Inbound

Asset sale funding purchase

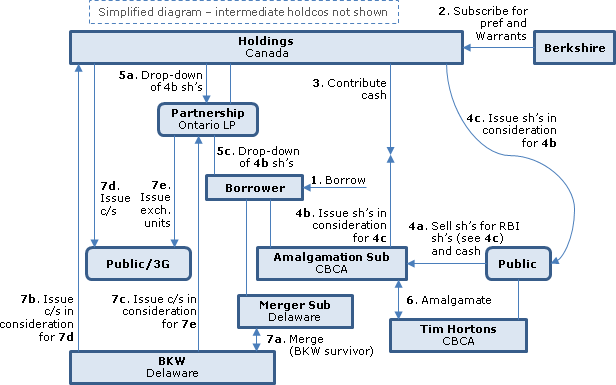

Burger King/Tim Hortons

Overview

Burger King Worldwide and Tim Hortons will effectively combine so that they will be held indirectly by a TSX-listed Ontario partnership (Partnership) of which a TSX and NYSE listed CBCA holding company (Holdings - formerly a B.C. ULC) held by former Tim Hortons and Burger King Worldwide shareholders will be general partner and the remainder of Burger King Worldwide shareholders will be limited partners. In the first set of transactions (mostly under a CBCA arrangement), a Partnership indirect Canadian subsidiary (Amalgamation Sub) will acquire Tim Hortons, resulting in Tim Hortons becoming an indirect subsidiary of both Holdings and Partnership and with cash being paid to Tim Hortons shareholders who elect cash (based on their election and subject to an aggregate cap of U.S.$8B) - and with those U.S. shareholders receiving Holdings shares benefiting from Code s. 351 reorg treatment. In the second principal step (the merger), Merger Sub (an indirect Delaware sub of Partnership) will merge into Burger King Worldwide, with Burger King Worldwide as the survivor, so that Burger King Worldwide becomes an indirect subsidiary of both Holdings and Partnership. On this merger, Burger King Worldwide stockholders can elect to receive exchangeable LP units of Holdings (so as to access Code s. 721 rollover treatment) rather than mostly shares of Holdings. In a preliminary step, Berkshire Hathaway Inc. ("Berkshire") will provide $3B of voting preferred share financing of Holdings together with an equity kicker (the warrant). Based on Holdings holding more than 50% in vote and value of Partnership interests and ex-Burger King Worldwide shareholders owning less than 80% of the Holdings and Partnership equity, as well as on substantial post-merger Canadian business activity, the Code s. 7874 rule should not deem Holdings or Partnership to be a U.S. corporation.

See full summary under Other - Continuances/Migrations - Inversions.

Kingspan/Vicwest/Westeel

Overview

In order to accomplish (under an OBCA Plan of Arrangement) a sale of a storage business (the Westeel Business) of Vicwest to the Westeel Purchaser and the effective use of those proceeds to fund an acquisition by a resident subsidiary (the BP Purchaser) of Kingspan Group Limited (BP Purchaser Parent) of all the shares of Vicwest, Vicwest will drop the Westeel Business into a Newco subsidiary (Westeel Canada) and the BP Purchaser will use the proceeds of a loan from the Westeel Purchaser to acquire all the Vicwest shares, bump the Westeel Canada shares under s. 88(1)(d) on a vertical amalgamation and (qua Amalco) transfer all the Westeel Canada shares (along with the shares of some non-resident subsidiaries) to the Westeel Purchaser in repayment of the loan.

Vicwest

Vicwest is a TSX-listed OBCA corporation and one of Canada's leading manufacturers and distributors of building construction products and steel containment products for agricultural grain, fertilizer and liquid storage. As at the close of business on December 22, 2014, there were issued and outstanding 17,648,142 Vicwest common shares, 520,000 Vicwest options, 236,112 Vicwest deferred share units ("DSUs"), 156,151 Vicwest performance share units ("PSUs") and $82,000,000 principal amount of Vicwest Debentures (in two series trading on the TSX).

Significant Vicwest Shareholder

Saul Koschitzky and IKO Enterprises Ltd. (collectively, the Significant Shareholder") hold 11.23% of Vicwest's common shares.

BP Purchaser/Parent

The BP Purchaser is a wholly-owned, indirect OBCA subsidiary of the BP Purchaser Parent created for the sole purpose of the acquisition of the Vicwest shares. The BP Purchaser Parent is a UK corporation. Kingspan Group plc, the indirect parent company of the BP Purchaser Parent, is a global leader in high performance insulation, building fabric and solar integrated building envelopes.

Westeel Purchaser/Parent

The Westeel Purchaser Parent is a CBCA corporation and a leading manufacturer of portable and stationary grain handling, storage and conditions equipment. The Westeel Purchaser is a wholly-owned CBCA subsidiary of the Westeel Purchaser Parent.

Asset Transfer Agreement

For the sale of assets of the "Westeel Business" of Vicwest (re seed, fertilizer and water storage) to 2441050 Ontario Limited ("Westeel Canada") in consideration for the assumption of liabilities and the issuance of common shares of Westeel Canada. This asset transfer essentially will occur effective the beginning of the Plan of Arrangement. A s. 85(1) election will be filed for the transfer to occur on a rollover basis.

Plan of Arrangement

- the Shareholder Rights Plan of Vicwest will be cancelled;

- the transactions contemplated by the Asset Transfer Agreement to be completed at the Effective Time of the Plan of Arrangement will be completed and become effective;

- the Westeel Purchaser will make the "Westeel Loan" of $221.5M to the BP Purchaser;

- the BP Purchaser will make the "Change of Control Settlement Loan" to Vicwest in an amount sufficient to repay the "ABL Facility" owing by Vicwest to CIBC and National Bank and to fund the payments in 5 below;

- all Vicwest PSUs, DSUs and options will be cash surrendered;

- each Vicwest common share other than any "Dissent Shares" for which rights of dissent have been validly exercised will be transferred to the BP Purchaser in exchange for cash of $12.70 per share, and each Dissent Share will be transferred to the BP Purchaser in consideration for a debt claim against the BP Purchase;

- Vicwest will repay the ABL Facility;

- the Change of Control Settlement Loan will be deemed to have been settled by a contribution of capital by the BP Purchaser to Vicwest;

- Vicwest will file with the CRA an election to cease to be a "public corporation";

- the stated capital of the Vicwest Shares will be reduced to $1.00;

- Vicwest and the BP Purchaser will be amalgamated to form Amalco under s. 177(1) of the OBCA, with the share capital of Amalco the same as the BP Purchaser; and

- in satisfaction of the Westeel Loan, all the shares of Westeel Canada and of certain non-resident subsidiaries will be transferred by Amalco to the Westeel Purchaser.

Vicwest Debentures

Vicwest currently intends to deliver a conditional notice of redemption of the first series of debentures conditional on completion of the Arrangement and, in the case of the second series, to hold a meeting of the holders to approve amendments permitting their redemption at a premium after the closing of the Arrangement.

Voting Agreement/s. 88(1)(c.3) property

The Significant Shareholder agreed, for a period of one year following the Effective Date of the Plan of Arrangement, that the Significant Shareholder will not purchase or otherwise acquire, directly or indirectly:

- convertible debentures issued by Vicwest or Westeel Purchaser Parent;

- common shares of Kingspan Group plc or of Westeel Purchaser Parent;

- "any other property that has previously been specifically identified to them by the BP Purchaser or the Westeel Purchaser, more than 10% of the fair market value of which is wholly or partly attributable to any property that was owned by [Vicwest] immediately prior to the Effective Time;

- any other property that has previously been specifically identified to them by the BP Purchaser or the Westeel Purchaser, the fair market value of which is determinable primarily by reference to the fair market value of, or to any proceeds of disposition of, any property that was owned by the Company immediately prior to the Effective Time; or

- any other securities convertible or exchangeable into any such securities or property apart from any such securities or other property that they may acquire, directly or indirectly, by reason of such securities or other property being held or acquired by an investment or pooled fund vehicle in which they have or acquire an interest and over which they do not have any influence."

Canadian tax consequences

"The disposition of Vicwest Shares by a Holder to the BP Purchaser will result in a capital gain (or capital loss) to the Holder… ."

Asset sale/share distribution

Chalice/Coventry

Overview

Under a BC Plan of Arrangement, Coventry is to transfer most of its subsidiaries (the "Targets") to Western Rift (a subsidiary of Chalice) in consideration for Chalice shares, which Coventry will then transfer to its shareholders as a stated capital distribution. The Arrangement is expected to result in the Coventry shareholders holding 15.46% of the Chalice shares, and in Coventry holding only cash and a project in Alaska.

Coventry

Coventry is a BC mineral exploration company which is listed on the TSXV and the ASX, with 91M shares outstanding. The Targets hold a gold project and other mineral rights in Ontario. It also has mineral rights in Ontario (also held through Targets).

Chalice

Chalice is an Australian mineral exploration company listed on the ASX and TSX, with 252M shares outstanding. Western Rift is its Australian wholly-owned subsidiary. Chalice sold a gold project in Eritrea in September 2012 for A$54M.

Plan of Arrangement

- All Target share will be transferred by Coventry to Western Rift in consideration for 46M shares of Chalice.

- Coventry will deliver such Chalice shares to its shareholders as a distribution of stated capital.

Canadian tax consequences

The fair market value of the Chalice shares distributed by Coventry is not expected to exceed the paid-up capital of the Coventry shares, so that no deemed dividend is expected.

Canadian Buyco

UnitedHealth/Catamaran

Overview

On an acquisition of Catamaran (a Canadian public company with a U.S.-focused pharmacy claims management business) under a Yukon Plan of Arrangement by Purchaser, each Catamaran shareholder will receive $61.50 per common share in cash. However, in order to accomplish a partial "de-sandwiching" of the resulting structure, the cash proceeds will be bifurcated. Approximately $18 to $24 per share (or $3.7B to $5B in total) will be received as a result of a (presumably non-Canadian) subsidiary of UnitedHealth Group lending to an indirect LLC subsidiary of Catamaran, with those funds being indirectly distributed to Catamaran which, in turn, will distribute those funds to its shareholders as redemption proceeds for preferred shares - which were issued to them under a s. 86 reorg. The balance of the $61.50 per share will be paid by Purchaser for the "Class X" common shares of Catamaran (also issued under the s. 86 reorg.)

Catamaran

A Yukon corporation trading on the TSX and NASDAQ whose principal executive offices are in Illinois. It has two business segments carried on in the U.S. and Canada: a pharmacy benefits management business (in which it processes one out of five prescription claims made in the U.S.); and health care information technology.

UnitedHealth Group

UnitedHealth Group Incorporated, a Minnesota corporation listed on the NYSE with a market cap of $113B, providing health care coverage and benefits services; and (through Optum) information and technology-enabled health services.

Purchaser

A wholly-owned B.C. subsidiary of UnitedHealth Group formed solely to engage in the contemplated transactions.

Company Sub 1

A Delaware wholly-owned subsidiary of Catamaran.

Company Sub 2

A Texas indirect wholly-owned subsidiary of Catamaran (and direct sub of Company Sub 1) which owes $2B to Luxco.

Company Sub 3

Catamaran PBM of Illinois, Inc., an indirect wholly-owned subsidiary of Catamaran (and direct sub of Company Sub 2) owing $350M to Luxco.

Luxco

Catamaran S. à r. L., a wholly-owned Luxembourg subsidiary of Catamaran.

Parent Sub

A subsidiary of UnitedHealth Group to be designated by it.

Plan of Arrangement

- Purchaser will subscribe for one common share of Catamaran for $61.50 in cash;

- Parent Sub will lend an amount to Company Sub 2 sufficient to fund the preferred share redemptions in 13 below;

- Company Sub 2 will repay all or part of a $275M note owing by it to Catamaran;

- A dividend or capital distribution will be made by Company Sub 2 to Company Sub 1;

- Company Sub 2 will repay all or part of the $2B owing by it to Luxco;

- Company Sub 2 will make a cash contribution to Company Sub 3;

- Company Sub 3 will repay all or part of the $350M owing by it to Luxco;

- Luxco will make a capital or dividend distribution to Catamaran;

- Company Sub 1 will make a capital or dividend distribution to Catamaran;

- each outstanding stock option, RSU award and PBRSU award granted prior to January 1, 2014 will be cancelled for the cash consideration;

- each of the common shares held by dissenting holders will be transferred to Purchaser in exchange for a right to be paid the fair value thereof;

- Catamaran will undertake a s. 86 reorganization of capital pursuant to which: (A) the authorized share capital of Catamaran will be amended to create two new classes of shares consisting of "class X common shares" carrying four votes per share and preferred shares which will be redeemable and retractable for a redemption price which will not exceed the paid-up capital of each common share immediately before the share exchange; and (B) each existing common share of Catamaran (other than any common shares owned by Purchaser) will be automatically exchanged for a newly created preferred share and one-half of a newly-created class X common share, with the stated capital of each preferred share being equal to the redemption consideration and the remainder of the paid-up capital of the common shares immediately before the share exchange being allocated to the stated capital of the class X common shares;

- each preferred share will be redeemed by Catamaran for a cash redemption price equal to the redemption consideration;

- each class X common share will be transferred to Purchaser for a cash purchase price equal to the product of (i) $61.50 minus the redemption consideration and (ii) two;

- each outstanding stock option, RSU award and (performance-based) PBRSU award granted on or after January 1, 2014 will be converted into a UnitedHealth Group share-based option, RSU or PBRSU, as the case may be; and

- Catamaran's employee share purchase plan will be terminated.

Canadian tax consequences

S. 86 exchange. The share exchange in 12 should not result in the realization of a capital gain (or capital loss) to a Canadian holder.

Pref redemption

The paid-up capital of the preferred shares will be equal to the portion of the arrangement consideration to be paid on the redemption of the preferred shares. Accordingly, a deemed dividend will not arise to Canadian holders on the share redemption in 13.

Taxable exchange

Exchange of Class X shares for cash in 14 will occur on a taxable basis.

U.S. tax consequences

Integrated transaction. The exchange of common shares for class X common shares and preferred shares, the redemption of the preferred shares, and the purchase of the class X common shares pursuant to the plan of arrangement should be treated as an integrated transaction pursuant to which each holder of common shares immediately prior to the consummation of the arrangement should be treated as receiving the arrangement consideration in exchange for common shares.

Dividend alternative

However, the IRS might successfully assert that the portion of the arrangement consideration paid by Catamaran in redemption of the preferred shares (expected to be in the range of $18 to $24 per common share) should instead be treated as a distribution by Catamaran with respect to common shares, followed by a purchase of common shares by UnitedHealth Group. If the transaction were so characterized, a U.S. holder would recognize dividend income equal to the lesser of the portion of the arrangement consideration paid in redemption of the preferred shares and the portion of the arrangement consideration that would be treated as paid out of Catamaran's current or accumulated earnings and profits. The portion of the arrangement consideration that would be treated as paid out of Catamaran's current or accumulated earnings and profits is expected by Catamaran to be materially less than the portion paid in redemption of the preferred shares.

PFIC rules

Catamaran believes that it currently is not a PFIC for U.S. federal income tax purposes and that it has not been a PFIC in prior taxable years.

Radian/Wheel

Overview

Radian, a listed Delaware corporation, is proposing that the Purchaser, a ULC subsidiary, acquire all of the shares of Wheels Group for cash or Radian shares under an OBCA Plan of Arrangement. No rollover treatment is offered. However, the Wheels majority shareholders (i.e., shareholders, including some of the individual company founders, holding 78% of the Wheels shares, who entered into a lock-up agreement with Radian) will agree to be subject to whatever proration will be necessary to ensure that those minority Wheels shareholders who validly elect for cash or Radian shares will not have their choice subject to proration.

Wheels

Wheels is an OBCA corporation trading on the TSXV with 89.6M common shares (the "Wheels Shares") outstanding. It is a supply chain logistics provider.

Purchaser/Radiant

The Purchaser is a wholly-owned subsidiary of Radiant, which is a Delaware corporation trading on the NYSE MKT.

Lock-up Shareholders

They hold 77.7% of the Wheels Shares, and include the "Company Founders" comprising Doug Tozer, Denise Messier and Peter Jamieson holding 39.9%, 10.4% and 5.0% of the Wheels Shares, respectively.

Share/cash election

Under the Arrangement, each Wheels Shareholder may elect to receive, for each Wheels Share, either (i) Cash Consideration of CDN$0.77 per Wheels Share, (ii) Share Consideration of 0.151384 Radiant Shares per Wheels Share, or (iii) a combination thereof. However, the number of Radiant Shares to be transferred to Wheels Shareholders must fall in the range of 4,540,254 to 6,900,000 shares. Any Wheels Shareholder other than a Locked-up Shareholder who makes a timely election will not be subject to proration, so that proration will only apply to the other shareholders. If the Wheels Shareholders elect to receive more than 6,900,000 Radiant Shares, the number of Radiant Shares to be received by the Locked-up Shareholders and all other (minority) shareholders who timely elected to receive Wheels Shares will be subject to proration in order to ensure that only 6,900,000 Radiant Shares are transferred to Wheels Shareholders. Conversely, if Wheels Shareholders elect to receive fewer than 4,540,254 Radiant Shares, the number of Radiant Shares to be received by the Locked-up Shareholders will be prorated to ensure that at least 4,540,254 shares are transferred to Wheels Shareholders.

Lock-up Agreement

Pursuant to the Lock-up Agreements, the Locked-up Shareholders who are Company Founders will elect to receive Share Consideration for 20% of their Wheels Shares and will refrain from transferring the Radiant Shares that they receive for one year following the Effective Date of the Arrangement. The remaining Locked-up Shareholders will elect to receive Share Consideration for 100% of their Wheels Shares and will refrain from transferring 20% of the Radiant Shares that they receive for 90 days following the Effective Date and for one year following the Effective Date as to the remaining 80% of the Radiant Shares.

Plan of Arrangement

Under the Plan of Arrangement:

- Unexercised Wheels options (and the Wheels Purchase Plan) will be cancelled.

- Each Wheels Share held by a dissenting shareholder will be transferred to the Purchaser.

- Each Wheels Share (other of a Dissenting Shareholder) will be transferred to the Purchaser by the holder thereof in exchange for the Cash Consideration, Share Consideration or Combined Consideration elected or deemed to be elected by such former Shareholder, subject to proration of the Share Consideration elected by the Locked-up Shareholders (and any other Wheels Shareholders who did not make a valid election).

Canadian tax considerations

The exchange will occur on a taxable basis.

U.S. tax considerations

The disposition of Wheels Shares for consideration in the Arrangement will be a taxable transaction to U.S. Holders. Wheels believes that likely it was not a PFIC for its tax year ended December 31, 2014.

Repsol/Talisman

Overview

Under a CBCA Plan of Arrangement, common shareholders of the Company (other than dissenting shareholders) will receive U.S.$8.00 in cash for each common share, which will be transferred to AcquisitionCo. Preferred shareholders (other than dissenting shareholders) will receive $25.00 in cash plus all accrued but unpaid dividends for each Preferred Share, which will be transferred to AcquisitionCo. Aggregate consideration is approximately U.S.$8.5B. This amount will be reduced by $Cdn.$200M plus accrued but unpaid dividends if Preferred Shareholder approval is not obtained to participate.

The Company

A Canadian oil and gas corporation whose core operations are in the U.S., Canada, Columbia and Asia-Pacific. Its Common shares trade on the TSX and NYE and its Preferred Shares trade on the TSX. It is not quickly apparent from the published materials whether it is a s. 212.3(10)(f) corporation.

Repsol

A Spanish oil and gas corporation whose ordinary shares are listed on four Spanish stock exchanges as well as on the Buenos Aires Stock Exchange and whose ADRs trade on the OTCQX market in the U.S.

AcquisitionCo

An indirect wholly-owned CBCA subsidiary of Repsol.

Dividend

A dividend of U.S.$0.1125 per Common Share will be declared and paid as of a record date before the Plan of Arrangement.

Canadian tax consequences

Acquisition of Company shares will occur on a taxable basis.

U.S. tax consequences

Taxable transaction.

Whiting/Kodiak

Overview

Kodiak, after being continued from the Yukon to B.C., will be acquired by Whiting Canadian Sub under a B.C. Plan of Arrangement and amalgamated with Whiting Canadian Sub with Kodiak as the survivor (a reverse triangular merger). On the acquisition of Kodiak, its shareholders will receive Whiting common shares from Whiting Canadian Sub with Whiting Canadian Sub simultaneously issuing common shares to Whiting in consideration for such Whiting common shares.

Whiting

Whiting is an independent oil and gas Delaware corporation whose common shares are listed on the NYSE.

Kodiak

Kodiak is a NYSE-listed company incorporated in the Yukon with a post-announcement market cap of U.S.$2.9B and offices in Denver, Colorado. It holds its (U.S. oil and gas) business through wholly-owned U.S. subsidiaries.

Whiting Canadian Sub

Whiting Canadian Sub, a wholly-owned subsidiary of Whiting, was incorporated under the BCBCA for the purpose of effecting the arrangement and has not conducted any non-arrangement related activities.

Continuance

Kodiak will continue from the Yukon to B.C.

Plan of Arrangement

- Each share of a Kodiak dissenting shareholder will be transferred to Whiting Canadian Sub with the payment therefor to be funded by a cash subscription for common shares of Whiting Canadian Sub by Whiting.

- Whiting Canadian Sub will acquire all of the outstanding shares of Kodiak in consideration for Whiting common shares (0.177 Whiting common shares for each Kodiak common share), with Whiting Canadian Sub concurrently issuing common shares to Whiting in consideration for such Whiting common shares.

- Each RSU, option and restricted stock award relating to Kodiak common stock that is outstanding immediately prior to the completion of the arrangement (whether vested or unvested) will be assumed by Whiting and converted automatically at the effective time of the arrangement into an RSU, option, or restricted stock award, as applicable (an "assumed award"), denominated in shares of Whiting common stock based on the exchange ratio and with corresponding adjustments to the per share exercise or purchase price of each assumed award.

- The aggregate stated capital of the outstanding shares of Kodiak will be reduced to $100.

- Whiting Canadian Sub will amalgamate with Kodiak to form one corporate entity, with Kodiak surviving the amalgamation as a direct wholly-owned subsidiary of Whiting and with the separate legal existence of Whiting Canadian Sub ceasing.

Canadian tax consequences

The continuance will not result in a disposition of Kodiak shares. The exchange of Kodiak for Whiting shares will occur on a taxable basis for residents.

U.S. tax consequences

Continuance/PFIC. The continuance will qualify as an F reorg. A U.S. holder that is deemed to dispose of Kodiak common shares pursuant to the continuance may be subject to adverse consequences if Kodiak were classified as a PFIC. Kodiak does not believe it has been a PFIC at least since 2005.

Arrangement

It is a condition to the obligation of both Whiting and Kodiak to complete the arrangement that Whiting receive a written opinion from Foley & Lardner LLP, counsel to Whiting that for Code purposes the arrangement transactions should (i) be treated as a single integrated transaction for such purposes and (ii) qualify as a "reorganization" under ss. 368(1)(1)(A) and 368(1)(2)(E). Kodiak agreed to use commercially reasonable efforts to cause Dorsey & Whitney LLP, counsel to Kodiak, to deliver a similar opinion. If Kodiak were a PFIC, and if Code s. 1291(f) were self-executing, a U.S. PFIC holder generally would be required to recognize a taxable gain as a result of the arrangement even if it qualified as such a reorganization, unless it has made certain elections.

IMZ/Chaparral/Hochschild

Overview

HOC, which is listed in the U.K. and headquartered in Peru, is interested in the 40% minority interest of IMZ in their Peruvian mining and development joint venture company, but not in IMZ's Nevada and Ecuadorian development properties (held through non-resident subsidiaries). IMZ, a Yukon corporation, with 118M common shares outstanding, is listed on the TSX and the Swiss Stock Exchange. IMZ will transfer its non-Peruvian assets and $58M of cash to a newly-incorporated Yukon subsidiary Chaparral Gold. Pursuant to a Yukon Plan of Arrangement, the shares of Chaparral Gold (which are expected to be listed on the TSX and are anticipated by Paradigm Capital Inc. to become worth between $0.58 and $0.85 each) will then be distributed to the IMZ common shareholders on a s. 86 reorganization, and the IMZ shares will be transferred to HOC Canada for $2.38 per share in cash.

For Detailed Summary, see under Spin-offs - S. 86 reorganization spin-offs.

IMIC/Afferro

Overview

Under a B.C. plan of arrangement, shareholders of Afferro will receive, for each Afferro share, £0.80 in cash and a 2-year unsecured convertible note of IMIC (the "Convertible Note") bearing simple interest of 8% on the principal of £0.40 (collectively, the "Consideration"). The Afferro shares will be acquired by Subco (a newly-incorporated B.C. direct subsidiary of IMIC) prior to IMIC and Subco amalgamating, with Amalco being a wholly-owned subsidiary of IMIC. Simultaneously with the Subco acquisition of Afferro, a Seychelles subsidiary of Afferro will lend US$70M to IMIC.

Afferro

A TSXV-listed B.C. corporation with a development-stage iron project in Cameroon. The Cameroon subsidiaries are grandchild subsidiaries of a direct Seychelles subsidiary of Afferro (Mano River), which holds substantial cash from a recent sale of Liberian mining assets.

IMIC

A U.K. company listed on the AIM Market.

Convertible Note terms

Upon maturity in 2 years they will be paid in cash, or converted to the equivalent market value in IMIC shares at the time of conversion, at IMIC's discretion. They are anticipated to be listed on the Irish Stock Exchange.

Plan of Arrangement

Under the Plan of Arrangement:

- IMIC will subscribe cash for common shares of Subco (to be issued "concurrently" with the acquisition of the Afferro shares by Subco below), and a further amount, equal to the amount of the Convertible Note consideration to be delivered by Subco, as the subscription amount for further Subco common shares also to be issued at such "concurrent" time

- Each common share of a dissenter will be transferred for its fair value to Subco

- Each Afferro stock option will be cash-surrendered

- Each common share of Afferro, other than of a dissenter, will be transferred to Subco in consideration for the (cash and Convertible Note) Consideration, which IMIC is directed to deliver on Subco's behalf

- Concurrently with the above step, Mano River will make the IMIC Loan to IMIC in the amount of US$70M

- Each Afferro share held by IMIC will be transferred to Subco in consideration for a common shares of Subco

- Afferro will file an election with CRA to cease to be a public corporation

- Afferro and Subco will amalgamate to form one corporate entity ("Amalco") under s. 269 of the BC Business Corporations Act under the name Afferro Mining Inc., with each Subco share continuing as an Amalco share; "the stated capital of the common shares of Amalco will be an amount equal to the paid-up capital, as that term is defined in the Tax Act, attributable to the common shares of Subco immediately prior to the amalgamation"

U.K. Securities Laws

The issuance of the Convertible Notes will not require a prospectus.

Canadian tax consequences

The acquisition will occur on a taxable basis. Discussion of consequences if the Convertible Notes are considered to be issued at a discount. Standard taxable Canadian property disclosure.

UK tax consequences

A disposal of Afferro shares by a UK resident may, depending on the circumstances, give rise to a chargeable gain or an allowable loss . No UK stamp duty.

Serabi/Kenai

Overview

Under a B.C. plan of arrangement, shareholders of Kenai will receive ordinary shares (and no deferred shares) of Serabi (representing an 87% premium). The Kenai shares will be acquired by Subco prior to Kenai and Subco amalgamating, with Amalco being a wholly-owned subsidiary of Serabi. Kenai shareholders will hold approximately 19.82% of Serabi's fully diluted shares outstanding. Serabi will lend up to US$2.75M to Kenai before the effective date of the arrangement to fund obligations of, and work on, Kenai's Brazilian property.

Kenai

A TSXV-listed B.C. corporation with a Brazilian gold property held through a wholly-owned Brazilian subsidiary and shareholders' equity of US$8.3M.

Serabi

A U.K. company listed on the TSX and the AIM Market, holding a Brazilian gold property through an indirect Brazilian subsidiary and with shareholders' equity of US$63.9M. Two private companies (Fratelli Investments Limited and Anker Holding AG) hold 51.1% and 11.1% of its shares.

Plan of Arrangement

Under the Plan of Arrangement:

- Each common share of a dissenter will be transferred for its fair value to Subco

- Each common share of Kenai, other than of a dissenter, will be transferred to Subco in consideration for the right to cause the delivery of .85 of an ordinary Serabi share

- As consideration for the issuance of each such ordinary Serabi share, Subco will issue one Subco share and add its fair market value to its stated capital account

- The Kenai warrants will be amended so that they apply to Serabi shares, with the exercise price and number of covered shares adjusted accordingly

- Each Kenai stock option will be exchanged for a replacement option on a Serabi share, with a view to s. 7(1.4) applying

- Subco and Kenai will amalgamate under the name Kenai Resources Ltd., with each Subco share continuing as an Amalco share, and with the stated capital of the shares of Amalco being the stated capital of the Subco shares issued under the arrangement plus the amount of cash to fund payments to dissenters

U.S. Securities Laws

The Serabi shares to be issued will not be registered under the U.S. Securities Act, and reliance will be placed on the s. 3(a)(10) exemption.

Canadian tax consequences

The acquisition will occur on a taxable basis. Standard taxable Canadian property disclosure.

Hecla/Aurizon

Overview

All the shares of Aurizon (a TSX- and NYSE-listed B.C. company with Quebec gold properties and no significant foreign subsidiaries) are to be acquired under a B.C. Plan of Arrangement by Acquireco (a B.C. wholly-owned subsidiary of Hecla) followed by their amalgamation. Hecla is a Delaware corporation listed on the NYSE. The consideration for each Aurizon share is (i) cash of $4.75 per share (the "Cash Consideration"), or (ii) 0.9953 of a Hecla share (the "Share Consideration"), or (iii) $3.11 in cash and 0.3446 of a Hecla share (the "Cash and Share Consideration"). This consideration represents a premium of 40% to the Aurizon share price before the previous Alamos offer. Although Aurizon shareholders will be able to elect between consideration alternatives, the total cash and share consideration will be limited to $513.6M and 57M Hecla shares (so that if all shareholders elected for the Cash Alternative or the Share Alternative, each shareholder would effectively receive the Cash and Share Consideration). The cash consideration appears to be paid directly by Hecla.

Alamos

The competing Alamos offer expired on March 19, 2013.

U.S. Securities law

The Hecla shares will be issued in reliance on the s. 3(a)(10) exemption.

Break fee

$27.2M.

Plan of Arrangement

Under the Plan of Arrangement:

- each Aurizon stock option will be surrendered to Aurizon for Aurizon shares equal to the options' in-the-money value (based on the Cash Consideration)

- outstanding Aurizon RSUs and DSUs will be cash-surrendered based on the Cash Consideration

- Aurizon shares of dissenting shareholders will be transferred to Acquireco for their fair value

- Hecla will subscribe for shares of Acquireco, with such subscription to be satisfied by Acquireco directing Hecla to deliver Hecla shares to Aurizon shareholders as the Share Consideration

- each outstanding Aurizon share (not held by Hecla) will be transferred to Acquireco for the Cash, Share, or Cash and Share, Consideration, at the election of the Aurizon shareholder, but subject to proration in light of the maximum cash and share consideration – with Acquireco being deemed to have directed Hecla to deliver the Share Consideration on its behalf

- each Aurizon share held by Hecla will be contributed to Acquireco in consideration for an Acquireco common share

- Aurizon will file an election to cease to be a private corporation

- the stated capital of the Aurizon shares will be reduced in aggregate to $1.00

- Aurizon and Acquireco will amalgamate under s. 288 of the Business Corporations Act (B.C.) "to form one corporate entity" (Amalco), with Hecla receiving one Amalco common share for each Acquireco common share, and the Aurizon shares being cancelled

Canadian tax consequences

Taxable exchange for Canadian residents. Taxable Canadian property disclosure for non-residents. Cautionary disclosure re offshore investment fund rules.

U.S. tax consequences

Exchange. Whether a U.S. holder will recognize full gain for Code purposes depends on whether the exchange qualifies as a reorganization under Code s. 368(a)(2)(D) (a forward triangular merger) which, in turn, depends largely on whether the transaction preserves a large part of the target shareholders' proprietary interest in the target (the continuity of interest requirement). Regulations provide that the continuity of interest requirement is satisfied where 40% by value of the total consideration provided to all target shareholders consists of share consideration, but do not establish a minimum percentage to satisfy the continuity of interest requirement. Under the Arrangement, the consideration will consist of approximately 35% share consideration and 65% cash consideration. Such amount of share consideration is not sufficient to establish with certainty that the continuity of interest requirement is satisfied, so that there is a significant risk that a U.S. holder will recognize gain in full on the exchange. Aurizon understands that Hecla intends to take the position that the exchange is a taxable transaction. If the exchange qualifies as a forward traingular merger, a U.S. holder will not recognize gain except to the extent of the cash received.

PFIC rules

Aurizon does not believe that it was a PFIC for it 2012 taxable year.

USRPC status

Based on its public statements, Hecla is not believed to be a U.S. real property holding corporation.

Coeur d'Alene/Orko

Overview

All the 142.1M shares of Orko, which is a B.C. company listed on the TSX-V and holding a Mexican subsidiary, are to be acquired under a B.C. plan of arrangement by Subco, which is a B.C. wholly-owned subsidiary of Coeur, which is an Idaho corporation listed on the NYSE and TSX. The consideration for each Orko share is (i) cash of $2.60 per share plus 0.01118 of a cashless exercise warrant (a "Warrant"), with a term of four years, and representing an entitlement to receive an amount based on a strike of US$30 per Coeur share, and with such value paid in Coeur shares (collectively, the "Cash Consideration"), or (ii) 0.1118 of a Coeur share and 0.01118 of a Warrant (collectively, the "Share Consideration"), or (iii) $0.70 in cash, 0.0815 of a Coeur share and 0.01118 of a Warrant (collectively, the "Cash and Share Consideration"). This consideration represents a premium of 71% to the Orko share price before the previous First Majestic offer. Although Orko shareholders will be able to elect between consideration alternatives, the total cash and share consideration will be limited to $100,000,000 and 11,584,187 Coeur shares. The acquisition of Orko is to be followed by its merger (as part of the Plan of Arrangement) with a B.C. subsidiary of Coeur, with Orko as the surviving entity. (For another example of a "survivor style" Canadian merger, see the Chesapeake Gold Corporation acquisition of American Gold Capital ca. 2007.)

First Majestic offer

The Orko board recommends approval of this offer (i.e., over the First Majestic offer).

U.S. Securities law

Orko is a foreign private issuer, so that the solicitation of proxies pursuant to the circular is not subject to the requirements of s. 14(a) of the U.S. Exchange Act. The Coeur shares and Warrants will be issued in reliance on the s. 3(a)(10) exemption. The s. 3(a)(10) exemption would not be available on the issuance of Coeur shares on the exercise of Warrants – hence the cashless exercise feature.

Break fee

Coeur has agreed to fund a $11.5M break fee payable to First Majestic.

Plan of Arrangement.

Under the Plan of Arrangement:

- The Orko shareholder rights plan will be cancelled

- Orko shares of dissenters will be transferred to Subco for their fair value

- each outstanding Orko share will be transferred to Subco for the Cash, Share, or Cash and Share, consideration, at the election of the Orko shareholder, but subject to proration in light of the maximum cash and share consideration

- the stated capital of the Orko shares will be reduced in aggregate to $1.00

- Orko and Subco then "shall merge to form one corporate entity ("Amalco") with the same effect as if they had amalgamated under Section 269 of the Business Corporations Act, except that the legal existence of Orko shall not cease and Orko shall survive the merger as Amalco…[and] the separate legal existence of Subco shall cease…and Orko and Subco shall continue as one company…."

These transactions would result in the number of issued and outstanding Coeur shares increasing to 101.5M.

Canadian tax consequences

Taxable exchange for Canadian residents. Taxable Canadian property disclosure for non-residents (including re Coeur shares and Warrants).

U.S. tax consequences

Exchange. A US holder will recognize gain or loss in an amount equal to the difference between the fair market value of the consideration received and the US holder's adjusted tax basis in the Orko shares surrendered.

PFIC rules

Orko believes that it and its subsidiaries have been and are PFICs. Discussion of consequences (e.g., gains recognized under the Arrangement may be taxable to US holders at ordinary-income rates with the tax so determined subject to an interest charge).

Warrants

The cashless exercise of the Warrants is expected to be tax-free.

Non-USRPC status

Coeur does not believe that it is (or has been within the last five years) a US real property holding company. Discussion of 5%-publicly traded exemption if this is not the case.

Direct Target Acquisition

Effective Energy/Uranium One

Overview

Under a CBCA plan of arrangement, shareholders of Uranium One, which is a TSX- and JSE-listed Canadian corporation, will receive Cdn.$2.86 cash per common share (or the Rand equivalent in the case of South African shareholders) from Effective Energy, representing a 32% premium over the 20 day pre-announcement VWAP on the TSX. ARMZ is the Russian parent of Effective Energy, a Netherland public limited liability company, and is an indirect wholly-owned subsidiary of Rosatom Nuclear Energy State Corporation. Effective Energy and another wholly-owned subsidiary of ARMZ together hold 51.4% of the shares of Uranium One. The cash consideration for the minority shares aggregates $1.3 billion.

Break fee

$45 million.

Plan of Arrangement

Under the Plan of Arrangement:

- Each common share of a dissenter will be transferred for its fair value to Effective Energy

- Each common share other than those of ARMZ or affiliates, or of dissenters, will be transferred to Effective Energy for cash of $2.86

- Each stock option will be cancelled in exchange for a cash payment equal to its in-the-money value (based on the $2.86 per share consideration) plus, in the case of an employee/officer optionholder, a payment on December 31, 2013 equal to the black-scholes value of the option minus the amount of any in-the-money payment received

MI 61-101 analysis

The arrangement is a business combination requiring a formal valuation of the Uranium One common shares. The arrangement resolution must be approved by a simple majority of the shareholders who are not interested parties. Interested parties hold 51.49% of the common shares and 50.21% of the stock options.

Canadian tax consequences

The acquisition will occur on a taxable basis. Standard taxable Canadian property disclosure.

U.S. tax consequences

Uranium One believes that it did not constitute a PFIC for its 2008 to 2012 taxation years, and expects that it should not be a PFIC for its 2013 year.

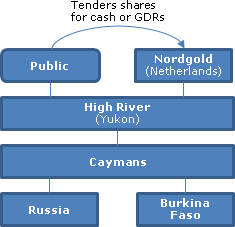

Nordgold/High River

Offer

Offer by Nordgold, which already holds approximately 75.1% of the common shares of High River, for the remaining common shares of High River on the basis of 0.285 of a global depositary receipt of Nordgold (a "GDR"), or $1.40 of cash, for each High River common share. This represents a 17.2% premium based on the respective closing prices, and values High River at $1.2 billion (or approximately 58% of the fully consolidated Nordgold after acquiring the balance of High River). The GDRs trade on the LSE, and the ordinary shares of Nordgold are not listed on any stock exchange. High River shareholders who elect for the GDRs will be deemed to have elected to receive Nordgold's Regulation S GDRs rather than its Rule 144A GDRs, except where it is considered reasonably necessary by Nordgold or the GDR depositary (including in response to a High River shareholder request) to issue Rule 144A GDRs in order to comply with applicable laws. There is a lock-up agreement for approximately 29% of the High River shares not already owned by Nordgold.

Nordgold intends all High River shares acquired under the offer to be voted in favour of any proposed subsequent acquisition transaction and, where permitted by MI 61-101, counted as part of any required minority approval.

High River

High River is governed by Yukon law, is listed on the TSX and derives substantially all its value from mining and exploration properties in Russia and Burkina Faso. It holds its foreign subsidiaries through a Caymans holding company.

Nordgold

It is a Netherlands company. Its GDRs listed on the LSE represent approximately 10.6% of its share capital.

Canadian tax treatment

High River share dispositions. Dispositions under the offer will occur on a taxable basis. If under a subsequent acquisition transaction, High River shares were exchanged under of plan of arrangement for cash or Nordgold GDRs, the tax consequences generally would be the same.

GDRs

Dividends on the GDRs, which would be subject to Dutch withholding tax, will be taxed as foreign dividends. Counsel is of the view that the value of the Novagold GDRs should not be regarded as being derived primarily from portfolio investments in properties described in the offshore investment fund rules - and, in any event, for s. 94.1 to apply, it also would be necessary for the "main reason" test to be satisfied.

Non-residents

No view is expressed as to whether the High River shares are taxable Canadian property (although they presumably are not).

Exchangeable Share Acquisitions

Mamba/Champion

Overview

Under a proposed OBCA plan of arrangement, a wholly-owned Ontario subsidiary (Canco) of Mamba, an Australian corporation listed on the ASX, will acquire (directly, except as described below) all of the common shares of Champion, an Ontario TSX- and Frankfurt-listed corporation focusing on the exploration and development of iron deposits in Quebec and Labrador and implicitly valued on a fully-diluted basis at $Cdn.60M, in consideration for Mamba ordinary shares on the basis of an Exchange Ratio of 0.733333 (i.e., 11 Mamba ordinary shares for each 15 Champion common shares) - provided that Canadian-resident taxable shareholders who are not financial institutions may elect to receive their share consideration as exchangeable shares of Canco. The Mamba ordinary shares will be listed on the TSX.

Exchangeable shares

The exchangeable shares are retractable by their holders on a one-for one basis for Mamba shares, subject to Mamba exercising its "Retraction Call Right" to purchase the retracted shares in exchange for Mamba shares (which presumably would occur in order to avoid Part VI.1 tax to Canco). Mamba issues a special voting share to a voting trustee for the exchangeable holders, with the number of votes equaling the number of outstanding voting shares. On a date to be determined by the Canco directors which is between January 1, 2015 and the 3rd anniversary of issue of the exchangeable shares, Canco will redeem all such shares through the delivery of Mamba ordinary shares, subject to Mamba exercising its call right. In a Support Agreement, Mamba agrees not to pays dividends on Mamba ordinary shares without corresponding dividends being paid on exchangeable shares, and not to engage in potentially dilutive transactions without approval of the exchangeable holders.

Options/Warrants

As preliminary steps in the Plan of Arrangement, Champion warrants are amended to be exercisable for Mamba ordinary shares, and stock options are exchanged for options on Mamba shares, in each case based on the Exchange Ratio.

Canadian tax consequences

Champion considers the voting rights granted on the issue of the exchangeable shares, and the Mamba call rights, to have a nominal fair market value. Eligible Champion shareholders who wish a potential rollover under s. 85(1) (or 85(2) if a partnership) must provide a signed and completed election form (in duplicate) to Canco within 90 days of the effective date of the Arrangement. Retraction of the exchangeable shares, but not their acquisition by Mamba pursuant to the Retraction Call Right, will give rise to deemed dividend treatment. Standard taxable Canadian property disclosure.

Australian tax consequences

Champion shareholders who are not Australian residents and who do not hold their Champion (or exchangeable) shares as part of a business in Australia should not be subject to Australian tax in respect of the disposal of their Champion shares (and should not be subject to Australian tax in respect of distributions received on their exchangeable shares or on a disposal of those shares). Mamba shareholders who are not Australian residents and who do not hold their Mamba shares as part of a business in Australia should not be subject to Australian tax on a disposal of their Mamba shares provided that, in the case of ordinary income tax, any profit does not have an Australian source (a facts and circumstances test) and, in the case of capital gains tax, the holder and its associates do not at any time hold or have the right to acquire 10% or more of the voting rights in or rights to distribution of income or capital from Mamba.

Molycorp/Neo Material

Overview

Under a proposed CBCA plan of arrangement, a BC subsidiary (Exchangeco) of Molycorp, a Delaware NYSE-listed corporation, will acquire all of the common shares of NEM, a CBCA TSX-listed corporation producing rare earth products and valued under the Arrangement at $1.3 billion, in consideration for cash or Molycorp shares at the option of the NEM shareholder (but subject to proration adjustments to ensure that the total cash and share consideration are 71.24% and 28.76%, respectively, of the total) - provided that Canadian-resident taxable shareholders may elect to receive their share consideration in the form of exchangeable shares of Exchangeco. The exchange ratio is .4242 of a Molycorp share (or exchangeable share) for each NEM share.

Retraction right

The exchangeable shares are retractable by their holders on a one-for one basis for Molycorp shares, subject to Molycorp or a BC subsidiary of Molcorp ("Callco") exercising their "Retraction Call Right" to purchase the retracted shares in exchange for Molycorp shares (which they presumably would do in order to avoid Part VI.1 tax to Exchangeco). Molycorp issues special voting shares to a voting trustee for the exchangeable holders. There is a sunset date for the exchangeables of their 6th anniversary.

Options/break fee

Employee stock options are cash-surrendered as the first step in the plan of arrangement. Break fee of C$30 million.

Canadian tax consequences

NEM considers the voting rights granted on the issue of the exchangeable shares, and the Molcorp/Callco call rights, to have a nominal fair market value. Eligible NEM shareholders who wish a potential rollover under s. 85(1) (or 85(2) if a partnership) must provide a signed and completed election form (in duplicate) to Exchangeco within 90 days of the effective date of the Arrangement. Depending on the cash (or other boot) received and the shareholder's ACB, full rollover treatment will not be available. Retraction of the exchangeable shares, but not their acquisition by Molycorp or Callco pursuant to the Retraction Call Right, will give rise to deemed dividend treatment.

U.S. tax consequences

The exchange will occur on a taxable basis. NEM, Exchangeco and Molcorp intend to take the position that the exchangeable shares are stock of Exchangeco and not of Molycorp for purposes of the Code, so that no US withholding tax will be withheld on dividends on those shares.

New NR Holdco (Inversion)

Pozen/Tribute

Overview

Tribute is proposing an inversion transaction with Pozen, a Delaware public company, which would result in both companies being held through an Irish holding company (Parent) with Pozen and Tribute shareholders holding approximately 63% and 37% of the shares of Parent, respectively, before giving effect to a subsequent financing. To achieve this structure, Pozen will cause Parent to be incorporated, "Ltd2" (an Irish private limited company) would be incorporated as a direct, wholly-owned subsidiary of Parent, and each of US Merger Sub and Can Merger Sub would be incorporated as sister corporations and subsequently transferred to become direct, wholly-owned subsidiaries of Ltd2. Can Merger Sub would acquire all of the outstanding common shares of Tribute under the (OBCA) "Arrangement" in exchange for delivering Parent shares, and US Merger Sub would be merged with and into Pozen under a Delaware merger, with Pozen as the survivor (the "Merger"). The Merger and Arrangement (collectively, the "Transaction") are conditional on an opinion from Pozen's special tax counsel to the effect that Code s. 7874, existing regulations promulgated thereunder, and official interpretation thereof should not apply so as to cause Parent to be treated as a U.S. corporation for Code purposes - – and a U.S.$3.5M termination fee is payable to Tribute if this opinion cannot be delivered.

See detailed description under Other - Inversions.

Endo/Paladin

Overview

It is proposed that a newly-formed Irish company (New Endo) will become the publicly-traded holding company for two public companies: Endo (a US public company) and Paladin (a Canadian pubic company). This is anticipated to avoid the U.S. anti-inversion rules in Code s. 7874 by virtue inter alia of the former Paladin shareholders holding more than 20% of the shares of New Endo (i.e., approximately 22.6%, corresponding to 35.4M ordinary shares). Under the terms of the Arrangement Agreement, (a) New Endo will cause it indirect newly-formed Canadian subsidiary (CanCo 1) to acquire the common shares of Paladin (the "Paladin Shares") pursuant to a CBCA Plan of Arrangement and (b) an indirect LLC subsidiary of Endo (Merger Sub) will merge with and into Endo, with Endo as the surviving corporation in the Merger. At the Merger Effective Time, each Endo Share will be converted into the right to receive one New Endo Share. As an alternative to selling their Paladin Shares directly, resident shareholders generally have the option of transferring their Paladin Shares to a respective newly-incorporated Canadian holding company (a Qualifying Holdco) solely in consideration for common shares, with the shareholders (presumably after engaging in a safe income strip) then transferring their Qualifying Holdco shares to CanCo 1. As a result of the above transactions, both Endo and Paladin will become indirect wholly-owned subsidiaries of New Endo. The Arrangement also includes the spin-off to Paladin Shareholders of a new Canadian public company (Knight Therapeutics) that intends to become a specialty pharmaceutical company.

New Endo (a.k.a. IrishCo)

Was incorporated, apparently by Paladin, as an Irish private limited company, with Paladin holding one ordinary share (see 7 of the Plan of Arrangement summary below). New Endo will be re-registered as a public limited company in connection with the Arrangement. It will be listed on the NASDAQ and TSX. It is expected to have the same executive officers as Endo.

Endo

Endo is a U.S.-based Delaware-incorporated specialty healthcare company whose shares trade on the NASDAQ.

Paladin

Paladin is a specialty pharmaceutical CBCA corporation trading on the TSX. Jonathan Ross Goodman and the other principal Paladin Shareholders, who owned in the aggregate approximately 34% of the outstanding Paladin Shares as of the date of the Arrangement Agreement, entered into Voting Agreements with Endo.

Merger Sub

Merger Sub is a Delaware LLC which has been newly formed and is wholly owned by Endo U.S.

Endo U.S

Endo U.S. is newly-formed under the laws of Delaware and is an indirect subsidiary of New Endo.

Interco (a.k.a., Endo Limited)

An Irish private limited company.

Interco 2

A private limited company incorporated in Ireland prior to the Effective Time of the Arrangement as a direct wholly-owned subsidiary of Interco.

Knight Therapeutics (a.k.a. Therapeutics)

Knight Therapeutics was incorporated under the CBCA on November 1, 2013 as a wholly-owned subsidiary of Paladin, and will hold a Barbados international business corporation and a Delaware subsidiary. The world-wide rights to the Impavido drug will be transferred to Knight Therapeutics or a Knight Therapeutics affiliate before the Arrangement by Paladin Labs (Barbados) Inc., a Barbados IBC and indirect subsidiary of Paladin.

Arrangement Consideration

The Arrangement Cash Consideration for a Paladin Share consists of the Arrangement Cash Consideration, the Arrangement Stock Consideration and the Arrangement Therapeutics Consideration. The Arrangement Cash Consideration is $1.16 in cash, subject to adjustment. The Arrangement Stock Consideration is 1.6331 newly issued ordinary shares of New Endo. The Arrangement Therapeutics Consideration is one Knight Therapeutics Share.

Adjustment of Arrangement Cash Consideration

The Arrangement Cash Consideration to be received by Paladin Shareholders will be increased if Endo's 10-day volume weighted average price declines during the ten trading day period ending on the third trading day prior to the Paladin shareholders' meeting by more than 7% relative to a reference price of US$44.4642 per share. Full cash compensation (determined on a U.S. dollar basis converted into and paid in Canadian dollars) will be provided by Endo to Paladin Shareholders for any share price declines of more than 7% but less than 20% from the reference price. If Endo's share price declines between 20% and 24% from the reference price during the agreed reference period, Endo will provide cash compensation (determined on a U.S. dollar basis converted into and paid in Canadian dollars) for one half of the incremental decline to Paladin Shareholders. Declines in Endo's share price beyond 24% from the reference price will not give rise to further cash compensation to Paladin Shareholders. The maximum amount potentially payable to Paladin Shareholders under this price protection mechanism is US$233 million.

Plan of Arrangement

- Each Paladin stock option with a positive in-the-money value will vest and be transferred to CanCo 1 in exchange for the delivery by Amalco (as the successor of CanCo 1) of one common shares of Knight Therapeutics plus a number of New Endo Shares equal to 1.6331 multiplied by a factor determined by dividing (y) the sum of the Arrangement Cash Consideration plus the in-the-money value per Paladin Share, by (z) the closing price of a Paladin share on TSX on the trading day immediately preceding the Effective Date of the Plan of Arrangement.

- Rights under the Paladin Share purchase plan will be cancelled in exchange for a cash amount based on the Paladin Share price immediately prior to Closing.

- Each outstanding Paladin Share other than a share held by a Qualifying Holdco will be transferred to CanCo 1 in consideration for the payment by New Endo on behalf of CanCo 1 of the Arrangement Cash Consideration, the delivery by New Endo on behalf of CanCo 1 of the Arrangement Stock Consideration and the delivery by Amalco (as a successor of CanCo 1) of the Arrangement Therapeutics Consideration. (However, per s. 2.6(e) of the Arrangement Agreement, Endo in its sole discretion may amend this alternative to permit it to be effected as a tuck-under transaction.)

- All of the outstanding share of the Qualifying Holdcos will be transferred to CanCo 1 in exchange for the payment by the same consideration as in 3, as adjusted for the number of Paladin Shares held by the respective Qualifying Holdcos.

- In consideration for the above-noted consideration, CanCo 1 will issue 35M common shares to New Endo having full stated capital.

- Each such CanCo 1 share will be contributed by New Endo to Interco, and Interco will in turn contribute those shares to Interco 2.

- Paladin's one ordinary share of New Endo will be transferred to a person identified by Endo for €1.

- CanCo 1 and each Qualifying Holdco will amalgamate under the CBCA, with each share of a Qualifying Holdco being cancelled, and the share capital including stated capital of Amalco being that of CanCo 1.

- All the outstanding common shares of Knight Therapeutics will be transferred to Amalco in exchange for a promissory note equal to their fair market value.

- Amalco, as the successor to CanCo 1 will deliver the Arrangement Therapeutics Consideration as required under 3, and the comparable (Knight Therapeutics share consideration) contemplated under 1 and 4), with Knight Therapeutics contemporaneously filing an election with CRA to be a public corporation.

Creation of New Endo distributable reserves

Under Irish law, dividends may only be paid (and share repurchases and redemptions must generally be funded) out of "distributable reserves". New Endo will not have distributable reserves immediately following the completion of the Transactions. Although New Endo does not expect to pay dividends for the foreseeable future, shareholders of Endo and Paladin are being asked at their respective special meetings to approve the creation of distributable reserves of New Endo (through the reduction of some or all of the share premium account of New Endo), in order to permit New Endo to be able to pay dividends (and repurchase or redeem shares) after the Arrangement.

Canadian tax consequences (per Summary)

The exchange of Paladin Shares for the Arrangement Consideration by a Paladin Shareholder who is a resident of Canada will generally be a taxable event… . A Paladin Shareholder who is not a resident of Canada will generally not be subject to tax in Canada in respect of such exchange of Paladin Shares unless such Paladin Shares constitute "taxable Canadian property" and are not "treaty-protected property" to such Paladin Shareholder… .

U.S. tax consequences (per Summary)

Under current U.S. federal income tax law, a corporation generally will be considered to be resident for U.S. federal income tax purposes in its place of organization or incorporation. Accordingly, under the generally applicable U.S. federal income tax rules, New Endo, which is an Irish incorporated entity, would generally be classified as a non-U.S. corporation (and, therefore, not a U.S. tax resident). Section 7874 of the Code…contain[s] specific rules…that may cause a non-U.S. corporation to be treated as a U.S. corporation for U.S. federal income tax purposes. These rules are complex and there is little or no guidance as to their application. …Section 7874… is currently expected to apply in a manner such that New Endo should not be treated as a U.S. corporation for U.S. federal income tax purposes. …Endo's obligation to complete the Transactions is conditional upon its receipt of the Section 7874 Opinion [of Skadden]. [Risk factors re this result then discussed.]

U.S. risk factors

Following the acquisition of a U.S. corporation by a foreign corporation, Section 7874 of the Code may limit the ability of the acquired U.S. corporation and its U.S. affiliates to utilize certain U.S. tax attributes such as net operating losses to offset U.S. taxable income resulting from certain transactions… .

New Endo may be subject to U.S. federal withholding tax as a result of Endo U.S.'s subscription for New Endo Shares in exchange for its promissory note.

Regardless of the application of Section 7874…New Endo is expected to be treated as an Irish resident company for Irish tax purposes because New Endo is incorporated under Irish law and is intending to have its place of central management and control (as determined for Irish tax purposes) in Ireland.

Irish tax consequences

Shareholders who are not resident in Ireland and do not hod their shares in connection with an Irish trade will not be subject to Irish tax on chargeable gains. A transfer of New Endo shares by transfer of book entry interest in DTC will not be subject to Irish stamp duty. Discussion of circumstances in which dividends of New Endo would be exempt from Irish withholding tax.

Reverse takeovers

QLT/Auxilium

Overview

To effect the combination of Auxilium and QLT, AcquireCo, an indirect wholly owned subsidiary of QLT, will be merged with and into Auxilium (the "merger"). Auxilium will be the surviving corporation and, through the merger, will become an indirect wholly owned subsidiary of QLT ("New Auxilium"). Auxilium stockholders will receive a fixed ratio of 3.1359 QLT common shares for each Auxilium common share. The equity exchange ratio may be increased by up to 0.0962 QLT common shares depending on the aggregate cash consideration (if any) received by QLT or its subsidiary at or immediately after the merger effective time in respect of any sale or licence of QLT's synthetic retinoid product in development. QLT shareholders will continue to own their existing QLT common shares after the merger. Upon the closing, current QLT shareholders and former Auxilium stockholders will own approximately 24% and 76% of the combined company on a fully diluted basis, so that it is anticipated that Code s. 7874 will not deem New Auxilium to be a U.S. corporation.

QLT

A TSX and NASDAQ listed B.C. biotech corporation engaged in the development of ocular products.

Auxilium

A NASDAQ listed Delaware specialty biopharmaceutical corporation. In negotiations with QLT it projected that it would have pre-tax non-GAAP income of $109M and $182M in 2015 and 2018, respectively.

HoldCo

A wholly-owned Delaware subsidiary of QLT formed the purpose of effecting the merger.

AcquireCo

QLT Acquisition Corp., a wholly-owned Delaware subsidiary of HoldCo.

Merger

- Immediately prior to the "Merger Effective Time," QLT will subscribe for a number of shares of common stock of HoldCo that is equal to the number of Auxilium Shares issued and outstanding immediately prior to the Merger Effective Time multiplied by the "Equity Exchange Ratio" (described below), for a purchase price in cash equal to the fair market value of such shares (the "Subscription Price").

- HoldCo will subscribe for a number of common shares of QLT that is equal to the number of Auxilium Shares issued and outstanding immediately prior to the Merger Effective Time multiplied by the Equity Exchange ratio for a purchase price in cash equal to the Subscription Price.

- At the Merger Effective Time:

- AcquireCo will be merged with and into Auxilium and the separate existence of AcquireCo will cease. Auxilium will survive the merger as an indirect wholly owned subsidiary of QLT.

- Each issued and outstanding common share of AcquireCo shall be converted into one fully paid share of redeemable preferred stock of the Surviving Company, such redeemable preferred stock to have an aggregate redemption amount and fair market value equal to the fair market value of converted common shares immediately prior to the Merger Effective Time.

- Each issued and outstanding Auxilium share shall be converted into the right to receive (from HoldCo, on behalf of AcquireCo) QLT shares based in number on the Equity Exchange Ratio.

- The Surviving Company, as successor to AcquireCo, shall issue such number of shares of common stock to HoldCo equal to the number of Auxilium shares issued and outstanding immediately prior to the Merger Effective Time multiplied by the Equity Exchange Ratio in consideration for HoldCo delivering (on behalf of AcquireCo) common shares of QLT to the former Auxilium Stockholders.

- The terms of the Auxilium stock option plan will be adjusted and QLT will assume such options.

The "Equity Exchange Ratio" reflects the right to receive, for each outstanding share of Auxilium common stock, 3.1359 QLT common shares (the "equity exchange ratio"), provided that in the event that, at or immediately after the merger effective time, QLT or its subsidiary receives aggregate cash consideration pursuant to the sale, license, sublicense or similar transaction related to its proprietary synthetic retinoid product in development known as "QLT091001", which is less than $25 million but equal to or greater than $20 million then, the equity exchange ratio shall be increased by 0.0192; and so on for further specified $5M increments as follows:

- $20 million to $15 million: 0.0385;

- $15 million to $10 million: 0.0577;

- $10 million to $5 million: 0.0770;

- or less than $5 million, or in the event that no such transaction is consummated at or immediately after the merger effective time, then the equity exchange ratio shall be increased by 0.0962.

The certificate of incorporation of AcquireCo immediately prior to the Merger Effective Time, shall be the certificate of incorporation of the surviving company. The Board of Directors of New Auxilium will consist of seven individuals designated by Auxilium and two individuals designated by QLT who are acceptable to Auxilium. Closing of the merger will occur on the earlier of December 31, 2014 and three business days after satisfaction of the stipulated conditions including approval by both companies' shareholders, regulatory approvals and lender consents. Auxilium will use commercially reasonable efforts to ensure that the Auxilium meeting will occur no more than two business days after the QLT meeting.

S. 7874 merger conditions

Auxilium's obligation to complete the merger is subject to there being no change in applicable law (whether or not yet effective) respecting Code s. 7874 of the Code or any official interpretations (other than IRS News Releases) thereof (whether or not yet effective), and there being no bills to implement such a change which have been passed by both houses of Congress and for which the time period for the President signing or vetoing such bills has not yet elapsed, in each case prior to October 31, 2014, that, once effective, in the opinion of nationally recognized U.S. tax counsel, would cause New Auxilium to be treated as a U.S. domestic corporation. Any such event after October 31, 2014 would not relieve Auxilium of its obligation to complete the merger. In addition, Auxilium's obligation to complete the merger is subject to receiving a Skadden, Arps opinion dated as of the closing date of the merger that s. 7874 should not apply so as to cause QLT to be treated as a domestic corporation from and after the closing date. Skadden's s. 7874 opinion will be based only on the tax laws in effect on or before October 31, 2014. Accordingly, in the event of such change of tax law after October 31, 2014 but before the closing date of the merger (other than as a result of bills that have been passed by both houses on or prior to October 31, 2014), Auxilium would be required to complete the merger even though New Auxilium would be treated as a U.S. domestic corporation for U.S. federal income tax purposes.

Canadian tax consequences

As of December 31, 2013 QLT had approximately $284.6 million of capital loss carryforwards and $102.9 million of non-capital loss carryforwards. QLT will be subject to a "loss restriction event" as a result of the acquisition of QLT common shares by Auxilium stockholders under the merger agreement.

U.S. tax consequences

Tax residence of New Auxilium (s. 7874). New Auxilium, including its expanded affiliated group, is not expected to have substantial business activities in Canada. However, after the merger, Auxilium stockholders are expected to be treated as holding less than 80% (by both vote and value) of the New Auxilium common shares by reason of their ownership of Auxilium common stock. The disclosure assumes that New Auxilium will not be treated as a U.S. corporation.

Offsetting of inversion gains

The Auxilium stockholders are expected to receive at least 60% (but less than 80%) of the vote and value of the New Auxilium common shares by reason of holding Auxilium common shares. Furthermore, Auxilium currently expects that the substantial business activities test will not be satisfied. As a result, Auxilium and its U.S. affiliates could be limited in their ability to utilize their U.S. tax attributes to offset any inversion gain (including gain from the transfer of shares or certain other property and income from licensing property which is transferred or licensed as part of the acquisition or to a foreign related person). However, neither Auxilium nor its U.S. affiliates expect to recognize any inversion gain as part of the proposed transaction, nor do they currently intend to engage in any transaction in the near future that would generate inversion gain. In addition, Auxilium expects that it will undergo an "ownership change" under s. 382 (see below). Nevertheless, Auxilium expects that it will be able to fully utilize its U.S. net operating losses prior to their expiration, to offset U.S. taxable income generated after the proposed transaction through ordinary business operations.

Shareholder gain recognition

Although the merger will qualify as a "reorganization" under s. 368(a), as New Auxilium should be respected as a foreign corporation the s. 367(a) rules will require U.S. holders exchanging shares of Auxilium common stock for New Auxilium common shares to recognize gain. Accordingly, a U.S. stockholder of Auxilium should recognize gain equal to any excess of the fair market value of the QLT common shares received on the merger over its adjusted tax basis in the shares of Auxilium common stock.

PFIC status

QLT believes that it may have been treated as a PFIC for U.S. federal income tax purposes for its taxable years ending December 31, 2008 through 2013. Nonetheless, New Auxilium is not currently expected to be treated as a PFIC for U.S. federal income tax purposes for the taxable year that includes the merger or for foreseeable future taxable years.

S. 382 (per Risk Factors)

As of December 31, 2013, Auxilium had approximately $135.9 million of net operating loss carryforwards. The merger is expected to result in an ownership change under Code s. 382 of the Code for Auxilium, potentially limiting the use of Auxilium's net operating loss carryforwards in future taxable years.

Intergeo/Mercator

Overview

Intergeo (a British Virgin Islands subsidiary of a BVI holding company, Daselina, of a Russian billionaire) which unsuccessfully attempted to go public two years ago, is effecting a reverse (share-for-share exchange) takeover of TSX-listed Mercator pursuant to a BCBCA Plan of Arrangement, with Daselina subscribing U.S.$100M for Mercator shares, so that Daselina will own approximately 85% of the post-reorganization Mercator (a.k.a., the Resulting Issuer) and the Resulting Issuer will own 100% of Intergeo. One Special Share will be issued to each of Daselina and another BVI company with a minor common share holding in the Resulting Issuer (Kirkland), which will provide that they have the right to nominate only three of the nine board members (but with the other six being nominated by the board itself) – but also give them veto rights on major decisions. In order to maintain the public float, Daselina presumably does not wish to buy out the existing shareholders. However, to placate them, they are to receive (under a s. 86 reorganization) the right to put their Common Shares to the Resulting Issuer for $5.00 per share (the equivalent of $0.10 per share before giving effect to a proposed 50-for-1 share consolidation) during an exercise window of 18 to 30 months following the Effective Date of the Plan of Arrangement, with $31.7M being placed into an escrow account to secure this contingent obligation.

Overview of FAD rule application

Although the Special Shares might have the effect of causing Daselina not to be the parent of the Resulting Issuer for foreign affiliate dumping purposes, the Special Shares will not be created and issued until after the reverse takeover (which, in turn, will occur after Intergeo already has acquired control of Mercator under the U.S.$100M private placement), so that the FAD rules will apply to such investment by Mercator in Intergeo. This should be acceptable as Mercator currently has approximately $393M of paid-up capital - so that with PUC-averaging, Daselina's shares will have full PUC. The FAD rules might not apply to the investment by Mercator (as the last step in the Plan of Arrangement) of the private placement proceeds in its Delaware subsidiary, as the board nomination restrictions will then be in effect.

Resulting ownership

Upon completion of the Arrangement, Daselina, Kirkland and the Mercator will own 84.38%, 0.45% and 15.17% of the outstanding Resulting Issuer Common Shares. "Mr. Prokhorov, through Daselina, will be the Resulting Issuer's ultimate principal shareholder. Daselina will have the voting power to control the outcome of most matters to be decided at future meetings of the Resulting Issuer's shareholders."

Mercator

Mercator is a B.C. company listed on the TSX whose principal assets are its 100% owned Mineral Park mine in Arizona (held through a "grandchild" Delaware subsidiary) and its 100% owned El Pilar project in Mexico (held through a Mexican subsidiary which is owned 99.8% by an immediate Canadian subsidiary of Mercator and 0.2% by a grandchild Canadian subsidiary of Mercator). It has 315.7M Common Shares outstanding (equivalent to 6.31M post-consolidation), with a paid-up capital of $393M.

Intergeo

A private BVI corporation owned by Mr. Mikhail Prokhorov (a Russian billionaire). It owns 100% of a Cyprus holding company, which in turn owns 99.5% of a Russian holding company for Russian copper development project subsidiaries (with the other 0.5% owned by Mr. Prokhorov). It filed a preliminary long form base PREP prospectus in Canada on May 15, 2012 in connection with a proposed IPO, but withdrew the prospectus on April 12, 2013 due to market conditions. 114M Intergeo shares are outstanding.

Kirkland

A private BVI corporation whose relationship with Daselina and Mr. Prokhorov is not disclosed.

Plan of Arrangement

- The Mercator Shareholder Rights Plan will be terminated.