Cases

Babich v. The Queen, 2013 DTC 5010 [at 5556], 2012 FCA 276, aff'g 2010 TCC 352

The taxpayer ("Babich") was the sole shareholder of a corporation ("Able") which provided a car exclusively for use (both personal and business) by Babich's mother and by his father, who was the corporation's general manager. V.A. Miller J. stated (at TCC para 22):

I conclude from all of the evidence that a benefit was conferred on Babich. The Automobile was owned by Able and all expenses were paid by Able. Babich was the sole shareholder of Able and he allowed his parents to have exclusive use of the Automobile for both personal and business purposes. According to subsection 15(5), the value of the benefit to be included in a shareholder's income with respect to an automobile relates to an automobile made available to the shareholder or to a person related to the shareholder.

Sharlow J.A. dismissed the taxpayer's contention that the benefit should have been taxed in the hands of his parents pursuant to s. 6, rather than in his hands under s. 15(1). The Court was satisfied that the trial judge's decision was "correct in law and is consistent with the evidence presented to her" (FCA para. 11).

The Queen v. Robinson, 2000 DTC 6176 (FCTD)

The inadvertent crediting by a company's accountants of an amount to the shareholder loan account owing to the taxpayer rather than to the sales account did not give rise to a shareholder benefit to the taxpayer given that he never drew on this balance and that, at the time of signing his personal return and the time of signing the corporation's tax return, the circumstances were not such that he ought to have known of this error.

The Queen v. Chopp, 98 DTC 6014, Docket: A-87-95 (FCA)

In finding that there was a shareholder benefit conferred when the taxpayer's daughter, while an inexperienced bookkeeper, used corporate funds to pay part of the purchase price for a new home, Denault J.A. quoted (at p. 6015) with approval the following statement in the Tax Court below:

"I think a benefit may be conferred within the meaning of subsection 15(1) without any intent or actual knowledge on the part of the shareholder or the corporation if the circumstances are such that the shareholder or corporation ought to have known that a benefit was conferred and did nothing to reverse the benefit if it was not intended ... . If there is a genuine bookkeeping error with respect to a particular amount and that amount is truly significant ... a court may conclude that the error should have been caught ...".

The Queen v. Fingold, 97 DTC 5449 (FCA)

A holding and management company owned by the taxpayer and his brother conferred a taxable benefit on the taxpayer when it purchased a Florida condominium (in the building where the taxpayer's mother had an apartment) at a cost of Cdn. $1.8 million, renovated and upgraded the condominium at a further cost of Cdn. $2.2 million and then provided the condominium free of charge (with the exception of the payment of some operating expenses) to the taxpayer and his family, who used it for winter vacations and for business entertaining on numerous occasions. There was no error in the assumption of the Minister that the "equity rate of return" method should be used to compute the shareholder benefit, i.e., calculating what the company could have earned on the money it had used in acquiring and renovating the condominium.

Hrga v. The Queen, 97 DTC 5165 (FCTD)

The taxpayer, who was the sole beneficial shareholder of a corporation ("Interconserv"), guaranteed a debenture of a partially-owned subsidiary of Interconserv ("Concept"). Jerome A.C.J. found that there was an unwritten agreement by Interconserv to indemnify Hrga if he should be required to honour that guarantee. Accordingly, when the taxpayer utilized assets of Interconserv to satisfy a demand under the guarantee, there was no conferral of a benefit on him by Interconserv.

Toma v. The Queen, 95 DTC 5356 (FCTD)

When one of the two corporations owned by the taxpayer ("Meridian Green") fell into financial difficulty, the taxpayer signed a personal promissory note for $110,000 in favour of a customer of the second corporation ("Meridian Seed") and agreed that a like amount of produce of Meridian Seed was pre-sold to the customer. In finding that there had been no appropriation of $110,000 by Meridian Seed to the taxpayer, Jerome A.C.J. noted that when the taxpayer received the $110,000 from the customer, he did not keep it for his personal use but rather used the money to rescue Meridian Grain; and further noted (at p. 5358) that "at all times, he was acting as he did for several years, as the operating mind of both corporations rather than in his personal capacity".

Penny v. The Queen, 95 DTC 5083 (FCTD)

An account receivable owing to a private corporation controlled by the taxpayer was found to have been appropriated by him given the receipt (and reporting of interest) by him on the receivable and the subsequent receipt of payment by him of the receivable. Although the receivable could not have been realized at the time of the appropriation (due to the financial position of the payor), Simpson J. found that in the absence of evidence of the actual value of the receivable, its value must be taken to be its face value. In response to a submission that the taxpayer could not have sued personally for payment of the receivable in view of the commission agreement which made it payable to the corporation, Simpson J. noted that s. 15 referred to an appropriation "in any manner" and stated (at p. 5086) that "to me, this language encompasses a de facto taking". He also noted that the word "appropriate" in s. 15(1)(b) "conveys a notion of taking but does not necessarily require a formal documented taking".

Cartwright v. The Queen, 94 DTC 6677 (FCTD)

The shareholder benefit received by the taxpayer as a result of a seasonal residence of the corporation being made available for use by him and his family was calculated by Rouleau J. to be $1,000 a week (or $12,000 for the summer season), being what the plaintiff would have paid had he and his family vacationed in an exclusive resort for a summer season of 12 weeks, rather than the higher figure calculated by the Minister on the basis of applying the prescribed rate to the relevant capital costs. No benefit was applicable to a subsequent summer in which no use was made of the residence.

Winter v. The Queen, 90 DTC 6681 (FCA)

Where an individual had a company controlled by him sell shares of another corporation to his son-in-law for a sale price that was less than their fair market value, s. 56(2) applied to the individual, rather than s. 15(1) applying to his son-in-law. Although the son-in-law held one share of the vendor corporation representing 0.01% of its total issued share capital, the son-in-law entered into the transaction qua son-in-law rather than qua shareholder.

Youngman v. The Queen, 90 DTC 6322 (FCA)

A corporation owned by the taxpayer and his family built a luxurious home in 1978 at a cost of $395,549 on land which originally had been acquired by it for a housing development which the municipal authorities had failed to approve. The taxpayer was reassessed on the basis that he had received a benefit computed by taking a 9% rate of return on the corporation's equity in the house (i.e., the cost of construction minus the amount of a third-party mortgage), adding thereto the mortgage interest and other expenses paid by the corporation, and subtracting the monthly rent of $1,100 paid by the taxpayer.

Pratte, J.A. accepted this computation of the benefit, with the proviso that it should be reduced by an amount of notional interest on an interest-free loan which the taxpayer had made to the corporation in order to help fund the construction, given that if the taxpayer had been dealing with a corporation of which he was not a shareholder, this interest-free loan would have been taken into account in determining the amount of the rent. Although the value of the benefit which was received, rather than the cost of the benefit to the corporation was relevant test, "in determining the value of benefit, one may take its cost into consideration" (p. 6325). Here, the high cost of the home was attributable to the special requirements of the taxpayer, and under such circumstances a corporation of which the taxpayer was not a shareholder "would have then charged a rent sufficient to produce a decent return on its investment" (p. 6326).

Vine Estate v. The Queen, 89 DTC 5528 (FCTD)

An incorporated car dealership (Carl Vine Ltd.) which was owned by an individual (Mr. Vine) and his wife contributed monies to fund the operating losses of a Florida company (W.J.V. Inc.) which was owned by Mr. Vine. Jerome, A.C.J. held:

"[T]he sums advanced to W.J.V. Inc. by Carl Vine Ltd. must be considered as income in the hands of Mr. Vine, as "funds of a corporation appropriated for the benefit of a shareholder" (to paraphrase s. 15(1)(b) or "a payment made pursuant to the direction of a taxpayer to some other person for the benefit of the taxpayer as a benefit the taxpayer desired to have conferred on the other party" (to paraphrase s. 56(2)). Either section has the effect of adding the advances from Carl Vine Ltd. to W.J.V. Inc. as income taxable in the hands of Mr. Vine. This is so, no matter how the monies appeared in the books of either company. ... As for the ultimate decrease in value suffered by Mr. Vine, it is irrelevant, as noted in Boardman and in Guilder News. ..."

Friedland v. The Queen, 89 DTC 5341 (FCTD)

An individual ("Friedland") carried on his business of economics consulting through a corporation ("SFRA"). When dissatisfied clients brought action against SFRA and Friedland, and the OSC charged Friedland with acting as an unlicensed securities adviser, SFRA incorporated a subsidiary ("Comar") which continued carrying on the consulting business.

The payment by Comar of all the related legal expenses did not give rise to shareholder benefits. "If all those proceedings had not been defended, or unsuccessfully defended, it is obvious, from a practical business point of view, Professor Friedland's services to clients and potential clients would have been tarnished and diminished. Comar's business would then have been affected."

The payment by Comar of various expenses associated with the use by Friedland of a Rolls and BMW for commuting to work assignments downtown and at York University also did not give rise to a shareholder benefit.

Grohne v. The Queen, 89 DTC 5220 (FCTD)

The taxpayer, along with other promoters of a company, entered into a "standby agreement" whereby they agreed to purchase shares of the company for 25¢ per share to the extent that shares pursuant to a rights offering by the company were not fully subscribed for. At the time the taxpayer acquired shares pursuant to the standby agreement, the market price was well in excess of the 25¢ per share paid by him.

Because, on balance, it appeared that both the corporation and the taxpayer were obligated to issue or subscribe for the shares regardless of their current market value, the honouring of this obligation by the corporation did not entail the conferral of a benefit. "In respecting such a contract and giving the customer-shareholder his due under the contract, the corporation is not conferring on him a benefit or advantage but simply fulfilling its contractual obligations."

Cooper v. The Queen, 88 DTC 6525, [1989] 1 CTC 66 (FCTD)

With reference to whether an interest-free loan gives rise to a taxable benefit, Rouleau J. stated:

"There is a considerable difference between the situation where the lender himself must go out and borrow funds at a specified rate of interest and then turns around and offers a loan to a shareholder interest free, and the case where the loan comes out of operating capital already held by the lender."

R. v. Century 21 Ramos Realty Inc., 87 DTC 5158, [1987] 1 CTC 340 (Ont.C.A.)

The summary conviction appeal court judge indicated that even if shares received by the accused had a value of only $25, the accused should still have included $25,000 in his return because all the parties concerned, including him, were of the belief that the shares had a value of $25,000. The Court of Appeal held that the belief of the accused was immaterial and it is "only the 'amount or value' of the property appropriated to or for the benefit of the shareholder that must be included in computing the income of the shareholder".

Hall v. The Queen, 86 DTC 6208, [1986] 1 CTC 399 (FCTD)

The shareholders of a company ("Quebec") purchased a $453,000 note owing by the company for a purchase price of $250,000, payable in 20 semi-annual instalments of $3,750, with the balance of $175,000 payable at the end of the 10 year period. The payment of one of the $3,750 instalments by Quebec, rather than its shareholders, gave rise to a taxable benefit under s. 15(1), notwithstanding that the payee ("Jersey") applied the amount as a reduction of the amount owing by Quebec on the $453,000 note. "What Jersey did, in its books, with the payment, cannot, to my mind, change the character of the transaction as between Quebec and its shareholders."

Indalex Ltd. v. The Queen, 86 DTC 6039, [1986] 1 CTC 219 (FCTD), aff'd 88 DTC 6053, [1988] 1 CTC 60 (FCA)

A "shareholder" does not include an affiliate that does not hold shares in the corporation.

Murphy v. The Queen, 85 DTC 5462, [1985] 2 CTC 248 (FCTD),

A company of which the taxpayer and her husband were the shareholders paid for work that was done on the family residence, which was owned by her in joint tenancy with her husband. Although she did not order the work that was done and had no knowledge of who paid for it, the inclusion of 1/2 of the amount charged to the company in her income was found to be proper.

The Queen v. Houle, 83 DTC 5430, [1983] CTC 406 (FCTD)

It was found that since a yacht had been acquired by a company primarily for business entertaining and promotional purposes rather than for the personal use of its shareholder, the benefit under s. 15(1)(c) was only a prorated portion of the yacht's operating costs, determined by comparing the hours of personal use to the total hours of use.

Schlamp v. The Queen, 82 DTC 6274, [1982] CTC 304 (FCTD)

Rent-free accommodation provided by a company to its shareholder with respect to a home constructed by the company was a taxable benefit. $350 per month was added to the taxpayer's income.

The Queen v. Schubert, 80 DTC 6366, [1980] CTC 497 (FCTD)

It was held that the transfer of all the assets of an unincorporated printing-table business by the owner to a company controlled by him entailed the transfer of substantial goodwill. There was one mechanic to whom the conduct of the business could be safely left, and the product of the business was of superior quality and widely known. Payments by the company to the vendor-shareholder of the purchase price represented by a promissory note were not benefits conferred under s. 15(1)(c).

Berbynuk v. The Queen, 78 DTC 6322, [1978] CTC 448 (FCTD)

A company did not report income generated from the sale of scrap metal. Some of the cash so generated came into the hands of the appellant, who held 1/3 of the company's shares. The cash was used as a slush fund for business purposes, including business promotion.

There was no benefit to her under s. 15(1). There is nothing in the Act "which would authorize the attribution of a corporation's suppressed income to an employee or shareholder simply because it was suppressed income. In order for it to be attributable ... the individual must have either received the money or its value in the form of a benefit or advantage."

Perrault v. The Queen, 78 DTC 6272, [1978] CTC 395 (FCA)

The appellant majority shareholder of a company, who agreed to purchase the shares held in the company by a minority shareholder in consideration of having the company first pay a dividend to the minority shareholder of $350,050, was found to have received a benefit of $350,050 in that the payment of the dividend satisfied his obligation to pay the price of the shares. "It is undeniable that a payment by a corporation, whatever its form, which has the effect of extinguishing a debt or obligation of a shareholder must be considered to be a benefit conferred on him ... The value of what he acquired in consideration of the debt or obligation is really irrelevant".

The Queen v. Ginter, 77 DTC 5274, [1977] CTC 418 (FCA)

A corporation, which was owned by the taxpayer, leased a building from him and made an addition to it. It was found that since it was anticipated that the addition would be removed or demolished at the termination of the tenancy, no benefit had been conferred on the taxpayer.

Steeves v. The Queen, 76 DTC 6269, [1976] CTC 470 (FCTD)

Two individuals who were engaged in the road construction business elsewhere, owned 1/2 the shares of a corporation ("Paving") engaged in that business which was in financial difficulty. The individuals purchased the shares of the other shareholders for $1, exonerated those shareholders from liability for Paving's debts and purchased debts from the other shareholders having a principal amount of $620,633 for $70,000. Amounts paid by Paving in excess of the individuals' $70,000 investment were a taxable benefit under s. 15(1)(c). The individuals knew at the time of acquring the debts that they could make a handsome gain by turning the business around through their own efforts.

The Queen v. Phillips, 76 DTC 6093, [1976] CTC 126 (FCA)

In 1964 the taxpayer acquired all the shares of a company from an individual ("Beaupré") for $12,000 and, as part of that arrangement, caused the company to enter into an agreement with Beaupré to pay him $48,000 in instalments, purportedly as consulting fees. Beaupré obtained a court judgment in respect of the failure of the company to pay instalments, and in 1966 the company paid $22,000 to Beaupré for a release of his claims.

The Crown's appeal in respect of the taxpayer's 1966 taxation year was dismissed because the benefit was conferred in 1964 when the company agreed to make the payments. "Such agreement was part of the inducement or consideration for the transfer of his shares by Beaupré to the respondent. If the company had not executed that agreement, the respondent would not have obtained the shares for ... $12,000".

Rosenblat v. The Queen, 75 DTC 5274, [1975] CTC 472 (FCTD)

In June 1967 a company ("Brilund") agreed to issue shares then worth no more than $120,000 to a non-resident shareholder, in consideration of past services rendered by him, but did not issue the shares to him until December, when the shares were worth substantially more. The shares were to be valued for purposes of s. 15 at the date of the contract, and there accordingly was no withholding tax exigible under s. 214(3)(a).

The Queen v. Neudorf, 75 DTC 5213, [1975] CTC 192 (FCTD)

The cost of improvements made by a company to leased building premises owned by its shareholder was included in his income. There was no agreement that the improvements belonged to the company.

The Queen v. Leslie, 75 DTC 5086, [1975] CTC 155 (FCTD)

In 1959 the taxpayer sold his food storage business having a fair market value of $5,078 to a company of which he was the majority shareholder in consideration of treasury shares having an expressed value of $10,000 and a promissory note in the principal amount of $15,300. No payments were made on the promissory note until 1969. Since the company at the time of issuance of the promissory note did not have "sufficient assets to create a good or sound expectation of the debt actually being paid" no benefit was conferred until the time of payment.

Huron Steel Fabricators (London) Ltd. v. M.N.R., 75 DTC 5006, [1974] CTC 889 (FCTD)

The Crown's theory was that an arrangement, whereunder (a) the majority shareholder ("Fratschko") of a private company ("Huron") acquired the shares in Huron held by a minority shareholder ("Peckham") as the result of the almost immediate default of Peckham on a loan to him by Fratschko, and (b) a contract whereunder a company ("Pelon") owned by Peckham agreed to perform services for Huron, should be regarded as a sale of shares by Fratschko to Peckham for consideration funded by the payments by Huron to Pelon under the service contract. However, the evidence established that Pelon had provided substantial services to Huron, and that the amount of the loan for which Peckham's shares were security approximated their fair market value. No shareholder benefit was conferred on Fratschko.

Angle v. M.N.R., 74 DTC 6278, [1975] 2 S.C.R. 248

"A tax assessment in respect of a benefit or advantage received is not inconsistent with an obligation to pay for the benefit or advantage where, for example, there is no apparent intention to honour the obligation. The decision that a taxable benefit has been received can stand in an appropriate case with an alleged obligation to pay for that benefit."

Byke Estate v. The Queen, 74 DTC 6585, [1974] CTC 763 (FCTD)

Following the acquisition of the shares of a company by the taxpayers for consideration that included a mortgage given by the company to the vendors, the company paid principal and interest on amounts borrowed by the taxpayers to acquire its shares, and also made payments of principal and interest under the mortgage. On both counts, the company conferred a benefit on the taxpayer. "When, periodically, the company carried out the terms of its commitment the benefit was quantified and the company's funds appropriated for their benefit." It was noted that it was irrelevant whether or not the mortgage was illegal.

Bernstein v. MNR, 74 DTC 6041, [1974] CTC 4 (FCTD), aff'd 77 DTC 5187, [1977] CTC 328 (FCA)

Pillsbury Holdings did not apply to a sale by a corporation ("Highland") to its individual shareholders of shares of a subsidiary ("Berkam") worth $100,000 for cash consideration of $200, because in the present case there was a clear invoking of the provisions of sections 15(1)(c) and 245(2). Walsh, J. stated that "there was no reorganization whatsoever of Highland's capital structure or business, the reorganization having taken place with respect to Berkam".

Kennedy v. MNR, 73 DTC 5359, [1973] CTC 437 (FCA)

The taxpayer's company acquired a property at a net cost of $159,000 and converted it for use in a car dealership at a cost of $185,000, so that its total cost was $359,000. In 1965 the taxpayer acquired the property from the company in consideration for the assumption of $311,000 of mortgages, and was issued a promissory note of the company for $53,000, so that his net cost was $259,000, i.e., $85,000 less than the company's cost. He then leased the premises back to the company on a 4 1/2 year lease. In 1966 the company expended $42,000 in making improvements.

The Minister assessed a shareholder benefit of $85,000 for 1965, and of $42,000 for 1966.

Respecting the 1965 assessment, the Trial Court's finding that the value of the property was at least $359,000 was appropriate as "it is to be assumed, in the absence of evidence to the contrary, that an experienced business man such as the appellant does not make business expenditures that are not calculated to produce results at least equal in value to the amounts expended" (pp. 5362-5363). In rejecting an argument that the promissory note did not give rise to a benefit in the year of issuance, Jackett CJ stated (at p. 5361):

[W]hen a debt is created from a company to a shareholder for no consideration, or inadequate consideration, a benefit is conferred. ...On the other hand, when a debt is paid, assuming it was well secured, no benefit is conferred because the creditor has merely received that to which he is entitled.

Respecting the 1966 assessment, the value of the benefit was not simply the amont of the expenditure but, rather "the present value, as of the time that the 1966 improvement was completed, of the respective amounts that [the taxpayer] would have been able to add to the rental payments covered by the lease but could not add because of the existence of the lease" (p. 5363).

MNR v. Bisson, 72 DTC 6374 (FCTD)

The taxpayer, who was the general manager and one of the two principal shareholders of a bus company ("Hull City Transport") agreed, in settlement of a dispute with the other principal shareholder ("Thorn"), to purchase the beneficial ownership of the shares of Thorn in consideration for annual payments of $3,000 for four years, and $5,000 per year thereafter until the sum of $60,000 had been fully paid. The previous day, the board of directors of Hull City Transport, resolved to pay Thorn the same sums directly.

Pratte J. rejected the taxpayer's submission that the shares purchased by him from Thorn were worthless, that the purchase agreement "was only a fictitious deed which concealed the real nature of the contract" (p. 6379) and that the taxpayer, in reality was under this agreement acting as agent of Hull City Transport in order for it to pay salary to Thorn (who had been President up to that time on a salary of $3,000 per year) . Pratte J. found that Thorn had undertaken no obligations to Hull City Transport (although the company directors hoped that he would not interfere with their franchise with the City being renewed) and found that there was a taxable shareholder benefit to the taxpayer under s. 16 of the pre-1972 Act resulting from the payment of the agreed-to sums by Hull City Transport to Thorn.

Guilder News Co. (1963) Ltd. v. MNR, 73 DTC 5048, [1973] CTC 1 (FCA)

The sale in 1964 of shares by a corporation to its sole shareholder at an undervalue gave rise to a benefit to the shareholder notwithstanding that the shares had been purchased at the same undervalue by the corporation from the shareholder two years earlier. "If it had not been for the 1964 resale, the individual would have continued in the relatively impoverished state that resulted from the 1962 sale. As a result of the 1964 resale he was restored to his relatively affluent state at the expense of the company and ... the company thereby conferred a benefit on him." Under the jurisprudence, it was irrelevant that "when an individual benefits a company whose stock is all owned by him or when such a company benefits the individual, the individual's overall net assets may well have neither increased nor diminished ... ." (pp. 5050-5051)

A price adjustment clause did not negate (although it arguably reduced) the amount of the benefit, given that there was no bona fide attempt to estimate a fair market value sale price. "If, in fact, a company simply sold property to its sole shareholder on expressed terms that the price payable was an amount equal to fair market value and provided a fair manner to determine such value, I would agree ... that there could not, as a matter of law, be a benefit arising out of the sale."

MNR v. Pillsbury Holdings Ltd., 64 DTC 5184 (Ex Ct)

In 1953 two subsidiaries of the taxpayer waived the interest that was coming due on two loans they had made to the taxpayer a year previously, and a year later all the further interest was waived in connection with the repayment by the taxpayer of a portion of the principal in full satisfaction of the loans.

Cattanach allowed the taxpayer's appeal against an assessment under s. 8(1)(c) of the pre-1972 Act given that the Minister had not assumed, in making the assessment, that such waivers were an arrangement or device adopted by the corporation to confer a benefit or advantage on the taxpayer as shareholder, nor had the Minister established such an arrangement on the evidence. Cattanach J. stated (at p. 5187):

"The word 'confer' means 'grant' or 'bestow'. Even where a corporation has resolved formerly to give a special privilege or status to the shareholders, it is a question of fact whether the corporation's purpose was to confer a benefit or advantage on the shareholders or some purpose having to do with the corporation's business such as inducing the shareholders to patronize the corporation."

See Also

Charania v. The Queen, 2015 TCC 80

The taxpayer owned a large portion of the non-voting shares in a corporation ("B&N"). The taxpayer lived in a property that B&N had purchased and rented out to him (i.e., a Declaration of Trust signed by B&N was ignored by it and discounted by VA Miller J - but the taxpayer thought he beneficially owned the property and that the monthly payments made by him were mortgage payments rather than rent). Preliminary to a subsequent sale by him of the house for $275,000, it was transferred to him by B&N, with an amount equal to the excess of its book value over the outstanding mortgage amount being treated in the B&N books as a shareholder loan. (Para. 15 appears to incorrectly ignore the mortgage amount.) However, the net fair market value of the property (based on its fair market value of $275,000) was $79,779 higher, and the taxpayer was assessed for this amount as a shareholder benefit.

In finding that there was no shareholder error (but with the understanding that the shareholder loan would be increased in order to correct the error), VA Miller J stated (at paras. 40-41):

The Appellant was not aware of the error in this case nor did he sanction the error. He believed that the Declaration of Trust was followed and that he already owned the Property.

It is clear that B&N did not intend to confer a benefit on the Appellant. It transferred the Property to him and included an amount with respect to the Property as a loan receivable from him. The problem was that the amount included was incorrect. This problem arose as a result of an error made by [the accountants] not from any intent of B&N or the Appellant to commit a fraud.

Rogers v. The Queen, 2015 DTC 1029 [at 124], 2014 TCC 348

Pursuant to a share appreciation right ("SAR") attached to stock options granted by a public corporation which he controlled and of which he was the CEO, the taxpayer surrendered the options for a cash payment equal to their value.

After finding that this "Surrender Payment" was not a taxable employment benefit, Hogan J dismissed the Minister's argument that it was a shareholder benefit, stating (at para. 52):

Mr. Rogers gave up something of equal value to receive the Surrender Payment. The Surrender Payment reflected the "in-the-money value" of the Options. It was consideration for the cancellation of the unexercised Options. Viewed in this light, the Surrender Payment can hardly be described as a "benefit" taxable under subsection 15(1)… .

Versteegh Ltd & Ors v. Commissioners, [2013] UKFTT 642 (TC)

One company in a group of UK companies (the "Lender") made a loan to a subsidiary (the "Borrower"). The loan terms obligated the Borrower to issue preference shares, in an amount equivalent to a market rate of interest on the loan, to another subsidiary of the Lender (the "Share Recipient"). The Borrower deducted that amount as interest, and no group company recognized interest income on the loan.

The Lender was not required under a specific provision to recognize interest income. That provision would have applied if the accounting method adopted by it (which was to not recognize interest income) could not be justified as conforming with GAAP. The Tribunal accepted the characterization of the taxpayer's accounting expert, which was that the Lender had made the loan in consideration for the right to receive back the principal plus the right to require a transfer of value between its wholly-owned subsidiaries, which latter right was of no incremental value to it, so that there should be no corresponding recognition of accounting income. It rejected the Crown expert's characterization that the transaction effectively was like an interest-bearing loan, but with the interest not being received directly, but invested by the Lender.

Tyskerud v. The Queen, 2012 DTC 1179 [at 3453], 2012 TCC 196

The taxpayer's use of her corporation's line of credit to pay down her personal debt resulted in a clear shareholder benefit, and her failure to report this benefit on her return was grossly negligent and warranted penalties under s. 163(2). Margeson J. noted that the amount of the benefit ($41,765.58) was large compared to the taxpayer's reported income ($12,925).

McIntosh v. The Queen, 2012 DTC 1049 [at 2741], 2011 TCC 579

The taxpayers were the sole shareholders and employees of a corporation engaged in the business of auto retailing. The corporation compensated the taxpayers for meals taken when they needed to work at night or on weekends, which was often. Woods J. found that this compensation arose in the taxpayers' capacity as employees, so it was not a shareholder benefit. The Minister had not made submissions as to whether the compensation was an employee benefit.

Canadian Winesecrets Inc. v. The Queen, 2011 DTC 1310 [at 1742], 2011 TCC 390

The taxpayer was incorporated by a non-resident individual carrying on a proprietorship. It then acquired assets of the proprietorship (comprising cash and accounts receivable) for a total of $118,342 and assumed accounts payable of $181,357 (for a difference of $63,015). The Minister assessed the taxpayer for failure to remit Part XIII tax under s. 215(1) on the basis that the proprietor was deemed to receive a dividend 0f $63,015 (perhaps under ss. 15(1) and 214(3)(a), although Angers J. referred instead to s. 212.2).

The taxpayer did not establish that the $63,015 difference corresponded to a transfer of goodwill. Angers J. noted that there was "no information concerning a client's list or regarding reputation, location, or brand loyalty" (para. 19). Whatever goodwill existed was personal goodwill towards the proprietor rather than commercial goodwill towards the proprietorship, and therefore was not transferable. He then stated (at para. 21):

[T]he question to ask to determine whether goodwill is personal is this: if the person withdraws from the business will any goodwill remain?

Boulet v. The Queen, 2010 DTC 1015 [at 2602], 2009 TCC 261

On September 18, 1998, the taxpayers both personally and on behalf of a land development corporation to be incorporated in the future (the "Company") agreed to submit on behalf of the Company an offer to purchase a property for development, and agreed (under rights referred to as the "Options") that upon their request, the Company would transfer to each of them certain lots included within the property at the same price that the Company paid to acquire those lots on December 22, 1998. The vendor of the property accepted an offer of the Company to purchase the property and on November 21, 1999 the Company sold to the two individual taxpayers two lots at a price that was substantially lower than what would have been their fair market value in the absence of the Options.

In finding that no benefit was conferred on the taxpayers (who were the shareholders of the Company) by virtue of their exercise of the Options in 1999, Bédard, J. noted (at para. 40) that there was a taxable benefit to the taxpayers in December 1998 when the Company acquired a right to the property (so that there was a corresponding right arising to the taxpayers under the Options at that time) but that there was no taxable benefit under subsection 15(1) in 1999 (the only years assessed in this regard by the Minister) because (para. 37) "no benefit is conferred on the shareholder during the subsequent year in which the Option is exercised, because, in that subsequent year, the Company is merely giving the shareholder what he is entitled to."

Potvin v. The Queen, 2008 DTC 4813, 2008 TCC 319

The provision of a truck to the taxpayer's husband by a corporation of which she was the sole shareholder and he the principal employee was found to be a benefit to her under s. 15(1) (as assessed by the Minister) rather than under s. 6(1)(e) given that the work performed by him in the year in question was negligible (the corporation had largely ceased operations). Accordingly, the benefit was conferred on her husband by reason of her shareholding rather than by reason of his employment.

Gestion Léon Gagnon Inc. v. The Queen, 2007 DTC 267, 2006 TCC 682

No s. 15(1) benefit was conferred on the taxpayer when a corporation, ("CFIC") whose common shares were owned as to 55% by the taxpayer's sole shareholder and as to 45% by his wife, issued preferred shares to the taxpayer with a redemption amount of $1,000 per share and a subscription price of $1 per share. The preferred shares were redeemed a month later in order to extract funds from CFIC). Lamarre Proulx J. found that subsection 15(1) did not contemplate that there would be a benefit conferred by virtue only of shares being issued with a high redemption amount given that their redemption would be deemed to give rise to a dividend under subsection 84(3).

Truckbase Corp. v. The Queen, 2006 DTC 2930, 2006 TCC 215

In finding that the payment by a corporation of professional fees incurred for the preparation of shareholder agreements did not give rise to a shareholder benefit to its (individual) shareholders, McArthur J. found that the revised Shareholder Agreements gave rise to a corporate structure that made the business of the corporation more profitable and, respecting an argument that the expenditures were on capital account, indicated (at p. 2934) that he would "liken the redrafting of the Shareholder Agreements as the maintaining of an asset and (at p. 2935) the Shareholder Agreements were "amended to function as originally intended".

Colubriale v. The Queen, 2006 DTC 2577, 2004 TCC 578

After finding that a shareholder benefit was conferred on the taxpayer when he transferred a property to a corporation of which he was majority shareholder for a sale price 50% higher than the property's fair market value, Angers J. stated (at p. 2582):

"Under that case law, the application of subsection 15(1) of the Act does not require an intent to confer a benefit on the shareholder. It is enough that the shareholder knew or should have known, given the facts in the case, that he was receiving a benefit further to the transaction at issue ... . The appellant and his accountant made no effort to determine the property's fair market value prior to the transfer."

Roth v. The Queen, 2005 DTC 1570, 2005 TCC 484, aff'd 2007 DTC 5222, 2007 FCA 38

The purported transfer by the taxpayer of an undeveloped project (i.e., of know-how he had developed with respect to a proposed LNG project) was not accomplished without any conveyance document and, in any event, "information, ideas, knowledge and/or know-how do not fall within the meaning of the word 'property'" (p. 1579). Accordingly, a shareholder benefit was conferred on him when through a journal entry the transferee corporation showed an amount owing to him for the transfer.

World Corp. v. The Queen, 2003 DTC 951, 2003 TCC 494

The taxpayer assigned a commission of $3.9 million that was to be paid on a deferred basis by a limited partnership in consideration for the taxpayer having helped secure $49 million in equity capital that was to be invested (largely on as deferred basis) in the limited partnership, which was slated to purchase an office tower property approximately six months later, to a Cayman Islands corporation that was an indirect shareholder and with which it did not deal at arm's length, for cash consideration of $41,300. It was assessed for Part XIII tax on the basis that the fair market value of the commission was $2,458,700.

In allowing the taxpayer's appeal, Bell T.C.J. noted that there was no signed agreement respecting the commission and apparently no oral agreement or understanding between the taxpayer and the limited partnership promoter as to the terms and conditions of such agreement, that the general partner of the partnership was without significant assets, that no commission would be payable until the partnership acquired the property and there was significant uncertainty as to whether such acquisition would occur.

Dobbin v. The Queen, 2003 DTC 118, Docket: 1999-2737-IT-G (TCC)

The taxpayer was unsuccessful in the submission that a shareholder benefit arising to him, computed as the difference between an imputed rate of return on capital and the amount of rent paid by him, arising from the construction of a home by a company that was partly used by him for personal use, should be reduced by an imputed rent on artwork and antiques, valued at least $834,000, which were owned by him and were kept at the house. There was no connection between the art and the costs incurred in acquiring the home.

Foresbec Inc. v. The Queen, 2002 DTC 1786, Docket: 98-2034-IT-G (TCC), aff'd 2003 DTC 5455, 2002 FCA 186

At the time of the purchase by the taxpayer of a control block of the shares of a public company (Foresbec), it and Foresbec "granted" to the vendor corporation a contract for the services of a former executive of Foresbec who was associated with the vendor.

Foresbec, by making payments to the vendor under that contract, conferred a benefit on the taxpayer. It was never contemplated that the consulting contract would be implemented and all that it provided for was an obligation to make the payments irrespective of the provision of any services.

Robson v. The Queen, 2001 DTC 1039, Docket: 97-3792-IT-G (TCC)

Bowman A.C.J. stated (at pp.1043-1044):

"There is a departmental mindset, shrouded in the euphemistic rubric of fiscal symmetry, that says that if you disallow an expense to a corporation you must simultaneously find a shareholder on whom to visit a parallel and matching tax consequence under s. 15 of the Income Tax Act. The premise on which this practice of double taxation is based is evidently some misplaced sense of moral rectitude that, so the argument goes, justifies the imposition of an additional punishment on the shareholders for allowing their company to incur disallowable expenses."

Davisson v. The Queen, 2000 DTC 2140, Docket: 97-2326-IT-G (TCC)

A loan made by a corporation of which the taxpayer was the sole shareholder to an insolvent corporation owned by his wife ("Arena") gave rise to an inclusion in his hands under s. 15(1) or s56(2) given that there was no loan agreement, no agreement for repayment had been established, and Arena had ceased operations when the payments were made.

Safety Boss Limited. v. The Queen, 2000 DTC 1767, Docket: 1999-1429-IT-G (TCC)

Before going on to find that amounts paid by the taxpayer to its non-resident shareholder and to a non-resident company controlled by him were reasonable in amount, and that their payment did not give rise to the conferral of any benefit, Bowman TCJ. noted that, in the case of the payments made to the non-resident company, the benefit under s. 214 was assessed on the individual rather than his non-resident company and stated (at p. 1770):

"I should have thought as a matter of common sense that the conferral of a benefit on a corporation, all of the shares of which are owned by a taxpayer, would constitute a benefit conferred on the taxpayer. It increases the value of the taxpayer's shareholding in the corporation that receives the benefit and allows the corporation to make payments to the shareholder that it could not otherwise do.

Pellizzari v. MNR, 87 DTC 56 (TCC)

Before going on to find that the taxpayer had received income from employment under s. 5(1) as a result of a corporation of which she was shareholder, director and officer paying all the legal expenses incurred in connection with defending her and the corporation against criminal charges, and before finding that this payment of her share of the legal fees by the taxpayer was made because she was an officer of the corporation, not because she was a shareholder, Couture C.J. stated (at p. 57):

"If a taxpayer is a shareholder and officer of a corporation and he or she receives a benefit or advantage from the corporation this is not, of itself, conclusive of the fact that the benefit or advantage was conferred on the taxpayer in his capacity of shareholder. In other words, it does not fall that in such a situation, the provisions of subsection 15(1) automatically apply."

Long v. The Queen, 98 DTC 1420 (TCC)

The inadvertent failure of a corporation's bookkeeper to debit the payment of a personal expenditure against the balance for the loan owing by the corporation to the taxpayer did not give rise to a shareholder benefit.

Donovan v. The Queen, 94 DTC 1143 (TCC), aff'd 96 DTC 6085 (FCA)

The shareholder benefit to the individual taxpayer from his free use of a Florida residence that he had transferred to a family corporation was not reduced by the amount of interest that he might have charged on an interest-free loan made by him to the corporation. The decision in Youngman v. The Queen, 90 DTC 6322 (FCA) was distinguished on the grounds that here there was no connection between the loans and the original cost of the residence and that in that decision, "the Federal Court of Appeal did not have put to it nor did it consider the implications of barter" (p. 1147).

Dale v. The Queen, 94 DTC 1100 (TCC), aff'd supra.

At the time of a purported capital dividend on preference shares, the authorized capital of the corporation had not yet been amended to include preference shares. Accordingly, the amount paid to the shareholders was a shareholder benefit rather than a capital dividend, notwithstanding a court order, made following the continuance of the corporation into another jurisdiction, purporting to add the preference shares to the corporation's authorized capital effective prior to the time of the purported dividend.

Del Grande v. The Queen, 93 DTC 133 (TCC)

The taxpayer, who was an officer, director and shareholder of two corporations and provided financial and business advice to the other principal was granted options to acquire the shares of the two companies for an exercise price equal to the nominal fair market value of the shares at that time and, three years later, at a time that the shares had substantially appreciated in value, exercised the options in order to facilitate an extension of the corporate line of credit through his giving of a guarantee. In finding that no benefit was received by the taxpayer, Bowman J. stated (p. 137):

"The word 'confer' implies the bestowal of bounty or largesse, to the economic benefit of the conferee and a corresponding economic detriment of the corporation. Such was not the case here. The corporations did no more than was legally required of them."

In addition, given that his rights under the option agreement did not depend upon his being a shareholder and his options were exercisable only while he was an officer or director, any benefit received by him would not have been received by virtue of being a shareholder.

Simpson v. MNR, 92 DTC 1912 (TCC)

A lump sum of $433,333 received by the taxpayer from a bank was found to have been received in settlement of his claim against the bank for putting his company into receivership without adequate notice rather than in settlement of any claims of the company. Although there may have been a claim by the company that as a matter of law the settlement sum paid to the taxpayer was its property, the only issue before the court was what the taxpayer in fact did (received damages for his claim) rather than what the civil consequences of his actions might have been if challenged by third parties. Accordingly, the sum received by him should not be included in his income as a shareholder benefit or as a dividend.

Mullen v. MNR, 90 DTC 1551 (TCC)

Brulé J. found that s. 15(1) did not apply to a shareholder of a connected corporation in light of the fact that this situation was specifically addressed in s. 15(2) but not in s. 15(1).

Doyon v. MNR, 90 DTC 1132 (TCC)

In rejecting a submission that because the majority shareholder of a plumbing company was (allegedly) aware of the company's payment of personal expenses of the taxpayers (who were minority shareholders), those appropriations should be regarded as loans, Lamarre Proulx J. stated (at p. 1134):

"In the case of a loan, the amount loaned and the intention to lend and to borrow must be certain. There must be a meeting of minds on a purpose. The evidence did not disclose any of these. There was, on the one hand, no entry in the company's books indicating "advances" to employees or shareholders, and on the other, the borrowers kept no records indicating their loans ... If this appropriation was done with the principal shareholder's knowledge, I would say that s. 15(1) of the Act applies. If not, s. 3 must apply."

Gendron v. MNR, 89 DTC 582 (TCC)

A corporation engaged principally in the construction business but deriving 6% of its revenues from rental properties, purchased a Florida bungalow for the exclusive use of its principal shareholder and his family. Tremblay J. accepted Revenue Canada's calculation of the amount of the shareholder benefit as being the difference between (a) the actual expenditures (including mortgage interest) made on the bungalow by the corporation, and interest at prescribed rates on the bungalow's actual cost, and (b) the $1,000 per annum paid for use of the bungalow.

President of India v. La Pintada Companid Navigacion S.A., [1985] A.C. 104

The common law gives the creditor no right to interest on his debt. Such a right can only arise by agreement or by statute.

Cangro Resources Ltd. v. MNR, 67 DTC 582 (TAB)

A payment received by the taxpayer that was stated to be made out of "paid-in capital and paid-in surplus" pursuant to the provisions of the Wisconsin Business Corporations Act was found to be a dividend for purposes of the Act. In finding that the payment did not qualify as a payment made "on the reduction of capital", Mr. Davis stated (at p. 585):

"As the funds distributed by Marine Capital Corporation admittedly represented nothing more than premiums paid into the treasury on the purchase of shares of prices in excess of their par value of $1 per share, the share capital is neither disturbed nor impaired by the distribution of these funds."

Administrative Policy

24 July 2015 Folio S2-F1-C1

1.41 Unless the particular facts establish otherwise, there is a general presumption that an employee-shareholder receives a benefit in the capacity of a shareholder when the individual can significantly influence business policy. A negative answer to one or more of the following questions may also suggest that benefits have been provided to an individual in the capacity of a shareholder:

- When all participating employees are shareholders or persons related to a shareholder, is the benefit coverage comparable (in nature, amount, and cost-sharing ratio) to coverage given to non-shareholder employees of similar-sized businesses, who perform similar services and have similar responsibilities?

- Is participation in the plan open to all employees, including those who are neither shareholders nor related to a shareholder? If not, is there a logical reason to exclude some employees?

- Is the benefit coverage for shareholders or persons related to a shareholder, comparable (in nature, amount, and cost-sharing ratio) to coverage given to other participating non-shareholder employees of the business, who perform similar services and have similar responsibilities?

3 March 2015 Memorandum 2014-0527841I7 F - Avantage imposable pour aéronef

In a situation where there was personal use of a corporate aircraft by the individual shareholder (Mr. A) of the "grandfather" (indirect parent) of the corporate owner of the aircraft and by Mr. A's father (Mr. B), CRA concluded that the valuation of the benefits should be based on their fair market value (corresponding "to the price which the shareholder would have to pay, in comparable circumstances, to obtain the same benefit from a corporation of which he was not a shareholder") rather than their cost – although, here, the denied operating expenses and CCA of the corporate owner "could be utilized in establishing the value of the benefit conferred on Mr. A and Mr. B to the extent that it could be demonstrated that this value approximated the FMV of the benefit received." A taxpayer submission, based on IT-160R3, that the benefits should be valued based on the prices of first class tickets for comparable trips, was not accepted. See summary under s. 246(1).

24 September 2014 T.I. 2014-0522261E5 - Shareholder benefit on leasehold improvements

Q.1

: Is the s. 15(1) benefit arising from improvements made by the corporation to shareholder-owned commercial real estate mitigated if under the lease the corporation at lease end must be repaid by its shareholder for the value of the improvements? Q.2: If the shareholder transfers the property to a wholly-owned sub but with the lease term being extended, when is he required to include the s. 15(1) benefit in income?

Q.1

: After stating that its position in IT-432R2, para. 10 was consistent with the principle established in Kennedy and Ginter that "the amount of the benefit is based on the present value of the amount, if any, by which the addition or improvement increases the value of the property to the shareholder when it reverts to the shareholder," CRA stated:

If the shareholder reimburses the corporation for the value of the improvements as they are completed each year or at the end of the lease term, the extent to which the reimbursement would reduce the present value of the shareholder benefit under subsection 15(1) will depend on the relevant circumstances, including the conditions and provisions of the lease.

Q.2

: CRA indicated that if the shareholder had an income inclusion in the year the improvements were made, there would be no further inclusion on the subsequent transfer or lease extension.

2013 May ICAA Roundtable Q. 22, 2011-0411491E5

In…2011-0411491E5, CRA commented on an interest in a United States Limited Liability Corporation (LLC) held by an Alberta Unlimited Liability Corporation (AULC) owned by a Canadian resident individual. …[T]he individual would be subject to US taxation on…LLC income attributed to the AULC. CRA indicated that payment of these taxes on the individual's behalf would constitute a taxable benefit, either under S 15(1) if paid by AULC or under S 246(1) if paid by LLC. Can CRA explain the economic enrichment of the individual which it perceives to arise through the ownership structure? CRA responded:

[A]n amount paid by a corporation to its individual shareholder as a reimbursement of that shareholder's personal tax liability would result in an impoverishment of the corporation and an enrichment of the shareholder for purposes of subsection 15(1). A similar enrichment would result for purposes of subsection 246(1) where the shares are held by that individual indirectly through another corporation.

11 March 2014 Memorandum 2013-0513221I7 F - Stock options

Publico determined to grant stock options to its directors and consultants, as a result of which a private corporation ("Corporation") was entitled to receive a grant of options. However, such options instead were granted directly to Mrs. Y, the sole shareholder of Corporation, who subsequently exercised and sold the acquired Publico shares, reporting a capital gain.

After finding that s. 56(4) or 56(2) applied to Corporation, CRA noted that such income inclusion to Corporation did not detract from there also being a taxable benefit to Mrs. Y under s. 15 (or 6(1)(a), if it was received by virtue of employment - with a potential deduction to Corporation.)

4 December 2013 T.I. 2012-0465891E5 F - Primes d'assurance / Premiums

When asked whether there would be a taxable benefit when Aco, which had other insured employees as well, paid insurance premiums for life insurance policies and disability policies covering Mr. A, who was an employee, director and majority shareholder, CRA stated (TaxInterpretations translation):

When a person who is at the same time a shareholder and employee receives a benefit which is not offered to other employees, the CRA presumes that the person has benefited therefrom qua shareholder. However, when a similar benefit is offered to all the employees including those who also are shareholders, the latter are considered to have received a benefit by virtue of their employment.

CRA further stated:

[A]n employee can be considered to be covered by a group plan if the level of benefits and the ratio of contributions shared by the employer and employee are similar to those for other employees covered by the plan.

7 November 2013 T.I. 2013-0473771E5 - Shareholder of a Not-for-profit corporation

In response to a detailed submission to the contrary, CRA maintained its position under the expanded definition of "shareholder" in s. 248(1)

that members of a non-profit corporation without share capital will be considered shareholders thereof for purposes of subsection 15(1) of the Act, notwithstanding that they are not entitled to receive dividends.

2012 Ruling 2010-0391281R3 - Incentive Plan - Reimbursement Agreement

underline;">: RSU plan. Parent (which is a US public company) has for a number of years been issuing stock options and restricted stock units to employees of it and subsidiaries ("Participants"), including of the Company (an indirect Canadian subsidiary, which is held by another Canadian subsidiary: "Direct Shareholder"). Following the vesting of a Participant's RSUs, Parent issues shares to the Participant.

Proposed transactions

The Company commence reimbursing Parent for the market value of the shares issued to Participant employees of the Company in respect of RSUs that vest. In accordance with s. 7(3)(b), the Company will not deduct the payments.

Ruling

. No benefit will be considered to have been conferred by the Company on Parent or Direct Shareholder under s. 15(1) or 246(1) and no inclusion in Direct Shareholder's income under s. 56(2) of the Act, by reason of the reimbursements:

(i) in respect of RSUs that were awarded prior to XX and that were not vested at the Effective Time, to the extent of the increase in the value of the RSUs after XX; and

(ii) in respect of RSUs awarded on or after XX, all of the RSU value.

To the same extent, no Part XIII tax.

1 May 2013 Memorandum 2009-0321721I7 - Stock Option Recharge on Grant Date

Canco, a Canadian subsidiary of USCo, a publicly traded company, was required under Canadian GAAP to compute the fair value of stock options granted by USCo to Canco's employees (using the Black-Scholes method) and to recognize, in the year of grant, an expense equal to such fair value minus a deduction for unvested options forfeited in the year. Canco reimbursed USCo, apparently for this net amount, which it added back in computing its income under s. 7(3)(b). The amounts "T4'd" to Canco's employees were instead computed as the in-the-money option values when exercised.

In finding that the reimbursement payment did not give rise to a benefit to USCo under ss. 15(1) and 214(3)(a) (subject to there being no written recharge agreement), CRA stated:

[I]t would be reasonable for Canco to reimburse USCo an amount equal to the intrinsic value of the options on the day of exercise. However…it also is reasonable for Canco to reimburse USCo with an amount equal to the fair value of the options on the day of grant. We understand that in practice, both methods are used….

The Valuations Section...has advised us that the Black-Scholes options pricing model is an acceptable approach to use, assuming that it is adjusted for the differences inherent in employee stock options….

[I]f Canco does not have a history of reimbursing USCo, then we would take the view that there is no [unwritten] recharge agreement in place. If an agreement is subsequently entered into, we would consider that only the portion of the fair value of the options on grant date attributable to the vesting period after the new agreement is in place could be paid to the parent company without subsection 15(1) applying.

29 April 2013 T.I. 2010-0356401E5 - Stock Option Recharge on Grant Date

Under an agreement between a non-resident public company (Parentco) and its wholly-owned Canadian subsidiary (Canco), Canco reimburses Parentco for the fair value at the date of grant of share awards or stock options awards made by Parentco to Canco employees. Such fair value (as computed under IFRS-2) takes into account the fact that the rights to the shares or options have not yet vested on the date of grant.

Such reimbursements by Canco generally would not be considered to be benefits conferred on Parentco under s. 15(1), 214(3)(a) and 246(1)(b). However, upon audit, CRA may review the method used to compute the fair value of the awards.

27 March 2013 Folio S4-F3-C1

CRA will consider a price adjustment clause to represent pricing at fair market value if:

- the agreement reflects a bona fide intention of the parties to transfer property at FMV;

- the purported FMV is determined by method that is fair and reasonable in the circumstances (which does not necessarily entail using CRA's preferred method, nor engaging a valuation expert);

- the parties agree that a CRA or Court valuation, if any, will supersede the price otherwise determined; and

- the excess or shortfall is actually refunded or paid, or legal liability therefor is adjusted (para. 1.5).

Price adjustment clauses involving shares may use a number of adjustment mechanisms. CRA non-exhaustively mentions changes in redemption value, the issuance of a note or change in the principle amount of a note, or a change in the number of shares issued - although CRA recommends against using the latter because of inherent legal and technical difficulties (para. 1.6).

5 October 2012 APFF Roundtable Q. , 2012-0454181C6 F

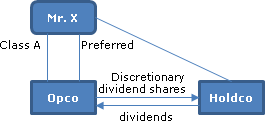

Mr. X holds 100 Class voting participating shares of Opco with a fair market value of $5M and nominal adjusted cost base and paid-up capital. He incorporates Holdco whose shares have nominal fair market value, adjusted cost base and paid-up capital and exchanges his Class A shares of Opco for preferred shares of Opco with the same FMV, ACB and PUC as the exchanged Class A shares. Opco isssues Mr. X 100 Class A shares for nominal consideration and also issues 100 discretionary dividend shares to Holdco. In order to limit the net asset value of Opco to $5M (i.e., for creditor-proofing purposes), Opco annually pays dividends of $500K on the discretionary shares held by Holdco.

CRA stated (TaxInterpretations translation):

We are of the view that subsection 15(1) ITA could apply to the extent that Holdco acquired the discretionary dividend shares of Opco for consideration less than their fmv.

7 May 2012 2010 CALU Roundtable Q. , 2012-043566

Holdco, and its subsidiary Opco, enter into a split-dollar insurance arrangement. They "purchase together permanent life insurance policy on the life of the key man," and agree that they will jointly make the beneficiary designations on the policy so that Holdco will be the owner of the cash surrender value of the policy, and will be entitled to the death benefit attributable to the cash surrender value of the policy; and Opco will be entitled to the death benefit attributable to mortality gain and not that portion attributable to the cash surrender value of the policy. They further agree that each will fund that portion of premiums under the policy relating to that corporation's respective interest in the policy. CRA stated:

CRA has consistently expressed the view that where a life insurance policy is co-owned by a corporation and its shareholder (corporation or individual) pursuant to a split dollar arrangement or other shared ownership arrangement, there is a potential for the corporation to confer a benefit on that shareholder through the premium sharing arrangement. Where the premium paid by the shareholder is less than that which would be paid for comparable rights available in the market under a separate insurance policy, the corporation may be viewed as having conferred a benefit to the shareholder that could result in a shareholder's benefit for the purpose of subsection 15(1) of the Act.

2011 T.I. 2010-0360001E5

Does a subsection 15(1) shareholder benefit result from the personal use and enjoyment of an airplane held by a single purpose corporation? CRA stated:

At Question 27 of the Round Table…at the 2008…APFF…Conference…CRA stated:

- When a single-purpose corporation owns a helicopter or another property which is used only for the personal purposes of the shareholder, the CRA will examine each situation on a case-by-case basis. It is possible, depending on the circumstances, that at a particular time, no benefit is conferred on a shareholder pursuant to the application of subsection 15(1) of the ITA, but such is not necessarily always the case.

CRA's response was consistent with the "imputed rent" method where the amount of the benefit determined under that method is nil because the shareholder personally finances the entire acquisition cost of a corporation's sole property and assumes all other expenses related to its use. Conversely…in document 2004-008679 about a luxury building…CRA indicated… that "if a luxury building was made available to a shareholder of a single-purpose corporation and this shareholder had financed 100% of the cost of acquiring the corporation's building through an interest free loan to the corporation and paid all the costs of operating the building, the shareholder could nonetheless be subject to a taxable benefit pursuant to subsection 15(1) I.T.A. if the fair market value of the building exceeds its acquisition cost."

6 December 2011 TEI Roundtable Q. 5, 2011-0427001C6

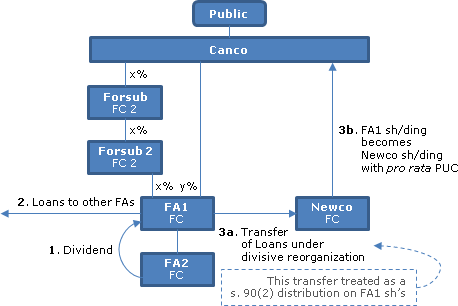

S. 15(1) will not apply to a distribution of a share premium of a foreign affiliate if it is a pro rata distribution governed by draft s. 90(2).

23 June 2011 T.I. 2011-039788 -

In the case of a corporation to which s. 149(1)(l) applied (non-profit corporation for recreation or pleasure), use by a shareholder of corporate property, for less than fair market value of the use, might be a taxable benefit under s. 15(1). If so, then the value of the benefit is the difference between such fair market value and the consideration paid by the shareholder.

Memorandum TPM-03 "Downward Transfer Pricing Adjustments Under Subsection 247(2)," 20 October 2003

The Minister may decide not to exercise his discretion under s. 247(10) where a Canadian company requests a decrease in the transfer price of sales to a non-arm's length non-resident without repatriation, and s. 15(1) does not apply to the amount. ("This situation may be considered abusive because the Canadian taxpayer has turned an otherwise taxable receipt of monies into a non-taxable amount.") Conversely, when a Canadian parent company requests and receive a decrease in the transfer price of sales to a non-resident subsidiary without repatriation, this is not considered abusive, because s. 15(1) would apply and offset the downward adjustment.

30 August 2004 T.I. 2003-000135 -

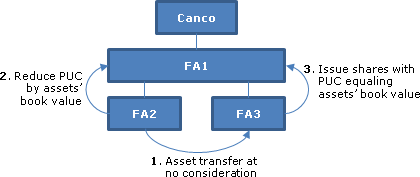

The only significant asset of FA2 is a loan receivable of $100 owing by its parent, FA1, which is a wholly-owned foreign affiliate of Canco. When the $100 debt is extinguished for less than its principal amount on a winding-up of FA2 into FA1, fapi is realized by FA1 by virtue of ss.15(1) and (1.2) assuming that FA2 does not actually carry on a business and given that the benefit conferred by FA2 on FA1 is a direct result of the settlement of the $100 note and not of the redemption or cancellation of the shares of FA2 on its dissolution. To the extent of the inclusion under s. 15(1), there would be a corresponding reduction in any "forgiven amount" for s. 80 purposes (provided that the $100 note was not considered to have been used by FA1 for a business use as a result of the application of s. 95(2)(a)(ii)(D)).

2003 Ruling 2002-017470

A great-grandchild foreign subsidiary ("Dco") of a Canadian public corporation ("Aco") and a great-grandchild foreign subsidiary of Aco ("Fco") held through another chain of corporations each hold ownership interest ("quota") in another foreign affiliate of Aco ("Eco"). The two quota holders of Eco agree that the principal assets of Eco will be assigned to a newly-incorporated corporation in the same foreign jurisdiction ("Jco") for no consideration; but that contemporaneously with the creation of Jco and the assignment of property of Eco to Jco, the capital account and retained earnings of Eco will be reduced and added to the capital and retained earnings of Jco (which is owned by Dco and Fco in the same proportions as they owned, and continue to own, Eco).

Ss.15(1), 56(2) and 246(1) do not apply.

26 March 2003 T.I. 2001-010531 -

Respecting the situation where an interest-bearing debt owing by one wholly-owned subsidiary to another wholly-owned subsidiary is exchanged for non-interest bearing debt with a term of two years, CCRA commented: "Generally, where a debtor corporation is in financial difficulty such as in the situation you described, it is our view that the conversion of an interest-bearing intercorporate loan to a non-interest-bearing intercorporate loan would generally not result in the application of subsections 15(1), 56(2) or 56(4) of the Act to the parent corporation provided the new debt has the same principal amount as the old debt, the corporate shareholder receiving the funds is or will be in a position to repay the loan or to provide reasonable security for repayment, and the loan is bona fide."

3 January 2003 T.I. 2002-014396 -

Respecting the question as to the consequences of a corporation that had carried on business for 16 years without issuing any shares then issuing one share, the Directorate indicated that, subject to an appropriate court rectification order being obtained, "the issue of a share of a corporation for a nominal amount at a time when the fair market value of that share is greater than a nominal amount will generally be considered to have resulted in a benefit being conferred on the purchaser of share, even if that purchaser is the first subscriber ... ."

22 February 2002 Memorandum 2001-010186

Discussion of whether s. 15(1) or 56(2) might apply to a loan to a sister corporation.

6 February 2002 T.I. 2001-010560

In response to a question as to whether expenses incurred in response to a takeover bid or sale would give rise to a shareholder benefit when incurred by a public corporation, the Agency stated that:

"The question of whether corporate-paid expenses constitute a shareholder's benefit under subsection 15(1) depends on whether the expenses were incurred primarily for the benefit of the shareholders, which is a question of fact to be determined on a case-by-case basis."

S.56(2) would not normally be considered.

2001 Ruling 2001-010588 -

A Canadian controlled private corporation ("Parent") and its U.K. subsidiary ("U.K. Sub") agree that UK Sub will pay to Parent an amount equal to the stock option benefits enjoyed by U.K. Sub's employees on the exercise of options to acquire shares of Parent. This amount is not included in Parent's income under s. 15(1) or 12(1)(x).

27 November 2001 T.I. 2001-009686

Respecting the CCRA position on single purpose corporations, it stated that "where each shareholder did not contribute their pro-rata share of the funds required to acquire the particular U.S. residential property (either by equity or non-interest bearing loan), the corporation would not qualify as a single purpose corporation. In addition, there is a requirement that "the corporation that acquired the particular U.S. residential property ... do so with funds provided solely by the shareholder(s) and not by virtue of the shareholder's holdings in that corporation or those of a related person and any other corporation".

9 October 2001 T.I. 2000-003491

Where a subsidiary reimburses its parent for the difference between the fair market value of shares of the parent company on the date of exercise of options on the shares of the parent previously granted to employees of the subsidiary, and the amount paid to the parent company by the employees who acquire the shares, there will be no inclusion in the income of the parent under ss.15(1), 12(1)(x) or 90 for the amount of the payment, provided that the payment is in respect of options granted after the arrangement was in place, or was in respect of the increase in the stock option benefit that, in the circumstances, may reasonably be considered to have arisen after the arrangement went into effect on options that were granted prior to the arrangement.

6 November 2000 Memorandum 2000-0050427 -

A company aircraft of the majority shareholder ("Mr. X") of a Canadian-controlled private corporation was used to fly Mr. X, his family and several business associates to a ski lodge in Western Canada where they went heli-skiing. After finding tht deductibility of the expenses was denied by s.18(1)(l), CRA stated:

IT-160R3 provides guidance on this situation in paragraphs 9 to 11. The benefit to a shareholder-employee is generally considered to be derived in his or her capacity as shareholder and is taxable as a shareholder's benefit under subsection 15(1) if:

- (a) the shareholder-employee controls the corporation or is one of a related group that controls the corporation or any affiliated corporation, and

- (b) there is extensive use of the aircraft for personal purposes by the shareholder-employee or, because of the latter's position, by relatives or friends of the shareholder-employee.

What constitutes "extensive use", for purposes of paragraphs 9 and 10 of IT-160R3, depends on the facts and circumstances in each case. As a general guideline, personal use amounting to one-third of the total flying time will be regarded as "extensive."

2000 Ruling 2000-000185

Waiver of dividends on exchangeable shares did not result in the application of benefit provisions.

1999 Ruling 990259

Canadian employees of a Canadian subsidiary of a foreign parent had "subscription rights" to acquire unlisted ordinary shares of the foreign parent. The subscription rights plan provided that at the same time the employee was granted a right she would acquire a non-interest bearing bond of the parent at an appropriate discount, and enter into put and agreements with a non-resident corporation ("Putcallco") under which the employee could cause Putcallco to acquire the employee's foreign parent shares at their fair market value at the time of exercise of the rights acquisition (as determined under a formula), and Putcallco could acquire those shares at their fair market value in the event the individual ceased to be an employee. The foreign parent and the Canadian subsidiary had agreed that when a subscription right was exercised by an employee, the Canadian subsidiary would be obliged to pay to the foreign parent the amount by which the fair market value of the shares acquired by the employee exceeded the exercise price.

The granting by the Canadian subsidiary to the employees of the right to surrender their subscription rights to it for a cash amount equal to the difference between the fair market value of a foreign parent share (determined on the same formula basis) and the exercise price would not result in a disposition under s. 7(1)(b) or result in a conferral of a benefit by the Canadian subsidiary on the foreign parent under s. 15(1).

2000 Ruling 2000-000185

Ruling that s. 15(1) would not apply to a waiver of dividends on exchangeable shares.

1999 TEI Roundtable Q. , 1999-0010070

Where a U.S. subsidiary guarantees debts of its Canadian parent without charging a guarantee fee, a benefit under s. 15(1) may apply. Where s. 15(1) so applies, it is considered to be a more specific provision that s. 247(2), so that no amount would be deemed to be paid or credited pursuant to s. 214(15)(a) and, consequently, no Part XIII tax would be exigible.

1999 Ruling 983014

An interest-free loan made by a controlled foreign affiliate (that was not resident in a designated treaty country) to its indirect wholly-owning Canadian parent did not give rise to an imputed benefit under s. 15(1) to the parent.

14 January 1999 T.I. 5-982855

Where shares bearing a non-cumulative dividend of 10% are exchanged on an s. 86 reorganization for shares bearing a non-cumulative dividend of 15%, the shareholder with the increased dividend rate will be considered to have received an s. 15 benefit, and other shareholders may be considered to have received fair market value proceeds under s. 69(1)(b).

2 May 1997 T.I. 970821

Where special shares of a wholly-owned subsidiary are converted into a nominal number of common shares of the subsidiary having a fair market value substantially less than the fair market value of the special shares before the conversion, RC generally will not consider applying s. 15(1).

27 November 1996 T.I. 5-962063

Where a corporation gives a remainder interest in ecologically sensitive property to a heritage or conservation organization and retains a life interest pur autre vie (on the joint lives of its shareholders and their children), a benefit under s. 15(1) or 56(2) would be considered to have been conferred by it.

27 June 1995 T.I. 5-932476

s. 15(1)(c) did not apply to a rights offering where the majority shareholder of the corporation agreed to purchase any of the rights not purchased by the other shareholders pursuant to the first stage or second stage of subscription pursuant to the rights offering.

13 February 1995 T.I. 950323

The Department's administrative concession respecting the holding of a U.S. residential property by a corporation only applies where all seven conditions stipulated by the Department are satisfied. Accordingly, the administrative concession is not available with respect to Canadian real estate. In any event, the Department is reconsidering the policy in light of the proposed Protocol to the Canada-U.S. Convention.

94 C.P.T.J. - Q. 26