Inversions

Burger King/Tim Hortons

Overview

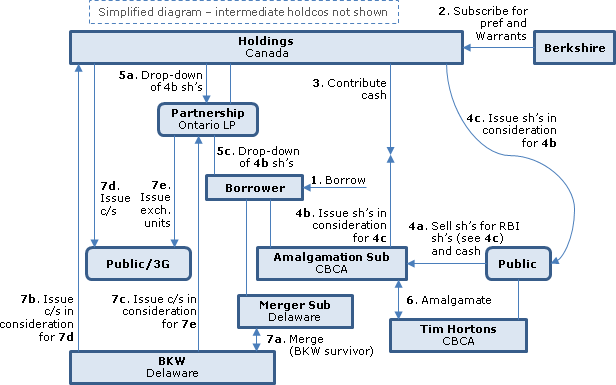

Burger King Worldwide and Tim Hortons will effectively combine so that they will be held indirectly by a TSX-listed Ontario partnership (Partnership) of which a TSX and NYSE listed CBCA holding company (Holdings - formerly a B.C. ULC) held by former Tim Hortons and Burger King Worldwide shareholders will be general partner and the remainder of Burger King Worldwide shareholders will be limited partners. In the first set of transactions (mostly under a CBCA arrangement), a Partnership indirect Canadian subsidiary (Amalgamation Sub) will acquire Tim Hortons, resulting in Tim Hortons becoming an indirect subsidiary of both Holdings and Partnership and with cash being paid to Tim Hortons shareholders who elect cash (based on their election and subject to an aggregate cap of U.S.$8B) - and with those U.S. shareholders receiving Holdings shares benefiting from Code s. 351 reorg treatment. In the second principal step (the merger), Merger Sub (an indirect Delaware sub of Partnership) will merge into Burger King Worldwide, with Burger King Worldwide as the survivor, so that Burger King Worldwide becomes an indirect subsidiary of both Holdings and Partnership. On this merger, Burger King Worldwide stockholders can elect to receive exchangeable LP units of Holdings (so as to access Code s. 721 rollover treatment) rather than mostly shares of Holdings. In a preliminary step, Berkshire Hathaway Inc. ("Berkshire") will provide $3B of voting preferred share financing of Holdings together with an equity kicker (the warrant). Based on Holdings holding more than 50% in vote and value of Partnership interests and ex-Burger King Worldwide shareholders owning less than 80% of the Holdings and Partnership equity, as well as on substantial post-merger Canadian business activity, the Code s. 7874 rule should not deem Holdings or Partnership to be a U.S. corporation.

Burger King Worldwide

A NYSE-listed Delaware corporation formed which is the indirect parent of Burger King Corporation, a Florida corporation that franchises and operates fast food hamburger restaurants.

Tim Hortons

A TSX-listed Canadian corporation operating quick service restaurant chains in North America.

Holdings

A B.C. corporation which prior to the reorganization will be continued under the CBCA. After the reorganization, it will become a TSX and NYSE listed holding company headquartered in Canada which through Partnership will hold Burger King Worldwide and Tim Hortons.

Partnership

An Ontario LP (initially formed as a general partnership between Holdings and a wholly-owned subsidiary) which following the reorganization will be held by Holdings (as general partner) and by some of the former Burger King Worldwide shareholders as limited partners.

Amalgamation Sub

A wholly owned subsidiary of Partnership which was incorporated under the CBCA solely to effect the transactions, and which under the arrangement agreement will acquire Tim Hortons.

Merger Sub

An indirect Delaware wholly-owned subsidiary of Partnership which was formed solely to effect the transactions and pursuant to the arrangement agreement will merge with and into Burger King Worldwide, with Burger King Worldwide as the surviving corporation.

3G/3G Capital

3GSpecial Situations Fund II, L.P, which is controlled by a New York private equity firm, holds approximately 69% of the Burger King Worldwide common shares.

Tim Hortons Plan of Arrangement consideration

Each holder of a Tim Hortons common share will be entitled to receive in exchange therefor C$65.50 in cash and 0.8025 newly issued Holdings common shares (the "arrangement mixed consideration") other than shareholders who elect to receive cash of C$88.50 per share (the "arrangement cash consideration") or 3.0879 newly issued Holdings common shares (the "arrangement share consideration") in exchange therefor. However, the overall cash and Holdings common shares available for all Tim Hortons shareholders will be fixed at the aggregate amount of cash and shares that would have been issued if all Tim Hortons common shareholders elected for the arrangement mixed consideration. In addition cash will be paid in lieu of any entitlement to receive a fractional share or unit.

Tim Hortons Preliminary Steps and Plan of Arrangement

- the shareholders rights plan of Tim Hortons will be terminated;

- Berkshire will purchase for U.S.$3 billion (a) U.S.$3 billion, Class A 9% cumulative compounding perpetual voting preferred shares of Holdings ("preferred shares") and (b) a warrant to purchase common shares (the "warrant"), which will represent 1.75% of the fully diluted common shares of Holdings as of the completion of the transactions, at an exercise price per Holdings common share of $0.01;

- transactions will result in the Berkshire subscription proceeds being contributed to Amalgamation Sub;

- each Tim Hortons common share held by a dissenting shareholder will be transferred to Amalgamation Sub by the holder thereof;

- Tim Hortons deferred stock units will be cash settled and performance stock units and restricted stock units will be settled through issuances of Tim Hortons common shares;

- each outstanding Tim Hortons common share (not held by Amalgamation Sub) will be transferred to Amalgamation Sub in exchange for, (i) the arrangement cash consideration, (ii) the arrangement mixed consideration or (iii) the arrangement shares consideration, as elected (with the arrangement mixed consideration being applicable if no election is made) subject to applicable proration and fractional share settlement in cash – with the consideration to Holdings for delivering, on behalf of Amalgamation Sub, Holdings common shares directly to Tim Hortons shareholders, being the issuance to it of Amalgamation Sub common shares (the "AS delivered common shares");

- each Tim Hortons option (and its tandem stock appreciation right) other than the options surrendered in 5 above will be exchanged for a Holdings option (with a tandem stock appreciation right) to acquire Holdings common shares;

- transfer agreements will result in all AS delivered common shares (see 6) being contributed to an indirect wholly-owned Delaware LLC subsidiary of Holdings;

- Holdings, Partnership and the Trustee will execute the voting trust agreement, Holdings will issue the special voting share to the Trustee and the stated capital of the Tim Hortons common shares will be reduced to $1.00; and

- at 5:00 p.m., Toronto time, on the first business day following the date of the arrangement, Amalgamation Sub and Tim Hortons will amalgamate to form a new amalgamated company (also, the "Amalgamation Sub"), so that the separate legal existence of Amalgamation Sub will cease without Amalgamation Sub being liquidated or wound up, and Amalgamation Sub and Tim Hortons will continue as one company.

Burger King Worldwide merger

On the merger:

- Merger Sub will be merged with and into Burger King Worldwide, with Burger King Worldwide as the "Surviving Company;"

- each share of Merger Sub held by Holdings and Partnership will be converted into one share of the Surviving Company and Surviving Company will further issue its shares to Holdings and to Partnership in consideration of Holdings' issuing the Holdings consideration in (c) below and Partnership issuing the exchangeable consideration in (d) below [see also 2001-0068223];

- except as noted in (d) below, each common share of Burger King Worldwide will be converted into the right to receive 0.99 newly issued Holdings common shares and 0.01 newly issued exchangeable units of Partnership (the "Holdings consideration") (plus cash in lieu of any fractional share); and

- if the BKW stockholder has made an "exchangeable election" in respect of the BKW share, it instead will be converted into the right to receive one exchangeable unit of Partnership (the "exchangeable consideration"); however, the maximum number of Partnership exchangeable units to be issued will be limited to ensure that Holdings' interest in Partnership is at least 50.1% of the fair market value of all equity interests in Partnership – so that proration may apply.

Exchangeable units

Each exchangeable unit of Partnership will be entitled to distributions from Partnership equal to any dividends or distributions that are declared on a common share of Holdings. From and after the one-year anniversary of the closing date of the transactions, each holder of an exchangeable unit will have the right to require Partnership to exchange all or any portion of such holder's exchangeable units for, at the election of Holdings, in its capacity as General Partner of Partnership, (1) cash (in an amount determined in accordance with the terms of the partnership agreement) or (2) common shares of Holdings, at a ratio of one common share of Holdings for each one exchangeable unit.

Voting trust agreement

Pursuant to the "voting trust agreement" among Partnership, Holdings and a trustee as agreed between Burger King Worldwide and Holdings (the "Trustee"), the Trustee will hold a special voting share in Holdings that entitles the Trustee to a number of votes equal to the number of exchangeable units of Partnership outstanding. The exchangeable unitholders can direct the Trustee, as their proxy, to vote on their behalf with respect to substantially all matters to be voted upon by Holdings common shareholders.

Conditions of closing

Do not include a condition re no change to U.S. inversion rules. If requested by Burger King Worldwide, Tim Hortons US shall have been liquidated through distribution of The TDL Group Co.

Debt financing

Burger King Worldwide and Holdings have entered into the "debt commitment letter", pursuant to which JPMorgan Chase Bank, N.A. and Wells Fargo Bank, National Association have agreed to provide:

- a senior secured term loan facility in an aggregate principal amount of $6,750 million;

- a senior secured revolving credit facility in an aggregate principal amount of $500 million; and

- a senior secured second lien bridge facility in an aggregate principal amount of up to $2,250 million (less the gross proceeds of any senior secured second-lien notes).

Post-merger structure

Holdings will own common units of Partnership equal to the number of outstanding Holdings common shares and preferred units of Partnership equal to the number of outstanding Holdings preferred shares. After taking into account the voting power attributed to the preferred shares of Berkshire, former Tim Hortons shareholders will own shares of Holdings representing an estimated 21% of the voting power and former Burger King Worldwide stockholders will own Holdings shares or Partnership exchangeable units representing approximately 69% of the voting power (and 3G Capital will beneficially own 51% of the Holdings common shares on a fully diluted and exchanged basis, representing an aggregate of 48% of the voting power of Holdings.) Three of the 11 board members of Holdings will be designated by Tim Hortons prior to closing and the other eight will be current Burger King Worldwide directors.

Canadian tax consequences

Share/unit exchanges. The exchanges of Tim Hortons shares for Holdings shares, and of Burger King Worldwide shares for Holdings shares or Partnership exchangeable units, will occur on a taxable basis, as will a redemption of exchangeable units.

SIFT tax

Although Partnership (which is assumed will be recognized as a partnership for Canadian taxation purposes) will be a SIFT partnership, its only anticipated source of income is dividends from a Canadian subsidiary, so that it is not expected to be subject to SIFT tax.

Non-resident taxation

Any such dividends will be subject to Part XIII tax based on Partnership's non-resident ownership. A non-resident partner of Partnership will not be subject to Part XIII tax on its share of income of Partnership if (as appears likely and with the assistance of s. 115.2) it is not carrying on business.

U.S. tax consequences

Inversion rules. Partnership (by virtue of trading on the TSX) should be treated as a publicly traded partnership for purposes of Code s. 7874 and as a member of Holdings' expanded affiliated group by virtue of Holdings holding more than 50% in vote and value of Partnership interests. Holdings and Partnership should be treated as indirectly acquiring all of the assets of Burger King Worldwide and the stockholders of Burger King Worldwide should own less than 80% of the Holdings common shares and Partnership units. Accordingly, Holdings and Partnership are expected to be treated as foreign entities for U.S. federal income tax purposes because the transactions should meet the 80% test under Code s. 7874. In addition, the Holdings and Partnership expanded affiliated group, including, after the closing of the mergers, Burger King Worldwide and Tim Hortons and each of their respective greater-than-50% owned subsidiaries, should be treated as having substantial business activities in Canada (Holdings' and Partnership's country of formation.) The balance of the disclosure assumes that Holdings and Partnership will be treated as Canadian corporations for Code s. 7874 purposes. Furthermore, although former BKW stockholders should be treated as owning at least 60% by vote and value of the aggregate Holdings stock, as Holdings and Partnership are expected to meet the substantial business activities test referred to above, restrictions on the use of BKW tax attributes under s. 7874 are not expected to apply.

S. 351 exchange for Tim Hortons shareholders

The arrangement, taken together with the merger, is intended to qualify as an exchange under Code s. 351. If this is correct, a U.S. holder will recognize gain equal to the lesser of: (i) the amount, if any, by which the sum of the cash and fair market value of the Holdings shares received by it exceeds the adjusted tax basis in its Tim Hortons shares; and (ii) the cash received by it. However, a U.S. holder of Tim Hortons common shares who is a "five percent transferee shareholder" of Holdings after the transactions will qualify for such treatment only if it timely files a gain recognition agreement with the IRS.

Merger exchange for Partnership units

The merger is intended to qualify as a transfer of Burger King Worldwide stock in whole or in part (as to at least 1%) in exchange for Partnership units, so that the receipt of Partnership exchangeable units pursuant to the merger qualifies as an exchange under Code s. 721. Furthermore, Partnership exchangeable units are expected to be treated as an interest in Partnership rather than as Holdings stock given that Partnership units cannot be exchanged during the first year and an exchange request can be satisfied in cash. On this basis, the receipt of Partnership units is not expected to give rise to gain except based on the (likely nominal) value of the Holdings voting shares also received.

Merger exchange for Holdings shares

When, as here, the transaction involves the transfer of stock of a U.S. corporation to a foreign corporation, s. 367 can apply to all U.S. holders rather than solely 5% transferee shareholders. Furthermore, the Burger King Worldwide stockholders will receive more than 50% of the Holdings common shares (taking into account option attribution rules for Partnership exchangeable units for purposes of s. 367). Consequently, they will be required to recognize gain (but not loss) on their exchange of Burger King Worldwide stock for Holdings common shares in the merger equaling any excess of the fair market value of Holdings common shares received over the U.S. holder's adjusted tax basis in the exchanged Burger King Worldwide stock. Such gain must be determined separately for separate blocks of stock.

Post-merger treatment of Partnership and Partnership units

Partnership's taxation as a partnership - that is not a publicly traded partnership taxable as a corporation (provided s. 7874 does not apply) - will depend on its ability to meet through operating results, the "qualifying income exception" under s. 7704. (if it fails to satisfy the qualifying income exception, it generally will be treated as transferring all its assets to a newly-formed corporation.) In light of the intended financing structure, Partnership may derive income that constitutes "unrelated business taxable income," or "UBTI." Partnership currently intends to make the s. 754 election. In order to maintain the fungibility of Partnership units, Partnership will seek to achieve the uniformity of U.S. tax treatment for all purchasers of Partnership units which are acquired at the same time and price (irrespective of the identity of the particular seller of Partnership units or the time when Partnership units are issued by Partnership), through the application of certain tax accounting principles that are believed to be reasonable.

Auxilium/QLT

Overview

To effect the combination of Auxilium and QLT, AcquireCo, an indirect wholly owned subsidiary of QLT, will be merged with and into Auxilium (the "merger"). Auxilium will be the surviving corporation and, through the merger, will become an indirect wholly owned subsidiary of QLT ("New Auxilium"). Auxilium stockholders will receive a fixed ratio of 3.1359 QLT common shares for each Auxilium common share. The equity exchange ratio may be increased by up to 0.0962 QLT common shares depending on the aggregate cash consideration (if any) received by QLT or its subsidiary at or immediately after the merger effective time in respect of any sale or licence of QLT's synthetic retinoid product in development. QLT shareholders will continue to own their existing QLT common shares after the merger. Upon the closing, current QLT shareholders and former Auxilium stockholders will own approximately 24% and 76% of the combined company on a fully diluted basis, so that it is anticipated that Code s. 7874 will not deem New Auxilium to be a U.S. corporation.

See full summary under Mergers & Acquisitions – Cross-Border Acquisitions – Inbound – Reverse Takeovers.

Endo/Paladin

It is proposed that a newly-formed Irish company (New Endo) will become the publicly-traded holding company for two public companies: Endo (a US public company) and Paladin (a Canadian pubic company). This is anticipated to avoid the U.S. anti-inversion rules in Code s. 7874 by virtue inter alia of the former Paladin shareholders holding more than 20% of the shares of New Endo (i.e., approximately 22.6%, corresponding to 35.4M ordinary shares). Under the terms of the Arrangement Agreement, (a) New Endo will cause it indirect newly-formed Canadian subsidiary (CanCo 1) to acquire the common shares of Paladin (the "Paladin Shares") pursuant to a CBCA Plan of Arrangement and (b) an indirect LLC subsidiary of Endo (Merger Sub) will merge with and into Endo, with Endo as the surviving corporation in the Merger. At the Merger Effective Time, each Endo Share will be converted into the right to receive one New Endo Share. As an alternative to selling their Paladin Shares directly, resident shareholders generally have the option of transferring their Paladin Shares to a respective newly-incorporated Canadian holding company (a Qualifying Holdco) solely in consideration for common shares, with the shareholders (presumably after engaging in a safe income strip) then transferring their Qualifying Holdco shares to CanCo 1. As a result of the above transactions, both Endo and Paladin will become indirect wholly-owned subsidiaries of New Endo. The Arrangement also includes the spin-off to Paladin Shareholders of a new Canadian public company (Knight Therapeutics) that intends to become a specialty pharmaceutical company.

See full summary under Mergers & Acquisitions - Cross-Border Acquisitions - Inbound - New Non-Resident Holdco.

New Canadian Holdco

Continental Gold/CGL Buritica

Overview

The common shareholders of Continental Gold (to be renamed CGL Buritica), which is a Bermuda corporation with central management and control in Canada, will transfer all their shares to Continental Holdco (a newly incorporated Ontario corporation) under a Bermujda Scheme of Arrangement for the same number of common shares of Continental Holdco. Taxable resident shareholders can elect under s. 85 to achieve rollover treatment. The transaction fits under the description of a "B" (share-for-share) reorg or a Code s. 351 contribution. However, U.S. shareholders who acquired their shares before 2014 (when Continental Gold ceased to be a PFIC) generally will not be eligible for tax-free exchange treatment unless they made a timely election to hold their Continental Gold shares on a mark-to-market basis or made a "purging election" to recognize gain (and pay U.S. tax) on a deemed sale of their shares at the end of 2013.

Continental Gold

A TSX-listed Bermuda company with a branch office and advanced gold project in Columbia.

Continental Holdco

A wholly-owned subsidiary of Continental Gold, named Continental Gold Inc. It was incorporated on April 27, 2015 under the OBCA in order to participate in the Scheme, and has no assets.

Scheme of Arrangement

- Each Common Share of Continental Gold will be exchanged for one common share (a "Replacement Share") of Continental Holdco;

- Continental Gold options will be exchanged for a replacement options issued by Continental Holdco entitling the holder to purchase the same number of Holdco Shares for the same exercise price;

- Continental Gold will surrender to Continental Holdco for cancellation the initial Holdco common shares that were issued to Continental Gold upon incorporation of Continental Holdco;

- The name of Continental Gold will be changed from "Continental Gold Limited" to "CGL Buritica Limited."

Canadian tax consequences

Residence. Although the Company is a Bermuda company, the Company has taken the position that it is resident in Canada for purposes of the Tax Act because, under the common law test of corporate residency, its central management and control are located in Canada.

S.85 rollover

An "Eligible Holder" (a resident, a non-resident who is not exempt from Canadian tax in respect of any gain realized on a disposition of the Continental Gold Common Shares or a partnership having such a member) may elect with Continental Holdco under s. 85 respecting the transfer in 1 above by providing completed tax election forms to Continental Holdco within 90 days following the Effective Date and return them to the Eligible Holder within 90 days of receipt thereof. Otherwise, the exchange in 1 occurs on a taxable basis.

U.S. tax consequences

B reorg or s. 351 contribution. If all Common Shares are exchanged for Replacement Shares and no other consideration is paid for the Common Shares and certain other requirements are met, the Scheme would be a transaction described in Code section 368(a)(1)(B) (a "B reorganization"), Code section 351 (a "351 contribution"), or both. Although a B reorganization or a 351 contribution is generally a tax-free exchange for U.S. tax purposes, there are two important exceptions: exchanges of shares in a passive foreign investment company (a "PFIC"); and exchanges of shares by U.S. persons that would own 5% or more of Continental Holdco following the exchange.

PFIC exception and safe harbours

Because Continental was treated as a PFIC in 2013 and earlier taxable years, any U.S. Holder who participates in the Scheme and who held Common Shares while Continental was a PFIC may be subject to U.S. tax, under the PFIC rules, on the Scheme. This is because the tax-free exchange treatment that would otherwise be available under a B reorganization or 351 exchange is generally not eligible upon exchange of PFIC shares due to the "once a PFIC, always a PFIC" rule of Code s. 1298(b)(1). Under this rule, a PFIC shareholder continues to be subject to the PFIC rules even when Continental Gold ceases to meet the PFIC income test or asset test, unless the shareholder has made one of three elections. The first election is to treat the PFIC as a Qualified Electing Fund ("QEF") effective for the first taxable year in which the shareholder holds the PFIC shares. Because the Company has not been providing the information needed to make QEF elections, this exception likely is not available. The second exception is if a shareholder has made a mark-to-market election, in which case there is authority for the "once a PFIC, always a PFIC rule" not to apply to the Scheme as long as the mark-to-market election continues to apply to PFIC. Finally, if a foreign corporation ceases to meet the definition of a PFIC, the shareholder can make a PFIC "purging" election in which the shareholder recognizes gain on a deemed sale of the shares as of the last day of the last taxable year for which the corporation was a PFIC and recognizes the resulting U.S. tax consequences of that election.

Consequences if no PFIC safe harbour

Unless one of these three elections have been made by the shareholder, a shareholder that held Common Shares while it was a PFIC will be treated as exchanging shares in a PFIC for Replacement Shares. In such case, if Continental Holdco is not also a PFIC, then the U.S. Holder will not be eligible for tax-free exchange treatment even if the Scheme otherwise qualifies as a B reorganization or a 351 transfer. Instead, the U.S. Holder is generally subject to the same US tax treatment as if it disposed of the Common Shares subject to the PFIC rules.

5% shareholder exception

Even if the Scheme qualifies as a B reorganization or 351 transfer, a U.S. Holder that would own 5% or more of Continental Holdco following the Scheme must recognize gain (although not loss) on the exchange of Common Shares unless the U.S. Holder enters into a five-year gain recognition agreement with respect to the transferred stock.

Outbound continuances

Revett

Overview

Shareholders of Revett Minerals are being asked to approve an application under s. 188 of the Canada Business Corporations Act (the "CBCA") to change the jurisdiction of incorporation of Revett Minerals from the federal jurisdiction of Canada to the State of Delaware by way of continuance, and to approve the certificate of incorporation of Revett Minerals, to be effective as of the date of its domestication under s. 388 of the Delaware General Corporation Law ("DGCL"). The domesticated corporation (Revett Mining Company, Inc.) will be deemed for purposes of the DGCL to have commenced its existence in Delaware on the date of original incorporation under the CBCA. Upon domestication, the CBCA director will be asked to issue a certificate of discontinuance bearing the same date as the date of effectiveness of the certificate of corporate domestication. Eventually, Revett Silver Company will be merged with and into Revett Mining Company, Inc.

Revett Minerals

Revett Minerals is a CBCA corporation which is headquartered in Washington state, which holds shares of a Montana corporation ("Revett Silver Company") as essentially its sole asset. Revett Silver Company through subsidiaries holds a Montana copper and silver mine (whose operations were suspended at the end of 2012 and will not resume until construction of a deeper decline is finished on or after November 2014), and a development-stage silver and copper deposit, also in Montana. It is listed on the NYSE Markets Division and the Frankfurt exchange (as well as on the TSX).

Canadian tax consequences

Continuance. Upon the continuance, Revett Minerals will be deemed (by s. 128.1(4)(b)) to have disposed of each of its properties for their fair market value, which could cause Revett Minerals to incur a Canadian income tax liability. Furthermore, an emigration tax will be imposed (under s. 219.1) on the amount by which the fair market value of all of the properties of Revett Minerals exceeds the aggregate of the paid-up capital of its shares and its liabilities. Tax will be so imposed at a 5% rate "unless it can reasonably be concluded that one of the main reasons for the Corporation becoming resident in the United States was to reduce the amount of such additional tax or Canadian withholding tax," in which case the rate will be 25% (s. 219.3). Management is of the view that there should be no material Canadian taxable income or liability arising as a consequence of the domestication. In particular, "if the market price of our common shares does not exceed $2.25 per share and the exchange rate….remains relatively constant…then we should not incur Canadian income taxation arising on the domestication" (p. 7). In 2013, the TSX trading price ranged from $1.44 to $2.72, and ranged as high as $5.10 in 2012.

Shareholders

A Canadian resident holder (as well as a non-resident shareholder) should not be deemed to have disposed of its Revett Minerals shares as consequence only of the domestication. Standard disclosure re dissenters.

U.S. tax consequences

For Revett Minerals. The change in its jurisdiction of incorporation is expected to be a tax-free reorganization under Code. S. 368(a)(F) or (D) (based on substantial corporate assets not being distributed to any shareholders who dissent). "However, to the extent the Corporation owns any United States real property interests…the Corporation will recognize gain to the extent consideration received by the Corporation for such interest exceeds the Corporation's adjusted tax basis in such interest, regardless of whether the transaction qualifies as an F Reorganization or a D Reorganization."

U.S. Holders – s. 367

U.S. holders of Revett Minerals shares generally will not recognize any gain or loss for Code purposes upon the exchange of their Revett Minerals shares for shares of New Revett Minerals pursuant to the continuance unless the Code s. 367 rules or PFIC rules apply. A U.S. holder that owns, directly or indirectly (under constructive ownership rules) less than 10% of the combined voting power of all classes of stock of Revett Minerals and owns shares of Revett Minerals with a fair market value of less than $50,000 is not subject to the s. 367 rules. A 10% Shareholder will be required to recognize as dividend income its proportionate share of Revett Minerals's "all earnings and profits amount", with a corresponding increase in its tax basis. A U.S. holder that is not a 10% Shareholder but whose shares have a fair market value of at least $50,000 generally will recognize gain (but not loss) upon the domestication equal to the difference between the fair market value of the Revett Mining Company, Inc. common stock received at the time of the domestication over the shareholder's tax basis in the shares of Revett Minerals. However, it will not be required to recognize any gain if it instead elects to include as a deemed dividend the "all earnings and profits amount" with respect to its Revett Minerals stock. Revett Minerals believes that no U.S. shareholder of Revett Minerals should have a positive "all earnings and profits amount" attributable to its shares (and that it is not a PFIC), so that no US shareholder should be subject to tax on the domestication.

U.S. Holders – PFIC

Revett Minerals believes that it is not and never has been a PFIC. Accordingly, the continuance should not be a taxable event for any U.S. holder under the PFIC rules.

Non- U.S. Holders

The exchange of shares of Revett Minerals for shares of Revett Mining Company, Inc. by a non-U.S. holder generally will not be a taxable transaction. Revett Minerals does not anticipate that Revett Mining Company, Inc. will become a USRPHC.

Gastar

Overview

Pursuant to a Plan of Arrangement under s. 193 of the ABCA, the jurisdiction of incorporation of Gastar will be changed from Alberta to Delaware by way of a domestication under s. 388 of the Delaware General Corporation Law ("DGCL") – so that its existence as a corporation will be deemed to have commenced on December 22, 2005, the date of original incorporation under the ABCA. Gastar will delist from the TSX.

Gastar

Gastar is a Houston-based corporation with a market cap of $173M engaged in the exploration and production of natural gas and oil, with a focus on the Marcellus Shale play in Appalachia. It is listed on the NYSE Amex (as well as on the TSX). Its share price has declined from around $25 shortly after its incorporation at the end of 2005 to $2.50 currently.

Plan of Arrangement

Under the Plan of Arrangement:

- dissenters will be deemed to have transferred their Gastar shares to Gastar for cancellation and will cease to have any rights other than to be paid the fair value of their shares

- Gastar shall continue under the DGCL as Gastar Delaware so that inter alia each outstanding Gastar share shall be exchanged for one share of Gastar Delaware , the property of Gastar shall continue to be property of Gastar Delaware, and Gastar Delaware will continue to be liable for obligations of Gastar

U.S. securities laws

The shares of Gastar Delaware to be issued will not be registered in reliance on the s. 3(a)(10) exemption.

Canadian tax consequences

Continuance. Upon the continuance, Gastar will be deemed (by s. 128.1(4)(b)) to have disposed of each of its properties for their fair market value, which could cause Gastar to incur a Canadian income tax liability. Furthermore, an emigration tax will be imposed (under s. 219.1) on the amount by which the fair market value of all of the properties of Gastar exceeds the aggregate of the paid-up capital of its shares and its liabilities. Tax will be so imposed at a 5% rate "unless one of the main reasons for our Company changing its residence to the United States was to reduce the amount of this corporate emigration tax or the amount of Canadian withholding tax paid by our Company, in which case the rate will be 25%" (s. 219.3). Management is of the view that there should be no material Canadian tax arising as a consequence of the continuance.

Shareholders

A Canadian resident holder (as well as a non-resident shareholder) should not be deemed to have disposed of its Gastar shares as consequence only of the continuance. Standard disclosure re dissenters.

U.S. tax consequences

Potential FIRPTA tax. As a result of the continuance, Gastar will be treated as (i) transferring all of its assets and liabilities to Gastar Delaware in exchange for stock of Gastar Delaware , and (ii) distributing to its shareholders the stock of Gastar Delaware in redemption of the shareholders' stock in Gastar. As Gastar Delaware will be a United States real property holding company (USRPC) within the meaning of Code s. 897, in the absence of an applicable exception, Gastar would be required to recognize any gain realized on its constructive distribution in (ii).

Private letter ruling/toll charge

In a private letter ruling, the IRS ruled that Gastar would qualify for an exception (and thus not realize gain in (ii)) provided that the reorganization qualified as a s. 368(a) reorganization and Gastar paid a "toll charge" equal to the taxes that would have been imposed under s. 897 on all persons who disposed of Gastar stock within the 10 years preceding the continuance if Gastar had been a domestic corporation, plus interest thereon. Gastar expects this toll charge to be approximately $500,000.

S 368(a) reorg

Although the ruling did not address the status of the continuance as a s. 368(a) reorganization, a condition to the completion of the reorganization will be an opinion of Bingham McCutchen that it so qualifies.

U.S. Holders – s. 367

If the continuance qualifies as a Code s. 368(a) reorganization, U.S. holders of Gastar shares generally will not recognize any gain or loss for Code purposes upon the exchange of their Gastar shares for shares of New Gastar pursuant to the continuance unless the Code s. 367 rules or PFIC rules apply. A U.S. holder that owns, directly or indirectly (under constructive ownership rules) less than 10% of the combined voting power of all classes of stock of Gastar and owns shares of Gastar with a fair market value of less than $50,000 is not subject to the s. 367 rules. A 10% Shareholder will be required to recognize as dividend income its proportionate share of Gastar's "all earnings and profits amount", with a corresponding increase in its tax basis. A U.S. holder that is not a 10% Shareholder but whose shares have a fair market value of at least $50,000 generally will recognize gain (but not loss) upon the exchange of its Gastar stock for Gastar Delaware stock. However, it will not be required to recognize any gain if it instead elects to include as a deemed dividend the "all earnings and profits amount" with respect to its Gastar stock if inter alia Gastar provides sufficient information to compute the "all earnings and profits amount" with respect to its stock. Gastar believes that it has incurred deficits in earnings and profits in each tax year beginning after 2005 except for the 2009 tax year. It will post information regarding its earnings and profits (or deficits) on its website.

U.S. Holders – PFIC

Gastar believes that it is not and never has been a PFIC. Accordingly, the continuance should not be a taxable event for any U.S. holder under the PFIC rules.

Non- U.S. Holders

The exchange of shares of Gastar for shares of Gastar Delaware by a non-U.S. holder on the continuance generally will not be a taxable transaction.

Franchise Services/Hertz

Overview

In order to merge the car rental business of Adreca, a private Delaware corporation, with the car rental business of FSNA, a TSXV-listed CBCA corporation, Adreca will be merged into a subsidiary of FSNA with Adreca as the survivor, and FSNA, following its continuance from Canada to Delaware ("New FSNA"), will then be merged with Adreca, with New FSNA as the survivor.

For a more detailed summary, see under Cross-Border Mergers - Outbound - Continuance and Merger.