CPC/Microcap Conversions

Holland Global/Maplewood REIT

Overview

Under a CBCA Plan of Arrangement, the shareholders of the Corporation (a recently-formed TSXV-listed capital pool company which has not yet made its qualifying acquisition - see TSX-V Policy 2.4 - Capital Pool Companies) will transfer their shares to a subsidiary Ontario LP of the REIT (Maplewood LP ) on a taxable basis in exchange for REIT Units on an 8-for-1 basis (the "Exchange Ratio") - or, if they wish to and elect to transfer on a s. 97(2) rollover basis, they will transfer their shares to Maplewood LP for (exchangeable) Class B LP Units of Maplewood LP in accordance with the Exchange Ratio together with an equal number of special voting units of the REIT. An indirect Netherlands subsidiary of Maplewood LP ("B.V.") will then make the qualifying acquisition of the legal title to a Netherlands property (the "Initial Property"), with its immediate parent (Maplewood Operating LP) acquiring the beneficial ownership. Following the completion of the Arrangement, the REIT and its affiliates will focus on acquiring further Dutch real estate.

Structure

The REIT is a Ontario unit trust. It will hold the Class A LP Units of Maplewood LP, along with the shares of the Ontario General Partner, with some of the former shareholders of the Corporation holding the (exchangeable) Class B LP Units of Maplewood LP. Maplewood LP will hold all of the LP units of Maplewood Operating LP and the shares of the general partner, and also all the shares (being Class A Shares) of the Corporation, which will have nominal value. Maplewood Operating LP will own all the securities of B.V.

Corporation

It is a CBCA corporation which was formed as a capital pool company on January 15, 2013, issued "seed shares" for gross proceeds of $500,000 on February 7, 2013, issued private placement shares for gross proceeds of $2,650,000 on February 8, 2013, and completed an IPO on April 5, 2013 for gross proceeds of $400,000. Its shares are listed on the TSXV. On August 13, 2013 it filed a non-offering prospectus dated August 8 indicating that it has no assets other than cash and that the Arrangement together with the acquisition of the Initial Property by the REIT as a successor to the Corporation will represent its qualifying transaction for CPC purposes.

Initial Property

The Corporation has identified the "Initial Property" (a large scale industrial complex in the Netherlands) as an appropriate initial property for the REIT to acquire. Conemporaneously with the completion of the Arrangement, the REIT will indirectly purchase the Initial Property for a purchase price of $9.1 million (€6.75 million) financed in part with a new mortgage of $5.4 milllion.

Plan of Arrangement

- Shares held by dissenting Shareholders will be deemed to have been transferred to Maplewood LP and cancelled so that their only right is to receive the shares' fair value

- in exchange for Class A LP Units of Maplewood LP, the REIT will contribute to Maplewood LP the number of REIT Units that it will be required to exchange for Shares two bullet points below

- Shares of Shareholders who are not Excluded Shareholders (see below) and have elected to receive exchangeable Class B LP Units will (subject to the applicable pro rata cap) be transferred to Maplewood LP in consideration for the issuance of Class B LP Units and "Ancillary Rights" (i.e., Exchange Rights and Special Voting Units of the REIT) in accordance with the Exchange Ratio

- The remaining Shares will be transferred to Maplewood LP in consideration for REIT Units in accordance with the Exchange Ratio

- The options under the Corporation's stock option plan will be exchanged for identical options on REIT Units, subject to adjustments based on the Exchange Ratio

- The REIT Unit initially issued to the Corporation for $10 will be redeemed for $10

- The issued and outstanding Shares of the Corporation will be exchanged for an equal number of Class A Common Shares and Preferred Shares, with the Preferred Shares then being redeemed for cash

Post-Arrangement steps

- Maplewood LP will make a joint s. 97(2) election with Shareholders who have transferred their Shares for Maplewood Class B LP Units provided they furnish it with the election forms within 60 days of the effective date of the Arrangement.

- A private placement units comprising REIT Units and warrants will be closed with insider private placement purchasers for gross proceeds of $2 million

Excluded Shareholders

These are defined as:

- A Shareholder which is not: a taxable Canadian resident or a Canadian partnership; or

- A person or partnership an interest in which is a tax shelter investment (or who acquires Class B LP Units as a tax shelter investment)

Canadian tax consequences

Exemption from SIFT tax. The REIT will not be considered to be a SIFT trust provided that (as stipulated in the investment guidelines) it does not own any non-portfolio property. Because the REIT does not own taxable Canadian property it is not subject to non-resident ownership restrictions.

FTGP rules

No assurance can be given that the foreign tax credit generator rules will not apply in respect of business-income tax or non-business income tax paid by Maplewood Operating LP and allocated to holders of Maplewood LP units, including the REIT.

Exchange of Shares

The Canadian tax consequences of a disposition of Shares to Maplewood LP for Class B LP Units are not discussed. An exchange for REIT Units is taxable.

Netherlands tax consequences

B.V. and Maplewood Operating LP are considered domestic and foreign tax residents, respectively. The financial statements state that Maplewood LP will be treated as a corporation for Dutch tax purposes. Discussion of fiscal unity rules without discussion of their specific application. B.V. will hold the legal ownership of the Initial Property, whereas beneficial ownership will be held by Maplewood Operating LP, which will be considered to have a Dutch branch business.

Capital BLF/BLF REIT

Overview

Under a CBCA Plan of Arrangement, the shareholders of the Corporation will transfer their shares to a subsidiary Quebec LP of the REIT (BLF LP ) on a taxable basis under a three-corner exchange arrangement, for REIT Units on a 40-for-1 basis (the "Exchange Ratio") - or, if they wish to and elect to transfer on a s. 97(2) rollover basis and their status is consistent with BLF LP qualifying as an excluded subsidiary entity (e.g., they are not individuals), they will transfer their shares to BLF LP for exchangeable LP units of BLF LP (the "Exchangeable LP Units") in accordance with the Exchange Ratio together with an equal number of special voting units of the REIT. The REIT is a Quebec unit trust.

Corporation

It is a CBCA corporation which started operations in 2007 as a capital pool corporation. As at the time of its annual management information circular, it held seven multi-family residential properties in Montreal, Dorval and Québec City representing 694 apartments, and it had two private company shareholders holding 19.99% and 15.5% of its shares. On March 15, 2013 it acquired a further three properties at a cost of $57M, financed in part through a private placement for $23.5M, and announced a further property acquisition in June 2013. It trades on the TSX Venture exchange with a market cap of $33M. (132M shares at $0.25 - so that the Exchange Ratio is targeting a REIT Unit value in the neighbourhood of $10).

Preliminary asset transfer

The Corporation will transfer essentially all its assets to BLF LP in consideration for: the assumption of liabilities; the issuance of promissory note; and the issuance of Class C LP units.

Plan of Arrangement

- Shares held by dissenting Shareholders will be deemed to have been transferred to the Corporation and cancelled so that their only right is to receive the shares' fair value

- Shares of Shareholders who are not Excluded Shareholders (see below) and have elected to receive Exchangeable LP Units (a.k.a. Class B LP Units) will (subject to a potential cap imposed by the general partner in its discretion) be transferred to BLF LP in consideration for the issuance of Exchangeable LP Units and Special Voting Units of the REIT in accordance with the Exchange Ratio

- The remaining Shares will be transferred to BLF LP in consideration for REIT Units in accordance with the Exchange Ratio, which will be issued by the REIT in consideration for the issuance to it by BLF LP of Class A LP Units

- The options under the Corporation's stock option plan will be exchanged for identical options on REIT Units, subject to adjustments based on the Exchange Ratio

- The REIT Unit initially issued to the Corporation for $10 will be redeemed for $10

Post-Arrangement steps

- BLF LP will make a joint s. 97(2) election (and the provincial equivalent) with Shareholders who have transferred their Shares for BLF LP Units provided they furnish it with the election forms within 60 days of the effective date of the Arrangement.

- The Corporation (whose shares will be delisted) will elect to cease to be a public corporation for purposes of the Act

- The Corporation will make a capital distribution, of all the notes owing to it by BLF LP, to its sole shareholder (BLF LP)

Excluded Shareholders

These are defined as any of:

- A non-resident (or a non-Canadian partnership)

- A financial institution

- A person or partnership an interest in which is a tax shelter investment (or who acquires an interest in BLF LP as a tax shelter investment)

- A person or partnership which is not a real estate investment trust, a taxable Canadian corporation, a SIFT trust or an excluded subsidiary entity (all as defined in the Act)

Canadian tax consequences

REIT qualification. Based on external advice, management expects the REIT to qualify as a REIT for 2013 and subsequent taxation years, and has implemented internal controls to ensure that BLF LP satisfies the necessary tests.

BLF LP

Is expected to qualify as an excluded subsidiary entity.

Exchange of Shares

The Canadian tax consequences of a disposition of Shares to BLF LP for Exchangeable LP Units are not discussed. An exchange for REIT Units is taxable.

LP Acquisitions of Corporations

Brookfield (BPY)/BPO

Overview

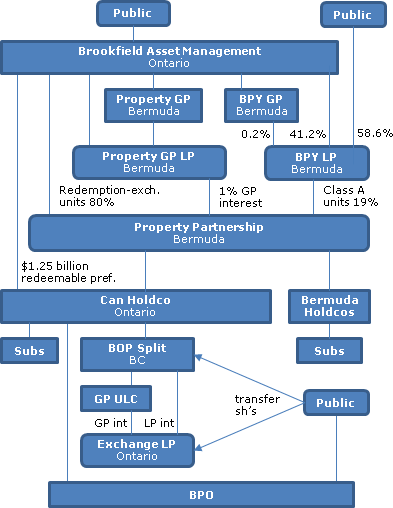

BPY, which "beneficially owns" approximately 49% of the common shares of BPO, and two of its indirect subsidiaries ("Brookfield Office Properties Exchange LP, or "Exchange LP;" and Brookfield Property Split Corp., or "BOP Split"), are making an "any or all" offering for the remaining common shares of BPO, in consideration for BPY units or cash subject to the overall mix of consideration being fixed at around 67% units and 33% cash. Canadian taxable shareholders of BPO (including individuals) can elect to receive their units consideration in the form of exchangeable LP units ("Exchange LP Units") of "Exchange LP," i.e., such units will be retractable for BPY units subject to an overall call right of BPY, but there will be no direct exchange right against BPY. The acquired BPO common shares which are not acquired by Exchange LP will be held by BOP Split, which is a B.C. subsidiary of an indirect Canadian subsidiary of BPY (i.e., CanHoldco described below) and the limited partner of Exchange LP. Exchange LP will qualify as a Canadian partnership due to its Canadian direct ownership.

The Offer

Each shareholder of BPO may elect to receive for each BPO Common Share tendered by such shareholder, one BPY Unit or $20.34 in cash, subject to pro-ration (which is stated to be likely). The total number of BPY Units that may be issued under the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction shall not exceed 186,230,125 and the total amount of cash available under the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction shall not exceed $1,865,692,297, which equates to approximately 67% and 33%, respectively, of the total number BPO Common Shares to be acquired under the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction. Shareholders who tender to the Offer but do not make an election between BPY Units and cash will be deemed to have elected to receive BPY Units. Canadian Shareholders can elect to receive, in lieu of BPY Units, Exchange LP Units.

Brookfield Property Partners ("BPY")

BPY is a TSX and NYSE listed Bermuda exempted limited partnership which has a 19% interest (in the form of Managing GP Units) in another Bermuda partnership (Brookfield Property L.P., or "Property Partnership"). The public hold 58.6% of the LP units of BPY and Brookfield Asset Management Inc. ("Brookfield Asset Management") holds 41.3% of the BPY LP units (for a total of 102M units). Brookfield Asset Management also has an 80.1% LP interest in Property Partnership in the form of 432M Redemption-Exchange Units. BPY "beneficially owns" [i.e., indirectly holds after treating the Redemption-Exchange Units of Brookfield Asset Management in Property Partnership as if they had been exchanged for BPY units, and ignoring preferred shares described below] 49.2% of the common shares of BPO (249M shares), its largest asset, and has an aggregate voting interest in BPO of 50.5%.

Property Partnership/CanHoldco

Property Partnership owns, directly or indirectly, all of the common shares or equity interests, as applicable, of the "Holding Entities" including Brookfield BPY Holdings Inc. ("CanHoldco"). Brookfield Asset Management holds $1.25 billion of redeemable preferred shares of CanHoldco, which it received as partial consideration for causing Property Partnership to directly acquire substantially all of Brookfield Asset Management's commercial property operations. In addition, Brookfield has subscribed for $5 million of voting preferred shares of each of CanHoldco and four wholly-owned subsidiaries of other Holding Entities.

BPO

BPO is a CBCA corporation which is listed on the TSX and NYSE and is focused on premier office properties in the U.S., Canada, Australia and the U.K. BPO owns an approximately 83.3% aggregate equity interest in Brookfield Canada Office Properties, a Canadian real estate investment trust that is listed on the TSX and the NYSE, and an approximately 84.3% interest in the U.S. Office Fund, which consists of a consortium of institutional investors and which is led and managed by Brookfield Office Properties.

BOP Split

BOP Split, a B.C. corporation, was incorporated on December 9, 2013 as a wholly-owned subsidiary of CanHoldco for the purpose of being an issuer of preferred shares and owning the Offerors' additional investment in BPO Common Shares.

Exchange LP

Exchange LP, an Ontario LP, was established on December 16, 2013 by BOP Split, as limited partner, and BOP Exchange GP ULC (‘‘GP ULC''), as general partner, for the sole purpose of the Offer. GP ULC is an indirect subsidiaries of BPY.

Exchange LP Units

Holders:

- Exchange right. Will be entitled at any time to retract any Exchange LP Units held by them and to receive in exchange one BPY Unit, plus all unpaid distributions.

- Overriding BPY call right. However, BPY will have the right to purchase all but not less than all of the units covered by the retraction request.

- Liquidation right (LP redemption right). Have a comparable liquidation right (and are subject to a right of Exchange LP to redeem after seven years, or earlier in certain circumstances), subject also to an overriding BPY call right.

- Voting. Generally have no voting rights.

- Preference. Will be entitled to a preference over holders of limited partnership units of Exchange LP respecting distributions including liquidating distributions.

- Distributions. Will be entitled to receive distributions economically equivalent to the distributions on BPY Units.

Exchange LP Support Agreement

BPY will covenant that it will:

- not declare or pay any distribution on the BPY Units unless: (i) on the same day Exchange LP declares or pays, as the case may be, an equivalent distribution on the Exchange LP Units; and (ii) Exchange LP has sufficient assets available to enable the timely payment of an equivalent distribution on the Exchange LP Units;

- advise Exchange LP sufficiently in advance of the declaration of any distribution on the BPY Units; and

- take all actions reasonably necessary to enable Exchange LP to pay the liquidation amount or retraction price, as applicable, of the Exchange LP Units.

BPO Preferred Shares

Brookfield Property Partners is not currently intending to make a concurrent offer for any of the BPO Preferred Shares, which will be unaffected by the Offer. If Brookfield Property Partners acquires 100% of the BPO Common Shares, it is Brookfield Property Partners' current intention to (i) provide holders of the outstanding convertible BPO Preferred Shares with the right to convert their shares for BPY Units rather than BPO Common Shares, (ii) make an offer (full or partial) to such holders to exchange up to $100 million of their shares for equivalent shares of another subsidiary of Brookfield Property Partners, or (iii) pursue other alternatives. The non-convertible BPO Preferred Shares will remain outstanding following the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction.

Options and Other Share Based Compensation Awards

If Brookfield Property Partners acquires 100% of the BPO Common Shares, it is intended that:

(a) Vested in-the-money Options then remaining be redeemed for a cash payment equal to the in-the-money value.

(b) Unvested in-the-money Options then remaining be exchanged for unvested BPY Options on a basis that preserves the in-the-money value at the time of the exchange with the BPY Options having expiry dates and vesting terms consistent with the unvested Options exchanged.

(c) Each outstanding out-of-the-money Option (whether vested or unvested) be exchanged for a BPY Option with a strike price equal to the value of a BPY Unit at the time of the exchange and expiry dates and vesting terms consistent with the Options to be exchanged.

(d) DSUs and BPO restricted shares (‘‘RSs'') be exchanged for awards in respect of BPY such that the fair market value is the same immediately before and after such exchange and other terms and conditions be substantially the same before and after such exchange.

Second stage transaction

If the Offerors take up and pay for a number of BPO Common Shares that constitute at least a majority of the BPO Common Shares that can be included for the purposes of ‘‘minority approval'' under MI 61-101, the Offerors will undertake a Compulsory Acquisition or Subsequent Acquisition Transaction to acquire any BPO Common Shares not deposited under the Offer for the same consideration as was paid by the Offerors under the Offer, subject to pro-ration.

Canadian tax consequences

S. 97(2) rollover. For BOP Canadian Shareholders who elect to receive Exchange LP Units, GP ULC, the general partner of Exchange LP, will make the necessary s. 97(2) elections with such Canadian Shareholders. The electing holder must provide the relevant information to GP ULC at http://www.brookfieldpropertypartners.com/bpotaxelection on or before the day that is 85 days following the date on which the exchange occurs. The resident holder will be solely responsible for executing its portion of the election and submitting it to CRA. An exchange for BPY units will occur on a non-rollover basis.

Exchange LP SIFT tax

GP ULC expects that Exchange LP will be a ‘‘SIFT partnership'' for each of its taxation years but it does not expect that Exchange LP will be liable for any material amount of SIFT Tax for any taxation year based on taxable dividends on Exchange LP's BPO common shares being essentially its only source of income.

Subsequent acquisition transaction

It currently is expected that on a Subsequent Acquisition Transaction, a BPO shareholder would receive a deemed dividend based on the paid-up capital per BPO share of C$8.91.

Non-residents

Non-residents who do not dispose of their BPO Common Shares pursuant to the Offer are cautioned that BPO Common Shares that are not listed on a ‘‘designated stock exchange'' at the time of their disposition will be considered ‘‘taxable Canadian property'' if at any time within the 60-month period immediately preceding the disposition, more than 50% of the fair market value of the BPO Common Shares was derived directly or indirectly from Canadian real property etc.

Qualified

investments. Exchange LP Units will not be qualified investments for RRSPs etc.

U.S. tax consequences

S. 721(a) exchange. An exchange by a BPO Shareholder of BPO Common Shares for BPY Units pursuant to the Offer is expected to qualify as an exchange to which Code s. 721(a) applies, i.e., a tax-free exchange in which no gain or loss is recognized. In particular, Torys considers that, under s. 7704, BPY (which has elected to be classified as a partnership) is not a publicly traded partnership that should be treated as a corporation and BPY should not be treated (under s. 721(b)) as a partnership that would be an ‘‘investment company'' if it were incorporated.

It is uncertain whether a U.S. Holder who receives a combination of cash and BPY Units in exchange for its BPO Common Shares pursuant to the Offer will be permitted to specifically identify the BPO Common Shares that are treated as sold for cash and the BPO Common Shares that are treated as transferred to Brookfield Property Partners in exchange for BPY Units. If such specific identification is ineffective, such U.S. Holder will be treated as having sold a single undivided portion of each BPO Common Share exchanged by such Shareholder pursuant to the Offer (equal to the percentage that the amount of the cash consideration received by such shareholder in exchange for its BPO Common Shares pursuant to the Offer bears to the fair market value of the total consideration (that is, cash plus the fair market value of BPY Units) received by such holder in exchange for its BPO Common Shares pursuant to the Offer), and to have contributed to Brookfield Property Partners in exchange for BPY Units the remaining single undivided portion of each BPO Common Share exchanged by such shareholder pursuant to the Offer.

Built-in gain

A former BPO Shareholder that is a U.S. taxpayer could be required under s. 704(c)(1) or 737 to recognize part or all of the ‘‘built-in gain'' in such Shareholder's BPO Common Shares exchanged for BPY Units pursuant to the Offer if BPY (i) sells or otherwise disposes of, in a taxable transaction at any time following the Offer, such BPO Common Shares, (ii) distributes such BPO Common Shares acquired from such Shareholder to another BPY Unitholder within seven years following the Offer, (iii) distributes any BPY property (other than money or BPO Common Shares acquired from such Shareholder) to such BPY Unitholder within seven years of the Offer, or (under s. 707(a)) (iv) makes any distribution (other than an ‘‘operating cash flow distribution'') to such former Shareholder within two years following the Offer. The BPY General Partner intends to use commercially reasonable efforts to ensure that a Shareholder that is a U.S. taxpayer is not required to recognize part or all of the ‘‘built-in gain'' in such Shareholder's BPO Common Shares deferred as a result of the Offer, in the event that Brookfield Property Partners undertakes any of the foregoing transactions.

BPY UBTI

The BPY General Partner intends to use commercially reasonable efforts to structure the activities of BPY and Property Partnership to avoid generating income connected with the conduct of a trade or business (which income generally would constitute unrelated business taxable income (‘‘UBTI'') to the extent allocated to a tax-exempt organization).

Privatizations

TransGlobe

Asset sale

It is contemplated that after the convening of a REIT meeting to approve the transactions, subsidiary LPs of the REIT (held by it through a newly-formed master LP) will transfer (on a non-rollover basis) a pool of assets to an LP of which a Canadian Apartment Properties REIT entity is the GP in consideration for debt assumption and the issuance of LP units (an arm's length transaction). The REIT subsidiary LPs then sell their LP interests in the CAPREIT LP to CAPREIT for $269 million cash. (CAPREIT presumably accesses the 5% de mininis Ontario land transfer tax exemption). Timbercreek Asset Management Inc. also acquires a pool of assets from the applicable REIT subsidiary partnerships - in consideration for debt assumption and cash consideration of $349 million.

Unit redemptions

The REIT makes a special cash distribution out of these sales proceeds to its unitholders of $4.82 per unit. PSPIB-RE Partners Inc. ("PSP Holdco") then subscribes $469 million in cash for REIT units, and all the REIT units held by the public are redeemed for cash of $9.43 per unit. PSP Holdco's REIT units then are redeemed through a distribution of an interest in the remaining real estate, so that the Drimmer group holds the sole remaining unit of the REIT.

Fees

Potential break-fee of $25 million (or $21 million if the Acquisition Agreement is terminated by the REIT to pursue a superior proposal before the end of the go-shop period (45 days after execution of the proposal letter.) The REIT covenants not to deduct any transaction expenses in computing 2012 income.

Canadian tax consequences

Distributions. All of the income of the REIT for 2012 will be treated as distributed on payment of the special cash distribution and previous ordinary monthly cash distributions - resulting in the tax deferral percentage of the previous monthly distributions being largely eliminated and in perhaps 5.8% of the special cash distribution being treated as a distribution of ordinary income, with most of the balance being a distribution of net capital gains (pp. 61-62) (The distributed net capital gains reduce the proceeds of disposition for the public's units; but not so for the distributed recapture of depreciation.) The income of the REIT will be increased by not having depreciable property at the end of its 2012 taxation year, as well as from the asset sales and transfers described above.

Withholding

The retroactive reduction in the tax-deferred percentage applicable to the previous 2012 monthly distributions also has the effect of retroactively subjecting those distributions to Part XIII tax (p. 64). Most of the special cash distribution paid to non-residents is subject to Part XIII tax, and the redemption proceeds are subject to Part XIII.2 withholding (p.63).

Section 132.2 Mergers

Bullion Fund Mergers

Sprott/Central Goldtrust

Overview

The Offeror is making the "Offer" to purchase all of the issued and outstanding GTU Units (other than those held directly or indirectly by the Offeror). The Offer comprises an exchange offer alternative (the ''Exchange Offer Election'') and a merger alternative (the ''Merger Election''). Holders of GTU Units (''GTU Unitholders'') that elect the Merger Election can exchange their GTU Units for PHYS Units based on the "NAV to NAV Exchange Ratio" (currently estimated to be approximately 4.4464 PHYS Units for each GTU Unit) on a tax-deferred basis for U.S. and Canadian income tax purposes. GTU Unitholders who wish to crystallize the realization of any gain (or loss) for Canadian income tax purposes may elect the Exchange Offer Election. The Offer is conditional on the number of GTU Units in respect of which an Exchange Offer Election or Merger Election is made, together with those GTU Units held by the Offeror at the Offer Expiry Time, representing at least 66 2/3% of the total outstanding GTU Units. On completion of the Merger, former GTU Unitholders would hold 36% of the outstanding PHYS Units.

Offeror

Sprott Asset Management Gold Bid LP, an Ontario limited partnership that is owned and controlled by Sprott Asset Management LP, the manager of Sprott Physical Gold Trust.

GTU

A mutual fund trust trading on the TSX and NYSE MKT and holding mostly gold bullion and with approximately 19.3M GTU Units outstanding. The GTU Units do not have the physical redemption feature of PHYS Units.

GTU Trustees' response

Their 19 June 2015 letter to unitholders (recommending rejection) stated:

The Sprott Offer does not provide any meaningful premium, but asks Unitholders to exchange their Units for units of Sprott PHYS, which involve higher costs, increased tax risks, and reduced governance rights. … Sprott PHYS' physical redemption feature is substantially the same as the one that Polar Securities proposed that GoldTrust adopt – a proposal that was overwhelmingly rejected by over 80% of votes cast (excluding Polar) at GoldTrust's Annual and Special Meeting of Unitholders held just last month. … Sprott PHYS' redemption feature would expose certain non-redeeming U.S. Unitholders to potentially increased ongoing future tax liabilities if Sprott PHYS delivers gold to satisfy a physical redemption request from a unitholder and the price of gold exceeds Sprott PHYS' undisclosed Canadian dollar cost base for its gold holdings. As a result, if any Unitholder elects to redeem when gold prices exceed the Canadian dollar cost base of Sprott PHYS' gold bullion, certain non-redeeming U.S. Unitholders could incur tax liabilities even though they took no action themselves.

Sprott Physical Gold Trust

A s. 108(2)(a) mutual fund trust trading on the TSX and NYSE Arca and holding mostly gold bullion. 152M PHYS Units are outstanding. PHYS Units may be redeemed at the option of a PHYS Unitholder for physical gold bullion in any month, but only for amounts that are at least equivalent in value to one London Good Delivery bar or an integral multiple thereof, plus applicable expenses. PHYS Units also may be redeemed at the option of a PHYS Unitholder for cash on a monthly basis at a redemption price equal to 95% of the lesser of: (i) the VWAP on NYSE Arca for the last five trading days for the month in which the redemption request is processed; and (ii) the NAV of the redeemed PHYS Units for the last day of the month in which the redemption request is processed. Prior to the public announcement of the Offer, the GTU Units were trading at a 7.6% discount to NAV.

Merger

Pursuant to the Merger Agreement, Sprott Physical Gold Trust would agree to acquire substantially all of the assets and assume all of the liabilities of GTU in return for such number of PHYS Units as is determined by the NAV to NAV Exchange Ratio based on the then outstanding GTU Units. GTU would agree to then redeem all outstanding GTU Units and distribute the PHYS Units to the former holders of GTU Units on the basis of the NAV to NAV Exchange Ratio. Any PHYS Units received by the Offeror as a holder of GTU Units at such time would be transferred to Sprott Physical Gold Trust and be cancelled. However, the Offeror may retain one GTU Unit to keep GTU in existence.

Advance Merger approval

The execution of a Letter of Transmittal (or, in the case of GTU Units deposited by book-entry transfer, the making of a book-entry transfer) appoints the Offeror as the depositing GTU Unitholder's nominee, proxy and attorney in respect of matters related to the Offer, the Merger Transaction, the nomination, election or removal of GTU Trustees, and amendments to the GTU Declaration of Trust. The Offer intends use the Power of Attorney granted in the Letter of Transmittal to pass special resolutions to approve the merger transaction and related trust deed amendments pursuant to a written resolution. Subject to the approval of the special resolutions, the Offeror intends to sign and deliver, on behalf of GTU, the Merger Agreement with Sprott Physical Gold Trust prior to the Expiry Time for the Offer.

Canadian tax consequences

Exchange Offer Election. An exchange pursuant to an Exchange Offer Election will occur on a non-rollover basis.

Merger

The Merger will constitute a ''qualifying exchange'' as per ITA s. 132.2 of the Tax Act, thereby allowing substantially all of the assets and liabilities of GTU to be transferred to Sprott Physical Gold Trust for proceeds of disposition equal to the tax cost of such assets. In such circumstances, there should be no taxable income to GTU arising from the transfer and, as a result there should be no tax liability to GTU Unitholders resulting from the transfer.

Merger Election

Where a Merger Electing GTU Unitholder or a Non-Depositing GTU Unitholder disposes of GTU Units to GTU in exchange for PHYS Units on the redemption of GTU Units pursuant to the Merger, the GTU Unitholder's proceeds of disposition for the GTU Units disposed of, and the cost to the GTU Unitholder of the PHYS Units received in exchange therefor, will be deemed to be equal to the adjusted cost base to the GTU Unitholder of the GTU Units immediately prior to their disposition.

U.S. tax consequences

Exchange. An exchange of GTU Units for PHYS Units pursuant to the Exchange Offer Election or the Merger Transaction should be treated as a single transaction for U.S. federal income tax purposes that is intended to qualify as a ''reorganization'' under Section 368(a) of the Code (a ''Reorganization''). If the Offer and the Merger Transaction were treated as a Reorganization then, subject to the PFIC) rules, a U.S. Holder that exchanged GTU Units for PHYS Units pursuant to the Exchange Offer Election or the Merger Transaction generally would not recognize gain or loss on the exchange.

PFIC rules

. Proposed U.S. Treasury regulations under s. 1291(f) provide that gain would not be recognized on a disposition of stock in a PFIC for which no election has been made, if the disposition results from a non-recognition transfer in which the stock of the PFIC is exchanged solely for stock of another corporation that qualifies as a PFIC for its taxable year that includes the day after the non-recognition transfer. Sprott Physical Gold Trust expects to be classified as a PFIC for its current taxable year. Accordingly, if the proposed U.S. Treasury regulations were finalized and made applicable to the Offer and the Merger Transaction (even if this occurs after the Expiry Date), the exchange of GTU Units for PHYS Units pursuant to the Exchange Offer Election or the Merger Transaction likely would not be treated as a taxable transaction pursuant to s. 1291(f).

Portfolio Mutual Fund Mergers

Connor, Clark: GFO/AUI

Overview

GFO (which has been an unsuccessful Connor, Clark mutual fund focused on international financial institution equities) will be merged into AUI under the s. 132.2 merger procedures after GFO unitholders, who wish to realize a capital loss, have been given an opportunity to redeem their GFO units. There will be no change to the Australian bank-equity focus of AUI.

GFO

GFO is a mutual fund trust investing in international financial sector companies. It has two classes of units: 2.2.M Class A units with a NAV and closing price on the TSX of $5.21 and $5.10 per unit on March 31; and 63K Class F units (not listed) with a NAV of $5.38. It has had negative NAV performance since its IPO in July 2007 for gross proceeds of $50M, and has experienced substantial unit redemptions.

AUI

AUI is a mutual fund trust investing in the common shares of the five largest Australian banks. It has two classes of units: 8.1.M Class A units with a NAV and closing price on the TSX of $11.20 and 10.85 per unit on March 31; and 117K Class F units (not listed) with a NAV of $11.73. It raised gross proceeds of $85.8M on its IPO in March 2011 and has had positive returns since then.

Pre-Merger steps

- GFO unitholders who do not wish to participate may redeem their units no later than May 31, 2013 for their NAV.

- immediately before the merger, GFO will pay a pro rata portion of the regular monthly distribution in cash, and a special distribution in the form of the issuance of additional GFO units, equal to the net realized capital gains arising in the year to date.

- immediately after the payment of such special distribution, the GFO units will be consolidated such that the number of previously-outstanding units is restored.

Merger steps

Commencing on or about June 11, 2013:

- GFO will transfer all or substantially its assets to AUI in consideration for AUI Class A and F units, with the exchange ratios based on relative net asset values on the immediately preceding business day

- Immediately thereafter, all the GFO units will be automatically redeemed for AUI Class A or F units based on the exchange ratios

- GFO and AUI will jointly elect under s. 132.2 within six months

No fractional AUI units or cash in lieu thereof will be issued or paid. GFO units will be delisted, and GFO will be wound up. Transaction costs will be borne by GFO.

Canadian tax consequences

Advance redemption. A GFO unitholder who redeems in advance of the merger will realize a capital gain or loss based on the redemption proceeds for its units. No allocation of income or capital gains will be included in those proceeds.

Special distribution

GFO will make designations under ss. 104(21), 104(19) and 104(22) in respect of net realized capital gains, taxable dividends (including eligible dividends) and foreign-source income (for the GFO taxation year ending immediately after the asset transfer under the merger) included in the special distribution.

Merger

The merger will be implemented as a qualifying exchange under s. 132.2.

REIT Mergers

Northview/True North

Overview

NPR proposes to add approximately 14,000 multi-family residential suites through a series of transactions with True North, affiliates of Starlight and affiliates of the Public Sector Pension Investment Board (''PSP''). NPR will acquire all of True North's assets pursuant to a plan of arrangement under the Business Corporations Act (Alberta) (the ''Arrangement'') in a merger described in s. 132.2 of the ITA, with each unitholder of True North receiving 0.3908 trust units of NPR (''NPR Ordinary Units'') for each True North "Ordinary Unit" held. Holders of exchangeable units in six subsidiary LPs of True North are given the choice of exchanging their LP units for NPR units or for new redeemable units of the same partnerships, i.e., LP units which are redeemable for NPR units. The tax disclosure treats an exchange for such new redeemable LP units as being eligible for a s. 97(2) rollover. On closing, former True North Ordinary Unitholders will own approximately 25.0% of Northview on a fully-diluted basis (i.e., including the redeemable units of the subsidiary LPs). NPR has also agreed to acquire 33 additional apartment properties from a joint venture between affiliates of Starlight and PSP, as well as from affiliates of Starlight directly, for consideration including units of subsidiary LPs. These transactions take the form of vendor LPs transferring the beneficial ownership of real estate (including Ontario properties) to new Ontario LPs for notes and Class B units, then NPR subscribing for Class A units, with such proceeds used to redeem the notes.

True North

Is an Ontario unit trust listed on the TSX with a portfolio of 83 residential rental properties, all of which are held through six subsidiary Ontario LPs (the "Ture North Partnerships"), in which it holds Class A LP units and others hold Class B exchangeable LP units, with a wholly-owned Ontario corporate subsidiary ("True North GP") being the GP. Daniel Drimmer and affiliates holds the equivalent of a 41.2% interest in the trust, mostly in the form of Class B LP units.

NPR

Is an Alberta unit trust listed on the TSX holding a portfolio of multi-suite residential rental properties. Its most significant subsidiary is NPR Limited Partnership, an Alberta LP.

Institutional (Starlight and IMH) Portfolio

NPR will acquire the Institutional Portfolio for $535 million at a ''going-in'' capitalization rate of 5.5%. The Institutional Portfolio comprises 33 properties with a total of 4,650 multi-family suites located in Ontario, New Brunswick and Nova Scotia. The purchase price for the Institutional Portfolio will be satisfied by a combination of $316 million in cash, approximately $49 million of assumed mortgages, the issuance to the Vendors of approximately 5.1 million NPR Ordinary Units valued at a $23.03 per NPR Ordinary Unit, and the issuance to the Vendors of approximately 2.3 million of Class B LP Units valued at $23.03 per Class B LP Unit. The Institutional Portfolio comprises seven apartment properties held by Starlight through subsidiary LPs (the "Starlight Portfolio") and 26 apartment properties held through subsidiary LPs by a joint venture between Starlight and PSP (the "IMH Portfolio").

Plan of Arrangement

- True North will subscribe for 10 redeemable retractable preferred shares of True North GP;

- True North and NPR will pay, as a special distribution on their Ordinary Units, the amount of any undistributed taxable income for their taxation years that will be deemed to end under s. 132.2;

- each Dissenting Units will be transferred to True North for a debt claim to be paid fair value;

- the conversion price for True North convertible debentures will be amended;

- the limited partnership agreement of each of the True North Partnerships will be amended to create the Redeemable Units, each of which will be redeemable for 0.3908 NPR Ordinary Units ;

- the holders of True North Partnerships Class B Units will exchange their Units for either (i) 0.3908 NPR Ordinary Units for each True North Partnerships Class B Unit; or (ii) (if so elected in the case of non-U.S. residents) Redeemable Units of the applicable True North Partnership;

- True North will transfer all its property to NPR in exchange for NPR Ordinary Units and the assumption by NPR of certain obligations;

- True North Special Voting Units will be redeemed and NPR will issue NPR Special Voting Units to holders of True North Partnerships Class B Units;

- True North will redeem each outstanding True North Ordinary Unit in exchange for 0.3908 NPR Ordinary Units;

- the True North Deferred Units, RURs; and Unit Options will be redeemed;

- Red-Starlight LP will transfer the real property interests of the Red-Starlight LP portion of the Starlight Portfolio to New1 LP (as well as shares of a (nominee?) subsidiary to a new Ontario LP ("New1 LP") and New1 LP will issue to Red-Starlight LP 194,896 Class B limited partnership units of New1 LP and a non-interest bearing demand promissory note having a principal amount of $10,711,533 (the "Red LP Note");

- NPR shall subscribe for 194,896 Class A limited partnership units of New1 LP and New1 LP shall repay the Red LP Note;

- after the acquisition of various nominee corporations by a new Ontario LP ("New2 LP), D. D. Acquisitions Partnership will transfer the real property interests of the D.D. Acquisitions Partnership portion of the Starlight Portfolio to New2 LP and New2 LP willl: (i) assume $16,307,372 in debt, (ii) issue to D.D. Acquisitions Partnership 684,157 Class B limited partnership units of New2 LP, and (iii) issue to D.D. Acquisitions Partnership a non-interest bearing demand promissory note having a principal amount of $58,036,472 (the "New DDA Note");

- NPR will subscribe for 684,157 Class A limited partnership units of New2 LP and New2 LP will repay the New DDA Note;

- similar transactions to 12 to 15 above will be engaged in to acquire the IMH portfolio; and

- True North will be formally dissolved.

Canadian tax consequences

S. 132.2 exchange. Provided True North and NPR file the election under section 132.2 of the Tax Act as described above, the Contemplated Transactions will constitute a ''qualifying exchange." True North and NPR have indicated their mutual intention that the amount of taxable gains on the asset transfer to NPR will be reduced to the greatest degree possible and it is currently the view of management that True North should not realize any net income (including taxable capital gains) as a result of such transfer. Accordingly, NPR will generally be deemed under section 132.2 of the Tax Act to acquire True North's assets at a cost that is expected to be materially lower than the fair market value of the True North assets so acquired. The cost of the assets held by True North's Subsidiaries which will be indirectly acquired by NPR under the Plan of Arrangement will generally not be affected.

S. 97(2) exchange

Holders of True North Partnerships Class B Units who exchange their Units for Redeemable Units of the applicable partnership and who jointly elect under s. 97(2) will be considered to have disposed of their units for an elected amount which complies with s. 97(2). An electing Unitholder must provide the election form with the necessary information within 90 days of the Effective Date.

Fiscal year end changes

NPR and True North are seeking CRA approval to change the fiscal and taxation year end of certain Subsidiaries (which includes NPR LP and the True North Partnerships) in order to ensure that substantially all of the income and net taxable capital gains earned by such Subsidiaries up to and including the Effective Date of the Arrangement will be allocated to NPR Unitholders and to holders of NPR Class B LP Units, or to True North Unitholders and True North Class B LP Unitholders, as the case may be.

REIT exception for NPR

Based on a review of NPR's assets and revenues, including the assets to be acquired by NPR as a consequence of the Contemplated Transactions and the revenues expected to be derived therefrom, management expects that NPR will satisfy the tests to qualify for the REIT Exception for its taxation year that will be deemed to end as a result of the consummation of the Contemplated Transactions and for its taxation year that will be deemed to begin immediately after such year-end, in each case both under the REIT Exception. In addition, management of NPR intends to conduct the affairs of NPR so that NPR will continue to qualify for the REIT Exception at all future times….

NorthWest Healthcare/NWI

Overview

NWI (see summary) will be merged into NWH under s. 132.2, with the former NWI unitholders receiving 0.208 NWH units for each NWI unit. The affiliated entities holding a 65% economic interest in NWI will exchange their exchangeable units under ITA s. 97(2) in a subsidiary LP of NWI for units which are redeemable for NWH units.

NWI

A TSXV-listed Ontario unit trust holding all the Class A LP units of an Ontario LP ("NWI LP") which, in turn indirectly holds a portfolio of medical office buildings, hospitals and other real estate in the healthcare industry in Australia and New Zealand, Germany, Brazil and (through NWH, as described below) Canada. NorthWest Value Partners Inc. directly or through affiliates ("NWVP") has a 65% interest in NWI through the holding of 27.6% (i.e., 24M) of the NWI units (as well as holding special voting units) and the holding of all of the (exchangeable) Class B LP units of NWI LP (92.3M units).

NWH

A TSXV-listed Ontario units trust with 39M units outstanding and holding assets through an Ontario LP ("NWH LP"). NorthWest Operating Trust, an indirect subsidiary unit trust of NWI held 4.35M NWH units and 7.552M units of NWH LP representing a 16.5% interest therein.

NWI AM

. NWI Asset Management Inc., an Alberta corporation (presumably, an affiliate of NWVP).

Proposed transactions

Under an Alberta Plan of Arrangement:

- NWI LP will subscribe $100 for 10 preferred shares of NWI AM.

- NWH LP will make a distribution of partnership capital to NWH and in payment thereof issue to NWH a demand promissory note having a principal amount equal to the fair market value of the NWH units held by NWI LP.

- NWH will redeem the NWH units held by NWI LP and in satisfaction thereof deliver the note in 2 above to NWI LP.

- NorthWest Operating Trust will make payable to its beneficiaries its taxable income for the taxation year ending immediately before step 11 below net of prior s. 104(6) deductions and tax attributes, with such distribution to be satisfied if there is insufficient cash through the issuance of additional units.

- Each of NWH and NWI will make payable to its beneficiaries its taxable income for the taxation year deemed to end by ITA s. 132.2(3)(b) net of prior s. 104(6) deductions and tax attributes, with such distribution to be satisfied if there is insufficient cash through the issuance of additional units.

- Units of dissenting unitholders will be transferred to NWI.

- Rights under the NWH unitholders' rights plan will be redeemed.

- The NWI LPA will be amended to create a new class of LP units (the "Redeemable Units") that will be redeemable at the option of the holder for a number of NWH units based on the exchange ratio.

- The holder of the NWI Class B LP units will exchange their units for Redeemable Units on a one-for-one basis under s. 97(2).

- NWVP and any of its affiliates holding "NWI Rights" (board appointment, pre-emptive and other specified contractual rights) will transfer them to NWH in exchange for similar "NWH Rights."

- NWH will acquire all of the assets of NWI in consideration for NWH units and the assumption of outstanding debentures of NWI, which will become convertible into NWH units.

- NWH will subscribe in cash for one NWI unit.

- NWI deferred units will be exchanged for NWH deferred units in accordance with ITA s. 7(1.4).

- NWI will redeem each NWI unit (other than the one unit is step 12 above) in consideration for 0.208 of an NWH unit (with fractions rounded down).

- NWI will redeem each NWI special voting unit in consideration for 0.208 of an NWH special voting unit (with fractions rounded down).

- All of the issued and outstanding common shares of NWI AM will be transferred by NWI LP to Healthcare Properties LP, a Manitoba limited partnership.

Canadian tax consequences

S. 132.2 merger. Provided that a joint s. 132.2 election is made on a timely basis, there should be no resulting net income to NWI or tax liability to its unitholders as a result of the transaction, which will constitute a qualifying exchange – except that the transfer may be organized to realize income in NWI equal to unused attributes.

SIFT rules

NWH expects to qualify for the REIT exception, although it is noted that it is acquiring a non-controlling interest in some entities under the transaction. NWH LP and NWI LP are expected to qualify as excluded subsidiary entities.

FTCG rules

No assurance is given respecting the Foreign Tax Credit Generator rules.

AOC/year ends

Upon completion of the Arrangement, NWVP is expected to own approximately 34% of NWH, so the Arrangement is not expected to result in an acquisition of control of NWH. NWI and NWH are seeking CRA approval to change the fiscal year ends of certain respective subsidiaries in order to ensure that substantially all their income earned up to the effective date will be allocated to the respective NWI and NWH unitholders.

Slate Retail/SUSO 3

Overview

SUSO 3 will be merged into the REIT under s. 132.2, with the former SUSO 3 unitholders receiving 7.5M Class U Units of the REIT and with U.S. holders of 207K exchangeable Class B units of its indirect Delaware holding partnership (Slate U.S. Opportunity (No. 3) Holdings L.P.) receiving exchangeable LP units of the corresponding Delaware holding LP for the REIT or its subsidiary Delaware LP. The number of units so received in each case is subject to a potential working capital adjustment. The number of class U units received will correspond to the relative net subscription prices for the various SUSO 3 units issued at the time of its September 2013 IPO. The REIT and LP units to be issued collectively represent approximately 30.72% of the outstanding REIT Units before the transaction on a non-diluted basis but including the outstanding Class B LP2 units (being exchangeable units in an indirect REIT LP.)

SUSO 3

An unlisted mutual fund trust holding a portfolio of U.S. grocery-anchored retail rental properties through an Ontario LP which, in turn, holds a Delaware holding LP (Slate U.S. Opportunity (No. 3) Holdings L.P.).

SLAM

. Slate Asset Management, the Toronto-based manager of SUSO 3 and the REIT.

Slate Retail Unit Classes

The Class A Units of the REIT were offered in Canadian dollars solely for the convenience of Unitholders wishing to pay the subscription price in Canadian dollars and receive distributions in Canadian dollars representing the equivalent of the U.S. dollar distributions on the other units. The Class U and Class I Units were offered in U.S. dollars and distributions paid in U.S. dollars. Class A and Class U Units were offered through a public offering, while Class I Units were offered through a private placement. Rights and characteristics of each Class I Unit are identical to those for each Class A Unit and Class U Unit, except that each Class I Unit was not required to pay agents' fees. Only the Class U units are listed on the TSX.

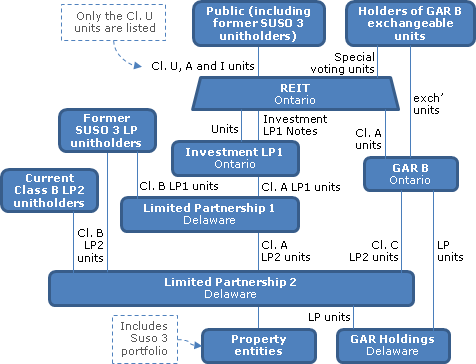

Current REIT structure

The REIT holds notes and units of an Ontario LP ("Investment LP1") which is a foreign corporation for Code purposes, which holds all the units (Class A LP1 Units") of a Delaware LP ("Limited Partnership 1"), which hold units ("Class A LP2 Units") of another Delaware LP ("Limited Partnership 2"). Some U.S. unitholders hold exchangeable units of Limited Partnership 2 ("Class B LP2 Units"). Unitholders of an Ontario LP ("GAR B") hold GAR B Exchangeable Units. GAR B holds LP Units of GAR Holdings (a Delaware LP directly or indirectly holding retail properties) and Class C LP2 Units of Limited Partnership 2. Each Class C LP2 Unit, taken together with the units of GAR Holdings held by GAR B, will, in all material respects, be economically equivalent to ownership of Class U Units of the REIT, subject to adjustment in respect of U.S. corporate income taxes paid by REIT and/or certain subsidiaries of the REIT.

Proposed transactions

In connection with the implementation of the Transaction:

- SUSO 3 will acquire the shares of the GP of its immediate Ontario subsidiary LP from SLAM.

- SUSO 3 will distribute any remaining cash as a distribution of taxable income or capital as determined by it.

- Any remaining taxable income of SUSO 3 for its deemed s. 132.2(3)(b) year end will be paid through the issuance, at least one business day prior to closing, of Vendor Units of the appropriate class.

- The Vendor will amend its Declaration of Trust to accommodate the redemption of the Vendor Units.

- SUSO 3 will arrange for the transfer of the LP interest in the SUSO 3 GP from the current holders thereof to an affiliate of the REIT in consideration for Class B Units of Limited Partnership 1 or 2 and agree to file any elections which could cause this to occur on a tax deferred basis.

- The REIT will acquire all of the assets of SUSO 3 in consideration for Class U units.

- SUSO 3 will redeem all SUSO 3 Units (except for any SUSO 3 Units acquired by the REIT) by delivering Class U units to SUSO 3 Unitholders.

- A reorganization will rationalize the resulting structure.

The number of units to be issued by the REIT and Limited Partnership 1 will be adjusted based on any changes in SUSO 3 working capital five days before closing as compared to the current estimate.

Canadian tax consequences

S. 132.2 merger. Provided that a joint s. 132.2 election is made on a timely basis, there should be no resulting net income to SUSO 3 or tax liability to its unitholders as a result of the transaction, which will constitute a qualifying exchange.

SIFT rules

The REIT and its subsidiary partnerships currently do not own any non-portfolio properties.

FTCG rules

No assurance is given respecting the Foreign Tax Credit Generator rules.

U.S. tax consequences

ECI taxation. The REIT, Investment LP1 and GAR B have elected to be corporations under the Code and they each will be considered to have a permanent establishment in the U.S. Accordingly, Investment LP1 and GAR B (as foreign corporations) will be subject to U.S. corporate income taxation on the net rental income which they derive (through subsidiary Holdings LP) from a U.S. trade or business and on gains from the sale of U.S. real properties that are allocable to them or on the sale of subsidiary investments. Income or gains of subsidiary LPs allocable to them generally will be subject under Code s. 1446 to withholding at a 35% rate, which generally will also apply in lieu of any FIRPTA withholding requirements, with such withholding being allowed as a credit on their U.S. federal income tax returns. Investment LP and GAR B also will be liable for a 5% branch profits tax (subject to the $500,000 Treaty exemption) on their after-tax earnings.

Interest

The REIT and Investment LP1 intend to treat the Investment LP1 Notes held by the REIT as debt. The earnings stripping rules (Code s. 163(j)) may apply. Interest received by the REIT on the Investment LP1 Notes will be subject to 0% withholding by virtue of the Canada-U.S. Treaty.

Slate Retail/ SUSO 2/GAR

Overview

SUSO 2 will be merged into SUSO 1 under s. 132.2. SUSO 1 will also acquire two of the GAR LPs (GAR A and C), with the GAR A and C unitholders receiving, at their option, units of SUSO 1 or exchangeable units of a subsidiary Delaware LP. A more complex exchangeable units structure will govern the acquisition of a third GAR partnership (GAR B), which will give unitholders who remain unitholders of GAR B the economic equivalence of ownership of SUSO 1 Units. The relative equity values going into the transaction are estimated to be SUSO 1 (38.2%), SUSO 2 (47.5%) and GAR (14.3%). The "Combination Transaction" is conditional on the SUSO 1 class U units (referred to as Class U Units of the "REIT" once the Combination Transaction is completed) being approved for listing on the TSX.

SUSO 1 and SUSO 2

Separate unlisted mutual fund trusts, each holding a portfolio of U.S. grocery-anchored retail rental properties through an Ontario LP which, in turn, holds a Delaware holding LP.

GAR

LPs which raised equity by private placement to invest in U.S. anchored retail properties.

SUSO 1 Unit Classes

The Class A Units of SUSO 1 were offered in Canadian dollars solely for the convenience of Unitholders wishing to pay the subscription price in Canadian dollars and receive distributions in Canadian dollars representing the equivalent of the U.S. dollar distributions on the other units. The Class U and Class I Units were offered in U.S. dollars and distributions paid in U.S. dollars. Class A and Class U Units were offered through a public offering, while Class I Units were offered through a private placement. Rights and characteristics of each Class I Unit are identical to those for each Class A Unit and Class U Unit, except that each Class I Unit was not required to pay agents' fees.

Resulting structure

The resulting "REIT" will hold notes and units ("Investment LP1 Units") of an Ontario LP ("Investment LP1") which is a foreign corporation for Code purposes, which will hold all the units (Class A LP1 Units") of a Delaware LP ("Limited Partnership 1"), which will hold units ("Class A LP2 Units") of another Delaware LP ("Limited Partnership 2"). Some of the former GAR A and GAR C unitholders will hold exchangeable units of Limited Partnership 2 ("Class B LP2 Units").

GAR B structure

The unitholders of GAR B will hold GAR B Exchangeable Units. GAR B will hold LP Units of GAR Holdings (a Delaware LP directly or indirectly holding retail properties) and Class C LP2 Units of Limited Partnership 2. "Each Class C LP2 Unit, taken together with the units of GAR Holdings held by GAR B, will, in all material respects, be economically equivalent to ownership of Class U Units, subject to adjustment in respect of U.S. corporate income taxes paid by REIT and/or certain subsidiaries of the REIT." "GAR B also will be authorized to issue class A limited partnership units, which generally will be issued to the REIT in connection with a redemption of GAR B Exchangeable Units." The holders of GAR B Exchangeable Units will have the right to cause GAR B to redeem all or a portion of such GAR B Exchangeable Units for Class U Units (of the REIT) or cash, at the option of the GAR B general partner.

Proposed transactions

In connection with the implementation of the Combination Transaction:

- The SUSO 1 declaration of trust will be amended to make the SUSO 1 class I units convertible into SUSO 1 class U units (a.k.a., Class U Units) and to rename SUSO 1 as Slate Retail REIT (the "REIT").

- The SUSO 2 declaration of trust will be amended to add a right of SUSO 2 to redeem SUSO 2 Units by delivering SUSO 1 class U units.

- SUSO 1 will acquire all of the assets of SUSO 2 in consideration for SUSO 1 class U units.

- SUSO 2 will redeem all SUSO 2 Units (except for any SUSO 2 Units acquired by SUSO 1) by delivering SUSO 1 class U units to SUSO 2 Unitholders.

- In consideration for their units of GAR A or GAR C, the limited partners of such partnerships will receive, at their election, either SUSO 1 class U units or Class B LP2 Units.

- The unitholders of GAR B may exchange their units for SUSO 1 class U units or GAR B Exchangeable Units, and will be issued one Special Voting Unit (of the REIT) for each GAR B Exchangeable Unit held. Each GAR B Exchangeable Unit will be redeemable for one Class U Unit or cash, as determined by GAR B.

- The indirect holders of the general partner interests of Holding LP1 (the principal holding subsidiary of SUSO 1), Holding LP2 (the principal holding subsidiary of SUSO 2) and GAR Holdings (the principal holding subsidiary of GAR) will transfer their interests to Limited Partnership 2 in consideration for Class B LP2 Units, thereby resulting in a crystallization of the general partner interests.

- The SUSO entities and GAR will effect a reorganization to rationalize the resulting structure.

The Combination Transaction will be effected based on the relative values of the Holding Partnerships, as compared to the total value of the REIT.

Canadian tax consequences

Conversions It is unclear if the conversion of SUSO 1 class A or class I Units into Class U Units would be a disposition.

S. 132.2 merger

Provided that a joint s. 132.2 election is made on a timely basis, there should be no resulting net income to SUSO 2 or tax liability to its unitholders as a result of the Combination Transaction, which will constitute a qualifying exchange.

FTCG rules

No assurance is given respecting the Foreign Tax Credit Generator rules.

U.S. tax consequences

ECI taxation. The REIT, Investment LP1 and GAR B will elect to be corporations under the Code and they each will be considered to have a permanent establishment in the U.S. Accordingly, Investment LP1 and GAR B (as foreign corporations) will be subject to U.S. corporate income taxation on the net rental income which they derive (through subsidiary Holdings LP) from a U.S. trade or business and on gains from the sale of U.S. real properties that are allocable to them or on the sale of subsidiary investments. Income or gains of subsidiary LPs allocable to them generally will be subject under Code s. 1446 to withholding at a 35% rate, which generally will also apply in lieu of any FIRPTA withholding requirements, with such withholding being allowed as a credit on their U.S. federal income tax returns. Investment LP and GAR B also will be liable for a 5% branch profits tax (subject to the $500,000 Treaty exemption) on their after-tax earnings.

Interest

The REIT and Investment LP1 intend to treat the Investment LP1 Notes held by the REIT as debt. The earnings stripping rules (Code s. 163(j)) may apply. Interest received by the REIT on the Investment LP1 Notes will be subject to 0% withholding by virtue of the Canada-U.S. Treaty.

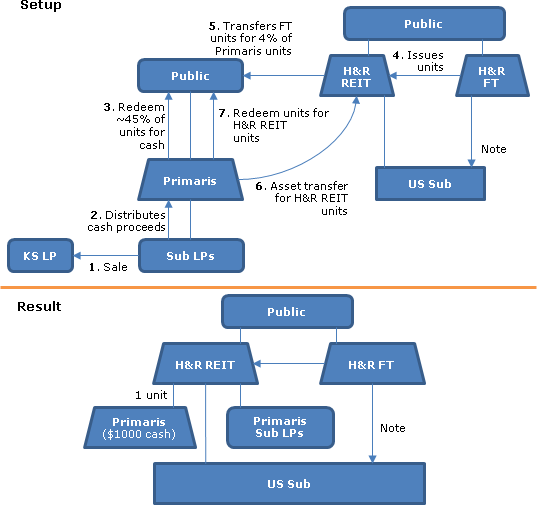

H&R/Primaris

Overview

Upon the sale of properties indirectly held by TSX-listed Primaris (having an aggregate value of approximately $1.9B) to the KingSett Consortium, unitholders of Primaris (who hold 98.486M units) will be given the option of having their units redeemed for cash consideration of $28.00 per units ($1.28B in the aggregate), or exchanging their units with H&R under an Alberta Plan of Arrangement on the basis of 1.166 stapled H&R units for each Primaris units in accordance with the ITA s. 132.2 merger rules (respecting the H&R REIT unit component of the stapled units). However, the cash and H&R stapled units consideration will be fixed in the aggregate, so that if all the Primaris unitholders elected to receive cash or elected to receive H&R stapled units, each would receive 0.642 H&R stapled units and $12.58 cash per Primaris unit.

H&R

H&R comprises H&R REIT and H&R Finance Trust. Their units trade on the TSX on a stapled basis (with the H&R Finance Trust unit estimated to represent less than 4% of the value of the stapled unit - p. 34). H&R Finance Trust holds a US$162.5M interest-bearing note receivable of a US subsidiary of H&R REIT.

KingSett Consortium

The KingSett Consortium comprises (i) KS Acquisition II LP (an LP whose LP interests are owned equally by a KingSett Capital Inc. affiliate and an Ontario Pension Board affiliate ("OPB Trust"), (ii) RioCan Real Estate Investment Trust ("RioCan"), (iii) Kingsett Canadian Real Estate Income Fund LP ("CREIF LP"), (iv) Kingsett Real Estate Growth LP No. 4 ("KS LP No. 4") and (v) OPB Trust.

Preliminary transactions

Options granted by Primaris pursuant to its equity incentive plan, including unvested options, may be surrendered (at the option of the holders) to Primaris for their in-the-money value (based on the five-day Primaris unit VWAP ending on the third business day prior to the Effective Date of the Plan of Arrangement. Exchangeable units of Primaris subsidiary LPs are to be exchanged for 2.122M Primaris units (subject to discussions to "to identify and, if applicable implement" transactions that are "more tax efficient."

Plan of Arrangement

Under the Plan of Arrangement

- All rights under the Primaris Unitholders Rights Plan will be cancelled

- The Primaris Declaration of Trust will be amended to provided that any taxable income arising to Primaris as a result of the sales to the KingSett Consortium (including income allocated to it by Primaris subsidiaries participating in such sales) will be allocated to Primaris unitholders (including dissenters) whose Primaris units are redeemed for cash as described below

- The sales to the KingSett Consortium will be completed

- Each Primaris trust subsidiary will allocate and make payable to its beneficiary its taxable income "for its taxation year ending immediately prior to the commencement of the steps set out [immediately below]; and each Primaris corporate subsidiary will increase the stated capital of its shares by such amount as is specified by it prior to the Effective Time" of the Plan of Arrangement

- Each Primaris subsidiary will distribute the cash proceeds arising directly or indirectly from the sales to the KingSett Consortium

- To the extent that the taxable income allocated, as described above, by a trust subsidiary, exceeds the distributed cash, it will satisfy its obligation to distributed such taxable income by issuing units

- The special voting units of Primaris will be redeemed for their paid-up amount

- H&R REIT, H&R Finance Trust and Primaris will pay special distributions of any amounts which are determined, prior to the Effective Time, to be equal to any taxable income arising under ITA s. 132.2 for their taxation years that are deemed to end under s. 132.2

- Units of dissenters will be transferred to Primaris in consideration for a Primaris debt claim equal to their fair value

- Primaris unitholders are required to elect to receive cash or H&R units by two busines days before the Primaris unitholders' meeting - failing which, they will be deemed to have elected for H&R units. The number of Primaris units in respect of which the holders will be entitled to receive cash redemption proceeds will be reduced (or increased) to the extent that Primaris otherwise would be obligated to pay aggregate cash redemption proceeds exceeding (or less than) $1,278,443,575. The Primaris units which (on this basis) have an entitlement to receive cash redemption proceeds are redeemed for $28.00 cash per unit

- In the case of the other Primaris units (i.e., for which there is an entitlement to receive H&R units), the "FT Percentage" of each such unit (corresponding to the relative fair market value of a H&R Finance Trust relative to that of an H&R stapled unit - apparently under 4% per p. 34) will be transferred by such unitholder to H&R REIT in consideration for 1.166 H&R Finance Trust units (together with certain ancillary rights under certain plans)

- The conversion features of various Primaris convertible debentures will be amended respecting their conversion now into H&R stapled units

- Restricted units issued under the Primaris equity incentive plan will be transferred by the holders to Primaris in consideration for replacement units issued by H&R REIT

- As contemplated in ITA s. 132.2, Primaris will transfer its property (other than $1,000 of cash) to H&R REIT in consideration for (i) H&R REIT units equal to the number of Primaris units (including those held by H&R REIT, but excluding one "Designated Unit" held by H&R REIT), multiplied by 1.166, multiplied by the inverse of the FT Percentage, and (ii) the assumption by H&R REIT of liabilities including the Primaris convertible debentures

- Also as contemplated in ITA s. 132.2, Primaris will then redeem all its units (other than the Designated Unit) by distributing its H&R REIT units (with the H&R REIT units so distributed to H&R REIT being cancelled by H&R REIT)

- Options granted by Primaris pursuant to its equity incentive plan will be surrendered for consideration consisting solely of replacement H&R REIT options in accordance with s. 7(1.4)

- "Separately, and not as consideration arising in connection with the exchange referred to in the immediately preceding step," each holder of a replacement H&R REIT option will be granted by H&R REIT a corresponding option to acquire an equivalent number of H&R Finance Trust units at an exercise price equal to the fair market value of such H&R Finance Trust units at the time of exercise

Break fee

$100M ($70M to H&R REIT and $30M to H&R REIT (U.S.) Holdings Inc. - but with a right of KS Acquisition II LP to receive 41.36% under a cooperation agreement.

Securities law matters

H&R will apply to local provincial regulators for exemptive relief respecting the distribution of stapled units pursuant to the exercise of various convertible securities. The H&R stapled units will be issued under the Plan of Arrangement in reliance on the s. 3(a)(10) exemption.

Canadian tax consequences

Sale transactions. Primaris will include in its income substantially all of the income (including recapture of depreciation) and net taxable capital gains arising from the sales to the KingSett Consortium. Such income will be allocated to the Primaris unitholders receiving the cash redemption proceeds, and to the dissenting unitholders.

S. 132.2 merger

The transfer of the Primaris assets to H&R REIT will be part of a qualifying exchange, so that it can occur on a rollover basis or, alternatively, at an elected gain to utilize any deductions available to Primaris.

Special distribution

If Primaris determines that its undistributed taxable income for its short taxation year arising under s. 132.2 (determined without regard to the sales to the KingSett Consortium) exceeds prior distributions in that period, Primaris will make an advance special distribution to distribute such taxable income.

Allocation of sale income, and access to CCA deduction

CRA approval is being sought to change the taxation year end of certain Primaris subsidiaries so as to end immediately before the sales transactions, so as to ensure that substantially all the income and net taxable capital gains earned by such subsidiaries up to the Effective Date (but ignoring the sales transactions) will be allocated to the Primaris unitholders who receive the special distribution, and so that the income and net taxable capital transactions arising from the sales transactions will be allocated to the Primaris unitholders whose units are redeemed for cash. Such year end change would also permit capital cost allowance claims on the sold assets.

If such CRA approval is not obtained by March 25, 2013, then the transactions in the Plan of Arrangement will be amended inter alia so that all the Primaris units will be exchanged for H&R Finance Trust units as described above, the balance of Primaris units will be exchanged for H&R REIT units under the s. 132.2 merger procedure also described above, and only then will the sale to the KingSett Consortium close, with the cash proceeds being use to redeem the H&R units of those whose units are to be redeemed for cash (p. 45).

Cash redemption

A resident unitholder whose units are redeemed for cash will be required to include in income the portion of the redemption proceeds which is taxable income (including recapture of depreciation – not expected to exceed $3.01 per redeemed unit) arising from the sales transactions. The unitholder's proceeds of disposition will not include the income and taxable capital gains so allocated to the unitholder and the non-taxable portion of such capital gains (assuming s. 104(21) designations are made).

Exchange of FT Percentage of Primaris units for

H&R Finance Trust units. Occurs on taxable basis – fmv cost for H&R Finance Trust units. The ancillary rights received are considered to have a nil fmv.

H&R REIT and H&R Finance Trust status

H&R REIT currently is an open-end (s. 108(2)(a)) unit trust, but "it is expected" that it will cease to so qualify if it completes an offering of preferred units. However, based in part on a CRA opinion, it is expected to qualify as a closed-end (s. 108(2)(b)) unit trust on such conversion.

H&R REIT is intended to be managed so that it qualifies as a REIT. H&R REIT has represented in the amended Arrangement Agreement that H&R Finance Trust is not a SIFT trust based on it not carrying on a business in Canada (and that H&R REIT's various subsidiaries are excluded subsidiary entities.) The stapled security proposals will not have a material adverse effect.

Non-resident consequences of cash redemption of Primaris units

Part XIII tax will apply to the portion of the cash redemption proceeds that represents a distribution of recapture of depreciation (or other ordinary income) or distributions out of the Primaris TCP gains balance (assuming that the 5% distribution-measured ownership threshold in s. 132(5.2) is exceeded). The balance of the redemption proceeds will be subject to Part XIII.2 withholding where the Primaris units are not taxable Canadian property.

Redemption of Non-residents' units for H&R REIT units

Part XIII.2 tax will not apply to the distribution of H&R REIT units on the s. 132.2 merger transaction.

Primaris unit market sales

A non-resident generally will not be subject to capital gains tax on a TSX sale of Primaris units "with a settlement date that is prior to the Effective Date."

US tax consequences

Characterization. Assuming that the stapled units are viewed as comprising separate financial instruments and that H&R Finance Trust qualifies as a fixed investment trust, a H&R Finance Trust unit will be treated as direct ownership in the underlying assets, so that the portfolio interest exemption potentially is available. If H&R Finance Trust were instead treated as a partnership or corporation, this could reduce interest deductions under Code s. 163(j). If the notes held by H&R Finance Trust were successfully recharacterized as equity, such notes would generally be treated as US real property interests.

Exchange

The exchange by US holders of their Primaris units for units of H&R REIT and H&R Finance Trust and cash will occur on a non-rollover basis.

PFIC rules

Primaris does not believe it currently is a PFIC. H&R REIT expects to be a PFIC for the current year, and likely will be a PFIC for subsequent years. Discussion of Code s. 1291 rules, and QEF and mark-to-market elections.

Dundee/Whiterock

Tender

Offer of Dundee REIT to acquire all the units of Whiterock REIT for $16.25 cash per Whiterock unit (subject to an aggregate cap of $360 million) or the issuance of units of Dundee REIT. Whiterock unitholders can tender their units in exchange for Dundee units on a taxable basis, or receive Dundee units on a rollover basis pursuant to draft s. 132.2(3)(g). Dundee does not take up the Whiterock units under its bid until if has received approval for the subsequent "Acquisition" transaction described below - with its offer containing a proxy to approve the Acquisition that can be checked off both by tendering and non-tendering unitholders.

S. 132.2 merger

Immediately after the take-up of the tendered units, Whiterock REIT transfers its assets into a limited partnership on a rollover basis, transfers its interest in the partnership to Dundee REIT in consideration for Dundee REIT units, the assumption of convertible debenture obligations and some cash and then (following a consolidation of its units to align with the number of Dundee REIT units held by it) distributes those Dundee units to its unitholders in redemption of the units of Whiterock. However, Whiterock unitholders who are non-residents of Canada instead receive cash proceeds of sale (net of withholding tax) of "their" share of the Dundee units.

Canadian tax consequences

Tax disclosure of consequences of taxable sale of Whiterock units or of participating in s. 132.2 merger transaction.

CAP REIT/ResREIT

Overview