Subsection 122.1(1) - Definitions

Gross REIT Revenue

Administrative Policy

23 December 2014 T.I. 2014-0551841E5 - Subsections 44(1) and 69(11) of the Act

S. 69(11) can apply to deem a taxpayer which thought it disposed of property on a rollover basis to have received higher proceeds of disposition (without explicitly deeming the taxpayer to have received those additional deemed proceeds) whereas the replacement property rollover in s. 44 potentially applies to "an amount that has become receivable by a taxpayer." CRA stated: "while subsection 69(11) does not specifically deem the taxpayer to have an amount receivable as proceeds of disposition… CRA will generally accept that this will not, in and by itself, prevent a taxpayer from making [the replacement property] election."

See summary under s. 44(1).

Investment

Articles

Shane Onufrechuk, Warren Pashkowick, "Tax Considerations of Major Construction Projects", 2014 Conference Report, Canadian Tax Foundation, 10:1-35.

Application of "replicate" test to public company investors (pp. 10:23-4)

[T]he "replicate test" within the definition of "investment" in subsection 122.1(1) is sufficiently broad to potentially treat publicly traded shares of a corporate partner as an investment in a SIFT partnership….

[T]he CRA has given an example [fn 34: … 2009-0309281E5…example 4)] illustrating how the possibility of publicly traded common I shares being characterized as an investment for the purposes of the SIFT rules would be reduced if, among other factors,

- the corporation is a large corporation with other sources of income;

- the partnership earnings represent a relatively small component of the corporation's business; and

- the partnership interest is not exchangeable for shares of the corporation.

Conversely, the CRA considers that the following factors, among others, would indicate that the replicate test might be satisfied:

- the corporation is a sole-purpose corporation and has no other material business activities,

- and the corporation makes a practice of paying dividends based on its earnings from the partnership.

Non-portfolio Property

Administrative Policy

16 April 2015 T.I. 2014-0561061E5 - Specified Foreign Property

The definition of "specified foreign property" in s. 233.3 excludes in para. (j) thereof a partnership interest where the property of the partnership "is used or held exclusively in the course of carrying on an active business of the…partnership." CRA considered that this exclusion likely did not apply for a foreign partnership that held Bitcoins and engaged in related FX hedging and arbitrage transactions. See summary under s. 233.3 – "specified foreign property."

Articles

Carrie A. Bereti, Edward Rowe, "Cross-Border Income Trusts", International Tax, No. 61, December 2011, p. 1

Includes description of North American Oil Trust structure (MFT on Canadian sub on US CFA).

Real Estate Investment Trust

Administrative Policy

2014 Ruling 2014-0547491R3 - REIT entering into new LP

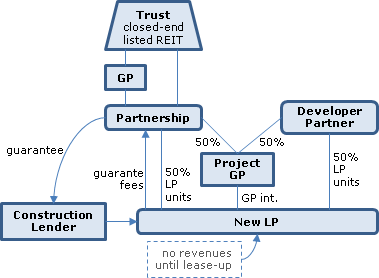

Current structure

The Trust, a closed-end listed mutual fund trust which is intended to qualify as a REIT and indirectly owns retail, commercial and industrial properties in Canada and the U.S., is the sole limited partner of Partnership and has a 100% interest in the general partner. The Trust previously received 2011-0429611R3.

Formation of New LP and site acquisition

Partnership and "Developer Partner" (a partnership of corporations unaffiliated with Trust) will form "New LP" under the provisions of a provincial Partnership Act for the purpose of acquiring the "Target Site" (by prepaying the ground rents for the site) and developing it for ultimate use as a rental property. The each will own ½ of the common shares of the "Project General Partner" of New LP and subscribe for an equal number of LP units.

Development and financing

Pursuant to a Development Agreement with New LP, Developer Partner will develop the property in consideration for stipulated fees and "DevCorp" will provide development administrative services to New LP for fees. The Partnership will be required to guarantee a construction loan to New LP (the "Guarantee"), and will receive periodic guarantee fee equal to a percentage of the Construction Loan principal. Trust will provide the balance of the financing required by New LP through a revolving credit facility (the "Mezzanine Loan"), secured by a second collateral leasehold real property mortgage. The Mezzanine Loan (as well as the LP units of New LP held by Partnership) will have a fair market value greater than 10% of the equity value of New LP.

After lease-up

New LP will not earn any revenue until the first tenant commences paying rent, following which it will earn rents, together with interest on bank deposits (not exceeding XX% of its revenues).

Rulings

Application of revenue tests (paras. b and (c)) where nil revenue

Assumptions made in connection with rulings that the Mezzanine Loan and LP interest in New LP of Partnership will qualify in a particular taxation year as real or immovable property to Partnership or Trust, as the case may be, pursuant to subparagraph (a)(i) of the definition of "real or immovable property" include that in the year New LP does not earn any gross REIT revenue or its only gross REIT revenue is rents and interest not exceeding 25% of its gross REIT revenue.

Guarantee as non-NPP

The giving of the Guarantee for a fee will not, by itself, be the carrying on of a business by Partnership, and the right to the Guarantee fee would not be property of Partnership described in paragraph (c) of the definition "non-portfolio property". If at any time the right to the Guarantee Fee is property described in paragraph (a) of the definition "non-portfolio property," that right would be qualified REIT property of Partnership, provided that the New LP satisfies the REIT tests.

1 November 2010 T.I. 2010-036821

where a subtrust has allocated to a trust a taxable capital gain of $50 under s. 104(21), the trust will be considered to have derived a capital gain of $100 from the particular subtrust properties which were disposed of. S. 108(5) does not apply to a taxable capital gain that has been designated under s. 104(21), and in fact both $50 amounts would be derived from the disposition of the particular properties in question.

29 October 2010 T.I. 2007-0244171E5

Where a trust was a limited partner, its share of the revenues of the partnership would be revenues of the trust for purposes of paragraphs (b) and (c) of the definition of "real estate investment trust" to the extent of its "profit (or loss) share for the year" in question, given that "a partnership is treated as a conduit, with its revenues being taxed in the hands of its partners and retaining its characteristics with respect to source and nature."

Rent from Real or Immovable Properties

Administrative Policy

29 October 2010 T.I. 2007-0244171E5

A net lease of a hotel or retirement residence to an arm's length operator thereof generally would qualify as giving rise to qualifying rents .

However, a participation under a lease in gross revenues would not give rise to "rent from real or immovable properties", if such revenues did not themselves qualify as "rent from real or immovable properties", eg., revenues for the use of hotel rooms.

Security

Administrative Policy

2014 Ruling 2014-0547491R3 - REIT entering into new LP

Partnership, which effectively is wholly-owned by a REIT (the ‘Trust,") and "Developer Partner" (a partnership of corporations unaffiliated with the Trust, will form "New LP" for the purpose of acquiring and developing a site for ultimate use as a rental property. They each will own ½ of the common shares of the "Project General Partner" of New LP and subscribe for an equal number of LP units. Upon lease-up, New LP will be able to exercise the "Call Right" to acquire the LP units of Developer Partner, and Developer Partner (if the Call Right is not exercised) will have the right to exercise the "Put Right" to sell those units to New LP, in either case, at fair market value.

Rulings

Include that the Call and Put rights will not be "securities," as defined in s. 122.1(1), of the Developer Partner.

See detailed summary under s. 122.1(1) – real estate investment trust.

Subsection 122.1(1.2) - Character preservation rule

Administrative Policy

29 July 2011 T.I. 2011-038551

All the units of Sub-trust 2 are held by Sub-trust 1 all of whose units, in turn, are held by a listed mutual fund trust. Rental income earned on real or immovable property held by Sub-trust 2 is distributed by it to Sub-trust 1 which, in turn, distributes all of its income to the mutual fund trust.

S. 122.1(1.2) (when enacted) would apply to deem all the income received by the mutual fund trust from Sub-trust 1 (and all the income received by Sub-trust 1 from Sub-trust 2) to be rent from real or immovable property.

Subsection 122.1(2)

Administrative Policy

11 July 2008 T.I. 2008-0267791E5 -

Convertible or exchangeable securities issued by a lower-tier SIFT will be treated as an equity substitute which counts against the growth room of the public SIFT.