Subsection 227(1.2)

Subsection 227(4) - Trust for moneys deducted

Cases

The Queen v. Royal Bank of Canada, 97 DTC 5089, [1997] 1 S.C.R. 411

A general security interest (and a charge under s. 427 of the Bank Act) in favour of the respondent represented a fixed and specific charge on the inventory of the debtor, thereby giving priority to the respondent over the statutory trust created under s. 227(4) with respect to subsequent failures to remit source deductions. Although the security interest of the respondent was limited by the licence accorded to the debtor to deal with inventory in the ordinary course of business, this limitation applied only to the extent that there was a sale of inventory and an application of proceeds to an obligation of a third party, and did not apply here, where there is no such sale of inventory in the ordinary course of business.

See Also

Aboriginal Federated Alliance Inc. v. The Queen, 2004 DTC 2701, 2004 TCC 336

The taxpayer withheld source deduction from employee remuneration but did not remit the source deductions in light of litigation in which it was asserted that the employees were exempt from taxation. O'Connor J. accepted the Minister's submission that the amounts held were deemed to be held in trust for payment to Her Majesty in accordance with the Act. The taxpayer was correctly assessed for the amounts withheld but not remitted.

Quebec (Dep. of Min. of Rev.) v. Nolair International Inc. (1999), 182 DLR (4th) 114 (SCC)

Source deductions which a Quebec employer had withheld from wages but not kept separate were not held subject to a deemed trust under the relevant Quebec legislation because, at the time of deduction, the provision did not yet contain the phrase "whether or not that amount has in fact been kept separate and apart from the debtor's own moneys or from assets of the estate".

Bhattacharjee v. Strong Western Holdings Ltd., [1993] GSTC 1 (BCSC)

Because a garnishment order could only have effect against monies that belong to the debtor, the court ordered that funds that had been seized pursuant to a garnishment order be paid over to the Receiver General to the extent of amounts that had been collected by the debtor on account of GST or deducted on account of employee source deductions. There was no requirement that such amounts have been kept separate and apart from other monies of the debtor.

Administrative Policy

28 January 2014 T.I. 2013-0506991E5 - Prescribed Security Interest

ACo extends a loan secured by a registered mortgage to the taxpayer, which then fails to remit source deductions, with the mortgage then going into default. Respecting a suggestion that "the term "obligation" refers only to the amount of the principal secured by the mortgage," CRA stated

[M]ortgages secure both the principal and interest owing on the debt. … Therefore, [under Reg. 2201(2)(b)] any payments of interest [as well as principal] made by the debtor after the Failure would be "on account of the obligation" and would so reduce it.

Subsection 227(4.1) - Extension of trust

Cases

Newcourt Financial Ltd. v. The Queen, 2006 DTC 6627, 2004 FCA 91

Before dismissing the appellant's appeal, the Court noted that s. 227(4.1) only gave the Crown the right to obtain proceeds from a property and did not alter the ownership of the property in question (here, the ownership of a skidder in respect of which the appellant had exercised its hypothecary rights.) under the applicable provincial law.

Attorney General of Canada v. National Bank of Canada, 2004 DTC 6527, 2004 FCA 92

The respondents, who seized and sold movable property secured by movable hypothecs, were required to comply with a demand made upon them to pay over amounts equal to the unpaid source deductions at the time of such sale given that they should be considered to be secured creditors rather than third party purchasers.

DaimlerChrysler Financial Services (Debis) Canada Inc. v. Mega Pets Ltd., 2003 DTC 5612 (BCCA)

The Appellant, who was the assignee of a conditional sales agreement for the sale of a vehicle to a purchaser ("Mega Pets") was entitled to priority over CCRA with respect to the sales proceeds received by CCRA on a sale of the vehicle after its seizure given that conditional sales agreements were not included in the definition of a security interest in s. 224 of the Act, and under the "but for" test in s. 227(4.1), the vehicle would never have become the property of Mega Pets if the sales agreement had not been entered into.

The Queen v. First Vancouver Finance, 2002 DTC 6998, 2002 SCC 49

The appellant ("First Vancouver") purchased accounts receivable from a tax debtor ("Great West") that was in arrears in remitting source deductions.

Requirements to pay that were issued under s. 224(1.2) by the Minister to the person owing the accounts receivable did not attach to the accounts receivable that had been purchased by First Vancouver. The s. 227(4.1) deemed trust was similar in principle to a floating charge over all the tax debtor's assets in favour of Her Majesty. Viewed in this way, property that came into possession of a tax debtor was caught by the trust and became subject to Her Majesty's interest and, similarly, property which the tax debtor disposed of was thereby released from the deemed trust (as occurred here)

Royal Bank of Canada v. Tuxedo Transport Ltd. (2000), 190 DLR (4th) 139 (BCCA)

The respondent was an assignee of a general security agreement which had been registered prior to a failure of the debtor ("Tuxedo") to remit source deductions. The Court reversed a finding of the chambers judge that only property existing at the time the trust under s. 227(4) is created is subject to the trust and that property of a taxpayer that comes into existence afterwards is not subject to the trust. Donald J.A. stated (at p. 145) that "the chambers judge's interpretation effectively adds words of limitation to 'property' confining that term to that which existed when the trust became operative".

Royal Bank of Canada v. Tuxedo Transport Ltd., 2000 DTC 6501 (BCCA)

The chambers judge concluded that the deemed trust arising in respect of a failure to make source deduction from August through November 1996 did not apply to property of the taxpayer that subsequently came into existence. The Court of Appeal overturned this finding, indicating (at p. 6504) that "beginning with the date the deductions are made, the trust continues forward in time and attaches to any property of the debtor as it comes into existence".

Administrative Policy

CBAO National Commodity Tax, Customs and Trade Section – 2014 GST/HST Questions for Revenue Canada, Q. 3

Can CRA collection agents apply ETA s. 222(3) (similar to ITA s. 227(4.1)) to pursue arm's length purchasers of the assets of a tax debtor? Before referring to the non-arm's length rule in ETA s.325 (similar to ITA s. 160), CRA stated:

[T]he deemed trust [under s. 222(3)] does not attach to any particular property. Rather, it is similar to a floating charge over all of the property of the person. Consequently, the person is free to sell or otherwise transfer property in the ordinary course of business. Where the person sells or transfers property, the deemed trust will detach from the property and attach to the proceeds of the sale or transfer.

2011 Roundtable Q. , 2011-0413081C6

"in broad terms, a deemed trust established under ITA ss. 227(4) and (4.1) ceases to apply to property of a tax debtor where the tax debtor disposes of the property in the normal course of business for FMV consideration to an arm's length bona fide purchaser."

Subsection 227(5) - Payments by trustees, etc.

Cases

The Queen v. Roll, 2001 DTC 5055, Docket: A-679-99 (FCA)

Given that the respondent had made payments of remuneration to employees as a bare trustee for the employer and that the decision to make payments of the net salaries of the employees was that of the principals of the employer alone, it followed that the respondent was not within the scope of s. 153(1), 153(1.3) or 227(5).

Linder v. Rutland Moving and Storage Ltd., [1991] 1 CTC 517 (BCCA)

A receiver was appointed to sell the defendant's Motor Carrier Commission licences by way of equitable execution.

Hollinrake J.A. found that the word "receivership" connotes "an intention to refer to all the assets of the person, and ... cannot be read to include the sale of one asset through equitable execution by a receiver".

Min. of Labour (Man.) v. The Queen in Right of Canada, 88 DTC 6514, [1988] 5 WWR 127 (Man QB), rev'd in part (1989), 59 DLR (4th) 34 (Man. C.A.) and (1989), 62 DLR (4th) 574 (Man. C.A.)

A statutory deemed trust created by s. 3(4) of the Payment of Wages Act (Manitoba), which provided that "every employer shall be deemed to hold the wages due or accruing due to an employee in trust for the employee ... whether or not the amount of the wages has been kept separate and apart by the employer" had priority over a s. 227(4) trust because it came into effect when the wages were due, whereas a s. 227(4) trust does not come into existence until an event of receivership.

B.C. (Govt.) v. Henfrey Samson Belair Ltd., [1987] 4 WWR 673 (BCCA), aff'd [1989] 2 S.C.R. 24

S.227(5) "created a trust fund which is artificial to the extent that trust moneys had been mixed with other assets of the deemed trustee. It obviates the necessity of tracing those funds in order to enforce the trust."

Dauphin Plains Credit Union Ltd. v. The Queen, 80 DTC 6123, [1980] CTC 247, [1980] 1 S.C.R. 1182

Since S.227(5) does not deem the amounts deducted to have been kept separate and apart, then if the amounts deducted are not kept separate they must be traceable as trust moneys in order to be recovered by the Crown.

See Also

Lewin v. The Queen, 2011 DTC 1354 [at 1979], 2011 TCC 476, aff'd 2013 DTC 5006 [at 5525], 2012 FCA 279 [but overridden by s. 214(3)(f)(i)(C)]

The taxpayer was a trustee for a family trust, which received a dividend in 2001 of over $2 million. The trust adopted an unconditional resolution on 11 September 2001 to pay (i.e., distribute) the dividend to the non-resident capital beneficiary, with the beneficiary having the right to require payment to himself at any time. The taxpayer then resigned as a trustee on 12 January 2002 and the beneficiary was paid on 18 January 2002. The trust failed to withhold and remit the 25% Part XIII tax.

After finding that the taxpayer was not liable under s. 215(6) for the failure to remit at the time of the resolution as the distribution amount had not been "credited" (or paid) at that time, he went on to reject a submission that the taxpayer was liable under s. 227(5) because he authorized the payment of the dividend distribution. The resolution created an obligation to pay the amount but did not authorize its payment, which did not occur until the taxpayer had ceased to be a trustee.

Roll v. The Queen, 2000 DTC 1454 (TCC)

The taxpayer, who was an employee of a corporation in financial difficulty, was persuaded by the president to receive deposits of the net payroll obligations of the corporation to his own bank account and to then disburse those amounts to the employees. In finding that the taxpayer was not a "specified person", Bowie TCJ. found (at p. 1459) that "the expression 'to have an influence' connotes some ability on the part of the person to affect the decision making process in relation to the payments", whereas here the taxpayer in his "separate capacity ... did nothing but prepare and sign cheques in accordance with precise directions given to him, and he had no power at all to influence the decision making with respect to the payments, the property, or the business".

Articles

Robertson, "Tax Collection and Insolvency: An Update", 1993 Conference Report, c. 8

Skulski, "Tax Collection in Recessionary Times", 1992 Conference Report, c.8

Account of the agreement negotiated between Revenue Canada and the office of the Superintendent of Bankruptcy.

Subsection 227(6) - Excess withheld, returned or applied

Cases

Sentinel Hill No. 29 LP v. Attorney General of Canada, 2008 DTC 6569, 2008 ON CA 132

The appellant partnership "grossed-up" fees paid by it to non-resident studios on the basis that the fees were subject to Part XIII tax. Later, CRA assessed the partners of the appellant on the basis that the fees were not deductible in computing its income. The effect of this treatment was that, under s. 212(13.1)(a), the fees were not subject to Part XIII tax.

The applicant brought an application against CRA for unjust enrichment (as the non-resident studios did not apply under s. 227(6) for a refund of the Part XIII tax that had been withheld by the appellant on the grossed-up fees). In dismissing this application, Feldman, J.A. stated (at para. 14) that "the Act provides a complete procedural code for the return of non-resident withholding taxes whether paid under mistake or where there was no liability for the tax" and stated (at para. 13):

"It would appear that if the person resident in Canada who was obliged to withhold and remit to CRA wants the ability to claim a refund from CRA in case of an incorrect or overpayment, it must have an assignment or other legal arrangement with the non-resident that allows the resident to assert that non-resident's rights."

Administrative Policy

7 November 2014 T.I. 2014-0542061E5 - Section 15(2.12), follow up to 2014-051943

A CRIC remits Part XIII tax under s. 214(3)(a) on the amount of a loan to non-resident "Parentco" and, more than two years after the end of the calendar year in which the Part XIII tax was paid, but within 3 years from the CRIC's filing due-date for the year the loan was made, the CRIC and Parentco jointly file a PLOI election, so that the loan is no longer subject to Part XIII tax. Would CRA refund the withholding even though the s. 227(6) application therefor was not made within the two-year limit specified in s. 227(6)? CRYA stated:

[The] written application for the refund [must be] made no later than 2 years after the end of the calendar year in which the excess amount was paid. …[B]ecause the application was not made within the two-year limit, the CRA is not able to refund the excess Part XIII tax. However…the scenario… described is…unlikely to occur except in rare circumstances.

Subsection 227(6.1) - Repayment of non-resident shareholder loan

Administrative Policy

24 April 2015 T.I. 2014-0560401E5 - Subsections 15(2) and 227(6.1) and Part XIII tax

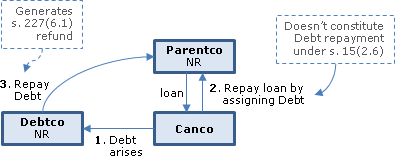

In 2013-0482991E5, CRA considered that where Canco seeks to avoid the application of s. 15(2) to a loan (the "Debt") owing to it by a non-resident sister company (Debtco) by assigning the Debt to their non-resident parent (Parentoco) in repayment of a loan owing by it to Parentoco, this assignment will not qualify as a repayment of the Debt (so that s. 214(3)(a) could then apply to impose Part XIII tax on the Debt amount). If Debtco subsequently repays the Debt to Parentco, can Debtco obtain a refund of such tax under s. 227(6.1)? CRA responded:

[S]ubsection 227(6.1) merely state that the person has to repay the loan or indebtedness. It does not state that the person has to repay the loan or indebtedness to the original creditor… . Therefore … if the Debt is subsequently repaid to Parentco, Debtor may be entitled to a refund of the Part XIII tax previously assessed.

Articles

John Lorito, Trevor O'Brien, "International Finance – Cash Pooling Arrangements", draft version of paper for CTF 2014 Conference Report.

Net decrease treated as repayment under cash pool (pp.16-17)

It is the position of the CRA [fn 52: …27 of IT-119R4…2006-021516117…and 990256… .] which is consistent with the decision in Edward C. Sargent v. MNR [fn 53: 83 DTC 572.] that repayments are to be treated on a first in first out basis unless the facts clearly indicate that the taxpayer intended a different allocation. However, in order for a repayment to be treated as a valid repayment for purposes of claiming a refund of withholding tax previously remitted, the repayment must not be made "as part of a series of loans or other transactions and repayments". [fn 54: Subsection 227(6.1).] …[U]nless facts indicate a different allocation, it would appear reasonable that a net decrease in a physical cash pool balance from the previous taxation year should be treated as a valid repayment and should be applied against the oldest outstanding "loan" balance (i.e., the oldest net annual increase to the cash pool for a taxation year that has yet to be repaid).

Subsection 227(6.2)

Articles

Brett Anderson, Daryl Maduke, "Practical Implementation Issues Arising from the Foreign Affiliate Dumping Rules", draft version of paper for CTF 2014 Conference Report.

227(6.2) does not eliminate deemed dividend for non-FAD purposes (p.22)

[S]ubsection 227(6.2) requires the CRA to accept late-filed paragraph 212.3(7)(d) forms and refund any Part XIII tax paid with respect to the investment (as long as the written application is filed within two years after the form described in subparagraph 212.3(7)(d)(i) is filed). Interestingly, subsection 227(6.2) does not retroactively rescind the deemed dividend. As a result, the CRIC should be considered, even after the paragraph 212.3(7)(d) form is late-filed, to have paid a dividend to the Parent on the filing-due date for the purposes of other provisions of the Act such as subsection 129(1), subsection 112(3), and Part IV tax….

Subsection 227(8) - Penalty

See Also

Maxi Maid Services Ltd. v. The Queen, 2012 DTC 1174 [at 3435], 2012 TCC 178

The taxpayer's belief that it had paid an employee through dividends rather than wages (which it corrected in the subsequent year with retroactive source deductions and T4 slips) was found to support a due diligence defence for the purposes of s. 227(8). The Minister had not led evidence to support the assessment of a penalty. C. Miller J. stated (at para. 12): "there is no proof that the so-called dividend draws were just a figment of [the director's] imagination."

Administrative Policy

IT-494 "Hire of Ships and Aircraft from Non-Residents"

RC will not apply the penalty provisions of s. 227(8)(a) in respect of a deficiency in tax withheld on an advance payment of rent respecting a bareboat charter for hire both inside and outside Canada, if the payer can demonstrate that he made a reasonable estimate of the proportionate use outside Canada.

Subsection 227(8.1) - Joint and several, or solidary, liability

See Also

Pechet v. The Queen, 2008 DTC 3381, 2008 TCC 208, aff'd 2009 FCA 341

The taxpayer was assessed for interest on withholding tax that a tenant of a rental property in Edmonton, Alberta owned by a partnership of which the taxpayer had a 50% partnership interest had failed to withhold from rents paid to the partnership, notwithstanding that subsequent to the taxation years in question (1997 to 2001) the taxpayer had filed income tax returns under s. 216(1) for those taxation years which showed that no Part I tax was owed by the taxpayer in respect of those years. Campbell J. stated (at para. 27):

"The legislative intent is that the resident/payor must withhold and remit amounts forthwith without taking into account or referencing in any manner the tax position of the recipient non-resident of those amounts. If the resident/payor does not withhold and remit, the non-resident will clearly be jointly and severally liable for interest in those amounts."

Tremblay v. MNR, 90 DTC 1124 (TCC)

The taxpayer, shortly before he ceased to be resident in Canada in June 1980, assigned annuity contracts (which he previously had concluded with two Canadian insurance companies) to the National Bank of Canada, and thereafter payments under the contracts were paid by the insurance companies to his account with the National Bank in Ste-Foy, Quebec. In June 1981, the taxpayer wrote to the insurance companies from Switzerland requesting them to make the annuity payments to his Swiss bank account, but not explicitly disclosing that he was a non-resident.

The taxpayer was liable under s. 227(8.1) in respect of interest on the Part XIII tax applicable to the annuity payments, notwithstanding the failure of the insurance companies to deduct and pay such taxes:

"No provision of the Act allows me to reduce the quantum of interest, even though in the instant case the appellant may have thought that he was not required to pay Part XIII tax on annuity payments made by the two aforementioned insurance companies, since the money in question was to remain in Canada." (p. 1127)

Subsection 227(8.2) - Retirement compensation arrangement deductions

Administrative Policy

14 September 1994 T.I. 5-941889

Where a letter of credit held in an RCA trust is called by the trustees, the payment by the issuer of the letter of credit to the RCA trust is a contribution by the employer to the RCA. The employer is liable for an equal payment in respect of Part XI.3 tax which should have been withheld pursuant to s. 153(1)(p). The employer is liable to pay an amount equal to the amount contributed to the RCA where there was no compliance with the withholding provisions in s. 153(1)(p).

Subsection 227(8.3) - Interest on amounts not deducted or withheld

Administrative Policy

7 February 2014 Memorandum 2013-0506151I7 - Section 216 returns and interest

After an agent of a non-resident was assessed for failing to withhold and remit Part XIII tax on rent collections paid to the non-resident as required by s. 215, the non-resident and agent submitted a s. 216(4) undertaking within six months of the year end. The timely-filed return showed nil taxes. The Part XIII tax was then reassessed to remove the initial amount that was not withheld. How much interest should be removed?

In finding that interest on the withholding amount accrued only up to the time at which the s. 216 elective filing was made (but with interest continuing to accrue on any arrears interest), CRA stated (after discussing Pechet, 2008 TCC 208, aff'd 2009 FCA):

For purposes of calculating Part XIII interest, the day upon which the subsection 216(4) filing was made is effectively the "the day of payment of the amount to the Receiver General" as per subsection 227(8.3). Such an interpretation is coherent with the purpose of section 215, as it recognizes the obligation to withhold and remit is not extinguished retroactively and thus the accrued interest on the Part XIII tax remains payable.

Subsection 227(8.4) - Liability to pay amount not deducted or withheld

Administrative Policy

6 November 2014 T.I. 2014-0530991E5 - Liability for the failure to withhold

A corporation failed to withhold the required amounts based on taxable benefits received by Canadian employees. Is it liable for the amount that should have been withheld? CRA responded:

…[W]here the corporation failed to make the required withholding of tax with respect to an employee who is a resident of Canada, the corporation and its directors…are liable only to penalties [under ss. 227(8) and 227(8.3)] and interest, and are not required to pay the amount of income tax that should have been withheld.

Subsection 227(9) - Penalty

Cases

741290 Ontario Inc. v. The Queen, 2012 DTC 5025 [at 6665], 2011 FCA 361, aff'g 2011 DTC 1089 [at 489], 2011 TCC 91

In a prior decision, the Tax Court had found that the taxpayer's directors were protected from liability for unremitted source deductions under s. 227.1(1) because they had a due diligence defence under s. 227.1(3). The question in the present case was whether the taxpayer would be liable under s. 227(9)(b). The taxpayer argued that its reassessment should be barred, because the question of source deduction liability on the present facts had already been settled by the prior Tax Court decision.

The Court of Appeal affirmed the Tax Court judge's finding that the reassessment was not barred by the doctrines of res judicata and issue estoppel. Regarding s. 227(9), Noël J. stated (at para. 3):

Like the Tax Court judge, I am prepared to assume for present purposes that a defence may be validly advanced against a failure to remit where the failure is caused by events beyond the employer's control. [In the TCC decision, Bowie J. gave the examples of a failure of the post office to deliver a remittance mailed on time, or an error made by a bank clerk in transferring funds.] However, such a failure cannot possibly be justified by a decision by the employer to appropriate for its own use source deductions in order to keep the business afloat in difficult times as was done here (reasons, paras. 21 and 22). In choosing to act as it did, the appellant ignored the unconditional duty imposed on it by subsection 153(1) and is, as such, liable to the assessed penalties.

Mollenhauer Ltd. v. The Queen, 92 DTC 6398 (FCTD)

An arrangement under which the plaintiff paid the net wage amounts owing to a subcontractor of the plaintiff in financial difficulty after being advised by the subcontractor of the gross salaries of the employees and the amount of applicable source deductions was characterized as the plaintiff having undertaken the obligation of the subcontractor to pay the salary and wages of the subcontractor's employees. Accordingly, the assessment of the Minister under s. 227(9) for the amount of source deductions plus penalty was affirmed.

Deloitte Haskins & Sells, Receiver-Manager for Comanche Drilling Ltd. v. The Queen, 89 DTC 5225 (FCTD)

The receiver-manager of a corporation ("Comanche") decided to pay the employees of Comanche the amounts owing to them net of source deductions, and instructed a corporation ("Comcheg") which previously had prepared the payroll for Comanche to prepare the payroll. Comcheg paid the employees the net amounts, issued them information slips showing the amount of their gross wages and source deductions, and was reimbursed by the receiver-manager. Rouleau, J. held that the source deductions had in fact been deducted, with the result that there was a failure to remit those deductions pursuant to s. 227(9). Unlike the Coopers & Lybrand case, funds were actually available to pay the remittances.

Re A.G. Canada and Coopers & Lybrand Ltd., 86 DTC 6243 (BCSC)

A penalty for failure to remit employee source deductions on the due date of February 15, 1985 was not a claim provable in bankruptcy because the proposal under the Bankruptcy Act was filed on February 6, 1985.

Electrocan Systems Ltd. v. The Queen, 86 DTC 6089, [1986] 1 CTC 269 (FCTD), aff'd 89 DTC 5079 (FCA)

An employer who does not remit source deductions on time is liable to the penalty even if he remits before the time of assessment. "[A] penalty comes into existence the moment the statute is breached."

The Queen v. Coopers & Lybrand Ltd., 80 DTC 6281, [1980] CTC 367 (FCA)

The payment by a receiver-manager of the net amount of the unpaid wages of the employees of the debtor company, without any deduction or remittance on account of taxes, was characterized as a default under S.227(8) (resulting in a 10% penalty) rather than S.227(9) (under which, prior to its replacement by the present ss.227(9) and (9.4) there in effect was a 110% penalty). Kelly D.J. stated (p. 6287):

"If the person paying fails to deduct, his failure has no effect on the liability of the employee for income tax it being assumed that the taxing authority will recover from the employee the full amount of the income tax; the only liability incurred by the person paying the salary or wages is a penalty calculated as a percentage of the amount he has failed to deduct. On the other hand if a deduction is actually made and the amount deducted not fully remitted ... the liability of the person paying, over and above the 10% penalty which may be assessed on account of his default in remitting, is an amount equal to the deductions he had failed to remit together with interest thereon."

See Also

Maxi Maid Services Ltd. v. The Queen, 2012 DTC 1174 [at 3435], 2012 TCC 178

Partway through 2008, the taxpayer ceased to pay wages to a worker and purported to pay dividends instead. On learning in 2009 that it was not in a position to have paid dividends, the taxpayer prepared a T4 slip for 2008 for the amounts so paid and remitted applicable source deductions on a late basis. The Minister assessed penalties pursuant to s. 227(9)(b) on the taxpayer for the failure to remit source deductions on a timely basis.

C. Miller J. found that penalties were not warranted. First, s. 227(9) only applies to source deductions which were made but not remitted. Failures to make timely source deductions are caught instead by s. 227(8).

Second, the taxpayer's director's uncontradicted evidence was that the payments were dividends at the time, and the onus was on the Minister to establish that source deductions should have been withheld. C. Miller J. stated (at para. 12): "there is no proof that the so-called dividend draws were just a figment of [the director's] imagination." The taxpayer therefore had a due diligence defence.

Subsection 227(9.4) - Liability to pay amount not remitted

See Also

Ville de Québec v. The Queen, 2008 DTC 4967, 2007 TCC 329

The Minister had the jurisdiction to make an assessment on the basis that the appellant had failed to remit amounts that it should have deducted or withheld from its employees' salaries.

Cana Construction Co. Ltd. v. The Queen, 95 DTC 127 (TCC)

It was found that the taxpayer, which was the prime contractor for the construction of a hotel, effectively established "total control and dominion over the funds used to pay the wages of the workmen" of a subcontractor that had fallen into financial difficulty (p. 133), with the result that the taxpayer was to be considered the person that was paying the employees' wages. Furthermore, given that the taxpayer was aware that it was represented to the workmen that source deductions had been made, it was logical to conclude that the taxpayer had deducted such amounts before the net payments were made to the workmen. Accordingly, the taxpayer was liable for such source deductions under s. 227(9.4).

Subsection 227(10) - Assessment

Cases

Zen v. The Queen, 2010 DTC 5109 [at 6979], 2010 FCA 180

Interest on unremitted source deductions continues to accrue after a s. 227(10) assessment. The Minister need not make a second assessment to recover that interest.

The Queen v. B.M. Enterprises Ltd., 92 DTC 6463 (FCTD)

An assessment which a junior collections official had typed up and sent to the taxpayer was found to have been made by the Minister given that the Deputy Minister was an official authorized under Regulation 900, and the assessment was done in accordance with procedures controlled by the Deputy Minister and by officials acting according to his directions. In any event, there was implied authority accorded to the Deputy Minister to subdelegate to the collections official.

Subsection 227(10.1) - Idem [Part XII.5]

See Also

Kwee v. The Queen, 93 DTC 904 (TCC)

An assessment for tax owing by the taxpayer under s. 116(5) that was issued beyond the normal reassessment was statute-barred. Although an assessment under s. 227(10.1) could have been issued in respect of penalty owing by the taxpayer for failure to remit the tax required by s. 116, an assessment for the tax itself was in respect of a Part I tax liability of the taxpayer, the normal reassessment period for which had expired.

Tremblay v. MNR, 90 DTC 1124 (TCC)

The taxpayer, shortly before he ceased to be resident in Canada in June 1980, assigned annuity contracts (which he previously had concluded with two Canadian insurance companies) to the National Bank of Canada, and thereafter payments under the contracts were paid by the insurance companies to his account with the National Bank in Ste-Foy, Quebec. In June 1981, the taxpayer wrote to the insurance companies from Switzerland requesting them to make the annuity payments to his Swiss bank account, but not explicitly disclosing that he was a non-resident.

Garon J. found that the taxpayer was liable for Part XIII tax under s. 227(10.1)(b) (for the taxpayer's post-1984 taxation years) and under s. 227(10) (for the taxpayer's 1980 to 1984 taxation years) notwithstanding that the Minister had not assessed the insurance companies under s. 215(6). It would be "unthinkable that it could be consistent with the scheme of Part XIII of the Act for the Minister of National Revenue to be unable to assess directly the person who must, in the final analysis, pay this tax, namely the non-resident person." (p. 1126)

Subsection 227(10.2) - Joint and several, or solidary, liability re contributions to RCA

Cases

Lloyd's Bank Canada v. International Warranty Co. (1989), 60 DLR (4th) 272 (Alta. C.A.)

A company ("IW") had made an assignment of book debts to the td Bank. After ceasing business operations, it paid salaries to its employees without withholding and paying source deductions. Revenue Canada thereafter issued a requirement to pay pursuant to s. 224(1.2)(b).

The court indicated that Revenue Canada would have had priority over the TD Bank if s. 227(10.2) had been proclaimed in force by the relevant time.