Subsection 84.1(1) - Non-arm’s length sale of shares

Cases

Fiducie Famille Gauthier v. The Queen, 2012 FCA 76, aff'g 2011 DTC 1343 [at 1917], 2011 TCC 318

The taxpayer, a family trust, made a non-arm's-length sale of shares to a numbered corporation ("4041763 or "404") for a promissory note of approximately $2.6 million. 404 then immediately sold the shares at arm's length to a third party ("Keolis") for approximately $2.8 million. The lower sale price on the first transfer reflected that it had been determined that 404 would bear the cost of professional fees, relating to the structuring of the sale to Keolis, of $233,786.

Archambault J. affirmed the Minister's position that the amount of these professional fees was "consideration" received by the taxpayer. That amount was therefore added to variable D in s. 84.1(1)(b), resulting in an increase in the dividend deemed to be received by the taxpayer. Archambault J. stated (at para. 16):

I accept the definition of consideration laid down in Currie and referred to by Judge Lamarre in Republic National Bank, above, and the definition in Black's Law Dictionary, according to which "consideration" can encompass "[t]he inducement to a contract... [s]ome right, interest, profit or benefit accruing to one party, or some forbearance, detriment, loss, or responsibility, given, suffered, or undertaken by the other." By agreeing to be billed for the fees related to the sale of the shares in the place of Fiducie, 404 was, in a sense, undertaking Fiducie's responsibility. A benefit therefore accrued to Fiducie.

The Court of Appeal dismissed the appeal on the basis that the question of who was responsible for the fees, between the taxpayer and 404, was a question of fact. Noël J.A. stated (at para. 15):

Nothing would have prevented the parties from allocating the fee charges differently if that had been their agreement. However, given the evidence, the onus was on the appellant to show that the reduction of the share price, as explained by the tax professional, was not intended to reflect the fact that 4041763 had made the payment on its behalf. This the appellant has not done.

The Queen v. Olsen, 2002 DTC 6770, 2002 FCA 3

The taxpayer transferred shares of a corporation ("Leader") to corporations controlled by the taxpayer's children and spouses in consideration for promissory notes. Noël J.A. held that, as s. 186(4) provided that a payor corporation is connected with a particular corporation for purposes of Part IV when the former is controlled by the latter, the term "control" could only have the meaning assigned to it by subsection 186(2). Therefore, it followed that the reference to s. 186(4) in s. 84.1(1) included a reference to the notion of control as defined in s. 186(2), with the result that the taxpayer was deemed to receive a dividend based on the fair market value of the promissory notes received by him. (A submission of the Crown that the deemed dividend should be calculated instead on the basis of the fair market value of the transferred shares was rejected. S.84.1(1)(b), which like s. 69(1)(b), only applied where the parties did not deal at arm's length, provided for its own fair market value computation.)

See Also

Fiducie Famille Gauthier v. The Queen, 2011 DTC 1343 [at 1917], 2011 TCC 318, aff'd 2012 FCA 76

The taxpayer, a family trust, made a non-arm's-length sale of shares to a numbered corporation for a promissory note of approximately $2.6 million. The numbered corporation then immediately sold the shares at arm's length to a third party ("Keolis") for approximately $2.8 million. The lower sale price on the first transfer reflected that it had been determined that 404 would bear the cost of professional fees, relating to the structuring of the sale to Keolis, of $233,786.

Archambault J. affirmed the Minister's position that the amount of these professional fees was "consideration" received by the taxpayer. That amount was therefore added to variable D in s. 84.1(1)(b), resulting in an increase in the dividend deemed to be received by the taxpayer. Archambault J. stated (at para. 16):

I accept the definition of consideration laid down in Currie and referred to by Judge Lamarre in Republic National Bank, above, and the definition in Black's Law Dictionary, according to which "consideration" can encompass "[t]he inducement to a contract... [s]ome right, interest, profit or benefit accruing to one party, or some forbearance, detriment, loss, or responsibility, given, suffered, or undertaken by the other." By agreeing to be billed for the fees related to the sale of the shares in the place of Fiducie, [the numbered corporation] was, in a sense, undertaking Fiducie's responsibility. A benefit therefore accrued to Fiducie.

Mills v. The Queen, 2010 DTC 1301 [at 4078], 2010 TCC 443, aff'd 2011 DTC 5124, 2011 FCA 219

The taxpayer exchanged shares for a promissory note. Under s. 84.1(1)(b), the receipt of the promissory note resulted in a deemed dividend. The issuer of the note defaulted. Sheridan J. cited Terrador Investments (99 DTC 5358) for the proposition that, once the note was deemed to be a dividend paid to the taxpayer, it was no longer a "debt owing." Therefore, the default could not give rise to a bad debt deduction under s. 20(1)(p).

McMullen v. The Queen, 2007 DTC 286, 2007 TCC 16

The taxpayer and an unrelated individual ("DeBruyn") accomplished a split-up of the business of a corporation ("DEL") of which they were equal common shareholders by transactions under which (i) DeBruyn converted his (Class A) common shares into Class B common shares, (ii) the taxpayer sold his Class A common shares of DEL to a newly-incorporated holding company for DeBruyn's wife ("114") for a purchase price of $150,000, (iii) DEL issued a promissory note to 114 in satisfaction of a $150,000 dividend declared by it on the Class A shares, (iv) 114 as signed the promissory note to the taxpayer in satisfaction of the purchase price for the Class A shares, (v) the taxpayer transferred the promissory note owing to him by DEL to a holding company ("HHCI"), and HHCI purchased assets of the Kingston branch of the business of DEL in consideration for satisfaction of the promissory note.

In finding that the sale of the Class A shares of DEL by the taxpayer to 114 was a transaction between persons dealing with each other at arm's length, Lamarre J. noted (at pp. 292-293) that the actions of the taxpayer and the DeBruyns in negotiating the share sale transaction were governed by their respective perceptions of their own self interest, that "buyer and seller do not act in concert simply because the agreement which they seek to achieve can be expected to benefit both" and that "it cannot be concluded that parties have acted in concert simply because they have used the same financial advisors". Accordingly, s. 84.1 did not apply.

Lloyd v. The Queen, 2002 DTC 1493, Docket: 2000-1146-IT-G (TCC)

Although the taxpayer signed an agreement with a holding company for the sale of shares in a company ("READ") to the holding company, Bowman T.C.J. found that the transaction was not completed, so that there was no disposition for purposes of s. 84.1. Among other things, none of the stipulated consideration was ever paid by the holding company and the directors of READ did not approve the transfer as required by the articles.

Administrative Policy

2014 Ruling 2014-0526361R3 F - Post Mortem Pipeline

An estate of B, and a spousal trust for which B had been the spouse, which on death acquired (Class F) preference shares of a portfolio investment company (Investmentco) at a stepped-up tax cost, will effectively step-up the paid-up capital of their shareholdings by selling their its preference shares to a Newco for Newco preference shares with a high PUC. After a specified period, Newco will amalgamate with Investmentco, and the estate will start gradually retracting its (high PUC/basis) preference shares.

Ruling respecting non-application of s. 84.1 to the transfer of the preference shares.

See detailed summary under s. 84(2).

25 November 2012 November , 2010 CTF Annual Roundtable Q. , 2013-0479402C6

Employees of Opco received Opco shares as incentives under an Opco employee share ownership plan ("ESOP"). Under the terms of the ESOP, on retirement or other termination of employment, the employees would be required to dispose of these shares. To facilitate the disposition of such shares on retirement or other termination, Opco incorporates another corporation ("Buyco"), and Buyco purchase the departing employee's Opco shares. CRA stated:

[G]iven the degree of accommodation provided by Buyco to the departing employees and the parties' lack of separate interests, the better view is that the employees and Buyco are generally not dealing at arm's length. This view is consistent with several of our published documents (2007-0243171C6, 2002-0166655, and 2004-0103061E5) as well as the jurisprudence (Petro-Canada v. The Queen (2003 DTC 94) (confirmed by the Federal Court of Appeal (2004 DTC 6329)) and RMM Canadian Enterprises Inc. et al. v. The Queen (97 DTC 302)). Accordingly, in ruling requests on this type of transaction, considered in 2012, we refused to confirm that section 84.1 would not apply to deem employees to receive a dividend from a Buyco on the disposition of their Opco shares.

3 July 2012 T.I. 2012-0443421E5 F

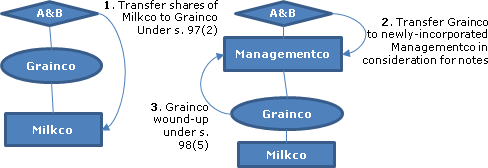

A and B are Canadian-resident spouses who have not utilized their capital gains exemption and who each hold 50 Class A shares (the only issued and outstanding shares) of their family farm corporation ("Milkco," a CCPC which has carried on a dairy farm for 20 years) having an fair market value of $500,000 an adjusted cost base and paid-up capital of $50, and qualifying under s. 110.6(1) as shares of the capital stock of a family farm corporation. They also each hold a 1/2 "interest in a family farm partnership" as defined in s. 110.6(1), namely, Grainco s.e.n.c., which has operated a cereal growing farm for three years, with each such 1/2 interest having an acb of $50.

A and B each roll their shares of Milkco into Grainco s.e.n.c. for additional partnership interests in Grainco s.e.n.c.

Five years later, after the fmv of the interests in Grainco s.e.n.c. have appreciated to $1.5 million and such interests continue to qualify as interests in a family farm partnership, A and then B (several days later) transfers his or her partnership interest in Grainco s.e.n.c. to a newly-incorporated corporation ("Managementco") - in which each of A and B holds common shares with an acb of $50) in consideration for a note receivable of $750,000 and claims the capital gains exemption. As Grainco s.e.n.c. now only has one partner (Managementco), it is dissolved by operation of law (with a view to the application of s. 98(5).)

Provided that Grainco s.e.n.c. has legal existence and does not hold title to the shares of Milkco as mandatary or nominee, s. 84.1 does not apply.

A stratagem permitting a taxpayer to strip the surplus of a private company by means of a reorganization which results in an indirect holding of its shares by means of a partnership appears to avoid the application of section 84.1.

The concept of series of transactions is enlarged by s. 248(10) - see Canada Trustco and Copthorne.)

[I]n order to determine if there is an abuse having regard to section 84.1, the CRA would need in particular to consider the source of funds used to pay off the consideration for the disposition of the partnership interests, as well as the value attributable to the shares of the corporation [i.e., Milkco] held by the partnership relative to the total value of the interests in the partnership....The CRA is preoccupied by transactions which could result in a stripping of corporate surplus. Furthermore, the CRA has concluded in certain cases (for example where a partnership serves only to hold shares of a private company), that this type of reorganization engages the application of the general anti-avoidance rule.

In response to a question as to whether the answer would change if Managementco instead was owned by the child of A and B, CRA indicated that although it was aware of the intergenerational rollover in s. 70(9.21), s. 84.1 did not take this consideration into account, so that the answer would not change.

2011 Roundtable Q. , 2011-0412121C6 F

As s. 84.1(1) takes precedence over s. s. 85(2.1), a "grind" of paid-up capital will not occur under s. 85(2.1) if all the conditions for the application of s. 84.1(1) are satisfied, even if the grind under s. 84.1(1)(a) is nil.

12 January 2005 T.I. 2004-010616

Under transactions in which Mr. A sells a portion of his shares of a family farm corporation ("Farmco") to a newly incorporated subsidiary ("Xco") of an unrelated individual (Mr. X) for a cash consideration of $500,000 which Mr. A then lends to Farmco, with Farmco using the loan proceeds to redeem the Farmco shares held by Xco, would be considered to be non-arm's length transactions that were subject to s. 84.1(1)(b). Such transactions also could be subject to s. 245(2).

9 January 2004 T.I. 2003-0037425

A farming partnership between a husband and wife transfers its business to a newly-incorporated corporation ("Opco") whose common shares are held by the husband and wife and which issued promissory notes and preferred shares in consideration for the acquired business. Later, the husband and wife transfer their partnership interests in the partnership to a Newco for consideration that includes a note with a principal amount that is in excess of the adjusted cost base of the transferred partnership interest by $500,000 each, and receives redeemable retractable preferred shares for the balance of the consideration.

Respecting whether s. 84.1 would apply to the transfer of the partnership interests, the Agency questioned the validity of the partnership following the transfer of its business to Opco and also indicated that the application of s. 245 to the series of transactions would be considered.

28 March 2003 T.I. 2002-016665

Two shareholders collectively holding 24% of the shares of Opco transfer their shares of Opco to a newly-incorporated holding company ("Xyco") and Xyco purchases shares held by two of the other shareholders for a non-share consideration. CCRA indicated that the shareholders of Opco

"Appear to be acting in concert to direct Xyco in connection with the sale of the shares of Opco. While there may be arm's length bargaining concerning the price to be paid for the shares of Opco, the shareholders appear to be acting in a highly independent manner to avoid tax in the transactions. In our view, Xyco may be viewed as merely accommodating the shareholders by structuring the transactions in this manner, since it does not appear to have any independent interest in acquiring the shares of Opco. Consequently, section 84.1 may apply to the above-described situation".

4 November 1998 T.I. 980169

A partnership that transfers shares will be considered to be a person and a taxpayer for purposes of s. 84.1.

23 December 1993 T.I. 5-932688 -

RC's practice is to apply s. 84.1 where the conditions for its application are present given that its provisions do not give RC any administrative discretion in its application. Accordingly, s. 84.1 will apply where a son of the taxpayer incorporated a holding company which purchased the taxpayer's shares for a promissory note payable over a ten-year period even when it is clear that the purchase price was equal to the fair market value of the shares and the purchased corporation had minimal retained earnings.

1993 A.P.F.F. Round Table Q. 4

It is not relevant to the application of s. 84.1 whether the subject corporation and the purchaser corporation were connected before the disposition in question; i.e., there is no requirement that they become connected.

29 January 1990 T.I. (June 1990 Access Letter, ¶1264)

The sale by Mr. and Mrs. A of all the shares of Holdco to a corporation owned by their daughter and son-in-law in consideration for a promissory note bearing a commercial rate of interest gives rise to a deemed dividend under s. 84.1(1)(b) equal to the amount by which the principal amount of the promissory note exceeds the greater of the paid-up capital of the shares of Holdco and their adjusted cost base.

18 December 1989 T.I. (May 1990 Access Letter, ¶1220)

An estate which acquires shares of a deceased person under a testamentary trust acquires the shares from a person with whom it was not dealing at arm's length.

October 1989 Revenue Canada Round Table - Q.11 (Jan. 90 Access Letter, ¶1075)

s. 84.1 will not apply where an individual taxpayer exchanges common shares of a corporation for preferred shares of the same corporation - because the shares will not be disposed of to another corporation.

18 Aug. 89 T.I. (Jan. 90 Access Letter, ¶1082)

s. 84.1 does not apply to the disposition by an individual of 1/2 of his common shares of Opco to Opco in exchange for preference shares of Opco because the common shares of Opco would not thereby be disposed of to another corporation.

Articles

David Wilkenfeld, "Section 84.2 Update", Tax for The Owner-Manager, Vol. 2, No. 1, January 2002.

Subsection 84.1(2) - Idem [Non-arm’s length sale of shares]

See Also

Emory v. The Queen, 2010 DTC 1074 [at 2901], 2010 TCC 71

The taxpayer and another individual ("Chen") owned 27% and 73%, respectively of the shares (being common shares) of a corporation ("Sona"). S. 84.1(1) deemed the taxpayer to receive a dividend when she and Chen transferred their shares of Sona to a corporation ("Ontario Inc.") that was mostly owned by Chen but in which she held 5% of the common shares and for consideration that in her case was paid in cash. This result occurred because the taxpayer was deemed by s. 84.1(2)(b) not to deal at arm's length with Ontario Inc. Woods J. stated (at para. 41) "the fact that the appellant owned a small number of shares in Ontario Inc. has unfortunately resulted in the application of this section."

Administrative Policy

25 July 1994 T.I. 940786

Where a transferor has acquired a subject share from a non-arm's length individual, the amount of any capital gain realized by the non-arm's length individual on the disposition, which is exempt from taxation in Canada by virtue of an exemption contained in a treaty between Canada and another country, will not normally be a capital gain included in s. 84.1(2)(a.1)(ii).

13 April 1994 T.I. 5-940501

An individual owns all the voting shares of a corporation ("Opco") and shares (including non-voting special shares) of Opco representing approximately 65% of the equity of Opco. A group of 20 arm's length employees own the balance of the non-voting special shares.

Ss.84.1(2)(b) and (e) would apply to deem the employees not to deal at arm's length with a new holding company ("Holdco") to which all the shareholders of Opco transferred their shares in exchange for shareholdings in Holdco which mirrored their shareholdings in Opco notwithstanding that, in fact, only the one individual controlled Opco and Holdco.

30 November 1991 Round Table (4M0462), Q. 10.1 - Non-Arm's Length Relationship and Death (C.T.O. September 1994)

Shares acquired by a taxpayer from his deceased spouse are acquired from a person with whom the taxpayer is not dealing at arm's length and are, therefore, subject to the reduction in adjusted cost base under s. 84.1(2)(a.1).

Paragraph 84.1(2)(a.1)

See Also

Côté-Létourneau v. The Queen, 2010 DTC 1116 [at 3092], 2007 TCC 91

The Court rejected a submission of the taxpayers that shares issued to them by a corporation were not acquired by them: an Order for them to acquire shares, there is no need for there to be a corresponding disposition of the shares.

Administrative Policy

10 August 2015 T.I. 2015-0602751E5 - Capital gains deduction and section 84.1

The taxpayer and his wife acquire all the shares, qualifying as qualified small business corporation shares, of a corporation (the "Corporation") directly from XX (the "Shareholder") in consideration for a promissory note having a principal amount equal to the fair market value of the acquired shares. They then transfer the shares to their newly-incorporated holding company ("Holdco") and use the funds of Holdco and the Corporation to repay the promissory note. CRA stated:

Section 84.1 of the Act is designed to ensure that a distribution of the retained earnings of the Corporation to you and your wife after the sale that would be taxed as a dividend if it had been paid directly to you remains taxed as a dividend after the transfer of the shares of the Corporation to Holdco (the conditions of application of section 84.1 would seem to be met because you and your wife would not deal at arm's length with Holdco and both Holdco and the Corporation would be connected for purposes of that provision).

…[B]ecause you and your wife would acquire the shares from the Shareholder (i.e. a person with whom you are not dealing at arm's length), subparagraph 84.1(2)(a.1)(ii) of the Act provides that the adjusted cost base, to you and your wife, of the Corporation shares would be reduced by the amount of capital gains deduction claimed under section 110.6… by the Shareholder.

… If instead of selling the shares to you and your wife, the Shareholder had sold the shares of the Corporation to Holdco and received a note, subsection 84.1(1)(b) of the Act might apply to deem the Shareholder to have received a dividend on the disposition of the shares.