Cases

The Queen v. Superior Plus Corp, 2015 FCA 241, aff'g 2015 TCC 132

The Superior Plus Income Fund (the "Fund") effectively converted (in accordance with the distribution method contemplated under s. 107(3.1)) into a public corporation using an existing corporation (the taxpayer, a.k.a. "Old Ballard") with non-capital losses and other tax attributes as the new corporate vehicle - rather than using a new corporation. The transactions were designed to ensure that there was no acquisition of control of the taxpayer (which would have resulted in a streaming of its losses). In particular, although the unitholders of the fund became shareholders of the taxpayer, this was considered not to entail an acquisition of control of the taxpayer by a group of persons. Subsequent to the conversion, s. 256(7)(c.1) was introduced, which would have deemed there to be an acquisition of control of the taxpayer, if it had had retroactive effect (which it did not). The Minister disallowed the use of the tax attributes, on the basis that there in fact had been an acquisition of control of the taxpayer or, alternatively, under s. 245(2) (i.e., GAAR).

At the discovery stage, the taxpayer moved to compel the Minister to answer various questions, or to produce documents, or previously redacted portions of documents previously requested under the Access to Information Act, which CRA had resisted principally on the grounds of irrelevance. The questions included whether the Department of Finance considered making the 2010 SIFT amendments retroactive, why it had changed its explanatory notes to say that s. 256(7)(c.1) "clarified" rather than "extended" the change-of-control rules and whether the Attorney General agreed that initially the policy choice of the SIFT conversion rules was to allow the use of existing corporations. Requested documents included GAAR Committee minutes including comments of individual members (whereas CRA had provided only the final Recommendation of the Committee), and correspondence between CRA and Finance (resulting in the drafting of s. 256(7)(c.1))and between the GAAR Committee and Aggressive Tax Planning, with the questions seeking particulars on the questions posed above and policy considerations brought to bear on this file, and respecting what initially may have been diffidence on the part of Finance as to how to proceed, if at all.

Following the reasons in Birchcliff, Hogan J in the Tax Court granted the taxpayer's motion in the main (including all the above-mentioned questions and documents).

In the Court of Appeal, Noël CJ stated (at para. 8):

As was held…in Lehigh Cement Ltd. v. R., 2011 FCA 120… information pertaining to the policy of the Act, even where it is not taxpayer specific, can be relevant on discovery. …

Inter-Leasing, Inc. v. Ontario (Revenue), 2014 ONCA 575

In order to minimize provincial income tax, a Canadian corporate group restructured so that various intercompany debts were owing (on a back-to-back basis through an intermediate company) to the taxpayer which, although it was resident in Canada and had a permanent establishment in Ontario for other tax reasons, was exempt from tax on the interest income by virtue of an exemption in the Corporations Tax Act (Ontario) for income from property earned by a corporation which had been incorporated outside Canada (here, the British Virgin Islands.) For more detail see under s. 115(1)(b) – and respecting the BVI situs issue, see summary under TA, s. 54(2)(b).

In finding found that Ontario's GAAR did not apply, as there was no abuse of the relevant provision, Pardu JA stated (at para. 55) that "in 1959, Ontario adopted the place of incorporation test [for residence], unlike the federal government and all other provinces," referred (at para. 60) to "the deliberate decision not to tax corporations incorporated outside Canada on income from property" and (at para. 61) noted that Copthorne stated that "in some cases the underlying rationale of a provision would be no broader than the text itself." She then stated (at paras. 62, 66):

Here, the purpose of s. 2(2) of the OCTA was to tax corporations incorporated outside Canada with a permanent establishment in Ontario on income from business but not on from income from property. Where such a corporation structures its affairs to earn income from property rather than income from business, it has not…defeated the underlying rationale of the provision… .

The approach taken by the appeal judge - to define the purpose of the provision as to raise revenue and to define the tax base as broadly as possible - renders "abusive" any transaction that has the effect of reducing tax. I do not accept that approach.

In rejecting an argument that situating the specialty debt instruments in the British Virgin Islands was an abusive transaction, Pardu JA noted (at paras. 95-7) that "the rule governing the situs of specialty debts instruments is a long-standing and well-established rule," "the situs for the instruments was not arbitrary, but was a place to which the corporation had some link, namely, its place of incorporation," and "the level of [the taxpayer's] activity in Ontario to generate the income from property was minimal."

The Queen v. Global Equity Fund Ltd., 2013 DTC 5007 [5526], 2012 FCA 272

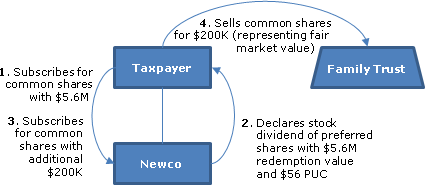

The taxpayer subscribed for common shares of a new subsidiary for approximately $5.6 million, which then declared a stock dividend in the form of preferred shares having $56 of paid-up capital and a $5.6 million redemption price. Consequently, the value of the common shares was largely eliminated. (The taxpayer's subscription for an additional $200,000 was acknowledged to be "window dressing" to give the common shares some value.) The taxpayer (which was involved in the business of trading securities) disposed of the common shares in consideration for their depleted value and reported a business loss.

Mainville J.A. found that the transactions were abusive of ss. 3, 4, 9, and 111. He stated (at para. 62):

The fundamental rationale underlying these provisions is that, in order to be used for taxation purposes, business losses must be grounded in some form of economic or business reality. As noted in Canderel at para. 53, "[i]n seeking to ascertain profit, the goal is to obtain an accurate picture of the taxpayer's profit for the year." That same common sense principle applies to a business loss, thus harmonizing the concept of business loss with the related concept of profit under the Act.

The Court concluded that the taxpayer's transactions were "nothing more than a paper shuffle," that "nothing was gained or lost," and that it would "defeat the underlying rationale of sections 3, 4, 9 and 11" for such paper losses to avoid "the payment of taxes otherwise owed on the profits resulting from the real-world business operations of Global" (para. 66-68).

The Minister argued in the alternative that no business loss had in fact occurred, given that the shares had not been acquired as inventory or as part of an adventure in the nature of trade. These arguments had not been raised at trial and entailed new evidence, and were therefore disallowed (paras. 35-37).

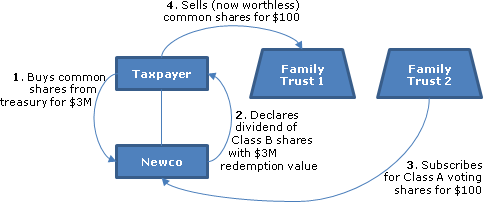

1207192 Ontario Limited v. The Queen, 2012 DTC 5157 [at 7396], 2012 FCA 259, aff'g 2011 DTC 1301 [at 1686], 2011 TCC 383

This was a companion case to Triad Gestco.

The taxpayer, which had realized a capital gain of $2,974,386, transferred cash and marketable securities with a value of $3 million to a newly-incorporated subsidiary ("Newco") as the subscription price for common shares of Newco. Newco then paid a stock dividend to the taxpayer consisting of preferred non-voting shares having a nominal paid-up capital and a total redemption value (in the hands of the initial holder) of $3 million, thereby effecting a "value shift" away from the common shares. Special voting shares of Newco having nominal value were issued to a trust for members of the family of the sole shareholder of the taxpayer ("Mr. Cross"). The taxpayer then sold the common shares of Newco to a second family trust for the sum of $100 and claimed a capital loss of nearly $3 million.

Paris J. denied the capital loss under s. 245(2). The taxpayer had clearly engaged in an avoidance transaction, and the transaction was an abuse of s. 38(b) of the Act. He stated (at TCC paras. 90, 92):

I find that the Respondent has shown that the purpose of paragraph 38(b) is to recognize economic losses suffered by a taxpayer on the disposition of property. The Respondent has also shown that despite the repeal of subsection 55(1) [a provision specifically aimed at stopping artificial capital losses such as surplus-stripping], the policy of the Act is still to disallow the artificial or undue creation or increase of a capital loss, which underlines the intention to allow capital losses only to the extent that they reflect an underlying economic loss. ...

These transactions did not reduce the Appellant's economic power in the manner contemplated by Parliament in allowing for the deduction of capital losses.

In accordance with its conclusions in Triad Gestco, the Court of Appeal affirmed Paris J.'s reasoning. Furthermore, in response to the taxpayer's argument that the main purpose of the transaction was to effect creditor protection for Mr. Cross, Sharlow J.A. stated (at FCA para. 20):

I am unable to accept this argument. In my view, Justice Paris followed the correct approach when he determined the purpose of the series of transactions on an objective basis – that is, by ascertaining objectively the purpose of each step by reference to its consequences – rather than on the basis of the subjective motivation of Mr. Cross, or his subjective understanding of what may or may not have been required to achieve creditor protection.

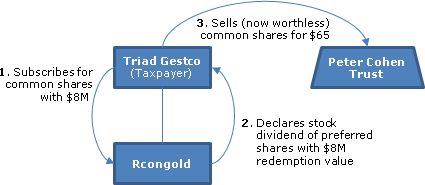

Triad Gestco Ltd. v. The Queen, 2012 DTC 5156 [at 7385], 2012 FCA 258

The taxpayer, which was directed and controlled by Mr. Cohen, and which had realized a capital gain of approximately $8 million, transferred $8 million of assets to a newly-incorporated subsidiary ("Rcongold") in consideration for the issuance of common shares. Rcongold declared a stock dividend of $1 on its common shares, which was payable through the issuance of 80,000 non-voting preferred shares with an aggregate redemption price of $8,000,000 and (presumably) a stated capital of $1. An unrelated individual settled, with $100, a trust of which Mr. Cohen was a beneficiary, so that under the "affiliate" definition then in effect it was an un-affiliated trust. The taxpayer then sold its common shares of Rcongold to the trust for $65 and claimed a capital loss of $7,999,935, which permitted it to offset the realized capital gain through a loss carry-back.

After noting (at para. 39) that after the taxpayer's disposition of its common shares it "was neither richer nor poorer," Noël J.A. (while citing Ramsay) stated (at para. 41) that "the capital gain system is generally understood to apply to real gains and losses" as contrasted to "paper gains or losses" (para. 44), so that, under the general capital loss provisions of the Act, there was:

relief as an offset against capital gain where a taxpayer has suffered an economic loss on the disposition of property... [and] offsetting a capital gain with the paper loss that was claimed [here] results in an abuse and a misuse of [these] relevant provisions... . (Para. 50.)

The Court found that the trial judge erred in his alternative finding that s. 40(2)(g)(i) reflects a general policy against the deduction of losses "within an economic unit" (paras. 54-56). Finally, although there was a corresponding accrued but unrealized gain on the taxpayer's preferred shareholding, the taxpayer had not "put forth a credible scenario indicating that the preferred shares were to be sold" (para. 59).

The taxpayer's appeal was dismissed.

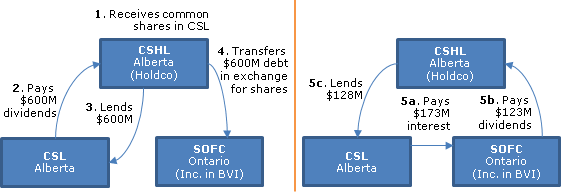

Canada Safeway v. Alberta, 2012 DTC 5133 [at 7271], 2012 ABCA 232

This case was a companion decision to Husky Energy.

An Alberta taxpayer ("CSL") borrowed $600 million from its Alberta parent ("CSHL") over the course of a month, and used the borrowed funds to repay commercial paper which it previously had borrowed for an income-producing purpose. At the same time as these borrowings occurred, CSL paid dividends totaling $600 million to CSHL. CSHL then assigned the $600 million of debt to another subsidiary ("SOFC") which had been incorporated in the British Virgin Islands but had a permanent establishment in Ontario. CSL paid interest to SOFC, SOFC paid dividends to CSHL, and CSHL would make further loans to CSL. CSL deducted the interest paid to SOFC in computing its income for Alberta purposes, SOFC was not taxable in Ontario on the interest it received from CSL, and CSHL claimed the intercorporate dividend deduction respecting the dividends it received from SOFC.

In the course of finding that the series of transactions was not subject to Alberta's general anti-avoidance rule (on similar reasoning to Husky), Hunt J.A. stated (at para. 38):

I am not persuaded by Alberta's argument that Safeway did not "need" to borrow $600 million... . It is clear that a taxpayer is free to replace retained earnings with borrowed money and doing so does not by itself show that the purpose of section 20(1)(c) has been frustrated: Lipson at para 41; see also Ludco and Singleton.

Husky Energy v. Alberta, 2012 DTC 5132 [at 7262], 2012 ABCA 231

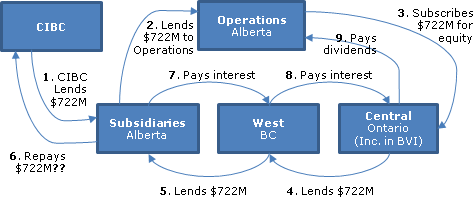

An Alberta corporate taxpayer within the Husky group of companies ("Operations") used the proceeds of loan repayments received from other Alberta taxpayers within the group (the "Subsidiaries" - who had borrowed those proceeds from a bank) to subscribe for equity in a subsidiary ("Central") which had been incorporated in the British Virgin Islands but which was resident in Ontario. Central used the subscription proceeds to make an interest-bearing loan to another (BC) subsidiary of Operations ("West") which, in turn, on-lent those funds at interest to the Subsidiaries. The Subsidiaries deducted the interest payments made by them to West, West included those payments in its income and deducted the interest paid by it to Central - however, Central was not required to include such interest payments in its income for Ontario corporate income tax purposes. Central applied the untaxed interest payments so received by it to make dividend payments to Operations, which claimed the intercorporate dividend deduction.

Further transactions were engaged, which were viewed as raising the same issues under the general anti-avoidance rule ("GAAR") in the Alberta Corporate Tax Act (ACTA), which is essentially identical to the federal GAAR.

The Court dismissed the Minister's submission that the Subsidiaries' deduction under 20(1)(c) of the interest payments to West, and Operations' claiming of the intercorporate dividend deduction under s. 112(1), abused those provisions. The principle of corporate non-consolidation, set out in para. 97 of Copthorne, requires that each corporation's tax liability be considered independently (para. 47). It was therefore irrelevant for the Subsidiaries' tax position that Central had no corresponding income inclusion on the interest payments (paras. 45-46), and it was irrelevant for Operations' tax position that dividends from Central came from a non-taxable stream of income (paras. 52-56).

Copthorne Holdings Ltd. v. The Queen, 2012 DTC 5006 [at 6536], 2011 SCC 63

The ultimate controlling family members decided that a Canadian subsidiary ("Copthorne I") should be amalgamated with a wholly-owned subsidiary of Copthorne I ("VHHC Holdings"), whose shares had a nominal fair market value but a paid-up capital of approximately $67 million. (The high paid-up capital of the shares of VHHC Holdings reflected the fact that it had previously been capitalized with those amounts by another family-owned Canadian-resident corporation, before it dissipated that capital through making a bad investment.) In order to preserve the paid-up capital in the shares of VHHC Holdings, the amalgamation was not accomplished as a vertical amalgamation. Instead, Copthorne I sold its shares of VHHC Holdings for a nominal amount to Copthorne I's non-resident parent company prior to a horizontal amalgamation of Copthorne I and VHHC Holdings (and some other Canadian corporations) to continue as Copthorne II.

With a view to effecting a substantial distribution to its non-resident shareholder (and after Copthorne II had amalgamated with another Canadian corporation to continue as Copthorne III), Copthorne III redeemed preferred shares held by the shareholder, with no Part XIII tax being withheld in light of the high paid-up capital of those shares.

After observing that s. 87(3) provides for the cancellation of the paid-up capital of a subsidiary on its vertical amalgamation, Rothstein J. stated (at para. 122):

Having regard to the text, context and purpose of s. 87(3), I would conclude that the object, spirit and purpose of the parenthetical portion of the section is to preclude preservation of PUC of the shares of a subsidiary corporation upon amalgamation of the parent and subsidiary where such preservation would permit shareholders, on a redemption of shares by the amalgamated corporation, to be paid amounts as a return of capital without liability for tax, in excess of the amounts invested in the amalgamating corporations with tax-paid funds.

Accordingly, the GAAR assessment was appropriate (para. 127):

The sale of VHHC Holdings shares to [the shareholder] circumvented the parenthetical words of s. 87(3) and in the context of the series of which it was a part, achieved a result the section was intended to prevent and thus defeated its underlying rationale. The transaction was abusive....

St. Michael Trust Corp. v. The Queen, 2010 DTC 5189 [at 7361], 2010 FCA 309, aff'd sub nom Fundy Settlement v. Canada, 2012 DTC 5063 [at 6881], 2012 SCC 14

After finding against the taxpayers on the grounds inter alia that two Barbados trusts were resident in Canada, Sharlow, J.A. found that if Barbados trusts were in fact entitled to a treaty exemption based on their residence in Barbados, this would not result in a misuse or abuse of that Convention given that the treaty exemption (para. 90):

...flows from the fact that in the Barbados Tax Treaty, Canada has agreed not to tax certain capital gains realized by a person who is a resident of Barbados. If the residence of the trust is Barbados for tax purposes, the trusts cannot misuse or abuse the Barbados Tax Treaty by claiming the exemption.

Lehigh Cement Ltd. v. The Queen, 2010 DTC 5081 [at 6844], 2010 FCA 124

After the terms of the debt owing by the taxpayer to a non-resident affiliate were amended so that they would comply with various requirements of the withholding tax exemption in s. 212(1)(b)(vii), the non-resident affiliate sold to an arm's length Belgian bank the right to be paid all interest payable under the debt for a sum of approximately $42.7 million, with the non-resident affiliate being required to buy back the sold interest coupon for a specified price in the event of a default by the taxpayer.

In rejecting a submission of the Crown that this transaction resulted in a misuse of such withholding tax exemption because the transaction did not result in the taxpayer "accessing funds in an international capital market" (para. 25) (which the Crown suggested was the purpose of the exemption, based on a brief statement in the related Budget papers respecting its introduction) Sharlow, J.A. noted (at para. 37) that the Crown had been unable to "establish by evidence and reasoned argument that the result of the impugned transaction is inconsistent with the purpose of the exemption, determined on the basis of a textual, contextual and propulsive interpretation of the exemption" (emphasis on the original) and that "no trace of the alleged fiscal policy can be discerned or reasonably inferred from subparagraph 212(1)(b)(viii) itself, from the statutory scheme of which subsection 212(1)(b)(viii) is a part, or from any other provision of the Income Tax Act that could possibly be relevant to its textual, contextual and purposive interpretation.

The Queen v. Remai Estate, 2009 DTC 5188 [at 6257], 2009 FCA 340

In order to make promissory notes that he had donated to a charitable foundation cease to be non-qualifying securities, the taxpayer arranged for the Foundation to sell those promissory notes to a corporation ("Sweet") owned as to 90% by his nephew, with Sweet issuing notes with identical terms to the Foundation as consideration for the purchase.

In rejecting a submission of the Crown that the "non-qualifying security" provisions of the charitable gift rules were intended to prevent donors from claiming a charitable tax credit for the value of the gift when they still retain control of the funds from which the obligation would be satisfied (which was the case on the facts in this case), the Court noted (at para. 58) that nothing in the text of the provisions supported this purpose, and that the associated Budget statements instead referred only to loan-back situations, which was not the case in the transactions under consideration before the Court.

Collins & Aikman Products Co. v. The Queen, 2009 DTC 1179 [at 958], 2009 TCC 299, aff'd 2010 DTC 5164 [at 7293], 2010 FCA 251

The taxpayer ("Products"), which was a corporation resident in the U.S., transferred the shares of its subsidiary ("CAHL"), which was non-resident in Canada notwithstanding that it had been incorporated in Canada in 1929, to a newly incorporated Canadian-subsidiary of Products ("Holdings") in consideration for a common share of Holdings that had a paid-up capital equal to the fair market value of CAHL. After CAHL became resident in Canada (as a result of its central management and control moving to Canada), CAHL paid dividends to Holdings, which distributed the same amounts to Products as distributions of paid-up capital.

In finding that it was not abusive for the stepped-up paid-up capital of the common share of Holdings to be utilized by Products to receive a distribution free of Part XIII tax, Boyle, J. rejected the Crown's submission that there was a scheme under the Act that should treat most distributions as subject to tax (noting (at paragraph 72) that any alleged legislative purpose "should be demonstrably evident from the provisions of the Act"), and noted (at paragraph 86) that the real reason the reorganization plan "worked" was that CAHL was a non-Canadian holding company whose shares were not taxable Canadian property and were excluded from the application of s. 212.1. On the appeal, Sharlow J.A. remarked: "We see no reason to conclude that the limited scope of those provisions was anything other than a deliberate policy choice by Parliament."

After finding for the taxpayer, Boyle J. went on to reject a taxpayer submission that there was no use of s. 84(4) and therefore no misuse of s. 84(4) because s. 84(4) did not apply: s. 84(4) applies every time a corporation returns capital even if a deemed dividend does not arise.

Landrus v. The Queen, 2009 DTC 5085 [at 5840], 2009 FCA 113

A partnership of which the taxpayer was a member ("Roseland II") and another partnership ("Roseland I") owning a similar and adjacent condominium development, sold all their assets to a newly-formed partnership ("RPM") with the purchase price being paid by way of set-off against the subscription price for the partnership interests in RPM, with such partnership interests in RPM being distributed to the partners of Roseland I and II.

In response to a submission of the Crown that various stop-loss provisions in the Act evidenced "a general policy to disregard dispositions of property to persons amongst related parties or parties within 'the same economic unit", Noël, J.A. noted (at para. 44) that "the precise and detailed nature of these provisions show that they are intended to deny losses in the limited circumstances set out in these provisions" and stated (at para. 47) that "where it can be shown that an anti-avoidance provision has been carefully crafted to include some situations and exclude others, it is reasonable to infer that Parliament chose to limit their scope accordingly." After noting (at para. 56) that he accepted "that the transactions in issue would be arguably abusive if they had given rise to the tax benefit in circumstances where the legal rights and obligations of the Respondent were otherwise wholly unaffected," he went on to note that here the changes in the position of the taxpayer were "material both in terms of risk and benefits" (para. 57) given that as a result of the transactions, the taxpayer acquired an undivided interest in assets that were double in size and shared in an expanded rental pool. Finally, having regard to the "overall result" test established in the Lipson case, the overall result in this case did not frustrate the object, spirit and purpose of the relevant stop loss provision (s.20(16)). Accordingly, the Crown's appeal was dismissed.

Lipson v. The Queen, 2009 DTC 5528, 2009 SCC 1

The taxpayer's wife ("Jordanna") borrowed $562,500 from the Bank of Montreal under an interest-bearing demand promissory note in order to purchase some of the shares of a family corporation from the taxpayer for that sum, with the sale proceeds being used by the taxpayer to purchase a family home. The next day, a mortgage loan on the home received from the Bank was used to retire the demand promissory note. The taxpayer did not report a capital gain on the sale of the shares (on the basis that the inter-spousal rollover in subsection 73(1) applied) and included in the computation of his income both the dividends on the shares purchased by Jordanna, and the interest expense incurred by her on the mortgage loan, on the basis that the attribution rules in subsection 74.1(1) applied.

Lebel J. found (at para. 42):

"As ... the purpose of s. 74.1(1) is to prevent spouses from reducing tax by taking advantage of their non arm's length relationship when transferring property between themselves ..., the attribution by operation of s. 74.1(1) that allowed Mr. Lipson to deduct the interest in order to reduce the tax payable on the dividend income from the shares, and other income, which he would not have been able to do were Mrs. Lipson dealing with him at arm's length, qualifies as abusive tax avoidance ... . Indeed, a specific anti-avoidance rule is being used to facilitate abusive tax avoidance.":

Respecting the position of Rothstein, J. who, in his dissenting reasons, stated (at para. 108) that "if there is a specific anti-avoidance rule [such, as here, s. 74.5(11)] that precludes the use of an enabling rule to avoid or reduce tax, then the GAAR will not apply", Lebel J. stated (at para. 45):

"Where the language of and principles flowing from the GAAR apply to a transaction, the court should not refuse to apply it on the ground that a more specific provision - one that both the Minister and the taxpayers considered to be inapplicable throughout the proceedings - might also apply to the transaction."

The Queen v. MIL (Investments) S.A., 2007 DTC 5437, 2007 FCA 236

In March 1993 an individual ("Boulle") transferred his shares of a Canadian public junior exploration company ("DFR") to the taxpayer, which was a newly-incorporated Cayman Islands company wholly owned by him. By June 1995, the taxpayer exchanged, on a rollover basis pursuant to s. 85.1, a portion of its DFR shares (which had substantially appreciated) for common shares of a large Canadian public company ("Inco"), with the result that the taxpayer's shareholding in DFR was reduced below 10%. This result positioned the taxpayer to clearly fit within an exemption from Canadian capital gains tax under Article XIII of the Canada-Luxembourg Income Tax Convention (the "Treaty") on a subsequent disposition of that block of shares once the taxpayer became resident in Luxembourg. In July 1995, the taxpayer was continued into Luxembourg, in August 1995 the taxpayer sold its shares of Inco and in August 1996 it sold its DFR shares to Inco.

In rejecting the submission of counsel for the Crown that the claiming of exemption under the Treaty on the August 1996 sale represented an abuse or misuse, Pelletier, JA stated (at para. 6-7):

"It is clear that the Act intends to exempt non-residents from taxation on the gains from the disposition of treaty exempt property. It is also clear that under the terms of the Tax Treaty, the respondent's stake in DFR was treaty exempt property. The appellant urged us to look behind this textual compliance with the relevant provisions to find an object or purpose whose abuse would justify our departure from the plain words of the disposition. We are unable to find such an object or purpose.

If the object of the exempting provisions was to be limited to portfolio investments, or to non-controlling interests in immoveable property (as defined in the Tax Treaty [including real estate company shares]), as the appellant argues, it would have been easy enough to say so. Beyond that, and more importantly, the appellant was unable to explain how the fact that the respondent or Mr. Boulle had or retained influence or control over DFR, if indeed they did, was in itself a reason to subject the gain from the sale of the shares to Canadian taxation rather than taxation in Luxembourg."

The Court also summarily dismissed an argument that the Treaty should not be interpreted so as to permit "double non-taxation", i.e., a result where there was no income tax under the laws of either jurisdiction.

The Queen v. Mathew, 2005 DTC 5538, 2005 SCC 55

An insolvent trust company ("STC") transferred a portfolio of mortgages with unrealized losses to a partnership of which a wholly-owned subsidiary was a general partner and in which it received a 99% interest ("Partnership A"). S.18(13) deemed the cost of the mortgages to be the same to Partnership A as their cost to STC. STC sold its partnership interest in Partnership A to a second partnership ("Partnership B") of which the taxpayers were members. Partnership A realized the losses on the mortgage portfolio, allocated 90% of the loss to Partnership B which, in turn, allocated those losses to its partners including the taxpayers.

In finding that the transactions defeated the purposes of s. 18(13) and the partnership provisions of the Act, the Court stated (at p. 5546):

"Section 18(13) preserves and transfers a loss under the assumption that it will be realized by a taxpayer who does not deal at arm's length with the transferor. Parliament could not have intended that the combined effect of the partnership rules and s. 18(13) would preserve and transfer a loss to be realized by a taxpayer who deals at arm's length with the transferor."

Canada Trustco Mortgage Co., v. The Queen, 2005 DTC 5523, 2005 SCC 54

The taxpayer purchased trailers from the U.S. user of the trailers ("TLI"), with the taxpayer appointing TLI as its agent to hold title on its behalf. The taxpayer leased the trailers to an English company ("MAIL") which in turn subleased the trailers to TLI. TLI then immediately made a lump sum prepayment of all the rents payable by it under the sublease, and MAIL used a portion of this sum to make a deposit with the bank that had helped fund the purchase by the taxpayer of the trailers in an amount equal to the bank loan and paid the balance of the prepayment to a Jersey affiliate of the bank on the condition that the affiliate use those funds to purchase a Government of Canada bond to be pledged to secure MAIL's obligations under the lease.

The claiming by the taxpayer of capital cost allowance on the acquired trailer was consistent with the object and spirit of the capital cost allowance provisions of the Act which did not, except in specified circumstances, reduce cost to reflect a mitigation of economic risk. Accordingly, the transactions did not defeat or frustrate the object, spirit or purpose of the capital cost allowance provisions read textually, contextually and purposively.

The Queen v. Imperial Oil Ltd., 2004 DTC 6044, 2004 FCA 36

The Court affirmed the finding of the Tax Court that the claiming of an investment allowance by the taxpayer on short-term loans made by it close to the end of its calendar fiscal period to a bank subsidiary, with the loans being guaranteed by the parent bank, did not result in a misuse or abuse for purposes of s. 245(4). The taxpayer was not indirectly lending money to a bank, as the business of the borrower was different than that of its parent and the money was available for use by it and not the bank; and "the fact that the bank guaranteed the loan did not make it a borrower of the money lent" (p. 6054). Although the taxpayer "took advantage of a loophole in the statutory scheme, namely the failure to deal with the consequences of different corporate year ends" ... "it must have been perfectly foreseeable to Parliament that large corporations would make short term loans to other large corporations which span the end of the lender's financial year, but not the borrower's, so that both corporations would escape that LCT on the amount of the loans" (p. 6055). Further, the Court could not agree with the Minister's submission "that there is a clear policy that a corporation's capital at the end of the fiscal year should be representative of its capital throughout the year", as Parliament had not chosen to require companies to report the value of their capital at several points during the year (p. 6055).

The Queen v. Donahue Forest Products Inc., 2003 DTC 5471, 2002 FCA 422

In order to realize an allowable business investment loss on its investment in a corporation ("DMI") held jointly by it and a third party ("Rexfor"), the taxpayer and Rexfor formed a new corporation ("DMI 1993") owned jointly by them, arranged for DMI to transfer all its assets and liabilities to DMI 1993 save for two sawmills worth $2.5 million and $2.5 million of debt owing to a third party, and then sold the shares of DMI to an unrelated third party for nominal consideration.

In finding that realization of the loss did not result in a misuse or abuse, Noël, J.A. stated (at p. 5475) that:

"There is nothing in the Act that bars a taxpayer from realizing a loss on the sale of shares to arm's length third parties, even if a significant portion of the assets to which the loss on the shares may be attributed remains within the group of corporations."

Novopharm Ltd. v. The Queen, 2003 DTC 5195, 2003 FCA 112

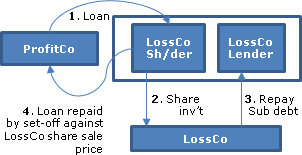

A profitable Canadian corporation ("Novopharm") acquired losses approximating $20 million of an arm's-length corporation ("Lossco") through a complicated series of transactions, which in simplified form were as follows:

- two special-purpose subsidiaries of Lossco formed a limited partnership ("Millbank") which borrowed $195 million from First Marathon Capital Corporation ("FMCC") and lent $195 million to First Marathon Inc. ("FMI") with FMI then immediately paying $20 million to Millbank as a prepayment of one year's interest and Millbank utilizing $20 million to pay down the principal of loan owing by it to FMCC to $175 million;

- Lossco acquired a 99.99% limited partnership in Millbank shortly thereafter (and immediately prior to the first fiscal year end of Millbank) thereby resulting in $20 million of income of Millbank being allocated to it, which eliminated its losses;

- the 99.99% partnership interest was transferred for nominal consideration by Lossco to an indirect special purpose subsidiary of Lossco ("540") and 540 then was sold to Novopharm;

- FMCC lent $175 million to Novopharm which used those proceeds to subscribe for shares of 540; 540 made a capital contribution of the same amount to Millbank, which paid off the $175 million loan owing by it to FMCC;

- a year later after $20 million of interest had accrued on the loan owing by Novopharm to FMCC, FMI repaid the $195 million principal amount owing by it to Millbank, Millbank distributed this sum to its partners (substantially 540), 540 purchased for cancellation most of the shares of Novopharm and 540 for $195 million (giving rise to a deemed dividend of $20 million), and Novopharm used the $195 million to discharge the amount owing by it to FMCC (including the $20 million of interest).

The deduction of interest by Novopharm was a result that was contrary to the object and spirit of the Act (given that the sole purpose of the series of related transactions "was solely to create a net interest deduction for Novopharm that reduced its income, the antithesis of the object of subparagraph 20(1)(c)(i), to create an incentive to accumulate capital with the potential to produce income") and the transactions were not in accordance with normal business practice (and instead "were pre-ordained, circular and limited in time" (p. 5205)). Accordingly, s. 245(1) of the Act as it applied in June 1987 denied the deduction of the interest along with fees that were incurred in connection with entering into the transactions.

The Queen v. Canadian Pacific Ltd., 2002 DTC 6742, 2002 FCA 98

The taxpayer borrowed 216 million in Australian dollars under debentures bearing interest at 16.125% per annum and that had been issued at a 2% premium and then, under a master swap agreement: exchanged the Australian dollar principal amount for Japanese yen at the current spot rate of exchange; swapped the Japanese yen proceeds for Canadian dollars at the current spot rate of exchange; under a series of forward contracts agreed to purchase Australian dollars using Japanese yen on the interest payment date and the principal maturity date; and agreed to exchange Canadian dollar payments for Japanese yen at the relevant future dates. The effect was to convert the proceeds of the debenture issues into Canadian dollars as soon as it received the borrowed funds, and to secure the future delivery of foreign exchange necessary to make the periodic payments of interest and to retire the principal. Sexton J.A. rejected a submission of the Crown that the taxpayer's act of denominating the debentures in Australian dollars was in and of itself a transaction.

In rejecting a submission that there was an abuse because the borrowing was structured so as to result, in effect, in the deduction of Canadian dollar principal payment (i.e., the high nominal rate of Australian-dollar interest was matched with a capital gain that would be realized on maturity under the forward arrangements), Sexton J.A. indicated that the amounts labelled as interest clearly were interest and that "a transaction cannot be portrayed as something which it is not, nor can it be recharacterized in order to make it an avoidance transaction."

OSFC Holdings Ltd. v. The Queen, 2001 DTC 5471, 2001 FCA 260

After becoming insolvent, a company ("Standard") in the mortgages business established a partnership, transferred a mortgage portfolio to the partnership and, prior to the end of the partnership's first fiscal year, sold its 99% direct interest in the partnership to the taxpayer who then sold a portion of its partnership interest to other parties. S.18(13) deemed the partnership to have the same cost amount for the portfolio as Standard, with the result that losses generated on the sale of the portfolio were allocated to the taxpayer and the other partners, rather than to Standard.

Although, in the view of the majority, the transactions did not result in a misuse of subsection 18(13) having regard to the policy of that provision (which was to preclude the transferor from realizing a loss on a disposition of non-capital property to a non-arm's length transferee, and to preserve the loss for recognition on a later occasion by the transferee), the transactions resulted in an abuse having regard to the general policy of the Act against the trading of non-capital losses by corporations, subject to specific limited circumstances. Accordingly, the denial of the losses to the taxpayer under s. 245 was confirmed. Rothstein J.A. noted that the Court should proceed cautiously in carrying out the unusual duty imposed upon it under s. 245(4) to invoke policy to override the words Parliament had used.

Longley v. The Queen, 99 DTC 5549 (B.C.S.C.)

Quijano J. found that GAAR would not apply to an arrangement under which taxpayers made contributions to a fringe political party on the basis that the money would be spent by the party on matters for the benefit of the taxpayer.

See Also

Birchcliff Energy Ltd. v. The Queen, 2015 TCC 232

Shortly after it became a public company, a predecessor ("Birchcliff") of the taxpayer entered into an agreement for a major acquisition of producing oil and gas properties and also negotiated a plan to merge with a corporation ("Veracel"), which had discontinued its medical equipment business, in order to access Veracel's non-capital losses and credits. Investors subscribed for subscription receipts of Veracel and received voting common shares of Veracel therefor under a Plan of Arrangement, Veracel and Birchcliff amalgamated immediately thereafter under the Plan, and the proceeds were used in the purchase of the oil and gas properties. The previous Veracel shareholders could elect to receive retractable preferred shares on the amalgamation, which most did.

As the voting common shares received by the investors on the amalgamation represented "a majority of the voting shares of the amalgamated entity (the "Majority Voting Interest Test")" (para. 13), no acquisition of control of Veracel occurred under s. 256(7)(b)(iii)(B), so that the loss-streaming rules under s. 111(5) were avoided. In upholding the Minister's finding that this avoidance was an abuse under s. 245(4), Hogan J stated (at paras. 105, 106):

[T[he Majority Voting Interest Test indicates that Parliament did not want amalgamations and reverse takeovers being used as techniques to avoid an acquisition of control in situations where the original Lossco shareholders do not collectively receive shares representing a Majority Voting Interest in the combined enterprise.

…Parliament adopted the Majority Voting Interest Test to prevent Lossco from being subsumed by Profitco without an acquisition of control of Lossco.

HMRC v Pendragon plc, [2015] UKSC 37

A scheme, which exploited a UK VAT rule which was intended to avoid double-taxation, so as to avoid tax, was found to be abusive. See summary under ETA, s. 274(4).

Superior Plus Corp. v. The Queen, 2015 TCC 132, aff'd supra

The Superior Plus Income Fund (the "Fund") effectively converted (in accordance with the distribution method contemplated under s. 107(3.1)) into a public corporation using an existing corporation (the taxpayer, a.k.a. "Old Ballard") with non-capital losses and other tax attributes as the new corporate vehicle - rather than using a new corporation. The transactions were designed to ensure that there was no acquisition of control of the taxpayer (which would have resulted in a streaming of its losses). In particular, although the unitholders of the fund became shareholders of the taxpayer, this was considered not to entail an acquisition of control of the taxpayer by a group of persons. Subsequent to the conversion, s. 256(7)(c.1) was introduced, which would have deemed there to be an acquisition of control of the taxpayer, if it had had retroactive effect (which it did not). The Minister disallowed the use of the tax attributes, on the basis that there in fact had been an acquisition of control of the taxpayer or, alternatively, under s. 245(2) (i.e., GAAR).

At the discovery stage, the taxpayer moved to compel the Minister to answer various questions, or to produce documents, or previously redacted portions of documents previously requested under the Access to Information Act, which CRA had resisted principally on the grounds of irrelevance. The questions included whether the Department of Finance considered making the 2010 SIFT amendments retroactive, why it had changed its explanatory notes to say that s. 256(7)(c.1) "clarified" rather than "extended" the change-of-control rules and whether the Attorney General agreed that initially the policy choice of the SIFT conversion rules was to allow the use of existing corporations. Requested documents included GAAR Committee minutes including comments of individual members (whereas CRA had provided only the final Recommendation of the Committee), and correspondence between CRA and Finance (resulting in the drafting of s. 256(7)(c.1))and between the GAAR Committee and Aggressive Tax Planning, with the questions seeking particulars on the questions posed above and policy considerations brought to bear on this file, and respecting what initially may have been diffidence on the part of Finance as to how to proceed, if at all.

Following the reasons in Birchcliff, Hogan J granted the taxpayer's motion in the main (including all the above-mentioned questions and documents). The scope of "relevance" in discovery is extremely broad. Hogan J stated (at para. 33):

As correctly pointed out by the Appellant's counsel, discovery serves a much broader purpose than eliciting evidence that is admissible at trial. For example, the discovery process allows the parties to gauge the weakness of their opponent's case.

Certain documents were irrelevant, or contained specific portions that should be redacted because of privilege, and certain questions improperly asked the Minister to draw conclusions of law.

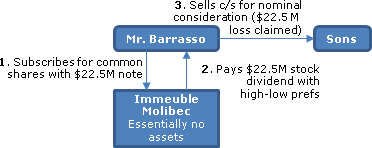

Barrasso v. The Queen, 2014 CCI 156

The taxpayer, who had realized a capital gain of $30 million earlier in the year, subscribed for Class A common shares of a corporation newly incorporated by him ("Immeubles Molibec") in consideration for a demand promissory note of $22.5 million. The next day, Immeubles Molibec paid a stock dividend to the taxpayer consisting of preferred shares having a nominal paid-up capital and a total redemption value of $22.5 million, thereby effecting a "value shift" away from the common shares. On the same day, the taxpayer sold all his common shares to his two sons for their nominal value, and realized a capital loss of approximately $22.5 million. He engaged in similar transactions in the two subsequent years to realize capital losses of approximately $35 million and $7.5 million.

The taxpayer sought to distinguish 1207192 and Triad Gestco on the basis that he was an individual rather than a corporation (so that offsetting gain would be realized on the preferred shares no later than his death) and had sold to his sons rather than family trusts. Paris J considered that "the fact that the appellant is an individual and not a corporation does not change the academic ["théorique"] nature or quality of the claimed losses" (para. 19) as "during the years under appeal, the appellant simply had not sustained a financial loss from the sale of the shares to his sons" (para. 20), and furthermore, "as in Triad Gestco, the taxpayer has not presented any evidence that he had sold the shares received as a stock dividend and has not requested an adjustment to the tax attributes arising under the application of the GAAR to take into account an eventual sale of the shares" (para. 21). Respecting the second point, the "decisions… in the two cases would have been the same irrespective of the identity of the share purchaser… with whom the taxpayer did not deal at arm's length" (para. 23).

His appeal from reassessments denying the losses under GAAR was dismissed.

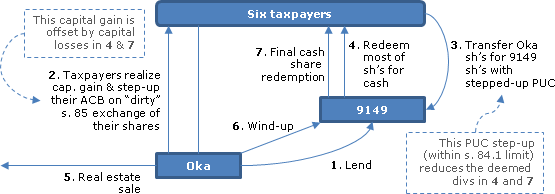

Descarries v. The Queen, 2014 DTC 1143 [at 3412], 2014 TCC 75

The six taxpayers, who were siblings (or a step-daughter of their deceased father), held all the shares, having an aggregate fair market value (FMV), adjusted cost base (ACB) and paid-up capital (PUC) of $617,466, $361,658 and $25,100 respectively, of a Canadian real estate company (Oka). They sought through the transactions described below to reduce the deemed dividend of $592,362, that otherwise would have arisen on the redemption of their shares, to approximately $265,505 (see 4 and 7 below [minor discrepancy in figures]). CRA assessed on the basis that a deemed dividend of the larger amount had been realized, as there had been an indirect distribution from Oka described in s. 84(2).

- Oka lent $544,354 to a newly-incorporated company (9149) in December 2004.

- In March 2005, the taxpayers exchanged their shares of Oka under s. 85(1) for Class B and C preferred shares of Oka, so that they realized a capital gain of $361,658 (which was offset by the current year's capital loss realized in 4 below and a carryback of the capital loss in 7 below) and with the Class B and C preferred shares having ACBs of $269,618 and $347,848 and low PUC.

- They exchanged their shares of Oka for Class A common shares of 9149 having an ACB and PUC of $347,848 (with such PUC "step-up" complying with s. 84.1) and Class B preferred shares of 9149 having an ACB and PUC of $269,618 and nil.

- Also in March 2005, 9149 redeemed the Class A common shares for their PUC and ACB of $347,848 (so that no deemed divided or capital gain resulted) and redeemed approximately ¾ of the Class B preferred shares, giving rise to a deemed dividend and capital loss of $196,506 to the taxpayers.

- Oka sold its real estate in December 2005, but with title issues not resolved until December 2006.

- Oka was wound-up into 9149 in December 2006, with the loan in 1 being extinguished.

- At the end of 2008, 9149 redeemed the (¼) balance of the Class B preferred shares for $69,000, giving rise to a deemed dividend and capital loss to the taxpayers of $69,000 and $73,112.

In finding that the transactions abused the object of s. 84.1, Hogan J stated (at paras. 56, 59):

The tax specialist was aware of the fact that section 84.1 of the Act would cause the Class B shares issued by 9149 [step 3] to have an adjusted cost base that is higher than their paid-up capital, which would prevent the additional value accumulated before 1971 from being used to strip Oka of its surpluses. However, applying this rule ensures that the redemption of these shares will generate a capital loss that is sufficient to erase the capital gain realized in the preceding step, namely, the internal rollover of Oka's common shares [step 2].

...

The result of all three transactions ... is that the tax-exempt margin made it possible for part of Oka's surplus to be distributed to the appellants tax-free in a manner contrary to the object, spirit or purpose of section 84.1 of the Act.

Having regard to $66,940 of capital gain having been realized on the death of the taxpayers' father, the Minister was directed to assess on the basis that the taxpayers received a deemed dividend of $525,422.

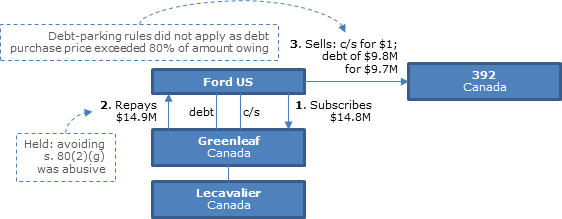

Pièces Automobiles Lecavalier Inc. v. The Queen, 2014 DTC 1126 [at 3319], 2013 TCC 310

A Canadian subsidiary ("Greenleaf") of Ford U.S. paid down to $9,750,000 (including accrued interest) a debt of $24,369,439 (plus accrued interest) owing by it to Ford U.S. through the application of share subscription proceeds of $14,843,596 received by it from Ford U.S.A. and the application of a small amount of cash on hand of $100,706. Eighteen days later, a predecessor of the taxpayer ("392"), which was at arm's length with Ford U.S., purchased all the shares of Greenleaf from Ford U.S. for consideration of $1, and purchased the debt at only a slight discount to the amount owing, so that the debt-parking rules in ss. 80.01(6) to (8) did not apply. The Minister applied s. 245(2) on the basis that Greenleaf had sustained a debt forgiveness in the amount of the debt-paydown.

In dismissing the taxpayer's appeal, Bédard J found (at para. 126-127) that the transactions were abusive having regard to s. 80(2)(g) (TaxInterpretations translation):

The spirit and object of paragraph 80(2)(g) are to ensure that, when a debt is settled in exchange for shares, the debt forgiveness rules apply by taking into account the actual value of the shares which are issued. ... In adopting this paragraph, the legislator sought to prevent a taxpayer from transforming a debt into shares with low value, thereby avoiding the debt forgiveness rules. ... In proceeding in two stages rather than effecting a direct conversion of debt to shares, the appellant circumvented the application of paragraph 80(2)(g) and, thus, a gain on debt settlement.

Gwartz v. The Queen, 2013 DTC 1122 [at 640], 2013 TCC 86

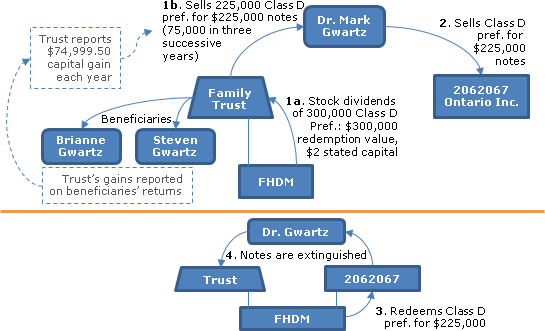

The taxpayers ("Brianne and Steven") were minors and beneficiaries of a family trust (the "Trust"). The Trust held all the common shares (as well as Class C preferred shares) of a management corporation ("FHDM") for a dental practice of the beneficiaries' father (Dr. Gwartz). The following transactions occurred:

- 1a. In 2003 and again in 2005, FHDM declared a stock dividend consisting of 150,000 Class D preferred shares, redeemable and retractable for $1 each, and having a total paid up capital of $1 (300,000 shares, $2 total PUC).

- 1b. In each of 2003 to 2005, the Trust disposed of 75,000 Class D shares to Dr. Gwartz for a $75,000 promissory note.

- 2. In 2005, Dr. Gwartz sold the 225,000 Class D shares to a numbered corporation ("206"), wholly owned by Dr. Gwartz's spouse, for $225,000 in promissory notes.

- 3. FHDM redeemed 206's Class D shares for $225,000.

- 4. Both sets of notes were repaid out of such redemption proceeds, effecting a transfer of $225,000 from 206 to the Trust.

The Trust reported a capital gain of $74,999.50 from step 1b for each of 2003 to 2005, which it allocated to the taxpayers for inclusion (as to the taxable capital gains portions) in their returns. The Minister reassessed the taxpayers under the general anti-avoidance rule on the basis that, by effecting the realization of capital gains and their distribution to the beneficiaries, rather than the distribution of taxable dividends, the series of transactions had abusively circumvented s. 120.4 of the Act. (The Minister conceded that reassessment of Steven's 2005 taxation year should be vacated as he was 18 in that year.)

Hogan J. allowed the taxpayers' appeals. Although s. 120.4 was circumvented, there was no abuse. He stated (at para. 65):

The fact that specific anti-avoidance provisions were enacted long before the introduction of section 120.4 leads me to infer that Parliament was well aware of the fact that taxpayers could arrange to distribute corporate surpluses in the form of taxable dividends or of capital gains subject to the application of those specific anti‑avoidance provisions. The fact that those provisions were not amended and that a specific rule was not included in section 120.4 to curtail well-known techniques leads me to infer that Parliament preferred simplicity over complexity when it enacted section 120.4.

The present case was distinguishable from Triad Gestco, which involved the creation of an artificial capital loss, rather than the shifting of an already-accrued capital gain on common shares of a taxpayer to other shares (namely, the Class D shares) of the taxpayer.

Swirsky v. The Queen, 2013 TCC 73, 2013 DTC 1078 [at 431], aff'd 2014 FCA 36

Paris J. noted obiter (at para. 75) that Overs v. The Queen, 2006 TCC 26, "has been implicitly overruled by the Lipson decision."

Birchcliff Energy Ltd. v. The Queen, [2013] 3 C.T.C. 2169, TCC Docket 2012-1087 (IT) G

The Reply of the Minister to the taxpayer's Notice of Appeal stated that "the Appellant sought to avoid the acquisition [of] control rules in the Act in order to utilize the tax pools of Veracel," but did not specify the object, spirit and purpose of the provisions of the Act (the "Policy") which CRA had determined had been abused in assessing the taxpayer under the general anti-avoidance rule. Before ordering "that the Respondent disclose what Policy the assessor relied upon in making the assessment as a material fact" (para. 24), Campbell J. stated that "surely the taxpayer is entitled in pleadings to know the basis of the assessment" (which, in a GAAR assessment, included the alleged Policy), and that the Minister's obligation in pleadings to provide "any other material fact" entailed an obligation to specify "the historical fact of what Policy the Crown actually relied upon" (para. 18).

Campbell J.'s order did not bind the Respondent as to what position it could take in the litigation as to the Policy (para. 24).

MacDonald v. The Queen, 2012 TCC 123, rev'd 2013 DTC 5091 [at 5982], 2013 FCA 110

The taxpayer planned to move to the U.S.. Although the capital gain on the shares of his wholly owned corporation ("PC") that would have arisen (under s. 128.1(4)(b)) on his emigration would have been sheltered for Canadian purposes by unutilized capital losses, there would have been no corresponding step up in the tax basis of his shares of PC for US tax purposes. In light of this issue, he sold his shares of PC (which held liquid assets) to his brother-in-law ("J.C.") in exchange for a promissory note, which was satisfied (within the following serveral months) with funds that J.C. extracted from PC (by first transferring his high-basis shares of PC to a "Newco" in consideration inter alia for a promissory note, which was repaid by Newco with funds which it, in turn, extracted from PC).

After finding that s. 84(2) did not apply to deem any portion of the sale proceeds to be a dividend, Hershfield J. found that s. 245(2) did not apply to produce the same result. The alleged abuse was that the capital gains, which enabled the use of the taxpayer's losses, arose from payments that, being funds from the taxpayer's own corporation, would normally be treated as dividend income. Hershfield J. stated (at para. 116):

Indeed, triggering capital gains to utilize capital losses is not discouraged by the Act in any way. Transfers to a corporation without a section 85 election can be used to realize capital gains as can transfers between spouses. There is nothing abusive about realizing capital gains for no other purpose than to utilize available net capital losses.

Furthermore, allowing capital gains treatment of the sale produced a "fair result" (para. 139), whereas "to deny a tax benefit to which he was entitled by an express provision of the Act [i.e., s. 128.1(4)(b)] because he achieved it by a different legally effectively means is, frankly, bizarre" (para. 121). Although the transactions entailed surplus stripping, "it is doubtful whether in an integrated corporate/shareholder tax system, a surplus strip per se can be said to abuse the spirit and object of the Act" (para. 101).

Antle v. The Queen, 2009 DTC 1305, 2009 TCC 465, aff'd 2010 DTC 5172 [at 7304], 2010 FCA 280

A plan for the taxpayer to avoid capital gains on his sale of shares of a corporation ("PM") would have entailed him gifting the shares to a Barbadian trust of which his wife was the sole beneficiary (so that the trust was intended to be a spousal trust), with the trust then selling the shares to his wife for a promissory note equal to the fair market value of the shares, and the trust distributing the promissory note to her on a wind-up of the trust and her selling the shares of PM to the purchaser. In finding that the transaction, if effective, would have given rise to an abuse for GAAR purposes, Campbell Miller, J. stated (at para. 119):

"Sleight of hand to inject a non-resident trust (not a legal entity but deemed an individual only for tax purposes) in the middle of a Canadian resident couple to take advantage of the tax treatment of a non-resident trust's own jurisdiction is intended to defeat Canada's policy of taxing residents on their capital gains."

Garron v. The Queen, 2009 DTC 1568, 2009 TCC 450, aff'd sub nom St. Michael Trust Corp. v. The Queen, 2010 DTC 5189 [at 7361], 2010 FCA 309, aff'd sub nom Fundy Settlement v. Canada, 2012 SCC 14

Woods, J. rejected a submission of the Crown that it would have represented an abuse of the Canada-Barbados Income Tax Convention to use the gains exemption in Article XIV(4) to avoid an anti-avoidance rule such as s. 94 of the Act (after noting that in the OECD Commentary, the OECD indicated that contracting states may need to explicitly provide in income tax conventions for the preservation of the right to apply domestic anti-avoidance provisions).

She also rejected a submission that it represented an abuse of that Convention to rely on such treaty exemption where the trust in question had very little connection with Barbados. She noted (at para. 381) that such an approach would result in a selective application of the Treaty to residents of Barbados, on the basis of criteria other than residence, and that the object and spirit of the Treaty was that residents of Barbados qualified for exemption.

OGT Holdings Ltd. v. Deputy Minister of Revenue (Québec), 2009 DTC 5705, 2009 QCCA 191

The taxpayers engaged in a "Québec shuffle" transaction in which they transferred shares of subsidiaries to a related Ontario purchaser on a rollover basis for Québec purposes but on a non-rollover basis for federal purposes (so that for Ontario corporate purposes the Ontario purchaser had full basis in the acquired subsidiaries) with the Ontario purchaser then selling the shares without any Ontario corporate tax being payable. In finding that these transactions represented abusive tax avoidance under s. 1079.10 of the Québec Taxation Act, the Court noted that the purpose of the Québec rollover provision (s.518) was to defer the realization of a capital gain, and not to be used in a scheme to avoid the payment of any Québec income tax on the gain.

Landrus v. The Queen, 2008 DTC 3583, 2008 TCC 274, aff'd supra.

A partnership of which the taxpayer was a member ("Roseland II") and another partnership ("Roseland I") owning a similar and adjacent condominium development, sold all their assets to a newly-formed partnership ("RPM") with the purchase price being paid for by way of set-off against the subscription price for the partnership interests in RPM with such partnership interest in RPM having been distributed to the partners of Roseland I and II.

After finding that these transactions were undertaken primarily to realize a tax benefit (the realization of terminal losses), Paris J. went on to find that the transactions did not result in an abuse or misuse and rejected a submission of the Crown (at para. 122) that "there is a general or overall policy in the Act prohibiting losses on any transfer between related parties, or parties described by counsel as forming an economic unit". Paris J. stated (at para. 120):

"In my view, the particularity with which Parliament has specified the relationship that must exist between the transferor and transferee for the purpose of each stop-loss rule referred to by the Respondent is more indicative that these rules are exceptions to a general policy of allowing losses on all dispositions."

He went on to state (at para. 123):

"I would also point out that Parliament has chosen to define the circumstances in which the terminal loss would be denied on transfers of depreciable property between partnerships in subsection 85(5.1) (now subsection 13(21.2)) and in doing so would appear to have chosen to allow taxpayers who are not within the circumstances set out in that provision to claim their terminal losses."

McMullen v. The Queen, 2007 DTC 286, 2007 TCC 16

The taxpayer and an unrelated individual ("DeBruyn") accomplished a split-up of the business of a corporation ("DEL") of which they were equal common shareholders by transactions under which (i) DeBruyn converted his (Class A) common shares into Class B common shares, (ii) the taxpayer sold his Class A common shares of DEL to a newly-incorporated holding company for DeBruyn's wife ("114") for a purchase price of $150,000, (iii) DEL issued a promissory note to 114 in satisfaction of a $150,000 dividend declared by it on the Class A shares, (iv) 114 as signed the promissory note to the taxpayer in satisfaction of the purchase price for the Class A shares, (v) the taxpayer transferred the promissory note owing to him by DEL to a holding company ("HHCI"), and HHCI purchased assets of the Kingston branch of the business of DEL in consideration for satisfaction of the promissory note.

After finding that none of the transactions was an avoidance transaction, Lamarre J. went on to indicate (at p. 298) that the Crown had not established "that the policy of the Act read as a whole is designed so as to necessarily tax corporate distributions as dividends in the hands of shareholders".

Ogt Holdings Ltd. v. Deputy Minister of Revenue of Québec, 2006 DTC 6604 (Court of Québec)

The taxpayers accomplished an indirect sale of their indirect investment in an operating company ("Canstar") to an arm's length purchaser ("Nike") by transferring their shares of holding companies for Canstar to a newly-incorporated Ontario corporation on a rollover basis for Québec purposes but not for federal purposes, followed by a sale of their shares of the Ontario corporation to Nike.

In determining that this transaction was abusive for purposes of the Québec anti-avoidance rule, De Michele J.C.Q. found that the purpose of the Québec rollover provision was to allow the deferral of capital gains tax, not its complete avoidance.

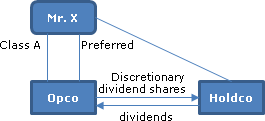

Ceco Operations Ltd v. The Queen, 2006 DTC 3006, 2006 TCC 256

The taxpayer transferred assets of a business to a partnership in what was intended to be an s. 97(2) rollover transactions in consideration for cash, promissory notes and assumption of debt ("boot") totalling an amount less than the cost amount of the transferred assets, and a Class "F" partnership interest stipulated to have a value equal to the balance of the purchase price. The partnership used cash (derived in part from a third party who had subscribed for ¾ of the equity in the partnership) to subscribe for preferred shares of a sister company of the taxpayer ("Holdings"), with Holdings in turn using the proceeds to subscribe for preferred shares of holding companies ("Holdcos") for the various indirect individual shareholders of the taxpayer. A "back-flow preventor" clause in the Partnership Agreement provided that in the event that the partnership received any payments in respect of preferred securities held by the partnership, the partnership would make distributions to the holders of Class F units equalling such payments received.

After noting (at p. 3015) that "in the real world" the Class F partnership unit "represented nothing more than an undertaking to pay $18.7 million for Holdings preference shares, which were of no practical value to the Partnership by reason of the Partnership Agreement", Bonner J. went on to find that the transactions were abusive in that in substance it could be said that the supposed "tax deferred proceeds" for the sale (represented by the Class F units) had reached the Holdcos. The Minister had been substantially correct in reassessing the taxpayer on the basis that it had received additional boot of $18.6 million.

Lipson v. The Queen, 2006 DTC 2687, 2006 TCC 148, aff'd supra.

The taxpayer's wife ("Jordanna") borrowed $562,500 from the Bank of Montreal to fund the purchase of shares of a family company from the taxpayer for $562,500. A day later, the taxpayer and Jordanna borrowed, on a joint and several basis, $562,000 from the Bank secured by a mortgage on a new personal residence that they had just purchased, with the proceeds of that loan being used to pay off the loan the Bank had made to Jordanna. The taxpayer used the share sale proceeds to pay the vendor of the residence. The taxpayer filed his return on the basis that the inter-spousal rollover applied to the share sale and that s. 74.1(1) attributed to him the loss sustained by Jordanna resulting from the deduction of the interest expense on the mortgage loan from the dividend income she received on her purchased shares.

Bowman C.J. indicated (at p. 2692) that "paragraph 20.(1)(c) was intended to permit interest on money borrowed for commercial purposes to be deducted" and "that interest on money borrowed for personal use (such as buying a residence) is not deducible" and (at p. 2691) that "subsection 20(3) allows a deduction for interest on money borrowed to repay money previously borrowed for commercial purposes." Here, subsection 20(3) was being abused through "the purported attachment to the subsequent mortgage loan [of] the tax incidents of Jordanna's original and fleeting use of the proceeds of the first loan" (p. 2692).

Desmarais v. The Queen, 2006 DTC 2376, 2006 TCC 44

The taxpayer, who held 14.28% of the common shares of a Canadian private corporation ("Consercom") transferred a 9.76% block to a wholly-owned holding company ("6311") in consideration for preferred shares of 6311 with a high paid-up capital (thereby giving rise to a capital gain eligible for the capital gains exemption). The taxpayer also transferred shares of a Canadian private corporation ("Gestion") that he owned together with his brother to 6311 in consideration for shares of 6311. The redemption of the taxpayer's preferred shares of 6311 was financed through dividends received by 6311 from Gestion.

After finding that s. 84.1 was intended to prevent the stripping of surpluses of an operating company, that although Parliament had assumed that a shareholder with less than a 10% block of shares would not be able to strip the surpluses of that company, such influence could be exercised when two related shareholders held all the shares of a company (Gestion), and that there would not have been an abusive transaction if the taxpayer had transferred to 6311 only the Consercom shares, Archambault J. found that there was an abuse here where 6311 used the surpluses from Gestion to redeem the preferred shares that had been issued in consideration for the Consercom shares.

The tax consequences to the taxpayer were to be determined on the basis that the sums received by him on such preferred shares in excess of their paid-up capital were a dividend to him.

Evans v. The Queen, 2005 DTC 1762, 2005 TCC 684

A corporation ("117679") owned by the taxpayer issued a stock dividend of non-voting shares to the taxpayer that were redeemable and retractable for an aggregate of $487,000. The next day, the taxpayer sold these shares to a partnership of which his wife was a general partner and three of his children held a 99% limited partnership interest in consideration for a $487,000 promissory note of the partnership bearing interest at the rate prescribed for purposes of s. 74.5. The taxpayer utilized the enhanced capital gains deduction in respect of his gain on the sale. Thereafter, dividends and proceeds of redemption of the redeemable shares of 117679 were paid by way of set-off against payments of principal and interest on the promissory note. The Minister recharacterized under s. 245 everything that the taxpayer received from the partnership as dividends.

In reversing the s. 245 reassessment of the taxpayer, Bowman C.J. indicated that he could not find that there was "some overarching principle of Canadian tax law that requires that corporate distributions to shareholders must be taxed as dividends, and where they are not the Minister is permitted to ignore half a dozen specific sections of the Act" and also noted that the transactions did not lack economic substance in that there was "a genuine change in legal and economic relations that took place as a result of the transactions".

XCo Investments Ltd. v. The Queen, 2005 DTC 1731, 2005 TCC 655

A partnership owned by the taxpayers admitted a third party ("Woodward") as a member of the partnership with a view to selling an apartment building of the partnership and allocating 80% of the resulting gain for tax purposes to Woodward, with Woodward also receiving 80% of the net proceeds of sale of the property (which were substantially reduced due to the leveraging of the property) and then ceasing to be a partner.

The allocation of 80% of the income to Woodward was found to be unreasonable given that "Woodwards' contribution was both ephemeral and for all practical purposes risk free". The reasonable treatment of the arrangement under s. 103 would be to treat Woodward's share of the income as the amount of income it actually received.

However, Bowman C.J. went on to find that if he had concluded that s. 103(1) did not apply, on balance s. 245 would be applied to reach the same conclusion, but with the possibility that perhaps all of the profit, rather than most of the profit, should have been allocated to the taxpayers.

The Queen v. Jabin Investments Ltd., 2003 DTC 5027, 2002 FCA 520

In order to avoid the application of the pre-1994 version of section 80, debt owing by the taxpayer was sold by a bank (for consideration equal to 2.2% of the total amount owing) to a corporation ("W720") that had similar ownership to the taxpayer.

In finding that the avoidance of the application of section 80 by this transaction did not represent a "misuse". Rothstein J.A. stated (at p. 5028) that:

"If a provision of the Income Tax Act is not used cannot be misused",

and also found that there was no "abuse" stating (at pp. 5028-5029) that:

"We are not satisfied from the references given to us that there is a clear and unambiguous policy that debts that are not legally extinguished are to be treated as if they were."

Loyens v. The Queen, 2003 DTC 355, 2003 TCC 214

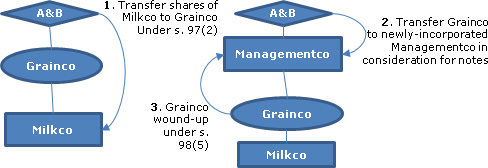

In order that the sale of a real estate property could be accomplished in a manner that utilized the losses of a loss company ("Lobro Stables") the taxpayers transferred the property to a partnership utilizing the rollover in subsection 97(2), transferred their partnership interests to Lobro Stables utilizing the rollover provision of subsection 85(1), with Lobro Stables then selling the property at a gain.

In finding that these transactions did not result in an abuse or misuse for purposes of s. 245(4), Campbell T.C.J. stated that the principles in OSFC Holdings with respect to loss trading should not be extended to profit trading, and the transactions simply utilized the provisions of the Act for the very purpose for which they were designed.

Hill v. The Queen, 2002 DTC 1749, Docket: 2000-3636-IT-G (TCC)

Under a non-recourse loan owing by the taxpayer and other tenants of an office building to the non-resident landlord, 90% of the cash flow was applied first to the payment of interest and then designated and paid as rent. If the interest expense (which had been reduced to a 10% rate in the taxation years in question) exceeded the cash flow, the taxpayer could request in writing that the landlord advance the excess to him as an addition to principal, with such excess interest also being added to the principal if no such request was made. By the taxation years in question, the principal had accumulated to well over twice the value of the property.

After finding that the excess interest was deductible in full notwithstanding that a portion of it accrued on amounts that had been reinvested by the landlord as stipulated in the loan, Miller T.C.J. declined to find that this result represented in an abuse or misuse in the absence of being referred to any material that would assist him in understanding why the government permitted the deduction of simple interest on a payable basis and only permitted the deduction of compound interest on a paid basis. He stated (p. 1763):

"What is the policy? It is not my role to speculate; it is the Respondent's role to explain to me the clear and unambiguous policy. He has not done so."

Fredette v. The Queen, 2001 DTC 621, Docket: 98-1340-IT-G (TCC)

A partnership ("SDF") of which the taxpayer and two trusts for his children were the partners owned substantially all the units in a second partnership ("SA") which, in turn, owned rental properties. SDF and SA had February 28 and January 31 fiscal periods with the result that net rental income of SA was not included in the income of the taxpayer for approximately two years. Archambault T.C.J. found that although the Act permitted income to be carried over for one year, the provisions of the Act, read as a whole, were contravened if a second, third or fourth partnership was interposed to defer the taxation of income for two, three or four years. Parliament's intent in enacting ss.96(1)(b), 248(1) and 249(2) was not to enable a taxpayer to defer the taxation of its income indefinitely. Accordingly, the fiscal period of SDF was to be treated as if it ended on February 28.

Given that s. 245(4) did not say "the Act and Regulations read as a whole", it was not appropriate for the Minister to assess on the basis that there was an abuse of the rental property restriction rules contained in Regulation 1100(11) for the taxpayer to finance his investment at a personal level and deduct interest personally without restriction. Furthermore, even if Regulation 1100(11) could be considered in determined whether there was an abuse, there was none given that it is quite common for a shareholder (or partner) to borrow in order to provide capital, and given that s. 245 cannot be used by the Minister as a tool to force taxpayers to structure a transaction in a manner most favourable to the tax authorities.

Geransky v. The Queen, 2001 DTC 243, Docket: 98-2383-IT-G (TCC)

The taxpayer, who owned a portion of the shares of the holding company ("GH") which, in turn, owned an operating company ("GBC") utilized the enhanced capital gains exemption in connection with the sale of a cement plant operated by GBC through the following transactions: the taxpayer and the other shareholders of GH transferred a portion of their shares of GH to a newly-incorporated company ("Newco") in consideration for shares of Newco having a value of $500,000; GBC paid a dividend-in-kind of most of the cement plant assets (having a value of $1 million) to GH; GH redeemed the common shares held in its capital by Newco by transferring to Newco the assets it had received from GBC; and the shareholders of Newco's sold their interests in Newco to the purchaser (who also purchased the remaining cement-plant assets directly from GBC).

Bowman T.C.J. found (at p. 250) that even if the transactions had been avoidance transactions, there would have been no abuse or misuse for purposes of s. 254(4):