Subsection 105(1) - Benefits under trust

Cases

Cooper v. The Queen, 88 DTC 6525, [1989] 1 CTC 66 (FCTD)

The taxpayer, who was a residuary beneficiary and executor of his mother's estate, was held not to have received a benefit by virtue of an interest-free $400,000 loan made to him by the executors for the purpose of buying himself a home. Rouleau, J. was influenced by the fact that specific legislation dealing with interest-free loans (section 80.4) made no reference to loans made by a trust.

See Also

Stevenson v. Wishart, [1987] BTC 283 (CA)

Substantial but regular payments of capital of a trust to pay the nursing-home expenses of the beneficiary were not income in her hands. "If, in exercise of a power over capital, [the trustees] chose to make at their discretion regular payments of capital to deal with the special problems of Mrs. Henwood's last years rather than release a single sum to her of a large amount, that does not seem to me to create an income interest."

Administrative Policy

16 June 2014 STEP Roundtable Q. , 2014-0523061C6

In the course of commenting on common audit issues for trusts, CRA stated:

In one audit that we dealt with, the taxpayer had been the sole shareholder and director of OPCO. The taxpayer settled a trust, purportedly for employees of OPCO, and was the sole trustee. Both taxpayer and the trust subscribed for new common shares of OPCO for a nominal amount. When an offer was received from an arm's length party to buy OPCO several years later, the taxpayer and OPCO entered an agreement to allow OPCO to redeem the shares held by the trust (which now had a significant fair market value) for the nominal amount originally paid for them. This effectively inflated the value of the remaining OPCO shares held by the taxpayer, and thus the amount received by him on the sale of the company. CRA took the position that there was a benefit pursuant to subsection 105(1) in respect of the taxpayer. Furthermore, because the taxpayer, the trust and OPCO were all persons not dealing at arm's length, the trust could be assessed pursuant to subparagraph 69(l)(b)(i) in respect of the disposition of shares.

10 July 2013 Memorandum 2013-0475501I7 F - Amounts returned to trustee/beneficiary

Father and Y were the trustees of a Quebec family trust, whose beneficiaries included father and his three children. Distributions made by the Trust to the children's bank accounts were, in large part, immediately "returned" out of the bank accounts to father, to reimburse him for expenses (both specific and general) which he claimed were their responsibility and for their benefit.

After finding that the amounts returned to the father were income to him under s. 104(13), CRA went on to indicate (TaxInterpretations translation) that such amounts should not be included in his income under s. 105(1):

[N]o benefit was conferred on Father "from or under a trust" …when each Child paid the sums to him in his personal capacity. The Trust assets were not diminished by reason of the reimbursements of the amounts by the Children to Father.

6 August 2013 T.I. 2012-0469481E5 F - Benefit under trust

An estate sold personal-use real estate to one of its beneficiaries for a price less than the property's fair market value, so that s. 69(1)(b)(i) applied. The capital gain to the estate was payable to a beneficiary other than the purchaser.

CRA rejected a submission that the exception in s. 107(1)(a) applied to exclude a taxable benefit to the purchaser because later in the same year the purchaser sold the property at a capital gain which was increased by the amount of the purchaser's reduced cost for the property. Accordingly, that difference represented a taxable benefit to the purchaser, but such amount was required to be added to the purchaser's adjusted cost base under s. 52(1) – with a resulting reduction in the capital gain on the subsequent sale.

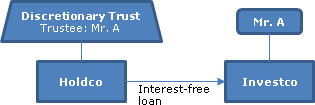

12 December 2012 Memorandum 2012-0464411I7 - Indirect Benefit

A taxable Canadian corporation (Holdco) which is wholly-owned by a trust of which Mr. A is the sole trustee and is a discretionary beneficiary, makes an interest-free loan to another taxable Canadian corporation (Investco) of which Mr. A is the sole shareholder. In finding that this did not give rise to a taxable benefit, CRA indicated that as there have been no relevant changes since Cooper, s. 105(1) "would not be considered favourably as a ground for including a foregone interest benefit in the income of Mr. A."

4 December 2012 T.I. 2012-0470951E5 F - Technical News no. 11

The questioner noted that ITTN No. 11 had been archived, and obtained CRA's confirmation (per the summary) that:

It is still the CRA's position that although a taxable benefit does arise from the rent-free use of trust property, such a benefit will not generally be assessed in the case of personal-use property owned by a trust, that is used by a beneficiary under the trust or any person related to the beneficiary.

The body of the response noted that although ITTN No. 11 referred to personal use property of a beneficiary (TaxInterpretations translation):

...the CRA has expanded its administrative position to the case where the property is utilized by a person who is related to a beneficiary as the property is, in that situation, a personal use property of the trust.

1999 Ruling 9911853 [DRIP produces taxable benefit]

Proposed transactions

The trustees of a listed REIT will implement a distribution reinvestment plan (the "Plan") under which Canadian-resident unitholders may enroll. Because of foreign securities legislation non-residents will not be eligible. The Plan provides that the REIT shall pay to the Agent (a trust company) all cash distributions paid on Units owned by Unitholders who participate in the Plan and the Agent will use such funds to purchase additional Units directly from the REIT. Additional Units purchased under the Plan will be registered in the name of the Agent, as agent for a Unitholder who participates in the Plan. The price at which Units of the REIT will be purchased by the Agent with cash distributions will be the "Average Market Price," namely XX% of the weighted average price of Units of the REIT on the applicable exchange for the five trading days immediately preceding the relevant Distribution Date. The right to participate in the Plan may not be transferred by a Unitholder without the approval of the REIT and the applicable securities regulatory authorities.

Rulings

A. By virtue of the provisions of subsection 105(1) of the Act, the amount by which the fair market value on the date of purchase of any Units of the REIT exceeds the purchase price paid for such Units pursuant to the provisions of the Plan… shall be included in computing the income of the Unitholder on whose behalf the Units are purchased.

B. By virtue of subsection 52(1)… the amount added to a Unitholder's income pursuant to ruling A shall be added in computing the cost to the Unitholder of such Units of the REIT except to the extent that such amount is otherwise added to the cost or included in computing the adjusted cost base to the Unitholder of such Units.

Comment in Summary

: "The issue was considered by the Policy Review Committee and it was decided that it would not be appropriate to extend our long-standing favourable administrative position concerning dividend reinvestment plans of corporations to income distribution reinvestment plans of trusts. This is consistent with E9321283 in which we concluded that the proposed discounts of 10% to 15% would result in a benefit under 105(1)."

Income Tax Technical News, No. 11, September 30, 1997: "Taxable Benefit for Use of Personal-Use Property"

26 August 1997 Memorandum 970731

A beneficiary generally will not be assessed a taxable benefit for her rent-free use of personal-use property owned by the trust.

9 January 1997 T.I. 963753

S.105(1) does not apply to a distribution of property to which s. 107(2) is applicable.

31 March 1993 T.I. (Tax Window, No. 29, p. 23, ¶2459)

The favourable administrative position applying to personal-use property of an individual that is held by a trust will also apply where a house is owned by a trust and used by parents of a beneficiary.

19 June 1992 Interpretation 9218430 (January - February 1993 Access Letter, p. 25, ¶C104-038)

RC is not prepared to extend the decision in Cooper to benefits arising otherwise than in respect of an interest-free loan emanating from a resident testamentary trust.

91 C.R. - Q10

RC will apply the Cooper decision in similar situations.

90 C.R. - Q24

An interest-free loan made by a trust to a beneficiary does not result in a taxable benefit. S.105(1) is not restricted to non-arm's length beneficiaries.

89 C.R. - Q31

The use of a trust's real property by a beneficiary constitutes a benefit. However, in the case of property that would be personal use property of an individual, such as a home or cottage, RC would generally not seek to assess a benefit for the use of the property where the trust is effectively standing in the place of the individual and no benefit or advantage would have arisen if the individual, instead of the trust, had allowed the use of the property.

88 C.R. - Q69

Where property such as a cottage is held on trust for the use of individuals, RC generally will not seek to assess a benefit where the trust is effectively standing in the place of the individual.

87 C.R. - Q82

S.105(1) benefits should be reported on a T3 supplementary. Appropriate methods should be used to value a benefit.

85 C.R. - Q27

Where an income beneficiary (i.e., a beneficiary with no right to enforce any payment of the capital) receives an interest-free loan. RC will assess a benefit where the borrowed funds are used for non-income-producing purposes, or their is an income-splitting advantage.

80 C.R. - Q45

S.105 will be applicable in most cases to a non-interest bearing loan made by an estate or trust to a beneficiary.