Subsection 112(1) - Deduction of taxable dividends received by corporation resident in Canada

Cases

MNR v. Trans-Canada Investment Corp. Ltd., 55 DTC 1191, [1955] CTC 275, [1956] S.C.R. 49

The respondent bought shares in Canadian corporations and endorsed them to a trustee who in turn issued investment certificates to the respondent, so that the respondent, along with others, held shares of "underlying companies" through an investment trust. The reference in s. 27(1)(a) of the 1948 Act to the resident Canadian corporation qualified the type of dividend, rather than the person from whom the dividend was to be received. Therefore, because the respondent was the beneficial owner of the dividends, it was entitled to the inter-corporate dividend deduction. "[T]he mere interposition of a trustee between the dividend-paying companies and the beneficial owner of the shares did not change the character of such sum."

Administrative Policy

13 December 1989 T.I. (May 1990 Access Letter, ¶1228)

The deduction under s. 112(1) is applicable to dividends received by a corporation on shares included in its inventory insofar as ss.112(2.1), (2.2) and (2.4) are not applicable.

84 C.R. - Q.80

RC will scrutinize whether payments made under dividend rentals purporting to be dividends are in fact such.

Subsection 112(2.1) - No deduction permitted

See Also

Heron Bay Investments Ltd. v. The Queen, 2009 DTC 1606, 2009 DTC 1288

In obiter dicta, Hogan, J. noted (at para. 66) that the prohibition against an inter-corporate dividend deduction in s. 112(2.1) would apply where an SFI in the business of lending money to third parties subscribed for preferred shares that were, in substance, identical to unsecured debt issued by its client, but that "if the same financial institution wanted to capitalize a subsidiary through an investment in preferred shares for a reason other than for its general business purpose of money lending or investing in shares of third parties, the shares might not be acquired in the 'ordinary course of business' ...

Société d'investissement Desjardins v. MNR, 91 DTC 393 (TCC)

The taxpayer, which was a venture capital corporation, was found not to have received a deemed dividend on a term preferred share in the ordinary course of the business carried on by it. The term preferred shares, which were held by the taxpayer for only nine days before their redemption, were not acquired in accordance with the taxpayer's investment philosophy, which was to acquire medium- and long-term investments. Instead, they were acquired as part of an arrangement to maintain the taxpayer's voting interest in the corporation notwithstanding the issuance of voting shares to employees. Tremblay J. also noted that s. 112(2.1) "was clearly enacted to avoid the improper use by lending institutions of shares similar to loans the dividends on which were tax-free while the interest on such loan had to be included in the income of these corporations", whereas here no such abuse was intended by the taxpayer (p. 410).

Reed v. Nova Securities Ltd., [1985] BTC 121 (HL)

As interpreted in General Motors Acceptance Corporation (U.K.) Ltd. v. IRC, [1987] BTC 71 (C.A.).

Shares acquired by the taxpayer did not constitute trading stock (which was defined as "property such as is sold in the ordinary course of the trade") because they were worthless, and thus unsaleable. Lord Templeman stated (at p.127): "If a company is to acquire an asset as trading stock, the asset must be not only of a kind which is sold in the ordinary course of the company's trade but must also be acquired for the purposes of that trade with a view to resale at a profit. A company which acquired an asset for purposes other than trading would not, in my opinion, acquire the asset as trading stock even though the company habitually traded in similar assets."

Blok-Andersen v. MNR, 72 DTC 6309 (FCTD)

In the course of considering a submission that s. 85B(1)(B) of the pre-1972 Act (now s. 12(1)(b)) did not apply to an adventure in the nature of trade, Cattanach J. stated (at p. 6321):

"The phrase 'in the course of' contemplates a succession of events in a regular order. It also contemplates a result which follows from an event being set in motion. Such a result will arise in the case of an isolated sale as well as in a continuous number of sales."

Administrative Policy

92 C.M.TC - Q.12

The position at 84 C.R. - Q.62 is affirmed. Whether the corporation is an SFI only by virtue of being related to a financial institution is not relevant to the determination.

19 March 1992 T.I. (Tax Window, No. 18, p. 11, ¶1819)

Generally, shares issued on the incorporation of a wholly-owned subsidiary where the proceeds are used to constitute permanent capital of the subsidiary are not acquired in the ordinary course of the parent company's business; nor are shares acquired on the sale of a business or part of the business in the course of an internal reorganization within a corporate group.

20 December 1990 Memorandum (Tax Window, Prelim. No. 3, p. 25, ¶1122)

The courts have rejected arguments to the effect that all securities acquired by certain types of corporation such as banks or life insurers have been acquired in the ordinary course of business, and in determining this question the courts have tended to use factors similar to those used in distinguishing income from capital.

86 C.R. - Q.15

(1) shares acquired from a related corporation in the course of its reorganization that are quickly redeemed generally will not be considered to have been acquired in the ordinary course; (2) the word "principal" must be given its ordinary meaning - see IT-290; where an SFI invests in term preferred shares of a related corporation, they generally will not be considered to have been acquired in the ordinary course.

ATR-10 (31 July 86)

S.112(2.1) would not apply to the issuance of term preferred shares (which are retractable and have a participating dividend) by a subsidiary to its parent which is an SFI and is engaged in a manufacturing and distribution business.

84 C.R. - Q.62

Factors considered in determining whether shares were acquired in the ordinary course, including whether the funds raised on issuance provided need capital for the subsidiary, and whether the shares were acquired as consideration on the sale of a business or part of a business where the holder's business had not previously included such transactions.

80 C.R. - Q.23

Shares issued on the incorporation of a wholly-owned subsidiary would not as a rule be issued "in the ordinary course of business".

Articles

Elizabeth J. Johnson, James R. Wilson, "Financing Foreign Affiliates: The Term Preferred Share Rules and Tower Structures", (2006), vol. 54, no. 3 Canadian Tax Journal, 726-761.

Fien, "A Directors' Liability and Indemnifications, Section 160 Assessments and Ordinary Course of Business Provisions", 1992 Conference Report , pp.53:32-53:35.

Subsection 112(2.2) - Guaranteed shares

Administrative Policy

86 C.R. - Q. 14

The conditions respecting whether the guarantor is an SFI or associated with the issuer are relevant at the time a dividend is paid and not simply at the time the shares are issued.

Articles

Webb, "Structuring International Joint Ventures: Canadian Tax Issues to Consider", Bulletin for International Fiscal Documentation , Vol. 48, No. 8/9, August/September 1994, Special IFA issue, p. 448

Discussion of "Unilever" and "Xerox" models.

Dyer, "Preferred Share Financing", 1986 Corporate Management Tax Conference, p. 20.

Discussion of background behind repeal of s. 112(2.2)(f) effective May 23, 1985.

Subsection 112(3) - Loss on share that is capital property

Cases

The Toronto Dominion Bank v. The Queen, 2011 DTC 5125 [at 6061], 2011 FCA 221, [2011] 6 CTC 19

The taxpayer ("TD") held common and preferred shares in a Canadian real estate company ("Oxford"). TD received dividends from Oxford over a number of years, which it used to buy new "Class E" shares having low paid-up capital, so that Oxford could use the resulting surplus to pay off existing obligations. With the surplus thus depleted, TD sold its Oxford shares at a capital loss and used the proceeds of sale to buy shares in an Oxford affiliate.

The Court found that s. 112(3) did not apply to reduce the taxpayers' loss on the Class E shares because no dividends had been paid on them. The Minister's argument that the Class E shares were "virtually identical" to the other shares was not accepted, because the shares had substantive differences in voting rights and paid-up capital. Furthermore, even if they were virtually identical, the wording of s. 112(3) clearly applied to the sale of a Class E share only if it actually were "the share on which the dividend was received."

Administrative Policy

24 November 2013 CTF Roundtable Q. , 2013-0508161C6

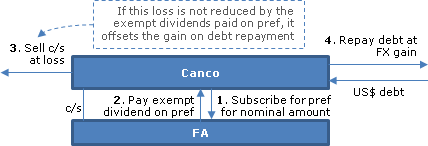

A shareholder having an accrued foreign exchange loss on common shares of an FA and an accrued foreign exchange gain on a related party debt used to acquire those shares acquires a separate class of the FA's shares and pays dividends thereon with a view to such dividends not reducing a loss to be realized on the a sale of the original FA shares owned - in order that such loss can offset the FX gain on settlement of the debt. In indicating that GAAR would apply to the resulting avoidance of the stop-loss rule in s. 93(2.01) respecting the sale of the shares, CRA stated that a loss would be denied "unless the related debt is a debt described in subparagraph 93(2.01)(b)(ii), a provision which precisely specifies which gains are intended to have an effect on the computation of the amount of a loss to be denied on the disposition of FA shares," and that one such requirement was that an "arm's length foreign currency debt… was entered into within 30 days of the acquisition of the FA share."

"It would be difficult to arrive at a different conclusion" for similar transactions in as s. 112(3) context:

given that subsection 112(3) is a loss denial rule similar in nature to subsection 93(2.01) (and 93(2) as it formerly read). Furthermore, the absence of an exception from 112(3) similar in nature to subparagraph 93(2.01)(b)(ii) could be viewed as being indicative of an intention to not have any gains have an effect on the computation of the amount of the loss to be denied on the disposition of non-FA shares.

2011 APFF Roundtable Q. 17, 2011-0412171C6 F

where there is an exchange of 100 common shares in the capital of a corporation for 100 "new" common shares in its capital, there could be considered to be no disposition of the old common shares (given that the share rights are identical), so that the s. 85(1) election is unavailable. On this basis, dividends received on the "old" shares could reduce a loss otherwise deemed to arise under s. 50(1)(b)(iii) on the insolvency of the corporation, so that it would be of no import that the continuity rule in s. 112(7) does not apply to (purported) s. 85(1) exchanges.

1996 A.P.F.F. Round Table No. 7M12910 (Item 2.1)

Because most transactions contemplated in s. 85.1 (unlike those contemplated in s. 85) significantly change the taxpayer's participation in capital, the transitional provisions will not be expanded to cover s. 85.1.

Furthermore, a "disposition made in accordance with a will, accompanied by-laws or the terms and conditions of a share redeemable by mutual agreement or at the pleasure of the holder, is not considered made in accordance with an agreement in writing."

Subsection 112(3.2) - Loss on share held by trust

Administrative Policy

16 June 2014 STEP Roundtable Q. , 2014-0523061C6

2009-031060117 concerned the redemption of common shares held by an estate in its first year, with the aggregate capital loss realized carried back to the final return under s. 164(6). CRA stated:

The share redemption was done in two steps so as to allow the corporation to make a subsection 83(2) election to the extent of its capital dividend account. The first redemption resulted in a deemed dividend on which the corporation made the 83(2) election, and a capital loss to the estate. The second share redemption, the following day, resulted in a deemed taxable dividend and another capital loss to the estate. It was later realized that the tax result would have been more favourable if all of the shares had been redeemed in a single transaction.

The result was that the two redemptions were viewed as separate transactions for the purpose of applying the stop-loss rule in subsection 112(3.2).

1996 Ontario Tax Conference Round Table under "S.112 Stop-Loss Amendments, Q. 1 to 4", 1997 Canadian Tax Journal , at pp. 215-218

Discussion of anomaly in s. 112(3.2) and of grandfathering rules.

Articles

Kevin Wark, "Corporate-Owned Insurance: Revisiting Share Redemption Arrangements", CALU Report, August 2004.

Joel Cuperfain, "Got Me Those 'Low Capital Gain, High Dividend Tax, Stop-Loss Rules, Estate Planning' Blues", Personal Tax Planning, 2002 Canadian Tax Journal, Vol. 49, No. 3, p. 764.

Jack Bernstein, "Don't Waste Capital Dividends", Canadian Tax Highlights, Vol. 8, No. 9, 26 September 2000, p.71.

Subsection 112(4) - Loss on share that is not capital property

Administrative Policy

7 April 1993 Memorandum (Tax Window, No. 31, p. 6, ¶2513)

A standard distress preferred share ruling is that s. 112(4) will not apply in respect of any dividends received by the specified financial institution on the distress preferred shares, to any loss realized by the institution on the debt subsequent to it being reacquired by the institution or to any loss realized by the institution on any loan made by the institution as described.

91 C.R. - Q.34

Re interaction between ss.112(4) and (4.1).

19 November 1990 Memorandum (Tax Window, Prelim. No. 2, p. 18, ¶1041)

Discussion of a situation which s. 112(4)(e) was intended to cure.

Subsection 112(4.1) - Fair market value of shares held as inventory

Administrative Policy

1995 T.E.I. Round Table, Q. 18, 953112 (C.T.O. "Dividends on Shares Held as Inventory")

A taxpayer who has chosen pursuant to Regulation 1801 to value all its inventory at fair market value will recognize a gain where the deemed fair market value under s. 112(4.1) is greater than the cost of the share on which the dividends were paid.

Subsection 112(9)

Administrative Policy

Edward Miller and Matias Milet, "Derivative Forward Agreements and Synthetic Disposition Arrangements", draft version of paper for CTF 2013 Conference Report.

Example of interaction between ss. 112(9) and (8)

[S]ubsection 112(9) expressly provides that the 365 day period is determined without reference to subsection 112(9) itself, and subsection 112(8) expressly provides that its results apply for purposes of subsection 112(9). The resulting interaction of the two provisions can be illustrated by the following example. A corporate taxpayer acquires a share of a taxable Canadian corporation, Canco, on January 1, 2014, enters into a 35 day SDA with respect to the share on January 5, 2015, continues to own the share after the termination of that SDA, then enters into another 35 day SDA with respect to the share on November 1, 2015, and finally disposes of the share at a loss at the conclusion of the second SDA on December 5, 2015. But for the 365-day exception, the taxpayer would be deemed by subsection 112(8) not to own the Canco share for dividend stop-loss purposes during the term of the first SDA (the 365 days beginning on January 5, 2015). However, since the taxpayer has owned the share for at least 365 days prior to the first SDA, the exception in subsection 112(9) applies (without any immediate consequence since the first SDA is not followed by a loss realization event). However, the exception will not apply to the second SDA, despite the fact that by the time the second SDA is entered into, on November 1, 2015, the taxpayer has, as a factual matter, held the Canco share for well over 600 days. The exception will not apply to the second SDA because in determining whether a taxpayer has owned a property for a 365 day period prior to the commencement of an SDA, that holding period is measured without reference to subsection 112(9) - the result being that the first SDA must be taken into account in determining whether prior to the second SDA's inception the taxpayer owned the Canco shares for 365 days.