Subsection 245(1) - Definitions

Tax Benefit

Cases

Copthorne Holdings Ltd. v. The Queen, 2012 DTC 5006 [at 6536], 2011 SCC 63

The taxpayer's shareholders circumvented the rule in s. 87(3), which required that the paid-up capital ("PUC") of a subsidiary corporation disappear on a vertical amalgamation, by arranging for the subsidiary corporation in question ("VHHC Holdings" - whose shares had a high PUC but a low value) to be first distributed to the non-resident parent of the parent of VHHC Holdings ("Copthorne I") before Copthorne I and VHHC Holdings were amalgamated horizontally to continue as a predecessor of the taxpayer. The taxpayer subsequently took advantage of the PUC which had been preserved by these transactions by making a substantial distribution of PUC to its non-resident parent.

The Court found that this preservation of PUC gave rise to a tax benefit. As per Trustco, a tax benefit can be established by comparing the taxpayer's situation with an alternative arrangement that would be reasonable but for the alleged tax benefit. Rothstein J. stated (at paras. 36-38):

Copthorne argues that an amalgamation while VHHC Holdings was owned by Copthorne I - a vertical amalgamation - "was never a live and reasonable option" and thus the Minister should not have used such a comparison. ... Copthorne says that a taxpayer would never have chosen this higher tax option, and thus that such option was unreasonable.

... As the Tax Court judge pointed out, the vertical amalgamation would have been the simpler course of action. It was only the cancellation of PUC that would arise upon a vertical amalgamation that led to the sale by Copthorne I of its shares in VHHC Holdings to Big City. To use the words of Professor Duff, "but for" the difference in how PUC was treated, a vertical amalgamation was reasonable.

The comparison was entirely appropriate. Copthorne has not satisfied its onus of showing that there was no tax benefit.

Canada Trustco Mortgage Co., v. The Queen, 2005 DTC 5523, 2005 SCC 54

McLachlin C.J. and Major J. stated (at para. 20):

If a deduction against taxable income is claimed, the existence of a tax benefit is clear, since a deduction results in a reduction of tax. In some other instances, it may be that the existence of a tax benefit can only be established by comparison with an alternative arrangement. For example, characterization of an amount as an annuity rather than as a wage, or as a capital gain rather than as business income, will result in differential tax treatment. In such cases, the existence of a tax benefit might only be established upon a comparison between alternative arrangements. In all cases, it must be determined whether the taxpayer reduced, avoided or deferred tax payable under the Act.

Canadian Pacific Ltd. v. The Queen, 2000 DTC 2428, [2001] 1 CTC 2190 (TCC)

In finding that there was a tax benefit to the taxpayer in borrowing in Australian dollars at a higher rate than would be applicable to a Canadian-dollar borrowing, Bonner TCJ noted that the definition of tax benefit "assumes the existence of a standard amount of tax against which reduction may be measured" and that "a direct borrowing of C$ is what the Appellant could have done and, in my opinion, would, but for tax reasons, have done".

See Also

MacDonald v. The Queen, 2012 TCC 123, rev'd 2013 DTC 5091 [at 5982], 2013 FCA 110

The emigration of the Canadian taxpayer to the United States would have caused the shares of his wholly- owned New Brunswick corporation ("PC") to be disposed of for their fair market value under s. 128.1(4)(b), resulting in a capital gain. While he had unutilized capital losses to shelter such gain in Canada, the United States would not recognize an increase in the cost base of his shares of PC on emigration. In light of this issue, he sold his shares of PC to his brother-in-law, with his brother-in-law then engaging in transactions to extract the assets of PC largely on a tax free basis and pay the purchase price to the taxpayer.

In the course of finding that the sale price paid to the taxpayer was not deemed to be a dividend under the GAAR (or s. 84(2)), Hershfield J. found that the transactions gave rise to a tax benefit even though it was not clear that the taxpayer had in fact reduced his tax payable under the Act. But for the US tax issue, the taxpayer would have engaged in the base-case alternative, described above, resulting in essentially the same utilization of his losses (para. 93). Nevertheless, he stated (at paras. 95-96):

I have no doubt that the assessment can proceed without reliance on a comparison. This is made clear in Canada Trustco. ...

... I do not find [the statement in Trustco that a tax benefit can be established by comparison with an alternative arrangement] to be sufficient to force the analysis in this case beyond accepting the simple and clear tax benefit identified by the Respondent; namely, the creation of a capital gain enabling the use of capital losses which resulted in a reduction of tax payable.

Administrative Policy

93 C.M.TC - Q. 11

Where a non-resident of Canada enters into a series of transactions designed primarily to secure an exemption or reduction from Canadian tax under an income tax convention, RC may seek to apply the general anti-avoidance rule to deny any tax benefit that such transactions would otherwise produce.

Transaction

Cases

R. v. Goldstein (1988), 42 C.C.C. (3d) 548 (Ont CA)

With respect to the interpretation of s. 548(1) of the Criminal Code, Houlden J.A. stated (p. 557) "the words 'the same transaction', in my opinion, mean the series of connected acts extending over a period of time which, the Crown alleges, proved the commission of the offence charged in the information." [Followed in R. v. Cancor Software Corp., 90 DTC 6457 at 6459 (Ont CA)]

See Also

MNR v. Granite Bay Timber Co. Ltd., 58 DTC 1066 (Ex Ct), briefly aff'd 59 DTC 1262 (SCC)

In finding that a resolution of the shareholders to wind-up a company was a "transaction" for purposes of s. 8(3) of the 1948 Act, Thurlow J. stated (p. 1071) that the word "transactions" is not:

"limited to sales of property nor to contractual transactions between parties ... [and] is wide enough to embrace all types of voluntary processes or acts by which a property of one person may become vested in another without regard for the reason or occasion for such processes or acts and regardless also of whether the processes undertaken or the act is done for consideration in whole or in part or for no consideration at all."

Subsection 245(2) - General anti-avoidance provision

Cases

Winter v. The Queen, 90 DTC 6681 (FCA)

Marceau J.A. accepted the following submission of Mr. Cumyn (p. 6683):

"There is a natural order to the provisions of the Income Tax Act with technical rules such as subsection 15(1) at the base, specific anti-avoidance rules like subsection 56(2) one level higher, and the general anti-avoidance rule in section 245 at the apex. As a matter of assessment practice, a specific anti-avoidance rule should be resorted to only when a particular transaction is not caught by any technical rule, just as the general anti-avoidance rule should not be invoked except in the absence of a specific anti-avoidance rule."

See Also

CIT Financial Ltd. v. The Queen, 2003 DTC 1138, 2003 TCC 544

Bowman A.C.J. noted that GAAR should not be applied if other sections of the Act are effective to eliminate the beneficial tax results sought by the taxpayer. In this instance, given that section 69 reduced the capital cost of software required by the taxpayer, there was no room left for the application of GAAR.

C.I.R. (New Zealand) v. Challenge Corporation Ltd., [1986] BTC 442 (PC)

The taxpayer acquired all the shares of a corporation ("Perth") with $5.8 million of tax losses from an arm's length vendor for a purchase price equal to the greater of $10,000 and 22.5% of the losses which proved to be deductible by the taxpayer or affiliated companies. Perth then gave notice of election under s. 191 of the Income Tax Act 1976 (New Zealand) transferring Perth's loss of $5.8 million to subsidiaries of the taxpayer.

Lord Templeman found that the utilization of the losses was denied by s. 99 of the Act, which provided that any contract shall be "absolutely void as against" the Commissioner "if and to the extent that, directly or indirectly, its purpose or effect" is to reduce "any liability to income tax". In response to a submission that s. 99 did not apply because the taxpayer complied with the specific provisions of s. 191 (including a specific anti-avoidance provision in s. 191(1)(c)(i)), Lord Templeman stated (p. 447):

"Tax avoidance schemes largely depend on the exploitation of one or more exemptions or reliefs or provisions or principles of tax legislation. Section 99 would be useless if a mechanical and meticulous compliance with some other section of the Act were sufficient to oust sec. 99... . [I]n the formulation and enforcement of effective anti-tax avoidance provisions, Parliament thought that an overlap might be useful and could not be harmful."

Articles

D. Sandler, J. Li, "The Relationship between Domestic Anti-Avoidance Legislation and Tax Treaties", 1997 Canadian Tax Journal, Vol. 45, No. 5, p. 891.

Subsection 245(3) - Avoidance transaction

Cases

The Queen v. Spruce Credit Union, 2014 DTC 5079 [at 7044], 2014 FCA 143

The taxpayer and 53 other BC credit unions maintained their required deposit insurance with two corporations ("CUDIC" and "STAB"). Due to a change in regulations, they were required to approximately double their insurance with CUDIC. In order to indirectly accomplish a transfer of funds from STAB to CUDIC, STAB paid dividend B to the credit unions (as well as dividend A, whose tax-free status was not challenged), with the credit unions paying an assessment of CUDIC for further contributions in an equivalent amount. Dividend B reflected STAB's aggregate accumulated assessment income (which had been received by STAB free of tax under s. 137.1(2)).

The taxpayer was entitled to a deduction (under s. 137.1(11)(a)) for the fresh assessment paid to CUDIC. If it had received dividend B in proportion to the assessments previously paid to STAB, dividend B would have been included in its income. However, dividend B had instead been paid in proportion to the credits unions' relative shareholdings in STAB, so that it was received by the taxpayer and the other credit unions free of tax.

Trudel JA found no reviewable error in the findings of Boyle J that dividend B was declared primarily for a bona fide non-tax purpose, namely, to allow for the credit unions to pay CUDIC's extraordinary assessments, and that "choosing the method of transferring funds that would result in member credit unions paying the least amount of tax" was not an avoidance transaction as "'[t]he act of choosing or deciding between or among alternative available transactions or structures to accomplish a non-tax purpose, based in whole or in part upon the differing tax results of each, is not a transaction'" (para. 35, see also para. 63). She further noted (at para. 64) that "the reason a declaration of dividends was chosen was that it aligned more closely with the CUDIC assessments on an individual credit union basis than a return of assessments."

1207192 Ontario Limited v. The Queen, 2012 DTC 5157 [at 7396], 2012 FCA 259, aff'g 2011 DTC 1301 [at 1686], 2011 TCC 383

In the course of applying s. 245 to deny the recognition by the taxpayer of a capital loss, the Court considered and rejected the argument of the taxpayer's principal (Mr. Cross) that his primary intention in entering the series of transactions in issue (which effected a surplus strip) was creditor protection, and that "each and every step in the plan was essential" to achieving such protection. Sharlow J.A. stated (at para. 20):

Justice Paris followed the correct approach when he determined the purpose of the series of transactions on an objective basis – that is, by ascertaining objectively the purpose of each step by reference to its consequences – rather than on the basis of the subjective motivation of Mr. Cross, or his subjective understanding of what may or may not have been required to achieve creditor protection.

Canada Safeway v. Alberta, 2012 DTC 5133 [at 7271], 2012 ABCA 232

The taxpayer implemented a series of transactions that gave rise to interest deductions in Alberta, with the interest income being received free of tax in Ontario and being repatriated free of tax back to Alberta. In the course of finding that the transactions did not run afoul of Alberta's general anti-avoidance rule (similar to s. 245 of the ITA), Hunt J.A. stated (at para. 28):

[Alberta] next argues that when a series of transactions such as the Plan is tax-motivated, "every transaction comprising the series is an ‘avoidance transaction'": para 32 Factum. It cites no authority for this proposition other than the language of section 245(3)(b) itself. That provision merely underscores that an avoidance transaction may form part of a series of transactions. In contrast, the provision itself concentrates on individual transactions, not the series.

The Queen v. MacKay, 2008 DTC 6238, 2008 FCA 105

In order for the taxpayers to acquire an interest in a shopping centre, a bank which held mortgages on the centre that were in foreclosure proceedings transferred the mortgages to a newly-formed subsidiary limited partnership, so that the mortgages, on which there was an accrued loss of $6 million, continued to maintain their cost amount of $16 million, with the taxpayers then becoming general partners of the partnership and the interest of the bank in the limited partnership subsequently being redeemed. Consequently, the taxpayers obtained the benefit of the accrued loss on the mortgages.

The Court concluded that the trial judge had erred in concluding, that because the entire series of transactions was one that was undertaken primarily for bona fide purposes other than to obtain the tax benefit represented by the accrued $6 million loss, that each transaction in the series was not an avoidance transaction. The transactions by which the bank became a limited partner of the partnership and transferred the mortgage receivables to the partnership had as their primary purpose to transfer the $6 million accrued loss to the partnership, and were avoidance transactions.

As the transactions also were abusive having regard to the similar result to the Mathew case, the Minister had correctly applied the GAAR to the taxpayers.

The Queen v. Canadian Pacific Ltd., 2002 DTC 6742, 2002 FCA 98

The taxpayer borrowed 216 million in Australian dollars under debentures bearing interest at 16.125% per annum and that had been issued at a 2% premium and then, under a master swap agreement: exchanged the Australian dollar principal amount for Japanese yen at the current spot rate of exchange; swapped the Japanese yen proceeds for Canadian dollars at the current spot rate of exchange; under a series of forward contracts agreed to purchase Australian dollars using Japanese yen on the interest payment date and the principal maturity date; and agreed to exchange Canadian dollar payments for Japanese yen at the relevant future dates. The effect was to convert the proceeds of the debenture issues into Canadian dollars as soon as it received the borrowed funds, and to secure the future delivery of foreign exchange necessary to make the periodic payments of interest and to retire the principal. Sexton J.A. rejected a submission of the Crown that the taxpayer's act of denominating the debentures in Australian dollars was in and of itself a transaction.

Sexton J.A. found that it was not possible to separate the currency of the borrowed funds from the borrowing itself so as to make the denomination of the borrowing a discrete transaction in and of itself, that the extended definition of transaction could not be interpreted to justify taking apart a transaction in order to isolate its business and tax purposes, and that, if the Crown's argument were correct, it could allege that the tax planning component of any transaction amounted to an event or arrangement, constituting a separate transaction. The finding of the Tax Court judge that the primary purpose of the Australian dollar borrowing transaction was for business purposes should not be overridden.

OSFC Holdings Ltd. v. The Queen, 2001 DTC 5471, 2001 FCA 260

After becoming insolvent, a company ("Standard") in the mortgages business established a partnership, transferred a mortgage portfolio to the partnership and, prior to the end of the partnership's first fiscal year, sold its 99% direct interest in the partnership to the taxpayer who then sold a portion of its partnership interest to other parties. S.18(13) deemed the partnership to have the same cost amount for the portfolio as Standard, with a result that losses generated on the sale of the portfolio were allocated to the taxpayer and the other partners, rather than to Standard.

Although, in the view of the majority, the acquisition of the partnership interest by the taxpayer was not part of the same series of transactions involving the establishment of the partnership and the transfer to it of the mortgage portfolio within the "common law" meaning of a series of transactions (i.e., transactions each of which is pre-ordained to produce a final result), that acquisition was part of the series in light of s. 248(10) given that the parties "knew of the Standard series and took it into account when deciding to complete the acquisition transaction". Therefore, given that the taxpayer acquired its interest primarily for the tax benefit (as was apparent from the significant disparity between that benefit and the expected returns from the operation and disposition of the portfolio, and the lack of involvement or knowledge of the other partners in such activities) the series of four transactions culminating in that acquisition also resulted in a tax benefit to the taxpayer and were avoidance transactions.

See Also

Birchcliff Energy Ltd. v. The Queen, 2015 TCC 232

A newly-launched public corporation ("Birchcliff") accessed the losses of a lossco ("Veracel"), in order to shelter the profits from producing oil and gas properties which it was acquiring. Private placement investors were directed to subscribe for subscription receipts of Veracel rather than Birchcliff, with their subscriptions followed immediately by Veracel's amalgamation with Birchcliff, and with the subscription proceeds applied to the properties' purchase. As they received a majority voting equity interest in Amalco, the loss streaming rules otherwise engaged by ss. 256(7)(b)(iii)(B) and 111(5)(a) were avoided.

Hogan J found (at para. 73) that although "the overarching purpose behind…the sale of subscription receipts by Veracel was to raise equity financing for the [properties'] acquisition, this does not provide a bona fide non-tax reason for having Veracel rather than Birchcliff issue the subscription receipts," so that such issuance was an avoidance transaction.

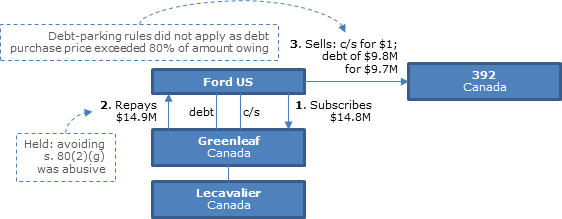

Pièces Automobiles Lecavalier Inc. v. The Queen, 2014 DTC 1126 [at 3319], 2013 TCC 310

A Canadian subsidiary ("Greenleaf") of Ford U.S. paid down to $9,750,000 (including accrued interest) a debt of $24,369,439 (plus accrued interest) owing by it to Ford U.S. through the application of share subscription proceeds of $14,843,596 received by it from Ford U.S.A. and the application of a small amount of cash on hand of $100,706. Eighteen days later, a predecessor of the taxpayer ("392"), which was at arm's length with Ford U.S., purchased all the shares of Greenleaf from Ford U.S. for consideration of $1, and purchased the debt at only a slight discount to the amount owing, so that the debt-parking rules in ss. 80.01(6) to (8) did not apply. The Minister applied s. 245(2) on the basis that Greenleaf had sustained a debt forgiveness in the amount of the debt-paydown.

After finding that the debt-paydown transactions were part of the same series of transactions as the sale as they would have occurred either for the tax related reasons of Ford U.S. (to realize a loss for U.S. tax purposes) or for those of Greenleaf (to avoid application of the debt forgiveness rules) on the subsequent sale transaction, Bédard J went on to find that it was implausible that the taxpayer did not have a hand in the debt-paydown transactions so as to avoid the application of the debt forgiveness rules. Accordingly, the debt-paydown transactions were avoidance transactions.

Bédard J proceeded to find abuse.

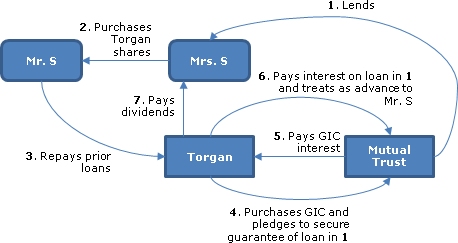

Swirsky v. The Queen, 2013 TCC 73, 2013 DTC 1078 [at 431], aff'd 2014 FCA 36

For creditor-proofing reasons, the taxpayer sold shares in a family real estate development company ("Torgan") to his wife, and used the sales proceeds to satisfy shareholder loans owing by him to Torgan. Torgan,in turn, used the proceeds to purchase a GIC, which it pledged (as security for a guarantee) to a trust company which had lent the shares' purchase price to the taxpayer's wife. He sought to have his wife's related losses (mostly due to interest on the loan) attributed to him pursuant to s. 74.1(1).

After finding that the loan interest was not deductible, Paris J. went on to address the Minister's argument that if, in fact, losses had arisen on the wife's share investment, the attribution of such losses should be denied under s. 245. Paris J. accepted the taxpayer's evidence that the transactions were carried out in order to pay off the shareholder loans to him and for creditor proofing, and that tax reduction was not one of the main reasons for the transactions. The taxpayer also enjoyed tax benefits in that he avoided the inclusion of the shareholder loans in income under s. 15(2), and avoided capital gains by virtue of the spousal rollover under s. 73(1), but these benefits were likewise not the primary purpose of the transactions.

McClarty Family Trust v. The Queen, 2012 DTC 1123 [at 3122], 2012 TCC 80

A family holding company ("MPSI") paid a stock dividend of preferred shares, having nominal paid-up capital and a redemption amount of $48,000, on the Class B non-voting shares of MPSI, which were held by a family trust ("MFT"). MFT then sold these preferred shares to "McClarty" (the family patriarch, holder of the Class A voting shares of MPSI and sole trustee of MFT) in consideration for a demand promissory note of $48,000. The capital gain of approximately $48,000 which thus was realized by MFT was distributed to the children beneficiaries of MFT by MFT issuing demand promissory notes to them. McClarty then sold his preferred shares of MPSI to a corporation ("101 SK") of which he was the sole shareholder and director in consideration for a $48,000 demand promissory note, which 101 SK then repaid out of cash proceeds received by it on the redemption of the preferred shares. The taxpayers alleged that these cash proceeds were used by McClarty to repay another loan (not described above) that had been made to him by MFT rather than the $48,000 promissory note that had been the consideration for his purchase of the preferred shares. The parties engaged in further similar transactions.

The series of transactions did not include an avoidance transaction. Although the series resulted in a clear tax benefit (the splitting of capital gains among the minor beneficiaries), every transaction in the series furthered McClarty's bona fide non-tax purposes of making himself indebted to MFT, and eroding his interest in MSPI to the benefit of MFT. Angers J. found that these transactions all were intended to protect McClarty's assets in the event that a firm which had been his former employer brought action against him for alleged theft of its intellectual property and goodwill. Furthermore, although the transfer by MPSI of $48,000 of value to MFT could have been accomplished in a more tax-ineffective manner (by MPSI declaring a full dividend for distribution by MFT to the children beneficiaries, which would have engaged the "kiddie tax" under s. 120.4), the fact of such an alternative transaction did not detract from the actual (stock dividend) transaction being implemented primarily for creditor-proofing reasons.

McMullen v. The Queen, 2007 DTC 286, 2007 TCC 16

The taxpayer and an unrelated individual ("DeBruyn") accomplished a split-up of the business of a corporation ("DEL") of which they were equal common shareholders by transactions under which (i) DeBruyn converted his (Class A) common shares into Class B common shares, (ii) the taxpayer sold his Class A common shares of DEL to a newly-incorporated holding company for DeBruyn's wife ("114") for a purchase price of $150,000, (iii) DEL issued a promissory note to 114 in satisfaction of a $150,000 dividend declared by it on the Class A shares, (iv) 114 as signed the promissory note to the taxpayer in satisfaction of the purchase price for the Class A shares, (v) the taxpayer transferred the promissory note owing to him by DEL to a holding company ("HHCI"), and HHCI purchased assets of the Kingston branch of the business of DEL in consideration for satisfaction of the promissory note.

Lamarre J. made a finding that the primary purpose of the sale of the Class A shares by the taxpayer to 114 was to sever his ties with DeBruyn, that the dividend from DEL to 114 was not a transaction to facilitate the taxpayer's obtaining a tax benefit (given that it was not a transaction that benefited the taxpayer), and that the primary objective of the assignment to the taxpayer of the $150,000 note was, again, to terminate the taxpayer's business association with DeBruyn. Lamarre J. also noted that s. 245(3) did not permit the recharacterization of a transaction for the purpose of determining whether or not it was an avoidance transaction, and that the transaction did not represent an appropriation of DEL's funds by the taxpayer.

MIL (Investments) S.A. v. The Queen, 2006 DTC 3307, 2006 TCC 460, aff'd 2007 FCA 236

In March 1993 an individual ("Boulle") transferred his shares of a Canadian public junior exploration company ("DFR") to the taxpayer, which was a newly-incorporated Cayman Islands company wholly owned by him. By June 1995, the taxpayer exchanged, on a rollover basis pursuant to s. 85.1, a portion of its DFR shares (which had substantially appreciated) for common shares of a large Canadian public company ("Inco"), with the result that the taxpayer's shareholding in DFR was reduced below 10%. This result positioned the taxpayer to clearly fit within an exemption from Canadian capital gains tax under Article XIII of the Canada-Luxembourg Income Tax Convention (the "Treaty") on a subsequent disposition of that block of shares once the taxpayer became resident in Luxembourg. In July 1995, the taxpayer was continued into Luxembourg, in August 1995 the taxpayer disposed of its shares of Inco and in August 1996 it sold its DFR shares to Inco.

In finding that the June 1995 exchange by the taxpayer of its DFR shares for Inco shares was not an avoidance transaction, Bell J. accepted the evidence of Boulle that he made the sale in order to raise cash and to diversify his portfolio. In finding that the continuation of the taxpayer to Luxembourg was not an avoidance transaction, he found that although one of the "driving forces" of the transactions was the taxpayer's desire to ensure the sale of its shares in a tax effective manner, this did not render the transaction an avoidance transaction where there was a bona fide commercial reason for selling the shares of DFR, and that in such circumstances it was open to the taxpayer to seek tax advice respecting the appropriate structure for concluding such a sale.

Respecting the subsequent sale of DFR shares by the taxpayer to Inco in August 1996, Bell J. noted that Boulle did not have the ability to organize and effect a favourable vote for the sale to Inco, and, in any event, it was "unimaginable" that Boulle could have persuade the sophisticated shareholders of DFR to vote in favour of that sale simply because he alone might enjoy a tax benefit.

Desmarais v. The Queen, 2006 DTC 2376, 2006 TCC 44

The taxpayer, who held 14.28% of the common shares of a Canadian private corporation ("Consercom") transferred a 9.76% block to a wholly-owned holding company ("6311") in consideration for preferred shares of 6311 with a high paid-up capital (thereby giving rise to a capital gain eligible for the capital gains exemption). The taxpayer also transferred shares of a Canadian private corporation ("Gestion") that he owned together with his brother to 6311 in consideration for shares of 6311. The redemption of the taxpayer's preferred shares of 6311 was financed through dividends received by 6311 from Gestion.

The transfer of a portion of the Consercom shares (being under the 10% threshold to which s. 84.1 would apply) to 6311 was an avoidance transaction. This transfer was completed primarily to make it possible for the taxpayer to receive a distribution sourced from Gestion surpluses free of tax.

Overs v. The Queen, 2006 DTC 2192, 2006 TCC 26

The taxpayer owed approximately $2.3 million to a wholly-owned corporation. The loan, which had been used by him for personal purposes, would be included in his income under s. 15(2) if not repaid.

The taxpayer's wife borrowed $2.3 million from a bank to purchase some of her husband's shares for that sum, and he used the proceeds to repay his loan to the corporation which, in turn, purchased cash collateral to be pledged to the bank as security for its guarantee of the bank loan. The share sale occurred on a rollover basis under s. 73(1), and the interest incurred on the bank loan was attributed to the taxpayer under s. 74.1(1).

Little J. found that the transactions were not avoidance transactions and (if he was not correct in this finding) were not abusive tax avoidance transactions.

Univar Canada Ltd. v. The Queen, 2005 DTC 1478, 2005 TCC 723

The taxpayer incorporated a Barbados subsidiary ("BarbadosCo") using borrowed money to subscribe for the shares of BarbadosCo, and BarbadosCo used the proceeds to purchase from the American parent of the taxpayer ("UC") an interest-bearing note owing to UC by a wholly-owned European subsidiary of UC ("UE"). Bell J. accepted evidence of the taxpayer's officers that there was never any intent for the taxpayer to itself acquire the note. Accordingly, there was no tax avoided through the incorporation of BarbadosCo and the receipt of tax-free dividends by the taxpayer from BarbadosCo funded out of the interest payments made on the note.

Brouillette v. The Queen, 2005 DTC 1004, 2005 TCC 203

The taxpayer facilitated a leveraged buy-out of him and his co-shareholder of a company ("Brouillette Automobiles") by incorporating a corporation ("9016") of which he controlled 51% of the voting shares with the balance of the shares being owned by the purchaser corporation ("9017") of which two unrelated individuals were equal shareholders, with 9016 using the proceeds of a loan to it by Brouillette Automobile to purchase for cash the shares of the co-shareholder of Brouillette Automobile, the taxpayer rolling his shares of Brouillette Automobile into 9016 for non-voting shares of 9016 (so that Brouillette Automobile was now a wholly-owned subsidiary of 9016) and then selling his shares of 9016 to 9017 for a promissory note.

Lamarre Proulx J. found that as she had already found that s. 84.1 did not apply to the transaction (because the taxpayer was dealing at arm's length with 9017), s. 245 should not be applied. To do so would be to legislate. Even if s. 245 could be so applied, the transactions were entered into fundamentally for a business or commercial purpose (obtaining the best possible price).

Geransky v. The Queen, 98-2383 (IT) G (TCC)

The taxpayer, who owned a portion of the shares of the holding ("GH") which, in turn, owned an operating company ("GBC") utilized the enhanced capital gains exemption in connection with the sale of a cement plant operated by GBC through the following transactions: the taxpayer and the other shareholders of GH transferred a portion of their shares of Holdings to a newly-incorporated company ("Newco") in consideration for shares of Newco having a value of $500,000; GBC paid a dividend-in-kind of most of the cement plant assets (having a value of $1 million) to Holdings; Holdings redeemed the common shares held in its capital by Newco by transferring to Newco the assets it had received from GBC; and the shareholders of Newco's sold their interests in Newco to the purchaser (who also purchased the remaining cement-plant assets directly from GBC).

Bowman T.C.J. found that even if the transactions had been avoidance transactions, there would have been no abuse or misuse for purposes of s. 254(4):

"Simply put, using the specific provisions of the Income Tax Act in the course of a commercial transaction, and applying them in accordance with their terms is not a misuse or an abuse. The Income Tax Act is a statute that is remarkable for its specificity and replete with anti-avoidance provisions designed to counteract specific perceived abuses. Where a taxpayer applies those provisions and manages to avoid the pitfalls, the Minister cannot say 'Because you have avoided the shoals and traps of the Act and have not carried out your commercial transaction in a manner that maximizes your tax, I will use GAAR to fill in any gaps not covered by the multitude of specific anti-avoidance provisions'."

Husky Oil Ltd. v. The Queen, 99 DTC 308 (TCC)

A Bermuda corporation, which was in financial difficulty and in which the taxpayer had an indirect 35% interest, transferred a drilling vessel, utilizing the rollover provisions of s. 85(5.1) of the Act, to a partnership in which the taxpayer had a substantial interest. The drilling vessel then was disposed of to an arm's-length purchaser giving rise to a substantial loss, most of which was allocated to the taxpayer.

In finding (at p. 322) that the transactions "were commercial transactions for commercial purposes from beginning to end", Beaubier TCJ. noted that the transactions permitted the taxpayer to sever its relationship with insolvent companies in the Bow Valley Group, to remove its guarantee in favour of its Export Development Corporation and to get rid of the drilling vessel.

Commissioner of Taxation of the Commonwealth of Australia v. Spotless Services Ltd., 71 ALJR 81, 34 ATR 183, 141 ALR 92

Under arrangements that were characterized as a deposit of funds by the taxpayer in the Cook Islands, the taxpayer received an interest rate on its deposit of 4% below the Australian bank bill buying rate, but took the position that it was exempt from Australian income tax because of the situs of the deposit.

In concurring in a reversal of a finding of the full Federal Court that the "dominant purpose" of the taxpayer for purposes of Part IV of the Income Tax Assessment Act of 1936 was to obtain the maximum return on money invested after the payment of all applicable costs including tax, and not to obtain a tax benefit, McHugh J. stated:

"... This case is far removed from the ordinary case of a taxpayer switching an investment from one which had no tax advantages to one from which it would or might obtain tax benefits ... . The elaborate nature of the scheme and its attendant circumstances lead inevitably to the conclusion that the scheme was not merely tax driven but that its dominant purpose was to enable the taxpayer to obtain a tax benefit by participating in the scheme."

RMM Canadian Enterprises Inc. v. The Queen, 97 DTC 302, [1998] 1 C.T.C. 2300 (TCC)

A non-resident corporation ("EC") approached a business associate who, along with two other individuals, formed a Canadian corporation ("RMM") to buy the shares of a Canadian subsidiary ("EL") of EC for a cash purchase price approximating the cash and near cash on hand of EL and a Canadian subsidiary of EL ("ECL"). Immediately following the purchase, EL was wound-up into RMM and ECL was amalgamated with RMM; and three or four days later, RMM used the cash received by it from EL and ECL to pay off a loan that had financed the acquisition.

In finding that the transaction gave rise to a benefit, Bowman TCJ. noted that the elimination of capital gains tax on the sale proceeds as a result of the application of the Canada-U.S. Income Tax Convention did not detract from such reduction occurring "under this Act", and also indicated that he was not prepared to say that because the envisaged U.S. tax saving was greater than the envisaged Canadian tax saving established that the primary purpose of the transaction was not the avoidance of Canadian tax.

Mark Resources Inc. v. The Queen, 93 DTC 1004 (TCC)

Before going on to find that the former s. 245(1) did not prohibit the deduction of interest by the taxpayer, Bowman J. stated, in obiter dicta that:

"... Even if there were any place in the analysis of the consequences of a tax-motivated arrangement for assessing some level of fiscal reprehensibility, which I doubt, I should think that the absorption of business losses within a corporate group would rank rather low ... There is a world of difference between the creation of artificial deductions and losses out of thin air and the utilization of legitimately incurred losses within an unrelated group."

Barclays Mercantile Industrial Finance Ltd. v. Melluish, [1990] BTC 209 (Ch. D.)

The taxpayer ("BMI") acquired a film from the producer ("WBI"), leased it to another corporation at a return that yielded 2.16% per annum on its expenditure, and claimed a 100% first-year capital allowance for the amount of the expenditure (on the basis that the film qualified as "plant"). S.3(1)(c) of Schedule 8 to the Finance Act 1971 denied the deduction of the allowance if it appeared with respect to the purchase of the plant "that the sole or main benefit which ... might have been expected to accrue to the parties ... was the obtaining of an allowance". In finding that this anti-avoidance provision did not apply, Vinelott J. accepted (at pp. 239-240) a submission that:

"The main object of WBI in selling the film to BMI was to recover the cost of making the film while ensuring that the film be distributed by the WBI organisation. They main object of BMI was to make profit by acquiring and leasing the plant. It is probable that BMI would not have been able to offer a leaseback to a company in the WBI organization at an acceptable rent unless it could obtain a capital allowance and unless it had spare capacity in the group sufficient to absorb it. But it does not follow that BMI's object was to obtain an allowance; BMI's object and purpose was to make a profit on a purchase and lease of the plant.

Mallalieu v. Drummond, [1983] BTC 380, [1983] 2 All E.R. 1095 (HL)

The court rejected the view that in ascertaining the purpose of an expenditure, the state of mind of the spender is the only relevant factor.

Newton v. Commissioner of Taxation of the Commonwealth of Australia, [1958] A.C. 450 (PC)

In interpreting the provisions of s. 260 of the Commonwealth Income Tax and Social Services Contribution Assessment Act, 1936-1951 (Australia), Lord Denning stated (p. 465):

"The word 'purpose' means, not motive but the effect which it is sought to achieve - the end in view."

Administrative Policy

23 May 2013 IFA Round Table Q. 4

Given that in all three cases, a new Canadian corporation (CanHoldco) is "inserted" to establish cross-border PUC so as to enable surplus of CanOpco to be extracted from Canada, CRA would consider the application of GAAR in each case. CRA stated:

The GAAR Committee has determined that the GAAR applies to cases involving "Post-acquisition" and "Non-acquisition" planning as described above. The GAAR will apply to treat the return of PUC paid by CanHoldco to NRCo as a distribution of a taxable dividend subject to Part XIII withholding tax. The GAAR Committee has not recently addressed the "Pre-acquisition" tax planning case described above....If the acquisition of Forco by CanHoldco in all three scenarios occurred after March 28, 2012, section 212.3 would generally apply.

2003 Ruling 2003-03924

The corporate general partner of a Canadian limited partnership operating a business in Canada borrows on an unsecured basis under a loan with a term of over twenty years from U.S. institutional lenders, and on-lends the funds on similar terms, but at a higher interest rate, to the limited partnership. Given that the interest rate on this borrowing is lower than the rate on comparable Canadian financings (if such financings were even available), s. 245(2) would not be applied to alter the tax consequences of the borrowing by the general partner, including its exemption nature under s. 212(1)(b)(vii).

1996 A.P.F.F. Round Table No. 7M12910 (Item 3.2)

In a situation where Canco subscribes for shares of its Barbados subsidiary, and the Barbados subsidiary loans the same funds to a U.S. subsidiary of Canco with interest, Revenue Canada will make a comparison with hypothetical transactions in which the U.S. subsidiary borrowed money at interest directly from Canco, with the result that Canco would earn interest income, and the U.S. subsidiary will be subject to Canadian withholding tax pursuant to ss.15(2) and 214(3).