Subsection 215(1) - Withholding and remittance of tax

See Also

Curragh Inc. v. The Queen, 94 DTC 1894 (TCC)

There was no written assignment or other convincing evidence that a loan that an Australian corporation ("Giant") had made to the taxpayer had been assigned by Giant to its Canadian subsidiary ("922"). Furthermore, the taxpayer was unsuccessful in its submission that because 922 was liable for withholding tax under s. 215(3), the taxpayer should be considered to be relieved of liability under s. 215(1). Mogan TCJ. stated (p. 1899) that:

"... when the initial Canadian payor knows that he is paying an agent resident in Canada acting on behalf of a non-resident principal ... the initial Canadian payor and the agent are jointly liable under subsections (1), (3) and (6) of section 215."

He also stated (p. 1899) that:

"It seems to me that the liability imposed by subsection 215(6) is dependent upon the knowledge of the payor but I am not required to decide that precise issue on the facts herein."

Nestle Enterprises Ltd. v. MNR, 92 DTC 1001 (TCC)

On January 17, 1989 the taxpayer withheld $535,579 of tax on a payment to a non-resident. On February 14, 1989 it mailed a cheque for that sum to the Receiver General, and on February 20, 1989 the cheque was received in Ottawa. In finding that the taxpayer was subject to the 10% penalty under s. 227(9) for failure to "forthwith remit" the withholding tax, Brulé J. stated (p. 1003):

"'Remit' means the receipt by the Receiver General of the tax. 'Forthwith' means as soon as possible, given the circumstances of the Appellant. No circumstances emerged as to why it was only remitted thirty-four days later."

Administrative Policy

IT-494 "Hire of Ships and Aircraft from Non-Residents"

Where rent for the use of a ship is paid in advance, so that the actual time spent in Canada has not yet been established, it is acceptable to base the amount withheld on reasonable estimates drawn up from proposed itineraries, and for any resulting excesses or defiencies to be made up out of subsequent rental payments to the non-resident owner of the ship.

IC 77-16R3 "Non-Resident Income Tax"

IC 76-12R4

"The payor can accept the name and address of the payee as being that of the beneficial owner unless there is reasonable cause to suspect otherwise".

Forms

NR7-R "Application for Refund of Part XIII Tax Withheld"

Subsection 215(2) - Idem [Exception - corporate immigration]

See Also

Havlik Enterprises Ltd. v. MNR, 89 DTC 159 (TCC)

Rip, J. stated, obiter, that "the words 'or otherwise' in subsection 215(2) provide that an agent or other person who pays or credits an amount on behalf of the debtor in a manner other than by redemption is to withhold or deduct tax and if he fails to do so, subsection 215(2) makes him liable to pay the tax he has not withheld or deducted."

Administrative Policy

IC-12R4 "Applicable Rate of Part XIII Tax on Amounts Paid or Credited to Persons in Treaty Countries" under "Beneficial Ownership"

Discussion of circumstances in which the payor can accept the name and address of the payee as being that of the beneficial owner.

Subsection 215(3) - Idem [Exception - corporate immigration]

Cases

Chilcott v. The Queen, 78 DTC 6111, [1978] CTC 152 (FCTD)

S.215(3) applied to a lawyer ("Chilcott") who placed funds of a non-resident client in the name of "W.D. Chilcott, in trust" and who was treated by the bank as being the non-resident's agent.

See Also

Curragh Inc. v. The Queen, 94 DTC 1894 (TCC)

There was no written assignment or other convincing evidence that a loan that an Australian corporation ("Giant") had made to the taxpayer had been assigned by Giant to its Canadian subsidiary ("922"). Furthermore, the taxpayer was unsuccessful in its submission that because 922 was liable for withholding tax under s. 215(3), the taxpayer should be considered to be relieved of liability under s. 215(1). Mogan TCJ. stated (p. 1899) that:

"... when the initial Canadian payor knows that he is paying an agent resident in Canada acting on behalf of a non-resident principal ... the initial Canadian payor and the agent are jointly liable under subsections (1), (3) and (6) of section 215."

He also stated (p. 1899) that:

"It seems to me that the liability imposed by subsection 215(6) is dependent upon the knowledge of the payor but I am not required to decide that precise issue on the facts herein."

Subsection 215(6) - Liability for tax

Cases

Cardinal Meat Specialists Ltd. v. Devereux, 92 DTC 6357 (Ont CA)

The respondent, which failed to withhold income tax on a payment to the appellant, was entitled under s. 215(6) to recover from the respondent the amounts of income tax which it paid on her behalf.

See Also

Solomon v. The Queen, 2007 DTC 1715, 2007 TCC 654

After noting that the University of Waterloo and Human Resources and Development Canada had failed to withhold Part XIII tax on pension income and Canada Pension Plan and Old Age Security payments made to the taxpayer, Miller J. stated (at para. 9):

"Subsection 215(6) does not shift a tax burden to the University of Waterloo and the HRDC. The University of Waterloo and the HRDC are liable for the tax they failed to deduct; however, this does not aid Mr. Soloman as both entities can recover the taxes from him."

Havlik Enterprises Ltd. v. MNR, 89 DTC 159 (TCC)

Sales contracts which the Canadian taxpayer ("Havlik") entered into with a Chinese supplier required Havlik to obtain irrevocable letters of credit in favour of the seller. When a particular letter of credit was due, the bank would draw the face amount of the letter of credit from Havlik's account and make payment to the supplier.

It was held that a failure of the bank to withhold from payments made under amended versions of the letters of credit in respect of interest gave rise to liability to Havlik because under s. 215(6), the debtor and the person who paid or credited an amount on behalf of the debtor are jointly liable.

Administrative Policy

2013 Ruling 2013-0488291R3 - Reorganization of Corporations - Rollover

Background

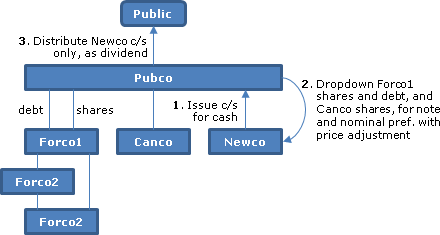

Pubco (a Canadian public company) wishes to spin-off Canco and Forco1 (a foreign affiliate) to its shareholders without incurring the expense of a plan of arrangement or holding a shareholders' meeting.

Proposed transactions

- Pubco will incorporate Newco (a taxable Canadian corporation) and subscribe for common shares.

- Pubco will transfer its shares of Canco and Forco1, and a loan owing by Forco1, to Newco mostly in consideration for interest-bearing notes of Newco - as well as the issuance of preferred shares with a nominal redemption amount and subject to a price adjustment clause. The agreed amount in s. 85(1) elections will be the fair market value of the transferred properties.

- Pubco will declare and pay a dividend-in-kind to its shareholders consisting of the Newco common shares.

- Pubco will lend cash to Newco for an interest-bearing note.

- "To facilitate the payment of the Part XIII tax associated with the dividend in kind, PUBCO will cause Newco to repurchase shares of its capital stock from the affected shareholder with a value equal to the amount of the withholding tax owing, which will then be remitted to the CRA."

Rulings

Include that s. 84(3) deemed dividends will arise in 5 based on any excess of the repurchased shares' fmv over their PUC.

16 November 2011 T.I. 2011-0419191E5

Where a foreign financial intermediary ("FFI") has represented to a Canadian financial institution ("CFI") that the beneficial owners of securities in a subaccount are eligible for a 0% rate of withholding based on Treaty exemptions and CFI later learns that there are Canadian beneficial owners in those accounts, CFI should withhold at a 25% rate as FFI has breached its undertaking to provide a replacement certificate which is accurate.