Subsection 93(1) - Election re disposition of share of foreign affiliate

Cases

Terrador Investments Ltd. v. The Queen, 99 DTC 5358, Docket: A-229-95 (FCA)

In connection with the liquidation of a U.S. corporation owned by the two Canadian corporate taxpayers, they received promissory notes owing by another U.S. corporation and cash, and elected under s. 93(1) in respect to the distribution. In finding that this election precluded the taxpayers from subsequently taking a deduction under s. 20(1)(p) when the unpaid balance of the promissory notes proved to be uncollectible, Décary J.A. stated (at p. 5362):

"Once a taxpayer has voluntarily elected, pursuant to subsection 93(1), to treat part of the proceeds of disposition comprised of some cash and of some promissory notes, as a 'deemed dividend received', the cash and parts of the promissory notes at issue lose their identity 'for the purposes of this Act'. When the deemed dividend is included in the taxpayer's income pursuant to paragraph 12(1)(k), it is included as a 'paid' dividend, not as cash and parts of promissory notes ... . The 'deemed dividend' being said by the Act to have been 'paid' and 'received', it cannot at the same time be a 'doubtful debt' or a 'bad debt'. What is deemed to have been paid cannot also be said to be due."

Administrative Policy

14 March 1991 Memorandum (Tax Window, No. 1, p. 21, ¶1143)

RC permits only one election to be made with respect to a particular disposition of shares.

Articles

Eric Lockwood, Maria Lopes, "Subsection 88(3): Deferring Gains on Liquidation and Dissolution", Canadian Tax Journal (2013) 61:1, 209-28, p. 209

They provide various examples indicating that a taxpayer (Canco) will realize a capital gain on the disposition of its shares of the disposing affiliate (Foreignco 1) – even where there has been a qualifying liquidation and dissolution (QLAD) election - where the adjusted cost base of Foreignco 1 in the distributed property, being the shares of Foreignco 2 (i.e., the inside basis), exceeds Canco's ACB of its Foreignco 1 shares, i.e., the outside basis. Before turning to the potential relief provided by the suppression election in s. 88(3.3), they make two preliminary observations.

First (at pp. 216-217) respecting accessing exempt surplus of Foreignco 2:

According to the Canada Revenue Agency (CRA), the exempt surplus of Foreignco 2 would not be available to reduce the capital gain realized by Canco. The CRA has expressed the opinion that a liquidation and dissolution of an FA involves a two-step process: the first step is the distribution of the assets of the disposing affiliate, and the second step is the disposition by the taxpayer of its shares of the disposing affiliate. [fn 19: See CRA document no. 2002-0178147, January 9, 2003.] As a result, by the time the taxpayer disposes of its shares of the disposing affiliate, the shares of the underlying FAs are no longer owned by the disposing affiliate and their surplus balances cannot be used to mitigate any capital gain realized by the taxpayer. Consequently, the surplus balances of Fas owned directly or indirectly by the disposing affiliate are not readily accessible to mitigate a capital gain realized by the taxpayer on the disposition of its shares of the disposing affiliate, unless planning is undertaken to use these balances before the liquidation and dissolution begin....

Second (at p. 217) respecting the adverse effect under amended s. 93(1)(a) of the shares of Foreignco 2 being disposed of on a rollover basis under s. 88(3)(a):

Prior to the proposed amendments, one approach to mitigating the gain was for Canco to file two section 93 elections. The first election would be filed in respect of the disposition by Foreignco 1 of the shares of Foreignco 2. This would elevate the exempt surplus of Foreignco 2 to Foreignco 1, making the second election possible. The second election would be in respect of the disposition by Canco of the shares of Foreignco 1. Unfortunately, this approach will no longer be available, as a result of amendments to paragraph 93(1)(a) included in Bill C-48. [fn 20: Paragraph 93(1)(a) is proposed to be revised, effective for dispositions occurring after August 19, 2011, to limit the elected amount to the capital gain.]…

Hetel Kotecha, "The Subsection 93(1) Election - Strategy and Pitfalls", International Tax Planning, 2003, p. 792.

Ron Nobrega, "Technical Bill Amendments Affecting Foreign Affiliate Share Transfers", Taxation Law, Ontario Bar Association, Vol. XIII, No. 3, p. 1.

Schwartz, "Tax-Free Reorganizations of Foreign Affiliates", 1984 Canadian Tax Journal, November-December 1984, p. 1039.

Bradley, "Foreign Affiliates: A Technical Update", 1990 Conference Report, c. 43

Forms

T2107 "Election For A Disposition Of Shares In A Foreign Affiliate"

Separate elections have to be made when a disposition of shares in a foreign affiliate involves shares of different classes or when dispositions are made at different times. ...

Surplus calculations must be filed with the election.. .

Subsection 93(2.01) - Loss limitation on disposition of share of foreign affiliate

Administrative Policy

15 August 2014 Memorandum 2014-0538591I7 - FX losses on CFA wind-up

A Canadian-resident corporation did not elect under s. 88(3.1) for the winding-up of its wholly-owned controlled foreign affiliate (CFA) to be a qualifying liquidation and dissolution. Would s. 93(2.01) limit the loss on the disposition of CFA shares disposed of in a wind-up where the loss is primarily due to FX fluctuations and no exempt dividends had been paid on the shares or substituted shares? CRA stated:

If no exempt dividends had been paid on the CFA shares or shares for which the CFA shares were substituted, then the amount determined under paragraph 93(2.01)(a) will not be less than the particular loss determined without reference to the subsection [i.e., per the Summary, "without the payment of exempt dividends, paragraph 93(2.01)(a) will not operate to reduce the loss.]

24 November 2013 CTF Roundtable Q. , 2013-0508161C6

A shareholder having an accrued foreign exchange loss on common shares of an FA and an accrued foreign exchange gain on a related party debt used to acquire those shares acquires a separate class of the FA's shares and pays dividends thereon with a view to such dividends not reducing a loss to be realized on the a sale of the original FA shares owned - in order that such loss can offset the FX gain on settlement of the debt. Would the conclusion at the 2013 IFA conference (see below) that GAAR would apply change if the funds used to acquire the original FA shares had been borrowed from an arm's length party more than 30 days before the acquisition of the shares?

In responding "no," CRA indicated that a loss would be denied "unless the related debt is a debt described in subparagraph 93(2.01)(b)(ii), a provision which precisely specifies which gains are intended to have an effect on the computation of the amount of a loss to be denied on the disposition of FA shares," and that one such requirement was that an "arm's length foreign currency debt… was entered into within 30 days of the acquisition of the FA share."

25 September 2013 Memorandum 2013-0476311I7 F - 93(2), 93(2.01) - Share substituted

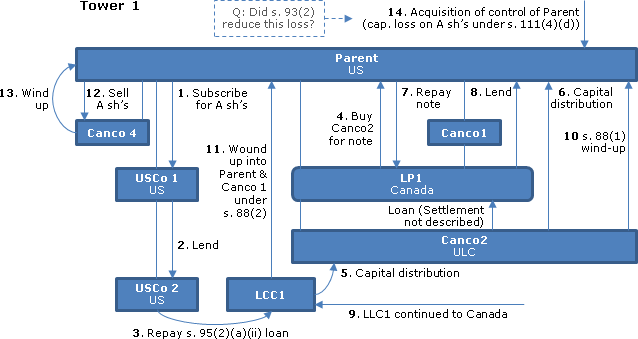

Tower 1

Under a Tower structure (Structure 1) a taxable Canadian corporation (Parent), all of whose shares were held directly or indirectly by a Canadian public company (Publico), was partner together with its subsidiary (Canco1) in a limited partnership (LP1), which had borrowed from banks and which held all the shares of a ULC (Canco2), which was the member of an LLC (LLC1). Interest received by LLC1 on a loan to a US Opco (USCO2, held by USCO1, held in turn by Parent) was deemed to be active business income by s. 95(2)(a)(ii), so that dividends paid by it to Canco2 were exempt dividends. Dividends received in turn by Parent and Canco1 through LP1 were deducted under s. 112(1).

Dismantling of Tower 1

Parent subscribed for preferred shares (A Shares) of USCO1 (1), with USCO1 lending the funds at interest to USCO2 (2), which repaid the loan from LLC1 (as well as a loan from LP1) (3). Parent acquired the shares of Canco2 for a note (4), LLC1 distributed the loan repayment funds to Canco2 as a capital reduction (5) with Canco2, in turn, making a matching capital distribution to Parent (6). Parent repaid the note (7), with LP1 using such proceeds to make an interest-bearing loan to Parent (8). LLC2 was continued under the CBCA (9), Canco2 was wound-up into Parent under s. 88(1) (10), LLC1 was wound-up into Parent and Canco1 under s. 88(2), with Parent claiming a capital loss on its shares of LLC1 (11). Such capital loss "technically" was not reduced under s 112(1) or 93(2) but CRA denied the loss under s. 245(2).

Realization of capital loss at issue

In connection with transactions described in 2007-023929, Parent transferred its A Shares to an affiliated company (Canco4) (12), which was wound-up into Parent under s. 88(1) (13). There then was an acquisition of control of Parent (14), so that it reported a capital loss under s. 40(3.4)(b)(iii).

Question 1

Was the membership interest in LLC1 a share for which the A Shares were substituted for purposes of s. 93(2)?

CRA response

In indicating "no", CRA stated (TaxInterpretations translation):

Subsection 248(5) contemplates rules of interpretation which establish the scope of the concept of substituted property for purposes of the Act. Paragraph 248(5)(a) circumscribes this concept in referring to a property acquired in a disposition or exchange of a given property, so that the latter property is the subject of a legal transaction. The second part of paragraph 248(5)(a) expands the scope of this concept in envisaging an indeterminate number of substitutions, establishing a link between the initial property under consideration and the property acquired in the final substitution. …

In this case, the XX A Shares of USCO1 were issued in the course of a legal transaction which did not involve in any way the interest in LLC1 or a property acquired in replacement for such interest.

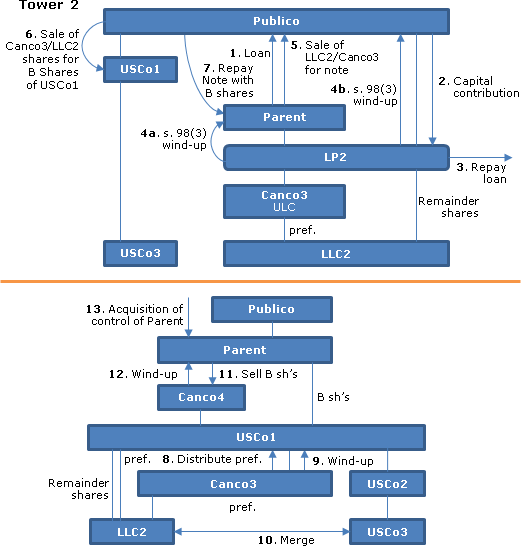

Tower 2

Publico and Parent were the partners of LP2, which held all the shares of a ULC (Canco3). Canco3 held preferred shares of a limited liability company (LLC2) and LP2 held the remainder shares. Interest received by LLC2 on a loan to a US Opco (USCO3, held by USCO2) was deemed to be active business income by s. 95(2)(a)(ii), so that dividends paid by it to Canco3 were exempt dividends. Dividends received in turn by Parent and Canco1 through LP2 were deducted under s. 112(1). No dividends were paid on the remainder shares of LP2.

Dismantling of Tower 2

Parent used borrowed money to lend US dollars to Publico at interest (1), which Publico used to make a capital contribution to LP2 (thereby changing their relative partnership interests) (2). LP2 repaid its 3rd party loan (3) before being wound-up into Publico and Parent under s. 98(3) (4). Parent transferred its undivided interest in the shares of Canco3, as well as the remainder shares of LLC2, to Publico in consideration for a note (5). As a result, Parent claimed a capital loss which was not reduced by s. 112(3). Publico transferred such properties, in turn, to USCO1 in consideration for the issue of preferred shares (B Shares) (6). As a result, Publico claimed a capital loss which also was not reduced by s. 112(3). Publico transferred the B Shares to Parent in repayment of a portion of the note (7). Canco3 effected a stated capital distribution of a portion of its preferred shares of LLC2 to USCO1 as a capital distribution (8). Canco3 was wound-up into USCO1 (9), and USCO3 and LLC2 were merged (10).

Realization of capital loss at issue

In connection with transactions described in 2007-023929, Parent transferred its B Shares to an affiliated company (Canco4) (11), which was wound-up into Parent under s. 88(1) (12). There then was an acquisition of control of Parent (13), so that it reported a capital loss under s. 40(3.4)(b)(iii).

Question 2

Did the preferred shares of LLC2 represent shares for which the B Shares held by parent were substituted for purposes of s. 93(2)?

CRA response

In indicating "no", CRA stated (TaxInterpretations translation):

[T]he loss realized on XX by parent respecting the XX B Shares of USCO1 was attributable entirely to a fluctuation in the exchange rate for the Canadian dollar over the course of the period … .

In this case, the XX B Shares of USCO1 held by Parent were issued in the course of a legal transaction which did not directly involve the preferred shares of LLC2 or a property acquired in replacement of such shares. …Those shares instead were acquired by Parent in replacement of shares of Canco3, and no Exempt Dividend was paid in respect of the latter shares. Furthermore, …the wording of element B does not support the amounts of the dividends received by Canco3 in respect of the preferred shares held in LLC2 being indirectly considered for purposes of the application of the rules.

GAAR review status

"The subject facts have also been provided to the specialized audit team of your tax services office in order that they can decide as to the possible application of...GAAR...regarding the avoidance transaction. We have received confirmation from a member of that team that the analysis has not been concluded and that a referral to the Division of abusive tax planning...has not been made in this file."

23 May 2013 IFA Round Table Q. 3

What is the CRA's position on the application of the GAAR to a series of transactions undertaken for the purpose of avoiding the application of s. 93(2) so as to preserve the portion of the loss on the disposition of FA shares that is attributable to foreign exchange, such that it remains available to effectively offset a foreign exchange gain related to the investment in the FA shares?

Response

: Given that proposed s. 93(2.01)(b)(ii) specifies "precisely which related foreign exchange gains realized by a taxpayer are intended to affect the computation of the amount of the loss to be denied on the disposition of an FA share," it follows that except in these narrow circumstances s. 93(2) and proposed s. 93(2.01) are intended to deny a loss on the disposition of an FA share to the extent that exempt dividends had been received on that share, or on a share for which that share had been substituted, prior to the disposition, "even in circumstances where the loss is arguably due to foreign exchange fluctuations rather than the extraction of earnings from the FA."

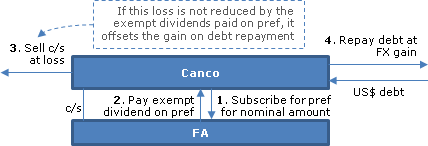

Consider a case where a corporation resident in Canada ("Canco") uses borrows U.S. dollar proceeds of a related party borrowing to acquire common shares of an FA, which then generates a large exempt surplus balance from its active business, but with a large FX gain accruing on Canco's borrowing. Canco acquires preferred shares of FA for nominal consideration, and receives thereon a distribution of FA's exempt earnings - in order that on the subsequent sale of the FA common shares, Canco can realize a loss which will offset a FX gain on repayment of Canco's debt. Given that a foreign exchange gain realized on the repayment of a non-arm's-length debt is not a gain described in proposed s. 93(2.01)(b)(ii), it was not intended that it should affect the computation of the loss denied under s. 93(2). "Therefore the issuance of the FA preferred shares and the payment of the dividends thereon result in an abuse having regard to subsection 93(2) such that the GAAR would apply." CRA's opinion would be the same if, for the purpose of avoiding the application of s. 93(2), the preferred shares were issued on the initial incorporation of FA.

10 May 2013 Memorandum 2012-0464901I7 - 93(2), 93(2.01) - Share substituted

Canco owns all the shares of Forco1, which it transfers to Forco2 for a promissory note payable in U.S. dollars, and then transfers the note to Forco3 in exchange for shares of Forco3. In finding that such shares of Forco3 were substituted for the shares of Forco1, CRA indicated that the concept of "share substituted" was not restricted "to a chain of substitutions in which only shares are substituted."