Subsection 107.4(1) - Qualifying disposition

Administrative Policy

2013 Ruling 2013-0492731R3 - qualifying disposition -mutual fund trust

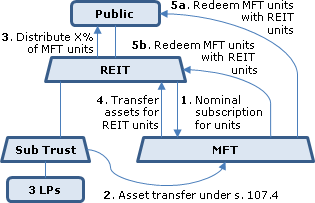

Current structure

The Fund is an open-end mutual fund trust, whose units trade on an exchange. It owns all the units of Sub Trust (a resident open-end "holding company" unit trust) which, in turn, holds all the Class A units of three subsidiary LPs (the LPs) and all the shares of their general partners (the GPs). Third parties hold the other units (of different classes) of the three LPs including exchangeable units. The LPs principally hold real estate (so that the Fund may be a REIT).

Proposed transactions

:

- All amounts owed by Sub Trust to the three LPs or the Fund or amounts owed by them to Sub Trust will be repaid in cash or by the issuance of additional units of the debtor.

- MFT will be settled with nominal cash consideration by a Canadian third-party settlor in exchange for one MFT unit. MFT's declaration of trust will have substantially the same terms as for Sub Trust, and its Canadian-resident trustee will not be a director of any of the GPs.

- The Fund will subscribe nominal cash consideration for units of MFT.

- Immediately before the "transfer time" (as defined in the "qualifying exchange" definition) for the assets in 6 below, Sub Trust will transfer its assets (namely Class A units of the three LPs, shares of the related GPs and cash) to MFT for no consideration, and Sub Trust will be wound up. MFT will file an election so that para. (f) of the definition of "disposition" in s. 248(1) will not apply to the transfer. Sub Trust will not make the (non-cost amount) election in s. 107.4(3)(a)(i).

- The Fund will distribute a certain number of its MFT Units to its unitholders on a pro-rata basis as a distribution of capital so that MFT can qualify as a mutual fund trust (and for purposes of satisfying the requirements of Reg. 4801, the MFT unitholders will include groups of unitholders that collectively meet such requirements, as determined under Regs. 4803(3) and (4).) The Fund will remit the required withholding under s. 218.3(2). Prior to its winding-up in 9 below, MFT will file an s. 132(6.1) election to be deemed to have been a "mutual fund trust" from the beginning of its first taxation year.

- MFT will transfer its assets (the same as in 4) to the Fund in consideration for the Fund units having a fair market value equal to the transferred assets.

- Immediately after the transfer time in 6, MFT will redeem all of the issued and outstanding MFT Units held by the Fund and the MFT unitholders (except for one MFT Unit which the Fund will continue to hold until 9), in consideration solely for Fund units. The Fund Units so received by the Fund will be cancelled upon receipt.

- The number of outstanding the Fund units will be consolidated back to the previous number (pursuant to a clause previously added to the Declaration of Trust providing for this to occur automatically).

- Subsequent to the filing of the ss. 132.2 and 132(6.1) elections, MFT will be wound up –with its one outstanding unit cancelled for no consideration.

Rulings

include:

- The transfer in 4 will be a "qualifying disposition" to which s. 107.4(3) will apply.

- Provided that at the transfer time in 6 each of MFT and the Fund is a mutual fund trust, the property so transferred has an aggregate FMV equal to at least 90% of the FMV of all property owned by MFT, and MFT and the Fund jointly elect in accordance with s. 132.2(1), transactions 6 and 7 will constitute a "qualifying exchange."

2013 Ruling 2013-0488351R3 - Conversion of a MFC to a MFT

The same (mutual fund corporation) taxpayer as for 2013 Ruling 2011-0395091R3 (immediately below) obtained essentially the same rulings for transactions which now reflected its acquisition of "Target" trust before the implementation of the merger of the taxpayer under s. 132.2 into REIT #1 (the internally-created replacement mutual fund trust) and the elimination of various subtrusts using s. 107.4 (or s. 248(1) – non-disposition) transfers and the s. 132.2 merger rules. To reflect the inclusion of Target in the starting structure, after the non-disposition transfers of four predecessor subtrusts to a new subtrust, that new subtrust, in turn, will effect a s. 107.4(3) transfer of all its property to Target, so that the transferor trust ceases to exist. Accordingly, the s. 107.4(3) transfer to REIT#2 will be by Target rather than Trust A. Furthermore, there will be similar transactions (involving "REIT#4" and "Target Operating Trust") for the elimination of a subtrust of Target.

See summary under s. 132.2 – qualifying exchange.

2013 Ruling 2011-0395091R3 - MFC to MFT Conversion

underline;">: Background. Taxpayer, which is a listed mutual fund corporation, wishes to convert to a mutual fund trust (so that following the conversions transactions its remaining assets will be nominal) and to eliminate subsidiary (non-personal trust) subtrusts.

Transactions

Taxpayer will settle a subtrust with modest assets, and distribute the units of the subtrust to its public shareholders, who thus will now hold assets of a "good" mutual fund trust ("REIT #1"), albeit with nominal assets. Next, Taxpayer will merge into REIT #1 under s. 132.2, so that REIT #1 is now the successor to substantially all its assets. In order to get rid of a subtrust which now is an asset of REIT #1 (and which was the result of an earlier s. 248(1) – disposition, (f) consolidation of four predecessor subtrusts into one), there will be s. 107.4 transfers of all its assets to a new subtrust ("REIT #2"), followed by a distribution of its units by REIT #1 to the REIT #1 unitholders. REIT #2 then will be merged into REIT #1 under s. 132.2. The same steps will then be repeated for a lower-tier subtrust.

Ruling

that such s. 107.4 transfers will be a qualifying disposition under s. 107.4(1).

See detailed summary under s. 132.2 – qualifying exchange.

17 October 2012 Ruling 2011-0428321R3 - qualifying disposition -mutual fund trust

Various mutual fund trusts (the "Funds") have several classes of outstanding units.

The sole difference among the various classes of Units is the management fee that is borne by the Fund [sic?] with respect to each class of Units....[I]t has been decided that it is preferable that the Class XXX unitholders of the Funds (the "Exchanging Unitholders"), rather than continuing to be unitholders of that Fund, become unitholders of a newly established unit trust (a "New Fund") in which the Exchanging Unitholders will, immediately after the Proposed Transactions occur, be the only unitholders.

Accordingly, and following a distribution by Funds to the unitholders of all income realized up to the Valuation Date for the reorganization, the Trustee of each Fund will transfer to the corresponding New Fund a percentage of each asset held by the Fund equal to the Transfer Percentage for the Fund (being the proportionate NAV of the Fund attributable to the Exchanging Unitholders for the Fund). However:

If and as necessary, a Fund will take advantage of the provisions of subsection 107.4(2.1) to avoid the need to transfer a fractional share to the New Fund where this would not be feasible. The New Fund will issue to each Exchanging Unitholder in respect of that New Fund such number of New Units of the New Fund as have a fair market value equal to the fair market value of that Exchanging Unitholder's Exchange Units of the Fund...[and] the Exchange Units of each Exchanging Unitholder of the Fund will be surrendered to the Fund by the Exchanging Unitholders.

Rulings that: the asset transfers by a Fund will be a "qualifying disposition;" the proceeds of disposition to a Fund and the asset cost to a New Fund will be determined under ss. 107.4(3)(a) and (b); and that s. 107.4(3)(j) will apply in respect of the cancellation of the Exchange Units and the receipt of New Units by the Exchanging Unitholders.

2004 Ruling 2003-005398 -

Ruling that the transfer of limited partnership units by a mutual fund trust to a subsidiary unit trust would be a "qualifying disposition".

Subsection 107.4(2) - Application of paragraph (1)(a)

Administrative Policy

2003 Ruling 2003-00498

On a transfer on the same day by a mutual fund trust (the "Fund") to a wholly-owned subsidiary trust (the "Trust") for no consideration of its shares and notes of a subsidiary corporation, s. 107.4(2)(a) would apply so that for purposes of s. 107.4(1)(a), the transfer would not result in any change in beneficial ownership of the transferred shares and notes.

Subsection 107.4(3) - Tax consequences of qualifying dispositions

Administrative Policy

20 March 2013 T.I. 2013-0474861E5 - Subparagraph 107.4(3)(a)(i) election

There is currently no prescribed form available for the subparagraph 107.4(3)(a)(i) election. In place of a prescribed form, the transferor trust should attach a letter, setting out the details of the election to the T3 Trust Income Tax and Information Return for the taxation year that includes the time of the qualifying disposition. The election should be filed on or before the filing due date of the transferor's T3 Trust Income Tax and Information Return.

2003 Ruling 2003-00498

On a transfer by a mutual fund trust (the "Fund") of shares and notes of a subsidiary to a subsidiary trust (the "Trust") of the Fund for no consideration, no amount would be added pursuant to s. 107.4(3) by virtue of such disposition to the cost of the Trust units owned by the Fund.

7 December 2000 T.I. 2000-003268

If a policyholder does not realize any disposition of an interest in a segregated fund contract (viewed as analogous to a capital interest in a trust) by virtue of a variation of the contract that occurs in connection with a qualifying disposition, s. 107.4(3)(k) would apply to add policyholder's cost base in the transferor to its basis, if any, in the transferee trust. Similarly, if a policyholder, in connection with a variation of a contract that occurs in connection with a qualifying disposition, should dispose of an interest in the segregated fund contract, s. 107(3)(j) would provide a rollover to the policyholder.