Subsection 186(1) - Tax on assessable dividends

See Also

Les Entreprises Michèle L'Heureux Inc. v. The Queen, 94 DTC 1693 (TCC)

Dussault TCJ. accepted the Minister's "successive calculation method" in solving the circularity issues arising where in the course of a butterfly reorganization the transferee and transferor corporations simultaneously received dividends (thereby simultaneously generating dividend refunds and corresponding Part IV tax liabilities) on the cancellation of cross shareholdings between the two corporations.

Administrative Policy

2014 Ruling 2014-0533601R3 - Spin-off butterfly - subsection 55(2)

A spin-off butterfly reorganization by DC entail a cross-redemption of shareholdings (being the "DC Butterfly Shares" and the "Spinco Redemption Shares") between it and "Spinco." Under the proposed transactions, DC will reduce the stated capital of the DC Butterfly Shares to an amount equaling that of the Spinco Redemption Shares before their redemption ("to ensure that each of Spinco's and DC's respective dividend refunds under subsection 129(1) and respective Part IV tax under paragraph 186(1)(a) (all in respect of the dividends arising on the redemption of the DC Butterfly Shares, and the dividends arising on the redemption of the Spinco Redemption Shares) will be approximately equal to each other, such that each of DC and Spinco will not have any net tax liabilities (i.e., as a result of each corporation's Part IV tax liabilities exceeding such corporation's dividend refund)."

See summary under s. 55(1) – distribution.

2014 Ruling 2013-0513211R3 - Butterfly Transaction

In a butterfly reorganization for the split-up of DC into three TCs, the Part Iv tax circularity problem is addressed by having DC transfer its properties to respective new Subcos of each TC, so that no s. 186(1)(b) Part IV tax is generated on the redemption of the prefs received by DC as consideration. The Subcos then are wound-up into the TCs, and DC is wound-up under s. 88(2) into the TCs. with non-circular s. 186(1)(b) applying to the resulting s. 88(2)(b)(iii) deemed dividends. See summary under s. 55(1) – distribution.

30 June 2014 Memorandum 2013-0508411I7 F - Part IV Tax and the Dividend Refund

As a result of a tuck under transaction, Investments and XX each held shares in the other. Investments, which had an RDTOH balance at year end, redeemed shares held by XX during the year, thereby giving rise to a deemed dividend; and XX also paid a dividend in that year to Investments. Each dividend resulted in a dividend refund and a Part IV tax liability. The RDTOH balance reported by Investments was incorrect. Moreover, it did not take into account the circular effect of the cross-dividends, so that it did not take this circularity into account in computing its dividend refunds and Part IV tax liability for the year. A reassessment of that year would now be beyond the normal reassessment period. The Directorate stated (TaxInterpretations translation):

The circular calculation is due to the fact that the dividend refund of a corporation has an effect on the Part IV tax payable by the other corporation whose Part IV tax payable affects the dividend refund of the first corporation. In general, the circular calculation of the dividend refund and Part IV tax liability of the affected corporations ceases when the dividend refund of the corporation having paid the smaller dividend is equal to 1/3 of the taxable dividend which it is deemed to have paid in the year.

In finding that the year could be reassessed, the Directorate noted that "the necessity to effect the circular calculation…is well known… ."

27 June 2014 T.I. 2013-0498191E5 F - Interaction entre 55(2) et l'impôt de partie IV

On a cross-share redemption between two connected Canadian-controlled private corporations, neither of which has a refundable dividend tax on hand account account immediately before the redemption, each corporation is deemed to receive a dividend from the other. Does the application of s. 55(2) to the deemed dividend received by each corporation, which generates an addition to its RDTOH account and, therefore, generates a dividend refund to it and associated Part IV tax on the deemed dividend paid by it to the other corporation, engage the exclusion from s. 55(2) for dividends which are subject to Part IV tax – or does the Part IV tax exclusion not apply so that s. 55(2) applies to the full amount of the deemed dividend received by each corporation? CRA stated (TaxInterpretations translation):

[I]n accordance with sections 129 and 186, it is provided that the dividend refund, the RDTOH account and thus the Part IV tax of a given corporation are calculated as a function of all relevant amounts in this regard for the whole taxation year.

Furthermore…in…943963 Ontario Inc. …the parties…and the Court accepted that there was a given amount subject to Part IV tax by the appellant, the dividend recipient, notwithstanding that a part of the deemed dividend…was deemed to not be a dividend received, by virtue of subsection 55(2). In other words, the part of the dividend giving rise to a capital gain by virtue of subsection 55(2) did not affect the amount of the "assessable dividend" taken into account for calculating the Part IV tax payable… . The application of subsection 55(2) in that case did not engage any circular calculation. …

Moreover, the fact of calculating the RDTOH account at the end of a taxation year of each corporation in such a situation…involving cross redemptions and thus cross dividends, entails circular calculations by them of their respective RDTOH, dividend refunds and Part IV tax. In policy terms, it does not appear acceptable to us that circular calculations could result in a complete reimbursement of the total RDTOH of each corporation in such a situation.

2013 Ruling 2013-0502921R3 - Split-Up Butterfly - Farm

Butterfly

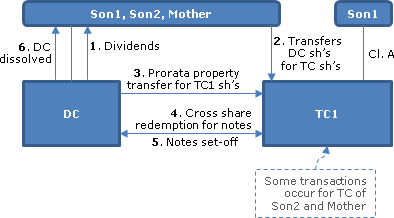

A standard split-up butterfly of D commences with DC paying a dividend (through issuing demand notes) to each of Son1, Son2 and Mother so as to entitle it to a refund of its RDTOH for that year and with DC designating such dividends as eligible dividends, and also paying capital dividends to them, with the notes and shareholder loans then being repaid in cash. The butterfly reorganization includes the cross-redemption of shares between the three TCs and DC through the issuance of notes, with the notes then being set-off.

Circularity comment

After giving relatively standard butterfly rulings and rulings that the s. 84(3) deemed dividends arising on the redemptions by the TCs and DC will be subject to Part IV tax to the extent described in s. 186(1)(b), CRA noted that this "could give rise to what is referred to as a "circular" calculation of RDTOH," and stated that "the district taxation office at which each of the corporations files its T2 income tax return will have to be consulted in order to determine which corporation will receive the dividend refund and which corporation will be subject to the Part IV tax liability under paragraph 186(1)(b)."

See more detailed summary under s. 55(1) – distribution.

2013 Ruling 2012-0443081R3 - Distribution of pre-72 Capital Surplus on Hand

(Amended only re one ruling in 2013-0512531R3)

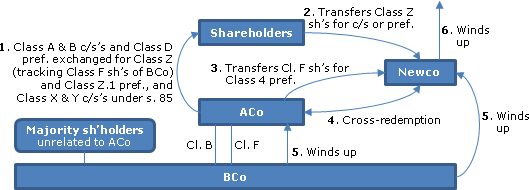

Current situation

ACo, which is a Canadian-controlled private corporation (with an RDTOH balance) owned by cousins (an unrelated group), owns Class B shares of BCo (which were acquired after V-day) and Class F shares of BCo (which were held on V-day). BCo is a CCPC, holds loans receivable and has pre-72 CSHOH balances as a result of sales of capital properties which had been held on V-Day. ACo and BCo deal at arm's length. The shareholders of ACo wish "to arrange for the receipt of pre-72 CSOH in conjunction with the disposition of the assets giving rise to such pre-72 CSOH."

Proposed transactions

- The two family groups of shareholders of ACo will exchange (on a "dirty" s. 85 rollover basis) their Class A and B common shares of ACo (as well as Class D preferred shares) for (i) Class Z preferred shares of Aco having a redemption value equal to the portion of the exchanged shares' value which is attributable to the Class F shares of BCo shares held by Aco, (ii) Class Z.1 shares of Aco whose redemption value is equal to the adjusted cost base of the exchanged shares minus the redemption value of the Class Z shares, and (in the case of the exchanged Class A and B shares) (iii) new common shares (Class X or Y) of Aco.

- They will then transfer their Class Z preferred shares of ACo to Newco under s. 85(1) for Class A shares of Newco (in the case of former Class A or B common shareholders of Aco) and for Class 1 to 3 preferred shares of Newco (in the case of previous preferred shareholders of Aco); a similar pref-for-pref transfer occurs re Class D shares of ACo.

- ACo will transfer its shares of BCo to Newco for Class 4 preferred shares (in order "to transfer ACo's entitlement to pre-72 CSOH to Newco"), and will elect under s. 85(1) "to ensure that paragraph 88(2.2)(b) applies on the transfer"; PUC will allocated to the Class 4 preferred shares equal to the PUC of the ACo shares held by Newco "to ensure that the deemed dividends on the redemptions [in 4 below] will be equal;"

- There will be a cross-redemption of shares between ACo and Newco in consideration for promissory note issuances, giving rise to equal dividends (as a result of the PUC of the Class 4 preferred shares of Newco being established with this end in view), with the promissory notes then being set-off.

- BCo will be wound-up and its remaining assets (being cash in an amount not exceeding its pre-72 CSOH) will be distributed ratably to its shareholders, including ACo and Newco.

- Newco then will be wound-up, with each shareholder receiving its remaining asset, being cash.

- Newco will establish a fiscal year end immediately after 4 "to avoid the possibility of other transactions which could impact the RDTOH balance of Aco."

Rulings

Listed in summary under s. 88(2).

Comment

ACo is expected to have a balance in its RDTOH at its year-end, and the taxation year of Newco in which it redeems its preferred shares owned by ACo will...coincide with the taxation year of ACo in which it redeems the preferred shares owned by Newco. Consequently, this gives rise to what is referred to as a "circular" calculation of RDTOH. You have indicated that you do not wish to avoid this "circularity problem". Consequently...the district taxation office at which each of ACo and Newco files its T2 income tax return will have to be consulted in order to determine which corporation will receive the dividend refund and which corporation will be subject to the Part IV tax liability under paragraph 186(1)(b)... .

2013 Ruling 2012-0449611R3 - single-wing butterfly reorganization

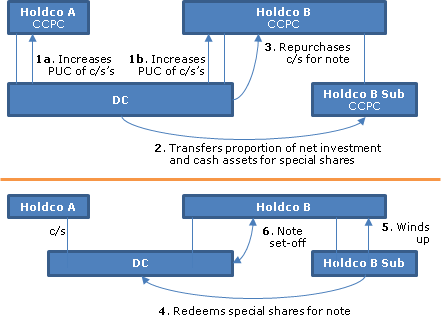

Existing situation

DC, which is a CCPC beneficially owning rental real estate encumbered with mortgages (the "Buildings") and which carries on a specifed investment busines, has Holdco A and B as its (common) shareholders, who also hold shareholder advances and deal with each other at arm's length, and with Holdco B being the controlling shareholder of DC. In connection with the settlement of a lawsuit between Holdco A and its shareholders, and Holdco B and its shareholders, it was agreed that Holdco B would make a payment to the plaintiffs and that there would be a transfer of Buildings on a single-wing butterfly basis to Holdco B.

Proposed transactions

- DC will increase the stated capital of its common shares by the applicable multiple of its RDTOH at the end of the taxation year arising from Holdco A's acqusisition of conrol referred to in 3 below, with such increase not exceeding the safe income on hand attributable to the DC common shares of Holdco A and Holdco B at the safe-income determination time. Holdco A and Holdco B will make s. 55(5)(f) designations in respect of the resulting deemed dividend.

- DC will transfer a proportionate share of its two types of property (cash and near cash; and investment property, namely, the Buildings and related assets) on a net asset butterfly basis under s. 85(1) to a newly-incorporated subsidiary of Holdco B (Holdco B Sub) in consideration for the assumption of liabilities and for Holdco B Sub Special Shares (which will carry more than 10% and less than 50% of the votes for all Holdco B Sub shares), with Holdco B Sub thereby being connected with DC; the shareholder loans will be considered current liabilities for this purpose;

- DC will purchase for cancellation all of the DC common shares held by Holdco B in consideration for issuing a Note, which will be accepted as absolute payment; no s. 256(9) election will be made respecting the resulting acquisition of control of DC by Holdco A.

- Holdco B Sub will redeem all of the Holdco B Sub Special Shares held by DC in consideration for issuing a Note, which will be accepted as absolute payment.

- Holdco B Sub will be wound–up – and then dissolved.

- The two Notes will be set-off.

Purposes of transactions

58. The purpose of the PUC increase [in 1]… is to enable DC to receive a dividend refund equal to the amount of DC's RDTOH at the end of the year that will end immediately before the acquisition of control of DC by Holdco A….

60. The purpose for Holdco B incorporating Holdco B Sub…is to avoid circularity in the calculation of DC's RDTOH and Part IV tax, that would otherwise occur if the Distribution Property were transferred directly to Holdco B by DC.

61. The purpose for DC not filing a subsection 256(9) election [see 3]… is to ensure that the dividend refund that DC will obtain, arising on the PUC increase [in 1]… will occur in the taxation year of DC that will end immediately before the acquisition of control of DC by Holdco A….

Rulings

Standard butterfly rulings.

93 C.R. - Q. 44

RC is prepared to consider requests for refunds of Part IV tax paid by a parent for a year in which it received a dividend from a subsidiary (that subsequently carried back a non-capital loss to eliminate the dividend refund giving rise to the Part IV tax) provided that the parent requests such refund in writing, its taxation year is not statute-barred and at the time of the request the parent has refundable dividend tax on hand in an amount equal to the Part IV tax payable in respect of the dividend received from the subsidiary.

4 March 1991 T.I. (Tax Window, No. 2, p. 15, ¶1183)

A private corporation is required to pay Part IV tax under s. 186(1)(b) irrespective whether the payor corporation actually applies for the dividend refund and whether the Minister in fact pays the dividend refund to the payor corporation.

IT-474R "Amalgamations of Canadian Corporations" under "Rules Respecting Shareholders, Option Holders and Creditors" under "Non-Resident Shareholders"

"A non-resident holder of shares of a predecessor corporation which constitute taxable Canadian property need not comply with the procedures set out in section 116 in respect of the deemed disposition of the old shares on an amalgamation to which subsection 87(4) is applicable".

Articles

Michael N. Kandev, Alan Shragie, "RDTOH on Butterfly", Canadian Tax Highlights, Volume 16, Number 11, November 2008, p. 2.

Use of sub of TC to avoid circularity (p.2)

CRA document 2007-0237361R3 suggests an approach that may permit an allocation of a share of the RDTOH to a departing shareholder in a single-winged butterfly.

The non-recognition of RDTOH as property represents a challenge on a single-winged butterfly. Assume that a distributing corporation (D Co) has three equal corporate shareholders, one of which, the transferee corporation (T Co), wants to leave the venture via a single-winged butterfly. T Co sets up a wholly owned subsidiary to receive its pro rata share of D Co's property and to avoid a circular computation of RDTOH. Upon the single0winged butterfly, T Co's shares in D Co are redeemed or repurchased, and T Co is deemed to receive a taxable dividend, triggering a refund of RDTOH to D Co and a corresponding part IV tax liability to T Co, but T Co cannot shelter its part IV tax liability with any of D Co's RDTOH refund.

Use of s. 84(1) dividend to avoid "transfer (p.2)

In the example given in the ruling, on the day before the butterfly transactions, D Co increased the PUC of its common shares held by its three corporate shareholders in order to move D Co's RDTOH balance on a proportionate basis to its shareholders. The resulting deemed dividend crystallized D Co's RDTOH into property, a receivable, part of which can be distributed by D Co to T Co. In proceeding by way of a PUC increase, there is no "transfer" and thus no "distribution" to which section 55 can apply….

Choice of one-day taxation year for DC (pp.2-3)

…The ruling states that the acquisition of control of D Co by the group composed of its remaining shareholders (subsection 256(9)) triggers a year-end between the PUC increase and the butterfly transactions. D Co chose a new year-end at the end of the day of the butterfly transactions, so that no material aggregate investment income was generated during that one-day taxation year in which the butterfly occurred, thus minimizing any possibility that RDTOH would be generated after the PUC increase.

Potter, "Part IV Tax Complications in Butterfly Transactions", 1992 Canadian Tax Journal, No. 4, p. 992.

Subsection 186(2) - When corporation controlled

See Also

Special Risks Holdings Inc. v. The Queen, 84 DTC 6505, [1984] CTC 553 (FCTD), aff'd 86 DTC 6036, [1986] 1 CTC (FCA)

Exactly 1/2 of the common shares of a corporation ("Melling, Hogg") were purchased by the plaintiff, and the other 1/2 were purchased by a United Kingdom corporation ("Hogg Robinson"). Eleven days later, the plaintiff purchased 1% of the shares of Melling, Hogg from Hogg Robinson, a step which had been planned from the beginning.

It was held that since the plaintiff had not been dealing at arm's length with Hogg Robinson during the 11 day period, a subsidiary of Melling, Hogg was controlled by the plaintiff within the extended meaning of control assigned by s. 186(2). "Hogg Robinson's temporary ownership was one of form only, to accommodate the plaintiff's purpose." The plaintiff had de facto "control through the abdication of Hogg Robinson in exercising any independent interest and its acquiescence in the transactions merely as an accommodation to the plaintiff."

Administrative Policy

10 October 2014 October APFF Roundtable Q. 18, 2014-0538081C6 F

Aco holds one share of Cco bearing 1000 votes and Cco holds 100 share of Bco carrying one vote per share. Aco and Cco deal at arm's length. The questioner noted (TaxInterpretations translation) that at the 1997 APFF Roundtable in in 2010-0359551I7 "CRA indicated that the test provided in ITA subparagraph 186(4)(b)(i) refers to the number of share carrying a right to vote in all circumstances rather than simply the number of votes independent of the number of shares. The CRA further indicated that the test provided in ITA subsection 186(2) was interpreted in the same manner." Is Bco controlled by Cco under s. 186(2)? CRA responded:

Consistently with the longstanding position of the Directorate,…the concept of control referred to in ITA subsection 186(2) contemplates that a corporation is controlled by another corporation if more than 50% of the issued shares in its capital (having full voting rights under all circumstances) belong to the other corporation, to persons with whom the other corporation does not deal at arm's length or to the other corporation and persons with whom the other corporation does not deal at arm's length.

We also confirm that the position in [the above documents] still represents the position of the Directorate respecting the share ownership test in ITA subparagraph 186(4)(b)(i).

However…if it emerged that the utilization of a capital structure as unusual as that described in your question was part of a series of transactions effected with a view to avoiding the payment of Part IV tax, it would be necessary to consider the application of ITA subsection 245(2).

29 July 1992 T.I. (Tax Window, No. 21, p. 7, ¶2054)

Where an individual owns all the shares of Holdco which, in turn, owns all the shares of Opco, a loan receivable owing by Holdco to Opco will constitute indebtedness of a corporation connected with Opco, because Holdco is deemed by s. 186(2) to be controlled by Opco.

15 May 1991 T.I. (Tax Window, No. 6, p. 2, ¶1357)

Where the shares of Parentco are owned by related persons, its subsidiary will be deemed for purposes of Part IV and the definition of a qualified small business corporation share to control it.

31 July 1989 T.I. (Dec. 89 Access Letter, ¶1053)

A corporation ("Opco") all of whose voting shares are held by an individual is connected with a second corporation which holds the non-voting preferred shares of Opco and which is controlled by the same individual.

Subsection 186(4) - Corporations connected with particular corporation

Administrative Policy

22 July 1993 T.I. 931385 (C.T.O. "Connected Corporations")

"The existence of a shareholders' agreement or a voting trust which dictates the manner in which the shares are to be voted will not disqualify the shares from satisfying the 'full voting rights' requirement of subparagraph 186(4)(b)(i) ... . Although the shareholder may have entered into an arrangement which dictates how the votes attached to his or her shares are to be voted, this does not alter the fact that the shares have full voting rights."

16 December 1992 T.I. 920178 (November 1993 Access Letter, p. 511, ¶C245-050)

Discussion of whether s. 245 will apply where additional shares are required, or shareholdings are pooled, in order that Part IV tax will not apply to an intercorporate dividend.

26 August 1992 T.I. (Tax Window, No. 23, p. 12, ¶2155)

The definition of control in s. 186(2) should be used in applying the tests in s. 186(4) even where those tests relate to provisions outside Part IV, for example, the definition of "qualified small business corporation share".

25 and 28 March 1991 T.I. (Tax Window, No. 1, p. 5, ¶1178)

A corporation is not "connected" with its wholly-owned subsidiary.

90 C.R. - Q26

A corporate beneficiary of a trust will not be considered for purposes of s. 186(4)(b) to own shares held by the trust notwithstanding that the trust has made a designation under s. 104(19) in respect of taxable dividends paid on the shares.

IT-269R3 "Part IV Tax on Taxable Dividends Received by a Private Corporation or a Subject Corporation"

Subsection 186(5) - Deemed private corporation

Administrative Policy

18 December 2001 T.I. 2001-007392 -

"While subsection 186(5) does not specifically refer to paragraph 88(1)(e.2) it is our view that such reference is not necessary. Therefore, where a subsidiary corporation is wound-up into its parent subsection 186(5) will cause paragraph 87(2)(aa) (as modified by paragraph 88(1)(e.2)) to be applicable to the winding-up provided each of the subsidiary and the parent are subject corporations at the relevant times required for these purposes.

Subsection 186(6) - Partnerships

Administrative Policy

6 November 2013 T.I. 2013-0485691E5 - Connected Corporation and Part IV Tax

The recipient corporation owns 20% of the shares of a payer corporation (and is thus connected under s. 186(4)(b), and also owns 12.5% of the total units of a limited partnership which owns 20% of the shares of the payer corporation. Are taxable dividends received through the limited partnership subject to Part IV tax?

CRA referred, without answering the question, to the position in IT-269R4, para. 15, that each member is deemed by s. 186(6)(b) to own a proportion of the shares owned by the partnership based on that member's share of all dividends received on such shares by the partnership.

Subsection 186(7) - Interpretation

Administrative Policy

8 January 2003 T.I. 2002-017366

Two corporations which have no direct ownership in each other but which are controlled by the same person would be considered to be connected corporations for purposes of the definition of "small business corporation" in s. 248(1).