Subsection 88(1) - Winding-up

Cases

The Queen v. Mara Properties Ltd., 96 DTC 6309, [1996] 2 S.C.R. 161

The taxpayer, which was in the business of developing and selling real estate, acquired, in an arm's length transaction and for a purchase price of approximately $70,000, all the shares of a corporation ("Fraserview") whose sole asset was a parcel of land having a cost amount of approximately $7.5 million. Mara then wound-up Fraserview in accordance with s. 88(1) and immediately thereafter sold the land in an arm's length sale for approximately $3.0 million.

La Forest J., without providing detailed reasons, found that in these circumstances the property retained its character as inventory in the hands of the taxpayer with the result that it realized a non-capital loss on the sale.

Hickman Motors Ltd. v. The Queen, 95 DTC 5575 (FCA), rev'd 97 DTC 5363, [1997] 2 S.C.R. 336

Hugessen J.A. rejected the taxpayer's submission that s. 88(1) established that property that was depreciable property to a subsidiary was depreciable property to the parent corporation (the taxpayer) upon the winding-up of the subsidiary.

Tory Estate v. M.N.R., 73 DTC 5354, [1973] CTC 434 (FCA), briefly aff'd 76 DTC 6312, [1976] CTC 415 (SCC)

The word "distributed" was held not to include a sale of accounts receivable for valuable consideration.

Administrative Policy

2014 Ruling 2014-0530371R3 - Combination of credit unions

underline;">: Proposed transactions. Acquireco and Targetco, both of which are widely-held credit unions, wish to combine their businesses to form a single corporate entity by way of an asset sale governed by section XX of Act1. Accordingly:

- At XX on the Effective Date (and subject to separate treatment of shares of any Member exercising dissent rights): each class A and class C Share of Targetco will be exchanged for one class A and one Class D Share, respectively, of Acquireco; and each class D Share of Targetco will be redeemed for cash.

- At XX on the Effective Date as part of its winding-up, Targetco will transfer to Acquireco all its property.

- The Registrar will issue a Certificate of Business Acquisition pursuant to paragraph XX of Act1 showing that, on the Effective Date, Acquireco will have acquired the assets and assumed the liabilities of Targetco.

- Targetco will be deemed to have been dissolved on the Effective Date pursuant to section XX of Act1.

Rulings

Include that ss. 88(1)(a)(iii) and (c) apply to the winding-up. The summary states:

For the purposes of paragraph 88(1)(a), we should consider that not less than 90% of the issued shares in the subsidiary will be held by the parent "immediately before the winding-up" since all the shares of the subsidiary will be owned by the parent prior to the transfer of its assets and the assumption of its liabilities, and its ultimate dissolution… .

See summary under s. 137(4.1).

18 November 2014 TEI Roundtable, Q. E.4

A corporation is wound up into its parent and dissolved at a time that it had a right to receive a refund of an overpayment. Although its right to the refund thereby ceased. if "all returns have been filed up to the date of dissolution, the articles of dissolution indicate that the corporation will distribute its assets to the shareholder…after satisfying its creditors,… the shareholder is the rightful owner of the funds and the sole shareholder completes and returns a signed ‘Release and Indemnification' form to the CRA," then CRA "may" issue the refund to the parent. See summary under s. 164(1).

26 November 2014 T.I. 2014-0551641E5 F - Winding-up and subsection 42(1)

In accordance with IT-126R2, para. 5(b), a corporation is considered to have "been wound up" on the basis that it has been liquidated and the only reasons for not yet filing articles of dissolution is outstanding litigation. CRA considers that if the corporation subsequently settles the litigation by making a payment that otherwise qualifies as a deemed capital loss under s. 42(1)(b)(ii), it can claim that capital loss in the year of payment thereof (i.e., after it is considered for s. 88 purposes to have been wound up).

See summary under s. 88(2).

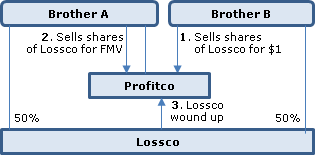

7 July 2014 T.I. 2014-0518561E5 F - Superficial loss

Brothers A and B, who each hold 50% of the shares of Opco, dispose of those shares to Holdco (wholly-owned by Brother A.) Opco is wound-up into Holdco (i.e., all assets are distributed and debts settled) under s. 88(1) and all indications are that Opco will be dissolved in short order after the end of the period terminating within 30 days of the disposition (the "Period"). Were the Opco shares disposed of within the Period for purposes of the superficial loss rule? CRA stated (TaxInterpretations translation):

[W]hen the particular requirements of paragraphs 5 and 9 of…IT-126R2 are satisfied and the capital loss sustained by Brother A is a real economic loss and not a theoretical or artificial loss…Holdco would be deemed to dispose of the shares...of Opco at the moment of the liquidation, being before the end of the Period.

2014 Ruling 2013-0505431R3 - XXXXXXXXXX

In connection with an extensive reorganization, a wholly-owned subsidiary of Pubco (Newco 2) will be wound-up into Pubco. Newco 2 will be dissolved, "but not before XX months have elapsed." Ruling that s. 88(1) will apply, with no qualifications re timing of application.

See more detailed summary under s. 55(3)(a).

1996 Corporate Management Tax Conference Round Table, Q. 2 (C.T.O. "Wind-Up Bump Dividends")

Discussion of the effect on the "bump" of dividends paid by subsidiaries of the target corporation prior to the acquisition of control of the target corporation.

29 August 1994 T.I. 933651 (C.T.O. "Adjusted Cost Base Bump")

An estate is not considered to acquire property from the deceased because of a bequest or inheritance for purposes of s. 88(1)(d.2). S.88(1)(d.2) generally will deem the estate of a deceased person to have acquired control of a corporation at the time that the deceased person last acquired control, or was deemed by s. 88(1)(d.2) to have last acquired control, of the corporation.

12 August 1994 T.I. 5-941549 -

Where there is a wind-up of a wholly-owned subsidiary that also owns 25% of the shares of the parent corporation, s. 88(1)(a) will deem the shares of the parent to have been disposed of by the subsidiary for proceeds equal to their cost amount. However, s. 84(3) will not apply because the parent will not have paid any amount to the subsidiary on the cancellation of its shares.

8 April 1994 T.I. 940841 (C.T.O. "Wind-up Without Dissolution")

Where a corporation has not been dissolved because it is involved in outstanding litigation, RC will accept that it has been wound up for purposes of ss.88(1) and (2) provided that: all of the corporation's assets and liabilities other than its rights and obligations under the outstanding litigation have been distributed or assumed by the shareholder; the sole reason for the delay in dissolving the corporation is the outstanding litigation; the corporation does not own or acquire any property or carry on any activity or undertaking (other than those required to pursue the litigation) after the distribution of its assets; and the corporation is dissolved within a reasonable time following the resolution of the litigation.

18 February 1993 T.I. 940244 (C.T.O. "Winding-Up of Corporation Without Share Capital")

The winding-up of a corporation without share capital by its sole member will not be governed by s. 88(1). Instead, s. 69(5) will apply.

92 C.R. - Q.31

The cost amount of a capital property that is debt is determined for purposes of s. 88(1)(a)(iii) pursuant to paragraph (b), rather than paragraph (e), of the definition of "cost amount" in s. 248(1).

1992 A.P.F.F. Annual Conference, Q. 16 (January - February 1993 Access Letter, p. 56)

Because a licence of property or rights by a parent to its subsidiary is not extinguished until after the holder and the issuer of the license become the same person, there is considered to be a distribution of property to the parent on the winding-up.

28 April 1992 Memorandum 912857 (C.T.0. "Winding-Up of a Canadian Corporation")

Where a corporation that otherwise would be wound up is not dissolved but is kept in existence merely to hold legal title to real estate for the beneficial owner thereof, RC will consider the corporation to have been wound-up for purposes of s. 88 provided that the only reason for the continued existence of the corporation is to hold legal title to the real property, it will not own or acquire any property or incur any liabilities, or engage in or carry on any activity other than the holding of the legal title to the real property, there will be no disposition of the outstanding shares of the beneficial owner to another person and the corporation will be dissolved immediately after the legal title to the real property has been conveyed to another person.

3 September 1991 T.I. (Tax Window, No. 8, p. 21, ¶1436)

S.84(3) does not apply to deem a dividend to have been paid when shares of a corporation owned by its wholly-owned subsidiary are cancelled on the winding-up of the subsidiary.

21 June 1991 T.I. (Tax Window, No. 4, p. 10, ¶1312)

Where a corporation ("S Co.") has owned real estate as a capital property and its shares are acquired by a corporation which includes gains from the sale of real estate in active business income, the bump under s. 88(1)(d) will be available on the winding-up of S Co. given that it is the facts surrounding the acquisition and holding of the property by the subsidiary rather than by the parent that are relevant.

15 April 1991 T.I. (Tax Window, No. 2, p. 24, ¶1201)

An incorporated insurance broker will be able to claim a reserve under s. 32 on its winding-up provided that s. 88(1) applies.

25 February 1991 T.I. (Tax Window, Prelim. No. 3, p. 14, ¶1126)

A corporation will be considered to have been wound up where its assets have been distributed to the shareholders, provided the corporation has not subsequently taken any action which would indicate that it will not be wound up.

27 December 1990 T.I. (Tax Window, Prelim. No. 2, p. 16, ¶1072)

Late s. 88(1)(d) designations are not permitted.

21 September 1990 T.I. (Tax Window, Prelim. No. 1, p. 11, ¶1004)

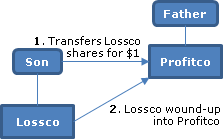

Where a taxpayer inherits the shares of an investment holding company ("Fatherco") from his father at a deemed cost equal to their fair market value on death of $1,000, transfers the shares of Fatherco to his own company ("Sonco") for a $1,000 promissory note, and then winds-up Fatherco and distributes the investment portfolio of Fatherco to Sonco, then for purposes of the bump under s. 88(1)(d), Sonco will be deemed under s. 88(1)(d.2) to have acquired control of Fatherco when the deceased father first acquired control of Fatherco given that the bequest of the Fatherco shares to the taxpayer was a non-arm's length transaction.

June 1990 Meeting of Alberta Institute of Chartered Accountants (November 1990 Access Letter, ¶1499, Q. 2)

Dividends paid to a foreign parent by the subsidiary prior to its winding-up will not reduce the "bump" under s. 88(1)(d).

15 January 1990 T.I. (June 1990 Access Letter, ¶1265)

In response to a proposal that Corporation A, which was in the business of building apartment buildings for investment purposes, indirectly acquire land held by Corporation B as inventory by acquiring the shares of Corporation B and then winding-up Corporation B, RC noted that in order for s. 88(1)(d) to apply, the property transferred to the parent must be capital property of the subsidiary at the time control is last acquired by the parent. Whether the real estate property held as inventory by Corporation B would become capital property upon entering into the share sale agreement with Corporation A would be a question of fact.

90 C.R. - Q40

The cost amount of inventory for purposes of s. 88(1)(a)(iii) is the value of such property immediately before the winding-up determined in accordance with the valuation method previously adopted by the subsidiary.

5 September 89 T.I. (February 1990 Access Letter, ¶1110)

The cancellation, on an s. 88(1) winding-up of a wholly-owned subsidiary, of a licence of intellectual property by the parent to the subsidiary, would not be considered a distribution, with the result that s. 88(1)(a)(ii) would not apply.

IT-488R "Winding-up of 90%-Owned Taxable Canadian Corporations"

IT-188R "Sale of Accounts Receivable"

An election under s. 22 is not available where debts are distributed to the parent on a winding-up under s. 88 because a sale does not take place.

IT-126R2, "Meaning of 'Winding-Up' ", March 20, 1995

4. Generally, the dissolution of a corporation is authorized by the applicable federal or provincial statute only where it can be shown that

(a) the debts, obligations or liabilities of the corporation have been extinguished or provided for, or that creditors have given consent to the dissolution and

(b) after the interests of all creditors have been satisfied, all remaining property of the corporation has been distributed among its shareholders.

5. Where the formal dissolution of a corporation is not complete but there is substantial evidence that the corporation will be dissolved within a short period of time, for the purpose of subsections 88(1) and (2) the corporation is considered to have been wound up. Evidence confirming that proposed dissolution would generally require proof that the requirements for dissolution, as outlined in 4 above, have been met. …

Articles

Boehmer, "Alternative to Butterfly Reorganization: Access to Investments of a Holding Company by Shareholders", Corporate Structures and Groups, Vol. IV, No. 3, p. 212

Description of considerations arising on the transfer of shares of a holding company to the operating company, followed by the winding-up of the holding company.

Roberts, Briggs, "Winding Up", The Taxation of Corporate Reorganizations, 1996 Canadian Tax Journal, Vol. 44, Nos. 2 and 3, pp. 533, 943.

Shafer, "Liquidation", 1991 Conference Report, c. 10.

Pister, "Paragraph 88(1)(d) Bump on the Winding-up of a Subsidiary", 1990 Canadian Tax Journal, pp. 148, 426.

Williamson, "Checklists: Corporate Reorganizations, Amalgamations (Section 87), and Wind-ups (Subsection 88(1))", 1987 Conference Report, c. 29.

Paragraph 88(1)(b)

Administrative Policy

2006 T.I. 2006-0196011C6

GAAR will not usually be applied to a pre-dissolution reduction of paid-up capital.

2003 APFF Round Table, Q.14 (No. 2003-003-0095)

Where an operating subsidiary previously had disposed of a depreciable property having a cost amount of $100,000 to its parent for the property's then nominal fair market value, and the subsidiary subsequently was wound up, the deemed ownership of depreciable property by the subsidiary on the wind-up under s. 13(21.2) would not apply for purposes of s. 88(1)(b), with the result that the $100,000 cost amount of the previously disposed-of depreciable property would not be included in the amount under s. 88(1)(d)(i) for purposes of determining whether there was a gain under s. 88(1)(b) on the wind-up of the subsidiary.

Paragraph 88(1)(c)

See Also

Harvest Operations Corp v. A.G. (Canada), 2015 ABQB 327

A last-minute requirement of a Target lender for its loan to be repaid on closing resulted in the purchase price being reduced by $35M and that amount being lent by an affiliate of the Buyer to the Target to fund the loan repayment. That was a mistake. The $35M purchase price reduction reduced the s. 88(1)(d) bump for partnership interests held by Target when it was amalgamated with Buyer to form Amalco, so that a capital gain was realized when the partnership interests were then transferred to repay debt owing by Amalco to the affiliate.

The potential bump problem was identified on the closing date, but the solution (involving the affiliate loan proceeds being lent instead to the Buyer and then applied to subscribe for Target shares so as to fund the third-party loan) was not identified until later. Dario J found that this precluded rectification.

See summary under General Concepts – Rectification.

Articles

Steve Suarez, "Canada's 88(1)(d) Tax Cost Bump: A Guide for Foreign Purchasers", Tax Notes International, December 9, 2013, p. 935

Changes to directly-held properties before acquisition of control ("AOC") (p. 941)

The requirement [in the midamble of s. 88(1)(c)] that eligible property be owned directly by the subsidiary at the time of the AOC means that the subsidiary can influence whether an 88(1)(d) bump will be available to the parent following the AOC and which properties would be eligible properties. Before the AOC, the subsidiary can change which properties it owns directly, sell or acquire properties, or take other steps to affect the parent's ability to claim an 88(1)(d) bump. It is often in the parent's interests to conclude an agreement with the subsidiary (or its shareholders) before the AOC to prevent the subsidiary from taking any actions that would impair the 88(1)(d) bump, or to require the subsidiary to take reasonable actions to enhance the 88(1)(d) bump. This form of agreement can add significant value to the parent.

Subparagraph 88(1)(c)(v)

Administrative Policy

31 October 2011 T.I. 2011-0422981E5 F

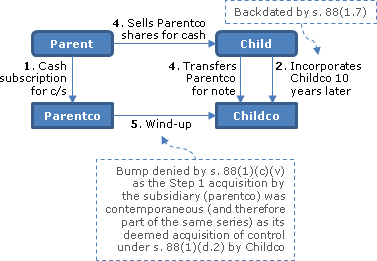

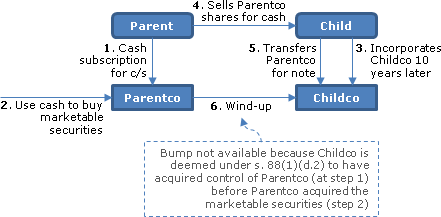

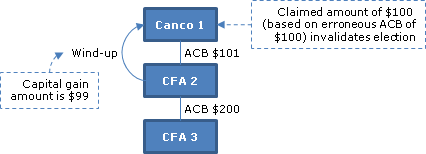

In 2000, an individual ("Parent") subscribed cash for common shares on the incorporation of a new asset management company ("Parentco"), with Parentco purchasing marketable securities a few months (or a few hours) later. In 2010, Parent sold his shares of Parentco to his child for FMV cash consideration (thereby realizing gain at which time the marketable securities are the only assets of Parentco.) The child shortly thereafter transferred the shares of Parentco to a newly incorporated corporation ("Childco") in consideration for a demand promissory note, and wound-up Parentco.

CRA found that the bump was not available because the marketable securities were deemed under s. 88(1)(d.2) not to be owned by Parentco at the time of its acquisition of control by Childco (as required in the midamble of s. 88(1)(c)): s. 88(1)(d.2) deemed Childco to have acquired control of Parentco when Parent acquired control of Parentco, and the marketable securities (which were subsequently acquired) "did not belong to Parentco at the moment of the acquisition of control of Parentco by Parent (being when Parentco was incorporated if Parent was the incorporator or otherwise when the first issuance of shares occurred in …2000)"... See the summary under s. 88(1)(d.2).

What if Parent owned the marketable securities, and acquired the shares of Parentco as consideration for the transfer to Parentco of the securities? After noting that the above response would not be different if control of Parentco was acquired on its incorporation, CRA stated (TaxInterpretations translation):

Conversely, if the moment when Parent acquired control of Parentco…instead was the moment of the first issuance of shares (for example, if Parentco was a "shelf" corporation….), the marketable securities which were transferred…belonged to Parentco at the moment when Childco was deemed to have last acquired control of Parentco under paragraph 88(1)(d.2). … [I]f each marketable security was a capital property, it would be necessary to determine if [it] belonged to the subsidiary without interruption from that moment until its distribution by Parentco to Childco… .

In the situation where…the marketable securities belonged to Parentco at the moment where Parent acquired the control of Parentco, subparagraph 88(1)(c)(v) would apply… . [T]he marketable securities would be acquired by Parentco from a person (Parent) who did not deal at arm's length with Childco (in accordance with subsection 88(1.7))… . Given that the acquisition of the marketable securities was made in consideration for this issuance of shares, it is difficult to consider that this acquisition was not part of the same series of transactions…as the acquisition of control of Parentco by Parent. Consequently, the marketable securities…constitute ineligible property by virtue of subparagraph 88(1)(c)(v).

…[S]ubsection 88(1.7) applies to deem Parent to not deal at arm's length with Childco even if they did not co-exist given that Parent did not deal at arm's length with Childco before the winding-up.

Articles

Steve Suarez, "Canada's 88(1)(d) Tax Cost Bump: A Guide for Foreign Purchasers", Tax Notes International, December 9, 2013, p. 935

Purpose of anti-stuffing rule in s

88(1)(c)(v) (p. 942)

Another rule is meant to prevent the parent from transferring property with accrued gains to a subsidiary on a tax-deferred basis before the AOC and eliminating those gains on the wind-up through the 88(1)(d) bump. This ''anti-stuffing'' rule disqualifies any property that the subsidiary acquires (as part of the AOC [acquisition of control] series) from either the parent or a person dealing NAL [not at arm's length] with the parent. That property, as well as any property acquired by the subsidiary in substitution for such property (an issue discussed below), is excluded from being eligible property.

Subparagraph 88(1)(c)(vi)

Administrative Policy

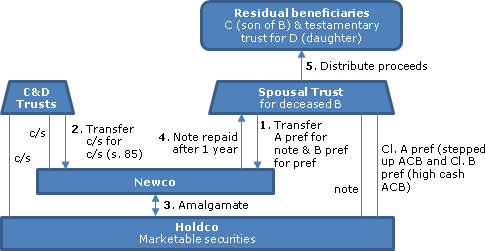

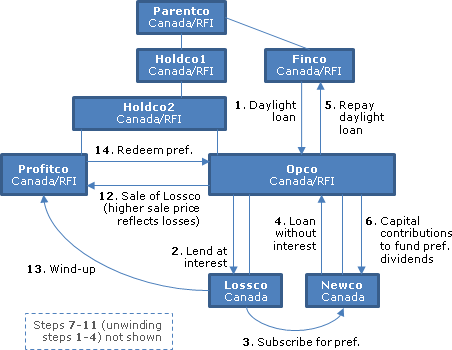

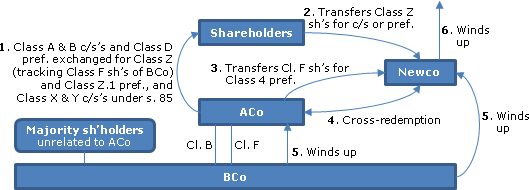

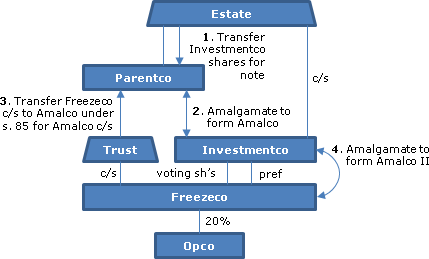

2014 Ruling 2013-0503611R3 - Post-Mortem Planning

Overview of transactions

A testamentary spousal trust (the "Spousal Trust") whose basis in pref shares of a portfolio investment company ("Holdco") was stepped up under s. 104(4)(a) on the death of the spouse in question (B), will engage in a "pipeline" transaction under which it will transfer those shares to a Newco for the "Newco Note" and for Newco pref, and the common shareholders of Holdco (being inter vivos trusts for her son (Trust C) and daughter (Trust D)) will transfer their Holdco common shares to Newco for Newco common shares. Newco will amalgamate with Opco (at least one year later) so that marketable securities of "Amalco" may be used to pay down the Newco Note. On completion of its administration, Spousal Trust will transfer its remaining assets to its beneficiaries (C and a testamentary trust for D).

Bump on amalgamation

Pursuant to ss. 87(11) and 88(1)(d), Amalco will designate an amount to increase the cost amount of some or all of the marketable securities. "The shares of the capital stock of Holdco will not be acquired by a person described in subclauses 88(1)(c)(vi)(B)(I), (II) or (III) as part of the series of transactions or events that includes the amalgamation of Holdco with Newco." No ruling was requested on the bump.

See detailed summary under s. 84(2).

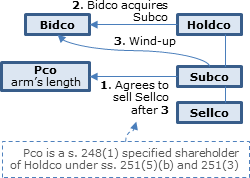

17 February 2012 T.I. 2011-0428561E5

following the death of Ms. X, who was the second wife of her previously-deceased husband, Holdco is controlled by A and B (children of the first wife), with the balance of 1/3 of the shares held by C, who is a son of Ms. X. They received such shares of Holdco from the estate at a cost equal to the shares' fair market value. C sells his shares of Holdco to A and B for cash (or, alternatively, a promissory note). A and B then transfer their shares of Holdco to Newco, and wind-up Holdco with a view to "bumping" the adjusted cost base of certain properties of Holdco.

Respecting a question as to whether s. 88(1)(c)(vi) would preclude such "bump," CRA noted that C would be a specified shareholder of Holdco during the series of transactions and before Newco acquired control of Holdco. CRA then simply states:

...if C receives from A and B property other than property distributed by Holdco to Newco or substituted property as consideration for the sale of his shares of the capital stock of Holdco then the bump denial rule in subparagraph 88(1)(c)(vi) should not be applicable ....On this point, it is worth noting that money is excluded from the notion of "substituted property" pursuant to subparagraph 88(1)(c.3)(iii) but not from the notion of "distributed property".

31 October 2011 T.I. 2011-0422981E5 F

in 2000, an individual ("Parent") subscribes cash on the incorporation of "Parentco" with Parentco purchasing marketable securities a few hours later. In 2010, Parent sells his shares of Parentco to his child, who then transfers the shares of Parentco to a newly incorporated corporation ("Enfantco"), and winds-up Parentco.

The bump will not be available to Enfantco on the winding-up of Parentco because Parent (and, thus, Enfantco under s. 88(1)(d.2)) will be considered to have acquired control of Parentco at the time of its incorporation (and before the issuance of any shares of Parentco to Parent), at which time Parentco will not hold the marketable securities. Furthermore, the marketable securities would be ineligible property under s. 88(1)(c)(v) where they were acquired by Parentco from a person not dealing at arm's length with Enfantco (i.e., Parent) as part of a series of transactions in which Enfantco last acquired control of Parentco.

19 March 2003 T.I.

For the purpose of clause 88(1)(c)(vi)(A) of the Act, the reference to the term 'acquire control' means the time that the parent actually acquired de jure control of the particular subsidiary corporation and not the time that the particular parent may otherwise be deemed, by paragraph 88(1)(d.2) or paragraph 88(1)(d.3), if applicable, to have 'last acquired control' of the particular subsidiary.

17 November 2000 T.I. 1999-000858 -

"The determination of whether a person is a 'specified person' for purposes of subclause 88(1)(c)(vi)(B)(I) of the Act is made at the time any property distributed to the parent on the winding-up or any other property acquired by any person in substitution therefor is acquired by that person."

29 October 1998 T.I. 5-982135 -

Where Target transferred a depreciable property to a newly incorporated wholly-owned subsidiary (Newco) in exchange for newly issued treasury shares, the transferred depreciable property would not be considered to be property that was acquired by Newco in substitution for the shares issued by it.

Articles

Paul Stepak, Eric C. Xiao, "The 88(1)(d) Bump – An Update", Draft paper for 2013 Conference Report (annual CTF conference).

Sequencing of steps (p. 30)

The steps set out in the plan generally include the repayment of historic Target debt, the cash-out or rollover of Target options and warrants and the exercise of dissent rights….all of the foregoing actions are typically structured to occur prior to transfer of Target shares to Bidco (and the resulting acquisition of control). This mitigates most concerns that the repaid debt or cashed-out historic securities could be substituted property, thus requiring further analysis.

Covenant of Target shareholders not to acquire additional buyer-group shares (pp. 31-2)

Where the ultimate buyer is a public entity or its equity or debt can be acquired without its control, the buyer should consider obtaining a covenant from shareholders of Target executing a voting support agreement that such shareholders will not acquire any equity or debt of the buyer group for a reasonable period of time after closing.

Such a covenant usually runs from the execution date of the voting agreement until some months after the closing of the transaction. The range varies but 12 to 24 months post-closing is typical. This helps guard against the argument that any subsequent acquisition by a former Target shareholder of buyer securities that are substituted property is part of the same series of transactions.

Covenant of Target shareholders not to acquire additional Target shares (p. 32)

A buyer will often identify certain former Target shareholders that will (or will likely) acquire substituted property as part of the series, and take comfort in knowing that those shareholders own in aggregate well less than 10% of Target's shares. Such shareholders may often have the ability to acquire additional Target shares in the interim period, either because Target is a public company or because the shareholders hold vested options in Target. In this circumstance, the buyer may also look for a covenant from such shareholders that neither they nor non-arm's length persons within their influence will exercise any options or otherwise acquire additional Target securities in the interim period….

Are rights under depositary agreements substituted property? (p. 31)

The depositary agreement is an escrow-like agreement that governs the treatment of cash and other assets deposited by Bidco, typically a few days before planned closing, which property will be dealt with in accordance with the plan of arrangement….

Thought needs to be given as to whether rights under the depositary agreement constitute substituted property. Stakeholders entitled to the proceeds held by the depositary, including shareholders of Target, as well as optionholders and warrantholders, are often not actually paid until after the amalgamation of Bidco and Target.

Once the money is on deposit with the depositary and the transaction closes, the funds are typically held for the benefit of the stakeholders (and not Bidco). Where it is clear that there would be no further recourse to Bidco, it should be the case that the right to the funds on deposit is not attributable property….

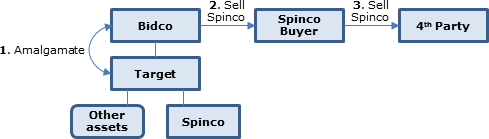

Non-specified persons in joint bid (p. 34)

[J[oint bidder/spin-out… arrangements all include the acquisition of distributed or substituted property by non-specified persons as part of the series… Where there is a majority-interest party in a joint bid, the minority interest investor will be a non-specified person, and both parties will be non-specified persons in a 50/50 arrangement. Similarly, the third party purchaser in a spin-out arrangement will also be a non-specified person. …

On-sale of spun assets to further (prohibited) buyer (p.35)

Consider the example where Amalco sells one of Target's divisions ("Spinco") to a third party ("Spinco Buyer"). Amalco will presumably have done its diligence to ensure that neither Spinco Buyer nor its shareholders are prohibited persons. However, if Spinco Buyer sells the acquired division (or Spinco Buyer itself is sold, subject to the 10% attributed property safe harbour) to a fourth party as part of the series, that sale (which is two degrees removed from the actual acquisition of Target) could taint the bump if the fourth party (or its shareholders, depending on the circumstances) is a prohibited person. … This will be the case even if the transferred division was not part of the bumped property!

Brian R. Carr, Julie A. Colden, "The Bump Denial Rules Revisited", Canadian Tax Journal (2014) 62:1, 273-99.

Purpose of bump denial rules (p. 276)

…Generally, the bump denial rules were introduced into the Act to prevent so-called back-door butterflies.

…A "purchase butterfly" facilitated the transfer of a portion of the assets of a corporation ("the transferor") to another corporation ("the transferee") in conjunction with the sale of the shares of either the transferor or the transferee without the incidence of corporate-level tax. A similar result could be obtained through a bump transaction pursuant to which a purchaser acquired a target corporation from its shareholder, bumped the tax cost of the target corporation's underlying non-depreciable capital property to its fair market value, and then sold the bumped property back to the shareholder without incurring corporate-level tax.

Steve Suarez, "Canada's 88(1)(d) Tax Cost Bump: A Guide for Foreign Purchasers", Tax Notes International, December 9, 2013, p. 935

Policy of bump denial rules (p. 946)

The policy behind the bump denial rule is deceptively simple: The parent should not be able to buy and wind up the subsidiary, claim an 88(1)(d) bump on its property, and then sell some of that property back to the subsidiary's former shareholders….

Prohibited persons/prohibited property (p. 947)

…At a core level:

- prohibited persons are shareholders of the subsidiary at a time that is both before the AOC and during the AOC series; and

- prohibited property is property distributed to the parent on the wind-up (that is, acquired from the subsidiary when it is merged or wound up into the parent).

The basic thrust of the bump denial rule is that property of the subsidiary that is distributed to the parent on the wind-up (herein, distributed property) should not, as part of the AOC series, be acquired by persons who were significant subsidiary shareholders at a time during the AOC series and before the parent acquired control of the subsidiary. The term ''significant'' for this purpose essentially means holding 10 percent or more of a class of the subsidiary's shares, individually or collectively.

Mark Jadd, Richard Lewin, "Anatomy of a Deal: Income Tax Issues Facing a Non-Resident Purchaser of a Public Canadian Corporation", International Tax (CCH), October 2006, No. 30 p. 9.

Nathan Boidman, "Unwinding or Otherwise Dealing With 'Sandwich' Structures Resulting From an International Merger or Acquisition", Tax Notes International, 10 May 2004, p. 601: Discussion of restrictions on bump where a Canadian corporation has been acquired by a foreign acquiror.

Clause 88(1)(c)(vi)(B)

Subclause 88(1)(c)(vi)(B)(II)

Administrative Policy

28 November 2010 , 2010 CTF Annual Conference Roundtable Q. , 2010-0386041C6

Is the reference to "all of the shares" in s. 88(1)(c)(vi)(B)(II) a reference only to shares of a subsidiary that is subsequently wound-up into its parent? CRA responded, "no:"

The reference to "all of the shares" in subclause 88(1)(c)(vi)(B)(II) is a reference to any shares owned by a person who acquires property distributed to the parent on the winding-up. The hypothetical person will be considered to be a specified shareholder of the subsidiary if it holds 10% or more of the issued shares of the subsidiary or of any other corporation that is related to the subsidiary and that has a significant interest in the issued shares of the subsidiary after applying the various presumptions in paragraphs (a) to (e) of that definition.

Articles

Paul Stepak, Eric C. Xiao, "The 88(1)(d) Bump – An Update", Draft paper for 2013 Conference Report (annual CTF conference).

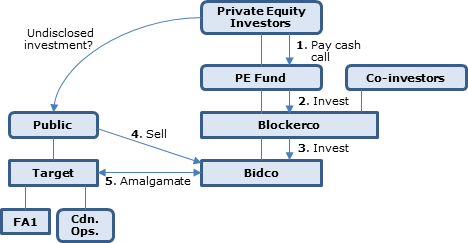

Cash calls on private equity investors who also are prohibited persons (pp. 33-4)

Private equity (PE) buyers can raise challenging bump issues, especially funds with more complicated ownership structures….

[A] PE fund will typically need to make a "capital call" from its investors each time it completes an acquisition. PE investors will not be specified persons because they will not be related to Bidco… . If the capital call results in an acquisition of property by a PE investor, and if such acquisition is part of the series, no bump would be available if any of the PE investors (alone or collectively) are prohibited persons.

[T]he 10% attributed property safe harbour is clearly applicable. However, where the test is not met, or where there is uncertainty, it will be necessary to diligence the investors of the fund to ensure that none of them are prohibited persons. This can be difficult, as EP funds are loathe to disclose the identity of their investors….

Confidentiality limitations on determining whether private equity investors are prohibited investors (p. 34)

[F]or confidentiality reasons, a fund cannot typically approach its investors to perform bump diligence until after a deal has been announced (i.e. signed). I f the fund discovers a cross-ownership issue in the interim period, it is unlikely to be able to walk from the deal (unless it specifically obtains this right when negotiating the arrangement agreement). Unless the fund can prevent an investor from participating in the particular investment, it may not have a way to consummate the transaction in a bump-friendly manner.

Brian R. Carr, Julie A. Colden, "The Bump Denial Rules Revisited", Canadian Tax Journal (2014) 62:1, 273-99.

Overview of aggregation rule (p. 283)

In addition, the bump will be denied if distributed property or substituted property is acquired as part of the series by two or more persons (other than specified persons) who, if treated as one notional person, would constitute a specified shareholder of the target at any time during the series and before the parent last acquired control of the target. This means that in analyzing whether the bump is available, in addition to specified shareholders, other persons acquiring prohibited property and their share ownership of the target (if any) should be considered. For example, employees could receive shares of a parent, or be issued employee stock options, as a bonus in the context of an acquisition such that the shares or options would not constitute specified property. If such employees owned in aggregate 10 percent or more of a class of shares of the target prior to its acquisition, the bump would be denied. No connection or relationship between the persons acquiring prohibited property for the purpose of this aggregation rule is necessary.

Aggregation of different property types (p. 284)

Moreover, any category of distributed or substituted property acquired as part of the series must be taken into account and aggregated. For example, if the employees referred to above (employees receiving stock options) held in total 6 percent of the shares of the target, and other shareholders of the target that in total held 4 percent of the shares of the target prior to its acquisition also subscribed for shares of an upstream foreign corporation as part of the series, the bump would be denied. In those circumstances, two or more persons who, if treated as one notional person, would be a specified shareholder, would have acquired substituted property. There is also no specific quantification relevant in respect of the distributed property or substituted property acquired by an aggregation of persons. The aggregation of persons need not acquire shares or options in respect of the acquiror that total at least 10 percent of the value of the target (for example). The relevant measure is the percentage of the shares of the target held prior to the acquisition of control by persons acquiring prohibited property as part of the series.

Look-through to pre-AOC subscribing partners (p. 284)

This aggregation rule can be relevant where the ultimate acquiror is a partnership such as a private equity fund. If the partnership raised equity financing for the acquisition by requiring its partners to subscribe for additional partnership units, the bump would be denied if the partners in aggregate held 10 percent or more of the shares of the target before the acquisition of control and as part of the series. Since the partnership units would be substituted property, an aggregation of persons (that, if treated as one notional person, would be a specified shareholder) would acquire substituted property as part of the series….

2012-0451421R3: "part of the relevant series" (p. 284)

In a recently released technical interpretation, the Canada Revenue Agency (CRA) has provided some comfort on the issue of whether substituted property acquired by persons described in subclause 88(1)(c)(vi)(b)(ii) would occur as part of the series. Specifically, in the document, the CRA provided an opinion (but not a ruling) that the acquisition of shares or debt of a parent (and other relevant entities) by persons that would not be described in clause 88(1)(c)(vi)(b) if subclause (ii) was ignored (for example, if the persons were not specified shareholders) would "not necessarily" occur as part of the relevant series….

Non-aggregation of shares held by non-arm's length persons (p. 285)

For the purpose of the application of the aggregation rule in subclause 88(1)(c)(vi)(b)(ii), shares held within a non-arm's-length group are not aggregated. That is, in determining whether a person is a specified shareholder, shareholdings of all non-arm's-length persons are aggregated. If the 10 percent threshold is met, then all non-arm's-length group members are specified shareholders of the target. If the 10 percent threshold is not met within the non-arm's-length group, in applying the aggregation test in subclause 88(1)(c)(vi)(b)(ii ), only the shareholdings of the persons actually acquiring distributed or substituted property are aggregated (not the shareholdings of non-arm's-length persons)….

Subclause 88(1)(c)(vi)(B)(III)

Administrative Policy

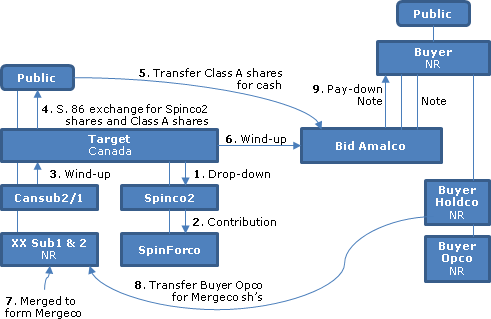

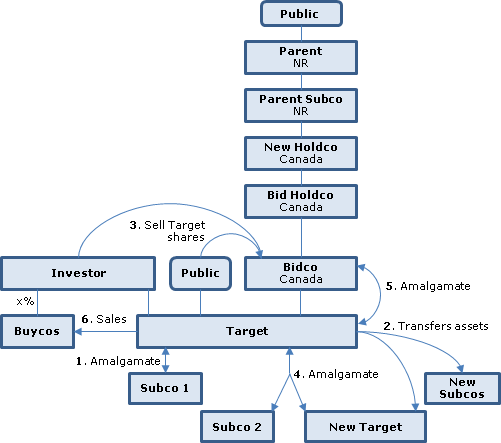

2013 Ruling 2011-0397081R3 - Bump Transaction

Buyer

Buyer is a listed non-resident corporation, and owns all but the exchangeable shares of a Canadian public corporation ("BuyerSub"). Following preliminary transactions carried out with a view to the Target acquisition, Buyer held Class A common shares and an interest-bearing note (the "BidAmalco Acquisition Note") of "BidAmalco" (which might have been a ULC).

Target/CanSub2 acquisition

Target, a Canadian public corporation, owned all the outstanding shares of CanSub2, which was a public company which it had acquired under a Plan of Arrangement under which, following a s. 86 exchange of CanSub2 shares for CanSub2 Class A and Spinco1 Shares and the CanSub2 Class A Shares were transferred to Target for cash and Target Shares. As a result of this arrangement, X2 acquired X% of the Target Shares. CanSub2 owns all the issued and outstanding shares of XXSub2 which in turn owns all the issued and outstanding shares of XXSub3. XXSub2 owes the XXSub2 Debt.

Target also owned all the outstanding shares of two other public companies which it had acquired (CanSub1 and CanSub3) and Spinco2 (which in turn owned SpincoXX). CanSub1 owned all the outstanding shares of XXSub1.

Target entered into lock-up agreements with the directors and officers of Target and X2, pursuant to which such persons cannot, among other things, purchase, directly or indirectly, for a period of X years after the Effective Date, Buyer Shares, exchangeable shares of BuyerSub, debt of Buyer or any other securities convertible or exchangeable into such securities or that derive their value, directly or indirectly, from such securities.

Preliminary to Target acquisition

Target transferred cash and certain Target assets to "Spinco2" in consideration for Spinco2 shares and the assumption of liabilities, electing under s. 85(1). Spinco2 subscribed cash for common shares of a wholly–owned non-resident subsidiary ("SpinForco") and of SpincoXX. (Various other preliminary transactions, including payment of exempt surplus dividends, and elections of subsidiaries to be disregarded entities for U.S. tax purposes, are not described.) CanSub1 and CanSub2 were then wound-up under s. 88(1) so that their assets could be bumped in 5 below.

Plan of Arrangement for Target

- Each Target Share held by a dissenting shareholder was deemed to be transferred to BidAmalco in consideration for a right to be paid fair value. It was a condition to the Plan of Arrangement that holders of not more than XXXXXXXXXX% of the Target Shares shall have exercised dissent rights.

- Target Options were transferred to Target for cash and Spinco2 Shares or physically exercised (with Target Shares acquired on such exercise automatically transferred to BidAmalco in consideration for cash; and an undertaking of BidAmalco to deliver Spinco2 Shares).

- Each Target Share not held by BidAmalco was exchanged, pursuant to section 86, for one Target Class A Share and one Spinco2 Share.

- Each Target Class A Share was transferred to BidAmalco for cash consideration.

- Target was wound-up into BidAmalco and BidAmalco designated an amount in respect of "Bumped Property" owned by Target immediately before the wind-up (including XXSub1 and XXSub2, being non-resident subsidiaries) in BidAmalco's return of income for its taxation year that includes the day of Target's wind-up.

- XXSub1 and XXSub2 merged to form Mergeco, with XXSub1 being the surviving entity.

- Buyer XX Holdco transferred the shares of Buyer XX Opco to Mergeco in consideration for common shares in the capital of Mergeco.

- BidAmalco transferred property (but not Mergeco shares) as partial repayment of the BidAmalco Acquisition Note.

Spinco2 has entered into an agreement with Buyer providing that it will not purchase, directly or indirectly, for a period of two years following the Effective Date, Buyer Shares, exchangeable shares of BuyerSub, debt of Buyer or any other security convertible or exchangeable into such securities or that derive their value, directly or indirectly, from such securities [see s. 88(1)(c)(vi)(B)(III)(2) and note shareholders-in-common of Target and Spinco2].

S. 88(1)(d) ruling

including statement that "property that will be distributed to BidAmalco on the winding-up will not be ineligible property for purposes of paragraph 88(1)(c) solely as a result of any of the Facts or Reorganization described herein."

Articles

Brian R. Carr, Julie A. Colden, "The Bump Denial Rules Revisited", Canadian Tax Journal (2014) 62:1, 273-99.

Specified shareholder must not also own 10% of shares of an acquiror (either alone or with non-arm's length persons): s. 88(1)(c)(vi)(B)(III)(1)

(p. 286)

First, a corporation (other than a specified person) that has a specified shareholder in common with a target is a prohibited person. That is, if a shareholder owns 10 percnt of a class of the shares of the target and also own 10 percent of the shares of an unrelated corporation that is not a specified person, the unrelated corporation cannot acquire distributed or substituted property as part of the series.

Aggregating to notional common specified shareholder: s. 88(1)(c)(vi)(B)(III)(2) (p. 286)

Further, where two or more persons (other than specified persons) would, if treated as one notional person, be a specified shareholder of a corporation after the acquisition of control, and such notional person would also be a specified shareholder of the target, such corporation will be a prohibited person. Consider the situation, for example, where (1) shareholder A owns 5 percent of a class of shares of the target and also owns 2 percent of the shares of a particular corporation, and (2) shareholder B owns 5 percent of the same class of shares of the target and also owns 8 percent of the same class of shares of the corporation. If shareholders A and B were treated as one notional person, the notional person would be a specified shareholder of the target and of the corporation. As a practical matter, in the context of public company transactions, it will be virtually impossible in many situations to monitor compliance with this rule.

Paragraph 88(1)(c.2)

Subparagraph 88(1)(c.2)(i)

Articles

Paul Stepak, Eric C. Xiao, "The 88(1)(d) Bump – An Update", Draft paper for 2013 Conference Report (annual CTF conference).

Parent relatedness to mooted specifed person from moment of its incorporation if not a shelf corp. (p. 19)

[A]t the time the parent is incorporated, technically it would not be related to anyone at that time such that no person will be related to the parent throughout the identified period. Note however that CRA's administrative practice related to this issue is to consider the incorporating person to control and therefore be related to a corporation on incorporation even where no shares are issued at that time. [fn 67: ...9800405 and ... 2002-0118145.]…Some care should be taken in certain jurisdictions where normal practice is for the incorporator to be a person unrelated to the buyer group (e.g. buyer's local counsel). While the argument might be made that the incorporator is acting as agent on behalf of the buyer, such an argument may be more difficult when applied to the purchase of an "off the shelf corporation.

Brian R. Carr, Julie A. Colden, "The Bump Denial Rules Revisited", Canadian Tax Journal (2014) 62:1, 273-99.

Related status before incorporator's share issuance (p. 297)

The joint [CBA/CICA] committee noted in its submission that there are deficiencies in the drafting of clause 88(1)(c.2)(i)(C) in that no person can be related to the parent corporation at the time that it is incorporated; shares of the parent must first be issued in order for a person to become related. On this interpretation, the legislative proposal would never have application. However, there is a principle of statutory interpretation against such a reading of the provision…. [citing Grunwald v. Canada, 2005 FCA 421]

Steve Suarez, "Canada's 88(1)(d) Tax Cost Bump: A Guide for Foreign Purchasers", Tax Notes International, December 9, 2013, p. 935

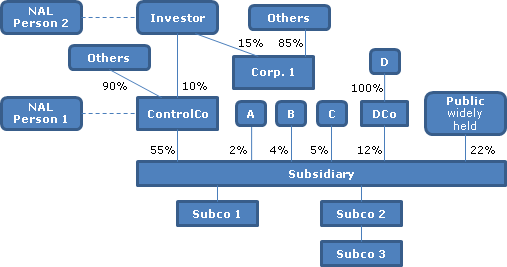

Examples of prohibited persons (pp. 947-8)

The most useful way to illustrate the wide range of potential prohibited persons is by using the example shown in Figure 6, as annotated by the discussion in the text accompanying footnotes 42-47 and 51.

1. Persons Owning (or Deemed to Own) 10-Plus Percent of a Relevant Class of Shares Pre-AOC [acquisition of control]

. The prohibited persons concept centers on persons who are specified shareholders of the subsidiary at a time that is both before the AOC and during the AOC series (herein, a pre-AOC subsidiary specified shareholder)….

- Ownership of Shares in Related Upstream Corporations: a person is deemed to be a specified shareholder of a particular corporation if that person meets the 10 percent share ownership (or deemed share ownership) threshold in any other corporation that both:

- is related to the first corporation; and

- has a ''significant direct or indirect interest'' in the first corporation — that is, an ''upstream'' related corporation. [fn 44: …Investor owns 10 percent of the shares of a corporation (ControlCo) that:

- is related to the subsidiary (since ControlCo has legal control of the subsidiary); and

- has a significant direct or indirect interest in the subsidiary. NAL [non-arm's length] Person 2 (who deals at NAL with Investor) is deemed to own Investor's shares of ControlCo, and is thus in the same position as Investor.]

2. Other Prohibited Persons

The prohibited person definition goes beyond pre-AOC subsidiary specified shareholders to include the following persons:

(a) any number of persons whose collective share ownership, if aggregated in the hands of one person, would make that one person a pre-AOC subsidiary specified shareholder [fn 45: For example, see A, B, and C collectively in Figure 6 since their shareholdings would, if aggregated, make the holder a specified shareholder of the subsidiary by virtue of owning more than 10 percent of its shares. If A, B, and C all acquired any prohibited property as part of the AOC series, the bump denial rule would apply.]

(b) a corporation, other than the subsidiary, in which a pre-AOC subsidiary specified shareholder is, at any time after the AOC and during the AOC series, a specified shareholder [fn 46: See, e.g., Corp. 1 in Figure 6, which is a corporation more than 10 percent of the shares of which are owned by a pre-AOC subsidiary specified shareholder (Investor) following the AOC.]; or

(c) a corporation, other than the subsidiary, if:

- persons described in (a) above acquired shares as part of the AOC series; and

- those acquired shares would, if aggregated in the hands of one person, make that single notional person a specified shareholder of that corporation at any time after the AOC and during the AOC series. [fn 47: For example, any corporation of which A, B, and C collectively own 10 percent or more of the shares of any class, if they acquired those shares as part of the AOC series.]

Again, in all cases, the parent and anyone dealing at NAL with the parent will not be a prohibited person.

Subparagraph 88(1)(c.2)(ii)

Articles

Brian R. Carr, Julie A. Colden, "The Bump Denial Rules Revisited", Canadian Tax Journal (2014) 62:1, 273-99.

Look-through specified shareholder definition v. s. 88(1)(c.2)(ii) entity approach (p. 288)

As a result of the interaction of subparagraph 88(1)(c.2)(ii) and the definition of "specified shareholder," it is not clear whether or when the bump denial rules may apply in respect of an acquisition by a partnership.

…For example,… if two or more shareholders of the target (other than specified persons) whose shareholdings in the target were at least 10 percent in aggregate were members of a partnership and the fair market value of their aggregate partnership interests was at least 10 percent of the fair market value of all partnership interests, the bump would be precluded as a result of the combined operation of sub-subclause 88(1)(c)(vi)(B)(iii)(2) and subparagraph 88(1)(c.2)(ii). That is, a deemed corporation of which two or more persons (other than specified persons), if treated as one notional person, would constitute a specified shareholder, and would also constitute a specified shareholder of the target, would have acquired prohibited property….

Partnership not qualifying as specified person (p. 289)

[T]he rule in subparagraph 88(1)(c.2)(ii) that deems a partnership to be a corporation is applicable to the definition of "specified person" (subparagraph 88(1)(c.2)(i)). For example, a partnership (such as a private equity fund) that establishes an acquisition corporation should be a specified person because, as a deemed corporation, the fund should be related to the acquisition corporation….[W]here a fund establishes a toehold position in a target of at least 10 percent, causing it to constitute a specified shareholder prior to the acquisition of control of the target… [i]f the fund does not control the acquisition corporation, it likely will not constitute a specified person. Consequently, any acquisition of attributable property (other than specified property) by the fund would preclude the bump.

Subparagraph 88(1)(c.2)(iii)

Clause 88(1)(c.2)(iii)(A)

Articles

Paul Stepak, Eric C. Xiao, "The 88(1)(d) Bump – An Update", Draft paper for 2013 Conference Report (annual CTF conference).

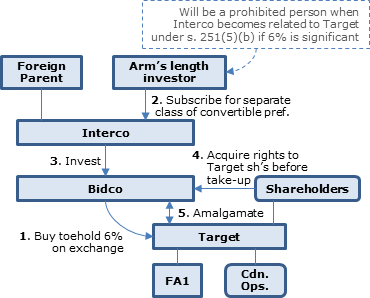

Meaning of "significant" in s. 88(1)(c.2)(iii)(A) (pp. 40-41)

[F]oreign Parent owns Interco, which owns Bidco. Bidco has acquired a toehold interest in Target - say 6%. Arm's Length Investor proposes to partially finance the transaction by subscribing for 100% o f a class of convertible preferred shares of Interco. [fn 104: Using convertible preferred shares in the example rather than simple preferred shares ensures that the shares are not carved out of the modified specified shareholder definition pursuant to paragraph 88(1)(c.8)] …

[I]t is reasonable to expect that at some point prior to the acquisition of control Bidco's paragraph 251 (5)(b) rights to acquire Target's shares will crystallize, and at that time Bidco, and therefore Interco, will be related to Target. If Arm's Length Investor is deemed to be a specified shareholder of Target at that time, then it is a prohibited person (as a pre-acquisition of control specified shareholder of Target that is not a specified person) who acquired bad property (the preferred shares) as part of the series, and the bump will not be available. …

Does Bidco's toehold interest in Target constitute a "significant direct or indirect interest" if it is below 10%? … Given that the lowest threshold for "significant interest" in the ITA is 10%, to us it is reasonable to argue that the threshold for "significant direct or interest interest" should be no less than 10%… .

Mitigate s. 88(1)(c.2)(iii)(A) risk by postponing kick-in date of conversion right (p.41)

One … approach [to mitigate risk in the above scenario] is to ensure that the non-specified person investor, i.e. Arm's Length Investor, does not become a specified shareholder until after the acquisition of control. This could be achieved by issuing convertible debt to Arm's Length Investor that is not convertible until after the acquisition of control.

Paragraph 88(1)(c.3)

Subparagraph 88(1)(c.3)(i)

Administrative Policy

2012 Ruling 2012-0451421R3 - Purchase of Target and bump

Ruling that Parent guarantees of the amended notes of Target will not constitute substituted property as described in s. 88(1)(c.3). See detailed summary under s. 88(4)(b).

31 January 2000 T.I. 1999-001096 -

"Where an earn-out or any similar type of agreement is clearly for the sole purpose of providing a mechanism to determine the fair market value of the shares of the subsidiary (where the fair market value of such shares cannot otherwise be determined), such property would not normally be considered as a property described in either subparagraphs 88(1)(c.3)(i) or (ii) of the Act. This would not be the case where an earn-out is used as a mechanism to distribute additional amounts based on the future sale or value of some particular property."

Articles

Paul Stepak, Eric C. Xiao, "The 88(1)(d) Bump – An Update", Draft paper for 2013 Conference Report (annual CTF conference).

10% attributable property test applied only during the series of transactions (p. 11)

[W]hen read in a textual, contextual and purposive manner, it would be reasonable to construe the "at any time" wording of the 10% test such that the test should not be affected by transactions or events that are not considered part of the series. This construction seems reasonable as a matter of statutory interpretation, and in that respect, the absence of an overt series rule in subparagraph 88(l)(c.3)(i) should not be considered to imply otherwise. …

[I]t is for the purpose of determining whether a person has acquired substituted property that subparagraph 88(l)(c.3)(i) extends the meaning of the concept of substituted property contained in subparagraph 88(l)(c)(vi). Accordingly, subparagraph 88(l)(c.3)(i) presumably must be read in the context of subparagraph 88(l)(c)(vi) and take into account the time period including the series referred to in that subparagraph.

Series for exchangeable shares of Target ending only when final exchange occurs (p.14)

[W]ould the bump potentially be available where Foreign Parent acquires Target in an exchangeable share transaction?...

[O]ne issue is that the initial issuance of exchangeable shares in consideration for Target shares and the final exchange of the exchangeable shares for Foreign Parent shares may be regarded as part of the same series….The final exchanges could be many years after Target is acquired and it would be difficult, if not impossible, to predict or control relative fair market values… .The Joint Committee's submission on this point was not addressed… .

No safe harbour for subsequent conversion of convertible debt (pp. 16-17)

Where the acquisition debt issued is a convertible debt, the subsequent conversion of such debt into shares of the borrower could still cause the application of the bump denial rule if, at the time of the conversion, the shares derive more than 10% of their value from distributed property on the basis that the subsequent conversion is part of the series that includes the winding-up of the subsidiary.

Earn-out as potential substituted property (p. 36)

[T]he concern is that an earn-out right could constitute substituted property as the value of the earn-out right is based on future performance of the business acquired….

A buyer should therefore be able to utilize an earn-out without putting a bump at risk, provided the buyer is comfortable (and can presumably demonstrate to CRA with evidence if asked) that the earn-out is structured solely to provide a mechanism to determine the fair market value of the shares at closing.

Brian R. Carr, Julie A. Colden, "The Bump Denial Rules Revisited", Canadian Tax Journal (2014) 62:1, 273-99.

Upstream equity or debt as substituted property (p. 280)

Any upstream equity interests (such as shares of the parent or other upper-tier corporate or partnership interests) or debt of any upstream entities owned after the acquisition of control will constitute substituted property since the value of such property will be considered wholly or partly attributable to distributed property.

Steve Suarez, "Canada's 88(1)(d) Tax Cost Bump: A Guide for Foreign Purchasers", Tax Notes International, December 9, 2013, p. 935

10%-plus properties as prohibited property (p. 951)

2. Property Deriving More Than 10 Percent of Its FMV From Distributed Property Post-AOC [acquisition of control]. Typically, the main concern with the scope of prohibited property is property that derives more than 10 percent of its FMV from distributed property at a time following the AOC and when owned by the prohibited person (herein, 10 percent-plus property). One of the most common examples of 10 percent-plus property is shares of an acquirer of the subsidiary (or of that acquirer's own controlling shareholder)….

Exclusions in s. 88(1)(c.3)

Some properties specified in the ITA that are 10 percent-plus property are excluded from being deemed substituted property. …

These are important exceptions, since they allow, for example, the parent to issue shares or debt in exchange for money in order to finance an acquisition of the subsidiary, without having to worry about whether the persons acquiring the shares or debt are prohibited persons. They also allow a taxable Canadian corporation to issue shares of itself directly in exchange for shares of the subsidiary, which permits Canadian acquirers to use their shares as currency to acquire the subsidiary without creating prohibited property. [fn 57: Moreover, since for these purposes a ''share'' includes a right to acquire a share (paragraph 88(1)(c.9) of the ITA), employee stock options to acquire subsidiary shares can be exchanged for employee stock options to acquire parent shares. Note, however, that this exception does not extend to stock options issued for other consideration — for example, options issued to subsidiary employees as an incentive to remain with the company post-AOC [acquisition of control].]

Exceptions do not extend to foreign securities (p. 953)

Unfortunately, none of these exceptions apply to shares or debt issued by non-Canadian corporations (other than the exception for debt issued solely for money). As such, securities of a foreign entity that is the direct or indirect acquirer of the subsidiary will generally constitute deemed substituted property, unless either:

- the securities are debt issued in exchange for money; or

- the foreign entity is so much larger than the Canadian target subsidiary that the foreign entity's securities cannot be said to derive more than 10 percent of their value from the Canadian target subsidiary's assets (that is, distributed property).

The result is that Canadian acquirers have an advantage over foreign acquirers in that they can use their shares and debt to pay for the shares of Canadian targets and still be able to claim the 88(1)(d) bump. If Canadian target shareholders who collectively hold 10 percent or more of the Canadian target's shares receive shares or debt of a foreign acquirer for their Canadian target shares, and if those foreign acquirer shares or debt derive more than 10 percent of their value from the Canadian target's properties, persons who in aggregate constitute a pre-AOC subsidiary specified shareholder will have received prohibited property, and the bump denial rule will apply. Hence, a foreign acquirer can generally use the 88(1)(d) bump only if it pays cash or if it acquires a Canadian corporation representing less than 10 percent of the acquirer's own value.

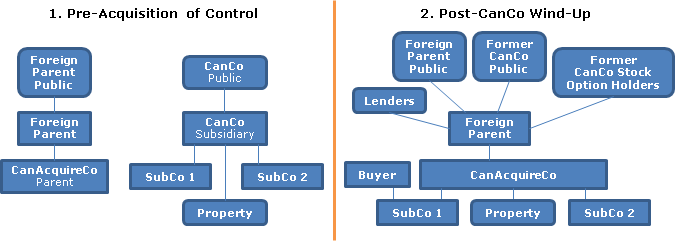

Example of problems arising on foreign acquisition (pp. 953-4)

Figure 9 illustrates some of the typical problems that can arise when a foreign acquirer (Foreign Parent) acquires a public Canadian target (CanCo) in exchange for Foreign Parent shares, using a Canadian corporation (CanAcquireCo):

- Foreign Parent shares would be prohibited property if more than 10 percent of their post-AOC FMV is attributable to CanCo's property. [fn 63: In ''exchangeable share'' transactions, CanCo shareholders receive exchangeable shares of CanAcquireCo that track the value of, and will ultimately be exchanged for, Foreign Parent shares. In such circumstances, while CanAcquireCo exchangeable shares may be ''specified property'' and thereby excepted from being prohibited property, the ultimate exchange of exchangeable shares for Foreign Parent shares would generally trigger the application of the bump denial rule if those Foreign Parent shares are 10 percent-plus property so as to be prohibited property….]

- Holders of CanCo employee stock options who exchange their options for Foreign Parent stock options will have acquired deemed substituted property (and thus prohibited property) if more than 10 percent of the options' post-AOC FMV is attributable to CanCo's property.

- A Foreign Parent receivable acquired by a lender as part of the AOC series would be a prohibited property if more than 10 percent of its post-AOC FMV is attributable to CanCo's property, unless it was issued solely for money.

- If after the wind-up, Foreign Parent disposes of SubCo 1 (a distributed property) to Buyer, it is important that Buyer not be a prohibited person. Buyer's own securities will also become prohibited property if they derive more than 10 percent of their FMV from the SubCo 1 shares (which are distributed property), creating the need to determine if Buyer's shareholders include former CanCo shareholders (prohibited persons). [fn 64: If Buyer securities are acquired as part of the AOC series by a single pre-AOC CanCo specified shareholder (a prohibited person) or by a number of smaller pre-AOC CanCo shareholders whose collective shareholdings would make a single holder of them a pre-AOC CanCo specified shareholder, the 88(1)(d) bump will be tainted. As described in Section VII.A.2, Buyer will itself be a prohibited person (tainting the bump if the purchase of SubCo 1 is part of the AOC series) if either:

- a single pre-AOC CanCo specified shareholder is also a post-AOC specified shareholder of Buyer (regardless of whether that shareholder acquired its Buyer shares as part of the AOC series); or

- as part of the AOC series, a number of smaller pre-AOC CanCo shareholders whose collective shareholdings would make a single holder of them a pre-AOC CanCo specified shareholder acquire enough Buyer securities to make a single holder of them a specified shareholder of Buyer following the AOC.] This is an important issue since one of the primary uses of the 88(1)(d) bump is on the post-wind-up sale of distributed property to third parties.

Carrie Smit, "Amendments to 'Bump' Rules May Permit Foreign Shares as Deal Consideration", International Tax, No. 68, February 2013, p.1

… where a foreign purchaser ("Forco") sets up a Canadian acquisition corporation ("Bidco") to acquire a Canadian target company ("Canco"), and the consideration to be paid for the Canco shares includes Forco shares, the tax cost bump will not be precluded provided that not more than 10% of the value of the Forco shares is attributable to Canco's property. … From a practical perspective, the Bump Amendment favours larger foreign purchasers (which are substantially more valuable than the Canadian target company) over smaller foreign purchasers.

… It is not entirely clear, however, how the timing in the Bump Amendment is intended to apply. The draft provision refers to property owned at any time after the acquisition of control where more than 10% of the fair market value of that property is, at that time, attributable to the target's property. If the consideration paid for the Canco shares includes Forco shares, and less than 10% of the value of those Forco shares is attributable to Canco's property at the time of the acquisition, does it matter if values fluctuate and, at a later point in time, more than 10% of the value of the Forco shares is attributable to Canco's property? The Bump Amendment does not even appear to have a same series concept in respect of this valuation issue. In order to preclude the bump, the Substituted Property must be acquired as part of the same series of transactions or events that includes the winding-up of Canco (the Forco shares issued as consideration for the Canco shares would clearly satisfy this series requirement where they are the actual deal consideration). The question as to whether the Forco shares constitute Substituted Property is governed by paragraph 88(1)(c.3), which does not include a series concept. It is not known whether post-closing value fluctuations over an unlimited time can determine whether the bump was available on a retroactive basis. In many situations, the bumped property will be transferred out of Canada quickly following the acquisition of control and winding-up (or amalgamation).

Subparagraph 88(1)(c.3)(ii)

Administrative Policy

31 January 2000 T.I. 1999-001096 -

"Where an earn-out or any similar type of agreement is clearly for the sole purpose of providing a mechanism to determine the fair market value of the shares of the subsidiary (where the fair market value of such shares cannot otherwise be determined), such property would not normally be considered as a property described in either subparagraphs 88(1)(c.3)(i) or (ii) of the Act. This would not be the case where an earn-out is used as a mechanism to distribute additional amounts based on the future sale or value of some particular property."

3 August 1998 T.I. 9727435

Respecting the acquisition by a public company (Aco) of shares of another public company (Bco) in a reverse takeover, CRA stated that "the shares of Aco would not be considered to be substituted property as substantially all of the value of those shares would not be attributable to property distributed on the winding-up (i.e. property of Bco."

Income Tax Technical News, No. 9, 10 February 1997

The words "wholly or partly attributable to" in subparagraph 88(1)(c.3)(i) are very broad and would apply, for example, to a share or interest in a corporation, partnership or trust which owns or has an interest in the subsidiary's property. However, shares of the parent issued as consideration for the shares of the subsidiary are expressly excluded from the rule.

The words "determinable primarily by reference to" in subparagraph 88(1)(c.3)(ii) are, we understand, intended to have a narrower meaning. As the Explanatory Notes confirm, subparagraph 88(1)(c.3)(ii) would apply to property such as "tracking" shares or debt, the value of which is somehow tied to the value of or proceeds from certain underlying property of the corporation. On the other hand, the provision would not ordinarily apply to conventional common or preferred shares or debt issued by the parent as consideration for the acquisition of the shares of the subsidiary.

Articles

Firoz Ahmed, "Substituted Property for Purposes of the Section 88(1)(d) Bump", Canadian Current Tax, Vol. 7, No. 7, April 1997, p. 70

Where a public corporation ("Smallco") makes a successful takeover bid for another corporation ("Bigco"), RC is prepared to rule that shares of Smallco issued to shareholders of Bigco will not be considered to be substituted property by virtue of s. 88(1)(c.3)(ii) if the fair market value of the gross assets of Smallco prior to the completion of the bid is greater than 10%, but less than 50%, of the fair market value of the gross assets of Smallco after the wind-up of Bigco.

Paragraph 88(1)(c.4)

Articles

Angelo Nikolakakis, Alain Léonard, "The Acquisition of Canadian Corporations by Non-Residents: Canadian Income Tax Considerations Affecting Acquisition Strategies and Structure, Financing Issues, and Repatriation of Profits", 2005 Conference Report (Canadian Tax Foundation), 21:1-61, at 21:24-25:

Policy for exclusion of shares or debt of foreign corporations (p. 280)

Why is it that shares of a non-resident Bidder should not constitute "specified property"? The answer to this question too seems to have nothing to do with the treatment of the proceeds of disposition to the Target stakeholders....

What is the problem, then, under paragraph 88(1)(c)? The Department of Finance may be considering whether or not it should be concerned about transactions by which non-Canadian assets are removed from Canadian corporate solution against tax attributes generated by consideration paid in foreign equity instead of cash or Canadian equity. At least with share consideration issued by a Canadian Bidder, the assets remain in Canadian corporate solution. In contrast, where non-Canadian assets are bumped and then distributed to a non-resident Bidder, there is no further Canadian tax claim with respect to these assets.

Subparagraph 88(1)(c.4)(ii)

Articles

Paul Stepak, Eric C. Xiao, "The 88(1)(d) Bump – An Update", Draft paper for 2013 Conference Report (annual CTF conference).

Is debt of Target non-specified property after it is amalgamated with Bidco? (pp. 14-16)

On a literal reading of old paragraph 88(1)(c.3), indebtedness of the subsidiary, the parent, and anyone up the chain of ownership is attributable property. Therefore, any loans made to finance the acquisition would constitute substituted property acquired as part of the series. A more technical concern arose with respect to historical debt of the subsidiary in that upon the winding-up or amalgamation the creditors arguably acquired new property, presumably as part of the series. Therefore, there was a concern that the bump could be denied if lenders to the buyer group or the subsidiary were prohibited persons.

Subparagraph 88(1)(c.4)(ii) was amended to extend to indebtedness issued for consideration that consists solely of money….

Generally, if the borrower is at a level anywhere above Bidco, no further issues should arise provided no reorganization is undertaken that involves the borrower as part of the series. However, if the debt is borrowed by Bidco itself, a technical concern arises on the subsequent amalgamation of Bidco and Target: has the holder of the Bidco debt acquired attributable property that is not specified property; namely, a debt of Amalco acquired as a result of the amalgamation (rather than debt issued for money)?

[P]aragraph 87(2)(a) deems Amalco to be a new corporation for the purposes of the lTA, and the cost rule in subsection 87(6) appears to presume that there is a disposition by a holder of debt of a predecessor upon an amalgamation. The deemed acquisition of the Amalco debt on the amalgamation does not appear to fit squarely into the definition of specified property as the Amalco debt is not issued as consideration for the acquisition of the Target shares, and it is not clear whether it continues to be issued solely for money. The same issue arises where the existing debt of Target or any vendor-take-back notes issued by Bidco to shareholders of Target become debt of Amalco as a result of the amalgamation.

Does paragraph 88(4)(b) resolve this potential issue?...

The Joint Committee made a submission on this point; however, no changes were made by Finance in response. It stands to reason that Finance believes that no changes are needed…

We also note that CRA has ruled favourably [fn 62: Document #2006-0205771R3 (E)] in the context of a short-form amalgamation dealing with the Amalco shares. CRA states that the Bidco shares issued to Target shareholders and which became Amalco shares on the Amalgamation did not constitute substituted property….

[W]e submit that paragraph 88(4)(b), when read in context, should reasonably be considered to have the effect of deeming the securities of Amalco to be the same as the securities of the predecessor corporation….

Alternatively, it may be argued that debt of a predecessor becoming debt of Amalco does not constitute an "issuance" of the debt. If the original debt was issued only for money, the "new" debt (representing the same obligation) may be debt "acquired" for something other than money, but it continues to be debt "issued" solely for money.

Is debt of Target non-specified property after it is wound-up into Bidco? (p. 16)

A similar issue could arise with respect to historic debt of the subsidiary assumed by the parent on the winding-up of the subsidiary. By virtue of paragraph 88(l)(e.2), subsection 87(6) is applicable to the substitution of the parent's obligation for that of the subsidiary. However, the above argument with respect to paragraph 88(4)(b) would not apply to debt of the subsidiary assumed by parent on the winding-up because paragraph 88(4)(b) only applies to amalgamations, not windings-up….

No safe harbour for subsequent conversion of convertible debt (pp. 16-17)

Where the acquisition debt issued is a convertible debt, the subsequent conversion of such debt into shares of the borrower could still cause the application of the bump denial rule if, at the time of the conversion, the shares derive more than 10% of their value from distributed property on the basis that the subsequent conversion is part of the series that includes the winding-up of the subsidiary.

Brian R. Carr, Julie A. Colden, "The Bump Denial Rules Revisited", Canadian Tax Journal (2014) 62:1, 273-99.

Dissent payment rights under a plan of arrangemnt as indebtedness (p. 292)

If the plan of arrangement ultimately receives shareholder approval, dissenting shareholders will be entitled to receive fair value for their shares at a later date. The dissent right represents indebtedness the value of which would be attributable to distributed property. If the plan of arrangement provides that the shares held by dissenting shareholders are to be acquired by the acquiror in exchange for payment, such indebtedness will constitute specified property since it will be issued by the parent as consideration for the acquisition of the shares of the subsidiary. In contrast, if the plan of arrangement provides that the shares held by dissenting shareholders are to be cancelled for payment, while such indebtedness will constitute substituted property, it will not be specified property. Thus, in the latter example, the acquisition of such substituted property (being the right of dissenting shareholders to receive fair value for their shares) will have to be taken into account in determining whether prohibited persons have acquired property….

Convertible debt as specified/determinable property (p. 293)