Subsection 5905(1)

Articles

Penny Woolford, Francis Favre, "The Latest Foreign Affiliate Proposals: Selected Aspects", 2010 Canadian Tax Journal, No. 4, at f.n. 84:

Proposed regulation 5905(1) applies any time there is an acquisition or a disposition of shares of a foreign affiliate and a change in the taxpayer's SEP [surplus entitlement percentage] in that particular foreign affiliate or any other foreign affiliate in which the particular affiliate has an equity percentage. Thus, the new rule applies whether the SEP increases or decreases....

There is no requirement that the acquisition or disposition of shares be undertaken by the corporation or another foreign affiliate. Thus, an issuance of shares to a third party (the situation currently addressed by regulation 5905(9)) should also be covered since it would be an acquisition by the third party. As a result of the substantially broader language in the new rules, the situations described above in which SEP is diluted will automatically trigger a gross-up of the underlying surplus balances without the need of a subsection 93(1) election.

Subsection 5905(5.2)

Articles

Kevin Yip, "Recent Legislation Affecting Partnerships and Foreign Affiliates – Subsection 88(1) and Section 100", Canadian Tax Journal, (2013) 61:1, 229-256, at 237

Proposed regulation 5905(5.2) is conceptually similar to paragraph 111(4)(c), which reduces the ACB of certain capital property of a Canadian corporation to the extent that the ACB exceeds the FMV of the property immediately before an acquisition of control. Proposed regulation 5905(5.4) is applied after any subsection 111(4) adjustment to the ACB of the foreign affiliate's shares. [fn.31: Proposed regulation 5905(5.3).]

After describing the formula in Reg. 5905(5.2), he stated (at 237):

The result is generally that the TFSB will be reduced (by virtue of a reduced exempt surplus or increased exempt deficit) to the FMV of the foreign affiliate shares at the time of the acquisition of control. Proposed regulations 5905(5.2) and (5.4) are intended to interact such that where regulation 5905(5.2) has applied to a foreign affiliate on an acquisition of control to reduce its TFSB, it should be the case that no bump amount would be available in respect of such shares pursuant to proposed regulation 5905(5.4). Note that proposed regulation 5905(5.2) applies whether or not there is a subsequent bump pursuant to paragraph 88(1)(d).

Geoffrey Turner, "The Acquisition of Control Surplus/ACB Trade-Off in the August 27, 2010 Foreign Affiliate Proposals", CCH International Tax, Nos. 54-55, December, 2010, p. 1.

Subsection 5905(5.4)

Articles

Steve Suarez, "Canada's 88(1)(d) Tax Cost Bump: A Guide for Foreign Purchasers", Tax Notes International, December 9, 2013, p. 935

General summary of bump limitation rule (p. 945)

…When control is acquired of a Canadian corporation that owns shares of a foreign affiliate, Canadian tax authorities perceive it as being duplicative to allow (in very general terms) the sum of the tax cost of the Canadian corporation's shares of the foreign affiliate and the amount of this ''good'' surplus the Canadian corporation has in the foreign affiliate to exceed the FMV of the Canadian corporation's shares of the foreign affiliate.

Accordingly, when the subsidiary owns shares of a foreign affiliate, an 88(1)(d) bump is not permitted to result in the sum of (1) the parent's tax cost of those shares and (2) the good surplus of the foreign affiliate at the time of the AOC exceeding the FMV of those shares. A comparable rule applies when the subsidiary owns shares of a foreign affiliate through a partnership….

Subsection 5905(7)

Articles

Kevin Yip, "Recent Legislation Affecting Partnerships and Foreign Affiliates – Subsection 88(1) and Section 100", Canadian Tax Journal, (2013) 61:1, 229-256, at 241-242

After noting that where property being bumped is an interest in a partnership holding foreign affiliate shares, proposed Reg. 5908(7) applies rather than proposed Reg. 5905(5.4)(a), and describing the formula in proposed Reg. 5908(7), he provided the following example:

Example 2 – Facts

Subsidiary is a corporation resident in Canada and holds a 50 percent interest in Partnership. Partnership owns all of the 100 shares of FA. Parent is a corporation resident in Canada and deals with Subsidiary at arm's length.

At the acquisition time, Parent acquires all the shares of Subsidiary. Partnership's ACB in FA is $600, and the FMV of the shares of FA is $2,400. At the acquisition time, FA has exempt surplus (a TFSB) in respect of Subsidiary of $2,800. FA has never paid a dividend.

On the acquisition of control of Subsidiary, proposed regulation 5905(5.2) will apply to reset the surplus balance of FA. The formula (A + B – C)/D in proposed regulation 5905(5.2) will apply as follows:

- A (FA's TFSB is $1,400 ($2,800 x 50% [Subsidiary's SEP in FA]).

- B (the cost amount of the shares of FA) is $300 ($600 x 50/100), pursuant to proposed regulation 5908(6)(a).

- C (the FMV of FA's shares deemed to be owned) is $1,200 ($2,400 x 50/100) (since FA has never paid a dividend, and therefore regulation 5908(6)(b) does not apply).

- D (Subsidiary's SEP in FA) is 50 percent 50/100).

The reduction to FA's exempt surplus is $1,000 ([$1,400 + $300 - $1,200]/0.50), but Subsidiary effectively has a reduction of only 50 percent of that amount ($500).

Assume that there is a winding up of Subsidiary into Parent immediately after the acquisition of control. The ACB to Subsidiary of the 50 percent interest in Partnership is $500, and the FMV of the 50 percent interest in Partnership is $1,500.

For the purposes of proposed subparagraph 88(1)(d)(ii), the prescribed amount in respect of the interest in Partnership is determined by the formula A x B in proposed regulation 5908(7), as follows:

- A is $1,800 ($2,800 - $1,000), pursuant to proposed regulation 5905(5.2) as determined above.

- B is 50 percent (50/100), since Subsidiary is deemed to own 50 shares of FA, pursuant to proposed regulation 5908(1).

The amount determined by the formula in proposed regulation 5908(7) is $900. The bump amount pursuant to proposed subparagraph 88(1)(d)(ii) is the excess of the FMV of the partnership interest ($1,500) over the aggregate of the cost amount of the partnership interest ($500) and the prescribed amount ($900). The bump amount is therefore $100.

Subsection 5905(7.1)

Articles

Penny Woolford, Francis Favre, "The Latest Foreign Affiliate Proposals: Selected Aspects", 2010 Canadian Tax Journal, No. 4, at f.n. 32:

Important points to note regarding this application rule are as follows:

- The provision applies only to exempt deficits. Thus, transactions that dilute taxable deficits should still be feasible under the new rules. In our view, this result is intended and reflects Finance's focus on exempt deficits created by previous subsection 93(1) elections or recharacterized interest.

- There is no requirement that the deficit affiliate dispose of any shares; it is only necessary that another person acquire shares of an affiliate some of the shares of which are held directly or indirectly by the deficit affiliate. Thus, transactions that seek to bypass deficits by acquiring newly issued shares in a lower-tier affiliate are caught. The explanatory notes state, "It is intended that the conditions in [regulation] 5905(7.1) capture acquisitions of shares of a lower-tier affiliate upon the winding-up of an upper-tier affiliate, as well as dispositions, and issuances, of shares of lower-tier affiliates."

- As currently drafted, the rule seems to apply to acquisitions of shares by the Canadian corporation, whether or not such acquisition causes a dilution of the deficit affiliate's SEP in the acquired affiliate.

Subsection 5905(7.2)

Administrative Policy

28 May 2015 IFA Roundtable Q. 7, 2015-0581611C6

Canco owns 100% of the shares of a foreign affiliate (FA1"), FA1 owns 100% of the shares of a second foreign affiliate ("FA2"), and FA2 owns 100% of the shares of a third foreign affiliate ("FA3"). FA1, the immediate subsidiary of Canco, and its 100% subsidiary, FA2 merge under a "foreign merger" (s. 87(8.1) under which FA2 ceases to exist and all its property (being all the shares of FA3) become property of FA1 ("Merged FA"). Immediately prior to the merger, the relevant surplus balances are: FA1: exempt surplus of $200, FA2: exempt deficit of $125, FA3: exempt surplus of $150. Will the deficit of FA2 would reduce not only the opening exempt surplus of Merged FA but the exempt surplus of FA3 as well? CRA responded:

[I]t was intended there should be symmetry with the "adjustments" required as a result of paragraphs 5905(7.2)(a) and (b)…[so that] it was intended that the adjustment to the deficit of FA2 under paragraph 5905(7.2)(b) should have effect before the operation of subsection 5905(3)… . [T]herefore…for purposes of determining the amount in the description of A of the formula in paragraph 5905(3)(b)… the amount of FA2's exempt deficit immediately before the merger is reduced by the amount otherwise determined in respect of FA2 under paragraph 5905(7.2)(b) of the Regulations. On this basis, while the exempt surplus of FA3 would be reduced to $25, … Merged FA's opening exempt surplus is $200. The Department of Finance concurs… .

Articles

Eric Lockwood, Maria Lopes, "Subsection 88(3): Deferring Gains on Liquidation and Dissolution", Canadian Tax Journal (2013) 61:1, 209-28, p. 209

They use the facts in various scenarios to illustrate that a taxpayer (Canco) will realize a capital gain on the disposition of its shares of the disposing affiliate (Foreignco 1) – even where there has been a qualifying liquidation and dissolution (QLAD) election - where the adjusted cost base of Foreignco 1 in the distributed property, i.e., the inside basis, exceeds Canco's ACB of its Foreignco 1 shares.

The authors then provide an example illustrating how, on the liquidation of a foreign affiliate (Foreignco 2), with a "blocking deficit," into Foreignco 1, followed by a "QLAD" liquidation of Foreignco 1 into Canco, the application of the fill-the-hole rule in proposed Reg. 5905(7.2) can give rise to situation where the inside basis is greater than the outside basis – thereby necessitating a suppression election by Canco under s. 88(3.3) in order to avoid a capital gain as a result of this difference.

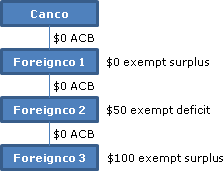

The starting facts are described at p. 222:

Assumptions

Canco is a company incorporated and resident in Canada for the purposes of the Act. Canco incorporated Foreignco 1, Foreignco 1 incorporated Foreignco 2, and Foreignco 2 incorporated Foreignco 3, all for nominal amounts. Foreignco 1's only asset is the shares of Foreignco 2, and Foreignco 2's only asset is the shares of Foreignco 3. Foreignco 1 has no exempt surplus, Foreignco 2 has an exempt deficit of $50, and Foreignco 3 has exempt surplus of $100. Foreignco 1 and Foreignco 2 have no liabilities….

After describing the fill-in-the-hole rule, they proceed (at pp. 223-224) with the example:

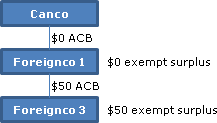

The liquidation of Foreignco 2 will trigger the application of proposed regulation 5905(7.2)(a), Foreignco 3's exempt surplus of $100 will be reduced by Foreignco 2's exempt deficit of $50. Under proposed regulation 5905(7.2)(b), Foreignco 2's exempt deficit will be eliminated. The result achieved is thus comparable to Foreignco 3's having paid a notional exempt surplus dividend to Foreignco 2, immediately before the liquidation and dissolution of Foreignco 2, to the extent necessary to fill Foreignco 2's exempt deficit. By virtue of proposed regulation 5905(7.5), proposed regulation 5905(7.6) will further apply to increase Foreignco 2's ACB in the shares of Foreignco 3 by $50, following the analogy that the notional exempt surplus dividend paid by Foreignco 3 to Foreignco 2 was reinvested by Foreignco 2 before the time of its liquidation and dissolution.

The liquidation and dissolution of Foreignco 2 occurs on a rollover basis under proposed paragraph 95(2)(3).…

Foreignco 1's ACB in the shares of Foreignco 3 (the inside basis) is now greater than Canco's ACB in the shares of Foreignco 1 (the outside basis) by $50 as a result of the application of the fill-the-hole rule in proposed regulation 5905(7.2). As permitted, Canco elects for the liquidation and dissolution of Foreignco 1 to be a QLAD, and realizes a capital gain of $50 on the disposition of its shares of Foreignco 1 under proposed subsection 88(3).

Because the liquidation and dissolution of Foreignco 1 is an elected QLAD, and assuming that the shares of Foreignco 3 are the capital property of Foreignco 1 immediately before the time of the distribution, Canco can elect under proposed subsection 88(3.3) for Foreignco 1 to have disposed of its shares of Foreignco 3 for PD [proceeds of disposition] equal to a claimed amount of nil. As previously discussed, the suppression election will enable Cano to fully defer the capital gain that it would otherwise realize on the disposition of its shares of Foreignco 1. Foreignco 3's exempt surplus balance of $50 will be preserved. We suspect that the suppression election was specifically intended to apply to circumstances such as these, where capital gains would arise on the liquidation and dissolution of top-tier FAs by reason of the prior application of the fill-the-hole rule in proposed regulation 5905(7.2).

Subsection 5905(7.6)

Articles

Geoffrey S. Turner, "New Foreign Affiliate Capital Distribution Elections: QROCs and Reg. 5901(2)(b) Dividends", CCH International Tax, No. 67, 2012, p. 1, at p. 4

Taxpayers may also consider the surplus and basis adjustments under the proposed "fill-the-hole" rules in Regulations 5905(7.1) to (7.7) addressing "out-from-under" transactions where foreign affiliates with positive surplus balances (i.e., TFSB) are extracted out from under foreign affiliates with exempt deficits. One of the consequences of such a transaction, under proposed Regulation 5905(7.6), is the conversion of the underlying TFSB into basis in the shares of the foreign affiliate that is extracted out from under the deficit affiliate. With Regulation 5901(2)(b) now applying to lower-tier foreign affiliate distributions, the conversion of surplus into basis under these rules may be a manageable implication, and in some circumstances even a desirable outcome.