Subsection 233.4(4) - Returns respecting foreign affiliates

Administrative Policy

15 May 2014 T.I. 2014-0520091E5 - Form T1134

A non-resident corporation ("NRCo") distributed all its property during its 2012 taxation year on liquidation and was formally dissolved on December 31, 2012. Between the distribution and dissolution, a shareholder ("CanCo") of NRCo that held a 20% interest in NRCo became a resident of Canada for purposes of the Act. Both, NRCo and CanCo's had calendar taxation year-ends. CRA stated:

[D]espite the fact that NRCo had previously distributed its property…NRCo should be considered a foreign affiliate of CanCo in the taxation year of CanCo that ended December 31, 2012.

We have considered whether NRCo could be regarded dissolved for purposes of the reporting requirement in subsection 233.4(4) prior to its formal dissolution in the circumstances described in IT-126R2…[and] we concluded that IT-126R2… would not apply for purposes of the reporting requirement in subsection 233.4(4).

23 May 2013 IFA Round Table, Q. 8(a)

Question and response are identical to 2013-0481401C6 below.

17 May 2013 CLHIA Roundtable Q. , 2013-0481401C6

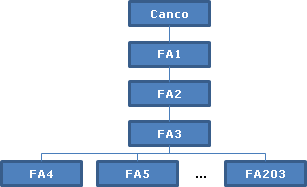

Because "equity percentage" in s. 95(4) includes indirect share ownership, the reporting requirements could lead to a considerable administrative burden where a taxpayer holds vertically structured foreign affiliates. CRA confirmed that, where a Canco holds an FA1, which holds an FA2, which holds an FA3 (all 100% ownership), FA3 should be reported in Section 3B of new Form T1134 twice, as both FA1 and FA2 hold 100% equity percentage in FA3.

In response to a further example where FA3 holds 200 additional FAs, CRA indicated that it is "considering developing administrative policy to provide relief in such situations."

CRA's change in the new Form T1134, which limits administrative relief for dormant or inactive foreign affiliates to situations where total investment in foreign affiliates is less than $100,000, is meant to eliminate a reporting gap between Forms T1134 and the "legislative thresholds for Form T1135."

Forms

T1134 "Information Return Relating To Controlled and Not-Controlled Foreign Affiliates (2011 and later taxation years)"

Do not file Form T1134 if the total cost amount to the reporting person at any time in the year of the interest in all foreign affiliates was less than $100,000 AND the foreign affiliate is "dormant" or "inactive" for the affiliate's taxation year ending in your taxation year. For purposes of completing Form T1134, a dormant or inactive foreign affiliate means, for a taxation year of the affiliate, one that:

- had gross receipts (including proceeds from the disposition of property) of less than $25,000 in the year; and

- at no time in the year had assets with a total fair market value of more than $1,000,000;

For the purpose of completing Form T1134, the definition of gross receipts refers to any receipt received in the year, and not just income amounts. This would include all non-revenue receipts, such as loans, etc. The purpose of the test is meant to indicate the level of activity in the foreign affiliate.