Subsection 129(1) - Dividend refund to private corporation

Cases

1057513 Ontario Inc. v. The Queen, 2015 FCA 207

During its 1997 to 2004 taxation years, the taxpayer received dividends subject to Part IV tax, and paid dividends which, if its returns had been filed within the three year period specified in s. 129(1), would have generated a dividend refund for each year. However, it did not file those returns until 2008.

In confirming the denial of the dividend refunds, Webb JA affirmed (at para. 5) the finding below "that the requirement to file tax returns within three years from the end of the taxation year in which the dividend is paid… is a condition that must be satisfied in order for the Appellant to receive the dividend refund… ."

He then stated obiter that the unclaimed refunds did not reduce the taxpayer's refundable dividend tax on hand.

See summary under s. 129(3).

See Also

Presidential MSH Corporation v. The Queen, 2015 TCC 61

The taxpayer paid taxable dividends in its 2005 to 2006 taxation years but missed the three-year deadline to apply for dividend refunds. Graham J found that Tawa Developments applied, so that there was no reduction in the taxpayer's RDTOH. Consequently, dividends paid by taxpayer in its 2010 to 2012 years generated dividend refunds as claimed by the taxpayer.

Thus, the taxpayer was successful in its submission that the "dividend refund" in s. 129(1)(a) was the "refund" actually paid and not, as the Minister submitted, the "amount" calculated under the s. 129(1)(a) formula, whether it was paid or not. Graham J (in the face of some submissions not made in Tawa) found that, although "dividend refund" is used inconsistently in the Act in ways that could support both "refund" and "amount" meanings, he agreed with the purposive analysis in Tawa.

Ottawa Ritz Hotel Company Limited v. The Queen, 2012 DTC 1172 [at 3427], 2012 TCC 166

The taxpayer was ineligible for a dividend refund because it did not send the required application within three years of the taxation year in question. However, Webb J. also noted that, in accordance with Tawa Developments, there was also no reduction in the taxpayer's refundable dividend tax on hand.

Administrative Policy

2 February 2015 T.I. 2013-0510751E5 F - Cooperatives and Dividend Refund

In finding that an agricultural cooperative corporation, as defined in s. 135.1(1), that is a private corporation and has an RDTOH balance may be eligible to a dividend refund pursuant to s. 129(1), CRA stated (TaxInterpretations translation):

A "share" in accordance with subsection 248(1) includes the part of the social capital of an agricultural cooperative corporation or a cooperative corporation, as respectively defined in subsections 135.1(1) and 1362)… . Furthermore…an amount which is annually paid to the holders of patronage shares of a cooperative as return on the invested capital and proportionally among the holders…generally will be taxable as dividends.

In finding that a cooperative formed under the Quebec Cooperatives Act that is neither an agricultural cooperative corporation nor a cooperative corporation is eligible for a dividend refund, CRA, after having noted that such a cooperative is a legal person and a corporation, stated:

Even if a cooperative has an RDTOH balance, it will likely not obtain a dividend refund in accordance with section 129 if the fractions of its capital do not constitute shares as defined under subsection 248(1).

As a fraction of the capital of a cooperative other than a corporation corporation as well as an agricultural cooperative corporation or credit union does not constitute a share…this type of cooperative is not able to obtain a dividend refund.

11 March 2014 Memorandum 2013-0499421I7 - Application of subsection 220(2.1) to 129(1)

An extension of time to make a return using s. 220(3) does not alter or affect whether a corporation has factually filed its return of income within the period required under the Act, so that if the corporation has not filed its return of income within three years of the end of the taxation year, it cannot obtain a dividend refund.

18 October 2012 T.I. 2012-0436181E5 - Part IV Tax / Denied Dividend Refund

There is a cross-redemption of preferred shares held by two connected corporations (Aco and Bco) in each other, thereby giving rise to Part IV tax based on their respective dividend refunds (which, in these circumstances, are generally determined on a circular basis). However, Aco misses the return filing deadline to obtain a dividend refund for that year. Bco submits that, based on Tawa Developments, Aco accordingly has no dividend refund for the year, so that there is no Part IV tax liability to Bco.

In rejecting this interpretation, CRA stated that in Tawa the Tax Court wrongly interpreted the definition of "dividend refund" in light of "the ordinary meaning of the word 'refund' instead of the precise and unequivocal meaning of the expression Dividend Refund under paragraph 129(1)(a)," which refers to an amount which arises on the payment of a taxable dividend, irrespective of whether the corporation in fact receives the refund.

92 CPTJ - Q.10

RC may accept the assignment of any dividend refund to which a corporation may be entitled in payment of withholding tax which the corporation otherwise is required to remit, provided that it does not perceive a collection problem having regard to the possibility that no dividend refund, in fact, has been earned.

4 March 1991 T.I. (Tax Window, No. 2, p. 15, ¶1183)

S.129(1)(a) does not permit the payor corporation to apply for less than the full amount of its dividend refund.

86 C.R. - Q.31

RC does not have any statutory authority to provide interest on dividend refunds.

Subsection 129(1.2) - Dividends deemed not to be taxable dividends

See Also

Speer v. The Queen, 99 DTC 157, Docket: 97-1791-IT-G (TCC)

The reasons for judgment include a description of an arrangement entered into prior to the introduction of s. 129(1.2) for the generation of a refund of RDTOH without the payment to the owner of a dividend.

Canwest Capital Inc. v. The Queen, 97 DTC 1 (TCC)

The taxpayer, which was a prescribed qualifying corporation within the meaning of s. 186.2 was found to be not subject to s. 129(1.2) when it paid a dividend on its preferred shares to a prescribed venture capital corporation given that at that time it was not aware that the dividend would be received free of Part IV tax by the recipient and given that the corporate structure in question was created for the purpose of achieving extraordinary economic results rather than with a view to tax considerations.

Administrative Policy

10 June 2013 STEP CRA Roundtable Q. , 2013-0480361C6

" In response to a request for an update on its position on s. 129(1.2), CRA noted that it had issued favourable s. 129(1.2) rulings on post-mortem estate planning transactions (2004-008855, 2010-0377601R3 and 2012-0456221R3) and further stated that where the purpose test in s. 129(1.2) was met, s. 129(1.2) could technically apply to deny a dividend refund to a payer corporation even if tax was paid by the shareholder on the dividend received from the payer corporation.

29 June 2009 T.I. 2008-029637

Three children, who own the shares of Corporation A which has a capital dividend account and refundable dividend tax on hand account but owns no assets, transfer their shares to Corporation X, which is owned by one of the children, following which Corporation A and Corporation X amalgamate, with the amalgamating corporation paying a dividend to Corporation X.

Section 129(1.2) would apply.

17 January 1997 T.I. 962932

"The provisions of subsection 129(1.2) of the Act will apply to a dividend in any situation where 'one of the main purposes' of acquiring a share and paying a dividend on that share is to enable a corporation to obtain a dividend refund. The Department has not adopted any administrative position with respect to transactions undertaken to shift refundable dividend tax on hand within a related corporate group."

23 June 1992 Memorandum 921769 (January - February 1993 Access Letter, p. 28, ¶C117-180)

It would be difficult to conclude that there has been an avoidance of Part IV tax by a recipient corporation where a related group carries out transactions so that a corporation with a balance in its refundable dividend tax on hand account generates a dividend refund on the payment of a dividend, and the recipient corporation eliminates its Part IV tax liability through the deduction of non-capital losses.

Subsection 129(3)

Cases

1057513 Ontario Inc. v. The Queen, 2015 FCA 207

Webb JA found that the taxpayer was ineligible for dividend refunds for various years because it did not file the returns claiming the dividend refunds within three years of the taxation year ends in question. Webb JA then stated (at para. 6):

[S]ince the condition…has not been satisfied, there would not be any amount that would be a dividend refund for any of the taxation years 1997 to 2004… for the purposes of paragraph 129(3)(d)… .. Therefore, the refundable dividend tax on hand account balance of the Appellant is not reduced by the dividends that were paid during the 1997 to 2004 taxation years in relation to which no amounts were refunded under subsection 129(1)… .

See summary under s. 129(1).

See Also

Ottawa Ritz Hotel Company Limited v. The Queen, 2012 DTC 1172 [at 3427], 2012 TCC 166

The taxpayer was ineligible for a dividend refund because it did not send the required application within three years of the taxation year in question. However, Webb J. also noted that, in accordance with Tawa Developments, there was also no reduction in the taxpayer's refundable dividend tax on hand.

Tawa Developments Inc. v. The Queen, 2011 DTC 1324 [at 1837], 2011 TCC 440

The taxpayer failed to apply for its dividend refund for a taxation year within the three year time-limit, and its dividend refund that year was therefore denied. Hogan J. found that the taxpayers' RDTOH was not reduced by the amount of the unclaimed dividend refund. The ordinary meaning of "refund" is the repayment of a sum of money (paras. 33-34). The meaning of "dividend refund" likewise refers to an amount actually paid rather than the notional amount the taxpayer is entitled to apply for, because the alternative would be arbitrarily punitive (paras. 49-50).

Subsection 129(4) - Definitions

Aggregate Investment Income

Administrative Policy

9 May 2012 T.I. 2012-0440781E5 -

A depreciable property of the taxpayer was rented to an associated company carrying on an active business, so that the CCA claims of the taxpayer were deducted from rental income that was deemed to be active business income under s. 129(6). However the active business was then sold, so that for subsequent years the CCA was deducted from passive rental income.

When the property is then sold, the resulting recapture of depreciation should be allocated between active business income and investment income on the same basis as the two types of income from which the CCA previously was deducted.

Canadian Investment Income

Cases

Burri v. The Queen, 85 DTC 5287, [1985] 2 CTC 42 (FCTD)

Net rental income which a company derived from an apartment building in its 1978 and 1979 taxation years was income from property rather than income from an active business. The services which were provided to the tenants "were of a very limited nature and typical of what any owner of a modern apartment building would expect to have to provide. As such they [the services] must be seen as incidental to the making of revenue from property through the earning of rent."

The Queen v. Brown Boveri Howden Inc., 83 DTC 5319, [1983] CTC 301 (FCA)

Interest earned on the investment in 30-day notes of progress payments received by a manufacturer on its long-term contracts related to money that was committed to the carrying-on of the manufacturing business, and thus was not Canadian investment income.

Morbane Developments Ltd. v. MNR, [1983] CTC 338 (FCA), briefly aff'g 81 DTC 5362, [1981] CTC 490 (FCTD)

Proceeds received for the expropriation of land inventory were active business income notwithstanding that there was a 4-year delay between a government freeze on the sale by the taxpayer company of its lands and the receipt of the proceeds.

A business, to be considered inactive, need not be in an "absolute state of suspension", and it is irrelevant that the business activities were carried on by another party on the taxpayer's behalf, rather than by the taxpayer itself.

The Queen v. Marsh & McLennan, Ltd., 83 DTC 5180, [1983] CTC 231 (FCA)

Interest earned, on the investment of funds received by an insurance broker, during the period before those funds had to be paid to the insurers, was held not to be Canadian investment income under the pre-1979 version of the definition. Per Clement, D.J.: The funds so invested may be contrasted with an investment in a long-term bond with no need to use the principal in the on-going business. Here, the funds would be required for payment to the insurers within 90 days of their investment, and the investments and the insurance broker's were interdependent. The investments thus were used in its business. Per Le Dain, J.: The funds were employed and risked in the business, as an amount equivalent to the amount so invested was committed to the carrying-on of the business in order to meet the insurance broker's obligations to the insurers, and the invested funds were thus property used or held in the course of carrying on its business. [C.R.: 129(4.1); 248(1) - "Business"]

Riviera Hotel Co. Ltd. v. The Queen, 82 DTC 6045, [1982] CTC 30 (FCTD)

The taxpayer bought and resold approximately 15 separate parcels of land over a 12-year period in addition to owning and operating a hotel. It was held that the sales of land were part of an active business carried on by the taxpayer (as the taxpayer itself had represented in its tax returns). This finding was not displaced by the fact that only 2% of the taxpayer's employees' time was required for managing the properties, given that the hotel business typically is more labour-intensive than the real-estate trading business.

Supreme Theatres Ltd. v. The Queen, 81 DTC 5136, [1981] CTC 190 (FCTD)

After noting (at p. 5138 (DTC)) that "there is a presumption that, since the purpose of a corporation is to make profits from carrying out its business objects, the income received by a corporation is business income," Gibson, J found that rentals received by the taxpayer company, whose business was the operating of motion picture theatres, the lease of a Theatre to a Lion's Club and of land and drive-in theatre facilities as well, were active business income and thus excluded.

See Also

Ben Barbary Co. Ltd. v. MNR, 89 DTC 242 (TCC)

The taxpayer sold to a related company its sporting goods business, a gas bar and the underlying land in consideration of an interest-bearing promissory note, and retained other businesses including a restaurant and a convenience store. Interest received on the note was not income from an active business in light of the failure of the taxpayer to demonstrate any investment activity. Any presumption created by an objects clause in the taxpayer's articles had been rebutted. [Mogan, J. was unenthused by the presumption.]

King George Hotels Ltd. v. The Queen, 81 DTC 5082, [1981] CTC 87 (FCA)

It was "stressed that whether a business is an active or inactive one is ... [a question] of fact dependent on the circumstances of each case ... . It cannot be said ... that income from 'other than an active business' necessarily means that derived from a business that 'is in an absolute state of suspension'".

Administrative Policy

19 September 1991 T.I. (Tax Window, No. 11, p. 15, ¶1509)

In any case where s. 129(4.1) does not apply, the taxable gain from disposition of a life insurance policy will constitute "income from property".

Articles

Durnford, "The Distinction Between Income from Business and Income from Property, and the Concept of Carrying on Business", 1991 Canadian Tax Journal, p. 1131.

Foreign Investment Income

Administrative Policy

81 C.R. - Q. 25

In determining whether or not income or loss is from property, the normal rules apply.

Subsection 129(4.1)

Cases

The Queen v. Irving Garber Sales Canada Ltd., 92 DTC 6498 (FCTD)

The taxpayer, which was engaged in the sale of raw fur skins and of manufactured fur coats, had its holdings of certificates of deposit grow from $285,000 to $623,000 from 1978 to 1982. Although the taxpayer's other assets (mainly accounts receivable of up to $16,000) were relatively minimal, Joyal J. found that $200,000 of the certificates of deposits constituted a reasonable reserves for the exigencies of the taxpayer's business (so that the income thereon was active business income) in light inter alia of the need to demonstrate financial stability in order to participate in fur auctions and the fact that it was at risk for the full amount of each individual purchase of furs which, in some cases, were substantial.

McCutcheon Farms Ltd. v. The Queen, 91 DTC 5047 (FCTD)

An incorporated farm which held more than $200,000 in demand deposits and which derived between 16% and 20% of its gross income from the interest income thereon was held not to receive such interest as income pertaining to or incident to its business. Strayer J. stated (p. 5052):

"I cannot find a 'financial relationship of dependence of some substance' between these sums and the ongoing existing business ... The possibilities of these funds being drawn upon to sustain the business in any important way was remote and in fact did not happen during the years in question."

Ensite Ltd. v. The Queen, 86 DTC 6521, [1986] 2 CTC 459, [1986] 2 S.C.R. 509

The taxpayer made U.S. dollar deposits with commercial banks in order to reduce its net borrowing cost under a swap arrangement respecting an investment by the taxpayer in a stamping plant in the Phillipines. The swap arrangement in turn resulted from a requirement under Phillipines law that it bring foreign currency into the Phillipines to finance the stamping plant.

The U.S. dollar deposits were held to be "property used or held by the corporation in the year in the course of carrying on a business." The deposits complied with the test that they be property that "was used to fulfil a requirement which had to be met in order to do business. Such property is then truly employed and risked in the business."

See Also

Balmoral Investments Ltd. v. The Queen, 97 DTC 802 (TCC)

Substantial interest income that the taxpayer derived from the investment of instalments from the sale of one of its hotel were property income.

Cornwall Gravel Co. Ltd. v. The Queen, 94 DTC 1709 (TCC)

The taxpayer, which was in the aggregates business, was in many cases required to secure a performance bond from a bonding company before obtaining contracts. Bonner TCJ. found that the taxpayer had failed to rebut the assumption made by the Minister that term deposits, equal in amount to the lowest level of term deposits held by the taxpayer in each year, were necessary in order to receive such performance bonds. Accordingly, the related interest income pertained to or was incident to income from its active business. In addition, Bonner TCJ. found that the rebuttable presumption that income earned by a corporation was income from an active business had application even though the taxpayer's corporate objects (if any) were not entered in evidence.

Lake Superior Investments Ltd. v. MNR, 93 DTC 898 (TCC)

Rental income from a plaza held by the taxpayer as an investment, and interest income from short-term investments in mortgages and other securities, did not give rise to income that was "incident to" or that "pertained to" the taxpayer's active business of selling building lots.

Regina News Ltd. and Mid-Western News Agency Ltd. v. MNR, 93 DTC 358 (TCC)

In upholding the contention of the taxpayer ("Mid-Western") that income from surplus cash invested in short-term deposits gave rise to Canadian investment income, Christie A.C.J. accepted evidence that "a financial relationship of dependence did not exist between the funds to generate the interest in dispute and the active business carried on by Mid-Western".

Alamar Farms Ltd. v. The Queen, 93 DTC 121 (TCC)

Royalty income that a family farm corporation derived from producing oil wells situate on the farm land was found to be income from property used or held principally for the purpose of gaining or producing income from the corporation's farm business (s.129(4.1)(c)). Kempo J. accepted an analogy "to a taxpayer leasing out building space owned by it that was then surplus to its own business needs" (p. 123).

Great Eastern Life Assurance Co. Ltd. v. Director General of Inland Revenue (Malaysia), [1986] BTC 372 (PC)

The phrase "incidental gross income" meant "merely income arising as an ordinary incident of the business" rather than "income of a particular subordinate or casual character".

Administrative Policy

19 August 1994 T.I. 5-941599

Recapture of depreciation on the disposition of a building the rental income from which was active business income, will also be active business income.

4 February 1994 T.I. 5-932536

Where a corporation whose principal business is farming owns certain rights to take petroleum from a well located on the farm land and leases such rights to an arm's length third party in consideration for a royalty, the royalty income will not be considered to be incidental to or to pertain to the corporation's farming business, nor will the rights be considered to be held or used principally for the purpose of gaining or producing income from the farming business.

Subsection 129(6) - Investment income from associated corporation deemed to be active business income

Cases

Norco Development Ltd. v. The Queen, 85 DTC 5213, [1985] 1 CTC 130 (FCTD)

The taxpayer was an equal partner with two associated corporations in a partnership (Noort Developments) which was engaged in an active business. Noort Developments paid deductible interest to an associated corporation (Noort Bros. Construction Ltd.), which treated such interest as Canadian investment income, on the basis that "subsection 129(6) applies only to amounts paid or payable to a corporation by another corporation so that it cannot possibly apply to the interest payments received by Noort Bros. Construction Ltd. from the partnership, Noort Devlopments (p. 5216)."

In finding that s. 129(6) so applied (so that the taxpayer was not entitled to the small business deduction as the active business income of the group was correspondingly increased), McNair J stated (at pp. 5217-8):

...the partnership, Noort Developments, is not a legal entity. Section 96 of the Act provides rules for the computation of partnership income. The partnership is envisaged as a separate person solely for the purpose of measuring the flow of income to the individual partners, which is then taxed in their hands.. It is the partners and not the firm itself which are the alleged subject of taxation.

Administrative Policy

10 May 2013 T.I. 2012-0442791E5 F - SENC - Revenu d'entreprise exploitée activement

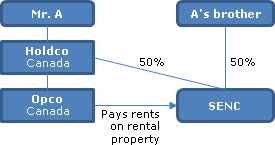

Mr. A holds all the shares of a Canadian holding company ("Holdco") which holds all the shares of Opco. Holdco also holds 50% of the units of a Quebec partnership (SENC), with the other 50% held by the brother of Mr. A. SENC rents real property to Opco for use in Opco's Canadian active-business operations.

In finding that such rents are deemed to be active business income to Holdco to the extent of its 50% share of SENC, CRA discussed Norco Development Ltd. v. The Queen, 85 DTC 5213 (FCTD), and then stated (TaxInterpretations translation):

Although in Quebec civil law a partnership is not a distinct juridical person, paragraph 96(1)(c) requires that the partnership calculate its income as if it were. According to paragraph 96(1)(f), the partners receive derived income whether from an active business of the partnership or from income from property of the partnership. In other words, the income earned by a partnership maintains its character in the hands of the partners….

[T]he reasoning of the Federal Court in Norco can be applied to the present facts. Otherwise, the interposition of the SENC between Holdco and Opco, could lead to rents which were deductible to Opco in respect of its active business becoming income from property to Holdco.

21 October 1994 T.I. 5-942150

Where s. 129(6) applies to deem rental income received by a corporation to be active business income, any recapture on the sale of the building that produced the rental income constitutes active business income.