MFC Conversion to MFT

Plazacorp

Background

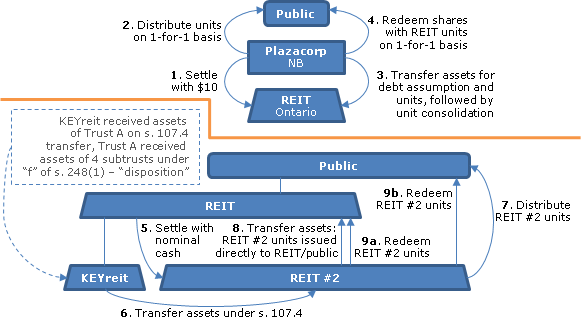

Plazacorp, which is a TSX-listed mutual fund corporation in the business of retail property ownership and development, wishes to convert under a New Brunswick plan of arrangement to a s. 108(2)(a) mutual fund trust (so that following the conversions transactions occurring effective January 1, 2014, its remaining assets will be nominal) and to eliminate subsidiary (non-personal trust) subtrusts, including KEYreit (a REIT previously acquired by it) and Plazacorp Operating Trust and four "Direct Subtrusts." Plazacorp converted on December 11, 2002 into a mutual fund corporation from a normal public corporation.

Transaction overview

Plazacorp will settle a new trust (REIT) with modest assets, and distribute the units of REIT to its public shareholders, who thus will now hold assets of a "good" mutual fund trust, albeit with nominal assets. Next, Plazacorp will merge into REIT under s. 132.2, so that REIT is now the successor to substantially all its assets. However, it will not be released under its covenant under convertible debentures, although they also will be assumed by REIT. In order to eliminate the Direct Subtrusts, KEYreit and Plazacorp Operating Trust, the Direct Subtrusts will transfer their assets to Trust A (a new subtrust of Plazacorp) in reliance on the no-disposition rule in s. 248(1) – disposition, (f), and then there will be s. 107.4 transfers of assets by Trust A to KEYreit, and (following the 1st merger) by KEYreit to a further new subtrust of REIT (REIT #2), followed by a de minimis distribution of REIT #2's units by REIT to the REIT unitholders (in order to qualify REIT #2 as a mutual fund trust). REIT #2 then will be merged into REIT under s. 132.2. The same steps will then be repeated to first eliminate Plazacorp Operating Trust, then a subtrust of Plazacorp Operating Trust.

For more detailed summary, see above under MFC Conversion to MFT.

Subtrust Elimination.

Calloway AIF

See also Calloway REIT elimination of subtrust through s. 107.4 transfer and s. 132.2 merger (including diagram)below.

Overview

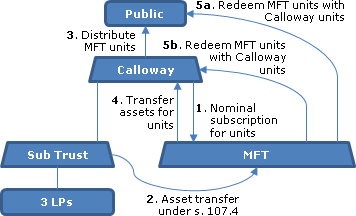

Calloway currently is a listed open-end mutual fund trust holding rental limited partnerships through a subsidiary trust ("Holdings Trust"). To facilitate "Exchangeable Securities" (including exchangeable LP units held in the subsidiary LPs as well as "development options") not being characterized as debt for accounting purposes, Calloway wishes to convert to a closed-end fund. However, to so qualify under s. 108(2)(b), Calloway must get rid of Holdings Trust, which it intends to do in 2014. Eliminating Holdings Trust presumably would increase the rental revenues which are allocated to Calloway for gross REIT revenue purposes.

Elimination of Subtrust

Accordingly, Holdings Trust will transfer its assets under s. 107.4 to a newly-formed subsidiary unit trust ("MFT") of Calloway, with 3% of MFT's units then being distributed to the Calloway unitholders in order to qualify MFT as a mutual fund trust. MFT then will be merged into Calloway under s. 132.2. These transactions are not discussed other than very elliptically in Calloway's AIF and instead are disclosed in a 1 November 2013 OSC Order for Exemptive Relief respecting Calloway, summarized and diagrammed further below. Immediately below we quote relevant extracts from Calloway's February 2014 AIF for its 2013 year.

Tax Ruling

Calloway intends to eliminate Holdings Trust in order to enhance Calloway's flexibility to comply with the restrictions governing its income trust status as a REIT (the "Reorganization"). To effect the Reorganization, Calloway has obtained the Tax Ruling [dated August 13, 2013]. Calloway intends to implement the Reorganization in 2014 in accordance with the Tax Ruling.

Potential debt character of Exchangeable Securities

Under IFRS, it was possible that, without certain amendments to the terms thereof including the exchange provisions, the various Exchangeable Securities of Calloway LP, Calloway LP II and Calloway LP III (i.e. the various series of Class B and Class D limited partnership units of Calloway LP, Calloway LP II and Calloway LP III that are convertible or exchangeable directly for Units without the payment of additional consideration therefor) would be considered debt instead of equity (as they are currently classified since they are intended to be the economic equivalent of Units).

Addition of Calloway option and potential conversion to closed-end fund

Consequently, in order to negate that impact on Calloway's financial statements, Calloway and SmartCentres agreed to amend the exchange provisions relating to certain of the Exchangeable Securities. The exchange procedure for certain of the Exchangeable Securities now provides that Calloway shall have the option (…the "Calloway Option") to make a cash payment to the holder of certain Exchangeable Securities in lieu of delivering Units, in an amount equal to the market value of the Units such holder would otherwise be entitled. The holder of the Exchangeable Securities shall have the right to accept or reject the determination by Calloway to make a cash payment to the holder in lieu of the delivery of Units. In the event that Calloway does not elect to exercise the Calloway Option, or the holder of the Exchangeable Securities rejects the determination by Calloway to pay cash in lieu of the delivery of Units, Calloway shall undertake all necessary and required actions, including of a regulatory nature, in order to effect a conversion from an open-end to a closed-end mutual fund trust (…the "Conversion Process"). Such actions shall include… obtaining an advanced tax ruling from the Canada Revenue Agency confirming that the conversion from an open-end to a closed-end mutual fund trust does not result in a disposition of Units. The exchange procedure shall be deferred until completion of the Conversion Process. In addition to the completion of the exchange of Exchangeable Securities for Units on the completion of the Conversion Process, Calloway may also be required to make a cash payment to the holder on the Exchangeable Securities in the event that the market value of Units falls over the time required to effect the Conversion Process. The Calloway Option provisions may be terminated by Mitchell Goldhar at any time. Upon receipt of a termination notice, Calloway shall immediately initiate a Conversion Process.

Calloway OSC order

Current structure

Calloway is an open-end REIT, with a market cap of $2.8B, whose units trade on the TSX. It owns all the units of Calloway Holdings Trust ("Sub Trust") which, in turn, holds Class A units of three subsidiary LPs. Third parties also hold units of the three LPs including exchangeable units.

Transaction overview

In order to effectively wind-up Sub Trust on a rollover basis:

- its assets will be transferred to a newly-formed subsidiary unit trust of Calloway ("MFT") under s. 107.4

- Calloway will distribute MFT units to Calloway unitholders in barely sufficient numbers for MFT to qualify as a mutual fund trust

- MFT will be merged into Calloway under s. 132.2

The transactions do not require approval of unitholders and will be described to them in a press release.

Proposed transactions

- All amounts owed by Sub Trust to the three LPs or Calloway or amounts owed by them to Sub Trust will be repaid in cash or by the issuance of additional securities of the debtor.

- Calloway will subscribe for units of MFT.

- Immediately before the transfer of assets in 5 below, Sub Trust will transfer its assets (namely Class A units of the three LPs, shares of the related GPs and cash) to MFT for no consideration, and Sub Trust will be wound up.

- Calloway will distribute a certain number of its MFT Units (approximately 3% of the total) to its unitholders on a pro-rata basis as a distribution of capital so that MFT can qualify as a mutual fund trust.

- MFT will transfer its assets (the same as in 3) to Calloway in consideration for Calloway units having a fair market value equal to the transferred assets.

- Immediately thereafter, MFT will redeem all of the issued and outstanding MFT Units held by Calloway and the MFT unitholders of the Filer (except for one MFT Unit which Calloway will continue to hold until 8), with the redemption price satisfied by the transfer of Calloway REIT units.

- The number of outstanding Calloway units will be consolidated back to the previous number.

- Subsequent to the filing of the necessary tax elections, MFT will be wound up.

Canadian tax consequences

To unitholders. "There will not be any Canadian tax payable by unitholders of the Filer [i.e., Calloway] in respect to the Proposed Transaction other than the immaterial amount of withholding tax that will be payable by non-resident unitholders of the Filer on the distribution of MFT Units. The Filer will pay and remit to the Receiver General, on behalf of each unitholder of the Filer that is non-resident, an amount equal to the amount required by the Tax Act to be withheld on behalf of non- resident unitholders of the Filer."

Objective

"The Proposed Transaction is being undertaken in order to ensure that the Filer continues to qualify as a ‘real estate investment trust' under the Tax Act."

Similar ruling.