Subsection 87(1) - Amalgamations

Cases

Envision Credit Union v. The Queen, 2013 DTC 5144 [at 6275], 2013 SCC 48

The taxpayer ("Envision") was formed on the amalgamation under the Credit Union Incorporation Act (B.C.) (the "CUIA") of two credit unions. S. 23(b) thereof provided that "the amalgamated credit union is seized of and holds and possesses all the property ... and is subject to all the debts ... of each amalgamating credit union."

The taxpayer sought to avoid having this qualify as an amalgamation described in s. 87(1) of the Act (which required that all property of the predecessors, other than intercompany shares or debts, become property of the amalgamated corporation). To this end, a beneficial interest in some "surplus" real estate was conveyed to a numbered corporation subsidiary at the exact stipulated time for the amalgamation in the amalgamation agreement.

Rothstein J found that s. 23(b) of the CIUA, which should not be overriden by the amalgamation agreement in light of the obvious intent that amalgamated corporations would be responsible for their predecessors' liabilities, caused the amalgamated corporation (Envision) to be seized of its predecessors' properties, including the surplus properties, at the moment of the amalgamation. As to the resulting effect on the sale agreement for the surplus properties (para. 46):

At the moment of amalgamation, the predecessors ... no longer had separate legal personalities capable of fulfilling the terms of the sale agreements. While they were continued under the CUIA, they continued inside Envision. ... So, despite the fact that the agreements listed [them] as the vendors, at the moment of the amalgamation, the vendor was Envision.

In rejecting a "tracing" approach of the Court of Appeal which, in effect, treated the shares of the numbered company as representing the surplus properties, Rothstein J enunciated (at para. 57) the "basic rule of company law that shareholders do not own the assets of the company."

Guaranty Properties Ltd. v. The Queen, 87 DTC 5124, [1987] 1 CTC 242 (FCTD), rev'd 90 DTC 6363 (FCA)

A corporation ("Dixie") amalgamated in 1978 to form Forest Glenn, and Forest Glenn amalgamated in 1980 to form Guaranty Properties. A notice of reassessment which the Minister sent in 1981 in the name of Forest Glenn rather than Guaranty Properties in respect of the 1976 taxation year of Dixie was a nullity. "Pursuant to paragraph 87(1)(b) all of the liabilities of the predecessor corporation, Forest Glenn, immediately before the merger became liabilities of the new corporation, Guaranty Properties, by virtue of the merger. Therefore, after November 28, 1980 liability could no longer be affixed to Forest Glenn for the reassessment of Dixie's 1976 taxation year."

Allendale Mutual Insurance Co. v. The Queen, 73 DTC 5382, [1973] CTC 494 (FCTD)

Three insurance corporations were merged pursuant to a special Rhode Island statute, which provided that the three predecessors were "made and consolidated into" the taxpayer and that the corporate existence of the predecessors was "consolidated into and continued in [the taxpayer] which shall be deemed to be the same corporation as each of the" predecessors. Cattanach J. found that the effect of the statute was to create the taxpayer as a new corporation, with the result that there was a qualifying merger under s. 85I(1) of the pre-1972 Act. S."85I(1) does not contemplate that the predecessor corporations must be extinguished ... the paramount factor is that a new entity must emerge."

It was held that the requirement that the shareholders of the predecessors and the taxpayer be the same was met where there were no shareholders of the predecessors or of the taxpayer.

See Also

University Health Network v. The Queen, [2000] PTR 4181 (Ont S Ct J)

The amalgamation of two incorporated hospitals did not cause them to lose their tax-exempt status under the Retail Sales Tax Act notwithstanding that the act of amalgamation did not specifically state such exemption and instead merely indicated that the amalgamated corporation possessed all the property, rights, privileges and franchises and was subject to all liabilities, contracts, disabilities and debts of the amalgamating corporations.

National Bank of Canada v. B.C. (1990), 48 BCLR (2d) 485 (BCSC),

The Bank Act was found to contemplate that the amalgamation of two banks gave rise to the emergence or creation of a new entity in light inter alia to the reference in the Bank Act to the "creation" of the amalgamated entity. Accordingly, an amalgamated bank did not have an instalment base for purposes of the Corporation Tax Act (B.C.).

Loeb Inc. v. Cooper, Cooper and Cooper (1991), 5 OR (3d) 259 (Ont. Ct. G.D.)

The amalgamation under the provisions of the Canada Business Corporations Act of a tenant did not result in an assignment of the lease. Henry J. accepted (p. 270) the submission:

"that an amalgamation under these provisions does not extinguish the existence of any of the amalgamating corporations or create any new corporation. Instead, all the amalgamating corporations are continued as one corporation."

The Great Western Railway Co. v. Commissioners of Inland Revenue, [1894] 1 Q.B. 507 (C.A.)

The Great Western Railway Act, 1892 (U.K.) provided that the undertakings of two other railway companies should be amalgamated with and form part of the undertaking of the Great Western Railway Company, with the amalgamated companies to be dissolved as from the date of the amalgamation. Before finding that this transaction entailed "a conveyance on sale" of the assets of the two dissolved companies for stamp tax purposes, Kay L.J. stated (p. 514):

"It is said that the true effect of this arrangement was that there was a combination of the two companies; the difficulty that suggests itself at once is, how there can be a combination of two companies one of which is dissolved?"

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.4 In Envision Credit Union v. R., 2013 SCC 48, 2013 DTC 5144 (SCC), the Supreme Court of Canada held that it was not possible for the predecessors to structure an amalgamation that did not meet the condition in [s. 87(1)(a)] because the governing provincial statute stipulated that on an amalgamation the amalgamated company "is seized of and holds and possesses all the property, rights and interests" of the predecessors.

1.5 An amalgamation will not be disqualified under [s. 87(1)(c)] solely because certain shareholders of a predecessor corporation receive consideration that is not shares of the new corporation, such as cash, by virtue of exercising the statutory right available in certain jurisdictions to dissent to the amalgamation. Further, subsection 84(3) will not otherwise apply to deem a shareholder of a predecessor corporation to have received a dividend where the shareholder exercises its statutory dissent rights in respect of the amalgamation and receives payment for its shares from the new corporation. ...

1.6 Regarding the condition described in ¶1.1(c), the CRA will not ordinarily apply subsection 245(2) to an amalgamation that is undertaken to squeeze out minority shareholders whereby the redeemable preferred shares received by the minority shareholders are redeemed shortly after the amalgamation (see paragraph 28 of Information Circular 88-2, General Anti-Avoidance Rule – Section 245 of the Income Tax Act).

1.35 Where one predecessor corporation has a leasehold interest in a property owned by a second predecessor corporation, the application of section 87 to the amalgamation will only be accepted where subsection 13(5.1) is applied concurrently as if the new corporation is the same corporation as, and a continuation of, the first mentioned predecessor corporation. ...

2012 Ruling 2010-0355941R3

Under a BC plan of arrangement, a BC corporation ("SubcoTarget") is merged with its wholly-owned BC subsidiary ("Target") to form "Amalco" with the same effect as if they had amalgamated under section 269 of the Business Corporations Act (BC), except that the legal existence of Target does not cease and it survives the merger, Subco ceases to exist and the property of Subco (other than its shares of Target, which are cancelled) become the property of Target. Target and Subco are continued as one company. The parent of Subco ("Acquireco") receives one Amalco common share for each of its Subco common shares.

The purpose of having Target survive the merger under the plan of arrangement was to allow for an exchange of Target shares for shares of Acquireco to qualify as a reorganization for US income tax purposes for US shareholders of Target, although at the end of the day the Target shareholders received cash consideration from Acquireco instead.

Rulings that the merger will be considered an amalgamation (within the meaning of s. 87(1)) in the context of s. 87(11) ; and that pursuant to s. 87(2)(a), Amalco will be considered to have acquired each capital property of Target within the meaning of s. 87(11)(b).

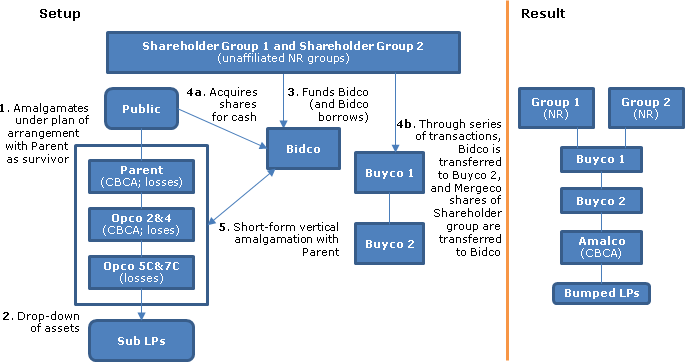

2006 Ruling 2006-0178571R3 -

Parent-group losses

/FIRPTA. Parent (a.k.a, Target and, following the merger below, Mergeco) is a CBCA public company. It and various direct Canadian subsidiaries (Opco 4 and Opco 2), as well as subsidiaries of Opco 4 (Opco 5C and Opco 7C) have non-capital or net capital losses). Opco 4 also has indirect US subsidiaries which may be relevant to the FIRPT issue referred to below.

Survivor merger

Under the first CBCA plan of arrangement, Parent, Opco2 and Opco4, and subsidiaries of Opco4 will merge with the same effect "as if the parties were amalgamated under section 184 and 186 of the CBCA, except that the separate legal existence of the Parent will not cease and the Parent will survive the Merger." This "approximates a merger of a parent corporation and its subsidiaries as could be effected under U.S. corporate statutes and this type of U.S. merger transaction is the basis for the short-form amalgamation provisions in the CBCA."

Drop-down to LPs for bump purposes

Mergeco then transfer various business assets to subsidiary limited partnerships utilizing the s. 97(2) election.

Funding of Bidco

An existing indirect non-resident shareholder of Mergeco (Shareholder 2) and a private international firm, an LLC, with no previous connection to the structure (Shareholder 1) jointly fund Bidco (a Canadian Newco), with Bidco also borrowing money, and Bidco will acquire convertible senior notes of Mergeco.

Acquisition of Mergeco by Shareholder 1 and 2 group

Under the second plan of arrangement:

- Bidco will transfer the convertible senior notes to Mergeco for cancellation

- The shareholder rights plan for Megeco will be cancelled

- The outstanding Mergeco options will be cash-surrendered to Mergeco

- Mergeco shares of dissenters will be transferred to Bidco for their fair value

- At the same time, all other Mergeco shares will be transferred to Bidco for cash consideration – except that Mergeco shares held by affiliates of Shareholder 2 will be transferred to Buyco 1 (a joint newly-formed 50/50 subsidiary of Shareholder 1 and 2) in consideration for shares of Buyco 1

- All the shares of Bidco held by the Shareholder 1 and 2 groups will be transferred to Buyco 1 in consideration for shares of Buyco 1, so that Buyco 1 is owned equally by the two groups

- The Mergeco shares held by Buyco 1 will be transferred to Buyco 2 (an affiliate of Shareholder 1) for shares of Buyco 2

- Mergeco will elect to cease to be a public corporation (and also elect under s. 256(9) in its tax return)

- Buyco 2 will transfer the shares of Mergeco to Bidco for shares of Bidco.

S. 88(1)(d) bump

Following the continuance of Bidco under the CBCA, Bidco and Mergeco will amalgamate in a vertical short form amalgamation to continue as Amalco.

Amalco will make a bump designation under s. 88(1)(d).

Purposes

The stated purposes include "(ii) to avoid any US FIRPTA…issue that could arise from the combination of the Parent and of the Subsidiaries, (iii) to consolidate, before the Effective Time [of the 2nd plan of arrangement], the Losses of the various Canadian entities into two corporations…."

Rulings

Ruling that s. 87 will apply to the merger pursuant to the 1st plan of arrangement; and s. 88(1)(d) bump ruling.

3 December 2003 T.I. 2003-004601

Where a predecessor corporation made a transfer to a partnership described in s. 97(2), the amalgamated corporation can file the s. 97(2) election in respect of the transfer.

10 April 2003 T.I. 2002-016977

Where a Japanese parent merges with his Japanese subsidiary which, in turn, holds shares of a Canadian company, the Japanese subsidiary will not be considered to have disposed of its assets, including the shares of the Canadian company, if the applicable corporate law in Japan is of a "continuation type". However, there may be a disposition of the share in the Japanese parent and subsidiary by the respective shareholders as a result of the merger before taking into account the possible effect of the addition of paragraph (n) to the definition of disposition.

2 February 2000 T.I. 2000-000338 -

The tax accounts of predecessor corporations do not flow through to the merged corporation in a non-qualifying amalgamation.

1997 Ruling 3-972405

An amalgamation under which a shareholder of one of the predecessors would be entitled to receive redeemable preferred shares which would be redeemed for cash shortly after the amalgamation, unless it dissented in which case it would receive a cash payment for its shares of the predecessor in accordance with section 190 of the CBCA, would qualify as an amalgamation irrespective whether or not the shareholder exercised its statutory rights of dissent.

12 August 1994 T.I. 5-941549 -

Although, on the amalgamation of a wholly-owned subsidiary with its parent where the subsidiary also owns shares of the parent, s. 69(1)(b) would ordinarily apply to deem the subsidiary to have received proceeds of disposition for the shares of the parent equal to their fair market value, para. 42 of IT-474R provides that where one predecessor corporation holds shares of another predecessor corporation, the cancellation of those shares on the amalgamation will not give rise to a gain or loss in the hands of the former corporation.

92 C.R. - Q.26

Where an amalgamation does not qualify under s. 87 and, under the governing corporate law, the amalgamated corporation is considered to be a continuation of its predecessors, the predecessor corporations generally will not be considered to have disposed of any assets held immediately before the amalgamation. However, shareholders of each predecessor generally will be considered to have disposed of their shares for capital gains purposes.

91 C.R. - Q.22

Where a shareholder of a predecessor corporation, who is entitled to only a fraction of a share of the amalgamated corporation, or who dissents to the amalgamation, receives cash, s. 87 will apply to the amalgamation.

89 C.P.T.J. - Q. 14

Because there is no provision like s. 87(1.2) deeming an amalgamated corporation to be a continuation of each predecessor, where a corporation has issued flow-through shares and amalgamates with another corporation prior to incurring the expenditures, the amalgamated corporation will not be able to renounce expenditures incurred subsequent to the amalgamation, unless the amalgamation was described in s. 87(1.1).

89 C.P.T.J. - Q15

Because Deltona indicates that an amalgamated corporation is incorporated on the amalgamation, a corporation that currently is disqualified as a JEC due to having once had more than 10 shareholders can be cleansed by an amalgamation.

IT-474R "Amalgamations of Canadian Corporations"

Articles

Henry Chong, "Surviving North of the Border: Structuring a Statutory Merger in Canada to Qualify as a U.S. Tax-Free Reorganization", Tax Management International Journal, 2012, p. 611

Respecting 2006-0178571R3, he states that the CRA position

appears to be based on the view that the reference in s. 87(2)(a) to "new corporation" referred to the amalgamated corporation, whether it was a continuation of the amalgamating corporation or, in the case of the ruling, a survivor….

Under this approach, s. 87(2)(a) deems a "new" corporation to exist for at least some Canadian tax purposes, regardless of its status under the corporate law. Based on the tax fiction that there is a "new" corporation, all of the assets and liabilities of the predecessor corporation can be said to have "become" the assets of the "new" corporation for tax purposes even if, for non-tax purposes, each corporation arguably continues into the merged corporation and accordingly continues to own or be liable for its assets and liabilities throughout. Based on [this ruling], this fiction would seem to apply equally where one of the corporations survives and continues to own its assets. The survivor would be deemed to be a "new" corporation….

Re 2010-0355941R3, it appears to produce "a reasonable result as there is nothing in the s. 87(2)(a) analysis that would be limited to cases where the parent is the survivor."

Stephen S. Ruby, "Recent Transactions of Interest", 2007 Conference Report (Toronto: Canadian Tax Foundation, 2008), 3:1-41, at 3:13-17

Discussion of the Chesapeake Gold Corporation acquisition of American Gold Capital entailing a "survivor style" merger.

Firoz Ahmad, "Amalgamation Versus Winding-Up Revisited", Canadian Current Tax, Vol. 15, No. 4, January 2005, p. 33.

Richards, "Amalgamations", The Taxation of Corporate Reorganizations, 1996 Canadian Tax Journal, Vol. 44, No. 1, p. 241.

Vesely, "Takeover Bids: Selected Tax, Corporate and Securities Law Considerations", 1991 Conference Report, c. 11.

Schwartz, "Statutory Amalgamations, Arrangements and Continuations: Tax and Corporate Law Considerations", 1991 Conference Report, c. 9.

Williamson, "Checklists: Corporate Reorganizations, Amalgamations (Section 87), and Wind-ups (Subsection 88(1))", 1987 Conference Report, c. 29.

Subsection 87(1.1) - Shares deemed to have been received by virtue of merger

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.9 … Subsection 87(1.1) deems the shares that are not cancelled on a short-form vertical or horizontal amalgamation to be shares of the new corporation. As a result, the condition in [s. 87(1)(c)] will be met in respect of these amalgamations. A merger that is a qualifying amalgamation by virtue of subsection 87(1.1) qualifies as an amalgamation for all purposes of section 87, including subsection 87(4)… .

Subsection 87(1.2) - New corporation continuation of a predecessor

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.56 In the case of an amalgamation to which subsection 87(1.2) does not apply, any undeducted balance in a predecessor corporation's resource expense pools (successored resource expenses) will only be deductible where the amalgamated corporation has filed the election (Form T2010) described in paragraph 66.7(7)(c). The amount of any successored resource expenses that the amalgamated corporation may deduct will be determined under the successor rules in subsections 66.7(1) to (5) and will generally be limited to specified resource income from the resource property acquired from the particular predecessor corporation.

Subsection 87(2) - Rules applicable

Paragraph 87(2)(a) - Taxation year

Cases

CGU Holdings Canada Ltd. v. The Queen, 2009 DTC 5685, 2009 FCA 20

Noël, J.A. rejected a submission of the taxpayer that s. 87(2)(a) deemed an amalgamation of three corporations (one of which was an NRO) to be a new corporation only for purposes of the computation of its income (Division B) and taxable income (Division C). Accordingly, the amalgamated corporation also was a new corporation for purposes of the NRO rules contained in Division F.

The Queen v. Pan Ocean Oil Ltd., 94 DTC 6412 (FCA)

The taxpayer was the result of a 1974 amalgamation of two Alberta corporations, one of which was a second successor corporation for purposes of s. 29(29) of the ITARs respecting exploration and drilling expenses made prior to 1972. Hugessen J.A. held that because the taxpayer was a new corporation for income-computation purposes and was not the second successor corporation, there was no provision of the Act permitting it to deduct oil and gas exploration expenses incurred by other taxpayers. With respect to the effect of the reasons of MacGuigan J.A. in the Guaranty Properties case, he indicated (at p. 6416) that they only established that "the provisions of paragraph 87(2)(a) are applicable only to the amalgamated company's computation of income under Division B (including the 'deductions to which it may be entitled') and, where necessary as a consequence thereof, to its computations of taxable income (Division C) and of tax (Division E)", and that the decision "should not be read as denying that the amalgamated corporation is to be deemed to be a new corporation for all purposes relating to the computation of its income".

The Queen v. Guaranty Properties Ltd., 90 DTC 6363 (FCA)

Following the amalgamation of the two predecessor corporations of the taxpayer under the laws of Ontario, the Minister issued a reassessment and then a notice of confirmation in the name of a predecessor corporation. In rejecting a submission by the taxpayer's counsel that the implication of s. 87(2)(a) was that the predecessor corporation had ceased to exist by virtue of the amalgamation (with the result that the reassessments were invalid) MacGuigan, J.A. stated (p. 6363):

"The principal effect of paragraph 87(2)(a) is that, for income tax purposes, the amalgamated corporation is deemed to be a new taxpayer with a fresh taxation year as of the date of amalgamation. In sum, nothing in the paragraph evinces an intention on the part of Parliament to deem that the amalgamating taxpayer ceases to exist, much less than it should be relieved of liability for its own income taxes prior to the date of amalgamation. That the paragraph, indeed the entire section, deals with the computation of income is also an inference to be drawn from the fact that it falls under Division B of Part I of the Act which deals with the computation of income, as opposed to [Division] A, which is concerned with liability for tax."

See Also

CGU Holdings Canada Ltd. v. The Queen, 2008 DTC 3347, 2008 TCC 167

The taxpayer was formed on the amalgamation of three predecessors, only one of which was a non-resident-owned investment corporation ("NRO"). Subsection 134.1(1) permitted a corporation that had been an NRO in its preceding taxation year to make an election. After referring (at para. 29) to the corporate law that "a predecessor remains in existence", Hershfield J. went on to find (at para. 33) that as s. 134.1 did not deal with the calculation of income or taxable income (as specified in s. 87(2)(a)), the case law was clear that the predecessor NRO had not ceased to exist by virtue of the amalgamation, so that the taxpayer, as a continuation of the NRO predecessor, could make the election in s. 134.1(1).

Administrative Policy

2 December 2014 Folio S4-F7-C1

New corporation

1.13

…[I]n the case of a qualifying amalgamation, paragraph 87(2)(a) deems the amalgamated corporation to be a new corporation for the purposes of the Act.

Tax year-end

1.14

Paragraph 87(2)(a) deems the first tax year of the amalgamated corporation to commence at the time of the amalgamation and the tax years of the predecessor corporations to terminate immediately before the amalgamation. Since paragraph 87(2)(a) also deems the amalgamated corporation to be a new corporation for purposes of the Act, the amalgamated corporation can select a new fiscal period (and thus tax year-end – see paragraph 249(1)(a)). Under paragraph 249.1(1)(a), a fiscal period of a corporation can be up to 53 weeks.

Effective date of amalgamation

1.15

… If the effective date of amalgamation is December 31, the first tax year of the new corporation will commence at the earliest moment on December 31, and the tax years of the predecessor corporations will end at midnight on December 30.

1.16

In certain situations, however, the CRA will consider an amalgamation to occur at a particular time on the amalgamation date even though no time is specified in the certificate of amalgamation. For example, if there is a series of transactions occurring on the same day, which is followed by an amalgamation on that same day for which no time is specified, the amalgamation will be considered to occur at the time specified in the arrangement insofar as the series occurs logically. Consequently, transactions that occur sequentially on the same day but prior to the amalgamation will be reported by the predecessor corporation in the tax year that is deemed to have ended immediately before the amalgamation.

1.17

…Where the duration of…short tax years of the predecessor corporations would be a matter of days, for instance where the normal tax year-ends are December 31 and the amalgamation takes place on January 2, and where there would be adverse implications in having short tax years, consideration should be given to requesting the Minister's concurrence to extend such year-ends… .

Acquisition of control followed by an amalgamation

1.19

If the acquisition of control of the target corporation and its subsequent amalgamation occur on the same day, and those transactions are the only transactions occurring on that day that are outside the normal course of the target corporation's business, the CRA will accept that the target corporation will have only one deemed year-end provided that:

(a) no election under subsection 256(9) is made in respect of the acquisition of control; and

(b) no time is specified in the certificate of amalgamation.

…Generally, a transaction would be considered to occur outside the normal course of business if, for example, the transaction is described in a closing agenda or other document describing the sequential order of transactions which must occur in order to carry out the amalgamation of the predecessor corporations.

1.20

Where a corporation amalgamates with a target corporation in the form of a horizontal amalgamation such that the former shareholders of the corporation acquire control of the new corporation, subparagraph 256(7)(b)(ii) will deem control of the target corporation to have been acquired immediately before the horizontal amalgamation. By virtue of subsection 249(4), the target corporation will be deemed to have a year-end immediately before the acquisition of control, being the time that is immediately before the time that is immediately before the horizontal amalgamation. Consequently, the horizontal amalgamation will result in two deemed year-ends for the target corporation: one under paragraph 87(2)(a) (being the time that is immediately before the horizontal amalgamation), and one under subparagraph 256(7)(b)(ii) and subsection 249(4). …

Multiple amalgamations

1.21

[A] short-form horizontal amalgamation of Corporation B with Corporation C is implemented to form Corporation BC. Then Corporation BC is amalgamated with Corporation A in a short-form vertical amalgamation to form Corporation ABC.

In such a situation, Corporation B and Corporation C will each be deemed by paragraph 87(2)(a) to have a tax year-end immediately before they amalgamate. Similarly, new Corporation BC will be deemed by paragraph 87(2)(a) to have a tax year-end immediately before its amalgamation with Corporation A.

15 April 2014 T.I. 2014-0527231E5 F - Acquisition of control and amalgamation

A plan of arrangement provides for the following transactions to occur on 18 January 20X1 and in the indicated order but without a particular hour for each transaction being specified:

- Sale of some assets of the corporation.

- Roll of its shares.

- Acquisition of its control (with no s. 256(9) election being made).

- Amalgamation with the acquirer.

After repeating general comments from 2014-0523251E5 F (quoted immediately below), and noting that s. 249(4)(a) deemed there to be a taxation year end immediately before the commencement of January 18, CRA stated (TaxInterpretations translation):

The moment of such taxation year end thus could only be before the effective hour of the transactions occurring before the amalgamation (taking the into account the logic of their ordering). … Therefore, the corporation must account for the tax consequences respecting the asset sale and share rollover transactions (which occurred before the acquisition of control and the amalgamation) in the taxation year of the corporation terminating before the amalgamation.

The corporation thus technically has two taxation years, one which is deemed to end at the end of 17 January 20x1, and the other which would end in the course of January 18… . The second…would be very short.

26 March 2013 T.I. 2014-0523251E5 F - Acquisition of control and amalgamation

Following a sale of assets of a corporation and a rollover of its shares on 18 January 20X1, an acquisition of control of the corporation occurs at 18:00 hours and it then is amalgamated with the acquirer. The plan of arrangement or closing agenda, as the case may be, does not specify particular times at which these transactions occur and the corporation elects under s. 256(9) for the acquisition of control to occur at 18:00 hours. Will multiple year ends occur as a result and, if so, in which taxation year will the preliminary transactions be considered to occur?

CRA stated (TaxInterpretations translation):

When a corporation does not effect transactions outside the ordinary course of business on the day of an amalgamation for which the certificate of amalgamation does not specify the hour of the amalgamation, we consider that the amalgamation generally will occur at the beginning of the day… . In contrast, our position is different when a plan of arrangement or a closing agenda provides for various transactions out of the ordinary course of business to occur on the day of the amalgamation in addition to the acquisition of control and the amalgamation… If the transactions are effected...in a logical order...[CRA] will consider that the amalgamation occurs at a moment determined in accordance with the logic of the transactions. … [Here] this moment follows the effective time of the acquisition of control. …

[B]y reason of the subsection 256(9) election, a deemed taxation year end occurs…at the moment immediately before 18:00 hours… .The corporation must take into account the taxation consequences of the sale transactions…and the share rollovers …in the taxation year…which terminated immediately before the effective time of the acquisition of control. …

Furthermore, given that the amalgamation occurs after all the transactions of January 18…, including the acquisition of control…at 18:00 hours, the second taxation year of the corporation terminates immediately before the amalgamation by virtue of paragraph 87(2)(a). …Therefore, the corporation technically has two taxation years which are deemed to end on January 18… . The second…is very short.

2010 T.I. 2010-0388081E5 -

On the amalgamation of public corporation ("Pubco") and a private corporation ("Holdco") to form Amalco, the three shareholders of Holdco acquire control of Amalco. In finding that this gave rise to two taxation year ends of Pubco, CRA stated:

[O]n the one hand…the taxation year of Pubco would be deemed to have ended immediately before the amalgamation of Pubco and Holdco pursuant to paragraph 87(2)(a)… . On the other hand, the group of three persons originally shareholders of Holdco would be deemed to have acquired, immediately before the amalgamation, control of Pubco pursuant to subparagraph 256(7)(b)(ii) of the ITA. Consequently, and in accordance with paragraph 249(4)(a)…the taxation year of Pubco…would be deemed to have ended immediately before that time. In other words, the deemed acquisition of control of Pubco resulting from the amalgamation would technically generate a deemed taxation year end with respect to Pubco immediately before the time that is immediately before the amalgamation.

1993 Memorandum 7-920752

The Rulings Directorate no longer is providing relief where taxpayers suffer unpredictable and unfavourable consequences pursuant to s. 87(2)(a).

3 July 1991 T.I. (Tax Window, No. 5, p. 13, ¶1334)

RC's assessing policies with respect to amalgamations are under review because of the decision in the Guaranty Properties case.

12 December 1989 T.I. (May 1990 Access Letter, ¶1221)

Although an amalgamated corporation is a new corporation for the purposes of computing income and tax otherwise payable, s. 87(2)(a) is not relevant in determining entitlement to VCT credits under section 8.3 of the Income Tax Act (B.C.).

Articles

MacDonald, "Amalgamations Following Guaranty Properties Limited", 1991 Canadian Tax Journal, p. 1399.

Paragraph 87(2)(b) - Inventory

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.27 …The new corporation will generally be expected to follow the inventory valuation method adopted by its predecessor corporations for the purposes of computing its income. Where, however, the new corporation can establish that another valuation method which is sanctioned by subsection 10(1) provides a truer picture of the new corporation's income, the new corporation may adopt such valuation method.

5 March 1992 T.I. (Tax Window, No. 17, p. 21, ¶1785)

Where two or more corporations amalgamate, the cost amount of the inventory of a predecessor corporation is its value determined for the purpose of computing its income for the taxation year which ended immediately before the amalgamation.

27 February 1991 Memorandum (Tax Window, Prelim. No. 3, p. 24, ¶1113)

An amalgamated corporation must use the same inventory valuation method as its predecessors. Where an amalgamated corporation has two predecessors with homogeneous inventories and different valuation methods, the amalgamated corporation will be justified in changing its method of valuing inventory in order to avoid distortion in the calculation of profit for accounting purposes.

Paragraph 87(2)(c) - Method adopted for computing income

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.98 In the case of an amalgamation or merger, there may not technically be a disposition of property from a predecessor corporation to the new corporation. Accordingly, subsection 69(13) deems the property of a predecessor corporation to have been disposed of immediately before the amalgamation or merger at its cost amount for the purposes of determining whether subsection 69(11) applies to the amalgamation or merger. The expression affiliated person is defined in subsection 251.1(1) except that, for the purposes of subsection 69(11), the affiliated person rules are to be read without the extended definition of control found in subsection 256(5.1). In other words, only de jure control is considered.

Paragraph 87(2)(d) - Depreciable property

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.30 …[T]he capital cost to the new corporation of depreciable property of a prescribed class acquired by it on the amalgamation will equal the cost amount, immediately before the amalgamation, to a predecessor corporation of each property included in that class by the new corporation. Cost amount of a depreciable property of a prescribed class is defined in subsection 248(1) and is generally the UCC of the class allocable to the particular property (on a pro rata basis, based on the capital cost of the particular property as a fraction of the capital cost of all properties in the class). The amount to be added by clause 87(2)(d)(ii)(A) is net of any deduction taken by the predecessor corporation under paragraph 20(1)(a) in computing its income for the tax year ending immediately before the amalgamation.

Paragraph 87(2)(e.1) - Partnership interest

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.42 Where the new corporation is not related to the predecessor corporation, subsection 100(2.1)… requires the predecessor corporation to recognize a gain on the disposition of any partnership interest which had a negative adjusted cost base immediately before the amalgamation. The rule in subsection 100(2.1) will apply even where the amalgamation is not a qualifying amalgamation for the purposes of section 87.

Paragraph 87(2)(ii) - Public corporation

Administrative Policy

2015 Ruling 2015-0577141R3 - Election to cease to be a public corporation

Under a Plan of Arrangement, the Canadian public target ("Pubco") was to be amalgamated with Bidco. The applicable rules did not permit the shares of Pubco to be delisted until three days after the effective date of the Plan of Arrangement.

CRA ruled that Amalco will cease to be a public corporation when it files an election, following the delisting, to cease to be a public corporation. See summary under s. 89(1) – public corporation.

Paragraph 87(2)(o) - Expiration of options previously granted

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.46 Where a corporation has granted an option (other than an option to acquire its shares, bonds or debentures), subsection 49(1) deems the corporation to have disposed of a property with an adjusted cost base of nil. However, if such an option is exercised in a subsequent tax year, subsections 49(3), (3.1) and (4) generally permit the corporation to move the recognition of the consideration for granting the option from the year of the option grant to the year in which the option is exercised. Where a predecessor corporation has granted such an option and that option is exercised following an amalgamation, there is no provision in the Act which allows the consideration for granting the option to be moved from the year of grant (for the predecessor corporation) to the year of exercise (for the new corporation). …

Paragraph 87(2)(q) - Registered plans

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.67 Pursuant to paragraph 87(2)(q), the new corporation is deemed to be the same corporation as, and a continuation of, each predecessor corporation for the purposes of sections 147, 147.1 and 147.2 and any regulations made under subsection 147.1(18). Therefore, in determining whether the new corporation can make an individual pension plan contribution in respect of services rendered by one of its employees to a predecessor corporation, subparagraph 8503(3)(a)(i) of the Regulations will apply following a qualifying amalgamation to include the period throughout which the employee of the new corporation was employed by, and received remuneration from, the predecessor corporation.

Subsection 87(2.1) - Non-capital losses, etc., of predecessor corporations

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.54 Where...where a subsidiary's losses have been carried forward to the parent under the provisions of subsections 88(1.1), (1.2) or (1.3), these losses can be carried forward to the new corporation on a subsequent amalgamation pursuant to section 87 involving the parent.

17 June 2003 T.I. 2002-017825

The non-capital losses of a subsidiary which amalgamates with its parent would be available to be applied against a forgiven amount arising on the forgiveness of a commercial debt obligation incurred by the subsidiary before the amalgamation. In particular, s. 87(2.1)(a) would apply to the application of s. 80(3): even though s. 80(3) is in Division B, not Division D, and s. 87(2.1)(a) applies for Division D and not Division B purposes, s. 80(3) applies for the purpose of computing Amalco's taxable income in Division D including a determination of Amalco's non-capital losses.

Subsection 87(2.11) - Vertical amalgamations

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.52 …[T]he new corporation formed on a qualifying vertical amalgamation can apply its post-amalgamation losses against the pre-amalgamation income of the predecessor parent corporation. Subsection 87(2.11) does not, however, permit losses of the predecessor subsidiary wholly-owned corporation to be applied against the taxable income of the predecessor parent corporation for any tax year prior to the amalgamation. It also does not permit the post-amalgamation losses of the new corporation to be applied against the taxable income of the predecessor subsidiary wholly-owned corporation for any tax year prior to the amalgamation. Effectively, following a qualifying vertical amalgamation, subsection 87(2.11) permits the parent corporation to be treated in substantially the same manner as if the subsidiary wholly-owned corporation had been wound up under subsection 88(1) into the parent corporation.

1.53 Subsection 87(2.11) may be applied to successive amalgamations of a parent corporation to allow the losses incurred by the new corporation to be carried back to offset the taxable income of the original predecessor parent corporation.

2011 Ruling 2011-0411821R3 -

a limited partnership ("BForLP") owns substantially all of the membership interests in a (presumably Netherlands) holding cooperative which owns all the shares of a non-resident corporation ("BForHoldco") which holds all of the shares of a taxable Canadian corporation ("BCo") which holds a majority of the voting common shares (Class B shares) of another taxable Canadian corporation ("Opco") with the balance of the common shares (Class A shares) and preferred shares being owned by a taxable Canadian corporation ("ACo") with which BCo deals at arm's length.

BForLP uses the proceeds of a daylight loan to make an interest-bearing loan (the "Sub Debt") to BCo, with BCo using the lent money to distribute paid-up capital (used by BCo for an income-producing purpose) to BForHoldco, and so on up the chain so that BForLP can fund the repayment of its daylight loan. BForHoldco then transfers its B shares to Opco in consideration for the issue of shares of a new class of common shares of Opco (with this "tuck-under" transaction not being ruled on), Aco effects a simultaneous s. 86 exchange of its shares in Opco (so as to preclude the tuck-under transaction giving rise to an acquisition of control of Opco by Aco), and BCo and Opco then amalgamate by way of a vertical short-form amalgamation.

Ruling that s. 87(2.11) will apply to the amalgamation.

22 June 1999 Memorandum 983352

Following a vertical amalgamation, the amalgamated corporation would not be able to carry back ITCs generated by it to reduce Part I tax of the subsidiary.

94 C.P.T.J. - Q.14

S.87(2.11) does not permit the carry-back of non-capital losses of a predecessor subsidiary corporation for utilization by the predecessor parent corporation.

Income Tax Regulation News, Release No. 3, 30 January, 1995 under "Subsection 87 (2.11)"

S.87(2.11) does not allow losses of a wholly-owned subsidiary corporation to be applied against the taxable income of its parent for taxation years of the parent prior to the amalgamation.

25 February 1993 T.I. (Tax Window, No. 30, p. 19, ¶2468)

S.87(2.11) permits an amalgamated corporation to carry back its non-capital losses to the predecessor parent corporation, but not to the predecessor wholly-owned subsidiary.

1992 A.P.F.F. Annual Conference Q.3 (January - February 1993 Access Letter, p. 51)

The purpose of s. 87(2.11) is to make the consequences of a vertical amalgamation similar to those for a winding-up.

Subsection 87(3) - Computation of paid-up capital

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.87 Although subsection 87(3) limits the aggregate paid-up capital of the issued shares of the new corporation, there is no specific provision which sets out how this aggregate paid-up capital is to be allocated to the issued shares of the new corporation. Where the streaming of paid-up capital to a specific class of shares of the new corporation has been done in order to accomplish a form of surplus strip, consideration will be given to the application of the general anti-avoidance rule in section 245. In addition, a transaction or series of transactions structured to avoid the cancellation of the paid-up capital of shares held by one predecessor corporation in another predecessor corporation will be subject to the application of the general anti-avoidance rule. In Copthorne Holdings Ltd. v. R., 2011 SCC 63, 2012 DTC 5007(SCC), the general anti-avoidance rule applied to a series of transactions whereby a parent and a subsidiary corporation were converted into sister corporations for the purposes of preventing the cancellation of the paid-up capital of the parent's shares in the subsidiary which would have occurred on a vertical amalgamation of the corporations.

80 C.R. - Q.29

RC may not object to the shifting of paid-up capital on an amalgamation if it is satisfied that the shifting is not primarily for the benefit of certain shareholders and the potential tax recovery will not have changed significantly.

Articles

Tetreault, "The Application of Subsection 87(3) in an Amalgamation Squeeze-out", Canadian Current Tax, November 1988, p. 41

The CBCA would appear to have provided less flexibility than the OBCA in avoiding a grind under s. 87(3) on an amalgamation squeeze-out.

Subsection 87(3.1) - Election for non-application of subsection (3)

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.88 When a new corporation has more than one class of shares, a proportional reduction of paid-up capital under subsection 87(3) may, in certain circumstances, result in an unintended shifting of paid-up capital between the classes of shares. Consequently, subsection 87(3.1) permits the new corporation to elect not to have the provisions of subsection 87(3) apply where both of the following conditions are satisfied:

(a) all of the issued shares of each class of shares (other than a class of shares all of the issued shares of which were cancelled on the amalgamation) of each predecessor corporation are converted into a separate class of shares of the new corporation; and

(b) after the amalgamation, the number of shareholders of each class, their proportionate ownership of each class, the number of issued shares of each class, the issued capital of each class for corporate law purposes and the terms and conditions of each class of shares of the new corporation are identical to those that existed for the particular class of shares of the predecessor corporation which were converted into that separate class of shares of the new corporation.

1.89 If the conditions in … (a) and (b) are satisfied and the new corporation elects in its return of income for its first tax year to have subsection 87(3.1) apply, each class of shares of the new corporation issued on the amalgamation will be deemed to be the same class as, and a continuation of, each class of shares of the predecessor corporation converted on the amalgamation for the purposes of computing their paid-up capital. Consequently, any paid-up capital reduction that applied to the specific class of shares of the predecessor corporation would flow through to the particular class of shares of the new corporation.

1.90 In the case of a short-form vertical or horizontal amalgamation, the CRA considers that the shares of the predecessor corporation which are not cancelled on the amalgamation have been converted into shares of the new corporation for the purposes of subsection 87(3.1).

Subsection 87(4) - Shares of predecessor corporation

Cases

Husky Oil Ltd. v. The Queen, 2010 DTC 5089 [at 6887], 2010 FCA 125

In order to accomplish a sale of a subsidiary of the taxpayer on a tax-deferred basis for a purchase price of $15.5 million payable in 25 years' time without interest, the subsidiary was amalgamated with a subsidiary of the purchaser, and the taxpayer received preferred shares which would be redeemable for $15.5 million in 15 years' time. In finding that the "gift portion" rule in s. 87(4) did not apply to deny rollover treatment to the taxpayer, Sharlow, J.A. noted that, as the purchaser dealt at arm's length with the taxpayer, there was no person related to the taxpayer who stood to benefit from the alleged shift in value to the purchaser resulting from the amalgamation, and stated (at para. 58) that this rule was:

"intended to deter a taxpayer from using the device of a corporate amalgamation to shift part or all of the value of a predecessor corporation to the amalgamated corporation if, but only if, a person related to the taxpayer has a direct or indirect interest in the amalgamated corporation that will be enhanced by the shift in value."

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.69 For greater certainty, the rollover under subsection 87(4) is not available to shareholders whose shares of a predecessor corporation are converted into shares of the amalgamated corporation on a non-qualifying amalgamation… .

1.70 The rollover provided for in subsection 87(4) will not be denied solely because a shareholder of a predecessor corporation receives cash or other consideration in lieu of fractional shares of the new corporation. … However, this choice is not available if the total amount or value of any non-share consideration received exceeds $200.

1.72 The allocation of cost described in [s. 87(4)(b)] may cause a shift of adjusted cost base from one class of shares of a predecessor corporation to a different class of shares of the new corporation… .

1.73 However, the CRA will not apply paragraph 87(4)(b) to reallocate the adjusted cost base of the shares of the new corporation if:

(a) the amalgamation agreement provides that the preferred and common shares of the predecessor corporation are to be converted into preferred and common shares, respectively, of the new corporation, or

(b) for a short-form amalgamation, the issued shares of one of the predecessor corporations become shares of the new corporation under the relevant corporate legislation. …

1.75 In situations where an amalgamation is used to shift all or part of the value of a shareholder's predecessor corporation shares to a person related to the shareholder whose interest in the new corporation will be enhanced by the shift in value, the rollover provided in subsection 87(4) will be denied in respect of that shareholder.

Example 5

The 87(4) exception can be illustrated by the following example.

A parent owns all of the shares of Pco, which have an aggregate adjusted cost base and fair market value of $100 and $1000, respectively. Child owns all of the shares of Cco, which have an aggregate adjusted cost base and fair market value of $500 and $1000, respectively. Pco and Cco amalgamate to form Aco, the shares of which have an aggregate fair market value of $2000. On the amalgamation, the parent is issued 50 shares of Aco with an aggregate fair market value of $500 and the child is issued 150 shares of Aco with an aggregate fair market value of $1500, such that there has been a shift of value of $500 from the parent to the child. Under paragraph 87(4)(c), the parent will be deemed to have disposed of the Pco shares for $600, being their aggregate adjusted cost base plus the gift portion of $500. Under paragraph 87(4)(e), the Aco shares received by the parent on the amalgamation will be deemed to have an aggregate adjusted cost base of $100… .

1.77

Where one predecessor corporation holds shares of another predecessor corporation, the cancellation of those shares on the amalgamation will not normally give rise to a gain or loss in the hands of the shareholder corporation.

2002 Ruling 2002-017716

Rights under a shareholder rights plan of Parent received by shareholders of Target on a triangular amalgamation of Target, a subsidiary of Parent and Parent would not constitute "consideration" for purposes of s. 87(4) given that the rights were of little or no value and given that:

"The Amalgamation Agreement will provide that the shares of Parent and Amalco ... will be the sole consideration for the exchange. It will not be a condition to the amalgamation that the Plan be in effect at the time of the amalgamation; instead, Parent will reserve the right to terminate the Plan in accordance with its terms before the amalgamation."

23 February 1999 T.I. 5-983222 -

The policy in IT-474R, para. 40 (respecting the maintenance of ACB when preferred and common shares of a predecessor are converted into preferred and common shares of the amalgamated corporation) will also generally apply where the amalgamation agreement provides for the conversion of numerous classes of preferred and common shares of the predecessor into numerous classes of preferred and common shares of Amalco.

Handbook on Securities Transactions, 94-110(E)

No reporting is required if, during an amalgamation, a shareholder receives cash or some other consideration totalling $200 or less, instead of a fractional interest in shares.

92 C.R. - Q.32

Where a corporation whose shares are owned by an individual amalgamates with a loss company whose shares are held by, and whose loan capital is owed to, a related individual, it is likely that ss.87(4)(c) to (e) will apply in respect of the amalgamation, in which case RC will not seek to apply s. 15(1).

25 August 1992, T.I. 921458 (April 1993 Access Letter, p. 144, C82-113)

The position in IT-474R, that s. 87(4) will not be applied where an amalgamation agreement provides that the preferred and common shares of a predecessor corporation are to be converted to preferred shares and common shares of the amalgamated corporation, will also prevail in the case of a short-form amalgamation even though in such instance the conversion takes place pursuant to the governing corporate legislation rather than pursuant to an amalgamation agreement.

Subsection 87(4.3) - Exchanged rights

See Also

Envision Credit Union v. The Queen, 2010 DTC 1399 [at 4585], 2010 TCC 576, aff'd 2012 DTC 5055 [at 6842], 2011 FCA 321, aff'd 2013 DTC 5144 [at 6275], 2013 SCC 48

Webb, J. found, in obiter dicta (at para. 89), that an amalgamated corporation resulting from an amalgamation that was not described in s. 87(1) was required to include in its preferred rate amount calculation the preferred rate amount balances of its predecessors, given that it was a continuation of them.

Subsection 87(7) - Idem [Adjusted cost base]

Cases

The Queen v. Dow Chemical Canada Inc., 2008 DTC 6544, 2008 FCA 231

The taxpayer ("Amalco") was formed on the amalgamation of two corporations, one of which ("UCCI") had previously incurred interest-bearing indebtedness to a financing affiliate within the Union Carbide group of companies and the other of which ("DCCI") was a Canadian subsidiary within the Dow group of companies that dealt at arm's length with UCCI and the financing affiliate up to the time of acquisition of control of that group by the Dow group of companies. The interest in question was incurred in the 2000 taxation year of UCCI, the next taxation year of UCCI ended in 2001 with the acquisition of its control by the Dow group, and its next taxation year ended in 2001with its amalgamation.

In finding that s. 78(1) applied to Amalco, Noël, J.A. rejected [at para. 31] the submission of the taxpayer "that Amalco should be viewed as having incurred the obligation back in 2000, but without regard to the non-arm's length relationship that prevailed at that time" after having noted [at para. 30] that under s. 87(7)(d) "an amalgamated corporation stands in the shoes of its predecessor insofar as previously incurred debts are concerned as of the time when they were incurred".

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.58 Since paragraph 87(7)(d) provides that the provisions of the Act apply as if the new corporation had incurred or issued the debt at the time it was incurred or issued by the predecessor corporation, subsection 78(1) may apply to the new corporation in respect of unpaid interest on a debt that is inherited by it from a predecessor corporation [citing R. v. Dow Chemical Canada Inc., 2008 FCA 231, 2008 DTC 6544 (FCA).]…

1.59 Where control of a corporation is acquired and that corporation makes a designation under paragraph 111(4)(e) to realize an accrued foreign exchange gain on a foreign currency denominated debt that arises because of the application of subsection 111(12), the new corporation formed on a subsequent qualifying amalgamation of that corporation would, under paragraph 87(7)(d) and for the purposes of subsections 40(10) and (11), be considered to be the corporation that realized the gain in respect of the foreign currency denominated debt under paragraph 111(4)(e) and subsection 111(12). As a result, no double taxation of the same gain would arise when the new corporation actually repays the debt.

Subsection 87(8) - Foreign merger

Articles

Mark, Thon-That, "Cross-Border Reorganizations", International Tax Seminar, IFA, 19 May 1999, c. 6.

R. Ian Crosbie, "Canadian Income Tax Issues Relating to Cross-Border Share Exchange Transactions", 1997 Corporate Management Tax Conference Report, c. 12.

Schwartz, "Tax-Free Reorganizations of Foreign Affiliates", 1984 Canadian Tax Journal, November-December 1984, p. 1039.

Subsection 87(8.1)

Administrative Policy

2 June 2003 T.I. 2003-001331

The position on receipt of cash in lieu of fractional shares on an amalgamation that is intended to be governed by s. 87(1), as described in paragraphs 38(b) and 39 of IT-474R, also applies to a foreign merger, as defined in s. 87(8.1).

25 August 2000 T.I. 2000-002624

Confirmation that there was a qualifying "foreign merger" where Canco launches a share-for-share exchange takeover bid to acquire shares of Target (a U.S. corporation) and, following completion of the bid, it carries out one of various described types of mergers with Target, including (in the situation where it has acquired more than 90% of the outstanding shares of Target) causing a new U.S. subsidiary of Canco to be merged into Target with the remaining Target shareholders receiving shares of Canco.

2000 Ruling 2000-002395 -

A vertical merger between a US corporation with a Canadian branch business ("Absorbco") and its US parent ("Subco 3") under which Absorbco survives the merger, the US parent of Subco 3 exchanges its shares of Subco 3 for shares of Absorbco, and the shares of Subco 3 are cancelled, would qualify as a foreign merger. Accordingly, unless the non-resident parent of Subco 3 elects otherwise, ss.87(a) and 87(4) will apply to the non-resident parent.

28 February 2000 T.I. 1999-001436 -

A foreign triangular merger qualified as a foreign merger notwithstanding that shareholders of the target would receive shares both of the merged company and the acquisition company.

14 December 1998 T.I. 981130

Where Subco A, Subco B and Parentco are all resident in the U.S. with Subco A being a wholly-owned subsidiary of Parentco, Parentco holding less than 10% of the shares of Subco B and the remainder of Subco B's shares being held by Canco, a merger of Subco A with Subco B as a result of which Subco A is the surviving corporation, with Parentco not receiving any shares of Subco A in exchange for its Subco B shares and Canco receiving shares of the amalgamated corporation in exchange for its shares of Subco B, would be a qualifying foreign merger.

Robert D'Aurelio, "International Issues

A Revenue Canada Perspective," 1990 C.R., p. 44: 13:

...it is the department's view, after giving consideration to the intention of subsections 87(8) and (8.1), that the "new foreign corporation" referred to in those subsections would include the surviving entity of an absorptive merger in the United States. This is a situation in which, on the effective date, every disappearing corporation that is a party to the merger is absorbed by the surviving corporation, and the surviving corporation automatically becomes owner of all real and personal property and becomes subject to all liabilities, actual or contingent, of each disappearing corporation. Such a reorganization will qualify as a "foreign merger" if all or substantially all of the shares of the capital stock of the disappearing corporation and the surviving corporation (except any such shares owned by any of those corporations) are exchanged for or become shares of the capital stock of the surviving corporation (that is, the "new foreign corporation").

84 C.R. - Q.50

Where one or more predecessor corporations continue in the form of one corporate entity, that corporate entity is considered to be a new foreign corporation.

Subsection 87(8.2) - Absorptive mergers

Administrative Policy

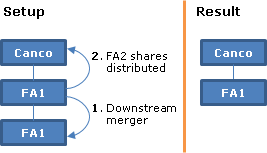

4 March 2013 Memorandum 2012-0449371I7 - Downstream absorptive merger

In 2006, a wholly-owned CFA (FA1) of Canco merged with a wholly-owned subsidiary (FA2) of FA1, with FA2 as the surviving corporation under the corporate law of the foreign jurisdiction (i.e., a downstream merger).

In accordance with the corporate law of that foreign jurisdiction, the shares of FA2 held by FA1 were distributed to Canco and the shares of FA1 were cancelled; all the property held by FA1 immediately before the merger was transferred to FA2 at the time of the merger; and FA1 ceased to exist after the merger.

CRA noted that draft s. 87(8.2) applied to both upstream and downstream mergers, and that there was no implication in the parenthetical exclusion in s. 87(8.1)(c) that the shares of FA2 be cancelled on the merger rather than being distributed to Canco.

As "Canco did receive consideration for its disposition of the shares of FA1 in the form of the FA2 shares it received," s. 87(4)(a) applied to the disposition by Canco of its FA1 shares (assuming that Canco did not elect to have s. 87(8) not apply), rather than draft para. (n) of the definition in s. 248(1) of disposition applying to deem Canco to have not disposed of its shares of FA1. However, draft para. (n) applied so tht FA1 did not realize gain (or loss) on its shares of FA2.

Subsection 87(8.3)

Articles

Edward A. Heakes, "Another Wave of Foreign Affiliate Proposals", International Tax Planning, Volume XVIII, No. 4, 2013, p. 1275

Avoidance of s. 85.1(4) eliminated (p. 1276)

It is currently arguably possible to avoid this limitation [in s. 85.1(4) by utilizing a triangular merger structure and relying on the tax-deferred treatment under the foreign merger rules contained in section 87, rather than on subsection 85.1(3). The July 12 Proposals would add a new restriction to the foreign merger rules to deny tax-deferred treatment of the shareholder where the shares of the merged company are excluded property and the shares or substituted property are sold to an arm's length person (or to a partnership that has an arm's length person as a member) as part of the same series of transactions….

Subsection 87(9) - Rules applicable in respect of certain mergers

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.12 … In general terms, this [s. 87(9)(c)(ii)] additional amount is equal to the amount by which the tax cost of the assets (less liabilities) of the new corporation immediately after the amalgamation (as described in subclause 87(9)(c)(ii)(A)(I)) exceeds the total of the adjusted cost bases to the parent of the shares of the predecessor corporations owned by it immediately before the amalgamation (referred to in this paragraph as the excess). The parent may choose how the excess is to be allocated to the different classes of shares owned by the parent in the new corporation. In making this allocation, the amount of the excess designated in respect of a particular class of shares cannot exceed the amount, if any, by which the fair market value of the shares of the particular class issued on the amalgamation exceeds the cost of those shares to the parent as otherwise determined. In addition, the aggregate of amounts designated in respect of all classes of shares cannot exceed the amount of the excess. The excess may be added to the adjusted cost base of the shares owned by the parent only if the parent makes a designation in respect of those shares for the tax year in which the amalgamation occurred in its return of income for that year.

5 February 1993 T.I. (Tax Window, No. 29, p.18, ¶2434)

The cost amount of Canadian resource properties for purposes of s. 87(9)(c) is nil irrespective whether or not there are undeducted resource pools.

24 June 1991 T.I. (Tax Window, No. 4, p. 7, ¶1315)

Discussion of reorganization in which the "bump" is unavailable because after the amalgamation the parent does not own all the shares of the amalgamated corporation.

Articles

Schwartz, "Statutory Amalgamations, Arrangements and Continuations: Tax and Corporate Law Considerations", 1991 Conference Report, c. 9.

Richler, "Triangular Amalgamations", March/April 1985 Canadian Tax Journal, p. 374

RC has been willing to accommodate transactions whereby option holders and debenture holders of a predecessor corporation in effect receive options or debentures of the parent on a rollover basis, but it has been unwilling to accede to arguments that the "new shares" referred to in s. 87(9)(c) refer only to the shares of Amalco received by the parent in exchange for its previous shareholding in a predecessor.

Subsection 87(10) - Share deemed listed

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.79 In certain amalgamations, the shares of a predecessor corporation which were listed on a designated stock exchange may be temporarily exchanged for shares of the new corporation which are not listed on a designated stock exchange. Subsection 87(10) deems such temporary shares to have been listed on a designated stock exchange provided that the new corporation is a public corporation and the temporary share is redeemed, acquired or cancelled within 60 days following the amalgamation. This deemed listing of the temporary shares of the new corporation is applicable for the purposes of determining whether such share is taxable Canadian property and excluded property for the purposes of section 116 and a qualified investment for certain registered plans

Subsection 87(11) - Vertical amalgamations

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.78 On an amalgamation described in [s. 87(11)], a capital gain may arise for the parent. Specifically,… if the paid-up capital of the subsidiary's shares exceeds their adjusted cost base to the parent immediately before the amalgamation, the parent will realize a capital gain by virtue of paragraph 87(11)(a).

2012 Ruling 2010-0355941R3

Under a BC plan of arrangement, a BC corporation ("SubcoTarget") is merged with its wholly-owned BC subsidiary ("Target") to form "Amalco" with the same effect as if they had amalgamated under section 269 of the Business Corporations Act (BC), except that the legal existence of Target does not cease and it survives the merger, Subco ceases to exist and the property of Subco (other than its shares of Target, which are cancelled) become the property of Target. Target and Subco are continued as one company. The parent of Subco ("Acquireco") receives one Amalco common share for each of its Subco common shares.

The purpose of having Target survive the merger under the plan of arrangement was to allow for an exchange of Target shares for shares of Acquireco to qualify as a reorganization for US income tax purposes for US shareholders of Target, although at the end of the day the Target shareholders received cash consideration from Acquireco instead.

Rulings that the merger will be considered an amalgamation (within the meaning of s. 87(1)) in the context of s. 87(11) ; and that pursuant to s. 87(2)(a), Amalco will be considered to have acquired each capital property of Target within the meaning of s. 87(11)(b).

9 December 2011 T.I. 2011-042807

general discussion of application of s 88(1)(d) to situation in which Parent has two successive vertical amalgamations with its wholly-owned subsidiaries, Subco 1 and Subco 2.

21 March 1997 T.I. 970670

Confirmation that the rules in s. 88(1)(c.3) apply on a vertical amalgamation.

6 February 1997 T.I. 970100 (C.T.O. "Bump where Assets Already Distributed?")

Where in connection with the winding-up of a subsidiary, the subsidiary has already distributed its property to its parent and it is then decided to amalgamate the subsidiary and parent rather than complete the winding-up, the property will not be eligible for the bump under s. 87(11) because it was not transferred "on" the amalgamation.