Subsection 118.1(1) - Definitions

Right to Receive Production

Articles

R. Ashton, "Leasing: Recent Developments", 1997 Corporate Management Tax Conference Report, c. 11.

Total Charitable Gifts

Cases

Castro v. The Queen, 2015 FCA 225, rev'g sub nom. David v. The Queen, 2014 DTC 1111 [at 3236], 2014 TCC 117

The taxpayers received charitable receipts for 10 times the amount of contributions, paid in cash, made by them to a registered charity. Woods J had allowed charitable credits for the amount of the cash donations made (see summary sub nom David).

Before allowing the Minister's appeal on the basis that the receipts were not in prescribed form (see summary under s. 118.1(2)), Scott JA dismissed the Minister's alternative argument that the inflated charitable receipt was itself a benefit that could vitiate a charitable gift. He stated (at para. 47):

...[T]he respondents were not involved in a leveraged charitable donation scheme in which their cash donations were connected to pretence documents as in Berg or a kickback of part of the donation as in Webb. ...

The trial judge was reasonable in refusing, on procedural grounds, to consider the Minister's position that the taxpayers lacked donative intent (paras. 37-39).

Berg v. The Queen, 2014 DTC 5028 [at 6664], 2014 FCA 25, rev'g infra

The taxpayer purchased timeshare units for cash equaling their fair market value and issued bogus promissory notes for nine times the units' fair market value as purported additional consideration for the units. He then donated the units to a registered charity and received charitable receipts for 10 times the units' fair market value.

In rejecting a submission that the taxpayer was entitled to credits for the cash portion of his "gift," on the basis that he received no benefit under this "deal" other than the charitable receipts, Near JA stated (at para. 28):

[I]t was not open to the judge to conclude that the pretence documents were "of no value" at the time that Mr. Berg consummated the "deal." ... He used them to support his initial claim for inflated tax credits.

Furthermore, the taxpayer did not have the requisite donative intent, as he "did not intend to impoverish himself by transferring the timeshare units" but instead "intended to enrich himself ... from inflated tax credit claims" (para. 29).

Kossow v. The Queen, 2014 DTC 5017 [at 6622], 2013 FCA 283

The taxpayer participated in an avoidance scheme similar to the one in Maréchaux, in which she made donations, financed as to 80% by a non-interest-bearing loan with a term of 25 years received from one of the promoters ("Talisker"), in order to obtain tax credits greater than her cash outlay (of 20% of her reported gift amount). The evidence indicated that virtually all of the cash portion of her donation was indirectly used to pay fees, and that the 80% financing received from Talisker was used, through a series of transactions, to in turn finance Talisker. There was no evidence that the art works, which supposedly were to be purchased for a charity with the donated funds, actually existed.

In finding no "gift," as the taxpayer had received a significant financial benefit as the recipient of long-term, interest-free loans as part of the same transactions, Near JA stated (at para. 25):

In my view, Maréchaux stands for two propositions, as follows:

(a) a long-term interest-free loan is a significant financial benefit to the lender; and

(b) a benefit received in return for making a gift will vitiate the gift, whether the benefit comes from the donee or another person.

Respecting point (b), Near JA rejected the taxpayer's submission that McNamee v. McNamee, 2011 ONCA 533, established that a gift is only vitiated by the donor's receipt of a benefit if the donee (rather than a third party) provided it.

Maréchaux v. The Queen, 2010 DTC 5174 [at 7315], 2010 FCA 287, aff'g 2009 DTC 1379 [at 2095], 2009 TCC 587

The taxpayer agreed in December 2001 to make a $100,000 donation to a charitable foundation, comprising $20,000 of his own funds and $80,000 from a non-interest bearing 20-year loan. He spent a further $10,000 of his own funds on a "security deposit" together with an insurance policy to ensure against the risk that the security deposit would not accrete to $80,000 in 20 years' time. In January, 2002, the taxpayer assigned the security deposit and the insurance policy to the lender (who was owned by the tax shelter promoter) in complete satisfaction of the $80,000 loan.

Evans JA found that the donation was not a gift, given the Tax Court finding that the $80,000 interest-free loan was a significant benefit that the taxpayer obtained only by making the donation. Furthermore, the taxpayer had a reasonable expectation at the time of making the donation that he would be able to assign the security deposit and the insurance policy to the lender in satisfaction of the loan, which represented a further benefit to him. It was irrelevant that the benefits came from a third party.

The Court of Appeal agreed with Woods J.'s further finding that the taxpayer's $20,000 initial outlay was also not a gift. She stated (at TCC para. 49): "There is just one interconnected transaction here, and no part of it can be considered a gift that the appellant gave in expectation of no return."

Slobodrian v. MNR, 2006 DTC 5625, 2005 FCA 336

The Court followed its earlier decision in Slobodrian v. Queen, 2003 DTC 5632, 2003 FCA 350 in finding (at p. 5626) that "the mere supply of services without compensation involves no property and hence cannot form the subject matter of a gift".

The Queen v. Doubinin, 2005 DTC 5624, 2005 FCA 298

A finding of the Tax Court Judge that the taxpayer had not made a gift of $6,887 to a registered charity with an expectation that he would be issued a tax receipt for $27,548, but that this was a mere possibility, was not made in a capricious manner or without regard to the evidence and, accordingly, the donation made by the taxpayer qualified as a gift.

Attorney General of Canada v. Nash, 2005 DTC 5696, 2005 FCA 386

A company ("CVI") operated a program through which it sold groups of limited edition prints to individuals, arranged for appraisal and located registered charities to whom the prints could be donated on behalf of the individuals.

The Court found that the Tax Court Judge had committed two errors: in accepting valuation evidence based on the retail market for individual prints when there was a normal market (that through which CVI actually purchased the prints) for the groups of prints the valuator was required to value; and in finding that the fair market value of the property was approximately three times the amount paid for the property by CVI with no credible explanation for the apparent three-fold increase.

Slobodrian v. MNR, 2003 DTC 5632, 2003 FCA 350

A retired physics professor who agreed to carry out research activities without remuneration pursuant to a contract between Public Works Canada on behalf of the Canadian Space Agency, and the University from which he was retired, was not entitled to a charitable credit for the value of the services performed by him. "The word 'gift' ... in a taxing statute must be taken as referring to what is known to the law as a gift, namely the gratuitous transfer of property (tangible or intangible) ..." (p. 5633), and as the statutory definition of property in s. 248(1) did not expand the word property beyond its normal meaning, the mere supply of services without compensation involved no property and, hence, could not form the subject matter of a gift. Furthermore, he did not provide receipts that complied with Regulation 3510.

Woolner v. Attorney General of Canada, 99 DTC 5722, Docket: A-912-97 (FCA)

Contributions made by the taxpayers to the First Mennonite Church that were designated as contributions to be applied to a student mutual aid programme did not qualify as a gift (i.e., "a voluntary transfer of property from one person to another gratuitously and not as the result of a contractual obligation without anticipation or expectation of material benefit" (p. 5723)), given that such contributions were made with the anticipation that their children would be provided with a bursary.

The Queen v. Friedberg, 92 DTC 6031 (FCA), rev'd 93 DTC 5507, [1993] 4 S.C.R. 285

The taxpayer purchased for $12,000 an antique textile collection which had been identified and brought to his attention by an employee of the Royal Ontario Museum, loaned the collection to the museum, then donated it after a certificate was issued by the Cultural Property Review Board for its appraised value of $229,437. The taxpayer was permitted a deduction for that latter amount under s. 110(1)(b.1). However, the taxpayer was denied a deduction with respect to the alleged donation by him of a second textile collection in a similar series of transactions given that the relevant documents established a direct transfer of title from the original owner of the textile collection to the museum. It was also noted (p. 6034) that if the original owner "had agreed to pass the title to the taxpayer, she would have undoubtedly insisted on a guarantee that the Collection be given to the ROM, which would also have defeated the legal conclusion that there was a gift of the textiles to the ROM from the taxpayer."

In reaching this conclusion, the Court stated (at p. 6032):

[A] gift is a voluntary transfer of property owned by a donor to a donee, in return for which no benefit or consideration flows to the donor.

The Queen v. Burns, 88 DTC 6101 (FCTD), aff'd 90 DTC 6335 (FCA)

The taxpayer whose daughter was a member of a Canadian Ski Association training squad, was not entitled to deduct payments made by him to the Association because they were not gifts. Pinard, J. found that there was an understanding or arrangement between the taxpayer and the Association that he would pay it certain sums of money and it would allow his daughter to participate in its Training Squad. However, even if there were no contractual obligation on the taxpayer, the taxpayer received a benefit from his contributions in the form of the development and ski training provided for his daughter. In order for there to be a gift "the donor must be aware that he will not receive any compensation other than pure moral benefit."

The Queen v. McBurney, 85 DTC 5433, [1985] 2 CTC 214 (FCA)

In order for a transfer of property to be a "gift", the property generally must be transferred voluntarily and not as the result of a legal obligation, with no advantage of a material character being received by the transferor by way of return. Donations made by the respondent parent to a private school which blended religious teaching with the teaching of secular subjects, were held not to be deductible because they were made out of a "sense of personal obligation on the part of the respondent as a Christian parent to ensure for his children a Christian education and, in return, to pay money to the operating organizations according to their expectations and his means." In addition, the payments fulfilled the respondent's legal obligation under the Education Act (Ontario) to ensure that his children received satisfactory instruction at some school.

The Queen v. Zandstra, 74 DTC 6416, [1974] CTC 503 (FCTD)

The taxpayer, whose two children were attending at the Canadian Christian School at Jarvis, Ontario (which was a registered charity) paid $590 to the school in 1968, and deducted $390 as a charitable contribution, on the basis that the non-deductible tuition portion of the payment was $200. The Department reassessed on the basis that the tuition component was $200 per child, rather than $200 per family.

The Crown's appeal was allowed. The payments "were not payments made without consideration and cannot therefore be considered 'gifts' ... . [E]ach parent here received a consideration, i.e., the Christian education of his children."

See Also

Mariano v. The Queen, 2015 TCC 244

The taxpayers were participants in leveraged donation transactions, which were intended to result in a step-up of the adjusted cost base of courseware licences (e.g., on how to use Microsoft products) under ss. 69(1)(c) and 107(2) (apparently with a view to avoiding s. 248(35)) before the licences were donated by them at a higher stipulated value to a registered charity ("CCA").

A Bahamian corporation ("Phoenix') acquired various courseware licenses, at costs of 13.3 to 26.7 cents each from a Florida corporation ("Infosource") which also packaged and sold such licences in the course of its business, and gifted most of them to a Canadian–resident Trust (with the balance being sold to raise cash to fund its purchase price). Ostensibly, the licences then were distributed to the program participants such as the taxpayers as capital beneficiaries of the Trust, with the participants then donating them to CCA. The participants also made cash donations to a second registered charity ("Millennium"), which redonated 80% of those amounts to CCA and used the balance to pay fees and other expenses. It was "clear…that any participants in the program knew that their cheques for the cash contribution [to Millennium] would not be cashed until they were notified they were accepted as capital beneficiaries [of the Trust] and, thus, would be receiving the further benefit of Licence distributions for further gifting" (para. 38). The participants were issued charitable receipts for three or more times their cash outlay (and perhaps 800 times the cost to Phoenix of the licences (para. 125)).

Pizzitelli J upheld the Minister's disallowance of the taxpayers' charitable tax credits. Among other reasons (including that the transactions were a sham - see summary under general concepts - sham), Pizzitelli J found that, as in Berg, the taxpayers had no donative intent for either the licence or cash gifts. Despite the pains taken by the promoters to separate out the two gifts, it was clear that the two were part of a single interconnected series of transactions (para. 48), and that the taxpayers did not seek to impoverish themselves by making the gifts, but rather to receive a net tax benefit. The taxpayers argued that they were necessarily impoverished through the act of giving away the gift property. Pizzitelli J stated (at para. 22):

The concept of impoverishment means more than depriving oneself of property; it clearly means depriving oneself of property in such a manner as to not benefit from such deprivation.

A further barrier to finding that the participants had gifted the licences is that their Deeds of Gift indicated that the subject licences were as described in "Schedule A," which had not yet been attached. The determination of the type and number of licences which were "allocated" to each participant was not determined until subsequently, based on a computer algorithm. Pizzitelli J stated (at para. 51):

This is prima facie evidence the Appellants could not have owned the Licences they say they voluntary gifted… . It simply defies common sense to suggest someone can voluntarily give a property he does not yet know of or otherwise has any way of specifically identifying.

See summaries under general concepts - sham, general concepts - fair market value, s. 104(1), and s. 107(2).

French v. The Queen, 2015 TCC 35

The taxpayer participated in the same donation scheme as in Kossow. The taxpayer, who was not a Quebec resident, sought to apply the Quebec civil law concept that "a remunerative gift ... constitutes a gift ... for the value in excess of that of the remuneration." His notice of appeal argued that consistency in the law ought to prevent the Income Tax Act from applying differently in different jurisdictions.

C Miller J granted the Minister's motion to strike the civil law argument from pleadings, calling it (at para. 22) "hopeless." Sections 8.1 and 8.2 of the Interpretation Act specifically reject uniformity in favour of bijuralism, to say nothing of the Harmonization Act, jurisprudence preceding the enactment of ss. 8.1 and 8.2 (see St. Hilaire, 2001 FCA 63), published articles, and s. 94 of the Constitution Act, 1867.

Webb v. The Queen, 2004 TCC 619

The taxpayer made a donation equal to his annual income to a charity (whose registration was revoked shortly thereafter). Bowie J found there was overwhelming indirect evidence that the taxpayer received significant peripheral kickbacks for this donation, which vitiated any donative intent. He upheld the Minister's decision to disallow the taxpayer's claim for charitable tax credits.

Regarding the point made in Doubinin that a tax benefit would not typically be considered a "benefit" vitiating a charitable gift, Bowie J stated (at para. 18):

I do not read [Doubinin] as purporting there to extend what was said ... in Friedberg to suggest that a scheme ... to claim tax credits for charitable donations in excess of the donations actually made ... [to] not be considered a benefit within the context of the definition of what constitutes a gift.

Johnson v. The Queen, 2014 DTC 1097 [at 3185], 2014 TCC 84

The taxpayer claimed donations, equal to approximately half of his salary, allegedly made to a registered charity ("CFCD") in three consecutive taxation years. The charity's president ran an "accounting" business on the side, in which false receipts were generated from CFCD in exchange for payments from taxpayers equal to 10% of their amounts. VA Miller J found that as the taxpayer had purchased receipts rather than making any donation, his claims were properly denied.

David v. The Queen, 2014 DTC 1111 [at 3236], 2014 TCC 117

The taxpayers or their spouses donated cash and, in some instances, household goods to a registered charity. The Minister assumed that the taxpayers "in consideration for a charitable receipt from [the charity,] would pay 10% of the face value of the receipt amount, plus a commission, to her tax preparer." The taxpayers did not succeed in establishing that they donated more than 10%.

After stating (at para. 61) that "the issuance of an inflated tax receipt should not usually be considered a benefit that negates a gift," and that although "the appellants likely knew that they were claiming inflated tax credits ... this is not a sufficient reason to deny the tax credits altogether" (para. 64), Woods J found that the taxpayers were eligible for credits based on 10% of the receipt amounts, and directed that any penalties be deleted. As to whether the taxpayers had donative intent (whose absence would vitiate a "gift"), the Minister had not raised this issue in pleadings.

Carson v. The Queen, 2014 DTC 1006 [at 2520], 2013 TCC 353

The taxpayer and his wife allowed a charity to use two rooms of their house for free (an office and a storage room), and claimed charitable credits for the fair market value of the use of the rooms (i.e. rent). C Miller J disallowed these credits, as the charity had no legally enforceable right to the space - and without an enforceable right, there was no property to donate.

However, C Miller J disagreed with CRA's position in 2003-0018595 that a grant of use cannot constitute a transfer of property. Manrell provides that "property" entails some exclusive right to make a claim against someone else (para. 6).

Hall v. The Queen, 2013 DTC 1241 [at 1313], 2013 TCC 314

Pizzitelli J found that there was no discrimination in denying the taxpayer charitable credits for donations made to the International Association of Scientologists, which was not a registered charity, because nobody is entitled to credits for donations to entities that are not registered charities.

Bandi v. The Queen, 2013 DTC 1192 [at 1032], 2013 TCC 230

The taxpayer participated in a donation scheme in which participants supposedly would acquire office software licences for a bulk rate and donate them for charitable receipts reflecting the ostensible fair market value (i.e. non-bulk rate) of the licences:

- A corporation ("Multisolve") would sell transferable software licences to an individual ("Intermediary") for $468 each. In lieu of cash payment, Multisolve would take vendor take-back charges over the licences for $468 (the "Liens").

- The Intermediary would donate the licences to a Trust.

- The participants would be named capital beneficiaries of the Trust.

- The Trust would distribute the licences to the participants as gifts.

- The participants would donate the licences to a charitable Foundation, along with a $468 cash "donation" to discharge the Liens.

The taxpayer received two charitable receipts, one for $468 per licence in respect of the cash portion, and one for $1031 per licence on the basis of a $1499 fair market value less the $468 Liens.

Hogan J upheld the Minister's decision to fully deny charitable credits claimed by the taxpayer. The taxpayer advanced no evidence that the software had existed. Respecting the cash "donation," there was a lack of donative intent given the taxpayer would not have paid the cash without the understanding that he would receive the software licences from the Trust, and the cash "donation" was earmarked to discharge the Lien.

See also the summary under s. 237.1(6).

Berg v. The Queen, 2013 DTC 1018 [at 93], 2012 TCC 406, rev'd supra

The taxpayer purchased timeshare units for cash (as to 1/9 of the consideration) and promissory notes (as to the balance), and then donated the units (which had a fair market value equal only to the cash portion of the "donation") to a registered charity. The Minister reassessed the taxpayer on the basis that neither the leveraged portion of his donation nor his actual cash outlay qualified for a charitable receipt. Bocock J. found that the promissory notes were pretences and did not reflect a bona fide obligation of the taxpayer - and that he asked for a discharge of such purported obligations only because of the risk that someone might subsequently mistake them for genuine obligations.

He also found that the cash outlay generated a credit, notwithstanding that the taxpayer's biggest motivation for making the outlay was to obtain a tax benefit. After reviewing the jurisprudence to the effect that charitable receipts do not, by themselves, represent a tangible or potential benefit that vitiates a finding of "gift," he concluded (at para. 48):

In the absence of some other benefit received beyond the Inflated Tax Receipts, no legal authority suggests donative intent as defined by the case law relevant to section 118.1 of the Act has been vitiated or nullified to the extent of the value of the Cash Donation Amount.

Bocock J. found (at para. 35) that Maréchaux was "easily distinguishable" on the basis that the promissory notes and transaction documents in the present case were legally ineffective - they provided no "tangible or potential benefit to the Appellant" beyond camouflaging the true amount of the gift from CRA.

Grosset v. The Queen, 2012 DTC 1185 [at 3465], 2012 TCC 179

The taxpayers relied on charitable receipts which showed donations amounting to approximately 25% of their annual income, and which had been obtained from a tax planner who had subsequently been convicted for selling fraudulent charitable receipts to taxpayers. Paris J. affirmed the Minister's finding that no gifts had in fact been made.

Russell v. The Queen, 2009 TCC 548, 2009 DTC 1371

C. Miller, J. followed the Nash decision in finding that quantities of art purchased by the taxpayers and immediately donated to charities had a fair market value equal to their purchase price. In rejecting the taxpayers' submission that the fair market value determination should be based on the retail market (i.e. what the art might be sold for to the public by galleries), he stated (at para. 25) that this argument "ignores the reality that the buyers/donors have no access to that retail market, other than through a gallery" and that he could speculate "that the buyers/donors might go knocking on the galleries' doors to sell in bulk, but this would not yield the retail price the gallery would sell the art for, only the wholesale price the gallery would buy the art for".

Benquesus v. The Queen, 2006 DTC 2747, 2006 TCC 193

It was found that the taxpayer's father, in transferring funds to a charitable foundation, had thereby made a transfer to his children of loans owing to them by the foundation, with the result that they were entitled to a charitable credit when they subsequently forgave a portion of the monies owing to them. The evidence supported that their father had intended to gift monies to them, the courts presume acceptance by a donee so that here, the fact that the children were aware of the transfer to the Foundation and were generally aware of the terms, with sufficient particularity to establish acceptance of the gift by them, and the effective control that they exercised over the money established that there had been a completed gift.

Klotz v. The Queen, 2004 DTC 2236, 2004 TCC 147, aff'd 2005 DTC 5279, 2005 FCA 158

The taxpayer purchased prints from a promoter at approximately $300 per print (which the promoter contemporaneously had purchased for approximately U.S.$10 to U.S.$50 per print) and immediately donated the prints to Florida State University for an appraised value of approximately $1,000 per print. After noting that the best evidence of the fair market value of the prints was the value in a contemporaneous arm's-length purchase transaction, i.e., the purchase at $300 per print, rather than what it might be possible with "world enough and time" to sell the occasional print for in a New York gallery, Bowman A.C.J. found that the fair market value of the prints was $300 each.

Nadeau v. The Queen, 2003 DTC 18 (TCC)

Employees of a college who wished to have a computer at home would make a payment to a charitable foundation associated with the college, with the foundation applying the money to the purchase of the computer and issuing a charitable receipt for 80% of that amount to the employee (the personal-use of the computer being estimated to be 20%). The payments did not qualify as gifts given that the making of a gift "implies gratuitousness, a disinterested donor in the absence of any consideration" (p. 23).

Dutil v. The Queen, 95 DTC 281 (TCC)

After confirming the Minister's reassessment that had been made on the basis that a painting donated by the taxpayer to a gallery have been over-valued by a factor of approximately five times, Dussault TCJ. went on to indicate (at p. 287) in obiter dicta "it may be seriously doubted whether such a gift even exists in the true sense when the taxpayer's sole motivation is clearly to enrich himself, not impoverish himself".

Administrative Policy

30 September 2015 T.I. 2015-0590501E5 F - Spousal sharing

An individual and his spouse each make a charitable gift of $10,000 in a year, and they wish to allocate $17,000 to the individual as his gift, and $3,000 to his spouse. What is CRA's policy on the allocation of gifts between spouses or common law spouses before 2016 or after 2015? CRA stated (TaxInterpretations translation):

[A]n individual can claim a tax credit for gifts which he, his spouse or common law spouse made in the course of the given year or the five preceding taxation years. Taking into account this administrative position, an individual and his spouse or common law spouse who otherwise satisfies the other conditions stipulated in section 118.1 respecting the income tax credit for a charitable gift for a taxation year can, for years before 2016, choose the most advantageous allocation for purpose of a deduction claim under subsection 118.1(3).

…As for the 2016 taxation year…an individual and his spouse or common law spouse who otherwise satisfies the other conditions stipulated in section 118.1 respecting the income tax credit for a charitable gift could continue to share, in the most advantageous manner, charitable gifts made by each of them, for purposes of a claim under subsection 118.1(3).

…[S]uch an arbitrary allocation of charitable gifts would also be possible for deduction claims for the five taxation years following the given taxation year, insofar as the unused portion of the eligible amount of the gift, as defined in subsection 248(1), is concerned.

12 February 2015 T.I. 2014-0550771E5 F - Allocation à des bénévoles - chantier particulier

A registered charity sends volunteers on missions to developing countries and pays them an allowance of $X per day. After finding that "remuneration that is quite unrepresentative of the services rendered would not be taxable," CRA turned to a question as to whether the charity could issue donation receipts in accordance with CPC-012 if the volunteers declined the allowance, and stated (TaxInterpretations translation):

[S]uch policy applies only to reimbursement of expenses incurred by the volunteers for the account of the charitable organization and not to allowances which are paid to them.

See summary under s. 5(1).

16 June 2014 STEP Roundtable Q. , 2014-0523061C6

In the course of commenting on common audit issues for trusts, CRA stated:

Compliance issues are often encountered [respecting]…gifts by will. … 2012-047216117 dealt with the issue of whether the executors of an estate were empowered to make a gift to charities, and thus claim a deduction pursuant to subsection 118.1(3) in computing the tax payable by the estate. Based on the terms of the will in the particular case, it was our view that the executors did not have the power to make such a gift.

22 May 2014 T.I. 2014-0526131E5 - Donation of a fossil

Would the value of the custody of a fossil transferred to a qualified donee can be considered a charitable gift" CRA stated tht this was a legal question on which it would not comment in the absence of further particulars.

27 January 2014 Memorandum 2012-0472161I7 - Gifts by Will

///?page_id=909#2012-0472161I7">s. 107(2)]: The Deceased had three wills in respect of defined components of her estate, including a second will in respect of the "Secondary Estate." CRA found that the second will did not accord the executors the discretion to make a gift to specified Charities, so that s. 118.1(5) did not deem distributions made to the Charities to have been gifts made by the Deceased. CRA also quoted E9918215 that:

it is a question of fact to be determined based on the specific wording of the will and the intentions of the trustees…whether the payment of amounts to a registered charity by a testamentary trust represent a distribution out of income to a beneficiary of the trust…within the scope of subsection 104(6), or are a charitable donation made by the trust for which a tax credit under subsection 118.1(3) may be claimed by the Estate

and further stated:

even if [the Executors] could make such a gift, pursuant to subsection 248(28)…, any trust [i.e., estate] income payable to the Charities that would be accounted for under section 118.1… as a gift from the Trust could not also be deducted under subsection 104(6)… and vice versa, by the Trust.

P113 – "Gifts and Income Tax" 2013

Fair market value (FMV)—This is usually the highest dollar value you can get for your property in an open and unrestricted market, between a willing buyer and a willing seller who are acting independently of each other.

2012 Ruling 2012-0466731R3 - Donation of flow-through shares

Donors (mostly Canadian-resident individuals) as well as non-donors use cash to subscribe for flow-through shares of a listed Canadian resource company, pursuant to a subscription agreement entered into by a dealer as their agent (the Agent), so that Canadian exploration expenses will be renounced to the subscribers.

The Donors issue directions to the Agent to transfer a portion (the Donated Shares) of their shares to the account of the relevant registered charity, which issues a charitable receipt. Independent persons (the Liquidity Providers) agree to purchase the Donated Shares for their fair market value from the charities. The Liquidity Providers also agree to purchase the balance of the Donors' shares (the Sale Shares) for their fair market value.

The charities receiving Donated Shares will pay a financial services fee to the Agent for its services in selling the Donated Shares to the Liquidity Providers; and Donors who sell Sale Shares will also pay a financial services fee to the Agent for its services in selling those shares to the Liquidity Providers. Mr. X, who is not a Donor, will also sell his shares on the same terms.

Rulings include:

...an amount equal to the fair market value of the Donated Shares will qualify as a gift for the purposes of the definition of "total charitable gifts" in s. 118.1(1) provided an official receipt is filed...

16 April 2013 T.I. 2013-0477981E5 F - Interpretation of Gift

A collective agreement requires each employee to make an annual contribution to a specified charitable foundation whose mission was aligned with that of the employer. Under a variation of this arrangement, any employee could opt out of this clause on giving a written notice. Respecting the 1st scenario, CRA stated (TaxInterpretations translation):

...the employees are subject, by virtue of the collective agreement, to an obligation to annually remit a pre-established amount to the foundation, which prevents the remitted amount from being a gift.

Respecting the 2nd scenario:

...the sole existence of an option permitting employees to withdraw from the application of the obligatory contribution clause would not suffice, by itself , to be able to conclude that an employee who had not exercised the option had necessarily made a donation….[I]t would be necessary to consider the particular circumstances... .

28 November 2010 CTF Roundtable Q. , 2010-0389111C6

CRA will generally not consider advance ruling requests for leveraged donation schemes such as the one considered in Maréchaux. CRA listed conditions under which it would refuse to make a ruling. In addition to five factors present in a Maréchaux-style scheme (essentially amounting to leveraging a donation with "borrowed" funds that do not represent a genuine economic burden on the donor or gain to the charity), the list included:

- The funds loaned to the taxpayer circle back to the lender.

- The use of a limited partnership or other structure permits losses or other deductions to flow through to investors.

- Offshore money managers or investment accounts are used.

- There is uncertainty about certain aspects such as valuation and questions of fact such as arm's-length issues.

3 December 2003 T.I. 2003-001859 -

A person allowing a charity to use office space at no charge would not be viewed as a transfer of property (i.e., a divesting of property by the donor and a vesting of the property in the registered charity) and, accordingly, would not qualify for a credit.

24 September 1996 T.I. 962770 (C.T.O. "Donations/Tuition Fees")

Unlike teaching or other training, religious training is not viewed as consideration for purposes of the definition of a gift.

13 August 1996 T.I. 960061 (C.T.O. "True Gift") (See also 30 August 1994 T.I. 933441)

"It is the Department's practice to view donations subject to a general direction from the donor as acceptable, provided that no benefit accrues to the donor, the directed gift does not benefit any person not dealing at arm's length with the donor and decisions regarding utilization of the donation within a program rest with the donee."

4 January 1996 T.I. 952477 (C.T.O. "Donation of Residual Interest")

"The gift of an 'object' (within the meaning of 'total cultural gifts' in subsection 118.1(1) and the disposition of an 'object' (within subparagraph 39(1)(a)(i.1)) refers to the gift and disposition of all interests in the object or objects. Consequently, a gift of a residual interest in an object would not be viewed as the gift of an object."

6 July 1995 T.I. 950356 (C.T.O. "118.1(1)")

"A right to use property (e.g., a helicopter or equipment) for a period of time could be considered a property and a donation of a right to use a property, depending on the facts in a particular case, could be considered a gift in kind. Where it is established on the facts in the case that a donation is a gift in kind, the donor is deemed to have received proceeds of disposition equal to the fair market value of the property donated."

5 October 1994 T.I. 5-942164 -

Listing of the four requirements that must be met in order for a transfer of property to qualify as a gift.

In valuing an equitable interest in a trust that has been donated, "the general approach is to value the various interests taking into consideration the fair market value of the property itself, the current interest rates, the life expectancy of any live tenants, or current terms of certain tables, and any other factors relevant to this specific case."

21 September 1994 T.I. 5-94149 -

Although a gift to a pooled fund remainder interest charitable trust could be considered to be a gift to a charity of an equitable interest in the trust provided that there could be no encroachment on capital, in this case it would be very difficult to determine the value of the interest in the trust because the property in the trust consisted of various investments. Accordingly, it was unlikely that a tax credit would be allowed.

13 September 1994 T.I. 5-942227

"Although gifts directed to a person designated by a donor are not eligible for an income tax receipt, donations made to a Canadian municipality can be subject to a general direction, but only in respect of the particular program in which the donations are to be used. Decisions regarding the utilization of the donations within the program must remain the exclusive responsibility of the municipality.

8 August 1994 T.I. 5-941513

The payment by an individual of expenses that she has incurred in performing services for the benefit of the charity does not constitute a gift to the charity even if the individual has voluntarily contributed her time.

25 July 1994 T.I. 5-941850 -

A purchase of kosher-approved products from various retailers does not meet any of the conditions for a charitable gift, i.e., the voluntary transfer of property (usually cash) by a donor to a registered charity with no consideration or benefit accruing to the donor or to anyone designated by the donor as a result of the transfer.

7 June 1994 T.I. 5-940574

In response to a question whether a life insurance policy will qualify as a charitable donation where a taxpayer names more than one charity as the beneficiary under the policy, RC stated:

"In order to absolutely assign a life insurance policy, the donor must transfer absolutely, unconditionally and otherwise than as security, all rights, title and interest in the policy. Accordingly, in our view, a life insurance policy cannot be absolutely assigned to more than one registered charity."

19 January 1994 T.I. 932689 (C.T.O. "Annuities Purchased from Charitable Organizations")

Providing a donor makes an irrevocable contribution directly to a registered charity in return for life annuity, it does not matter what steps the charity may take to fund its liability under the annuity.

1994 Institute of Chartered Accountants of Nova Scotia Roundtable Q. 7, 7-940145

Where a registered charity has solicited individual contributions of capital to the charity in exchange for immediate guaranteed payments to the individual for life at a specified rate, the charity is not restricted as to the steps it may take to facilitate payment of the annuity. It may purchase an annuity from a recognized annuity issuer, either in the name of the donor or in its own name with a direction to pay in favour of the donor. The amount of the gift to the charity will be equal to the amount, if any, by which the amount of the payment to the charity exceeds the total of the annuity payments expected to be received by the donor pursuant to the life expectancy tables provided in IT-111R.

12 January 1993 T.I. 922833 (November 1993 Access Letter, p. 506, ¶C117-208; Tax Window, No. 28, p. 28, ¶2368)

A gift (i.e., a voluntary transfer of property without consideration and without conditions) is considered to occur where an individual has paid more for an annuity purchased from a charity than the total amounts expected to be received as annuity payments. Where the annuity payments vary with fluctuations in the interest rate, it is not possible to determine the amount of the donation, and the charitable organization is not authorized in these circumstances to issue any receipt.

The comments in IT-111R do not apply where the charitable organization issues a term deposit instead of an annuity to the donor.

14 July 1992 T.I. 5-921248 -

A taxpayer will be permitted a credit, on the purchase of an annuity from a charitable organization, based on the difference between the purchase price paid by him and the expected total amounts to be received by him under the annuity.

24 March 1992 T.I. (March 1993 Access Letter, p. 76, ¶C109-126; Tax Window, No. 18, p. 24, ¶1827)

The irrevocable gift of a covenant which runs with land and is binding on the landowner and his successors in title can qualify as a gift.

12 March 1992 T.I. and 13 March 1992 Memorandum (Tax Window, No. 17, p. 10, ¶1802)

In order for an Indian band council to be recognized as a municipality, the council, at a minimum, must have enacted one valid by-law under section 81 of the Indian Act and one valid by-law under section 83 of the Indian Act.

In order for a gift of land to an Indian band to qualify, it must become part of the "Reserve" pursuant to an Order-in-Council.

9 October 1991 T.I. (C.T.O. Fax Service Doc. No. 233; Tax Window, No. 11, p. 18, ¶1514)

In the case where a "donation" is made to a Canadian municipality with a request that the municipality pass the money on to a community group with which the municipality has little or no active involvement, the payment will not be considered a gift to the municipality if the municipality is merely acting as a conduit in respect of payments received on behalf of the organization.

September 1991 T.I. 1991-92 [FMV excludes GST]

If a corporation or individual donated a work of art to a public cultural institution, does the tax receipt reflect the fair market value plus the original GST paid on the original purchase? CRA responded:

The amount recorded on the receipt does not include the amount of GST paid on the original purchase. In fact, the fair market value of property at a particular point in time does not include any costs incurred by the donor.

26 August 1991 T.I. (Tax Window, No. 8, p. 20, ¶1413)

A surviving spouse may claim a tax credit in the year of death in respect of a gift bequeathed by the will of the deceased spouse, to the extent not previously claimed.

10 April 1991 Memorandum (Tax Window, No. 2, p. 24, ¶1191)

A charitable organization may issue an official receipt for a gift of future breeding rights.

25 February 1991 T.I. (Tax Window, Prelim. No. 3, p. 28, ¶1125)

Where the annuity payment on an annuity purchased from a charitable organization varies with fluctuations in the interest rate, it is impossible to calculate the amount of the gift and no charitable donation receipt may be issued.

88 C.R. - F.Q.2

A premium paid prior to the transfer of a life insurance policy to a charity is not deductible as a charitable donation.

81 C.R. - Q. 38

A taxpayer who transfers property to a trust of which a charity is the capital beneficiary has not thereby made a gift to a charity.

IT-86R "Vow of Perpetual Poverty".

Where an individual agrees that a salary to which he is legally entitled will be paid to a religious institution and he, in return, will receive board, lodging and a small living allowance, the difference between the salary assigned or paid over by him to the religious institution and the value of the board, lodging and living allowance will be treated as a charitable donation.

IT-226R "Gift to a Charity of a Residual Interest in Real Property or an Equitable Interest in a Trust".

Articles

Blake Bromley, "Flaunting and Flouting The Law of Gift: Canada Customs and Revenue Agency's Philanthrophobia", Estates Trusts and Pensions Journal, Vol. 21 No. 3, June 2002, p. 177.

Ghosh, Robson, "Charity and Consideration", British Tax Review, 1993, No. 6, p. 496: Discussion of the concept of no consideration.

Total Crown Gifts

Administrative Policy

ATR-63, 20 April 1995 "Donations to Agents of the Crown"

In the absence of a specific provision to this effect in an organization's enabling legislation, RC required an opinion from the Deputy Attorney General of the province that the organization was a Crown agent.

Although decisions regarding specific beneficiaries must be the exclusive responsibility of the entity to which the donations are made (in this case, the organization), here "the direction that the donations be used for particular purposes was not binding and was in such general terms that it was clear that the exclusive responsibility regarding the use of the funds remained with the organization".

20 January 1995 T.I. 5-950041

Given that s. 53 of the College and Institute Act, R.S.B.C. 1979, c. 53 provided that an institution was for all its purposes an agent of the Crown in right of the Province, a gift to a college designated as a provincial institute under that Act qualified as a gift to the provincial Crown.

16 December 1992 T.I. 923559 (C.T.O. "Crown Gifts to Agents of Her Majesty")

A gift to a foundation established under the University Foundation Act (Ontario) qualifies as a gift to an agent of the provincial Crown.

Total Cultural Gifts

Cases

The Queen v. Malette, 2004 DTC 6415, 2004 FCA 187

It was agreed that the fair market value of 981 individual works of art by a Canadian artist named Harold Feist that the taxpayer donated to the Art Gallery of Algoma was reduced by a "blockage discount" (i.e., the depressive effect on the value of individual items that occurs due to the fact that the number of items offered for sale exceeds the number of willing buyers); and the references to "object" in the singular in the legislation did not establish that a blockage discount must not be applied.

Total Ecological Gifts

Administrative Policy

4 March 2014 T.I. 2013-0513251E5 - Ecogifts

Under the Nova Scotia policy of no net loss of wetlands, a consultant may assume a wetland restoration or creation obligation in consideration for the reduction of other wetlands. In discharging this obligation, the consultant may approach landowners respecting the restoration of their lands to wetlands. After any resulting restoration, a conservation easement in favour of the province or a registered charity may be registered on title. Would the landowner be considered to have made a gift?

In the course of a general discussion, CRA stated that it

generally does not recognize temporary transfers of property as gifts… . Accordingly… a conservation interest created for a specified term is not a gift of land within the meaning of an ecological gift in subsection 118.1(1) and paragraph 110.1(1)(d)… .

5 February 1997 T.I. 963345

The grant of an easement in fulfilment of a pre-condition to subdivision approval would not qualify as a gift.

Total Gifts

Administrative Policy

25 October 1994 Memorandum 7-942317 -

Pursuant to s. 70(2), a deceased taxpayer is considered to be another person whose only income for the year is the value of rights or things as shown on the separate return. Accordingly, for purposes of the determination under the definition of "total gifts", the balance of the deceased taxpayer's income is shown in the other tax return as if he were a different taxpayer having only that income for the year.

Subsection 118.1(2) - Proof of gift

Cases

Castro v. The Queen, 2015 FCA 225, rev'g sub nom. David v. The Queen, 2014 DTC 1111 [at 3236], 2014 TCC 117

The taxpayers received charitable receipts for 10 times the amount of contributions, paid in cash, made by them to a registered charity. Woods J had allowed charitable credits for the amount of the cash donations made (see summary sub nom David).

After finding that the inflated receipt was not - in itself - a benefit that would vitiate a gift (see summary under s. 118.1(1) - total charitable gifts), Scott JA allowed the Minister's appeal on the basis that the receipts did not comply with Reg. 3501(1)(h) as they did not show the amount of the cash gifts and that Reg. 3501(6)(b) applied, which deems a receipt to be spoiled if it incorrectly records the amount of the cash gifts.

Jurisprudence (e.g. Mitchell) that "allowed for some flexibility on the basis that all the information was, in any event, readily available to the Minister" (para. 76) was not applicable, as such information was not so available here and Reg. 3501(6) unambiguously and specifically requires that a receipt accurately record the cash donation (paras. 78-80).

See Also

Slobodrian v. The Queen, 2003 DTC 1252 (TCC)

A retired professor who provided his services free of charge for a research project performed for the Department of Public Works was not entitled to a credit based on the value of the services given that there was no evidence of any property that had been given by him to the Government of Canada and he did not file prescribed receipts with the Minister.

O'Brien Estate v. MNR, 91 DTC 1349 (TCC)

No receipt from a charity was required for a bequest to the charity of the residue of the testator's estate upon the death of the life tenant. Mogan J. stated (pp. 1353-1354):

"Even if the gift by will were an immediate bequest, it is unlikely that any tangible value would be transferred to the charity until a year after death when the executors would have brought together for administration the assets of the deceased. ... But when a tangible gift is not in fact made and the registered charity is given only an intangible but vested future interest in property, the charity cannot be expected to issue a receipt because the value of the gift can frequently be determined only with the knowledge of many facts (like the age and health of the life tenant as in this case) which may not be available to the charity ..."

Administrative Policy

10 February 1993 T.I. (Tax Window, No. 28, p. 20, ¶2419)

Where an individual has made an anonymous gift through an agent, she will not be able to comply with the requirements of Regulations 3501 that the receipt shows her name and address, with the result that no credit will be available.

21 October 1992 T.I. 922450 (September 1993 Access Letter, p. 420, ¶C117-201)

A charitable organization can issue a receipt for the inter vivos gift to it of an equitable interest in a trust, as described in IT-226R, paragraph 3. In the case of property other than real property, the longer the period before full ownership of the property passes to the charity, the more difficult it is to establish the value of the interest.

IT-110R2 "Deductible Gifts and Official Donation Receipts"

25 October 89 T.I. (March 1990 Access Letter, ¶1150)

The total charitable gifts made in the year can be utilized before the utilization of cultural gifts from preceding taxation years, and there is no requirement to use up prior years' donations first.

Subsection 118.1(3) - Deduction by individuals for gifts

Total charitable gifts

See Also

Coleman v. The Queen, 2010 DTC 1096 [at 3000], 2010 TCC 109, aff'd 2011 DTC 5040 [at 5651], 2011 FCA 82

The corporate taxpayer was indirectly controlled by the individual taxpayer. The two taxpayers contributed funds to a charitable organization that provided bursaries and scholarships. The organization's program was to have prospective students at various Christian colleges solicit donations. The student would then be eligible for a bursary generally of 80% of the amount raised and a scholarship of up to 20%. Because the candidates soliciting the taxpayers' donations were the individual taxpayer's children, Miller J. found that the contributions were not charitable gifts. He found at para. 35 that the taxpayers had an "understanding, indeed a knowledge, at the time of the donation, that 80 to 100% of monies they donated would go to cover the education cost of those students who solicited the funds - primarily their offspring."

Subsection 118.1(4) - Gift in year of death

Administrative Policy

31 May 1995 Memorandum 7-950491 -

Where an executor of an estate or a trustee has a right to encroach on the capital of the estate or trust, no tax credit in respect of a donation of the capital is allowed because the size of the donation cannot reasonably be determined.

Subsection 118.1(5) - Gift by will

See Also

Turcotte v. ARQ, 2015 QCCA 396

An estate which, under the Quebec equivalent of s. 118.1(5), had claimed a charitable credit in the terminal return of the deceased for a gift directed to be made in the will, was precluded from also claiming a deduction under the equivalent of s. 104(6)(b) in the estate return on the basis that paying the gift to the charity in question was a distribution of income.

See summary under s. 104(6).

O'Brien Estate v. MNR, 91 DTC 1349 (TCC)

The testator in his will provided for the payment of any or all of the income of the trust fund to his nephew for life without any power to encroach on capital, and for payment of the residue on the death of the nephew to a charity. The testator was held to have made a gift for purposes of s. 110(2.1) and (1.2) equal to an actuarial estimate of the value of the future payments to be made to the charity.

Administrative Policy

2 January 2014 Memorandum 2013-0490141I7 - Charitable Donations

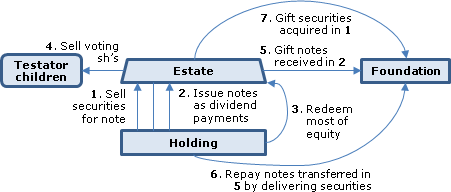

The Will of the "Deceased" provided that half the residue of the Estate was to be transferred to the "Foundation," a registered charity. The primary assets of "Holding" (a majority of whose (Class A) shares were held by the Deceased, and the balance (as Class B shares) were held by his two non-resident children) were marketable securities. After Holdings redeemed the children's Class B shares and issued Class Z common shares to the Estate for a nominal subscription price:

- Holding sold its marketable securities (in contradiction to 6 below, described as substantially all its marketable securities) to the Estate for a demand note;

- Holdings declared capital and eligible dividends, and satisfied them by issuing demand notes;

- Holdings redeemed the Estate's shares;

- the Estate sold the Class Z shares to the children;

- the Estate apparently gifted demand notes (issued in 2) to the Foundation;

- Holding apparently discharged these notes by delivering marketable securities to the Foundation; and

- (at some point) the Estate gifted marketable securities (apparently, the ones purchased by it in 1) to the Foundation (and also made a cash donation).

The bequest to the Foundation was partly satisfied by a direct transfer of marketable securities by the Estate, perhaps as described in 7. In rejecting a submission of the executors ("Trustees") that they had "sufficient discretion to decide… how to make that donation" so that it would not qualify as a charitable bequest at the time of death under s. 118.1(5), and so that the Estate could instead claim the donation tax credit under s. 118.1(3), the Directorate quoted from 2001-009020 that a gift by an individual generally will so qualify:

if the terms of his or her will provide for a donation of a specific property, a specific amount or a percentage of the residual of the individual's estate to charity, it is clear from the terms of the will that the trustee is required to make the donation, the estate is able to complete the donation after the payment of its debts, and the donation is made to a qualified donee

and then stated:

Nothing in the terms of the Will provided for any discretionary powers vested in the Trustees to modify this specific bequest.

And in the Supplement further stated:

A gift of the residue or a specified portion of the residue of an estate can be a Gift of Will when the FMV of the subject residue could be reasonably ascertained at the time of death of the deceased.

Respecting the character of the donated notes being non-qualifying securities, the Directorate stated:

Generally, pursuant to paragraph 118.1(13)(c), where the non-qualifying security is disposed of by the donee within 60 months, the donor may be treated as having made the gift (the value of which is deemed pursuant to that paragraph) at this later time. However, it should be noted that by virtue of subsection 118.1(15), in this case, for purposes of section 118.1, the gift shall be deemed to have been made by the Deceased immediately before his death.

Respecting "marketable securities transferred by Holding on behalf of the Estate to the Foundation" (apparently as described in 5 and 6 above), the Directorate stated:

the better view is that…[this] constitutes a gift by will under subsection 118.1(5)… and is deemed to have been made by the Deceased immediately before his death.

27 January 2014 Memorandum 2012-0472161I7 - Gifts by Will

The Deceased had three wills in respect of defined components of her estate, including a second will in respect of the "Secondary Estate." CRA found that the second will did not accord the executors the discretion to make a gift to specified Charities, so that s. 118.1(5) did not deem distributions made to the Charities to have been gifts made by the Deceased.

11 October 2013 APFF Roundtable Q. , 2013-0492791C6 F

The executors named in a will, who are different than the directors of a corporation of which the testator was the shareholder, are directed in the will to make a gift to a registered charity equal to $100,000 minus all sums given to the charity by the corporation following the death of the testator. In response to a submission that such a gift by the executors would qualify under s. 118.1(5) given that the directors are different from the executors, CRA stated (TaxInterpretations translation):

[T]he testamentary clause which you submitted leaves a certain discretion to the executors, which would prevent the gift from qualifying as a gift by will. Furthermore, this type of bequest is not a gift of a specific property, of a precise amount, nor a precise percentage of the residue.

CRA noted that it was unfamiliar with this type of clause and was not prepared to comment further.

14 June 2012 T.I. 2011-0430131E5 -

Respecting an inquiry as to the situation where a charity does not receive the property donated under the deceased's will (a specified percentage of the residue of the estate) until two years after death, CRA stated:

[A] gift is considered to have been made "by the individual's will" where the executor of the estate is required to transfer a specific property or amount to a recipient that is a qualified donee. An amount is certain, in this regard, if there is no discretion given to the executor as to whether the gift can be made or as to the amount of the gift (e.g., a specific bequest, a gift of residue, or a specified portion of the residue can be a gift by will). A gift, the occurrence or quantum of which is subject to the discretion of an executor, is not a gift by will.

25 November 2005 T.I. 2005-013961

A will indicated that pieces of art in the estate that the spouse did not select within one year of death would be donated to the charity. Because the executor would not have any discretion on whether the paintings would be donated following the one-year period, this gift would qualify as made by the testator's will.

9 August 2000 T.I. 2000-002918

If, under the terms of a will, a guaranteed annuity had been donated to a charitable organization, the deceased would be entitled to a non-refundable tax credit based on the fair market value of the annuity.

11 October 1994 T.I. 5-941667 -

"Subsection 118.1(5) of the Act does not apply in respect of the death benefit paid on a life insurance policy to a registered charity where the registered charity has been designated as the beneficiary under the policy and no mention of the policy is made in a will."

9 July 1992 T.I. 5-921172

The payment of proceeds of a life insurance policy pursuant to a designation of a beneficiary in a document other than a will would not constitute a gift by will.

20 December 1989 Memorandum (May 1990 Access Letter, ¶1229)

Where a taxpayer purchases an annuity of which its registered charity is the beneficiary on his death, or where a registered charity is named as the beneficiary under a life insurance contract, no gift is made for purposes of s. 118.1(5) on death.

16 October 89 T.I. (March 1990 Access Letter, ¶1150)

Where Mr. A in his Will provides a life interest to his surviving wife (who is not permitted to encroach), with the residue of the estate on her death to be transferred to a registered charity, Mr. A will be deemed to have made a gift of the residue to the registered charity in the taxation year in which he dies, and his legal representative will be eligible to make the designation under s. 118.1(6) in Mr. A's final return.

Articles

D. Bruce Ball, Brenda R. Dietrich, "Bequests and Estate Planning", Personal Tax Planning, 1999 Canadian Tax Journal, Vol. 47, No. 4, p. 995.

Subsection 118.1(5.1) - Direct designation — insurance proceeds

Administrative Policy

19 September 2015 STEP Roundtable, Q. 11

Amended s. 118.1(5.1) require that a donation be a gift of "property that was acquired by the estate on and as a consequence of the death" or "property that was substituted for that property." The individual, at death after 2015, held "Holdco" owning appreciated marketable securities. The estate is directed by will to make a donation.

Scenario 1

Holdco sells the securities and pays a dividend to the graduated rate estate, which makes the donation. Would the cash from the dividend be considered substituted property?

CRA responded that the estate has not replaced the Holdco shares received on death, so that the cash dividend is not property substituted for the Holdco shares. As the requirement in s. 118.1(5.1)(b) is not met, only the estate could claim a donation in the year or in the five subsequent taxation years.

Scenario 2

Estate transfers the shares of Holdco under s. 85(1) to Newco and takes back high PUC shares of Newco. Holdco is wound up and Newco receives the marketable securities (whose adjusted cost base has been "bumped" under s. 88(1)(d).) Newco uses the proceeds of sale of the securities to purchase for cancellation some of the estate's shares. Estate uses such cash to make the charitable donation. Is the donation is made with substituted property?

CRA responded that, as the shares of Holdco (which were received on death) are disposed of in exchange for the Newco shares, the Newco shares are substituted property. Furthermore, the cash received on the purchase for cancellation would be substituted property for the cancelled Newco shares and, under the extended meaning of "substituted property" in s. 248(5)(a), that cash also would be substituted property for the Holdco shares. Accordingly, s. 118.1(5.1)(b) would be satisfied.

Articles

Jessica Fabbro, "Dying to Donate – Determining Charitable Donation Tax Credits on Death after 2015", Tax Topics, Wolters Kluwer, Number 2249, April 16, 2015

Allocation of gifts on death (p.2)

The amended Legislation will no longer deem all charitable gifts to have been made by the deceased immediately prior to the deceased's death. Instead, all charitable gifts made by the deceased on his or her death will be deemed to have been made by the deceased's estate at the time the property is transferred to the donee. [fn 12: Subsection 118.1(5), effective 2016] … While this would seemingly eliminate the deceased's ability to claim the CDTC [charitable donations tax credit] on his or her terminal tax return or penultimate tax return, the definitions of "total charitable gifts", "total cultural gifts", and "total ecological gifts" have all been amended to allow the executors to allocate the charitable gifts made by the deceased on death between the deceased and the deceased's estate, provided that the deceased's estate is a "graduated rate estate" at the time the gift is made.

Spousal credit claim (p. 3)

[N]one of the amendments will permit the deceased's spouse to claim the CDTC with respect to charitable gifts made by his or her spouse on death. Furthermore, the CRA has confirmed that it will no longer apply this administrative position to gifts made under a wilt, as the gift will no longer be deemed to have been made by the deceased, but is deemed to have been made by the estate instead. [fn 20: … 2014-0555511E5…] As a result, after the amendments are in force, spouses will have less flexibility with respect to the allocation of charitable gifts between themselves than they did under the CRA's former administrative position.

Need for further valuations at gift time (p. 3)

[U]nder the current legislation, no further valuations are required when the property is transferred to the donee, because the charitable gift is deemed to have been made by the deceased at the exact same time the deceased is deemed to have disposed of all of his or her assets. However, under the amended legislation, the gift is deemed to have been made by the estate at the time the property is transferred to the donee. If the gift is not a cash gift, the executors will likely have to carry out another valuation of the gifted property at the time the gift is made,…

Potential for gifts to be made after estate ceases to be graduated rate estate (p.4)

The treatment of charitable gifts made by estates that are not graduated rate estates is particularly disconcerting for gifts of all or a portion of the residue of more complex estates, as these estates may take more than 36 months to fully administer and would therefore cease to be graduated rate estates before the gifted property can be transferred to the donee. Similarly, if the estate is the subject of litigation, the executors of the estate may be unable to transfer property that is the subject of a charitable gift within 36 months after the donor's death and the estate may cease to be a graduated rate estate before the gifted property can be transferred.

Individuals can mitigate the risks that their charitable gifts will not be completed within 36 months after their death by making Direct Designation Gifts [from RRPs etc.] instead of making their charitable gifts under a will, as the assets comprising the Direct Designation Gifts will not form part of the deceased's estate. Another alternative for individuals who anticipate having a complex estate would be to make specific bequests to qualified donees in their will instead of making a gift of the residue,…

Subsection 118.1(6) - Gifts of capital property

Administrative Policy

28 June 1993 T.I. (Tax Window, No. 32, p. 11, ¶2605)

The election under s. 118.1(6) is available in respect of the gift of an equitable interest in a trust.

15 January 1991 T.I. (Tax Window, Prelim. No. 3, p. 5, ¶1093)

The election is not available to a spousal trust under which the trust property is to be distributed to registered charities after the death of the spouse, as in such case the spouse trust would not be considered to have made a gift.

20 October 89 T.I. (March 1990 Access Letter, ¶1151)

Mr. X dies leaving assets in a spousal trust with power to the trustees to encroach on capital and with the direction that the residue of the trust is to be donated to a charitable organization on the spouse's death. On the death of the spouse, s. 118.1(6) will not apply to limit the fair market value proceeds deemed to be received pursuant to s. 104(4)(a) because it was Mr. X by his Will, rather than the spousal trust, which made the donation. Because of the power of encroachment, Mr. X could not be considered to have made a gift at the time of his death, so that s. 118.1(5) could not apply.

IT-297R2 "Gifts in Kind to Charity and Others"

Subsection 118.1(7.1) - Gifts of cultural property

Articles

Innes, "Gifts of Cultural Property by Artists", Estates and Trust Journal, Volume 12, No. 3, March 1993.

Subsection 118.1(13) - Non-qualifying securities

Administrative Policy

2 January 2014 Memorandum 2013-0490141I7 - Charitable Donations

A testator bequeathed half the residue of his estate to a charitable foundation. The executors apparently satisfied this bequest, in part, by having an investment holding company issue notes to it in satisfaction of dividends, gifted the notes to the foundation, with the notes being paid off with a transfer of marketable securities by the holding company to the foundation. In finding that the testator was thereby deemed by s. 118.1(5) to have made a gift in his terminal year, the Directorate noted that "nothing in the terms of the Will provided for any discretionary powers vested in the Trustees to modify this specific bequest," and stated:

Generally, pursuant to paragraph 118.1(13)(c), where the non-qualifying security is disposed of by the donee within 60 months, the donor may be treated as having made the gift (the value of which is deemed pursuant to that paragraph) at this later time. However, it should be noted that by virtue of subsection 118.1(15), in this case, for purposes of section 118.1, the gift shall be deemed to have been made by the Deceased immediately before his death.

See summary under s. 118.1(5).

15 July 2013 T.I. 2013-0486701E5 - Gift by will of a non-qualifying security

There is a gift by will of a non-qualifying security ("NQS") to a qualified donee where the legal representative of the deceased individual makes a designation under s. 118.1(6) in respect of the gift. The correspondent submitted that s. 118.1(5) applies to deem the gift of the NQS to have been made immediately before the death of the deceased individual for proceeds of disposition equal to the amount designated under s. 118.1(6), so that s. 118.1(5), rather than s. 70(5)(a), is the provision causing recognition of any capital gain in the terminal return. CRA instead found that the NQS was deemed to be disposed of by s. 70(5)(a), albeit for the designated proceeds under s. 118.1(6) rather than for fair market value proceeds:

Subsection 118.1(13), which applies for the purpose of section 118.1, provides that where at any particular time an individual makes a gift of a NQS ... and the gift is not an excepted gift, the gift is deemed not to have been made. However, paragraph 118.1(13)(a) provides an exception from this deeming rule for the purpose of applying subsection 118.1(6) to determine the proceeds of disposition of the NQS.

Essentially, notwithstanding that a gift by will of a NQS is deemed not to have been made, the legal representative may, by reason of the exception in paragraph 118.1(13)(a), designate an amount as the proceeds of disposition of the NQS under subsection 118.1(6) to reduce the amount of any capital gain that might otherwise result from the disposition of the NQS. In such circumstances, the designated amount in respect of the NQS (rather than its FMV as provided for in paragraph 70(5)(a)) is used in calculating the amount of the capital gain arising on the deemed disposition of the NQS immediately before the individual's death.

... However, for capital gain purposes, paragraph 70(5)(a) operates to deem the NQS to have been disposed of immediately before death but the proceeds of disposition would be the designated amount under subsection 118.1(6).

Articles

Wolfe D. Goodman, "Commentary on Some Revenue Canada Rulings Regarding Charitable Gifts", Goodman on Estate Planning, Vol. VIII, No. 4, p. 642.

Subsection 118.1(18) - Non-qualifying security defined

Administrative Policy

May 1998 Conference for Advance Life Underwriting Round Table, Q. 13, No. 9807000

The provisions of ss.118.1(18)(a) and (b) will not be applicable where father, who owns all the shares of Holdco together with a promissory note issued by Holdco, with Holdco holding a promissory note issued by Opco whose common shares are owned by father's children and whose voting redeemable preferred shares are owned by Opco, donates the shares and note of Holdco to a registered charity; however, GAAR may be an issue if it can reasonably be concluded that the real gift to the charity is the promissory note of Opco.

May 1998 Conference for Advance Life Underwriting Round Table, Q. 12, No. 9807000

A remainder interest in a charitable reminder trust is not a security described in any of paragraphs (a) to (c) in the definition of "non-qualifying security".

Subsection 118.1(19) - Excepted gift

Administrative Policy

19 June 2015 STEP Roundtable, Q. 12

Given that s. 118.1(5)(a) provides that a testamentary gift made to a public foundation is deemed to be made by the estate, will such a gift of unlisted shares which are non-qualifying securities be an "excepted gift" under s. 118.1(19)?

CRA responded that as the estate typically will be a "personal trust" under the s. 248(1) definition and, under s. 251(1)(b), a personal trust generally will be deemed not to deal at arm's length with a person which is beneficially interested in it then, assuming that the public foundation is a beneficiary of the estate, the estate will be deemed not to deal at arm's length with the foundation. Accordingly, the gift of the shares, which are non-qualifying securities as defined in s. 118.1(18), will not qualify as an "excepted gift" under s. 118.1(19).