Subsection 5907(1)

Paragraph 5907(1)(l)

Administrative Policy

5 June 1996 T.I. 961803 (C.T.O. "Income or Profits Tax for Foreign Affiliate Rules")

"Income or profits tax" for purposes of the definition of "underlying foreign tax" could include Canadian income tax paid by a foreign affiliate in respect of its taxable earnings.

Earnings

Administrative Policy

14 March 2014 Memorandum 2013-0499141I7 - IRC 338(h)(10), "earnings" and safe income

After the Directorate found (at para. 232) that the earnings amounts of "US-Opco" foreign affiliates should be calculated similarly to what would have been calculated if the U.S. tax basis of their assets had not been stepped up under IRC 338(h)(10), so that where US-Opco goodwill, for which no actual expenditure had been, had been amortized, the amortization taken on the stepped-up tax basis under IRC 338(h)(10) should be added to the earnings amount pursuant to Reg. 5907(2)(f), the Directorate noted that, in the alternative, the amortization amount should not be considered in computing the earnings amount determined under s. (a)(i) of Reg. 5907(1) –"earnings" (apparently on the basis "that ‘notional' income or deductions are simply excluded from the earnings amount" (para. 15)].)

See more detailed summary under Reg. 5907(2)(f).

5 September 2013 T.I. 2011-0431031E5 - Guatemala's taxes

A Guatemalan tax on gross revenue was imposed at a rate (for 2013) of 5% up to a low threshold (appx. Cdn. $3,925) and 6% above under the same "Guatemalan Income Tax Law" which allowed the taxpayer to annually choose whether to pay tax on its gross revenue or to pay tax on its net income or profit. In a taxation year where a foreign affiliate that carries on its active business only in Guatemala has chosen to pay the Guatemalan tax on gross revenue, its "earnings" will be determined under s. (a)(iii) rather than (a)(i) of the definition of "earnings" in Reg. 5907(1), since this revenue tax did not require the affiliate to compute its income or profit.

20 May 2011 Roundtable Q. , 2011-040450

A US LLC wholly owned by a US corporation, which has not checked the box to be treated as a corporation for US tax purposes, nevertheless has "earnings" under subparagraph (a)(i) of the s. 5907(1) definition. To fall under that subparagraph, it is sufficient that the LLC's earnings are required to be calculated under US law in order to compute the owning corporation's taxes rather than its own taxes. However, CRA also stated:

If the CRA encounters a Canadian corporation that has attempted to inflate the surplus balances of a foreign affiliate that is a US limited liability company by computing its "earnings" in accordance with the Act and ignoring discretionary deductions, the CRA may challenge the taxpayer's filing position as if none of these positions existed. The result may be that U.S. limited liability company does not qualify as a "foreign affiliate" as defined in subsection 95(1) of the Act.

5 December 2003 T.I. 2002-0165195

Where a debt owing by a controlled foreign affiliate to its Canadian parent had financed the acquisition of shares of a U.S. subsidiary in order to earn dividends that were deemed active business income under s. 95(2)(a)(ii), the forgiveness of that debt would not give rise to an inclusion under paragraph (a) or (b) of the definition of earnings.

8 July 1998 T.I. 980712

A U.S. incorporated company (USco) which is a wholly-owned subsidiary of a corporation resident in Canada (Canco) is deemed to be a non-resident of Canada under s. 250(5) but is not resident under common law principles in a designated treaty country. Just prior to the end of its taxation year, USco becomes a common-law resident in the U.S. and is so resident there at the end of its taxation year. If USco during the taxation year carried on an active business through a permanent establishment in the U.S., its net earnings from that active business in the U.S. for the year would be included in the exempt surplus of USco with respect to Canco.

80 C.R. - Q.17

Since under the income tax laws of the U.S. and the U.K. a payment made by one Canadian foreign affiliate to another in connection with group consolidation or group relief are not taken into account in computing the profits or loss of either company, such payments would not affect their surplus accounts.

Articles

Arda Minassian, Kara Ann Selby, "Computation of Surplus Accounts", 2002 Conference Report, (CTF), c. 43

Business in multiple countries (p. 43:6)

If a foreign affiliate carries on a business in multiple countries, the earnings definition may not adequately resolve the appropriate tax system to use in computing earnings. Assume that a Canadian corporate taxpayer purchased FA 1 in 1972. FA 1 carries on an active business, is a resident of country A, and is required by law to file income tax returns there. In that same year, FA 1 purchased a foreign resource property in country B. By virtue of the active business income generated from that resource property, FA 1 is considered to carry on a business in country B and is required to file income tax returns there as well....A technical reading of the earnings definition requires FA 1 to compute its income from its active business for the year in accordance with the income tax law of country A, but this result is not logical.

S. 95(2)(a) income (p. 45:7)

"Income from property" is a defined term in the Act. Therefore, income from property deemed to be income from an acive business by virtue of paragraph 95(2)(a) would be computed generally by following the rules in Part I of the Act. Difficulties may arise when applying Canadian rules to foreign affiliates under other tax regimes. [After discussing captive insurance company example:] The real difficulty is in computing the income under Canadian rules, because certain amounts, such as the claims and premium reserves, may be difficult to determine.

Exempt Earnings

Administrative Policy

14 March 2014 Memorandum 2013-0499141I7 - IRC 338(h)(10), "earnings" and safe income

An indirect wholly-owned foreign affiliate ("FA") of Canco made an arm's length purchase of all the shares of "US Holdco," whose wholly-owned subsidiaries ("US-Opcos") had accrued gains inherent in the appreciated assets of their active businesses including capital property, depreciable property and intangible property such as goodwill. The US-Opcos each carried on an active business in the United States.

In finding that the exempt earnings of the US-Opcos included gains that had accrued prior to the US-Opcos becoming foreign affiliates of Canco on the intangible property disposed of by the US-Opcos, the Directorate noted that, unlike capital gains, neither "net earnings" nor "earnings" has "a carve-out rule for gains on account of income that accrued prior to the US-Opcos becoming foreign affiliates of Canco" (para. 32).

See more detailed summary under Reg. 5907(2)(f).

10 March 2011 T.I. 2008-030285

Where Canco owns all the shares of two foreign affiliates (FA1 and FA2) which, in turn, each hold a 50% interest in a partnership, the exempt portion of a capital gain realized by the partnership will be included in the exempt earnings of FA1 and FA2, notwithstanding that s. 96(1) is silent with respect to each partner's share of that capital gain. Each of FA1 and FA2 will be considered to have been allocated a share of the capital gain in proportion to its respective interest in the partnership.

Exempt Surplus

Administrative Policy

23 June 1993 T.I. (Tax Window, No. 32, p. 13, ¶2608)

Where a foreign corporation with a December year-end pays a dividend in June and then becomes a foreign affiliate of a Canadian corporation in October, the dividend so paid will not be deducted from exempt or taxable surplus of the foreign corporation in relation to the Canadian corporation because it will not be a "whole dividend" as defined in Regulation 5907(1)(n), i.e., the dividend was paid prior to the Canadian corporation acquiring shares of the foreign affiliate.

15 January 1992 Memorandum (Tax Window, No. 15, p. 1, ¶1675)

Where a Canadian subsidiary owns shares in its U.S. parent, a taxable dividend paid to the parent will not be included in the exempt surplus of the parent under Regulation 5907(1)(d)(vii).

Net Earnings

Administrative Policy

21 April 2015 Memorandum 2014-0560811I7 - FACL carryback Surplus & PAS election

In 2010, CFA paid the "2010 Dividend" to its 100% parent ("Canco"). On audit, CRA identified that CFA had realized a capital gain (giving rise to foreign accrual property income). Canco designated a portion of a foreign accrual capital loss arising from a disposition in 2011 to be carried back to 2010. Must CFA's surplus pools be retroactively adjusted for the 2011-FACL carryback?

CRA responded:

…(b) of the definition of "net earnings" in subsection 5907(1) of the Regulations is clear… . It generally provides…that for surplus purposes an amount of FAPI is to be determined without reference to variable F.1 of the FAPI definition, i.e. without regard to any loss carryback. A loss in respect of FAPI is, correspondingly, accounted for under paragraph (b) of the definition of "net loss" in subsection 5907(1)… and is taken into account only in the taxation year of the affiliate in which the loss is incurred.

See summaries under Reg. 5901(2)(b) and Reg. 5903.1(1).

15 January 1992 Memorandum (Tax Window, No. 15, p. 2, ¶1676)

The U.K. ACT is not an "income or profits tax", although the normal corporate tax payable by a foreign affiliate, before any deduction in respect of any ACT paid by the affiliate, is such a tax.

Underlying Foreign Tax

Administrative Policy

30 October 2014 T.I. 2013-0488881E5 - Upstream Loan

///?page_id=873#2013-0488881E5">s. 90(9).

27 November 1998 T.I. 982283

The tax paid by a U.S. C.-Corp (which is a foreign affiliate of the Canadian taxpayer) in respect of its share of the investment income earned by a U.S. LLC will qualify as underlying foreign tax at such time as the income in respect of which the tax was paid is distributed (i.e., a dividend is paid) to it by the LLC.

88 C.R. - Q.12

Foreign tax paid in respect of a capital gain may reasonably be regarded as having been paid in respect of taxable earnings to the extent that such foreign tax is required to eliminate the Canadian income tax which otherwise would be payable under the FAPI rules or through the repatriation of the taxable surplus resulting from the gain.

Underlying Foreign Tax Applicable

Administrative Policy

3 April 2013 T.I. 2012-0460671E5 - Disproportionate UFT election

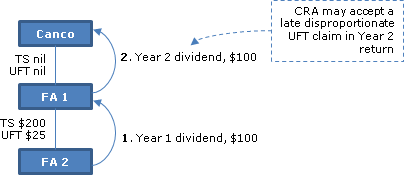

In Year 1, FA2, which has no exempt surplus, and taxable surplus and underlying foreign tax of $200 and $25, respectively, pays a $100 dividend to its immediate wholly-owning parent, FA1. In Year 2, FA1, which has no ES, TS or UFT, pays a $100 dividend to Canco. Accordingly, the TS of FA2 and FA1 change to $100 each and their UFT balances change to $12.50 each.

CRA stated that "the relevant return of income under Part I of the Act in which Canco should file a disproportionate UFT claim in respect of the FA2 dividend is its return for Year 1 [not Year 2]," and after referring to 901185 [immediately below], CRA then stated:

We continue to be of the view that the "return of income under Part I of the Act in respect of the whole dividend" referred to in paragraph (b) of the definition of "underlying foreign tax.., in which any claim must be made, is the return of Canco that includes the time when the whole dividend which is the subject of the claim is paid. However, if Canco had not filed a disproportionate UFT claim in respect of the FA2 dividend in its return for Year 1…CRA.. is prepared, in limited circumstances, to accept a disproportionate UFT claim from Canco in respect of the FA2 dividend in its return for Year 2 (i.e., in Canco's return for the year that includes the time it received the FA1 dividend).

Where FA2 at all relevant times was a wholly-owned subsidairy of FA1 with one class of shares, this limitation is that Canco's Year 2 claim "be limited to the maximum amount which could have been claimed by Canco in respect of the FA2 dividend in its return for Year 1."

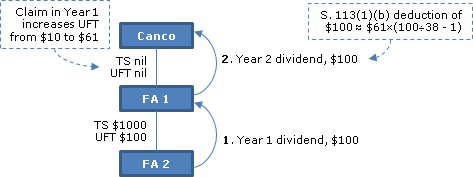

9 August 1991 T.I. 901185

In Year 1, FA2, which has no exempt surplus, and taxable surplus and underlying foreign tax of $1,000 and $100, respectively, pays a $100 dividend to its immediate wholly-owning parent, FA1. In Year 2, FA1, which has no ES, TS or UFT, pays a $100 dividend to Canco. Accordingly, the TS of FA2 and FA1 change to $900 and $100, and their UFT balances change to $90 and $10, respectively.

The Directorate indicated that a "claim" can be made by Canco pursuant to 5907(1)(m)(ii) [now, para. (b) of the definition of "underlying foreign tax applicable" in Reg. 5907(1)] with respect to the $100 dividend paid from FA2 to FA1 in year 1 in its Part I tax return for year 1

...as there is nothing in 5907(1)(m)(ii) that would restrict its application to dividends from top tier affiliates. The amount of the "claim" could be up to a maximum of the total underlying foreign tax account of FA2 (subject to the amount of the dividend and the balances in exempt and taxable surplus).

The Directorate noted that if the additional claim in Year 1 was for $51, the increased UFT of $61 would permit a full s. 113(1)(b) deduction in respect of the dividend paid to Canco in Year 2 based on a relevant tax factor of 100/38. The Directorate went on to state:

…because the computation of "underlying foreign tax" pursuant to paragraph 5907(1)(1) of the Regulations is "at a particular time", it is our view that the two dividends could be paid in the same taxation year of Canco (i.e. one from FA2 to FA1 and then another from FA1 to Canco) with the same result being achieved. The underlying foreign tax of FA2 could be utilized to increase the deduction available to Canco pursuant to paragraph 113(1)(b) of the Act by making a disproportionate claim on Canco's Part I return. This would be accomplished by notifying the Department by letter attached to Canco's Part I return identifying the dividend from FA2 to FAl and the amount of the disproportionate "claim" pursuant to subparagraph 5907(1)(m)(ii) of the Regulations for that dividend.

Subsection 5907(1.1)

Administrative Policy

22 November 1991 Memorandum (Tax Window, No. 13, p. 9, ¶1608)

Provided that the primary and secondary affiliates are going concerns and the intercompany account has been charged with a number of offsetting items, the secondary affiliate will be considered to have paid the primary affiliate for the taxes where their amount has been booked to the intercompany account.

Subsection 5907(1.3)

Administrative Policy

8 April 2004 Memorandum 2003-0037291I7 - US LLC and Regulation 5907(1.3)

A wholly-owned US C-corp subsidiary (US Holdco) of a taxable Canadian corporation wholly-owned two LLCs (US LLC1 and US LLC2), which earned only foreign accrual property income, with their income being included in that of US Holdco for Code purposes. Under a tax sharing agreement, each group member paid its respective tax costs as if it had filed a separate return, with the amount of this hypothetical tax distributed accordingly - e.g. should an LLC be in a loss position, that LLC would receive compensatory payments from the other group members that represented the hypothetical tax refund.

After finding that the compensatory payments were foreign accrual tax under s. (a)(ii) of the FAT definition in s. 95(1) to the extent that the LLC earnings were distributed to US Holdco, CRA went on to find that the payments were not deemed to be FAT under Reg. 5907(1.3)(a) as the LLCs had no liabilities for US tax in the first place (being flow-through entities), so that:

[A]ny compensatory payment made by US LLC1 or US LLC2 under the tax sharing agreement cannot reasonably be regarded as being in respect of income or profits tax that would otherwise have been payable by either US LLC1 or US LLC2.

Reg. 5907(1.3)(b) also did not apply as here there was not a group loss system such as obtained in the UK.

Subsection 5907(1.5)

Administrative Policy

6 February 2015 T.I. 2014-0542281E5 - Foreign affiliate - prescribed foreign accrual tax

Under the income tax law of "Country X" FA2, its sister, FA3 and FA1, which is the parent of FA2 and FA2 and the wholly-owned subsidiary of Canco, determine their income tax on a consolidated basis, so that FA1 (which has no income or loss for any year) pays such tax on behalf of FA2 and FA3 (with FA1, the "Group"). In year 1, FA2 earns $100 of FAPI, FA3 has a $100 active business loss and FA2 makes the "Payment" of $40 to FA1. The Payment may reasonably be regarded as in respect of the income tax otherwise payable by FA2 (at a 40% rate) respecting FAPI had there been no consolidation.

In year 2, FA2 has no FAPI or other income and FA3 has a foreign accrual property loss ("FAPL") of $100. Would the portion of the Payment otherwise prescribed by Reg. 5907(1.3) to be foreign accrual tax ("FAT") be reduced to nil by Reg. 5907(1.4)?

CRA stated that this determination:

must be made based on the income and losses of the members of the Group for year 1 and, if applicable, preceding taxation years. Accordingly, the FAPL realized by FA3 in year 2 would not be relevant to the analysis. In year 1, it is reasonable to consider that the Payment made by FA2 is in respect of the active business loss of FA3. Therefore…[Reg.] 5907(1.4)… applies to reduce the amount otherwise prescribed by subsection 5907(1.3)…to be the FAT applicable to the amount included in income by Canco to nil. Our view would be the same regardless of the year in which the Payment in respect of year 1 is made by FA2.

Suppose that in year 2, FA2 had no income (as before) but FA3 had active business income of $100, so that Reg. 5907(1.5) would prescribe in year 2 an amount equal to the Payment to be FAT applicable to the amount included under s. 91(1) in the income of Canco in year 1. In finding that the deduction under s. 91(4) would not be available to Canco in year 1, CRA stated:

[T]he operation of subsection 5907(1.5)… will cause the deduction under subsection 91(4) of the Act to become available to Canco in year 2.

Subsection 5907(1.6)

Articles

Adam Freiheit, "Reinstated Foreign Accrual Tax and the Multi-Period Perspective", Canadian Tax Journal, (2015) 63:2, 521-42, p. 521.

General reduction under Reg. 5907(1.4) (p. 523)

[R]egulation 4907(1.3) can prescribe the particular FA's tax compensation payments to other members of the group to be FAT….

[R]egulation 5907(1.4) reduces the amount otherwise prescribed to be FAT pursuant to regulation 5907(1.3) to the extent that the amount "can reasonably be considered to be in respect of" a loss or capital loss of another corporation, where that loss or capital loss would not be a FAPL of a CFA of a relevant person or partnership in respect of the taxpayer….

Purpose of Reg. 5907(1.4) (p. 524)

The-[Finance] explanatory notes to regulation (1.4) clarify its purpose merely by stating that any resulting FAT denial is "consistent with the fact that... active business losses and capital losses resulting from the disposition of excluded property of a foreign affiliate are not included in the computation of a FAPL." This can be interpreted to mean that, just as a stand-alone FA cannot use active business losses to reduce FAPI, so too an FA should not be able to generate FAT by compensating a separate entity for its active business losses. Regulation 5907(1.4) blocks a taxpayer from increasing FAT deductions on the reassignment of active business losses within a consolidated group.

One-shot reinstatement only when full notional loss deduction (pp. 524-5)

[I]f regulation 5907(l.5) reinstates FAT, it does so all at once—with prescribed FAT in the taxpayer's taxation year that includes the last day of the FA's designated taxation year. Thus, if the [Finance] explanatory notes example is modified so that FA 3 earns active business income of $299 in 2006 and $1 in 2007, the FAT is still reinstated only in 2007, with no FAT deductionin2006.

FAT deduction under s. 91(4) (in e.g. 2007) in respect of year (e.g. 2004) of FAPI inclusion (p. 527)

[C]anco, pursuant to Finance's approach, is viewed as having a FAT reduction in 2004 and therefore a net FAPI income inclusion for that year. Canco's deduction in respect of reinstated FAT, however, is delayed until 2007. A taxpayer may be prevented from carrying back a loss resulting from reinstated FAT to the FAPI year….

Imaginary nature of deduction/application of local rules (pp. 527-8)

[U]nder regulation 5907(1.6), 2007 is a designated taxation year of FA 2, because the 2004 losses of the members of the consolidated group could "reasonably be considered" to have been fully deducted in computing US taxable income in that year. The local deductions in this context are hypothetical. Regulation 5907(1.6)(a) requires a taxpayer to ignore all FAPI earned by the members of the consolidated group, whereas, in reality, FA 3's losses are applied against FA2's FAPI in 2004, and no losses are available for carryover….

In evaluating the hypothetical carryover, the FAT reinstatement regulations only authorize the assumption that no FAPI is earned by the relevant affiliates. All other local prerequisites for loss carryovers must be applied, regardless whether they resemble those under the Act….

[A] taxpayer cannot be certain of its intended deduction for reinstated FAT until it resolves its income and losses under local rules for each period that might have losses that can be carried back to a relevant year.

No reinstatement if FAPI earner ceases to be FA (p. 528)

…FAT reinstatement is seemingly possible only if the FA that has earned the relevant FAPI remains an FA of the taxpayer. The requisite relationships may be lost if, for example, the taxpayer transfers the FA to a parent or sister company.

Tainting effect of Losscos joining group (p. 529)

The hypothetical carryover under the FAT reinstatement regulations does not seem to ignore losses of entities that join the consolidated group, even while ignoring the income of such entities. Regulation 5907(1.6)(a) authorizes only one assumption in analyzing the carryover: that FAPI is ignored. The hypothetical deductions are arguably prevented if income in periods following the FAPI year is actually offset by losses of entities that are newly formed, or acquired… .

Requirement to utilize capital losses? (p. 529)

[R]egulation 5907(1.6) appears to require that all "losses" from the FA years ending in the FAPI year be fully deducted. "All losses" presumably includes capital losses, FAPLs, and FACLs realized by the group companies. [fn 29: While FAPLs realized by members of a consolidated group would not of themselves cause regulation 5907(1.4) to reduce FAT, this provision can nonetheless apply when there are FAPLs in a group if other members of the group realize active business losses in the year.]…

Several local taxation periods ending in FAPI year (p. 530)

[A] taxpayer is eligible for FAT reinstatement only if losses for all taxation years ending in the FAPI year are hypothetically deducted against non-FAPI income. The FAPI year is a taxation year of the Canadian taxpayer. The relevant FAs might have several local taxation periods ending in this FAPI year. There could be situations where losses in some of the periods ending in the FAPI year did not "cause" the relevant FAT denial….

Blocking effect of FAPLs (p. 530)

[T]he losses in question must be fully deducted against any income on the assumption that the relevant foreign corporations have no FAPI. Thus, a taxpayer could arguably fail to get FAT reinstated even if the members of the group have active business income that would offset the FAPI-year losses, if those members also have FAPLs in the relevant years.

In the example illustrated by table 3, FA 1 has a FAPL of $200 in 2006. Seemingly, no 2004 losses can be deducted hypothetically against FA 3's 2006 active business income because, this income can be viewed as being already offset by FA l's FAPL in that year….

Reinstatement by deducting FAPI-year losses against passive income earned by non-FAs (p. 532)

The members of the consolidated group might include non-FAs, which by definition cannot earn FAPI. [fn 30: FAPI is defined in subsection 95(1) only relative to FAs of a taxpayer. To illustrate, an FA ("US Sub 2") of a Canadian taxpayer ("Canco") might be a member of a consolidated group that includes non-FAs if Canco is wholly owned by a US parent ("USP"); USP directly owns all the common shares of US Sub I and US Sub 2; USP, US Sub 1, and US Sub 2 form a consolidated group; and Canco owns only all of the special shares of US Sub 2.] As a result, one could arguably achieve reinstatement by deducting FAPI-year losses against passive income earned by non-FAs, even if that income would have been FAPI had the non-resident entities been FAs of the taxpayer….

Deduction against 50% of non-excluded property capital gains (p. 532)

The FAT reinstatement regulations seemingly permit losses to be used against other kinds of non-active business income, such as passive income earned by FAs for local purposes that is excluded in computing FAPI. For example…assuming that "income" for the purposes of regulation 5907(1.6)(a) can include capital gains, one should arguably be able to deduct FAPI-year losses against 50 percent of an FA's gains on the disposition of non-excluded property because the FA would still have such gains even assuming that it had no FAPI.

No reinstatement when no FAPI-year losses (p. 533)

…FA 1 compensates FA 2 in year 2 for the use of its active business losses realized in year 1. FA 2 later earns active business income in year 6. The FAT in respect of FA 1 otherwise prescribed by regulation 5907(1.3) is arguably reduced under regulation 5907(1.4), by the amount of FA l's compensation payment to FA 2, since FA 2 is not being compensated for a FAPL. However, this FAT seemingly cannot be reinstated, despite the active business income earned in year 6, because regulations 5907(1.5) and (1.6) trigger such reinstatement only when FAPI-year losses are hypothetically carried over, and in this example there are no FAPI-year losses whatsoever.

Initial multi-year perspective (pp. 537-8)

The CRA had applied [in 901876] a multi-period perspective in an even earlier head office memorandum [than in9719055 and 2002-013420117]...in interpreting the FAT definition and regulation 5907(1.3). ... FA 1 and FA 2 are FAs of a Canadian taxpayer; FA 1 is the head company of a consolidated group that includes FA 2. … The CRA accepted that FA 2's compensation payment in year 1 could constitute FAT in respect of its FAPI in year 2 if the consolidated group could hypothetically carry back the active business loss from year 2 to offset its active business income in year 1….

Multi-year perspective where local differences (p. 542)

Many provisions in the Act and regulations require a taxpayer to determine whether income or profits taxes can "reasonably be considered" to have been paid "in respect of" income from a specific source. Where a taxpayer has different sources of income for local purposes in various years, the challenge is to determine in what respects a multi-period perspective can be adopted in determining what the taxes reasonably relate to….

For some time, the CRA has respected a multi-period perspective in analyzing some of these broad provisions. … In implementing regulations 5907(1.5) and (1.6), Parliament codified an application of the multi-period perspective – but only in the context of FAT denial rules applicable to consolidated groups. The FAT reinstatement regulations were intended to permit FAT deductions when active business losses causing FAT denial are hypothetically deducted against active business income earned in subsequent years.

It is not clear whether the legislature, in enacting the FAT reinstatement regulations, sought to change how the multi-period perspective was already being applied. Parliament may have merely been clarifying how to apply the multi-period perspective in more difficult, multiple company scenarios.

Subsection 5907(2)

Paragraph 5907(2)(f)

Administrative Policy

6 May 2014 May CALU Roundtable Q. , 2014-0523341C6

Mr. X, a Canadian resident, owns 100% of Canco which owns 100% of the shares (having a low ACB) of Foreignco, which is required by the income tax law in its country of residence to compute its income from its active business carried on therein. The proceeds of a life insurance policy (previously acquired by Foreignco) received by it upon the death of Mr. X are exempt under the local tax law and also would be exempt if received in Canada. Into which surplus account will they go? After stating that it is "conceivable" that "in very rare cases" the proceeds might be viewed as income pertaining or incident to the active business, CRA went on to state:

[T]here are no facts provided as to why a life insurance policy was acquired by Foreignco on the life of Mr. X and therefore no basis to conclude the policy was related to Foreignco's active business. If that is the case, the life insurance proceeds would not be added to "earnings" from an active business of Foreignco under paragraph 5907(2)(f) of the Regulations. … As no amount is included in the computation of income under the provisions of the Act, no amount could be included as FAPI. Therefore, the life insurance proceeds received by Foreignco would not be included in its taxable surplus pool. Accordingly, the life insurance proceeds … would form part of Foreignco's pre-acquisition surplus pool.

If no exempt, hybrid, or taxable surplus is available any dividend paid by Foreignco will be determined to be paid out of Foreignco's pre-acquisition surplus and a capital gain will be triggered by virtue of subsection 40(3)… .

14 March 2014 Memorandum 2013-0499141I7 - IRC 338(h)(10), "earnings" and safe income

An indirect wholly-owned foreign affiliate ("FA") of Canco made an arm's length purchase of all the shares of "US Holdco," whose wholly-owned subsidiaries ("US-Opcos") had accrued gains inherent in the appreciated assets of their active businesses including capital property, depreciable property and intangible property such as goodwill. The US-Opcos each carried on an active business in the United States.

FA and the common parent of the selling consolidated group filed a joint election under s. 338(h)(10) of the Code (the "IRC") with respect to FA's acquisition of the US Holdco shares, so that the US-Opcos recognized gain as if they had sold all their assets at FMV and they were treated as having purchased all of their assets for an amount equal to the purchase price of the shares of US Holdco. The US-Opcos thereafter disposed of a portion of their assets including depreciable and intangible property.

The Directorate found that the US-Opcos' earnings amounts should be calculated similarly to what would have been calculated if no IRC 338(h)(10) election had been made. In particular:

- Where a depreciable or intangible property had been fully depreciated/amortized, respectively, the depreciation or amortization taken in excess of the actual expenditure as the result of the stepped-up tax basis under IRC 338(h)(10) election, should be added to the earnings amount pursuant to Reg. 5907(2)(b).

- Where an intangible property having no actual expenditure (i.e., goodwill) had been amortized, the amortization taken on the stepped-up tax basis under IRC 338(h)(10) should be added to the earnings amount pursuant to Reg. 5907(2)(f) (or in the alternative should not be considered in computing the earnings amount determined under s. (a)(i) of Reg. 5907(1) –"earnings" [apparently on the basis "that ‘notional' income or deductions are simply excluded from the earnings amount" (para. 15)].) (Conversely, such amortization would not "be in respect of an ‘expenditure made' and, therefore, could not result in an add back pursuant to paragraph 5907(2)(b)" (para. 23))

- To the extent the disposition of intangible property resulted in income from an active business, the increase in tax basis as the result of the IRC 338(h)(10) election (net of any accumulated amortization taken thereon), of intangible property disposed of other than goodwill may be added to the earnings amount pursuant to Reg. 5907(2)(b) and the net stepped-up tax basis under IRC 338(h)(10) of the goodwill disposed of should be added to the earnings amount under Reg. 5907(2)(f) (or, in the alternative, should not be considered in computing the earnings amount determined under s. (a)(i) of the "earnings" definition) – without duplication of the adjustments in 1 and 2.

See also summary under s. 55(2).

5 December 2003 T.I. 2002-0165195

The U.S. subsidiary ("CFA1") of Canco has non-interest bearing loans payable by it to Canco. The proceeds of those loans had been used by CFA1 to acquire shares of U.S. subsidiaries of CFA1 in order for CFA1 to earn dividends that were deemed active business income pursuant to s. 95(2)(a)(ii). The forgiveness of those loans would not result in an adjustment to "earnings" under Regulation 5907(2)(f) because this provision only applies to revenue, income or profit derived from an active business carried on by a foreign affiliate. However, the forgiveness would be considered to be a contribution of capital which could be added to the ACB of the shares of CFA1 held by Canco pursuant to s. 53(1)(c).

Paragraph 5907(2)(j)

Administrative Policy

28 May 2015 IFA Roundtable Q. 11, 2015-0581571C6

"Borrower FA," which exclusively carries on an active business, borrows money from "Lender FA" to pay a dividend in an amount not exceeding its accumulated profits used in its business. Assuming the other s. 95(2)(a)(ii)(B) conditions are met, is the interest deductible by Borrower FA in computing the amount prescribed to be its earnings or loss from an active business, so that it will be included in the active business income of Lender FA? In responding affirmatively, CRA stated:

If the interest expense is not deductible by Borrower FA in any taxation year under the relevant foreign country's income tax law, it will nevertheless be deductible…pursuant to paragraph 5907(2)(j)… because it will be considered to have been made or incurred by Borrower FA for the purpose of gaining or producing earnings from an active business carried on by it as determined under subparagraphs (a)(i) or (ii) of the definition of "earnings" in subsection 5907(1)… .

See summary under s. 95(2)(a)(ii)(B).

6 March 1995 Memorandum 941221 (C.T.O. "Adjustments in the Computation of Exempt Surplus")

Interest paid on overdue taxes must be deducted under Regulation 5907(2)(j) in computing the earnings of a foreign affiliate.

93 C.M.TC - Q. 2

Discussion of treatment of interest paid by one U.S. foreign affiliate to another where only part of the interest paid is deductible under s. 163(j) of the Internal Revenue Code.

20 May 1993 T.I. (Tax Window, No. 31, p. 3, ¶2509)

Where funds are lent by FA1 to a second foreign affiliate (FA2) which carries on business in the U.S., and due to the application of the excess interest rule in s. 163(j) of the IRC, FA2 is unable to claim a current deduction for the interest paid to FA1, Regulation 5907(2)(j)(i) will not be applicable in computing the earnings of FA2 for the year the interest is paid because s. 163(j) only defers the deduction. However, the Regulation would apply if FA2 is sold prior to claiming the deduction for the interest paid to FA1 or if the interest deduction were applied to passive income.

22 November 1991 Memorandum (Tax Window, No. 13, p. 9, ¶1608)

In the absence of persuasive evidence, charitable donations, political donations and penalties will not be considered to be deductible.

Articles

Arda Minassian, Kara Ann Selby, "Computation of Surplus Accounts", 2002 Conference Report, (CTF), c. 43

The underlying principle of the regulation 5907(2) adjustments is to determine the amount of assets available to repatriate surplus. Permanent non-deductible expenses, such as the disallowed portion of meals and entertainment, illustrate this principle....

The deduction of amounts in excess of the actual expense artificially reduces earnings, and the taxpayer will want to increase exempt surplus by the additional amount. For example, Thailand and Singapore provide deductions in excess of actual expenses. Thailand offers tax relief for certain manufacturing companies in the form of a second deduction of its utility expenses, while Singapore allows certain capital assets to be depreciated to 150 percent of their original cost.

Subsection 5907(2.6)

Administrative Policy

1 March 1991 Memorandum (Tax Window, No. 2, p. 18, ¶1185)

The election cannot be filed late.

Subsection 5907(2.7)

Administrative Policy

25 April 1995 T.I. 942987 (C.T.O. "6363-1 Foreign Affiliates Deemed ABI")

Where one U.S. subsidiary ("B") of a Canadian corporation lends money on an interest-bearing basis to a second U.S. subsidiary ("C") of the Canadian corporation and the interest is added to the cost of C's inventory for U.S. tax purposes, Regulation 5907(2.7) will require the interest to be deducted by C in computing its earnings from an active business in the year the interest first becomes paid or payable. When the inventory is sold, the earnings of C from an active business will be adjusted upwards.

Subsection 5907(2.01)

Administrative Policy

22 April 2015 T.I. 2014-0550451E5 - Interpretation of paragraph 5907(2.01) of the Regulations.

Does "consideration received" in Reg. 5907(2.01)(a) include any liabilities assumed by a foreign affiliate (the "Receiving Affiliate") on a transfer of property to it by another foreign affiliate (the "Disposing Affiliate") of the taxpayer? After citing Daishowa-Marubeni International Ltd. v The Queen, 2013 SCC 29, for the proposition that "'consideration received' by a taxpayer in respect of a particular disposition of assets includes the amount of any liabilities of the taxpayer that are assumed by a purchaser as part of the purchase of the disposed assets," CRA concluded:

[T]he assumption by the Receiving FA of liabilities of the Disposing FA on a transfer of property to it, is "consideration received" by the Disposing FA for the property transferred… . Accordingly, any such transfer of property by a Disposing FA would not meet the test in paragraph 5907(2.01)(a)… .

Subsection 5907(2.02)

Articles

Paul Barnicke, Melanie Huynh, "Exempt Earnings Anti-Avoidance", Canadian Tax Highlights, (Canadian Tax Foundation), Vol. 23, No. 12, December 2015, p. 5

Application of rule to non-rollover reorgs, cf. fresh start rule (p. 5)

The main target of this anti-avoidance rule may be intercompany excluded-property transfers, but its application can be much broader. It may be possible to consider in this light (1) an FA that pays a dividend in kind; (2) a non-QLAD (qualifying liquidation and dissolution) subsection 88(3) liquidation; and (3) an FA-to-FA liquidation or merger that is not structured as a rollover. One should also ask whether the asset-packaging rule in regulation 5907(2.01) may, in the right circumstances, be caught by regulation 5907(2.02), because, for example, surplus maximization is a stronger motivation than any conditions that were stipulated by the third-party purchaser. Moreover, on the basis of Finance's technical notes, regulation 5907(2.02) may also apply to exempt earnings generated from a deemed disposition of active business assets under the fresh start rules in paragraphs 95(2)(k) and (k.l). However, it is questionable whether the FA's deemed disposition and reacquisition of its asset is considered a disposition of the asset by the FA to itself; a disposition to a person is a precondition of regulation 5907(2.02).

Jenny Li, "The Interaction of the Fresh Start and Surplus Reclassification Rules", International Tax, Wolters Kluwer CCH, April 2014, No. 75, p. 8.

Two conditions under Reg. 5907(2.02) (p. 9)

[T]he "surplus reclassification rule". [fn 5: Regulation 5907(2.02).]…rule reclassifies an amount of exempt earnings as taxable earnings if the following two conditions are met:

- Condition 1: The amount is an increase in exempt earnings (or a decrease in exempt losses) that arises from a disposition of property (other than money) to a "designated person or partnership". [fn 7: …defined in Regulation 5907(1)]

- Condition 2: The disposition is a transaction that is an "avoidance transaction as defined in section 245… .

Example of FA of Canco ("USSub") switching to s. 95(2)(a)(ii) licensing business (p.9)

In 2014, USSub decides to change its business from producing and selling its energy food bars to licensing its "secret" recipe. The primary licensee of the secret recipe will be a company related to USSub. Under subparagraph 95(2)(a)(ii) of the Tax Act, the future income of USSub will be deemed to be active business income and thus classified as exempt surplus. This strategy shift is in response to business and economic conditions in the United States. This strategy shift will cause USSub's business to change from an active to a passive business. [fn 8: USSub's business will be an "investment business" as defined in subsection 95(1) because, among other reasons, its business of licensing property will be principally carried on with non-arm's length persons.]

Boosting of USSub exempt surplus under fresh start rule (p.9)

Under the fresh start rules [in ss. 95(2)(k) and (k.1)], USSub will be deemed to have disposed of and reacquired its assets used in the business at their fair market value at December 31, 2013. A potentially large amount of exempt surplus could be created when the fictional tax reset button is pushed. The assets will be stepped-up to fair market value and subsequently amortized, thereby reducing the exempt surplus of USSub.

Should the surplus reclassification rule re-characterize this exempt surplus as taxable surplus in these circumstances?

Application of Reg. 5907(2.02) 1st condition (disposition "to") (p.10)

Has an increase in exempt earnings arisen from a disposition of property to a "designated person or partnership"? ...[T]he fresh start rules do not explicitly deem USSub to have disposed of its property to any person in particular. Rather, the rules only provide that there is a deemed disposition and a deemed re-reacquisition of such property… .

[T]he Technical notes…stated that: …any exempt earnings that are otherwise created by these rules are subject to the new anti-avoidance rule in subsection 5907(2.02)….

Clearly, the government intended a deemed disposition and reacquisition under the fresh start rules to be within the ambit of regulation 5907(2.02). Whether this position is correct is unclear… .

Application of Reg. 5907(2.02) 2nd condition ("avoidance transaction") (p.10)

What about the primary purpose?...USSub clearly changes its business for bona fide business reasons and not to obtain a tax benefit (e.g., to generate exempt surplus). In some cases, this may not be so clear… .

[E]ven if a possible tax benefit is realized, the intent of USSub was not to accelerate or create exempt surplus in order to repatriate cash to Canada…The absence of excess cash that cannot be repatriated due to a lack of exempt surplus in USSub could support the position that the transaction (i.e., the change in business) was not undertaken to realize a tax benefit.…

Subsection 5907(2.03)

Administrative Policy

22 January 2013 T.I. 2012-0460121E5 - Computation of "earnings" of a foreign affiliate

In taxation year X, the tax regime in Forland changes so that FA ceases to be required under the income tax law of Forland to compute its income or profit from its active business, and instead becomes subject to a flat rate of tax based on its gross revenue, so that FA commences to be required under (a)(iii) of the definition of "earnings" in Reg. 5907(1) to compute its income under Canadian principles. CRA was asked whether FA would be required to deduct, in taxation year X and subsequent taxation years, amounts that it had previously deducted in computing its earnings in taxation years preceding taxation year X for which its calculation of earnings had been made in accordance with the income tax law of Forland. For example, if the cost of a depreciable capital property used by FA in its active business had already been fully depreciated under Forco's income tax laws in the prior years, would the cost of the same asset be required to be claimed again in computing the earnings under Canadian principles in taxation year X pursuant to proposed Reg. 5907(2.03), having regard to the requirement therein that such earnings be computed as if FA had "claimed all deductions that it could have claimed under the Act, up to the maximum amount deductible in computing [FA's] income."

In responding, CRA stated that in applying proposed Reg. 5907(2.03) in respect of the particular taxation year:

any deduction claimed by the affiliate in computing its earnings or loss from that business, in any taxation year of the affiliate that began on or before the commencement of the particular taxation year and for which the earnings or loss from that business had been determined under subparagraph (a)(i) or (ii) of the definition "earnings" in subsection 5907(1) of the Regulations, would be considered to have been actually claimed under the Act and to be within the maximum amount deductible.

Articles

Michael W. Colborne, "Regulation 5907(2.03) and Offshore Metal Streams", Resource Sector Taxation, Volume IX, No. 2, 2013, p. 647.

Description of offshore metal streams transactions (pp. 647-8)

While a detailed description of offshore metal streams transactions is beyond the scope of this article, a brief description of the typical, or base-case, "offshore" transaction is warranted. The usual situation involves a Canadian parent company that owns a foreign affiliate ("Mineco"), which has a mineral project under development in a foreign country. Mineco enters into an off-take contract for the sale of metal at spot prices with another foreign affiliate ("Saleco") of the Canadian parent, which is resident in a low or no-tax jurisdiction. Saleco in turn enters into a metal stream agreement with an arm's length third party, under which Saleco agrees to sell a metal to the third party under certain terms and conditions. One of the terms is that the third party is required to advance money to Saleco as a deposit, which deposit is reduced and applied as part payment for metal to be delivered by Saleco (the amount of deposit so applied is the difference between the spot price that day and a specific fixed amount for each unit of metal).

This structure is intended to allow the upfront deposit to escape foreign taxation in the country in which Mineco operates because Mineco does not receive the upfront deposit as proceeds from the metal sale. Instead, the upfront amount will usually find its way from Saleco by way of equity or debt investment by the Canadian parent.

Treatment before Reg. 5907(2.03) (p. 648)

Absent subsection 5907(2.03) of the Regulations, provided Saleco is resident in, say the Cayman Islands, it would compute its earnings from an active business using Canadian rules by reason of subparagraph (a)(iii) of the definition of "earnings." Assuming typical terms to the metal stream agreement, in computing earnings, Saleco would be required to include the amount of the upfront deposit in income under paragraph 12(1)(a) and would be entitled to claim a reasonable reserve in respect of that amount for goods to be delivered after the end of the year pursuant to paragraph 20(1)(m). However, Saleco would not claim the deduction under paragraph 20(1)(m) so as to allow it to add the entire amount of the deposit to its earnings from an active business. Thus, the deposit could be distributed by Saleco to the Canadian parent by way of dividend in accordance with the usual rules in Part LIX of the Regulations. This would allow the Canadian parent to invest the money downstream in Mineco, which for foreign tax reasons is often much more desirable than having Saleco make the investment in Mineco.

Effect of Reg. 5907(2.03) (p. 648)

Regulation 5907(2.03) curtails this result because it requires Saleco to claim the maximum amount of a reserve under paragraph 29(1)(m) of the Act in computing Saleco's earnings. Thus, Saleco cannot distribute the cash on hand to its Canadian parent by way of dividend. If it has none of the balances described in subsection 90(9) of the Act (typically not), then it is unlikely that Saleco will be able to loan the money upstream unless it was certain it could be repaid within the two-year period required by paragraph 90(8)(a) of the Act.

Subsection 5907(5)

Articles

Philippe Montillaud, Grant J. Russell, "Foreign Accrual Tax and Flow-through Entities", International Tax Planning, Volume XVIII, No. 4, 2013, p. 1280

Application of s. 93(2.01) stop-loss rule to DLAD capital loss (p. 1282)

Regulation 5907(5) requires that capital gains and losses for surplus purposes are to be calculated in accordance with the rules in subsection 95(2) of the Act, which rules obviously include paragraph 95(2)(e). The reference to subsection 93(4) in the Regulation's definition of "hybrid surplus," however, makes clear that recourse should also be had to other relevant rules in the Act, including the stop loss rule in subsection 93(2). Subsection 93(2), in combination with newly introduced subsection 93(2.01), provides that any loss realized by a Canadian resident corporation or a foreign affiliate of the corporation on the disposition of a share of a foreign affiliate must be reduced by the total of any "exempt dividends" received or deemed to have been received on the share by the corporation or affiliate prior to the disposition. Accordingly, where a shareholder affiliate's capital loss on a DLAD is otherwise recognized for the purpose of calculating an affiliate's hybrid surplus, the loss is nevertheless reduced under subsections 93(2) and (2.01) by the amount of any exempt dividends previously paid on the shares of the disposing affiliate. An "exempt dividend" is defined in subsection 93(3) and generally refers to a dividend that is deductible from a Canadian-resident corporation's income under section 113 of the Act.

Example showing reduction of DLAD capital loss by exempt dividend (p. 1282)

Consider the following example:

- FA1 owns all the shares of FA2, which shares have an adjusted cost base of $100.

- FA2 has only one asset ("Asset"), which Asset has an adjusted cost base and fair market value of $100; the Asset is not an "excluded property" within the meaning assigned under subsection 95(1).

- FA2 has $100 of exempt surplus.

- FA2 distributes the Asset by way of an exempt dividend to FA1.

- FA2 is then liquidated on a DLAD.

Save for subclause 95(2)(e)(iv)(A)(II)1, FA1 would realize a capital loss on the disposition of FA2's shares equal to their cost basis of $100. This loss is recognized for hybrid surplus purposes, but is nevertheless deemed nil because of the $100 exempt dividend paid prior to the DLAD. Accordingly, no amount in respect of the loss is included in FA1's hybrid surplus calculation.

Subsection 5907(5.1)

Articles

Melanie Huynh, Eric Lockwood, "Foreign Accrual Property Income: A Practical Perspective", International Tax Planning, 2000 Canadian Tax Journal, Vol. 48, No. 3, p. 752.

Subsection 5907(6)

Administrative Policy

10 October 2014 APFF Roundtable Q. 24, 2014-0538181C6 F

Reg. 5907(6) was amended for taxation years commencing after 18 December 2009 to eliminate a prohibition against maintaining surplus accounts of a foreign affiliate in Canadian dollars. (a) What are the criteria which CRA applies to determine if it is reasonable to maintain the surplus accounts in Canadian dollars or a foreign currency other than the currency of the affiliate's residence, or to change the currency? (b) For surplus accounts of foreign affiliates calculated in the foreign currency of a particular country before the amendments, does CRA accept that the balance as at December 18, 2009 is converted to Canadian currency at the exchange rate on that date and that the surplus accounts are then maintained in Canadian currency? CRA responded (TaxInterpretations translation):

…(a) As indicated in response to question 7 at the Corporate Management Tax Conference Roundtable of the Canadian Tax Foundation in 1992, there is no hard and fast rule for determining what, in a particular situation, is considered reasonable respecting the choice of a currency in which the surplus accounts of a foreign affiliate are to be maintained for purposes of ITR subsection 5907(6). Those comments remain appropriate despite the amendments…[which] essentially…had the effect of adding the possibility of using Canadian currency, to the extent it is reasonable to do so.

…A number of criteria may apply in determining if it is reasonable to use the Canadian dollar…such as…the principal currency in which the corporation maintains its books and registers for purposes of presenting its financial results, the currency generally used in conducting its commercial transactions in the country in which it carries on business, and the currency which it uses for taxation purposes in the country of its residence. If an examination of these criteria, as well as others considered to be appropriate, permits a determination that use of the Canadian dollar presents a fair picture ["image juste"] of the surplus account balances of the foreign affiliate, we will consider that such use is reasonable in the circumstances.

…(b) Provided that the use of the Canadian dollar is reasonable in the circumstances and that there is no retroactive tax planning involved, we will accept that the surplus account balances of a foreign affiliate for its taxation years terminating before the entry into force of the amendments effected by the 2012 Act [on 26 June 2013] are to be converted into Canadian dollars using the "relevant spot rate," as that expression is defined in ITA subsection 261(1), at the first day of the first taxation year of the foreign affiliate commencing after 18 December 2009… . Generally, we would not consider that retroactive tax planning is involved if the taxpayer advised us in writing well in advance of the time of the preparation of the accounts for the purposes of a determination… .

Brian Darling, "Revenue Canada Perspectives" in Income Tax and Goods and Services Tax Considerations in Corporate Financing, 1992 Corporate Management Tax Conference Report (Canadian Tax Foundation, 1993), 5

1-20, question 7, at 5:13:

[w]hat is reasonable in the circumstances can be determined on a case-by-case basis. There are no hard-and-fast rules. In our view, the use of a particular currency in presenting an affiliate's financial statements or for denominating shares or loans does not, by itself, constitute a reasonable basis for using that currency as the "calculating currency." Where a particular currency has become a generally accepted currency for conducting business in a country, such currency may be considered "reasonable in the circumstances," notwithstanding that some other currency is the official currency of that country. As well, the currency that is used for income tax purposes in the foreign jurisdiction would normally be considered "reasonable in the circumstances."

Subsection 5907(10)

Administrative Policy

The Queen v. Old HW-GW Ltd., 93 DTC 5199 (FCA)

Because Puerto Rico was a country distinct from the United States for purposes of paragraphs (b) and (c) of Regulation 5907(10), it followed given that Puerto Rico was excluded from the listed countries in Regulation 5907(11), that it was a country for purposes of paragraph (a). The subsequent references in paragraphs (b) and (c) were to "that" country or "such" country. Accordingly, a Puerto Rican tax incentive which was designed to promote sales in the continental U.S. was an "export incentive".

Subsection 5907(11)

Administrative Policy

2009 CLHIA Roundtable Q. 4, 2009-0316641C6

In order for income from an active business carried on by a foreign affiliate to qualify as 'exempt earnings', the affiliate must be resident in a designated treaty country under common law and the active business must be carried on by it in a designated treaty country. Accordingly, if the central management and control of a foreign affiliate is in Country A (a non-treaty country) and it carries on business only in Country B (also a non-treaty country), it would be necessary for Canada to have a TIEA with both countries. Conversely, if the foreign affiliate was incorporated in Country A but not resident there under common law definitions, and was resident in Country B at common law and also carried its entire business on in Country B, it would only be necessary for a TIEA to be entered into with Country B.

7 June 1991 T.I. (Tax Window, No. 4, p. 31, ¶1285)

St. Vincent includes the Grenadine Islands of the Bequia, Mustique, Canouan, Mayreau, Union Island and associated islets which are under the jurisdiction of the St. Vincent government.

Articles

Nathan Boidman, "Canada's Two-Faced TIEAs - Netherlands Antilles Trumps Bermuda", Tax Notes International, Vol. 55, No. 12, September 21, 2009, p. 1023.

Subsection 5907(11.2)

Administrative Policy

2013 Ruling 2013-0477871R3 - 5900(1)(a) and dividends from foreign affiliate

Background

A non-resident subsidiary (ForeignHoldco) of a taxable Canadian corporation (Parent) made a non-interest-bearing loan (the Loan) to parent following a liquidation and dissolution (to which Reg. 5907(7) applied) of a Labuan subsidiary of ForeignHoldco (LabuanOpco). LabuanOpco was incorporated under the Offshore Companies Act 1990 (Malaysia) and was resident in Malaysia. Rather than being subject to income tax under the Malaysian Income Tax Act 1967, it was required under the Labuan Offshore Business Activity Tax Act 1990 (Malaysia) to pay 3% of its net income (except for a year in which it elected to pay a flat tax of MYR 20,000), on the basis that such income was from an offshore business activity carried on in a foreign currency in or from Labuan. Such activity was an active business for the purposes of Reg. 5906(1)(a). Immediately prior to the dividends paid to ForeignHoldco in connection with or prior to the liquidation of LabuanOpco, the total of all of the net earnings of LabuanOpco for its preceding years from the active business carried on by it in Malaysia, net of any prior dividends, was equal to or exceeded the amount of those dividends.

Proposed transactions

In order for Parent to settle the Loan:

- ForeignHoldco will declare a dividend equal to the amount outstanding on the Loan at that time, to be paid by the issuance of a non-interest bearing promissory note payable on demand.

- The promissory note will be transferred by Parent to ForeignHoldco in payment of the outstanding amount of the Loan.

Ruling

: For the purposes of applying the surplus rules to the proposed dividend to Parent, the amount of ForeignHoldco's surplus balances:

in respect of Parent will be determined on the basis that each of the dividends received by ForeignHoldco from LabuanOpco were prescribed by paragraph 5900(1)(a) of the Regulations to have been paid out of LabuanOpco's exempt surplus in respect of Parent.

10 November 1997 T.I. 971117

A Barbados corporation that had International Business Corporation status in Barbados and that was ineligible for any tax benefit under the Canada-Barbados Income Tax Convention by virtue of Article XXX(3) thereof would qualify as a resident of a designated treaty country under Regulation 5907(11.2) if it was, in fact, liable to tax in Barbados on its worldwide income.

1997 A.P.F.F. Round Table , Q. 3.5, No. 9M19020

"Under the IBC Act, a corporation that is not incorporated under the laws of Barbados in which it has a branch that qualifies as an IBC, is liable for Barbados tax only with respect to the income attributable to its Barbados branch. The Department is of the view that such a corporation would not be a resident of Barbados for purposes of the tax convention because it is not liable for tax on its world income."

27 October 1997 T.I. 970470

A foreign affiliate ("USCO") that was incorporated in the U.S. but operates in Mexico through a branch and has its central management and control in Mexico will not have its earnings derived from its active business included in its exempt surplus as it will not qualify as resident in Mexico under Regulation 5907(11.2).

17 February 1997 T.I. 961753

The ten-year tax holiday for Barbados Enclave Enterprises would not, by itself, disqualify them from being considered as being resident in Barbados.

8 March 1996 T.I. 960067

A foreign affiliate incorporated in Barbados and licensed under the Exempt Insurance Act, 1983 will not be considered to be "liable to taxation" in Barbados given that its main and, most likely, source of income will effectively be exempt from taxation in Barbados for a guaranteed period of 30 years with the exception of amounts, which although expressed as an income tax, in substance represent an annual licence fee of Bds. $5,000.

1996 Corporate Management Tax Conference Round Table, Q. 3

Because the term "resident in a designated treaty country" is not defined, a company must be resident in a designated treaty country under Canadian common law principles in addition to not being deemed not to be a resident of that country under Regulation 5907(11.2).

Subsection 5907(13)

Administrative Policy

3 October 2000 T.I. 1999-001556

In a situation where a foreign affiliate continues into Canada, the Agency indicated that although s. 128.1(1)(b) "may deem certain dispositions to have occurred, generally no income or profits tax would actually have been paid by the affiliate in respect of such deemed disposition. As a result, no amount of notional tax (in respect of such deemed dispositions) would be included in the 'underlying foreign tax' of the affiliate and hence would not be reflected in the 'taxable earnings' or 'taxable surplus' of the affiliate for purposes of paragraph 5907(13)(a) of the Regulations".