Subsection 115(1) - Non-resident’s taxable income in Canada

Paragraph 115(1)(a)

Subparagraph 115(1)(a)(i)

Cases

Hurd v. The Queen, 81 DTC 5140, [1981] CTC 209 (FCA)

The employment income referred to in s. 115(1)(a)(i) includes stock option benefits that are deemed by s. 7 to have been received by an employee by virtue of his employment.

See Also

Mullen v. The Queen, 2012 DTC 1154 [at 3358], 2012 TCC 139

The taxpayer's exercise of stock options while he was resident in China gave rise to taxable income in Canada because he had received those stock options while he was a Canadian resident in the course of his employment there.

Price v. The Queen, 2013 DTC 5024 [at 5615], 2012 FCA 332, aff'g 2011 DTC 1334 [at 1879], 2011 TCC 449

The taxpayer was a Barbados-resident Canadian citizen who worked as a pilot for Air Canada. His pay was based predominantly on flight time. He calculated his income from employment performed in Canada on the following bases:

- 10% of the income earned on flights between Toronto and Vancouver, based on a purported 90% of flight time spent in U.S. airspace.

- A percentage on Canadian international flights based on the ratio of the time spent in Canadian airspace to the total time, flying or not, between embarking and disembarking in Canada. (The taxpayer claimed that he was responsible for managing his craft while out of Canada, and that sleep was a part of his obligations.)

- 0% of all other income, including training and disability payments.

McArthur J rejected the taxpayer's income allocations. Air Canada paid its pilots based on flight time, and therefore the Minister's allocation of the taxpayer's duties based on flight time was more reasonable than the taxpayer's allocation based on total time spent abroad. Affirming that finding, Mainville JA stated (at para. 25):

The appellant has failed to show why we should disregard the method set out in the collective agreement [between Air Canada and its pilots] in order to favour a method which is largely based on non-remunerated wait time and layover time.

The 90% allocation of Toronto-Vancouver flight time to US airspace was not credible. Lacking any better method, McArthur J adopted the allocations arrived at in Sutcliffe, which used Air Canada's average flight path and took the percentage of the path length in U.S airspace - 49% for Toronto to Vancouver, and 31% for the return trip. This method assumed a constant air speed and no deviation from the standard flight path, and the taxpayer cast doubt on both assumptions. However, no better method was established.

In affirming that, in accordance with Sutcliffe, the disability payments should be allocated in the same proportion as flight income, Mainville JA stated (at para. 33):

The fact that subparagraph 115(1)(a)(i) refers to incomes from duties or offices and employments performed by the non-resident persons in Canada does not exclude from the scope of that paragraph the benefits and amounts referred to under subsection 6(1) of the Act. Rather, the words "duties" and "performed" are simply used in this context to distinguish between incomes earned from offices or employments in Canada from those earned outside Canada.

Sutcliffe v. The Queen, 2006 DTC 2076, 2005 TCC 812

The taxpayer was a U.S. resident who was employed by Air Canada as a pilot on domestic flights (between Toronto and other Canadian cities) and international flights (between Toronto and U.S. cities). His income from performing or exercising his employment in Canada was to be determined by reference to the estimated portion of his flights that occurred in the U.S. (including domestic flights that traversed U.S. airspace). Sickness and vacation pay, which should be viewed as part of his remuneration, should be apportioned on the same basis.

Austin v. The Queen, 2003 DTC 2181, 2004 TCC 6

A non-resident Canadian Football League football player was entitled to have the portion of his employment income that was not subject to Canadian income tax calculated on the basis of the ratio of games played in Canada to the number of games played both in Canada and the United States, rather than on the basis of the number of days spent in the respective jurisdictions in the course of his employment, given that his employment contract provided that he would be paid only for games played (with the exception of token amounts received for a training camp), unless he did not play because of a game injury.

Varnam v. Deeble, [1985] BTC 150 (C.A.)

In determining the level of employment income "attributable to duties performed outside the United Kingdom", reference should be had to the amount allocated to overseas employment by the taxpayer's employment contract. If there is no allocation in the contract, then an apportionment generally should be made on the basis of the number of days spent abroad performing his duties. [C.R.: 126(1)]

Administrative Policy

16 June 2014 T.I. 2013-0515431E5 - International traffic and airline enterprise

During peak season, Canco, which transports passengers to destinations inside and outside Canada, is supplied planes and non-resident pilots and crew by an arm's length U.K. resident ("Forco") who is the pilots' and crew's employer, to transport Canco's passengers. In finding that s. 115(3) did not apply to the non-resident pilots employed by Forco (i.e., they were not "indirectly" employed by a Canadian airline), CRA stated:

[P]ilots employed by a non-resident airline corporation will generally not be subject to this measure. …[but] the taxable income earned by a non-resident from an office or employment exercised in Canada must nevertheless be computed for purposes of…subparagraph 115(1)(a)(i). ..[T]he attribution of income to Canada must be reasonable and may be based on the allocation methods provided in Sutcliffe v. The Queen, 2006 TCC 812 and Price v. The Queen, 2011 TCC 449.

27 March 2013 Folio S5-F2-C1

The geographic source of employment is generally the physical place where the individual performs the related duties. Where this references more than one country, proration generally occurs on a relative working day basis. Directors' fees generally are earned where the meetings are held (para. 1.57).

25 September 2012 B.C. Canadian Tax Foundation Roundtable Q. , 2012-0459411C6

Formerly, CRA generally had presumed for purposes of applying the domestic provisions of the Act (s. 115(1)(a)(i)) that an employee stock option benefit is in respect of employment exercised by the employee in the year in which the option was granted for purposes of determining the portion of the stock option benefit which was attributable to the exercise of Canadian employment of the optionee.

However, for stock options exercised after 2012, the CRA will apply the principles set out in para. 12 to 12.15 of the OECD Commentary on Article 15 to allocate a stock option benefit for purposes of the Income Tax Act, unless an income tax treaty otherwise specifically applies. Under these principles, the stock option benefit typically will be allocated based on the number of days of employment exercised in Canada during the vesting period compared to the total number of days of exercise of employment during that period.

6 July 2012 Memorandum 2012-0440741I7 - stock option benefit derived by US resident

USCo, which is a qualifying person for purposes of the Canada-US Income Tax Convention and is a wholly-owned subsidiary of a Canadian public company, employed a US-resident individual and performed employment duties for USCo in Canada for 55, 100 and 75 days in 2009, 2010 and 2011, respectively. On January 1, 2009, the US employee was granted stock options by Canco in consideration for his duties of employment performed for USCo and, when the options were exercised, USCo paid Canco a sum equal to the in-the-money value of the options at the time of such exercise.

Before considering the effect of the Canada-US Convention, CRA stated that

Canada's default position regarding the allocation of the stock option benefit is that a stock option benefit is allocable to the services rendered in the year of grant, unless it is clear from the circumstances that some other period is more appropriate, and vesting is not relevant.

Accordingly, if in 2009, the employee worked 55 days in Canada out of a total of 315, and he realized a benefit of $20,000 when he exercised the options on December 31, 2010, CRA would consider 55/315 of that benefit to be taxable in Canada in 2010.

7 May 2009 T.I. 2008-027618 -

a US-resident individual who is a director of a Canadian public corporation, who receives retainer fees in excess of $10,000 annually and who is expected to attend quarterly meetings of the board of directors in Canada will be required to include the amount of the benefit on exercise of the options in his income by virtue of ss. 7 and 1115(1)(a)(i), and will be entitled to the s. 110(1)(d) deduction where the usual conditions are satisfied. Where the individual's services are exclusively performed in Canada, the entire benefit will be sourced to Canada based on the allocation method set out in Annex B to the 5th Protocol to the Canada-US Convention. The amount of the required withholding (based on graduated rates) can take the s. 110(1)(d) deduction into account.

4 December 2003 T.I. 2001-01177

Where rights under a share appreciation rights plan are granted while an employee is resident in Canada, but redeemed when the employee is a non-resident, the portion of the SAR benefit that is attributable to services rendered in Canada (or outside Canada if the employee was resident in Canada at that time) is "taxable income earned in Canada" to the non-resident.

19 January 2001 T.I. 2000-005840 -

"Generally, the stock option benefit relating to the options granted to an individual while he or she is employed by a foreign employer while the individual was resident and employed only in a foreign country that were exercised after the individual ceased to be resident in Canada will not be included in the individual's income under subparagraph 115(1)(a)(i) of the Act because the entire stock option benefit is considered to be attributable to the individual's duties of employment performed in the foreign country for the foreign employer in the year the stock option was granted."

28 May 1996 TI 9601625

"Where the duties of a particular office or employment are performed partly in Canada and partly outside of Canada, a reasonable apportionment of the related income is necessary. This apportionment is usually calculated on a per diem basis having regard to the rate of remuneration applicable at that time."

1996 Ruling 962639

RC declined to rule that a non-resident director's fees could be allocated to Canada only to the extent of the number of days worked in Canada divided by the number of days in the year.

2 December 1993 T.I. 933330 (C.T.O. "Non-Resident Exercise Stock Option (4093-U5-100-15)"

Where a U.S.-resident was employed for several years by a wholly-owned Canadian subsidiary of a U.S. public company and in the course of his employment was granted stock options to purchase shares of the U.S. parent, a stock option benefit realized by him when exercising the options after he ceased to be employed and resident in Canada would be taxable in Canada as though he were still an employee of the Canadian subsidiary.

13 June 1991 T.I. (Tax Window, No. 4, p. 28, ¶1299)

Disability payments received by a U.S. resident under a disability policy maintained by his former employer will be subject to Canadian tax if the disability insurance premiums related to employment in Canada, irrespective whether the duties of employment to which the payments related were performed in a previous year.

12 September 1990 T.I. (Tax Window, Prelim. No. 1, p. 18, ¶1015)

A non-resident director of a Canadian corporation who exercises his stock option is taxable under s. 7(1) to the extent that the granting of the stock option related to services performed in Canada, and the Canadian corporation would have an obligation to file a T4 Supplementary.

81 C.R. - Q.56

The territorial source of employment income is the place where the related duties are normally performed.

IT-420R3 "Non-Residents - Income Earned in Canada"

IT-168R3 "Athletes and Players Employed by Football, Hockey and Similar Clubs" under "Non-Residents"

Articles

Tobias, "Taxing Benefits Realized by Former Canadian Residents", Taxation of Executive Compensation and Retirement, March 1994, p. 889

The author argues that Canada has no right to tax the benefit resulting from the exercise or realization of employee stock options on shares of non-Canadian corporations with no connection to Canada if such options are exercised after the employee has departed Canada and has established residence in a treaty jurisdiction and the individual is present in Canada in the year of exercise or realization for less than 183 days.

Finley, "Non-Resident Directors' Fees May Be Subject to Withholding in Canada", Taxation of Executive Compensation and Retirement, October 1990, p. 348

RC has acknowledged that where a non-resident director participates in a meeting held by teleconference call, his fees are not income from duties performed inside Canada.

Subparagraph 115(1)(a)(ii)

Cases

Inter-Leasing, Inc. v. Ontario (Revenue), 2014 ONCA 575

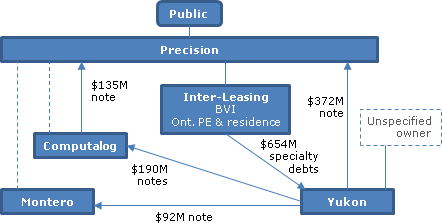

In order to minimize Alberta corporate tax, the Precision group of companies reorganized, as a result of which:

- Interest-bearing debts were owing by them to a newly-incorporated company ("Yukon");

- Yukon owed equivalent interest-bearing debts to the taxpayer, which had been incorporated in the British Virgin Islands but had an Ontario-resident director, and had an Ontario permanent establishment by virtue of making a small investment in an Ontario LP (see 2000-0048685) and was a group subsidiary; such debts were in the form of deeds of specialty debt, which were physically transferred to the British Virgin Islands - this was done to avoid Ontario corporate minimum tax which, under the Corporations Tax Act s. 47(2)(b)(ii), applied only to "property situated in Canada;"

- The taxpayer channeled the interest income received by it (net of federal tax) back to Precision by a combination of inter-corporate dividends (eligible for the inter-corporate dividend deduction under ITA s. 112 as the taxpayer was a controlled corporation resident in Canada) and interest-free loans.

As a corporation incorporated outside Canada but with a permanent establishment in Ontario, the taxpayer was subject to tax under s. 2(2) of the Corporations Tax Act, but only on income from business, not income from property.

In finding that the interest income of the taxpayer was exempt as income from property, Pardu JA stated (at para. 35) "that the level of activity associated with the once annual payment of interest on each of the four specialty debt instruments does not make this interest income from business," and (at para. 42) that "there was no other business in which income from the specialty debt instruments was employed or risked." Furthermore, the rebuttable presumption articulated in Marconi – that income earned by corporations acting consistently with their objects is income from a business – was not helpful here as "presumably corporations will act within their objects [and] the legislative scheme expressly contemplates a corporation earning income from property." (Para. 32.)

See Also

Maya Forestales S.A. v. The Queen, 2005 DTC 514, 2005 TCC 66, aff'd 2008 DTC 6100, 2006 FCA 35

The taxpayer was found to be carrying on business in Canada on the basis that through a Canadian mandatory it offered for sale, in Canada, Costa Rican plantation lots and solicited orders for services to be provided by it in connection with the sold lots, with each investor paying an overall amount in connection with the transactions which constituted an "indivisible whole" (p. 519). Although s. 115(1)(a)(ii) required a reasonable allocation of revenue and deductions, the Minister had assessed on the basis that all the revenues and expenses were applicable to Canada, and the appellant had provided no evidence of any kind whatsoever that would permit the allocation of a portion of the revenues and expenses to Costa Rica.

Commissioner of Inland Revenue v. Kwong Myle Services Ltd. (2004), 7 ITLR 239 (HK CFA)

The taxpayer (a company incorporated in Hong Kong) underwrote the sale of apartment units in a building erected in mainland China pursuant to an underwriting agreement entered into in China. Because the marketing of the apartments took place in Hong Kong, and all but two of the apartments were sold to Hong Kong purchasers, the profits of the taxpayer were found to arise in Hong Kong.

Twentieth Century Fox Film Corp. v. The Queen, 85 DTC 5513, [1985] 2 CTC 328 (FCTD)

Before finding that film revenues of the U.S. taxpayer were reasonably attributable to its Canadian distributorship business notwithstanding they were also attributable to U.S. movie production, so that they would be exempted under Reg. 805 from Part XIII tax, Addy J stated:

Its film distribution activities and the advertising activities and public relations promotions connected with them are the equivalent of the sales and the sales promotion activities of a manufacturer who produces goods for sale. The distribution of the product results in the generation of income and profits which of course is the ultimate goal of the entire undertaking. ... Therefore, this is not the case of a US firm being engaged in business dealings in Canada, promoted, controlled and carried out entirely from the United States without a branch or organization in Canada.

And further stated:

The fact that a company chooses to have certain of its business activities carried out by agents does not of itself prevent those activities from being the business operations of the company.

See summary under Reg. 805.

Yates v. GCA International Ltd., [1991] BTC 107 (Ch. D.)

In accepting a finding of the Commissioners that the income earned by a U.K. petroleum consulting firm from work done pursuant to a contract with a Venezuelan company for the "rehabilitation investigation" of three Venezuelan oil fields arose partly in the U.K. and partly in Venezuela, Scott J. stated (p. 123):

"What conceptually or from a linguistic point of view is the matter with regarding remuneration from a contract with an international complexion as producing income which ... can be regarded as arising partly in one country and partly in another?"

CIR v. Hang Seng Bank Ltd., [1990] BTC 482 (PC)

The gains realized by a Hong Kong bank from the purchase and resale outside Hong Kong of certificates of deposit, bonds and gilt-edged securities were correctly found by the Commissioners not to be "profits arising in or derived from Hong Kong" from carrying on a trade or business in Hong Kong. The activities of the bank from which the income arose was the buying and selling of the securities in overseas markets and not the decision-making process in Hong Kong. Lord Bridge stated (p. 488):

"If [the taxpayer] has rendered a service or engaged in an activity such as the manufacture of goods, the profit would have arisen or derived from the place where the service was rendered or the profit making activity carried on. But if the profit was earned by the exploitation of property assets [such] as by letting property, lending money or dealing in commodities or securities by buying and reselling at a profit, the profit will have arisen in or derived from the place where the property was let, the money was lent or the contracts of purchase and sale were effected."

Furness Withy & Co. Ltd. v. MNR, 66 DTC 5358 (Ex Ct), aff'd 68 DTC 5033, [1968] CTC 35, [1968] S.C.R. 221

The Canadian branch office of the taxpayer, which was a U.K.-resident company earning profits from international shipping conducted by itself and its subsidiaries, earned income from servicing the shipping activities of the subsidiaries and third parties, e.g., providing stevedoring services and booking cargo. Thurlow J. found that in computing the Canadian branch profits, the taxpayer was entitled to deduct head office administrative expenses that were applicable to those profits, stating (at p. 5307):

[W]here the business of the non-resident company is carried on both in Canada and elsewhere some proportionate part of the general expenses incurred in carrying on the business in more than one country including Canada would ordinarily be attributable to the portion of the business carried on in Canada and be deductible on ordinary principles... .

United Geophysical Co. of Canada v. MNR, 61 DTC 1099 (Ex Ct)

The U.S. parent of the taxpayer rented equipment to the taxpayer for use by the taxpayer in its Canadian operations. Although the U.S. parent was considered to be carrying on a business in Canada, i.e., providing various administrative, supervisory and other services to the taxpayer at cost, the rents received by it could not reasonably be attributed to any part of the business which it carried on in Canada. The rental agreements were made in the United States, rentals started when the equipment left California, delivery of the equipment to the taxpayer took place in the United States, and payment was received in the United States. Accordingly, as the rental payments were revenues of a business carried on instead in the U.S., the withholding tax exemption in Reg. 805 was not available.

Commissioner for Inland Revenue v. Nell (1961), 3 S.A. 774 (A.D.)

The taxpayer, who was a consulting electrical and mechanical engineer practising in Johannesburg, visited project sites in Rhodesia for the purpose of ascertaining the precise requirements of the clients, advising them and preparing rough sketches, and then returned to Johannesburg where the plans for the electrical and mechanical installation work were prepared. Hoexter J.A. affirmed a factual finding that s. 9(1)(b) of the Income Tax Act, 31 of 1941 did not apply to the portion of his fees allocated to the work performed in Rhodesia. This provision provided that "an amount shall be deemed to have accrued to any person from a source within the Union, whenever it has been received by or accrued to or in favour of such person by virtue of ... any service rendered ... by such person in the carrying on in the Union of any trade ...".

International Harvester Co. of Canada, Ltd. v. Provincial Tax Commission, [1949] A.C. 36 (PC)

The taxpayer, which was an Ontario corporation engaged in the business of manufacturing and selling agricultural implements, carried on its manufacturing operations exclusively outside Saskatchewan while selling operations occurred partly in that province and partly in other provinces and countries. Any part of the taxpayer's net profit which might fairly be attributed to its manufacturing operations outside Saskatchewan, was found not to be profit arising from the business of the appellant inside Saskatchewan within the meaning of the Income Tax Act, 1932 (Saskatchewan).

Federal Commissioner of Taxation v. United Aircraft Corp. (1943), 7 A.T.D. 318 (HC)

An American manufacturer of airplanes purported to license its rights to use Australian patents and registered designs to an Australian company in consideration for a lump sum of $25,000 and further sums based on the number of aircraft engines manufactured by the Australian licensee. In fact, the American company did not own any Australian patents or any designs registered in Australia. The drawings of specifications were delivered in New York. Six technicians from the Australian company were to visit the American factory for the purpose of obtaining information and the American company further agreed to give the Australian company pertinent information and advice.

In finding that the American company was not subject to tax on income "derived directly or indirectly from all sources in Australia" in respect of this agreement, Latham C.J. found (at p. 321) that "the agreement was in reality an agreement for the communication of information which would facilitate the manufacture of the engines in Australia", that the knowledge so communicated did not represent property and (at p. 322) that "a person who neither owns anything in a country nor does nor has done anything in that country cannot ... derive income from that country".

Watson v. Commissioner of Taxation (W.A.) (1930), 1 A.T.D. 61 (HC)

The taxpayer, while practising as a public accountant in Western Australia, agreed with the client that if the taxpayer were able to secure a remission of taxes assessed on the client, the taxpayer would be entitled to a portion of the remission as his commission for those services. The taxpayer then closed his office in Perth, went to Melbourne in order to lobby for a legislative amendment and, following the passage of a favourable amendment, returned to Western Australia to apply for and obtain the remission. In finding that the fees were taxable pursuant to s. 30(3) of the Land and Income Tax Assessment Act, 1907-24 (Western Australia), the High Court noted that neither of the Courts below had been satisfied that the taxpayer's lobbying effort in Melbourne was the effective cause of his obtaining the remission, and that, instead, he earned his commission by applying for and obtaining the remission while in Western Australia. The Court also noted that "the place where those earnings [sic] occur which directly gave rise to income must be regarded rather than the place or places where remoter causes exist" (p. 67).

Administrative Policy

19 June 2015 T.I. 2013-0475751E5 - Withholding Tax on Royalty Payments

In response to what CRA treated as a general inquiry, it referenced the question of whether the non-resident company (which received royalties from digital shows in Canada as well as selling products to Canadian residents and providing services to them) was carrying on business in Canada, and stated:

For guidance regarding factors to consider when determining where a particular business (or a part of the business) is carried on, see paragraphs 1.52-1.56 of S5-F2-C1: Foreign Tax Credit... .

5 February 2014 T.I. 2012-0466671E5 - Non-resident source withholdings

Canco will pay a fee to an India partnership providing technical support based on a percentage of the total technical support fee revenues to be collected by Canco from its customers located in Canada and the U.S. In providing general comments on whether the non-resident members of the partnership may be considered to carry on business in Canada, CRA stated:

[I]n the case of a service business, the business would generally be considered to be carried on at the place where the services are performed.

27 March 2013 Folio S5-F2-C1

1.53 While a determination of the place where a particular business (or a part of the business) is carried on (that is, the location of the source of the business income...) necessarily depends upon all the relevant facts, such place is generally the place where the operations in substance, or profit generating activities, take place. For the following particular types of business, the following factors (among others) should be given consideration:

- development and sale of real or immovable property – the place where the property is situated;

- merchandise trading – the place where the sales are habitually completed, but other factors, such as the location of the stock, the place of payment or the place of manufacture, are considered relevant in particular situations;

- transportation or shipping – the place of completion of the contract for carriage, and the places of shipment, transit and receipt;

- trading in intangible property, or for civil law incorporeal property (for example, stocks and bonds) – the place where the purchase or sale decisions are normally made;

- money lending – the place where the loan arrangement is in substance completed;

- personal or movable property rentals – the place where the property available for rental is normally located;

- real or immovable property rentals – the place where the property is situated; and

- service – the place where the services are performed.

1.54 Other factors which are also relevant, but generally given less weight than the factors listed above include, but are not limited to:

- the place where the contract for the sale of property or the provision of services is formed or entered into;

- the place where payment is received;

- the place where assets of the business are located; and

- the intent of the taxpayer to do business in the particular jurisdiction.

1.55 In the case of a single business comprised of more than one of the above-mentioned activities, each activity is considered separately for purposes of determining in which country or countries the business is carried on (this situation should not be confused with the situation in which the taxpayer has separate businesses—see Interpretation Bulletin IT-206R, Separate businesses). If, however, one activity of a business is clearly incidental to a predominant one, the incidental activity is not considered when determining in which country or countries the business is carried on. For example, if a vendor of machinery provides customers with an engineer to supervise the installation of the machinery, this service would generally be considered to be incidental to the activity of selling the machinery; however, this type of service could in some cases be considered to be a significant activity on its own, depending on the machinery being sold, the nature of the installation service, and the terms of the contract with the customer.

11 January 2001 Memorandum 2000-0001017

The Directorate agreed that the taxpayer, which was a Canadian manufacturer transferring some of its goods to a Japanese branch for sale there, was overstating its profits for purposes of s. 126(2), by treating most or all of the profits on the sale of such products as being profits of the Japanese branch. The taxpayer was required to follow the same method it used to compute its net foreign business income under the Japanese Treaty (namely, computing a notional cost of sales based on an arm's length value of the goods "sold" by the manufacturing division in Canada) as this gave a truer picture of the profits earned in Japan by the Japanese branch.

In reaching this conclusion, CRA stated that it disagreed with the taxpayer's position that "the place of contract is the primary determinant of where business is carried on," and stated:

Under Common Law principles, a business is generally considered to be carried on in the place where the operations from which the profits arise are located. The weight given to any particular factor to determine this place depends on the nature of the business. One factor is the place of manufacture or production. Another factor which is indicative of the location of a business is the place where the business' profit-producing contracts are made (based on old case law such as Grainger v. Gough (Surveyor of Taxes) [1896] A.C. 325 (H.L.) and Firestone Tyre v. Lewellin (HM Inspector of Taxes) (1957), 37 TC 111)). For example, in Twentieth Century Fox Film Corporation, 85 DTC 5513 (FCTD), the court did not put much weight on where the contracts were made.

2005 Ruling 2004-009482

Ruling given that the expansion of services provided by a Canadian corporation ("Canco") to its affiliated non-resident administrator of investment funds (the "Funds") including processing subscriptions, transfers and redemptions and handling related correspondence, processing distributions, conducting anti-money laundering due diligence, publishing the NAVs, disbursing fees, maintaining a register of shareholders, dispatching shareholder meeting materials and audited financial statements, and providing various "middle office" accounting assistance, would not cause the Funds or the Administrator to be carrying on business in Canada for purposes of ss. 2(3)(b) and 115(1), or Part XIV. The statement of facts indicate that no resolutions will be passed by the Administrator or the Funds to appoint Canco as agent, "the various contracts entered in by Canco in the course of carrying on its business in Canada will create rights and obligations that are personal to Canco vis-à-vis the third parties", Canco will have limited contact with the investors in the Funds and "in particular, Canco does not and will not handle the receipt of monies paid by investors upon the investors' subscription for interest in the Funds" and "subscriptions are accepted or rejected by the Funds, not by Canco or the Administrator".

2004 Ruling 2004-008266

Ruling that the delegation by a non-resident service provider ("C Limited") to a non-resident investment fund (the "Fund") of accounting and valuation services (e.g., preparing books and records and financial statements, computing NAV each month and calculating redemption amounts and distributions) and investor services (including maintaining a register of investors, processing subscriptions, redemptions and transfer requests, monitoring compliance with anti-money laundering rules, maintaining capital accounts, and mailing or emailing periodic statements to investors) to a related Canadian corporation ("Canco") where "Canco will have no right to directly affect the legal relations of C Limited as regards to other persons and will have no authority to make contracts on behalf of C Limited" will not result in the Fund or C Limited carrying on business in Canada for purposes of ss. 2(3)(b), 115(1) or Part XIV. In the summary, CRA stated that "a business is carried on where the profit producing activity takes place and the profit producing activity of the Fund and the non-resident service provider are not in Canada".

19 April 2000 T.I. 1999-001100 -

Interest on money borrowed by a non-resident individual to make a capital contribution to a partnership that carries on business in Canada through a permanent establishment will be deductible to the extent it is allocable to a business source of income and the tests in s. 20(1)(c) are satisfied.

1999 Ruling 992060

Ruling that a Canadian company engaged by a non-resident fund manager to provide accounting and clerical services in Canada would not thereby cause the fund or its manager to be considered to be carrying on business in Canada.

1997 Ruling 970492

Where a non-resident corporation has contracted to perform certain administrative duties for other non-resident corporations, the fact that it has a non-related Canadian company perform certain accounting and clerical services for it under a sub-contract will not, by itself, cause it or its non-resident clients to be carrying on business in Canada.

1 December 1992 Memorandum (Tax Window, No. 27, p. 11, ¶2352; October 1993 Access Letter, p. 475)

Where a non-treaty country subsidiary of a Canadian corporation manufactures or process goods outside Canada with no purchasing or processing of raw materials taking place in Canada, and it appoints its Canadian parent as agent to sell its products in Canada as well as outside Canada in consideration for a sales-based commission and with authority granted to its parent to negotiate and conclude sales contracts in its name, RC will ignore the agency relationship with the parent and consider the subsidiary to have Canadian business income equal to all income from Canadian sales of its product minus costs incurred to earn that income. Such costs generally will include a notional cost of sales (based on the fair market value of the goods manufactured or processed), commissions and other expenses that could reasonably be attributed to the Canadian business activity.

8 July 1992 T.I. 921814 (March 1993 Access Letter, p. 87, ¶C248-129)

Discussion of allocation of business income between Canada and a foreign country where: a Canadian corporation, acting as a wholesaler, buys property in Canada and sells it to a foreign purchaser; a Canadian corporation manufacturing property in Canada, sells it to a purchaser outside Canada; the Canadian branch of a foreign corporation carries on the above activities; and a corporation resident in a non-treaty country imports property into Canada.

IT-420R2 "Non-Residents - Income Earned in Canada", para. 10

Income from property earned in Canada by a non-resident is not subject to tax under s. 115(1) but, rather, may be subject to Part XIII tax.

Articles

Jinyan Li, "Rethinking Canada's Source Rules In The Age Of Electronic Commerce: Part I", 1999 Canadian Tax Journal, Vol. 47, No. 5, p. 1077.

Constantine Kyres, "Carrying on Business in Canada", 1995 Canadian Tax Journal, Vol. 45, No. 5, p. 1629.

Broadhurst, "Financing by Non-Residents", 1992 Corporate Management Tax Conference Report, pp. 9:10 -9:18

Discussion of whether a non-resident purchaser of accounts receivable would be considered to be carrying on business in Canada.

Subparagraph 115(1)(a)(iii.1)

Administrative Policy

23 January 2015 T.I. 2013-0509771E5 - Oil & gas payments made to U.S. resident

Mr. A, a U.S. resident, grants the right to drill for or take the oil & gas from his Canadian freehold property to a Canadian company, in consideration for an upfront bonus of $100,000, and annual royalties payable out of any oil & gas production. The fair market value of this royalty right is $300,000.

After noting that these transactions result in a negative cumulative Canadian oil and gas property expense ("CCOGPE") pool, that any resulting credit balance would be deducted from his cumulative Canadian development expense ("CCDE") pool under variable L, and any negative balance CCDE balance for the year is added to his income pursuant to ss. 66.2(1), 59(3.2)(c) and 115(1)(a)(ii) or (iii.1), CRA noted that a.115(1)(a)(ii) applies if the amount required to be included in income is from a business carried on by Mr. A, whereas s. 115(1)(a)(iii.1) applies to any amount required by s. 59(3.2)(c) to be included in income over and above the amount included in income from a business carried on by Mr. A.

Subparagraph 115(1)(a)(iii.2)

Administrative Policy

27 February 1991 T.I. (Tax Window, No. 1, p. 10, ¶1167)

If an individual ceases to be a resident of Canada and subsequently disposes of depreciable properties used in a business carried on outside Canada, the recapture of depreciation will be included in his income under s. 115(1)(a)(iii.2) if s. 2(3) applies, that is, if in the taxation year or any previous taxation years he was employed in Canada, carried on business in Canada or disposed of taxable Canadian property.

Paragraph 115(1)(d)

Paragraph 115(1)(e)

See Also

Matlas, S.A. v. The Queen, 94 DTC 1591 (TCC)

Archambault TCJ. found that losses of the non-resident corporate taxpayer from the operation of a condominium (being its sole investment) were property losses rather than business losses given that the income statement did not evidence any activities of the taxpayer other than those consistent with the passive ownership of the property. Accordingly, the rebuttable presumption that activities within the corporate objects of a taxpayer give rise to business income or loss was rebutted in this instance, and the taxpayer could not reduce a taxable capital gain realized on the ultimate disposition of the property by the application of non-capital losses.

Administrative Policy

10 March 1995 Memorandum 950145 (C.T.O."115(1)(e) (HAA 6815-4)")

"An individual who, while a resident of Canada, incurred a non-capital loss from a business carried on in Canada can, assuming the other requirements of the Act are met, apply that non-capital loss against a taxable capital gain realized on the disposition of a taxable Canadian property, income from the duty of an office or employment performed by him in Canada, or income from a business carried on by him in Canada in a subsequent year when he is a non-resident of Canada."

Paragraph 115(1)(f)

See Also

Delancy v. The Queen, 2004 DTC 2907, 2004 TCC 465

The taxpayer, who was a U.S. resident, and was employed by two Canadian professional football teams, was unable to deduct his living expenses incurred while living in the vicinity of his home clubs. Woods J. indicated that the deductions that are allowed under paragraph 115(1)(f) are only those listed in Division C of the Act.

Matlas, S.A. v. The Queen, 94 DTC 1591 (TCC)

Archambault TCJ. found that the other deductions referred to in s. 115(1)(f) were deductions other than those referred in paragraphs 115(1)(d) and (e). Accordingly, non-capital losses that could not be deducted under s. 115(1)(e) also could not be deducted under s. 115(1)(f).

Subparagraph 115(1)(b)(ii)

See Also

Pampered Chef, Canada Corp. v. CBSA, [2008] ETC 4514 (CITT)

Individual self-employed sales representatives of the taxpayer secured orders for sales of kitchen products shown at various home parties by them with the products then being imported by the taxpayer from its U.S. parent for shipment directly to the individual customers. The Tribunal found that the sales for export by the U.S. parent were made to the taxpayer rather than to the individual customers. On this basis, the taxpayer satisfied the test of carrying on business in Canada for the purposes of the definition of "permanent establishment" in the Valuation for Duty Regulations.

Subsection 115(2) - Idem [Non-resident’s taxable income in Canada]

Paragraph 115(2)(c)

Cases

Jarlan v. The Queen, 84 DTC 6452, [1984] CTC 375 (FCTD)

Awards which a French resident received for an invention he had made over 10 years previously while still in the employ of the National Research Council fell within s. 115(2)(c). Although the awards were calculated as a percentage of the gross royalties received by Canadian Patents and Development Ltd. on account of use of the patents for his invention, the awards nonetheless arose out of his former employment and were income from employment rather than royalties.

Administrative Policy

26 September 2014 T.I. 2014-0531441E5 - Unfunded LTD plan payment to non-resident employee

A Canadian resident employee, after qualifying for benefits under the unfunded long term disability plan ("LTD Plan") of the Canadian resident employer, becomes a resident of the U.S. Under the terms of the Plan, the employee is not required to fulfill any duties of employment and will continue to receive benefits until the earlier of rehabilitation and commencement of benefits under the employer pension plan. Would Part XIII withholding apply? CRA stated:

[T]he LTD Plan payments would be salary, wages or other remuneration…because they would be amounts arising out of the employment relationship. … As such, the amount of LTD Plan payments that would be taxable as income earned by a non-resident employee would be determined in accordance with subsection 115(2) and withholdings under Part XIII would not be applicable… [and] the LTD Plan payments would be subject to withholding under paragraph 153(1)(a)… .

CRA went on to note that as Art. XVIII, para. 3 of the Canada-U.S. Convention defines "pensions" to include any payment under a disability plan "a U.S. resident employee receiving LTD Plan payments could file a Canadian income tax return in order to obtain a refund of any withholdings made in excess of the 15% amount specified in paragraph 2 of Article XVIII."

31 October 1995 Memorandum 950748 (C.T.O. "Employees at Canadian Embassy in Saudi Arabia (8019-6)")

Former Canadian residents working at the Canadian Embassy in Riyadh will have their remuneration subject to tax under s. 115(2) since such remuneration is not subject to an income or profits tax in Saudi Arabia.

Paragraph 115(2)(e)

Subparagraph 115(2)(e)(i)

Cases

Hale v. The Queen, 90 DTC 6481 (FCTD), aff'd 92 DTC 6473 (FCA)

The taxpayer, while a non-resident of Canada, received $25,000 for the performance of his duties as director of a Canadian company. Although the taxpayer maintained that, given that he spent only 57 days in Canada in the year in question in connection with his duties as director, only 57/366 of this sum was taxable in Canada, Rouleau J. upheld the Minister's reassessment that 1/2 of the amount was taxable under s. 115(2)(e) in the absence of any convincing evidence that the taxpayer had devoted a significant amount of time outside Canada to the Canadian company.

Hurd v. The Queen, 81 DTC 5140, [1981] CTC 209 (FCA)

"Remuneration" does not include a S.7 stock option benefit.

Administrative Policy

20 March 2015 T.I. 2014-0534301E5 - Canadian Withholding Tax on Retiring Allowance

A lump sum payment in compensation for a loss of employment at a French subsidiary is made by Canco to a non-resident of Canada who had been seconded to the subsidiary. CRA first found that s. 212(1)(j.1) would apply to this payment, so that it would not be taxable pursuant to s. 115(2)(e)(i).

Subparagraph 115(2)(b)(ii)

Administrative Policy

14 December 1995 T.I. 952925 (C.T.O. "International Shipping - Gain from Disposition of Goodwill")

Goodwill would be considered personal property for purposes of the exemption in s. 115(2)(b)(ii)(B).

Subsection 115(4) - Non-resident’s income from Canadian resource property

Administrative Policy

16 June 2014 T.I. 2013-0515431E5 - International traffic and airline enterprise

During peak season, Canco, which transports passengers to destinations inside and outside Canada, is supplied planes and non-resident pilots and crew by an arm's length U.K. resident ("Forco") who is the pilots' and crew's employer, to transport Canco's passengers. In finding that s. 115(3) did not apply to the non-resident pilots employed by Forco (i.e., they were not "indirectly" employed by a Canadian airline), CRA stated:

[P]ilots employed by a non-resident airline corporation will generally not be subject to this measure. …[but] the taxable income earned by a non-resident from an office or employment exercised in Canada must nevertheless be computed for purposes of…subparagraph 115(1)(a)(i). ..[T]he attribution of income to Canada must be reasonable and may be based on the allocation methods provided in Sutcliffe v. The Queen, 2006 TCC 812 and Price v. The Queen, 2011 TCC 449.

93 CPTJ - Q.10

If a non-resident disposes of some, but not all, of its Canadian resource properties, whether ss.115(4)(a) to (c) apply may depend on whether it carried on two or more separate businesses.