Cross-Border REITs

TitanStar

Overview

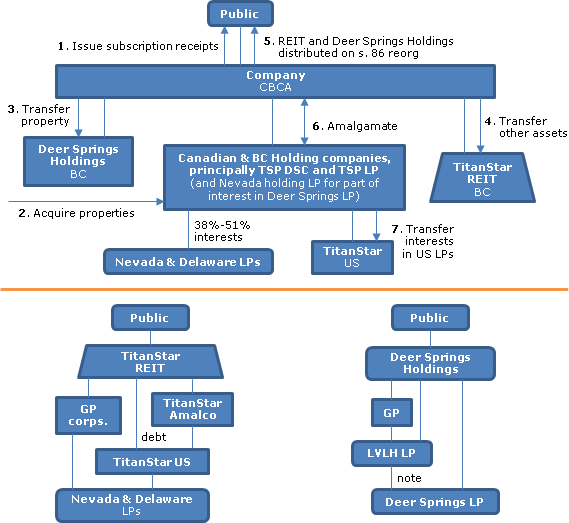

Under a CBCA Plan of Arrangement, the Company will transfer its assets other than its interest in a non-rental Nevada property (the Deer Springs property held through Deer Springs LP, a Nevada LP) to a newly-formed unit trust (TitanStar REIT), and then will transfer its interests in Deer Springs LP to a new B.C. holding company (Deer Springs Holdings). Its units of TitanStar REIT and its shares of Deer Springs Holdings will then be distributed to its shareholders under a s. 86 reorg. Deer Springs Holdings will not be listed and will have the same board and management as TitanStar REIT. "TitanStar REIT units are expected to provide an enhanced ability for TitanStar REIT to access the Candian equity capital markets, given that most publicly traded real estate entities in Canada are REIT structures or high yielding corporate structures."

The Company

Is listed on the TSXV and holds interests in U.S. retail shopping centres and the Deer Springs property through Nevada or Delaware LPs (with interests therein ranging from approximately 38% to 51%) held by it directly (in the case of that portion of an interest in Deer Springs LP which is held through a holding Nevada LP) or through Canadian or BC holding companies (principally, TSP DSC and TSP LP Holdings).

Preliminary Steps (1 to 3), Plan of Arrangement (steps 4 to 9) and post-Arrangement Steps (steps 10 to 12)

- TitanStar REIT was settled with the Company as its beneficiary as a B.C. unit trust.

- the Company has entered into purchase agreements for further U.S. asset acquisitions to be funded out of the equity raised in 3 below and with debt financing from Barclays Bank plc.

- an offering of subscription receipts pursuant to a short form prospectus (to raise between $20M and $45M) will be completed pursuant to which Preferred Shares of the Company will be issued on the basis of one preferred Share for each subscription receipt.

- the Company will transfer to Deer Springs Holdings its beneficial interest in the Deer Springs Property (comprised of its interests in Deer Springs LP and in a Nevada holding LP) in exchange for, among other things, Deer Springs Holdings Shares and Deer Springs Holdings Options;

- the Company Common Shares held by dissenting shareholders will be repurchased by the Company and cancelled;

- the Company will transfer all of its assets and liabilities to TitanStar REIT, excepting its shares in Deer Springs Holdings. In consideration, TitanStar REIT will agree to assume all of the Company's liabilities including its Debentures, and will issue TitanStar REIT Units to the Company.

- each outstanding TitanStar Option will be exchanged for a TitanStar REIT Option to acquire a TitanStar REIT Unit and a Deer Springs Holdings Option to acquire a Deer Springs Holdings Share;

- all of the Outstanding Shares of the Company (both Preferred Shares and common shares) will be purchased by the Company from the Company Outstanding Shareholders for cancellation, in exchange for the transfer by the Company per each Outstanding Share of: (a) one TitanStar REIT Unit; and (b) one Deer Springs Holdings Share per outstanding common share. Simultaneously with the cancellation of the Outstanding Shares, TitanStar REIT will subscribe for one common share for nominal consideration;

- the TitanStar REIT Units will be consolidated on a basis of one "new" TitanStar REIT Unit for the lesser of that number of "old" TitanStar REIT Units that is: (a) allowable under TSXV policies; and (b) $4 divided by the market price of the Common Shares as determined in accordance with Section 1.11(1) of Multilateral Instrument 62-104 TakeOver Bids and Issuer Bids), and the exercise price of each TitanStar REIT Option will be adjusted accordingly.

- The Company, TSP DSC and TSP LP Holdings will amalgamate to form TitanStar Amalco;

- TitanStar REIT will transfer its interest in three Nevada LPs (TSPLP I, TSP LP II and Blue Springs LP) to TitanStar Amalco; and

- TitanStar Amalco will transfer its interest in those LPs to TitanStar US.

Resulting structure

TitanStar REIT will have equity and debt interests in TitanStar Amalco, debt interests in TitanStar US and hold two GP corporations. Non-resident ownership of TitanStar REIT will be limited to 49%. The TitanStar REIT units will be redeemable for the lesser of their closing market price and 95% of the 10-day average immediately following the redemption date.

Securities considerations

The TitanStar REIT units and Deer Springs Holdings shares will be received in reliance on the s. 3(a)(10) rule. Shareholder approval is required by a 2/3 majority.

Canadian tax consequences

Asset transfers. The various transfers to TitanStar REIT and Deer Springs Holdings will result in capital gain. However, this is anticipated to be offset by available capital losses. Subsequent transfers of the various limited partnership interests by TitanStar REIT to TitanStar Amalco and from TitanStar Amalco to TitanStar US will not result in a capital gain.

SIFT rules

Following the Arrangement, TitanStar REIT's property will be its shares of TitanStar Amalco, TitanStar GP and Blue Springs GP, which will be portfolio investment entities.

FAPI

TitanStar US is a "foreign affiliate" and a CFA of TitanStar Amalco. It is expected that income earned by TitanStar US will be foreign accrual property income.

S. 86 exchange

The fair market value of the distributed Deer Spring Holdings shares is not expected to exceed the paid-up capital of the Company common shares, so that no deemed dividend should arise on the exchange of the Company common shares for TitanStar REIT units and Deer Spring Holdings shares. S. 86 will apply to such exchange so that a holder of the Company common shares will be considered to have disposed of its shares for the greater of their adjusted cost base and the fair market value of the Deer Spring Holdings shares and TitanStar REIT units received on the exchange.

Dissenters

Disposition will give rise to a deemed dividend to the extent that the amount received (excluding any interest award) exceeds the paid-up capital of the common shares.

Deer Springs Holdings

Deer Springs Holdings is expected to comply on a continuous basis with the ownership and dispersal of share requirements described in Reg. 4800, and to elect to be a "public corporation" in its first return.

WPT

Overview

Through an indirectly owned Delaware LP (the "Partnership"), the REIT (an Ontario unit trust) will acquire a portfolio of 37 warehouse and distribution industrial rental properties in the U.S., appraised at between $460.8M and $468.9 million. The properties will be acquired from a Minnesota-headquartered LLC ("Welsh"), which will hold exchangeable units in the Partnership (i.e, an "UPREIT" structure), and will be the asset and property manager. Although the REIT will be a U.S. corporation under the U.S. anti-inversion rule, this will be addressed by it being a U.S. REIT under the Code. For Canadian purposes, it will avoid the SIFT rules by not holding non-portfolio property.

Structure

A direct Delaware LLC subsidiary of the REIT ("US Holdco") will hold all the Class A units of the Partnership, which will be general partner units.

Following closing, Welsh will hold an approximate 52.1% effective interest in the REIT units (48.6% after over-allotment) by virtue of holding all of the Class B exchangeable units of the Partnership (being 10.9M units).

Unitholders/Redemptions

In order to assist in qualifying as a U.S. REIT, the declaration of trust will prohibit any person from actually or constructively owing more than 9.8% of the REIT units, subject to any exemptions granted by the board. There will be a unitholder rights plan. Unit redemptions in excess of $50,000 per month (with the redemption price calculated at the lesser of closing market price and 90% of VWAP) are satisfied with notes of the REIT.

Management

Almanac Realty Investors, LLC, formerly Rothschild Realty Manager, LLC holds a $183M note of Welsh, which is convertible into 81% of the Welsh equity. The CEO of the REIT is the CEO of Welsh.

Debt

Debt level targeted at below 55% of consolidated gross book value ($236.2M at closing) (p. 80).

Distributions

Monthly, of $0.0583 representing 90% of AFFO. The tax-deferred percentage for 2013 was estimated in the prelim. to be 75%. It is estimated for 2013 that 69% of the monthly distributions will be paid out of the REIT's current or accumulated earnings and profits and, accordingly, will be subject to US withholding tax. Distributions will be paid in US dollars, with FX hedging of the REIT's US-dollar revenues.

Implementation of Structure

The following transactions will occur upon closing of the offering:

- the REIT will use the net proceeds of the offering to subscribe for preferred and common shares of US Holdco, which will subscribe for Class A units of the Partnership

- Welsh will transfer its equity of the property LLCs or LPs to the Partnership in consideration for cash of $68.4 million and 10.9M Class B units

Canadian tax consequences

SIFT tax. Management does not anticipate that the REIT will hold any non-portfolio property or carry on a Canadian business, so that it should not be considered to be a SIFT trust.

FAPI

. A portion of the income earned by US Holdco (and CFAs of the Partnership, or certain subsidiary partnerships thereof) will be foreign accrual property income, and included in the income of the REIT.

FTCs

The tax disclosure is not directed to investors who hold more than 5% of the REIT units for Code purposes. The U.S. withholding tax deducted in respect of a distribution paid on a Unit in a taxation year will generally be characterized as "non-business income tax," and may be deducted as a foreign tax credit where the holder has sufficient non-business income from U.S. sources. Alternatively, such non-business income tax (including any amount not deductible as a foreign tax credit) generally may be deducted by the Holder in computing the Holder's income. A Holder's ability to apply U.S. withholding taxes in the foregoing manner may be affected where the Holder does not have sufficient taxes otherwise payable under Part I of the Tax Act, or sufficient U.S. source income in the taxation year the U.S. withholding taxes are paid, or where the Holder has other U.S. sources of income or losses, or has paid other U.S. taxes. Per 2014 AIF:

The proceeds receivable on a disposition of a Unit may not qualify as U.S. source income for purposes of the Tax Act (including for Canadian foreign tax credit purposes), and beneficiaries of certain Unitholders that are trusts may not be considered to have paid such tax for purposes of the Tax Act and, accordingly, may not be entitled to a foreign tax credit in respect of such U.S. tax for Canadian tax purposes.

U.S. tax consequences

REIT status. The REIT is treated as a U.S. corporation for all Code purposes under Code s. 7874 and, accordingly, is permitted to elect to be treated as a real estate investment trust. The REIT will elect real estate investment trust status beginning with its taxable year ending December 31, 2013. Management intends to make timely distributions sufficient to satisfy the annual distribution requirements.

Ordinary distributions to non-US holders

Distributions that are neither attributable to gains from the sales or exchanges by the REIT of U.S. real property interests ("USRPIs"), nor designated as capital gains dividends, will be treated as dividends of ordinary income to the extent they are made out of the REIT's current or accumulated earnings and profits, so that qualifying non-US holders generally are entitled to a 15% withholding rate on such distributions under the Treaty. Such qualifying non-US holders are holders holding no more than 5% of the outstanding units if the units are publicly traded, individuals holding no more than 10% of the outstanding units, and those holding no more than 10% of the outstanding units and the REIT is diversified (based on no single property exceeding 10% of the gross value of the real property). RRSPs, RRIFs and DPSPs may be eligible for exemption. Distributions received by a TFSA, RESP or RDSP will be treated for the above purposes as received by the beneficiary or annuitant.

Distributions in excess of the REIT's current and accumulated earnings and profits will reduce the adjusted tax basis of the non-resident holder's units. Because management expects that the REIT units will be considered to be regularly traded on an established securities market, it does not expect to be required to withhold on such excess distributions made to non-US holders owning 5% or fewer of the outstanding units during the applicable testing period.

FIRPTA re distributions

A distributions of proceeds attributable to the sale or exchange by the REIT of USRPIs will not be subject to FIRPTA tax or branch profits tax and instead will be treated as an ordinary distribution if (as anticipated -see below) the REIT units qualify as regularly traded on an established securities market located in the U.S. and the recipient unitholder does not own more than 5% of the units at any time during the preceding one year. A non-US unitholder who fails to give notice of becoming the owner or constructive owner of more than 5% of the units, will have the excess (over 5%) units sold, with the lesser of the original purchase price for the excess units and the net sales proceeds being remitted to it.

FIRPTA re unit dispositions

Although the REIT is expected to be a U.S. real property holding corporation ("USRPHC"), the REIT units will not be treated as an interest in a USRPHC to a disposing unitholder who does not own or constructively own more than 5% of the units at any time in the five years preceding the disposition (or such shorter period as the units were held), if the units qualify as "regularly traded on an established securities market." As the REIT has received indications that at least two brokers or dealers are willing to regularly quote and make a market in the REIT units on the pink sheets and/or the OTCQX, the units should qualify as "regularly traded" on an established securities maket in the U.S. A more rigorous test would apply if reliance were placed on the TSX as the relevant securities market for these purposes.

Inovalis

Overview

The REIT, which is an Ontario unit trust, is offering 10.5M units for $105M. It will acquire four leasehold interests in French and German office properties, which are currently managed by a privately owned investment management company with a Parisian head office ("Inovalis"). The aggregate acquisition cost of these leaseholds plus aggregate option exercise prices to acquire the related properties will be less than the properties' appraised value of €165 million (including €144 million for the French properties).

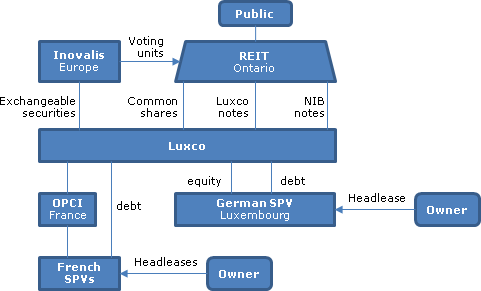

Structure

A Luxembourg subsidiary s.à r.l. of the REIT ("Luxco") will hold equity, and interest-bearing debt, of a wholly-owned German SPV of Luxco (also a s.à r.l.), which will hold the Hanover, Germany property. Luxco will hold interest-bearing notes of French SPVs holding the three Parisian properties and will hold the equity of the French SPVs through a French holding company ("OPCI"). Luxco will be capitalized with $5 million of non-interest bearing notes ("NIB Notes"), $5 million of 15-year notes bearing interest at 7.8% ("Luxco Notes") and common shares. Inovalis will hold exchangeable securities of Luxco (comprising NIB Notes, Luxco Notes and common shares) representing the equivalent of an approximate 10% ownership interest in the REIT, and will hold the equivalent number of special voting units of the REIT.

Redemption notes

The maturity date and interest rate on redemption notes issued by the REIT on any large unit redemptions will have a maturity date and interest rate to be determined by the Trustees at the time of issuance – or, alternatively, securities of REIT subsidiaries may be delivered in the Trustees' discretion.

Distributions

91% of distributions for 2013 (at an estimated monthly rate, following the initial distribution for most of the balance of 2013 of $0.6875 per unit) are estimated to be tax-deferred. Such distributions are estimated to approximate 93% of AFFO. Under an FX hedging arrangement, an arm's length counterparty will agree to exchange euros for Canadian dollars on a monthly basis at an agreed exchange rate. The DRIP will use 3% bonus distributions.

Management

The annual asset management fee of Inovalis, and 50% of its acquisition fees, will be paid entirely in exchangeable securities of Luxco. Upon the earlier of the REIT achieving a market capitalization of $750 million and the 5th anniversary, management will be internalized.

Canadian tax consequences

SIFT tax. The REIT will not be subject to SIFT tax on the basis of not holding any non-portfolio property. As it will not hold any taxable Canadian property, it is not subject to non-resident ownership restrictions.

FAPI

It is expected that the income of the REIT's subsidiaries will be foreign accrual property income. However, it is expected that the REIT's distributions will be sufficient for it not to be subject to Part I tax.

French tax consequences

Provided OPCI and the French SPVs comply with their distribution obligations (to inter alia distribute 85% of their distributable income), they are exempt from French corporate income tax. A French withholding tax of 5% will be levied on dividends paid by OPCI to Luxco (p. 61). There will be no withholding tax on the interest paid by the French SPVs to Luxco. As financial lease agreements are not considered to be real estate assets and no elections have been made to purchase real estate assets, the 3% tax assessed on directly or indirectly held real estate will not be applicable.

German tax consequences

Corporate income tax. The German SPV is a Luxembourg s.à r.l. that is managed in Luxembourg and, therefore, should not be resident in Germany for German tax purposes. However, it nonetheless will be subject to German corporate income tax rate at a rate of 15.825%. The German SPV is acquiring real estate under a head lease by prepaying the rent under the head lease, and earning rents from the sublessees. The rental payments received by it from the sublessees will be included in computing its income for German corporate income tax purposes; however, it will be able to take deductions based on amortization of the headlease prepayment. Deductions of interest should not be limited under the German interest barrier provided that the net interest expense of the German SPV is below €3 million p.a., and the financing arrangements comply with the arm's length principle.

Wthholding/trade tax

Dividends paid by the German SPV to Luxco should be exempt under the participation exemption. The German SPV should not be subject to municipal trade tax given that the mere subleasing of the property would not create a German permanent establishment.

RETT

The assumption of the headlease and the subleases, and the acquisition of the property option should not trigger German real estate transfer tax. However, RETT will be triggered (currently at a 4.5% rate) when the option is exercised.

Milestone Apartments

Overview

Offering of 20 million REIT units ($200 million). Through an indirectly owned Delaware LP (the "Partnership"), the REIT will acquire a portfolio of 52 multi-family residential rental properties in the U.S, appraised at $1.2B. Prior to the offering, ownership and profit interests in the Partnership were held by a partnership ("Milesouth"), which was affiliated with Invesco Ltd., and by an affiliated LLC ("MST Investors"). Milesouth and MST Investors will hold exchangeable Class B units of the Partnership.

Structure

A direct Delaware LLC subsidiary of the REIT ("US Holdco") will hold all the Class A units of the Partnership, and control the general partner of the Partnership. The Partnership will hold the 52 properties through subsidiary partnerships.

Following closing, Milesouth/ MST Investors will hold 14M REIT units and 8.923M Partnership units (being Class B exchangeable units).

Unitholders

In order to assist in qualifying as a U.S. REIT, the declaration of trust will prohibit any person from actually or constructively owning more than 9.8% of the REIT units, subject to any exemptions granted by the board. There also is an expropriation provision re over 5% blocks discussed re FIRPTA below. There will be a unitholder rights plan.

Management

The CEO is Managing Partner of Milestone. A member of the Milestone group is the asset manager. After 10 years at the latest, asset management will be internalized without termination fees unless the independent trustees determine otherwise. The property manager is an LLC owned by the Partnership.

Debt

Debt level targeted at below 55% of consolidated gross book value ($646M at closing).

Distributions

Monthly, at a rate (after the first montly distribution) of $0.05417 per unit, representing 90% of AFFO. As distributions will be paid in Canadian dollars, the REIT will hedge its first two years of dollar distributions from U.S. Holdco.

Implementation of Structure

The following transactions will occur upon closing of the offering:

- the REIT will acquire units of the Partnership in exchange for 14M units of the REIT

- the REIT will contribute the net proceeds of the offering and its Partnership units to US Holdco in subscription for preferred and common shares

- US Holdco will use the proceeds received from the REIT to purchase Partnership units from Milesouth for $180.6M, and acquire for nominal consideration the membership interest in the general partner of the partnership which is a general partner of the Partnership

- at the same time, the LPA for the Partnership will be amended so that the partnership interests of US Holdco and Milesouth/MST Investors will be Class A, and Class B exchangeable, units respectively

Canadian tax consequences

SIFT tax. Management does not anticipate that the REIT will hold any non-portfolio property, so that it should not be considered to be a SIFT trust.

FAPI

A portion of the income earned by US Holdco (and CFAs of the Partnership, or certain subsidiary partnerships thereof) will be foreign accrual property income, and included in the income of the REIT.

FTCs

The tax disclosure is not directed to investors who hold more than 5% of the REIT units for Code purposes. The U.S. withholding tax deducted in respect of a distribution paid on a REIT unit in a taxation year will generally be characterized as "non-business income tax," and may be deducted as a foreign tax credit where the resident holder has sufficient non-business income from U.S. sources. Alternatively, such non-business income tax (including any amount not deductible as a foreign tax credit) generally may be deducted by the holder in computing the holder's income. A resident holder's ability to apply U.S. withholding taxes in the foregoing manner may be affected where the holder does not have sufficient taxes otherwise payable under Part I of the Tax Act, or sufficient U.S. source income in the taxation year the U.S. withholding taxes are paid, or where the holder has other U.S. sources of income or losses, or has paid other U.S. taxes.

U.S. tax consequences

REIT/U.S. corporation status. The REIT is treated as a U.S. corporation for all Code purposes under Code s. 7874 and, accordingly, is permitted to elect to be treated as a real estate investment trust. The REIT will elect real estate investment trust status beginning with its taxable year ending December 31, 2013. Management intends to make timely distributions sufficient to satisfy the annual distribution requirements.

Ordinary distributions to non-US holders

Distributions that are neither attributable to gains from the sale or exchange by the REIT of U.S. real property interests ("USRPIs"), nor designated as capital gains dividends, will be treated as dividends of ordinary income to the extent they are made out of the REIT's current or accumulated earnings and profits, so that qualified residents of Canada generally are entitled to a 15% withholding rate on such distributions under the Treaty. RRSPs, RRIFs and DPSPs may be eligible for exemption. Distributions received by a TFSA, RESP or RDSP will be treated for the above purposes as received by the beneficiary or annuitant.

Management anticipates that there will be distributions in excess of the REIT's current and accumulated earnings and profits. These will reduce the adjusted tax basis of the non-resident holder's units. Because management expects that the REIT units will be considered to be regularly traded on an established securities market (see below), it does not expect to be required to withhold on such excess distributions made to non-US holders owning 5% or fewer of the outstanding units during the applicable testing period.

FIRPTA re distributions

A distributions of proceeds attributable to the sale or exchange by the REIT of USRPIs will not be subject to FIRPTA tax or branch profits tax and instead will be treated as an ordinary distribution if (as anticipated -see below) the REIT units qualify as regularly traded on an established securities market located in the U.S. and the recipient unitholder does not own more than 5% of the units at any time during the preceding one year. A non-US unitholder who fails to give notice of becoming the owner or constructive owner of more than 5% of the units, will have the excess (over 5%) units sold, with the lesser of the original purchase price for the excess units and the net sales proceeds being remitted to it.

FIRPTA re unit dispositions

Although the REIT is expected to be a U.S. real property holding corporation ("USRPHC"), the REIT units will not be treated as an interest in a USRPHC to a disposing unitholder who does not own or constructively own more than 5% of the units at any time in the five years preceding the disposition (or such shorter period as the units were held), if the units qualify as "regularly traded on an established securities market" - and the purchaser would not be requried to withhold, if the units are considered "regularly traded on an established securities market" regardless whether the selling unitholder held more than 5% of the outstanding units during the applicable testing period. As the REIT has received indications that at least two brokers or dealers are willing to regularly quote and make a market in the REIT units on the pink sheets and/or the OTCQX, the units should qualify as "regularly traded" on an established securities market in the U.S. A more rigorous test would apply if reliance were placed on the TSX as the relevant securities market for these purposes.

Agellan

Overview of structure

The REIT will invest directly or indirectly in a mix of Canadian and US industrial and commercial (plus one retail) rental properties, having a gross purchase price of $421.1M. Its Ontario and Quebec properties (representing 41% and 2% respectively of NOI) will be held by it directly. Its US properties will be held in a Delaware subsidiary LP of a US corporate subsidiary (Agellan US) which, in turn, will be held by a Canadian corporate subsidiary of the REIT (Agellan Canada). Agellan Capital Partners Inc. ("AGPI") will be the asset manager (and was previously the asset manager for 22 of the 23 properties).

Offering

13.4M REIT units for gross proceeds of $134.6M.

Structuring

On the day of closing of the offering or the day after:

- The REIT will acquire interests in the Canadian properties in consideration for the issuance of 9.226M REIT units ("Units") to and for the assumption of mortgages

- The REIT will acquire additional interests in the Canadian properties with $3.571M of the proceeds of the offering and also in consideration for the issuance of 0.148M additional Units and the assumption of mortgage debt; $68.55M of the issue proceeds also will be used to redeem the 9.226M Units referred to above

- The REIT will lend U.S.$30M and U.S.$33.5M on an interest-bearing basis to Agellan Canada and Agellan US, respectively

- The REIT will use the remaining net proceeds of the offering, and the proceeds of Units issued to the US LP to subscribe for common shares of Agellan Canada

- Agellan Canada will apply such proceeds to subscribe for common shares of Agellan US

- Agellan US, in turn, will subscribe for Class A units of the US LP

- The US LP will use such proceeds to subscribe for 2.642M Units

- The US LP will use such Units and U.S.$63.81M of the balance of the proceeds to acquire the US properties (and also will assume mortgage on such acquisition)

The partnership agreement for the US LP contemplates that in future US asset acquisitions it may issue Class B units which are economically identical to (REIT) Units and are exchangeable into Units.

Vendor interests/ Special Rights

The Vendors in respect of the Units they retain are referred to as the "CarVal Retained Interest Holders" (respecting 18.9% of the REIT units if the over-allotment option is exercised) and the "ACPI Retained Interest Holders" (0.4%). They will be contractually obliged to retain such Units for 18 months and to pledge them to secure certain of their obligations as vendors. The CarVal Retained Interest Holders are entities managed by CarVal Investors, LLC. They have a "Piggyback Registration Right" (respecting future REIT offerings) and a "Demand Registration Right" 9re qualifying their Units for distributions).

There is a Unitholders' Rights Plan.

Distributions

Monthly of $0.06458 representing approximating 90% of AFFO. A DRIP with 3% bonus distributions.

Canadian tax consequences

REIT. The REIT is anticipated to qualify as a REIT under both the current and proposed REIT-qualification rules.

Agellan Canada

Agellan Canada will deduct the interest on the note owing by it to the REIT. It is expected that income earned by Agellan US including income allocated to it by the US LP will be foreign accrual property income (fapi). Dividends paid by Agellan US to Agellan Canada out of its fapi generally will not result in further income inclusions. The adjusted cost base of the shares of Agellan US will be reduced to the extent they are paid out of pre-acquisition surplus.

Non-investor US tax consequences

Anti-inversion rules. The REIT will be a foreign corporation. The anti-inversion rules in Code s. 7874 are not expected to apply as the REIT will have substantial business activities in Canada and because the number of Units issued in connection with the US property acquisitions is not expected to exceed 60% of the total Units issued in connection with all the property acquisitions.

Internal leverage

The REIT should be eligible for Treaty benefits as long as its Units are primarily and regularly traded on a Canadian stock exchange (the TSX). The interest-bearing note owing by Agellan US to the REIT will be treated as debt and the interest thereon on that basis will be exempt from withholding.

Agellan US's debt-to-equity ratio is expected to exceed 1.5 to 1 and it is expected that s. 163(j) initially will apply to limit its interest deductions.

Northwest Healthcare

Offering

Of units of the REIT, which is TSXV-listed, at $2.00 per unit for gross proceeds of $25M ($28.75M if over-allotment).

Current structure

Asset manager interest. As a result of the preliminary transactions described below for conversion to an international REIT (see 5 October 2012 Circular of the REIT then named GT Canada Medical Properties REIT), NorthWest Value Partner Inc. ("NWVP'), which is the asset manager of the REIT, is the largest unitholder of Northwest Healthcare Properties REIT ("NWHP REIT") and is owned by Paul Lana, the CEO of the REIT , holds 26.5M, or 88%, of the units of the REIT and 55.9M exchangeable Class B units of the REIT's subsidiary LP ("NWI LP"), so that after giving effect to the exchange of the Class B units, NFWVP holds 96% of the REIT units.

SLA on New Zealand REIT

The REIT holds an indirect 20% interest in the Vital Trust, an NSX-listed trust invested in health-care properties in Australia and New Zealand. NWI LP has transferred such units to a Canadian financial institution under a securities lending agreement under which the counterparty pays amounts equal to the returns on the lent units and also exercises voting rights in accordance with the instructions of NWI LP.

Brazil. Through an LLC and two-tiers of Brazilian subsidiaries of NWI LP (with an individual holding one share in each), it holds a Brazilian children's hospital which it acquired under a sale lease-back arrangement, with a portion of the rents receivable having been securitized.

Germany

A German limited partnership (KG) holding a Berlin medical office building portfolio is held through a tiered structure of two Gibralter corporations on top of a S.à r.l. on top of a GmbH, with a management company of Paul Lana holding a 10% interest in the top Gibralter company.

Preliminary transactions for conversion to international REIT

On December 24, 2010 a former capital pool company was converted into the REIT, which by May 2012, held 12 Canadian medical office buildings. NWVP acquired 82% of the REIT units pursuant to a take-over bid circular on June 11, 2012, at $1.87 per unit. In November 2012, all of the REIT's buildings were sold to a subsidiary LP of NWHL REIT for cash of $9.2M and a $30M promissory note. On November 16, 2012, the REIT acquired the international portfolio described above from NWVP and announced an increase to its annual distributions from $0.064 per unit to $0.16 per unit (95% of AFFO).

Put/Call Agreement

On November 16, 2012, the REIT and NorthWest Operating Trust ("NW Trust" - a trust of which Paul Lana is the sole trustee and a beneficiary) entered into a put/call agreement under which the REIT could acquire up to approimately 28% of the outstanding units of NWHP REIT pursuant to a put right of NW Trust or a call right of the REIT.

FX hedging

Management intends to implement FX hedging of the REIT's Canadian dollar distributions on a one-year rolling basis.

Canadian tax consequences

The REIT expects to qualify as a REIT provided the October 24, 2012 proposals are enacted. Furthermore, it will not be subject to the SIFT rules if it does not hold any non-portfolio property.

It is expected that income earned by some of the foreign subsidiaries will be fapi and, therefore, would be included in computing the income of NWI LP. No assurance is given that the foreign tax credit generator proposals (draft s. 91(4.1) et seq.) will not apply to NWI LP to deny deductions for foreign accrual tax.

Granite

Structure

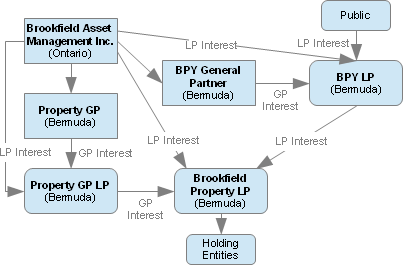

Granite REIT, a TSX and NYSE listed Canadian mutual fund trust governed by Ontario law, will be the 99.999% limited partner of a Quebec LP ("Granite LP") which, in turn, will hold: Canadian real estate through a subsidiary Ontario LP; US real estate through a Delaware subsidiary LP ("US Holdco LP") which, in turn, will hold a US private REIT ("Granite America"); hypothecs owing by Granite America; the equity of European and Mexican real estate subsidiaries through Granite; and hypothecs (owing by the European subsidiaries) through a Quebec subsidiary LP ("Fin LP") in which Granite LP will be an 80% limited partner (with Granite, directly and through a GP, holding the other 20%). Granite GP, the general partner of Granite LP, will not be a subsidiary of Granite REIT. Instead, all its common shares will be held by the Granite REIT unitholders on a "stapled basis," so that what will trade on the TSX and NYSE will be stapled units consisting of one Granite REIT unit and one common share of Granite GP.

Setup of structure

The conversion occurs under a Quebec Plan of Arrangment (Granite having continued in June 2012 to Quebec):

- Granite transfers, to a wholly-owned Quebec LP ("Fin LP"), loans owing to it by various European subsidiaries;

- Granite contributes its Canadian and U.S. assets, which are held through subsidiary partnerships ("Canadian Realty LP" and "US Holdingo LP"), and its LP interest in Fin LP, to another subsidiary Quebec LP ("Granite LP"), of which a B.C. subsidiary of Granite (Granite GP) will be the general partner holding a 0.001% GP interest

- Granite transfers its LP units of Granite LP to Granite REIT (which had been settled by it previously) in consideration for the issuance of additional units, and the assumption of debenture debt

- employee stock options on Granite commons shares are exchanged for options on Granite REIT units and Granite GP common shares

- Granite purchases for cancellation all its outstanding common shares in consideration for:

- the issuance of Class X common shares of Granite (which are convertible common shares that subdivide or consolidate pro tanto with REIT units) in a number (the "Residual Number") that correspond to the relative value of the equity in the (principally European) subsidiaries which will be retained by Granite compared to the total consolidated equity value of Granite REIT once all the Granite assets are tucked underneath it, multiplied by the number of previously outstanding Granite common shares

- the immediate delivery, in the case of each of the 200 largest shareholders, of 25 Granite REIT units and 25 Granite GP non-voting common shares

- the obligation to make a deferred delivery of Granite REIT units and Granite GP non-voting common shares which are equal in number to the total number of outstanding Granite common shares minus the number of Class X shares which are issued as described above and minus the number of units and shares that are delivered to the 200 largest shareholders (which, therefore, reduce the number of Granite REIT units and Granite GP non-voting common shares which they otherwise would receive on a deferred basis)

- Granite REIT issues Granite REIT units (and delivers Granite GP non-voting shares) to the Class X shareholders in consideration for the right to require their Class X shares to be contributed to Granite LP (with the Class X shares subsequently being converted in the hands of Granite LP into common shares)

- Granite LP transfers all of its voting LP units of Fin LP (representing approximately a 20% partnership interest therein) to Granite in consideration for Granite common shares

- the Granite GP (voting) common share held by Granite is cancelled and the non-voting common shares of Granite GP (held by the public) are converted into (voting) common shares

- the European loans owing to Fin LP and the Granite America loan owing to Granite LP become hypothecs (i.e., loans secured by way of movable hypothec) through a pledge by the debtor of units or promissory notes of real estate subsidiaries of the debtor

- all the Granite GP common shares and all the Granite REIT units (other than 25 units held by the GP of Fin LP) commence to trade on a stapled basis, with each stapled unit consisting of one such share and one such unit

Distributions

Initially, $0.175 per month per stapled unit (all on the REIT unit component of stapled unit) with return-of -capital percentage for 2013 estimated at 20% to 30%.

Management

The Granite REIT trustees and the Granite GP directors initially will be the same seven individuals. Senior management will be employed by Granite LP.

Canadian tax treatment

Reason for stapled structure. "It was determined to be desirable to utilize a 'stapled unit' structure so as to to not have an acquisition of control of Granite for Canadian income tax purposes and thereby preserve significant capital loss carry-forwards."

Mutual fund trust status

The declaration of trust has the standard 49% non-resident ownership limitations, which it is anticipated will be met. In addition, it is anticipated that Granite REIT's only undertaking will be investing in subsidiaries (i.e., Granite LP) whose units or shares are not taxable Canadian property.

REIT status

Management anticipates that Granite REIT will satisfy the four REIT tests in 2013; and has no reason to anticipate that it will not continue to satisfy those tests thereafter. Respecting the non-portfolio property test: Granite REIT's units of Granite LP, and Granite LP's units of Canadian Realty LP will be qualified REIT property; Granite LP's shares of Granite and units of Fin LP will be securities of portfolio investment entities; and the Granite America hypothecs held by Granite LP and the European hypothecs held by Fin LP will be securities of entities that are not subject entities. Respecting the 75% revenue test, "a movable hypothec on units, shares or debts of a Subsidiary which qualify as (deemed) 'real or immovable property' can bear interest that qualifies as interest on a hypothec on 'real or immovable property'."

Consequences of reorganization to Granite

Although a taxable capital gain of around $160 million will be realized on the units of Canadian Realty LP, this taxable capital gain can be sheltered with net capital losses of around $340 million, assuming these losses were not (or will not be) lost due to an acquisition of control of Granite by a group of persons. Respecting a $6 million taxable capital gain to be realized on shares of Granite America, this gain could be eliminated through a s. 111(4)(e) designation.

US Holdco LP

Management anticipates that in 2013, the level of activity in Granite America will be such as to not give rise to foreign accrual property income ("fapi") to U.S. Holdco LP and, in any event, the level of dividends (based on the US REIT requirement for Granite America to distribute all its taxable income for Code purposes) paid to US Holdco LP is anticipated to exceed any potential fapi if such activity test is not satisfied. However, in these circumstances there could be fapi arising on asset dispositions, including asset dispositions which qualified for "like kind" exchange treatment under the Code.

Granite

Similar fapi issue may arise for Granite in respect of its European subsidiaries. Management's anticipation that Granite LP and Granite REIT will satisfy the 75% revenue test under the REIT rules for 2013 assumes that (following an election to cease to be a public corporation), most distributions by Granite will be paid-up capital distributions rather than dividends.

Reorganization consequences to resident Granite shareholders

Their exchange of Granite common shares for Granite common shares plus the receipt or right to receive (to-be-) stapled units will be under a s. 86 reorganization, giving rise to capital gain only if the fair market value of such stapled units exceeds the adjusted cost base of their common shares. A deemed dividend is unlikely given the paid-up capital per common share of around $45. However, the subsequent exchange of Class X shares will not occur on a rollover basis.

Non-resident unitholders

It is unclear whether qualifying U.S. residents (who otherwise would benefit under Article XXII of the Canada-US Convention from the 0% withholding tax rate applicable to distributions made out of income arising outside Canada, and a 15% rate applicable to income arising in Canada) would have that benefit denied under the anti-hybrid rule in Art. IV, para, 7(b). Return-of-capital distributions are not expected to be subject to Part XIII.2 tax given the relative propertion of Canadian real property.

U.S. tax treatment

Anti-stapling rule. The anti-stapling provisions of Code s. 269B should not apply adversely (so that Granite GP common shares should not be treated as stapled to Granite America, which in turn could potentially result in Granite America not qualifying as a U.S. REIT).

Granite REIT as partnership

Granite REIT will elect to be a partnership for Code purposes. As it will be a publicly traded partnership, its status as a partnership for Code purposes will dpend on 90% or more of its gross income for every taxable year consisting of qualifying income including dividends and interest. Canadian Realty LP will elect to be a corporation for Code purposes.

Debt

The hypothec debt owing by Granite America to Granite LP shold be treated as debt, with Granite America deducting the interest thereon, and with the interest thereon generally not giving rise to withholding tax to Granite REIT unitholders, based on the portfolio interest exemption.

Reorganization

The receipt of stapled units for Granite common shares will be taxable to US shareholders under the rules generally applicable to the distribution of property by a corporaton to its shareholders. Accordingly, US shareholders will be rqeuired to include the fair market value of the stapled units received in gross income to the extent of the current and accumulated earnings and profits of Granite (including any gain recognized by Granite on its disposition of the stapled units - which will be treated as a taxable distribution of property by it, resulting in the recognition of gain on Granite's interest in Granite America, but with such gain being offset by available losses). The excess of the fair market value of the distributed stapled units over current and accumulated earnings and profits will be treated, first, as a non-taxable return of capital to the extent of the US unitholoders' basis in their Granite comon shares, and then as a taxable exchange of Granite common shares for stapled units.

The contribution of Class X shares of Granite (viewed as being the remaining common shares of Granite) to Granite LP at the direction of Granite REIT will be deemed to be a transfer of those shares to Granite REIT in a non-taxable contirbution to a partnership for Code purposes, so that no gain or loss will be recognized on the contribution by a US shareholder.

Although the basis of the stapled units received by the US shareholders in two tranches will be separately computed because a partner in a partnership generally has a single basis in its partnership interest, each unitholder will have a combined basis in its Granite REIT units. (The fair market value of, and basis allocated to, Granite GP units is expected not to be material.)

PFIC rules

Granite believes that it and its subsidiaries and, following the Arrangement, the subsidiaries of Granite REIT, should not be classifed as PFICs.

On-going taxation of US unitholders

As a partnership, Granite REIT's income will be allocated to its partners, and US unitholders will be provided with K-1s.

On-going taxation of non-US unitholders

The applicable rates under the Canada-US Treaty of withholding on the share of a non-U.S. unitholder who qualifies for Treaty benefits should be 0% for RRSPs, pension plans and tax-exempt organizations and 15% for individuals who so qualify. Corporate unitholders including most mutual fund trusts should be subject to a 30% rate.

FIRPTA

Granite REIT does not intend to dispose of its shares of Granite America (which are US real property interests), has no plans for Granite America to make distributions in excess of the sum of Granite REIT's earnings and profits and Granite REIT's adjusted basis in its shares of Granite America, and intends to avoid Granite America making distributions which are attributable to FIRPTA gains - for example, it may dispose of property in like-kind exchanges.

Non-US unitholders who otherwise do not have US tax reporting or filing obligations will not have such obligations as a result of a sale of their Granite REIT units provided that they were considered to own 5% or less of the Granite REIT units that were listed for trading at the time of sale and at all times in the preceding five years, and Granite REIT met the regularly traded requirement for the quarter in which the sale occurred - and the transferee would on the same basis not be required to withhold and remit 10% of the sale proceeds. Granite REIT expects the Granite REIT units to satisfy the regularly traded standards.

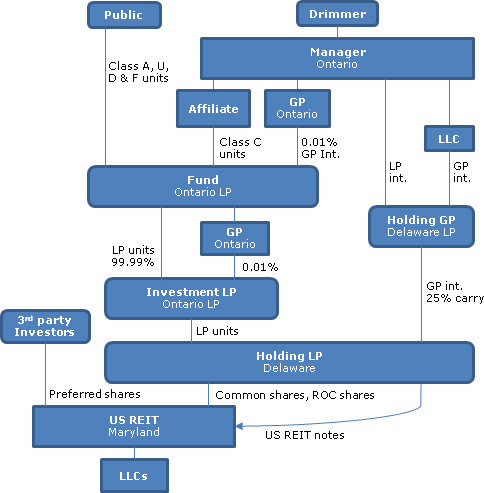

Timbercreek

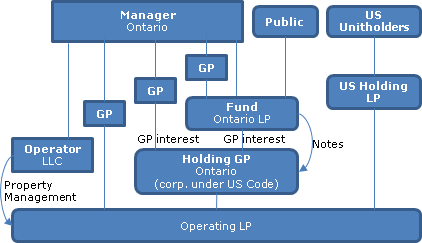

Structure

The Fund subscription proceeds described below are used by the Fund to subscribe for a general partner interest in a subsidiary general partnership (Holding GP) with the other general partner (Holding GP) being an Ontario corporation owned by the Manager. The Fund General Partner also is owned by the Manager. The Fund may also subscribe for interest-bearing notes of Holding GP.

A Delaware limited partnership (US Holding LP) raises money on a private placement of LP units with US investors (to close concurrently with the public offering and the Canadian private placement referred to below). Holding GP and US Holding LP invest jointly in another Delaware LP (Operating LP). US Holding LP has received a commitment from the Operator (see below) to subscribe for US$5M of US Holding LP units.

4-year program

Operating LP will acquire apartment buildings in the south-eastern U.S. over the following two years (i.e., this is a blind pool offering). The Fund has a term of four years (subject to a single one-year extension at the discretion of the general partner.) The Fund will "seek to exit an investment promptly upon completion of the renovation and repositioning program in order to maximize returns for investors" (p. 41).

Unit offerings

The prospectus will qualify an offering by the Fund of Class A and B units, each for $10 per units, for aggregate proceeds of between $25M and $75M. Distributions on the Class A units bear a trailer fee (referred to as the Service Fee) of 0.5% p.a. The units will not be listed.

Canadian private placement financing

The Manager (described below), which has made an equity commitment of $2.5M of which a minimum of $1M will be invested at closing, and certain other investors subscribe for Class C units of the Fund at the same price on a private placement basis. The Manager also subscribes for equity in the general partner corp's.

Debt financing

The Fund will target a 65% loan to value ration on a consolidated basis (non-recourse mortgages only).

Distributions

Targeted quarterly disributions of 95% of (net) free cash flow from operations (expected to generate a yield of 4% to 5%) plus 100% of net proceeds of property sales. Manager has a carry (paid as a fee) of 25% of the pre-tax annual return in US dollars in excess of 8% p.a. (cumulative), plus a further 10% of any excess over 14%. Taxable income is allocated among the three unit classes as at the end of each month in proportion to distributions paid.

Management

The Manager, which employs 90 professionals in its Toronto head office, will delegate property management to the Operator, a third-party Florida-based LLC.

Canadian taxation

The SIFT taxation rules are not expected to apply as there will be no Canadian business. The Fund expects substantially all gains from property dispositions to be on income account. Foreign income taxes paid by the partnerships (including US federal income taxation of Holding GP as a result of electing to be a corporation for purposes of the Code) will be allocated to the Fund partners. The August 27, 2010 foreign tax credit generator proposals, respecting where a holder's share under US tax law of partnership income which is subject to US tax is less than its share under the Canadian Act, are not expected to apply.

"[I]f the Fund is allocated losses from Operating LP (indirectly through Holding GP) that are limited by the 'at-risk' rules, such losses may not be available to the Fund and, therefore, allocable to Holders...." (see 31 May 2012 T.I. 2012-0436521E5).

Fund units are not RRSP-eligible (no listing).

US taxation

Holding GP will elect to be classified as a corporation for Code purposes. As a foreign corporation that derives effectively-connected income from a partnership engaged in a US trade or business (i.e., Operating LP), it will be subject to 35% withholding under Code s. 1446 on distributions made to it by Operating LP, and will be required to file a federal return reporting its allocable share of Operating LP income on distributions made by it. As a foreign corporation owning a US real property interest, Holding GP will be subject to corporate tax on gains arsing on sales of the Operating LP properties. If withholding is made on gains distributions by Operating LP under Code s. 1446, no withholding will be required under Code s. 1445 on gains from the dispositions of the properties. The s. 1446 withholding will be allowed as a credit against US tax shown on Holding GP's federal income tax return.

The Fund will elect to be classified as a partnership for purposes of the Code. However, it does not expect to have any effectively-connected income. Interest on any note owing by Holding GP to the Fund should not be subject to US withholding tax provided that the Fund unitholders are able to establish that such interest is exempt under the Canada-US Convention or under the portfolio interest exemption. Deductibiity of interest on these notes (which are intended to be respected as debt and to be allocable to Holding GP's interest in Operating LP) may be limited inter alia by the earnings strippings rules in Code s. 163(j).

Healthlease

Overview of structure

A TSX-listed REIT (HealthLease REIT) will hold a portfolio of seniors care facilities in the case of the western Canadian homes and (in the case of its US properties) through an Indiana LP which will be held by a US corporation ("HealthLease US") whose shares will be held by a Canadian subsidiary of HealthLease REIT ("HealthLease Canada") and whose interest-bearing notes will be held directly by the REIT. Distributions are anticipated to be 93% of AFFO. The homes in the US will be operated by a third-party US operator. An LLC of the vendors of the US properties to the REIT will hold exchangeable Class B units of the Indiana LP along with special voting units of the REIT. Units are redeemable for the lesser of the closing market price and 90% of preceding 10-day VWAP, with monthly redemptions in excess of $50,000 satisfied with notes of the REIT.

Canadian tax

Management anticipates that HealthLease REIT will qualify as a REIT for Canadian income tax purposes. The income earned by HealthLease US from the US properties is anticipated to be foreign accrual property income, which will be included in the income of HealthLease Canada subject to a deduction for foreign accrual tax but will not be subject to further inclusion as income to HealthLease Canada when distributed as dividends to it. The REIT intends to be majority-owned by Canadian residents.

US taxation

HealthLease REIT will receive an opinion that the anti-inversion rules in s. 7874 should not apply to it. It should be eligible for benefits under the Canada-US Convention provided that its units are primarily and regularly traded on the TSX. Interest on the notes of HealthLease US held by the REIT (which should be characterized as debt rather than equity based on certain interest rate and debt feasibility studies) should be exempt from US withholding tax under the Convention. HealthLease REIT's debt-to-equity ratio will initially be under 1.5 to 1 and, accordingly, it is expected that s. 163(j) will not initially disallow the deduction of interest on these notes.

Pure Multi-Family

An Ontario LP ("REIT LP") that will trade on the TSX Venture Exchange invests in a Maryland corporation (holding US apartment buildings) that qualifies as a US private REIT. Management is not entitled to fees (other than expense reimbursement); but the Managing GP holds Class B units of REIT LP that stay fixed at a 5% interest, notwithstanding subsequent Class A unit issuances to the public, until the market cap reaches $300 million (or there is a successful takeover). No (cross-border) internal debt.

Canadian taxation

The US REIT has six full-time employees. Avoidance of FAPI to REIT LP is desirable because at least some of the distributions paid by the US REIT to REIT LP will be in the form of redemption proceeds for a fraction of an "ROC Share" which will be deemed under draft s. 90(2) to give rise to dividends, which presumably will come out of exempt or pre-acquisition surplus. (These redemption proceeds also are treated as distributions of taxable income for purposes of satisfying the US-REIT tests.)

No SIFT partnership tax as REIT LP does not hold any non-portfolio property. More detailed discussion of Canadian foreign tax credit and s. 98.1 rules than typical. No discussion of "zeroing" of at-risk amount under s. 96(2.3) to subsequent purchasers (to whom the disclosure is not directed).

US taxation

REIT LP does not elect to be a corporation for US purposes and its income from the US REIT is qualifying income, so that it is a partnership for Code purposes. As the shares of the US REIT (looking through REIT LP) are targeted to regularly trade on the TSX Venture Exchange (which includes a test that the 100 largest unitholders hold less than 50% of the units), non-US persons holding less than 5% of REIT LP are not subject to FIRPTA tax and related reporting requirements on sales of their units. The US REIT is not generally subject to corporate income tax, but the non-US unitholders are subject to US withholding tax on their shares of dividends from the US REIT; and as neither REIT LP nor the US REIT should be treated as hybrid entities (each is a partnership or corporation, respectively, in each jurisdiction) qualifying Canadian residents should be eligible for Treaty-reduced rates of withholding (0% for RRSPs and 15% for individuals including TFSAs, provided they hold less than 10%). The US estate tax treatment of the units of REIT LP is unclear.

Domestic LPs

Flow-through LPs

Front Street

Offering

Each Class will have its own investment portfolio comprised of CEE flow through shares, CDE flow through shares, and CEE flow through shares most suitable for residents of Québec (i.e., for CEE flow through share issuers primarily in Québec).

Rollover transaction

It currently is contemplated that the Partnership will transfer its assets (consisting of the three portfolios) to a mutual fund corporation managed by the Portfolio Advisor (Front Street Investment Management Inc.) or an affiliate thereof on a s. 85(2) basis in exchange for redeemable shares, and then distribute 99.99% of such shares to the Limited Partners pro rata under s. 85(3). If this transaction is not implemented by 31 May 2016, the Partnership will be dissolved on or about 30 June 2016.

Canadian tax consequences

Holders of National CEE Class Units or Québec CEE Class Units will be entitled to deduct 100% of the CEE renounced by the Partnership and allocated to them in respect of the fiscal year of the Partnership (30% in the case of renounced CDE for holders of the National CDE Class Units in respect of most renounced CDE). Where a limited partner finances units with limited-recourse amount debt, any resulting CEE or CEE reduction will be allocated first to that partner. Dissolution of the Partnership (in lieu of the Rollover transaction) generally would occur on a rollover basis provided the Partnership is a Canadian partnership, a s. 98(3) election is made and a partition can occur under the applicable provincial law.

Three separate federal and Québec tax shelter identification numbers were obtained in respect of the three Classes. Separate discussion of Québec income tax considerations.

Domestic REITs

Automotive Properties

Overview

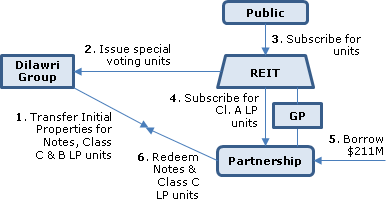

The Dilawri Group will transfer a portion of their Canadian automobile dealership properties (subject to leases back to them) to a subsidiary LP (the Partnership) of the REIT for Notes and Class C LP units (to be redeemed for cash shortly thereafter) and for Class B exchangeable LP units (which will be treated as debt for accounting purposes), with a s. 97(2) election being made. The public then will subscribe for conventional (s. 108(2)(a)) REIT units and the REIT will subscribe for (conventional) Class A LP units of the Partnership (which will be an excluded subsidiary partnership). Through their Class B LP Units (and corresponding special voting units of the REIT) the Dilawri Group initially will have a 60% interest in the REIT. The exchange right for their Class B LP units will be buttressed by a conventional exchange agreement between them, the Partnership and the REIT.

Dilawri Group

The largest automotive dealership group in Canada with revenues of $1.6 billion and owning 57 dealerships.

Partnership

Automotive Properties Limited Partnership

Initial Properties

26 commercial properties located in Ontario, Saskatchewan, Alberta and B.C. totaling approximately 958,000 square feet of gross leasable area. 24 are exclusively occupied by the Dilawri Group for use as automotive dealerships or, in one case, an automotive repair facility, while the other two properties are jointly occupied by the Dilawri Group (for use as automotive dealerships) and one or more third parties (for use as automotive dealerships or complementary uses, including restaurants). Full value of the Initial Properties on an "as completed" basis is between approximately $364.3 million and $371.3 million.

Leases

The Partnership will lease each Initial Property to the applicable member which, in the case of two of the properties will sublease the applicable portions to third parties. The rent from the portions of the Initial Properties occupied by the Dilawri Group will represent approximately 88% of the REIT's Cash NOI over the Forecast Period, with the portions of the Initial Properties occupied by the sublessees accounting for the remainder. The initial terms of the Dilawri Leases will range from 11 to 19 years, with a Cash NOI weighted average lease term of 15 years.

ROFO

Dilawri will be required to offer to sell to the REIT any property that is acquired or developed by a group member that is determined by Dilawri, acting reasonably, to be a "REIT-Suitable Property" (i.e., according with the REIT's investment guidelines). The Dilawri Group has, on average, opened or acquired five new automotive dealerships in each year for the last five years, including, on average, two to three automotive dealership properties.

Distributions

Monthly cash distributions, initially expected to provide Unitholders with an annual yield ranging from approximately 7.5% to 8.0% based on an AFFO payout ratio of approximately 90%. Approximately 100% of the monthly cash distributions in 2015 estimated to be tax-deferred.

Debt financing

The REIT anticipates having an Indebtedness to GBV ratio of approximately 56% immediately following Closing, bearing interest at a weighted average effective rate of approximately 3.2% (all of which will be fixed), with a weighted average term to maturity of approximately 5.1 years.

Administration Agreement

Dilawri will provide (subject to Board direction) the REIT with the REIT's President and Chief Executive Officer and Chief Financial Officer, as approved by the REIT, and other support services, including assisting the President and Chief Executive Officer and Chief Financial Officer with the standard functions of a public company. Dilawri will provide these services on a cost-recovery basis (or for a fixed fee of $700,000 during the Forecast Period.)IPO of Automotive Properties REIT

Transaction steps

Property transfer. On or before the day of Closing, the (Dilawri) Transferors will transfer their beneficial interests in the Initial Properties to the Partnership in consideration for a combination of Transferor Notes, Class B LP Units (with an equivalent number of Special Voting Units in the REIT) at the Offering Price of $10 or, in certain cases, other redeemable (Class C) partnership units in the Partnership at a price of $10.00 per such unit.

Use of proceeds

The REIT will use the Offering proceeds of approximately $__ million to pay some Offering expenses and to subscribe for Class A LP Units. The Partnership will use such proceeds together with advances of approximately $210.8 million under Credit Facilities, to pay the remaining Offering expenses, repay the Transferor Notes, redeem all of the Class C redeemable partnership units and redeem certain of the Class B LP Units from one or more of the Transferors at the Offering Price.

Resulting capitalization

Immediately following Closing, Unitholders' equity of the REIT (including the Partnership) is expected to be as follows:

Units $K

Unitholders Equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,500,000 65,180

Class B LP Units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9,872,200 98,720

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17,372,200 163,900

LTT

Deferred land transfer taxes are estimated at $1.8 million.

Class B and C LP Units

Each will be exchangeable at the holder's option for one REIT Unit, will be accompanied by a Special Voting Unit of the REIT, and will receive distributions of cash from the Partnership equivalent to those on the REIT Units. Each Class B LP Unitholder will enter into a voting trust agreement pursuant to which Dilawri will be granted sole voting control over the Class B LP Units and the associated Special Voting Units. The Class C limited partnership units of the Partnership can be redeemed by the holders or by the REIT LP at any time for a fixed amount of $10.00 per unit. The limited IAS 32 exception for presentation as equity does not extend to the Class B and C LP Units. As a result, they will be classified as financial liabilities.

Exchange Agreement

The REIT will agree with the Partnership and the Class B LP Unitholders to issue Units upon the exchange of Class B LP Units in accordance with their terms.

Canadian tax consequences

The REIT believes that it will meet the REIT Exception. The Partnership is expected to qualify as an "excluded subsidiary entity" at all relevant times. The UCC of the Initial Properties will be equal to the amounts jointly elected by the Partnership and the Dilawri Group and will be less its fair market value of such property.

CT/Canadian Tire

Overview

Offering to the public of 26.35M units by the REIT at $10 per unit (30.302M units with over-allotment). The REIT, an Ontario unit trust and s. 108(2)(b) closed end fund, will indirectly acquire the beneficial ownership of a Canadian real estate portfolio (43.3% in Ontario) by investing in a newly-formed Ontario limited partnership (the "Partnership") formed by three Canadian subsidiaries of Canadian Tire Corporation, Limited ("CT"), namely, Canadian Tire Real Estate Limited ("CTREL") and two LPs (such three subsidiaries, collectively "CTC"). The portfolio transferred by CTC to the Partnership (the "Initial Properties") will consist of 255 Canadian retail properties and one distribution centre, whose aggregate purchase price will be $3.53B and has been independently appraised at between $3.745B and $3.818B (corresponding to cap rates of 6.20% to 6.08%). CTC will hold (exchangeable) Class B LP Units and (preferred) Class C LP Units of the Partnership, as well as units of the REIT.

Canadian Tire

CT, which is TSX-listed, has a market cap of $7.6B. The Initial Properties represent approximately 72% (by square footage) of the real estate of CT.

CT-group tenants will generate 95.7% of rents. CTREL (and CT re the distribution centre) will enter into leases with the Partnership with staggered initial terms of 10 to 21 years (and with multiple options to extend the terms), and weighted average escalations of 1.5% p.a. At closing, the REIT will enter into a right of first offer agreement, and development agreement, with CT.

Structure

CT will hold an approximate 83.1% effective interest (assuming exercise of the over-allotment option) in the REIT, directly, and through the holding by CTC of Class B LP Units of the Partnership (and a matching number of special voting units of the REIT with nominal economic attributes), with CTC also holding Class C LP Units (see below). The Class B LP Units will be exchangeable on a one-for-one basis for REIT units, whose economics they will track. The REIT will hold Class A LP Units of the Partnership, together with the GP thereof, which will have a 0.001% profits interest.

Class C LP Units

The (non-voting) Class C LP Units of the Partnership will consist of nine series, each with a par value of $200M and with an aggregate par value of $1.8B and with distribution rates during their initial fixed rate period ranging from 3.5% (for the Series 1 and 2 maturing on 31 May 2015 and 2016) to 5.0% for the Series 6 to 9 (maturing between 31 May 2031 and 2038). The distribution entitlements are cumulative and have priority over the other classes of units. After each initial fixed rate period and every five year period thereafter, the holder of the series may elect a fixed rate (based on 5-year Canadian government yields plus a spread) or floating rate (a T-Bill yield plus 1/12 of the foregoing spread). At the end of each 5-year period the Class C LP Units are redeemable and retractable for their redemption amount (i.e., par value plus any unpaid distributions) and are also redeemable by the Partnership at any time after January 1, 2019 at the "Canada Call Price" (i) out of property sales proceeds, provided that the Series 1 shares are redeemed first (or that right is waived), or (ii) on a specified REIT change-of-control event. Such redemptions of Class C LP Units (other than upon a change of control at the REIT) can be settled at the option of the Partnership, in cash or an equivalent number of Class B LP Units.

Closing transactions

At closing:

- CTC will transfer its beneficial interest in the Initial Properties to the Partnership in exchange for (i) $263.5M, $597.1M, $409.4 and $200M of Class A LP Notes, Class B1 LP Notes, Class B2 LP Notes and Class C LP Notes, respectively, (ii) 48.6M Class B LP Units (accompanied by an equivalent number of Special Voting Units of the REIT) and (iii) 1.6M Class C LP Units

- The Partnership will repay (in sequence) its Class C LP Notes, Class B2 LP Notes and Class B1 LP Notes by issuing 0.2M Class C LP Units (resulting in 1,800,000 Class C LP Units being outstanding), 40.9M Class B LP Units with an equivalent number of Special Voting Units (resulting in $895.598M of Class B LP Units being outstanding) and 86.1M Class A LP Units to CTC, respectively

- CTC will then transfer its 86.1M Class A LP units to the REIT in exchange for a promissory note

- The REIT will issue 26.35M units under the offering for gross proceeds of approximately $263.5B units (reduced by costs estimated at $22.3M); (the underwriters have agreed that no units will be offered in the U.S. except under Rule 144A)

- The REIT will use $241.2M of the offering proceeds and issue 59.7M units in order to repay the promissory note owing to CTC (see two steps above), with the prospectus also qualifying such units

The Partnership will not own the shares of four nominee companies holding title to Initial Properties in Quebec.

Distributions

Monthly, of $0.054167 per unit ($0.65 per annum), estimated to be 90% of AFFO. Estimated tax deferred percentage of 23% for 2014 (per preliminary prospectus). DRIP with 3% bonus distribution. Upon conversion of the request of Class B LP unitholders, the Partnership will adopt a similar DRIP for them (and they also may elect to receive distributions on the Class B LP Units in the form of REIT units).

Management

The REIT will have internal management. It will receive CTC services on a cost recovery basis, and CTREL will be the property manager.

Canadian tax disclosure

SIFT status. Management believes that the REIT will satisfy the REIT exception (per p.142), "throughout 2013 and beyond". The Partnership is expected to qualify as an excluded subsidiary entity. Management intends to ensure that the REIT satisfies the s. 108(2)(b) tests (p. 142).

Preferred units

In the event the REIT wishes to issue preferred units, it will seek a CRA ruling (p. 100).

Reduced UCC under s. 97(2)

Certain of the Initial Properties will be acquired on a rollover basis.

Choice/Loblaw

Overview

Offering of 60M units by the REIT at $10 per unit. The REIT, an Ontario trust and s. 108(2)(a) unit trust, will indirectly acquire the beneficial ownership of a Canadian real estate portfolio (38% in Ontario) by acquiring a newly-formed Ontario limited partnership (the "Partnership") from Canadian subsidiaries (the "Transferors") of Loblaw Companies Limited ("Loblaw"). The portfolio (the "Initial Properties") will consist of 425 properties, including 415 retail properties, with an appraised value (including a portfolio premium of 2% to 4%) of $7.25B to $7.40B (reflecting a cap rate of 5.92% to 6.04%). The Transferors will hold Class B exchangeable LP units and preferred Class C LP units of the Partnership. The parent of Loblaw, George Weston Limited ("GWL"), will hold 20M units of the REIT.

Loblaw

Loblaw, which is TSX-listed, has a market cap of $14.0B. Its majority shareholder is GWL, which is a Canadian public company. The Initial Properties represent approximately 75% of the real estate of the Transferors.

Loblaw-group tenants will generate 91% of rents. Loblaw will enter into a Strategic Alliance Agreement with the REIT for an initial term of 10 year (e.g., REIT right of 1st offer, REIT responsibility for expansion costs, Loblaw right of 1st lease, no supermarket leasing to competitors).

Structure

Loblaw (i.e., ignoring the 20M units of GWL) will hold an approximate 81.7% effective interest (assuming exercise of the over-allotment option) in the REIT, directly, and through the holding by the Transferors of Class B LP units of the Partnership (and a matching number of special voting units of the REIT with nominal economic attributes), with the Transferors also holding Class C LP units (see below). The Class B LP units will be exchangeable on a one-for-one basis for REIT units, whose economics they will track. The REIT will hold Class A LP units of the Partnership, together with the GP thereof, which will hold Class A GP units (representing a 0.001% profits interest).

Class C LP units

Class C LP units of the Partnership will be entitled to a fixed priority draw of 5% of their $925M value, distributed monthly and will have priority over the other clases of units. Upon the request of the Transferors, the Partnership will be obligated to redeem up to $300M, $330M and $325M, of the outstanding Class C LP units in 2027, 2028 and 2029. Both the Class C LP units and Class B LP units are treated as debt under IFRS.

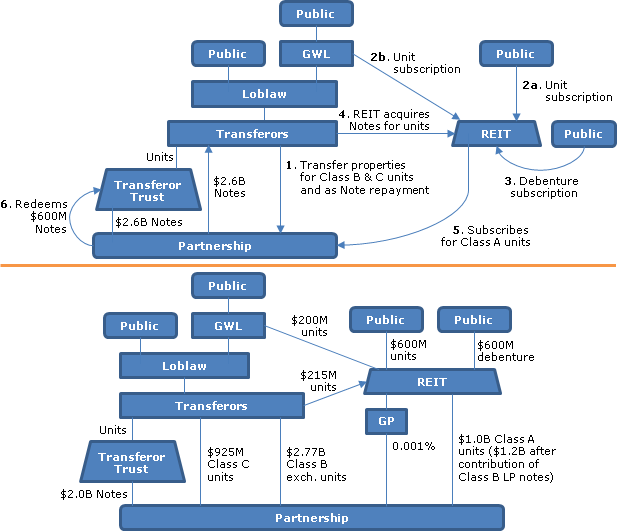

Closing transactions

At closing:

- The Transferors will subscribe for $2.6B of units of a new trust (the Transferor Trust) in exchange for the issuance by the Transferors to the Transferor Trust of $2.6B of "Transferor Trust Notes"

- The Partnership will acquire the Transferor Trust Notes from the Transferor Trust in consideration for the issuance by it of $2.6B of "Transferor Notes" (bearing interest at 3.24%) to the Transferor Trust

- The Transferors will transfer their beneficial interest in the Initial Properties to the Partnership "in exchange for the assignment" (i.e., as repayment) by them of the $2.6B of Transferor Trust Notes and in exchange for the issuance to them of $600M of Class A LP Notes, $215M of Class B LP Notes, 272M Class B LP units (accompanied on a one-for-one basis by Special Voting Units of the REIT) with a value of $2.72B, and 92.5M Class C LP units, with a value of $925M

- The REIT will issue 40M units under the offering, and 20M units to GWL, for gross proceeds of $600M; (the underwriters have agreed that no units will be offered in the U.S. except under Rule 144A)

- The REIT will issue (pursuant to a separate prospectus offering) $400M of Series A, and $200M of Series B, debentures bearing interest at 3.554% and 4.903%, respectively

- The REIT will acquire all the outstanding Class B LP Notes in exchange for 21.5M REIT units

- The REIT will transfer all the proceeds of the offering and of the 20M units issued to GWL, and contribute the Class B LP Notes, to the Partnership as subscription consideration for Class A LP units of the Partnership

- The Partnership will use $600M of the subscription proceeds received by it to redeem the Class A LP Notes

- The REIT will lend the $600M debenture proceeds to the Partnership, which will repay $600M of the Transferor Notes (with those proceeds presumably being distributed by the Transferor Trust to the Transferors)

Distributions

Monthly, of $0.054 per unit ($0.65 per annum), estimated to be 90% of AFFO. No estimate of tax deferred percentage. DRIP with 3% bonus distribution. Upon the request of a Class B LP unitholder, the Partnership will adopt a similar DRIP for them (and they also may elect to receive distributions on the Class B LP units in the form of REIT units).

Management

The REIT will have internal management. It will receive Loblaw services on a cost recovery basis, and Arcturus Realty Corporation initially will be the property manager for 150 of the properties.

Canadian tax disclosure

SIFT status. Per the Forecast, the REIT believes that it will satisfy the REIT exception for 2013 ("counsel will not review the REIT's compliance.") The Partnership is expected to qualify as an excluded subsidiary entity.

Reduced UCC under s. 97(2)

Per Risk Factors, the Initial Properties will be acquired on a rollover basis.

Melcor

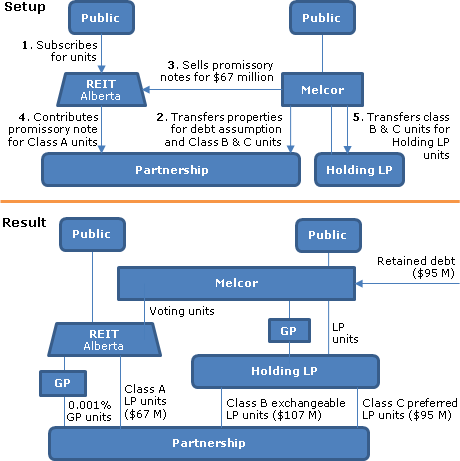

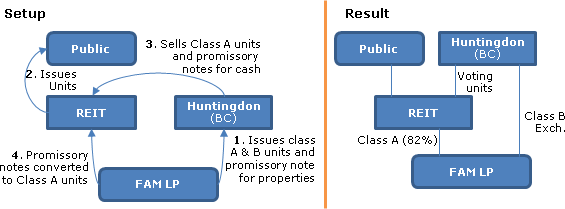

Overview