of s. 248(25.1); therefore the ACB of Taxpayer's interest in Trust A will be equal to the aggregate ACB of Taxpayer's interests in the Direct Subtrusts before the transfer.

- 5 and 6, and 10 (and the subsequent merger in 11) will be qualifying exchanges.

- The guarantee in 5 will not cause REIT #1 to not be a MFT.

- S. 20(1)(c) ruling re assumed obligation of REIT #1 in 5 (and re interest obligation of Taxpayer on legally retained Debentures).

- The transfer in 8 (and similarly re 11) will be a qualifying disposition under s. 107.4(1).

- S. 245(2) will not be applied.

5 May 1995 T.I. 951193 (C.T.O. "Newly Established Fund")

Where a mutual fund corporation transfers its assets to a newly established unit trust that will not meet the distribution requirements under Regulation 4801 until it issues units to the mutual fund corporation for distribution to the mutual fund corporation's shareholders, such trust will qualify as a mutual fund trust at the time of the transfer provided that it elects under s. 132(6).

Subsection 132.2(3) - General

Paragraph 132.2(3)(a)

Articles

Darcy De Moche, Greg Johnson, "Recent Developments and Transactions Affecting Income Funds and Royalty Trusts", 2005 Conference Report, c. 17.

Forms

T1169 "Election On Disposition Of Property By A Mutual Fund Corporation (Or A Mutual Fund Trust) To A Mutual Fund Trust