Subsection 248(2) - Tax payable

Cases

R. v. Simmons, 84 DTC 6171 (Nfld. Prov. Ct.)

"[O]n the point raised by Mr. Sopinka that the charges were premature ... I will follow the Myers case (R. v. Myers and Inter Publishing Co. Ltd., 35 C.C.C.(2d)1) 'that a tax is imposed whether or not an assessment or reassessment is made'." (Charges apparently were laid before the accused was assessed for the unreported income.)

Subsection 248(3) - Property subject to certain Quebec institutions and arrangements

Cases

Construction Bérou Inc. v. The Queen, 99 D.T.C 5869, Docket: A-249-96 (FCA),

Létourneau J.A. found (at p. 5872) that s. 248(3) "is intended to treat beneficial ownership of property in the same way as various forms of ownership recognized in the civil law of Quebec."

Subsection 248(4) - Interest in real property

Administrative Policy

16 March 2015 Memorandum 2013-0479861I7 - Section 116 & forfeited deposits on real property

A non-resident vendor received a deposit under an agreement for sale of B.C. real property, which will be forfeited to it due to failure of the purchaser to close. Is the deposit subject to s. 116 withholding?

CRA first stated (based on the s. 248(1) – "disposition" definition) that "there is a disposition of a right under a contract where an agreement of sale has been cancelled and the buyer's deposit is forfeited to the vendor," and noted that under s. 248(4) "where the property is a security interest derived by an agreement for sale, it is excluded from being an interest in real property and is thereby excluded from the definition of taxable Canadian property." Before referring to Howe v. Smith (1884), 27 Ch D 89 and Tang v. Zhang, 2013 BCCA 52, CRA stated that "at common law, a deposit in respect of an agreement for the sale of real property has been viewed as an earnest or security for the performance of the purchase and sale, unless there is evidence that the contract requires otherwise," and then concluded that on forfeiture of the deposit:

there would be a disposition of a security interest derived by virtue of an agreement for sale or similar obligation. Since the property disposed of would not be an interest in real property for the purposes of the Act, it would not be taxable Canadian property and would not be subject to the application of section 116.

13 September 2012 CICA Compliance Roundtable Q. , 2012-0453021C6

Respecting a question as to whether shares of an unlisted corporation would be taxable Canadian property if during the preceding 60 months "most of the value of the corporation's shares was derived directly from assets consisting of non-defaulted arm's length mortgages secured by real property situated in Canada," CRA stated:

An interest in real property derived from a non-defaulted arm's length mortgage secured by real property is generally limited to an interest as security only, and subsection 248(4) of the Act clarifies that for the purposes of the Act, an interest in real property does not include an interest as security only derived by virtue of a mortgage. Therefore, CRA is of the view that the fact that at some time during the 60-month period that ended at the determination time, most of the value of the shares of a corporation that is not listed on a designated stock exchange was derived directly from assets consisting of non-defaulted arm's length mortgages secured by real property situated in Canada, would not result in a share of that corporation being TCP. However, if the rights of a particular mortgagee were different from those described in subsection 248(4) of the Act, we would need to examine all of the facts and circumstances relating to that particular mortgage before taking a final position....

2001 Ruling 2001-008388 -

A mortgage bond secured by a leasehold interest in land would constitute a mortgage secured by real property situated in Canada in light of s. 248(4).

18 January 1993 T.I. 5-921718 -

A three-year second mortgage loan, bearing interest at 11% per annum, made by a non-resident to a Canadian partnership provided that on maturity the lender would receive, in addition to principal and interest, 10% of the increase in the value of the building, if any, over the three-year term as determined by independent appraisal. In concluding that any disposition of the loan during the term of the loan would be a disposition of "real property situated in Canada" for purposes of s. 115(1)(b), the Department indicated that "the non-resident's interest in the building, which includes a right to participate in the appreciation of the building, is not 'an interest as security only' for purposes of s. 248(4), so that the mortgage loan was an interest in real property.

December 1990 TI 1990-240

In light of s. 248(4), leasehold improvements to a leasehold interest would, if rented, be considered to give rise to income from real property for purposes of the specified investment definition.

15 January 1987 TI 7-1282

Although s. 248(4) deem leases (in this case grazing leases on Crown lands) to be interest in real property, the definition of qualified farm property in s. 110.6(1) referred only to real property and, therefore, did not include a leasehold interest.

Subsection 248(5) - Substituted property

Cases

Sommerer v. The Queen, 2012 DTC 5126 [at 7219], 2012 FCA 207

In determining whether s. 75(2) should apply to the taxpayer, Sharlow J.A. stated (at para. 46):

This provision must be read together with paragraph 248(5)(a) of the Income Tax Act, which provides, broadly speaking, that for the purposes of most provisions of the Income Tax Act, the notion of the substitution of property contemplates any number of substitutions.

The Court proceeded to find on other grounds that s. 75(2) did not apply.

See Also

Saint Pierre v. The Queen, 2008 DTC 3730, 2007 TCC 90

The taxpayer transferred shares of a corporation ("3101") to a management company controlled by him and the management company disposed of a portion of those transferred shares to the taxpayer's wife approximately a year later. Approximately half a year after that, the taxpayer's wife exchanged her shares of 3101 for shares of another class of 3101, following which 3101 was merged with another corporation and the taxpayer's wife disposed of her shares of the merged company to a purchaser at a capital gain.

Tardif J. found that the shares of the merged company were substituted property for the shares that the taxpayer had transferred to the management company and stated (at para. 38) that "there is no basis to hold that there has to be a series of interrelated operations here".

Administrative Policy

25 September 2013 Memorandum 2013-0476311I7 F - 93(2), 93(2.01) - Share substituted

In the course of reviewing the facts summarized under s. 93(2.01), CRA stated (TaxInterpretations translation):

Subsection 248(5) contemplates rules of interpretation which establish the scope of the concept of substituted property for purposes of the Act. Paragraph 248(5)(a) circumscribes this concept in referring to a property acquired in a disposition or exchange of a given property, so that the latter property is the subject of a legal transaction. The second part of paragraph 248(5)(a) expands the scope of this concept in envisaging an indeterminate number of substitutions, establishing a link between the initial property under consideration and the property acquired in the final substitution. …

In this case, the XX A Shares of USCO1 were issued in the course of a legal transaction which did not involve in any way the interest in LLC1 or a property acquired in replacement for such interest.

10 May 2013 Memorandum 2012-0464901I7 - 93(2), 93(2.01) - Share substituted

Canco owns all the shares of Forco1, which it transfers to Forco2 for a promissory note payable in U.S. dollars, and then transfers the note to Forco3 in exchange for shares of Forco3. In finding that such shares of Forco3 were substituted for the shares of Forco1, CRA indicated that the concept of "share substituted" was not restricted "to a chain of substitutions in which only shares are substituted."

6 April 1992 T.I. 920265 (March 1993 Access Letter, p. 71 ¶C56-218; Tax Window, No. 18, p. 1, ¶1852)

Where, in 1978, a taxpayer transferred property to his spouse who, in turn, transferred the property to a holding company for preferred shares and also subscribed for common shares, the attribution rules may apply to the sale of the common shares by the spouse.

15 January 1992 T.I. (Tax Window, No. 15, p. 12, ¶1700)

Where a minor son received shares from his father on a rollover basis pursuant to former s. 73(5), realizes an exempt capital gain on a later disposition of those shares and invests the proceeds in GIC's, the interest on the GIC's (including the interest on the portion relating to the exempt capital gain) would fall within the definition of substituted property, with the result that s. 74.1(2) will apply to attribute the interest income back to the father.

Subsection 248(6) - “Class” of shares issued in series

See Also

Bowater Canadian Ltd. v. R.L. Crain Inc. (1987), 62 OR (2d) 752 (C.A.)

The articles of amalgamation of the corporation provided for common shares, and for "special common shares" which were entitled to ten votes per share as long as such shares were held by the person to whom they originally were issued, and thereafter to one vote per share. The "step-down" provision in the special common shares provisions was found to violate the principle (implicit in s. 24(3) of the Canada Business Corporations Act) that there must be equality of rights within a class of shareholders. Accordingly, the step-down provision was found to be void, with the result that the special common shares continued to carry ten votes per share following their transfer.

Subsection 248(7) - Receipt of things mailed

See Also

The Queen v. Schafer, 2000 DTC 6542, Docket: A-414-98 (FCA)

A notice of assessment that the trial judge found the respondent had never received was deemed by s. 334(1) of the ETA to have been received by her on the date of mailing.

Sameden Oil of Canada, Inc. v. Provincial Treasurer of Alberta (1993), 102 DLR (4th) 125 (Alta. C.A.)

The taxpayer mailed his 1988 corporate tax return by registered mail from the United States on June 30, 1989, and the return was received by the respondent on July 13, 1989. In finding that the taxpayer had not complied with the requirement in the Alberta Corporate Tax Act that the return be filed with the Provincial Treasurer by June 30, 1989, the Court of Appeal affirmed the finding of Rawlins J. that the word "filed" is "clear and unequivocal and connotes the requirement of actual delivery before filing and therefore a mailed document is not considered 'filed' until it is received and not at the point of mailing".

Rolling v. Willann Investments Ltd. (1989), 63 DLR (4th) 760 (Ont CA)

An offer was considered to have been "delivered" to a person ("Willann") when it was faxed to Willann:

"Where technological advances had been made which facilitates communications and expedite the transmission of documents we see no reason why they should not be utilized. Indeed, they should be encouraged and approved. Nothing is to be gained in the circumstances of this case in requiring an attendance at Willann's offices to deliver the documents, and Willann suffered no prejudice by reason of the procedure followed."

Subsection 248(8) - Occurrences as a consequence of death

Paragraph 248(8)(a)

See Also

Bueti v. The Queen, 2015 TCC 265

Owen J made a factual finding that a particular property (a house in the estate of the taxpayer's father) was purchased for cash consideration by her and her husband, as joint tenants, rather than being devised to her under her father's will. Accordingly, her and her husband's cost of the property was their cash purchase price rather than being deemed by s. 70(5)(b) to be its higher fair market value at the time of their purchase.

Before so concluding, he observed that, under the laws of Ontario, residuary beneficiaries do not acquire an interest in any specific property in the residue of the estate and it is instead the residuary property is vested in the executors. Neither counsel mentioned s. 248(8)(a). See summary under s. 70(5).

Husel Estate v. The Queen, 94 DTC 1765 (TCC)

Kempo TCJ. found (at p. 1769) that s. 248(8)(a) was added "to obviate the denial of a rollover in situations where an individual, qua beneficiary, acquired estate property upon payment of consideration to satisfy the terms of a testamentary condition or instrument". Here, however, the transfer of shares to the wife of the deceased did not occur as a consequence of the death of the deceased because the transfer occurred pursuant to what was viewed as an independent purchase transaction.

Administrative Policy

16 December 2014 T.I. 2014-0539841E5 F - Testamentary Trust

Would a trust created by will in favour of the child of the deceased (the "Child Trust") cease to qualify as a testamentary trust in the year of operation of a clause in the will directing that a trust created by the will for the exclusive benefit of the deceased's spouse to pay over the residue to the Child Trust on the spouse's death? After referring to s. 248(8)(a), CRA stated (TaxInterpreations translation):

[A] contribution of property to a trust by a deceased contributor which takes effect at a date subsequent to death, such as a contribution of property to a trust following the death of a surviving spouse, generally would not disqualify the trust as a testamentary trust.

The summary stated that "the property is contributed to the second [child] trust by the deceased person, through specific directions given in that person's will."

12 June 2012 STEP CRA Roundtable Q. , 2012-0442931C6

In the situation where the estate trustees are instructed under the Will to set up a number of trusts from the residue of the estate, CRA "generally has viewed the trusts created out of the residue as arising on death."

11 January 2012 STEP Roundtable Q. , 2011-0402291C6

Where a taxpayer dies intestate, then provided the property of the deceased is distributed to the beneficiaries in accordance with the shares specified in the applicable provincial law of intestacy, such property will be considered to have been distributed as a consequence of the deceased's death per s. 248(8) even if each type of property is not distributed on a pro rata basis among the beneficiaries. For example, it would be permissible for a surviving spouse to receive, in accordance with such provincial law, all of an RRSP of the deceased that was included in the estate, in order to access the s. 60(l) rollover.

5 May 1995 T.I. 950098 (C.T.O. "Assumption of Liabilities")

A transfer of shares of a private corporation made to the surviving spouse after her agreement to assume liabilities of the estate and provide security therefor would not be considered a transfer "under or as a consequence" of the terms of the will of the taxpayer but, rather, as the result of the agreement between the executors and the surviving spouse.

17 August 1994 T.I. 941053 (C.T.O. "Trusts - 'As a Consequence of the Taxpayer's Death'")

A discretion accorded by the will to the executors to determine the particular assets to be distributed to the spouse or spousal trust of the deceased would not, by itself, cause the rollover in s. 70(6) not to be available.

Articles

Hoffstein, Lee, "Restructuring the Will and the Testamentary Trust: Methods, Underlying Legal Principles and Tax Considerations", Estates and Trust Journal, Volume 13, 1993, p. 42.

Paragraph 248(8)(b)

See Also

Sembaliuk v. Sembaliuk (1984), 43 R.F.L. (2d) 425 (Alta. C.A.)

"[A] disclaimer, being an avoidance of a gift, is not a conveyance of the property comprised in that gift."

Montreal Trust Co. v. Matthews, [1979] 3 WWR 621 (BCSC)

"A disclaimer can be made by deed, writing, under hand only or even as a result of contract, as any document is admissible so that evidence of the disclaimer is available. A disclaimer may even be evidenced by conduct ... A disclaimer once made is retroactive to the date of death of the deceased."

Administrative Policy

10 April 1997 T.I. 970618

Where children surrender (as defined in s. 248(9)) their interest in an RRSP and the surviving spouse (their mother) thereby acquires an interest in that property, it will be considered to have become receivable by the spouse "as a consequence of the death" by virtue of s. 248(8)(b).

9 March 1992 T.I. (Tax Window, No. 17, p. 9, ¶1788)

Discussion of factors relevant to determining whether a transfer of rights under a will by a beneficiary is a true disclaimer, release or surrender.

8 March 1991 T.I. (Tax Window, No. 1, p. 21, ¶1152)

An election under the Family Law Act (Ontario) by a surviving spouse is a disclaimer for purposes of s. 248(8)(b), with the result that the spousal rollover will be available for property transferred to the surviving spouse in satisfaction of the election if the transfer is made under a court order.

22 February 1990 T.I. (July 1990 Access Letter, ¶1348)

IT-385R, para. 6, continues to reflect RC's position where a taxpayer renounces any part of his income interest in a trust subsequent to having accepted funds from the trust in respect of that interest.

Paragraph 248(8)(c)

Administrative Policy

19 September 2014 Folio S6-F2-C1

1.14 When subsection 248(8) applies, the more restrictive requirements of the definition of release or surrender found in subsection 248(9) must be met. Pursuant to paragraph 248(8)(c), a release or surrender by a beneficiary with respect to any property that was property of a deceased individual immediately before death, is not considered to be a disposition of the property by the beneficiary . However, paragraph 248(8)(c) does not apply to an income interest that arises upon the death of the deceased, as such an interest could not have been property of the deceased immediately before death.

Subsection 248(10) - Series of transactions

Cases

Groupe Honco Inc. v. The Queen, 2014 DTC 5006, 2013 FCA 128, aff'g 2013 DTC 1032 [at 149], 2012 TCC 305, infra

On January 13, 1999, a newly-incorporated corporation ("New Supervac") was leased the assets of an unrelated corporation ("Old Supervac"), coupled with an option to acquire those assets and the right to also acquire all the shares of Old Supervac. The business was restored to profitability in short order, and New Supervac then acquired the assets on October 7, 1999, acquired the Old Supervac shares on November 17, 1999 and amalgamated with it on January 1, 2001. The amalgamated New Supervac paid a capital dividend in the fall of 2004 to one of the taxpayers (with such capital dividend being further distributed), and the Minister applied s. 83(2.1) to the capital dividends.

In response to the taxpayers' submission that too much time had passed between the different transactions for them to be one series of transactions, Trudel JA noted that Copthorne indicated that sometimes the elapsed time would be a relevant factor in this determination, and that Boyle J had made a finding of fact that, at the time the decision was taken to pay a capital dividend, New Supervac had taken into consideration the capital dividend account that had been acquired with the Old Supervac shares.

Copthorne Holdings Ltd. v. The Queen, 2012 DTC 5006 [at 6536], 2011 SCC 63

The taxpayer's shareholders circumvented the rule in s. 87(3), which required that the paid-up capital ("PUC") of a subsidiary corporation disappear on a vertical amalgamation, by arranging for the subsidiary corporation in question (whose shares had a high PUC but a low value) to be first distributed to the shareholder group before it and its previous parent were amalgamated horizontally to continue as a predecessor of the taxpayer. At the time of these transactions, the shareholder group had not yet decided how (or whether) they would utilize the preserved PUC. However, [over] a year later, the taxpayer redeemed a large portion of its shares and utilized the PUC attributable to the redeemed shares through a distribution to its non-resident shareholder, thereby avoiding Part XIII tax.

In finding that the taxpayer should be reassessed under s. 245, the Court found that the series of transactions pertaining to the reorganization, and the subsequent redemption, were part of the same series of transactions. Under Canada Trustco, a transaction is completed "in contemplation of" a series of transactions whenever it is completed "because of" or "in relation to" the series. The finding at trial that the transactions shared a "strong nexus" thus fit the expansive meaning of "series of transactions" under s. 248(10).

The Court also addressed the criticism of its finding in Canada Trustco that the words "in contemplation of" could be retrospective. (The argument was essentially that the plain meaning of "in contemplation of" implies the contemplation only of a future event.) The Oxford English Dictionary definition of "to contemplate" does not require that contemplation be prospective (para. 53). Rothstein J. stated (at para. 56):

The fact that the language of s. 248(10) allows either prospective or retrospective connection of a related transaction to a common law series and that such an interpretation accords with Parliamentary purpose, impels me to conclude that this interpretation should be preferred to the interpretation advanced by Copthorne [that "in contemplation of" is prospective only].

The Toronto Dominion Bank v. The Queen, 2011 DTC 5125 [at 6061], 2011 FCA 221, [2011] 6 CTC 19

A transitional provision in the Act provided that the old s. 55(1) would apply to a transaction if it were "part of a series of transactions, determined without reference to subsection 248(10) of said Act, commencing before the day on which this Act is assented to and completed before 1989... ." The Minister argued that the exclusion of s. 248(10) did not automatically restrict "series of transactions" to mean only series that were pre-ordained. The Court disagreed. Evans J.A. stated (at para. 46):

It would only make sense to exclude subsection 248(10) - which is designed to include transactions otherwise excluded from the common law meaning of "series of transactions" because not pre-ordained - if the series of transactions had to be pre-ordained.

Lipson v. The Queen, 2007 DTC 5172, 2007 FCA 113, aff'd 2009 DTC 5015 [at 5528], 2009 SCC 1

The taxpayer's wife ("Jordanna") borrowed $562,500 from the Bank of Montreal under an interest-bearing demand promissory note in order to purchase some of the shares of the a family corporation from the taxpayer for that sum, with the sale proceeds being used by the taxpayer to purchase a family home. The next day, a mortgage loan on the home received from the Bank was used to retire the demand promissory note. The taxpayer did not report a capital gain on the sale of the shares (on the basis that the inter-spousal rollover in subsection 73(1) applied) and included in the computation of his income both the dividends on the shares purchased by Jordanna, and the interest expense incurred by her on the mortgage loan, on the basis that the attribution rules in subsection 74.1(1) applied.

After noting (at para. 47) that in the Canada Trustco case, the Court had confirmed that "the expression 'series of transactions' in section 245 refers to transactions that are 'pre-ordained in order to produce a given result' with 'no practical likelihood that the planned events would not take place in the order ordained'", the Court noted that here the series of transactions comprised those described in the paragraph above together with the following events which were later completed in contemplation of the series, namely, the deduction by Jordanna of interest costs, and the utilization by the taxpayer of the attribution rules.

Canada Trustco Mortgage Co., v. The Queen, 2005 DTC 5523, 2005 SCC 54

The Court stated (at 5528) that s. 248(10) has application:

"where the parties to the transaction 'knew of the ... series, such that it could be said that they took it into account when deciding to complete the transaction'. We would elaborate that 'in contemplation' is read not in the sense of actual knowledge but in the broader sense of 'because of' or 'in relation to' the series. The phrase can be applied to events either before or after the basic avoidance transaction found under s. 245(3)."

OSFC Holdings Ltd. v. The Queen, 2001 DTC 5471, 2001 FCA 260

Although the "common law" meaning of a series of transactions was transactions each of which is pre-ordained to produce a final result, s. 248(10) was found to have expanded this meaning.

See Also

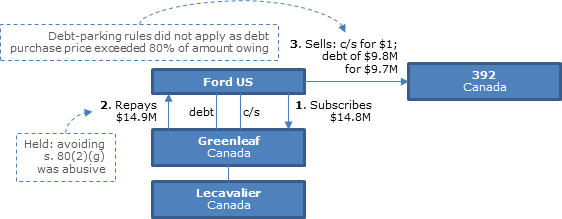

Pièces Automobiles Lecavalier Inc. v. The Queen, 2014 DTC 1126 [at 3319], 2013 TCC 310

A Canadian subsidiary ("Greenleaf") of Ford U.S. paid down to $9,750,000 (including accrued interest) a debt of $24,369,439 (plus accrued interest) owing by it to Ford U.S. through the application of share subscription proceeds of $14,843,596 received by it from Ford U.S.A. and the application of a small amount of cash on hand of $100,706. Eighteen days later, a predecessor of the taxpayer ("392"), which was at arm's length with Ford U.S., purchased all the shares of Greenleaf from Ford U.S. for consideration of $1, and purchased the debt at only a slight discount to the amount owing, so that the debt-parking rules in ss. 80.01(6) to (8) did not apply. The Minister applied s. 245(2) on the basis that Greenleaf had sustained a debt forgiveness in the amount of the debt-paydown.

After indicating that he was not convinced that the debt-paydown transactions had occurred only at the behest of Ford U.S., Bédard J went on to indicate that, in any event, they were part of the same series of transactions as the debt purchase as Ford U.S. had effected them in order to realize a capital loss on its shares of Greenleaf, so that the debt-paydown transactions were related transactions effected in contemplation of the subsequent sale transaction.

Bédard J proceeded to find abuse.

MIL (Investments) S.A. v. The Queen, 2006 DTC 3307, 2006 TCC 460, aff'd 2007 FCA 236

In March 1993 an individual ("Boulle") transferred his shares of a Canadian public junior exploration company ("DFR") to the taxpayer, which was a newly-incorporated Cayman Islands company wholly owned by him. By June 1995 the DFR shares had substantially appreciated in value, at which time the taxpayer exchanged, on a rollover basis pursuant to s. 85.1, a portion of its DFR shares for common shares of a large Canadian public company ("Inco"), with the result that the taxpayer's shareholding in DFR was reduced below 10%.

In finding that the (final) sale by the taxpayer of DFR shares in August 1996 was not part of the series of transactions that included the sale by the taxpayer of DFR shares to Inco in June 1995, and the continuation of the taxpayer to Luxembourg in July 1995, Bell J. found that at and prior to the time of continuation, DFR management, including Boulle, and therefore, the taxpayer, had no intention of selling DFR shares after having stated (at p. 3314):

"There must be a strong nexus between transactions in order for them to be included in a series of transactions. In broadening the word 'contemplation' to be read in the sense of 'because of' or 'in relation to the series', the Supreme Court cannot have meant mere possibility, which would include an extreme degree of remoteness. Otherwise, legitimate tax planning would be jeopardized ... ."

Canutilities Holdings Ltd. v. The Queen, 2003 DTC 1029 (TCC), rev'd in part 2004 DTC 6475, 2004 FCA 234

Normal course dividends paid by the taxpayers were not paid in contemplation of transactions in which their common shares of a public company were converted into special shares of an amalgamated corporation and redeemed and, therefore, were not assimilated to the series comprising such amalgamation/redemption transactions.

Les Placements E&R Simard Inc. v. The Queen, 97 DTC 1328 (TCC)

On September 10, 1988, the taxpayer transferred its assets to a subsidiary ("Alimentation 1988") in consideration for a demand promissory note and 506,125 Class B shares having a redemption value of $1 per share and nominal paid-up capital. 151,125 of the Class B shares were redeemed in the fiscal years of Alimentation 1988 ending on May 31, 1990, 1991 and 1992.

In finding that the redemptions did not occur as part of the same series of transactions that included the 1988 sale, Tardiff TCJ. noted that they did not occur close in time to the first transaction, the transactions were not interdependent in the sense that there was a real possibility that Alimentation 1988 might never have redeemed the shares, and the fundamental objective underlying the 1988 transaction was for one of the two principals of the taxpayer to retire from the business of the taxpayer. The financial objective of converting, at some time, the Class B shares into cash was secondary.

Craven v. White, [1988] BTC 268 (HL)

Lord Jauncey stated:

"If it were appropriate to prepare a formula defining 'composite transaction' in the light of the passages in the speeches in Ramsay, Burmah and Dawson to which I have referred I should be tempted to suggest the following:

'A step in a linear transaction which has no business purpose apart from the avoidance or deferment of tax liability will be treated as forming part of a pre-ordained series of transactions or of a composite transaction if it was taken at a time when negotiations or arrangements for the carrying through as a continuous process of a subsequent transaction which actually takes place had reached a stage when there was no real likelihood that such subsequent transaction would not take place and if thereafter such negotiations or arrangements were carried through to completion without genuine interruption.'"

Administrative Policy

24 October 2012 Memorandum 2012-0456711I7 F - Inadmissibilité à la déduction pour GC

Contains a general discussion of the series of transactions doctrine in the context of a proposes asessment under s. 110.6(7)(b). CRA notes that under Copthorne, a series of transactions can include the prospective or retrospective attachment of a related transaction to the series.

17 November 2000 T.I. 1999-000858 -

"A particular transaction will be part of a series of transactions if that transaction is logically and reasonably connected to another transaction or series of transactions or is a related transaction undertaken in contemplation of another transaction or series of transactions."

23 August 1991 T.I. (Tax Window, No. 8, p. 21, ¶1409)

A preliminary transaction will form part of a series of transactions that includes subsequent transactions if at the time of the preliminary transaction the taxpayer has the intention to implement the subsequent transactions when the subsequent transactions are eventually carried out, even though at the time of completion of the preliminary transactions the taxpayer either had not determined all the important elements of the subsequent transactions or lacked the ability to implement the subsequent transactions.

9 May 1990 Meeting (October 1990 Access Letter, ¶1474)

"If at the time of the 'butterfly' reorganization the shareholders had formed the intention to sell their shares, and their shares are eventually sold, the reorganization and the ultimate sale will be considered to form part of the same series even though at the time of the reorganization the shareholders either had not determined all of the important elements of the subsequent sale - such as, for example, the identity of the purchaser or the purchase price and terms of payment - or lacked the ability to implement the subsequent sale."

3 November 89 T.I. (April 90 Access Letter, ¶1172)

"A preliminary transaction will form part of the series of transactions or events determined with reference to subsection 248(10) if, at the time that the preliminary transaction is carried out, the taxpayer is intending to implement the subsequent transactions constituting the series, and the subsequent transactions are eventually carried out. Thus, the preliminary and subsequent transactions will be part of the series even though at the time of completing the preliminary transactions the taxpayer either had not determined all the important elements of the subsequent transactions - such as, for instance, the identity of the other taxpayers involved - or lacked the ability to implement the subsequent transactions."

Articles

Benjamin Alarie, Julia Lockhart, "The Importance of Family Resemblance: Series of Transactions After Copthorne", Canadian Tax Journal (2014) 62:1, 273-99.

Extension of common-law series (pp. 76-77)

… Kandev et al. argue that the purpose of subsection 248(10) is merely to bring into the Act the common-law meaning of series; [fn 25: Michael Kandev, Brian Bloom, and Olivier Fournier, "The Meaning of 'Series of Transactions' as Disclosed by a Unified Textual, Contextual, and Purposive Analysis" (2010) 58:2 Canadian Tax Journal 277-330, at 279.] however, that view is not one that is widely held….

In Copthorne, the Supreme Court again stated that the "common law series is expanded by s. 248(10) of the Act." [fn 28: Copthorne, 2011 SCC 63, at paragraph 43.]…

Meaning of "related transactions" (p. 78)

[N]one of the cases involving subsection 248(10) explicitly purports to define "related transactions or events" as an independent element. [fn 32: On the other hand, it should be noted that in OSFC…at paragraph 36, Rothstein JA wrote, "As long as the transaction has some connection with the common law series, it will, if it was completed in contemplation of the common law series, be included in the series by reason of the deeming effect of subsection 248(10) [emphasis added]."…] The courts seem to have simply taken the view that a transaction is related to a series where it is carried out in contemplation of that series. In other words, the courts appear to have effectively read subsection 248(10) as though it had used the words "related in the sense of having been completed in contemplation of the series."

This interpretation is arguably inconsistent with the principle of statutory interpretation to the effect that Parliament does not speak without reason. [fn 33: See, for example, R v. D.A.I., 2012 SCC 5, at paragraph 31.]…

Breaking of series by intervening event (p. 84)

One possible standard to consider for intervening events comes from the field of tort law: the concept of novus actus interveniens…. Applying this test to the series concept would mean asking whether the intervening event was foreseeable at the time of the earlier transaction or series. If the event was foreseeable, it would not be sufficient to break the series….

Length of time between series and related transactions (p. 85)

The courts have previously expressed a variety of views on what might count as a sufficient length of time to prevent a series from existing. In Les Placements E. & R. Simard Inc. v. The Queen, for example, Tardif J wrote that a 12-month interval constituted a "long period of time" for the purpose of determining whether a series existed. [fn 65: 97 DTC 1328, at 1337 (TCC).] Similarly, in Industries SLM Inc. v. MNR, Archambault J suggested that intervals of 9 months and 33 months were relatively long for a common-law series. [fn 66: [1996] 2 CTC 2572, at 2489 (TCC).] Finally, in Copthorne itself, Ryer J of the Federal Court of Appeal appeared to be of the view that while 18 months might be sufficient to prevent subsection 248(10) from applying, one year was relatively short. [fn 67: … 2009 FCA 163, at paragraph 51.]

Meaning of "family resemblance" (pp. 90-1)

Milet has explained the idea of family resemblance as follows:

[T]he various instances of a general term's application would be linked by, as Wittgenstein called them, "family resemblances" – the reference here being to the way that traits are shared by and dispersed among members of a family: for instance, a girl has red hair and is short like her father and grandmother, while her brother, who is also red-haired, is tall like his blond mother. Despite having no single set of features in common, the various members viewed as a group may quite visibly belong to the same family. …[fn 80: Matias Milet, "Hybrid Foreign Entities, Uncertain Domestic Categories: Treaty Interpretation Beyond Familiar Boundaries" (2011) 59:1 Canadian Tax Journal 25-57, at 34.]

Application of purpose of non-GAAR provision to series determination (pp. 93-4)

[H]aving determined the purpose of the provision, how should a court use that purpose to determine whether or not a series exists? The answer in many statutory contexts is that the set of transactions must bear a family resemblance to those that Parliament could reasonably be considered to have had in mind in invoking the series concept as a means of anti-avoidance. Under a family resemblance approach to series of transactions, a court would begin by identifying a stylized set of transactions or events (generally an avoidance arrangement of some kind) that Parliament could reasonably be considered to have had in mind in drafting the provision (or provisions) in which the series concept appears. The court would then attempt to ascertain whether the transactions carried out by the taxpayer bore a sufficient family resemblance to that stylized set of transactions or events to be considered a series for the purposes of that particular statutory invocation of the term.

Example: are replacement stock options part of bump denial series? (pp. 94-5)

Consider the following example…

- Bidco is a wholly owned subsidiary of a public corporation, Pubco. Bidco intends to acquire all of the shares of Target, also a public corporation, in an all-cash deal. Certain management employees of Target are specified shareholders for purposes of the bump denial rules in paragraph 88(1)(c)….

- Bidco will enter into employment agreements with the management employees of Target providing that those employees will receive, in accordance with Pubco's regular compensation policy, options to acquire shares of Pubco. The purpose of the stock option grant is to retain Target's management employees and foster their loyalty to Pubco following the takeover. Target's management has no involvement in Bidco's tax planning and is unaware that Bidco is contemplating a bump reorganization. [fn 87: Mark D. Brender, "Series of Transactions: A Case for a Purposive Interpretation," Corporate Tax Planning feature (2007) 55:1 Canadian Tax Journal 220-34.]

…Brender argues that the transactions do not form a series because they do not share a common purpose, a point with which we agree. That being said, in our view, the option grant should not form part of the series for a more fundamental reason—namely, that the option grant does not bear any family resemblance to the types of transactions that Parliament can reasonably be considered to have had in mind when it enacted subparagraph 88(1)(c)(vi). ...[T]here is no subset of the sequence of events described in Brender's example that bears a family resemblance to the avoidance arrangements that Parliament sought to address... .

Application of purpose of GAAR to series determination (p. 104)

We contend that if a particular transaction in its context bears a family resemblance to a stylized transaction that is accepted as being abusive, then the safeguard of subjection 245(4) ought not to operate to protect the tax benefit claimed by the taxpayer, which will be denied "as is reasonable in the circumstances" by the operation of subsection 245(2).

UK GAAR (p. 107)

[I]t is instructive that the United Kingdom has decided not to use the series concept in its new general anti-abuse rule ("UK GAAR"). Instead, it has adopted a "tax arrangement" test, which sets a low threshold for determining whether transactions are tax-motivated….

David M. Williamson, Michael H. Manly, "Subsection 69(11) - Unexpected Problems from Inappropriate Positions", Corporate Structures and Groups, Vol. V, No. 4, 1999, p. 285.

Thivierge, "Emerging Income Tax Issues", 1993 Conference Report, c. 4

J. Tiley, "Series of Transactions", 1988 Conference Report, c.8.

Subsection 248(16) - Goods and services tax — input tax credit and rebate

Administrative Policy

27 November 2014 T.I. 2013-0503861E5 F - Application du paragraphe 248(16)

Where a building drop-down under s. 85(1) generates an ITC to the transferor under ETA s. 193, such ITC does not reduce the UCC of the property for s. 85 elected amount purposes. CRA appears to be effectively ignoring s. 248(16)(a)(i), which deems the ITC to have been received as government assistance when the GST originally was payable by the transferor, because that does not make any sense under facts such as these. See summary under s. 85(1)(e).

3 January 1992 T.I. (Tax Window, No. 15, p. 24, ¶1683)

A cash-basis taxpayer will be considered to have received a GST input tax credit in the period for which the refund is claimed on the GST return.

19 August 1991 Memorandum (Tax Window, No. 8, p. 12, ¶1395)

A GST input tax credit is considered to be received or credited in the reporting period in which the claim was made rather than the reporting period to which the claim relates.

22 March 1991 T.I. (Tax Window, No. 1, p. 7, ¶1164)

A GST rebate which is claimed by a partner of a partnership at the end of the 1991 calendar year in respect of expenses incurred by him personally before the end of the partnership's fiscal year ending in 1991 will not be included in his income until the year in which it is received or credited, which will be 1992 at the earliest.

Subsection 248(18) - Goods and services tax — repayment of input tax credit

Administrative Policy

19 August 1991 Memorandum 911368(E)

Where the taxpayer was assessed in July 1993 to deny an input tax credit, appealed successfully to the Tax Court but with the Minister then successfully appealing the Tax Court decision, the "particular time" referred to in s. 248(18) would be July 1993. If the taxpayer had ultimately prevailed in its GST appeal at a time when the July 1993 had become statute-barred, there would be a loss to the fisc.

Subsection 248(20) - Partition of property

Administrative Policy

9 June 2015 T.I. 2014-0554381E5 F - Copropriété par indivision - partage de biens

Mr A held land used by him in farming in co-ownership with his brother. Following a partition and cessation of farming, Mr A became the sole owner of the land and sold it to a third party. What was the date of Mr A's acquisition for purposes of s. 110.6(1.3)(a) and (c)? CRA stated (TaxInterpretations translation):

The fractional interest in land which Mr A held from the death of his father is deemed under paragraphs 248(20)(a) and (b) to have not been acquired or disposed of by him. As he acquired that interest before 18 June 1987, paragraph 110.6(1.3)(c) applies to that interest.

In accordance with 248(20)(d), Mr A is deemed to have acquired the fractional interest that his brother held in the land. As that was not acquired before 18 June 1087, paragraph 110.6(1.3)(a) applies to that interest.

25 September 2000 T.I. 2000-0038595

"In a situation where more than one property is acquired under one deed, such properties would be considered to be one property for purposes of the partitioning rules even if the properties were not adjacent. Subsection 248(20) of the Act applies where the fair market value of the separate piece of property received by a co-owner upon partition is less or greater than the fair market value of the co-owner's previous interest. Where the value is less, the co-owner is deemed to have disposed of the part of the interest in the property attributable to the shortfall. An amount received by such a co-owner because of an unequal partition could result in a gain or loss from the disposition. Where the value is greater, the co-owner is deemed to have acquired an interest in the property attributable to such excess. Furthermore, where a partition occurs but the property is not divided proportionately with respect to fair market values, the exception provided by subsection 248(21) of the Act will not apply, and thus subsection 248(20) will apply, in those situations where the joint owners make up for the disproportionate interest by cash contributions or otherwise, such as a disproportionate allocation of debt."

1996 Ruling 961817 Renewed as 970265 [partition of securities holdings]

A partnership holding publicly-traded shares and limited partnership units was to be wound-up under s. 98(3), with the shares and units (while being held by a nominee) were partitioned into new share and unit certificates. RC ruled that the partition would not constitute a disposition provided that there was a partition under the provincial law.

27 April 1998 Memorandum 980456 [partition of milk quota]

The partition of a jointly owned non-real estate asset, such as a milk quota, could be accomplished under either s. 248(20) or (21) of the Act without causing a disposition, provided the fair market value tests were satisfied.

23 December 1992 T.I. (Tax Window, No. 27, p. 20, ¶2341) [partition of non-adjacent properties]

If non-adjacent parcels of land are acquired at one time and under one deed, they will be considered as property that can be partitioned under s. 248(20).

24 February 1992 Memorandum (Tax Window, No. 13, p. 17, ¶1622)

Where an undivided interest in partnership property is distributed to each partner in accordance with s. 98(3), any partition of property which is jointly owned by the former partners after the distribution will be subject to the application of s. 248(20).

23 October 1991 T.I. (Tax Window, No. 12, p. 18, ¶1552)

Where a co-owner exchanges an undivided interest in a property for an undivided interest in each subdivided parcel, followed by an exchange of the undivided interest for a divided interest in the subdivided parcel, no partition would have occurred.

Subsection 248(21) - Subdivision of property

Administrative Policy

2011 Ruling 2011-0408781R3 -

A rental property comprised of land and three buildings, is beneficially owned by three co-owners, holding their interests as capital property. S. 248(21) ruling given (based inter alia on the FMV test being satisfied) respecting the subdivision and partition of the property so that Property 1 and Property 2 (representing XX% of the FMV of the Project at that time) are held under one new title and co-owned by two of the former co-owners; and Property 3 (representing XX% of the FMV of the Project at that time) is held under a separate new title by the third former co-owner.

1 September 2010 T.I. 2009-0338641E5

In a general response, CRA stated:

Subsection 248(21) applies where a co-owner receives, upon the partition of "a property", title to a separate piece of property whose fair market value equals the fair market value of the co-owner's previous interest. In such a situation, paragraph 248(21)(b) of the Act deems the co-owner's new interest to be a continuation of the co-owner's undivided interest in the property immediately before the partition. In other words, the co-owner will have neither disposed of nor acquired any property and, as a result, there is no capital gain or loss upon the partition of the property. Since the term "a property" is used, this means a singular property or one property. However, paragraph 248(21)(c) provides an exception to the single property rule for purposes of subsection 248(21) and modifies the meaning of the term "a property" so that subdivisions of land established in the course of, or in contemplation of, a partition shall be regarded as one property.

…Where more than one property is acquired under one deed, it is our general view that such properties would be considered to be one property.

8 August 2005 T.I. 2005-0145251E5

The summary states:

Can a property with two buildings on it be partitioned so that each former co-owner receives one building?...No. The buildings are separate properties and are not being partitioned.

The body is inconsistent internally and with this summary.

2003 Ruling 2003-003336 -

A professional partnership in the health field winds up its operations with a view to electing under s. 98(3), on the winding-up each partner receives an undivided interest in the Partnership's property including goodwill and, immediately thereafter, each of the former partners enters into a contract to acquire a divided interest in the former Partnership's goodwill and, in order that the division will be legally enforceable between the parties, each former partner signs a non-solicitation agreement with respect to the patients that may follow a particular former partner after the wind-up of the Partnership. The former partners or companies related to them enter into contractual arrangement with a newly-incorporated operating company whereby it will be able to utilize goodwill and related assets of the corporation in consideration for paying a licensing fee and also retaining the former partners for agreed-upon per diem fees.

A ruling is given that provided the contracts between the former partners to acquire a divided interest in the goodwill constitutes a "partition" under the governing laws, s. 248(21) of the Act will apply, s. 248(20) will not apply, and each Partner's divided interest in goodwill will be deemed to be a continuation of each such Partner's undivided interest in such partnership goodwill immediately before its partition.

2003 Ruling 2003-000951 -

A master partnership invests in a lower-tier operating partnership which, in turn, transfers a business acquired by it to a newly-formed taxable Canadian corporation ("Canco") in exchange for preferred shares pursuant to s. 85(2) and the lower-tier partnership is wound up under s. 85(3), so that the master partnership receives the preferred shares. On a wind up of the master partnership under s. 98(3) each partner receives an undivided proportionate interest in each preferred share. Following a dissolution of the master partnership, the former partners partition each of the preferred shares so that each partner's respective undivided interest in the particular preferred share becomes a divided interest. [With an equivalent fair market value] Canco issues certificates for any fractional shares created as a result of the partition and the shareholders' register indicates fractional shares held by each shareholder to the extent necessary to reflect the partition. The holders of the preferred shares then exchange the preferred shares for common shares of the corporation with an equivalent fair market value

Ruling that s. 248(21) applies to the partition.

28 October 2002 T.I. 2002-013478

Respecting the situation where corporations own undivided interests in shares of public corporations and in an interest in a mutual fund trust following the dissolution of a partnership, and wish to partition such properties, the Director stated:

"If a corporation can legally issue fractional shares and if the partition of a share gives rise to the issuance of fractional shares, all of such fractional shares would be considered to represent the same property as the share being partitioned and each person would be considered to have a new interest in such a share. Consequently, subsection 248(21) may apply to the partition of a share in such circumstances. If subsection 248(21) does not apply, the partition of the share may not necessarily attract adverse tax consequences pursuant to subsection 248(20) ... . [A]n interest in a trust constitutes one property, even if described by reference to units. Consequently, if it is legally possible to effect a partition of an interest in a trust owned by two or more persons and if each person's respective undivided interest in such an interest becomes a divided interest in the said interest, the Rulings Directorate would generally consider that subsection 248(21) may apply to such partition if the fair market value test in subsection 248(21) is met ... ."

17 September 1996 T.I. 962525 (C.T.O. "ACB of Partitioned Interest")

Where three parties jointly own equal undivided interests in a property, and the property is subdivided into three lots with each party having 100% ownership of one lot, s. 248(21)(b) provides that the cost of each co-owner's new interest will be the same as the cost of its undivided interest in the property before the partition.

12 July 1995 T.I. 942878 (C.T.O. "General Scheme of Partition")

After a detailed description by the correspondent of the manner in which the partition of real property in B.C. typically is undertaken, RC indicated that s. 248(21)(b) would apply provided the prerequisites contained in s. 248(21) are met. RC also stated that the term "a property" means "a singular property or one property", and that s. 248(21)(c) "modifies the meaning of this term so that subdivisions of land established in the course of or in contemplation of a partition shall be regarded as one property."

1994 A.P.F.F. Round Table, Q. 31

"The conditions for applying subsection 248(21) ... cannot be met where the property that is the subject of a parition is an undivided interest in a partnership ... . Subsection 248(21) of the Act usually applies only to property listed in paragraph (c), i.e., to buildings and parcels of land."

27 January 1992 T.I. (Tax Window, No. 15, p. 18, ¶1687)

S.248(21) generally will apply where a piece of land has been subdivided into several parcels and the subdivided parcels are then partitioned between the joint owners. However, if subsequent to the partition, several other subdivided parcels continue to be held in joint ownership by all the joint owners and they subsequently exchange with each other their undivided interests so that each owner receives a divided interest, a disposition will occur at that time.

8 January 1992 T.I. (Tax Window, No. 15, p. 17, ¶1686)

The rules in s. 248(21) could apply where there is a stratification of a condominium building and a subsequent proportionate distribution of the units to the owners.

Articles

McMullen, "Tax Considerations in the Reorganization of Partnerships", 1994 Corporate Management Tax Conference Report, c. 6.

Subsection 248(22) - Matrimonial regimes

Administrative Policy

Tax Professionals Mini Round Table - Vancouver - Q. 32 (March 1993 Access Letter, p. 110)

S.248(22) and (23) are not restricted in their application to the ownership of property under the matrimonial regimes in the Province of Quebec.

Subsection 248(24) - Accounting methods

Administrative Policy

7 August 1991 T.I. (Tax Window, No. 7, p. 18, ¶1386)

The enactment of s. 248(24) does not affect the computation of safe income under s. 55(2)

Subsection 248(25) - Beneficially interested

Cases

The Queen v. Propep Inc., 2010 DTC 5088 [at 6882], 2009 FCA 274

The taxpayer was owned by another corporation (9059) which, in turn, was owned by a Quebec trust whose first-ranking beneficiary was 9059, and second-ranking beneficiary was the son of an individual who controlled two other corporations with which CRA had found the taxpayer was associated. It was accepted that the taxpayer would be so associated if the son was deemed by s. 256(1.2)(f)(ii) to own 9059.

Although the discretion conferred on the trustees to distribute capital to the son could not be exercised before the winding-up of 9059 or the expiration of 100 years, the trustees could in exercising their discretion and at the time of their choosing wind up 9059, thereby making the son the sole beneficiary. Accordingly, the son was deemed by s. 256(1.2)(f)(ii) to own 9059. In addition, he was an income beneficiary, and under the Act an income beneficiary was treated as a beneficiary of the trust.

Finally, he was a beneficiary under the expanded definition of "beneficially interested" in s. 248(25). In this regard, Noël JA stated (at paras. 23-24) after referring to s. 248(25)(a):

The TCC judge seems to be of the opinion that this definition does not apply here because the expression "beneficially interested" is not used in either of the provisions dealing with associated corporations (256(1)( c ), 256(1.2) and 256(1.3))... . With respect, the expression "beneficially interested" does not have to be reproduced in each provision where it is likely to be applied. This concept applies each time the question arises whether a person is "beneficially interested" in a particular trust. A person who has a contingent right to the capital or income of a trust is "beneficially interested" for the purposes of the Act.

Administrative Policy

10 October 2014 APFF Roundtable Q. 4, 2014-0538231C6 F

Can a legatee by particular title referred to in s. 808 of the Quebec Civil Code be considered a person beneficially interested pursuant to subsection 248(25)? CRA stated (TaxInterpretations translation):

[N]otwithstanding that the legatee by particular title has a payment priority over the heirs by virtue of certain provisions of the Quebec Civil Code, the legatee nonetheless has a beneficial interest in the succession as contemplated by subsection 248(25).

10 October 2014 APFF Roundtable Q. , 2014-0538021C6 F

In Fiducie Famille Salammbô c. Ville de Montréal (2011 QCCQ 11322), a mutations tax case, the Court found that potential non-designated beneficiaries should not be taken into account as beneficiaries at the moment of registration of the land transfer. In considering whether a person is related to each beneficiary under a trust, does CRA accept that it should consider only the persons who have been designated as beneficiaries at the particular time?

After referring to Propep, where the definition of "beneficially interested" in s. 248(25) was stated to apply for determining that an individual was a beneficiary, CRA stated (TaxInterpretations translation):

The CRA believes that the courts would adopt this expanded sense of the concept of beneficiary for purposes of ITA subparagraph 55(5)(e)(ii). The CRA further could consider arguing that this expanded concept of beneficiary is also engaged by the text of ITA subparagraph 55(5)(e)(ii) which refers to "each beneficiary under a trust who is or may (otherwise than by reason of the death of another beneficiary under the trust) be entitled to share in the income or capital of the trust." Consequently, the position stated in [2004-0086961C6]…is not valid.

…It is beyond the scope of this Roundtable to comment on the meaning to be accorded to the term "beneficiary" and under the definition of "beneficially interested" in ITA subsection 248(25) in accordance with the applicable private law… .

1 May 2014 Folio S1-F5-C1

1.31 The following are examples of situations where an individual is beneficially interested in a trust:

- a) trust income is payable to the individual;

- b) income is held in trust and will be paid upon the individual's attainment of a certain age;

- c) the individual is one for whom a preferred beneficiary election may be made;

- d) the individual is one of a class who has a remainder interest under the trust; or

- e) the individual has contributed property to the trust (for example, the settlor of the trust) and may, by virtue of the existence of a power of appointment, be added as a beneficiary of the trust at a later date.

1.32 An individual is beneficially interested in the trust in the circumstances described in ¶1.31(b) even if the individual's right to receive income ceases if the individual should die before attaining the specified age. Similarly, an individual is beneficially interested in the trust in the circumstances described in ¶1.31(c) even if the trustees have full discretionary powers concerning the distribution of the capital or income of the trust so that the individual may in fact receive nothing from the trust.

26 June 2012 T.I. 2011-0417391E5 F -

Where the trustees of a Quebec inter vivos trust have the power to appoint beneficiaries including a testamentary trust. However, a particular testamentary trust is not so designated. CRA referred to Art. 1282 of the Civil Code, which provided:

In the case of a personal or private trust, the power to appoint may be exercised by the trustee or the third person only if the class of persons from which he may appoint the beneficiary is clearly determined in the constituting act.

CRA stated (TaxInterpretations translation):

[A] trust created by will that is part of the category of persons from which the trustee can designate beneficiaries of an inter vivos trust has a beneficial interest by virtue of subsection 248(5).

Articles

Michael Goldberg, "Not Quite Chicken Soup – Part II: Are Powers to Add and Remove Beneficiaries Safe for Canadian Family Trust Precedents", Tax Topics, Number 2175, November 14, 2013, p.1.

Effect of power to add and remove beneficiaries (PARB) (p. 2)

Does the inclusion of a PARB mean that pursuant to paragraph (1) of this definition everyone in the world would become beneficially interested in the trust? I would hope not as I'm not sure that, say, the Prime Minister of Malaysia [Note 2: Zoolander, Dir. Ben Stiller, 2001.] could be seen to have any "right … as a beneficiary under a trust" just because of the inclusion of such a clause. However, bad facts often lead to bad decisions, [Note 3: See Propep Inc. v. R., 2009 DTC 5170 (discussed below).] so I worry that the case that tests an issue will end up being the wrong one. Still, I would like to think a reasonable panel of judges and CRA officials would place sensible limits on paragraph (a) of the "beneficially interested" definition.

However, I think that the same reasonable panel of judges would find that where a trust includes a PARB, subclauses 248(25)(b)(iii)(A)(I)-(III) would likely result in anyone not at arm's length with the settlor/freezer being found to be beneficially interested in a trust with this type of power. Assuming that this is the case, then one needs to consider what provisions in the Act are impacted by a person's being beneficially interested in a trust (at least under paragraph (b)).

Interaction with s. 55(2) (p.2)

However, if the beneficially interested concept is applicable for purposes of subsection 55(2), then it appears that PARBs in trusts could cause those trusts to be unable to avail themselves of the exception to that provision, which might otherwise be available under paragraph 55(3)(a). The reason for this is that only trusts that meet the restricted related persons provisions in paragraph 55(5)(e) [Note 6: Generally, trusts where the only beneficiaries are the lineal descendants of an individual and/or registered charities, which is quite typical in many traditional Family Trust situations.] qualify for this exception. In this regard, although the CRA has indicated that "the concept of 'person beneficially interested' is irrelevant for the purposes of subparagraph 55(5)(e)(ii)", it also indicated that it "feel[s] that the right described in subparagraph 55(5)(e)(ii) I.T.A. and paragraph 248(25)(a) I.T.A. are fairly similar". [Note 7: See CRA document No. 2004-0086961C6, October 8, 2004.]

It is unclear whether the CRA's views regarding subparagraph 55(5)(e)(ii) would also be applicable to situations caught by paragraph 248(25)(b). Nevertheless, given the CRA's conclusion, it would appear that the inclusion of a PARB might well be problematic for the purposes of subsection 55(2).

Subsection 248(25.1) - Trust-to-trust transfers

Administrative Policy

10 February 2003 T.I. 2003-014702 -

An election made by the former trustees, including an election under s. 259(3), will continue to be valid following a trust-to-trust transfer described in s. 248(25.1).

Subsection 248(26) - Debt obligations

Cases

Imperial Oil Ltd. v. The Queen, 2004 DTC 6702, 2004 FCA 361, rev'd 2006 SCC 46

S.248(26) had no application to the issuance of a U.S.-dollar debenture by the taxpayer because there was no doubt about the date upon which the taxpayer "issued" the debt evidenced by the debenture, or the "principal amount" of the debt at that time. Furthermore, even if s. 248(26) did apply, its effect would simply be to confirm the conclusion that the original principal amount of the debenture was the Canadian-dollar equivalent of its U.S. dollar principal amount at that time. S.248(26) did not say that, for income tax purposes, the principal amount of a debt denominated in a foreign currency was always equal to the principal amount of the debt translated at the date of issuance. Accordingly, s. 248(26) was not inconsistent with the conclusion of the Court that the principal amount of the debentures, in Canadian dollars, increased from the date of issuance, to the date of repayment, due to an appreciation in the U.S. dollar, thereby giving rise to a deduction under s. 20(1)(f)(ii).

Administrative Policy

20 May 2014 T.I. 2013-0516121E5 F - Debt forgiveness

In finding that s. 80 would not apply to the settlement under Part III of the Bankruptcy and Insolvency Act of a debt for unremitted GST and QST, CRA stated (TaxInterpretations translation) that:

[T]he portion of the amount of the gain arising from the settlement of the unremitted GST and QST (including interest and penalties) would not be subject to …section 80 given that such [amounts]…would not be considered as a "debt issued" by the debtor under the terms of subsection 248(26)… .

Subsection 248(28) - Limitation respecting inclusions, deductions and tax credits

Cases

Imperial Oil Ltd. v. The Queen, 2004 DTC 6702, 2004 FCA 361, rev'd 2006 SCC 46

After finding that the taxpayer was entitled to deduct 75% of the difference between the Canadian- dollar equivalent of a U.S. dollar debenture at the time of its issuance by the taxpayer, and the Canadian-dollar equivalent of the amount repaid at maturity measured at the exchange date prevailing at the time of repayment under s. 20(1)(f)(ii), Sharlow J.A. found that the taxpayer was prohibited by s. 248(28) from deducting the remaining 25% under s. 39(2), by virtue of s. 248(28).

Holder v. The Queen, 2004 DTC 6413, 2004 FCA 188

The taxpayer designated an elected amount of $50,010 in an election under s. 110.6(19) in respect of shares that were non-qualifying real property and whose fair market value was nominal, with the result that there was a deduction of $50,000 under each of s. 110.6(21)(b) and s. 110.6(22). Sharlow J.A. found that as both adjustments were the same in quantum and were the result of the same event, it was appropriate to apply s. 4(4) to provide that only one deduction should be made. She stated (at p. 6415) that "the fact that two statutory provisions have different objectives cannot, by itself, justify an inference that double taxation was intended".

Kruco Inc. v. The Queen, 2001 DTC 668, Docket: 98-3100-IT-G (TCC), aff'd 2003 FCA 284

A proposed adjustment of the Minister to the safe income of a corporation from which the taxpayer received a deemed dividend, which entailed the exclusion of income inclusions to the corporations resulting from having claimed investment tax credits was found to result in an inappropriate double taxation of the same income first in the hands of the corporation and, second, in the hands of the taxpayer as a capital gain.

MNR v. Chrysler Canada Ltd., 92 DTC 6346 (FCTD)

S.4(4) precluded the value of shares being taxed as income from employment in both the year of transfer of the shares to a trust (under s. 7(1)) and in the year of transfer of the shares or the proceeds to the employees (under s. 6(1)(g)). Strayer J. stated (p. 6349):

"While subsection 4(4) precludes this kind of double taxation without indicating which rule is to prevail, both paragraphs 7(3)(a) and the canons of interpretation lead us to the conclusion that the special regime provided in section 7 for the calculation and timing of deemed income should govern."

R. v. Inland Revenue Commissioners, ex parte Woolwich Equitable Buildings Society, [1990] BTC 490 (HL)

After referring (p. 500) to the "presumption against double taxation" and the "presumption that income tax, being an annual tax is payable only on the income of a particular year", Lord Oliver went on to state (p. 500) that these presumptions "are clearly rebuttable if sufficiently clear express words are used. But they can also be rebutted, as it seems to me, by circumstances surrounding the enactment of the particular legislation which lead to an inevitable inference that the Parliament intended, in using the words that it did, that these presumptions or principles should not apply."

Robertson v. The Queen, 90 DTC 6070 (FCA)

Before going on to find that the amount of a non-statutory stock option benefit effectively was taxable at the time of exercise, notwithstanding that a real economic benefit also arose at the time of the granting of the option, Marceau J.A. stated:

"Obviously, double-tier taxation should not be imposed on gains from a single transaction, nor should the same benefit be taxed on two occasions. We certainly cannot have two benefits of the same type, both taxable under paragraph 6(1)(a) of the Act."

Canadian Pacific Ltd. v. The Queen, 88 DTC 6265, [1988] 1 CTC 429 (FCA)

Mahoney J. suggested that it was contrary to the scheme of the Act for the taxpayer to receive $17.6 million as a tax-free grant toward the cost of restoring railway lines in Western Canada, and at the same time to claim CCA.

The Queen v. Thyssen Canada Ltd., 87 DTC 5038, [1987] 1 CTC 112 (FCA)

The denial (by virtue of s. 18(4)) of the deduction for interest paid by the taxpayer to a non-resident, where that interest was subject to withholding, "did not result in double taxation or in anything resembling double taxation since, as a consequence of that denial, the respondent did not and will not have to pay tax twice on the same income."

Bye v. Coren, [1985] BTC 7 (HC), aff'd [1986] BTC 330 (C.A.)

"There is ... no rule that the same sum cannot be subject to two separate taxes. Whether it is so subject is a matter of construction of the statute or statutes which have imposed the two taxes."

Furniss v. Dawson, [1984] BTC 71 (HL)

An "element of double taxation exists whenever a shareholder sells at a profit his shares in a company which has itself realized a capital asset at a profit. So I do not see any undesirable element of double taxation involved in the revenue's submission [which would potentially lead to that result]." (Lord Brightman)

The Queen v. Robichaud, 83 DTC 5265, [1983] CTC 195 (FCTD)

A husband and wife were unsuccessful in claiming each other as dependants.

Gillespie v. The Queen, 82 DTC 6334, [1982] CTC 378 (FCA)

The purpose of s. 63(4) (since repealed) was found to be preventing both a man and a woman from obtaining deductions from income for the same child care expenses when a child was in the joint custody of both.

Noranda Mines Ltd. v. The Queen, 82 DTC 6212, [1982] CTC 226 (FCTD), aff'd 85 DTC 5001, [1984] CTC 659 (FCA)

An argument that the phrase "taxable income earned in the year" should be interpreted as referring to taxable income before the deduction of any loss carry-backs, thereby permitting a 15% mining tax credit to be calculated on the basis of the larger grossed-up amount, was rejected "for the simple reason that the loss carry-back has already been considered in computing taxable income and failing a very clear provision of the Act to that effect, the same deduction should not be taken into account twice".

IRC v. Garvin, [1981] 1 WLR 793 (HL)

It was stated, obiter, that "I can see a powerful argument being mounted to the effect that, if a receipt falls to be treated as income and taxed as such under one code, it must, by necessary implication, be exempt from liability to taxation as a capital receipt under another code". (Lord Bridge)

The Queen v. Malloney's Studio Ltd., 79 DTC 5124, [1979] CTC 206, [1979] 2 S.C.R. 326

"Mutuality of tax treatment of parties to the same transaction, or even the avoidance of double taxation have never been principles with which the draftsmen of taxing statutes have ever regarded themselves as saddled."

Quebec North Shore Paper Co. v. The Queen, 78 DTC 6426, [1978] CTC 628 (FCTD)

The court found that the Crown's method of computing the taxpayer's income during a year in which it changed its method of adjusting for depreciation "would be to compute the same amount twice for income tax purposes," and that method was rejected.

Perrault v. The Queen, 78 DTC 6272, [1978] CTC 395 (FCA)

The treatment of a single payment under different provisions of the Act as income in the hands of two taxpayers may result from an unfortunate arrangement of the taxpayer's affairs.

Denison Mines Ltd. v. MNR, 74 DTC 6525, [1974] CTC 737, [1976] 1 S.C.R. 245

Costs of removing ore were deductible in computing the taxpayer's profit. Since "no single disbursement can be reflected twice in the accounts", those costs could not also be treated as the capital cost of depreciable property.

F.S. Securities, Ltd. v. C.I.R. (1964), 41 TC 688 (HL)

"[D]ouble taxation in itself is not something which is beyond the power of the Legislature to provide for when constructing its tax scheme ... [T]he law approaches the interpretation of the complicated structure of the code with a strong bias against achieving such a result. This, after all, is the general principle upon which rests the particular and well-accepted rule that a form of income which is made the subject of taxation under one of the five Schedules cannot be included, directly or indirectly, as a taxable subject under another Schedule ... Dividends that had borne tax or suffered deductions of tax ... before receipt are ... 'exhausted as a source of income', and the general principle applied to the construction of the provisions of the Income Tax code prevents there being brought in again, directly or indirectly, as a subject of taxation in the form of another class of taxable income" (pp. 697-698).

MNR v. Trans-Canada Investment Corp. Ltd., 55 DTC 1191, [1955] CTC 275, [1956] S.C.R. 49

In his dissenting reasons, Rand J., in finding that the intercorporate dividend deduction in s. 27(1) of the 1948 Act was not available to the taxpayer, stated (p. 1194):

"The deduction claimed is not permitted and it results in what may be called triple taxation. That is a consideration which inclines a court to a rigorous scrutiny of the enactment before it, but it does not permit an interpretation that supplies what Parliament must be taken to have deliberately omitted."

See Also

Létourneau v. The Queen, 2010 DTC 1098 [at 3020], 2009 TCC 614

By operation of 96(1.1)(b), which applies notwithstanding any other provision of the Act, "allowances" received by a retired partner from his former firm had to be treated as partnership income rather than pension income. Lamarre J. further indicated at para. 28 that, if the income were treated pension income, that would be in addition to its treatment as partnership income - a double-counting of income, prohibited by s. 248(28).

Beament Estate v. MNR, 70 DTC 6130, [1970] CTC 193, [1970] S.C.R. 680

In finding, in his concurring reasons for judgment, that the contractual right of beneficiaries of an estate to enforce an agreement for the purchase by them of shares of the estate for the shares' par value rather than for the much higher amount that otherwise would have been the shares' fair market value, represented property of the beneficiaries, and therefore should be excluded in the valuation of property of the estate, Pigeon J. stated (at p. 6135) in his concurring reasons for judgment that:

"Parliament cannot have intended that the same value would be included in two separate items of 'property'."

Consoltex Inc. v. The Queen, 97 DTC 724 (TCC)

Bowman TCJ. found that because the cost of expenditure by the taxpayer on yarn qualified as SR&ED for purposes of s. 37 of the Act, those costs also could not be deducted as cost of sales under s. 9 of the Act, in light of former s. 4(4) of the Act.

Pezzelato v. The Queen, 96 DTC 1285 (TCC)

In obiter dicta, Bowman TCJ. accepted a submission that if the taxpayer were taxable under s. 80.4(1)in its 1988 taxation year in respect of imputed interest on a loan made to him by his employer, he should not also be taxed on a similar benefit under s. 6 for his 1989 taxation year based on an alleged reimbursement by his employer of the interest that accrued in 1988 on that loan.

Attis v. MNR, 92 DTC 1128 (TCC)

The exclusion in s. 15(2) for payments made as part of a series of loans or other transactions and repayments does not apply where there is a series of payments of bonuses and dividends. In light of the presumption against double taxation in s. 4(4), it could not have been intended that such repayments would be included in income both under s. 5 (in the case of bonuses) or s. 12(1)(j) (in the case of dividends), and under s. 15(2).

Marcantonio v. MNR, 91 DTC 917 (TCC)

After finding that the Minister had properly reassessed the taxpayer to increase his income pursuant to s. 69(1)(a) by the amount of charges made to him by a related corporation ("Andrea") which were in excess of the fair market value of the goods purchased by him from Andrea, Mogan J. went on to indicate that he assumed that the Minister would attempt, when permitted by law, to reassess Andrea by reducing its income by an equivalent amount.

Administrative Policy

10 October 2014 APFF Roundtable Q. 21, 2014-0538091C6 F

CRA indicated respecting any potential double taxation arising from the applicability of both s. 84(2) and (3) to a surplus stripping transaction that, in practice, CRA would avoid double taxation through applying s. 248(28)(a). See summary under s. 84(2).

30 October 2014 T.I. 2013-0488881E5 - Upstream Loan