Subsection 92(1) - Adjusted cost base of share of foreign affiliate

Paragraph 92(1)(a)

Articles

Allan Lanthier, "FAPI or Taxable Surplus Dividend", Canadian Tax Highlights, Vol. 23, No. 2, February 2015, p. 4.

Dispute as to whether FA earns ABI or FAPI (p. 4)

Assume that Canco owns CFA and that the relevant years are all before 2012. In year 1, CFA earns income of $1,000; there is no foreign tax. CFA pays a dividend of $1,000 to Canco, either in the year in which the income is earned (after the first 90 days) or at any time in any subsequent year. Canco is of the view that CFA's earnings are income from an active business and exempt surplus, and the CRA, is of the view that the earnings are FAPI and taxable surplus….

Deletion of "required to be" from s. 92(1)(a) (pp. 4-5)

[T}he wording in respect of the ACB addition mandated by paragraph 92(l)(a) was amended from "any amount required to be included ... by reason of subsection 91(1) … in computing the taxpayer's income" to "any amount included … under subsection 91(1) ... in computing the taxpayer's income."…

Distinction between "required to be included" and (factually) "included" (p. 5)

The Act distinguishes between amounts "required to "be included" and amounts "included" in a number of provisions. In Quigley (96 DTC 1057 (TCC), cited in Skinner, 2009 TCC 269), the TCC referred to a similar amendment in the domestic shareholder loan and repayment provisions: "The reason for the amendment is obvious as it was arguable that a deduction would result from repayment even if there were no prior inclusion."…

Effect: statute-barring does not start running until FAPI is distributed (p.5)

[U]nder the amended legislation, if year 1 is still open to assessment, the CRA can reassess and include FAPI in Canco's income under subsection 91(1) as the Act requires. Alternatively, the CRA can ignore the mandatory FAPI inclusion and simply not assess a FAPI inclusion. The CRA can instead assess the year or years in which CFA pays dividends, and indirectly tax the FAPI by denying the section 113 deduction and assessing the dividend as having been paid out of taxable surplus with no offsetting relief under subsection 91(5): FAPI was not "included" in Canco's income (according to Skinner, as determined by the CRA's final assessment for the year), and thus there was no ACB addition under amended paragraph 92(l)(a). The dividend from CFA to Canco is a transaction that gives rise to the additional, three-year reassessment period, and so the CRA can now circumvent the normal reassessment period for the assessmentof FAPI by taxing it as part of a taxable surplus dividend….

Subsection 92(5) - Deemed gain from the disposition of a share

Administrative Policy

7 May 2014 Memorandum 2012-0433731I7 - Application of subsections 92(5) and (6)

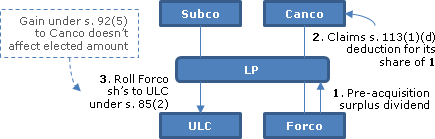

Two Canadian corporations ("Canco" and "Subco") were the respective limited and general partners of "LP" which, in turn, held all of the shares of "Forco"), which paid a dividend from its pre-acquisition surplus in Year 1, with Canco including its share of the dividend in income and claiming the s. 113(1)(d) deduction. In Year 3 LP transferred all of its shares in Forco to newly-formed "ULC" in consideration for the issuance of shares, with a joint s. 85(2) election made designating the shares' ACB as the elected amount.

Should the deemed gain to Canco under s. 92(5) arising from the Year 3 disposition result in an adjustment to: the proceeds of disposition ("POD") reported by LP; the ACB of the Forco shares received by ULC; or the elected amount described under s. 85(1)(a)? CRA stated:

[T]he ACB of the Forco shares held by LP would not be reduced by the amount of the Dividend paid from Forco's pre-acquisition surplus. … Canco was deemed to realize a gain in Year 3… equal [to] the total of amounts deducted by Canco under paragraph 113(1)(d) in respect of Forco dividends received through LP that were paid out of Forco's pre-acquisition surplus, less any foreign tax paid in respect of Canco's share of those dividends. …[T]he deemed gain…would not result in an adjustment to LP's POD and…ULC's ACB of the transferred shares and, consequently, would not affect an "agreed amount" under subsection 85(1) by virtue of subsection 85(2).

22 May 2014 IFA Roundtable Q. , 2014-0526751C6

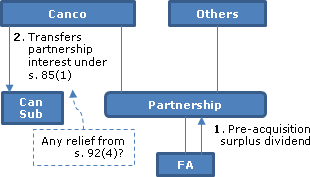

Will the CRA provide administrative relief in circumstances where the partnership interest or foreign affiliate shares are disposed of as part of an internal reorganization that, absent subsections 92(4) through (6), would occur on a tax-deferred basis? CRA stated:

[T]he amount of the increase to the proceeds of disposition under subsection 92(4) and the amount of the deemed gain determined under subsection 92(6)… are both calculated in relation to the amount of dividends from the pre-acquisition surplus of the foreign corporation that was held through the partnership. …In either circumstance, the application of these provisions results from a disposition of property, being the disposition of an interest in the partnership for purposes of subsection 92(4), or the disposition by the partnership of its shares of a foreign corporation for purposes of subsections 92(5) and (6).

After referring to 7 May 2014 Memo 2012-0433731I7 immediately above, CRA stated:

[W]e have taken this opportunity to consult with officials within the Compliance Programs Branch, and we confirm that there is no administrative relief available in the circumstances that you have described.

Articles

Geoffrey S. Turner, "ACB Adjustments for Foreign Affiliate Shares Held Through Partnerships", International Tax (Wolters Kluwer CCH), No. 79, December 2014, p. 1.

No immediate ACB grind for pre-acq dividends received by partnership (p.4)

Thus, instead of applying the regular ACB reduction rule in subsection 92(2) to pre-acquisition surplus dividends received on foreign affiliate shares held by a partnership, the Act defers the consequence of the pre-acquisition surplus dividend until such time as either the foreign affiliate shares or the partnership interest is disposed, and deems the Canadian corporate partner to have either a gain or increased proceeds of disposition in the same amount as the subsection 92 ACB reduction that would otherwise have applied.

Gain instead under s. 92(4) on FA share or partnership interest disposition (p.4)

[T]he problem is that the subsection 92(4) or (5) deemed proceeds/gain consequences will arise on any disposition of the partnership interest or foreign affiliate shares, regardless of whether the disposition occurs pursuant to a tax-deferred rollover.

Potential cure through QROC election (p.4)

In some cases, taxpayers holding foreign affiliate shares through a partnership may be able to use "self-help" to avoid the latent proceeds/gain recognition under subsections 92(4) and (5). In particular, a taxpayer may be able to avoid pre-acquisition surplus dividends and instead ensure that any such distributions are made by the foreign affiliate as a capital distribution to the partnership that can be electively treated as a QROC. However, this solution will not be available in all cases since capital distributions are not possible under the corporate laws of all countries or may be subject to more onerous approval requirements.

Adopt QROC scheme as legislative cure? (p.5)

[T]he scheme of the Act is similar for pre-acquisition surplus dividends and QROCs, in that both are taxed essentially as tax-free returns of capital that reduce ACB. But where the foreign affiliate shares are held in a partnership, the Act departs from this scheme for pre-acquisition surplus dividends by substituting the deferred proceeds/gain recognition consequences of subsections 92(4) and (5) in lieu of an immediate ACB reduction. The solution may be to adopt the QROC ACB reduction mechanics for pre-acquisition surplus dividends….

Paul Barnicke, Melanie Huynh, "FA Shares Held in Partnership", Canadian Tax Highlights, Vol 22, No 6, June 2014, p. 8

Additional problem where partner is an FA (pp. 8-9)

The problem created by subsections 92(4) to 92(6) is not limited to structures in which a partner is a Canco: the rules apply equally to offshore structures in which the partner is another FA of a corporate or non-corporate taxpayer. In the offshore context, if a transfer is otherwise subject to a rollover provision, a gain may be triggered because of the operation of subsections 92(4) to 92(6) and, depending on the excluded-property status of the transferred partnership interest or FA shares, a gain may give rise to FAPI or to hybrid surplus. This problem is exacerbated by subsection 90(2), which deems all distributions – whether they are legally dividends or returns of PUC – to be dividends for the purposes of the Act. A partnership that receives a legal return of PUC can elect under subsection 90(3) to treat the payment as a return of capital and not as a dividend in order to avoid the potential trap in subsections 92(4) to (92(6); but a significant onus is thus placed on the taxpayer in Canada to detect the existence of a triggering situation and then to ensure that the election is filed.