Non-Triangular Amalgamations

Contact/Donnycreek

Overview

Under an Alberta Plan of Arrangement, Donnycreek and Contact will amalgamate on the basis of exchange ratios which will reflect a 56% premium for the Donnycreek shares and with Amalco's management comprised of current Contact management. Donnycreek and Contact shareholders initially will hold 56.4% and 43.6% of Amalco, respectively. Dissenters may receive deemed dividend treatment.

Donnycreek

A TSV-listed oil and gas Alberta company.

Contact

A TSV-listed oil and gas Alberta company.

Plan of Arrangement and Amalgamation

Under the Plan of Arrangement, the shares and options of Donnycreek and Contact held by dissenters shall be deemed to be transferred to Donnycreek or Contact, as the case may be, for their fair value. Under an amalgamation of Donnycreek and Contact (also occurring under the Plan of Arrangement) each Donnycreek and Contact share (other than those held by Contact or Donnycreek) will be exchanged for 0.6 and 0.075 of an Amalco share, respectively, and with options on Donnycreek and Contact being exchanged for options on Amalco shares on a basis reflecting these exchange ratios. The stated capital of the Amalco shares will be equal to aggregate paid-up capital of the Donnycreek and Contact shares immediately before the amalgamation minus those of the shares of Donnycreek and Contact held by each other.

Canadian tax consequences

The amalgamation exchange will occur to shareholders on a rollover basis. Resident holders exercising dissent right may be deemed to have realized a dividend to the extent that the proceeds of disposition exceed the paid-up capital of their shares.

Charger/AvenEx/Pace

Overview

Under an Alberta Plan of Arrangement, all the non-dissenting shares of Charger and AvenEx will be exchanged for treasury shares of Pace, following which Charger and AvenEx will be amalgamated into Pace to continue as Spyglass (which will have a market cap of $344M). Charger, AvenEx and Pace are Alberta companies listed on the TSXV, TSX and TSX, respectively. The shareholders of Charger, AvenEx and Pace will hold 9%, 43% and 48%, respectively, of the shares of Spyglass.

Plan of Arrangement

Under the Plan of Arrangement:

- each of the issued and outstanding Pace shares will be subdivided into 1.3 shares

- AvenEx, Charger and Pace shares of dissenters will be transferred for their fair value to the respective companies

- the stated capital of the shares of AvenEx and Charger will be reduced to $1.00

- each Charger share will be transferred to Pace in exchange for 0.18 of a Pace share

- each AvenEx share will be transferred to Pace in exchange for 1.00 of a Pace share

- Charger and AvenEx will be amalgamated with Pace to continue as Spyglass (with the Pace shares continuing as Spyglass shares)

- the stated capital of the Spyglass shares (whose pro forma equity book value is $636.2M) will being reduced to $1.00, with the reduction added to contributed surplus

Options

In-the-money Charger and Pace options will be exercised and out-of-the –money options will be surrendered for $0.001 per option.

Canadian tax consequences

Share exchange occurs under s. 85.1/rollover on amalgamation. No estimate of the quantum of deemed dividends to dissenters.

U.S. tax consequences

Charger, AvenEx and Pace believe they are not and were not PFICs. On this basis and given that the Arrangement should qualify as a tax-deferred exchange under Code s. 368(a), no gain or loss will be recognized by a U.S. holder on the exchange of Charger, AvenEx or Pace shares for Spyglass shares, provided that U.S. holders who own directly or by attribution 10% or more of the Charger, AvenEx or Pace shares or, following the amalgamation, the Spyglass shares, may be required to recognize a proportionate share of the earnings and profits of Charger, AvenEx or Pace as dividends.

Triangular Amalgamations

Delavaco/Sereno

Overview

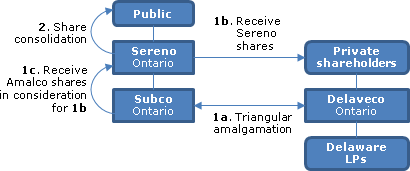

There will be a triangular amalgamation of Delavaco (a privately-held Ontario corporation holding US single-family homes, and which will be acquiring US multi-family properties, through Delaware limited partnerships) with a subsidiary of Sereno ("Subco") so that Delavaco shareholders receive approximately 99% of the shares of Sereno (whose name will be changed to Delavaco Residential Properties Inc. – referred to as the "Resulting Issuer.") Sereno is TSXV listed and was a CPC (capital pool company) issuer which migrated to the NEX due to failure to complete a Qualifying Transaction on a timely basis. The proposed transactions will satisfy the requirement for Sereno to engage in a qualifying transaction under the CPC programme of the TSXV (see TSX-V Policy 2.4 - Capital Pool Companies), thereby permitting it to graduate from a capital pool company to a Tier 2 Real Estate or Investment Issuer.

Background

Delavaco was incorporated on January 27, 2011, and financed its US acquisitions through various private placements of equity and debt. Its homes are mostly rented to working class families in the southeastern U.S., and it already has disposed of a number of homes. It will now be focusing on acquiring multi-family properties. On May 24, 2013, Sereno and Delavaco entered into a letter of intent which contemplated the acquisition by Sereno of all the issued and outstanding Delavaco shares pursuant to a court-approved plan of arrangement, and Sereno's subsequent conversion into a REIT. An agreement for the revised business combination was entered into on September 18, 2013.

Reverse takeover/triangular amalgamation

Subco and Delavaco will amalgamate under the OBCA. On the effective date of the amalgamation:

- The Delavaco shares will be cancelled and their holders (other than dissenting shareholders) will receive common shares of Sereno in accordance with the Exchange Ratio of 7.36.

- The common shares of Subco will be cancelled and replaced with one common share of the amalgamated corporation ("Amalco" – named "Delavaco Properties Inc.").

- The terms of Delavaco warrants will be adjusted, also based on the Exchange Ratio.

- As consideration for the issuance of common shares by Sereno in 1, Amalco will issue to Sereno one common share of Amalco for each such Sereno share.

- Sereno will consolidate all of the outstanding Sereno common shares on a 7.36 to one basis (with comparable consolidations of the Delavaco warrants and options).

These transactions will pursuant to the terms of notes of Delevaco cause the conversion of those notes into common shares of the Resulting Issuer.

As a result, former shareholders of Sereno will hold approximately 1% of the common shares of the Resulting Issuer and the former shareholders of Delavaco holding approximately 99%.

Finco Financing

Concurrently with the completion of the above business combination, a special purpose entity ("Sereno Finco") will complete an offering to raise between $43,700 and $250,000 through issuing non-voting non-participating special shares of Sereno Finco. Under a share exchange agreement to be entered into by these subscribers, the holder of the sole common share of Sereno Finco, and Sereno,these special shares will be exchanged with Sereno (who also wll acquire such common share) for post-consolidation (see 5) common shares of the Resulting Issuer (representing under 0.01% of the total). The purpose of this transaction is to meet the minimum public board lot requirements for a Tier 2 Real Estate or Investment Issuer.

Canadian tax disclosure

A Delavaco shareholder holding Delavaco shares as capital property will receive rollover treatment under s. 87. Under the CRA administrative practices, a dissenting shareholder should be considered to have disposed of its Delavaco shares for proceeds of disposition equal to the amount paid by Amalco (excluding any interest). i.e., no deemed dividend treatment.

Trident/Andor

Overview

After the preliminary transactions described below, there will be a triangular amalgamation of Trident (a privately-held exploration and development company) with a subsidiary of Andor ("Subco") so that Trident shareholders receive approximately 96.2% of the shares of Andor (whose name will be changed to Trident Gold Corp.) Andor is TSX-V listed and a CPC (capital pool company) issuer, e.g., it has filed a preliminary CPC prospectus. Trident is not listed. This transaction will satisfy the requirement on Andor to engage in a qualifying transaction under the CPC programme of the TSX-V (see TSX-V Policy 2.4 - Capital Pool Companies).

Preliminary transactions

After spinning-off some of its assets into a separate corporate structure, Trident, which holds a 49% interest in the Marquesa Gold Project, will acquire the remaining interest mostly by issuing shares and warrants to the owner, so as to result in that owner now owning 49% of the outstanding Trident shares and warrants before a financing. Under the financing, Trident will issue subscription receipts to raise between $4.8M and $7M.

Reverse takeover/triangular amalgamation

After the completion of the preliminary transactions:

- Andor will be continued under the BCBCA and its shares will be consolidated on the basis of 0.176 new common shares for each old share

- Dissenters' shares will be deemed to be transferred to Andor with a right to be paid their fair value

- Subco and Trident will amalgamate under the CBCA

- On the amalgamation, each Trident share will be cancelled and its holder will receive that number of shares of Andor (now called Trident Gold Corp.) based on the exchange ratio (1 Andor share for 10.75 Trident shares)

- A similar exchange of options and warrants will occur

- Each common share of Subco outstanding before the amalgamation will become a common share of Amalco; and as consideration for the issuance of Andor shares to the former Trident shareholders, Subco shall issue to Andor one Amalco share for each such share so issued to such shareholders

Canadian tax disclosure

None.

Gallic/Petromanas

General

Proposal for all the shareholders of Gallic to become shareholders of Petromas and for Gallic to be amalgamated with AcquisitionCo. The Petromanas shares to be received are estimated to represent a value of $0.07 per Gallic share, representing an 11% premium based on the 10-day pre-announcement VWAP of Petromas shares on the TSXV.

Plan of Arrangement

Under an Alberta Plan of Arrangement:

- Gallic shares of dissenters are deemed to have been transferred to Petromanas, with a right to be paid their fair value by Petromanas

- Gallic shares held by those shareholders who have so elected by 2:00 pm Calagary time two days before the proposed November 30 effective date ("Exchanging Gallic Shareholders") are transferred to Petromanas on the basis of 0.3736 of a Petromanas share for each Gallic share (the "Exchange Ratio")

- AcquisitionCo and TORC amalgamate to continue under the Petromanas AcquisitionCo name ("AmalCo"). On the amalgamation:

- each issued and outstanding Gallic share (other than Gallic shares held by Petromanas) is exchanged for 03736 of a Petromanas share

- Petromanas's shares of AcquisitionCo and of Petromanas become shares of AmalCo on a 1-for-1 basis

- warrants entitling the holders to acquire Gallic shares ("Gallic Warrants") are exchanged for warrants to acquire Petromanas shares equal in number to that number of Gallic shares otherwise issuable on the exercise of the Gallic Warrants multiplied by 0.3736, with the exercise price adjusted accordingly

S. 85 elections

Exchanging Gallic Shareholders who wish to make an s. 85(1) or (2) election must provide a completed election package within 90 days of the effective date of the arrangement, subject to Petromanas extending this deadline.

Canadian tax consequences

The transfer of Gallic shares held as capital property by Exchanging Gallic Shareholders will occur on a rollover basis under s. 85.1 unless they include any portion of the capital gain or loss otherwise to be recognized in the computation of their income for the year, or they make a valid election under s. 85(1) or (2). There will be a rollover under s. 87(9)(a) and 87(4) for Petromanas shares received on the triangular amalgamation if the Gallic shares were capital property. The exchange of Gallic Warrants will occur on a rollover basis under ss. 87(4.3) and 87(9)(a.2).

Dissenters will realize a capital gain or loss based on the cash amount received (excluding interest).

Standard non-resident disclosure.

TORC/Vero

Overview

The arrangement effectively represents an acquisition of TSX-listed Vero, seen as a high netback, light oil focused Cardium resource play, by TORC (an unlisted Alberta company), which is focused on the southern Alberta Bakken petroleum system. The implied value of the arrangement to Vero shareholders of $3.00 per share (based on the pricing of the private placement described below) represents a premium of 48% to the 10-day pre-announcement VWAP of their shares on the TSX.

Break fees

There are potential reciprocal break fees of $6.5M.

Private placement of subscription receipts

There first is a private placement by TORC of up to 35.42M subscription receipts and 12.91M subscription receipts to acquire TORC shares on a flow-through basis, for total proceeds of approximately $132M. The proceeds will be released to New TORC (described below) if the arrangement is implemented by December 21, 2012, and the cash proceeds returned if it is not.

Plan of Arrangement

Under an Alberta Plan of Arrangement:

- TORC shares of dissenters are cancelled, with an entitlement to be paid their fair value by New TORC (or by Vero per the tax disclosure)

- TORC (non-flow through) subscription receipts are converted into TORC shares on a 1-for-1 basis

- AcquisitionCo (a wholly-owned Alberta subsidiary of Vero) and TORC amalgamate to continue under the TORC name ("AmalCo 1"). On the amalgamation:

- each issued and outstanding TORC share (other than TORC shares held by Vero and AcquisitionCo) is exchanged for 0.87 of a Vero share

- Vero's shares of AcquisitionCo and of TORC become shares of AmalCo 1 on a 1-for-1 basis

- the stated capital of the AmalCo 1 shares is reduced to $1, and Vero and AmalCo 1 amalgamate in a short-form style amalgamation to continue under the TORC name ("AmalCo" or "New TORC")

- each TORC flow-through subscription receipt is "converted and exchanged" for 0.87 of an AmalCo share

There will be approximately 225M New TORC shares outstanding.

Options

Options to acquire Vero shares will become fully vested immediately prior to the effective date of the arrangement. Vero has agreed to use its reasonable commercial efforts to cause all outstanding Vero options to be exercised or surrendered prior to the effective date. All of the outstanding options and warrants to acquire TORC shares will roll over in accordance with their terms and become obligations of New TORC.

Canadian tax consequences

Conversion/exercise of subscription receipts. No capital gain or loss will be realized on the issuance of a TORC share pursuant to a TORC subscription receipt, or of a New TORC share pursuant to a TORC flow through subscription receipt, based on counsel's understanding that each such subscription receipt "evidences a right to acquire a TORC Share." The cost of the TORC or New TORC shares thereby acquired will equal to the amount paid for the subscription receipts.

Amalgamations

TORC shareholders will receive Vero shares on a rollover basis under ss. 87(9)(a) and 87(4), and Vero shareholders will receive New TORC shares on a rollover basis under s. 87(4).

Dissenters

Will realize a capital gain or loss.

Non-residents

Vero shares received by TORC shareholders on the first amalgamation, and New TORC shares received in exchange therefor on the second amalgamation, will be deemed under s. 87(4) to be taxable Canadian property for the following 60 months.

US tax consequences

The Arrangement Agreement contemplates that the arrangement will qualify as a tax-deferred reorganization under Code s. 368(a).