Subsection 84(1) - Deemed dividend

See Also

Aylward v. The Queen, 97 DTC 1097, Docket: 96-4781-IT-I (TCC)

The issuance to the taxpayer of shares having a paid-up capital of $350,000 did not give rise to a deemed dividend because they were in respect of past services he had provided to the corporation having an agreed value of the same amount. It was not relevant that the corporation's financial statements did not record the value of the services as a liability.

Administrative Policy

2014 Ruling 2014-0533601R3 - Spin-off butterfly - subsection 55(2)

A spin-off butterfly reorganization by DC includes a preliminary step for distributing a small portion of DC's retained business from its immediate subsidiary (Subco 1) to DC. This involves Subco 1 selling that business on a taxable basis for a note, and then setting that note off against amounts that became owing by Subco 1 to DC as a result of a stated capital and dividend distribution.

See summary under s. 55(1) – distribution.

27 March 2013 Folio S4-F3-C1

Where the consideration received on the transfer of property to which a price adjustment clause that meets the conditions listed in ¶1.5 is in the form of shares and the shares are redeemed before the price is adjusted as a result of the application of a price adjustment clause and the corporation subsequently makes an additional payment as a consequence for that adjustment, the additional payment to the shareholders whose shares were redeemed will be included in the shareholder's income in the year of receipt under subsection 84(3) of the Act.

17 February 2003 T.I. 2002-017645 -

Aco holds 30 common shares of Opco (30% of the common shares) having an ACB and PUC of $30 and an FMV of $300 (the gross and net fair market value of the assets of Opco having an FMV of $1,000). A and Aco deal at arm's length with Opco. A (an individual who is the sole shareholder of Aco) transfers all his common shares of Aco (being 30 common shares having an FMV of $300 and ACB and PUC of $30) to Opco in exchange for 30 Opco shares, realizing a capital gain of $270.

There is no deemed dividend under s. 84(1) by virtue of s. 84(1)(b)(i) because the value of Opco's assets increase by $300 when Opco acquires the Aco common shares.

12 August 1994 T.I. 5-932594

Where an individual transfers his 5% shareholding in Opco, having a paid-up capital and ACB of $100,000 and a fair market value of $1 million, to Holdco in exchange for shares of Holdo whose stated capital is limited under s. 24(3)(a) of the Business Corporations Act (Ontario) to $100,000 and an election is filed under s. 85(1) to limit the proceeds of disposition to $600,000, RC is of the view that s. 84(1)(c.3)(iii) is not available. In its view, Holdco used s. 24(3)(a) to set the stated capital of Holdco at $100,000, rather than initially setting the stated capital at a higher figure and reducing it.

23 September 1992 T.I. (Tax Window, No. 24, p. 1, ¶2190)

Where preferred shares having a low paid-up capital are transferred by the shareholder to the corporation in exchange for common shares having a high paid-up capital, s. 84(1) will apply to deem the receipt by the shareholder of a dividend, without any relief under s. 85(2.1).

92 C.R. - Q.27

Where convertible preference shares having a high stated capital and a low paid-up capital are converted into common shares having both a stated capital and paid-up capital equal to the stated capital of the preference shares, s. 84(1) will apply.

1992 June Hong Kong Seminar, Q. B.8 (May 1993 Access Letter, p. 226)

S.84(9) applies for purposes of s. 94(1).

1992 A.P.F.F. Annual Conference, Q. 1 (January - February 1993 Access Letter, p. 49)

Where an individual exchanges all the outstanding common shares of Opco, having a paid-up capital of $500,000 and a fair market value of $600,000, for treasury shares of another class having a stated capital and fair market value of $600,000, he will be deemed under s. 84(1) to receive a dividend of $100,000.

28 August 1991 Memorandum (Tax Window, No. 8, p. 6, ¶1435)

Where preferred shares having a stated capital of $2 million and a paid-up capital of $1 are converted into common shares having a stated capital of $2 million, the net increase in the paid-up capital of the corporation will be deemed to be a dividend.

81 C.R. - Q.6

Where consequences of receiving a s. 84(1) dividend as a result of the paid-up capital of shares issued on a s. 85(1) roll exceeding the fair market value of the property transferred are "extremely harsh", RCT is prepared to consider whether administrative relief is warranted.

Articles

Brussa, "Capital Reorganizations", 1991 Conference Report, c. 16.

Subsection 84(2) - Distribution on winding-up, etc.

Cases

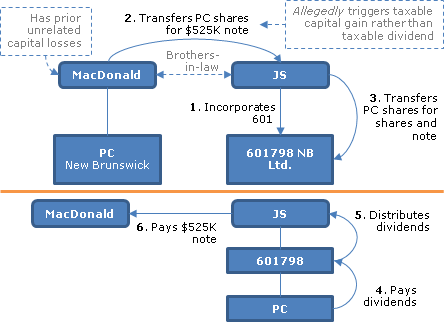

MacDonald v. The Queen, 2013 DTC 5091 [at 5982], 2013 FCA 110, rev'g 2012 TCC 123

In order to make use of available capital losses before emigrating to the United States, the taxpayer sold the shares of his former professional corporation ("PC") to his brother-in-law ("JS") for a $525,000 promissory note, which was $10,000 less than the net asset value of PC (in the form of liquid assets). JS then transferred his shares of PC to a newly-incorporated holding company ("601") in consideration for a promissory note of 601 in the same amount and for the issue of common shares. The assets of PC were distributed within the following several months to 601, with $525,000 of such assets being applied to repay the two promissory notes in succession; and PC was dissolved.

Hershfield J found that s. 84(2) did not apply because the taxpayer was not a shareholder at the time he received the distributed funds - he found that "the McNichol approach which was to look to section 245 when subsection 84(2) does not apply on a strict construction of its language, is the correct approach" (TCC para. 59).

Near JA granted the Minister's appeal. The trial judge's approach "led him to fail to give effect to the statutory phrase 'in any manner whatever,'" and "[was] not consistent with Merritt, Smythe, or RMM" (para. 28). McNichol was distinguishable. Near JA stated (at para. 29):

In this case, at the end of the winding up, all of PC's money... ended up through circuitous means in the hands of Dr. MacDonald, the original and sole shareholder of PC who was both the driving force behind, and the beneficiary of, the transactions.

The Queen v. Vaillancourt-Tremblay, 2010 DTC 5079 [at 6833], 2010 FCA 119

In order to convert their shares of a private company ("MHT") that held preferred shares of a Canadian public corporation ("Videotron") into excluded property, the taxpayers transferred their shares of MHT to a newly incorporated corporation ("8855") in exchange for shares of 8855, and then had MHT transfer its Videotron securities to 8855 on a rollover basis in consideration for convertible securities of 8855. The taxpayers then sold their shares of 8855 to Videotron in consideration for shares of Videotron and Videotron wound up 8855 on a rollover basis, with the securities that 8855 held in Videotron thereby being cancelled.

Section 84(2) did not apply to this transaction because the property received by the taxpayers (the shares of Videotron) was never the property of 8855: "the property received by the Respondent simply never existed in the hands of 8855" (para. 40).

Gilmour v. The Queen, 81 DTC 5322, [1981] CTC 401 (FCTD)

The taxpayer was the sole individual shareholder of a personal corporation ("LVG") which, in turn, owned approximately 1/3 of the common shares of another corporation ("Trident") which was engaged in the oil business through holding controlling shareholdings in three corporations. Trident realized proceeds as a result of a sale of the most valuable of these subsidiaries and distributed the proceeds to its shareholders, including LVG, on March 22, 1971 and on August 3, 1971 in anticipation of the liquidation and winding-up of Trident.

Collier J. found (at p. 5324) that "as a practical matter there was a 'discontinuance or reorganization' of Trident's business in 1971 and that the amounts received were "on" such event notwithstanding that they were in anticipation of the formal winding-up of Trident and that there was a possibility, due to warranties given on the sale, that some of the money received might have to be returned.

Perrault v. The Queen, 78 DTC 6272, [1978] CTC 395 (FCA)

A substantial dividend was not paid on the "winding-up, discontinuance or reorganization" of a company's business because, following the payment (and the sale of one of the company's two plants), the company continued to carry on business for over a year, "albeit on a reduced scale". (p. 6277) (s.81(1) of the old Act)

David v. The Queen, 75 DTC 5136, [1975] CTC 197 (FCTD)

Approximately four months after the corporation of which the taxpayers (the "David group") were shareholders sold its principal business assets, the taxpayers sold their shares of the corporation to the corporation's pension plan (acting through the "Dunn group"), with the individuals associated with the pension plan then causing a distribution of the assets of the corporation.

Walsh J. concluded that although the payments made to the taxpayers were "made to them in an indirect manner as a result of actions taken by third parties over whom the David brothers had no control, the end result was nevertheless that it was the funds of the company, including its undistributed income, which were used to pay for their shares and that the words 'otherwise appropriated in any manner whatsoever to or for the benefit of one or more of its shareholders' are wide enough to cover what took place".

Respecting the issue as to whether this appropriation occurred 'on' a winding-up, discontinuance or reorganization of a business (which after the August sale was that of an investment company), Walsh J. stated (at p. 5148) "that if any meaning is to be given to the word 'on' it must at the very least mean at the 'same time as' or possibly 'as a result of' or 'consequential to', and went on to find that even though it was "not at the time of or 'on' the discontinuance of the commercial operations of the company in August that the funds were appropriated for the benefit of the David group but only five months later", it nonetheless was "evident that the Dunn group planned to wind-up not only the commercial but all business of the company immediately after they took over, so that a winding-up was part of the plan." Accordingly, s. 81(1)(b) of the pre-1972 Act (similar to what now is s. 84(2)) applied to the amounts received by the taxpayers.

Smythe v. MNR, 69 DTC 5361, [1969] CTC 558, [1970] S.C.R. 64

The taxpayers were shareholders of a company (the "old company") who effectively converted its assets to cash through a series of transactions: those assets were sold to a related company owned in essentially the same manner (the "new company") in consideration for a promissory note; the note was paid-off through bank borrowings of the new company; the old company used those cash proceeds to invest in preference shares of two unrelated companies (the "dividend-stripping companies"); and the taxpayers sold the shares of the old company to the dividend-stripping companies for a cash amount based on the old company's net asset value. A portion of the cash proceeds of the sale were reinvested by the taxpayers in debentures of the new company. In finding that these transactions were governed by s. 81(1) of the pre-1972 Act, with the result that the taxpayers were deemed to receive a dividend, Judson J. stated (p. 5364) that:

"There was a winding-up and a discontinuance of the business of the old company, although it is apparent that there was no formal liquidation under the Winding-Up Act or the winding-up provisions of the Ontario Companies Act."

Judson J also found that the purported sale of the shares of the old company to the dividend-stripping companies should be disregarded.

Merritt v. MNR (1941), 2 DTC 513 (Ex Ct), rev'd [1942] S.C.R. 269, 2 DTC 561

The Security Loan and Savings Company ("Security") acquired all the shares of the taxpayer and other shareholders of the Premier Trust Company ("Premier") in consideration for (at the option of the shareholder) shares of Security or a combination of shares and cash. Security then amalgamated with Premier. The Minister assessed under s. 19(1) of the Income War Tax Act, which provided that:

on the winding-up, discontinuance or reorganization of the business of any incorporated company, the distribution in any form of the property of the company shall be deemed to be the payment of a dividend to the extent that the company has on hand undistributed income.

A portion of the consideration so received by the taxpayer would have been includable in her income (under s. 19(1)) to the extent of her share of the "undistributed income" (i.e., accumulated retained earnings) - but for the fact that the Act was interpreted as excluding from undistributed income the income which Premier had earned prior to 1935. McLean J. noted that on the facts there clearly was a discontinuance ("whether that was bought about by a sale to or amalgamation with the Premier Company") or a winding-up of the business (notwithstanding the absence of a formal liquidation procedure), and that the transactions resulted in a distribution of Security property notwithstanding "that the consideration received by the Appellant for her shares happened to reach her directly from the Premier Company and not through the medium of the Security Company (p. 516).

See Also

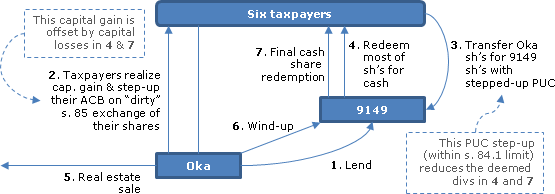

Descarries v. The Queen, 2014 DTC 1143 [at 3412], 2014 TCC 75

The six taxpayers, who were siblings (or a step-daughter of their deceased father), held all the shares, having an aggregate fair market value (FMV), adjusted cost base (ACB) and paid-up capital (PUC) of $617,466, $361,658 and $25,100 respectively, of a Canadian real estate company (Oka). They sought through the transactions described below to reduce the deemed dividend of $592,362, that otherwise would have arisen on the redemption of their shares, to approximately $265,505 (see 4 and 7 below [minor discrepancy in figures]). CRA assessed on the basis that a deemed dividend of the larger amount had been realized, as there had been an indirect distribution from Oka described in s. 84(2).

- Oka lent $544,354 to a newly-incorporated company (9149) in December 2004.

- In March 2005, the taxpayers exchanged their shares of Oka under s. 85(1) for Class B and C preferred shares of Oka, so that they realized a capital gain of $361,658 (which was offset by the current year's capital loss realized in 4 below and a carryback of the capital loss in 7 below) and with the Class B and C preferred shares having ACBs of $269,618 and $347,848 and low PUC.

- They exchanged their shares of Oka for Class A common shares of 9149 having an ACB and PUC of $347,848 (with such PUC "step-up" complying with s. 84.1) and Class B preferred shares of 9149 having an ACB and PUC of $269,618 and nil.

- Also in March 2005, 9149 redeemed the Class A common shares for their PUC and ACB of $347,848 (so that no deemed divided or capital gain resulted) and redeemed approximately ¾ of the Class B preferred shares, giving rise to a deemed dividend and capital loss of $196,506 to the taxpayers.

- Oka sold its real estate in December 2005, but with title issues not resolved until December 2006.

- Oka was wound-up into 9149 in December 2006, with the loan in 1 being extinguished.

- At the end of 2008, 9149 redeemed the (¼) balance of the Class B preferred shares for $69,000, giving rise to a deemed dividend and capital loss to the taxpayers of $69,000 and $73,112.

Before going on to find that the transactions were subject to s. 245(2) as being contrary to the object of s. 84.1, Hogan J found that s. 84(2) did not apply. He noted (paras. 19-20) that at the alleged time of the distribution (in 4), Oka continued as a creditor of 9149, so that at this time its "overall assets remained unchanged" (para. 27), with such asset not being extinguished until the winding-up 20 months later (in 6). Furthermore, there was no change in Oka's real estate business until the sale nine months after the alleged distribution (step 5), and its real estate business did not cease for a further year – whereas s. 84(2) required such a change to occur contemporaneously with the distribution. Finally, after noting that the rule in s. 84(3) according priority to s. 84(2) did not apply as the redemption (by 9149) and the mooted distribution (by Oka) were by different corporations, he stated (at para. 37) that ss. 84(2) and (3) could not "be applied at the same time to the same distributions."

MacDonald v. The Queen, 2012 TCC 123, rev'd 2013 DTC 5091 [at 5982], 2013 FCA 110

In order to make use of available capital losses before emigrating to the United Statees, the taxpayer sold the shares of his former professional corporation ("PC") to his brother-in-law ("J.C.") for a $525,000 promissory note, which was $10,000 less than the net asset value of PC (in the form of liquid assets). JC then transferred his shares of PC to a newly-incorporated holding company ("601") in consideration for a promissory note of 601 in the same amount and the issue of common shares. The assets of PC were distributed within the following several months to 601, with $525,000 of such assets being applied to repay the two promissory notes in succession; and PC was dissolved.

Hershfield J. rejected the Minister's position that the series of transactions gave rise to a deemed dividend under s. 84(2). He disagreed with the finding in RMM that the words "in any manner whatever" were broad enough to apply to a former shareholder at the time of the distribution or appropriation. He stated (at para. 59):

In my view, the McNichol approach which was to look to section 245 when subsection 84(2) does not apply on a strict construction of its language, is the correct approach.

S. 245 also did not apply.

Hershfield J. also indicated (at para. 80) that the position of CRA that s. 84(2) did not apply to the somewhat similar "post-mortem pipeline transactions" (see 2011 STEPs Roundtable, Q. 5 2011-0401861C6) only if the liquidating distribution does not take place within one year of the sale and the subject corporation (the equivalent of PC) continues to carry on its pre-sale activities during that period, represented "arbitrary conditions" that were "not invited by the express language in subsection 84(2)," so that such conditions should not apply.

He indicated obiter dicta (at para. 85) that in addition to entailing a winding-up of PC's business, the transactions also entailed a reorganization of PC's business (as "it went from carrying on a medical business that fed its investment activities to a holding vehicle").

McMullen v. The Queen, 2007 DTC 286, 2007 TCC 16

The taxpayer and an unrelated individual ("DeBruyn") accomplished a split-up of the business of a corporation ("DEL") of which they were equal common shareholders by transactions under which (i) DeBruyn converted his (Class A) common shares into Class B common shares, (ii) the taxpayer sold his Class A common shares of DEL to a newly-incorporated holding company for DeBruyn's wife ("114") for a purchase price of $150,000, (iii) DEL issued a promissory note to 114 in satisfaction of a $150,000 dividend declared by it on the Class A shares, (iv) 114 assigned the promissory note to the taxpayer in satisfaction of the purchase price for the Class A shares, (v) the taxpayer transferred the promissory note owing to him by DEL to a holding company ("HHCI"), and HHCI purchased assets of the Kingston branch of the business of DEL in consideration for satisfaction of the promissory note.

In finding that the transactions did not effect a reorganization of DEL's business, so that s. 84(2) did not apply, Lamarre J. found that the transactions did not result in a discontinuance of the business of DEL (it continued to operate a heating and air conditioning business (albeit at just one location rather than two locations), that the taxpayer subsequently to the transactions no longer had any dealings with DEL and that the transactions were no different than a sale to a third party.

Geransky v. The Queen, 2001 DTC 243, Docket: 98-2383-IT-G (TCC)

The taxpayer who owned a portion of the shares of a holding ("GH") which, in turn, owned an operating company ("GBC") which was engaged in a cement construction business. GBC owned a cement plant which produced all of the cement needed by GBC, with its remaining output (approximately 1/3) being sold to third parties. Following a determination that the cement plant would be sold to an arm's length purchaser ("Lafarge") in transactions which sought to utilize the enhanced capital gains exemption, the following transactions were implemented: the taxpayer and the other shareholders of GH transferred a portion of their shares of GH to a newly-incorporated company ("Newco") in consideration for shares of Newco having a value of $500,000; GBC paid a dividend-in-kind of most of the cement plant assets (having a value of $1 million) to GH; GH redeemed the common shares held in its capital by Newco by transferring to Newco the assets which it had received from GBC; and the shareholders of Newco sold their interests in Newco to the Lafarge (who also purchased the remaining cement-plant assets directly from GBC).

Bowman T.C.J. found that s. 84(2) did not apply to deem the taxpayer to have received a dividend: there was no discontinuance, winding-up or reorganization of any company's business, as both GH and GBC continued to do what they had done before (Bowman TCJ having previously found that the cement construction and cement production activities of GBC were one business given the integration of personnel and operations); the taxpayer was a shareholder only of GH and not of GBC, and the only "business" of GH was the holding of shares of GBC, which state of affairs was not altered by the reorganization; and under the transactions no funds or property of either GBC or GH ended up in the taxpayer's hands.

James v. The Queen, 2000 DTC 2056, Docket: 98-2519-IT-G (TCC)

After the taxpayer's company was struck from the B.C. Register of Companies and dissolved for failure to file annual returns, the Minister reassessed the taxpayer on the basis that an amount, shown in subsequent accounts (that had been prepared without knowledge of the dissolution) as owing to him by the company, had been distributed to him for purposes of s. 84(2), Bowman TCJ. allowed the appeal on the basis that such amount was not owing at the time of dissolution.

RMM Canadian Enterprises Inc. v. The Queen, 97 DTC 302, [1998] 1 C.T.C. 2300 (TCC)

A non-resident corporation ("EC") approached a business associate who, along with two other individuals, formed a Canadian corporation ("RMM") to buy the shares of a Canadian subsidiary ("EL") of EC for a cash purchase price approximating the cash and near cash on hand of EL and a Canadian subsidiary of EL ("ECL"). Immediately following the purchase, EL was wound-up into RMM and ECL was amalgamated with RMM; and three or four days later, RMM used the cash received by it from EL and ECL to pay off a loan that had financed the acquisition.

In finding that s. 84(2) deemed the difference between the sale price and the paid-up capital of the shares of EL to be a dividend, Bowman TCJ. noted that "RMM was interested only in earning what was in essence a fee for acting as a facilitator or accommodator in the transaction the purpose of which was to enable EC to get its hands on EL's and ECL's cash and near cash without paying withholding tax", and that although there had been a sale of the EL shares, he did "not think that the brief detour of the funds through RMM stamps them with a different character from that which they had as funds of EL distributed or appropriated to or for the benefit of EC".

McNichol et al. v. The Queen, 97 DTC 111 (TCC)

The taxpayers sold their shares of a corporation ("Bec"), whose assets (following a sale of real estate) consisted largely of cash, to a corporate purchaser for a cash purchase price that reflected, in part, the savings that would accrue to the taxpayers from effectively receiving that cash as an exempt capital gain rather than as a liquidation dividend from Bec. Following the acquisition, the purchaser amalgamated with Bec and used the cash received on the amalgamation to pay off a bank loan that had funded the acquisition.

Bonner TCJ. found that s. 84(2) did not operate so as to recharacterize the cash received as dividends, on the basis that the taxpayers were not in fact shareholders at the time. He stated:

The respondent's argument involves the conversion of the transaction which in fact took place into something else which is regarded as its equivalent and the application of the subsection to the latter. I know of no authority for such a process. Subsection 84(2) is not ambiguous.

However, he proceeded to find the taxpayers liable under the general anti-avoidance rule (s. 245).

Kennedy v. MNR, 72 DTC 6357 (FCTD), aff'd 73 DTC 5359 (FCA)

A corporation of which the taxpayer was the sole shareholder purchased a property for use as the new site for its car dealership business, paid for some renovation work and then sold the property to the taxpayer at a price that was less than its total cost including that of the renovation work, with the property then being leased back to the corporation for use in its business.

Cattanach J. stated (at p. 6362):

"If an undertaking of some definite kind is being carried on but it is concluded that this undertaking should not be wound-up but should be continued in an altered form in such manner that substantially the same persons will continue to carry on the undertaking, that is what I understand to be a reorganization.

...

[T]he word 'reorganization' presupposes the conclusion of the conduct of the business in one form and its continuance in a different form.

In the Shorter Oxford Dictionary ... the words 'reorganization' is defined as 'a fresh organization' ... .

Here, there was no "fresh" organization as the same corporation continued the same business in the same manner in the same form - the sale by it of a capital asset did not result in the end of its business.

Accordingly, there was no "reorganization" of the business for purposes of s. 8(1) of the pre-1972 Act (now, s. 15(1)).

Administrative Policy

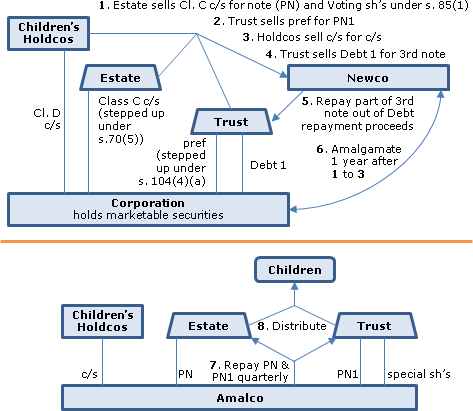

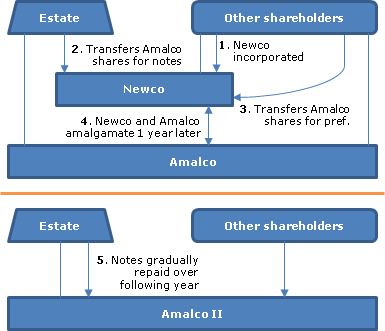

2015 Ruling 2014-0548621R3 - Post Mortem Pipeline Planning

Background

On the death of B (the surviving spouse of A), B was deemed under s. 70(5)(a) to have disposed of the Class C common shares of the Corporation for their fair market value and the Trust (which had been settled for the exclusive benefit of A and B for their lifetimes, with the beneficiaries on the death of the survivor being their four children), was deemed to have disposed of Class F and I preferred shares of the Corporation under s. 104(4)(a) for their FMV, as well as non-interest bearing demand notes which the Corporation had issued to the Trust as consideration for a previous redemption of preferred shares ("Debt1"). The only assets of the Corporation were marketable securities.

Proposed transactions

- The estate will transfer its Class C common shares of the Corporation to a newly-incorporated corporation ("Newco") in consideration for a promissory note ("PN") and for non-participating voting common shares of Newco, with a joint election being made under s. 85(1).

- The Trust will transfer its Class F and I preferred shares of the Corporation to Newco in consideration for a promissory note ("PN1") with a principal equal to the FMV of such shares.

- The four holding companies ("Holdcos") for the four children (and their spouses) will transfer their respective Class D common shares of the Corporation to Newco in consideration for Class B non-voting participating shares of the Corporation with par value, with a joint election being made under s. 85(1).

- During the following one year, the Trust will transfer Debt1 to Newco in exchange for a promissory note with the same principal amount and terms.

- During the one year following 1 to 3, the Corporation will pay part of Debt1 up to a maximum amount of $XX, with Newco, in turn, paying part of the promissory note payable by it to the Trust. Dividends funded out of the earnings of the Corporation will be paid on the Class B common shares of the Holdcos.

- At least one year after 1 to 4, Newco and the Corporation will amalgamate.

- The PN and PN1 will be repaid over a period of no less than one year after the amalgamation, and the repayment in any given quarter of the period of one year after the date of the amalgamation will not exceed XX% of the aggregate principal amount of the PN and PN1 when they were issued. The amalgamated corporation ("Amalco") will continue carrying on the investment business with the remaining marketable securities.

- The Trust and estate will distribute their properties to the four children.

Rulings

Re ss. 84.1 and 84(1) not applying to the Trust or estate, and s. 245(2) not applying.

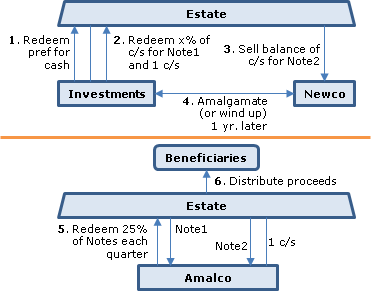

2014 Ruling 2014-0540861R3 F - Post-Mortem Planning

Background

At death, X was the sole shareholder of Investments (a CCPC, whose shares did not qualify as QSBCs), which held bank balances, shares of public companies and fixed income investments. Although X's spouse was a beneficiary (as well as their adult children), X's estate made the election in s. 70(6.2) for the shares bequeathed to the surviving spouse to be disposed of for their fair market value.

Proposed transactions

- Investments will redeem preferred shares held by the estate for cash.

- Investments will purchase for cancellation a portion of its Class A common shares for Note 1 thereby giving rise to a capital loss to be carried back under s. 164(6).

- The estate will transfer its remaining Class A shares to Newco in consideration for Newco issuing Note 2 (with an amount equal to the ACB of the transferred shares) and a common share, with a joint election being made under s. 85(1).

- At least one year following 3, Investments will be wound-up into or amalgamated with Newco (thereafter, "Amalco").

- Amalco will repay the Notes and its other debts, then be liquidated. The Note repayments will occur at a maximum rate of XX% per quarter for the year following the amalgamation.

- At the opportune time, the estate will distribute the funds to its beneficiaries.

Rulings

Standard ss. 84(2), 84.1 and 245(2) rulings.

2015 Ruling 2014-0563081R3 - Post-mortem pipeline

Current structure

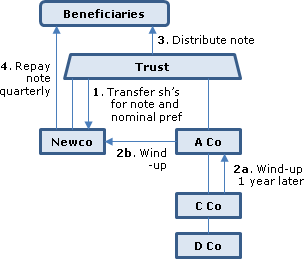

All the shares of A Co (being Class A voting common shares and Class B non-voting common shares) are held by a spousal trust (the "Trust"), which reported a deemed disposition of its assets at their fair market value on the death of the surviving spouse (Mrs. X). The sole asset of A Co is all the shares of C Co, whose sole asset is all the shares of D Co. D Co carries on a business directly and through four U.S. subsidiaries. The Trust will continue until the X anniversary of Mrs. X's death.

Proposed transactions

- The Trust will transfer its shares of A Co to its newly-incorporated subsidiary ("Newco") in consideration for a note equal to their combined fair market value and for a preferred share, electing under s. 85(1). A capital loss on the transfer will be suspended under s. 40(3.4).

- After at least one year, A Co and C Co will be amalgamated with, or wound-up into, Newco.

- Thereafter, Newco may gradually begin to make payments on the note payable to the Trust and/or to the Beneficiaries and Grandchildren, to whom the note will be distributed on XX. For greater certainty, the amount paid in any quarter of the first year that the note is outstanding after the amalgamation or wind-up in 2 will not exceed XX% of the note' original principal.

Rulings

. For ss. 84.1, 84(2) and 245(2).

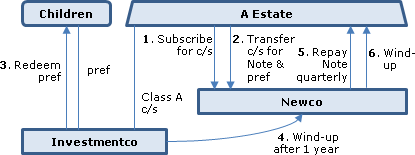

2015 Ruling 2014-0559481R3 F - Post Mortem Planning

Current structure

Since the death of A (who used Investmentco in his professional practice but had Investmentco accumulate investments, Investmentco has been a portfolio investment company holding bank deposits, fixed income investments and shares. On the death of A, his Estate acquired his shares of Investmentco for their fair market value. None of the shares of Investmentco were qualified small business corporation shares at any time, and their adjusted cost base was not based on the tax-free zone. A's Class A common shares of Investmentco were bequeathed to his three adult children (Child 1, 2 and 3) and Child 1 was his executor.

Proposed transactions

- The Estate of A will subscribe for common shares of newly-incorporated "Newco."

- The Estate of A will transfer its Class A common shares of Investmentco to Newco in consideration for a demand non-interest bearing note ("Newco Note") and in consideration for Class B non-voting retractable preferred shares of Newco and with a s. 85(1) election made.

- The preferred shares of Investmentco held by Child 1, 2 and 3 will be redeemed by them.

- One year after 2, Investmentco will be wound-up into Newco under s. 88(1).

- Newco then will proceed to repay the Newco Note held by the Estate of A at the rate of 25% at the beginning of each trimester.

- Newco then will be liquidated, with ss. 88(2) and 84(2) applying.

Standard Rulings

respecting ss. 84.1, 84(2) and 245(2).

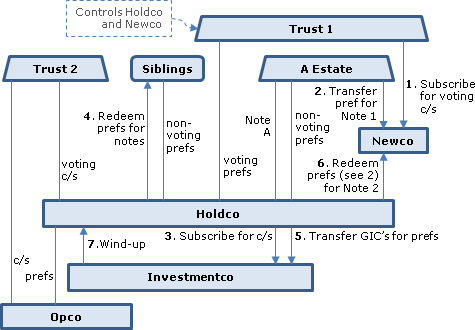

2015 Ruling 2014-0541261R3 F - Post-Mortem Planning

Current Holdco structure

Holdco is a portfolio investment company holding bank deposits, certificates of deposit, notes payable and preferred shares of Opco, and some real estate. Its sole liability is demand notes (Notes A to D) payable to its "Shareholders" (Brother 1, Brother 2, Sister, and the Estate of A, who was the fourth child of deceased Father.) Trust 2 holds the Class A voting common shares of Holdco, Brother 1 and 2, and Sister along with the Estate of A, hold its Class B non-voting retractable preferred shares and Trust 1 holds its Class D voting retractable preferred shares, giving Trust 1 de jure control of Holdco.

Trusts 1 and 2, A Estate and Opco

Opco carries on an active business and its Class A common shares are held by Trust 2. Trust 1 is a testamentary trust that came into existence on the death of Father, with the Shareholders (including now the Estate of A) as equal beneficiaries and with Brother 2, Sister and an Opco employee as trustees. Trust 2 is a discretionary inter vivos trust that participated in an estate freeze, and whose beneficiaries are Mother, the Shareholders and their issue or any of their corporations, and an income beneficiary (X). The principal beneficiary of the Estate of A is Trust 3, which, in turn, has A's two children as beneficiaries.

Proposed transactions

- Trust 1 will subscribe for Class A common shares of newly-incorporated "Newco," so that Holdco will be connected to Newco by virtue of ss. 186(4)(a) and 186(2)

- The Estate of A will transfer its Class B preferred shares of Holdco (which were stepped up under s. 70(5) on the death of A, without the s. 110.6(2.1) deduction being available) to Newco in consideration for a demand non-interest bearing note ("Note 1").

- Holdco will subscribe for Class A common shares of newly-incorporated "Investmentco."

- Holdco will redeem the Class B preferred shares held by Sister, Brother 1 and Brother 2, in consideration for a demand non-interest bearing note, with Holdco making eligible dividend designations.

- Holdco will transfer its GICs to Investmentco in consideration for Class B non-voting retractable preferred shares, with the sale agreement containing a price adjustment clause, and with a s. 85(1) election made.

- Holdco will redeem the Class B preferred shares which Newco acquired in 2, in consideration for a demand non-interest bearing note ("Note 2"), with Note 2 containing a price adjustment clause. Newco thereby will realize a capital loss, which will be deemed to be nil by s. 40(3.6).

- Investmentco will be wound-up into Holdco under s. 88(1).

Subsequent transactions

The Estate of A will demand repayment of Note A by Holdco. At an opportune time, the Estate of A will distribute Note 1 to Trust 3 as described in s. 107(2). At least one year following 2, the Estate of A (or Trust 3, as the case may be) will progressively over various years demand the repayment of Note 1 in order to generate distributions to its beneficiaries. Newco will generate the necessary liquidity to satisfy such demands by making demands for repayments of Note 2 owing by Holdco. It is contemplated that Holdco and Opco will continue their activities in a similar manner as before (including maintaining their separate existence.)

Standard Rulings

respecting ss. 84.1, 84(2) and 245(2).

2014 Ruling 2014-0537161R3 - Reduction of stated capital

underline;">: Current structure. The Company is a listed public corporation carrying on the "Business" (comprising resource projects) directly and through subsidiaries and, with the exception of one non-resident individual shareholder, its common shares are widely held. It holds one common share (being all the issued shares) and non-interest-bearing advances (the "Subco1 Loan") of Subco1, which is a holding company for the "investments" (including advances) of the Company (likely foreign resource project subsidiaries held directly or through a further holdco), other than a share and warrant investment in another public company, which is held through Subco2.

Proposed transactions

"The Company proposes to reorganize its Business as follows" pursuant to a Plan of Arrangement:

- The Company will exchange a portion of the Subco1 Loan for Subco1 treasury common shares (the "Subco1 Distribution Shares") and "Subco1 Warrants," entitling the holder to purchase one common share of Subco1 at an exercise price which will increase after XX months.

- The Company will distribute the Subco1 Distribution Shares and Subco1 Warrants as a paid-up capital reduction (with the fair market value of each distributed share or warrant being approximately $XX and $XX, respectively), and with the Subco1 common shares thereafter being listed.

Rulings

Ss. 15(1) and 246(1) will not apply to the distribution. S. 84(2) will apply and ss. 84(4.1) and 212(2) will not apply to such distribution. The cost to the Company shareholders of the distributed shares and warrants will be equal to their FMV at that time.

10 October 2014 APFF Roundtable Q. 21, 2014-0538091C6 F

What is the CRA position on Descarries? After noting that the case was not appealed because in the result it was favourable and it was only an informal procedure case, CRA then summarized the facts, stating that the Oka shareholders engaged in "three avoidance transactions" (TaxInterpretations translation) for appropriating the surplus of Oka which, in December 2004, had already "liquidated around 93% of its business assets with the rest…also in the course of liquidation:"

First, on 1 March 2005, they effected an internal transfer ["roulement interne"] of their shares in the capital of Oka in order to crystallize in the adjusted cost base ("ACB") of new shares [of Oka], the excess of the fair market value ("FMV") of the transferred shares over their ACB, thereby realizing a capital gain… .

The second transaction, effected on 15 March 2005, consisted in rolling those new shares in the capital of Oka to…Quebec Inc….in exchange for shares of two classes in the capital of Quebec Inc.: the first…having a low PUC and an ACB equal to their FMV (the "1971 FMV Shares") and the second class having a high PUC (which was the objective of the second transaction) and a high ACB equal to their FMV (the "Stripping Shares").

The third transaction consisted of redeeming for cash on 29 March 2005 all of the Stripping Shares, and part of the 1971 FMV Shares, so as to generate a capital loss sufficient to expunge the capital gain generated in the first transaction.

The CRA continues of the view that ITA subsection 84(2) should have applied in this case especially by reason of …MacDonald… . Furthermore, the CRA is concerned by the approach adopted by the TCC respecting the analysis of the avoidance transactions for purposes of the application of ITA subsection 245(2).

Respecting its s. 84(2) concerns, CRA noted the broad wording of s. 84(2), that the funds received on the redemption of the shares of Quebec Inc. "corresponded closely in dollars to the advance which was provided to Quebec Inc. by Oka," so that , paraphrasing RMM, the funds in the shareholders hands "were actually the funds of Oka, notwithstanding the interposition of Quebec Inc.," and that the "restrictive interpretation" accorded by Hogan J to the word "on" was inconsistent with the meaning of "as a result of" suggested in David, where there was a delay of five months. As for any potential double taxation arising from the applicability of s. 84(3), in practice CRA would avoid double taxation through applying s. 248(28)(a).

After also articulating its concerns about the decision's GAAR analysis, CRA concluded:

CRA will seek a decision of the Federal Court of Appeal or the Supreme Court of Canada…confirming the broad scope of subsection 84(2) recently established….in…MacDonald…and on whether or not there is a specific scheme under the Act for taxing any direct distribution of surplus of a Canadian corporation as a taxable dividend in the hands of individual shareholders; as well as a specific scheme under the Act against indirect surplus stripping.

See also summary under s. 245(4).

2014 Ruling 2011-0415811R3 - Internal reorganization

underline;">: Current structure. Parent, a public corporation which previously had been spun-off by Subco 2 (also a public corporation, but with Subco 1 holding all its common shares), owns all the common shares of Subco 1, Subco 3, Can Holdco (as well as preferred shares of Subco 1), and a portion of the common shares of FA2. Subco 3 owns the remaining common shares of FA2 and Subco 2 owns all the common shares of FA 1. The assets held in Subco 2 and FA 1 constitute the majority of the assets in the Parent group.

Proposed transactions

- Parent will transfer to Can Holdco (which currently has nominal assets) all its FA 2 shares in consideration for common shares of Can Holdco having an equal FMV, and elect at the lesser of under s. 85(1)(c.1)(i) and (ii).

- Subco 3 will transfer all its FA 2 shares to Can Holdco for a purchase price equal to the shares' adjusted cost base (and with a price adjustment clause based only on any adjustment to such ACB), and Can Holdco will issue in consideration therefor redeemable retractable Class B shares having a redemption amount, apid-up capital and FMV equal to such purchase price. Subco 3 and Can Holdco will elect at the lesser of the s. 85(1)(c.1)(i) and (ii) amounts.

- Similarly, Subco 2 will transfer its FA 1 shares to Can Holdco for Can Holdco Class C preferred shares with a redemption amount, paid-up capital and FMV equal to the ACB of the transferred shares, with a similar s. 85(1) election made.

- Can Holdco will transfer all its FA 1 shares to FA 2 in consideration for additional FA 2 shares with an equivalent FMV.

- Can Holdco will redeem its Class C shares held by Subco 2 for demand notes (accepted as full payment, and with their terms acknowledging that their principal amount is subject to adjustment based on the Class C share price adjustment clause).

- Similarly, Can Holdco will redeem its Class B shares held by Subco 3 for demand notes.

- Parent will draw down under its credit facility and subscribe for Can Holdco common shares in amounts sufficient to fund the note redemptions in 8 below.

- Can Holdco will satisfy the notes owing to Subco 2 and 3 in cash.

- Subco 2 will reduce the stated capital of its common shares by making a single cash distribution, within XX months from the transfer in 3, with the reduction being subject to a price adjustment clause.

- Subco 1 will make a corresponding stated capital distribution in cash to Parent.

- Subco 3 will reduce the stated capital of its common shares by making a cash distribution, subject to a price adjustment clause.

- Parent will repay the advance in 7.

Rulings

Ss. 85(1)(e.2), 15(1), 56(2), 69(4) and 246(1) will not apply to the transfers in 2 and 3. The transfer of FA 1 shares in 4 will not by itself cause those shares to cease to be capital property. S. 84(2) will apply and s. 84(4.1) will not apply to the distribution in 9.

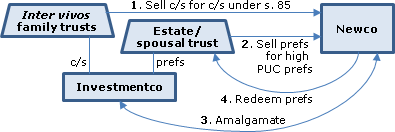

2014 Ruling 2014-0526361R3 F - Post Mortem Pipeline

Background

Prior to the death of B (who had been predeceased by her spouse), the Class A common shares of Investmentco, which was a portfolio investment company, were held by Trusts A and B, and its non-voting non-cumulative redeemable retractable Class F shares were held by B and a spousal trust (B2 Trust). Accordingly, the Class F shares were deemed to be disposed of and reacquired under s. 70(5) or 104(4)(a) for their fair market value. The adjusted cost base of the Class F shares was not based on the tax free zone.

Proposed transactions

Following capital dividends on the Class A and F shares paid through the issuance of demand promissory notes:

- Trusts A and B will sell their Class A shares of Investmentco to newly-incorporated Newco for Class A shares of Newco with identical attributes and elect under s. 85 with Newco.

- B2 Trust and the estate of B will sell their Class F shares of Investmentco to newly-incorporated Newco for shares of Newco with identical attributes and with a paid-up capital equal to the fair market value of the transferred shares (being also their FMV on death).

- After a period of XX, during which it will continue its portfolio investment activities, Investmentco will amalgamate with Newco.

- Thereafter, Amalco will proceed with partial seriatim redemptions of its Class F shares held by the Estate of B and by B2 Trust in maximum amounts of $XX per quarter.

Rulings

Respecting non-application of s. 84.1 to the transfer of the Class F shares and non-application of s. 84(2) to B Estate and B2 Trust to deem a dividend on their Class F shares of Investmentco.

2014 Ruling 2013-0503611R3 - Post-Mortem Planning

Overview

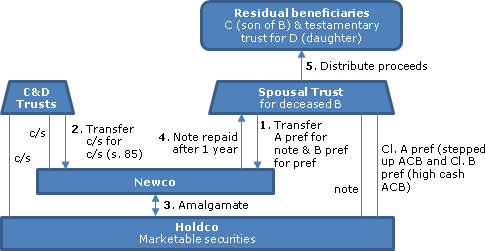

A testamentary spousal trust (the "Spousal Trust") whose basis in pref shares of a portfolio investment company ("Holdco") was stepped up under s. 104(4)(a) on the death of the spouse in question (B), will engage in a "pipeline" transaction under which it will transfer those shares to a Newco for inter alia the "Newco Note," with Newco then amalgamating with Opco (at least one year later) so that marketable securities of "Amalco" may be used to pay down the Newco Note.

Prior to B's death

Following the death of A, the Spousal Trust engaged in an estate freeze transaction under which it received redeemable retractable non-cumulative Class A preferred shares of Holdco under s. 86 in exchange for its common share, and inter vivos trusts for her son (Trust C) and daughter (Trust D) each subscribed for one common shares. Spousal Trust also subscribed cash for redeemable retractable non-cumulative Class B preferred shares of Holdco, and holds debt of Holdco. Holdco's only activity is to hold marketable securities.

B's death and preliminary transactions

On B's death, there was a deemed disposition at fair market value by Spousal Trust under s. 104(4)(a) of its property including its Class A preferred shares. Newco was incorporated with Trusts C and D as nominal common shareholders.

Proposed transactions

:

- Spousal Trust will transfer its Class A and B preferred shares of Holdco to Newco in consideration for the Newco Note (in the case of the A's) and voting redeemable retractable non-cumulative Class B preferred shares (in the case of the B's).

- Trusts C and D will each transfer its common share of Holdco to Newco under s. 85(1) for one Newco common share.

- Holdco and Newco will amalgamate to form Amalco no sooner than one year after the above transfers. Any dividends paid in the interim by Holdco or Newco will not be funded through a disposition of corporate investments. Pursuant to ss. 87(11) and 88(1)(d), Amalco will designate an amount to increase the cost amount of some or all of the Marketable Securities. "The shares of the capital stock of Holdco will not be acquired by a person described in subclauses 88(1)(c)(vi)(B)(I), (II) or (III) as part of the series of transactions or events that includes the amalgamation of Holdco with Newco."

- The Newco Note "will be gradually repaid over a period of at least one year after the amalgamation date, but the amount of the repayments in any given quarter of that year will not exceed X% of the principal amount of the Newco Note when it was issued. …While Amalco may sell some of the Marketable Securities in order to enable it to make the above-mentioned repayments of the Newco Note, it intends to continue carrying on its investment business with the remaining Marketable Securities left."

- On completion of its administration, Spousal Trust will transfer its remaining assets to its beneficiaries (C and a testamentary trust for D).

Rulings

:

- S. 84.1 will not apply to the transfer of shares by Spousal Trust to Newco.

- S. 84(2) will not apply to deem Spousal Trust to have received a dividend on the Class A preferred shares.

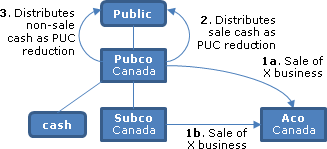

2013 Ruling 2012-0470281R3 - Reduction of paid-up capital

Background

Pubco (which is a listed Canadian public corporation engaged in the commercialization of innovative products, and is reorganizing to concentrate on XX) and its indirect Canadian subsidiary, Subco, completed an arm's length sale of the X Business. Following the sale, the Board announced an X% reduction in the workforce. No material amount of the PUC of Pubco was the result of its "acquisition of shares of previously unaffiliated corporations for FMV that was significantly less than the aggregate PUC of such corporations or the result of an acquisition that involved non-capital losses…being made available to Pubco" (para. 7).

Proposed transactions

Pubco may effect a distribution (Distribution #1) of its paid-up capital in an amount equal to or less than the proceeds of the sale of its X Business, with Distribution #1 being derived from such sale and occurring within X months thereof.

Within the same time period, Pubco may effect a distribution (Distribution #2) of its paid-up capital which is derived from cash or near cash on hand of it or its subsidiaries.

Rulings

Standard.

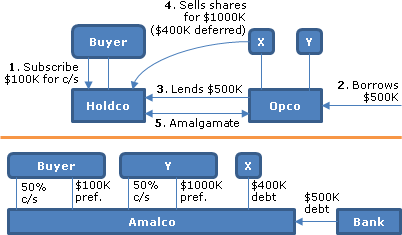

2 April 2013 T.I. 2013-0479651E5 F - Leveraged buy-out

X and Y each hold half of the common shares of Opco. X deals at arm's length with Y and Buyer. Buyer incorporates Holdco and subscribes $100,000 for its shares. Opco borrows $500,000 and on-lends at interest to Holdco. Holdco purchases X's shares for $1,000,000, with $600,000 paid on closing, with the deferred $400,000 portion of the purchase price bearing interest.

Holdco and Opco then amalgamate. Buyer and Y each receive 50% of the voting common shares of Amalco, and Amalco preferred shares with a value of $100,000 and $1,000,000 respectively, minus the value of the common shares. Amalco continues to carry on the Opco business.

In response to a query as to whether s. 84(2) applied, CRA stated (TaxInterpretations translation):

…it would be difficult to consider that this business was reorganized by virtue of the amalgamation as the amalgamation would not entail a change to that business. Your request does not provide any other information that would permit us to conclude that there was a winding-up, discontinuance or reorganization of Opco's or Amalco's business.

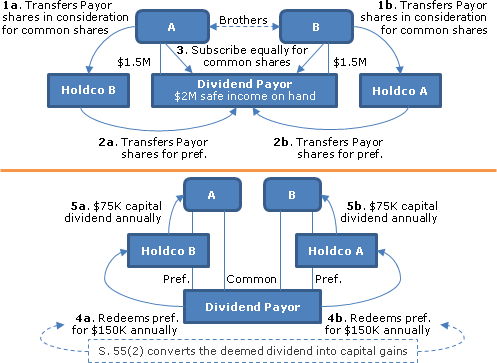

18 June 2013 T.I. 2012-0433261E5 F - 55(5)(f) and Surplus Stripping

Two Canadian-resident brothers (Messrs. A and B), who each hold a 50% block of the common shares of a small business corporation (Dividend Payor) having a fair market value of $1.5M and nominal adjusted cost base and paid-up capital, and safe income on hand of perhaps $1M, transfer their respective shareholdings to wholly-owned Newcos (Holdco A and Holdco B), utilizing the s. 85(1) rollover, in consideration for common shares of Holdco A and Holdco B with the same attributes (FMV- $1.5M; nominal ACB and PUC). Each of the two Holdcos then transfers its common shares of Dividend Payor under s. 85(1) to Dividend Payor in consideration for the issuance by Dividend Payor of preferred shares, also with such attributes (FMV- $1.5M; nominal ACB and PUC). Immediately thereafter, A and B subscribe equally for common shares of Dividend Payor.

Thereafter, Dividend Payor annually redeems preferred shares held by each of the Holdcos for $150,000. Although $100,000 of the resulting deemed dividend of approximately $150,000 is attributable to safe income on hand, no s. 55(5)(f) designation is made, so that the full amount of such deemed dividend is converted to a capital gain under s. 55(2). Each Holdco then pays a capital dividend of $75,000 to its individual shareholder (A or B).

In indicating that the general anti-avoidance rule could be applied to this and similar transactions involving trusts, CRA stated (TaxInterpretations translation):

[T]he surplus of Dividend Payor is annually stripped in favour of A and B given that annual taxable dividends of $150,000 which otherwise would be paid by Dividend Payor (namely its accumulated surplus) directly to each are, through a series of transactions entailing the insertion of Holdco A and Holdco B, converted in form to capital dividends free of tax (in the amounts of $75,000), through utilizing section 55….

[T]he insertion of Holdco A and Holdco B is part of a stratagem for the surplus-stripping of Dividend Payor with a goal of converting annual taxable dividends paid by Dividend Payor, which dividends would normally be inter-corporate dividends eligible for the subsection 112(1) deduction…, into proceeds of disposition of shares in a manner that abuses subsections 84(3), 55(2) and 83(2).

After referring to the adverse view taken by the GAAR committee of the somewhat similar transactions in 2004-0099201R3, CRA stated that (notwithstanding the decision in Gwartz v. The Queen, 2013 TCC 86) (TaxInterpretations translation):

CRA proposes, at the first favourable occasion, to demonstrate to the Court that there is a specific scheme under the Act for taxing the distribution of surplus of a Canadian corporation as a taxable dividend in the hands of individual shareholders who are the taxpayers; and that there is also an overall scheme of the Act against surplus stripping.

2012 Ruling 2012-0464501R3 - Post-mortem planning

Background

X's Class A, B and C shares of Amalco (a Canadian private corporation that was not a small business corporation) passed on his death to an estate (the Estate) of which two of his sons (Y and Z) were the executors. After giving effect to the immediate bequest of the Class B shares of Amalco to Y and Z, the shares of Amalco were held by the estate (holding Class A and C shares), Y and Z (each holding Class B shares and one common share) and a trust (the Trust) for the children of the other son of X (holding the other common share).

Proposed transactions

:

- The Estate will transfer its Class A and C shares to a newly-incorporated corporation (Newco), whose common shares are owned equally by X, Y and the Trust, in consideration for two Notes

- Y and Z will transfer their common and Class B shares, and the Trust will transfer its common share, of Amalco to Newco in consideration for non-voting preferred shares of Newco

- Amalco will be amalgamated with Newco no sooner than one year after the above transfers

- The Notes "will be gradually repaid over a period of at least one year after the amalgamation date, but the amount of the repayments in any given quarter of that year will not exceed X% of the principal amount of Note 1 and Note 2 when they were issued"

Rulings

:

- S. 84.1 will not apply to the transfer of shares by the Estate to Newco for the Notes, except that it will so apply to the extent of the V-Day value of the Class A shares so transferred by it

- S. 84(2) will not apply to deem the Estate to have received a dividend on the Class A and C shares

29 May 2012 CTF Prairie Tax Roundtable Q. , 2012-0445341C6

CRA would generally not differentiate between a corporation carrying on an active business and a corporation carrying on a business of earning income from property when considering whether funds or property of a corporation resident in Canada have been distributed or otherwise appropriated in any manner whatever to or for the benefit of the shareholders, on the winding-up, discontinuance or reorganization of the corporation's business.

Moreover, the Federal Court of Canada, Trial Division has mentioned in Conrad David v. The Queen, 75 DTC 5136, that the word "on" used in the expression "on the winding-up, discontinuance or reorganization of its business" may possibly mean "as a result of" or "consequential to". Therefore, it could be argued that, even if no business exists at the time of the distribution or appropriation of funds or property, such distribution or appropriation could still occur "on" the winding-up, discontinuance or reorganization of the corporation's business if it happens "as a result of" or is "consequential to" the winding-up, discontinuance or reorganization of the business. For example and depending on the circumstances, subsection 84(2) could apply to the distribution by a corporation to its shareholders of funds or investments resulting from the prior sale of operating assets linked to a former business.

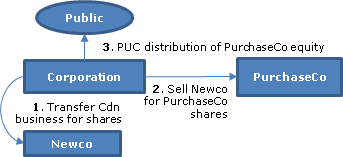

2012 Ruling 2011-0425211R3

Pubco holds foreign affiliates owning non-core foreign exploration properties through two Canadian holding companies (Canco 1 and Canco 2). After preliminary transactions to capitalize these holdings (which are designed to increase the adjusted cost base of its shares of Canco 1 and Canco 2), Pubco transfers its shares of Canco 1 and 2 to a newly-incorporated Canadian subsidiary (Spinco), utilizing the s. 85(1) election. Spinco then may obtain equity financing from third parties on a private placement basis, thereby diluting Pubco's ownership of Spinco.

Pubco then distributes Spinco to its shareholders as a reduction in the paid-up capital of its common shares (such reduction being equal to the fair market value of the Spinco shares).

Rulings that s. 84(2) will apply, and s. 84(4.1) will not apply, to the distribution; and that subject to s. 47, the cost amount to a Pubco shareholder of the Spinco shares will be equal to their fair market value at the time of distribution.

2012 Ruling 2012-0435291R3

A CBCA Canadian public company (the "Corporation") transferred Canadian property, which represented substantially all of the assets used by it in an active business, to a CBCA Newco on an s. 85(1) rollover basis in consideration for common shares. It then sold Newco to PurchaseCo (a Canadian public company which was a "capital pool company") in consideration for PurchaseCo common shares and special warrants (apparently in order to qualify the issuance of the related common shares of PurchaseCo for securities law purposes).

Corporation will distribute the PurchaseCo common shares to its shareholders, as a one-time reduction of its paid-up capital.

Ruling that s. 84(2) will apply, and s. 84(4.1) will not apply, to the distribution.

2012 Ruling 2012-0432431R3 -

Ruling that s. 84(2) will apply to the distribution by a resource public company of a resource subsidiary as a reduction of stated capital, in order that the former can focus on its more promising projects.

2012 Ruling 2012-0401811R3

At the time of death of Mr X, he held common and preferred shares of (and controlled) Holdco, which carried on an investing business and held a wholly-owned subsidiary carrying on a business (Opco). Mrs X held common shares and preferred shares of Holdco of a different class.

A testamentary trust created by Mr X will transfers the estate shares to a Canadian corporation (Newco) which is jointly owned by the trust and Mrs X and controlled by the trust in consideration for two promissory notes equal to the fair market value of such common and preferred shares at the death of Mr X, and for preferred shares having a redemption amount equal to any appreciation in the fair market value of the common shares subsequent to such death (and having a nominal paid-up capital so as not to engage s. 84.1). A s. 85(1) election is filed in due course. Mrs X effects a similar transfer of her Holdco shares to Newco.

After at least one year has elapsed since the transfer of the shares of the capital stock of Holdco to Newco, Holdco will be amalgamated with or wound-up into Newco. Pursuant to paragraph 88(1)(d) and within the limits of this provision, Newco will designate an amount to increase the ACB of the shares of the capital stock of Opco that will be distributed or acquired on the amalgamation/winding-up.

Subsequently to such amalgamation or winding-up, Newco may gradually begin to make payments on the notes owing by it to the testamentary trust in order to fund distributions to beneficiaries in accordance with the terms of the trust.

Ruling that s. 84(2) will not apply to deem Holdco to have paid a dividend to the testamentary trust.

2011 STEPs Roundtable Q. 5, 2011-0401861C6

An estate engages in a "pipeline" strategy in which it disposes of its shares of ACo (having a stepped-up adjusted cost base under s. 70(5)) to a newly-incorporated holdco ("AHoldco") in consideration for a promissory note, and AHoldco applies an intercorporate dividend from ACo to repay the promissory note. CRA stated that the circumstances which "could" lead to the application of s. 84(2) included: the funds or property of ACO being distributed in a short time frame following the death of the deceased; and ACo having no business and instead holding mostly cash.

12 August 2010 T.I. 2010-037055 F -

Given that the Tremblay decision contained a strong dissent based on the Smythe decision and given that the general anti-avoidance rule was not invoked in that case, CRA will continue to challenge abusive surplus stripping arrangements including those taking the form of "tuck under" transactions. However, it maintains its position that ss. 84(2) and 245(2) should not apply to "tuck under" transactions carried out in the context of "safe income extraction" scenarios.

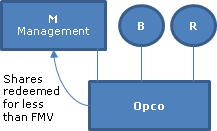

26 April 2006 Ruling 2004-0099201R3

Mr. A is the sole shareholder of Aco, which generates an annual profit from its operations of more than $100,000. His Aco shares have a significant fair market value and nominal paid-up capital and adjusted cost base.

In a given year, A transfers a portion of his shares of Aco, having a FMV of $100,000, to Aco in consideration for preferred shares of Aco having a redemption amount of $100,000 and a nominal PUC. As s. 84(5) applies, there is no deemed dividend and A realizes a capital gain of $100,000.

In the same year, A transfers his $100,000 preferred shares of Aco to a Newco formed by him (Bco) in consideration for a demand promissory note of $100,000. As his preferred shares had an ACB for purposes of s. 84.1(2)(a.1) of $100,000, no deemed dividend arises. Aco then redeems the $100,000 of preferred shares (giving rise to a deemed dividend to Bco of that amount – which is not subject to s. 55(2) as Bco had full ACB in those shares), and BCo uses the redemption proceeds to discharge the note owing to A.

CRA stated (TaxInterpretations translation):

The goal of the series of transactions which you presented to us was to convert an annual dividend, which otherwise would have been paid by your corporation, into a taxable capital gain, by the annual conversion, in a taxable transaction, of participating shares in your corporation into preferred shares and the transfer of such preferred shares to a holding company controlled by you….[This] series of transactions constitutes a mechanism for the stripping of surplus of your corporation so that all the conditions for the application of the GAAR are satisfied.

2004 Ruling 2004-007547

An indirect foreign subsidiary ("Forco 1") of a Canadian public company ("Opco 1" - likely, BCE Emergis Inc.) sold a foreign subsidiary of Forco 1 ("Forco 2" - likely BCE Emergis Corporation) in an arm's length sale to a purchaser. As a condition to the sale of Forco 2, a loan owing by Forco 2 to another indirect foreign subsidiary of Opco 1 ("Forco 3") was required to be paid off. Accordingly, Opco 1 used money borrowed by it from a Canadian bank to contribute, through a series of transactions, capital to Forco 2, in order that Forco 2 could pay off the loan owing by it to Forco 3. Upon completion of the sale of Forco 2, the sale proceeds were distributed, through winding-up of Forco 1 and its immediate parent to Opco 1 ,which used a portion of the proceeds so received by it to pay off the bank loan. Thereafter, Forco 3 uses the loan repayment proceeds received by it to effect a capital distribution to its immediate Canadian parent ("Sub 2") which, in turn, will effect a capital distribution directly (and through another intermediate corporation) to Opco 1, which will then effect a stated capital distribution of a portion of such cash proceeds on its shares.

CRA gave a favourable s. 84(2) ruling.

2003 Ruling 2002-018027

U.S.-resident shareholders of a Canadian investment company ("Canco") sell their shares of Canco to an unrelated Canadian purchaser ("Holdco"), and Holdco winds-up Canco, "bumps" the investments of Canco under s. 88(1)(d) and sells some of those investments to persons other than those described in s. 88(1)(c)(vi)(B)(I), (II) and (III). S.84(2) does not apply to the transactions as Holdco is not a special purpose corporation and has been an investment holding company since the 1970s, and sales by it of the bumped assets will be in the ordinary course of its business. "Therefore it cannot be said that Holdco is an instrumentality designed to facilitate these proposed transactions."

2003 APFF Roundtable Q. 1, 2003-0029955

After negotiations with a purchaser, who is interested in the assets of the business of Opco, it is agreed that the Opco shareholders will sell their Opco shares after Opco has transferred all its assets in a taxable transaction to a newly-incorporated subsidiary ("Subco"). The capital dividend account of Opco is distributed to the vendor shareholders of Opco immediately after the taxation year end resulting from the amalgamation of Opco and Subco and the acquisition of control of Opco. The sale price for the shares is adjusted to reflect the income tax payable on the asset drop-down and the funds distributed on payment of the capital dividend. The vendors utilize their capital gains exemption on the sale.

Would s. 84(2) (which was invoked in Geransky) be applied? Given that tax was paid on the asset sale, would s. 245(2) be applied? CRA responded:

[W]here none of Opco's funds or property are distributed or otherwise appropriated in any manner whatever to or for the benefit of the selling shareholders of Opco in the Given Situation, subsection 84(2) of the ITA would not be applicable. This could be the case where the selling shareholders and the purchaser are dealing at arm's length, the selling shareholders would receive a cash amount from the purchaser's own funds in return for their Opco shares, and Opco's assets would continue to be used in an active business by Opco or by another entity within the purchaser's corporate group.

Respecting the application of subsection 245(2)…it is possible to confirm that in a situation of the type described in the preceding paragraph, subsection 245(2) would not normally apply to the selling shareholders to redetermine the tax consequences arising from the sale of their shares.

…[I]t is not possible to comment definitively on the application of subsection 84.1 in the Given Situation given…the brief description [respecting facts relevant to arm's length dealing].

…[However] where the proposed transaction is a business transaction and is supported by bona fide business purposes (other than obtaining a tax benefit), where a purchaser is interested in the assets of an unrelated person (the "Target Corporation"), and where the purchaser and the shareholders of the Target Corporation are unrelated persons with distinct and different interests, the sole fact that the parties have finally agreed that the purchaser would acquire the Target Corporation's assets by purchasing shares of its capital stock would not be sufficient, in and by itself, to consider that the purchaser and the vendors are not dealing at arm's length, with respect to the disposition of the shares of the capital stock of the Target Corporation. …

2000 Ruling 2000-001444

Ruling that a transfer by a Canadian public company in a taxable transaction of all the assets of a business to a Newco, followed by a distribution of Newco shares to its shareholders would give rise to a dividend only to the extent that the fair market value of the distributed shares exceeded the paid-up capital reduction associated with the distribution.

1997 Ruling 30970152

Description of reorganization of a public corporation in which the paid-up capital of its issued and outstanding common shares are reduced through the distribution of the common shares of Newco to the shareholders, with s. 84(4.1) not applying because of the application of s. 84(2).

22 June 1990 T.I. (November 1990 Access Letter, ¶1534)

Where Mr. A effectively wishes to withdraw cash from a corporation of which he is the sole shareholder and accomplishes this by selling the shares of the corporation to another unrelated corporation which then winds-up the purchased corporation, s. 84(2) may possibly apply to Mr. A.

88 C.R. - Q.34

The "amount or value" of the property distributed is reduced by liabilities assumed by the shareholder of the corporation.

Articles

Charles P. Marquette, "Hybrid Sale of Shares and Assets of a Business", Canadian Tax Journal, (2014) 62:3, 857 – 79.

Description of hybrid transaction using external step-up in basis method (pp. 878-9)

[T[he hybrid form of transaction for a corporate business sale utilizes both traditional elements of a business acquisition – the purchase of shares and assets – in order to limit the ultimate tax liability incurred by the vendor and to maximize the cost base of assets for the purchaser….

In our example, the family trust's shares in the target are sold to the purchaser, and the capital gains exemption is claimed by the individual beneficiaries of the trust. This aspect of the transaction may require a purification of the non-qualifyingj assets of the target.

Once the shares of the target have been sold by the family trust, the assets of the target, primarily composed of eligible capital property (goodwill), are sold to the purchaser at fair market value. This allows the purchaser to receive full basis in the assets.

When the target subsequently redeems the shares held by the purchaser, using the proceeds from the sale to pay the redemption price, in order to avoid the applicability of part IV tax (tax on taxable dividends received by a private corporation) the shares must represent more than 10 percent of the votes and value of the target's issued shares. Following the redemption, the parent/freezor owns all of the remaining issued and outstanding shares of the target. The effect is that the target is left with the balance of the proceeds from the sale of goodwill ($20 million in our example),, which will ultimately be distributed to the parent/freezor.

Ultimately, the full CDA of the target is used to reduce the overall tax liability for the parent/freezor.

Utility of hybrid transaction (p. 879)

[T]he hybrid sale has saved many transactions from failing, including in the following circumstances:

- The purchaser wished to acquire business assets in order (among other reasons) to obtain a step-up in basis of the assets.

- Certain shareholders preferred selling shares, as opposed to assets, in order to access their capital gains exemption.

- The majority shareholder ended up with a yield equivalent to that which he would have received on a sale of his shares.

Non-application of s.84(2) to hybrid transaction: sale of some Target shares to purchaser to utilize capital gains exemption, sale of Target assets (mostly goodwill) to purchaser and redemption of Target shares held by purchaser (pp. 869-870)

[T]he CRA seems to accept that subsection 84(2) would not apply to recharacterize the proceeds as dividends from the target corporation where the vendor shareholders and the purchaser are dealing at arm's length and, essentially, the purchaser is using its own funds to purchase the target's shares. [fn 22: … 2003-0029955… See also Geransky v. The Queen, 2001 DTC 243…] The CRA has confirmed that in such a situation, subsection 84(2) or 245(2) would not normally apply provided that (1) the vendors and the purchaser deal at arm's length, (2) the vendor shareholders receive a cash amount from the purchaser's own funds in return for shares of the target, and (3) the target's assets continue to be used in an active business by the target, or by another entity within the purchaser's corporate group. [fn 23: … 2003-0029955…]

Perry Truster, "Turning Dividends into Capital Gains", Tax for the Owner-Manager, Volume 14, Number 1, January 2014, p. 7.

Sale of stock dividend shares for note which is repaid out of corporate surplus (p. 7)

[I]it is advantageous to convert distributions that would otherwise be dividends into capital gains….

…Assume that Opco pays X a stock dividend in the form of preferred shares that are redeemable and retractable for $100,000 but have a stated capital of $1 in the aggregate. X will be taxed on a $1 dividend. X realizes a capital gain by selling the shares to a related individual (say, an adult child) for a $100,000 note. The child transfers the shares to his Holdco, and his Holdco assumes the note owed to X. Holdco then tenders the shares to Opco for redemption. Opco pays the redemption proceeds with its $100,000 cash, and Holdco pays X the $100,000 cash to retire the note….

GAAR (p.7)

The obvious question is whether GAAR is a concern. At the moment, the answer appears to be no. This conclusion is based on Gwartz (2013 TCC 86), a case that involved a series of transactions similar to those described above that converted dividends into capital gains to avoid the section 120.4 kiddie tax….

Steve Suarez, Firoz Ahmed, "Public Company Non-Butterfly Spinouts", 2003 Conference Report, c. 32.

Subsection 84(3) - Redemption, etc.

Cases

The Queen v. MacMillian Bloedel Ltd., 99 DTC 5454, Docket: A-655-97 (FCA)

The taxpayer redeemed U.S.-dollar denominated preferred shares at a time that the U.S. dollar had appreciated relative to the exchange rate at the time of issuance. The taxpayer was found to have realized a loss under s. 39(2) notwithstanding that s. 84(3) simultaneously operated to deem it to have paid a dividend to the shareholders.

See Also

McClarty Family Trust v. The Queen, 2012 DTC 1123 [at 3122], 2012 TCC 80

A family holding company ("MPSI") paid a stock dividend of preferred shares, having nominal paid-up capital and a redemption amount of $48,000, on the Class B non-voting shares of MPSI, which were held by a family trust ("MFT") whose sole trustee ("McClarty") was the father. MFT then sold these preferred shares to McClarty in consideration for a demand promissory note of $48,000. McClarty then sold these preferred shares to a corporation ("101 SK") of which he was the sole shareholder and director in consideration for a $48,000 demand promissory note, which 101 SK then repaid out of cash proceeds received by it on the redemption of the preferred shares.

The Minister contended that, because of the breadth of the words "in any manner whatever" in s. 84(3), the redemption resulted in a deemed dividend for MFT in the amount of $48,000. This contention was supported by the Tax Court's decision in RMM, which held that the breadth of the words "in any manner whatever" meant that "each person" in s. 84(3)(b) could include people who no longer held the shares.

Angers J. rejected the Minister's argument. RMM concerned a situation where the economic substance of the transactions was that the redeemed shares were still the property of the taxpayer. In the present case, none of the transactions were fictitious or lacking in economic substance. Angers J. stated (at para. 65):

Even if I were to look into the method by which the shares were redeemed, I would need to view the transactions as many steps in the process of redemption, acquisition or cancellation, which I do not believe to be the case here. The steps in this case were undertaken for a bona fide reason [namely, to protect assets from an anticipated civil suit] and I do not believe that, in these circumstances, subsection 84(3) can be applied so as to have MFT declared the recipient of a deemed dividend on the redemption of the 2003 and 2004 stock dividend shares.

Gagnon v. The Queen, 2008 DTC 3111, 2006 TCC 194

The taxpayer originally signed an agreement for the sale of his half interest in a business (which was found to be held in a corporation) to his brother. After receiving payment of the purchase price from the corporation, his brother purported to have the corporation retroactively issue two shares to the taxpayer and got the taxpayer to sign a second agreement providing for the purchase of those two shares by the corporation from the taxpayer in consideration for the two payments that the corporation had in fact made to him. In finding that the taxpayer had received deemed dividends, Lamarre J. stated (at para. 22) that "a person can be declared a shareholder retroactively" and found that the second agreement was the one that prevailed as it reflected the contractual reality negotiated by the two brothers.