Capital distributions

Intrepid

Overview

Intrepid Mines, an Australian company, is proposing to distribute approximately 87% of its assets in cash as a capital distribution.

Company

The Company is listed on the ASX and the TSX and which received US$80 million in settlement of all disputes surrounding ownership of the Tujuh Bukit copper/gold project in Indonesia.

Capital distribution

If shareholder approval is given, the Company will pay US$0.258 per share (or US$143.6M in total) as a return of paid-up share capital pursuant to s. 256B of the Corporations Act, resulting in most of its cash reserves being distributed. There will be no effect on the outstanding number of shares. Listing Rule 7.22.3 provides that in a return of capital, the number of options must remain the same, and the exercise price of each option must be reduced by the same amount as the amount returned in relation to each ordinary security. The distribution will reduce the Company's total assets from US$177M to US$23M, and its equity to US$21M.

Canadian income tax consequences

As a matter of Australian corporate law, the Company is of the view that the payment to be made constitutes a return of capital (as opposed to a dividend, a return of share premium or contributed surplus, or any other type of distribution). ... This summary is not applicable to…a Canadian shareholder in respect of which the Company is a "foreign affiliate." ...

CRA's administrative practice is that where a distribution from a non-resident corporation is a return of legal capital under the foreign corporate law, that characterisation will generally not be challenged by the CRA. Accordingly, based on the characterisation of the payment under Australian corporate law described above, Canadian Shareholders who receive payment of the return of capital from the Company should not be required to include the amount of such payment in computing income… . The aggregate amount (expressed in Canadian dollars) received on the return of capital will be deducted in computing the adjusted cost base to the Canadian Shareholder of their Shares.

Australian income tax consequences

The Company is seeking a Class Ruling from the Australian Taxation Office (ATO) in relation to the tax treatment of the return of capital for certain Shareholders. Once the Class Ruling has been issued by the ATO, a Shareholder may rely on that Class Ruling in preparing their income tax return. ... The Class Ruling...does not apply to those Shareholders who hold their Shares as "revenue assets" or as "trading stock". The return of capital received by these Shareholders will be taxed under the general provisions of the income tax laws.

Australian Resident Shareholders

- No part of the proposed return of capital should be treated as a "dividend" for Australian income tax purposes.

- The cost base for each Share acquired after 19 September 1985 should be reduced by the return of capital amount (on a cents per share basis) for the purpose of calculating any capital gain or loss on the ultimate disposal of that share.

- If the cost base (after any adjustment, as may be relevant, for any indexation or any previous return of capital) of Shares acquired after 19 September 1985 is less than the return of capital amount (on a cents per share basis), then a capital gain may arise for the difference.

- For certain Shareholders that have held the Shares for greater than 12 months prior to the payment of the return of capital, the amount of the capital gain may be reduced by 50% (individuals, trusts) or 33 1/3% (complying superannuation funds).

- No capital gain or loss should arise in respect to Shares acquired on or before 19 September 1985.

Non-resident Shareholders

- No Australian income tax implications should arise as a consequence of the return of capital.

- It is anticipated that the final Class Ruling will be published on the ATO website before the date of the Meeting although this is not certain.

Share repurchases

Intrepid/Blackthorn

Overview

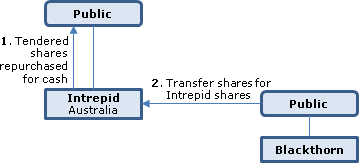

In order to give its shareholders a choice between being cashed out and participating in a Zambian copper development property, ASX-listed Intrepid will offer to purchase its ordinary shares for cancellation (subject to an aggregate cap of 2/3 of its cash), with the non-tendering shareholders remaining as shareholders of a company which will acquire all the shares of another listed Australian company (Blackthorn) under an Australian scheme of arrangement in consideration for Intrepid shares. The Australian tax disclosure is subject to a ruling which will not be granted (if at all) until after the results of the share buyback offer are known.

Intrepid

An ASX-listed Australian corporation with 558M ordinary shares outstanding. It received US$80 million in settlement of all disputes surrounding ownership of the Tujuh Bukit copper/gold project in Indonesia and has total assets of US$173M including cash of US$165M. It has no operating activities.

Blackthorn

An ASX-listed Australian corporation with 164M ordinary shares outstanding and indirectly holding a Zambian copper project.

Proposed Buyback

An equal access buyback under s. 257C of the Corporations Act 2001 (Australia) of up to A$110M worth of ordinary shares in Intrepid at A$0.30 per share (the "Proposed Buyback"). Intrepid shareholders will have the option of either participating in the Proposed Buyback or retaining all (or part) of their investment in Intrepid. A cash pool of A$110M is available for the buyback. If the buyback is oversubscribed, Intrepid shareholders will be scaled back on a pro-rata basis.

Merger

This would occur under a scheme of arrangement conditional on completion of the Buyback. All of the issued and outstanding ordinary shares of Blackthorn (the Scheme Shares) will be transferred to Intrepid in consideration for Intrepid ordinary shares (the Share Scheme Consideration) – except that the Scheme Shares which otherwise would be issued to "Ineligible Overseas Shareholders," namely, U.S. and Singapore and potentially other non-resident Blackthorn shareholders (other than New Zealand) shareholders, will be issued to a Nominee, with the net proceeds of sale by the Nominee on the ASX being remitted to them. The Share Scheme Consideration will represent 35.6% of the issued and outstanding Intrepid ordinary shares after giving effect to the Intrepid share buy-back.

Contingent Buyback

In the event that the Proposed Buyback and Merger are not approved, and this alternative buyback (the "Contingent Buyback" is approved by the shareholders in the alternative, there will be an equal access buyback of Intrepid ordinary shares of up to A$153M at A$0.275 per share. Intrepid shareholders would have the option of not participating, so that they would retain their shares.

Australian tax consequences (pp. 76-7)

Shareholder ruling re Buyback. Intrepid currently is applying for a class ruling from the Australian Taxation Office. The ATO is not expected to issue a ruling until after the results of the Buyback offer are known. If the ruling is issued, capital gains or loss treatment will arise on the Buyback to resident shareholders, and there will be no tax consequences to non-residents.

Intrepid ruling re Buyback

Intrepid is seeking a Class Ruling that the dividend substitution anti-avoidance rule will not apply to the Buyback. If this rule does not apply, there should be no adverse tax consequences to Intrepid from the Buyback.

COT

Intrepid must pass a continuity of ownership (COT) test in order to be able to set off prior year revenue and capital losses of approximately A$241M against taxable income in a given taxation year. There is a risk that the proportionate change in ownership of Intrepid as a result of the Buyback will cause Intrepid to fail the COT, and otherwise it will increase the likelihood of failing in the future.

Canadian tax consequences

Capital gains (or loss) treatment for Canadian residents.