New Holdco

US Silver/RX Gold

A combination of U.S. Silver (TSX, US OTCQX and Fankfurt) and RX Gold (TSX-V) pursuant to a Combination Agreement originally dated June 7, 2012 is to be effected by (1) each outstanding common share of U.S. Silver being exchanged pursuant to a CBCA plan of arrangement for 0.67 of a common share of a newly-incorporated OBCA holding company (U.S. Silver & Gold Inc., or "Combined Company"), and (2) each outstanding common share of RX Gold being exchanged (at the same time as (a)) pursuant to an Ontario plan of arrangement for 0.109 of a common share of Combined Company. This will result in the former shareholders of U.S. Silver holding 70% of the shares of Combined Company, and receiving an implied premium of 45% based on the pre-announcement trading price. Combined Company will have been a subsidiary of RX Gold before the exchange.

Outstanding options on U.S. Silver and RX Gold common shares are exchanged for the same number of options on common shares of Combined Company, but with the number of optioned shares multiplied by the exchange ratio, and the exercise price divided by the exchange ratio. Warrants become exercisable against Combined Company common shares by their terms. A break fee is payable by each party of 3% of its implied equity value under a "Superior Proposal."

Those who have validly exercised dissent rights will be deemed to have transferred their U.S. Silver or RX Gold shares to Combined Company for an entitlement to be paid the fair value of their shares.

Canadian taxation

The s. 85.1(1) rollover will apply to exchanging shareholders holding their U.S. Silver or RX Gold shares as capital property (unless they elect to report a capital gain or loss). A foreign tax credit for any US tax on the exchange will not be available if there is no US-source income. Resident dissenting shareholders will be considered to have received proceeds of disposition equal to the cash compensation received by them (other than any interest award, which would be ordinary income).

Shares of non-residents may not be taxable Canadian property - and if they are (and are not Treaty-exempt), the s. 85.1(1) rollover generally would be available.

US taxation

Even though U.S. Silver is organized as a Canadian corporation, it should be treated as a US domestic corporation for purposes of s. 7874 of the Code. Combined Company should not be treated as a US domestic corporation because less than 80% of its shares will be held by the former shareholders of U.S. Silver. However, as such shareholders will hold at least 60% of the shares of Combined Company, U.S. Silver is required to recognize any "inversion gain" on the transaction. For a period of 10 years, U.S. Silver will not be able to use any deductions, net operating losses, or credits to offset any inversion gain.

The exchange of a US-resident holder of its U.S. Silver shares should qualify as a tax-deferred transaction under s. 368 or 351 of the Code. However, pursuant to special rules in s. 367(a), the US holder should recognize gain (but not loss) equal to any excess of the fair market value of the Combined Company shares received over the adjusted tax basis of the exchanged shares.

Although U.S. Silver is believed to be a U.S. real property holding corporation, its shares qualify as being traded on an "over-the-counter market," so that only a non-US shareholder with a greater than 5% interest (as defined) in U.S. Silver will be subject to 10% withholding on the gross fair market value of shares of the Combined Company received on the exchange.

RX Gold believes that it has been a PFIC for each year prior to its 2010 fiscal year, but does not expect to be a PFIC in the year of the transaction, and does not expect the Combined Company to be a PFIC. A US holder of RX Gold shares who acquired RX Gold shares when it was a PFIC will be subject to adverse consequences under s. 1291 on the exchange. The exchange of RX Gold by other US holders generally will be a non-recognition event.

Share-for-Share

OceanaGold/Romarco

Overview

OceanaGold, which is a BC corporation based in Australia, is proposing to acquire all the shares of Romarco under a B.C. plan of Arrangement in consideration for OceanaGold shares (which in ASX trading, are represented by certificates of beneficial interest), so that s. 85.1 would apply. Although it is intended that the exchange qualify as a Code s. 368(a) reorganization, it is believed that Romarco may be a PFIC, and that OceanaGold is not, so that the PFIC rules may apply to the exchange. An exchange of Romarco options for OceanaGold options (rather than having such options converted into Romarco shares to be included in the exchange) has the effect of avoiding the Romarco shareholders becoming the majority owners of OceanaGold.

OceanaGold

A BCBCA corporation whose head office is in Melbourne, Victoria and which is listed on the ASX, NZX and TSX. It holds gold mining properties in a New Zealand subsidiary and a Phillipines subsidiary (held through a Singapore and B.V. structure). Van Eck Associates Corp. and Ingalls & Snyyder LLC hold or have direction of 13.19% and 10.74% of its shares.

Romarco

A BCBCA corporation listed on the TSX and with a South Carolina gold property held in a Delaware subsidiary. The directors and officers group beneficially owned or exercised direction over Romarco Shares and Options representing approximately 0.55% and 2.45%, respectively, of the Romarco Shares. The Baupost Group, LLC and BlackRock Investment Managemnt (U.K.) Ltd. hold or have direction of 13.27% and 12.07% of its shares.

OceanaGold CDIs

OceanaGold participates in the Clearing House Electronic Subregister System ("CHESS") in Australia. It is not presently possible for securities issued by OceanaGold to be settled electronically on CHESS. Accordingly, OceanaGold CDIs have been created and issued to enable OceanaGold Shareholders to trade on the ASX. CDIs are units of beneficial ownership in securities registered in the name of CDN, a wholly-owned subsidiary of the ASX.

Combined Company

Following completion of the Arrangement, the board of directors of the Combined Company will initially be comprised of one Romarco appointment and seven incumbent directors of OceanaGold. The Combined Company had a pro forma market capitalization of approximately C$1.35 billion.

Plan of Arrangement

- Romarco Shares held by dissenters will be transferred to Romarco for cancellation.

- Each Romarco Share will be transferred to OceanaGold in exchange for 0.241 of an OceanaGold Share.

- Each Romarco option will be exchanged for an option to acquire OceanaGold Shares with the intention that ITA s. 7(1.4) apply.

Consequences of Exchange

The maximum number of OceanaGold Shares issuable in exchange for Romarco Shares pursuant to the Arrangement is equal to approximately 98.6% of the 303,677,847 OceanaGold Shares that were issued and outstanding but does not include OceanaGold Shares issuable upon the exercise of the "Replacement Options" that are issuable on completion of the Arrangement. The maximum number of Replacement Options to be issued at closing is 9,759,489 being exercisable thereafter for 9,759,489 OceanaGold Shares, which is equal to 3.2% of the 303,677,847 outstanding OceanaGold Shares which, collectively with the OceanaGold Shares to be issued in exchange for Romarco Shares under the Arrangement, is 309,248,640 OceanaGold Shares or 101.8% of the 303,677,847 OceanaGold Shares that were issued and outstanding. Following completion of the Arrangement, current OceanaGold Shareholders will own approximately 51% of the OceanaGold Shares and current Romarco Shareholders will own approximately 49% of the OceanaGold Shares.

Canadian tax consequences

S. 85.1 rollover. The share exchange will occur on a tax-deferred basis under s. 85.1 unless the Romarco Shareholder chooses to recognize any portion of the capital gain or capital loss otherwise arising by taking the positive step of reporting the capital gain or capital loss in the Romarco Shareholder's tax return under the Tax Act for the Romarco Shareholder's taxation year in which the exchange occurs.

New 55(2) language

In certain circumstances, subsection 55(2) of the Tax Act (as proposed to be amended by Proposed Amendments released on July 31, 2015) will treat a taxable dividend received by a Resident Holder that is a corporation as proceeds of a disposition or a capital gain….

U.S. tax consequences

Reorganization. The Arrangement is intended to qualify as a tax-deferred reorganization under s. 368(a) of the Code. However, even if the Arrangement qualifies as a Reorganization, under the PFIC rules, U.S. Holders may be required to recognize gain (but not loss) on the exchange of Romarco Shares for OceanaGold Shares pursuant to the Arrangement if (a) Romarco was classified as a PFIC for any taxable year during which such U.S. Holder held Romarco Shares, and (b) OceanaGold is not a PFIC for its taxable year that includes the day after the Effective Date. In such instance, a U.S. Holder would generally recognize any gain on such exchange equal to the difference, if any, between (i) the fair market value of the OceanaGold Shares (determined as of the Effective Date) received in exchange for Romarco Shares pursuant to the Arrangement and (ii) the U.S. Holder's adjusted tax basis in the Romarco Shares exchanged therefor. Any gain realized on the exchange would be subject to the "excess distribution rules" unless such U.S. Holder has made a QEF election or a mark-to-market election. Romarco believes that it may have been a PFIC for prior taxable years and that it may be a PFIC during the current taxable year. Although not free from doubt, OceanaGold does not expect to be classified as a PFIC for its taxable year ending December 31, 2015.

NOLs

The Arrangement is expected to result in an ownership change under Section 382 of the Code for Romarco, potentially limiting the use of Romarco's NOL carryforwards in future taxable years.

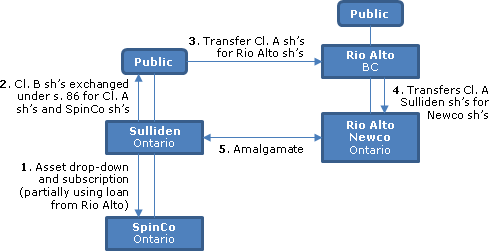

Rio Alto/Sulliden

Overview

Following the spin-off of SpinCo on a s. 86 reorg of Sulliden on the basis of 0.10 of a SpinCo Share for each (common) Sulliden Share, all of the outstanding Sulliden Shares will be exchanged for (common) Rio Alto Shares on the basis of 0.525 of one Rio Alto share for each Sulliden Share. Sulliden, upon amalgamation with Rio Alto NewCo, will become a wholly-owned subsidiary of Rio Alto. Rio Alto expects to issue Rio Alto Shares, equal in number to 86.5% of the non-diluted Rio Alto Shares outstanding immediately prior to the Circular date, thereby requiring Rio Alto shareholder approval. The reorganization is considered to likely qualify as a Code s. 368(a) reorg in light inter alia of SpinCo representing less than 10% of Sulliden's net assets. This likely implies that the transaction is viewed as a reverse triangular merger under s. 368(a)(2)(E) rather than as a forward triangular merger governed by s. 368(a)(2)(D). A 1992 temporary PFIC regulation indicates that the transaction would not qualify for nonrecognition given that Sulliden is a PFIC and Rio Alto is not. The U.S. disclosure suggests that the transaction nonetheless should qualify for nonrecognition if these regulations are not finalized in their current form.

Rio Alto

The main business of Rio Alto (a B.C. company listed on the TSX, NYSE and BVL) is the mining, production and sale of gold from the La Arena Project located in Peru and held in a lower-tier Peruvian subsidiary.

Sulliden

Sulliden (listed on the TSX and BVL) is a QBCA Canadian-based precious metals company focused on the exploration and development of the Shahuindo Project located in Peru and held in a lower-tier Peruvian subsidiary. As a preliminary step, Sulliden will be continued from Quebec to Ontario.

SpinCo

SpinCo is currently a wholly-owned OBCA subsidiary of Sulliden that has been established to acquire and hold the "SpinCo Assets" (principally an exploration project in the Abitibi region of Quebec) and assume related liabilities. It has applied for a TSX listing.

Rio Alto Newco

A wholly-owned OBCA subsidiary of Rio Alto, named "Shahuindo Gold Limited," incorporated at least one day before the effective time of the Plan of Arrangement.

U.S. securities laws

The securities issued under the Arrangement have not been registered under the U.S. Securities Act, and are being issued in reliance on the Section 3(a)(10) exemption.

Ontario Plan of Arrangement

- Sulliden Shares held by a dissenting shareholder will be deemed to be transferred to Rio Alto.

- All outstanding Sulliden RSUs and DSUs shall be deemed to have vested, and shall be settled;

- Sulliden will assign and transfer the SpinCo Assets and SpinCo Liabilities to SpinCo in consideration for SpinCo Shares;

- Rio Alto will lend Sulliden $25M by way of a non-interest bearing demand promissory note, and subject to Rio Alto's election, Sulliden will subscribe for $10M of Rio Alto Shares.

- Sulliden will subscribe for $25M of additional SpinCo Shares in cash – or as to $15M in cash and as to $10M trough the transfer of the Rio Alto acquired in 5;

- Sulliden Options will be exchanged for Sulliden Class A Options and 0.10 of a SpinCo Option;

- Following the amendment of the authorized share capital of Sulliden to redesignate the Sulliden Shares as Class B Shares (common shares with one vote per share) and create Class A Shares (common shares with two votes per share), Sulliden shall undertake a reorganization of capital whereby each outstanding Class B Share will be exchanged with Sulliden for one Class A Share and 0.10 of a SpinCo Share;

- Each outstanding Class A Share (other than Class A Shares held by Rio Alto or any affiliate thereof) will be transferred to Rio Alto for 0.525 of a Rio Alto Share;

- Each Sulliden Class A Option shall be exchanged for a Rio Alto Replacement Option;

- Each Class A Share held by Rio Alto will be transferred to Rio Alto Newco in consideration of the issue by Rio Alto Newco to Rio Alto of one common share of Rio Alto Newco for each Class A Share so transferred;

- Rio Alto NewCo and Sulliden shall amalgamate to form Amalco with the same effect as if they had amalgamated under Section 177 of the OBCA.; and

- The terms of the Sulliden Warrants will be consequentially adjusted.

Canadian tax consequences

S. 86 reorg. The fair market value, however, of the SpinCo Shares at the time of this exchange is expected to be less than the paid-up capital of the exchanged Class B Shares immediately before the exchange and consequently Sulliden Shareholders should not be deemed to receive a dividend from Sulliden…

Share exchange

On the subsequent exchange of Class A Shares for Rio Alto Shares pursuant to the Arrangement, Sulliden Shareholders generally may defer under s. 85.1 realizing any capital gain (or capital loss) that would otherwise arise on this exchange provided they choose not to report, in their return of income for the taxation year in which the exchange occurs, a capital gain or capital loss in respect of such exchange.

U.S. tax consequences

Continuance. The continuance of Sulliden should qualify as a tax-deferred reorganization under Section 368(1)(1)(F) of the Code.

Integrated transaction

The share exchange, amalgamation and the transfer of the SpinCo Share Consideration (collectively, the "Acquisition") "should be treated as a single integrated transaction for U.S. federal income tax purposes. This summary assumes that the Acquisition will be treated for U.S. federal income tax purposes as if Rio Alto NewCo and Sulliden merged to form Amalco as specified in the Plan of Arrangement and the Sulliden Shareholders exchanged their Sulliden Shares for Rio Alto Shares and the SpinCo Share Consideration as part of such merger. If the Acquisition is treated as a single integrated transaction for U.S. federal income tax purposes, the SpinCo Share Consideration is treated as part of the consideration paid by Rio Alto for the Sulliden Shares, and the Substantially All Assets Requirement discussed below is satisfied, although not free from doubt, the Acquisition should qualify as a tax-deferred "reorganization" within the meaning of Section 368(a) of the Code (a "Reorganization"), subject to the PFIC rules described below.

Substantially all requirement

Amalco must acquire "substantially all" of the assets of Sulliden (the "Substantially All Assets Requirement")…For ruling purposes, the IRS defines "substantially all" as at least 70% of the gross assets and at least 90% of the net assets of Sulliden….If the fair market value of the Sulliden Shares on the Effective Date of the Acquisition approximately equals its value on the date of this Circular, Rio Alto and Sulliden believe that the Substantially All Assets Requirement should be satisfied.

Consequences of integrated transaction

Assuming the Acquisition is treated as a Reorganization, and subject to special rules applicable to interests in PFIC, the U.S. Holders of Sulliden Shares should not recognize gain or loss, except to the extent of the SpinCo Share Consideration received, for U.S. federal income tax purposes on the exchange of Sulliden Shares for Rio Alto Shares and the SpinCo Share Consideration pursuant to the Acquisition. In addition, the distribution of the SpinCo Shares not treated as additional consideration paid by Rio Alto for the Sulliden Shares should generally be treated as a taxable distribution.

Treatment of SpinCo share distribution

"Because of the form of the distribution of SpinCo Shares and the fact that the assets of SpinCo will consist, in part, of historic Rio Alto assets, the treatment of the distribution of SpinCo Shares with regard to U.S. Holders receiving such shares is not clear. Specifically, in the event that the Acquisition qualifies as a Reorganization, upon the receipt of the distribution of SpinCo Shares, U.S. Holders receiving such shares may be treated as receiving: (a) additional consideration paid by Rio Alto to U.S. Holders for their Sulliden Shares in the Acquisition to the extent that the value of the SpinCo Shares is attributable to the historic assets of Rio Alto, with the remaining value of such SpinCo Shares treated as a taxable distribution under Section 302(b)(2) or under Section 301 of the Code; (b) additional consideration paid by Rio Alto to U.S. Holders for their Sulliden Shares in the Acquisition to the extent of the entire value of the SpinCo Shares; or (c) a taxable distribution under Section 302(b)(2) or under Section 301 of the Code (because the distribution would not qualify as a tax-free spin-off under Section 355 of the Code). Although the matter is unclear, to the extent that the value of the SpinCo Shares distributed to U.S. Holders is attributable to the historic assets of Rio Alto, this summary assumes that such SpinCo Shares will be treated as additional consideration paid by Rio Alto to U.S. Holders for their Sulliden Shares in the Acquisition."

PFIC rules

"Under proposed U.S. Treasury Regulations, a Non-Electing Shareholder does not recognize gain in a Reorganization where the Non-Electing Shareholder transfers stock in a PFIC so long as such Non-Electing Shareholder receives in exchange stock of another corporation that qualifies as a PFIC for its taxable year that includes the day after the transfer. For purposes of this summary, this exception will be referred to as the "PFICfor-PFIC Exception". However, a Non-Electing Shareholder generally does recognize gain (but not loss) in a Reorganization where the Non-Electing Shareholder transfers stock in a PFIC and receives in exchange stock of another corporation that does not qualify as a PFIC for its taxable year that includes the day after the transfer. While it is anticipated that Sulliden will be classified as a PFIC, based on current business plans and financial projections, Rio Alto does not expect to be classified as a PFIC for the tax year that includes the day after the Effective Date of the Acquisition. Consequently, it is not expected that the "PFIC-for PFIC Exception" will be satisfied, and under the foregoing rules contained in the proposed U.S. Treasury Regulations, a Non-Electing Shareholder will recognize gain (but not loss) on the Acquisition under the rules applicable to excess distributions and dispositions of PFIC stock set forth in Section 1291 of the Code, regardless of whether the Acquisition qualifies as a Reorganization. ...The proposed U.S. Treasury Regulations discussed above were proposed in 1992 and have not been adopted in final form. ... In the absence of the proposed U.S. Treasury Regulations being finalized in their current form, if the Acquisition qualifies as a Reorganization, the U.S. federal income tax consequences to a U.S. Holder should be generally as set forth [above]... ; however, it is unclear whether the IRS would agree with this interpretation."

SASC/HDG

Overview

TSXV-listed HDG is being acquired under a joint BC plan of arrangement by TSX-listed SASC on the basis of 0.275 of a SASC share for each HDG share. However, to ensure that HDG shareholders do not share significantly in any arbitration award made as a result of the seizure of a Bolivian mine of a subsidiary of SASC, SASC first will undergo a s. 86 reorganization under which its common shares will be exchanged for Class A shares (with rights apparently identical to the common shares) and Class B shares which are redeemable and retractable for 85% of any net arbitration award or settlement, subject to an overriding call right of a SASC subsidiary (Newco) to purchase the shares for the redemption amount. Thus, the HDG shareholders will receive only Class A shares.

Continuance

Both SASC and HDG are CBCA corporations. However, SASC will be continued to BC before the arrangement, as the corporate incest rules in the CBCA would prohibit Newco from exercising the call right described below.

SASC and HDG Arrangement

- Each SASC common share of a dissenter will be transferred to SASC.

- Each of the other SASC common shares will be disposed of in exchange for one SASC Class A Share (essentially a common share, and to be redesignated as a common share) and one SASC Class B Share.

- Each HDG common share of a dissenter will be transferred to HDG.

- Each remaining HDG common share will be transferred to SASC in exchange for 0.275 of a SASC Class A Share.

- HDG warrants will be exchanged for warrants on SASC Class A Shares.

Attributes of SASC Class B Shares/Newco call right

- non-voting

- in aggregate have a "Class B Share Total Entitlement" equal to 85% of any final award (or settlement amount) re the appropriation of a Bolivian property of a Bolivian subsidiary exceeds arbitration expenses

- all the shares will be redeemed on the "Redemption Date" (e.g., 60 days after a final award or settlement) based on the Class B Share Total Entitlement, and there also is a retraction right of the holder based on this redemption amount

- notwithstanding the foregoing, a SASC subsidiary (Newco) has an overriding "call" right to purchase all the SASC Class B Shares on the Redemption (or retraction) Date for the redemption amount

Application will be made to list the Class B shares on the TSX.

Canadian tax consequences

S. 86 reorg. No indiction that a deemed dividend could arise. As the relative fair market values of the SASC Class A Share and SASC Class B Share cannot currently be determined, SASC will advise holders on its website shortly after the closing of the Arrangement as to its views on the allocation of the ACB of the SASC common shares between the Clas A and B shares.

Holding and disposing of SASC shares

Dividends received or deemed to be received on a disposition of Class A or B shares generally will be deductible in computing a resident corporation's income.

Non-residents

Standard disclosure re dividends and taxable Canadian property disclosure.

Asanko/PMI

Overview

Pursuant to a B.C. plan of arrangement, Keegan (to be renamed Asanko) will acquire all the PMI shares, so that each PMI shareholder will receive 0.21 common shares of Asanko (held through CDSs), and PMI will become a wholly-owned subsidiary of Asanko. On completion, the former Keegan and PMI shareholders will each own approximately 50% of Asanko inclusive of in-the-money dilutive securities, and the Asanko shares will be listed on the TSX, ASX and NYSE MKT Equities Exchange. The Asanko shares are being issued to the PMI shareholders in reliance on the s. 3(a)(10) exemption in the U.S. Securities Act of 1933.

Keegan/Asanko

Keegan is a TSX-listed and NYSE MKT-listed B.C. company holding the Esaas gold project in Ghana through a 90%-owned Ghana subsidiary (held through two wholly-owned Barbados subsidiaries).

PMI

PMI is a TSX- and ASX-listed B.C. company, with a registered and records office in Vancouver, and an office in West Perth, Australia, which holds the Obatan gold project in Ghana through subsidiaries.

Break fee

$13M (mutual termination fee triggered by: entering into of agreement to effect a "Superior Proposal;" the making of a "Change in "Recommendation;" or failure of the applicable shareholder group to approve).

MI 61-101

As a result of the payment of fees to Macquarie as a financial advisor, Macquarie will be considered to receive a collateral benefit. The 13.29% of the PMI shares held in the Macquarie group will be excluded from the minority approval vote conducted pursuant to MI 61-101.

Directors/CEOs

The Osanko board will consist of three directors from each of Keegan and PMI, with the seventh appointed thereafter. The Keegan CEO will continue as CEO and the PMI CEO will be president.

Plan of Arrangement

Under the Plan of Arrangement:

• PMI shares of dissenters will be transferred to PMI for their fair value

• each outstanding PMI share will be transferred to Keegan for 0.21 of a Keegan share "without any act or formality on the part of the holder"

• each outstanding option to acquire PMI shares will be exchanged for an option to purchase Keegan common shares, with the number of subject shares and exercise price adjusted in accordance with the exchange ratio (so as to ensure that the in-the-money value stays the same)

• there will be a similar exchange of PMI warrants

Canadian tax consequences

Under s. 85.1, the exchange of PMI shares for Asanko shares will not give rise to capital gain (or loss) to a resident shareholder unless such shareholder elects to report such gain (or loss). Dissenters will be deemed to receive a dividend to the extent, if any, that the cash payment exceeds the paid-up capital of their shares.

Standard disclosure re taxable Canadian property rules to non-residents.

US tax consequence

S. 368(a) rollover. Subject to the PFIC rules, an exchange of PMI shares for Asanko shares should qualify as a tax-deferred reorganization under Code s. 368(a). If so, a U.S. holder will not realize gain or loss on the exchange.

PFIC rules

PMI believes that it was a PFIC for one or more of its prior tax years and expects to be a PFIC for its current tax year. Accordingly, the arrangement may be classified as a taxable exchange even if it qualifies as a reorganization, with gain allocated rateably over the holding period, taxed as ordinary income as to the amount allocated to the current tax year and any year prior to the first year in which PMI was classified as a PFIC, with the amount allocated to each of the other tax years being subject to tax at the highest rate of tax in effect for the applicable class of taxpayer for that year and with interest charges for a deemed deferral benefit being imposed with respect to the resulting tax attributable to each of the other tax years.

These consequences can be mitigated or avoided with a QEF election.

However, Asanko expects to be classified as a PFIC for the current tax year, so that the exception (under proposed Regulations) for transfers of PFIC stock in exchange for stock of another PFIC may apply - so that no gain is recognized on the exchange.

Australian tax consequences

PMI shareholders who make a capital gain on the disposal of their PMI shares generally will be eligible for rollover relief in respect of that gain, claimed by not including the gain in their assessable income. Where rollover relief is elected, the cost base of the PMI shares becomes that of the acquired Asanko shares. A PMI shareholder who makes a capital loss on the disposal of PMI shares cannot choose rollover relief.

Bonterra/Spartan

Overview

TSX-listed Bonterra is to acquire each outstanding share of TSX-listed Spartan in exchange for 0.1169 common shares of Bonterra under an Alberta Plan of Arrangement, resulting in the former Spartan shareholders holding approximately 35% of Bonterra. This was considered by the Spartan board to be a superior proposal to that under an arrangement agreement with Pinecrest Energy Inc., resulting in a break fee of $12.5M being paid to Pinecrest.

Options

All holders of options granted pursuant to the Spartan options plan (which will vest) have agreed to exercise.

Plan of Arrangement

Under the Plan of Arrangement:

- Spartan shares held by dissenters are transferred to Bonterra, with such dissenters being entitled to be paid the fair value of their shares by Bonterra

- all Spartan shareholders (other than Bonterra) transfer each of their Spartan shares to Bonterra for 0.1169 Bonterra common shares

Break fees

$12.5M by either Bonterra or Spartan.

Canadian tax consequences

S. 85.1 generally will apply to the share-for-share exchange. Dissenters will realize capital gains treatment. Standard disclosure of taxable Canadian property rules for non-residents.

Shares for Cash and Warrants

Alamos/Esperanza

Overview

All the shares of Esperanza, which is a B.C. company listed on the TSX-V and quoted on the OTCQX and holding a Mexican subsidiary, are to be acquired under a B.C. plan of arrangement by Subco, which is a wholly-owned B.C. subsidiary of Alamos, which is a B.C. company listed on the TSX and NYSE, in consideration for cash of $0.85 per share plus 0.0625 of a warrant expiring on May 24, 2017 to acquire an Alamos share at an exercise price of $29.48 (an "Alamos Warrant") – approximately double the current trading price of an Alamos share. The estimated value of this consideration represents an estimated premium of 52%.

For another example of warrant consideration, see Coeur d'Alene offer (Coeur d'Alene acquisition of Orko for cashless exercise warrants, and cash or shares).

U.S. Securities law

The Alamos Warrant will be issued in reliance on the s. 3(a)(10) exemption. The solicitation of proxies made pursuant to the Circular is not subject to the requirements of s. 14(a) of the U.S. Exchange Act by virtue of Esperanza being a foreign private issuer.

Break fee

$500,000.

Plan of Arrangement

Under the Plan of Arrangement:

- all outstanding in-of-the-money options to acquire Esperanza shares will be surrendered on the basis of the option holder receiving , for each in Esperanza share subject to the option (i) a cash payment equal to the amount by which $0.85 exceeds the applicable exercise price, and (ii) 0.0625 of an Alamos Warrant

- all outstanding out-of-the-money options to acquire Esperanza shares will be cancelled

- Esperanza shares of dissenters will be transferred to Subco for their fair value

- each outstanding Esperanza share will be transferred to Subco for cash of $0.85 and 0.0625 of an Alamos Warrant

- each outstanding Esperanza Warrant will be exchanged of 0.15 of an Alamos Warrant

- each outstanding Esperanza RSU will be redeemed for the equivalent number of Esperanza shares, which will be transferred to Subco for cash of $0.85 and 0.0625 of an Alamos Warrant

Application has been made to list the Alamos Warrants on the TSX

Canadian tax consequences

The exchange will occur on a non-rollover basis. Standard taxable Canadian property disclosure for non-residents.

U.S. tax consequences

Exchange. The arrangement generally will be a fully taxable event to a U.S. Holder.

PFIC rules

Esperanza believes that it will be a PFIC for its current taxable year and that it was a PFIC for certain prior taxable years. If a U.S. Holder disposes of Esperanza Shares under the arrangement that were held by the U.S. Holder directly or indirectly at any time that Esperanza was a PFIC and the U.S. Holder has not made either a QEF Election or a Mark-to-Market Election, the gain the U.S. Holder recognizes will be taxed under the "excess distribution" regime. Esperanza has not, and will not, provide a PFIC Annual Information Statement, so that no QEF Election is available.

Alamos Warrants

A U.S. Holder generally will not recognize gain or loss on the exercise of an Alamos Warrant. On the lapse or expiration of an Alamos Warrant, a loss will be recognized in an amount equal to the U.S. Holder's tax basis in the Alamos Warrant. Under Code s. 305, an adjustment to the number of Alamos shares that will be issued on the exercise of the Alamos Warrants, or an adjustment to the exercise price of the Alamos Warrants, may be treated as a constructive distribution to a U.S. Holder of the Alamos Warrants if, and to the extent that, such adjustment has the effect of increasing such U.S. Holder's proportionate interest in the "earnings and profits" or assets of Alamos, depending on the circumstances of such adjustment (for example, if the adjustment is to compensate for a distribution of cash or other property to shareholders).

Taxation of distributions

As Alamos does not maintain the calculations of earnings and profits in accordance with U.S. federal income tax principles, each U.S. Holder should assume that any distribution by Alamos with respect to the Alamos Warrant Shares will constitute ordinary dividend income.

Shares for Shares and Cash

Agnico/Yamana/Osisko

Overview

Under a CBCA Plan of Arrangement, each Osisko common share will be exchanged under s. 86 for one new (Class A) common share of Osisko and a common share of a newly-formed subsidiary (New Osisko). Each Class A share will then be transferred to Acquisitionco (an Ontario Newco owned on a 50-50 basis by Agnico and Yamana or their subsidiaries) in consideration for the "Transaction Consideration," comprising $2.09 of cash, 0.07264 of an Agnico common share and 0.26471 of a Yamana common share. Non-resident shareholders will receive New Osisko shares instead as consideration for the transfer of their Osisko shares to Acquisitionco. Holders of out-of-the-money Osisko options will be paid their Black Scholes value.

Osisko

A CBCA corporation listed on the TSX and the Deutsche Borse which is currently producing gold in the Abitibit region of Quebec.

New Osisko

A Quebec company, newly-formed by Osisko, which will hold Mexican assets (through two Canadian subsidiaries each holding 50% of Campania Minera Osisko Mexico, S.A. de C.V.), a 2% NSR on Canadian exploration properties held directly or indirectly by Osisko and a 5% NSR on the "Canadian Malartic Properties" (mining rights and related assets in the Abitibi region of Quebec including reserves of 6.3M gold ounces) to be held by Canadian Malartic GP (collectively, the "New Osisko Assets" referred to in 2 below). It will be capitalized with $155M of cash and will apply for a TSX listing.

Canadian Malartic GP

Will be a wholly-owned partnership of Osisko with the exception of a small GP interest held through a wholly-owned Osisko subsidiary. According to the chart, it will be a hybrid entity, i.e., a partnership for Canadian purposes and a corporation for U.S. tax purposes.

U.S. securities laws

The issuance of Agnico, Yamana and New Osisko shares to Osisko shareholders is occurring in reliance on the s. 3(a)(10) exemption. Each of Osisko, Agnico and Yamana is a foreign private issuer, so that solicitations of U.S. shareholders of Osisko are being made only in accordance with Canadian securities laws.

Plan of Arrangement

- Osisko will transfer its interest in the Canadian Malartic Assets to Canadian Malartic GP in consideration for the assumption of liabilities and an increased partnership interest.

- Osisko will transfer its interest in the New Osisko Assets to New Osisko in consideration for the issuance of commons shares and the assumption of liabilities.

- Each Osisko common share held by a dissenter will be surrendered to Osisko.

- Osisko will issue shares to those exercising options.

- If so approved by the shareholders, out-of-the-money options will be cash-surrendered for their Black Scholes value.

- Each Osisko common share held by a non-resident or acquired in 4 will be transferred to Acquisitionco in consideration for the right to receive the Transaction Consideration and the right to receive one New Osisko common share.

- Each outstanding Osisko common share will be exchanged for one Osisko Class A share (essentially a common share with two votes per share and with a requirement that the Class A share terms not be modified without 75% class approval – and with their stated capital subsequently being reduced to $1.00 in aggregate) and one New Osisko common share.

- Acquisitionco will deliver New Osisko common shares as required in 6.

- Each outstanding Class A share of Osisko (other than those held by Acquisitionco) will be transferred to Acquisitionco for the Transaction Consideration (with Acquisitionco having been funded by Agnico and Yamana with such consideration pursuant to a "Funding Agreement," immediately before the Plan of Arrangement)..

- Yamana Subco (a CBCA subsidiary of Yamana holding Osisko and Yamanacommon shares) will be wound up, with such Yamana common shares cancelled.

Consolidation

If so approved by the New Osisko shareholders, the New Osisko shares will be consolidated on a 10-for-1 basis.

Canadian tax consequences

S. 86 exchange. The fair market value of the distributed New Osisko shares is not expected to exceed the paid-up capital of the (old) Osisko common shares of $4.02 per share, so that no deemed dividend should arise on the exchange of the Osisko common shares for Class A shares and New Osisko shares. S. 86 will apply to such exchange so that a holder of Osisko common shares will be considered to have disposed of its shares for the greater of their adjusted cost base and the fair market value of the New Osisko shares received on the exchange.

Class A share exchange

Will occur on a taxable basis.

Dissenters

Disposition will give rise to a deemed dividend to the extent that the amount received (excluding any interest award) exceeds the paid-up capital of the common shares subject (in the case of a corporate shareholder) to s. 55(2) applying.

U.S. tax consequences

The exchange of Osisko common shares for cash, Agnico and Yamana shares, and New Osisko shares is believed to be a taxable transaction.

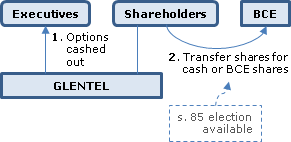

Mitel/Aastra

Overview

It is proposed that Mitel (a CBCA corporation listed on the TSX and NASDAQ with 53.9M common shares outstanding) acquire all of the outstanding common shares of Aastra (a TSX-listed CBCA corporation with 11.8M shares outstanding) under a CBCA Plan of Arrangement for consideration estimated at $392M and comprising, for each Aastra share, U.S.$6.52 of cash and 3.6 Mitel common shares. Consequently, the outstanding Mitel common shares will increase by 44.3M to 98.3M. Following the Arrangement, Mitel may subsequently amalgamate with Aastra. All outstanding Aastra options are to be rolled into options on Mitel common shares with the exercise price based, in part, on the s. 7(1.4) test.

U.S. securities law

Aastra and Mitel are foreign private issuers, although Mitel has voluntarily determined to file 10-Ks, 10-Qs and 8-Ks. The Mitel shares to be issued will not be registered in reliance on the s. 3(a)(10) rule.

Plan of Arrangement.

- The Aastra Shareholder Rights Plan will be terminated.

- Each outstanding Aastra share held by dissenting shareholder will be deemed to be transferred to Mitel.

- Each outstanding Aastra deferred share unit, and each vested Aastra stock appreciation right, will be cancelled for a cash payment.

- Simultaneously with the exchange in 5. below, each Aastra option will be exchanged for a replacement option to acquire that number of Mitel common shares (rounded down to the nearest whole number) equal to the product of the number of Aastra common shares under the option, and the Exchange Ratio. The Exchange Ratio is the sum of: 3.6; and $6.52 divided by the 5-day VWAP of Mitel common shares on the NASDAQ immediately preceding the Arrangement Effective Date. The exercise price under the replacement option will equal the greater of: the old exercise price divided by the Exchange Ratio; and "such minimum amount that meets the requirements of paragraph 7(1.4)(c)."

- Each Aastra share will be transferred to Mitel in exchange for U.S.$6.52 of cash and 3.6 Mitel common shares.

Canadian taxation

S. 85 elections. Non-exempt Canadian residents may make a s. 85(1) election (or s. 85(2) election for a partnership - or the Quebec equivalents) with Mitel provided they provide election forms completed with the number of transferred shares and the agreed amounts to the Depositary within 90 days following the effective date of the Arrangement; and Mitel will sign and return the election forms within 90 days. Full rollover treatment may not be available depending on the adjusted cost base of the holder's Aastra shares.

Non-rollover if no election

In the absence of a s. 85 election, the exchange will be taxable (no s. 85.1 rollover.)

Non-residents

A non-resident Aastra shareholder will not be subject to Canadian capital gains tax on the exchange if the holder's shares are not taxable Canadian property.

Yamana/Extorre

CBCA Plan of Arrangement under which Yamana (TSX and NYSE) acquires all of the outstanding common shares of Extorre (TSX and NYSE MKT). $3.50 of cash (estimated to represent 82% of the consideration) and 0.0467 of a Yamana common share is to be provided in exchange for each Extorre common share. (This consideration is calculated to represent a premium of 54% and values the outstanding Extorre shares at $414 million). Each holder of an Extorre incentive stock option is entitled to receive, on exercise of the option, 0.2648 of a Yamana common share. A break fee of $15 million is payable in connection with the acceptance of a superior proposal or if the Extorre ceases to support the transaction.

Canadian taxation

Canadian residents or non-residents holding their Extorre shares as taxable Canadian property may make a s. 85(1) election (0r s. 85(2) election for a partnership - or the Quebec equivalents) with Yamana provided they provide the necessary information within 90 days after the effective date of the Arrangement; and Yamana will sign and return the election forms within 30 days. The tax election package and instruction letter will be made available on the Yamana website within 30 days of the effective date of the Arrangement. Full rollover treatment may not be available depending on the adjusted cost base of the holder's Extorre shares.

In the absence of a s. 85 election, the exchange will be taxable (no s. 85.1 rollover.)

A non-resident Extorre shareholder will not be subject to Canadian capital gains tax on the exchange if the holder's shares are not taxable Canadian property. In this regard, Extorre considers that its common shares do not currently derive more than 50% of their fair market value from Canadian resource properties etc.

US taxation

The exchange generally will be a fully taxable event. Extorre is believed to be a PFIC for its current and prior years. Extorre will make available upon written request a "PFIC Annual Information Statement" as described in US Treasury Regulation Section 1.1295(g) for its 2011 and 2012 years.

Shares for Shares and Nominal Cash

AuRico/Alamos/AuRico Metals

Overview

Under an Ontario Plan of Arrangement, AuRico will acquire all the shares of Alamos ("Alamos Shares") in consideration for AuRico common shares ("AuRico Shares") and nominal cash (so that a s. 85 election is required for rollover treatment), and then amalgamate with Alamos. Former AuRico and Alamos Shareholders are anticipated to own 50.1% and 49.9% of Amalco, respectively. 95.1% of the shares of a newly-incorporated subsidiary, namely, AuRico Metals, holding the Kemess East development project, cash and royalty interests, will be spun-off to all the Amalco shareholders under a s. 86 reorg involving an exchange of Amalco common shares for Amalco Class A shares (with identical substantive attributes) and common shares of AuRico Metals ("AuRico Metals Shares"). The AuRico Metals distribution will be treated as a dividend for Code purposes based on current or accumulated E&P of Amalco; and the merger is intended by the parties to qualify as a Code s. 368(a) reorg. An acquisition of control of AuRico (which likely has significant Canadian resource pools) by Alamos under ITA s. 256(7)(c) will be avoided by having the AuRico Metals spin-off occur after the merger. There also is a preliminary transaction in which Alamos subscribes for 9.9% of the shares of AuRico.

AuRico

An Ontario corporation listed on the TSX and NYSE which has gold mines and projects in North America, and focuses on the Young Davidson Mine in northern Ontario, and the El Chanate Mine in Sonora State, Mexico. AuRico's project pipeline also includes the advanced-stage Kemess Project in northern B.C. Shareholders' equity at December 31, 2014 was US$2.0B after deduction of a deficit of U$285M, and its market cap is US$867M.

Alamos

A B.C. corporation listed on the TSX and NYSE. Its primary asset is the Mulatos Mine and concessions in the state of Sonora, Mexico. In addition, in 2010 Alamos acquired the development-stage Aği Daği Project and Kirazlı Project in the Biga district of northwestern Turkey.

AuRico Metals

. Was incorporated under the laws of the Province of Ontario for the sole purpose of participating in the Arrangement. It has applied for a TSX listing. Its carve out (i.e., pro forma) financial statements show owners' equity of US$125M as at December 31, 2014. The market cap of AuRico is US$867M, i.e., a significant discount to book. The "AuRico Metals Properties" (described below) currently are held by AuRico.

AuRico Metals Properties. Include: the Kemess Project; cash equal to $20 million less the Earn-In Committed Amount (see below); and royalties on the Young Davidson mine (i.e., a 1.5% NSR) and Australian properties.

Amalco Earn-In Interest

AuRico Metals will grant to Amalco a right to earn up to a 30% participating interest in the Kemess East Project by spending C$20 million on the Kemess East Project by December 31, 2016, of which C$9.5 million, subject to upward adjustment, is a committed amount (the "Earn-In Committed Amount"). The Earn-In Committed Amount is payable to AuRico Metals on the Effective Date of the Arrangement. AuRico Metals shall spend the Earn-In Committed Amount, on AuRico's behalf, at the Kemess East Project on exploration. Upon Amalco receiving the 30% interest, it and AuRico Metals shall enter into a joint venture agreement to form a special-purpose entity to hold the project.

Preliminary transactions. D

irectors and officers of AuRico and Alamos, representing approximately 3.1% and 4.5% of the outstanding AuRico Shares and Alamos Shares on a fully diluted basis, respectively, each entered into support agreements. Pursuant to the Arrangement Agreement, Alamos subscribed for approximately 27.9 million AuRico Shares on a private placement basis for total gross proceeds to AuRico of approximately $83.3 million. Alamos will be continued to Ontario.

Plan of Arrangement

- Alamos shall subscribe for a number of AuRico Shares to be agreed by AuRico and Alamos.

- AuRico shall transfer the AuRico Metals Property to AuRico Metals, AuRico Metals shall assume liabilities and the Earn-In Covenants shall become effective. [No mention of share consideration or of when the AuRico Metals Shares are issued.]

- Each Alamos or AuRico Share held by a dissenting shareholder shall be deemed to have been transferred Alamos or AuRico , as the case may be, in consideration for a debt claim against that corporation.

- Each Alamos Share shall be transferred to AuRico in exchange for (i) the issuance to the holder of 1.9818 of an AuRico Share (subject to adjustment) and (ii) $0.0001. The aggregate stated capital of such AuRico Share shall be equal to the fair market value of such Alamos Shares minus the cash consideration.

- Each Alamos Option outstanding immediately prior to the Effective Time shall be exchanged for an option granted by AuRico to acquire AuRico Shares.

- Alamos SARs shall be exchanged for a replacement award by AuRico.

- Alamos shall make a non-interest bearing loan payable on demand to AuRico.

- The aggregate stated capital of the Alamos Shares shall be reduced to C$1.00.

- AuRico and Alamos shall be amalgamated under the OBCA to continue as Alamos Gold Inc. ("Amalco"), with the common shares of AuRico and Alamos in each other being cancelled. The aggregate stated capital of the Amalco common shares (carrying one vote per share) shall be equal to the aggregate stated capital of the AuRico Shares and the Alamos Shares immediately prior to the amalgamation, less the amount of any stated capital attributable to the AuRico Shares or the Alamos Shares that are cancelled on the amalgamation.

- The articles of Amalco shall be amended to add "Class A Common Shares" (with the same substantive attributes as the Amalco common shares).

- Each issued and outstanding Amalco Share shall be exchanged with Amalco for 0.5046 of a Class A Share and a pro rata portion of 95.1% of the outstanding AuRico Metals Shares.

Canadian tax consequences

Continuance. The Alamos continuance will not result in a disposition of Alamos Shares.

Exchange of

Alamos Shares for AuRico Shares and nominal cash This exchange will occur on a taxable basis unless a s. 85 election is made by an "Eligible Holder," being (i) a taxable resident, (ii) a non-resident whose Alamos Shares are "taxable Canadian property" and who is not Treaty-exempt, or (iii) a partnership any member of which is described in (i) or (ii) and is not Treaty-exempt. Tax election information must be provided to the AuRico representative by the 60th day following the Effective Date of the Arrangement.

Amalgamation

Shareholder rollover.

S. 86 reorg

Management of AuRico advised counsel that it expects the paid-up capital in respect of the Amalco common shares immediately prior to the distribution of the AuRico Metals Shares pursuant to the Arrangement to be substantially in excess of the aggregate fair market value of the AuRico Metals Shares so distributed, so that no deemed dividend is anticipated. Resident Shareholder will realize a capital gain only to the extent that the fair market value of the AuRico Metals Shares received exceeds the adjusted cost base of such Shareholder's Amalco common shares.

U.S. tax consequences

Continuance. The continuance of Alamos should qualify as a tax-deferred reorganization under Code s. 368(a)(1)(F).

Exchange

The exchange of Alamos Shares for AuRico Shares followed by the amalgamation of Alamos into Amalco and the conversion of Amalco Shares into Class A Shares pursuant to the Arrangement is intended to qualify as a tax-deferred reorganization under Code s. 368(a) (a "Reorganization"); the amalgamation of AuRico into Amalco and the conversion of Amalco Shares into Class A Shares pursuant to the Arrangement is also intended to qualify as a Reorganization. Because Alamos Shareholders will be receiving cash of $0.0001 per Alamos Share in addition to AuRico Shares, any gain realized by such holder must be recognized to the extent of such cash received.

PFIC exception

However, in the case of an Alamos Shareholder who owned Alamos Shares during any year (i.e., prior to 2006) in which Alamos was a passive foreign investment company, the foregoing tax consequences do not apply. AuRico, Alamos and Amalco (but not AuRico Metals) are not expected to be PFICs for the current year. No disclosure of the PFIC status of AuRico for prior years.

Distribution of

AuRico Metals. The receipt of AuRico Metals Shares pursuant to the Arrangement will be treated as a distribution by Amalco in an amount equal to the fair market value of the AuRico Metals Shares. The distribution will be treated as a dividend to the extent such distribution is made out of current or accumulated earnings and profits of Amalco. As for the excess, it will be treated as a non-taxable return of capital to the extent of the U.S. Holder's adjusted basis in the Amalco Shares on which the distribution is made and as a capital gain to the extent it exceeds that basis.

Tahoe/Rio Alto

Overview

Under an Alberta Plan of Arrangement there will be an exchange of all the Rio Alto common shares (other than of dissenters) for Tahoe common shares (together with nominal cash so as to require a joint s. 85(1) election to achieve Canadian rollover treatment), with Tahoe then dropping its Rio Alto shares into a wholly-owned subsidiary ("Subco") and causing their amalgamation in a conventional amalgamation. The share exchange, drop-down and amalgamation are intended to qualify as a Code s. 368(a) reorganization – so that tax deferral (except re the nominal cash) generally will be available for U.S. shareholders who acquired their Rio Alto shares after May 2011, as Rio Alto is believed not to have been a PFIC since then. As the U.S. does not have a Treaty with Peru, U.S. shareholders (unlike Canadian-resident shareholders) will not be exempt from Peruvian tax under the Peruvian equivalent of the taxable Canadian property/FIRPTA rules, and typically will not be entitled to a U.S. foreign tax credit as any gain on their Rio Alto shares would be treated as U.S.-source income.

Rio Alto

An Alberta company listed on the TSX, NYSE, Frankfurt and Lima ("BVL") exchanges with 334M common shares outstanding, of which 2.96% are held by directors and officers and 17.74% by Van Eck Associates accounts. Pervuvian subsidiaries hold a gold oxide mine and a gold-silver project. Rio Alto acquired Shahuindo Gold Limited, formerly Sulliden Gold Corporation ("SGC") on August 5, 2014.

Tahoe

A TSX- and NYSE-listed Canadian-resident corporation that is headquartered in Reno, Nevada and which indirectly produces silver in Guatemala. 39% of its common shares are owned by Goldcorp. Post-merger it will have a market cap of over $3.2B. It will seek a BVL listing. Six of the existing Tahoe members and three Rio Alto nominees will be on its board.

Subco

1860927 Alberta Ltd., a wholly-owned sub of Tahoe.

Plan of Arrangement

The first steps in the Plan of Arrangement will be the cancellation of the Rio Alto rights plan and the transfer of each Rio Alto common share held by a dissenting shareholder to Tahoe, with Tahoe required to pay the fair value therefor. Thereafter:

- Each outstanding Rio Alto common share will be transferred to Tahoe in exchange for 0.227 of a Tahoe common share and Cdn.$0.001 in cash; and Rio Alto Options (including SGC replacement options) will be exchanged for Tahoe options – provided that in the event that the in-the-money value of such Tahoe options exceeds that of the Rio Alto options, the number of Tahoe common shares which may be acquired on exercise will be reduced.

- Each Rio Alto common share will be transferred by Tahoe to Subco in consideration for one Subco common share having a stated capital equal to the paid-up capital of the transferred shares (and with the stated capital of the transferred shares then being reduced to $1.00, and Rio Alto filing an election with the CRA to cease to be a public corporation).

- Rio Alto and Subco will merge to form Amalco (with the same effect as if they had amalgamated under the OBCA except that Subco will survive and Rio Alto will cease to exist), and with the Rio Alto common shares thereby being cancelled and Tahoe receiving one Amalco common share on the amalgamation in exchange for each Subco common share.

Canadian tax consequences

Share exchange. In the absence of an s. 85 election, the exchange of Rio Alto common shares for Tahoe common shares will occur on a non-rollover basis. The deadline for providing an s. 85(1) election form to Tahoe by "Eligible Shareholders" (generally non-exempt residents or partnerships with such a member, and non-residents whose shares are taxable Canadian property) is 60 days after the Effective Date of the Plan of Arrangement. Capital gains/loss treatment will apply to dissenters except re interest.

Non-residents

Standard (non-informative) taxable Canadian property disclosure for non-residents.

U.S. tax consequences

Structuring of merger. The exchange of Rio Alto common shares for Tahoe common shares and cash, the contribution of the Rio Alto shares to Subco and the amalgamation should be treated as a single integrated transaction so that, provided the substantially-all test is satisfied, it should qualify as a reorganization under Code s. 368(a). The substantially-all test, which includes reference to any cash or other assets directly or indirectly transferred by Rio Alto to any Rio Alto shareholder and which for IRS ruling purposes, requires that at least 70% of the gross assets and 90% of the net assets of Rio Alto immediately before the acquisition are acquired by Tahoe, is believed by Tahoe and Rio Alto to be satisfied. The arrangement should qualify as a tax-deferred reorganization under Code s. 368(a) – so that if the PFIC rules do not apply, a U.S. holder should not recognize gain (except based on the amount of nominal cash received).

PFIC rules

Rio Alto believes that it was a PFIC for its tax years ended prior to June 1, 2011, but not thereafter, and Tahoe believes that it is not a PFIC for its current taxable year. On this basis and under proposed retroactive Regulations, a Rio Alto shareholder who has not made a timely and valid QEF election or mark-to-market election with respect to its Rio Alto common shares and who owned Rio Alto shares while it was a PFIC will be required to recognize gain (but not loss) as a result of the Arrangement, regardless of whether it qualifies as a reorganization, based on the fair market of the Tahoe shares (and nominal cash) received, with such gain being subject to tax and interest charges under the PFIC excess distribution regime. However, in the absence of the proposed Regulation becoming final, it is unclear whether the IRS would treat the transaction as being taxable under this or another basis. There can be no assurance that Rio Alto will provide U.S. Holders with the required information (i.e., PFIC annual information statements) in order for QEF elections to be available.

FTC re Peruvian tax

As the U.S. and Peru have not entered into a Treaty, gain recognized by a U.S. Holder on the transfer of Rio Alto Shares pursuant to the Arrangement will be characterized as U.S. source income for purposes of the foreign tax credit rules under the Code. Accordingly, a U.S. Holder generally would not be able to claim a credit for any Peruvian tax paid or withheld with respect to the Arrangement unless, depending on the circumstances, such U.S. Holder has excess foreign tax credit limitation due to other foreign source income that is subject to a low or zero rate of foreign tax.

Peruvian gains tax

Gain under domestic law. Under Peruvian domestic law, the transfer of Rio Alto shares under the Arrangement will qualify as an "indirect transfer" of the shares of a Peruvian company as the fair market value of the shares of the Peruvian subsidiaries represent 50% or more of the fair market value of the Rio Alto Shares, and at least 10% of the Rio Alto Shares will be transferred. However, "in the case of those Rio Alto Shareholders which held Rio Alto Shares on February 15, 2011, they will have the right to "step-up" the cost basis of said shares considering their quotation value at the relevant Stock Exchange on that date."

Canadian Treaty exemption

Under Canada-Peru Tax Convention, Rio Alto Shareholders who are resident or deemed resident in Canada for the purpose of that Treaty will be exempt from Peruvian tax on any gain arising from the exchange.

Tax to U.S. residents

However, Peru does not have a Treaty with the U.S. Non-Treaty "Rio Alto Shareholders will be required to pay a 30% income tax on the capital gain unless the shares of Rio Alto are recorded on the Securities Market Public Registry (Registro Publico del Mercado de Valores) of the Peruvian Superintendence of the Securities Market and the transaction is perfected through the BVL, in which case the rate of tax will be reduced to 5%."

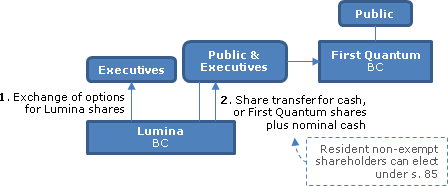

Goldcorp/Probe

Overview

After rolling its exploration assets (the "New Probe Assets") into a new Ontario subsidiary (New Probe), so that it will still retain the Borden gold project, Probe will distribute its common shares of New Probe to its shareholders as a paid-up capital distribution. Also occurring under an Ontario Plan of Arrangement will be an exchange of all the Probe common shares (other than of dissenters) for Goldcorp common shares (together with nominal cash so as to require a joint s. 85(1) election to achieve Canadian rollover treatment), with Goldcorp then dropping its Probe shares into a wholly-owned subsidiary ("Subco") and causing their amalgamation (with Subco as the survivor.) The former Probe shareholders will now hold 1.6% of the Goldcorp shares (as well as 100% of New Probe). The share exchange and amalgamation is intended to qualify as a forward triangular merger - although Probe is believed to be and have been a PFIC and Goldcorp is believed not to be a PFIC, so that Code rollover treatment generally would not be available as per a proposed retroactive Regulation.

Probe

A TSXV-listed Ontario company with 91M common shares outstanding (representing a market cap of $475M) and with a focus on its Borden gold project near Chapleau, Ontario. Palmer, the CEO, holds 1.3M common shares (a 1.5% interest) and 1.7M options, and somewhat similarly for Peterson, another director. Goldcorp held a 19.8% interest (through common shares and warrants) on 9 February 2015.

Goldcorp

A TSX- and NYSE-listed Canadian-resident corporation and senior gold producer.

New Probe

A wholly-owned CBCA subsidiary of Probe which will apply for a TSXV listing.

Subco

2426854 Ontario Inc., a wholly-owned sub of Goldcorp.

Plan of Arrangement

The first step in the Plan of Arrangement will be the transfer of each Probe common share held by a dissenting shareholder to Goldcorp, with Goldcorp required to pay the fair value therefor. This and the following steps will be deemed to occur at one-minute intervals:

- Probe will transfer the New Probe Assets and the related liabilities to New Probe in consideration for 100 New Probe common shares, with an ITA s. 85(1) election filed.

- Goldcorp will lend $15M to Probe by way of non-interest bearing demand note.

- Probe will subscribe for New Probe common shares for $15M. The New Probe common shares will be subdivided so as to equal 1/3 of the number of outstanding Probe common shares. Each option under the Probe stock option plan will be exchanged for a Probe replacement option and a New Probe option (with the intention that ITA s. 7(1.4) apply.)

- The New Probe common shares "will be distributed by Probe to the … Probe Shareholders on a return of share capital pursuant to a reorganization of Probe's business and a distribution of proceeds from a disposition of Probe's property outside the ordinary course of Probe's business."

- Each outstanding Probe common share (if not held by Goldcorp or an affiliate thereof) will be transferred to Goldcorp in exchange for 0.175 of a Goldcorp common share and Cdn.$0.001 in cash; and Probe replacement Options will be exchanged for Goldcorp options (with the intention that ITA s. 7(1.4) apply.)

- Each Probe common share will be transferred by Goldcorp to Subco in consideration for one Subco common share having a stated capital equal to the paid-up capital of the transferred shares (and with the stated capital of the transferred shares then being reduced to $1.00, and Probe filing an election with the CRA to cease to be a public corporation).

- Probe and Subco will merge to form Amalco (with the same effect as if they had amalgamated under the OBCA except that Subco will survive and Probe will cease to exist), and with the Probe common shares thereby being cancelled and Goldcorp receiving one Amalco common share on the amalgamation in exchange for each Subco common share.

Canadian tax consequences

New Probe distribution. The fair market value of the New Probe common shares distributed up to the paid-up capital of the Probe common shares should be treated as a return of paid-up capital. Probe expects that such fair market value will not exceed the paid-up capital of the Probe common shares. There are qualified investment and taxable Canadian property risks if the New Probe shares may not be listed on a timely basis.

Share exchange

In the absence of an s. 85 election, the exchange of Probe common shares for Goldcorp common shares will occur on a non-rollover basis. The deadline for providing an s. 85(1) election form to Goldcorp by "Eligible Shareholders" (generally non-exempt residents or partnerships with such a member) is 90 days after the Effective Date of the Plan of Arrangement. Capital gains/loss treatment will apply to dissenters except re interest.

Non-residents

Standard (non-informative) taxable Canadian property disclosure for non-residents.

U.S. tax consequences

Structuring of merger. Probe and Goldcorp intend that the exchange of Probe common shares for Goldcorp common shares and cash will qualify as a reorganization under Code s. 368(a)(2)(D), so that subject to the PFIC rules a U.S. Holder will generally not recognize gain upon receipt of Goldcorp common shares pursuant to the Arrangement (except based on the amount of nominal cash received).

PFIC rules. Probe believes that it is and has been a PFIC, and Goldcorp believes that it is not a PFIC for its current taxable year. On this basis and under proposed retroactive Regulations, a Probe shareholder who has not made a timely and valid QEF election or mark-to-market election with respect to its Probe common shares will be required to recognize gain (but not loss) as a result of the Arrangement, regardless of whether it qualifies as a reorganization, based on the fair market of the Goldcorp shares (and nominal cash) received, with such gain being subject to tax and interest charges under the PFIC excess distribution regime. There can be no assurance that Probe will provide U.S. Holders with the required information (i.e., PFIC annual information statements) in order for QEF elections to be available, and "U.S. Holders should assume that a QEF election will not be available."

New Probe

distribution. Probe intends that the receipt of New Probe common shares pursuant to the Arrangement by a U.S. Holder will be considered to be a taxable distribution in an amount equal to the fair market value of such shares. However, it is possible that the receipt of such shares would be treated instead as additional consideration for the Probe common shares, in which case the receipt of the New Probe common shares would be taxable in a similar manner to the cash consideration. New Probe is likely to be treated as a PFIC for its current taxable year.

Agnico Eagle/Cayden

Overview

Each Cayden (common) share will be transferred to Agnico under a B.C. Plan of Arrangement for 0.09 of an Agnico Eagle common share and cash of $0.01 (so that no rollover treatment obtains unless a s. 85 election is filed). The Agnico Eagle shares to be issued would represent 2.2% of its outstanding common shares on a fully diluted basis. No subsequent amalgamation of Cayden is specified, and no Code s. 368(a) reorg treatment is anticipated.

Cayden

A BCBCA company which is listed on the TS-XV and trades on the OTCQX, and whose principal mineral exploration assets are held in a Mexican subsidiary.

Agnico Eagle

An international gold mining OBCA corporation listed on the TSX and NYSE, and headquartered in Toronto.

Plan of Arrangement

- Cayden options and warrants will be deemed to be exercised.

- Each Cayden common share (not held by Agnico Eagle or a dissenting shareholder) will be transferred to Agnico Eagle for 0.09 of a Agnico Eagle common share (subject to rounding) and cash of $0.01.

- Each Cayden common share of a dissenter will be transferred to Agnico Eagle with the right to receive the fair value therefor.

Canadian tax consequences

Exchange of Cayden shares. Eligible Shareholders (non-exempt Canadian residents, and partnerships of such persons) who provide a s. 85 election form to Agnico Eagle within 45 days of the Arrangement effective date will have those election forms completed and returned by Agnico Eagle. Those who do not make and timely-file a valid election will be considered to have disposed of their shares on a non-rollover basis.

Non-residents

Standard taxable Canadian property disclosure.

U.S. tax consequences

The exchange will occur on a taxable basis. Cayden believes that it currently is a PFIC. No PFIC determination has been made re its non-U.S. subsidiaries.

Primero/Brigus

Overview

Brigus will be spinning-off a newly-established exploration CBCA subsidiary (Fortune) (per the s. 86 rules) under a CBCA Plans of Arrangement, with each Brigus share then being transferred to Primero for 0.175 of a Primero common share and cash of $0.000001 (so that no rollover treatment obtains unless a s. 85 election is filed). Brigus then will be amalgamated with a newly-incorporated CBCA subsidiary of Primero (Primero NewCo) with nominal assets. Code s. 368(a) reorg treatment is anticipated.

Brigus

A CBCA company which is listed on the TSX and NYSE MKT whose principal asset is an Ontario gold mine.

Primero

A B.C. company which is listed on the TSX and NYSE. Its head office is in Toronto and it has Mexican precious metal mines.

Post-merger picture

Fortune is expected to be listed on the TSXV, with Brigus holding 9.9% of its shares. Brigus shareholders will hold approximately 27% of the Primero common shares and an amalgamated Brigus will be a wholly-owned subsidiary of Primero.

Brigus Pre-Spinout Reorganization

- Brigus will transfer various Canadian exploration properties and shares of non-resident subsidiaries to Fortune in consideration for the issuance of common shares.

- The Brigus shareholders will approve a stated capital reduction to $217 million to take effect immediately prior to the Arrangement, subject to the Board determining not to proceed.

Plan of Arrangement

- The Brigus Rights Plan will be terminated.

- The Brigus DSUs will vest and the DSUs will be satisfied through Brigus issuing common shares.

- Each Brigus common share of a dissenter will be transferred to Primero in exchange for a debt claim against Primero.

- Primero will lend $10M to Brigus by way of non-interest-bearing promissory note.

- Brigus will use such loan proceeds to subscribe for additional Fortune common shares.

- Each of the other Brigus common shares will be exchanged for one Brigus Class A share and 1/10 of an Fortune common share, with the stated capital of the Brigus Class A shares being equal to the paid-up capital of the exchanged Brigus common shares minus the fair market value of the Fortune common shares. As a result, the Brigus shareholders will hold all the Fortune shares other than 9.9% of the shares which are retained by Brigus.

- Each Brigus common share will be transferred to Primero for "an indivisible combination" of 0.175 of a Primero common share and cash of $0.000001 (with the total cash entitlement of each shareholder rounded up to the nearest nickel).

- Each employee stock option to acquire an Brigus common share will be exchanged for an option to acquire 0.175 new Primero common shares, with the old exercise price divided by 0.175.

- Primero NewCo and Brigus will amalgamate under s. 192 of the CBCA to form Amalco (named "Brigus Gold Corp"), with the Class A shares (of Brigus) continuing as common shares of Amalco and the common shares of Amalco (its only class of shares) being equal to the paid-up capital of all the shares of Brigus before the amalgamation.

U.S. securities laws

The Brigus Class A, Primero and Fortune shares will be issued in reliance on the s. 3(a)(10) exemption. Shares issuable on the exercise of Brigus warrants and options in the U,S. or by or on behalf of a U.S. person after the Effective Date may not be issued in reliance on the s. 3(a)(10) exemption.

Canadian tax consequences

S. 86 reorg. Description of s. 86 rules. No deemed dividend is anticipated.

Exchange of Brigus Class A shares

Eligible Shareholders (non-exempt Canadian residents, and partnerships of such persons) who use Primero's web-based system to complete a s. 85 election and who provide the election to Primero within 90 days of the Arrangement effective date will have those election forms completed and returned by Primero. Those who do not make and timely-file a valid election will be considered to have disposed of their shares on a non-rollover basis.

Qualified investments

If the Fortune shares are not listed before the due date for Fortune's first income tax return, they will not be qualified investments.

Non-residents

Standard taxable Canadian property disclosure.

U.S. tax consequences (from Summary)

[S. 368(a) reorg.]

[I]t is anticipated that the Arrangement will be treated as a partially tax-deferred reorganization under Section 368(a) of the Code. As a result, U.S. Holders…should recognize gain, but not loss, as a result of the Arrangement. The gain, if any, recognized will equal the lesser of (a) the fair market value, at the time of the Arrangement, of the Fortune Shares and cash received pursuant to the Arrangement and (b) the amount of gain realized in the Arrangement. The amount of gain that is realized by a U.S. Holder in the Arrangement will equal the excess, if any, of (i) the sum of the cash plus the fair market value, at the time of the Arrangement, of the Primero Shares and Fortune Shares received pursuant to the Arrangement over (ii) such U.S. Holder's adjusted tax basis in the Brigus Shares surrendered in the Arrangement.

[PFIC rules.]

Based on its current and projected income, assets and business, it is expected that Fortune will be classified for U.S. federal income tax purposes as a PFIC for the current taxable year and in future taxable years. As a consequence, the complex U.S. federal income tax rules relating to PFICs would apply to U.S. Holders of Fortune Shares, potentially resulting in gains realized on the disposition of such shares being treated as ordinary income rather than as capital gains, and the application of interest charges to those gains as well as to certain distributions.

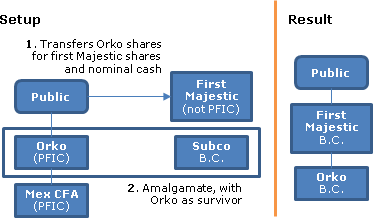

Fission/Alpha

Overview

Alpha and Fission (both TSXV-listed, and ABCA and CBCA corporations, respectively) will be transferring various (mostly uranium) exploration assets to Alpha Spinco and Fission Spinco and spinning-them off (per the s. 86 rules) under ABCA and CBCA Plans of Arrangement (the Alpha Arrangement and Fission Arrangement), with each Alpha share then being transferred to Fission under the Alpha Arrangement for 5.725 Fission common shares and nominal cash (so that no rollover treatment obtains unless a s. 85 election is filed).

Post-merger picture

The Spincos are expected to be listed on the TSXV. Alpha shareholders will hold approximately 50.7% of the new Fission common shares (or 49.3% after giving effect to the private placement referred to in 10 below). The merger will consolidate ownership of the Patterson Lake South uranium property in Saskatchewan, a core asset for both companies.

Alpha Pre-Spinout Reorganization

- Alpha will transfer various Canadian exploration properties to Alpha Spinco in consideration for the issuance of common shares; and Alpha Spinco will assume liabilities in respect of the transferred properties in consideration for a cash payment from Alpha with Alpha also subscribing $3M for Alpha Spinco common shares.

Alpha Arrangement

- Each Alpha common share of a dissenter will be transferred to Fission.

- Each of the other Alpha common shares will be exchanged for one Alpha Class A share and ½ of an Alpha Spinco common share, with the stated capital of the Alpha Class A shares being equal to the paid-up capital of the exchanged Alpha common shares minus the fair market value of the Alpha Spinco common shares.

- Each Alpha common share will be transferred to Fission for 5.725 "new" Fission common shares (see 3 of section below) and cash of $0.0001

- Each employee stock option to acquire an Alpha common share will be exchanged for an option to acquire 5.725 new Fission common shares, with the exercise price reduced by the fair market value of ½ an Alpha Spinco common share; and similarly re Alpha warrants.

Fission Arrangement

- Fission will transfer various exploration properties in Alberta, Saskatchewan and Peru to Fission Spinco on essentially the same terms as 1 above.

- Each Fission common share of a dissenter will be transferred to Fission.