Subsection 15(1.1) - Conferring of benefit

Cases

Wong v. The Queen, 99 DTC 458, Docket: 95-3255-IT-G (TCC)

It was accepted that the effect of an arrangement under which family members subscribed for non-voting Class B common shares of a corporation carrying on the taxpayer's medical practice, with the corporation then paying significant stock dividends to them, was to significantly reduce the taxpayer's interest in the corporation. However, Rowe D.J. accepted evidence that the sole purpose of the stock dividends was to split income with the family members and that there was no intent to reduce the value of the taxpayer's shareholdings, it being accepted that the possibility of ever selling shares in his incorporated medical practice was very remote.

The Queen v. Wu, 98 DTC 6004, Docket: A-762-96 (FCA)

The Tax Court Judge had erred in finding that the relevant purpose under s. 15(1.1) must be demonstrated to have been in the conscious intent of the taxpayer, i.e., a subjective test should be applied. Instead, the words "it may reasonably be considered" placed a substantial onus on the taxpayer to produce some explanation which is objectively reasonable that none of the purposes was to alter the value of a shareholder's interest".

Administrative Policy

10 October 2014 APFF Roundtable Q. 19, 2014-0538041C6 F

Mr. X holds all 100 of Opco's Class A shares with a fair market value of $1,000,000 and nominal ACB and PUC. Opco pays a stock dividend comprising Class B shares which have a retraction right for $900,000; the 100 Class shares are exchanged for estate freeze Class C preferred shares; and the family trust subscribes for Class shares for $10. (a) Does s. 15(1.1) not apply so that Mr. X only includes the $1 increase in PUC of the Class B shares in his income? (e) If the shares of the corporation instead were held equally by three shareholders and the steps otherwise were the same except that the new common shares would be issued to three family trusts, would s. 15(1.1) would apply to the stock dividend. CRA responded (Tax Interpretations translation):

…(a)…[S]ubsection 15(1.1) generally does not apply when a corporation pays a stock dividend solely to a person who holds all of the issued and outstanding shares…of the corporation.

…(e)..An increase or reduction in the value of the interest of a shareholder does not generally result if the stock dividend is payable to all the shareholders in proportion to their interest in the corporation, as would appear to be the case in [this] situation… .

26 November 2013 CTF Roundtable Q. , 2013-0507981C6

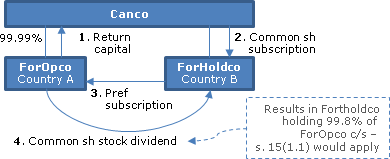

Under a proposed ruling request, Canco, which directly owned approximately 99.99% of all the common shares of ForOpco, which was resident in Country A (with the other .01% held by another foreign affiliate of Canco), would reduce the number of outstanding shares by a factor of 100,000 (so that 100,000 previously outstanding shares would be represented by 1 share). ForOpco would return capital to Canco, which would use such funds to subscribe for additional common shares in ForHoldco (which was newly incorporated by Canco in Country B), with ForHoldco using those proceeds to invest in preferred shares of ForOpco. ForOpco then would pay a stock dividend, consisting of common shares, to ForHoldco. After the stock dividend, ForHoldco and Canco would hold approximately 99.8% and 0.2% respectively of the outstanding common shares of ForOpco.

In describing its refusal to rule that s. 15(1.1) did not apply to the proposed stock dividend, CRA noted that its purpose "was to transfer over 99% of the equity in ForOpco from Canco to ForHoldco," and that it is "not relevant whether the Canadian income tax effects of a stock dividend paid by a corporation would be similar to the effects of a transfer of shares under subsection 85.1(3), or under any other "rollover" provision."

9 May 1990 Meeting (October 1990 Access Letter, ¶1474)

S.15(1.1) generally does not apply where the stock dividend by itself does not significantly reduce the value of a specified shareholder's interest in the paying corporation, as opposed to the result of the redemption of the stock dividend shares.

Subsection 15(1.4) - Interpretation — subsection (1)

Paragraph 15(1.4)(c)

Administrative Policy

24 June 2015 T.I. 2015-0575911E5 F - Benefit to shareholder or conferred on a person

Corporation A, which has equal unrelated Shareholders 1, 2, 3 and 4, disposes of a capital property to the spouse (who is not herself a shareholder) of Shareholder 4 at a price which is determined to be less than the property's fair market value. (a) What are the consequences? (b) What if the four Shareholders instead are four unrelated shareholders of Holdco, which wholly-owns Corporation A ? (c) What if the four Shareholders are brothers?

CRA responded (TaxInterpretations translation):

Q. (a)

…[S]ince the spouse of Shareholder 4 does not deal at arm's length with the latter by virtue of paragraphs 251(1)(a) and 251(2)(a) (and also is allocated with the latter by virtue of paragraph 251.1(1)(a)), the benefit conferred on her is deemed to be a benefit conferred on her spouse, Shareholder 4.

Q. (b)

…To the extent that the spouse of the Holdco shareholder does not deal at arm's length with Holdco or is affiliated with Holdco…., Holdco (qua shareholder of Corporation A) would be required to include in its income, by virtue of subsections 15(1) and 15(1.4) the value of the benefit conferred. For example, if Shareholder 4 or his spouse controlled Holdco in fact, the spouse could be considered affiliated with Holdco (by virtue of subparagraph 251.1(1)(b)(i) and the definition of "control" in paragraph 251.1(3)) or did not deal at arm's length with Holdco.

Q.(c)

…[T[he spouse of Shareholder 4, in addition to not dealing at arm's length with her spouse, also does not deal at arm's length with her brothers-in-law…by virtue of paragraphs 251(1)(a), 251(2)(a) and 252(2)(b). However….to the extent the paragraph 15(1.4)(c) included the benefit in computing the income of Shareholder 4, the amount of the benefit would not, among other things, also be included in computing the income of the three other shareholders in the circumstances.

3 March 2015 Memorandum 2014-0527841I7 F - Avantage imposable pour aéronef

In a situation where there was personal use of a corporate aircraft by the individual shareholder (Mr. A) of the "grandfather" (indirect parent) of the corporate owner of the aircraft and by Mr. A's father, CRA indicated that there would be no taxable benefit respecting such use by the father for the years under review before the effective date of s. 15(1.4)(c) – but thereafter, the value of the benefit enjoyed by the father was taxable to the son (Mr. A). Under Massicotte (a.k.a. Pub Création), the conferral of a benefit by a corporation on the shareholder of its parent (or, in this case, the grandparent) constitutes an indirect benefit to the shareholder of the grandparent which is a taxable benefit to him (Mr. A) under s. 246(1). S. 15(1.4)(c) would then apply to add the benefit conferred on Mr. A's father to the benefits which were taxable to Mr. A under s. 246(1).

See summary under s. 246(1).

10 October 2014 APFF Roundtable Q. , 2014-0538101C6 F

The son of the sole shareholder of a corporation works for the corporation and receives automobile benefits in the course of his employment. Is the father taxable on a shareholder benefit under s. 15(5) notwithstanding that his son must include the same benefit in his income under s. 6? After noting that in the absence of s. 15(1.4)(c), the benefit would be taxable to father under s. 15(5), CRA stated (TaxInterpretations translation):

[P]aragraph 15(1.4)(c) provides in particular that a benefit conferred by a corporation on an individual is a benefit to a shareholder of the corporation if the individual does not deal at arm's length with the shareholder. However, this rule does not apply to the extent that the value of the benefit is included in computing the income of the individual or another person. …

If the automobile benefit was conferred on Son…in his capacity of employee of the corporation and Son included the value of the benefit in computing his income from employment…no amount would be included in computing income of his father under subsection 15(1)… .

Subsection 15(2) - Shareholder debt

Cases

The Queen v. Gillette Canada Inc., 2003 DTC 5078, 2003 FCA 22

Some of the shares held by the taxpayer in its French subsidiary were purchased for cancellation by the subsidiary in consideration for the assignment to the taxpayer of a note (denominated in French francs) owing to the subsidiary by a French partnership whose principal partner was the U.S. parent of the taxpayer. A month later, the note was converted into indebtedness denominated in Canadian dollars. The Court rejected a submission that this conversion gave rise to a loan so that ss.15(2) and 214(3)(a) applied. No debtor-creditor relationship existed and the assignment did not involve the discharge of any obligation by the partnership -- the partnership merely happened to be the maker of the note which was assigned in payment; and the Canadian-dollar note was issued and accepted as replacement for the original note in circumstances where the terms remained the same except for the currency of payment.

Magicuts Inc. v. The Queen, 2001 DTC 5665, 2001 FCA 332

Whether there was an amount owing by the taxpayer to its non-resident parent turned on whether accounts between them were netted. The Court found that balance sheet entries by the taxpayer and its parent for the taxation year in question were evidence of an intent or agreement between them to set off.

Wallace v. The Queen, 98 DTC 6326, Docket: A-327-96 (FCA)

The taxpayer became indebted to a company of which he was a sole shareholder as a result of a bank calling in a guarantee by the company of a loan that had been made to him. The writing-off by the company of the debt was not the equivalent of its repayment, with the result that the amount of the indebtedness was to be included in his income.

Dunlop v. The Queen, 95 DTC 5351 (FCTD)

The taxpayer failed to establish that a loan had been made to him directly by a brokerage firm ("Walwyn") rather than from a corporation ("Canam") of which he was a major shareholder, given that Walwyn had deposited the funds to a Canam account, Walwyn never sought repayment of the loan from the taxpayer in his personal capacity, and the taxpayer's intention at the time apparently had been to secure a housing loan from Canam.

The Queen v. Silden, 93 DTC 5362 (FCA)

The taxpayer, who was an employee of a Norwegian multinational corporation ("Musnor") was transferred to Canada and issued 1/3 of the shares of a newly-incorporated Canadian subsidiary of Musnor ("Muscan"), and was found to have become an officer or other employee of Musnor. When the taxpayer acquired a house in April 1980, Musnor agreed to provide a loan to refinance the existing mortgage. The new mortgage loan was made by Muscan in September 1981 and the existing mortgage paid off in June 1982. The new mortgage loan was repayable if the taxpayer should leave the employ of Musnor or in the event of the resale or transfer of the house.

In first finding that the taxpayer was eligible to avail himself of the potential exemption in s. 15(2), Pratte, J.A. found that it was apparent from the list of the exceptions contained in s. 15(2)(a) that s. 15(2) "applies not only to loans made to shareholders as shareholders but also to loans made in the ordinary course of business to employees who happen to be shareholders." However, the new mortgage loan was not exempted under s. 15(2)(a) because the arrangements made at the time of the loan did not permit a determination with any certainty of the time within which the loan was to be reimbursed.

Nellis v. The Queen, 86 DTC 6377, [1986] 2 CTC 216 (FCTD)

"The purpose of Section 15 of the Income Tax Act is to prevent a corporation from distributing its profits to its shareholders under the guise of a loan."

Schlamp v. The Queen, 82 DTC 6274, [1982] CTC 304 (FCTD)

The amount of a loan, made by a company to its shareholder for the purchase by him of a home for occupation by his family, was added to his income.

See Also

Erb v. The Queen, 2000 DTC 1401, Docket: 97-3216-IT-G (TCC)

The taxpayers, along with related persons owned shares of a corporation ("Enterprises") and received draws from a partnership, of which they and Enterprises were members, that were substantially in excess of their share of income of the partnership. Bowman TCJ. found that they were not liable under s. 15(2) in respect of the excess draws because partnership law was clear that a deficit position in a partner's capital account did not create indebtedness. Furthermore, even if the excess drawing were indebtedness, the specific provisions of the Act relating to withdrawals from a partnership (which he described at p. 1412 as "a specific and complete code on one relatively narrow aspect of the fiscal consequences of being a partner") overrode the more general provisions of s. 15(2), which dealt broadly with a variety of types of indebtedness to corporations and partnerships.

Lemoine v. The Queen, 96 DTC 1655 (TCC)

The taxpayer was unsuccessful in his attempt to establish that a loan received by him from a controlled corporation (Lemoine Inc.) was in fact a loan from a customer of Lemoine Inc. which had lent the money to fund the loan from Lemoine Inc. to the taxpayer. In particular, Tremblay TCJ. noted that there had been a failure to establish that the terms for repayment applicable to the two loans were the same or virtually the same, and were respected.

Haynes v. The Queen, 94 DTC 1906 (TCC)

Before finding that the taxpayer had received $210,000 from his corporation as an appropriation rather than a loan, Margeson TCJ. stated (p. 1910) that:

"The Appellant was an educated and sophisticated person, he was familiar with corporations, he had accounting and legal advice, he must have been familiar with the requirement to keep company minutes and resolutions so that one who needed to know would know what was going on in the corporations. The amounts involved were considerable and it is almost inconceivable that a loan of this magnitude would be taken out without more documentation than existed here."

285614 Alberta Ltd. and Maplesden v. Burnet, Duckworth & Palmer, [1993] WWR 374, 8 BLR (2d) 280 (Alta. Q.B.)

Te defendant was found to be negligent in not advising of the risk that the signing by the individual plaintiff of a demand promissory note as security for a housing loan made to her would not be considered to represent a bona fide arrangement for repayment of the loan within a reasonable time.

Laflamme v. MNR, 93 DTC 50 (TCC)

In finding that the inclusion of the amount of a loan made to the taxpayer by a corporation owned by his father in the taxpayer's income was not contrary to s. 15(1) of the Charter, Watson D.J. stated (p. 53):

"... the purpose of subsection 15(2) is to prevent the de facto tax-free distribution of corporate funds to shareholders. A distinction made on the basis of a blood relationship or dependence to a shareholder is directly relevant to this purpose."

Tonolli Canada Ltd. v. MNR, 91 DTC 520 (TCC)

After a venture carried on through a U.S. subsidiary which was owned by the taxpayer and its Netherlands parent proved to be unsuccessful, the Netherlands parent advised the taxpayer's auditors that it had agreed to reimburse the taxpayer for 89% of the total loss, as a result of which the taxpayer's balance sheet showed an asset equal to the amount of the proposed reimbursement. Mogan TCJ. found that this "agreement" was "gratuitous and not enforceable" (p. 522), with the result that the promise to reimburse did not give rise to indebtedness of the Netherlands parent owing to the taxpayer for purposes of ss.15(2) and 214(3)(a).

Mogan TCJ. also stated (p. 523):

"In the absence of a special statutory definition, 'debt' means a sum payable in respect of a liquidated money demand, recoverable by action ..."

Wolinsky v. MNR, 90 DTC 1854 (TCC)

The non-payment of interest did not constitute the "making of a loan" for purposes of the pre-1982 version of the provision, although it resulted in the shareholder "becoming indebted" to the corporation within the meaning of s. 15(2) for 1982 and subsequent taxation years.

Miconi v. MNR, 85 DTC 696 (TCC)

A real estate property was found to be beneficially owned by the taxpayer rather than by a corporation controlled by him, with the result that amounts paid by the corporation in respect of the property constituted loans made to him that were subject to s. 15(2). In rejecting a submission that the property was held by the individual under a parol trust in favour of the corporation, Rip TCJ. found that although this claim was supported by probability and by convincing parol evidence, it was not supported by writing, indisputable facts and disinterested testimony.

Heal v. MNR, 80 DTC 1169 (TCC)

Before finding that an advance by the company of which the taxpayer was the principal shareholder to aid in his construction of a home was includable in his income, Taylor J stated (at p. 1171) that ss. 15(1) and (2) were placed in the Act

at least in part for the purpose of dissuading taxpayers from using the funds of corporations in which they were shareholders for purposes and in ways materially different from those to which such funds would be put by them in the regular business operations of the corporation. The risk in perceiving a closely-held private corporation as a mere business extension or alter ego of a shareholder taxpayer personally must be avoided, or the penalty paid.

Administrative Policy

2 October 2014 T.I. 2013-0506551E5 - Transitioning from 15(2) to a PLOI

27 February 2014 T.I. 2013-0506401E5 - Loan from a partnership to an individual

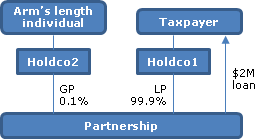

A partnership between Holdco1 as the 99.9% LP and Holdco2 as the 0.1% GP makes a $2 million non-interest-bearing demand loan to the taxpayer, the individual shareholder of Holdco1. CRA stated:

[S]ubsection 15(2) appears to be applicable…subject to the exceptions outlined in subsections 15(2.2) to 15(2.6), such that the

amount of the loan or indebtedness would be included in computing the income for the year of Taxpayer.... .

2010 Ruling 2010-035314

a loan from a controlled foreign affiliate to a related non-resident entity will not trigger the application of s. 15(2) and Part XIII.

17 February 1997 T.I. 964065

S.15(2) does not apply to a loan made by a corporation to an individual who only becomes a shareholder of the corporation after the loan is made.

25 November 1993 Memorandum 932357 (C.T.O. "Interest Cost on Bridge Financing upon Relocation")

RC's policy is that an employee will not be subject to a taxable benefit for the interest costs associated with bridge financing arrangements respecting the pending relocation of an employee where "all reasonable efforts" have been made to sell the employee's previous residence. RC notes that the first issue to be addressed is whether the executive is a shareholder of the company (given that the total amount of funds advanced were in excess of those that typically would be received by virtue of an individual's employment), and notes the factors that are relevant to the reasonable-efforts test if the individual received the loan by virtue of his employment.

5 January 1993 T.I. 923226 (November 1993 Access Letter, p. 491, ¶C9-290; (Tax Window, No. 28, p. 16, ¶2375)

A loan may still qualify after its transfer at fair market value to a related corporation by which the employee is also employed, because the transfer, by itself, will not result in a new loan agreement.

The acquired dwelling need not be located in Canada, and the shareholder's occupation of it as a vacation property for one month each year would qualify as habitation. However, acquisition for some other purpose, e.g., as an investment or occupation by relatives, would disqualify the property.

92 C.R. - Q.43

Where an open or running account of a shareholder with a corporation is cleared at every year-end by the payment of salaries or dividends, s. 15(2) will not be applicable.

19 November 1990 T.I. (Tax Window, Prelim. No. 2, p. 19, ¶1050)

Because the application of s. 15(2) is determined only at the time the debt is incurred, it will not apply by virtue only of the debtor having become a shareholder at a later time.

October 1989 Revenue Canada Round Table - Q3 (Jan. 90 Access Letter, ¶1075)

A partnership is a person for purposes of s. 15(2).

84 C.R. - Q.16

"Taxpayer" in s. 20(1)(j) is considered to include a partnership where a loan subject to s. 15(2) previously has been included in the partnership's income.

80 C.R. - Q.39

If a person who holds shares as a nominee or trustee is not in his personal capacity a shareholder of the corporation or a related corporation and deals at arm's length with each shareholder of such corporations, s. 15(2) will not apply.

Where a public corporation makes bona fide loans to a shareholder quo employee rather than qua shareholder, on the same conditions as to other employees, s. 15(2) will not apply.

80 C.R. - Q.7

The holding of the shares by a trustee will not cause the loss of the exemption, provided that the shareholder was the beneficial owner.

IT-119R4 "Debts of Shareholders and Certain Persons Connected with Shareholders"

Articles

John Lorito, Trevor O'Brien, "International Finance – Cash Pooling Arrangements", draft version of paper for CTF 2014 Conference Report.

Withholding based on net increase (p. 16)

If the shareholder loan rules apply to loans made by a Canadian resident corporation to a non-resident, and there is a series of loans and repayments, the CRA has indicated that the withholding tax payable as a result of the deemed dividend shall be "based on the net increase of the loan during the taxation year of the lender" [fn 51: IT-119R4…]. As a result, in a physical cash pooling arrangement that does not qualify to be exempted from the shareholder loan rules, it may be reasonable to treat the net increase in a physical cash pool balance over a particular taxation year as the amount that should be deemed to be a dividend paid and subject to Canadian withholding tax.

See description of cash pooling under s. 15(2.3).

Randy S. Morphy, "The Modern Approach to Statutory Interpretation, Applied to the Section 15 Anomaly in Foreign Affiliate Financing", Canadian Tax Journal, (2013) 61:2, 367-85: summary under s. 15(2.3).

Chris Van Loan, "Canada Revenue Agency Rules Positively on Second Tier Financing Structure", Business Vehicles, Vol. XIII, No. 4, 2010, p. 713.

Singer, "Shareholder Loan Can Be Used to Acquire Recreational Home Outside of Canada", Taxation of Executive Compensation and Retirement, December 1990/January 1991, p. 381.

"Loan May Be Disqualified Where it is Made to Acquire Dwelling Already Occupied as Owner", Taxation of Executive Compensation and Retirement, March 1990, p. 249.

Subsection 15(2.2) - When s. 15(2) not to apply — non-resident persons

Administrative Policy

21 June 1995 T.I. 951091 (see also 21 May 1996 T.I. 952686)

With respect to a loan by a wholly-owned foreign affiliate of a Canadian corporation ("Canco") to a non-resident corporation that was related to Canco but not a foreign affiliate of any person resident in Canada, RC indicated that "in the event the above transactions were part of a series of transactions that was designed to avoid the application of subsection 15(2) to monies acquired by a shareholder or a corporation connected to the shareholder of Canco, the series of transactions may be considered a misuse of subsection 15(8) of the Act and subsection 245(2) may apply".

Subsection 15(2.3) - When s. 15(2) not to apply — ordinary lending business

Administrative Policy

2012 Ruling 2011-0417711R3

Canco, which is a grandchild subsidiary of Parentco (a resident of Country 1), borrows money from time to time under note offerings in Canada or through issuing commercial paper in Canada, in each case, under a Parentco guarantee, and uses the proceeds to make interest-bearing loans (at not less than the rate prescribed under Regulation 4301(c), and at a positive spread, and at a term of X to Y years) to non-resident members of the Parentco group which are not foreign affiliates of Canco.

Rulings that such loans will be exempt loans under s. 17(15) and will not be subject to s. 15(2) by virtue of s. 15(2.3), and that there will be no income inclusion under s. 17(1).

2007 Ruling 2007-0226281R3 -

Non-resident bondholders make a loan to a corporation ("Finco") which is wholly-owned by a charitable discretionary trust and Finco lends the money at a positive spread. to a construction project limited partnership.

Ruling that s. 15(2.3) will apply to the loan to the limited partnership.

8 February 2006 T.I. 2004-0064811E5

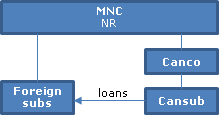

Cansub is a wholly-owned subsidiary of Canco which, in turn, is wholly-owned by MNC, a non-resident multi-national corporation. All the treasury functions for the group are carried out by Cansub. Cansub lends to non-resident subsidiaries of MNC (Foreign Subs) at market rates of interest, and bona fide arrangements are made for repayment of the loans within a reasonable period of time.

CRA stated:

Cansub only lends money to the members of the Group with whom it does not deal at arm's length. One would expect that in an ordinary business of lending money, loans would be made to arm's length persons. Hence, it may be that any loan made by Cansub to the Foreign Subs cannot be said to be made in the ordinary course of Cansub's ordinary business of lending money. …

In the event that a corporation's business includes the making of loans but those loans cannot be viewed as having been made in the corporation's ordinary business of lending money, it is our view that those same loans cannot be considered as "debts that arose in the ordinary course of the creditor's business". ... [W]here a loan is made by a taxpayer as a lender, the phrase "a debt that arose in the ordinary course of the creditor's business" in subsection 15(2.3) is not applicable to that taxpayer in respect of the loan. That phrase is meant to cover situations where an indebtedness other than a loan occurs... .This is so because a lender/borrower relationship is more specific than a creditor/debtor relationship.

2006 Ruling 2006-0211781R3 -

Non-resident term lenders make a loan to a newly-incorporated wholly-owned subsidiary ("Finco") of the general partner of a Canadian limited partnership that is a subsidiary partnership (through an intermediate unit trust) of an income fund. Finco on-lends on similar terms to the limited partnership.

Ruling that s. 15(2.3) will apply to the advances from Finco to the limited partnership.

2006 Ruling 2006-0191881R3

Ruling that s. 15(2.3) will apply to a loan made by an indirect special purpose finance subsidiary of an income fund to an indirect general partnership subsidiary of the income fund that is funded out of the proceeds of a cross border loan made to Finco.

1996 Tax Executive Institute Round Table, Q. X (Draft, No. 963906)

"When a loan is made to a shareholder in the ordinary course of the creditor's business with the same terms and conditions as offered to the public at large, the terms of repayment will normally be considered reasonable for the purpose of proposed subsection 15(2.3) of the Act. In particular, the minimum payments required under the terms of most commercial revolving credit sources will be considered to meet the requirement that bona fide arrangements be made for repayment of the debt or loan within a reasonable time ... ." By way of contrast, RC requires that specific terms of repayment for the full amount of indebtedness be set out in a loan in order to qualify for the exclusion in s. 15(2.4)(f) or 15(2.5)(d).

Articles

John Lorito, Trevor O'Brien, "International Finance – Cash Pooling Arrangements", draft version of paper for CTF 2014 Conference Report.

Descripton of physical and notional cash pooling (pp. 2-3)

[I]n general terms there are essentially two types of cash pooling arrangements [fn 1: …A representative listing…can be found…at www.rbinternational.com]: physical pooling, also known as zero-balancing, and notional pooling.

In a physical pooling arrangement, participants in the pool maintain their own bank accounts which are sub-accounts linked to a main or head account. …The head account is generally held by a different legal entity from the operating participants. …The participants carry out their daily activities, paying and receiving funds. At the end of each day, the accounts are "zero-balanced". Any positive balances in an account are transferred to the head account and any negative balances are funded from the head account such that each account, other than the head account, as a zero balance at the end of each day. The cash flows between the head-and participant accounts are generally treated as intercompany loans….

Notional pooling refers to the offset of interest income and expense that arises from the various cash positions in accounts that members of a multinational group maintain with a single bank….

Ordinary course exception for Canadian head account holder in cash pool (p. 16)

Where the Canadian resident corporation is the head account holder and therefore receives and makes loans and advances to the various cash pool members, it should be reasonable to conclude that such loans and advances were made in the ordinary course of the lender's ordinary business of lending money (provided this represents the ordinary business of the Canadian resident corporation). However, depending upon the terms of the cash pool, the loans and advances made under the cash pool may simply represent demand loans and therefore may not have any specific terms requiring repayment within a specific period of time….

Randy S. Morphy, "The Modern Approach to Statutory Interpretation, Applied to the Section 15 Anomaly in Foreign Affiliate Financing", Canadian Tax Journal, (2013) 61:2, 367-85:

Example 1 – loan to direct foreign sub (pp. 369-370)

In example 1, a Canadian parent ("Canco") makes an interest-free loan ("the loan") to a wholly owned foreign subsidiary ("Forco"), which uses the loan for the purpose of earning income from an active business. Under this arrangement, a deemed income inclusion under subsection 17(1) would be avoided as a result of the exception in paragraph 17(8)(a), which in general terms provides that subsection 17(1) will not apply in respect of an interest-free loan advanced to a controlled foreign affiliate where the proceeds of the loan are used for the purpose of earning income from an active business. Similarly, the arrangement should not give rise to an income inclusion under the shareholder loan provisions in subsection 15(2) because Forco is not a shareholder of Canco, either directly or through a partnership or trust, and (pursuant to subsection 15(2.1), discussed below) Forco is not connected with a shareholder of Canco.

Example 2 – loan to foreign holding company for Opco (pp. 370-371)

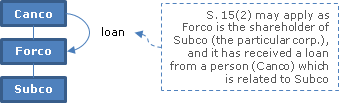

Should the result change for the arrangement depicted in example 2, where Forco holds all of the shares of another active or inactive foreign subsidiary ("Subco") but still carries on an active business in respect of which the loan proceeds are used? Subsection 17(8) would continue to apply in this example, such that no imputed income would arise under subsection 17(1) provided that the loan proceeds are used in an active business. However, a similar result may not arise under subsection 15(2).

…The relevant portions of subsection 15(2) read as follows:

15(2) Where a person (other than a corporation resident in Canada)…is

(a) a shareholder of a particular corporation, [or]

(b) connected with a shareholder of a particular corporation…

and the person…has in a taxation year received a loan from…the particular corporation [or] any other corporation related to the particular corporation…the amount of the loan…is included in computing the income for the year of the person.

The "person" to focus on in example 2 is Forco. Forco is not a corporation resident in Canada and has received a loan from Canco. Forco is a shareholder of a "particular corporation," Subco, and is indebted to a person, Canco, to which Subco is related by virtue of the fact that Canco controls Subco….

Exception in s. 15(2.3) (p. 372)

…Subsection 15(2.3) provides that subsection 15(2) will not apply to

a debt that arose in the ordinary course of the creditor's business or a loan made in the ordinary course of the lender's ordinary business of lending money where, at the time the indebtedness arose or the loan was made, bona fide arrangements were made for repayment of the debt or loan within a reasonable time.

The word "or" should be given its presumed disjunctive reading; accordingly, the financing arrangement in example 2 should qualify for this exemption if it meets either of the two exceptions specified above. For the purposes of the analysis that follows, it is assumed that bona fide arrangements have been made. It should, however, be noted that a demand loan will generally not satisfy this requirement. [fn 10: Perlingieri v. MNR, 93 DTC 158 (TCC).]

With respect to the first exception, the Canada Revenue Agency (CRA) is of the view that the term "debt" does not include a loan. [fn 11: CRA document no. 2004-0064811E5, February 8, 2006.]…

Exclusion of foreign affiliates in connected corporation definition is not relevant to s. 15(2)(a) (p. 373)

[T]he loan is brought within the charging provision of subsection 15(2) by paragraph 15(2)(a) [rather than (b)], because Forco is itself "a shareholder of a particular corporation"; therefore, the exception in subsection 15(2.1) is of no assistance.

Application of s. 214(3)(a) (p. 374)

[A] Canadian corporation can be deemed to have paid a dividend to a person that does not hold shares in the Canadian corporation. ...Therefore...Canco would be deemed to have paid a dividend to Forco, notwithstanding that Forco is not a shareholder of Canco.

More on debt arising in ordinary course of business (pp. 380-382

As noted earlier, subsection 15(2.3) provides that subsection 15(2) will not apply to

- a debt that arose in the ordinary course of the creditor's business, or

- a loan made in the ordinary course of the lender's ordinary business of lending money…

With respect to the first exception, the term "debt" is not defined in the Act….

…Thus, by any understanding, "debt" is a broad term describing any amount of money owed by one person to another. This certainly seems to capture the loan in example 2; as a consequence of the loan, Forco is obligated to pay to Canco an amount of money. ...On that presumption, if the term "debt" includes a loan in subsection 22(1) (and it plainly does), it should include a loan for the purposes of subsection 15(2).

If the loan in example 2 is a debt, the next question is whether it arose in the ordinary course of Canco's business. Whether a transaction occurs in the "ordinary course of the business" is a question of fact. [fn 43: Heron Bay Investments Ltd. v. The Queen, 2009 TCC 337, at paragraph 58 (TCC), Heron Bay was later overturned on appeal for procedural reasons (Heron Bay Investments Ltd. v. Canada, 2010 FCA 2013).] The loan will be made in the ordinary course of Canco's business if it is made as part of "the ordinary day-to-day business activities [of the company], having no unusual or special features." [fn 44: Ibid. (TCC), at paragraph 53, quoting British Columbia Telephone Company v. MNR, 86 DTC 1286, at 1290 (TCC).] In other words, for the loan to be outside the "ordinary course of the business," it would need to be "extraordinary or extracurricular in some distinct fashion and clearly different from the day-to-day operation of the business." [fn 45: Heron Bay, supra note 43 (TCC), at paragraph 54, quoting Highfield Corporation Ltd. v. MNR, 82 DTC 1835, at 1843 (TRB).]…

…However, it is customary in many industries for a Canadian parent to finance the activities of its subsidiaries in foreign countries. There are examples in the jurisprudence that support the notion that a loan to a related party can be part of the ordinary course of the taxpayer's business. [fn 47: See Loman Warehousing Ltd. v. The Queen, 99 DTC 1113, at paragraph 31 (TCC) (aff'd. 2000 DTC 6610 (FCA)), where the Tax Court suggests that the loan between related parties at issue in the case could have been made in the ordinary course of business even though that business was not a business of lending money.] Thus, it is entirely possible that Canco could meet this test and would consequently avoid the application of subsection 15(2) on a textual reading of the provision.

Guy Fortin, Melanie Beaulieu, "The Meaning of the Expressions ‘In the Ordinary Course of Business' and ‘Directly or Indirectly'", 2002 Conference Report (Toronto: Canadian Tax Foundation, 2003) 36:1-60.

Subsection 15(2.4) - When s. 15(2) not to apply — certain employees

See Also

Goreham v. The Queen, 2000 DTC 1561, Docket: 96-4040-IT-G (TCC)

At the time the taxpayer received a loan from a company carrying on a fishing business that was beneficially owned, as to 50%, by the taxpayer and his wife, a written agreement was entered into under which it was agreed that he would repay the advances out of the proceeds of sale of his home and out of bonuses payable whenever he returned from a fishing voyage. It was found (at p. 1566) that this "agreement failed to provide a recognizable and reasonable termination date for payment of the loan" given that, at the time of the agreement, it was reasonably clear to the taxpayer and his wife that they would be unable to sell their home and given that the decision to pay the bonuses was within his complete control (and, in fact, there were a number of occasions in which he determined that the company would not pay him the bonuses).

Lavoie v. The Queen, 95 DTC 673 (TCC)

Before finding that a demand promissory note signed by the taxpayer to evidence a loan made to him by a corporation he controlled did not represent a bona fide arrangement for repayment within a reasonable time, Lamarre Proulx TCJ. referred to the Perlingieri case (93 DTC 158) and stated (at p. 675):

"It is clear that an important feature of the Appellants's legal situation regarding the demand note signed by him is that he owned 98% of the voting shares of the corporation from which he had obtained the loan. In such circumstances, it is impossible to consider a demand loan as a binding agreement between the corporation and its debtor."

Kalousdian v. The Queen, 94 DTC 1722 (TCC)

Mogan TCJ. accepted evidence that a loan made to the taxpayer by a corporation owned equally by him and an unrelated individual was made to him on the basis that he would be required to repay the loan when he and the other shareholder had finished paying off other mortgage loans owed by them, notwithstanding that the promissory note signed by the taxpayer did not document this arrangement. Mogan TCJ. stated (p. 1724):

"There may not be as much need for formality if the shares of a corporation are held in equal portions by two or more persons who deal at arm's length. In those circumstances, if only one shareholder has received a loan from the corporation on terms which are not reduced to writing, and if all of the shareholders are in agreement with respect to the oral terms of the loan, the conflicting commercial interests of the arm's length non-borrowing shareholders will ordinarily cause them to ensure that the loan is repaid within a reasonable time."

Spencer v. The Queen, 93 DTC 1222 (TCC)

Oral evidence by the individual's shareholder of his intent to repay money that had been advanced to him by a numbered corporation to construct a dwelling for his personal use was found by Sarchuk TCJ. to be "not evidence of an agreement creating enforceable rights and obligations but rather ... an open ended arrangement in which the date of any repayment was wholly within the control of the borrower" (p. 1225). Accordingly, there is no bona fide arrangement for repayment of the loan within a reasonable time.

Kanters v. MNR, 92 DTC 1508 (TCC)

What at best was an agreement for the shareholders to repay money to the corporation when the operation in which they invested the loaned monies became viable did not constitute a bona fide arrangement for repayment of the loans within a reasonable time.

Deckelbaum v. MNR, 82 DTC 1636 (T.R.B.)

A home purchase loan arrangement was evidenced by a resolution of the corporation authorizing the making of the loan and providing for its repayment in six equal annual instalments without interest. Mr. Taylor found that there was not a bona fide arrangement for a repayment given that no loan agreement or promissory note was signed by the taxpayer for the loan (p. 1638):

"An arrangement is an accord or agreement between parties and where the purpose of that arrangement is the conscious avoidance of income tax otherwise payable, it behooves the parties affected to be meticulous in the extreme ... It is difficult for the Board to accept that an arrangement for repayment of a loan from a shareholder to his personally-held corporation, should be regarded as 'bona fide' when it is less stringent than that which the same shareholder would insist his corporation impose on an unrelated third party."

Fabry v. MNR, 81 DTC 638 (T.R.B.)

The terms of a mortgage owing by the taxpayer to his company the proceeds of which were used to finance the acquisition and completion of construction on his house, were not honoured. Accordingly, the mortgage was a sham and there were no bona fide arrangements for repayment of the loan within a reasonable time.

Hendriks v. MNR, 81 DTC 939 (T.R.B.)

Bona fide arrangements for the repayment of a loan from the corporation to the taxpayer were found not to exist in light of the fact that the loan was followed by two contradictory "ex post facto corporate Resolutions: one stating that the $28,000 loan was to enable the appellant to purchase shares of [the company] to be repaid from the company dividends at a rate of $7,000 per annum; the other, a correcting Resolution, indicates that [the company] granted the appellant a loan of $28,000 to help him erect a dwelling for his own residence, the repayment to be made from dividends at a rate of not less than $4,000 per annum" (p. 944).

Reekie v. MNR, 80 DTC 1447 (T.R.B.)

A promissory note and a letter acknowledging indebtedness, which were prepared in the taxation year following the taxation year in which the loan was made, did not constitute bona fide arrangements for repayment made at the time the loan was made.

Altenhof v. MNR, 73 DTC 239 (T.R.B.)

The taxpayer was unable to establish that at the time he received an advance from the corporation arrangements were made for its repayment or that this requirement was even focussed on before the Department commenced its enquiries into the matter.

Administrative Policy

5 February 2002 T.I. 2001-011547 -

Where a loan which previously had been exempted under s.;15(2.4)(c), (e) and (f) subsequently was assigned to a partnership without being novated, the loan would still meet the exception in s. 15(2.4)(c) subsequent to this assignment.

26 May 1997 T.I. 970545

Where a loan is received by an employee who is not a specified employee at that time, but later in the year becomes a specified employee, the exception in s. 15(2.4)(a) will be available.

1996 Tax Executive Institute Round Table, Q. X (Draft, No. 963906)

"With respect to a loan which is excluded from a shareholder's income by reason of proposed subsection 15(2.4) or (2.5) of the Act, we expect that the specific terms of repayment of the full amount of the indebtedness will be set out at the time the loan is made. As a result, a demand loan or a revolving credit source will not ordinarily be accepted ... ."

11 August 1995 T.I. 950974 (C.T.O. "Shareholder/Employee Housing Loan")

Where changes to an original loan result in its novation, the new loan, because it serves to refinance an existing debt, will not qualify for the exemption in s. 15(2)(a)(ii). The comments in IT-448 are of assistance in determining whether the changes are sufficient to have resulted in a disposition of the previous loan.

Income Tax Regulation News, Release No. 3, 30 January, 1995 under "Paragraph 15(2)(b) and 20(1)(j)"

bona fide repayments of shareholder loans which are the result of the declaration of dividends, salaries or bonuses should not be considered part of a series of loans or other transactions and repayments.

30 March 1994 Memorandum 933613 (C.T.O. "Allocation of S/H Loan to Farm and P/R")

Where a loan made by the corporation to the employee exceeds the amount used for a qualified purpose (in this case, because the loan proceeds were used to acquire farm land in addition to the principal residence situate thereon) the entire amount of the loan will be included in income under s. 15(2) notwithstanding that a part of the loan was used for a qualified purpose.

28 March 1994 T.I. 933225 (C.T.O. "Meaning of 'Dwelling'")

When asked whether the exemption would apply to the making of a loan of $100,000 for the acquisition by an individual of a 20-year lease of a cottage property on an Indian reservation, RC stated that:

"The ordinary meaning of the word 'dwelling' is not broad enough to include a leasehold interest in a dwelling".

17 June 1994 T.I. 933229 (C.T.O. "Shareholder Loans - Employee Gifts Loan to Spouse for Home")

"It is our view that a loan will not meet the exclusion requirements of subparagraph 15(2)(a)(ii) of the Act where the individual to receive the loan is not the same individual to acquire the dwelling."

Accordingly, the exclusion is not available where the purpose of a loan to an employee is to enable the employee to give the proceeds to his spouse so that she can acquire a dwelling in which they will reside.

"Further, where the prima facie purpose of the loan is for a purpose other than the acquisition of a dwelling (such as gifting the proceeds to a spouse or other person), it is our opinion that the loan may fall outside the requirements of subparagraph 15(2)(a)(ii) ..."

20 May 1994 T.I. 940083 (C.T.O. "Loan to a Shareholder")

Commercial housing loans specify a term (the maximum of which is normally seven years) under which the loan can be renewed, at which point the lender will assess whether to extend the loan and charge interest at the relevant rate pursuant to circumstances existing at that time. Accordingly, a loan with a 25-year amortization period that does not provide for any renewal during that term will not accord with commercial lending practice, with an increased likelihood that the arrangement may not be viewed as being bona fide.

RC also noted that "a housing loan amortized over 25 years, and renewable every five years, at a prescribed rate of interest would be considered to be consistent with normal commercial practice ... ."

93 C.R. - Q. 17

It normally is unreasonable and inconsistent with normal commercial practice for a lender to loan a large sum of money without security or not to require the reimbursement of the unpaid balance of the loan when the property is sold.

In considering whether any arrangements for repayment are bona fide, RC will review the extent to which they have been carried out by the borrower.

92 C.R. - Q.42

The exception in s. 15(2)(a)(ii) will not apply to loans made or indebtedness arising in respect of repairs, alterations, or renovations to a dwelling that was acquired with the intention to perform such repairs, alterations or renovations prior or shortly after the dwelling becomes inhabited.

30 November 1991 Round Table (4M0462), Q. 2.3 - Housing Loan (s.15(2)(a)(ii), I.T.A.) (C.T.O. September 1994)

Where changing an interest-bearing loan into an interest-free loan results under the applicable civil legislation in a new security, the new security will not qualify under s. 15(2)(a)(ii) because it serves to refinance an existing debt.

30 November 1991 Round Table (4M0462), Q. 2.1 - Automobile Loan (s.15(2)(a)(iv), I.T.A.) (C.T.O. September 1994)

Although RC does not apply tests of minimum degree or percentage of use of an automobile in the performance of the duties of an employee's office or employment for purposes of s. 15(2)(a)(iv), the loan must enable the employee to acquire an automobile to be used by him in the performance of the duties of his employment.

7 October 1991 T.I. (Tax Window, No. 10, p. 6, ¶1507)

An employee housing loan which was repayable over a 25-year period would not have a reasonable repayment term, although a repayment or renewal term of five to seven years with a 25-year amortization period (or a 10-year amortization period for a summer home) would be considered reasonable. A non-recourse mortgage also may not be exempted by s. 15(2)(a)(ii).

4 April 1991 T.I. (Tax Window, No. 2, p. 28, ¶1221)

If under the terms of a separation agreement entered into some years after the acquisition of the home, the employee must leave the home, s. 15(2)(a)(ii) will continue to apply to the loan.

21 September 1990 T.I. (Tax Window, Prelim. No. 1, p. 7, ¶1002)

Where the amount of a loan from an employer in respect of a recreational property ordinarily inhabited by the employee is in excess of the proportionate cost of the house and land that is reasonably required for the use and enjoyment of the houses as a dwelling, the entire loan is subject to s. 15(2). Generally, RC will not dispute that up to 1/2 hectare of land subjacent or contiguous to the dwelling is reasonably necessary to the use and enjoyment of the house as a dwelling.

86 C.R. - Q.61

The loan need not be interest-bearing in order to demonstrate a bona fide arrangement for repayment.

86 C.R. - Q.63

Where a public corporation makes a bona fide loan to a shareholder qua employee rather than qua shareholder, on the same conditions as to other employees who are not shareholders, it will be treated as an employee loan.

Paragraph 15(2.4)(a)

See Also

Canadian Occidental U.S. Petroleum Corp. v. The Queen, 2001 DTC 295, Docket: 2000-1232-IT-G (TCC)

The taxpayer lent money on an interest-free basis to a non-resident wholly-owned subsidiary in 1988 and then, in November 1994 transferred the shares of the subsidiary to a sister company so that the borrower ceased to be a subsidiary controlled corporation of the taxpayer. The Minister assessed on the basis that the loan thereupon ceased to qualify for the exemption in former s. 17(3), which was available to a loan that "was made to a subsidiary controlled corporation."

Bowman A.C.J. rejected this position on the basis that it had the effect of adding the words "and throughout the period in which the loan was outstanding the corporation continued to be a subsidiary controlled corporation" to s. 17(3).

Paragraph 15(2.4)(e)

See Also

Mast v. The Queen, 2013 TCC 309

The taxpayer was the sole shareholder, and he and his wife were the only regular employees, of a corporation engaged in a packaging business. He maintained that he received an interest-free loan of approximately $1,000,000 from the corporation, in order to enable him to acquire a new residence as described in s. 15(2.4)(b), in his capacity as an employee rather than a shareholder, and that s. 15(2.4)(e) did not apply. The loan was required to be repaid over 10 years at the rate of at least $50,000 per year, the sums were advanced as construction work on the residence occurred, and the corporation had no security interest in the housing property.

Angers J dismissed the taxpayer's appeal. He adopted a requirement in 2011-0406271E5 (similar to IT-119R4, para. 11) that the taxpayer establish that a loan might be made on similar terms to a non-shareholding employee. No evidence was adduced to establish this. Instead, the loan terms were inconsistent with what would be available to a mere employee - as it represented a substantial portion of the corporation's retained earnings, and was unsecured. The loan also was labeled as a shareholder advance in the corporation's accounts. Furthermore, the "very flexible" repayment conditions (para. 29) did not represent bona fide repayment arrangements as required by s. 15(2.4)(f).

Administrative Policy

4 November 2011 T.I. 2011-0406271E5 -

A loan made in 2011 by a corporation to its sole shareholder-employee to facilitate the repayment of a secured line of credit used to finance a home purchase in 2009 would be exempt from inclusion in the shareholder's income in the year the loan was made. After referring to IT-119R4, para. 18. CRA stated:

Whether the conditions set forth in paragraphs 15(2.4)(e) and (f) of the Act have been satisfied are [sic] always questions of fact to be determined on a case by case basis. Where a shareholder is the only employee of a corporation, the Canada Revenue Agency will generally consider a loan to be received by virtue of employment where a shareholder-employee can demonstrate that employees with similar duties and responsibilities with another employer of similar size, but who are not shareholders of that other employer-corporation, receive loans of similar amounts under similar conditions as that granted to the shareholder-employee.

18 February 2002 T.I. 2002-011849

A loan made by a closely-held private corporation at the direction of its controlling shareholder to enable an employee to buy shares from such shareholder generally will be considered to be received "because of any person's shareholding".

9 January 2001 T.I. 2000-005999

Before concluding that s. 15(2.4)(b) did not apply to a housing loan received by a specified employee, the Directorate stated that "it has generally been our view that 'benefits' are received by an individual by virtue of his or her shareholding in the corporation where the shareholder can significantly influence business policy. Similarly, it is our view that an employee-shareholder would receive a loan from a corporation by virtue of his/her shareholdings where he/she can significantly influence business policy.

IT-119R4 "Debts of Shareholders and Certain Persons Connected with Shareholders"

11. Whether or not a loan made by a corporation to an individual is considered to have been received by that individual in his or her capacity as an employee or as a shareholder involves a finding of fact in each particular case. When a public corporation makes a loan to a shareholder on the same terms and conditions as to other employees who are not shareholders, the loan is normally considered to be a loan received by virtue of that individual's office or employment rather than his or her shareholdings. However, when the opportunity to borrow funds is only made available to shareholders or when the terms and conditions attached to loans to employee-shareholders are more favourable than those attached to loans to other employees, the loan will be considered to have been made to the employee-shareholder in his or her capacity as a shareholder unless the facts clearly indicate otherwise.

Paragraph 15(2.4)(f)

See Also

Mast v. The Queen, 2013 TCC 309

This case is summarized above under s. 15(2.4)(e). Angers J found that there were no bona fide repayment arrangements for the taxpayer to repay a $1 million housing loan received by him from his corporation, as required by s. 15(2.4)(f), notwithstanding that he was required to pay back a minimum of $50,000 of principal a year and the term was 10 years.

Davidson v. The Queen, 99 DTC 933, Docket: 96-4005-IT-G (TCC)

Before finding that a loan made by a family company to the taxpayer to finance the acquisition of a home satisfied the requirements for bona fide arrangements for repayment (based on evidence that the taxpayer and her husband intended that the loan would be repaid through the proceeds of a dividend to be made within five years of the date of advance). Bowie TCJ. indicated that there was no requirement for an arrangement to be contractually binding (the plain meaning of the word "arrangement" indicated as much), that there was no requirement for repayment on a date certain and that evidence that the payment was not made in accordance with the arrangement (as was the case here) was relevant to the issue of bona fides but was not conclusive on the issue.

Administrative Policy

24 April 2001 Memorandum 2001-006700 -

Loans from a corporation to an employee/shareholder that were used to acquire previously issued publicly traded shares of the corporation, where the loan was not repayable until the shares acquired were sold, the borrower died or his employment ended, did not satisfy s. 15(2.4)(f).

IT-119R4 "Debts of Shareholders and Certain Persons Connected with Shareholders"

12. In considering whether any arrangements for repayment were bona fide, the extent to which the arrangements have been carried out by the borrower is reviewed and, if the borrower is in default, any unusual circumstances that might have hindered them from being carried out. Whether or not the period allowed for repayment is "within a reasonable time" is a question of fact. In a given situation, one of the factors considered in determining what is a reasonable time is the normal commercial practice which would prevail in a similar situation. For example, for a housing loan, normal commercial practice requires the borrower, among other things, to give the lender some security (not necessarily a mortgage) and to repay any balance on the loan should the property be sold while an amount is still owing.

Subsection 15(2.6) - When s. 15(2) not to apply — repayment within one year

See Also

Hill v. MNR, 2009 93 DTC 148

After noting (at para. 33) that "if the repayment in question was itself part of a series of loans or other transactions, then the purpose of 15(2)(b) [now s. 15(2.6)] is offended and the preclusion becomes operative", Kempo, TCJ went on to note that here, a repayment occurring within the one-year period "was not that kind of repayment" as the shareholder advances were repaid out of a through one-off capital dividend.

Magicuts Inc. v. The Queen, 98 DTC 2085, Docket: 94-1573-IT-G (TCC)

There was insufficient evidence to establish that there was an agreed intention between the taxpayer and its non-resident shareholder to set-off an amount owning by it to the shareholder against amounts owing by the shareholder to it. Accordingly, s. 15(2) and s. 214(3) applied to the amounts owing by it to the shareholder.

Ozawa v. The Queen, 97 DTC 1500 (TCC)

Before going on to find that amounts advanced by a corporation to the taxpayer had not been eliminated by way of set-off against amounts allegedly advanced by the taxpayer to the corporation, Sarchuk TCJ. stated (at p. 1503) that the Gannon decision (88 DTC 1282) "stands for the proposition that there is a requirement of an agreement or contract calling for the mutual liquidation of the indebtedness and that this requirement is mandatory".

Meeuse v. The Queen, 94 DTC 1397 (TCC)

Each of the loans made to the taxpayer by her husband's company were for separate purposes, for example, financing her acquisition of an automobile, erection of a storage building, and acquisition of a coffee shop franchise. CRA assessed on the basis that the loan to finance the construction of the storage building should be included in her income under s. 15(2) and the subsequent repayment of that loan should be ignored. (The taxpayer received a new loan for the coffee shop franchise just weeks after such repayment.) Bowman TCJ held that the amount fell within the exception set out in paragraph 15(2)(b) (as it then read) for loans repaid within one year and did not form part of a "series of loans or other transactions and repayments." He stated (at pp. 1399-1400):

"I do not think that a mere succession of loans is sufficient to constitute them as series without more. This, I think, is a mechanical and simplistic interpretation of subsection 15(2)(b) of the Income Tax Act that ignores its purpose. It must be borne in mind that the purpose of subsection 15(2) is to prevent corporate funds to be paid out to shareholders or persons connected with them otherwise than by way of dividend under the guise of loans."

Attis v. MNR, 92 DTC 1128 (TCC)

The exclusion in s. 15(2) for payments made as part of a series of loans or other transactions and repayments does not apply where there is a series of payments of bonuses and dividends. In light of the presumption against double taxation in s. 4(4), it could not have been intended that such repayments would be included in income both under s. 5 (in the case of bonuses) or s. 12(1)(j) (in the case of dividends), and under s. 15(2).

Docherty v. MNR, 91 DTC 537 (TCC)

In finding that the elimination of indebtedness of the taxpayer to his corporation by set-off was sufficiently evidenced by information contained in the working papers of the corporation's accountant, Brulé TCJ. stated (p. 540):

"There does not seem in law a requirement for a written contract in order to effect a set-off. The Court must determine the intention of the parties and the nature of the obligations imposed on them by reference to credible evidence of another kind ..."

Burgeo Trawlers Ltd. v. MNR, 91 DTC 231 (TCC)

At a shareholders' meeting, it was decided that capital of the shareholders would be returned to them by way of offset against advances to the shareholders. It was found that such a repayment had in fact occurred in light of the working papers of the liquidator of the corporation which contained an entry reflecting this decision.

Taylor v. MNR, 87 DTC 475, [1987] 2 CTC 2178 (TCC)

At the end of the following taxation year, the taxpayer owed $22,529 to the corporation in respect of advances which it had made to him, and the corporation owed nearly $150,000 to the taxpayer's father-in-law. In refusing to give effect to a later purported retroactive set-off by the taxpayer's father of the amount owing by the taxpayer to the corporation against a portion of the amount owing by the corporation to the father-in-law, Tremblay J. noted that greater documentation of transactions is required when one of the parties to an arrangement is a corporation and, in addition:

"The formality must be more strictly followed when the result is an advantage received by the main shareholder ... because the lack of formality is his ... mistake." (p. 480)

Administrative Policy

8 September 2014 T.I. 2013-0482991E5 - 15(2) and related provisions

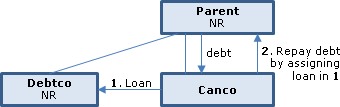

Debtco, a non-resident corporation which is connected to the non-resident wholly-owning parent (Parentco) of Canco, is indebted to Canco. Canco repays a debt owing by it to Parentco by assigning its debt receivable from Debtco to Parentco within one year after the end of Canco's taxation year in which Debtco became indebted to Canco. Does s. 15(2.6) apply to prevent an income inclusion under s. 15(2)? CRA stated:

[A]bsent novation of the debt … Canco's assignment of its debt receivable … would not constitute repayment of the debt by Debtco to Canco for the purposes of subsection 15(2.6). Since the debt would not be repaid as required under subsection 15(2.6), subsection 15(2) would continue to apply and the Part XIII tax imposed pursuant to paragraph 214(3)(a) would also remain. … If on the other hand, the debt was novated … section 245 may apply … .

2014 Ruling 2013-0505181R3 - 15(2.6) Series of Loans and Repayments

underline;">: Structure/accounting standards. Parentco, a non-resident and an indirect subsidiary of non-resident Pubco, wholly-owns Canco. Parentco's other subsidiaries are non-resident. Parentco's and Pubco's financial statements are prepared in accordance with IFRS and ASC, respectively.

Description of Notional Cash Pool

Parentco and a number of the non-resident Members have cash shortages from their operations which are funded by deficits in their accounts with "Non-resident Bank." Under a "Notional Cash Pool" structure, excess cash of each Member of the Group is regularly transferred from the Member's local bank account to its account with Non-resident Bank and, conversely, where a Member needs funds, there is a transfer from its account with Non-resident Bank to its local bank account, so that its account balance with Non-resident Bank may be in a deficit position. However, an account balance legally is an asset or liability, as the case may be, of the Member itself and no cash sweep to Parentco or another Member occurs. A single interest rate is applied by Non-resident Bank, whether a Member account is in a credit or debit position.

Upstream quarter-end advance

Canco will make an unsecured interest-bearing loan to Parentco (presumably, shortly before each quarter end or year end) of an amount equal to its excess cash on deposit with Non-resident Bank on each such date, resulting in the lent amount being drawn down from Canco's account with Non-resident Bank and being deposited to Parentco's account with Non-resident Bank. Each loan will be repaid by its due date of four days later by the amount owing being drawn down from Parentco's account with Non-resident Bank and being deposited to Canco's account with Non-resident Bank. Similar transactions will occur at the same time between Parentco and other Members.

Financial statement presentation purpose

"Parentco and Pubco are of the view that a company reporting a net balance of cash and cash equivalents is regarded by the readers of financial statements as a demonstration of the company's competence in the management of its funds...[and that therefore] off-setting assets and liabilities…has a positive impact on how shareholders…value a company. …The Proposed Transactions will be undertaken for the purpose of permitting Parentco and Pubco to prepare consolidated financial statements…on a basis that reports the Group's net cash position of the accounts in the Notional Cash Pool."

Ruling

"The making of each of the Loans together with the repayment of each of the Loans will not, in and of themselves, be considered a series of loans or other transactions and repayments for the purposes of subsection 15(2.6)… ."

Ruling rationale (per summary)

The "series of loans ... and repayments" referred to in subsection 15(2.6) is intended to prevent, by temporary repayment, a deferral of the recognition as income of amounts that are advanced as loans, rather than paid to the borrower as dividends, fees, bonuses or other amounts that would be included in the borrower's income. The four 4-day loans made in this case are not for the purpose of deferring the recognition of the loaned amounts as income, and the repayment of each loan in this case is not temporary.

10 January 2014 T.I. 2013-0506571E5 F - Subsections 15(2) and 15(2.6)

underline;">: Facts. Each year, Aco makes monthly advances to its sole individual shareholder, A; and each year Aco pays a dividend to A which has the effect of repaying part of such advances. Aco shows the remaining balance of the advances as an asset in its annual financial statements.

Question

If each of the advances incurred by Aco in the course of a taxation year of Aco is repaid within one year following the end of the taxation year of Aco in which the advance arose, would s. 15(2.6) apply where there is an outstanding balance of advances at the end of each taxation year of Aco?

Response

After quoting IT-119R4, paras. 27-29, CRA stated (TaxInterpretations translation) that "subsection 15(2.6) would apply ["pourrait s'appliquer"] in the context of the given situation."

12 June 2012 STEP Roundtable Q. , 2012-0442911C6

A shareholder loan repaid by the executors of the shareholder within one year after the end of the creditor's taxation year in which the loan was made will be treated in the same manner as a repayment by a surviving shareholder.

CRA stated that where the loan is not repaid by the estate within one year:

[T]he Estate can claim the deduction under paragraph 20(1)(j) in the year a repayment is made to the extent that the deceased person had included the amount of the loan in computing his or her income pursuant to subsection 15(2) in a preceding taxation year….[H]owever…CRA has indicated in technical interpretation 9918015 that [this] position in paragraph 32 of IT-119R4 does not apply where the loan is subsequently repaid by a beneficiary of the Estate.

15 August 2012 T.I. 2012-0443581E5 - Shareholder Loans

Before indicating that repayments made in 2011 (which exceeded the shareholder loan balance at the end of 2010), likely could be applied first against such 2010 indebtedness, so that there would be no income inclusion under s. 15(2), CRA stated:

The CRA's current position is that a "series" is generally restricted to a situation where a repayment is made shortly before the year-end of the corporation and the same amount, or substantially the same amount, is borrowed shortly thereafter in the immediately following year. This payment is not considered by the CRA to be a legitimate repayment... .

Generally speaking, repayments in a given fiscal period are applied to the oldest outstanding indebtedness of the shareholder unless the facts clearly indicated otherwise (i.e. where the shareholder has specifically allocated payments on another basis and has communicated this to the corporation).

17 February 2004 T.I. 2003-0033915 -

In indicating that a cash pooling arrangement entered into by a Canadian subsidiary with its non-resident parent corporation could result in an income inclusion under s. 15(2), Revenue Canada indicated that its review of the jurisprudence on s. 15(2) suggested that debts between a shareholder and a particular corporation do not generally offset for purposes of determining either whether the shareholder became indebted to the corporation in the first place, or whether that indebtedness has been repaid.

2000 December TEI Roundtable Q. , 2000-005603

The CCRA gave a generally favourable response to a question asking for confirmation that the exception in s. 15(2.6) will apply where loans are repaid as part of a series of loans and repayments, provided the series is terminated within one year after the end of the taxation year in which the loan was made. A detailed analysis of a shareholder's loan account will determine whether there has been a bona fide repayment of the loan or other indebtedness and whether the series of loans or other transactions and repayments has terminated.

5 October 1992 T.I. 5-921911

Canco makes loans in 1992 and 1993, evidenced by promissory notes, to its U.S. parent, with the loans being repaid by the end of 1993. Would such repayments be part of a series if a new laon were made in 1994?

The Directorate stated:

It is acceptable to have a repayment of an older loan and to make a new loan in the same year around the same time if the facts support the transactions. Given a situation where an earlier loan is made for a specific purpose, say to purchase equipment, and is to be repaid on or before a given date and subsequently another loan is made for a specific purpose, say to purchase land, around the date the earlier loan is repaid, we would accept this as being a repayment of an earlier loan and a new loan having been made, rather than insisting that it is part of a series of loans and repayments. On the other hand, if there are numerous non-specific loans and non-specific payments, it would be considered as being part of a series of loans and repayments, in which case the increases in a particular year-end balance would be treated as a loan in that year and a decrease in a year-end balance would be treated as a repayment. …

It is the Department's long standing practice not to regard an offset of a shareholder's loan account debit balance against a dividend payable as part of a series of loans and repayments for purposes of paragraph 15(2)(b)... .

92 C.R. - Q.44

Although there is no statutory relief to a non-resident where a particular loan, that previously was subject to s. 15(2) and s. 214(3)(a), is repaid, RC will give consideration to a request that the amount of tax should not be subject to withholding tax a second time if, and when, a dividend is paid to the non-resident.

30 November 1991 Round Table (4M0462), Q. 3.4 - Series of Loans and Repayments (C.T.O. September 1994)

S.15(2) will apply where a corporation makes monthly advances to its sole shareholder, with such advances being repaid through a payment of dividends immediately before the end of the subsequent taxation year. However, s. 15(2) would not apply if the dividends were paid immediately before the end of the particular year.

18 January 1990 T.I. (June 1990 Access Letter, ¶1256)

Where trade accounts receivable arise from sales of a subsidiary corporation to its non-resident parent, the creation of each account receivable and the subsequent repayment will be regarded as a separate transaction and not part of a series of other transactions and repayments (respecting the other receivables). The subsidiary can apply repayment to its oldest outstanding trade accounts receivable.

IT-119R4 "Debts of Shareholders and Certain Persons Connected With Shareholders" 7 August 1998

27 Repayments are considered to apply first to the oldest loan or debt outstanding ("first-in, first -out basis") unless the facts clearly indicate otherwise.

28....It is a question of fact whether or not a repayment of a loan is part of a series of loans or other transactions and repayments. In most cases, when there are only a few loans or other transactions and a few repayments made during a taxation year of a lender, there is no such series. However, when only one loan or other transaction and one repayment occur in each taxation year of a lender, a series of loans or other transactions and repayments may still be in evidence. This could occur, for example, when a repayment is of a temporary nature, such as a loan that is repaid shortly before the end of the year and the same amount, or substantially the same amount is borrowed shortly after the end of the year....

29....Bona fide repayments of shareholder loans that result from, for example, the payment of dividends, salaries, or bonuses, are not part of a series of loans or other transactions and repayments.

Subsection 15(2.11) - Pertinent loan or indebtedness

Administrative Policy

7 November 2014 T.I. 2014-0542061E5 - Section 15(2.12), follow up to 2014-051943

A CRIC remits Part XIII tax under s. 214(3)(a) on the amount of a loan to non-resident "Parentco" and, more than two years after the end of the calendar year in which the Part XIII tax was paid, but within 3 years from the CRIC's filing due-date for the year the loan was made, the CRIC and Parentco jointly file a PLOI election, so that the loan is no longer subject to Part XIII tax. Would CRA refund the withholding even though the s. 227(6) application therefor was not made within the two-year limit specified in s. 227(6)? CRYA stated:

[The] written application for the refund [must be] made no later than 2 years after the end of the calendar year in which the excess amount was paid. …[B]ecause the application was not made within the two-year limit, the CRA is not able to refund the excess Part XIII tax. However…the scenario… described is…unlikely to occur except in rare circumstances.

2 October 2014 T.I. 2013-0506551E5 - Transitioning from 15(2) to a PLOI

Can a s. 15(2) loan made to a non-resident person prior to March 29, 2012 ("Original Loan") be transitioned to the pertinent loan or indebtedness ("PLOI") regime by repaying it and re-lending the same amount after March 28, 2012 so that the new loan ("New Loan") qualifies for a PLOI election? CRA stated:

[O]nly new, post-March 28, 2012 loans or indebtedness that are not part of a Series of Loans [described in s. 15(2.6)] that include the repayment of a pre-March 29, 2012 loan or indebtedness can benefit from the PLOI regime. …

However, where subsection 15(2) and consequently Part XIII withholding tax had applied to a loan or indebtedness that is part of a Series of Loans, it will not apply again to the same amount of another loan or indebtedness in the Series of Loans. … Therefore, subsection 15(2) would not apply in respect of the New Loan such that the requirement in paragraph 15(2.11)(a) that the loan otherwise be subject to subsection 15(2) will not be satisfied. As such, the PLOI election in respect of the New Loan cannot be made or, if it was made, it would be considered invalid with the result that no interest income under subsection 17.1(1) would be imputed to the Canadian lender in respect of the New Loan.

8 September 2014 T.I. 2013-0482991E5 - 15(2) and related provisions

Debtco, a non-resident corporation which is connected to the non-resident wholly-owning parent (Parentco) of Canco, became indebted to Canco before March 28, 2012. Debtco replaces its pre-March 28, 2012 indebtedness to Canco with a new loan or indebtedness to Canco. Would this constitute a "series of loans and repayments?" After stating that "Parliament's specific requirement that an amount become owing after March 28, 2012, as set out in paragraph 15(2.11)(b), in order for the amount to qualify for PLOI treatment must be respected," CRA responded:

[I]f a pre-March 28, 2012, debt is replaced with a newer debt of the same or substantially similar amount, the transactions may constitute a series of loans or other transactions as discussed in ¶ 28 of IT-119R4 … However, as discussed in ¶ 29 of IT-119R4 ... all of the relevant factors would need to be considered to determine whether a series of loans or other transactions and repayments existed and bona fide repayments would not be seen as part of a series of loans or other transactions and repayments.