Subsection 212.1(1) - Non-arm’s length sales of shares by non-residents

See Also

Dairy Queen Canada Inc. v. The Queen, 95 DTC 634 (TCC)

Bell TCJ. found on the basis of the testimony of various executives that shares of a Canadian corporation ("OJC") were acquired by the taxpayer's U.S. payment as agent for the taxpayer. Accordingly, s. 212.1 did not apply when the shares of OJC subsequently were transferred into the name of the taxpayer.

Subsection 212.1(4) - Where section does not apply

Administrative Policy

2 December 2014 CTF Roundtable, Q. 4

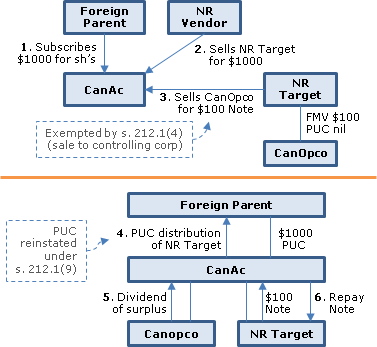

At the May 2013 IFA Conference, CRA indicated that the GAAR Committee had determined that GAAR applies to cases involving post-acquisition and non-acquisition cross-border PUC planning, but had not recently addressed pre-acquisition PUC planning. Has it considered pre-acquisition PUC planning more recently? Consider the following:

- Foreign Parent subscribes for shares of its wholly-owned Canadian acquisition company (CanAc) having full paid-up capital.

- CanAc acquires from an arm's length vendor the shares of a non-resident corporation (NR Target), which owns high value, low PUC shares of a Canadian operating corporation (CanOpco).

- NR Target sells the shares of CanOpco (which are not taxable Canadian property) to CanAc in consideration for a Note Receivable. S. 212.1 does not apply because of s. 212.1(4).

- CanAc distributes the shares of NR Target to Foreign Parent on a reduction of PUC (which has been restored under s. 212.3(9).)

- The surplus of CanOpco is distributed to CanAc as a dividend (deductible under s. 112(1).)

- CanAc then distributes the same amount outside Canada as a principal repayment on the Note Receivable.

CRA responded:

…GAAR indeed applies. The infusion of capital by Foreign Parent into CanAc and the arm's length acquisition of the shares of NR Target by CanAc do not mitigate the potential for the future payment of Part XIII tax by NR Target on the distribution of CanOpco surplus. The PUC of the shares of CanOpco held by NR Target remains low such that NR Target's access to CanOpco's surplus is reliant on CanOpco making dividend distributions to NR Target.

Subsection 212.1(1) is an anti-surplus stripping rule designed to prevent a non-resident corporation from avoiding Part XIII tax when extracting the corporate surplus of a corporation resident in Canada by way of a disposition of the shares of that corporation to a non-arm's length corporation resident in Canada….

Subsection 212.1(4) is intended to provide relief if there has been no corporate surplus stripped out of Canada and no increase in the ability to strip surplus tax-free out of Canada. …The sale of CanOpco shares to CanAc together with the subsequent transfer by CanAc of NR Target to Foreign Parent sidestep the provisions of subsection 212.1(1) resulting in the surplus of CanOpco being transferred offshore without payment of Part XIII tax by NR Target. It would be inappropriate for subsection 212.1(4) to operate to prevent a deemed dividend arising under [s. 212.1(1)]… in respect of a sale of shares that results in or enables the tax-free distribution of the corporate surplus of CanOpco. Therefore, … the application of subsection 212.1(4) in this case would defeat the objective of section 212.1… .

[O]ther transactions… carried out by the corporate group after the capitalization of CanAc by Foreign Parent and the acquisition by CanAc of the shares of NR Target as described in facts 1 and 2 above, to achieve the tax-free distribution of the surplus of CanOpco out of Canada…[also] would be viewed by the CRA as abusive… .

24 May 2013 IFA Roundtable Q. 4, 2013-0483771C6

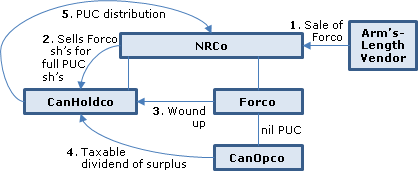

Consider these facts:

- NRCo owns Forco. Forco owns 100% of a Canadian operating subsidiary (CanOpco). The paid-up capital (PUC) of the shares of CanOpco is nominal.

- NRCo sets up a new Canadian company (CanHoldco), and CanHoldco acquires the shares of Forco for shares of CanHoldco. The PUC of the CanHoldco shares is equal to the FMV of the shares of Forco.

- Forco is wound up into CanHoldco, and the shares of CanOpco are transferred to CanHoldco. S. 212.1(1) does not apply on the transfer.

- CanOpco pays a taxable dividend to CanHoldco in an amount equal to its retained earnings. CanHoldco deducts the dividend from its taxable income under s. 112(1). CanHoldco pays the same amount to NRCo as a reduction of PUC.

What is CRA's position on whether GAAR will apply if the above planning is carried out:

- Pre-acquisition – i.e. NRCo injects equity into CanHoldco, and CanHoldco acquires Forco from an arm's length vendor (assume CanHoldco can't acquire CanOpco directly because NRCO also wishes to acquire Forco's other assets);

- Post-acquisition – i.e. NRCo acquires Forco from an arm's length vendor, then after a number of months transfers Forco to CanHoldco in exchange for shares of CanHoldco; and

- Non-acquisition – i.e. the NRCo, Forco, CanOpco structure has been in place since the inception of CanOpco's business activities, and NRCo transfers the shares of Forco to CanHoldco in exchange for shares of CanHoldco?

Response

: Given that in all three cases, a new Canadian corporation (CanHoldco) is "inserted" to establish cross-border PUC so as to enable surplus of CanOpco to be extracted from Canada, CRA would consider the application of GAAR in each case. CRA stated:

The GAAR Committee has determined that the GAAR applies to cases involving "Post-acquisition" and "Non-acquisition" planning as described above. The GAAR will apply to treat the return of PUC paid by CanHoldco to NRCo as a distribution of a taxable dividend subject to Part XIII withholding tax. The GAAR Committee has not recently addressed the "Pre-acquisition" tax planning case described above. ... If the acquisition of Forco by CanHoldco in all three scenarios occurred after March 28, 2012, section 212.3 would generally apply.

Articles

Angelo Nikolakikis, Alain Léonard, "The Acquisition of Canadian Corporations by Non-Residents: Canadian Income Tax Considerations Affecting Acquisition Strategies and Structure, Financing Issues, and Repatriation of Profits", 2005 Conference Report, c. 21, p. 21:8.

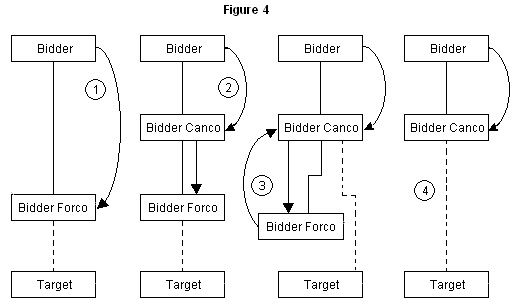

In step 1 of figure 4, Bidder transfers Target to Bidder Forco in exchange for a promissory note ("the Bidder Forco reorganization note") with a face amount equal to the fair market value (FMV) of Target. Section 212.1 does not apply because this is not a transfer of the shares of one corporation resident in Canada to another, and there is no gain from the disposition of the Target shares because they were just acquired in a taxable arm's-length transaction. 30 In step 2, Bidder transfers Bidder Forco shares and the Bidder Forco reorganization note to Bidder Canco in | exchange for Bidder Canco shares and a promissory note ("the Bidder Canco capital note") in an appropriate combination. Again, section 212.1 does not apply, because there is no transfer of the shares of one corporation resident in Canada to another, and there is no gain from the disposition of Bidder Forco shares or the Bidder Forco note because they were just acquired in a taxable transaction. In step 3, Bidder Forco transfers Target to Bidder Canco in exchange for a promissory note ("the Bidder Canco reorganization note") with a face amount equal to the FMV of Target. Section 212.1 does not apply because of subsection 212.1(4): the disposition of Target by Bidder Forco to Bidder Canco is "a disposition by a non-resident corporation of shares of a subject corporation to a purchaser corporation that immediately before the disposition controlled the non-resident corporation," and there is no gain from the disposition of the Target shares because they were just acquired in a taxable transaction. At this point, Bidder Canco holds Bidder Forco as well as the Bidder Forco reorganization note, and is indebted to Bidder Forco under the Bidder Canco reorganization note. Thus, in step 4, the Bidder Forco reorganization note is set off against the Bidder Canco reorganization note. Bidder Forco is then dissolved, such that Bidder Canco is left holding Target; the cross-border tax attributes (PUC and debt) have been increased to the amount of the fresh capital expended by Bidder in respect of the acquisition of Target.

It should also be possible for Target subsequently to be combined with Bidder Canco, although additional considerations will arise, including with respect to capital tax liability concerns (see the discussion below).

Vesely, Roberts, "Takeover Bids: Selected Tax, Corporate, and Securities Law Considerations", 1991 Conference Report, pp. 11:30-11:31

Discussion of technique for avoidance of s. 212.1 where a non-resident acquirer is making a bid for shares of a Canadian target.