Subsection 85(1) - Transfer of property to corporation by shareholders

Cases

Barnabe Estate v. The Queen, 99 DTC 5387 (FCA)

A farmer, before dying, made an oral agreement with a corporation owned by him to transfer the assets of a farming business to it. It was found that a valid election could be made under s. 85(1) by his executors on his behalf.

Dale v. The Queen, 97 DTC 5252, Docket: A-15-94 (FCA)

The taxpayers agreed with the corporation controlled by them to transfer an apartment building to the corporation in consideration for the issuance of preference shares. However, at the time of the agreement, the authorized capital of the corporation did not include preference shares. After this deficiency was discovered, and following the continuance of the corporation from Prince Edward Island to Nova Scotia, two judicial orders were obtained pursuant to subsections 109(3) and 44(1) of the Companies Act (Nova Scotia) declaring the contract for the issuance of the shares to be retroactively valid and declaring the authorized and issued share capital of the corporation to be retroactively amended to reflect the issuance of the preference shares.

Robertson J.A. found that because an order of a superior court that has not been set aside must receive full effect according to its terms and is not (subject to very limited exceptions) subject to collateral attack, the issuance of the preference shares should also have retroactive effect for taxation purposes.

Deconinck v. The Queen, 90 DTC 6617 (FCA)

Although on the taxpayer's evidence an election form filed by the taxpayer was intended to accord rollover treatment for the conveyance by the taxpayer of ten properties and showed as the elected amount the aggregate estimated ACB of six of those properties that had been owned by him on V-Day it only referred to and described one of those properties due to an error of the taxpayer and his professional advisors. The taxpayer was held to have realized a capital gain equal to the difference between the elected amount and the ACB. "An election by a taxpayer under section 85 must be made in such a way that it is possible to determine in respect of which property it is made. It is not enough for a taxpayer simply to intend to elect in respect of a given property; he must actually do so."

See Also

Dale v. The Queen, 94 DTC 1100 (TCC), aff'd supra.

The taxpayers agreed with a corporation controlled by them to transfer an apartment building to the corporation in consideration for the issuance of preference shares. However, at the time of the agreement, the authorized capital of the corporation did not include preference shares, and this deficiency was not rectified until well after the taxation year of the taxpayers in question.

Bowman J. found that the expression "consideration that includes shares" was not confined to executed consideration, and it was only essential "that there be either an actual issuance of shares or a binding obligation to do so at the time of transfer and that the shares be issued within a reasonable period of time that, in all the circumstances, is reasonable". Accordingly, an election under s. 85(1) in respect of the transfer of the apartment building was effective, notwithstanding that a purported issuance of preference shares at the time was not validated until a subsequent date.

The Queen v. Miller, 90 DTC 6335 (FCTD)

Collier, J. indicated that "common sense dictates" that where the taxpayer's income for a year was increased as a result of a Revenue Canada reassessment, the corresponding amounts in a forward averaging election made by the taxpayer also should be increased, notwithstanding the absence of legislative provisions specifically allowing for such a correction on the forward averaging election form.

Cox v. I.R.C., [1988] BTC 37 (HCJ)

An obligation to file returns was not satisfied when "to be advised" or "details to follow" were entered against certain items.

Ward-Stemp v. Griffin, [1988] BTC 12 (HCJ)

Walton, J. stated, obiter, that it might be arguable that a statutory requirement to make an election "in such form and manner as the Board may prescribe" was met if the taxpayer and his wife had written a letter containing all the required information, rather than using the required form.

The Queen v. Leslie, 75 DTC 5086, [1975] CTC 155 (FCTD)

On the incorporation of a business the agreement purported to transfer net assets having a value of $5,078 and goodwill having a value of $20,222 in consideration of the issuance of $10,000 of treasury shares and a promissory note in the principal amount of $15,300. In fact, the business had no goodwill. It was held that there was some consideration for the promissory note since the promissory note was not expressed in the agreement to be given for any part of the goodwill but merely for part of the balance of the purchase price of all the assets sold.

Deltona Corp. v. MNR, 71 DTC 5186, [1971] CTC 297 (Ex Ct), briefly aff'd 73 DTC 5180, [1973] CTC 215 (SCC)

An election filed by a predecessor corporation for the amalgamated corporation to be taxed as an NRO was invalid. "I can find no suggestion of any principle that would justify the Court in concluding that an 'election' that was filed under the Income Tax Act when the amalgamated corporation did not exist and which was not, therefore, filed by it, must nevertheless be found a fact to have been filed by it."

Administrative Policy

29 January 2015 Memorandum 2014-0544651I7 - Section 85 transfer of Swap Contracts

The taxpayer entered into cross-currency (U.S.$/Cdn$) Swap Contracts with a counterparty respecting the issuance of U.S.-dollar notes issued by it or an affiliate and whose proceeds were used to repay existing indebtedness and general corporate purposes. The taxpayer subscribed for common shares in companies for nominal amounts and shortly thereafter transferred its rights under each of the Swap Contracts to the new corporations. The joint s. 85(1) election forms which were filed on transfers, which specified the cost and agreed amounts, recorded the Swap Contracts on the line "Security or debt obligation property" (rather than the Inventory line) by writing "See attached" on that line. The attachment referred to: "Right, title and interest to swap Cdn $XX into US $XX pursuant to a utilization notice dated XX".

After finding that the swaps qualified as "inventory" under the broad s. 248(1) definition and, therefore, as eligible property under s. 85(1.1)(f), the Directorate responded to the view of the TSO that "the election…was invalid," the Directorate stated:

[T]he Taxpayer's derivatives could be considered as inventory for the purposes of subsection 85(1), which supports the Taxpayer's contention that XX intention was to record the transfer as inventory. We have also taken into consideration that the… property and values were accurately described. Accordingly… it is reasonable to consider the error was clerical in nature, which…should not, in and of itself, invalidate the election… .

See summary under s. 85(1.1).

2 December 2014 Folio S4-F7-C1

1.61 If the laws governing an amalgamation provide that the predecessor corporations are continued in the amalgamated corporation, the amalgamated corporation may file an election under the various provisions contained in the Act on behalf of a predecessor corporation provided that the predecessor corporation itself would otherwise have been eligible to file the election on its own behalf if the amalgamation had not occurred. For example, the amalgamated corporation may file an election under subsection 85(1), subject to the time limits referred to in subsection 85(6) or within the parameters of subsections 85(7) or (7.1), for a property transfer which involved one or more of the predecessor corporations.

11 October 2013 APFF Roundtable Q. , 2013-0495821C6 F

In order to isolate cost base in preferred shares, a taxpayer transfers his common shares of a corporation to the corporation in exchange for preferred shares and common shares. In 2004-0092561E5, CRA indicated that there will not be a disposition of the "transferred" common shares to the extent that, following this transfer, the taxpayer holds shares with the same rights and restrictions as the transferred common shares. Is this position changed as a result of the enactment of s. 49, para. 3 of the Quebec Business Corporations Act, which provides that "the articles may provide that the shares of two or more classes or two or more series of the same class carry the same rights and restrictions"? CRA stated (TaxInterpretations translation):

[W]e consider the participation of a shareholder in the share capital of a corporation as being intangible property constituting the collection of the rights and conditions ("bundle of rights") respecting the shares, in accordance with the articles and relevant corporate law. The CRA applies the same position as stated in the above-noted interpretation if, by virtue of the BCA, a share of a given class issued in exchange for a share of a different class of shares has the same rights, privileges, conditions and restrictions as the share of the other class.

2011 APFF Roundtable Q. 17, 2011-0412171C6 F

Where there is an exchange of 100 common shares in the capital of a corporation for 100 "new" common shares in its capital, there could be considered to be no disposition of the old common shares (given that the share rights are identical), so that the s. 85(1) election is unavailable.

8 October 2010 T.I. 2010-0373231E5 -

CRA did not specifically respond to a question as to whether it will accept an election under s. 85(1) where the shares to be issued by the transferee corporation are not added to its authorized capital until after the filing deadline in s. 85(6), and instead indicated:

...that, in general, if the conditions set out in paragraph 35 of Interpretation Bulletin IT-291R3 are respected, the CRA should consider the election to be valid.

10 November 2004 T.I. 2004-0092561E5 F -

Mr. X, who holds all 100 common shares of Corporation A having a fair market value, ACB and PUC of $1,000,000, $500,000 and $1000, respectively, exchanges those common shares for 100 common shares and 500,000 preferred shares of Corporation A. Such exchange of common shares of the capital stock of a corporation for preferred shares and common shares in its capital stock would not constitute a disposition of all the common shares for purposes of s. 85(1).

6 July 2004 T.I. 2004-008163

CRA will accept a rollover form filed with a "yes" answer to the question concerning the existence of a price adjustment clause, as sufficient notice of a price adjustment clause. However, in order to give effect to a price adjustment clause, the parties will be required to file an amended election under s. 85(7.1) and pay the penalty under s. 85(8).

12 November 2003 T.I. 2002-012183

On a sale by a contractor of its construction contracts to a corporate purchaser, the fair market value of builder's holdbacks assumed by the purchaser would be considered to be non-share consideration for purposes of s. 85(1).

2001 T.I. 2001-009208 -

The assumption of a short sale obligation of an individual by a corporation controlled by him would result in realization of the accrued gain or loss on the short sale obligation.

17 March 1997 Memorandum 963100

The benefit of making an election under s. 110.6(19) in respect of an eligible capital property or a depreciable property effectively will be lost if the property is transferred on a rollover basis to a corporation. In addition, in the case of an eligible capital property, s. 14(3) will apply regardless of the fact that the property was transferred to the corporation at less than its fair market value, with the result that the corporation's cumulative eligible capital will be reduced until the asset is disposed of.

24 May 1995 T.I. 942067 (C.T.O. "Wyoming LLCs")

An interest in a Wyoming LLC receivable by a taxpayer as consideration for the disposition of shares of a foreign affiliate to the LLC would constitute "shares of the capital stock of the acquiring affiliate" provided that the LLC otherwise qualified as a foreign affiliate of the taxpayer immediately after the disposition.

Income Tax Regulation News, Release No. 3, 30 January, 1995 under "Section 85 (Dale Case)"

While awaiting the decision of the Federal Court of Appeal in the Dale case, RC intends to maintain its current practice of accepting election under s. 85(1) where the shares to be issued are not authorized at the time of the transfer, as long as three listed conditions are satisfied: the transfer agreement requires the transferee to issue the shares; the transferee immediately files articles of amendments; and the transferee corporation issues the shares once the amendments to its articles are made.

1994 A.P.F.F. Round Table, Q. 42

While awaiting the decision of the Federal Court, Trial Division in the Dale case, RC will allow an election under s. 85(1) where the transferee is required under the agreement to issue the required shares, the transferee immediately undertakes the steps necessary to issue the shares (eg., filing articles of amendment), and then issues the shares promptly following the necessary changes to the transferee's articles.

3 December 1993 T.I. 920099 (C.T.O. "Transfer of Inventory to a Corporation")

Since the entitlement of a farmer under a gross revenue insurance program constitutes an account receivable to him that relates to the farming business carried on by him, it is on income account and is not a capital property to him. Accordingly, it will not constitute an "eligible property".

17 September 1992 T.I. (Tax Window, No. 24, p. 4, ¶2195)

A taxpayer cannot elect under both ss.85(1) and 22 with respect to accounts receivable.

92 C.R. - Q.20

A joint election can be filed under s. 85(1) with respect to the changing of common shares of a corporation into preferred shares by the filing of articles of amendment.

26 March 1992 T.I. 5-913338 -

Where a holding company assumes all of the debt associated with a property acquired by it from its subsidiary, interest on that debt will be deductible provided the property is used by the holding company for the purpose of earning income, even though for purposes of an s. 85(1) election, a substantial portion of that debt was assumed as consideration for a promissory note of the subsidiary rather than as payment for the transferred property.

24 February 1992 Memorandum (Tax Window, No. 13, p. 17, ¶1617)

The minimum permissible agreed amount in respect of the transfer of a partnership interest is nil.

91 C.R. - Q.20

If a taxpayer transfers debt or shares of a taxable Canadian corporation to that corporation in consideration for treasury shares, and those shares have rights that are sufficiently changed to result in a disposition, RC is of the view that the disposition is to the corporation.

10 July 1991 Decision Summary (Tax Window, No. 5, pp. 4-5, ¶1345)

Where on an s. 85(1) roll of real estate with excess mortgage debt, the transferor gives the transferee a promissory note in the amount of the excess debt, the interest on the assumed mortgage debt will be deductible.

14 June 1991 T.I. (Tax Window, No. 4, p. 24, ¶1308)

Share purchase warrants issued by the transferee corporation do not constitute a right to receive shares.

October 1989 Revenue Canada Round Table - Q.11 (Jan. 90 Access Letter, ¶1075)

Where a taxpayer receives an undivided part of a block of flow-through shares following the liquidation of a limited partnership under s. 98(3), and then exchanges this undivided part for shares of the same category of the same corporation, having the same paid-up capital, RC will accept an election under s. 85(1), and will accept that the shares issued to the taxpayer have a paid-up capital equal to that of the undivided block of shares.

86 C.R. - Q.32

A deferred tax liability does not constitute non-share consideration.

85 CR - Q.52

S.85(1)(e.2) may apply notwithstanding that the taxpayer has obtained an independent valuation. However, a price-adjustment clause is usually employed by taxpayers to ensure that their intention of transferring the property for fair market value consideration is in fact achieved and s. 85(1)(e.2) will not apply.

84 C.R. - Q.47

Where a mortgage to be assumed exceeds the ACB of the property, RC will accept an allocation of the excess to other transferred assets, or as the consideration for a promissory note delivered by the transferor in the amount of the excess.

84 C.R. - Q.78

In situations where the tax consequences of an election were unintended and extremely harsh, RC is prepared to provide taxpayers with administrative relief only in exceptional circumstances. Where the redemption amount of preference shares taken back on an estate freeze is too low, administrative relief is provided to increase the redemption value, especially where a price adjustment clause was contained in the agreement.

12 December 1980 TI RCT 85-013

Construction holdbacks would be considered to be eligible property. The cost amount of the right would be calculated by eliminating the profit element from the face amount.

80 CR - Q.14

Adjustments to the agreed amount will be made to reflect changes in V-Day value only.

IT-188R "Sale of Accounts Receivable"

"The use of the 'rollover' provisions of section 85 precludes the use of the section 22 election ... ."

IT-243R4 "Dividend Refund to Private Corporations"

IT-291R "Transfer of Property to a Corporation under Subsection 85(1)"

IT-457R "Election by Professionals to Exclude Work in Progress from Income"

IT-489R: "Non-Arm's Length Sale of Shares to a Corporation"

Articles

Michael J. Welters, "Limited Partner's Interest in Partnership Property", Canadian Tax Highlights, Vol. 21,No. 7, July 2013, p. 3 at 4

"…most authorities have concluded that limited partners are the owners of partnership properties." [then discussing Donroy Ltd. (196 F. Supp. 54 (Calif. Dist. Ct. 1961); aff'd. 301 F. 2d 200 (9th Cir. 1962)); Unger v. Commissioner, TC Memo 1990-15; Memec Plc v. Inland Revenue Commissioners, [1998] STC 754; Re Lehndorff Gen. Partner (1993), 17 CBR (3d) 24 (Gen. Div.)and Kucor Construction & Developments & Associates v. Canada Life Assurance Co. (1998 CanI.II4236 (ONCA)]

Dunn, Nielsen, "Exchanges of Property for Shares: section 85-Part 2", 1995 Canadian Tax Journal, Vol. 43, No. 2, p. 496.

David W. Smith, "Corporate Restructuring Issues: Public Corporations", 1990 Corporate Management Tax Conference Report, pp. 6:10-6:11

Discussion of relative merits of ss.85.1 and 85(1) elections.

Carsley, "Loan Receivables Denominated in a Foreign Currency", Canadian urrent Tax, July 1988, p. 31

RC has taken the position that for the purpose of determining the cost amount of a foreign currency receivable the amount of the receivable should be converted into Canadian dollars at the date of the transfer, thereby giving rise to gain or loss.

Wise, "The Valuation of Preferred Shares Issued on a Section 85 Rollover", 1984 Canadian Tax Journal, March-April, p. 239.

Sylph, Percival, "Accounting Options for Section 85 Rollovers", CA Magazine, July 1981, p. 42

"The fair market value of the asset to the transferee should recognize the future tax effects of the differences between the tax bases and the amount assigned to the asset in the legal agreement."

Forms

T2057 "Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation" 23 January 2009

File...at the tax centre serving the area where the transferor is located. Where two or more co-owners or members of a partnership referred to above elect, the elections will be processed in bulk and should be filed at the tax centre of the transferee; and...separate from any tax returns. You may put it in the same envelope with a return, but do not insert it in or attach it to the return.

TP-518-V (Quebec)

TP-518 (Quebec - French)

Paragraph 85(1)(b)

Administrative Policy

10 March 2004 Ruling 2003-005401 -

A subsidiary is to become a co-obligor of a parent's debts on a s. 85(1) transfer of property from the parent, but the parent will fully indemnify the child for the debt. CRA rules that the subsidiary is not considered to have assumed the parent's liabilities.

12 November 2003 T.I. 2002-012183

Where a contractor transferred its construction contract to a corporate purchaser, the amount previously withheld by the contractor as a holdback in respect of amounts otherwise payable to its subcontractor would represent part of the non-share consideration received by the contractor given that the liability in respect of these holdbacks would be assumed by the transferee corporation.

6 December 2000 Tax Executives Institute Roundtable Q. 22, 2000-0056485

Where shares received on an s. 85(1) roll are immediately redeemed by issuing a promissory note, CRA will not consider s. 85(1)(b) to apply, i.e., it will not consider the note to be a non-share consideration received on the transfer of assets by the transferor to the transferee.

10 April 2002 T.I. 2002-017048 -

Where a corporation owes $100 to the taxpayer, and the taxpayer transfers a property with an FMV of $300, cost to the taxpayer of $200, and encumbered by a debt of $275, then (provided the $100 debt is genuine) the corporation may assume a portion of the $275 debt (e.g., $75) as repayment of that portion of the $100 debt, so that the property may be transferred for an elected amount of $200 (i.e., the consideration described in s. 85(1)(b) will be considered to have been reduced to the elected amount of $200).

2000 T.I. 2000-003933 -

The Agency has now reversed its position on the assumption of excess debt in an s. 85(1) rollover transaction (for example, the purchaser assuming the excess debt in consideration for a note of the vendor) and now treats the total debt assumed as being consideration for the properties initially transferred. The Agency also confirmed its view "that paragraph 85(1)(b) does not apply to increase proceeds if the fair market value of the non-share consideration given (including the assumption of debt by the purchaser) is allocated among several properties transferred to and retained by the purchaser and the amount allocated to each asset is not greater than the amount elected in respect of each asset".

2000 Ruling 1999-001074

S.85(1)(b) would not apply where the portion of liabilities assumed by the transferee that were in excess of the cost amount of the transferred property were so assumed in consideration for a cash payment.

1996 Corporate Management Tax Conference Round Table, Q. 7

Until it completes its review, RC will permit excess debt to be assumed by the transferee corporation in consideration for the issuance by it of a note payable or in consideration for the redemption by it of some of the shares issued to acquire the transferred assets.

1992 A.P.F.F. Annual Conference, Q. 21 (January - February 1993 Access Letter, p. 58)

RC will consider roll-over treatment under s. 85(1)(b) to be available on the transfer of a property subject to mortgage indebtedness in excess of its ACB where the transferee corporation receives a promissory note from the transferor in consideration of its assumption of the excess portion of the mortgage debt, and uses this promissory note to redeem the preference shares issued by it to the transferor. However, this position is under review.

26 March 1992 T.I. (Tax Window, No. 18, p. 2, ¶1831)

Where, in connection with the transfer by Opco to its parent, Holdco, of property subject to debt in excess of the property's ACB, Holdco first assumes the excess debt in consideration for a promissory note of Opco, and then Holdco surrenders that promissory note to Opco in consideration for the redemption of preference shares issued by Holdco to Opco on the transfer, s. 85(1)(b) will not apply to alter the agreed amount (being the property's ACB), i.e., the allocation of the assumed debt as consideration for the promissory note of Opco rather than as consideration for the transfer of the property will be respected.

Commentary [in progress]

Paragraph 85(1)(c.2)

Administrative Policy

IT-427R "Livestock of Farmers"

IT-433 "Farming or Fishing - Use of Cash Method"

Paragraph 85(1)(e)

Administrative Policy

27 November 2014 T.I. 2013-0503861E5 F - Application du paragraphe 248(16)

Where a taxpayer claims an input tax credit under ETA s. 193 on transferring a depreciable building on a rollover basis under ITA s. 85(1), can it treat the undepreciated capital cost of the property as being reduced by such ITC for purposes of the determination of the elected amount under s. 85(1)(e)? CRA responded (TaxInterpretations translation):

[T]he taxpayer does not have the right to receive the government assistance before the disposition of the depreciable property, because it cannot…claim its ITC before the disposition…by reason of the rules of ETA section 193. The UCC…consequently is reduced through the operation of variable J…after the disposition… .

…[T]he calculation of the UCC under subparagraph 85(1)(e)(i) is made immediately before the disposition of the depreciable property. Consequently, the taxpayer …cannot adjust the UCC for purposes of subparagraph 85(1)(e)(i) irrespective of whether the ITC claim is made in the reporting period in which the disposition occurs or in a subsequent period, because it will not receive the ITC and will not have a right to receive it immediately before the disposition of the depreciable property.

2006 Ruling 2006-018106

in a single-wing butterfly in which assets are distributed to a holding company for one of the two brothers which control the corporation, the business assets of the distributing corporation which are transferred on a rollover basis to "Newco" include depreciable property. For purposes of determining the elected amount:

the reference to the "undepreciated capital cost to the taxpayer of all property of that class immediately before the disposition" found in subparagraph 85(1)(e)(i) will be interpreted to mean that proportion of the undepreciated capital cost to the taxpayer of all the property of that class that the FMV of the assets that are transferred immediately before the disposition is of the FMV of all property of that class immediately before the disposition.

October 1989 Revenue Canada Round Table - Q.6 (Jan. 90 Access Letter, ¶1075)

On the division pursuant to a butterfly reorganization of two depreciable assets of the same class, RC will accept the apportionment of the undepreciated capital cost on a pro-rata basis to each asset of the class in accordance with ATR-27.

Paragraph 85(1)(e.2)

Administrative Policy

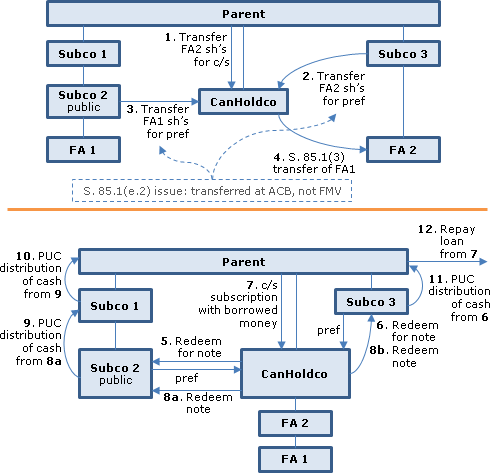

2014 Ruling 2011-0415811R3 - Internal reorganization

Current structure

Parent, a public corporation which previously had been spun-off by Subco 2 (also a public corporation, but with Subco 1 holding all its common shares), owns all the common shares of Subco 1, Subco 3, Can Holdco (as well as preferred shares of Subco 1), and a portion of the common shares of FA2. Subco 3 owns the remaining common shares of FA2 and Subco 2 owns all the common shares of FA 1. The assets held in Subco 2 and FA 1 constitute the majority of the assets in the Parent group.

Proposed transactions

- Parent will transfer to Can Holdco (which currently has nominal assets) all its FA 2 shares in consideration for common shares of Can Holdco having an equal FMV, and elect at the lesser of under s. 85(1)(c.1)(i) and (ii).

- Subco 3 will transfer all its FA 2 shares to Can Holdco for a purchase price equal to the shares' adjusted cost base (and with a price adjustment clause based only on any adjustment to such ACB), and Can Holdco will issue in consideration therefor redeemable retractable Class B shares having a redemption amount, paid-up capital and FMV equal to such purchase price. Subco 3 and Can Holdco will elect at the lesser of the s. 85(1)(c.1)(i) and (ii) amounts.

- Similarly, Subco 2 will transfer its FA 1 shares to Can Holdco for Can Holdco Class C preferred shares with a redemption amount, paid-up capital and FMV equal to the ACB of the transferred shares, with a similar s. 85(1) election made.

- Can Holdco will transfer all its FA 1 shares to FA 2 in consideration for additional FA 2 shares with an equivalent FMV.

- Can Holdco will redeem its Class C shares held by Subco 2 for demand notes (accepted as full payment, and with their terms acknowledging that their principal amount is subject to adjustment based on the Class C share price adjustment clause).

- Similarly, Can Holdco will redeem its Class B shares held by Subco 3 for demand notes.

- Parent will draw down under its credit facility and subscribe for Can Holdco common shares in amounts sufficient to fund the note redemptions in 8 below.

- Can Holdco will satisfy the notes owing to Subco 2 and 3 in cash.

- Subco 2 will reduce the stated capital of its common shares by making a single cash distribution, within XX months from the transfer in 3, with the reduction being subject to a price adjustment clause.

- Subco 1 will make a corresponding stated capital distribution in cash to Parent.

- Subco 3 will reduce the stated capital of its common shares by making a cash distribution, subject to a price adjustment clause.

- Parent will repay the advance in 7.

Purposes

. To combine FA 1 and 2 groups within a single ownership chain. The transfers in 2 and 3 occur at ACB rather than FMV in order "to restrict the increase in Parent's ACB of its Can Holdco Common Shares arising from its subscription for additional common shares in Can Holdco…[in 7] to the sum of Subco 3's aggregate ACB of its FA 2 Shares and Subco 2's aggregate ACB of its FA 1 Shares" [i.e., to avoid shifting more ACB away from the Subco 1 and 3 chain, which have important assets?]

Rulings

Ss. 85(1)(e.2), 15(1), 56(2), 69(4) and 246(1) will not apply to the transfers in 2 and 3. Per summary:

Based on the specific unique facts of the present situation, it would not be reasonable to regard any part of the excess, as described in paragraph 85(1)(e.2), as a benefit that Subco 2 or Subco 3 desired to have conferred on a person related to Subco 2 or Subco 3.

The transfer of FA 1 shares in 4 will not by itself cause those shares to cease to be capital property. S. 84(2) will apply and s. 84(4.1) will not apply to the distribution in 9.

9 June 2003 T.I. 2003-000483 -

In a s. 97(2) transfer, the partnership is not considered a person related to the taxpayer solely because the taxpayer is a majority interest partner. Therefore, assuming that the taxpayer is not a corporation controlled by the partnership, and there is no intention to confer any benefit on the other partners, s. 85(1)(e.2) would not apply to the transfer.

1996 Tax Executives Round Table, Q. IV (No. 9639160)

"Generally, where the facts show that the parties to the transaction intended to transfer the property at its fair market value and their efforts to establish that value are based on a fair and reasonable method the Department will not consider that a taxpayer desired to confer a benefit."

15 November 1990 T.I. (Tax Window, Prelim. No. 2, p. 14, ¶1078)

A taxpayer will not be considered to have conferred a benefit pursuant to s. 85(1)(e.2) where the redemption and retraction amount of preferred shares received in exchange for rental property transferred to a corporation equals the fair market value of that property, even if the dividend rate on the shares is low in relation to current market conditions.

90 C.R. - Q34

It is not the intention of RC to apply s. 85(1)(e.2) to a "classic" estate freeze provided that the transferor receives retractable preference shares with a value equal to the difference between the fair market value of the transferred property and any other consideration taken back.

89 C.R. - Q.23

"Where the fair market value of the business assets exceeds the fair market value of the consideration used to pay for the business assets in a situation where a taxpayer owns all the share capital of a corporation to which it transfers the business assets ... it appears reasonable to conclude that the excess is a benefit that the taxpayer wishes to confer on the corporation."

October 1989 Revenue Canada Round Table - Q.10 (Jan. 90 Access Letter, ¶1075)

s. 85(1)(e.2) will be applicable where the price is less than the fair market value of the property, regardless whether the consideration consists of shares redeemable at a price equal to the sale price, or whether the consideration consists of common shares the total value of which is less than the sale price - assuming that it is reasonable to consider the excess as a benefit that the transferor decided to confer upon the related corporation (in this case, its wholly-owned subsidiary).

88 C.R. - "Demise of the Wingless Butterfly"

s. 85(1)(e.2) will apply where property is transferred from a corporation to its wholly-owned subsidiary if the fair market value of the consideration provided by the subsidiary for the property is less than the fair market value of the property transferred by the parent.

81 C.R. - Q.6

S.85(1)(e.2) will not be applied to transactions which comply with s. 55(3)(b).

IT-489R: "Non-Arm's Length Sale of Shares to a Corporation"

Articles

Tung, "Application of the Gifting Provisions of Section 85", Tax Profile, October 1990, p. 42

Discussion of the overstatement of RC in IC 76-19R2, para. 22.

Paragraph 85(1)(e.4)

Administrative Policy

IT-521R: "Motor Vehicle Expenses Claimed by Self-Employed Individuals"

IT-522R: "Vehicle, Travel and Sales Expenses of Employees"

Subsection 85(1.1)

See Also

Boland v. Boland (1980), 14 Alta. L.R. (2d) 154 (Alta. Q.B.)

Cormack J. found that s. 24 of the Partnership Act (Alberta) (which deemed partnership property consisting of land to be personal property and not real property) to be a narrow provision which merely codified the equitable doctrine of notional conversion for purposes of devolution of estates. ("On the principle that, in the liquidation of partnership debts, the share of each partner was to be sold and turned into money, it followed that, in equity, the share, whether consisting of land or not, as between the real and personal representative of a deceased partner should be deemed to be personal and not real estate.") (p. 174)

Seven Mile Dam Contractors v. The Queen in Right of British Columbia (1980), 116 DLR (3d) 398, 1980 CanLII 451 (BCCA)

On a sale of equipment by one partnership ("Seven Mile") to another ("Kootenay Power") in which the two partners of Seven Mile had a 40% and 10% partnership interest, tax was imposed under the Social Service Tax Act (B.C.) on the price of "property purchased" on the basis that only a 1/2 interest in the equipment had been transferred. Hutcheon J.A. adopted a statement in Lindley on the Law of Partnerships that the share of a partner "is regarded as a proportionate interest in the specific items of property which together constitute the partnership property."

Lavin v. Geffen (1920), 61 SCR 356, aff'g (1920), 51 DLR 203 (Alta. C.A.)

An oral agreement of one partner to purchase the other partner's interest was enforceable, notwithstanding that the assets of the partnership included a leasehold interest in real estate and notwithstanding section 4 of the Statute of Frauds which applied to "the sale of lands tenements or hereditaments or any interest in or concerning them," because the partnership interests were mere choses in action.

Winsby v. Tait, [1941] 2 DLR 81 (SCC), rev'd [1943] 1 DLR 81 (PC)

A provision of the Mineral Act (B.C.), which provided that "no person ... shall be recognized as having any right or interest in or to any mining property unless he or it has a free miner's certificate unexpired," did not prevent a partner from seeking an accounting of his share of partnership profits from mining claims." Davis J. quoted the following statement of Romer L.J. in Re Bourne, [1906] 2 Ch. 427:

"It is to be borne in mind that the real interest of the partnership in real estate is of a personal character, because wherever the legal estate may by, whether it is in the partners jointly or in one partner or in a stranger it does not matter, the beneficiary interest in the real estate belongs to the partnership, with an implied trust for sale for the purpose of realizing the assets and for the purpose of giving to the two partners their interests when the partnership is wound up and an account taken."

In re Fuller's Contract, [1933] 1 Ch. 652

In commenting on a submission that Re Bourne should be regarded as "a decision that a partner has no beneficial interest in the partnership real estate that he can point to," Luxmoore J. stated:

"I think Romer L.J. was only pointing out that the beneficial interest in the real estate belonged to the partnership, that is, to those persons who constituted the partnership, and that those persons were together entitled to the partnership property. Of course, as between the partners, the partnership property must be dealt with in a particular way, but so far as all the rest of the world is concerned, there is no limitation on the interests of the partners; the partners have the beneficial interest in the partnership assets, which are held together as an undivided whole, but they respectively have undivided interests in them."

Porter v. Armstrong, [1926] 2 DLR 340, [1926] S.C.R. 328

Two individuals did not agree to purchase land as partnership property given that in their mind there was no "binding agreement which would disable either of them from dealing with the share - that is to say, with the share in the land itself - as his own separate property" (p. 330). Duff J. stated:

"The property of the partnership is not divisible among the partners in specie. The partner's right is a right to a division of profits according to the special arrangement, and as regards the corpus, to the sale and division of the proceeds on dissolution after the discharge of liabilities. This right, a partner may assign, but he cannot transfer to another an undivided interest in the partnership property in specie."

Boyd v. Attorney General for BC (1917), 54 SCR 532

An Ontario domiciled person had died owning a partnership interest in a partnership that carried on business in Ontario, did not carry on business in British Columbia but held timberland situate in British Columbia. In rejecting a submission that BC succession duty did not apply because the deceased did not have an interest in property situate in BC, Duff J. stated (at p. 559):

"At the death of the deceased partner his interest was undivided interest in the partnership assets as a whole, including the British Columbia assets, an undivided interest in every item of the assets subject to a charge for a payment of debts."

Driver v. Broad, [1893] 1 Q.B. 744 (C.A.)

A debenture containing a floating charge on leasehold property of a company, consisting of a factory and warehouse, constituted an interest in land for purposes of the Statute of Frauds. [C.R: 206(1)(h)]

Administrative Policy

29 January 2015 Memorandum 2014-0544651I7 - Section 85 transfer of Swap Contracts

The taxpayer entered into cross-currency (U.S.$/Cdn$) Swap Contracts with a counterparty respecting the issuance of U.S.-dollar notes issued by it or an affiliate and whose proceeds were used to repay existing indebtedness and general corporate purposes. The taxpayer subscribed for common shares in companies for nominal amounts and shortly thereafter transferred its rights under each of the Swap Contracts to the new corporations. "After taking into account the Taxpayers' XX [the] swaps would be on account of income."

In responding to the view of the TSO that "that the Swap Contracts do not constitute inventory for the purposes of paragraph 85(1.1)(f) as the cost or value was not relevant in computing the taxpayer's income, the Directorate stated:

[T]he cost or values of XX Swap Contracts are relevant components in the computation of the taxpayer's income from a business for a taxation year. Accordingly…the Swap Contracts are considered to be inventory for the purposes of paragraph 85(1.1)(f).

See summary under s. 85(1).

6 October 2014 T.I. 2014-0543751E5 F - Rollover of a part of an interest in a partnership

X, who wished to dispose of half of interest (which is capital property) in a partnership to a taxable Canadian corporation in consideration for shares. Is a s. 85(1) election available? After noting that "property" included the fractional interest, and referring to the ACB apportionment rule in s. 43(1), CRA stated:

Thus, a part or fraction of an interest in a partnership would be eligible property as described in paragraph 85(1.1)(a).

16 June 2014 STEP Roundtable Q. , 2014-0526561C6

Can a capital interest in a personal trust qualify as eligible property? After noting that eligible property in s. 85(1.1) includes most capital property, capital property in s. 54(1) includes any non-depreciable property a gain from which would be a capital gain, and further noting that s. 107(1)(a) contemplates that the disposition of a capital interest in a personal trust could give rise to a capital gain, CRA stated:

[T]he capital interest in a personal trust will qualify as "eligible property" pursuant to subsection 85(1.1) and for the purposes of subsection 85(1), provided it is a capital property of the taxpayer.

5 March 2014 Memorandum 2013-0500891I7 - Hedging

Parent hedged a U.S.-dollar borrowing by entering into foreign currency forward contracts, which were found to have been acquired on capital account notwithstanding they were entered into a few years later.. In order to utilize capital loss carryforwards of a wholly-owned subsidiary ("Subco"), it assigned its rights and obligations under the forward contracts to Subco, and they elected under s. 85 for rollover treament. The forward contracts were eligible property:

As indicated in Rulings document XXXX, we have previously confirmed that an "in-the-money" forward contract is an eligible property within the meaning of subsection 85(1) provided that it was linked to a capital transaction.

1 May 2013 T.I. 2012-0459541E5 - Capital interest in a trust

"[T]he capital interest in a personal trust will qualify as eligible property pursuant to subsection 85(1.1) and for the purposes of subsection 85(1) of the Act, provided it is a capital property of the taxpayer."

1998 A.P.F.F. Round Table, Q. 14, 9824750

Know-how is not property. Accordingly, although the know-how relating to a business may be part of the goodwill that is transferred on an incorporation of that business, this position (reflected in IT-386R, para. 2(d)) cannot be relied upon in determining whether know-how is an eligible property for purposes of s. 85(1.1).

23 September 1996 T.I. 5-962304 -

The rights of a person to obtain a patent in respect of know-how represent property and, accordingly, can qualify as an eligible property under s. 85(1.1).

22 June 1995 T.I. 5-922415

A pool of unclaimed R&D expenditures is not eligible property, although any capital property the cost of which is included in the pool would be an eligible property.

29 March 1995 Memorandum 950250 (C.T.O. "Right to Royalty Eligible Property")

Although "a right to receive income, in or by itself, would generally not be considered capital property", here the taxpayer also owned the underlying property which gave rise to the rights (making it arguable that the rights to the royalty income in question were capital property) and, further, such rights related to a business (with the result that the rights might qualify as eligible capital property). Accordingly, the rights qualified as eligible property.

94 C.P.T.J. - Q.20

"In order for a right to a royalty income in respect of 'know-how' to qualify as an eligible property, it must be either a capital property or an eligible capital property ... . The right to receive income where there is no underlying right to the property that may create this income would not be regarded as a capital property."

1 September 1994 T.I. 941377 (C.T.O. "Eligible Property & Dividends")

"The right to accrued cumulative dividends would be just one of the bundle of rights that would be attached to a particular share ... . The transfer or exchange of shares with the right to accrued cumulative dividends would not, in and by itself, result in the accrued cumulative dividends being paid or deemed to have been paid by the corporation."

3 February 1994 T.I. 5-923647

Holdbacks and unapproved billings of a contractor are eligible property in respect of which the elected amount can be $1.

9 September 1991 Memorandum (Tax Window, No. 10, p. 16, ¶1476)

Holdbacks receivable of building contractors cannot be transferred on a rollover basis under s. 85(1).

15 August 1991 T.I. (Tax Window, No. 7, p. 19, ¶1393)

Where an individual carrying on a profession has made an election under s. 34 to exclude work-in-progress from income, the work-in-progress is "eligible property". Unbilled disbursements are costs incurred in the year to earn income and are not "eligible property".

8 January 1991 T.I. 5-902839

It is not possible for a contractor following the completion method to transfer a contract in progress to a subsidiary under s. 85(1) without realizing income.

2 January 1991 T.I. (Tax Window, Prelim. No. 3, p. 11, ¶1083)

A butterfly reorganization involving the distribution of land inventory achieved on a rollover basis under ss.97(2) and 90(3) through the use of partnerships could entail an abuse through circumvention of the provisions of s. 85, which deny the benefits of the rollover to real estate inventory.

3 December 1990 T.I. (Tax Window, Prelim. No. 2, p. 11, ¶1062)

A receivable that is capital property is an eligible property which may be transferred to the debtor corporation for treasury shares.

90 C.R. - Q.35

Because an interest in a partnership is not considered to be an interest in its underlying assets, a capital interest in a real estate partnership held by a non-resident will qualify as eligible property, although s. 245 could apply where a partnership formed as part of a series of transactions which are designed to circumvent s. 85(1.1).

30 April 1990 T.I. (September 1990 Access Letter, ¶1423)

RC has not addressed the issue of whether deferred leasing costs constitute property eligible for transfer.

89 C.M.TC - Q.10

a partnership interest in a real estate partnership owned by a non-resident generally is eligible property. "However, where the formation of the partnership and the transfer of the land held by a non-resident are undertaken to circumvent the prohibition in section 85, subsection 245(2) of the Act would likely apply."

88 C.R. - Q.24

Seismic data the cost of which is in fact CEE rather than inventory cannot be rolled under s. 85(1).

86 C.R. - Q.50

Since a partnership interest is not considered to be an interest in the underlying assets, an interest in a partnership with real estate inventory is eligible property.

86 C.R. - Q.54

An interest in a partnership, the underlying property of which consists of Canadian resource property, is not a Canadian resource property.

84 C.R. - Q.48

Although RC accepts that a capital property that is an interest in a partnership, the underlying property of which is real estate inventory, can be transferred pursuant to s. 85(1), in a particular set of circumstances it will be a question of fact whether there is a transfer of a partnership interest.

12 December 1980 TI RCT 85-013

Before going to find that the contingent right to receive construction holdbacks was property that could be transferred on a rollover basis, RCT stated "we agree that the work in progress is inventory for purposes of subsection 85(1) if in fact it has been used in computing profit under section 9."

Articles

Donn, "Exchanges of Property for Shares: Section 85 - Part 1", 1995 Canadian Tax Journal, Vol. 43, No. 1, p. 203.

Vesely, "Takeover Bids: Selected Tax, Corporate and Securities Law Considerations", 1991 Conference Report, c. 11.

Wilson, "Shares in a Corporation that Primarily Holds Land Inventory May Not Qualify for a Rollover", Corporate Structures and Groups, Vol 1, No. 2, 1992, p. 27

A taxpayer's shares in a corporation that primarily holds land inventory may be property that is neither capital property nor inventory.

Subsection 85(1.3)

Administrative Policy

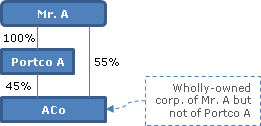

12 May 2014 T.I. 2013-0503531E5 F - Discretionary Dividends Shares

In the context of a general discussion of s. 85(1)(e.2) and after paraphrasing s. 85(1.3), CRA stated (TaxInterpretations translation):

For example, in the situation where Mr. A holds all the issued and outstanding shares of Portco A, that corporation is thus a wholly-owned corporation of Mr. A by virtue of paragraph 85(1.3)(a). Furthermore, Mr. A and Portco A respectively hold 55% and 45% of the issued and outstanding shares of Aco. Thus, respecting Mr. A qua transferor, Aco is a wholly-owned corporation of him by virtue of paragraph 85(1.3)(c). On the other hand, relative to Portco A as transferor, Aco would not be a wholly-owned corporation of Portco A because Mr. A cannot qualify as a wholly-owned corporation of Portco A.

22 January 1992 T.I. (Tax Window, No. 15, p. 3, ¶1708)

Where two individuals each transfer property to a wholly-owned corporation immediately following which the two corporations are amalgamated, s. 85(1)(e.2) will not apply to the transfers of property to the corporations.

Subsection 85(1.11) - Exception

Administrative Policy

2001 Tax Executive Institutes Roundtable Q. 21, 2001-0110985

In response to a question noting the untenable breadth of s. 85(1.11) the Agency indicated that it "does not have the experience in administering this rule which would be necessary in order to be in a position to provide general guidelines."

Subsection 85(2) - Transfer of property to corporation from partnership

Administrative Policy

2004 Ruling 2004-008431 -

On the transfer of the assets of a partnership to a corporation ("Newco") in consideration for shares and a promissory note, for reasons of legal simplification the shares and note are issued in the respective names of the partners (based on their pro-rata share) instead of the name of the partnership, with such pro-rata interest then being distributed to the respective partners on the subsequent wind-up of the partnership under s. 85(3). A comment that this manner of issuing the shares and promissory notes did not invalidate the application of ss.85(2) and (3).

IT-378R "Winding-up of a Partnership" 1 January 1995

2. The consideration received by the partnership for one or more properties disposed of under subsection 85(2) must include at least one share of the capital stock of the corporation. In practice the number issued is determined by the need for shares in the course of winding up under subsection 85(3). For administrative ease the shares are sometimes issued in the names of the partners instead of the name of the partnership. The Department's view is that this procedure does not invalidate the application of subsection 85(2), nor a subsequent application of subsection 85(3), if the intent is that the shares beneficially belong to the partnership and not to the partners themselves.

IT-457R "Election by Professionals to Exclude Work in Progress from Income"

Articles

Bernstein, "Partnership Versus Joint Company", Tax Profile, March 13, 1990

RC will consider the requirements of s. 85(2) to be met where the shares are issued in the names of the partners instead of the name of the partnership.

Forms

Form T2058 "Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation"

TP-529-V (Quebec) "Transfer of Property by a Partnership to a Taxable Canadian Corporation"

Subsection 85(2.1) - Computing paid-up capital

Administrative Policy

17 June 2013 Memorandum 2013-0475621I7 - PUC adjustment

A non-resident corporation and another taxpayer transferred forward purchase agreements (FPAs) and promissory notes to a Canadian corporation in consideration for the issuance of common shares and jointly filed a T2057 election form. CRA determined that the fair market value of the FPAs was lower than as reflected in the election and initially took the view that as it was now too late to file to file an amended T2057 pursuant to s. 85(7.1) in order to correct the amounts reported in the election, a deemed dividend arose to the non-resident corporation under s. 84(1) which was subject to Part XIII tax. In finding that the PUC of the shares issued on the "Disputed Transaction" was "automatically reduced by an amount of $XX pursuant to subsection 85(2.1)," so that no deemed dividend arose, CRA stated:

Although we had initially believed that an amended T2057 form had to be filed by XX and XX in order to correct the amounts reported on their joint election, the wording of the aforementioned provisions rather suggests that the PUC adjustment pursuant to subsection 85(2.1) shall be made automatically where the Agreed Amount exceeds the FMV of the transferred property. Therefore, it would be incorrect to assess XX pursuant to subsection 84(1) on the basis that XX and XX have failed to file an amended election pursuant to paragraph 85(7.1)(b) since the PUC increase to the class of shares issued by XX is reduced to the FMV of the FPAs at the time of the Disputed Transaction.

7 July 1994 T.I. 941331 (C.T.O. "Internal Crystallization")

Two unrelated persons each owning 50% of the common shares of Opco having a fair market value of $500,000 and an adjusted cost base and paid-up capital of $100,000 exchange those shares for preferred shares having a fair market value and stated capital of $500,000. The elected amount under an s. 85 election is $500,000.

The adjustment under s. 85(2.1) will be nil because the cost to the corporation of the common shares will be deemed to be $500,000. Accordingly, they will realize a deemed dividend of $400,000 under s. 84(3).

27 March 1994 T.I. 933322 (C.T.O. "Shareholder Benefit")

Where a taxpayer has transferred property to a corporation pursuant to s. 85(1) and has received consideration in excess of the fair market value of the property transferred, s. 85(2.1) in its amended form will operate to apply that provision prior to subsection 84(1). Accordingly, to the extent that the excess consideration exceeds the paid-capital of the shares received by the taxpayer on the transfer, such amount will no longer be taxed as a deemed dividend but will be taxed as a shareholder benefit under s. 15(1).

1992 A.P.F.F. Annual Conference, Q. 1 (January - February 1993 Access Letter, p. 49)

Where an individual exchanges all the common shares of Opco, having an ACB of $100,000, a paid-up capital of $500,000 and a fair market value of $600,000, for treasury shares of another class having a fair market value and stated capital of $600,000, s. 85(2.1) will only reduce the paid-up capital of the treasury shares received on the exchange at a time of computation subsequent to the time of the exchange, and will not eliminate the deemed dividend.

Articles

Ewens, "Forced Share Conversions", 1993 Canadian Tax Journal, No. 6, p. 1407.

Subsection 85(3) - Where partnership wound up

Administrative Policy

14 January 2015 T.I. 2014-0559731E5 - 85(3) rollover

Is the 60-day requirement in s. 85(3)(b) satisfied if beneficial ownership of land owned by the partnership is transferred within the 60-day period but legal title is not transferred until after the end of that 60-day period, given that the relevant governmental authority for transferring title requires a valuation, which may not be performed until after the 60-day period? CRA stated:

[I]f beneficial ownership… has in fact been transferred from a partnership to a corporation within the 60-day period…, the partnership still holds legal title to the property after the 60-day period only because the parties are awaiting the valuation necessary to effect the transfer of title, and legal title to the property in question will be transferred as soon as is practical after the valuation is completed, we would generally consider the 60-day requirement in paragraph 85(3)(b)… to be met.

8 May 2014 T.I. 2014-0522771E5 - Whether a partnership has ceased to exist

Partner A sold his 50% partnership interest in a Quebec general partnership (the "Partnership") operating a grocery business in the province of Quebec to Partner B (also a Canadian-resident individual). The Partnership immediately disposed of all of its properties to a taxable Canadian corporation (the "Corporation") of which Partner B was the sole shareholder in consideration for the issuance of promissory notes and common shares (and elected under s. 85(2)) but with title to all assets staying the name of the Partnership. Partner B filed for dissolution of the Partnership under the Civil Code of Quebec (the "CCQ") more than 60 days after such disposition.

After indicating that "a partnership would generally cease to exist if there are no longer at least two partners carrying on the business," CRA noted that s. 98(1) would deem the partnership to have not ceased to exist until all partnership property had been distributed.

Respecting a question as to whether the requirement of s. 85(3)(b) that "the affairs of the partnership were wound up within 60 days after the disposition" would be met "even though a dissolution under the CCQ is filed more than 60 days after the disposition," CRA stated that "this issue is addressed in paragraph 7 of IT-378R."

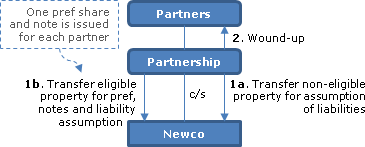

2012 Ruling 2011-0392041R3 - Incorporation of a Professional Partnership

Background

. As described below, a professional partnership (the "Partnership") with resident Canadian partners will effectively be converted into a CCPC ("Newco"). The Partnership's "Property" consists of "Non-85(2) Property" (i.e., cash, accounts receivable and prepaid expenses), and "85(2) Property" (i.e., goodwill, inventory, equipment and other capital property); and its "Liabilities" consist of accounts payable, accrued liabilities and long-term debt.

Proposed transactions

:

- Newco (a CCPC) will issue one common share to each Partner for nominal consideration.

- In connection with the transfer by the Partnership of all the Property to Newco, Newco will assume a portion of the Liabilities equal in amount to the fair market value of Non-85(2) Property as sole consideration for such transfer (with a joint election being filed under s. 22 respecting the accounts receivable) and as consideration for the Partnership's transfer to Newco of the 85(2) Property, Newco will: (i) assume the "Remaining Liabilities" (i.e. the portion of the Liabilities remaining after the transfer of the Non-85(2) Property), (ii) and issue the "Promissory Notes" and the "Preference Shares" to the Partnership (with a joint s. 85(2) election being made). In accordance with IT-378R, one Newco Preference Share and one Promissory Note will be issued in the name of each Partner rather than in the name of the Partnership, but with the Partnership being the beneficial owner. The amount of each Promissory Note will be equal to that Partner's pro rata share of the aggregate Promissory Notes.

- On the immediately following day, the Partnership will be wound up under s. 85(3), at which time its only property will be the Preference Shares and the Promissory Notes. Accordingly, each Partner will receive one Newco Preference Share and one Promissory Note.

- "New Contracting Corporations" owned by Partners will then commence to provide services for agreed fees to Newco. See summary under s. 125(7) – specified partnership income.

No rulings are provided on ss. 85(2) and (3).

20 December 2013 T.I. 2013-0501831E5 - Partnership - 85(2), (3) and 100(2)

A general partnership will transfer its goodwill, having a nil cost amount, to Corp under s. 85(2) in return for consideration that includes shares of Corp., and will elect at $1. Corp would assume all the partnership debt. The partnership would be wound-up as per s. 85(3), and a partner has a negative ACB. After confirming that the excess boot rule in s. 85(1)(b) applied on the transfer to Corp, CRA confirmed that the negative ACB would be triggered as gain:

[T]he wind-up of the partnership does result in a disposition of the partnership interest. Therefore, for those partners that have a negative ACB, subsection 100(2) of the Act would be applicable such that the negative ACB would be added to the amount, if any, determined under subsection 40(1)… .

6 July 1995 T.I. 5-951216 -

"Subsection 85(3) requires that property of a partnership be transferred to only one corporation prior to its winding-up. For example, the construction of paragraphs 85(3)(e) and 85(3)(f) indicates that a transfer of property from a partnership to more than one corporation was not intended by subsection 85(3)."

IT-378R "Winding-up of a Partnership" 1 January 1995

3. Subsections 85(2) and (3) taken together provide a means whereby partnership property may be transferred to a corporation and the related partnership interests converted into share holdings without realization of gains or losses at either level. (Those results may be different where property other than property described in subsection 85(2) is transferred to the corporation and/or property having a fair market value in excess of the adjusted cost base of a partner's partnership interest is transferred to him.) The Department's view is that the validity of an election under subsection 85(2) and of a winding-up under subsection 85(3) is contingent upon the partnership property being transferred to and share capital taken back from only one corporation. ...

7. For the purpose of paragraph 85(3)(b) the Department will consider the affairs of a partnership to have been wound up when all the property of the partnership, including money, has been distributed to the members in satisfaction of their interests in the partnership. The "rollover" will not be denied for the reason only that some of the requirements to complete the dissolution of the partnership, other than the distribution of all property, have not been fulfilled within 60 days after the disposition of property to the corporation.

8. For the purposes of paragraph 85(3)(c) the partnership must not own any property immediately before the winding up other than property received from the corporation as consideration for the disposition or money. Consequently any other partnership property must have been disposed of prior to distribution on winding up of the property described in paragraph 85(3)(c).

Subsection 85(4)

See Also

Zinkhofer v. MNR, 91 DTC 643 (TCC)

Sobier TCJ. accepted the taxpayers' submission that a corporation was not "controlled directly or indirectly in any manner whatever" by them in taxation years prior to the enactment of s. 256(5.1) where they did not acquire de jure control of the corporation.

Administrative Policy

24 March 1995 T.I. 943154 [Executor in personal capacity]

"Subsection 85(4) of the Act will not generally apply where all the shares of a corporation held by an estate are disposed of to the corporation which, immediately following the disposition, is controlled by the legal representative of the estate in his or her personal capacity unless, immediately after the disposition, the corporation is controlled, directly or indirectly in any manner whatever... by the estate (i.e., the legal representative of the estate in the capacity as executor ... ."

28 July 1994 T.I. 941639 (C.T.O. "Deny the Loss Added to ACB")

With respect to whether ss.85(4)(a) and 53(1)(f.1) would apply to the transfer by a corporation and its subsidiary of their respective undivided interest in a property to another corporation where both the transferor corporations and the transferee corporation were owned by several unrelated entities with no single shareholder holding an interest greater than 40% and each shareholder owning the same interest in both the transferor group of corporations and the transferee corporation, RC stated that:

"Two or more persons will be considered to be a group which controls a corporation where there is evidence they have a common link or interest or that they act together to control the corporation."

26 January 1994 T.I. 9336015 ["immediately after disposition" meaning"]

It was submitted that where a taxpayer transfers property to a corporation that is controlled by the taxpayer and shortly thereafter the taxpayer disposes of its shares in the transferee corporation to an arm's length purchaser, s. 85(4) and (5.1) would not apply because the taxpayer would not control the corporation within a relatively short time after the disposition and because the taxpayer would have indirectly disposed of the property to the purchaser. RC considered that this interpretation would result in the term "immediately after the disposition" be equivalent to "at the end of the series of transactions or events". Given that the expression "series of transactions or events" is used in numerous other provisions of the Act, Parliament could not have intended that the phrase "immediately after the disposition" be given the suggested interpretation.

8 February 1993 T.I. (Tax Window, No. 28, p. 2, ¶2416)

The capital loss otherwise deemed to be received by the sole individual shareholder of a holding company on the redemption of preferred shares of the holding company having a low paid-up capital and a high redemption amount would be denied by s. 85(4) because he would control the holding company immediately thereafter.

12 January 1993 T.I. 922257 (November 1993 Access Letter, p. 495, ¶C38-178; (Tax Window, No. 28, p. 11, ¶2363)

A foreign exchange loss realized under s. 39(2) on the repayment of a U.S.-dollar loan owing by a non-resident subsidiary to a Canadian corporation will not be subject to the stop-loss rules in s. 40(2)(e) or 85(4) because the debt is not viewed as having been disposed of to the subsidiary.

29 July 1992 Memorandum (Tax Window, No. 21, p. 1, ¶2038)

S.85(4) would not apply where all the shares of a corporation held by an estate are disposed of to a corporation which, immediately following the disposition, is controlled by the executrix in her personal capacity unless at that time the corporation is controlled, directly or indirectly in any manner whatever, by the estate, for example, by virtue of the estate holding a promissory note whose demand for payment would have an adverse impact on the operations of the corporation.

20 July 1992 T.I. 5-901453 -

If an estate transfers 40% of the shares of a corporation to the son of the deceased before the remaining 60% of the shares are redeemed in the hands of the estate, s. 85(4) will not apply to deny the capital loss arising on the redemption because the corporation would be controlled immediately after that time by the son, who would not be considered to control the estate by virtue only of being the executor. Similary, s. 85(4) would not apply if the common shares of the corporation were owned equally by father and mother prior to the decease of the father, following which his shares were redeemed in the hands of the estate whose executrix was the mother.

16 April 1992 T.I. (Tax Window, No. 18, p. 12, ¶1861)

Where a parent corporation settles a note receivable from a wholly-owned subsidiary for less than its principal amount, s. 85(4) will apply to deem the amount of the resulting capital loss to be nil.

92 C.R. - Q.19

Where an estate owns all the shares of Opco and 90% of its shares are redeemed, s. 85(4) will deem the capital loss to be nil, with the result that s. 164(6) will not apply.

30 November 1991 Round Table (4M0462), Q. 10.2 - Application of Subsection: 85(4) to an Estate (C.T.O. September 1994)

Re application of s. 85(4) where preferred shares of an estate are redeemed and the common shares are transferred to the children of the deceased.

91 C.R. - Q.42

If all shares held by an estate are disposed of to the corporation but the legal representatives in a personal capacity continue to control the corporation, s. 85(4) generally will not apply.

27 December 1990 Memorandum (Tax Window, Prelim. No. 2, p. 21, ¶1073)

S.85(4) does not apply to deny a capital loss realized by testamentary trust on the retraction of preferred shares held by it.

Subsection 85(5.1) - Acquisition of certain tools — capital cost and deemed depreciation

Administrative Policy

11 June 1990 T.I. (November 1990 Access Letter, ¶1524)

Where a parent corporation sells depreciable property to a wholly-owned subsidiary under a sales agreement, the depreciable property is transferred back to the parent on default by the subsidiary at a time that the property has a UCC of $100,000 and a fair market value of $50,000, and the debt owing by the subsidiary of $80,000 to the parent is extinguished by a quit claim deed, the more specific provisions of s. 85(5.1) will override the more general provisions of s

Articles

Bernstein, "Restructuring Real Estate Syndications that are in Trouble", 1992 Conference Report, c.10

Discussion of transactions that potentially avoid s. 85(5.1) in order to realize a terminal loss.

Subsection 85(6) - Time for election

Administrative Policy

90 C.R. - Q36

The RC position that the "taxation year" referred to in s. 85(6), in the case of a transfer by a partner or proprietor of capital property included in a business, is the calendar year in which the relevant fiscal period of that business ended, no longer applies.

Subsection 85(7) - Late filed election

Administrative Policy

1994 A.P.F.F. Round Table, Q. 15

Except in very limited circumstances, RC will not allow a parent corporation to file a late election on behalf of a subsidiary that has been wound-up into that corporation.

91 C.R. - Q.21

RC will no longer adjust the agreed amount where the taxpayer has made a reasonable but incorrect effort to determine the V-day value. RC now requires an amended election and the payment of the penalty.

Subsection 85(7.1) - Special cases

Cases

S. Cunard & Company Limited v. Canada (AG), 2012 DTC 5122 [at 7192], 2012 FC 683

Scott J. found that the Barnabe Estate principle, which allowed elections to be made by the estate of a deceased person, did not apply to a late-filed election by a corporation that had been wound up. The required T2057 form was signed only by the transferor and not by an officer of the transferee corporation. Scott J. stated (at para. 44):

It is also well established in jurisprudence that a person cannot bind a corporation after its dissolution unless the corporation is subsequently revived... .

Moreover, the applicable standard of review for a late filing under s. 85(7.1) is reasonableness, and there was nothing unreasonable about the Minister's decision to disallow a wound-up corporation from making an election that a wound-up corporation lacks the capacity to make (para. 45).

Bugera v. MNR, 2003 DTC 5282 (FCTD)

Before dismissing an application for judicial review of a decision of the Minister to not grant a request for the making of late-file elections, with the decision referring to the failure of the taxpayers to file the late elections with a request for review and to pay the estimated penalty, and to the taxpayers' request for late-filing elections having arisen out of a sophisticated tax plan which required them to recognize gain on the transactions (rather than have automatic rollover treatment under section 85.1) because of a plan to generate cumulate net investment losses, Dawson J. stated (at p. 5286):

"Nothing in the wording used in subsection 85(7.1) of the Act leads me to conclude that Parliament's intent is thwarted if persons who seek the Minister's favourable exercise of discretion are generally required to accompany their request with a properly completed election and are required to pay a properly identified estimate of the penalty owing in respect of the requested election."

Administrative Policy

Halifax Round Table, February 1994, Q. 19

Where capital gains are crystallized using an s. 85 election, RC will normally accept an amended election in cases where the estimates proved to be inaccurate provided a reasonable effort was made to estimate fair market value. (Implicitly, RC accepted that it was not necessary to have retained a share valuator.)

90 C.R. - Q37

RC's policy concerning the acceptance of an amended election is as outlined in IC 76-19R2.

86 C.R. - Q33

guidelines for filing and acceptance of late-filed elections.

Commentary

Availability of election

Where a taxpayer disposes of property to a taxable Canadian corporation for consideration that includes shares in the capital of the corporation, the taxpayer and corporation may make a joint election in the prescribed form (i.e., on form T2057). Subject to limits and exceptions set out in s. 85, the taxpayer's proceeds of disposition and the corporation's cost of the property will be deemed to be the elected amount (often referred to as the agreed amount). In essence, the subsection allows a shareholder or prospective shareholder to transfer property to the corporation on a rollover basis.

It has been found that the requirement that the consideration for the disposition of the property include shares can be satisfied where the transferee corporation is under an obligation to issue shares to the taxpayer, but does not do so immediately ([pin type="node_head" href="856-DaleFCA"]Dale[/pin]).

The property which has been disposed of must be "eligible property," as defined in [pin type="subtopic" href="856-85_1_1"]s. 85(1.1)[/pin].

There is no requirement that the taxpayer dispose of the property to the corporation pursuant to a written agreement, so that s. 85(1) potentially may be engaged where the taxpayer disposes of property to a corporation pursuant to an oral agreement ([pin type="node_head" href="856-Barnabe"]Barnabe Estate[/pin]).

Overview of agreed amount limitations

Paragraphs 85(1)(b) and (c) impose a general lower and upper bound on the elected amount, respectively. The minimum elected amount (subject to further limitations discussed below) is the value of consideration received by the taxpayer other than shares (the "boot"). The maximum is the fair market value of the property disposed of to the corporation. An amount outside these boundaries will be raised to the minimum or reduced to the maximum, as appropriate. In the event that the s. 85(1)(b) minimum value exceeds the s. 85(1)(c) maximum value (i.e. the boot's value exceeds the property's value), s. 85(1)(c) trumps, and the taxpayer is deemed to dispose of the property for fair market value. (The excess value received by the taxpayer may be taxed under s. 15(1) as a shareholder benefit or as a deemed dividend under s. 84.1 or s. 212.1. However, note that where the "boot" consists of a promissory note issued by the transferee corporation, the value of such promissory note may be limited by the net asset value of the transferee corporation - see [pin type="node_head" href="856-Leslie"]Leslie[/pin].)

Paragraphs 85(1)(c.1)-(e.4) deal with specific types of eligible property. In general, paragraphs (c.1)-(e.3) impose a minimum on the elected amount in order to prevent the taxpayer from utilizing the election to generate a loss. (In the absence of making an election, the suspended loss rules in ss. 40(3.4), 13(21.2) or 14(12) may apply.) Paragraph (e.4) is an anti-avoidance rule, related to the treatment of passenger vehicles in s. 13(7)(g).

Requirements for completion of election

The Interpretation Act, s. 32, provides that deviations from the prescribed form "not affecting the substance or calculated to mislead" do not invalidate the form used (see also [pin type="node_head" href="856-WardStemp"]Ward-Stemp[/pin]). Furthermore, where the correct version of the prescribed form (form T2057) is utilized, issues can arise as to whether deficiencies in the manner of its completion will invalidate the purported election. The election must clearly specify the property in issue at the time the election is filed ([pin type="node_head" href="856-Deconinck"]Deconinck[/pin]). Major omissions in the completion of the form may also invalidate the election (see generally, [pin type="node_head" href="856-Cox"]Cox[/pin]).

S. 85(1) requires that the taxpayer and the corporation to which it disposed of the property in question be parties to the election. This raises the issue as to whether successors of the taxpayer or the corporation may execute the election on the predecessor's behalf. Under most corporate statutes, an amalgamated corporation is considered to be a continuation of the amalgamating corporations (Guaranty Properties), so that the amalgamated corporation may execute an election on behalf of one of its predecessors. However, where the amalgamated corporation is not a continuation of its predecessors, the execution of an election by the amalgamated corp0ration may not satisfy a requirement that its applicable predecessor make the election (see [pin type="node_head" href="856-Deltona"]Deltona[/pin]).